How are we doing? Shadow portfolio update

Portfolio since 14th Feb: USD -7k, Ytd +151k

Summary: It’s been a while since the last update, but neither I nor the markets have been idle. That said, the portfolio’s P&L is pretty much unchanged. Starting with the least successful trade, I stopped out of the GBP/USD 5y5y cross-currency basis trade which subsequently went further offside. The RX/UB invoice spread box, while up from its inception in December last year, finished down versus the 1st Jan mark: it was becalmed in a 3.5/5.5 bp range and had not exhibited any of the relative richening of Bunds that I had anticipated for the first quarter. I switched my outright USD steepening exposure into a box trade versus GBP in two versions (vanilla swaps and CMS caps) and that is working for now. The rally in EUR rates since mid-February worked well for the 2y2y/5y10y bull-steepener, for even though the curve did not steepen, the relative moneyness of the 2y2y leg ensured a gain. As a tactical bet on a hawkish ECB at the March meeting I set a 3y1y/10y10y flattener in swaps: this performed into the meeting and further after the initial announcement, however Draghi’s Q&A reversed sentiment and the trade gave back a lot (but not all) of the initial gains. Most recently I have added a 1y expiry EUR CMS 10-5 collar (selling 80bp cap to buy 33bp floor) as a long-term flattening position.

Changes:

- Closed USD 2y-10y, 1y fwd steepener and replaced with two versions of the cross-market GBP/USD 2y-10y box trade

- Stopped out of GBP/USD 5y5y xccy basis

- Closed RX/UB invoice spread box before contract roll

- Closed EUR 2y2y/5y10y bull-steepener

- Opened and closed EUR 3y1y/10y10y tactical flattener around the March ECB meeting

- Opened EUR CMS 10-5 collar flattener

|

Trade Idea |

Entered |

Level |

Size |

Status |

Exit/Current Level |

Exit Date |

P&L k USD |

|

US 2-10 steepener via CMS caps |

28-Dec-17 |

0 bp |

USD 25 k/bp |

CLOSED |

0 bp |

15-Jan-18 |

0 |

|

RX/UB ASW Box |

28-Dec-17 |

-6.1 bp |

EUR 50 k/bp |

CLOSED |

-5.2 bp |

06-Mar-18 |

-56 |

|

EUR 1y3y/5y5y Mid-curve flattener |

28-Dec-17 |

13.7 bp |

EUR 20 k/bp |

CLOSED |

29 bp |

31-Jan-18 |

380 |

|

GBP 1y1y1y MC Payer spread |

28-Dec-17 |

0.7 bp |

GBP 25 k/bp |

CLOSED |

-1 bp |

31-Jan-18 |

-60 |

|

EUR 9m1y1y/9m1y5y Bear Flattener |

28-Dec-17 |

4.2 bp |

EUR 25 k/bp |

CLOSED |

0 bp |

30-Jan-18 |

-130 |

|

Receive GBP/USD 5y5y xccy basis |

28-Dec-17 |

1 bp |

GBP 40 k/bp |

CLOSED |

6.4 bp |

28-Feb-18 |

-297 |

|

EUR 2-5-10 weighted swap fly |

28-Dec-17 |

-28.1 bp |

EUR 40 k/bp |

CLOSED |

-25 bp |

25-Jan-18 |

-154 |

|

GBP 2y-10y Bull-steepener |

05-Jan-18 |

0 bp |

GBP 20 k/bp |

OPEN |

0 bp |

0 |

|

|

EUR 2y2y/5y10y Bull-Steepener |

30-Jan-18 |

0 bp |

EUR 25 k/bp |

CLOSED |

4 bp |

05-Mar-18 |

123 |

|

USD 2y-10y, 1y fwd steepener |

02-Feb-18 |

22 bp |

USD 25 k/bp |

CLOSED |

20.5 bp |

21-Feb-18 |

-38 |

|

GBP/USD 2y-10y 1y fwd Swaps |

21-Feb-18 |

-25.5 bp |

GBP 25 k/bp |

OPEN |

-18.6 bp |

244 |

|

|

GBP 2y-10y vs USD CMS Caps |

21-Feb-18 |

0 bp |

GBP 25 k/bp |

OPEN |

1 bp |

35 |

|

|

EUR 3y1y/10y10y flattener |

06-Mar-18 |

124 bp |

EUR 25 k/bp |

CLOSED |

120 bp |

08-Mar-18 |

123 |

|

EUR CMS 10-5 collar |

06-Mar-18 |

0.5 bp |

EUR 40 k/bp |

OPEN |

0.1 bp |

-20 |

|

|

Total YTD |

151 |

||||||

|

Note on trade sizing: Each trade is sized to generate approx. USD 150k 2y 99% hist. VaR at inception with no netting |

|||||||

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

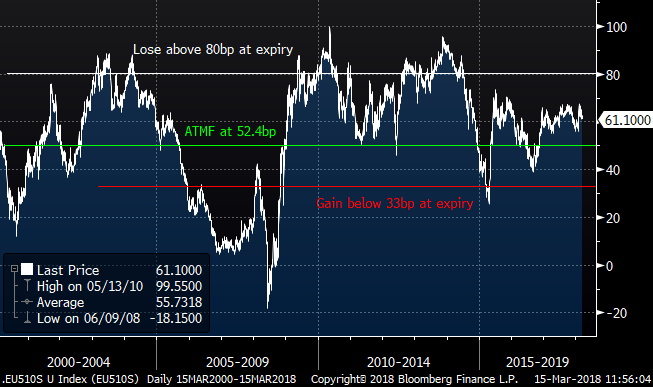

Trade: EUR flattener via CMS collars on 5y-10y

Bottom line: My previous piece on EUR 5-10-30 went through the reasons that I like EUR flatteners, this trade is another expression. The high skew on curve caps compared to floors offers an interesting risk/reward on a zero-cost structure.

Trade:

Buy EUR 1bn 1y floor on CMS 10-5 k=33bp

Sell EUR 1bn 1y Cap on CMS 10-5 k=80bp

for zero-cost (indicative mid)

equivalent to EUR 100k/bp of the 5y-10y curve.

Atmf at 52.4bp. Spot vanilla 5y-10y at 61bp.

Rationale: It won’t have escaped notice, but I like EUR flattening exposure, for all the reasons I have gone into previously. This collar structure is a more leveraged way to position for a flattening. The cap is struck 27.6bp OTM, while the floor that you are long is only 19.4bp OTM, due to the high skew on otm caps compared to floors (implied vol: 23.8 bp/y on the cap vs 18.6 on the floor). The curve will probably not steepen enough to reach the lower boundary, however the value of the structure will increase if the curve flattens.

The risk is that the curve steepens through 80bp at expiry. This would be a significant reversal in the current dynamic and require a move back to Jul-14 levels. One scenario could be a large sell-off in the US while Europe stagnates (and hence short rates do not join in the sell-off).

Love to hear your thoughts,

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

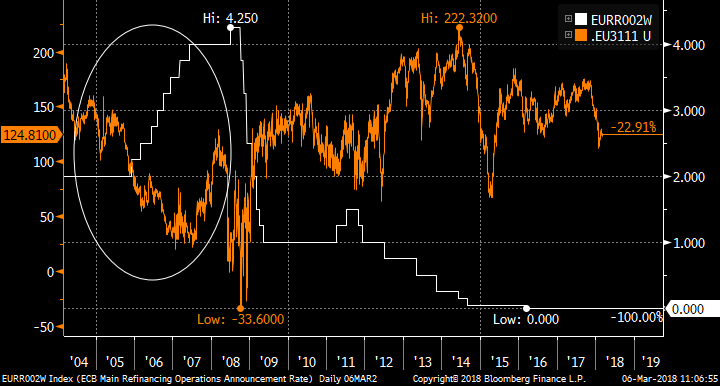

Trade: A tactical proposal to re-enter EUR flatteners ahead of Thursday's ECB

Summary: I’m making a highly tactical case to be in flattening positions over this week’s ECB meeting. For the past two meetings the market has taken a bearish read of ECB statements, triggering moves higher in short rates. Recent comments from the more hawkish Governing Council members have done nothing to suggest this view is misplaced. I have a long-term flattening view, so this may be the best opportunity to reset that after the re-steepening of early Feb.

Trade:

Pay EUR 1bn 3y1y

Recv EUR 123mm 10y10y

EUR 100k/bp equivalent.

Enter at 124bp. Near-term target 114bp. Stop 127bp. Rolldown of -3.5bp over one month.

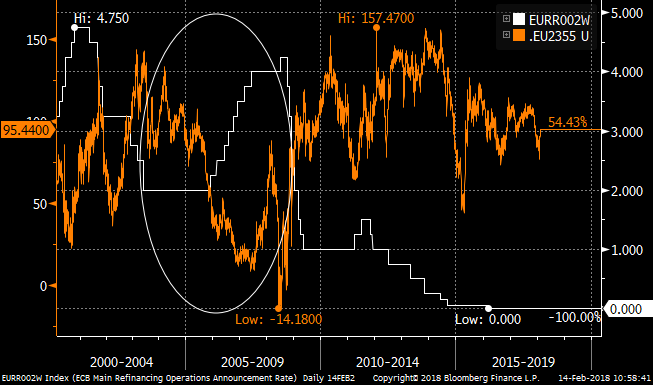

Rationale: My underlying view is that the EUR curve should bear-flatten as the ECB moves towards an exit from QE (or at least new purchases) and the eventual raising of rates. The chart shows the long history of the 3y1y/10y10y spread (orange) together with the ECB target rate. Back in 2005, the curve flattened in anticipation of rising rates, and continued to flatten as the first hikes took place. The difference in tenors between 3y1y and 10y10y has been chosen deliberately to highlight the move: short rates react much more rapidly to central bank action while long-term rate expectations are slower to respond.

In recent months (again perhaps unsurprisingly) ECB meetings and minutes releases have coincided with bearish moves in rate expectations. Even though at first read the statement and minutes have not been particularly hawkish, the market has taken them as a green light to re-assess the future path of rates.

