Trade: EUR tactical zero-cost bear-steepeners on 3y2y/5y5y

Bottom line: For the next month, the risk events for the EUR curve will likely come from internal politics (BREXIT, Italy etc) or global moves (eg US/China trade). In both cases, the ECB is likely side-lined (the next GC meeting is not until 7th March) and the curve should hold the recent bull-flattening/bear-steepening mode as long rates drive. The levels of implied volatility on EUR mid-curves do not yet reflect this, hence it is possible to set zero-cost bear-steepeners (on EUR 3y2y vs 5y5y) which should be well-protected in a continued rally.

Trade:

Sell EUR 500mm 1m3y2y mid-curve payer atmf (k=0.50%)

Buy EUR 205mm 1m5y5y mid-curve payer atmf (k=1.282%)

Net premium take-out of EUR 25k (0.25bp running) mid indic.

Equivalent to EUR 100k/bp of the underlying at expiry

Forward curve strike at 78.2bp vs spot at 78.7bp

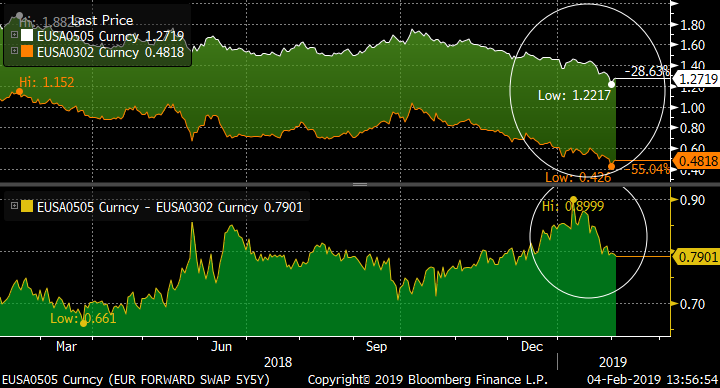

Rationale: I wrote in my last piece (“Regime change? Has the dynamic flipped on the EUR curve”) that the EUR curve has flipped almost seamlessly between bull-steepening and bull-flattening as the market rapidly re-assessed the prospects for ECB rate action. The chart shows the spread of the 3y2y and 5y5y forward rates. In the last month, the curve mode has been clear: the curve has flattened sharply as rates have headed lower.

This trade is a tactical position for a near-term sell-off (coming for example from a US-China trade accord) sending medium-term rates higher, while the outlook for the ECB is unchanged. Usually the relative implied volatility levels on mid-curves mirror the directionality of the curve, but currently the implied vol on 3y2y tails is higher than on 5y5y. Hence it is possible to construct zero/negative cost bear-steepeners. Should the recent curve mode be validated, one would expect the relative volatilities to adjust to reflect this.

Using mid-curve payers eliminates losses if both 3y2y and 5y5y rates rally. The ATMF strikes on both forwards are 2bp and 1.5bp higher than spot on 3y2y and 5y5y respectively, making the trade marginally positive carry/roll by 0.5bp over the 1m term.

The risk comes from the possibility of a flip back to a bear-flattening dynamic. However a 1m horizon today would expire just before the next ECB meeting on 7th March, which reduces the scope for the ECB to regain its driving seat on the curve (unless the minutes of the Jan meeting reveal a surprise hawkish element, which was not evident from the press conference or statement).

So, what do you think?

Best

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Regime change? Has the dynamic flipped on the EUR curve ...

Bottom line: I’m going to advance the case that the ECB is missing the boat on significant rate hikes (beyond getting the deposit rate to flat). The European economy is facing multiple domestic and global challenges, and the sharp repricing of the FOMC curve is further constricting the ECB’s room for manoeuvre. My view is that there is now an asymmetry in the outlook that strongly favours continued flattening of the EUR curve. On the same theme, the volatility on long tails (eg 10y20y) has been suppressed and should outperform.

Trade 1: EUR 1x2 Floor spread on 30-2

Buy EUR 1bn 1y SL cap on CMS 30-2 atmf (k=134bp)

Sell EUR 2bn 1y SL cap on CMS 30-2 atmf-20bp (k=114bp)

for an upfront premium of 2bp.

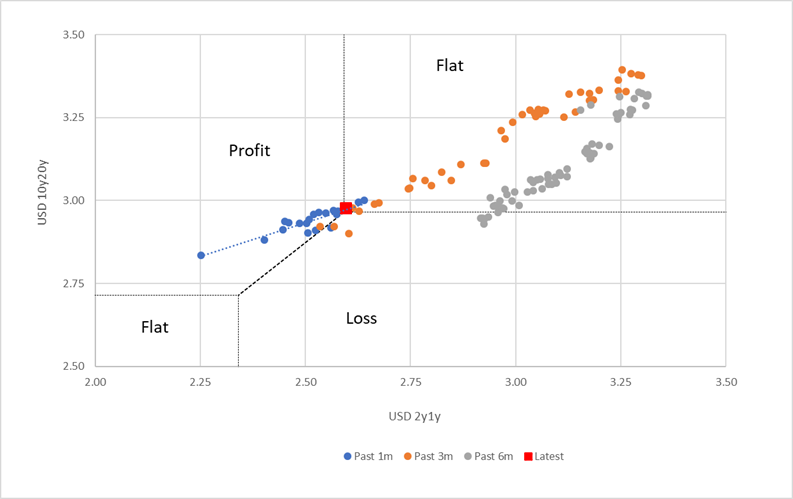

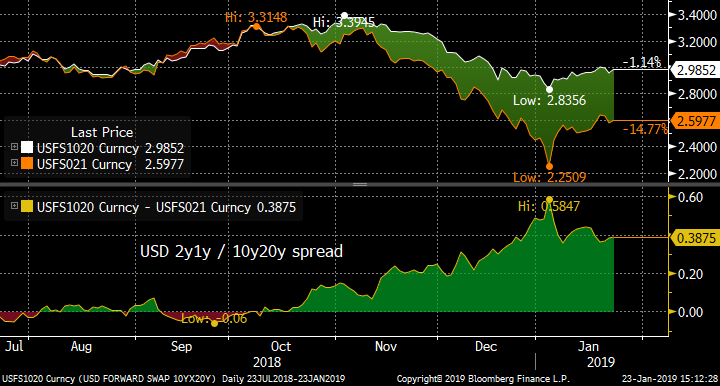

Trade 2: Buy Vol on EUR 10y20y vs 2y1y

Sell EUR 994mm 1y expiry mid-curve straddles on 2y1y atmf (k=0.364%)

Buy EUR 69mm 1y expiry mid-curve straddles on 10y20y atmf (k=1.602%)

For zero cost, delta-hedged

Equivalent to 100k/bp on 2y1y vs 110k/bp on 10y20y

(or DV01 neutral weighting for a premium take out of 3.3bp)

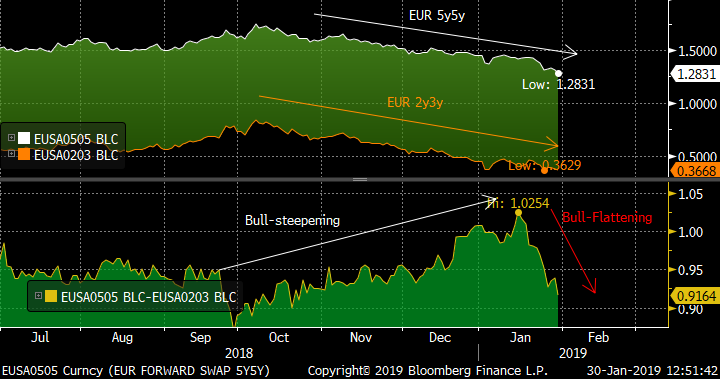

Rationale: At the start of the year I published a trade idea suggesting EUR 2y3y vs 5y5y bear-flatteners. In the event this trade has performed in the rally as the flattening has outweighed the fall in rates. However the price action of the last week (following the ECB meeting) has flipped the curve directionality directly from bull-steepening to bull-flattening (without any intervening bear periods). This represents an abrupt shift from the short end driving the curve to the long end making the running.

