USD Front end: buy 6m2y 1 x 2 payer spread @ zero cost

Hi guys,

I did a quick writeup on this…

__________________________________________________________________

So I’ve been racking my brain looking for the best way to make money near term on the back of the Fed’s continuing liquidity operations.

For me, this is the best expression:

- We now know that Fed will continue bill purchases $60bn per month until April, and expect them to taper to $30bn in May and June.

- Fed also announced that they will extend their repo operations (Term OMOs) at least through April to ensure excess supply of reserves beyond their stated $1.5trn floor.

My view is that the Front end is pegged at least til April (3 months) and I would argue for a lot longer than that.

After much consideration, I think that 1x2s payer spreads are the best way to take advantage of this.

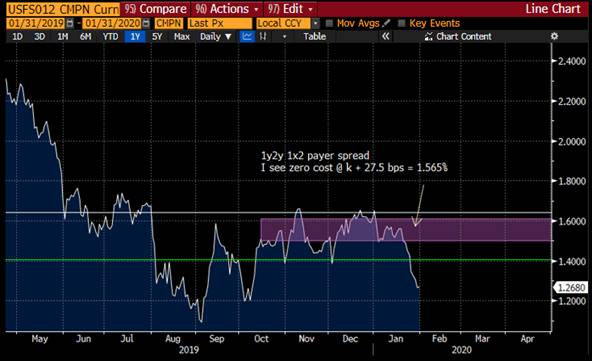

I looked at many expiries but 6m2y and 1y2y came out best. (1y2y gives a little extra cushion (higher otm strike) but sacrifices optimal 3m decay)

6m2y 1x2 payer spread

Atm = 1.343%

Otm + 18 bps for zero cost = 1.523%

3m decay = +2.7bps for this structure

1y2y 1x2 payer spread

Atm = 1.29%

Otm + 27.5 bps for zero cost = 1.565%

3m decay = +2.4bps for this structure

Please let us know your thoughts, your feedback is much appreciated.

Best regards,

Mike

![]() image003.jpg@01D57AD2.CB892020">

image003.jpg@01D57AD2.CB892020">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th Street, New York NY 10017

Office: +44 (0) 203 -143 - 4171

Mobile: +44 (0) 7989-854-611

Email: mike.ohr @astorridge.com

Website: www.astorridge.com

This commentary was prepared by Mike Ohr at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

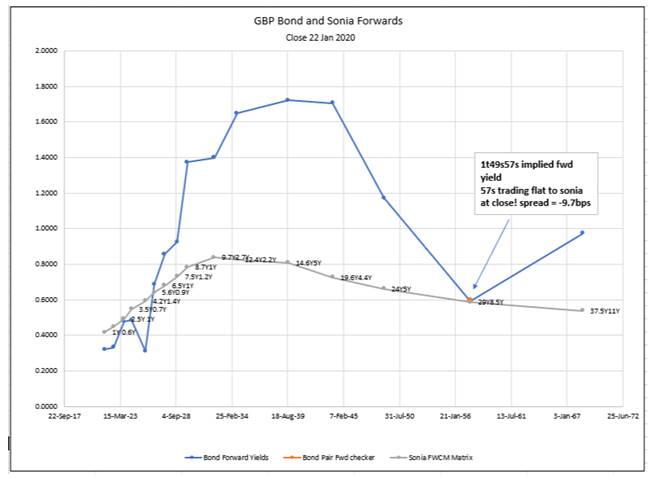

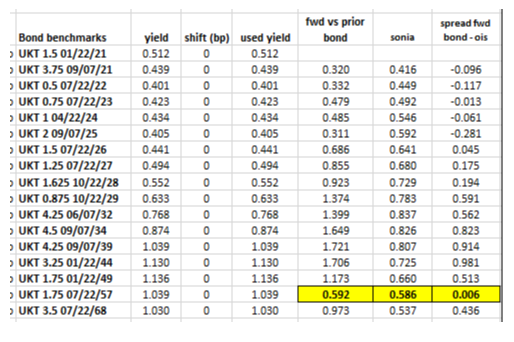

Trade idea: UKT 1.75 1/49s vs. UKT 1.75 7/57s steepener @ -9.5bps or better

Trade = Buy UKT 1.75 1/49 vs Sell UKT 1.75 7/57 @ -9.5 bps

Carry and Roll = + .17 bps per 3 months

Target = -4.5 bps

Add = @ -10.5 bps

Stop = @ -12.5 bps

UKT 57s are and have been very rich on the curve.

