Trades & Fades - James & Will, Astor Ridge

A few things we’re looking at for the week ahead in Global RV

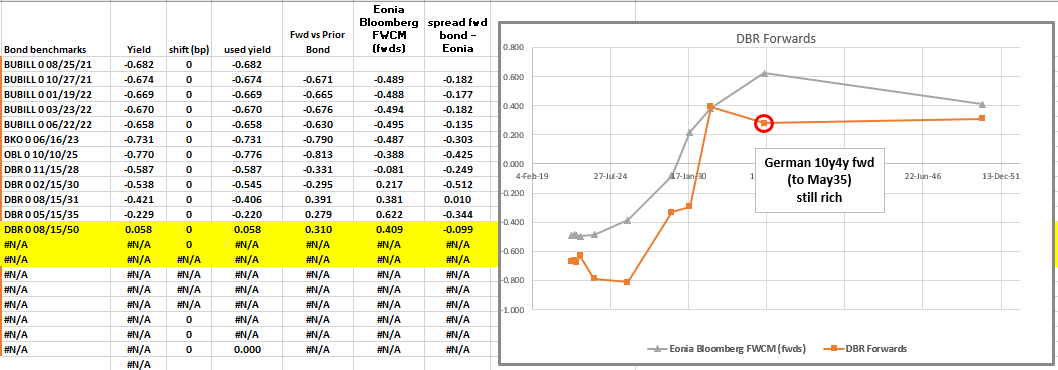

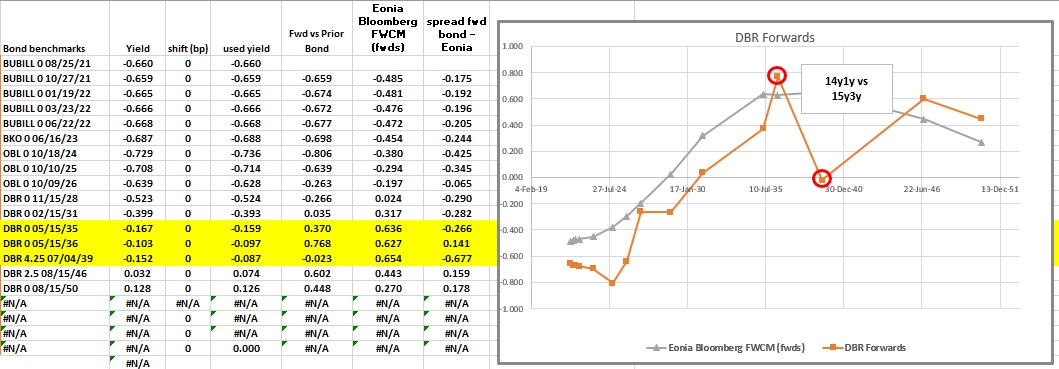

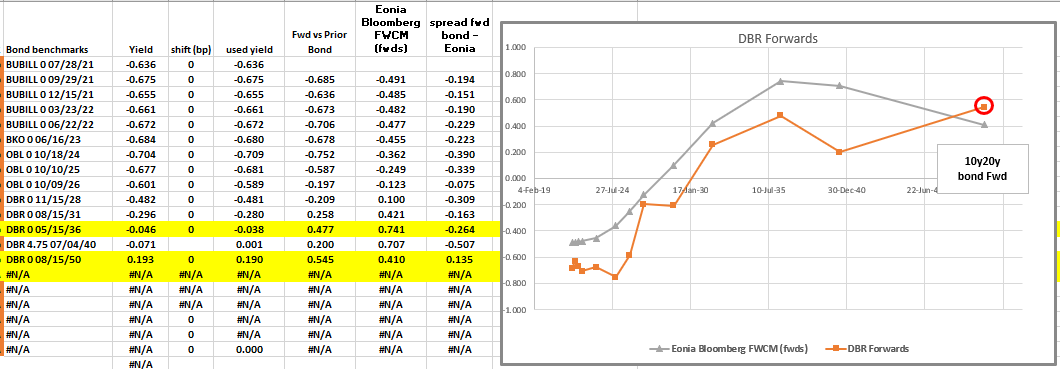

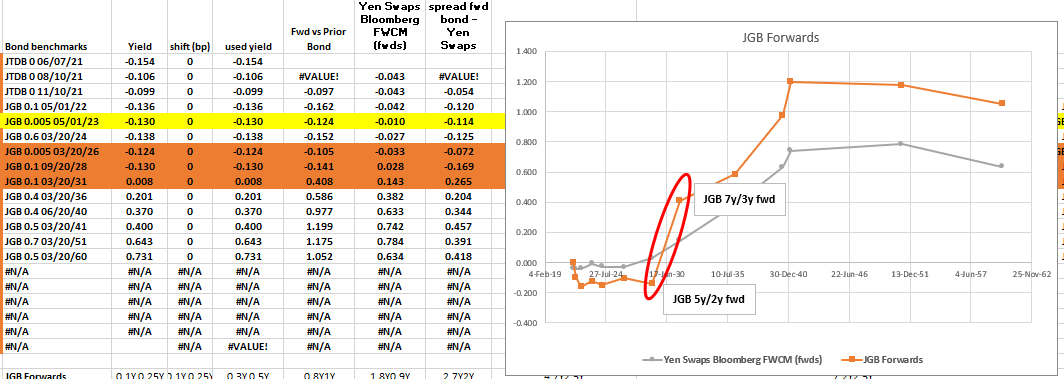

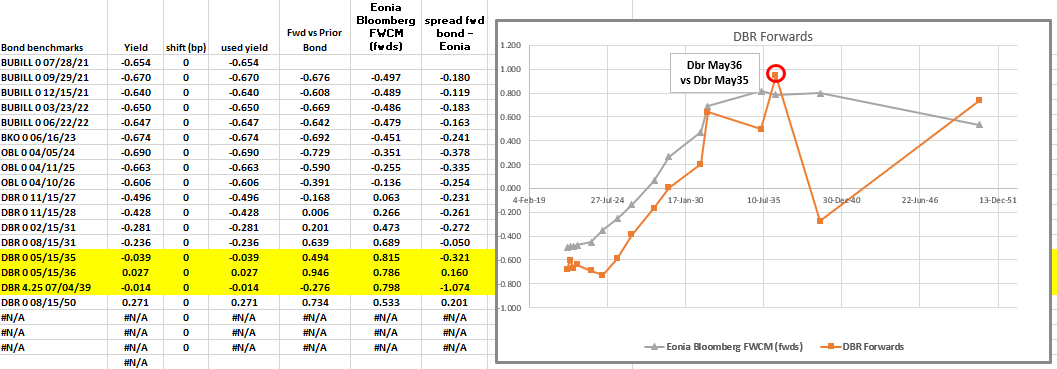

Germany to tap the 15y Dbr 0% May36 this week

Our Auction strategy analyser suggests this relatively new Tenor for Germany will keep getting cheaper and there’s no rush to buy…

Auction Strategy Output - Germany 15y

|

Old Bond |

DBR 0 05/15/35 |

|

YLD_CNV_MID (%) |

-0.229 |

|

AMT_OUTSTANDING (Bln) |

22.5 |

|

Tenor at Issue: |

15.0 |

|

Tenor at last tap: |

14.5 |

|

Date of Last Tap: |

28-Oct-20 |

|

Cheapest date vs double prior issue: |

22-Jul-21 |

|

New Bond |

DBR 0 05/15/36 |

|

Amount issued vs Last Issue |

58% |

|

YLD_CNV_MID (%) |

-0.167 |

|

AMT_OUTSTANDING (Bln) |

13.0 |

|

Announced Last Tap |

24-Nov-21 |

|

Expected Last Tap (based on prior): |

29-Oct-21 |

|

Current Tenor: |

14.8 |

|

Expected Cheapest Date: |

23-Jul-22 |

- Cheap now - On the Bloomberg fitted curve the cheapest point is the 10y NOT the 15y. That would imply there’s absolutely no rush to the 15y auction at this point in the cycle

- Fitted curve is not the only metric – although it’s cheap using the BBG exponential spline, that metric skewed by the High coupon German issues that continue get richer due to PEPP

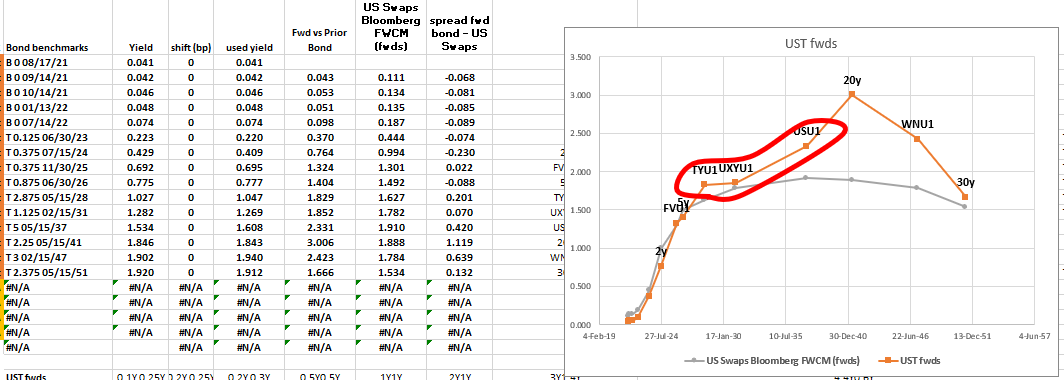

- Buy it cheap on forwards – the best metric is not to rely on too many other complex metrics – let’s not go swap blind, or stare at High Coupon off the runs – when it’s too cheap vs 10s and 30s we should buy it BASED ON FORWARDS

Current Forward Rates (Bonds adjusted to be par bond equivalents)

So basically if we think we should buy the old 15y then we should buy it at cheap to the earlier forwards

We don’t get to that point for another 6bps!!! So forget it – like so many 15y points in Europe – they simply roll poorly and the 10y points are all so much cheaper

Trade Level – just not there yet – I’ll call you if it is… but we need forward steepeners

From the ECB this week - ECB comments about inflation

‘the Governing Council expects the key ECB interest rates to remain at their present or lower levels until it sees inflation reaching two per cent well ahead of the end of its projection horizon and durably for the rest of the projection horizon, and it judges that realised progress in underlying inflation is sufficiently advanced to be consistent with inflation stabilising at two per cent over the medium term. This may also imply a transitory period in which inflation is moderately above target.'’

