** BOJ May Get More Policy Freedom If Abe Quits: Ex-BOJ Kiuchi **

By Takashi Nakamichi and Tesun Oh

(Bloomberg) -- The Bank of Japan will likely find it easier

to make its inflation target less binding if recent scandals

throw Prime Minister Shinzo Abe from power, according to

Takahide Kiuchi, a former board member at the central bank.

“If the unusually strong administration changes, the Bank

of Japan could get a little more freedom,” Kiuchi said in an

interview Tuesday. The BOJ has faced “considerable political

pressure” these past five years, he said.

“If the Abe administration is replaced by another

administration, it could become easier” to re-frame the

inflation target as a medium- to longer-term goal, said Kiuchi,

54, who is now executive economist at Nomura Research Institute

Ltd. in Tokyo. The BOJ, which is by law independent from the

government, has said it wants to reach its price goal at the

earliest possible time.

The BOJ’s policy path could come under fresh scrutiny as

speculation intensifies over Abe’s future because of scandals

that have prompted a series of public apologies and driven his

poll numbers to near record lows. Kiuchi, who served on the

BOJ’s policy board from 2012 to 2017, was one of its perennial

dissenters, saying that achieving 2 percent inflation isn’t

feasible and that trying to do so could have a negative impact.

In a Bloomberg survey of 49 economists before last month’s

BOJ policy meeting, 68 percent of those expecting the central

bank’s next move will be monetary tightening forecast such a

move in January 2019 or later.

While BOJ Governor Haruhiko Kuroda has repeatedly said he

is committed to easy policy to reach the price goal, Kiuchi

suspects that the bank is moving toward normalization, citing

its reduced purchases of government bonds. If Abe steps down,

the price-target change could come around next year, Kiuchi

said.

Abe must win a leadership vote scheduled for September by

his political party to stay on as premier. While Abe has said he

would stay in his job and work to restore public trust in the

government, a poll published by the Asahi newspaper on April 16

showed respondents would prefer to see former Defense Minister

and Abe critic Shigeru Ishiba as the next leader. Ishiba said in

an interview in June last year that it wouldn’t be good if the

unprecedented easing policy continued indefinitely.

The BOJ could scrap its negative rate policy in late 2019,

provided that the government delays a sales tax hike scheduled

for October of that year, Kiuchi said. “What will likely come

first is the termination of negative rates or a reduction in the

purchases of exchange-traded funds,” he said.

See also: Kiuchi says BOJ will stay on ‘virtual

normalization’ path

It may be in 2021 at the earliest when the BOJ begins to

cut its corporate bond holdings accumulated as part of its

stimulus, Kiuchi said.

Ahead of such changes, the BOJ may also redesign its long-

term interest-rate target if there is little risk that that

would cause the yen to rise, Kiuchi said.

One option would be for the bank to scrap its zero percent

target for the 10-year government bond yield and make it a goal

for the five-year yield instead, he said. The latter rate would

be “far easier to control” partly because it’s less sensitive to

developments in overseas bond markets, he said.

“This will depend on market conditions so it’s hard to tell

when that could happen,” he said of the possibility of a change

to the 10-year yield target. “But it will probably come ahead of

the termination of negative rates.”

Japan's workers win biggest pay raises in 20 years

Logistics and retail lead the way as companies compete for labor

KYO KITAZUME, Nikkei staff writer April 16, 2018 13:30 JST

TOKYO -- Japanese workers appear headed for their biggest wage increase in two decades as companies led by the logistics and retail sectors compete for a slice of the country's ever-shrinking workforce.

Businesses lifted wages by an average of 2.41% this year, according to data collected by Nikkei as of April 3. This raise -- made up of base pay and automatic, seniority-based pay -- topped last year's average increase by 0.35 percentage point, the first such growth in three years.

In value terms, monthly pay rose by an average of 7,527 yen ($70), also the highest since 1998.

Rising wages in Japan usually are driven by manufacturers. But nonmanufacturers have taken the lead this year for the first time since 1997. They increased pay by 2.79%, their biggest hike in 21 years and more than half a point above the raises from manufacturers.