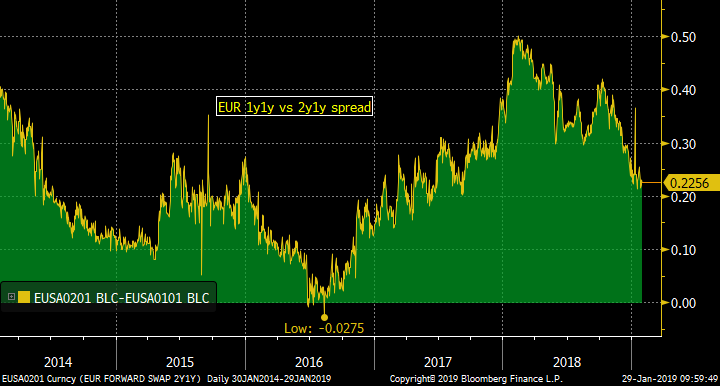

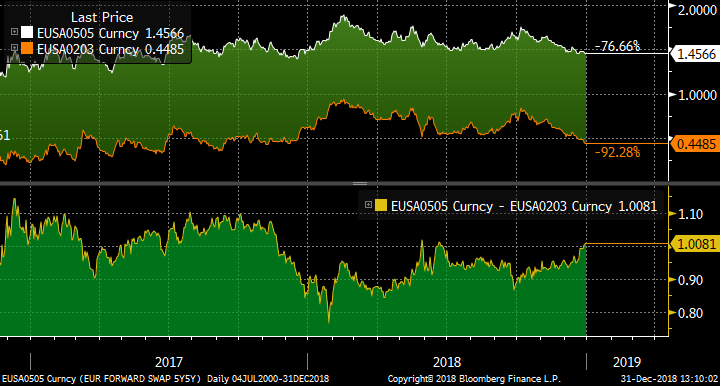

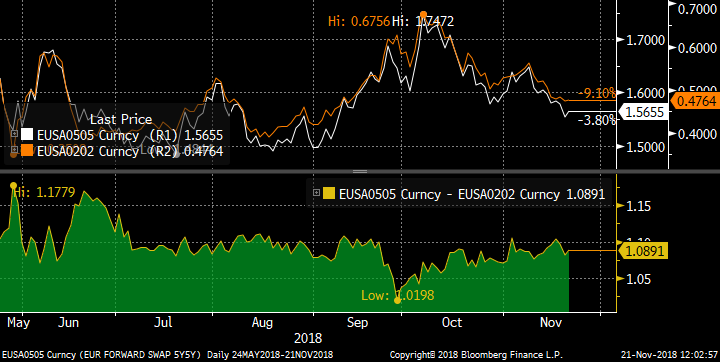

As a barometer of ECB rate hike expectations consider the EUR 1y1y/2y1y curve. The first chart shows that the market’s pricing of an ECB hiking path that peaked in Feb 2018 at 50bp. Subsequently this spread halved to its current value, driven in large part by the reassessment of the prospects for the US Fed and the lacklustre nature of the German economic outlook. Should we see a reversal to neutral sentiment, the short-term move could be a steepening but if the economic picture improves (eg a US-China and US-EU trade deal, and a non-catastrophic BREXIT resolution) then ECB hikes come back onto the table and the classical bear-flattening could resume. This is why I see the prospects for large flattening moves to be significantly better than for steepeners.

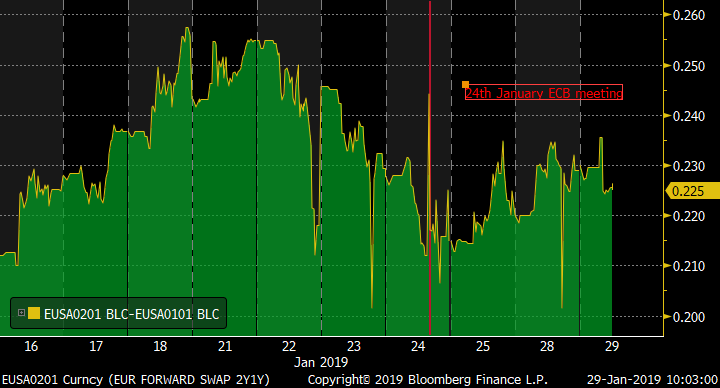

Looking more closely at the last fortnight, I’ve highlighted the recent January ECB meeting. The ECB has for some time had an “Autumn ‘19” timescale for the first hike pencilled into the diary. On the basis of the short-end slope of the curve, it is hard to see any major repricing following the meeting. If anything 2y1y sold off slightly in the aftermath.

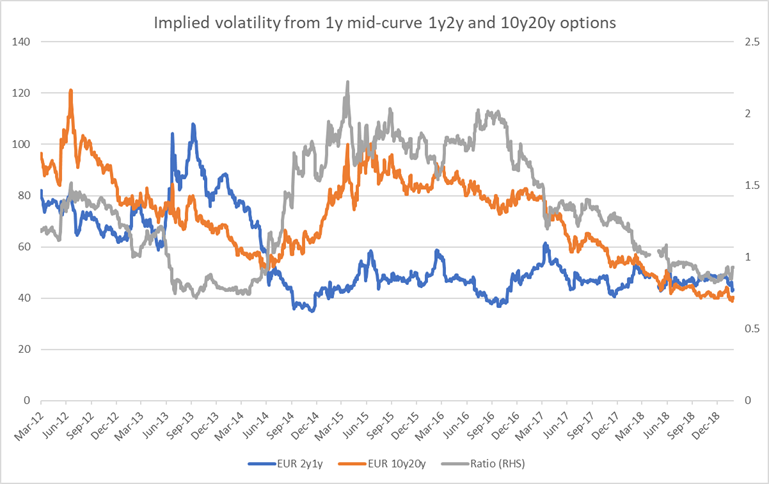

To illustrate how the short-end has been driving the curve in the last two years, this is the history of the market implied vols of 1y mid-curve options on EUR 1y2y and 10y20y forward rates, and the ratio of the two. Since 2017 the implied volatility on 10y20y tails has been falling steadily, while that on 2y1y has remained rangebound. The ratio of the two volatilities is at 0.91 close to the low of the past five years. On this basis, 10y20y vol looks cheap to 2y1y.

Source: CitiVelocity

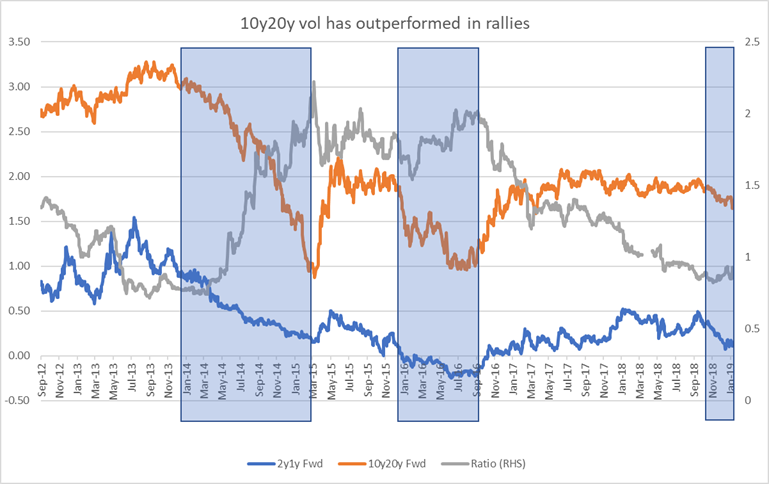

To explore this further, I’ve overlaid the actual forward rates on the ratio of the implied volatilities. I’ve highlighted three periods: the first when the prospect of QE from the ECB went from a possibility to an actuality from Jan 2014 to Feb 2015 and the curve flattened dramatically; the second in Jan-Sep ’16 as long rates rallied but already suppressed depo rate expectations had nowhere to go; and finally the recent situation where short rates have been leading the way, but even so 10y20y vol has begun to outperform 2y1y. Should the European outlook weaken further, the long-end once again has much more scope to rally, especially if speculation grows that QE could be reinvigorated in some form (note that I am not saying that QE would regain the pace of 2016 as Germany simply does not have the paper to buy, but it could return to the 2018 levels).

Source: CitiVelocity

So, in essence I have two trades: flatteners on the EUR curve, and buying of mid-curve gamma on 10y20y vs 2y1y. Taking each in turn:

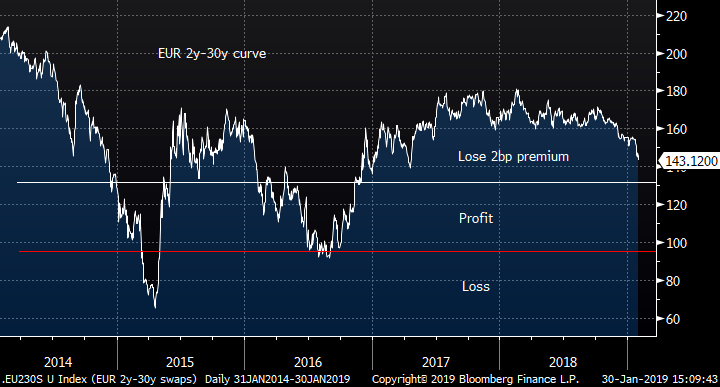

1. EUR flatteners: the issue here is that flatteners like 2y1y/10y20y are painful in terms of negative roll-down (given that the EUR short-rate curve is still upward-sloping). One way to mitigate this is to look at CMS floors on 2y-30y, with a 1y expiry in a 1x2 structure (as the atmf rolls away from the strike, the out-of-the-money option loses value more rapidly than the at-the-money in the first 6 months).

Buy EUR 1bn 1y SL cap on CMS 30-2 atmf (k=134bp)

Sell EUR 2bn 1y SL cap on CMS 30-2 atmf-20bp (k=114bp)

for an upfront premium of 2bp.

The reason to chose the -20bp strike is that the trade makes money in a flattening move if the curve doesn’t flatten through the 2016 low of around 94bp. I am not overly concerned about the 2015 low as that was the limit of the QE effect on the curve, and I don’t see us revisiting that situation (as sovereigns have now adapted by issuing more long-dated paper, taking the opportunity to extend the duration of their debt).

How does the rolldown look? This is how the PV of the structure evolves as we roll down the rate and vol surfaces. The trade has positive net rolldown over the first 6 months, which offsets some of the upfront premium cost. Thereafter the out-the-money leg starts to become valueless so the PV change comes from the negative theta of the atm option.

PV change

Entry 0bp

1m +0.25bp

3m +0.75bp

6m +0.5bp

9m -0.25bp

11m -1.25bp

2. Buying mid-curve vol on 10y20y versus 2y1y. The trade here is to simply:

Sell EUR 994mm 1y expiry mid-curve straddles on 2y1y atmf (k=0.364%)

Buy EUR 69mm 1y expiry mid-curve straddles on 10y20y atmf (k=1.602%)

For zero cost, delta-hedged

Equivalent to 100k/bp on 2y1y vs 110k/bp on 10y20y

(or DV01 neutral weighting for a premium take out of 3.3bp)

There a plenty of ways to skin the cat of this view … so would love to hear your thoughts on alternative expressions!

Best wishes

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Re-send: Trade: Low-cost US bull-STEEPENER (!) via spread of mid-curve receiver spreads on 2y1y/10y20y

Bottom line: The US curve has been set in a bear-flattening / bull-steepening dynamic with the short-end leading the way as all eyes are on the Fed. As a consequence straight bull-flatteners require an upfront premium as the volatility is high on short rates. This trade gives the bull-steepening exposure for a reduced cost by capping the potential upside on a steepening move (as well as discounting the potential for a shift to bull-flattening).

