Daily Japan - 15th March 2018

Summary:

Another lacklustre day in JGBs despite the last 20years auction of the fiscal year which went well, averaging 0.543% and a btc of 4.47 times, the lowest yield since November 2016. This had a small flattening impact on the curve with 20yrs still being the best carry & roll point on the curve outperforming.

Currently no further fall out from the political ‘School’ scandal (heavily discounted sale of public land to an Abe family acquaintance) although Minister of Finance ASO is not expected to attend the G20 meeting on the 19/20th as people call for his head. At the moment everybody is focusing on the Ministry of Finance which is accused of doctoring documents and if ASO needs to fall on his sword the knives will then quickly turn on ABE which could prove to be the start of something much bigger.

Worth a mention was the large buying of Foreign Bonds by Japanese investors in the last week. I assume a combination of $/Y trading round 105.50 and 10yrs USTs @ 2.90% must have been the catalyst for some ‘unhedged buying’ as the ‘cost of funding USD purchases’ is still prohibitively high.

With the end of the fiscal year only 2weeks away we need to start thinking what domestic investors are likely to be looking to do in April. Traditionally they are large sellers of JGBs to realise profits early for the new f/year and whilst I don’t think they are sitting on huge amounts of pnl on their JGB portfolios I do think this trend will continue.

Investing in EGBs will most probably be high on their list as well (hedged and unhedged) whilst any investments in USTs is most likely to be on an unhedged basis due to continuous high hedging cost as the FED continues to push rates higher.

Please see below how much more attractive it is for a domestic investor to buy hedged Bunds & Oats compared to hedged USTs.

We are now at yield levels that the whole JGB yield curve yields LESS than 10yrs France hedged back into JPY.

10yrs USTs hedged back into JPY

10yrs Bunds hedged back into JPY

10yrs OATs hedged back into JPY

Jscc/Lch basis: unchanged across the curve.

Daily Closes:

|

Jgb Close |

Change on day |

High |

Low |

||||

|

150.76 |

+9 |

150.77 |

150.69 |

||||

|

|

|

|

|

|

|

||

|

Jgb |

Change on day |

Swaps Jscc |

Change on day |

||||

|

2yrs |

-0.145 |

+0.5 |

0.04875 |

-0.125 |

|||

|

5yrs |

-0.105 |

unch |

0.1075 |

-0.375 |

|||

|

7yrs |

-0.065 |

-0.5 |

0.16375 |

-0.375 |

|||

|

10yrs |

0.04 |

-0.5 |

0.26375 |

-0.5 |

|||

|

20yrs |

0.54 |

-0.5 |

0.63375 |

-0.875 |

|||

|

30yrs |

0.75 |

unch |

0.81125 |

-0.75 |

|||

|

40yrs |

0.895 |

+0.5 |

0.89875 |

-0.75 |

|||

|

|

Daily JGBs & Nikkei graphs:

MoF Flow of funds data:

Big week of buying of foreign bonds by domestic investors!

- Japanese investors bought 1.1t yen ($10.3b) in overseas bonds and notes

- Japanese investors sold 23b yen in overseas stocks

- Foreign investors bought 486b yen in Japanese bonds

- Foreign investors sold 432.5b yen in Japanese stocks

Supply next 5 days:

- 16th of March – 1yr Tbill auction

- 20th of March – Liquidity auction

- 22nd of March – 3mth Tbill auction

BoJ Rinbans next 5 days:

- 16th March – Up to 1year, 10-25yrs & 25yrs+

- 19th March - 1-3yrs, 3-5yrs & 5-10yrs

- 22nd of March - 5-10yrs, 10-25yrs & 25yrs+

- 23rd of March - 1-3yrs & 3-5yrs

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Jean-Francois Lucas

O: +44 (0) 203 - 143 - 4175

M: +44 (0) 7493 026514

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Jean-Francois Lucas. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

'Abexit' fears send chill through Tokyo stock market

Worries over political risk recall 1998 government collapse amid 'lost decade'

Mio Tomita, Nikkei Staff Writer March 14, 2018 06:44 JST

Private school operator Moritomo Gakuen is suspected of having benefited from a sweetheart land deal courtesy of Abe's government to build this elementary school near Osaka. (Photo by Konosuke Urata)

Private school operator Moritomo Gakuen is suspected of having benefited from a sweetheart land deal courtesy of Abe's government to build this elementary school near Osaka. (Photo by Konosuke Urata)

TOKYO -- International investors with long memories fear the scandal engulfing Japan's Finance Ministry threatens the political future of Prime Minister Shinzo Abe, recalling the setback to economic reforms that followed the downfall of a Japanese government two decades ago.