This table shows the change in rates between the day before and the day after recent ECB events. The biggest movers have, on average, been the 3y1y moving higher while 10y10y and 10y20y moved lower. Even on the release of the Jan minutes in February, where the market took a bullish tone, the 3y1y rate rallied less than the 10y10y rate and the curve still flattened.

|

|

|

Spot |

|

|

|

Fwds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Event |

|

2y |

5y |

10y |

30y |

1y2y |

1y5y |

1y10y |

1y30y |

2y2y |

2y5y |

2y10y |

2y30y |

1y1y |

2y1y |

3y1y |

4y1y |

2y3y |

5y5y |

10y10y |

10y20y |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

14-Dec-17 |

Meeting |

2.8 |

0.4 |

-2.0 |

-4.7 |

0.6 |

-0.8 |

-2.4 |

-5.2 |

0.2 |

-1.3 |

-3.0 |

-5.5 |

0.2 |

1.2 |

-0.4 |

-0.3 |

-0.2 |

-3.5 |

-6.1 |

-6.9 |

|

11-Jan-18 |

Minutes |

1.9 |

6.4 |

4.1 |

0.7 |

6.8 |

6.4 |

3.5 |

-0.4 |

8.2 |

6.6 |

2.9 |

-0.6 |

3.9 |

10.1 |

9.3 |

8.2 |

8.0 |

4.4 |

-2.6 |

-2.9 |

|

25-Jan-18 |

Meeting |

2.4 |

6.9 |

3.1 |

-4.4 |

4.9 |

7.6 |

2.1 |

-4.7 |

9.3 |

8.0 |

1.3 |

-5.2 |

2.2 |

7.3 |

13.5 |

10.7 |

9.8 |

0.6 |

-9.6 |

-9.2 |

|

22-Feb-18 |

Minutes |

0.1 |

-4.3 |

-4.1 |

-6.0 |

-1.9 |

-3.9 |

-4.9 |

-4.5 |

-3.6 |

-5.0 |

-5.4 |

-4.6 |

-0.3 |

-3.5 |

-3.2 |

-7.5 |

-4.3 |

-8.0 |

-4.4 |

-4.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Average |

1.8 |

2.4 |

0.3 |

-3.6 |

2.6 |

2.3 |

-0.4 |

-3.7 |

3.5 |

2.1 |

-1.0 |

-4.0 |

1.5 |

3.8 |

4.8 |

2.8 |

3.3 |

-1.7 |

-5.7 |

-5.9 |

Focusing on the 3y1y/10y10y spread:

|

3y1y / 10y10y |

|

|

14-Dec-17 |

-5.7 |

|

11-Jan-18 |

-12.0 |

|

25-Jan-18 |

-23.2 |

|

22-Feb-18 |

-1.3 |

The simplest way to position for a repeat of this move would be to pay the 3y1y vanilla rate and receive 10y10y.

Too speculative? All feedback welcome!

Best

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

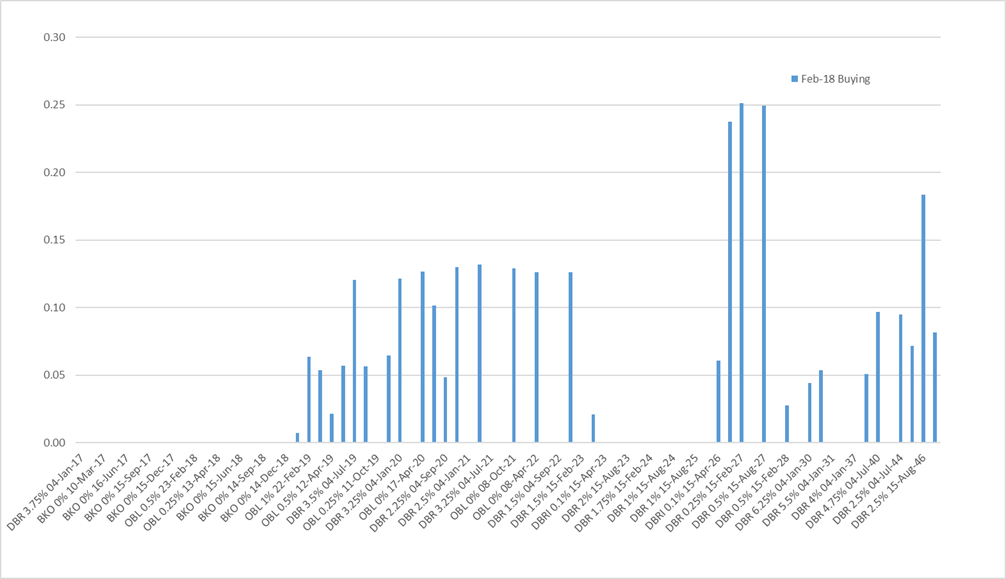

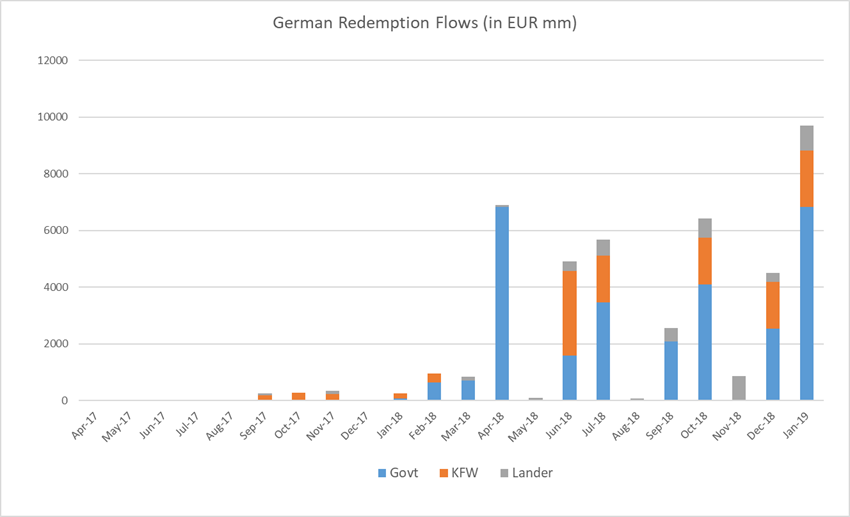

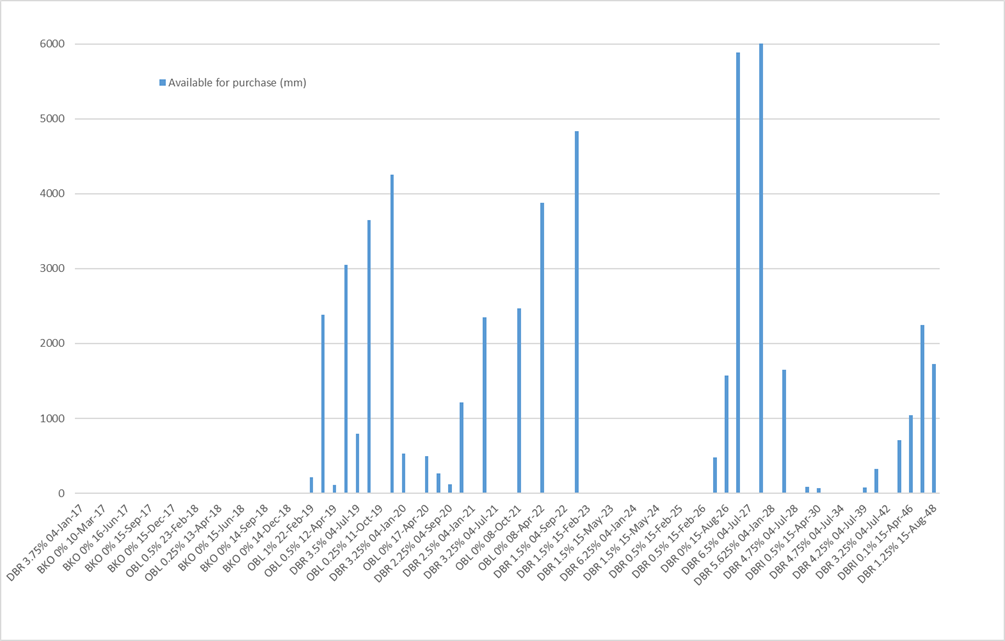

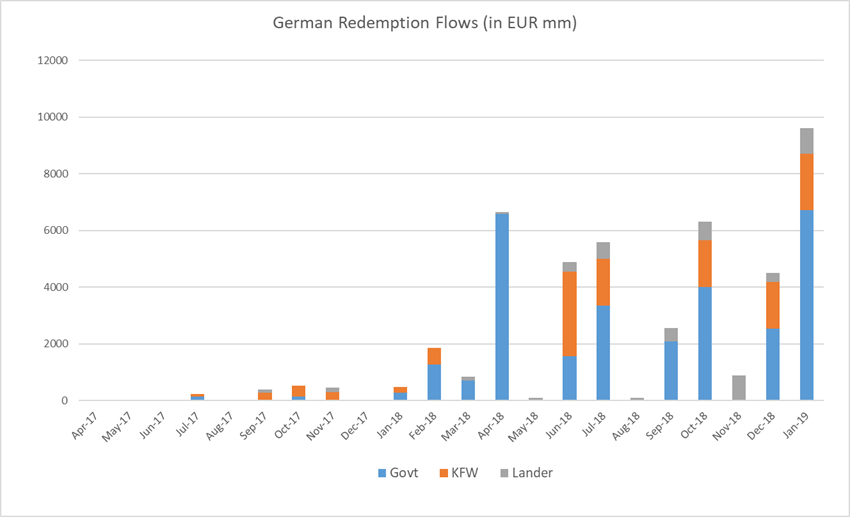

PSPP2 data for Germany suggests a significant lengthening of purchases in February