Trades:

6m 25bp-wide version:

Buy USD 1,070mm 6m2y1y mid-curve receiver spread a/a-25 (k=2.593% / 2.343%)

Sell USD 84mm 6m10y20y mid-curve receiver spread a/a-25 (k=2.974% / 2.724%)

For 0.1bp upfront premium (indicative mid)

Fwd curve strike at 38.1bp. Spot spread at 38.4bp

1y 50bp-wide version:

Buy USD 1,070mm 1y2y1y mid-curve receiver spread a/a-50 (k=2.613% / 2.113%)

Sell USD 84mm 1y10y20y mid-curve receiver spread a/a-50 (k=2.964% / 2.464%)

For 0.2bp upfront premium (indicative mid)

Fwd curve strike at 35.1bp. Spot spread at 38.4bp

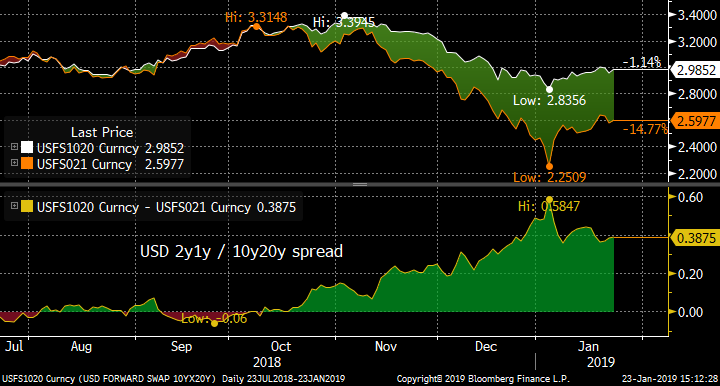

Rationale: For some months, if not years, the USD curve has been driven by Fed expectations, and this is especially true in the rally which started at the end of last year. As a consequence the curve has an established bear-flattening/bull-steepening dynamic. The options markets are not unaware of this, and generally bull-steepeners require an upfront premium. One way to mitigate this cost is to trade off the upside of a significant rally, by using receivers spreads (as well has discounting the chance of bull-flattening). Hence these trades work best in a scenario where 25bp to 50bp are shaved off Fed expectations for the next year, rather than pricing in cuts.

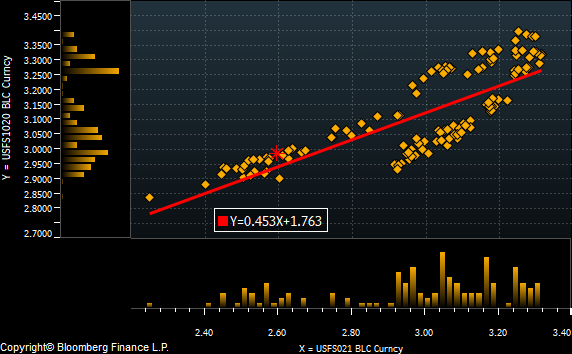

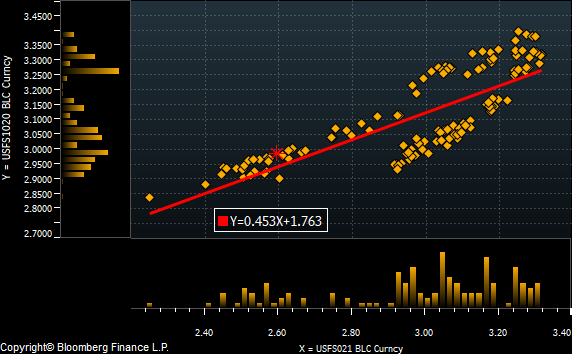

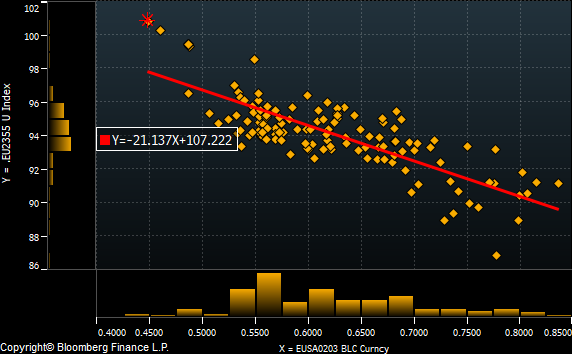

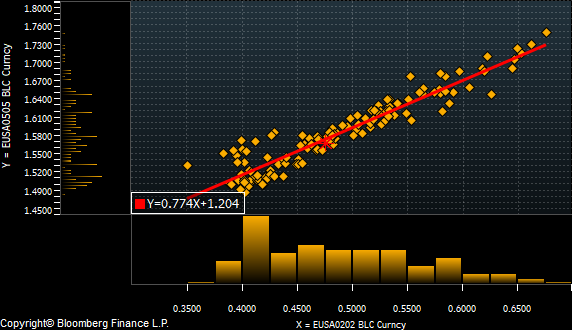

Regression using 6m first and then 3m of history: it is clear that the curve has become much more correlated recently, as the market consensus oscillates on Fed expectations (as exemplified by the 2y1y rate).

6 months of data:

Past 3m months:

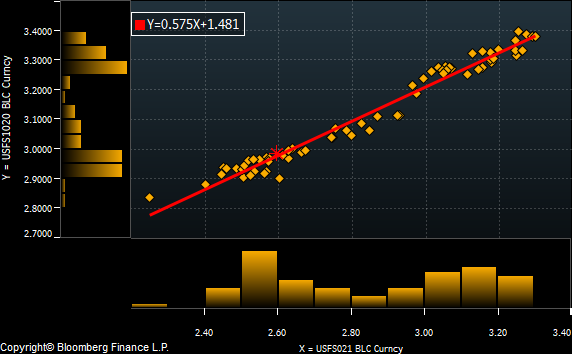

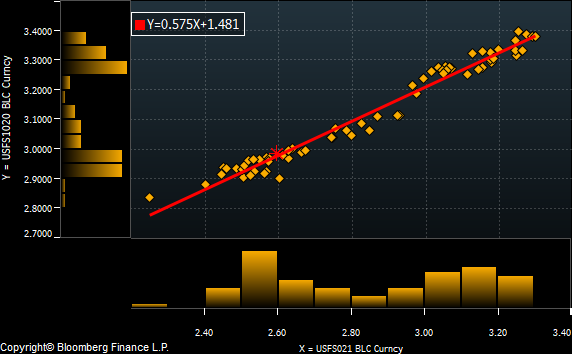

This chart shows the payoff regimes for the 6m 25bp spread of receiver spreads overlaid with the scatter plot of the recent realized datapoints.

This pricing is possible due to the high skew on low-strike mid-curve receivers on 2y1y, compared to that on 10y20y.

Skew:

6m -25bp 1y -50bp

2y1y +5.3bp/y +8.8bp/y

10y20y +2.2bp/y +3.7bp/y

If we accept a beta of roughly 50% for 10y20y vs 2y1y, then the maximum payoff is 12.5bp for the 6m/25bp version, and 25bp for the 1y/50bp version. The payoff could be smaller or larger if the beta changes significantly.

Roll-down/ carry for the first 3 months of the trade (rolling down yield curve and vol surface):

6m/25bp, positive P&L rolldown of +0.7bp.

1y/50bp, positive P&L rolldown of +1.25bp.

As above, the risk to the trade is the market falling into bull-flattening. One scenario might be where the Fed issues concrete forward guidance, limiting the volatility at the short end, while the long-end rallies. The recent price action suggests this is not a consensus outcome, given the current link between equity sentiment and the Fed outlook.

I’d love to hear your thoughts!

Best

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade: Low-cost US bull-flattener via spread of mid-curve receiver spreads on 2y1y/10y20y

Bottom line: The US curve has been set in a bear-flattening / bull-steepening dynamic with the short-end leading the way as all eyes are on the Fed. As a consequence straight bull-flatteners require an upfront premium as the volatility is high on short rates. This trade gives the bull-steepening exposure for a reduced cost by capping the potential upside on a steepening move (as well as discounting the potential for a shift to bull-flattening).

Trades:

6m 25bp-wide version:

Buy USD 1,070mm 6m2y1y mid-curve receiver spread a/a-25 (k=2.593% / 2.343%)

Sell USD 84mm 6m10y20y mid-curve receiver spread a/a-25 (k=2.974% / 2.724%)

For 0.1bp upfront premium (indicative mid)

Fwd curve strike at 38.1bp. Spot spread at 38.4bp

1y 50bp-wide version:

Buy USD 1,070mm 1y2y1y mid-curve receiver spread a/a-50 (k=2.613% / 2.113%)

Sell USD 84mm 1y10y20y mid-curve receiver spread a/a-50 (k=2.964% / 2.464%)

For 0.2bp upfront premium (indicative mid)

Fwd curve strike at 35.1bp. Spot spread at 38.4bp

Rationale: For some months, if not years, the USD curve has been driven by Fed expectations, and this is especially true in the rally which started at the end of last year. As a consequence the curve has an established bear-flattening/bull-steepening dynamic. The options markets are not unaware of this, and generally bull-steepeners require an upfront premium. One way to mitigate this cost is to trade off the upside of a significant rally, by using receivers spreads (as well has discounting the chance of bull-flattening). Hence these trades work best in a scenario where 25bp to 50bp are shaved off Fed expectations for the next year, rather than pricing in cuts.

Regression using 6m first and then 3m of history: it is clear that the curve has become much more correlated recently, as the market consensus oscillates on Fed expectations (as exemplified by the 2y1y rate).

6 months of data:

Past 3m months:

This chart shows the payoff regimes for the 6m 25bp spread of receiver spreads overlaid with the scatter plot of the recent realized datapoints.