As a conclusion…

Am looking for longer tenor forward rate steepener – so actually it makes me continue to like buying 10y vs selling 9y and 15y

200 * (yield[DBR 0 08/15/31 Govt]-0.7*yield[DBR 0 02/15/30 Govt]-0.3*yield[DBR 0 05/15/35 Govt])

Which continues to do very well

Conclusion

15y not cheap enough in an acceptable structure

And as a short in a 7s 10s 14s structure the location isn’t great

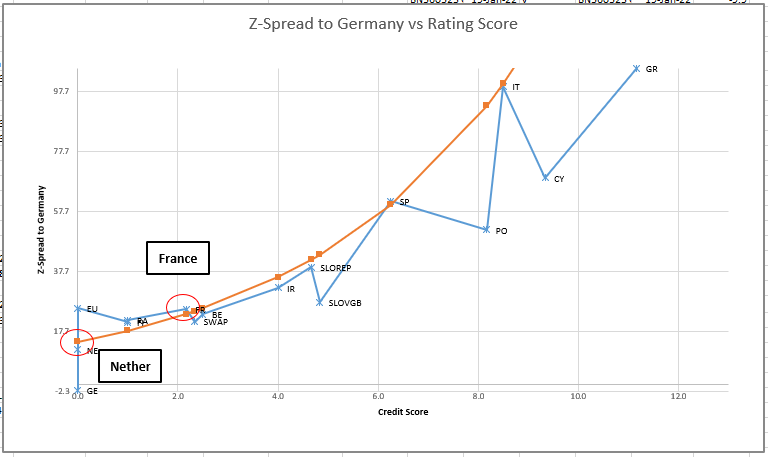

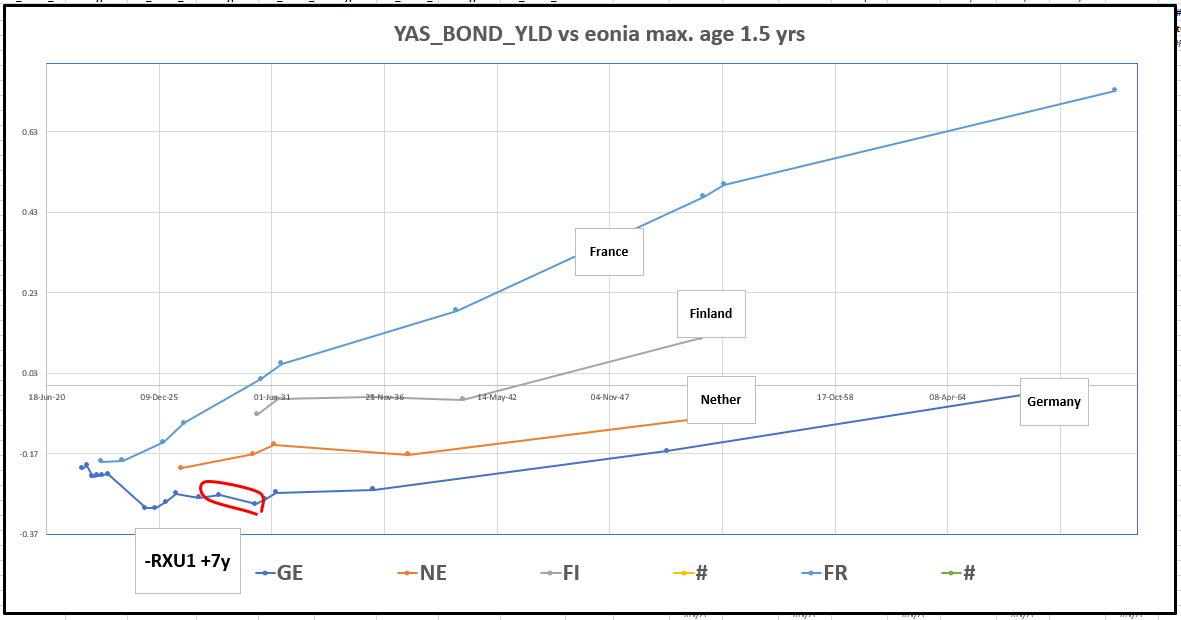

Holland cheap on ‘Credit Blend’ vs Other countries

- Holland is a Triple A issuer without the supply issues that say EU has – the next issue is set for 31st August according the DSL issuance calendar

Holland has drifted cheaper vs a regressed blend of Germany and France of late…

(regression of Changes

Trade

Nether Jul30 vs Regressed RXU1 & OATU1 – if you’d like the weightings pls ask

Levels

Enter: +9bp and +10g

Target +5.5bp

1 Bond plus two futures means lower friction costs than many of these credit flys

Country Spreads vs Rating – credit spread vs credit rating curve – slope is very flat in the better credits

If we plot ‘Spread to Germany’ vs ‘Rating Score’ (proprietary combination of Rating and Outlook amalgamated for three Rating Agencies)

we see the following

The spread curve is very flat in the short end – the relative give up from France to Holland is at it’s recent lows vs the spread of France to Germany

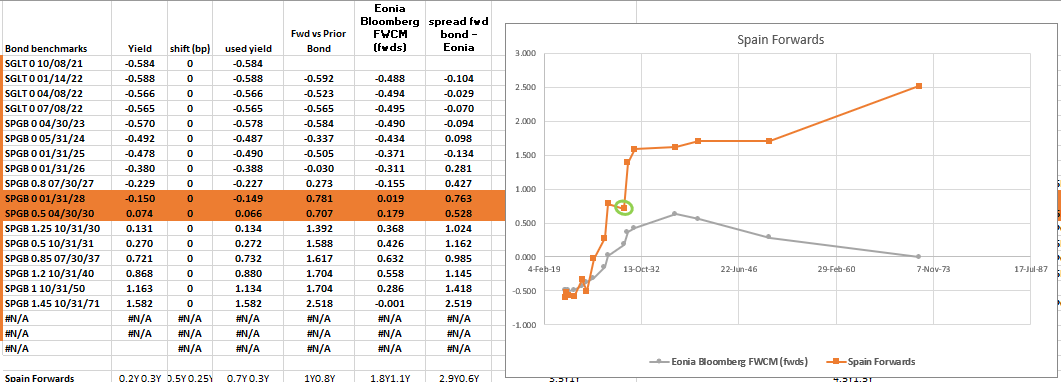

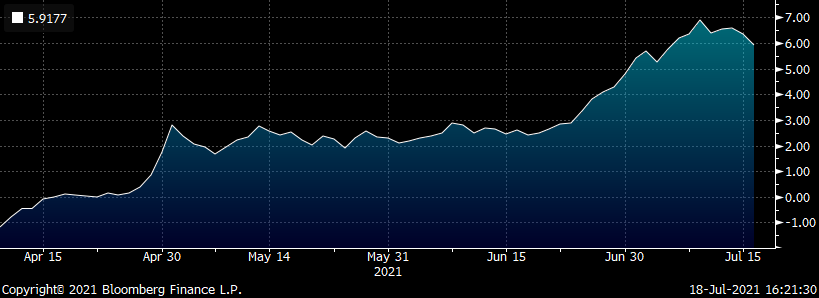

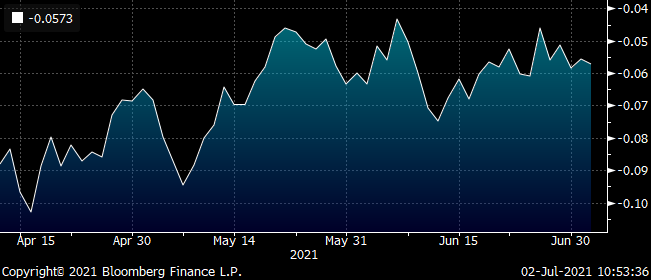

Spanish OIS spreads have richened significantly over the last 3 trading sessions

-SP210[ES0000012F76 Corp] (SP210 = swap spread)

We’re still looking for longer tenor steepeners, so maybe we can have a steepener vs Eonia that will benefit from a widening…

We see the forward from 7y Spain to 9y as one of the closest to Eonia…

Trade – Sell Spain 9y vs 7y vs OIS

Levels:

Current: -9.3bp

Enter: > -7bp

Bit optimistic – but at this level then that curve is just plain wring – and in the new paradigm of more ‘Macro’ levels for RV finding – that’s my entry point – if it doesn’t get there – then let everyone else make a giant horse race out of High Friction / Low Var RV