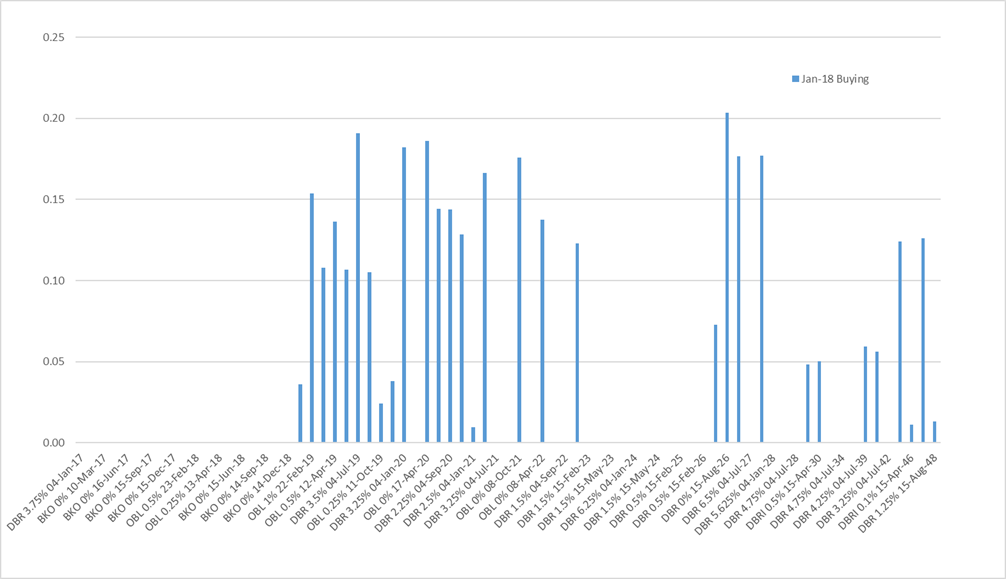

I’ve put today’s PSPP2 data for Germany through my Maximum Likelihood Model, and here are the main conclusions:

- A significant increase in the WAM of Germany buying in February, up from 6.3y to 9.1y;

- A larger than usual buying of Lander paper (up to an estimated 2.2 bn vs 1.3bn previously);

- Thus the percentage on non-Bund purchases was 48% (from 34% in Jan);

- I estimate an extra 0.96bn of buying from redemption flows in Feb (in Bunds and KFW);

- The largest buying came in the Aug-26, Feb-27 and Aug-27;

- More buying of Bunds in 10y and 30y sectors;

- The new Bobl Apr-23 which was issued in February was bought (it appeared in the repo list) though my model only suggests 20mm of buying.

The model’s results in detail:

The estimate for the WAM for purchases in January for the various categories of paper are as follows:

|

Category |

Notional |

WAM |

|

German Govt |

3.0 |

9.3 |

|

KFW |

0.6 |

9.4 |

|

Lander |

2.2 |

8.7 |

|

All Purchases |

5.8 |

9.1 |

The per-issue charts for monthly purchases, and available notional left to purchase:

Given the model’s estimates for purchasing, here is how I see the redemption flows in Bunds currently. Numbers for Mar-19 onwards will continue to rise as more purchases are made.

|

Redemptions |

||||

|

Govt |

KFW |

Lander |

Total |

|

|

Apr-17 |

0 |

0 |

0 |

0 |

|

May-17 |

0 |

0 |

0 |

0 |

|

Jun-17 |

0 |

0 |

0 |

0 |

|

Jul-17 |

0 |

0 |

0 |

0 |

|

Aug-17 |

0 |

0 |

0 |

0 |

|

Sep-17 |

2 |

189 |

78 |

269 |

|

Oct-17 |

7 |

279 |

0 |

286 |

|

Nov-17 |

0 |

231 |

123 |

354 |

|

Dec-17 |

0 |

0 |

0 |

0 |

|

Jan-18 |

82 |

185 |

0 |

267 |

|

Feb-18 |

653 |

311 |

0 |

964 |

|

Mar-18 |

708 |

0 |

144 |

852 |

|

Apr-18 |

6832 |

0 |

78 |

6910 |

|

May-18 |

0 |

0 |

106 |

106 |

|

Jun-18 |

1593 |

2970 |

342 |

4905 |

|

Jul-18 |

3457 |

1650 |

581 |

5688 |

|

Aug-18 |

0 |

0 |

85 |

85 |

|

Sep-18 |

2088 |

0 |

473 |

2561 |

|

Oct-18 |

4108 |

1650 |

668 |

6426 |

|

Nov-18 |

0 |

0 |

867 |

867 |

|

Dec-18 |

2540 |

1650 |

324 |

4514 |

|

Jan-19 |

6840 |

1980 |

892 |

9712 |

|

Feb-19 |

5210 |

0 |

629 |

5839 |

|

Mar-19 |

1948 |

3300 |

302 |

5550 |

|

Apr-19 |

5260 |

274 |

753 |

6287 |

|

May-19 |

0 |

0 |

558 |

558 |

|

Jun-19 |

1281 |

0 |

487 |

1768 |

|

Jul-19 |

7324 |

495 |

96 |

7915 |

|

Aug-19 |

0 |

660 |

332 |

992 |

|

Sep-19 |

695 |

0 |

623 |

1318 |

|

Oct-19 |

5280 |

1650 |

1863 |

8793 |

|

Nov-19 |

0 |

0 |

349 |

349 |

|

Dec-19 |

101 |

0 |

493 |

594 |

|

Jan-20 |

6920 |

3300 |

1568 |

11789 |

|

Feb-20 |

0 |

7 |

592 |

599 |

|

Mar-20 |

0 |

0 |

1285 |

1285 |

|

Apr-20 |

11577 |

0 |

98 |

11675 |

|

May-20 |

0 |

0 |

330 |

330 |

|

Jun-20 |

0 |

1650 |

535 |

2185 |

|

Jul-20 |

7176 |

0 |

1497 |

8673 |

|

Aug-20 |

0 |

0 |

471 |

471 |

|

Sep-20 |

5252 |

0 |

696 |

5948 |

|

Oct-20 |

5165 |

495 |

520 |

6180 |

|

Nov-20 |

0 |

0 |

1063 |

1063 |

|

Dec-20 |

0 |

0 |

741 |

741 |

|

Jan-21 |

6270 |

3630 |

928 |

10828 |

Or, in chart form:

Finally, here are the per-issue estimates for Bunds:

|

Bond |

Opened |

O/S (bn) |

Purchasable |

Market Yield |

Purchased |

% Purchased |

Remaining |

Margin of Error |

MV Remaining |

Feb-18 Buying |

|

DBR 3.75% 04-Jan-17 |

Nov-06 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.75% 24-Feb-17 |

Jan-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 10-Mar-17 |

Feb-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 07-Apr-17 |

May-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 16-Jun-17 |

May-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-17 |

May-07 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 15-Sep-17 |

Aug-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

+/- 72% |

0.0 |

0.0 |

|

OBL 0.5% 13-Oct-17 |

Sep-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

+/- 31% |

0.0 |

0.0 |

|

BKO 0% 15-Dec-17 |

Nov-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

DBR 4% 04-Jan-18 |

Nov-07 |

0.0 |

0.0 |

|

0.1 |

|

0.0 |

+/- 8% |

0.0 |

0.0 |

|

OBL 0.5% 23-Feb-18 |

Jan-13 |

0.0 |

0.0 |

0.7 |

0.0 |

+/- 3% |

0.0 |

0.0 |

||

|

BKO 0% 16-Mar-18 |

Feb-16 |

13.0 |

0.0 |

-0.750 |

0.7 |

0.0 |

+/- 5% |

0.0 |

0.0 |

|

|

OBL 0.25% 13-Apr-18 |

May-13 |

17.0 |

0.0 |

-0.837 |

2.1 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

OBLI 0.75% 15-Apr-18 |

Apr-11 |

15.0 |

0.0 |

4.7 |

0.0 |

+/- 1% |

0.0 |

0.0 |

||

|

BKO 0% 15-Jun-18 |

May-16 |

14.0 |

0.0 |

-0.707 |

1.6 |

0.0 |

+/- 3% |

0.0 |

0.0 |

|

|

DBR 4.25% 04-Jul-18 |

May-08 |

21.0 |

0.0 |

-0.710 |

3.5 |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

|

BKO 0% 14-Sep-18 |

Aug-16 |

13.0 |

0.0 |

-0.683 |

2.1 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

OBL 1% 12-Oct-18 |

Sep-13 |

17.0 |

0.0 |

-0.687 |

4.1 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

BKO 0% 14-Dec-18 |

Nov-16 |

13.0 |

0.0 |

-0.682 |

2.5 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

DBR 3.75% 04-Jan-19 |

Nov-08 |

24.0 |

0.0 |

-0.717 |

6.8 |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

|

OBL 1% 22-Feb-19 |

Jan-14 |

16.0 |

0.0 |

-0.696 |

5.2 |

|

0.0 |

+/- 1% |

0.0 |

0.1 |

|

BKO 0% 15-Mar-19 |

Mar-17 |

13.0 |

4.3 |

-0.673 |

1.9 |

45% |

2.3 |

+/- 2% |

2.4 |

0.1 |

|

OBL 0.5% 12-Apr-19 |

May-14 |

16.0 |

5.3 |

-0.671 |

5.3 |

100% |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

BKO 0% 14-Jun-19 |

May-17 |

13.0 |

4.3 |

-0.652 |

1.3 |

30% |

3.0 |

+/- 2% |

3.0 |

0.1 |

|

DBR 3.5% 04-Jul-19 |

May-09 |

24.0 |

7.9 |

-0.665 |

7.3 |

92% |

0.6 |

+/- 1% |

0.6 |

0.1 |

|

BKO 0% 13-Sep-19 |

Aug-17 |

13.0 |

4.3 |

-0.652 |

0.7 |

16% |

3.6 |

+/- 3% |

3.6 |

0.1 |

|

OBL 0.25% 11-Oct-19 |

Sep-14 |

16.0 |

5.3 |

-0.626 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 13-Dec-19 |

Nov-17 |

13.0 |

4.3 |

-0.623 |

0.1 |

2% |

4.2 |

+/- 14% |

4.2 |

0.1 |

|

DBR 3.25% 04-Jan-20 |

Nov-09 |

22.0 |

7.3 |

-0.622 |

6.9 |

95% |

0.3 |

+/- 1% |

0.4 |

0.1 |

|

DBRI 1.75% 15-Apr-20 |

Jun-09 |

16.0 |

5.3 |

|

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 17-Apr-20 |

Jan-15 |

20.0 |

6.6 |

-0.546 |

6.3 |

95% |

0.3 |

+/- 1% |

0.3 |

0.1 |

|

DBR 3% 04-Jul-20 |

Apr-10 |

22.0 |

7.3 |

-0.533 |

7.2 |

99% |

0.1 |

+/- 1% |

0.1 |

0.1 |

|

DBR 2.25% 04-Sep-20 |

Aug-10 |

16.0 |

5.3 |

-0.503 |

5.3 |

99% |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

OBL 0.25% 16-Oct-20 |

Jul-15 |

19.0 |

6.3 |

-0.474 |

5.2 |

82% |

1.1 |

+/- 1% |

1.1 |

0.1 |

|

DBR 2.5% 04-Jan-21 |

Nov-10 |

19.0 |

6.3 |

-0.444 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 09-Apr-21 |

Feb-16 |

21.0 |

6.9 |

-0.393 |

4.7 |

68% |

2.2 |

+/- 1% |

2.2 |

0.1 |

|

DBR 3.25% 04-Jul-21 |

Apr-11 |

19.0 |

6.3 |

-0.355 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.25% 04-Sep-21 |

Aug-11 |

16.0 |

5.3 |

-0.316 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 08-Oct-21 |

Jul-16 |

19.0 |

6.3 |

-0.298 |

3.9 |

63% |

2.3 |

+/- 1% |

2.4 |

0.1 |

|

DBR 2% 04-Jan-22 |

Nov-11 |

20.0 |

6.6 |

-0.256 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 08-Apr-22 |

Feb-17 |

18.0 |

5.9 |

-0.206 |

2.2 |

37% |

3.8 |

+/- 2% |

3.8 |

0.1 |

|

DBR 1.75% 04-Jul-22 |

Apr-12 |

24.0 |

7.9 |

-0.190 |

7.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 04-Sep-22 |

Sep-12 |

18.0 |

5.9 |

-0.143 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 07-Oct-22 |

Jul-17 |

17.0 |

5.6 |

-0.115 |

0.9 |

16% |

4.7 |

+/- 2% |

4.7 |

0.1 |

|

DBR 1.5% 15-Feb-23 |

Jan-13 |

18.0 |

5.9 |

-0.053 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 14-Apr-23 |

Feb-18 |

4.0 |

1.3 |

-0.002 |

0.0 |

2% |

1.3 |

+/- 27% |

1.3 |

0.0 |

|

DBRI 0.1% 15-Apr-23 |

Mar-12 |

16.0 |

5.3 |

|

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 15-May-23 |

May-13 |

18.0 |

5.9 |

-0.004 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2% 15-Aug-23 |

Sep-13 |

18.0 |

5.9 |

0.047 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 6.25% 04-Jan-24 |

Jan-94 |

10.3 |

3.4 |

0.096 |

3.4 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.75% 15-Feb-24 |

Jan-14 |

18.0 |

5.9 |

0.126 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 15-May-24 |

May-14 |

18.0 |

5.9 |

0.162 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1% 15-Aug-24 |

Sep-14 |

18.0 |

5.9 |

0.199 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-25 |

Jan-15 |

23.0 |

7.6 |

0.262 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1% 15-Aug-25 |

Jul-15 |

23.0 |

7.6 |

0.314 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-26 |

Jan-16 |

26.0 |

8.6 |

0.386 |

8.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBRI 0.1% 15-Apr-26 |

Mar-15 |

13.0 |

4.3 |

|

3.5 |

82% |

0.8 |

+/- 2% |

0.9 |

0.1 |

|

DBR 0% 15-Aug-26 |

Jul-16 |

25.0 |

8.3 |

0.451 |

7.0 |

84% |

1.3 |

+/- 1% |

1.2 |

0.2 |

|

DBR 0.25% 15-Feb-27 |

Jan-17 |

26.0 |

8.6 |

0.508 |

3.0 |

35% |

5.6 |

+/- 2% |

5.5 |

0.3 |

|

DBR 6.5% 04-Jul-27 |

Jul-97 |

11.2 |

3.7 |

0.512 |

3.7 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Aug-27 |

Jul-17 |

25.0 |

8.3 |

0.568 |

0.9 |

11% |

7.3 |

+/- 2% |

7.3 |

0.2 |

|

DBR 5.625% 04-Jan-28 |

Jan-98 |

14.5 |

4.8 |

0.569 |

4.8 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-28 |

Jan-18 |

11.0 |

3.6 |

0.623 |

0.0 |

1% |

3.6 |

+/- 20% |

3.6 |

0.0 |

|

DBR 4.75% 04-Jul-28 |

Oct-98 |

11.3 |

3.7 |

0.607 |

3.7 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 6.25% 04-Jan-30 |

Jan-00 |

9.3 |

3.1 |

0.700 |

3.0 |

99% |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

DBRI 0.5% 15-Apr-30 |

Apr-14 |

9.5 |

3.1 |

|

3.1 |

99% |

0.0 |

+/- 1% |

0.0 |

0.1 |

|

DBR 5.5% 04-Jan-31 |

Oct-00 |

17.0 |

5.6 |

0.774 |

5.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.75% 04-Jul-34 |

Jan-03 |

20.0 |

6.6 |

0.942 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4% 04-Jan-37 |

Jan-05 |

23.0 |

7.6 |

1.028 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-39 |

Jan-07 |

14.0 |

4.6 |

1.093 |

4.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.1 |

|

DBR 4.75% 04-Jul-40 |

Jul-08 |

16.0 |

5.3 |

1.109 |

5.1 |

96% |

0.2 |

+/- 1% |

0.4 |

0.1 |

|

DBR 3.25% 04-Jul-42 |

Jul-10 |

15.0 |

5.0 |

1.175 |

5.0 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.5% 04-Jul-44 |

Apr-12 |

23.5 |

7.8 |

1.225 |

6.5 |

84% |

1.2 |

+/- 1% |

1.6 |

0.1 |

|

DBRI 0.1% 15-Apr-46 |

Jun-15 |

7.0 |

2.3 |

|

1.3 |

57% |

1.0 |

+/- 2% |

1.2 |

0.1 |

|

DBR 2.5% 15-Aug-46 |

Feb-14 |

23.0 |

7.6 |

1.242 |

5.5 |

73% |

2.1 |

+/- 1% |

2.7 |

0.2 |

|

DBR 1.25% 15-Aug-48 |

Sep-17 |

5.5 |

1.8 |

1.280 |

0.2 |

10% |

1.6 |

+/- 6% |

1.6 |

0.1 |

|

Italic = index-linked |

Total |

56.2 |

3.0 |

|||||||

|

Yield below Depo Floor |

||||||||||

|

Yield above Depo Floor |

Bund WAM |

9.3 |

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

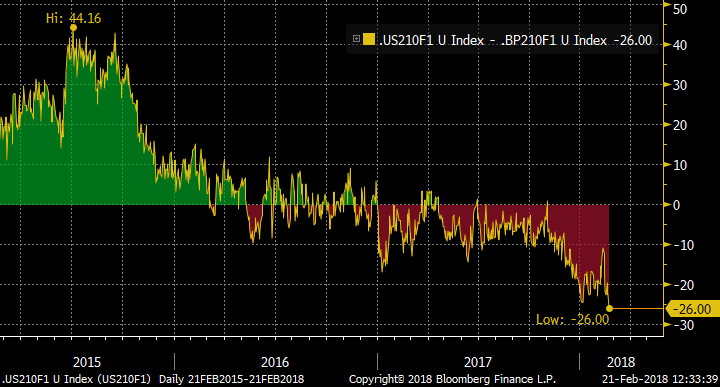

UK to play catch-up to the US? Trades on USD vs GBP 2y-10y curve box

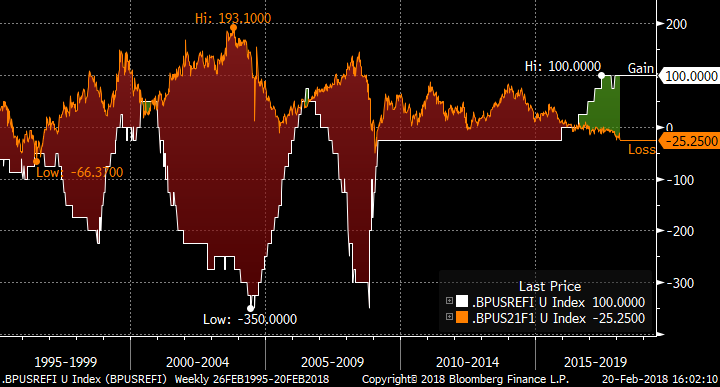

Bottom line: The US curve (however it is viewed) is at, or close to its flattest for the last 20 years, as the Fed hikes rates. At the same time, though the GBP curve has flattened somewhat it is still significantly steeper than before the financial crisis of 2008, despite the market pricing hikes from the MPC. Thus in isolation we would independently favour a steepener in the US and a flattener in the UK. Given the relatively high realized correlation between the US and UK on certain curve sectors, there is a good case to be made for looking at the box trade.

Trade(s):

In vanilla swaps:

Recv USD 525mm 1y2y

Pay USD 116mm 1y10y

Pay GBP 365mm 1y2y

Recv GBP 77mm 1y10y

Equivalent to USD 100k/bp on the box

Enter at -25.5bp. Target flat (0bp). Stop at -32bp. Rolldown over first 3m: -0.8bp.

In CMS spread caps:

Buy USD 1bn 1y expiry CMS 10y-2y cap atmf + 5bp (k=25.1bp)

Sell GBP 718mm 1y expiry CMS 10y-2y cap atmf + 10bp (k=54.8bp)

For zero cost (indicative mid)

Forward entry at -29.7bp.