Using the closing levels from last night for the spread at -9.7bps, this puts the implied forwards of the 57s flat to Sonia.

These current levels are close to the range low for inversion.

There are 2 near term catalysts to this trade.

- Today’s linker 48 tender will clear out selling pressure on the UKT 1.75 49s as it is the hedge bond for that issue.

- Ultra long syndication coming week of 10th of February.

Please feel free to share any thoughts, feedback much appreciated.

Best,

Mike

![]() image003.jpg@01D57AD2.CB892020">

image003.jpg@01D57AD2.CB892020">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th Street, New York NY 10017

Office: +44 (0) 203 -143 - 4171

Mobile: +44 (0) 7989-854-611

Email: mike.ohr @astorridge.com

Website: www.astorridge.com

This commentary was prepared by Mike Ohr at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

EGB conventional supply for the week to the 4th, November.

Of the 5 lines of supply, most compelling - 15y Finland within the broader Finnish curve - either 10/15y both in YLD and ZCM, 10/15/30y curve, 15y Finland vs Germany

- 30y Finland in ASW at at a multi-year cheap level vs swaps

- 15y France vs 15y Belgium has value but my preference is for 10/15y ASW box which I struggle to see why the Belgium curve is flatter than France(ex-supply dynamic)

Generally supply points in smaller and much less liquid markets such as Finland and Austria, give one good opportunities to reduce friction cost for one side of the entry/exit cost.

As for the other markets, I see little in the way of RV trades at the moment. Lack of volatility and range trade mentality persist for the time being and offers up fewer distortions on the curve. That may change as

we get closer to year end.

So for what is worth, here is my take:

France: One big duration event for the day - historical pattern into and out of supply for large duration events well documented, but apart from duration event - not much to do on the micro RV side.

10yrs - roll has moved out to +8.5bps(1bps wider) vs 11/28s(ctd) - part directional, but in ASW terms very stable at +2.4bps - maybe 1bps in the trade vs Futures

15y - Fair value on the french curve at the moment - middle of tight ranges - only consideration for myself - 10/15y ASW box vs Belgium(chart below) - not sure Belgium curve should trade rich in this metric v France

30y - nothing to do, tight range in YLD and ASW locally.

50y - with the exception of one spike higher in ASW terms 30y/50y, the 50y in ZCM towards the higher end of a 3bps range.(chart below)

Spain: 5y - marginally expensive locally, and mid-range on wider flys

10y - marginally expensive locally, expensive vs France, cheap vs larger credit trade German/Italy blend vs Spain - possibly look for risk off trade into year?

15y - 10/15/30 fly in Spain - middle of the range - locally cheap vs other High Coupons taking into account duration differential

Austria: 5y - has come back quite quickly from cheap valuation to slightly through Fair Value, looks at the expensive of the range vs Germany.

10y - Nothing to do -mid range on all metrics.

Finland: 15y - cheap in 10/15/30 Finnish Curve, 10/15y both Yld and ZCM, cheaper end of range vs Germany in an environment whereby semi-core has been compressed into low and tight range generically.(chart below)

30y - cheap in ASW(chart below)

UK: 10y - we see good value in the 10y roll in LC UK gilts and as we get closer to expiry of the DEC futures(our thoughts on performance of new ctd 2030s) and the lead up to a new 10y in early 2020, seasonally the

issue is nearer its cheaper end of cycle range.