This pricing is possible due to the high skew on low-strike mid-curve receivers on 2y1y, compared to that on 10y20y.

Skew:

6m -25bp 1y -50bp

2y1y +5.3bp/y +8.8bp/y

10y20y +2.2bp/y +3.7bp/y

If we accept a beta of roughly 50% for 10y20y vs 2y1y, then the maximum payoff is 12.5bp for the 6m/25bp version, and 25bp for the 1y/50bp version. The payoff could be smaller or larger if the beta changes significantly.

Roll-down/ carry for the first 3 months of the trade (rolling down yield curve and vol surface):

6m/25bp, positive P&L rolldown of +0.7bp.

1y/50bp, positive P&L rolldown of +1.25bp.

As above, the risk to the trade is the market falling into bull-flattening. One scenario might be where the Fed issues concrete forward guidance, limiting the volatility at the short end, while the long-end rallies. The recent price action suggests this is not a consensus outcome, given the current link between equity sentiment and the Fed outlook.

I’d love to hear your thoughts!

Best

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

PSPP2 ... So long, farewell, auf wiedersehen, adieu ....

So long, farewell, auf wiedersehen, adieu ....

This will likely be the last of my model updates on PSPP2 and German buying, having started the updates in November 2016. I hope you have found the information and analysis useful, and many thanks to those who have given me feedback and advice on the model over the past two years!

New purchases in the ECB’s public sector QE programme ended last month. Around the last ECB meeting, two modifications were made to the reinvestment programme: the intention to adjust each country’s holdings to converge with the new Capital Key allocations; and allowing each central bank greater flexibility over the timeframe in which they reinvest redemption cash.

Taken together, the two changes constitute a challenge to my PSPP2 model. The major issue is that we cannot easily predict how much reinvestment is made in a given month. Thus trying to extract information from the scant data provided by the ECB will be more complicated, absent any further clarification (such as a breakdown of what is held in cash, and what in bonds). As such, this publication of my Maximum Likelihood model could well be the last, unless I start to make assumptions about how long the Bundesbank will hold redemption cash before spending it.

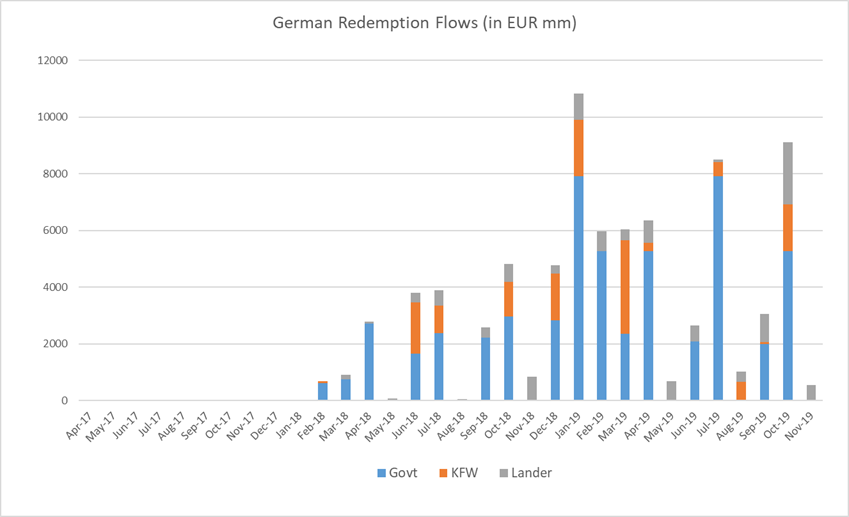

Previously, the heavy redemption profile of Germany’s PSPP2 holdings compared to those of France over the first months of 2019 strongly favoured Bunds. With the new widening of the reinvestment window, this effect should be reduced, if not completely eliminated, and will likely be overshadowed by fluctuating sentiment on the political situation in France.

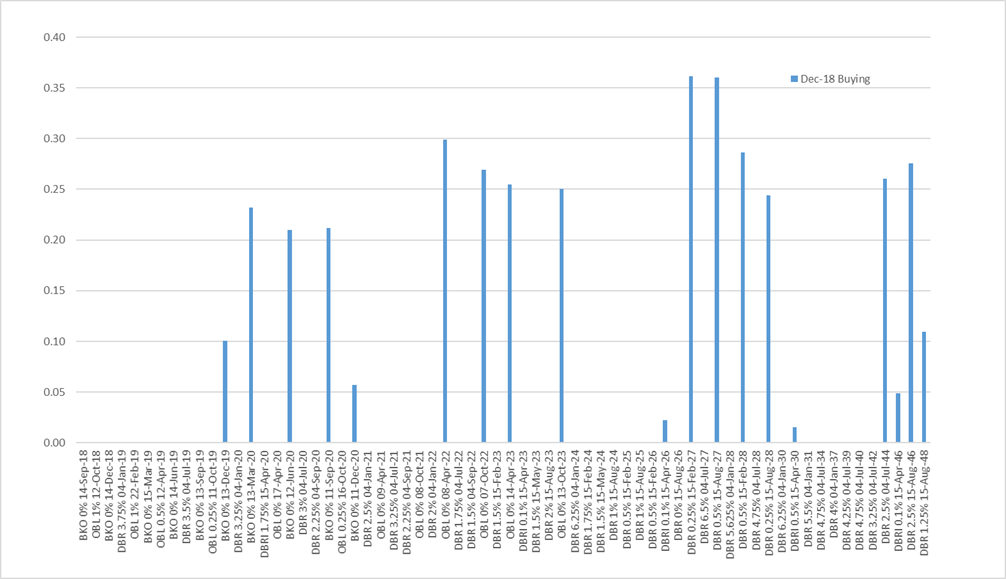

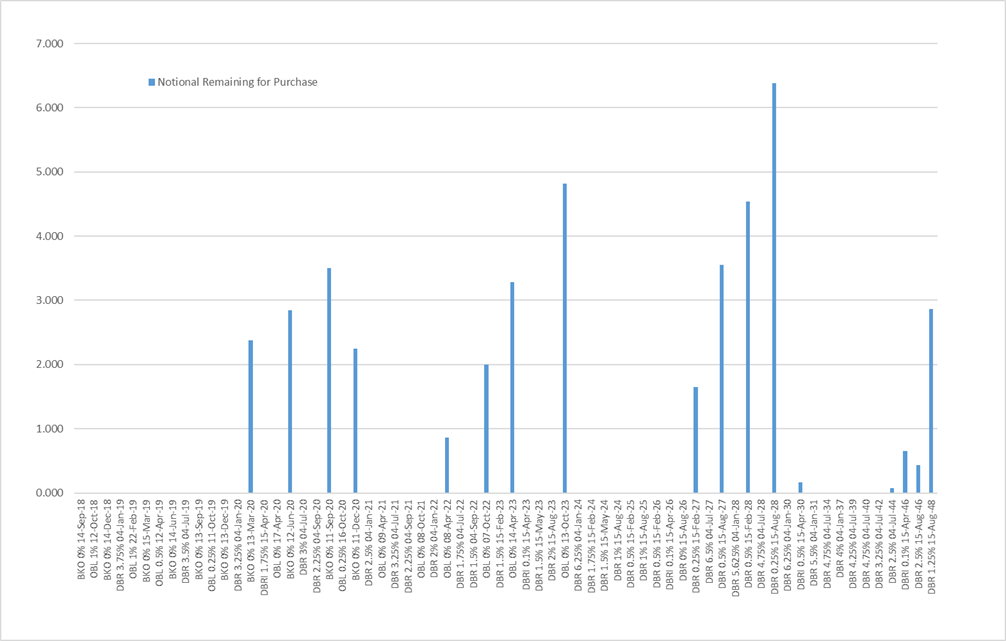

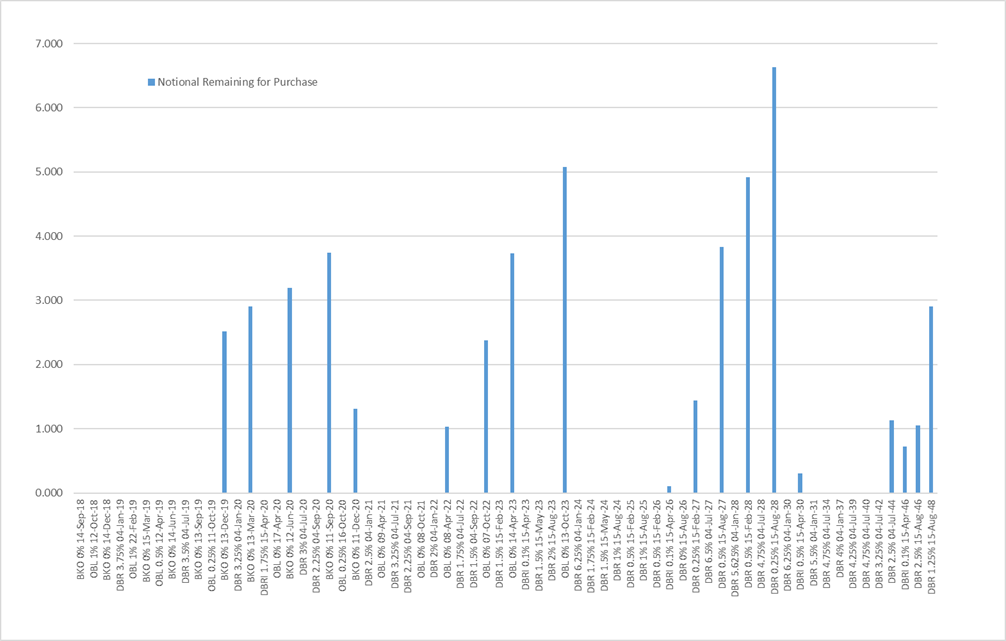

So, here are the (possibly final) results from my model for December 18: the general conclusions have not changed. The bonds that are available to purchase are increasingly concentrated at the supply points of 2y, 5y, 10y and 30y with only the more recent off-the-runs having any capacity for further buying. Beyond the 10y sector, the 2048 will be the main bond, though taps of the 2044 (Apr) and 2046 (Feb and Jun) and will provide some additional room until the new 2050 is launched in August (when it will be just under 31y to maturity). Capacity is greater in the 10y sector (with the new 10y, 2029 being launched tomorrow).