The chart:

Rationale: The market is pricing two to three more hikes from the FOMC over the next 12 months. Over the same period, the MPC is forecast to hike once or maybe twice. For the ECB, the EONIA market is not even pricing one hike.

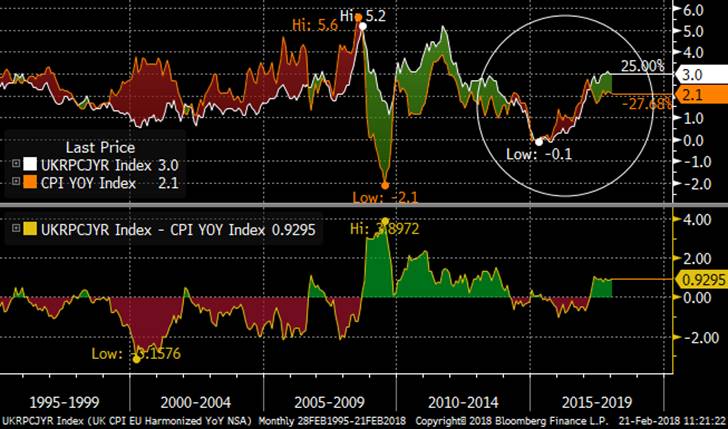

This chart shows the CPI history of the US and UK. The reflation in the UK since 2015 is matching, if not outpacing the US, and on this metric the MPC looks to be a little late to the hiking party. Of course, the elephant in the room is BREXIT with all its associated uncertainties: a ill-controlled departure from the EU could weaken Sterling and import further inflation while the apparent contraction in the labour force (from falling numbers of EU nationals) could continue to push wages higher. Or not, if some accommodation is thrashed out with the EU 27. That is not to say the US does not have inflationary pressures of its own, from rising wages to possible increased infrastructure (and other) spending.

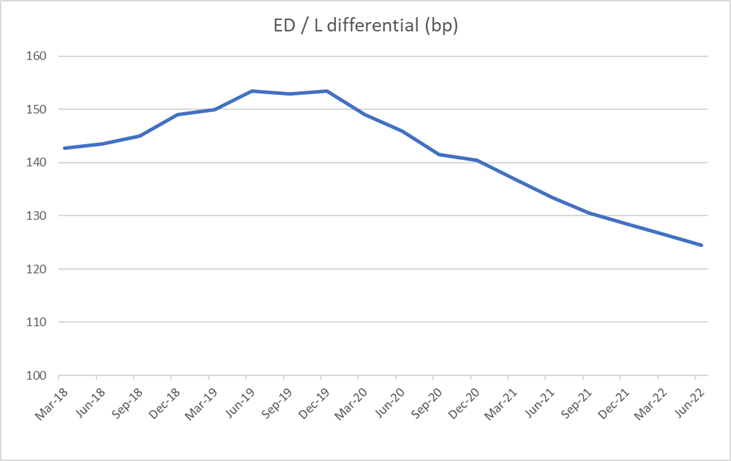

The next chart shows the differential between US and UK refi rates, overlaid with the history of the US-GBP 2y-10y, 1y forward curve box. The policy rate spread, at 100bp is the highest for the last 20 years. Beneath this is the spread between the Eurodollar and Short Sterling strips, which shows the rate differential forecast to increase to 150bp by Q2 19 before starting to narrow gradually. Effectively the market is pricing that the Fed will be pretty done a year to 18 months from now, while the BoE will still be on a hiking path (albeit a shallow one). The empirical history of the curve box from the 2004 – 2006 period saw the US curve flattening faster than the GBP in the early stages of the hiking cycle, before the box sharply changed direction in early ’06 as the MPC vacillated between cutting and hiking. It was at this point that the UK curve started flattening in earnest. Even though the short rate differential between the Fed and BoE was still widening, the box level rose.

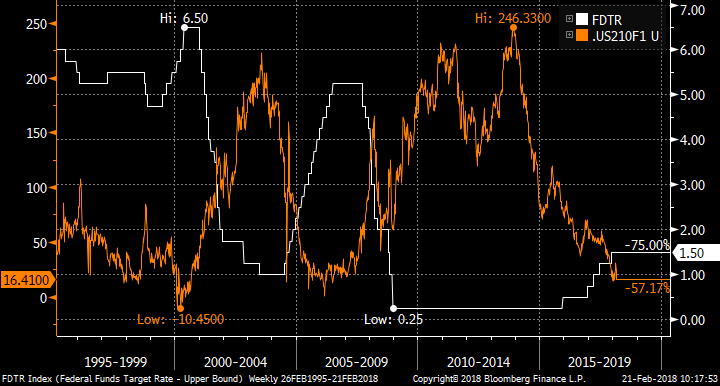

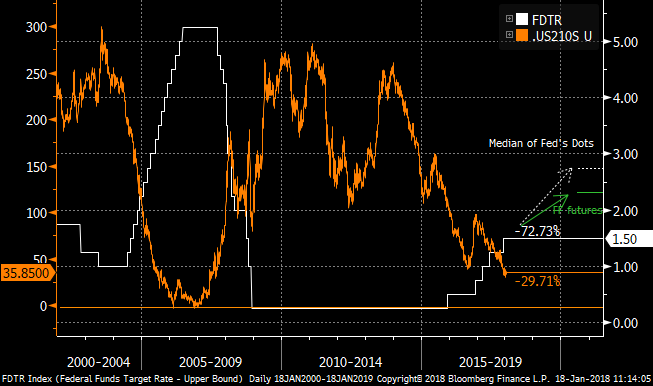

Taking each country in turn, this chart shows the US side of things: the Fed target rate vs USD 2y-10y, 1y fwd. The ’04-’06 period in the US saw the curve flattening classically as the belly of the curve could not keep pace with rising short rates. This process continued until roughly halfway through the hiking cycle, which is arguably where we are in the current cycle with another 4 or so hikes to come as priced by the market. Having flattened to its lows in the 10bp area, the curve held within a choppy range for the next 18 months. Thus the argument for the present day is that, given the forward curve is back to the previous cycle lows and the hiking cycle has matured, the next move from the US curve will be sideways, if not steeper. This is before an increasing US bond term premium is factored in.

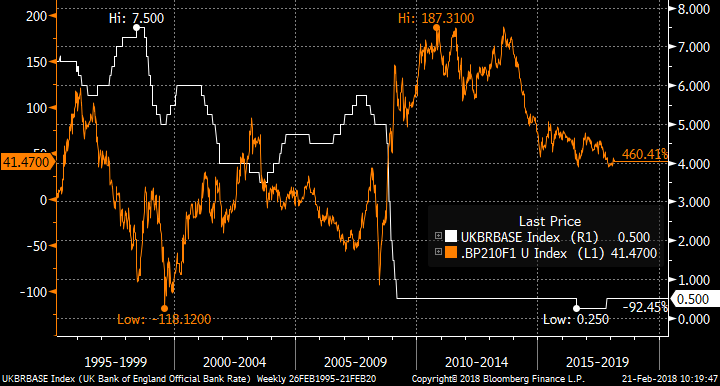

The corresponding chart for the UK shows a curve that has yet to embrace the prospect of a tightening rate cycle. The GBP 2y-10y, 1y forward curve is close to its local lows since 2008 (though has steepened back a shade in the past month), but well above the flat/inverted levels observed before the financial crisis. It is fair to note that the term premium in the UK should be higher now given the fog of BREXIT, but we have yet to see the degree of flattening associated with the MPC’s previous hiking period in ’04 to ’07.

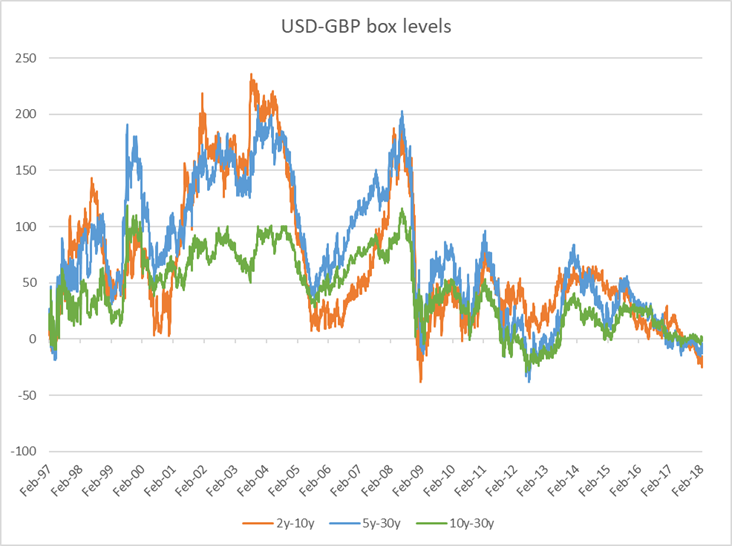

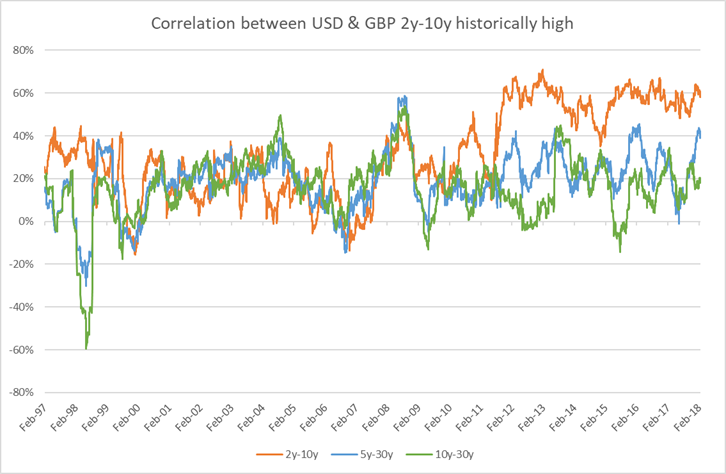

Why have I focused on 2y-10y and not other curve segments? The next chart shows three candidate box trades (2-10y, 5y-30y and 10y-30y). All three are very low levels historically. However at around 23bp inverted (on the spot 2y-10y), this sector looks the most stretched compared to the previous range.

