Trade: Tactical Bear-Flattener in USD after recent rally and curve steepening

Bottom line: A very simple proposition: the US curve has bull-steepened, giving the opportunity to fade via mid-curve payers.

Trade:

Buy USD 1,040mm 1m1y1y mc payer atmf+10bp (k=3.205%)

Sell USD 250mm 1m5y5y mc payer atmf+10bp (k=3.36%)

Expiry 20-Dec-18

For 0.4bp running net premium (mid)

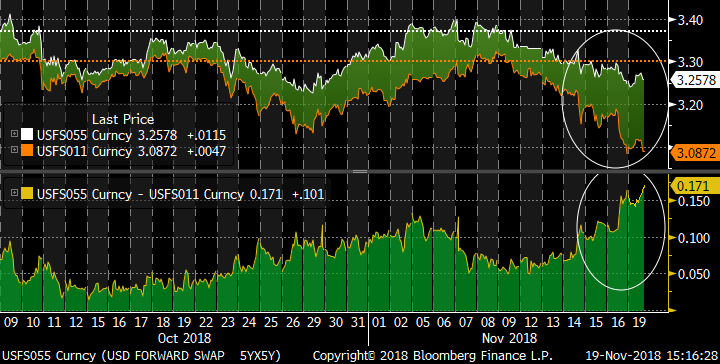

Rationale: The recent bullish move in the US has confirmed the bull-steepening dynamic, as the chart shows.

Hence, any relaxing bearish reversal should trigger a re-flattening. The up-coming Fed events are the Minutes on 29th November and then the FOMC decision on 19th December, hence a 1-month expiry spans two risk events. The 1y1y/5y5y curve has steepened some 12bp from its flattest levels earlier in the month (9th November), so this is a reasonable target if we see a back-up in rates.

There is some negative skew on high-strike payers on 1y1y (while there is no skew to mention on 5y5y), hence moving the trade out-of-the-money improves the cost slightly (from 0.7bp for atm strikes to 0.4bp for atm+10bp strikes). Clearly, should the market take a bearish view on the Fed there is plenty of upside potential in 1y1y: around 20bp to the recent highs.

In a further rally, both legs expire worthless and the premium is sacrificed. The main risk is a sharp sell-off in 10y rates which is not matched by changing Fed expectations, however the market’s focus is very much on the Fed over the coming month (in addition you have some protection from the OTM strikes).

Any thoughts or comments?

Best wishes,

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades: The USD 10y20y forward swap rate is at multi-year technical levels.

Bottom line: USD 10y20y is at fascinating technical levels and makes a good candidate for a duration long in the US

Trades:

- Simply receive USD 10y20y

- Mid-curve receiver spreads/ladders on 10y20y with 6m or 1y expiries

- Receiver USD 10y20y vs paying EUR 10y20y

See below for candidate structures.

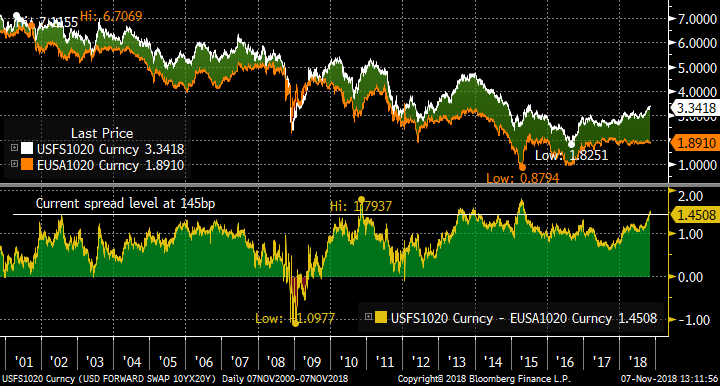

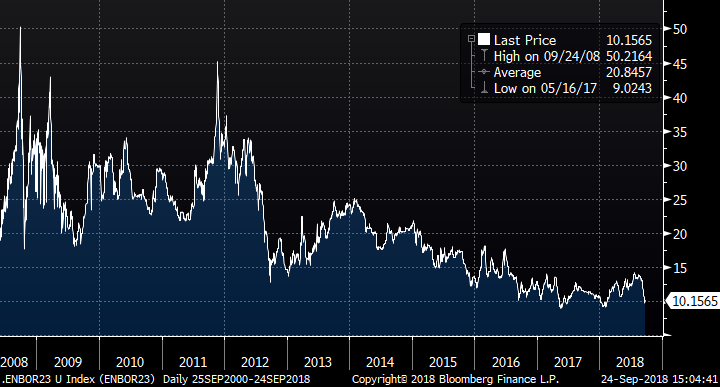

Rationale: I don’t usually take technical analysis as my starting point, but a hat-tip to my colleague Chris Williams for the monthly chart of the USD 10y20y (20y rate, 10y forward) below. He has highlighted the powerful technical signals of the current level, in terms of RSI and 100-month moving average, using data stretching back to 1996.

The technical observations are timely as I am on the lookout for a place to receive on the USD curve. The results of yesterday’s US Mid-term elections have delivered a small Democratic majority in the House of Representatives: my high-level view is that this reduces the chances of further tax cuts and some of the more expansive spending plans for Defence (and certain building projects in the border zone). As a consequence changes on both sides of the budget look more positive in terms of the budget deficit, and lessens somewhat my fears of a ramping of long-end Treasury supply. This allows me to consider trades with a 10-30 flattening exposure, such as receiving 10y20y. Recall that the 10y20y forward rate is essentially one-part 30y outright plus 0.5-part 10y-30y curve: hence a reduction in the prospects for 10-30 steepening make this more of an essentially bullish trade (cf 5y5y, which is equal parts direction and curve).

How best to position for a failure of 10y20y at the 100-month moving average?

Simply receiving the 10y20y forward outright has the merit of ample liquidity and may act as a hedge to portfolios with more bearish positioning at the short end. The US 10y20y rate has got slightly ahead of Fed expectations over the past 6 months: the chart shows the residual of the regression between 10y20y and the 2y1y rate. On this basis, 10y20y looks around 10bp too high given the market’s pricing for short rates (R^2 of 83%). Being long 10y20y rolls negatively by 1.4bp over the first year, but does, of course, offer a long convexity exposure to compensate for this. A hedged spread using realized betas would be 1:1.08 DV01 of 10y20y: 2y1y.

For a non-linear payoff, look at mid-curve receivers on 10y20y as spread structures (or perhaps conditional curve trades vs short rates). The next chart shows the Fibonacci retracement levels for 10y20y, which gives us some idea of where to set breakeven points for receiver spread structures. Within the past six months the low has been in the 2.90% region, while further back the 2.60% level has been a strong support. The first retracement from current levels is around 3.00%, and would be target for a failure of 10y20y to breach the 100-month moving average.

This receiver ladder structure costs around 1.5bp running (mid indic):

Buy 90mm 1y10y20y receiver k=3.30%

Sell 90mm 1y10y20y receiver k=3.05%

Sell 90mm 1y10y20y receiver k=2.85%

(with Atmf = 3.33%)

The structure makes money with 10y20y at expiry from 3.285% to 2.615%, with the maximum P&L of 23.5bp between 3.05% and 2.85%. A break below the 2.615% level would start to incur losses. The trade is short gamma at inception, and slightly long the market.

On a shorter horizon with tighter strikes, this ladder costs 0.5bp running (mid indic)

Buy 90mm 6m10y20y receiver k=3.30%

Sell 90mm 6m10y20y receiver k=3.15%

Sell 90mm 6m10y20y receiver k=3.00%

(with Atmf = 3.34%)

and makes the largest P&L of 14.5 bp on a move to between 3.15% and 3%. The trade starts to lose money at 2.85% (a rally of 50bp in 10y20y over 6m).

Zero-cost 1x2 structures for comparison are (indicatively):

3m10y20y 3.30% / 3.15%, breakeven at 3%

6m10y20y 3.30% / 3.10%, breakeven at 2.90%

1y10y20y 3.30% / 3%, breakeven at 2.70%

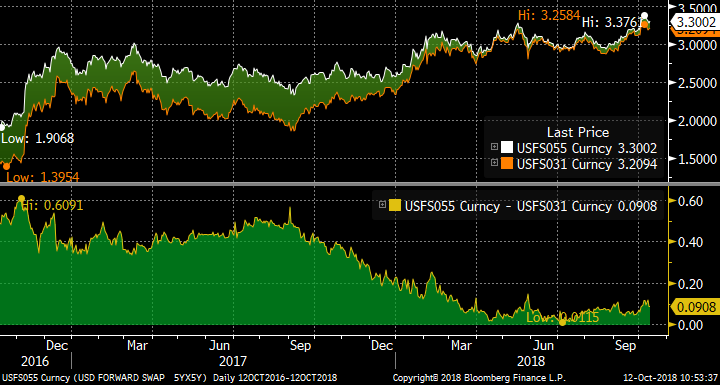

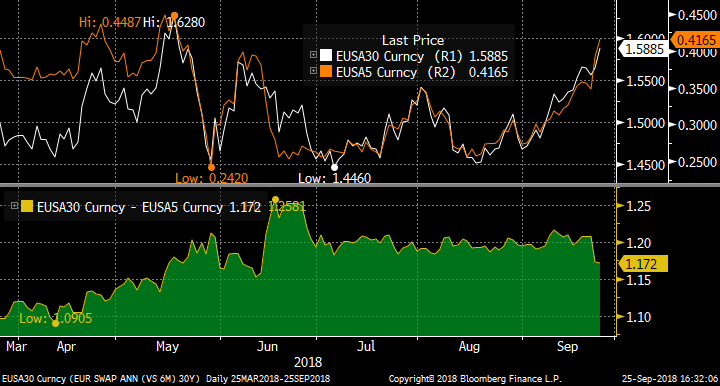

Another way to approach the USD 10y20y is in comparison to the EUR 10y20y as in the chart below. The spread is pushing on its highest levels for some time and exceeded only by the period leading into the start of the ECB’s QE (and the substantial flattening of EUR 10y-30y): a situation unlikely to be repeated. Again, the simplest way is to receive USD 10y20y vs paying EUR 10y20y. Given the higher volatility of US rates (and the recent comatose price action in EUR 10y20y) this is essentially a proxy for receiving USD 10y20y outright.