Logistics providers and service industry players in particular are working harder to attract employees. Yamato Transport agreed to the full 11,000-yen increase in monthly base pay, or 3.64%, requested by the Yamato Holdings unit's labor union during annual wage negotiations.

The logistics sector enacted an average pay raise of 3.39%, the highest across all industries and the only one with an average increase exceeding 10,000 yen. The industry is struggling to keep pace with the surge in demand for e-commerce shipments.

A Life Corp. supermarket in central Tokyo. The grocery chain will raise wages for both full-time and part-time workers. (Photo by Takuya Imai)

A Life Corp. supermarket in central Tokyo. The grocery chain will raise wages for both full-time and part-time workers. (Photo by Takuya Imai)

Department stores and supermarkets raised wages by 2.53%. Grocery store chain Life Corp. will raise salaries for full-time employees by 3.86%, while also pledging to increase wages for part-time workers.

Manufacturers boosted pay by 2.27%, just 0.18 point more than in 2017. Toyota Motor, which likely posted a record net profit for the fiscal year ended in March, has agreed to a 3.3% pay raise but is not releasing specific yen figures.

Many big electronics makers such as Hitachi and Panasonic are offering just 1,500 yen more in base pay this year. Sony, which is not part of industrywide negotiations with unions, decided on a 5% increase to final yearly pay as the company hopes to attract experts in artificial intelligence and other technologies to boost its competitiveness.

Yet Japanese wages continue to fall in real terms due to rising food and oil prices. The government has urged companies to boost pay for the past five years, and Prime Minister Shinzo Abe gave a specific target for the first time this year, calling for 3% raises.

Businesses are catching on, primarily because they need to secure the talent to compete on the global stage. Many companies are switching away from a seniority-based wage structure and raising starting salaries.

Competition for workers is particularly fierce in the technology sector. Job postings for data scientists have quadrupled in a year, recruitment services provider en-japan said. Companies from China and elsewhere also are luring Japanese graduates away with generous offers.

Some companies are focusing on seniors to overcome labor shortages. West Japan Railway and farm equipment maker Kubota are including post-retirement hires 60 and older in their pay increases. Honda Motor pushed back its retirement age last year and raised pay for senior employees.

** Japanese Prime Minister Abe, Embroiled in Scandals, Faces Calls to Stand Down **

Former PM Koizumi says Abe will harm party candidates in

parliamentary elections.

By Anna Fifield

(Washington Post) -- SEOUL — President Trump and Japanese Prime

Minister Shinzo Abe will have something new to bond over when

they meet at Mar-a-Lago Tuesday: how to weather a storm of

relentless political onslaughts.

Both are embroiled in controversies surrounding dodgy financial

deals but, while Trump's poll numbers are holding up, Abe's have

plummeted to record lows.

The Japanese leader is flailing so badly that former prime

minister Junichiro Koizumi has suggested that he should stand

down at the end of June to avoid tainting the entire Liberal

Democratic Party.

"When the current Diet term ends, that would be a good time for

Abe to resign. No third term for him as the party president,"

Koizumi, who was prime minister between 2001 and 2006, said in an

interview published by the weekly magazine Aera on Monday.

The current session in Japan's Diet, or parliament, finishes on

June 20.

The scandals percolating around Abe will affect next year's Upper

House election, the former prime minister said. "Candidates will

get anxious if they have to go into an election with Abe."

Polls published on Monday showed Abe's steadily-tanking ratings

have fallen further in recent days. One, from the Nippon News

Network, put his approval rating at 26.7 percent, almost four

points down from March and the first time it has fallen into the

20s since Abe returned as prime minister in 2012.

Other polls put Abe in the 30s, but this is a far cry from the

support levels in the 60s he was enjoying at the beginning of

last year.

As many as 50,000 people protested outside the Diet over the

weekend, calling Abe a "liar" and urging him to resign.

The LDP, which has been in power for all but five of the years

since it was formed in 1955, changed its rules last year to allow

leaders to seek a third term at the helm. At the time, Abe seemed

a shoo-in to serve until 2021, which would make him Japan's

longest-serving prime minister and give him a chance to pursue

some of his controversial goals.