There is another reason to prefer 2y-10y for the box. This chart shows the rolling realized 6m correlation between various USD and GBP curve sectors. While 5y-30y and 10y-30y correlations have remained in the 20-year range, the 2y-10y curves have become more correlated since 2011. Correlation is key on cross-market trades, otherwise the box is simply two orthogonal curve trades.

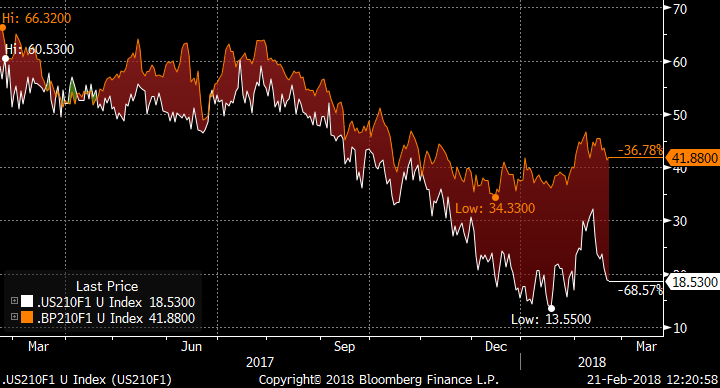

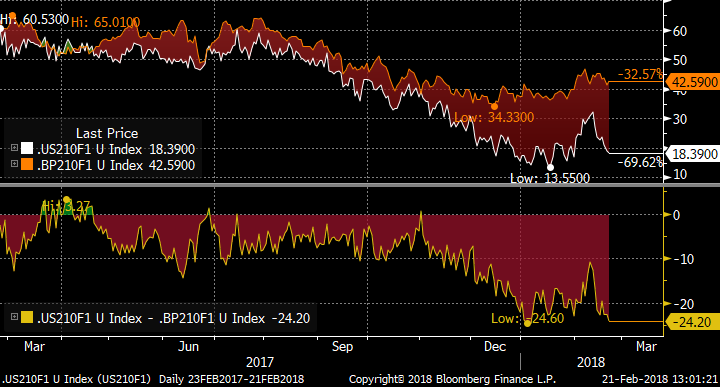

This correlation is visible in the recent history of the US/GBP 2y-10y, 1y forward curves.

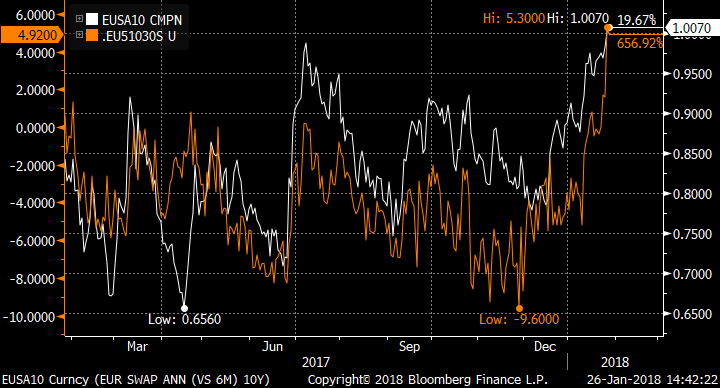

An alternative way to vanilla swaps is to use CMS spread options. Re-visiting the recent history of the 2y-10y, 1y forward curves, the box has been directional in terms of curve as the US leg has been more volatile than the GBP side: heading lower as curves flattened. Thus it is interesting to look at the expression via CMS spread caps, buying a USD cap and selling the GBP. If the US curve continues to flatten, with the GBP curve following, then both options expire out of the money. On a steepening move, empirically we might expect the US curve to steepen more than the GBP and so the USD cap would prove to be more valuable than the GBP one.

The other reason to express the trade via caps rather than floors is that GBP curve implied volatility is higher than in USD, which is the opposite of relative realized volatilities (see table). The 1y expiry offers the greatest implied volatility pick-up in bp/y.

|

2y-10y implied volatility |

Realized Vol |

||||

|

3m |

6m |

1y |

2y |

3m |

|

|

USD |

39 |

38 |

37 |

35 |

36 |

|

GBP |

41 |

41 |

40 |

37 |

33 |

|

Ratio USD/GBP |

0.95 |

0.93 |

0.93 |

0.95 |

1.08 |

This differential allows us to improve the entry level on the box versus the vanilla swap structure. As usual, I like to have the option that I am short slightly out-of-the-money compared to the atmf, so this structure is approximately zero cost (mid):

Buy USD 1bn 1y expiry CMS 10y-2y cap atmf + 5bp (k=25.1bp)

Sell GBP 718mm 1y expiry CMS 10y-2y cap atmf + 10bp (k=54.8bp)

Thus the forward entry is at -29.7bp (indicative), beating the vanilla trade by 4bp.

I look forward to any and all comments you might have!

Best wishes,

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

How are we doing? Shadow portfolio update

Portfolio since 1st Feb: USD +256k, Ytd +158k

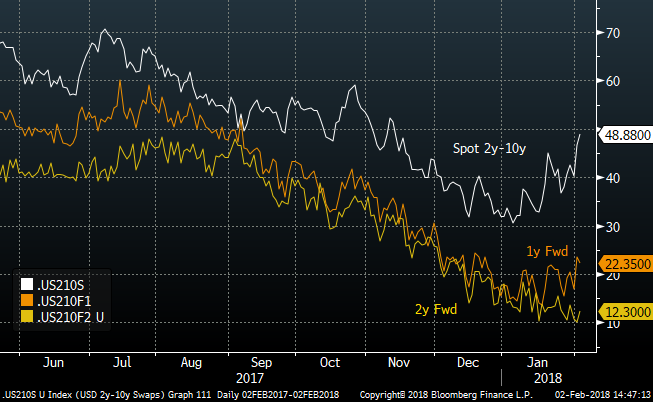

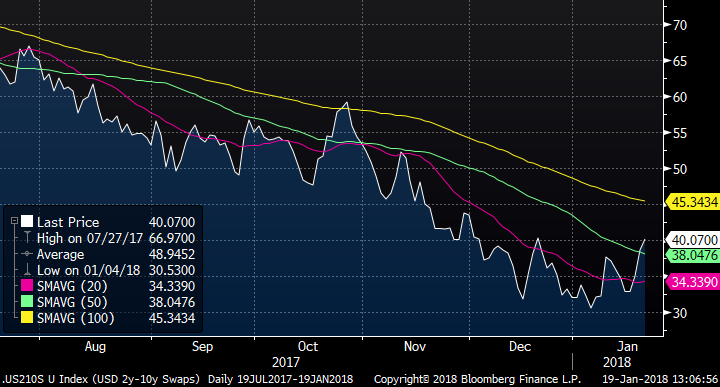

Summary: It’s been an interesting fortnight since the last update, with an impressive equity sell-off and significant swings on bond yields. The portfolio has benefited from the long-awaited steepening of the US curve, as the market wakes up to the prospects of higher deficits, higher inflation and a possible Fed response. This is the effect that I played for right at the start of the Trump presidency, but which failed to materialize (to the detriment of my 2017 P&L) until last week. However the steepening has not been whole-hearted, so it is a little early to see it as a trend for a wholesale repricing of term premia. The moving-average indicators support holding the US 2y-10y, 1y fwd trade for now, however it might be worth considering using some of the positive P&L to pay the premium for conditional curve trades.

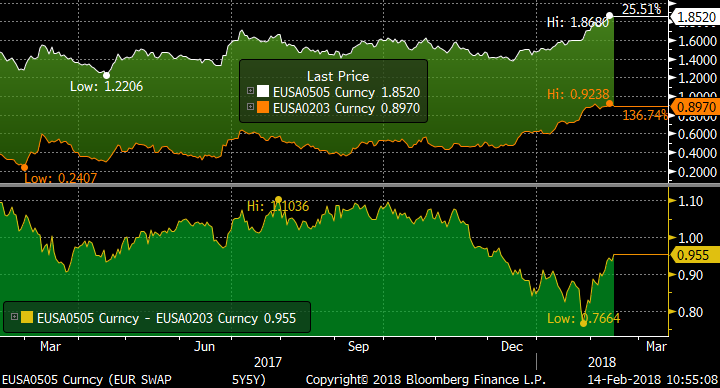

Elsewhere, the EUR forward curve is still a conundrum. My bull-steepening exposure is making some money from the steepening part and roll-down, though clearly this is unlikely to be held to expiry. Over the longer term, my macro view is for bear-flattening as the ECB moves towards ending new PSPP2 purchases and then rate hikes (in 2019?), but that dynamic is the opposite of what is happening now. The chart is EUR 2y3y vs 5y5y, which has steepened as the belly has underperformed in the sell-off.

Looking back (a long way) to the last ECB hiking cycle (circled in the chart) we should expect 2y3y/5y5y to flatten … though even in that cycle the curve was somewhat schizophrenic in the 12 months leading up to the first actual hike. The steepening of 2y3y/5y5y at the start of 2005 (1st hike in November later that year) is reminiscent of what we are seeing now. So the bottom line is that eventually the bear-flattener will be the right trade, but there’s no rush as the entry level is improving almost daily. Another one for the momentum indicators, but if the spread reaches 100bp (currently 95) it will be hard to ignore.