There are many ways to skin a cat … if a different expression fits your needs better please let me know and we can investigate.

Best wishes,

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

What has the Bundesbank bought for PSPP2 in October? ML model results including future redemption estimates.

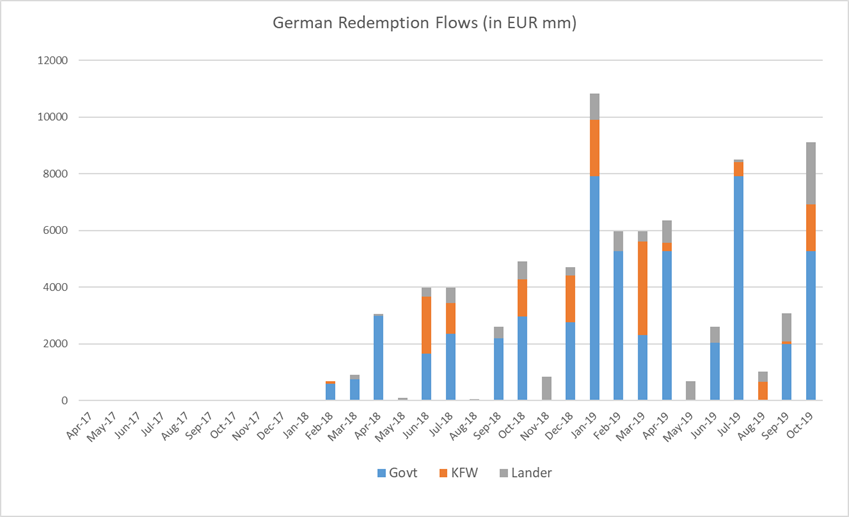

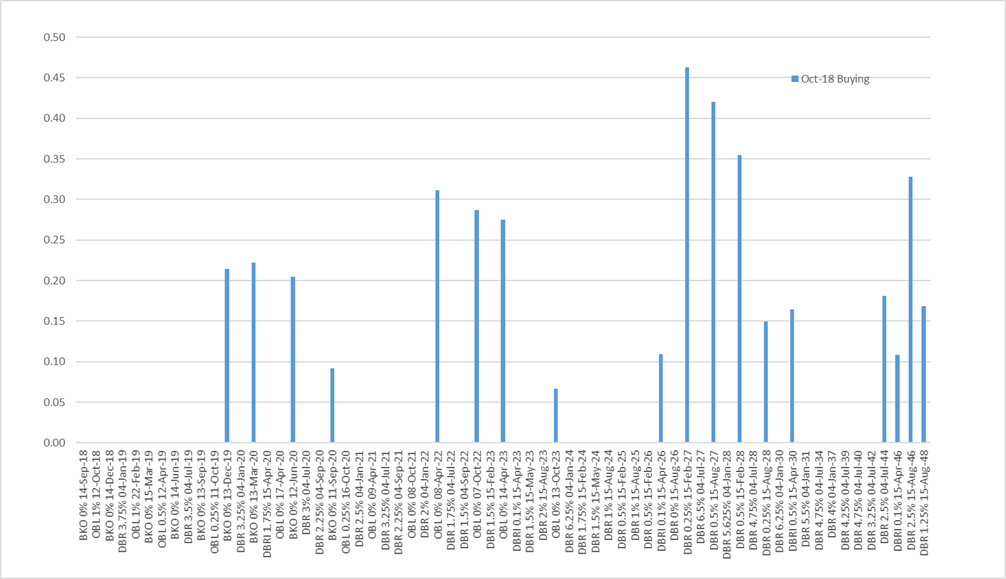

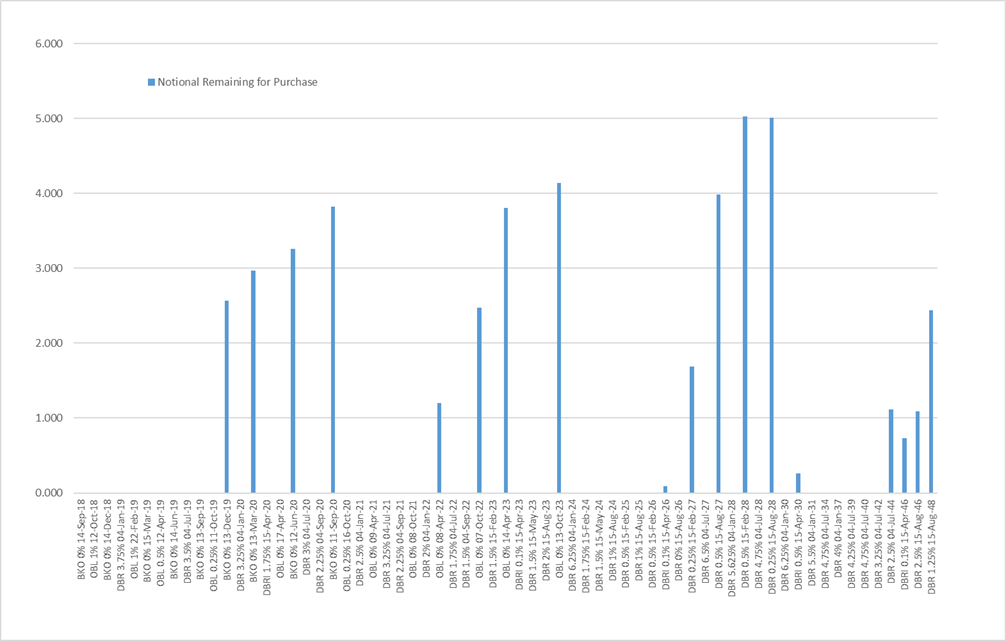

Here are the results of my Maximum Likelihood model for PSPP2 purchases in Germany for October. Once again, the model suggests strong buying in the 10y sector, with the remainder localized around 1y-2y, 5y and 30y (unsurprisingly, as these are the supply points where bonds have been in the programme for a shorter period).

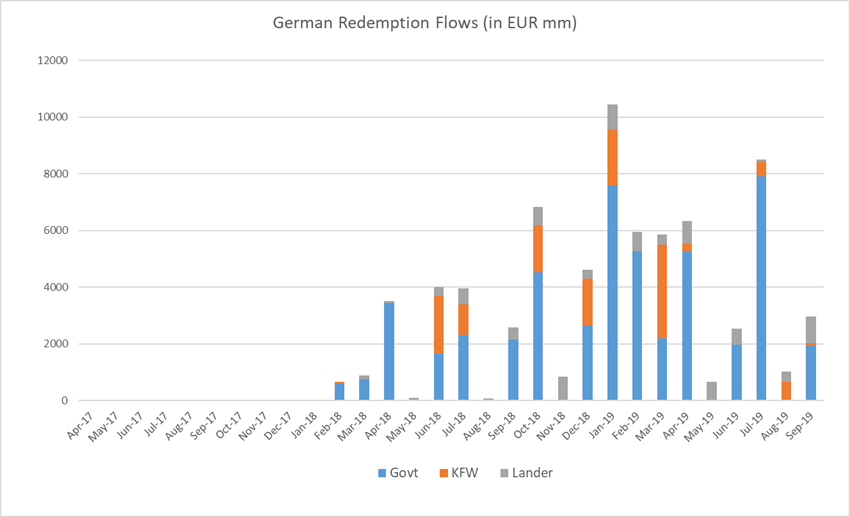

To recap: the redemption flows for the first 3 months of 2019, when new purchases will have ceased, are substantial. For governments the model estimates redemptions of 7.6bn in January, 5.3bn in February and 2.2bn in March: an average of 5bn per month for the first quarter of 2019.

The estimated breakdown of purchasing for September across Govts, KFW and the Lander:

|

Category |

Notional |

WAM |

|

German Govt |

4.1 |

10.1 |

|

KFW |

1.4 |

6.2 |

|

Lander |

2.1 |

7.6 |

|

All Purchases |

7.5 |

8.7 |

Given the model, here’s a chart showing the estimated redemption flows for the year ahead:

And the numbers for that chart:

|

Redemptions |

||||

|

Govt |

KFW |

Lander |

Total |

|

|

Apr-17 |

0 |

0 |

0 |

0 |

|

May-17 |

0 |

0 |

0 |

0 |

|

Jun-17 |

0 |

0 |

0 |

0 |

|

Jul-17 |

0 |

0 |

0 |

0 |

|

Aug-17 |

0 |

0 |

0 |

0 |

|

Sep-17 |

0 |

0 |

0 |

0 |

|

Oct-17 |

0 |

0 |

0 |

0 |

|

Nov-17 |

0 |

0 |

0 |

0 |

|

Dec-17 |

0 |

0 |

0 |

0 |

|

Jan-18 |

0 |

6 |

0 |

6 |

|

Feb-18 |

606 |

82 |

0 |

688 |

|

Mar-18 |

763 |

0 |

150 |

913 |

|

Apr-18 |

2989 |

0 |

63 |

3051 |

|

May-18 |

0 |

0 |

95 |

95 |

|

Jun-18 |

1668 |

2002 |

327 |

3996 |

|

Jul-18 |

2367 |

1069 |

549 |

3985 |

|

Aug-18 |

0 |

0 |

65 |

65 |

|

Sep-18 |

2202 |

0 |

414 |

2616 |

|

Oct-18 |

2966 |

1304 |

649 |

4919 |

|

Nov-18 |

0 |

0 |

853 |

853 |

|

Dec-18 |

2766 |

1650 |

304 |

4720 |

|

Jan-19 |

7917 |

1980 |

930 |

10828 |

|

Feb-19 |

5280 |

0 |

692 |

5972 |

|

Mar-19 |

2306 |

3300 |

374 |

5980 |

|

Apr-19 |

5280 |

289 |

792 |

6361 |

|

May-19 |

0 |

0 |

684 |

684 |

|

Jun-19 |

2045 |

0 |

571 |

2616 |

|

Jul-19 |

7920 |

495 |

99 |

8514 |

|

Aug-19 |

0 |

660 |

370 |

1030 |

|

Sep-19 |

2009 |

80 |

991 |

3081 |

|

Oct-19 |

5280 |

1650 |

2190 |

9120 |

For the model itself, here are the estimates for the buying of German Governments in October:

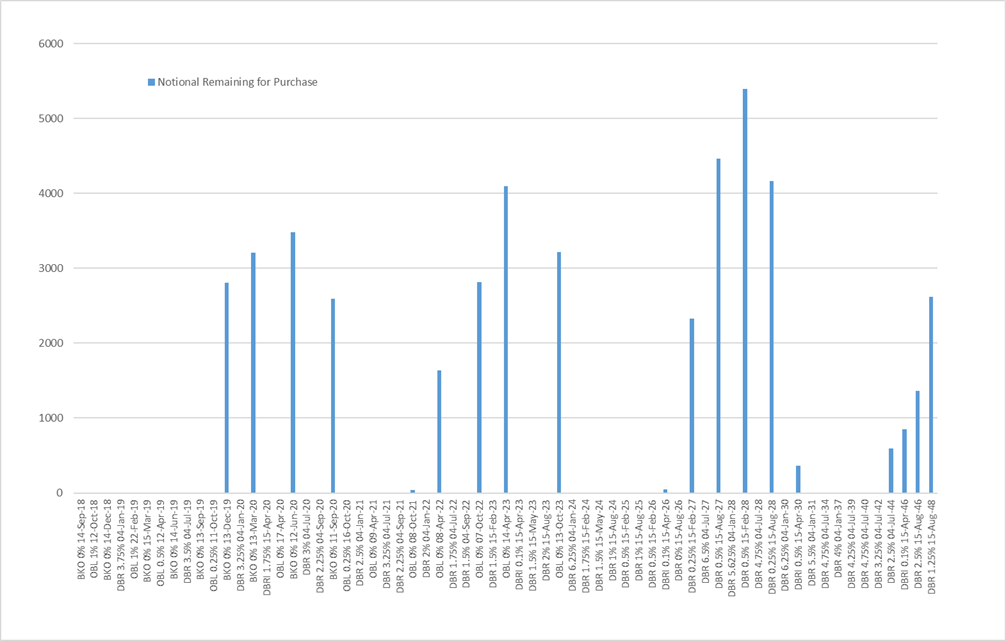

This chart shows the remaining notional available for purchase by the programme given the estimated buying to date and the notional limits in place.

Finally, here’s the issue by issue breakdown of how much of each government bond my model estimates that the Bundesbank has bought:

|

Bond |

Opened |

O/S (bn) |

Purchasable |

Market Yield |

Purchased |

% Purchased |

Remaining |

Margin of Error |

MV Remaining |

Oct-18 Buying |

|

DBR 3.75% 04-Jan-17 |

Nov-06 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.75% 24-Feb-17 |

Jan-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 10-Mar-17 |

Feb-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 07-Apr-17 |

May-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 16-Jun-17 |

May-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-17 |

May-07 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 15-Sep-17 |

Aug-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 13-Oct-17 |

Sep-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 15-Dec-17 |

Nov-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

DBR 4% 04-Jan-18 |

Nov-07 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 23-Feb-18 |

Jan-13 |

0.0 |

0.0 |

|

0.6 |

|

0.0 |

+/- 3% |

0.0 |

0.0 |

|

BKO 0% 16-Mar-18 |

Feb-16 |

0.0 |

0.0 |

|

0.8 |

|

0.0 |

+/- 3% |

0.0 |

0.0 |

|

OBL 0.25% 13-Apr-18 |

May-13 |

0.0 |

0.0 |

|

1.3 |

|

0.0 |

+/- 3% |

0.0 |

0.0 |

|

OBLI 0.75% 15-Apr-18 |

Apr-11 |

0.0 |

0.0 |

|

1.6 |

|

0.0 |

+/- 3% |

0.0 |

0.0 |

|

BKO 0% 15-Jun-18 |

May-16 |

0.0 |

0.0 |

|

1.7 |

|

0.0 |

+/- 2% |

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-18 |

May-08 |

0.0 |

0.0 |

|

2.4 |

|

0.0 |

+/- 2% |

0.0 |

0.0 |

|

BKO 0% 14-Sep-18 |

Aug-16 |

0.0 |

0.0 |

|

2.2 |

|

0.0 |

+/- 2% |

0.0 |

0.0 |

|

OBL 1% 12-Oct-18 |

Sep-13 |

0.0 |

0.0 |

3.0 |

0.0 |

+/- 1% |

0.0 |

0.0 |

||

|

BKO 0% 14-Dec-18 |

Nov-16 |

13.0 |

0.0 |

-0.646 |

2.8 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

DBR 3.75% 04-Jan-19 |

Nov-08 |

24.0 |

0.0 |

-0.961 |

7.9 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

OBL 1% 22-Feb-19 |

Jan-14 |

16.0 |

0.0 |

-0.754 |

5.3 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

BKO 0% 15-Mar-19 |

Mar-17 |

13.0 |

0.0 |

-0.744 |

2.3 |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

|

OBL 0.5% 12-Apr-19 |

May-14 |

16.0 |

0.0 |

-0.725 |

5.3 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

BKO 0% 14-Jun-19 |

May-17 |

13.0 |

0.0 |

-0.694 |

2.0 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

DBR 3.5% 04-Jul-19 |

May-09 |

24.0 |

0.0 |

-0.677 |

7.9 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

BKO 0% 13-Sep-19 |

Aug-17 |

13.0 |

0.0 |

-0.677 |

2.0 |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

|

OBL 0.25% 11-Oct-19 |

Sep-14 |

16.0 |

0.0 |

-0.677 |

5.3 |

|

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 13-Dec-19 |

Nov-17 |

13.0 |

4.3 |

-0.686 |

1.7 |

40% |

2.6 |

+/- 2% |

2.6 |

0.2 |

|

DBR 3.25% 04-Jan-20 |

Nov-09 |

22.0 |

7.3 |

-0.792 |

7.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 13-Mar-20 |

Feb-18 |

13.0 |

4.3 |

-0.696 |

1.3 |

31% |

3.0 |

+/- 2% |

3.0 |

0.2 |

|

DBRI 1.75% 15-Apr-20 |

Jun-09 |

16.0 |

5.3 |

|

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 17-Apr-20 |

Jan-15 |

20.0 |

6.6 |

-0.701 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 12-Jun-20 |

May-18 |

12.0 |

4.0 |

-0.667 |

0.7 |

18% |

3.3 |

+/- 2% |

3.3 |

0.2 |

|

DBR 3% 04-Jul-20 |

Apr-10 |

22.0 |

7.3 |

-0.679 |

7.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.25% 04-Sep-20 |

Aug-10 |

16.0 |

5.3 |

-0.655 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 11-Sep-20 |

Aug-18 |

12.0 |

4.0 |

-0.622 |

0.1 |

3% |

3.8 |

+/- 2% |

3.9 |

0.1 |

|

OBL 0.25% 16-Oct-20 |

Jul-15 |

19.0 |

6.3 |

-0.632 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.5% 04-Jan-21 |

Nov-10 |

19.0 |

6.3 |

-0.621 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 09-Apr-21 |

Feb-16 |

21.0 |

6.9 |

-0.572 |

6.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 3.25% 04-Jul-21 |

Apr-11 |

19.0 |

6.3 |

-0.544 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.25% 04-Sep-21 |

Aug-11 |

16.0 |

5.3 |

-0.519 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 08-Oct-21 |

Jul-16 |

19.0 |

6.3 |

-0.505 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2% 04-Jan-22 |

Nov-11 |

20.0 |

6.6 |

-0.468 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 08-Apr-22 |

Feb-17 |

18.0 |

5.9 |

-0.424 |

4.7 |

80% |

1.2 |

+/- 1% |

1.2 |

0.3 |

|

DBR 1.75% 04-Jul-22 |

Apr-12 |

24.0 |

7.9 |

-0.396 |

7.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 04-Sep-22 |

Sep-12 |

18.0 |

5.9 |

-0.370 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 07-Oct-22 |

Jul-17 |

17.0 |

5.6 |

-0.345 |

3.1 |

56% |

2.5 |

+/- 1% |

2.5 |

0.3 |

|

DBR 1.5% 15-Feb-23 |

Jan-13 |

18.0 |

5.9 |

-0.297 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 14-Apr-23 |

Feb-18 |

16.0 |

5.3 |

-0.259 |

1.5 |

28% |

3.8 |

+/- 2% |

3.8 |

0.3 |

|

DBRI 0.1% 15-Apr-23 |

Mar-12 |

16.0 |

5.3 |

|

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 15-May-23 |

May-13 |

18.0 |

5.9 |

-0.260 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2% 15-Aug-23 |

Sep-13 |

18.0 |

5.9 |

-0.222 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 13-Oct-23 |

Jul-18 |

13.0 |

4.3 |

-0.173 |

0.2 |

4% |

4.1 |

+/- 4% |

4.2 |

0.1 |

|

DBR 6.25% 04-Jan-24 |

Jan-94 |

10.3 |

3.4 |

-0.158 |

3.4 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.75% 15-Feb-24 |

Jan-14 |

18.0 |

5.9 |

-0.138 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 15-May-24 |

May-14 |

18.0 |

5.9 |

-0.104 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1% 15-Aug-24 |

Sep-14 |

18.0 |

5.9 |

-0.067 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-25 |

Jan-15 |

23.0 |

7.6 |

-0.002 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1% 15-Aug-25 |

Jul-15 |

23.0 |

7.6 |

0.049 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-26 |

Jan-16 |

26.0 |

8.6 |

0.115 |

8.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBRI 0.1% 15-Apr-26 |

Mar-15 |

14.5 |

4.8 |

|

4.7 |

98% |

0.1 |

+/- 1% |

0.1 |

0.1 |

|

DBR 0% 15-Aug-26 |

Jul-16 |

25.0 |

8.3 |

0.183 |

8.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.25% 15-Feb-27 |

Jan-17 |

26.0 |

8.6 |

0.243 |

6.9 |

80% |

1.7 |

+/- 1% |

1.7 |

0.5 |

|

DBR 6.5% 04-Jul-27 |

Jul-97 |

11.2 |

3.7 |

0.231 |

3.7 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Aug-27 |

Jul-17 |

25.0 |

8.3 |

0.304 |

4.3 |

52% |

4.0 |

+/- 1% |

4.1 |

0.4 |

|

DBR 5.625% 04-Jan-28 |

Jan-98 |

14.5 |

4.8 |

0.296 |

4.8 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-28 |

Jan-18 |

21.0 |

6.9 |

0.366 |

1.9 |

27% |

5.0 |

+/- 1% |

5.1 |

0.4 |

|

DBR 4.75% 04-Jul-28 |

Oct-98 |

11.3 |

3.7 |

0.352 |

3.7 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.25% 15-Aug-28 |

Jul-18 |

16.0 |

5.3 |

0.428 |

0.3 |

5% |

5.0 |

+/- 3% |

4.9 |

0.1 |

|

DBR 6.25% 04-Jan-30 |

Jan-00 |

9.3 |

3.1 |

0.440 |

3.1 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBRI 0.5% 15-Apr-30 |

Apr-14 |

12.1 |

4.0 |

|

3.7 |

93% |

0.3 |

+/- 2% |

0.3 |

0.2 |

|

DBR 5.5% 04-Jan-31 |

Oct-00 |

17.0 |

5.6 |

0.511 |

5.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.75% 04-Jul-34 |

Jan-03 |

20.0 |

6.6 |

0.695 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4% 04-Jan-37 |

Jan-05 |

23.0 |

7.6 |

0.793 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-39 |

Jan-07 |

14.0 |

4.6 |

0.853 |

4.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.75% 04-Jul-40 |

Jul-08 |

16.0 |

5.3 |

0.860 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 3.25% 04-Jul-42 |

Jul-10 |

15.0 |

5.0 |

0.927 |

5.0 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.5% 04-Jul-44 |

Apr-12 |

26.5 |

8.7 |

0.992 |

7.6 |

87% |

1.1 |

+/- 1% |

1.5 |

0.2 |

|

DBRI 0.1% 15-Apr-46 |

Jun-15 |

8.0 |

2.6 |

|

1.9 |

72% |

0.7 |

+/- 1% |

0.9 |

0.1 |

|

DBR 2.5% 15-Aug-46 |

Feb-14 |

25.5 |

8.4 |

1.023 |

7.3 |

87% |

1.1 |

+/- 1% |

1.5 |

0.3 |

|

DBR 1.25% 15-Aug-48 |

Sep-17 |

10.5 |

3.5 |

1.060 |

1.0 |

30% |

2.4 |

+/- 2% |

2.6 |

0.2 |

|

Italic = index-linked |

Total |

47.2 |

4.1 |

|||||||

|

Yield below Depo Rate |

||||||||||

|

Yield above Depo Rate |

Bund WAM |

10.1 |

Any questions? More than happy to run you through the numbers in detail.

Best wishes

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

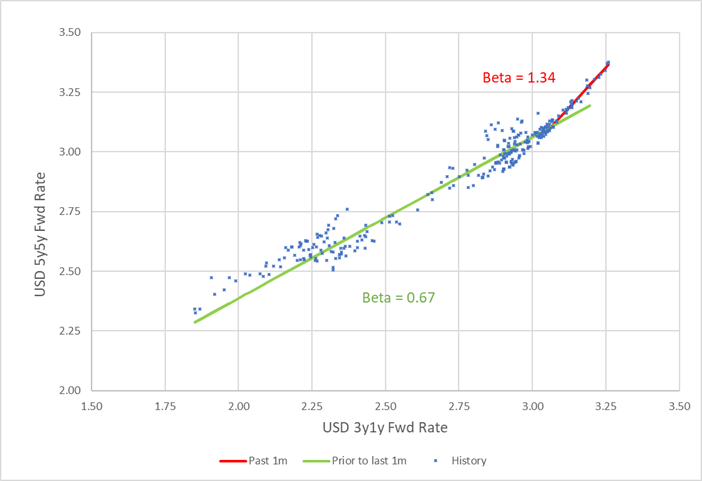

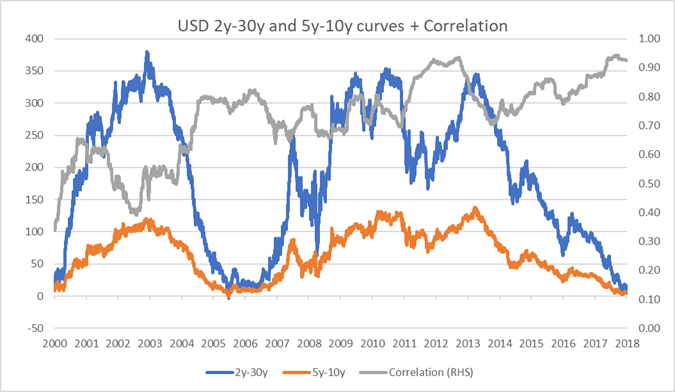

Friday thought: USD Curve: Mode of curve is changing: Time for bear-steepeners?

Bottom Line: The moves in equities and the breakout of long-dated Treasury yields have asserted a bear-steepening dynamic on the curve. The implied volatility markets for mid-curves do not yet reflect this, opening up the opportunity for low-cost steepeners. Love it? Hate it? Too soon? It would be great to hear your thoughts.

Trade:

Sell USD 1,110mm 6m3y1y mc payer atmf (k=3.168%)

Buy USD 249mm 6m5y5y mc payer atmf (k=3.287%)

For a premium take out of 0.9bp running (mid indic)

Fwd strike at 11.9bp vs spot at 10bp

(Equivalent to USD 100k/bp on underlying at expiry)