The estimated breakdown of purchasing for December across Govts, KFW and Lander:

|

Category |

Notional |

WAM |

|

German Govt |

4.0 |

9.0 |

|

KFW |

1.1 |

5.3 |

|

Lander |

2.8 |

5.4 |

|

All Purchases |

7.9 |

7.2 |

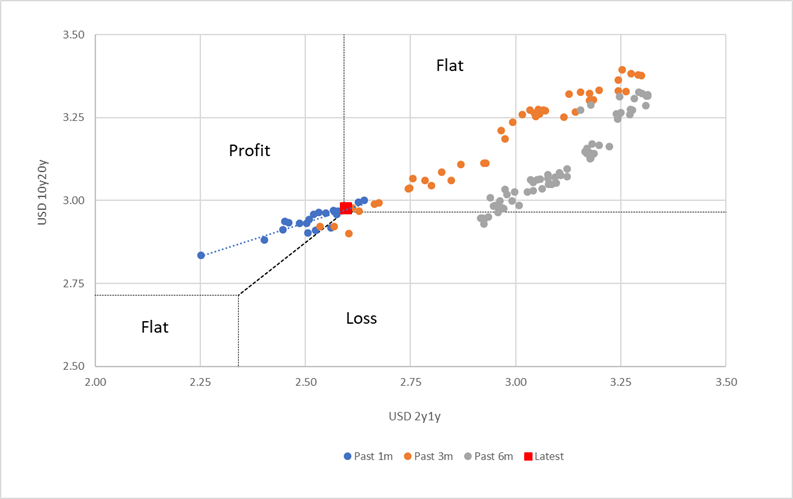

Given the model, here’s a chart showing the estimated redemption flows for the year ahead:

And the numbers for that chart:

|

Redemptions (EUR mm) |

||||

|

Govt |

KFW |

Lander |

Total |

|

|

Apr-17 |

0 |

0 |

0 |

0 |

|

May-17 |

0 |

0 |

0 |

0 |

|

Jun-17 |

40 |

0 |

0 |

40 |

|

Jul-17 |

326 |

364 |

0 |

690 |

|

Aug-17 |

0 |

0 |

0 |

0 |

|

Sep-17 |

0 |

564 |

235 |

799 |

|

Oct-17 |

401 |

661 |

0 |

1063 |

|

Nov-17 |

0 |

531 |

250 |

781 |

|

Dec-17 |

0 |

0 |

0 |

0 |

|

Jan-18 |

575 |

297 |

0 |

872 |

|

Feb-18 |

1236 |

531 |

0 |

1767 |

|

Mar-18 |

699 |

0 |

142 |

841 |

|

Apr-18 |

6411 |

0 |

86 |

6497 |

|

May-18 |

0 |

0 |

115 |

115 |

|

Jun-18 |

1541 |

2970 |

338 |

4849 |

|

Jul-18 |

3258 |

1650 |

582 |

5490 |

|

Aug-18 |

0 |

0 |

95 |

95 |

|

Sep-18 |

2086 |

0 |

483 |

2569 |

|

Oct-18 |

3941 |

1650 |

711 |

6303 |

|

Nov-18 |

0 |

0 |

974 |

974 |

|

Dec-18 |

2554 |

1649 |

330 |

4532 |

|

Jan-19 |

6530 |

1980 |

1017 |

9527 |

|

Feb-19 |

5040 |

0 |

675 |

5715 |

|

Mar-19 |

2083 |

3300 |

385 |

5769 |

|

Apr-19 |

5280 |

321 |

829 |

6430 |

|

May-19 |

0 |

0 |

683 |

683 |

|

Jun-19 |

2045 |

0 |

600 |

2645 |

|

Jul-19 |

7920 |

495 |

99 |

8514 |

|

Aug-19 |

0 |

660 |

396 |

1056 |

|

Sep-19 |

2196 |

132 |

1032 |

3360 |

|

Oct-19 |

5280 |

1650 |

2195 |

9125 |

|

Nov-19 |

0 |

0 |

605 |

605 |

|

Dec-19 |

2256 |

0 |

578 |

2833 |

For the model itself, here are the estimates for the buying of German Governments in December:

This chart shows the remaining notional available for purchase by the programme given the estimated buying to date and the notional limits in place.

Finally, here’s the issue by issue breakdown of how much of each government bond my model estimates that the Bundesbank has bought:

|

Bond |

Opened |

O/S (bn) |

Purchasable |

Market Yield |

Purchased |

% Purchased |

Remaining |

Margin of Error |

MV Remaining |

Dec-18 Buying |

|

DBR 3.75% 04-Jan-17 |

Nov-06 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.75% 24-Feb-17 |

Jan-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 10-Mar-17 |

Feb-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 07-Apr-17 |

May-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 16-Jun-17 |

May-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

+/- 12% |

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-17 |

May-07 |

0.0 |

0.0 |

|

0.3 |

|

0.0 |

+/- 5% |

0.0 |

0.0 |

|

BKO 0% 15-Sep-17 |

Aug-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 13-Oct-17 |

Sep-12 |

0.0 |

0.0 |

|

0.4 |

|

0.0 |

+/- 3% |

0.0 |

0.0 |

|

BKO 0% 15-Dec-17 |

Nov-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

DBR 4% 04-Jan-18 |

Nov-07 |

0.0 |

0.0 |

|

0.6 |

|

0.0 |

+/- 4% |

0.0 |

0.0 |

|

OBL 0.5% 23-Feb-18 |

Jan-13 |

0.0 |

0.0 |

|

1.2 |

|

0.0 |

+/- 2% |

0.0 |

0.0 |

|

BKO 0% 16-Mar-18 |

Feb-16 |

0.0 |

0.0 |

|

0.7 |

|

0.0 |

+/- 4% |

0.0 |

0.0 |

|

OBL 0.25% 13-Apr-18 |

May-13 |

0.0 |

0.0 |

|

1.9 |

|

0.0 |

+/- 2% |

0.0 |

0.0 |

|

OBLI 0.75% 15-Apr-18 |

Apr-11 |

0.0 |

0.0 |

|

4.5 |

|

0.0 |

+/- 1% |

0.0 |

0.0 |

|

BKO 0% 15-Jun-18 |

May-16 |

0.0 |

0.0 |

|

1.5 |

|

0.0 |

+/- 4% |

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-18 |

May-08 |

0.0 |

0.0 |

|

3.3 |

|

0.0 |

+/- 2% |

0.0 |

0.0 |

|

BKO 0% 14-Sep-18 |

Aug-16 |

0.0 |

0.0 |

|

2.1 |

|

0.0 |

+/- 3% |

0.0 |

0.0 |

|

OBL 1% 12-Oct-18 |

Sep-13 |

0.0 |

0.0 |

|

3.9 |

|

0.0 |

+/- 1% |

0.0 |

0.0 |

|

BKO 0% 14-Dec-18 |

Nov-16 |

0.0 |

0.0 |

2.6 |

0.0 |

+/- 2% |

0.0 |

0.0 |

||

|

DBR 3.75% 04-Jan-19 |

Nov-08 |

0.0 |

0.0 |

6.5 |

0.0 |

+/- 1% |

0.0 |

0.0 |

||

|

OBL 1% 22-Feb-19 |

Jan-14 |

16.0 |

0.0 |

-0.548 |

5.0 |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

|

BKO 0% 15-Mar-19 |

Mar-17 |

13.0 |

0.0 |

-0.587 |

2.1 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

OBL 0.5% 12-Apr-19 |

May-14 |

16.0 |

0.0 |

-0.617 |

5.3 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

BKO 0% 14-Jun-19 |

May-17 |

13.0 |

0.0 |

-0.624 |

2.0 |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

|

DBR 3.5% 04-Jul-19 |

May-09 |

24.0 |

0.0 |

-0.599 |

7.9 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

BKO 0% 13-Sep-19 |

Aug-17 |

13.0 |

0.0 |

-0.613 |

2.2 |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

|

OBL 0.25% 11-Oct-19 |

Sep-14 |

16.0 |

0.0 |

-0.609 |

5.3 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

BKO 0% 13-Dec-19 |

Nov-17 |

13.0 |

0.0 |

-0.607 |

2.3 |

|

0.0 |

+/- 1% |

0.0 |

0.1 |

|

DBR 3.25% 04-Jan-20 |

Nov-09 |

22.0 |

7.3 |

-0.713 |

7.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 13-Mar-20 |

Feb-18 |

13.0 |

4.3 |

-0.607 |

1.9 |

45% |

2.4 |

+/- 1% |

2.4 |

0.2 |

|

DBRI 1.75% 15-Apr-20 |

Jun-09 |

16.0 |

5.3 |

|

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 17-Apr-20 |

Jan-15 |

20.0 |

6.6 |

-0.603 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 12-Jun-20 |

May-18 |

12.0 |

4.0 |

-0.624 |

1.1 |

28% |

2.8 |

+/- 1% |

2.9 |

0.2 |

|

DBR 3% 04-Jul-20 |

Apr-10 |

22.0 |

7.3 |

-0.619 |

7.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.25% 04-Sep-20 |

Aug-10 |

16.0 |

5.3 |

-0.631 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 11-Sep-20 |

Aug-18 |

12.0 |

4.0 |

-0.606 |

0.5 |

12% |

3.5 |

+/- 3% |

3.5 |

0.2 |

|

OBL 0.25% 16-Oct-20 |

Jul-15 |

19.0 |

6.3 |

-0.603 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 11-Dec-20 |

Nov-18 |

7.0 |

2.3 |

-0.581 |

0.1 |

3% |

2.2 |

+/- 11% |

2.3 |

0.1 |

|

DBR 2.5% 04-Jan-21 |

Nov-10 |

19.0 |

6.3 |

-0.640 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 09-Apr-21 |

Feb-16 |

21.0 |

6.9 |

-0.592 |

6.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 3.25% 04-Jul-21 |

Apr-11 |

19.0 |

6.3 |

-0.578 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.25% 04-Sep-21 |

Aug-11 |

16.0 |

5.3 |

-0.560 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 08-Oct-21 |

Jul-16 |

19.0 |

6.3 |

-0.551 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2% 04-Jan-22 |

Nov-11 |

20.0 |

6.6 |

-0.539 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 08-Apr-22 |

Feb-17 |

18.0 |

5.9 |

-0.508 |

5.1 |

86% |

0.9 |

+/- 1% |

0.9 |

0.3 |

|

DBR 1.75% 04-Jul-22 |

Apr-12 |

24.0 |

7.9 |

-0.483 |

7.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 04-Sep-22 |

Sep-12 |

18.0 |

5.9 |

-0.463 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 07-Oct-22 |

Jul-17 |

17.0 |

5.6 |

-0.449 |

3.6 |

64% |

2.0 |

+/- 1% |

2.0 |

0.3 |

|

DBR 1.5% 15-Feb-23 |

Jan-13 |

18.0 |

5.9 |

-0.411 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 14-Apr-23 |

Feb-18 |

16.0 |

5.3 |

-0.382 |

2.0 |

38% |

3.3 |

+/- 1% |

3.3 |

0.3 |

|

DBRI 0.1% 15-Apr-23 |

Mar-12 |

16.0 |

5.3 |

|

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 15-May-23 |

May-13 |

18.0 |

5.9 |

-0.385 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2% 15-Aug-23 |

Sep-13 |

18.0 |

5.9 |

-0.354 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 13-Oct-23 |

Jul-18 |

16.0 |

5.3 |

-0.318 |

0.5 |

9% |

4.8 |

+/- 4% |

4.9 |

0.3 |

|

DBR 6.25% 04-Jan-24 |

Jan-94 |

10.3 |

3.4 |

-0.281 |

3.4 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.75% 15-Feb-24 |

Jan-14 |

18.0 |

5.9 |

-0.288 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 15-May-24 |

May-14 |

18.0 |

5.9 |

-0.253 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1% 15-Aug-24 |

Sep-14 |

18.0 |

5.9 |

-0.225 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-25 |

Jan-15 |

23.0 |

7.6 |

-0.164 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1% 15-Aug-25 |

Jul-15 |

23.0 |

7.6 |

-0.117 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-26 |

Jan-16 |

26.0 |

8.6 |

-0.058 |

8.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBRI 0.1% 15-Apr-26 |

Mar-15 |

14.5 |

4.8 |

|

4.8 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0% 15-Aug-26 |

Jul-16 |

25.0 |

8.3 |

-0.004 |

8.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.25% 15-Feb-27 |

Jan-17 |

26.0 |

8.6 |

0.052 |

6.9 |

81% |

1.6 |

+/- 1% |

1.7 |

0.4 |

|

DBR 6.5% 04-Jul-27 |

Jul-97 |

11.2 |

3.7 |

0.046 |

3.7 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Aug-27 |

Jul-17 |

25.0 |

8.3 |

0.106 |

4.7 |

57% |

3.5 |

+/- 1% |

3.7 |

0.4 |

|

DBR 5.625% 04-Jan-28 |

Jan-98 |

14.5 |

4.8 |

0.105 |

4.8 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-28 |

Jan-18 |

21.0 |

6.9 |

0.171 |

2.4 |

34% |

4.5 |

+/- 1% |

4.7 |

0.3 |

|

DBR 4.75% 04-Jul-28 |

Oct-98 |

11.3 |

3.7 |

0.171 |

3.7 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.25% 15-Aug-28 |

Jul-18 |

21.0 |

6.9 |

0.234 |

0.5 |

8% |

6.4 |

+/- 4% |

6.4 |

0.2 |

|

DBR 6.25% 04-Jan-30 |

Jan-00 |

9.3 |

3.1 |

0.258 |

3.1 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBRI 0.5% 15-Apr-30 |

Apr-14 |

12.6 |

4.1 |

|

4.0 |

96% |

0.2 |

+/- 0% |

0.2 |

0.0 |

|

DBR 5.5% 04-Jan-31 |

Oct-00 |

17.0 |

5.6 |

0.321 |

5.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.75% 04-Jul-34 |

Jan-03 |

20.0 |

6.6 |

0.508 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4% 04-Jan-37 |

Jan-05 |

23.0 |

7.6 |

0.611 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-39 |

Jan-07 |

14.0 |

4.6 |

0.677 |

4.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.75% 04-Jul-40 |

Jul-08 |

16.0 |

5.3 |

0.683 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 3.25% 04-Jul-42 |

Jul-10 |

15.0 |

5.0 |

0.744 |

5.0 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.5% 04-Jul-44 |

Apr-12 |

26.5 |

8.7 |

0.812 |

8.7 |

99% |

0.1 |

+/- 0% |

0.1 |

0.3 |

|

DBRI 0.1% 15-Apr-46 |

Jun-15 |

8.0 |

2.6 |

|

2.0 |

75% |

0.7 |

+/- 2% |

0.8 |

0.0 |

|

DBR 2.5% 15-Aug-46 |

Feb-14 |

25.5 |

8.4 |

0.841 |

8.0 |

95% |

0.4 |

+/- 1% |

0.6 |

0.3 |

|

DBR 1.25% 15-Aug-48 |

Sep-17 |

12.0 |

4.0 |

0.876 |

1.1 |

28% |

2.9 |

+/- 2% |

3.2 |

0.1 |

|

Italic = index-linked |

Total |

43.6 |

4.0 |

|||||||

|

Yield below Depo Rate |

||||||||||

|

Yield above Depo Rate |

Bund WAM |

9.0 |

With best wishes,

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Your starter for 2019: Bear-flatteners in EUR as a low-risk fade to the recent rally

Bottom line: The EUR curve has been bull-steepening, and 2y3y/5y5y is ending 2018 at its highs. Position for a reversal in ECB/Fed sentiment using mid-curve payers for a bear-flattener. This is a low-cost way to position for increased optimism for the economic outlook to start 2019.

Trade:

Buy EUR 330mm 6m2y3y mid-curve payer atmf (k=0.60%)

Sell EUR 210mm 6m5y5y mid-curve payer atmf (k=1.55%)

For zero cost (indicative mid)

Forward strike at 95bp vs spot 2y3y/5y5y at 101bp.

Rationale: For the last three months of 2018, the EUR curve (in forward space) as been bull-steepening, as short-rates rally in sympathy with the abrupt volte-face in Fed expectations across the Atlantic. At the same time, the fog of BREXIT and an apparent weakening of German manufacturing data have provoked a more dovish outlook for the ECB. It is not then a surprise that curve moves have been led by shorter rates. Set against this dovish reading, the ECB has ended new PSPP2 purchases and reiterated its policy of “patience, prudence and persistence”. Various speakers have re-affirmed “Autumn 2019” as the expectation for a first move in refi rates.

Thus the rally of EUR rates down to their YTD lows opens up the possibility of a reversal in sentiment, which would most likely come from either stronger US equity performance in 2019 or a non-apocalyptic resolution to the BREXIT question.

The first chart is the EUR 2y3y/5y5y spread of forward rates for the past 2y. We are at the steepest for the past year, and well above the economic cycles flattest lows that we saw in 2005 (second chart). Thus a flattener would be a consideration even in vanilla space, though with the attendant downside should the rally persist. Please see my previous pieces on why I have chosen the 2y3y/5y5y spread: in essence it is because that rate combination is reliably directional and the mid-curve implied volatilities are very close allowing a zero-cost structure.

A longer history, showing the pre-WFC levels of close to flat in 2005:

So, the level is interesting to set a flattener, but how directional is 2y3y/5y5y? The next chart shows the two separate forward rates and their spread. In the recent rally, the curve has steepened steadily by 10bp off its September low and even further off the 80bp from last January.

This is the scatter of the evolution of the 2y3y/5y5y spread compared to the 2y3y rate for the past 6 months. The curve has quite reliably bull-steepened and bear-flattened during this period.

In vanilla swap space, the flattener is a negative rolldown trade (around 3bp over the first 3m). However, the volatility surface rolldown mitigates this to only a 0.75bp rolldown over the first 3m for the mid-curve structure. Since both ATMF strikes are higher than spot, at expiry both options would expire worthless.

The main risk is that the directionality of the curve breaks down and we see bear-steepening. That is hard to envisage in the current circumstances where Central Banks are the main focus. In the interim the mark-to-market will follow the curve position: positive in a flattening, negative in a further steepening.

As always, I’d love to hear your thoughts, and please accept my Best Wishes for a prosperous 2019!

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

So, farewell then 2018. The highs and lows of my shadow portfolio!

Shadow Portfolio P&L (as of 19th Dec): USD +1984k

As has been my custom, it’s time to do a roundup of the performance of my trade ideas for the past year.

Bottom Line: The final P&L came out at an Orwellian USD +1,984k, with a winner/loser ratio of 2.5:1. Given the repeated regime-shifts through the year, I’m happy enough to be in positive territory given that the bulk of my trades are based on relative value.