But in the ensuing months, he has been plagued by a cronyism

scandal that won't go away but has yet to be damning enough to

topple him.

Abe has not been able to shake allegations that his government

gave huge discounts in land sales to two educational institutions

linked to associates of he and his wife, and then tried to cover

up the links.

The Finance Ministry last month admitted to altering documents

relating to the sale of land in Osaka to a nationalist school

with links to Akie Abe, including deleting her name and the prime

minister's name from the papers.

Taro Aso, the finance minister and deputy prime minister,

resisted calls to resign over the admission, a move that would

have been politically fatal for Abe, analysts said. Abe and his

wife have denied all wrongdoing.

Now, the Finance Ministry is in further hot water after

allegations — backed up with audio recordings — that its top

civil servant had been sexually harassing female journalists on a

regular basis.

Junichi Fukuda, vice finance minister, has strongly denied

reports by the Shukan Shincho magazine that he made sexually

suggestive comments to female reporters during drinking events

and has said he will sue for defamation.

The magazine is standing by its reporting and released a

recording Monday in which a man, alleged to be Fukuda, says to a

female reporter in a restaurant or bar: "Can I touch your

breasts?"

Abe's government has so far deflected calls to fire Fukuda but on

Monday the ministry opened an investigation into his conduct.

The ministry has also asked any female reporters with similar

experiences with Fukuda to come forward, a call that would have

been unimaginable before the "Me Too" movement.

The prime minister can't even play up his strong ties with Trump

since the American president has been publicly attacking Japan

over trade and did not grant Japan the exemption to new steel

tariffs that was given to other allies.

While signing the tariff order, Trump says that Abe will have "a

little smile" on his face when they talk. "And the smile is, 'I

can't believe we've been able to take advantage of the United

States for so long.' So those days are over."

Abe was "blindsided" by the tariff decision and by the sudden

burst of diplomacy with North Korea, said Sheila Smith, senior

fellow on Japan at the Council on Foreign Relations.

"Anxiety has grown in Tokyo over the prime minister's 'special

relationship' with Trump," she said.

Abe had wanted a third term to tend to unfinished business:

namely, revising the pacifist constitution for the first time

since it was imposed on Japan by its American occupiers after

World War II. Abe wants to amend the clause denying Japan a

full-fledged military and cast off some of the postwar shackles.

This issue has been contentious in Japan, where many people think

seven decades of pacifism has served them well. The steady

barrage of missiles from North Korea last year, however, helped

Abe make his case for a stronger military.

Now, though, diplomacy is front and center, with the South Korean

President Moon Jae-in preparing to hold a summit with Kim Jong Un

next week, and Trump planning his own meeting with the North

Korean leader in May or June.

BOJ's Kuroda rules out tapering, aims for inflation 'overshoot'

Reappointed central bank chief will monitor impact on private banks' profitability

MITSURU OBE, Nikkei staff writer April 09, 2018 21:52 JST

Governor of the Bank of Japan, Haruhiko Kuroda, speaks at a news conference in Tokyo on April 9.

Governor of the Bank of Japan, Haruhiko Kuroda, speaks at a news conference in Tokyo on April 9.

TOKYO -- Bank of Japan Governor Haruhiko Kuroda began his second term on Monday by declaring he would continue the unprecedented run of monetary easing, even as the U.S. Federal Reserve steadily withdraws its own fiscal stimulus policy.

In a news conference held after he was formally reappointed for a second five-year term by Prime Minister Shinzo Abe, Kuroda said that "it is way too early" to discuss exiting the monetary easing campaign.

He emphasized that the central bank had pledged to keep expanding the country's monetary base even after inflation hits 2%. "It is important to commit to an inflation overshoot," the governor said at a press conference.

Kuroda, who is the first BOJ chief to serve two consecutive terms in 57 years, began his second term amid criticism that he has failed to keep the promise he made in 2013 to achieve 2% inflation in two years. He is also facing complaints from the banking industry for introducing negative interest rates, a decision he made in 2016 that has led to a collapse in interest rates and has made it difficult for commercial banks to earn interest income from their lending operations.