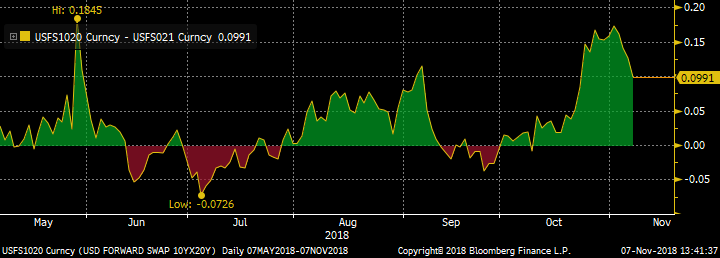

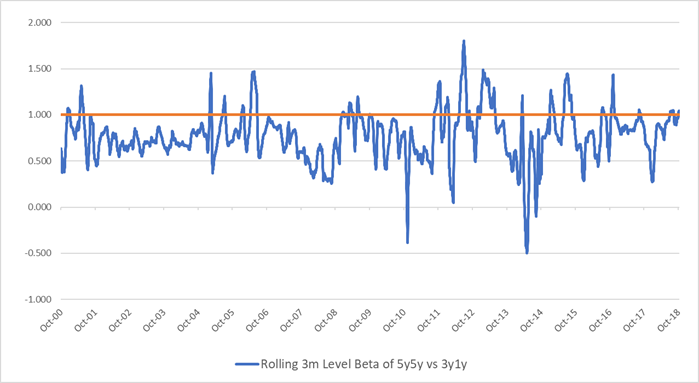

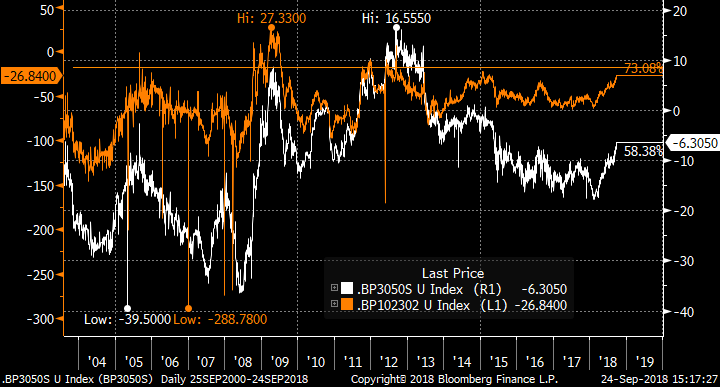

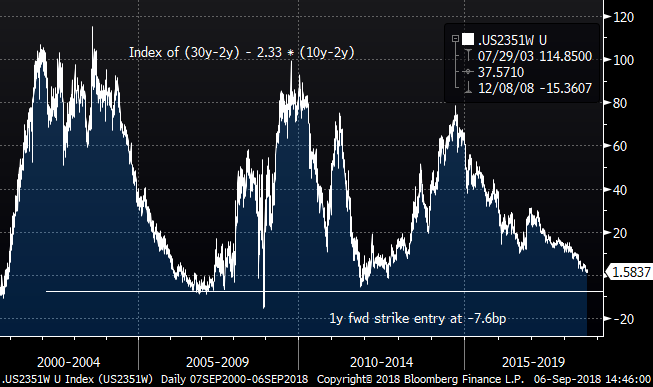

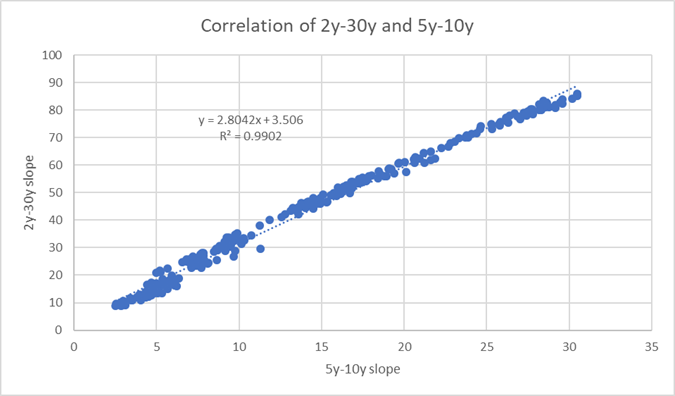

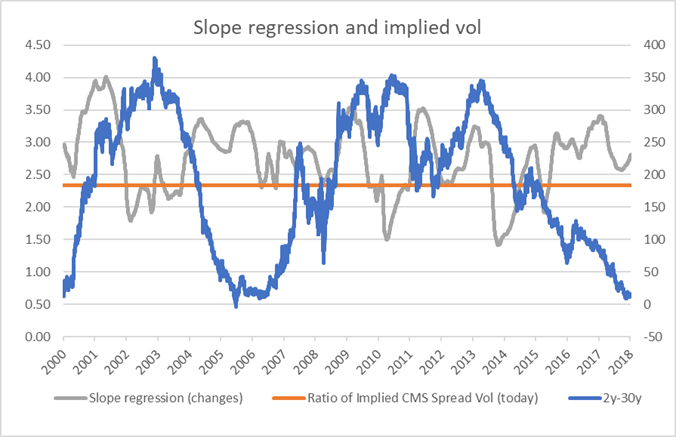

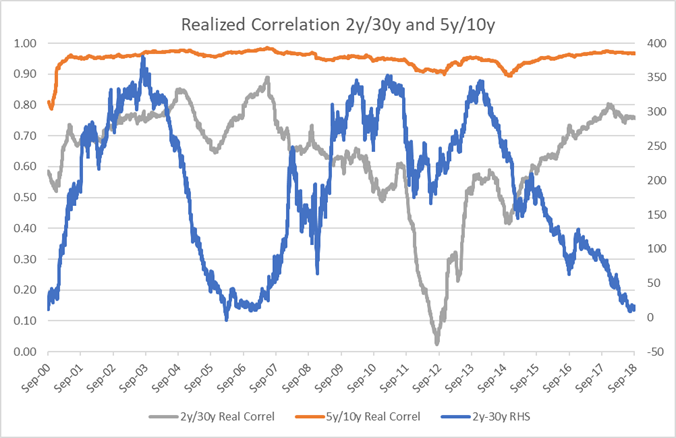

Rationale: It is not an earth-shattering observation to note that the US yield curve is very flat. However the path to this point has come from bear-flattening, as the Fed laced on its hiking boots. In recent weeks, this mode has become weaker, and curve directionality has become vague at best. The reversal in US equity markets, and the President’s novel interpretation of Fed independence has provoked more volatility in the belly of the curve.

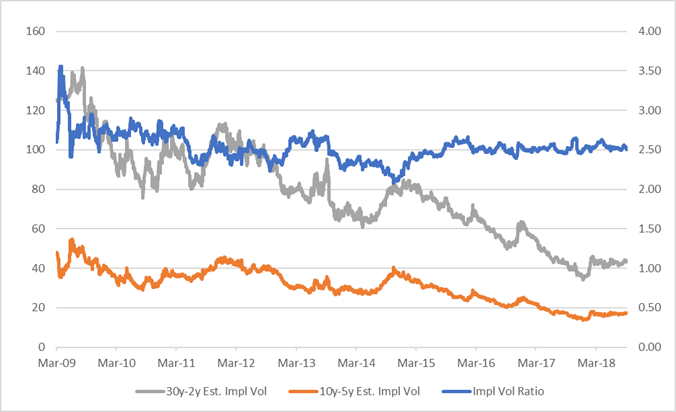

As usual, I’ve been looking at forward rates, and I’m drawn to 3y1y (1y, 3y forward) vs longer rates (eg 5y5y). The point about 3y1y is that tail is pretty much the peak of the implied volatility surface for mid-curve options, so is a good candidate on which to sell options versus shorter or longer rates.

The USD 3y1y/5y5y curve over the past two years is shown in the first chart.

The rolling 3m beta of the 5y5y vs 3y1y. A beta of more than 1.0 suggests that 5y5y realized volatility is higher and curve is bear-steepening / bull-flattening.

If we look at just the last month of realized data, the picture is even more stark. The last one month of datapoints are shown in red, with the previous two years in green.

Street analysts (eg some in-depth pieces from Deutsche) have suggested that the change in dynamic has come from the closing of a window for tax relief on pension investments. Previously (the argument goes) the combination of a tax benefit and massive repatriation flows have driven corporate pension injections and given a bias for curve flattening. With the closing of this window on 15th September, sponsorship of the US Treasury long-end has wilted and yields have broken out to new highs. Hence the recent bear-steepening dynamic on the curve.

The volatility markets have yet to reflect this recent move, so there is an opportunity to set bear-steepeners at zero cost (or maybe a modest premium take-out). The sharp repricing of equities has focused interest on the belly /long-end of the curve and away from the Fed reaction function, and reintroduced term premium. This trade plays for this to continue. Hence the risk is that the Fed takes over the headlines and the short-end starts to drive the curve again: however in a strong bull-steepening move the trade would have positive mark-to-market. It is only a bear-flattening (from already flat levels) that would provoke a loss.

I would love to hear your thoughts on this!

Best wishes

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

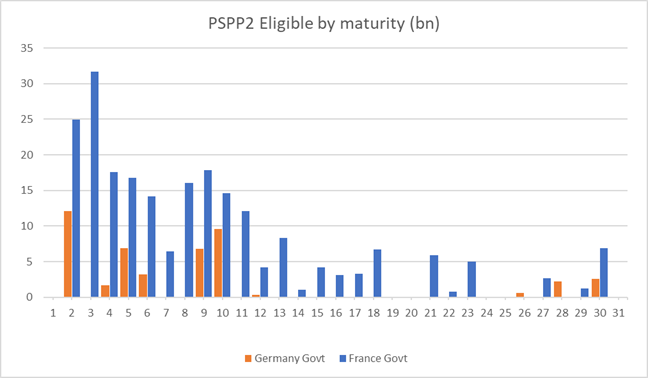

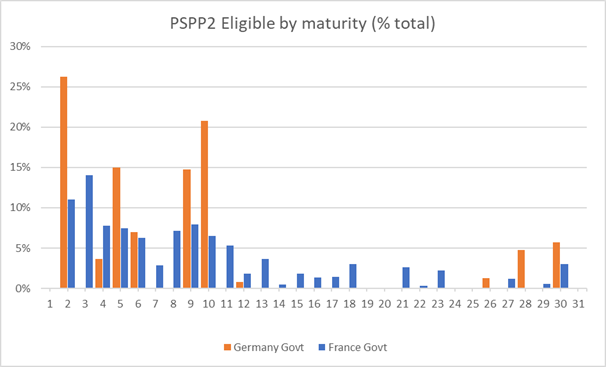

More on PSPP2 for 2019: Bias is for France-Germany wideners in 2y and 10y sectors next year

In Friday’s note (let me know if you didn’t see it), I presented my model estimates of redemption flows from the PSPP2 portfolios for Germany and France. What was clear is that for 2019, German redemptions run well ahead of French and by more than the capital key differential. For 2019, I estimate 39bn of Bund redemptions and only 23.2bn of OATs, a ratio of 1.68: 1 compared to the capital key ratio of 1.27:1. If I look at all purchases (including KFW, CADES, Lander and other agencies) the picture is even starker: 56bn of redemptions in Germany and 27.2bn in France giving a ratio of 2.05:1.

As I mentioned in the note, the profile of available bonds for purchase in Germany is very different from that of France. According to my estimates, Germany not only has fewer bonds available for purchase in notional terms, but these bonds are far more concentrated around the 2y,5y,10y and 30y supply points than in France.

If we look at the same numbers as a percentage of the available stock for purchase (not taking into account coming supply), the picture is even starker. On current issue sizes, over 25% of Bund purchases in 2019 could come in the 1y-2y bucket, compared to just over 10% in OATs. In the 10y sector it is a similar picture.

Hence not only could we see larger Bund buying compared to the capital key, but this buying will be concentrated in a smaller number of issues than for OATs. This very much suggests that it makes sense to go into the new year with an overweight of Germany vs France in the 2y and 10y sectors.

Does this sound plausible? All and any comments welcome!

Best wishes,

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

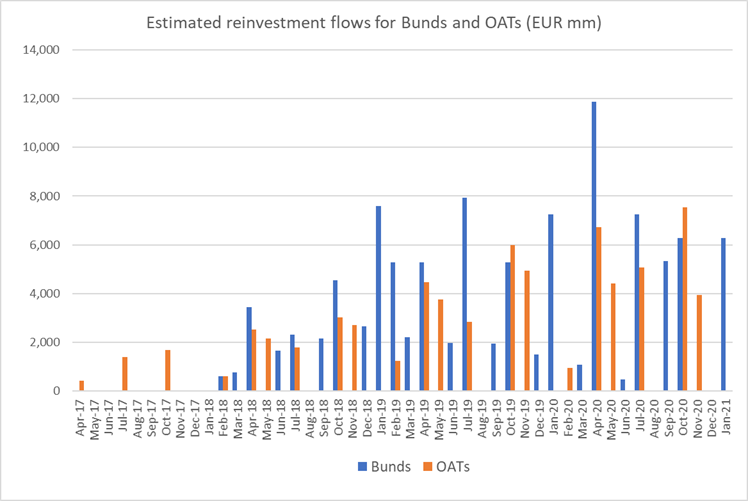

PSPP2 redemption/reinvestment flows for Bunds and OATs in 2019: Bunds should get a boost in Q1 19

Hi,

As many of you will know, I have been running my model for PSPP2 buying specifically for Germany (Bunds, KFW, Lander). After finally beating the French bond size data into submission, I have done the same with France (OATs, CADES & others).

What are the key observations, given my model estimates?

- The first 4 months of 2019 will see over EUR 20bn of Bund redemptions compared to just EUR 5.7bn for France.

- Taking 2019 as a whole, Bunds should see 18.1bn vs France’s 12.8bn. This is a ratio of 1.67 : 1. The capital key ratio is 1.27 : 1. This means that Germany will see considerably more buying relative to France than might be expected from the capital key.

- Bear in mind also that German purchases are likely more concentrated in specific issues (since the 33% ownership limit has been reached on many older issues). Currently purchases are being focused on the supply points: 5y, 10y and 30y.

- Ahead into 2020 the reinvestments are much closer to the capital key ratio.

Taken together, this suggests that Germany-France spreads should (all things being equal) come under widening pressure in 5y,10y and 30y sectors in the first quarter of next year.

Of most interest for the coming months is the pattern of redemption/reinvestment flows, and this is shown in the chart using last month’s data. Hence the redemption sizes will increase slightly as we still have three months of (reduced) purchases of new assets. I am assuming that government redemptions are reinvested into governments while agency/Lander debt is also reinvested in the same bond class.