(P2509[SPGB 0.5 04/30/30 Corp] - P2509[SPGB 0 01/31/28 Corp])

Old 15y Italy rich vs On the run 15y and 10y

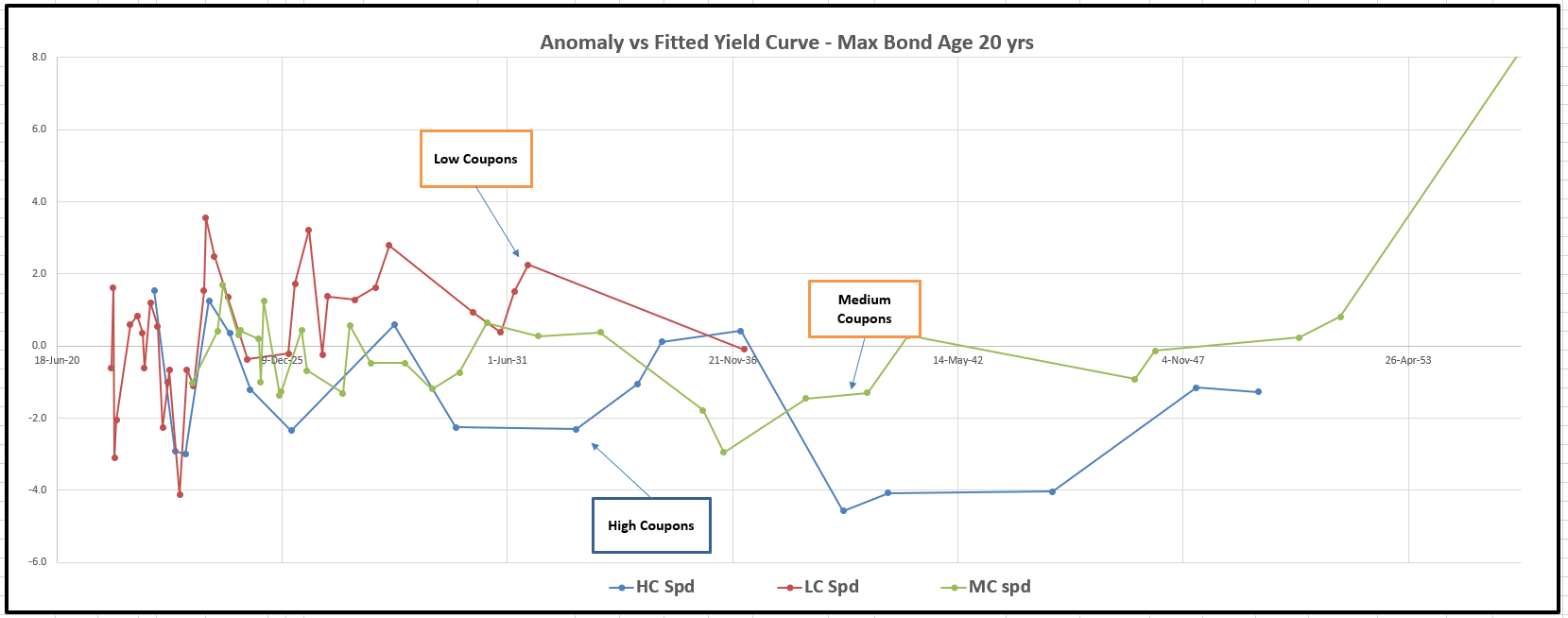

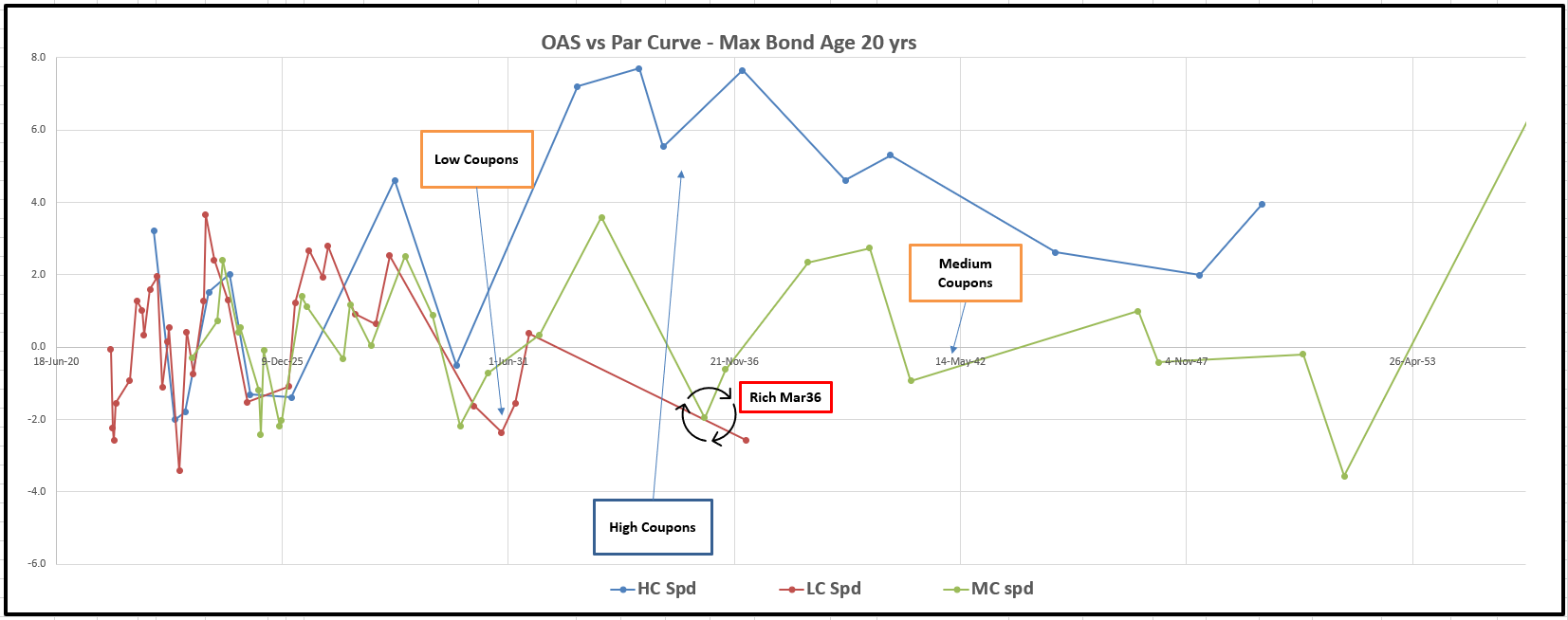

At first it that there’s no limit to how rich the highs coupons in Italy can get – in regular yield space we see the following: that the high coupons trade richest, the medium coupons trade better and the low coupons trade the worst

This can lead us to question our valuation strategy – we end up thinking there’s no limit to how cheap the low coupons can be

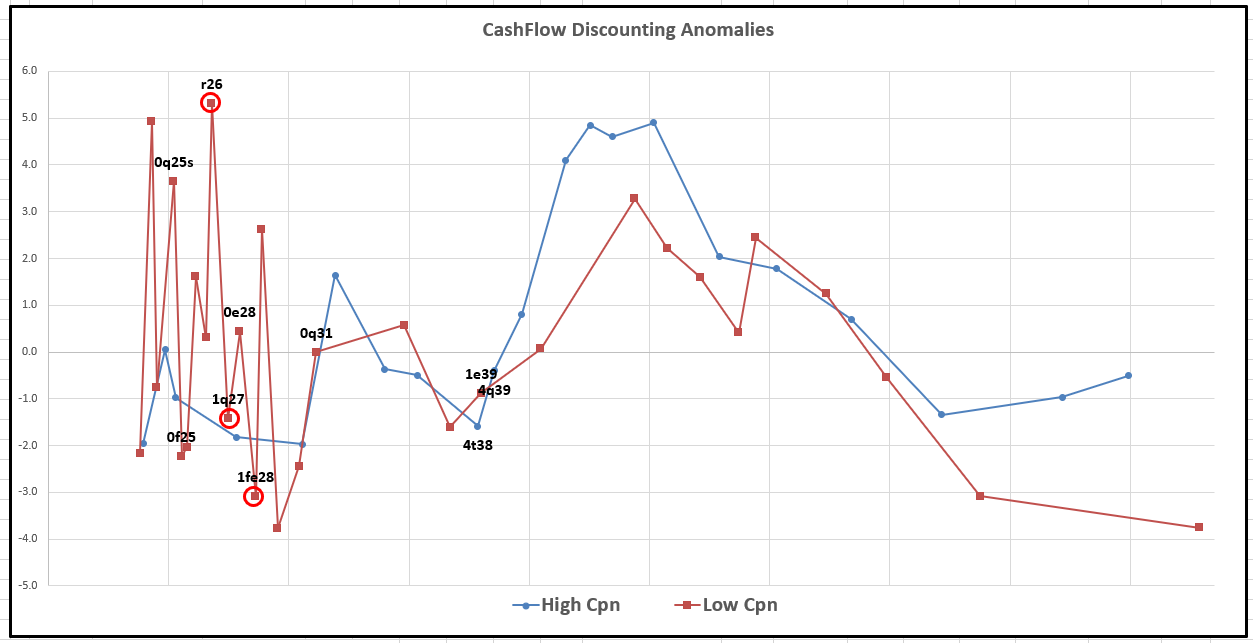

Italy high / Medium and Low coupons anomalies vs fitted Yield

Graph

It’s not we don’t know that gets us into trouble – it’s what we know for sure, that just ain’t so’ – Mark Twain