Kuroda said he was aware of the plight the commercial banks face. He said he would "keep a close watch on the effects of the prolonged monetary easing on the health of the banking system." But he stood by his easing measures and the elusive 2% target.

He argued that 2% inflation was a reasonable goal widely adopted by central banks around the world, and stressed that the target had helped bring much-needed stability to the nation's foreign exchange rate.

On Monday, the Japanese yen was trading at about 107 to the U.S. dollar.

Kuroda maintained that the central bank was "making steady progress toward the inflation target." But consumer inflation, excluding volatile fresh food prices, stood at just 1% in February.

The governor's efforts will likely face more challenges ahead. In the near term, the market is concerned about a flare-up of a trade war between the United States and China.

Next year, the nation's sales tax rate will finally be raised to 10% from 8% after two postponements, potentially putting a damper on private consumption. In 2020, the economy is expected to cool after the nation hosts the summer Olympics.

However, Kuroda played down such concerns. According to him, the sales tax increase of 2 percentage points should not produce as big a drag on the economy as it did in 2014, when the tax rate was increased by 3 percentage points to 8%. Consumer necessities, such as food, will also be exempted from the next tax increase, he noted.

He predicted that private-sector investment would pick up the slack in public-sector investment, which has been running high as preparations are made for the Olympics.

Earlier on Monday, Prime Minister Abe met with Kuroda and asked him to "mobilize all policy tools available" to lift the country out of its decades-long deflation. Kuroda responded by promising to "make maximum efforts."

Kuroda said that Abe made no specific policy requests during their meeting.

Bank of Japan overtakes foreign investors as top buyer of stocks

Central bank accounts for highest net purchases in Abenomics era

Mio Tomita, Nikkei Staff Writer April 06, 2018 06:37 JST

The Bank of Japan, headquarters above, has become a major support for Tokyo Stock Exchange equities. (Photo by Kaisuke Ota)

The Bank of Japan, headquarters above, has become a major support for Tokyo Stock Exchange equities. (Photo by Kaisuke Ota)

TOKYO -- The Bank of Japan has surpassed overseas investors to become the largest net buyer of Japanese stocks since the launch of Abenomics in late 2012, suggesting the market's heavy dependence on the central bank.

Foreigners bought about 12 trillion yen ($111 billion at current rates) more in Japanese stocks than they sold between November 2012 and the end of March 2018, according to Tokyo Stock Exchange operator Japan Exchange Group. The BOJ purchased about 18 trillion yen in exchange-traded funds over this period, central bank data shows.

The stock market rally under Abenomics, the signature economic program of Prime Minister Shinzo Abe, was initially driven by bullish overseas investors. But they began pulling back in mid-2015, with net stock purchases since November 2012 peaking at more than 20 trillion yen that May. Net sales by foreign investors came to 625.5 billion yen last fiscal year.

Japanese stocks look like a relative bargain, said Emmanuel Bourdeix, CEO of Seeyond, part of the Natixis group, based in France. But fears of a global economic slowdown and uncertainty about the pace of U.S. interest rate hikes have spurred a sharp drop in overall stock weightings, he said.

Japan's stock market is heavy on exporters, which tend to be sensitive to global economic conditions. Concern that the yen's continued strength against the dollar will weigh on previously strong corporate earnings has fueled the outflow of foreign capital. And recent scandals have shaken the faith in the stability of Abe's government that had underpinned the Abenomics rally, prompting hedge funds to turn instead to emerging markets and elsewhere.

The BOJ, which buys exchange-traded funds as part of its campaign to lift inflation to 2%, is filling the void. Its annual purchases have risen gradually from 1 trillion yen in 2013, just after the start of its massive monetary easing program, to a record 6.17 trillion yen in fiscal 2017. The central bank's ETF holdings stood at an estimated 24 trillion yen at fiscal year-end based on current market value -- nearly 4% of the total market capitalization of Japanese stocks.

Since the BOJ tends to buy on dips, it is unlikely to do much to drive share prices higher. Rekindled interest among foreign investors, who account for the majority of trading, will be needed to bring back real upward momentum.