On other trades, the RX/UB box is be-calmed and slightly offside. I’d look to add if the box touches -4bp again. The GBP/USD 5y5y xccy basis remains elevated and has spent longer in positive territory than on previous spikes. The 5y-10y spot curve is steepening, as the 5y basis falls faster than the 10y. It’s a hold for now, but may be a slow burn to profitability.

|

Trade Idea |

Entered |

Level |

Size |

Status |

Exit/Current Level |

Exit Date |

P&L k USD |

|

US 2-10 steepener via CMS caps |

28-Dec-17 |

0 bp |

USD 25 k/bp |

CLOSED |

0 bp |

15-Jan-18 |

0 |

|

RX/UB ASW Box |

28-Dec-17 |

-6.1 bp |

EUR 50 k/bp |

OPEN |

-5.1 bp |

-64 |

|

|

EUR 1y3y/5y5y Mid-curve flattener |

28-Dec-17 |

13.7 bp |

EUR 20 k/bp |

CLOSED |

29 bp |

31-Jan-18 |

380 |

|

GBP 1y1y1y MC Payer spread |

28-Dec-17 |

0.7 bp |

GBP 25 k/bp |

CLOSED |

-1 bp |

31-Jan-18 |

-60 |

|

EUR 9m1y1y/9m1y5y Bear Flattener |

28-Dec-17 |

4.2 bp |

EUR 25 k/bp |

CLOSED |

0 bp |

30-Jan-18 |

-130 |

|

Receive GBP/USD 5y5y xccy basis |

28-Dec-17 |

1 bp |

GBP 40 k/bp |

OPEN |

2.9 bp |

-104 |

|

|

EUR 2-5-10 weighted swap fly |

28-Dec-17 |

-28.1 bp |

EUR 40 k/bp |

CLOSED |

-25 bp |

25-Jan-18 |

-154 |

|

GBP 2y-10y Bull-steepener |

05-Jan-18 |

0 bp |

GBP 20 k/bp |

OPEN |

0.1 bp |

3 |

|

|

EUR 2y2y/5y10y Bull-Steepener |

30-Jan-18 |

0 bp |

EUR 25 k/bp |

OPEN |

2 bp |

62 |

|

|

USD 2y-10y, 1y fwd steepener |

02-Feb-18 |

22 bp |

USD 25 k/bp |

OPEN |

31.1 bp |

226 |

|

|

Total YTD |

158 |

||||||

|

Note on trade sizing: Each trade is sized to generate approx. USD 150k 2y 99% hist. VaR at inception with no netting |

|||||||

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

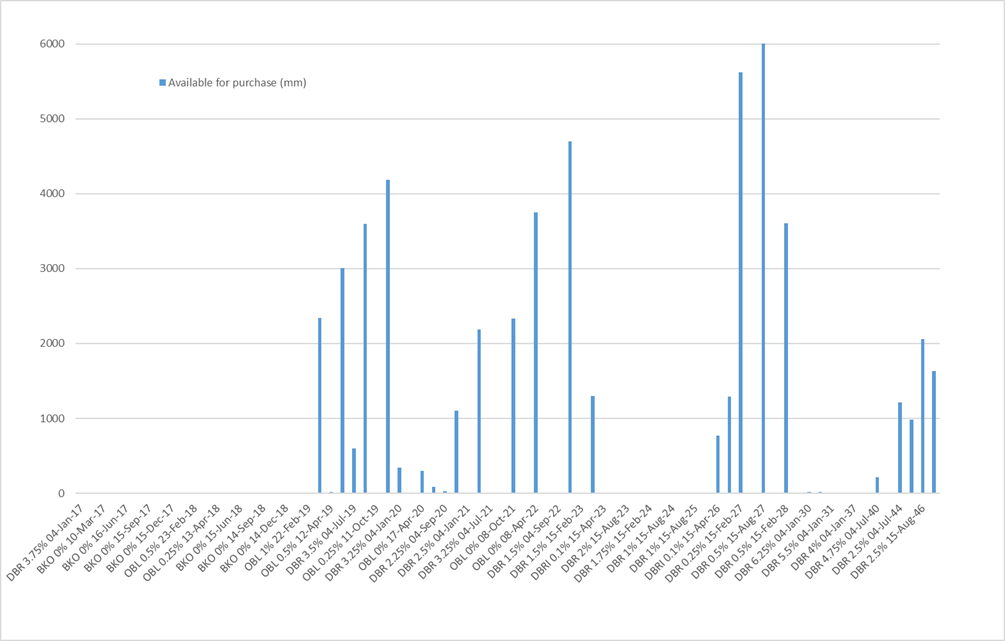

PSPP2 buying of Germany in Jan-18. Buying rates outside of "high redemption" months should have diminishing impact?

The PSPP2 data for January was out yesterday, and here are the results of my Maximum Likelihood model that estimates how the purchases have been made

- The estimated monthly WAM of purchases of Bunds in January under the reduced purchasing rate is 6.5 years, compared to 5.9 years in December.

- As in previous months, buying in the 10y sector has been limited to the on-the-run issues

- The model suggests that there still has not been any significant buying of the on-the-run 30y

- The percentage of non-Bund purchases in January was 34%, similar to December (30%)

- Redemption reinvestment flows are estimated at EUR 480mm in January

- The largest estimated single purchase was 203mm of the Aug-26, or just 10mm per day. Compare this to the volume of say 500k RX contracts daily, which is 5bn. As purchases in 10y and 30y concentrate more in the on-the-run, liquid issues it suggests PSPP2 will have a diminishing impact there. At the same time, “high redemption” months should see a greater relative impact from Buba buying: eg April when over twice the amount of German paper will need to be bought compared to March, IF all the redeemed principals are invested promptly.

The model’s results in detail:

The estimate for the WAM for purchases in January for the various categories of paper are as follows:

|

Category |

Notional |

WAM |

|

German Govt |

3.4 |

6.6 |

|

KFW |

0.4 |

7.5 |

|

Lander |

1.3 |

5.3 |

|

All Purchases |

5.0 |

6.3 |

The per-issue charts for monthly purchases, and available notional left to purchase:

Given the model’s estimates for purchasing, here is how I see the redemption flows in Bunds currently. Numbers for Feb-19 onwards will continue to rise as more purchases are made.

|

Redemptions |

||||

|

Govt |

KFW |

Lander |

Total |

|

|

Apr-17 |

0 |

0 |

0 |

0 |

|

May-17 |

0 |

0 |

0 |

0 |

|

Jun-17 |

0 |

0 |

0 |

0 |

|

Jul-17 |

142 |

88 |

0 |

230 |

|

Aug-17 |

0 |

0 |

0 |

0 |

|

Sep-17 |

2 |

273 |

124 |

399 |

|

Oct-17 |

155 |

369 |

0 |

523 |

|

Nov-17 |

0 |

296 |

167 |

462 |

|

Dec-17 |

0 |

0 |

0 |

0 |

|

Jan-18 |

272 |

209 |

0 |

480 |

|

Feb-18 |

1269 |

588 |

0 |

1857 |

|

Mar-18 |

700 |

0 |

136 |

836 |

|

Apr-18 |

6592 |

0 |

71 |

6662 |

|

May-18 |

0 |

0 |

108 |

108 |

|

Jun-18 |

1572 |

2970 |

340 |

4882 |

|

Jul-18 |

3346 |

1650 |

592 |

5588 |

|

Aug-18 |

0 |

0 |

90 |

90 |

|

Sep-18 |

2087 |

0 |

478 |

2566 |

|

Oct-18 |

4000 |

1650 |

665 |

6315 |

|

Nov-18 |

0 |

0 |

881 |

881 |

|

Dec-18 |

2534 |

1650 |

326 |

4510 |

|

Jan-19 |

6727 |

1980 |

913 |

9621 |

|

Feb-19 |

5062 |

0 |

630 |

5693 |

|

Mar-19 |

1909 |

3300 |

300 |

5509 |

|

Apr-19 |

5170 |

273 |

751 |

6194 |

|

May-19 |

0 |

0 |

556 |

556 |

|

Jun-19 |

1237 |

0 |

496 |

1733 |

|

Jul-19 |

7127 |

495 |

96 |

7719 |

|

Aug-19 |

0 |

660 |

330 |

990 |

|

Sep-19 |

644 |

0 |

608 |

1252 |

|

Oct-19 |

5278 |

1650 |

1861 |

8790 |

|

Nov-19 |

0 |

0 |

341 |

341 |

|

Dec-19 |

38 |

0 |

493 |

530 |

|

Jan-20 |

6726 |

3300 |

1562 |

11588 |

|

Feb-20 |

0 |

0 |

592 |

592 |

|

Mar-20 |

0 |

0 |

1284 |

1284 |

|

Apr-20 |

11388 |

0 |

79 |

11467 |

|

May-20 |

0 |

0 |

330 |

330 |

|

Jun-20 |

0 |

1650 |

528 |

2178 |

|

Jul-20 |

6994 |

0 |

1460 |

8454 |

|

Aug-20 |

0 |

0 |

470 |

470 |

|

Sep-20 |

5158 |

0 |

687 |

5845 |

|

Oct-20 |

5056 |

495 |

499 |

6050 |

|

Nov-20 |

0 |

0 |

1062 |

1062 |

|

Dec-20 |

0 |

0 |

741 |

741 |

|

Jan-21 |

6270 |

3630 |

910 |

10810 |

Or, in chart form:

Finally, here are the per-issue estimates for Bunds:

|

Bond |

Opened |

O/S (bn) |

Purchasable |

Market Yield |

Purchased |

% Purchased |

Remaining |

Margin of Error |

MV Remaining |

Jan-18 Buying |

|

DBR 3.75% 04-Jan-17 |

Nov-06 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.75% 24-Feb-17 |

Jan-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 10-Mar-17 |

Feb-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 07-Apr-17 |

May-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 16-Jun-17 |

May-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-17 |

May-07 |

0.0 |

0.0 |

|

0.1 |

|

0.0 |

+/- 7% |

0.0 |

0.0 |

|

BKO 0% 15-Sep-17 |

Aug-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

+/- 58% |

0.0 |

0.0 |

|

OBL 0.5% 13-Oct-17 |

Sep-12 |

0.0 |

0.0 |

|

0.2 |

|

0.0 |

+/- 8% |

0.0 |

0.0 |

|

BKO 0% 15-Dec-17 |

Nov-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

DBR 4% 04-Jan-18 |

Nov-07 |

0.0 |

0.0 |

0.3 |

0.0 |

+/- 5% |

0.0 |

0.0 |

||

|

OBL 0.5% 23-Feb-18 |

Jan-13 |

17.0 |

0.0 |

-0.556 |

1.3 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

BKO 0% 16-Mar-18 |

Feb-16 |

13.0 |

0.0 |

-0.567 |

0.7 |

0.0 |

+/- 4% |

0.0 |

0.0 |

|

|

OBL 0.25% 13-Apr-18 |

May-13 |

17.0 |

0.0 |

-0.652 |

2.0 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

OBLI 0.75% 15-Apr-18 |

Apr-11 |

15.0 |

0.0 |

4.6 |

0.0 |

+/- 1% |

0.0 |

0.0 |

||

|

BKO 0% 15-Jun-18 |

May-16 |

14.0 |

0.0 |

-0.658 |

1.6 |

0.0 |

+/- 3% |

0.0 |

0.0 |

|

|

DBR 4.25% 04-Jul-18 |

May-08 |

21.0 |

0.0 |

-0.683 |

3.3 |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

|

BKO 0% 14-Sep-18 |

Aug-16 |

13.0 |

0.0 |

-0.653 |

2.1 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

OBL 1% 12-Oct-18 |

Sep-13 |

17.0 |

0.0 |

-0.695 |

4.0 |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

|

BKO 0% 14-Dec-18 |

Nov-16 |

13.0 |

0.0 |

-0.662 |

2.5 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

DBR 3.75% 04-Jan-19 |

Nov-08 |

24.0 |

0.0 |

-0.719 |

6.7 |

|

0.0 |

+/- 1% |

0.0 |

0.0 |

|

OBL 1% 22-Feb-19 |

Jan-14 |

16.0 |

5.3 |

-0.700 |

5.1 |

96% |

0.2 |

+/- 1% |

0.2 |

0.2 |

|

BKO 0% 15-Mar-19 |

Mar-17 |

13.0 |

4.3 |

-0.694 |

1.9 |

44% |

2.4 |

+/- 2% |

2.4 |

0.1 |

|

OBL 0.5% 12-Apr-19 |

May-14 |

16.0 |

5.3 |

-0.697 |

5.2 |

98% |

0.1 |

+/- 1% |

0.1 |

0.1 |

|

BKO 0% 14-Jun-19 |

May-17 |

13.0 |

4.3 |

-0.667 |

1.2 |

29% |

3.1 |

+/- 2% |

3.1 |

0.1 |

|

DBR 3.5% 04-Jul-19 |

May-09 |

24.0 |

7.9 |

-0.673 |

7.1 |

90% |

0.8 |

+/- 1% |

0.9 |

0.2 |

|

BKO 0% 13-Sep-19 |

Aug-17 |

13.0 |

4.3 |

-0.620 |

0.6 |

15% |

3.6 |

+/- 2% |

3.7 |

0.1 |

|

OBL 0.25% 11-Oct-19 |

Sep-14 |

16.0 |

5.3 |

-0.615 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 13-Dec-19 |

Nov-17 |

13.0 |

4.3 |

-0.584 |

0.0 |

1% |

4.3 |

+/- 10% |

4.3 |

0.0 |

|

DBR 3.25% 04-Jan-20 |

Nov-09 |

22.0 |

7.3 |

-0.595 |

6.7 |

93% |

0.5 |

+/- 1% |

0.6 |

0.2 |

|

DBRI 1.75% 15-Apr-20 |

Jun-09 |

16.0 |

5.3 |

|

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 17-Apr-20 |

Jan-15 |

20.0 |

6.6 |

-0.522 |

6.1 |

93% |

0.5 |

+/- 1% |

0.5 |

0.2 |

|

DBR 3% 04-Jul-20 |

Apr-10 |

22.0 |

7.3 |

-0.497 |

7.0 |

96% |

0.3 |

+/- 1% |

0.3 |

0.1 |

|

DBR 2.25% 04-Sep-20 |

Aug-10 |

16.0 |

5.3 |

-0.470 |

5.2 |

98% |

0.1 |

+/- 1% |

0.1 |

0.1 |

|

OBL 0.25% 16-Oct-20 |

Jul-15 |

19.0 |

6.3 |

-0.445 |

5.1 |

81% |

1.2 |

+/- 1% |

1.2 |

0.1 |

|

DBR 2.5% 04-Jan-21 |

Nov-10 |

19.0 |

6.3 |

-0.408 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 09-Apr-21 |

Feb-16 |

21.0 |

6.9 |

-0.350 |

4.6 |

66% |

2.4 |

+/- 2% |

2.4 |

0.2 |

|

DBR 3.25% 04-Jul-21 |

Apr-11 |

19.0 |

6.3 |

-0.308 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.25% 04-Sep-21 |

Aug-11 |

16.0 |

5.3 |

-0.263 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 08-Oct-21 |

Jul-16 |

19.0 |

6.3 |

-0.242 |

3.8 |

61% |

2.5 |

+/- 1% |

2.5 |

0.2 |

|

DBR 2% 04-Jan-22 |

Nov-11 |

20.0 |

6.6 |

-0.198 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 08-Apr-22 |

Feb-17 |

18.0 |

5.9 |

-0.148 |

2.1 |

35% |

3.9 |

+/- 2% |

3.9 |

0.1 |

|

DBR 1.75% 04-Jul-22 |

Apr-12 |

24.0 |

7.9 |

-0.127 |

7.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 04-Sep-22 |

Sep-12 |

18.0 |

5.9 |

-0.091 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 07-Oct-22 |

Jul-17 |

17.0 |

5.6 |

-0.053 |

0.8 |

14% |

4.8 |

+/- 3% |

4.8 |

0.1 |

|

DBR 1.5% 15-Feb-23 |

Jan-13 |

18.0 |

5.9 |

-0.004 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBRI 0.1% 15-Apr-23 |

Mar-12 |

16.0 |

5.3 |

|

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 15-May-23 |

May-13 |

18.0 |

5.9 |

0.045 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2% 15-Aug-23 |

Sep-13 |

18.0 |

5.9 |

0.095 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 6.25% 04-Jan-24 |

Jan-94 |

10.3 |

3.4 |

0.145 |

3.4 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.75% 15-Feb-24 |

Jan-14 |

18.0 |

5.9 |

0.168 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 15-May-24 |

May-14 |

18.0 |

5.9 |

0.207 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1% 15-Aug-24 |

Sep-14 |

18.0 |

5.9 |

0.243 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-25 |

Jan-15 |

23.0 |

7.6 |

0.320 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1% 15-Aug-25 |

Jul-15 |

23.0 |

7.6 |

0.370 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-26 |

Jan-16 |

26.0 |

8.6 |

0.440 |

8.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBRI 0.1% 15-Apr-26 |

Mar-15 |

12.0 |

4.0 |

|

3.5 |

88% |

0.5 |

+/- 2% |

0.5 |

0.1 |

|

DBR 0% 15-Aug-26 |

Jul-16 |

25.0 |

8.3 |

0.505 |

6.7 |

81% |

1.6 |

+/- 1% |

1.5 |

0.2 |

|

DBR 0.25% 15-Feb-27 |

Jan-17 |

26.0 |

8.6 |

0.566 |

2.7 |

31% |

5.9 |

+/- 2% |

5.7 |

0.2 |

|

DBR 6.5% 04-Jul-27 |

Jul-97 |

11.2 |

3.7 |

0.583 |

3.7 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Aug-27 |

Jul-17 |

25.0 |

8.3 |

0.627 |

0.7 |

8% |

7.6 |

+/- 4% |

7.5 |

0.2 |

|

DBR 5.625% 04-Jan-28 |

Jan-98 |

14.5 |

4.8 |

0.639 |

4.8 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-28 |

Jan-18 |

5.0 |

1.7 |

0.681 |

0.0 |

0% |

1.7 |

|

1.6 |

0.0 |

|

DBR 4.75% 04-Jul-28 |

Oct-98 |

11.3 |

3.7 |

0.686 |

3.7 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 6.25% 04-Jan-30 |

Jan-00 |

9.3 |

3.1 |

0.760 |

3.0 |

97% |

0.1 |

+/- 1% |

0.1 |

0.0 |

|

DBRI 0.5% 15-Apr-30 |

Apr-14 |

9.5 |

3.1 |

|

3.1 |

98% |

0.1 |

+/- 2% |

0.1 |

0.1 |

|

DBR 5.5% 04-Jan-31 |

Oct-00 |

17.0 |

5.6 |

0.832 |

5.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.75% 04-Jul-34 |

Jan-03 |

20.0 |

6.6 |

0.978 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4% 04-Jan-37 |

Jan-05 |

23.0 |

7.6 |

1.062 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-39 |

Jan-07 |

14.0 |

4.6 |

1.130 |

4.5 |

98% |

0.1 |

+/- 1% |

0.1 |

0.1 |

|

DBR 4.75% 04-Jul-40 |

Jul-08 |

16.0 |

5.3 |

1.147 |

5.0 |

94% |

0.3 |

+/- 1% |

0.6 |

0.1 |

|

DBR 3.25% 04-Jul-42 |

Jul-10 |

15.0 |

5.0 |

1.215 |

5.0 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.5% 04-Jul-44 |

Apr-12 |

22.0 |

7.3 |

1.270 |

6.5 |

90% |

0.7 |

+/- 1% |

0.9 |

0.1 |

|

DBRI 0.1% 15-Apr-46 |

Jun-15 |

7.0 |

2.3 |

|

1.3 |

55% |

1.0 |

+/- 3% |

1.2 |

0.0 |

|

DBR 2.5% 15-Aug-46 |

Feb-14 |

23.0 |

7.6 |

1.290 |

5.3 |

70% |

2.2 |

+/- 1% |

2.9 |

0.1 |

|

DBR 1.25% 15-Aug-48 |

Sep-17 |

5.5 |

1.8 |

1.341 |

0.1 |

5% |

1.7 |

+/- 10% |

1.7 |

0.0 |

|

Italic = index-linked |

Total |

55.6 |

3.4 |

|||||||

|

Yield below Depo Floor |

||||||||||

|

Yield above Depo Floor |

Bund WAM |

6.5 |

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: .5 ye

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.