France/ Belgium ASW Box 29s vs 34s (34 Belgium Expensive vs France)

30/50y France 5/50 vs 5/66 - ZCM

Finland 10/15/30y Fly - 15y back to the cheaper end of the range

15y Finland vs Germany - 34s - spikes wider for supply announcement

10y/15y Finland 29s vs 34s Yield - possible directional bias - but relatively all curves in EGB space looking even flatter relative to the back up in yields of late

Finland 10/15 ASW Box rarely seen the side of positive in 2019

30y Finland ASW YY - back to multi year cheaper end of the range.

![]()

Stephen Creaturo

O: +44 (0) 203 - 143 – 4175

M: +44 (0) 7 809 575 890

E: stephen.creaturo@AstorRidge.com

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This marketing was prepared by Stephen Creaturo, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

EGB Supply - Week of 14/10/19 - A few Thoughts, Ideas

EGB Supply this week:

Germany: 2y Shatz 9/21 - 4bl & Old 30y 8/48s - 1bl

Spain: combination of 10/21, 7/24 & 10/29 - total 3.5bl

France: combination of 2/22, 3/25 & 5/26 - up to 9bl

UK: 10y Gilts - 10d/29s - 2.75bl

My take on German Supply:

2y Shatz 9/21s:

* Shatz roll - tight range -1.3 vs -3bps, currently -1.5bps - no value

* Outright yld - off richest levels from Aug. Ecb meeting(-93bps), currently at -72bps(carry and roll negative and in need of more clarity from ECB - rate cuts vs QE etc).

* 2y Invoice spreads at the cheaper end of the range at -30bps - maybe worth a stab on the long side but risk is understanding tiering impact on funding in the next statement period.

* 2/5y curve is flat - both rates anchored in current environment - carry marginally negative for the steepener, but level looks attractive but my guess is we need a large sell off to realise steeping bias.

30y OTR - 1.25% 48s:

* 30y Roll - also very tight range - 2.7bps to 3.4bps - currently 2.9bps - no concession

* ASW- Invoice sprd(proxy) - bounce off the lows from 35bps to current level near 40.5bps, ASW Box vs 10yrs has been volatile of late in a wide range btwn +5 and -5bps. Currently +1.5bps(10yrs wider). I would look to sell 30yrs spreads vs 10yr - nearer flat to slightly negative.

* 10/30y Curve - lower end of the range - lacking inspiration as to next move.

* 10/20/30 Fly vs Zspd - 20yrs flagging expensive(will depend on QE bonds targeted)- spread curve very flat beyond 10yrs- would favour shorting 20yr vs buying 10yrs and 30yrs. (ie 0.25 2/29 x 4.75 7/40 x 1.25 8/48(carry neg. small at -.3bps/mos assuming 10bps repo diff)

My take on French Supply:

* Fairly advanced for the year ~90%. Cash Flows this month very positive per seasonal input(well flagged) - mostly see the positive performance in FRTR 15-10days prior to the 25th, Oct.. At this level of yields not sure we get as much uplift this time around - generally worth 3-4bps vs core markets on spread.

FRTR 2/22 OAT: (26bl outstanding, 6 taps to date)

* Roll vs 5/21 at -2bps - uninspiring - should be flat to positive but spread curve inverted, in need of some structural changes to the front end

* C+R for the front end also negative just shy of 1bps/mos - difficult to hold, need more clarity on tiering and funding

* Like the front end of Germany - either outright yield or ASW have come back off their low prints from mid-august, but I fail to understand why the ECB will push for lower short rates – it’s not the solution in my opinion to Europe's structural problems.