Some overseas market players with long time horizons see promise in Japanese stocks. Daniel Farley, chief investment officer of the investment solutions group at State Street Global Advisors in the U.S., expects monetary easing to continue and corporate governance to improve. A softer yen may also lure back foreign money on hopes of renewed earnings growth.

BOJ Gov. Haruhiko Kuroda has stressed that the ETF purchases have played a major role in bolstering the economy and inflation. But the stock market's growing reliance on central bank activity has some analysts worried about pricing distortions.

** Libor Hurting Japan’s Appetite for Foreign Assets as Costs Rise **

Libor Hurting Japan’s Appetite for Foreign Assets as Costs Rise

By Chikako Mogi and Takako Taniguchi

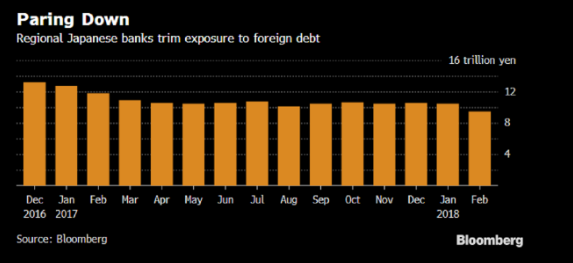

(Bloomberg) -- The ripple effects from Libor’s surge have

traveled as far as regional Japan.

As the benchmark for U.S. borrowing costs climbs, it

becomes more expensive to hedge dollar-denominated investments

back into yen. That’s prompted the country’s regional banks to

reduce overseas holdings to the lowest in more than three years,

even as another element of their hedging costs - the cross-

currency basis - moves in their favor.

The higher hedging costs, a re-ignition of bullish

sentiment toward the yen and increased scrutiny from the

Financial Services Agency have prompted a reassessment,

according to three money managers at the lenders who asked not

to be identified in discussing investment strategies.

Foreign securities, mostly bonds with some stocks, held by

the lenders shrank more than 9 percent in February to 9.5

trillion yen ($89 billion), the lowest since November 2014,

according to the Bank of Japan. The drop is more than double the

4 percent decline in holdings by larger banks.

The selling may continue, analysts and other fund managers

said.

“Regional banks probably cut losses before the fiscal year-

end as hedged-foreign debt holdings clearly became costlier and

weren’t paying off,” said Shinji Kunibe, general manager and

head of fixed-income at Daiwa SB Investments Ltd. in Tokyo.

“Many factors are driving up funding costs, particularly in the

U.S. Selling in March may even be bigger.”

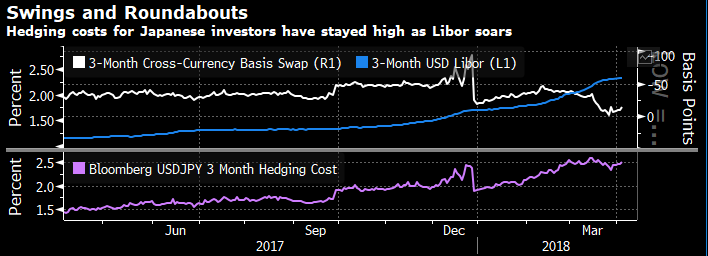

The cost for a Japanese investor to purchase U.S.

securities and hedge the currency risk is a function of short-

term interest rates for the dollar and yen, as well as the

cross-currency basis. The basis has narrowed about 10 basis

points so far this year, lowering the cost for investors to

hedge.

However, Libor has soared by over 60 basis points,

offsetting the benefit. The cost to hedge dollar-yen currency

risk has risen from 1.90 percent to 2.46 percent in 2018,

according to data compiled by Bloomberg.

While the possibility of purchasing the securities unhedged

to avoid the increased costs may be tempting, Japan’s regional

banks now find themselves among the Financial Services Agency’s

strategic “priorities”. The regulator is urging the banks to

step up risk management of foreign debt holdings to help them

withstand losses in the event of a market selloff.

“The rise in volatility makes us more cautious about taking

risks on interest rates,” Kenichi Kawamura, president of Bank of

Yokohama Ltd., told reporters last week.