Synopsis: I carried several trades over from 2017 with mixed results: on the plus side the EUR 1y3y/5y5y curve flattened a little further, and I realized more of the intrinsic value (given the short payer was well OTM); set against that my selling of GBP/USD 5y5y xccy basis was the largest single loss of the year, when the ceiling at +2bp (which had held for an eternity) was breached and the spread never looked back (it’s close to +30 now!). As the year progressed I finally made some opportunistic money on USD steepeners, albeit boxed vs GBP. Into Q1-end in the UK, 10y-30y flattened sharply and fading that (weighted vs the short end) worked well. Thereafter it was a succession of modest gains on trades incepted during the summer. One slow-burn trade that went under the radar was an RV idea on the EUR 6s3s basis curve (2y3y / 5y5y flattener) which has worked steadily and I’m still holding. Within the last couple of months sentiment has changed sharply on the US, with Fed hike expectations getting slashed. As a consequence my mid-curve receiver ladder on 1y1y is well underwater, with the market close to the low strike, but I am holding for now. On the flip side, a departure from RV into an outright receive on USD 10y20y turned out to be well-timed as the market rallied 25bp (and more) and this became my best performing trade of the year (especially considering the one month holding period).

|

Trade Idea |

Entered |

Level |

Size |

Status |

Exit/Current Level |

Exit Date |

P&L k USD |

|

US 2-10 steepener via CMS caps |

28-Dec-17 |

0 bp |

USD 25 k/bp |

CLOSED |

0 bp |

15-Jan-18 |

0 |

|

RX/UB ASW Box |

28-Dec-17 |

-6.1 bp |

EUR 50 k/bp |

CLOSED |

-5.2 bp |

06-Mar-18 |

-56 |

|

EUR 1y3y/5y5y Mid-curve flattener |

28-Dec-17 |

13.7 bp |

EUR 20 k/bp |

CLOSED |

29 bp |

31-Jan-18 |

380 |

|

GBP 1y1y1y MC Payer spread |

28-Dec-17 |

0.7 bp |

GBP 25 k/bp |

CLOSED |

-1 bp |

31-Jan-18 |

-60 |

|

EUR 9m1y1y/9m1y5y Bear Flattener |

28-Dec-17 |

4.2 bp |

EUR 25 k/bp |

CLOSED |

0 bp |

30-Jan-18 |

-130 |

|

Receive GBP/USD 5y5y xccy basis |

28-Dec-17 |

1 bp |

GBP 40 k/bp |

CLOSED |

6.4 bp |

28-Feb-18 |

-297 |

|

EUR 2-5-10 weighted swap fly |

28-Dec-17 |

-28.1 bp |

EUR 40 k/bp |

CLOSED |

-25 bp |

25-Jan-18 |

-154 |

|

GBP 2y-10y Bull-steepener |

05-Jan-18 |

0 bp |

GBP 20 k/bp |

CLOSED |

2.5 bp |

31-May-18 |

66 |

|

EUR 2y2y/5y10y Bull-Steepener |

30-Jan-18 |

0 bp |

EUR 25 k/bp |

CLOSED |

4 bp |

05-Mar-18 |

123 |

|

USD 2y-10y, 1y fwd steepener |

02-Feb-18 |

22 bp |

USD 25 k/bp |

CLOSED |

20.5 bp |

21-Feb-18 |

-38 |

|

GBP/USD 2y-10y 1y fwd Swaps |

21-Feb-18 |

-25.5 bp |

GBP 25 k/bp |

CLOSED |

-10.8 bp |

23-Mar-18 |

521 |

|

GBP 2y-10y vs USD CMS Caps |

21-Feb-18 |

0 bp |

GBP 25 k/bp |

CLOSED |

-3 bp |

24-Sep-18 |

-98 |

|

EUR 3y1y/10y10y flattener |

06-Mar-18 |

124 bp |

EUR 25 k/bp |

CLOSED |

120 bp |

08-Mar-18 |

123 |

|

EUR CMS 10-5 collar |

06-Mar-18 |

0.5 bp |

EUR 40 k/bp |

OPEN |

0 bp |

-23 |

|

|

GBP 10-30 vs 2y1y |

27-Mar-18 |

29 bp |

GBP 40 k/bp |

CLOSED |

33.8 bp |

09-Apr-18 |

271 |

|

EUR 3y1y/5y5y bear steepener |

12-Apr-18 |

0 bp |

EUR 40 k/bp |

CLOSED |

0 bp |

14-Jun-18 |

0 |

|

GBP/USD 2y-10y, 1m Floors |

20-Apr-18 |

0.6 bp |

GBP 25 k/bp |

CLOSED |

0 bp |

21-May-18 |

-20 |

|

EUR 2y1y/10y10y Bear Flattener |

20-Apr-18 |

-0.5 bp |

EUR 25 k/bp |

CLOSED |

4 bp |

04-Jun-18 |

132 |

|

EUR 2y1y/5y5y Bull Steepener |

17-Jun-18 |

0 bp |

EUR 40 k/bp |

CLOSED |

4 bp |

13-Sep-18 |

187 |

|

EUR 3y2y 1x2 Midcurve Payers |

27-Jun-18 |

0 bp |

EUR 25 k/bp |

CLOSED |

4.9 bp |

09-Nov-18 |

139 |

|

GBP 6m2y1y Payer Ladder |

28-Aug-18 |

2.5 bp |

GBP 20 k/bp |

OPEN |

5.1 bp |

66 |

|

|

GBP 3m CMS 10-2 Cap Fly |

28-Aug-18 |

4.5 bp |

GBP 25 k/bp |

CLOSED |

8.1 bp |

09-Oct-18 |

118 |

|

EUR 6m 2y3y/5y5y Bull Steepener |

30-Aug-18 |

-1.25 bp |

EUR 25 k/bp |

CLOSED |

4.4 bp |

17-Dec-18 |

160 |

|

USD 2y-30y / 5y-10y Steepener |

11-Sep-18 |

0 bp |

USD 50 k/bp |

OPEN |

-2.1 bp |

-105 |

|

|

EUR 6s3s 2y3y vs 5y5y |

11-Sep-18 |

0 bp |

EUR 250 k/bp |

OPEN |

-1.2 bp |

357 |

|

|

EUR 1m5y vs 1m30y straddles |

30-Aug-18 |

0.4 bp |

EUR 40 k/bp |

CLOSED |

1.1 bp |

29-Oct-18 |

32 |

|

USD 1y1y1y Receiver Ladder |

11-Sep-18 |

-1 bp |

USD 25 k/bp |

OPEN |

-10.5 bp |

-238 |

|

|

GBP 10y20y/30y20y flattener |

11-Sep-18 |

-26.5 bp |

GBP 50 k/bp |

OPEN |

-25.5 bp |

-63 |

|

|

USD 10y20y receive |

07-Nov-18 |

3.35 % |

USD 25 k/bp |

CLOSED |

3.1 % |

05-Dec-18 |

575 |

|

USD 6m10y20y payer ladder |

12-Dec-18 |

0.2 bp |

USD 25 k/bp |

OPEN |

0.8 bp |

15 |

|

|

Total YTD |

1984 |

||||||

|

Note on trade sizing: Each trade is sized to generate approx. USD 150k 2y 99% hist. VaR at inception with no netting |

|||||||

I’ll be back later with my thoughts for 2019, and the positions with which to start 2019!

Best wishes for the festive season,

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

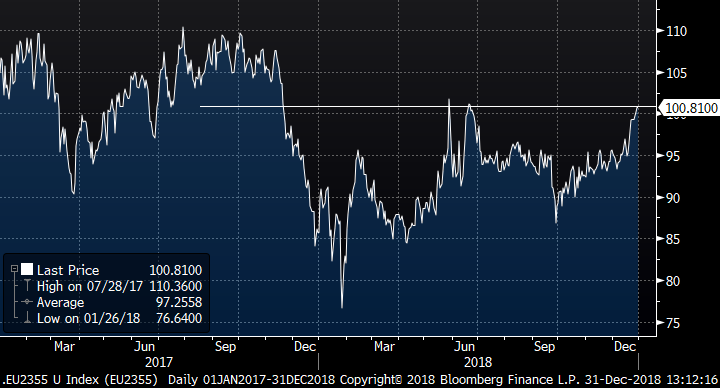

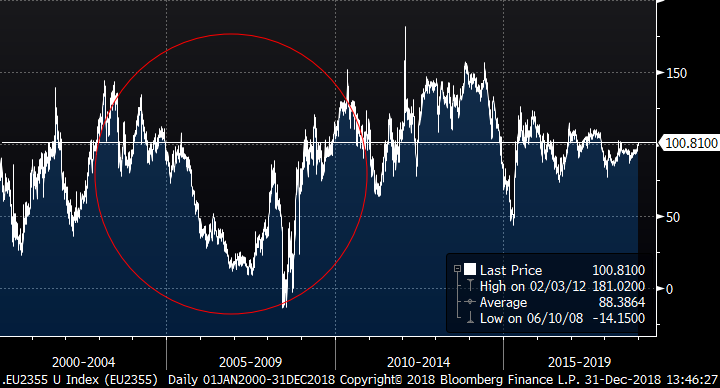

Trade: USD 10y20y forward sitting on technical levels again: position for a bounce

Bottom line: The USD 10y20y forward rate has rallied hard, and is once again sitting on interesting technical levels. An outright pay here is tempting, but instead I prefer to position for a moderate bounce via a mid-curve payer ladder. The upper bound of the ladder (at which P&L turns negative) is 3.50%, compared to the recent peak at 3.40%. The upfront premium is close to zero, with a maximum upside of 15bp at expiry.

Trade:

Buy USD 85mm 6m10y20y mid-curve payer atmf (k=3.05%)

Sell USD 85mm 6m10y20y mid-curve payer atmf+15 (k=3.20%)

Sell USD 85mm 6m10y20y mid-curve payer atmf+30 (k=3.35%)

For upfront premium of 0.2bp running (mid indic)

Atmf strike 3.05% vs spot 10y20y at 3.06%

Rationale:

There has been a substantial rally across the US curve. We highlighted the over-bought level on the 10y20y forward at the start of November, and the subsequent move has been dramatic. The 10y20y has fallen over 30bp, and has found a floor at 3.06%, the 76% retracement.