Kyoya Okazawa at BNP Paribas in Hong Kong has been fielding questions from investors who want to know whether the prime minister might have to resign in an "Abexit," and how such turmoil would affect the government's nomination of Haruhiko Kuroda for a second term as Bank of Japan governor.

Jesper Koll at WisdomTree Japan has been similarly inundated by phone calls since the end of last week.

The Nikkei Stock Average gained 0.6% Tuesday to close at 21,968. But the yen's recent appreciation and escalating trade frictions between the U.S. and other big economies seem to be keeping Tokyo shares from performing as strongly as their counterparts on Wall Street and elsewhere.

And with the Finance Ministry having admitted to altering documents regarding the sale of state-owned land to private school operator Moritomo Gakuen, more investors are looking to lock in paper gains on Japanese shares soon, Koll said. Questions over the sale have dogged Abe's government, which is suspected of favoring the patriotism-promoting educator, but the latest revelations have put his finance minister, Taro Aso, in what some see as an untenable position.

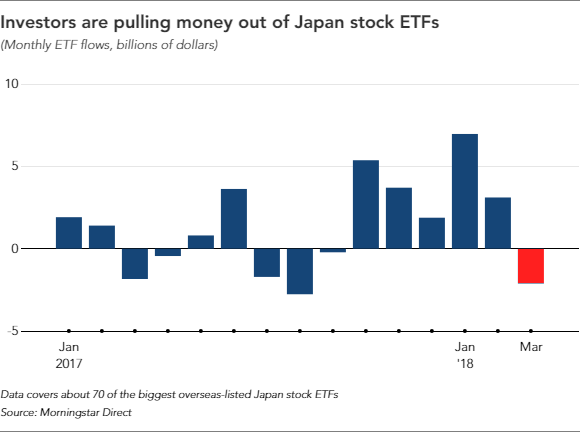

A combined $2.1 billion has flowed out of about 70 Japan-focused exchange-traded stock funds in overseas markets this month, data from fund tracker Morningstar Direct shows.

Investors remember the political upheaval that struck Japan in 1998. A bribery scandal involving wining and dining of Finance Ministry officials at a restaurant employing scantily clad waitresses led to the downfall of then-Prime Minister Ryutaro Hashimoto's government, putting on hold efforts to reform Japan's bureaucracy and clean up bad loans from the bubble era.

Economic stagnation resulted after false assumptions that Japan's financial crisis was over and the economy had entered a period of self-sustaining growth, Koll said, adding that many investors worry history will repeat itself.

"The main reason investors have held out hope for Abenomics is that the government, the Finance Ministry and the BOJ have worked in sync on policy," BNP Paribas' Okazawa said, referring to Abe's pro-growth policies.

After 1998, Japanese fiscal and monetary policy were out of step, and the country failed to overcome deflation. In light of this, "investors with deeper understanding of Japan are less likely to bet on an optimistic scenario" now, Okazawa said.

Japanese companies and financial institutions are in robust health today, unlike 20 years ago, making any political turmoil unlikely to produce a swift economic slump. But with a rising yen and trade disputes creating uncertainty for the economy, investors "are prone to shed Japanese equity risk in reaction to negative news," Shinichi Ichikawa of Credit Suisse Securities said.

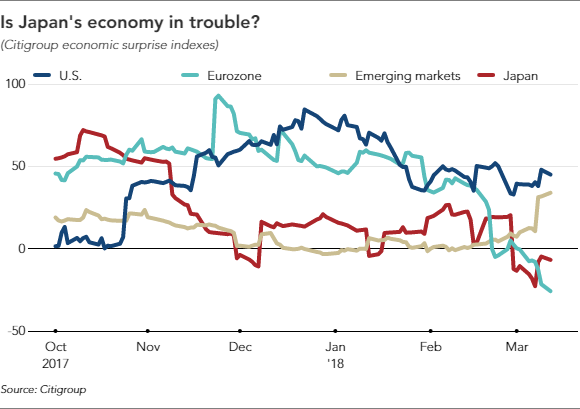

Citigroup's economic surprise index, a barometer of how data over the past three months compared with market expectations, shows that Japan's fundamentals are falling short of analyst projections.