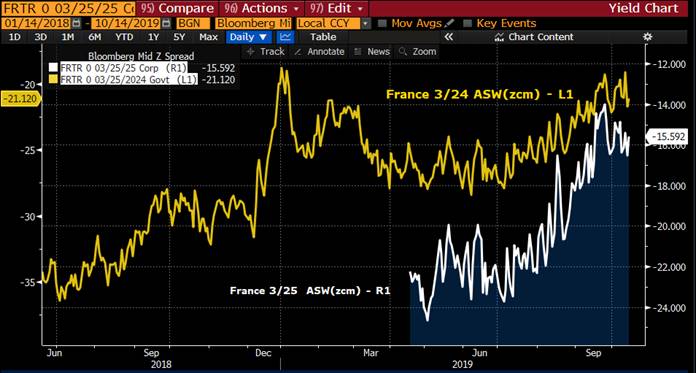

FRTR 3/25 OAT: (20.3bl outstanding, 5 taps to date)

* Roll vs 3/24 is at +9.6bps up from a low at 7.2bps should find support for the issue vs shorter bonds.

* Roll down on the Spread curves still looks attractive as well. ASW(zspd) has come back to -15.5bps from a low in the summer months at -23.5bps. - worth having a look.

* 2/5/10 Curve - 5yrs at the top of the range while market has more or less grinded lower in yield and 2y/5yrs yields in EGB have anchored. Need to be bearish to support 2/5/10.

FRTR 5/26 OAT: (33bl outstanding, 8 taps to date)

* In my opinion 5/26s are spot on FV on the French Curve - been in a very tight 1bps range vs spline curve via just shorter and longer maturities. I see nothing to do here unless someone knows more about the repo, I am just not sure why the street asked for the bond.

UK Gilt supply:

UK Gilts 0.875% 10/29s - (Currently 9bl outstanding, 3 taps)

* Yields have backed up some 20bps over the last week, including today's move ~ 7bps richer. 10y Gilts building a base at .40bps but overall direction remains tied to the outcome of Brexit. Either way, Gilts should remain volatile over the short to medium term with valuation poor.

* Supply for the Fiscal Q3 will see continued taps of both 10/29s and 6/25s with the balance made up from a tap of longs -49s and potential for either a syndicated long conventional or linker.

* Benchmark 10y 10/29 in Micro RV - roll vs 10/28s at +8.15bps has had a range +9.5 to + 6.5bps.

* Micro Fly either 27/29/32, 27/29/30 or 28/29/30 are fairly range bound. We still feel that as far as issue specific, 12/27 expensive and while 12/30s is slightly expensive, they will be the next CTD and still have good value on the curve. So for time being, similar to 6/25s, 10/29s should remain

cheap with ongoing taps for the balance of the QTR and most likely start to perform on the curve as we get closer to QTR end and into the next part of the last Fiscal Qtr.

* Trades we continue to favour are in ASW terms(sonia) and taking advantage of the steepness of the curve between 5yrs and 15/20yrs.

Spain Supply:

* Funding well advanced at 87% but more or less on par with last years funding.

* October is also very positive cash flow month for Spain coming at the very end of the month.

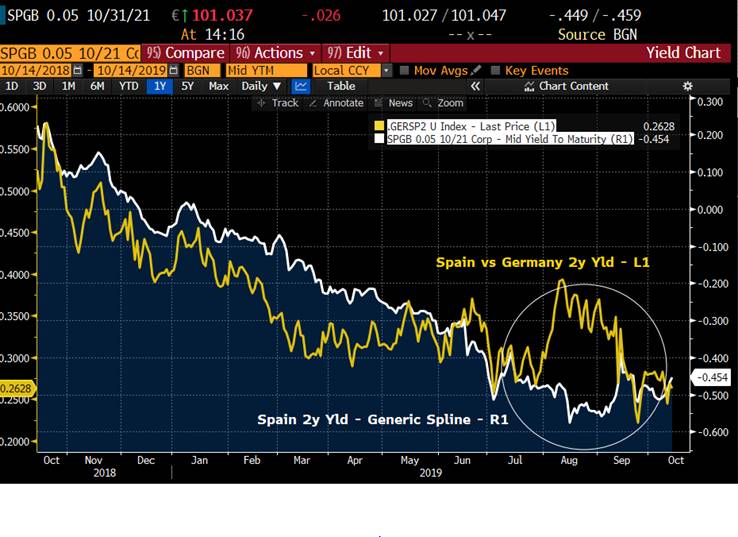

SPGB 10/21 (17.8bl oustanding, 12 taps to date)

* Outright level stuck at the bottom of the range - Interesting that the spread vs core markets has become richer since the summer months, much of this performance is coming from Germany ylds higher

SPGB 7/24 (10.8bl outstanding, 8 taps to date)

* 5y Roll - 7/23 vs 7/24 has made a small concession into supply, currently at +7.4bps from a low 5.1bps 1 week ago.