The daily RSI measure also indicates a strongly over-sold regime:

Since the rate peak there has been a substantial shift to dovish outlooks for the Fed, with the market pricing sharply reducing FOMC action in 2019. However, the downward rate movement looks technically oversold here, so this trade positions for a modest re-assessment of rates to the upside. The trade is short the market at inception, with a positive roll-down on the rate and vol surface of 3.5bp over the first three months of the trade.

As ever, I’d love to hear your thoughts!

Best wishes

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

PSPP2: What do we estimate that Germany has bought in November '18?

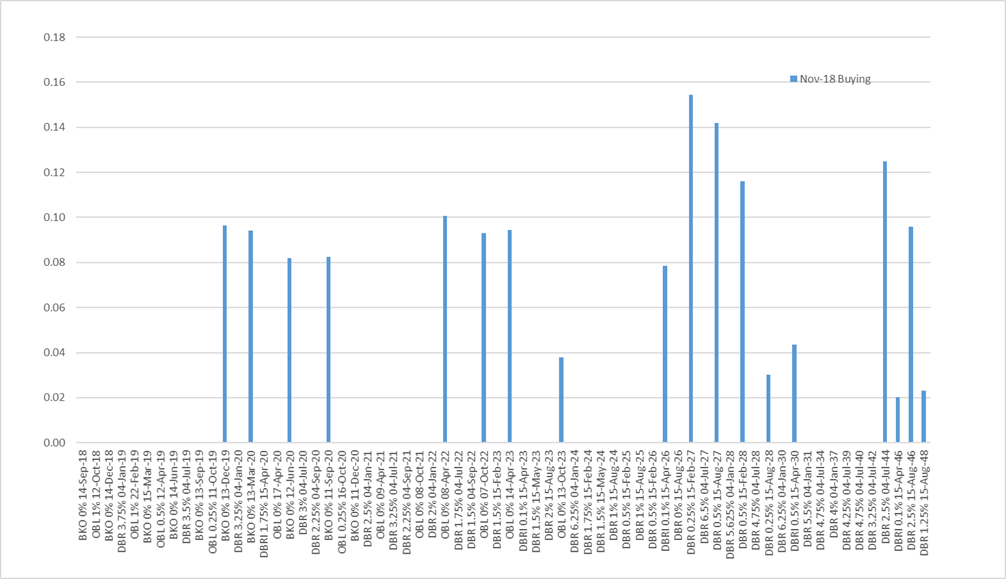

Here is the November update to my PSPP2 model for the purchasing of German bonds. The buying this month has been reasonably balanced across the available issues, concentrated in the 2y,5y,10y and 30y sectors.

At the forthcoming ECB meeting on 13th Dec, the GC is expected to confirm the end to net purchases of government bonds going forward. Thereafter all the purchases will come from the reinvestment of maturing issues. There are two areas on which we could get more information:

1. How the ECB will re-balance the portfolios to adjust to the new Capital Key (which is increasing for Germany and falling for Italy, to take two examples), and over what timescale this could happen.

2. Whether the ECB will interfere in the investment decisions of the Central Banks by issuing guidelines to length the duration of purchases (the “twist”). While some speakers seem to have floated this idea (eg Praet), others seem to have rejected the principle (eg Coeure). It seems that the barrier to this kind of action is high, not least because purchasing decisions have been pretty much a matter for each CB (which knows its market, the segmentation, and the liquidity available), and the market neutrality has hitherto been the main ECB guideline.

The estimated breakdown of purchasing for November across Govts, KFW and Lander:

|

Category |

Notional |

WAM |

|

German Govt |

1.5 |

9.0 |

|

KFW |

0.5 |

6.5 |

|

Lander |

1.2 |

5.8 |

|

All Purchases |

3.2 |

7.4 |

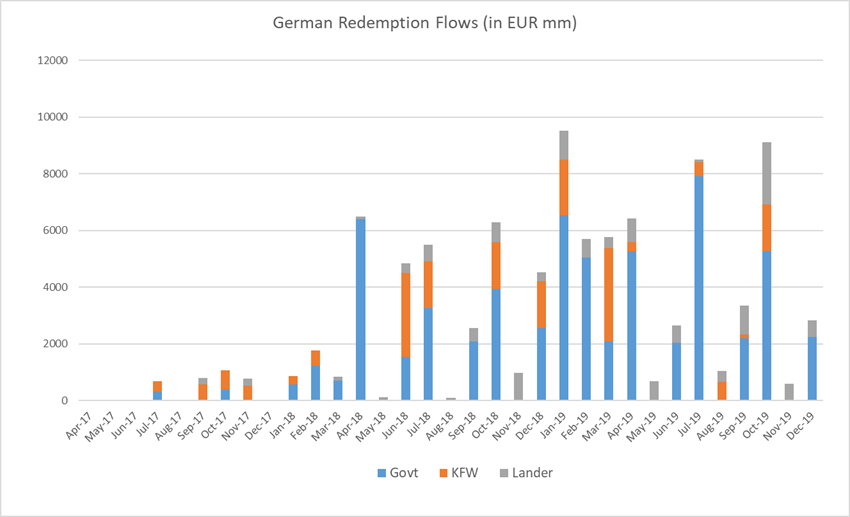

Given the model, here’s a chart showing the estimated redemption flows for the year ahead:

And the numbers for that chart:

|

Redemptions |

||||

|

Govt |

KFW |

Lander |

Total |

|

|

Apr-17 |

0 |

0 |

0 |

0 |

|

May-17 |

0 |

0 |

0 |

0 |

|

Jun-17 |

0 |

0 |

0 |

0 |

|

Jul-17 |

0 |

0 |

0 |

0 |

|

Aug-17 |

0 |

0 |

0 |

0 |

|

Sep-17 |

0 |

0 |

0 |

0 |

|

Oct-17 |

0 |

0 |

0 |

0 |

|

Nov-17 |

0 |

0 |

0 |

0 |

|

Dec-17 |

0 |

0 |

0 |

0 |

|

Jan-18 |

0 |

6 |

0 |

6 |

|

Feb-18 |

610 |

82 |

0 |

692 |

|

Mar-18 |

762 |

0 |

145 |

906 |

|

Apr-18 |

2732 |

0 |

64 |

2796 |

|

May-18 |

0 |

0 |

87 |

87 |

|

Jun-18 |

1669 |

1806 |

322 |

3797 |

|

Jul-18 |

2386 |

970 |

542 |

3898 |

|

Aug-18 |

0 |

0 |

65 |

65 |

|

Sep-18 |

2216 |

0 |

381 |

2597 |

|

Oct-18 |

2977 |

1217 |

629 |

4823 |

|

Nov-18 |

0 |

0 |

835 |

835 |

|

Dec-18 |

2828 |

1650 |

301 |

4779 |

|

Jan-19 |

7920 |

1980 |

925 |

10825 |

|

Feb-19 |

5280 |

0 |

691 |

5971 |

|

Mar-19 |

2368 |

3300 |

369 |

6038 |

|

Apr-19 |

5280 |

280 |

789 |

6349 |

|

May-19 |

0 |

0 |

691 |

691 |

|

Jun-19 |

2082 |

0 |

572 |

2654 |

|

Jul-19 |

7920 |

495 |

99 |

8514 |

|

Aug-19 |

0 |

660 |

369 |

1029 |

|

Sep-19 |

2001 |

75 |

977 |

3054 |

|

Oct-19 |

5280 |

1650 |

2190 |

9120 |

|

Nov-19 |

0 |

0 |

563 |

563 |

|

Dec-19 |

1777 |

0 |

577 |

2355 |

|

Jan-20 |

7260 |

3300 |

1967 |

12527 |

|

Feb-20 |

0 |

149 |

721 |

870 |

|

Mar-20 |

1382 |

0 |

1369 |

2751 |

|

Apr-20 |

11880 |

0 |

482 |

12362 |

|

May-20 |

0 |

0 |

414 |

414 |

|

Jun-20 |

770 |

1935 |

706 |

3411 |

|

Jul-20 |

7260 |

0 |

2342 |

9602 |

|

Aug-20 |

0 |

0 |

561 |

561 |

|

Sep-20 |

5498 |

0 |

1050 |

6548 |

|

Oct-20 |

6270 |

495 |

1071 |

7836 |

|

Nov-20 |

0 |

0 |

1154 |

1154 |

|

Dec-20 |

7 |

0 |

813 |

820 |

|

Jan-21 |

6270 |

3630 |

1130 |

11030 |

For the model itself, here are the estimates for the buying of German Governments in Novermber:

This chart shows the remaining notional available for purchase by the programme given the estimated buying to date and the notional limits in place.

Finally, here’s the issue by issue breakdown of how much of each government bond my model estimates that the Bundesbank has bought:

|

Bond |

Opened |

O/S (bn) |

Purchasable |

Market Yield |

Purchased |

% Purchased |

Remaining |

Margin of Error |

MV Remaining |

Nov-18 Buying |

|

DBR 3.75% 04-Jan-17 |

Nov-06 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.75% 24-Feb-17 |

Jan-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 10-Mar-17 |

Feb-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 07-Apr-17 |

May-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 16-Jun-17 |

May-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-17 |

May-07 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 15-Sep-17 |

Aug-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 13-Oct-17 |

Sep-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 15-Dec-17 |

Nov-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

DBR 4% 04-Jan-18 |

Nov-07 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 23-Feb-18 |

Jan-13 |

0.0 |

0.0 |

|

0.6 |

|

0.0 |

+/- 4% |

0.0 |

0.0 |

|

BKO 0% 16-Mar-18 |