These high coupons have not ‘disappeared’ as we might conclude – it’s just that to a holder – they still aren’t rich – if you’re a cash investor – even if you’re the PEPP, you need a return on CASH, not on leverage– and so, in the context of Italian Govt Bonds, then we need to discount all the Cash-Flows versus a smooth zero curve in order to make proper comparisons

When we do that – IT ALL MAKES SENSE

Graph of anomalies using Cash-Flow discounting vs Smooth Zero Curve

Now we see that the market pricing much more sense – High coupons are still cheap to the Cash investor and low coupons are still rich (except in the sub10y sector where they are equal) – so a good trade is only where High or Medium coupons are rich on this fully adjusted metric – see Btps Mar36

So what’s a good trade? – so we want to sell rich bonds under this metric… and it’s best in a longer tenor where the probability of some risky event may still occur, such as a elections fears (Italy has had 66 Governments since WW2 – one every 1.14 yrs – google)

Highlighted on the graph is the genuinely rich 1.45% Mar36

Sell 1.45% Btps Mar36

Buy 0.95% Mar37 & Buy Btps 0.95% 12/31

cix:

(+2.0*yield[BTPS 1.45 03/01/36 Govt ]-0.3 * yield[ IT0005449969 Govt]-1.7 * yield[BTPS 0.95 03/01/37 Govt])*100

Here’s a fly using the Shorter Aug31 on the short wing for more history

(+2.0*yield[BTPS 1.45 03/01/36 Govt ]-0.3 * yield[IT0005436693 Govt]-1.7 * yield[BTPS 0.95 03/01/37 Govt])*100

Levels:

Current: -3.5bp

Enter: -3.25bp (25%)

Add: -4bp

Target: -1bp

Carry

So this IS a take out cash structure of approx 2% - so we cannot expect positive carry

@ flat repo spread it’s -0.2bp /3mo

@ -5bp repo spread it -0.4bp /3mo

Guess what else is truly rich? – IKU1, but that’s another story 😊

Best,

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

where we gonna remove curvature next?

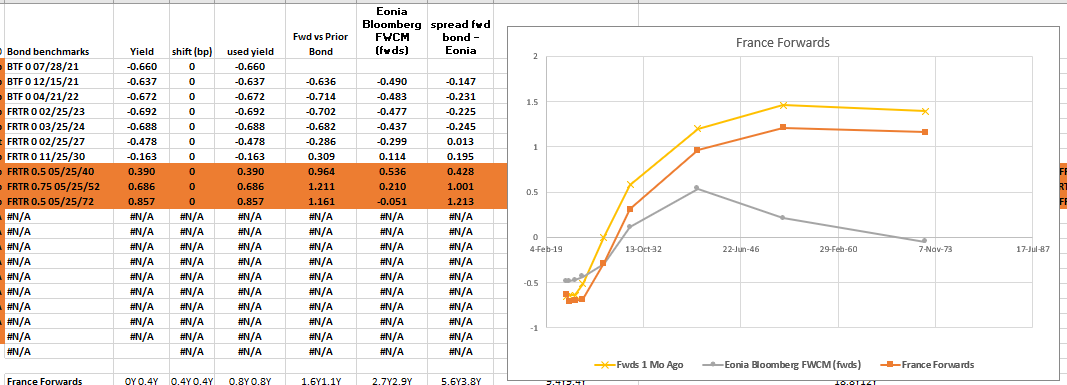

I was just looking at French Forward rates after the rally in EGBs

And TBH there’s no stand out point that looks wholly wrong – so if we think about what actually happened in terms of Rate expectations we need top look at forward rates

Forwards

Forward give us a clearer view of the path of rates rather than looking at yields – which are an average return over the lifetime of a bond – rather than from Time A to Time B

Graph: French Forwards (actual bond Forwards, not CMB) Current vs 1 Month ago

From the Graph we’ve removed fwd yield across the board – in terms of forwards its been fairly orderly – although the scope to cut yields / forwards in the short end is fairly limited

so to me it seems reasonable that if we reduce the extent and of hikes and push back their timing we could go this sort of curve shape….

Graph of Forwards for possible outcome in France

Green: forwards now

Blue: forwards after the following changes…

5y: -12bp

10y: -20bp

20y: -19bp

30y: -15bp

50y: -10bp

So what we’re saying is that for forwards to continue to represent a more accommodative stance wit ha delayed reaction function to a ‘2% target’ rather than ‘below 2%’ then I read that as aone similar to the road map change from the US last year

That in effect the target isn’t inflation perse – but it is it’s accumulation, its average or even its integral over time – as inflation (although I think they are loathed to admit it) is their way out

Corollary

So bullets in EGB in the 10y space could well continue to outperform 5s and 10s or even more extremely 2s and 50s

Lets take a look at RV in France – luckily the 10y trades cheap but counterintuitively we’re gonna buy an old, higher coupon issue – we’re gonna go for a bond that actually is cheap it just doesn’t seem so

it’s the Frtr 1.5% May31 €49,1Bln issue it came in 2015 as an original 15y bond – so it’s aged and it’s reasonable to assume it has both been stripped and it gets to be CTD to the OAT contract in December

finally I want to hedge my generic curve risk out using Eonia – there’s be nothing worse than being bullish at the top – or having a good idea at letting the macro moves sweep it away

So looking at

-Frtr May27 + Frtr May31 – Frtr May36

1 / 2 / 1 : all vs OIS

2 * (P2509[FRTR 1.5 05/25/31 Corp] + -0.5 * P2509[FRTR 1.25 05/25/36 Corp] + -0.5 * P2509[FRTR 1 05/25/27 Corp])

Lvls

Small just above here : +3.5bp

Full Add: > +4bp

target: < 0bp

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades & Fades - James & Will @ Astor Ridge

Things we're looking at in Global RV

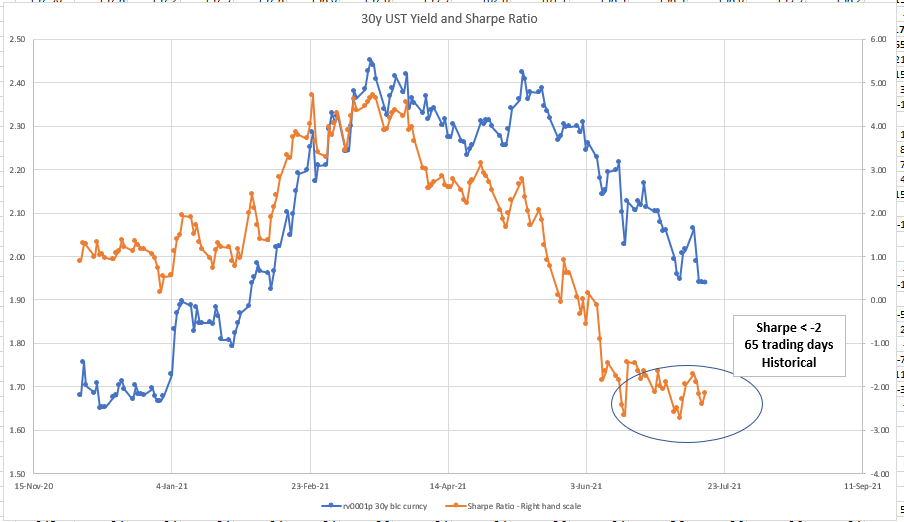

Germany

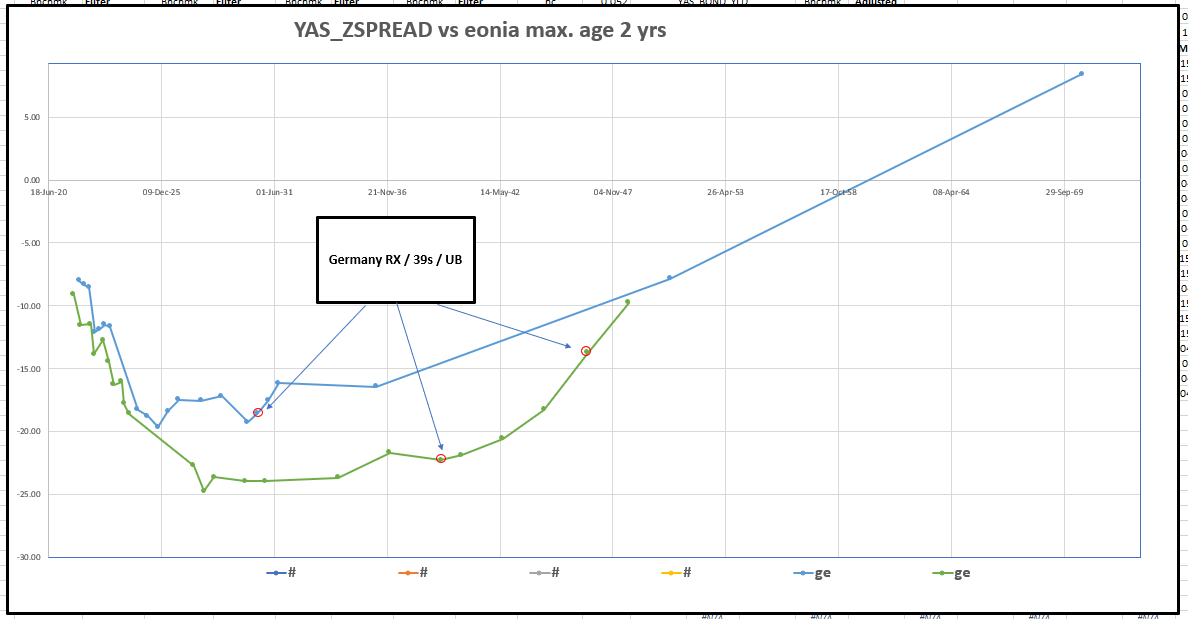

Short old 15y / Long New 15y / Short High coupon 20y

This trade has started to kick in – there's a temptation to feel that RV is somewhat broken in EGBs. To an extent that's true. When the going gets tough, the tough look at forward rates. On that metric, there aren't so many truly, disconnected parts of the curve and it's those very anomalies that are robust trades when we look at cash-flow value over time. Stay focussed on structures that we can carry for long periods – they will be stronger. Rather than look at relative pricing for hints and suggestions of dislocations from other curves