"Until the excessively high hopes are corrected, the stock market is unlikely to have a full-fledged rebound," Ryota Sakagami of JPMorgan Securities said.

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Jean-Francois Lucas

O: +44 (0) 203 - 143 - 4175

M: +44 (0) 7493 026514

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Jean-Francois Lucas. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Kuroda recommits to stimulus in long struggle with deflation

Breaking mindset on prices is no easy task, BOJ chief warns ahead of second term

Nikkei Staff Writers March 10, 2018 06:17 JST

Bank of Japan Gov. Haruhiko Kuroda at a news conference at the bank's headquarters in Tokyo on March 9. (Photo by Akira Kodaka)

Bank of Japan Gov. Haruhiko Kuroda at a news conference at the bank's headquarters in Tokyo on March 9. (Photo by Akira Kodaka)

TOKYO -- Bank of Japan Gov. Haruhiko Kuroda reaffirmed his commitment again Friday to the central bank's easy-money policy as he nears the end of his first term without achieving his goal of 2% inflation.

Kuroda gave a news conference after the BOJ policy board, at the last meeting of the current leadership, voted to maintain current stimulus policies. He has been asked by the government to serve a second five-year term, starting in April, with two new deputy governors.

"Dispelling the deflationary mindset is taking time, and this is why we have been unable to realize the 2% price stability target," Kuroda told reporters at the bank's headquarters in Tokyo.

Several factors hit Japan that stifled a rise in prices during Kuroda's first term, from plunges in crude oil prices to the hiking of the consumption tax rate to 8% in 2014. But he cited consumer sentiment as an even greater force. Seemingly endless deflation has kept consumers from even imagining higher prices, and that attitude is preventing prices from rising in reality, he believes.

Breaking such a mindset is taking longer than Kuroda expected, and the BOJ has decided to keep stimulus measures in place for the long haul. The central bank initially bolstered its Japanese government bond purchase program and took other quantitative easing steps. But facing speculation about the limitations of the bond-buying program, the bank introduced a policy overhaul with yield-curve control in September 2016. That was "an important change," Kuroda said Friday, while pledging to "persistently continue with easing."ee also

The BOJ believes that, if it keeps the current extremely loose monetary policy in place, prices will eventually rise 2%. The gap between the Japanese economy's demand and its potential supply capabilities has improved, Kuroda pointed out, noting that businesses have started raising wages and prices more seriously. This will lead to a 2% inflation rate by around fiscal 2019, he predicted.

"We see no changes to the economy's strong fundamentals," he said.

Financial markets saw an exodus from risky assets in February, depressing stocks around the world. But the Japanese economy's foundation remains solid, Kuroda said, describing corporate earnings outlooks as "robust." Asked about the yen's possible rise in light of the U.S. administration's protectionist moves, the governor said he does not expect "protectionism to spread globally."

Looking ahead to his second term, Kuroda emphasized the central bank's commitment to its easy-money policy. "This is not the time to have any concrete debate on an exit," he said.

If there is speculation that the BOJ might be moving to normalize its policy, the yen might keep strengthening, squeezing profits at exporters. Earnings deterioration probably would discourage employers from raising wages, further stalling any inflation trend. "If the momentum [for inflation] is not maintained, we'll consider additional easing," Kuroda said.

Waseda University professor Masazumi Wakatabe is an outspoken proponent of aggressive monetary easing.

Waseda University professor Masazumi Wakatabe is an outspoken proponent of aggressive monetary easing.

At the same time, however, the longer the BOJ keeps its loose policy, the more it is expected to pay attention to the policy's side effects, including a profit squeeze at financial institutions. While shooting down speculation about normalization, Kuroda suggested that tweaking its policy of guiding short-term interest rates to minus 0.1% and long rates around 0% might be an option separate from a debate on an exit. Lifting the nominal interest rate if the inflationary trend picks up "would be theoretically possible," he stated, leaving wiggle room for a policy adjustment.

Kuroda is to begin his second five-year term April 9, assuming the Diet approves his reappointment. To replace Deputy Governors Hiroshi Nakaso and Kikuo Iwata, the government has nominated Waseda University professor Masazumi Wakatabe and BOJ Executive Director Masayoshi Amamiya.