In addition, a surge in the yen to its highest since 2016

and with the key 100 level against the dollar firmly in its

sights is making investors wary about taking on currency risk.

The yen traded just under 106.60 against the dollar as of 3:20

p.m. Tokyo time Wednesday.

“Until 105 is confirmed as the dollar/yen’s bottom, it’s

hard to expect dollar buying to emerge,” said Akio Kato, general

manager of trading at Mitsubishi UFJ Kokusai Asset Management

Co. in Tokyo. “The surge in Libor highlights hedging cost

concerns and makes currency-hedged investment difficult.”

Regional banks account for about a fifth of foreign

securities held by the whole banking category, the Bank of Japan

data showed. Most of their holdings are in U.S. debt.

U.S. protectionism has added to upside risk for the yen and

that saps the incentive to invest without currency hedging, said

the money managers. Because of this, European bonds are a better

alternative from a funding aspect, they said. There is also

potential investment opportunities in markets where volatility

is expected to rise, such as equities or equity-linked products,

they added.

Whatever one’s view on risk, last year’s allocation style

based around an assumption of moderate yen weakness has to be

scrapped, according to Tadashi Matsukawa, head of fixed-income

investment at PineBridge Investments Japan.

“Investors might have to plan based on a higher yen/weaker

dollar scenario, which brings us back to the issue of hedging

costs,” he said.

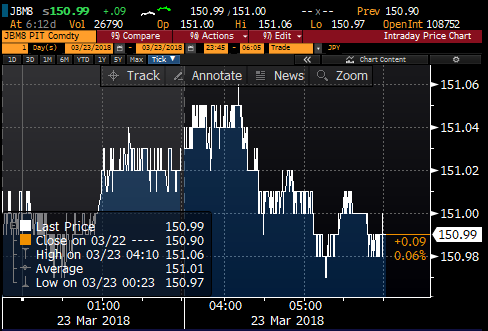

Daily Japan - 23rd March 2018

Summary:

Jgbs finish the day stronger (+9sen) and the curve flattener, with outperformance of swaps, whilst Nikkei collapses 1000pts (-4.5%) closing just 350pts off the domestic investors key September Book closing levels as markets react to Trump announcement that the US will impose Trade tariffs on China!

With $/Yen trading at 104.80, a level not seen since 2016 and some investors suggesting that now 100.00 is in sight, positions in unhedged foreign bond portfolios are looking ugly and with the recent correction in equities one has to question whether there is enough profit to off-set against these potential losses with only 1 week to go before year end.

MoF weekly flow of funds data indicates that domestic investors have been selling equities whilst increasing foreign bond investments. (Unfortunately break down of sectors and whether hedged/unhedged is not yet available)

National Core CPI halfway to BoJ’s target of 2% printing at 1%(yoy) for Febuary suggesting that Kuroda and his team still have a lot to do, and with FX moving back to 2016 level it will not be helpful.

We have had various officials over the last 2 days stating that the BoJ can Not Buy Foreign Bonds to weaken the Yen which is the start of another round of FX Verbal intervention in my opinion.

*ASO:BOJ BUYING FOREIGN BONDS SEEN AS FX INTERVENTION,SO IS HARD

What to do as a Japanese investors in this low domestic yield environment when the JPY continues to appreciate and equities look weak is starting to become very difficult.

EGB hedged back into JPY still seem to represent the best investment although no doubt some will see the USD weakness as a long term buying opportunity.

No doubt some funds will be re-invested into ever stable low yielding Jgbs but does that make long term sense?

More to be revealed on that front in the next few weeks as Life Insurance companies start to publish their investment plans for next fiscal year.

Jscc/Lch basis: unchanged curve.