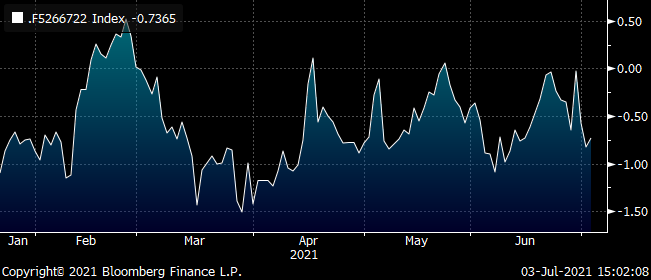

-Dbr May35 / +Dbr May36 / -Dbr 4.25 39

Weights:

-1.7 / 2 / -0.3

Cix:

(2 * YIELD[DBR 0 05/15/36 Corp] + -1.7 * YIELD[DBR 0 05/15/35 Corp] + -0.3 * YIELD[DBR 4.25 07/04/39 Corp]) * 100

Graph:

Levels:

Current: +12.25bp

Enter: +12.75bp

Target: < +11.25bp

Forwards:

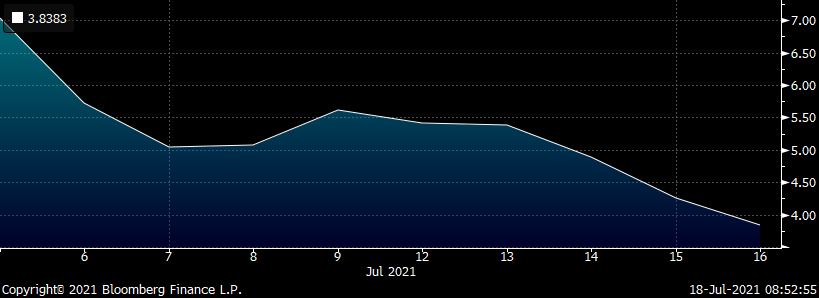

Germany

RXU1 rich vs wider wings – am starting to see Bund yields as too low and although not in full, fade-mode, I don't mind a bearish structures if they have a lot of value

We've seen the 9y point in Germany go bid as PC3 has been removed from F.I. curves in the global rally

Sell RXU1 vs buying new 5y and on the run 10y

Structure:

-RXU1 (Ctd Dbr 0% Aug30) vs

+ Obl Oct26 (Obl184) & +Dbr Aug31

Current Fly vs 1yr shorter…

Cix:

( +2.0 * YIELD[BJ948280 Corp] - 0.75 * YIELD[DE0001141844 Corp] - 1.25 * YIELD[DE0001102564 Corp]) * 100

Level:

+3.8bp

Enter: +3.75 (sell the belly)

Add: 0bp (strong add – fwd rates flat then steep)

Target: > +7bp (beyond the roll point), +10bp in the long term and bullets are just too rich in this segment and could well cheapen further in a sell-off

Looking at the Fly of one year shorter this fly rolls to a cheaper value of +7bp – so we see our trade as expensive on roll – where the curve can be expected to be in a year and also fundamentally rich in terms of Forward Rate value

Graph - Fly of one year short in Maturity: OBlOct25 / Dbr Aug29 / Dbr Aug30

(+2.0*yield[AZ461235 Corp ]-0.75 * yield[BK306463 Corp]-1.25 * yield[BJ948280 Corp])*100

Forwards:

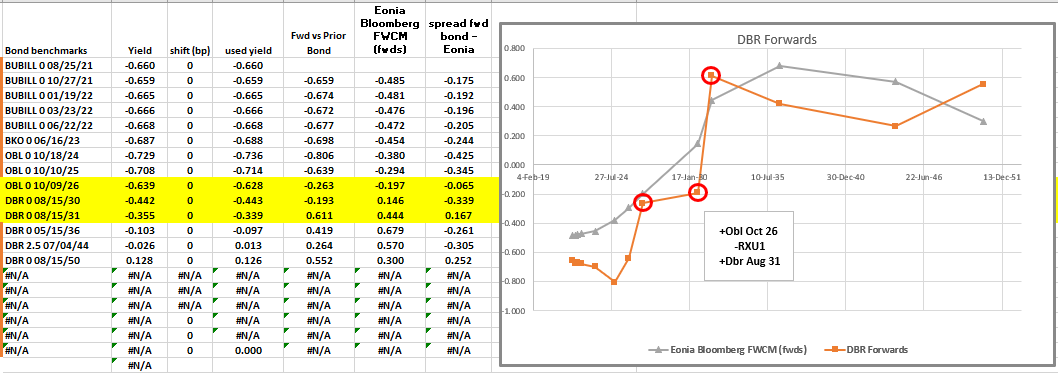

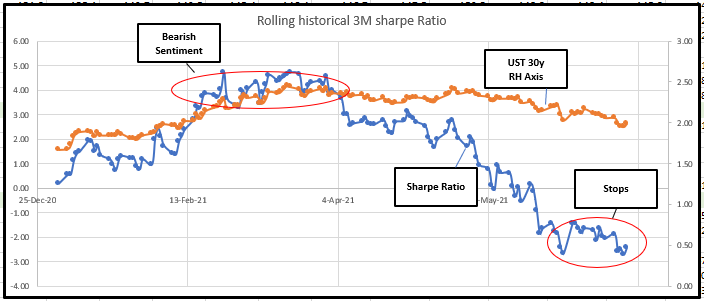

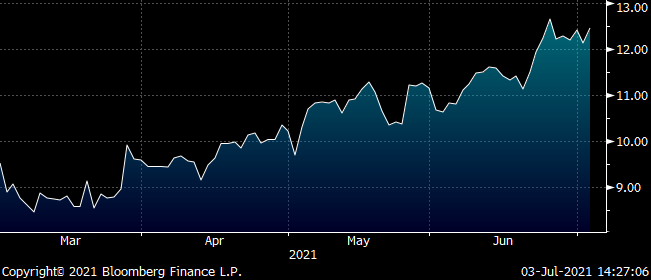

US Rates on recent lows – Sharpe Ratio suggests a decent Fade – sell rich bullets and buy wings – also we're taking profits on Long belly 7y

We like Paying US Fixed Income here – historical Sharpe Ratio of less than -2

Our trade from a few weeks ago of -5y / +7y / -10y has done well and we would take profits here…

100 * (RV0001P 7Y BLC Curncy - 0.5 * RV0001P 5Y BLC Curncy - 0.5 * RV0001P 10Y BLC Curncy)

Also / in addition….

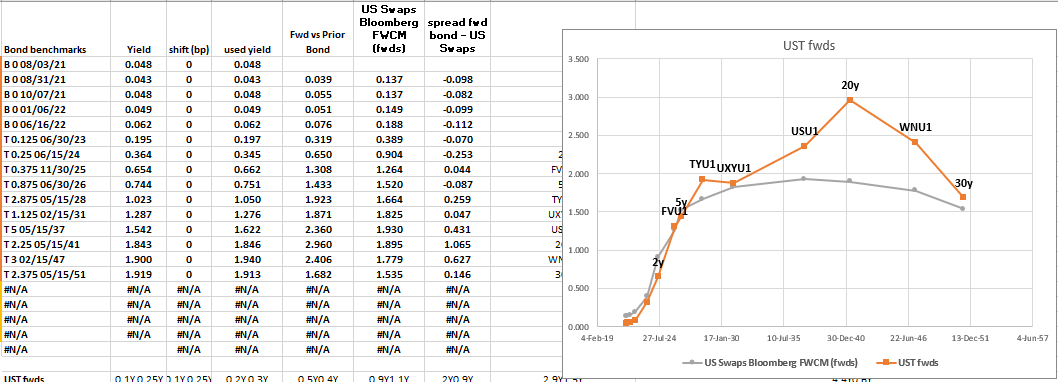

Overlay Trade – Sell 10y vs Long 7s and 15s

We can consolidate 5s7s10s by getting ready to pay 10y(UXY) vs 7y (TY) and USA (Bond Futures - approx 15y)

Structure:

+TYU1 / -UXYU1 / +USU1

2.875 May28 / 1.125 Feb31 / 5 May37

Cix:

( +2.0 * YIELD[T 1.125 02/15/31 Govt] - 1.0 * YIELD[T 2.875 05/15/28 Govt] - 1.0 * YIELD[T 5 05/15/37 Govt]) * 100