Wakatabe, an outspoken reflationist, told a parliamentary committee at his confirmation hearing that further easing was an option. But such a path is risky given the likely side effects. This means the Kuroda-led BOJ cannot afford to either scale down or expand its stimulus program -- and thus is entering its second five-year term with few options on the table.

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Jean-Francois Lucas

O: +44 (0) 203 - 143 - 4175

M: +44 (0) 7493 026514

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Jean-Francois Lucas. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Japan's FSA finds regional banks incurred losses on foreign bond investments -source - Reuters News

Japan's FSA finds regional banks incurred losses on foreign bond investments -source - Reuters News 20-Feb-2018 15:31:43 TOKYO, Feb 20 (Reuters) - Around 20 of Japan's regional banks lost money on their foreign bond investments amid the recent jump in U.S. long-term yields, an emergency review conducted by Japan's Financial Services Agency (FSA) showed, a source with direct knowledge of the matter told Reuters. The FSA is expected to ask banks to improve their performance, said the source, who is not authorised to discuss the matter publicly. Squeezed by shrinking local populations and the Bank of Japan's negative interest rate policy, many of these smaller banks have managed to stay in the black thanks to securities trading. However, their bond investments have taken a hit, and there are worries these banks could face more trouble ahead. The FSA has fretted for some time about the long-term health of regional banks, which hold about half the country's $4 trillion in outstanding bank loans. Over half of Japan's 100 or so regional banks lost money on their core lending and fees businesses in the year to March 2017, with profits falling faster than expected. (Full Story) The FSA conducted a similar investigation when U.S. yields rose after Donald Trump was elected president in 2016, and ordered some regional banks to improve their performance. U.S. Treasury yields have surged this year, with those of the benchmark 10-year note US10YT=RR rising to its highest in four years, on expectations the Federal Reserve could raise interest rates more than expected this year. The 20 or so banks the FSA inspected recently were the ones it singled out during its 2016 review as needing improvement. Finance Minister Taro Aso told a regular news conference on Tuesday that while some regional banks have incurred capital losses on their foreign bond investments, it has not reached a dangerous level.

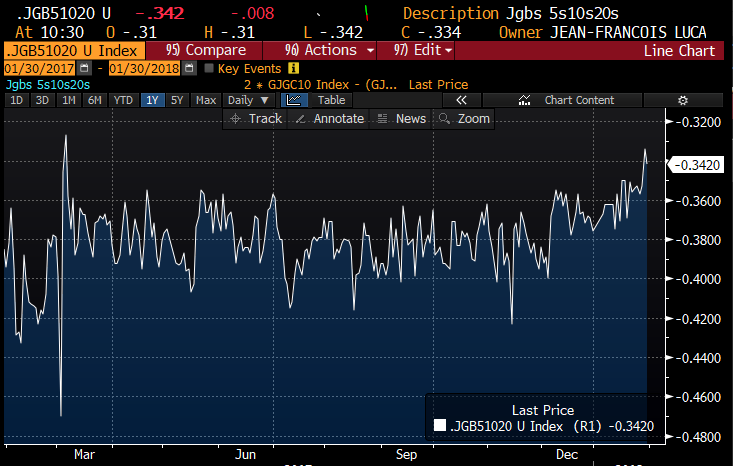

JGB TRADE IDEA; Buy belly of the 5s10s20s cash fly

Rational:

We are of the view that the BoJ is not in the process of tapering or changing its monetary policy any time soon.

CPI is still way off its 2% target.

Why take the risk when wages are not increasing and we will have another stab in the heart of inflation with Consumption Tax hike next year!?

Recent USD/JPY will not be supportive in attaining that CPI target soon either.

A small ‘fine tuning’ of its long end Rinbans early January had impact of moving USD/JPY 3%, can you imagine the damage to JGB holdings and Nikkei if real speculation of end of QE was in motion!

Japanese MoF was on wires overnight talking down Kuroda’s comments of 2% CPI being ‘close’ suggesting he was ‘taken out of context’.

Entry level -34bps

Target -38bps

Add -32bps

Reminder that BoJ’s current monetary policy is to target 10yrs yields between 0-10bps.

Each time we have seen 10yrs Jgbs move to 11bps it has conducted an “unlimited buying operation” preventing 10yrs yields to move higher.

We have a 10yrs auction on the 1st of Feb which will be a good opportunity for dealers and investors alike to pick up some 10yrs paper as close to 10bps as possible.

Jgb349 is trading -35bps on repo whilst 5s and 20s are GC.