Daily Closes:

|

Jgb Close |

Change on day |

High |

Low |

||||

|

150.99 |

+9 |

151.06 |

150.97 |

||||

|

|

|

|

|

|

|

||

|

Jgb |

Change on day |

Swaps Jscc |

Change on day |

||||

|

2yrs |

-0.16 |

unch |

0.0425 |

-0.375 |

|||

|

5yrs |

-0.125 |

-1 |

0.09 |

-0.625 |

|||

|

7yrs |

-0.08 |

-1 |

0.14125 |

-0.75 |

|||

|

10yrs |

0.015 |

-2 |

0.23625 |

-1 |

|||

|

20yrs |

0.515 |

-2 |

0.5825 |

-1.875 |

|||

|

30yrs |

0.735 |

-1.5 |

0.765 |

-2.375 |

|||

|

40yrs |

0.88 |

-1.5 |

0.85 |

-2.625 |

|||

|

|

Daily JGBs & Nikkei graphs:

MoF Flows of Funds Data:

- Japanese investors bought 853.8b yen ($8.1b) in overseas bonds and notes

- Japanese investors sold 386.1b yen in overseas stocks

- Foreign investors sold 352.3b yen in Japanese bonds

- Foreign investors sold 1.2t yen in Japanese stocks

Supply next 5 days:

- 27th of March – 40yrs auction

- 28th of March – 2years auction

BoJ Rinbans next 5 days:

- 28th of March - 10-25yrs & 25yrs+

- 30th of March - 1-3yrs, 3-5yrs & 5-10yrs

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Jean-Francois Lucas

O: +44 (0) 203 - 143 - 4175

M: +44 (0) 7493 026514

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Jean-Francois Lucas. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Daily Japan - 22nd March 2018

Summary:

Another particularly dull day in fixed income in Japan with Jgbs closing slightly higher(+3sen) after yesterday’s Bank Holiday whilst Nikkei plays catch up and rallies +211pts(+1%) despite the stronger JPY following the FOMC signalling just another 2 rate hikes during 2018, although it was a very close call.

Only 6 business days left before financial year end making cash flows very subdued with swaps outperforming in a bullish flattening trend.

Cross currency basis has snapped in over 10bps in the last 24hrs with a large Japanese securities firm speculating that a domestic investor liquidated a large USD position and repatriated funds home therefore needing to pay the basis.

With the attractiveness of EGBs yields hedged back into JPY and USTs outright compared to JGBs I continue to expect to see domestic investor shift into foreign bonds as soon as we start the new fiscal year especially with any risks that FED’s Powell would be very hawkish having faded.

10yrs Bunds back into JPY yielding 0.84%

10yrs OATs back into JPy yielding 1.075%

10yrs USTs unhedged yielding 2.86%

Compared to 20yrs JGBs yielding 54bps!

Being SHORT Jgbs into the start of the new fiscal year is starting to make sense to me and I would favour the 20yrs point which I believe is still a sector that some of the Mega Banks hold and have some unrealised PNL which could be realised early on into April.

Jscc/Lch basis: unchanged curve.

Daily Closes:

|

Jgb Close |

Change on day |

High |

Low |

||||

|

150.90 |

+3 |

150.95 |

150.87 |

||||

|

|

|

|

|

|

|

||

|

Jgb |

Change on day |

Swaps Jscc |

Change on day |

||||

|

2yrs |

-0.16 |

-0.5 |

0.04625 |

unch |

|||

|

5yrs |

-0.115 |

unch |

0.09625 |

-0.375 |

|||

|

7yrs |

-0.065 |

unch |

0.14875 |

-0.625 |

|||

|

10yrs |

0.035 |

umch |

0.24625 |

-0.875 |

|||

|

20yrs |

0.535 |

+0.5 |

0.6125 |

-1 |

|||

|

30yrs |

0.75 |

unch |

0.79 |

-1 |

|||

|

40yrs |

0.895 |

unch |

0.8775 |

-1 |

|||

|

|

Daily JGBs & Nikkei graphs:

Press News:

- Japan firms see no BOJ tightening until 2019 or beyond 2020 - Reuters poll

https://uk.finance.yahoo.com/news/japan-firms-see-no-boj-tightening-until-2019-231148971--business.html

Supply next 5 days:

- 27th of March – 40yrs auction

- 28th of March – 2years auction

BoJ Rinbans next 5 days:

- 23rd of March - 1-3yrs & 3-5yrs

- 28th of March - 10-25yrs & 25yrs+

- 30th of March - 1-3yrs, 3-5yrs & 5-10yrs

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Jean-Francois Lucas

O: +44 (0) 203 - 143 - 4175

M: +44 (0) 7493 026514

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Jean-Francois Lucas. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Japan: LDP policy chief - BOJ should consider exit strategy from stimulus

Whilst I would generally take such comments with a pinch of salt they are worth noting as Kishida, the LDP policy chief, is a strong contender to succeed Prime Minister Abe as the next leader of the LDP. Any further fall out from the current "school scandal" could see him being propelled to power.