And here are the numbers (as of end-Sept 18), with the annual totals. Bear in mind that the redemption can be reinvested over subsequent months, rather than immediately.

|

Month |

Bunds |

OATs |

|

Apr-17 |

- |

427 |

|

May-17 |

- |

- |

|

Jun-17 |

- |

- |

|

Jul-17 |

- |

1,389 |

|

Aug-17 |

- |

- |

|

Sep-17 |

- |

- |

|

Oct-17 |

- |

1,693 |

|

Nov-17 |

- |

- |

|

Dec-17 |

- |

- |

|

2017 Total |

- |

3,509 |

|

Jan-18 |

- |

- |

|

Feb-18 |

592 |

598 |

|

Mar-18 |

750 |

- |

|

Apr-18 |

3,446 |

2,522 |

|

May-18 |

- |

2,153 |

|

Jun-18 |

1,652 |

- |

|

Jul-18 |

2,312 |

1,777 |

|

Aug-18 |

- |

- |

|

Sep-18 |

2,164 |

- |

|

Oct-18 |

4,535 |

3,012 |

|

Nov-18 |

- |

2,712 |

|

Dec-18 |

2,659 |

- |

|

2018 Total |

18,111 |

12,775 |

|

Jan-19 |

7,596 |

- |

|

Feb-19 |

5,280 |

1,248 |

|

Mar-19 |

2,206 |

- |

|

Apr-19 |

5,280 |

4,453 |

|

May-19 |

- |

3,765 |

|

Jun-19 |

1,973 |

- |

|

Jul-19 |

7,920 |

2,847 |

|

Aug-19 |

- |

- |

|

Sep-19 |

1,937 |

- |

|

Oct-19 |

5,280 |

5,976 |

|

Nov-19 |

- |

4,948 |

|

Dec-19 |

1,485 |

- |

|

2019 Total |

38,957 |

23,236 |

|

Jan-20 |

7,260 |

- |

|

Feb-20 |

- |

959 |

|

Mar-20 |

1,079 |

- |

|

Apr-20 |

11,880 |

6,719 |

|

May-20 |

- |

4,419 |

|

Jun-20 |

482 |

- |

|

Jul-20 |

7,260 |

5,068 |

|

Aug-20 |

- |

- |

|

Sep-20 |

5,328 |

- |

|

Oct-20 |

6,270 |

7,530 |

|

Nov-20 |

- |

3,945 |

|

Dec-20 |

- |

- |

|

2020 Total |

39,558 |

28,638 |

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

What has the Bundebank bought for PSPP2 in September? ML model results including future redemption estimates.

Here are the results of my Maximum Likelihood model for PSPP2 purchases in Germany for September. This month the model suggests strong buying in the 10y sector, with the remainder localized around 1y-2y, 5y and 30y (unsurprisingly, as these are the supply points where bonds have been in the programme for a shorter period).

The redemption flows for the first 3 months of 2019, when new purchases will have ceased, are substantial. For governments the model estimates redemptions of 7.6bn in January, 5.3bn in February and 2.2bn in March: an average of 5bn per month for the first quarter of 2019. As a consequence the ending of new purchases may hardly be noticed.

The estimated breakdown of purchasing for September across Govts, KFW and the Lander:

|

Category |

Notional |

WAM |

|

German Govt |

4.8 |

9.2 |

|

KFW |

1.2 |

6.0 |

|

Lander |

2.5 |

6.4 |

|

All Purchases |

8.5 |

7.9 |

Given the model, here’s a chart showing the estimated redemption flows for the year ahead:

And the numbers for that chart:

|

Redemptions |

||||

|

Govt |

KFW |

Lander |

Total |

|

|

Apr-17 |

0 |

0 |

0 |

0 |

|

May-17 |

0 |

0 |

0 |

0 |

|

Jun-17 |

0 |

0 |

0 |

0 |

|

Jul-17 |

0 |

0 |

0 |

0 |

|

Aug-17 |

0 |

0 |

0 |

0 |

|

Sep-17 |

0 |

0 |

0 |

0 |

|

Oct-17 |

0 |

0 |

0 |

0 |

|

Nov-17 |

0 |

0 |

0 |

0 |

|

Dec-17 |

0 |

0 |

0 |

0 |

|

Jan-18 |

0 |

5 |

0 |

5 |

|

Feb-18 |

592 |

83 |

0 |

674 |

|

Mar-18 |

750 |

0 |

151 |

901 |

|

Apr-18 |

3446 |

0 |

70 |

3516 |

|

May-18 |

0 |

0 |

97 |

97 |

|

Jun-18 |

1652 |

2036 |

329 |

4017 |

|

Jul-18 |

2312 |

1081 |

561 |

3954 |

|

Aug-18 |

0 |

0 |

71 |

71 |

|

Sep-18 |

2164 |

0 |

423 |

2587 |

|

Oct-18 |

4535 |

1650 |

643 |

6828 |

|

Nov-18 |

0 |

0 |

847 |

847 |

|

Dec-18 |

2659 |

1650 |

303 |

4612 |

|

Jan-19 |

7596 |

1980 |

880 |

10456 |

|

Feb-19 |

5280 |

0 |

676 |

5956 |

|

Mar-19 |

2206 |

3300 |

349 |

5855 |

|

Apr-19 |

5280 |

272 |

784 |

6336 |

|

May-19 |

0 |

0 |

664 |

664 |

|

Jun-19 |

1973 |

0 |

563 |

2536 |

|

Jul-19 |

7920 |

495 |

99 |

8514 |

|

Aug-19 |

0 |

660 |

369 |

1029 |

|

Sep-19 |

1937 |

78 |

951 |

2966 |

|

Oct-19 |

5280 |

1650 |

2179 |

9109 |

|

Nov-19 |

0 |

0 |

520 |

520 |

|

Dec-19 |

1485 |

0 |

574 |

2059 |

|

Jan-20 |

7260 |

3300 |

1870 |

12430 |

|

Feb-20 |

0 |

121 |

680 |

801 |

|

Mar-20 |

1079 |

0 |

1369 |

2447 |

|

Apr-20 |

11880 |

0 |

395 |

12275 |

|

May-20 |

0 |

0 |

388 |

388 |

|

Jun-20 |

482 |

1786 |

653 |

2922 |

|

Jul-20 |

7260 |

0 |

2186 |

9446 |

|

Aug-20 |

0 |

0 |

560 |

560 |

|

Sep-20 |

5328 |

0 |

957 |

6285 |

|

Oct-20 |

6270 |

495 |

942 |

7707 |

|

Nov-20 |

0 |

0 |

1125 |

1125 |

|

Dec-20 |

0 |

0 |

783 |

783 |

|

Jan-21 |

6270 |

3630 |

1102 |

11002 |

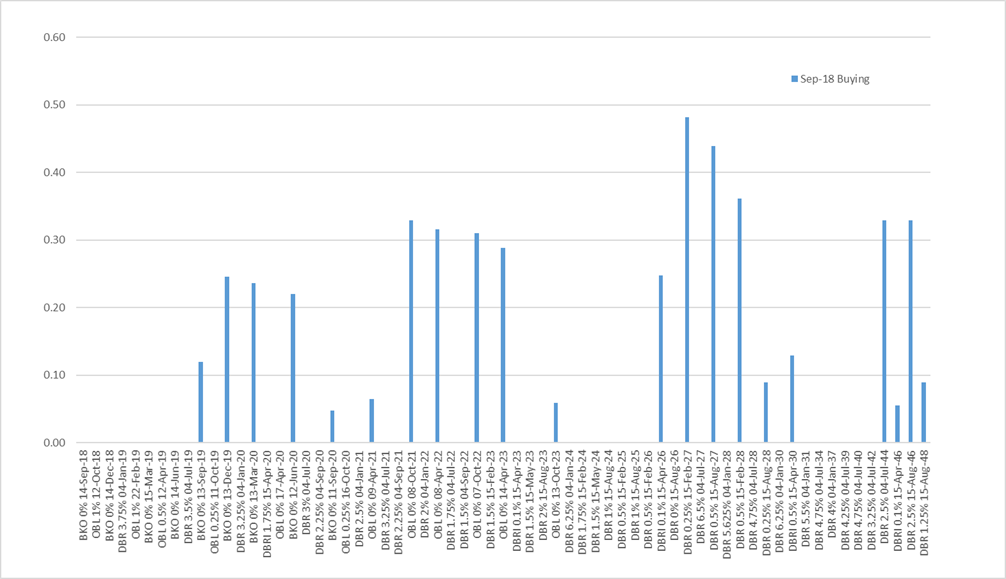

For the model itself, here are the estimates for the buying of German Governments in September:

This chart shows the remaining notional available for purchase by the programme given the estimated buying to date and the notional limits in place.

Finally, here’s the issue by issue breakdown of how much of each government bond my model estimates that the Bundesbank has bought:

|

Bond |

Opened |

O/S (bn) |

Purchasable |

Market Yield |

Purchased |

% Purchased |

Remaining |

Margin of Error |

MV Remaining |

Sep-18 Buying |

|

DBR 3.75% 04-Jan-17 |

Nov-06 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.75% 24-Feb-17 |

Jan-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 10-Mar-17 |

Feb-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 07-Apr-17 |

May-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 16-Jun-17 |

May-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-17 |

May-07 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 15-Sep-17 |

Aug-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 13-Oct-17 |

Sep-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 15-Dec-17 |

Nov-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

DBR 4% 04-Jan-18 |

Nov-07 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 23-Feb-18 |

Jan-13 |

0.0 |

0.0 |

|

0.6 |

|

0.0 |

+/- 3% |

0.0 |

0.0 |

|

BKO 0% 16-Mar-18 |

Feb-16 |

0.0 |

0.0 |

|

0.8 |

|

0.0 |

+/- 4% |

0.0 |

0.0 |

|

OBL 0.25% 13-Apr-18 |

May-13 |

0.0 |

0.0 |

|

1.3 |

|

0.0 |

+/- 3% |

0.0 |

0.0 |

|

OBLI 0.75% 15-Apr-18 |

Apr-11 |

0.0 |

0.0 |

|

2.1 |

|

0.0 |

+/- 2% |

0.0 |

0.0 |

|

BKO 0% 15-Jun-18 |

May-16 |

0.0 |

0.0 |

|

1.7 |

|

0.0 |

+/- 2% |

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-18 |

May-08 |

0.0 |

0.0 |

|

2.3 |

|

0.0 |

+/- 2% |

0.0 |

0.0 |

|

BKO 0% 14-Sep-18 |

Aug-16 |

0.0 |

0.0 |

2.2 |

0.0 |

+/- 2% |

0.0 |

0.0 |

||

|

OBL 1% 12-Oct-18 |

Sep-13 |

17.0 |

0.0 |

-0.688 |

4.5 |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

|

BKO 0% 14-Dec-18 |

Nov-16 |

13.0 |

0.0 |

-0.602 |

2.7 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

DBR 3.75% 04-Jan-19 |

Nov-08 |

24.0 |

0.0 |

-0.733 |

7.6 |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

|

OBL 1% 22-Feb-19 |

Jan-14 |

16.0 |

0.0 |

-0.659 |

5.3 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

BKO 0% 15-Mar-19 |

Mar-17 |

13.0 |

0.0 |

-0.644 |

2.2 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

OBL 0.5% 12-Apr-19 |

May-14 |

16.0 |

0.0 |

-0.631 |

5.3 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

BKO 0% 14-Jun-19 |

May-17 |

13.0 |

0.0 |

-0.619 |

2.0 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

DBR 3.5% 04-Jul-19 |

May-09 |

24.0 |

0.0 |

-0.638 |

7.9 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

BKO 0% 13-Sep-19 |

Aug-17 |

13.0 |

0.0 |

-0.633 |

1.9 |

|

0.0 |

+/- 2% |

0.0 |

0.1 |

|

OBL 0.25% 11-Oct-19 |

Sep-14 |

16.0 |

5.3 |

-0.617 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 13-Dec-19 |

Nov-17 |

13.0 |

4.3 |

-0.618 |

1.5 |

35% |

2.8 |

+/- 2% |

2.8 |

0.2 |

|

DBR 3.25% 04-Jan-20 |

Nov-09 |

22.0 |

7.3 |

-0.697 |

7.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 13-Mar-20 |

Feb-18 |

13.0 |

4.3 |

-0.599 |

1.1 |

25% |

3.2 |

+/- 2% |

3.2 |

0.2 |

|

DBRI 1.75% 15-Apr-20 |

Jun-09 |

16.0 |

5.3 |

|

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 17-Apr-20 |

Jan-15 |

20.0 |

6.6 |

-0.609 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 12-Jun-20 |

May-18 |

12.0 |

4.0 |

-0.578 |

0.5 |

12% |

3.5 |

+/- 3% |

3.5 |

0.2 |

|

DBR 3% 04-Jul-20 |

Apr-10 |

22.0 |

7.3 |

-0.601 |

7.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.25% 04-Sep-20 |

Aug-10 |

16.0 |

5.3 |

-0.576 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 11-Sep-20 |

Aug-18 |

8.0 |

2.6 |

-0.553 |

0.0 |

2% |

2.6 |

+/- 7% |

2.6 |

0.0 |

|

OBL 0.25% 16-Oct-20 |

Jul-15 |

19.0 |

6.3 |

-0.564 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.5% 04-Jan-21 |

Nov-10 |

19.0 |

6.3 |

-0.552 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 09-Apr-21 |

Feb-16 |

21.0 |

6.9 |

-0.509 |

6.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.1 |

|

DBR 3.25% 04-Jul-21 |

Apr-11 |

19.0 |

6.3 |

-0.474 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.25% 04-Sep-21 |

Aug-11 |

16.0 |

5.3 |

-0.450 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 08-Oct-21 |

Jul-16 |

19.0 |

6.3 |

-0.441 |

6.2 |

99% |

0.0 |

+/- 1% |

0.0 |

0.3 |

|

DBR 2% 04-Jan-22 |

Nov-11 |

20.0 |

6.6 |

-0.403 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 08-Apr-22 |

Feb-17 |

18.0 |

5.9 |

-0.365 |

4.3 |

72% |

1.6 |

+/- 1% |

1.7 |

0.3 |

|

DBR 1.75% 04-Jul-22 |

Apr-12 |

24.0 |

7.9 |

-0.336 |

7.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 04-Sep-22 |

Sep-12 |

18.0 |

5.9 |

-0.313 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 07-Oct-22 |

Jul-17 |

17.0 |

5.6 |

-0.285 |

2.8 |

50% |

2.8 |

+/- 2% |

2.8 |

0.3 |

|

DBR 1.5% 15-Feb-23 |

Jan-13 |

18.0 |

5.9 |

-0.242 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 14-Apr-23 |

Feb-18 |

16.0 |

5.3 |

-0.200 |

1.2 |

23% |

4.1 |

+/- 2% |

4.1 |

0.3 |

|

DBRI 0.1% 15-Apr-23 |

Mar-12 |

16.0 |

5.3 |

|

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 15-May-23 |

May-13 |

18.0 |

5.9 |

-0.206 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2% 15-Aug-23 |

Sep-13 |

18.0 |

5.9 |

-0.169 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 13-Oct-23 |

Jul-18 |

10.0 |

3.3 |

-0.124 |

0.1 |

3% |

3.2 |

+/- 7% |

3.2 |

0.1 |

|

DBR 6.25% 04-Jan-24 |

Jan-94 |

10.3 |

3.4 |

-0.105 |

3.4 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.75% 15-Feb-24 |

Jan-14 |

18.0 |

5.9 |

-0.089 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 15-May-24 |

May-14 |

18.0 |

5.9 |

-0.058 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1% 15-Aug-24 |

Sep-14 |

18.0 |

5.9 |

-0.021 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-25 |

Jan-15 |

23.0 |

7.6 |

0.041 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1% 15-Aug-25 |

Jul-15 |

23.0 |

7.6 |

0.091 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-26 |

Jan-16 |

26.0 |

8.6 |

0.151 |

8.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBRI 0.1% 15-Apr-26 |

Mar-15 |

14.0 |

4.6 |

|

4.6 |

99% |

0.1 |

+/- 1% |

0.1 |

0.2 |

|

DBR 0% 15-Aug-26 |

Jul-16 |

25.0 |

8.3 |

0.212 |

8.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.25% 15-Feb-27 |

Jan-17 |

26.0 |

8.6 |

0.267 |

6.3 |

73% |

2.3 |

+/- 1% |

2.3 |

0.5 |

|

DBR 6.5% 04-Jul-27 |

Jul-97 |

11.2 |

3.7 |

0.252 |

3.7 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Aug-27 |

Jul-17 |

25.0 |

8.3 |

0.323 |

3.8 |

46% |

4.5 |

+/- 1% |

4.5 |

0.4 |

|

DBR 5.625% 04-Jan-28 |

Jan-98 |

14.5 |

4.8 |

0.315 |

4.8 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-28 |

Jan-18 |

21.0 |

6.9 |

0.383 |

1.5 |

22% |

5.4 |

+/- 1% |

5.5 |

0.4 |

|

DBR 4.75% 04-Jul-28 |

Oct-98 |

11.3 |

3.7 |

0.368 |

3.7 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.25% 15-Aug-28 |

Jul-18 |

13.0 |

4.3 |

0.443 |

0.1 |

3% |

4.2 |

+/- 6% |

4.1 |

0.1 |

|

DBR 6.25% 04-Jan-30 |

Jan-00 |

9.3 |

3.1 |

0.451 |

3.1 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBRI 0.5% 15-Apr-30 |

Apr-14 |

12.1 |

4.0 |

|

3.6 |

91% |

0.4 |

+/- 2% |

0.4 |

0.1 |

|

DBR 5.5% 04-Jan-31 |

Oct-00 |

17.0 |

5.6 |

0.525 |

5.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.75% 04-Jul-34 |

Jan-03 |

20.0 |

6.6 |

0.700 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4% 04-Jan-37 |

Jan-05 |

23.0 |

7.6 |

0.793 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-39 |

Jan-07 |

14.0 |

4.6 |

0.853 |

4.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.75% 04-Jul-40 |

Jul-08 |

16.0 |

5.3 |

0.862 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 3.25% 04-Jul-42 |

Jul-10 |

15.0 |

5.0 |

0.927 |

5.0 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.5% 04-Jul-44 |

Apr-12 |

25.0 |

8.3 |

0.997 |

7.7 |

93% |

0.6 |

+/- 1% |

0.8 |

0.3 |

|

DBRI 0.1% 15-Apr-46 |

Jun-15 |

8.0 |

2.6 |

|

1.8 |

68% |

0.8 |

+/- 2% |

1.1 |

0.1 |

|

DBR 2.5% 15-Aug-46 |

Feb-14 |

25.5 |

8.4 |

1.025 |

7.1 |

84% |

1.4 |

+/- 1% |

1.8 |

0.3 |

|

DBR 1.25% 15-Aug-48 |

Sep-17 |

10.5 |

3.5 |

1.064 |

0.8 |

24% |

2.6 |

+/- 2% |

2.7 |

0.1 |

|

Italic = index-linked |

Total |

47.5 |

4.8 |

|||||||

|

Yield below Depo Rate |

||||||||||

|

Yield above Depo Rate |

Bund WAM |

9.1 |

Any questions? More than happy to run you through the numbers in detail.

Best wishes

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Three: that's the magic number. Time-sensitive OTC trade ideas in EUR, USD and GBP

Hello … here are three trades (one each in EUR, USD and GBP) that are interesting me right now. I’ve kept the write-ups brief, but they will give a flavour of my thinking. All are very timely given Draghi’s comments in Europe, the imminent FOMC meeting and the ultra-long supply coming in the UK over the next week or so. All and any comments welcome as usual!

1. EUR: Buy 1m5y straddles, sell 1m30y straddles: Changing ECB expectations will drive the curve in the near-term

Buy EUR 203mm 1m5y atmf straddle (k=0.443%)

Sell EUR 42.2mm 1m30y atmf straddle (k=1.595%)

Strike entry at 115.2 bp vs 117.1 spot

For a premium of 0.4bp running (mid indic)

EUR 100k/bp equivalent at expiry

The recent Draghi comments on a “vigorous pick-up in underlying inflation” yesterday (Monday) drove a sharp sell-off in EUR rates. Praet’s attempt to dampen the market’s hawkish reading have not stemmed the move, with 2y1y almost 10bp higher than Friday’s close. The belly of the curve has underperformed as 5y/10y rates have led the way, with the 5y-30y spot curve bear-flattening and taking it out of the becalmed directionless range of the summer.