Levels:

Current: +0.2bp

Enter: Flat (small risk 25%)

Add: Strong add @ -2.5bp (full Risk)

Forwards (coupon adjusted, all bonds re-equated as par Bonds)

Short JGB 7y working – still rich

Still coming up as a great trade on risk / return is short the JBA, Japanese Bond future

JGB 0.1% 09/28 #352 is CTD & comes up as over-bought

We proposed shorting it vs 25% 2y and 90% 10y

Net Delta of -15% as per regression of changes

That's working nicely and still has room to revert further – it's highlighted by Stats and on Forwards and the curve is flat all the way from 2y to 7y and steep thereafter – seems an unusually informed curve stasis and probably just the imbalance of recent futures led buying

Cix:

200 * (RV0003P 7Y BLC Curncy + -0.9 * RV0003P 10Y BLC Curncy + -0.25 * RV0003P 2Y BLC Curncy)

UKT – September's New Issue UKT 29s makes us want to give (PAY) any rich forwards in the 7-10y segment

We're trying to be careful only to sell bonds either at the beginning or at the very end of their APF / DMO buying cycle – we're looking to sell expensive forwards as the market juggles to accommodate the 1st of September's new Jan/31/2029 new Issue

OFC this is without resorting to anomalous valuations only, to kid ourselves we've found a bid part of the curve – it's clear that in generics the richer forwards are 5y1y and 6y1y

Then overlaying on top of that the anomalies 1q27 and the 1fe28 look to be the most fully bought bonds. When we strip the cashflows down in the bonds their RV reflects that…

Graph - Cash-Flow discounted Anomalies – all cashflows stripped to smooth zero curve

1q27 and 1fe28 are revealed as truly rich when we properly discount all the cash-flows using a smooth zero curve

Similarly the Ukt r26 are cheap

Trade

Short Ukt 1fe28

Long r26 and Long 0q31

Levels:

Current: -17.4bp

Enter: -17.75bp (25%)

Add: -18.75bp (75%)

Target: -15.25bp

Cix:

( +2.0 * YIELD[UKT 1.625 10/22/28 Corp] - 1 * YIELD[UKT 0.375 10/22/26 Corp] - 1 * YIELD[UKT 0.25 07/31/31 Corp]) * 100

Graph

Carry: -0.1bp /3mo @5bp spread

Roll: +0.25bp /3mo (Roll from v smooth curve, not overly using the anomaly curve)

Sharpe Ratio (65 trading , 90 Cal days): -1

EGB – Italy 30s50s very steep

50y is on the recent steep vs 30y – it is an anti – PEPP play but with added bonus of cashflow value. The Low coupon on the run 50y is rich and the old 50y (2.8% 67) is cheap – that coupon difference in a positive curve for 50yrs has extra value that Internal Rate of Return does not fully reveal (nor does Z-Spread even)

50yrs are definitely blowing in the wind – as the major buyers of EGBs are the ECB and anyone unlucky enough to be indexed to those yields and returns – as such, because the PEPP remit ends at the 31y tenor, the 50yrs are left hanging out in the in wind

This means they are disconnected from the rest of the curve – so to apply this RV principle, one has to believe some kind of return to normalcy or for the growing anti-QE, political debate to start to take hold in Europe. Last week saw a highly critical report from the House of Lords Committee on UK QE as 'unproven' – if we believe the same debate could intensify in Europe, then this is an decent anti-PEPP play. We must be careful of trading around what we think will happen vs what we wish policy makers would do! – Scale accordingly

Structure

Buy Old Italy 50y

Sell Italy 30y and on the run Italy 50y

Weights:

-.4 / 2 / -1.6

Cix:

(2 * YIELD[BTPS 2.8 03/01/67 Corp] - 0.4 * YIELD[BTPS 1.7 09/01/51 Corp] - 1.6 * YIELD[BTPS 2.15 03/01/72 Corp]) * 100

Graph:

Carry: +0.3bp / 3mo @-5bp repo spread

Roll: +0.2bp /3mo

Sharpe: +4.5 (65 days, 90 cal days)

See the AUD F.I. overbought – as tourists to the market – purely on our radar is the fly

+8y -9y +10y

cix:

(2 * YIELD[ACGB 1 12/21/30 Corp] - YIELD[ACGB 1 11/21/31 Corp] - YIELD[ACGB 2.75 11/21/29 Corp]) * 100

We're thinking how best to pay the belly here – looks totally wrong on forwards- much like the US – unless you think rates are going back down to Covid levels this fly looks a sell in the belly

Invoice spreads In Germany and EGBs in general have done well…

Notwithstanding a stronger equity sell-off – am minded to start having some small shorts here and the most obvious fade would be a steepener in Germany vs OIS

The obvious, liquid way that has a bit of value is

Short RXU1 / Long Dbr 7y

vs OIS

cix:

(P2509[DBR 0 11/15/28 Corp] - P2509[BJ948280 Corp])

Graph

Levels – am thinking my first piece goes on @ +2.25bp and then have a think and be happy to add or trade this around

Graph- Invoice spreads in Core EGBs

Let's get something done

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades & Fades - a few things on our Radar

Early thoughts for the weekend – will add more

Italy Low Coupon 15y supply – cheapens and gives chance to take back low coupons

Absorbing the Low coupon 15y supply in Italy tomorrow

The Btps mar37 trade rich by most metrics - the anomalous behaviour is strongly correlated to discount nature of the bond

The trade am looking at to absorb the Btps mar37 is to sell the slightly higher coupon Mar36 and the 30y

{IT} -mar36 +mar37 -sep51

-1.7 / +2 / -.3

cix:

100*(2*yield[BTPS 0.95 03/01/37 Govt ] + -0.3 * yield[BTPS 1.7 09/01/51 Govt] + -1.7 * yield[BG013029 Corp])

Levels

Current: -2.8bp

Enter: > -2.25bp

Target: < -4bp

Fades

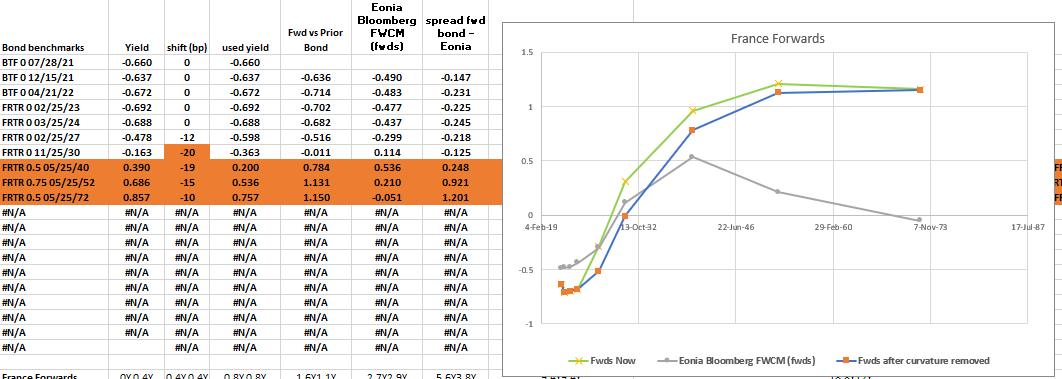

UST F.I. rich on a statistical Basis (90d, 65 trading days)

The narrative end of Q1 was for higher rates – headlines describe recent moves as Stops on those positions going off

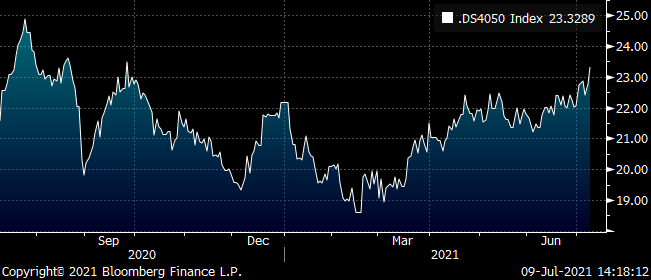

Graph 1 - UST on a Historical 3m Sharpe Ratio

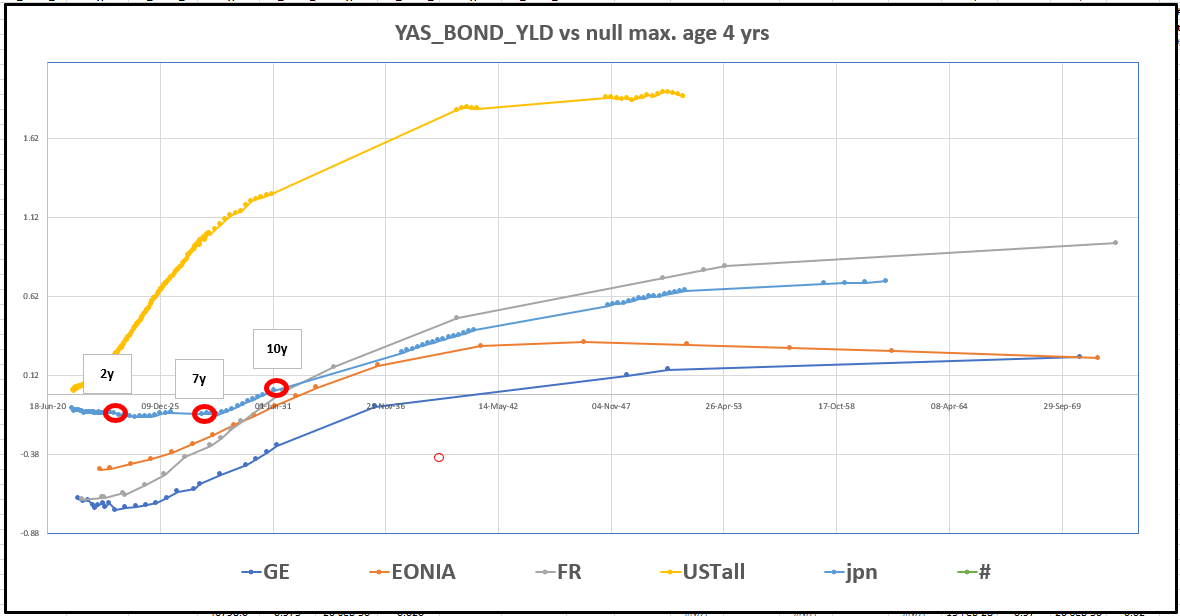

Graph 2 – UST forwards, richest point on fwd rates at the 10y UXY1 future (*yields adjusted to be par bonds)