* 3/5/7y Spain curve back to the top of the range - looking at 4/24 x 7/24 x 10/26 close to flat looks good value.

SPGB 10/29 - (14.6bl outstanding, 4 taps to date)

* After a fantastic run in performance this year led by strong buying from the far east region, Spain has taken a breather but mostly on a relative basis to other credit markets such as Italy or Portugal. The 10y credit blend back to top of the range amid strong performance in BTPs and Portugal through the summer months. Worth having a look at credit fly(not vol. Adj) Germany/Spain/Italy 1x2x1 or France/Spain/Italy with a bit of vol. Wtd 70%x/30%.Both spreads have come back from very rich levels prior to August ECB meeting.

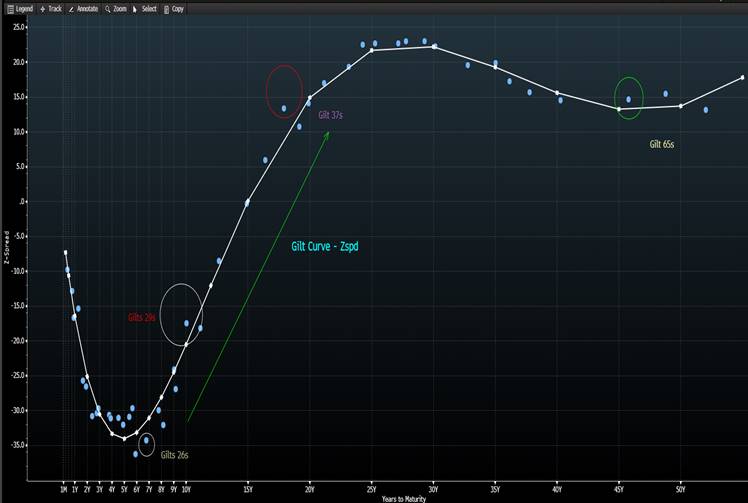

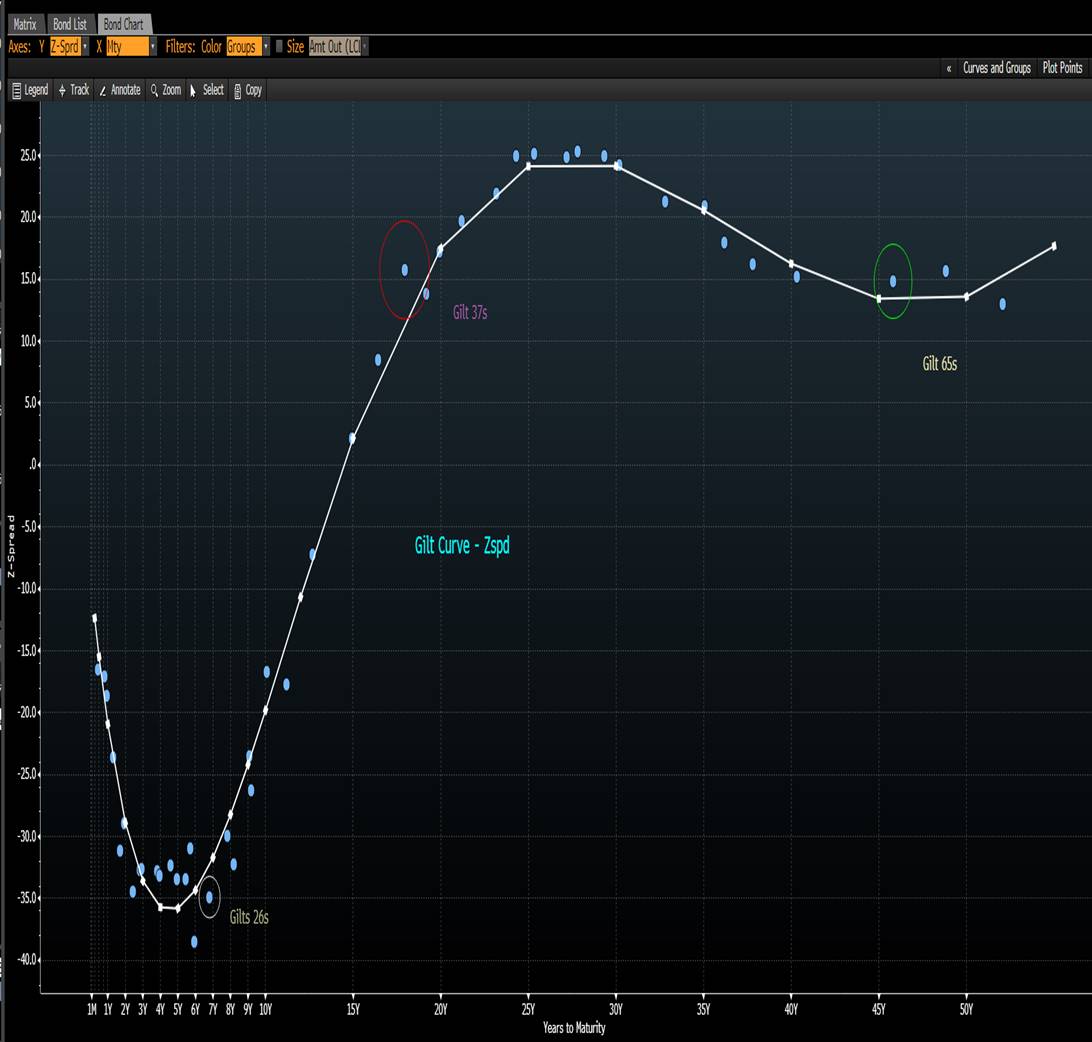

UK Gilt Trade: Wide Fly vs Sonia - 26s/37s/65s ~50bps

Trade: Gilt Fly: 1x2x1 wtd vs Sonia – buying the belly – 1.5% 7/26 x 1.75% 9/37 x 2.5% 7/65

Level: +49.85bps

Stop: +54bps

Target: +40bps

Carry: ~0.6bps postive/mo

Rationale:

- Last tap of the 37s which should make room for new 20y next year.

- 37s - Carry + Roll down best part of the Gilt curve.

- 15y or 20y vs ultra long curve has re-inverted – Pension dynamics/de-risking, RPI ruling still outstanding etc.

- APF done till Q2 next year, supply for the balance of 2019 will see one more longs - 49s in early Nov., and either

a linker or conventional syndicated deal some time in Nov. Growing belief is more likely a conventional

for one or the other - 54s or 71s.

- Potential for more Gilt Issuance on the back of Fiscal Relaxation should lend itself to more long end supply.

We like the trade better vs Sonia – at the highs near +50bps. In bond yld terms(+63bps), more volatility, larger range and recent correlation with directional input

could see the fly cheapen further before finding resistance.

- 20y vs 45y Gilts Disinversion back to the lows.

- Carry & Roll – 15y – 20y Part of the Gilt Curve represent the highest levels.

- May want to have a look at 47 vs 37s to own in the belly, but our thinking is that there is still the 49s to come before year end and then a syndicated tap of 54s or 71s.

If 54s, could see congestion in 30yr sector – hence preference at this time for more 15yrs.