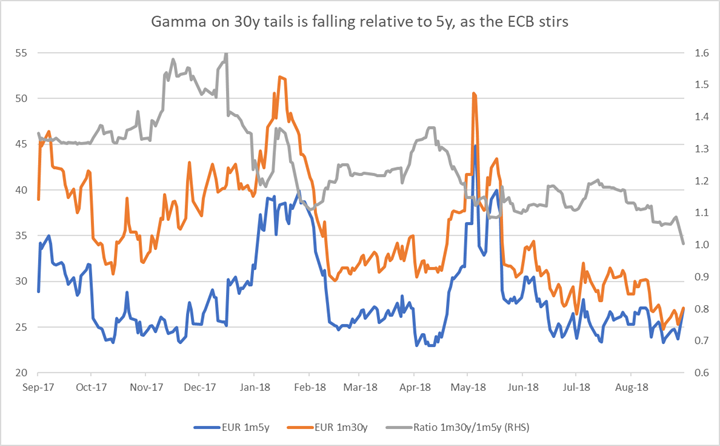

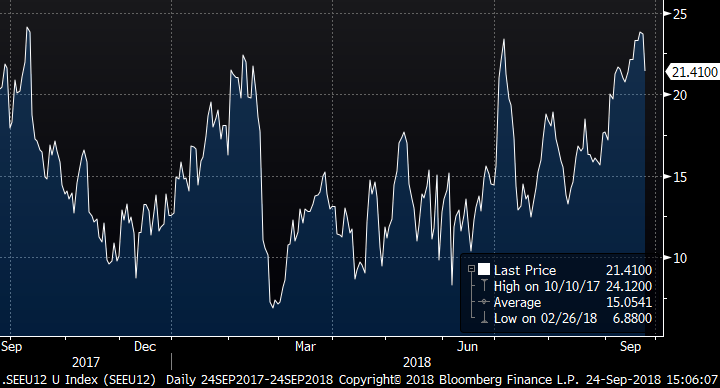

The theme of this trade is therefore momentum-based: in the near-term, ECB speculation will continue to increase the volatility of 5y rates compared to 30y. The chart shows how gamma on 30y tails is still decreasing, while 5y gamma has found a floor.

Source: CitiVelocity

So with 5y leading 30y, I see the curve bull-steepening back in a relief rally, or bear-flattening further if the hiking genie escapes from the bottle. Either way, the trade then is to buy 1m5y straddles, funded by selling 1m30y. The 1-month expiry takes us up to the next ECB meeting on 25th October, and spans the next release of the ECB minutes.

2. USD: Buy 1y1y1y receiver ladders: Position for a modest reduction in Fed expectations

Buy USD 1.05bn 1y1y1y mid-curve receiver k=3.25%

Sell USD 1.05bn 1y1y1y mid-curve receiver k=3.00%

Sell USD 1.05bn 1y1y1y mid-curve receiver k=2.75%

Atmf at 3.23%

For premium take out of 1bp running (mid indic)

USD 100k/bp equivalent at expiry

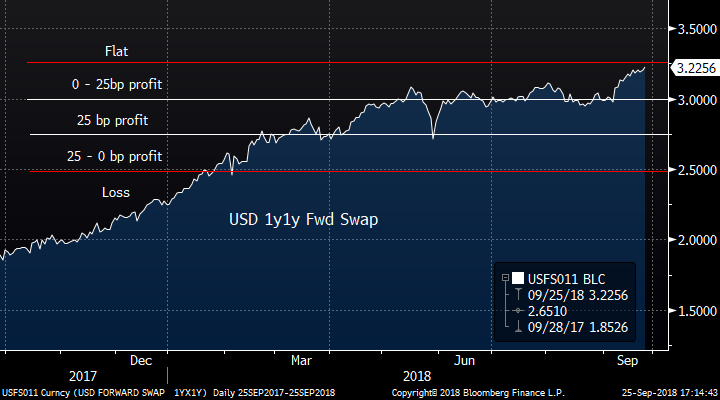

In the past month the market has added almost another 25bp hike to the terminal rate for US Libor, which had been stalled at 3%. The US economy is doing fine, so I am not saying this is unwarranted, but it does make me look for low-cost trades for a mild reversal. This suggests mid-curve receiver ladders, with relatively wide strikes. There are numerous combinations of expiry, forward rate and strikes, but as an example, I’ve priced 1y expiry ladders on 1y1y fwd with 25bp strike intervals.

The bottom line is that as long as the 1y1y rate in a year’s time expires above 2.50% (ie fewer than three hikes have been taken out of the Fed hiking path) the trade at least nets the premium taken out at inception, with a maximum profit of 25bp. In the meantime, if expectations remain steady the trade will show positive mark-to-market as the out-of-the-money strikes become less valuable. The risk is that there is a catastrophic reversal in the fortunes of the US economy and the Fed only hikes once or even reverses course.

3. GBP: Flattener on 10y20y/30y20y in swaps: Forthcoming ultra-long supply will be well-received at these yield levels

Pay GBP 68mm 10y20y fwd swap (20y rate, starting in 10y)

Recv GBP 90.5mm 30y20y fwd swap (20y rate, starting in 30y)

at -26.5bp

DV01 of EUR 100k/bp

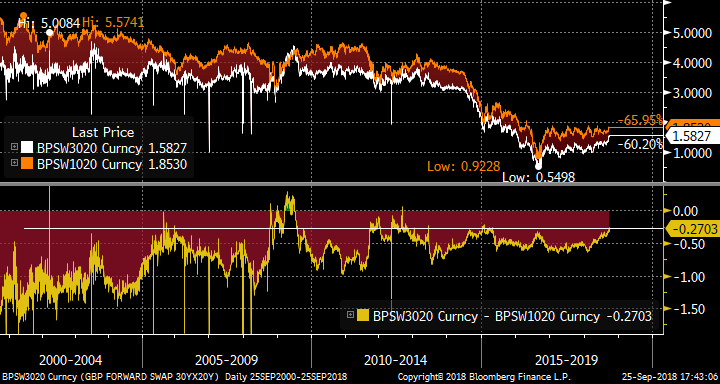

As I mentioned in my latest portfolio update, the steepening of the 30y-50y sector of the UK curve has pushed the 30y20y forward rate to its historical highs (absent ‘08/’09). This is tied up inextricably with the forthcoming ultra-long supply.

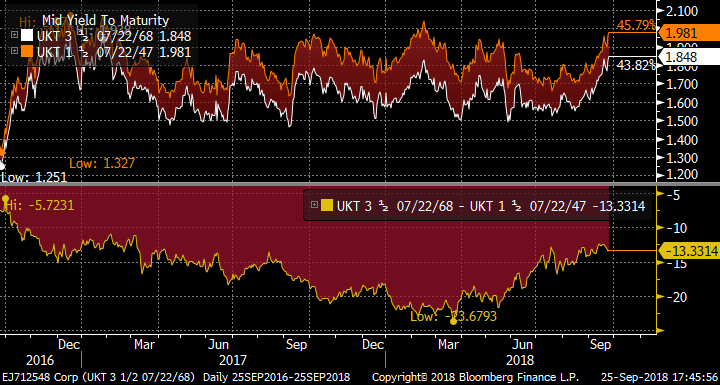

Chart of the spread (yellow) of the 10y20y / 30y20y rates in GBP:

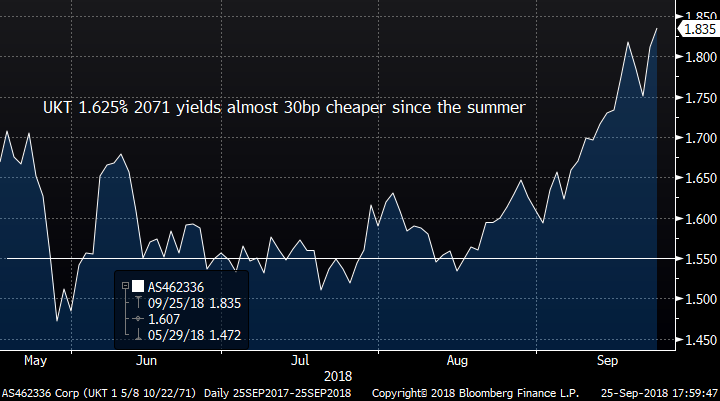

The steepening is closely connected to the UKT 30y – 50y Gilt curve, as we approach the re-opening syndication of the UKT 1.625% 2071 conventional Gilt on or around 9th October (our estimate). Before that we the possible sale by Prudential of 33NC13 and 50NC30 paper, maybe as early as tomorrow (Weds) and the size of these books will be a good guide to ultra-long demand. Our anticipation is that the 71 supply will be oversubscribed by real-money investors given the high absolute yield levels after a 30bp sell-off since the summer.

UK 30y-50y conventional Gilt curve has been steepening into the supply event, and yields are now close to their historic peaks:

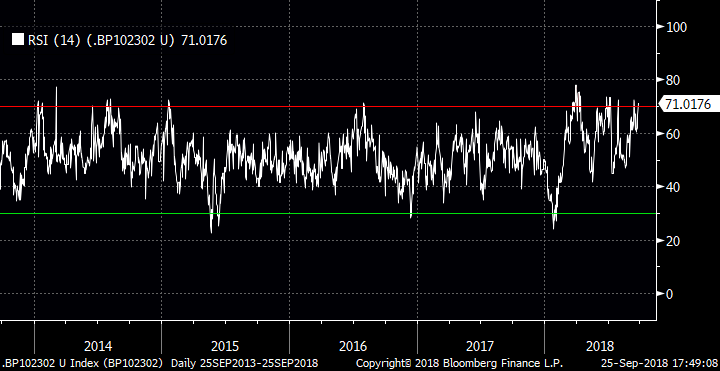

For the technically-minded, the RSI of the 10y20y/30y20y is into overbought territory (thanks to Chris Williams for this observation).

If any, or all of these trades are of interest, please get in touch!

Best wishes,

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490