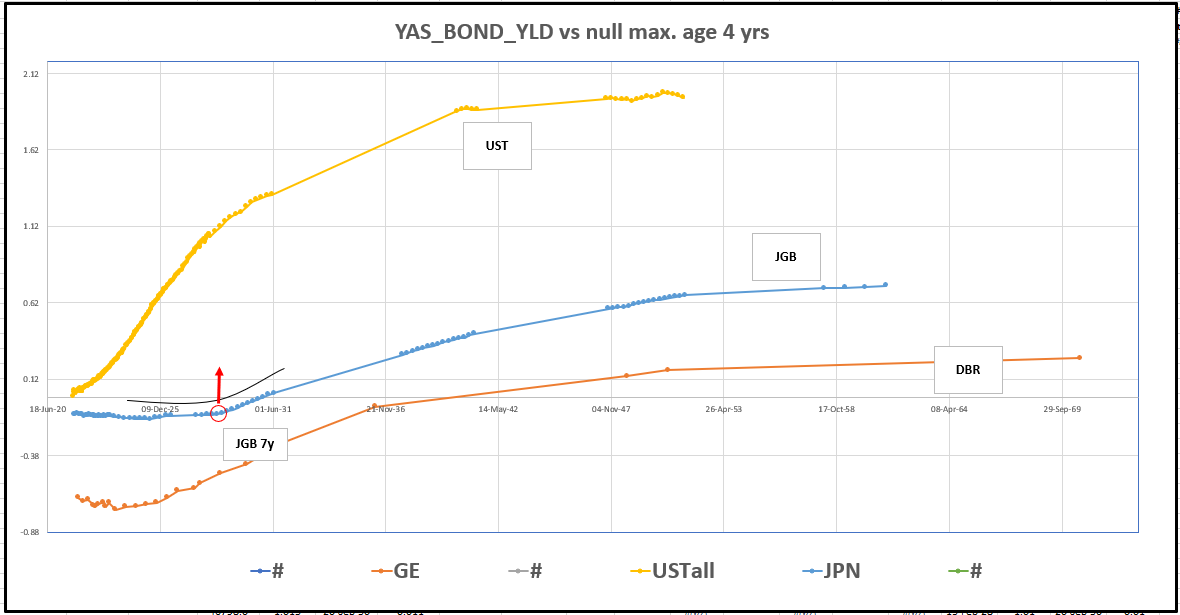

JGB Futures Rich

Jgb futures (Ctd #352 JGB 0.1% 09/28)

Have led the way in the recent rally – pushing the curve into a strange shape

Graph – Global Yield Curves – UST / JGB / Dbr

Trade

Sell Rich German Old High coupon 20y vs 30y on OIS

Graph OIS

(P2509[ZR097974 Corp] - P2509[DBR 4.75 07/04/40 Corp])

Levels

Current: +23.3bp

Enter: +23.6bp

Add: +25.5bp

Target: < +20.5bp

Rationale

The long German High coupons appear impossible to value – even using Z-Spread – but that method is fundamentally flawed as Z-spread is an average – and averages hide the value when the swap and bond curves are different slopes

- But in fact when we discount the bonds using a smooth zero curve they make a lot more sense – in that framework, German Longs & High coupons are genuinely rich

- Fwd Spread is above Eonia – hence the OIS hedge

- There will be a tap of 2048s in July and a tap of the 2050s in August, after which Germany will switch to issuing a new 30y Dbr 2052, which will receive its first tap by November

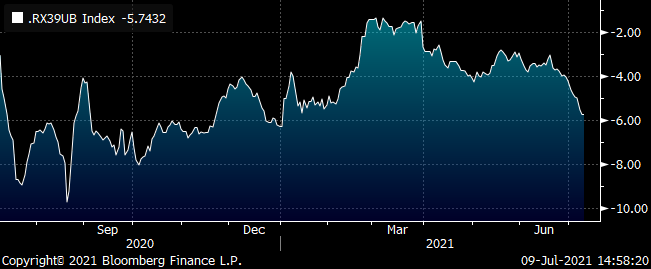

Sell Dbr 39 rich vs RXU1 and UBU1

Weights: 0.66 / 2 / 1.34

Cix:

100 * (2 * YIELD[DBR 4.25 07/04/39 Corp] - 1.34 * YIELD[DBR 2.5 08/15/46 Corp] - 0.66 * YIELD[BJ948280 Corp])

Levels:

Current -5.75bp

Enter: -5.75bp

Target: -3bp

In OIS space…

(2 * P2509[DBR 4.25 07/04/39 Corp] - 1.34 * P2509[DBR 2.5 08/15/46 Corp] - 0.66 * P2509[BJ948280 Corp])

39s richened in the higher yield environment of q2, buoyed by the addition of curvature in 10s20s30s

– any chance of tapering should impact these high coupons that are back to rich even versus the swap curve

Stats

Distance from mean: 2bp

Sharpe (65 days): -3.45

Size of 1sd: 0.6bp

Carry & Roll

Carry: -0.4bp /3mo

Roll: +0.2bp /3mo

Will & James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades & Fades - James & Will at Astor Ridge

JGB rally – futures led leaves 7y looking rich vs 2y and 10y

This has left the curve flat out to 7years and steep thereafter. When we look both at yields and at forwards it seems an implausible stasis for the JGB curve

We get expect either a reversal of the rally in JGB forwards or the power of the 7s10s roll to flatten the longer leg possibly both

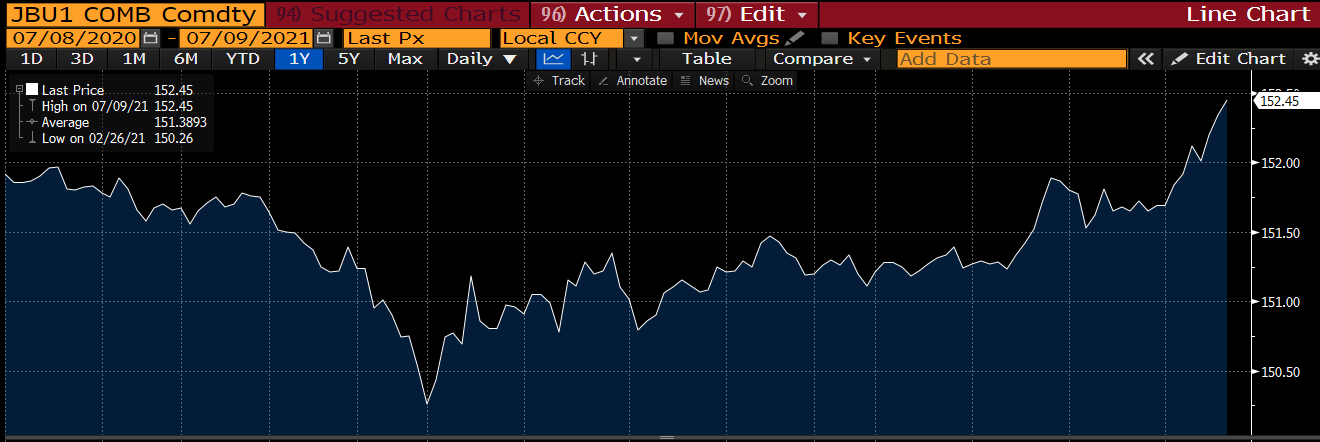

JGB futures Have rallied to a recent high since the end of June – (CTD is a 7y Bond)

Consider the Japanese Yield Curve in a more macro context

2s/7s curve is now flat – with the curve only positive from the 7y and longer – this seems a an odd set of expectations in the context of other yield curves

Global Yield Curves…

If we look at Constant Maturity Bonds (CMB) on Bloomberg, we can estimate the empirical delta and slope of a butterfly of the form

+2y -7y +10y

Weightings

Bi-variate regression on changes (1yr = 250 trading days)

-0.25 / +1 / -0.9 (all x2, expressed as long the belly)

Nett Delta: 15% short (long the bullet 50/50 trades like a long)

Nett Slope: 30% steepener (long the bullet 50/50 trades like a flattener)

Cix:

200*(RV0003P 7Y BLC Curncy + -0.9 * RV0003P 10Y BLC Curncy + -0.25 * RV0003P 2Y BLC Curncy)