FW: Taking Profits on 4y Austria and 4y Finland vs Germany. Taking profits on 9y Austria vs Germany/France 75%/25% wtd

Subject: Taking Profits on 4y Austria and 4y Finland vs Germany. Taking profits on 9y Austria vs Germany/France 75%/25% wtd

Stephen Creaturo

![]()

O: +44 (0) 203 - 143 - 4800

D: +44 (0) 203 - 143 - 4175

M: +44 (0) 780 – 957 - 5890

E: Stephen.Creaturo@AstorRidge.com

UK: Dowgate Hill House, 14-16 Dowgate Hill, London, EC4R 2SU

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

This marketing was prepared by Stephen Creaturo. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a research recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Belgium vs France 25s vs 34s ASW Box

For those leaning on credit curve should be theoretically positively sloped and particularly in semi-core when tensions build, BELGIUM/FRANCE 25s vs 34s ASW Box back through ZERO(levels we saw pre-Italy blow out move back in mid 2018). Soft way for those thinking markets have been too far ahead of Policy response yet to come and need larger correction.(I believe supports MF's trade earlier in the week - Buying 15y France vs Belgium). Here's the chart

Stephen Creaturo

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

O: +44 (0) 203 - 143 - 4800

D: +44 (0) 203 - 143 - 4175

M: +44 (0) 780 – 957 - 5890

E: Stephen.Creaturo@AstorRidge.com

UK: Dowgate Hill House, 14-16 Dowgate Hill, London, EC4R 2SU

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

This marketing was prepared by Stephen Creaturo. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a research recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