LDP policy chief - BOJ should consider exit strategy from stimulus: NHK

2018-03-21 10:07:15.329 GMT

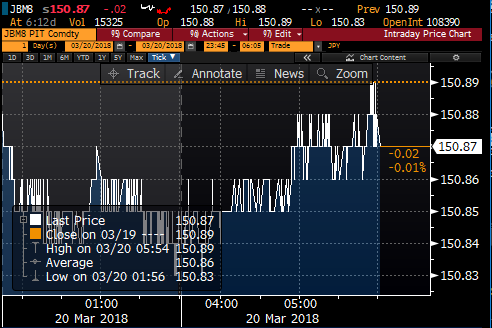

Daily Japan - 20th March 2018

Summary:

Another lacklustre day in Jgbland with futures trading in a 6sen range on only 15k contracts. We are 7 business days away from the new fiscal year and its fair to assume all the end of f/year booking keeping has now been done!

With FED’s Powell holding his first 2 days meeting(results expected 21/03 at 6pm) and a Bank Holiday tomorrow in Tokyo these were further reasons for investors to play the ‘wait & see’ game.

Today’s liquidity auction targeting 15.5-40yrs went and gone with not much follow thru’. With another 4 sets of Rinbans over 7 business days likely to be supportive to the market against that we only the 40yrs auction on the 27th to be a bit of a challenge although lack of inventory in that sector should be supportive. Net net don’t expect Jgbs to drift very far from these levels before books close completely.

I’m still of the opinion that early April should start to see some liquidating of Jgbs to realise some profits early on in the New f/year by Mega Banks with some proceeds being parked back into unhedged USTs whilst $/Y remains around these levels but also into EGBs hedged back into JPY which yield significantly more than any JGBs across the whole curve.

The Political “School scandal” is unlikely to go away in a rush but at the moment despite plunge in his popularity ratings Abe continues to deny any involvement or influence. One should keep a close ear to the ground on this topic as the demise of Abe could potentially mean the end of the Kuroda regime.

Jscc/Lch basis: more or less unchanged across the curve with very small steepening of the curve.

Daily Closes:

|

Jgb Close |

Change on day |

High |

Low |

||||

|

150.87 |

-2 |

150.89 |

150.83 |

||||

|

|

|

|

|

|

|

||

|

Jgb |

Change on day |

Swaps Jscc |

Change on day |

||||

|

2yrs |

-0.16 |

-0.5 |

0.04625 |

-0.125 |

|||

|

5yrs |

-0.115 |

unch |

0.10125 |

-0.125 |

|||

|

7yrs |

-0.065 |

unch |

0.15625 |

unch |

|||

|

10yrs |

0.035 |

umch |

0.2550 |

-0.125 |

|||

|

20yrs |

0.535 |

+0.5 |

0.6225 |

-0.25 |

|||

|

30yrs |

0.75 |

unch |

0.80 |

-0.25 |

|||

|

40yrs |

0.895 |

unch |

0.8875 |

-0.25 |

|||

|

|

Daily JGBs & Nikkei graphs:

Supply next 5 days:

- 22nd of March – 3mth Tbill auction

- 27th of March – 40yrs auction

- 28th of March – 2years auction

BoJ Rinbans next 5 days:

- 22nd of March - 5-10yrs, 10-25yrs & 25yrs+

- 23rd of March - 1-3yrs & 3-5yrs

- 28th of March - 10-25yrs & 25yrs+

- 30th of March - 1-3yrs, 3-5yrs & 5-10yrs

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Jean-Francois Lucas

O: +44 (0) 203 - 143 - 4175

M: +44 (0) 7493 026514

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Jean-Francois Lucas. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796