Long Term Chart

Statistics (3mo = 65 trading days)

Average: -19.2bp

Size of 1 Std Dev: 1.0bp

# of Std Dev: -4.5bp

# of bp rich/cheap: -4.3bp

Historical Sharpe: -1.7

Current Level: -23.5bp

Target Entry: < -24.5bp

Add: < -27bp

JGB forwards

Let us know

Best

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades & Fades - James & Will @ Astor Ridge

Here's a few things on our radar in Europe

We'll be switching to a new distribution list so please let us know if you want to keep receiving this

Germany – tap bond too cheap creating forwards over Eonia – best way to take down supply

-dbr35 +dbr 36 -Dbr 39

-.85 / +1 / -0.15

cix: 200*(yield[DBR 0 05/15/36 Govt ] + -0.15 * yield[DBR 4.25 07/04/39 Govt] + -0.85 * yield[DBR 0 05/15/35 Govt])

Levels

Current: +12.45bp

Enter: +12.75bp (min 2bp in the fly to my first target of +10.75bp)

Graph

Forwards

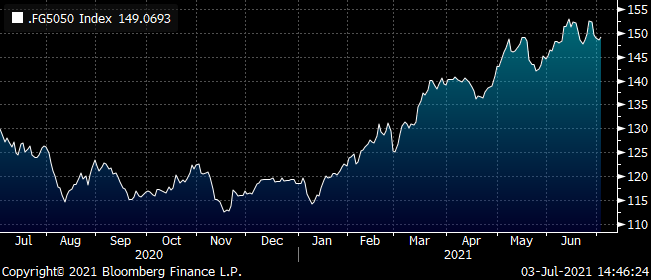

French 10s30s too steep from overhang and fear of 30y syndication, OAT invoice spread recovery should pass itself on to long end spread contraction

Long France 30y vs 50% German 30y and 50% OAT futures

We like that flattener but we also like the long credit spreads – so we asked the solver to fin an optimal hedge for the French 30y using German 30 and French 10y

It came up with 40/60 as a hedge and an r2 of 0.95 – but we've shifted that to be a 50/50 trade

Cix: 200 * (YIELD[FRTR 1.5 05/25/50 Corp] + -0.5 * YIELD[ZR097974 Corp] + -0.5 * YIELD[FRTR 2.5 05/25/30 Corp])

Levels

Current: +149.1

Enter: +155bp

1sd = 4.7bp (90 cal days) size accordingly

Graph

French 30s50s too flat vs 30y relative to other curves and relative to the Forwards – play for a steepening in 30s50s

Fade: sell Old French 50y 66s

vs buying 30y and new 50y

weighting .33/.67 (third / two thirds)

cix: 200 * (YIELD[FRTR 1.75 05/25/66 Corp] + -0.67 * YIELD[FRTR 0.5 05/25/72 Corp] + -0.33 * YIELD[FRTR 0.75 05/25/52 Corp])

Levels

Current: -0.75bp

Enter-1.5bp (small Entry)

Target: > +1bp

We're a ways away from entering this one – to be candid the index has 'spent too long ' at levels better than the current mid – but I really like this theme and my sense is that if France 30s50s did steepen at some point, then the 66s and 72s would probably move one for one. Over Summer I think PEPP will still be seen as strong and there's a chance any 30y goes well and that 50yr could just drift cheaper as the only really buyer at lower yields, the PEPP is constrained to a max maturity of 31 years

Eu flattener vs 10s30s MMS – EU as a composite issuer has value on spread and was too steep at recent highs (vs MMS)

The EU curve blew out (steepened) to resemble something akin to the Euro Curves – albeit still a little flatter (as is the swap curve)

On vol vs swap spread analysis we now see EU as 'Fair' in relative to its peer Group – France / Austria / Belgium – yet it retains its triple A rating and should not prone to the idiosyncratic sell-off risk from single name issuer risk – for example impending election risk in France and Germany

The Recent RFP's have gone well and NGEU seems well bedded into the curve and that bodes well for NextGen EU too – so generally we're constructive on the issuer as these levels

This credit has started to flatten vs swaps – if we can get anything back to these historical highs – I think that's how we want to be over Summer

SP037[EU 0.3 11/50 Corp] - SP037[EU 0 10/30 Corp]

Best

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Dbr 39s ????

Correction

Carry on Dbr39s vs rx and ub -0.4bp /3mo (not -0.2bp)

roll +0.3bp

net -0.1bp

…

James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Dbr 39s ????

Am seeing this Dbr 2039 creep richer and richer – and I do like the roll down form 46s down to 39s – so being short would be my natural way – but the absence of vol and the Friction seem to be allowing these anomalies to free – range in Germany

I have been waiting for the absolute Sharpe Ratio to get over 2

Are we ever going to get to a point where selling 39s (or even 40s) makes sense?

The bond will ultimately move towards the tap area of 15years – and this did have a cheapening effect on the 37s and should do on the 39s

But as important, is the fact that the 46s drop out of delivery in June next year – at which point they will have less than 24 yrs to maturity and hence no longer satisfy the delivery criteria

Trade:

Buy RXU1 , Sell Dbr 39 , Buy UBU1

Weights: +.33 / -1 / +.67 (all x2 to normalise vs 1/2/1 flys)

Carry: -0.2bp /3mo @ -5bp repo spread

cix:

200 * (YIELD[DBR 4.25 07/04/39 Corp] + -0.67 * YIELD[DBR 2.5 08/15/46 Corp] + -0.33 * YIELD[BJ948280 Corp])

vs OIS…

2 * (P2509[DBR 4.25 07/04/39 Corp] + -0.75 * P2509[DBR 2.5 08/15/46 Corp] + -0.25 * P2509[BJ948280 Corp])

At the end of the day tho – this trade needs a taper story to give it legs

More coming on EU…

James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

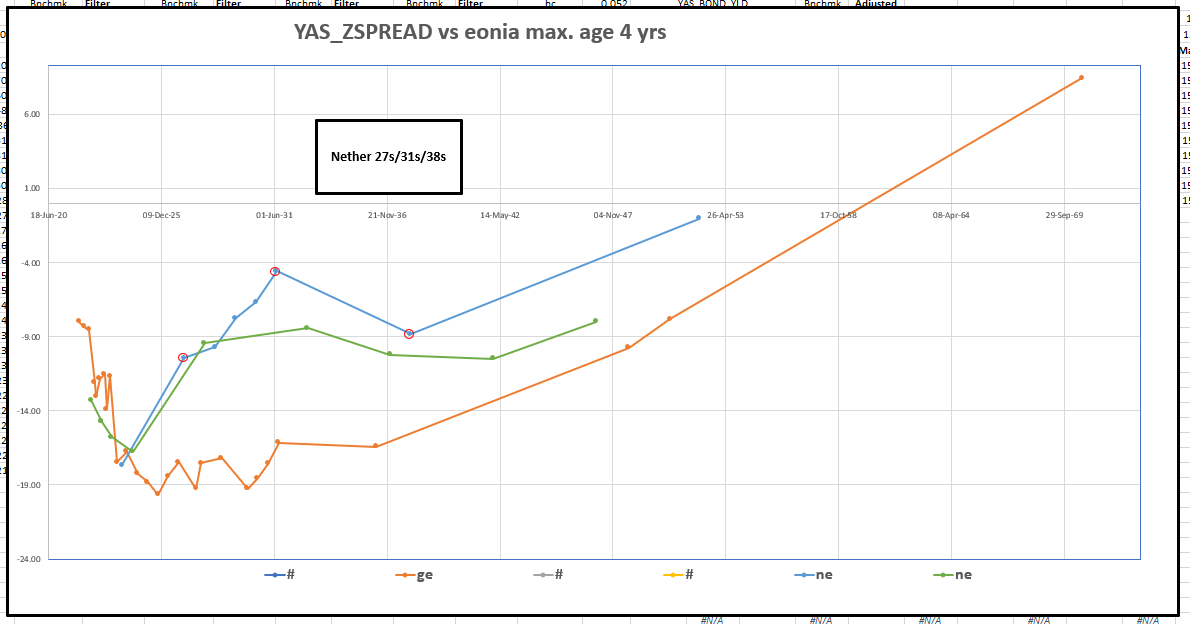

+PC3 in Nether

Looking at Nether vs Europe in Z-spread space – the 10y point is quite pointedly high

Orange – Germany

Blue - Nether Recent Issues

Green – Nether High coupons

From history…

I force the regression to be Duration Matched

buy Nether 31 vs sell jan27 and jan38

-0.4 / 1 / -0.6 (all x2 to normalise vs 1/2/1 flys)

cix: 2 * (YIELD[NETHER 0 07/15/31 Corp] + -0.6 * YIELD[NETHER 0 01/15/38 Corp] + -0.4 * YIELD[NETHER 0 01/15/27 Corp])

Graph…

Levels

Am thinking here – or perhaps 1bp cheaper want to have some of this – essentially PC3 (curvature) long

James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Spanish 30y supply

Spanish 30y – my preference on any further steepening is to do look at Spgb 9s20s curve

Makes me like Spain -9y +20y on regression – see 20y as a bit cheaper

-Apr30 (90%) +oct40 (100%)

net delta long 10%

index looks like this

100 * ((YIELD[SPGB 1.2 10/31/40 Corp] - 0.9 * YIELD[SPGB 0.5 04/30/30 Corp]))

Anything over 88 looks decent discount given the current vol

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796