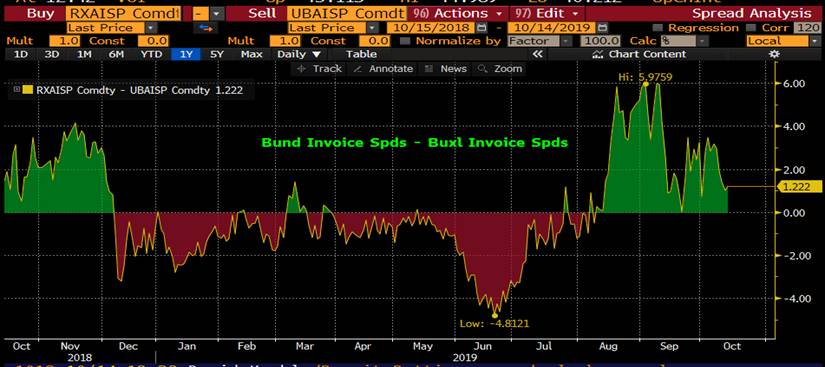

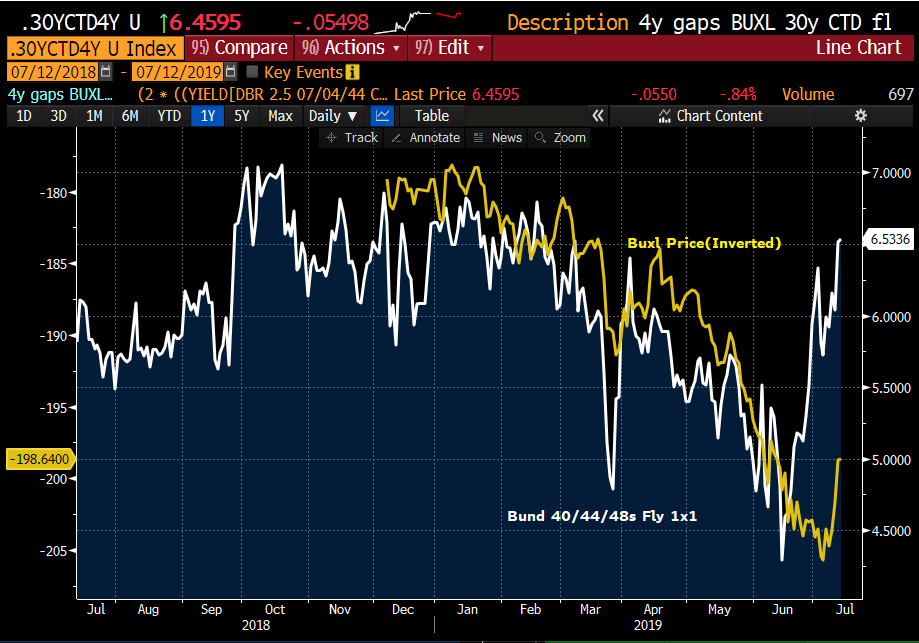

Trade: buxl 4y gap fly

Micro RV - Market sell-off/correction over the past several days has been clearly sharper/faster than the previous grind higher we experienced over the month. The grind higher has been so orderly and lacked volatility we did not see much in dislocations surrounding FUTURES contracts in micro-gaps on the way up(Ex IK-still rich). But on the sell-off BUXL has taken the brunt of pressure with many hedging delta(3/8 retrace so far) and curvature. Of all the futures in EGBs, BUXL 2y and 4y Gaps producing largest reversals - even outpacing level of market. Much of the work here is 40/44s steepening. Worth having a look at shorting 40s basis and or the FLY 40/44(ctd)/48s either 1x1 or 55/45wtd.

Stephen Creaturo

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

O: +44 (0) 203 - 143 - 4800

D: +44 (0) 203 - 143 - 4175

M: +44 (0) 780 – 957 - 5890

E: Stephen.Creaturo@AstorRidge.com

UK: Dowgate Hill House, 14-16 Dowgate Hill, London, EC4R 2SU

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

This marketing was prepared by Stephen Creaturo. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a research recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BOJ's bond buys drop to pre-Kuroda levels

Persistent shortfall from nominal target fuels talk of stealth tapering

YOSHIKAZU IMAHORI, Nikkei staff writer April 19, 2018 13:10 JST

The Bank of Japan's purchases of Japanese government bonds have slowed since it shifted its policy focus to yields in 2016. (Photo by Akira Kodaka)

The Bank of Japan's purchases of Japanese government bonds have slowed since it shifted its policy focus to yields in 2016. (Photo by Akira Kodaka)

TOKYO -- The Bank of Japan's purchases of Japanese government bonds have slowed to a pace not seen since the central bank launched its massive monetary easing program, a development that has not escaped the notice of market watchers.

The BOJ reported an increase of just 49.42 trillion yen ($461 billion) in its holdings of long-dated JGBs at the end of March compared with a year earlier, a 13th straight month of slowing growth. This rise also missed the 50 trillion yen target that the central bank set when Gov. Haruhiko Kuroda introduced qualitative and quantitative easing in April 2013. The goal has since been lifted to 80 trillion yen.

New Deputy Gov. Masazumi Wakatabe told upper house lawmakers on Monday that the BOJ is "supplying money to the economy to beat deflation." The outspoken reflation advocate has argued that the bank should aim to lift its JGB holdings by 90 trillion yen a year.

Yet the central bank's long-JGB holdings fell to 426.56 trillion yen at the end of March, down 3.39 trillion yen from a month earlier. This represented the largest monthly decline since June 2008, though the fact that government bonds mature in larger numbers than usual in March played a role, as Mizuho Securities noted.

The BOJ shifted the focus of its monetary policy in 2016 to interest rates rather than the quantity of bonds purchased. Under the yield curve control strategy, the central bank adjusts its JGB purchases to keep long-term interest rates around zero.

The slowdown likely is also an effort to stabilize the market. The BOJ holds 45% of JGBs in circulation, distorting prices and yields.

Its decision to maintain a quantitative bond-buying target despite these factors was a "measure to head off criticism from reflationists," said Takahide Kiuchi of the Nomura Research Institute, who sat on the central bank's policy board until last summer.

The discrepancy between the actual increase in the bank's JGB holdings last fiscal year and the nominal target has been interpreted by some market watchers as a form of stealth tapering.

The BOJ plans to maintain the 80 trillion yen target when the policy board meets April 26 and April 27. Any cuts to this figure would be viewed as a sign of actual tapering, rattling markets. But a widening gap between the target and reality could harm the central bank's credibility.