Trade carries/rolls positively by 2.5bps for 6mths.

Fly has moved into the upper range of 1year range.

10yrs yields seems to have decorrelated from USD/JPY

Whilst traditionally, I have always favoured the 20yrs point of the JGB curve with its generous carry & roll, with it trading sub 60bps and with the steep JSCC/LCH curve (10bps in 20yrs) we have noted some 20yrs ASW profit taking which should also put pressure on 20yrs cash. Also as mentioned above the 10yrs point has cheapen enough for the fly to carry & roll positively.

Risk Scenario:

BoJ’s Kuroda is not re-appointed at Governor

BoJ continues its fine tuning of Rinbans and ends up spooking market.

PLEASE NOTE that fine tuning can be decided by the BoJ’s Daily Monitoring Team BUT a lifting of the FLOOR can ONLY be decided by the Board of the BoJ (next meeting 9th of March)

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Jean-Francois Lucas

O: +44 (0) 203 - 143 - 4175

M: +44 (0) 7493 026514

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Jean-Francois Lucas. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Daily Japan - 20th February 2018

Summary:

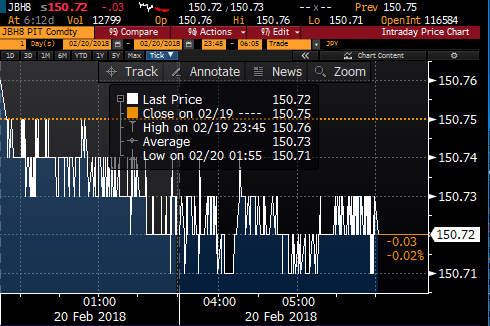

Quiet and dull day in low volumes for Jgbs closing 3sen weaker with Liquidity auction being a non-event.

Further to yesterday decent 428pts rally Nikkei lost 1% on profit taking.

Expect this trend to continue into any rally as domestics look to lock in profits ahead of F/Y end to offset against foreign bond holdings.

Tomorrow we have the BoJ Rinbans targeting 1-10yrs and all eyes will be on the 5-10yrs bucket and whether the BoJ sticks to its recently Yen450bln increased size or revert back to 410bln. We doubt the latter as with JPY finally coming off its recent highs I doubt BoJ will want to trigger another currency rally as was the case in early January when the long end rinbans had been reduced by as little as 20bln.

In respect to year end activity a story on Reuters suggesting FSA is looking into losses at Regionals (yet again) on foreign bond portfolios

“Japan's FSA finds regional banks incurred losses on foreign bond investments”.

Thursday will be the key event of the week, 20yrs auction, which despite the lowest yield this calendar year should be reasonably well supported as we continue to see buying of the long end from Lifers. The above stories of Regionals incurring losses of foreign bond portfolios will most also be supportive to long end as money gets shifted back home.

This auction will be followed by another long end Rinban and a large month end extension.

Jscc/Lch basis: unchanged across the curve.

Daily Closes:

|

Jgb Close |

Change on day |

High |

Low |

||||

|

150.72 |

-3 |

150.76 |

150.71 |

||||

|

|

|

|

|

|

|

||

|

Jgb |

Change on day |

Swaps Jscc |

Change on day |

||||

|

2yrs |

-0.155 |

unch |

0.0525 |

+0.125 |

|||

|

5yrs |

-0.10 |

unch |

0.1225 |

+0.125 |

|||

|

7yrs |

-0.04 |

+0.5 |

0.1850 |

+0.25 |

|||

|

10yrs |

0.06 |

+0.5 |

0.28875 |

+0.25 |

|||

|

20yrs |

0.565 |

+0.5 |

0.6550 |

+0.375 |

|||

|

30yrs |

0.785 |

unch |

0.83 |

+0.125 |

|||

|

40yrs |

0.92 |

unch |

0.9225 |

+0.125 |

|||

|

|

Daily JGBs & Nikkei graphs:

Supply next 5 days:

- 22nd February – 3mths Tbill auction

- 22nd February – 20yrs auction

BoJ Rinbans next 5 days:

- 21st February - 1-3yrs, 3-5yrs and 5-10yrs

- 23rd February - 1-3yrs, 3-5yrs, 10-25yrs & 25yrs+

- 26th February - 5-10yrs

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Jean-Francois Lucas

O: +44 (0) 203 - 143 - 4175

M: +44 (0) 7493 026514

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Jean-Francois Lucas. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796