High coupons rich in Europe?....

Why is a rich bond rich to us?

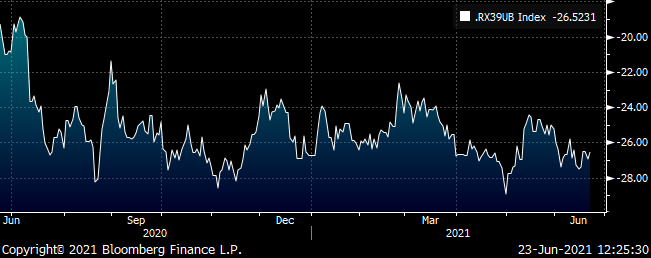

'Cos to someone else it's cheap

Generally, The high coupons throughout Europe trade on lower yields vs their interpolated par-bond, local equivalents

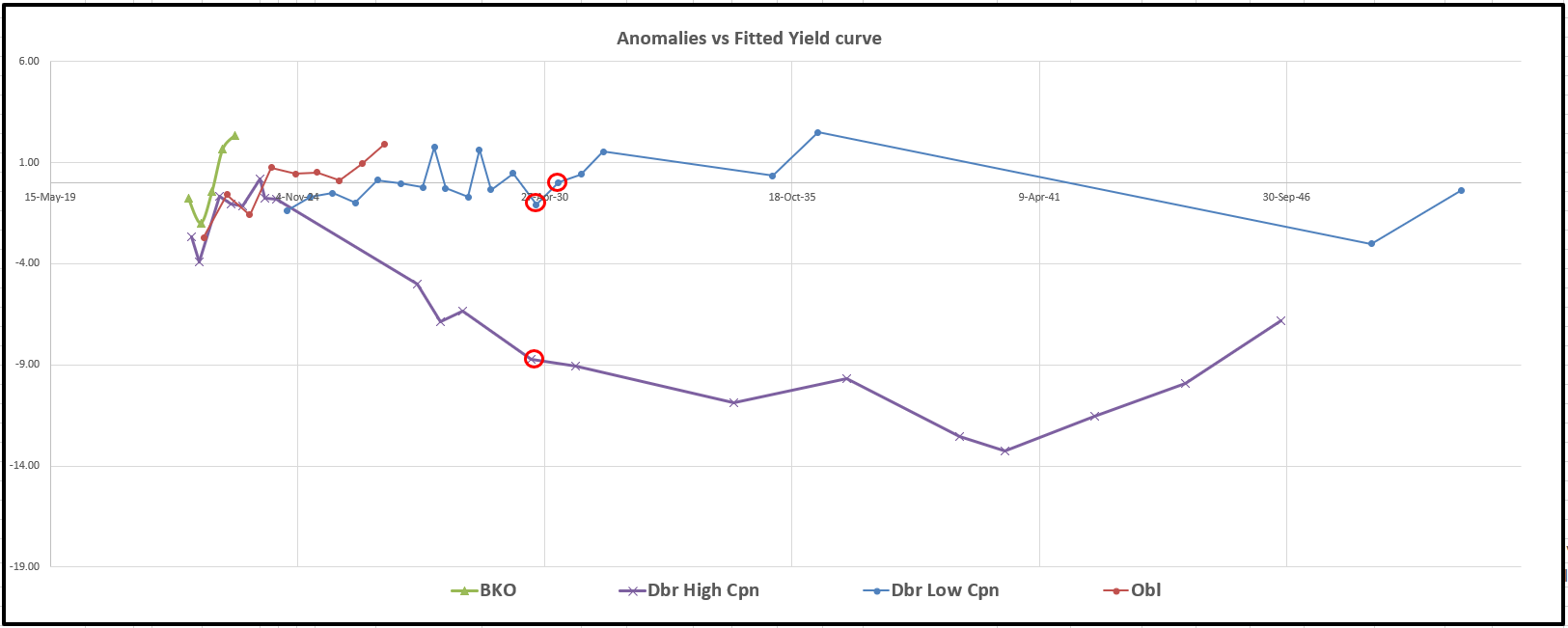

Germany – High vs Low Coupon anomalies

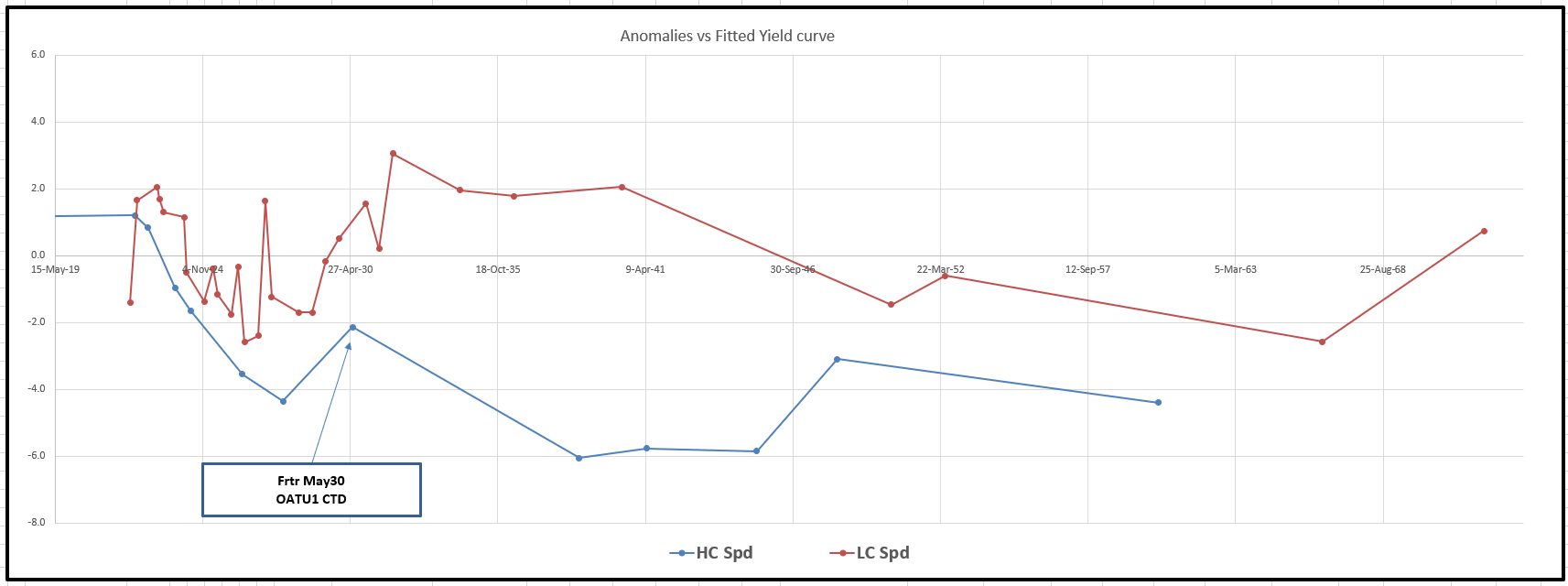

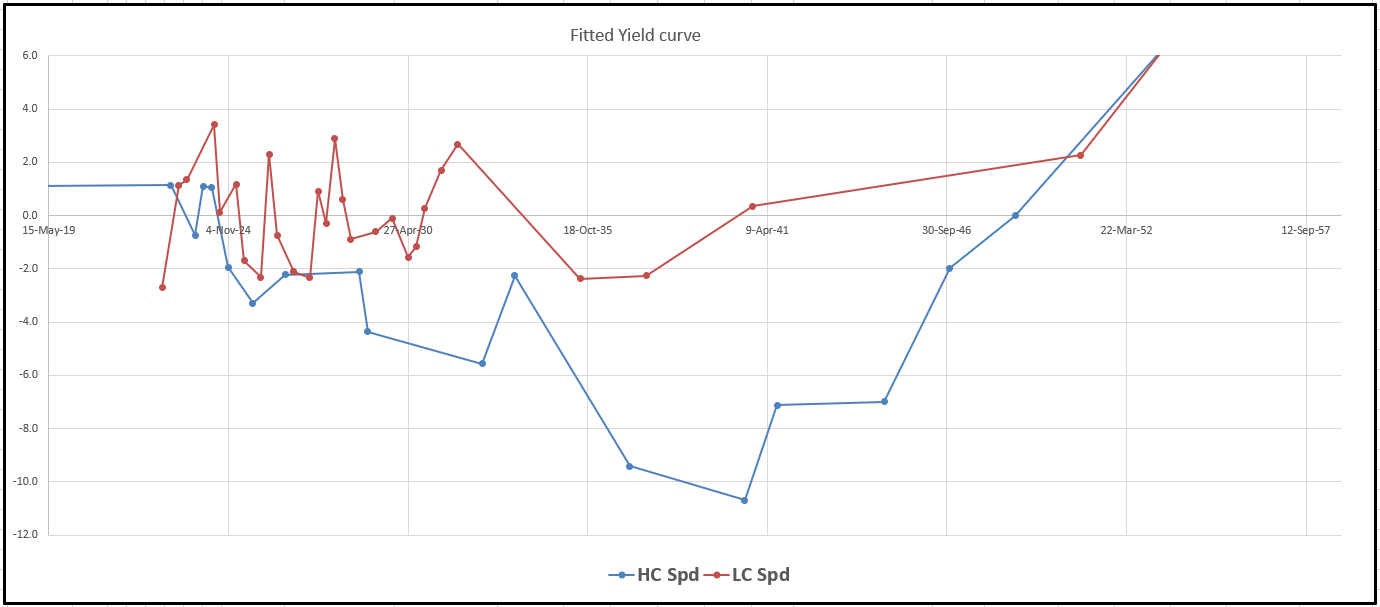

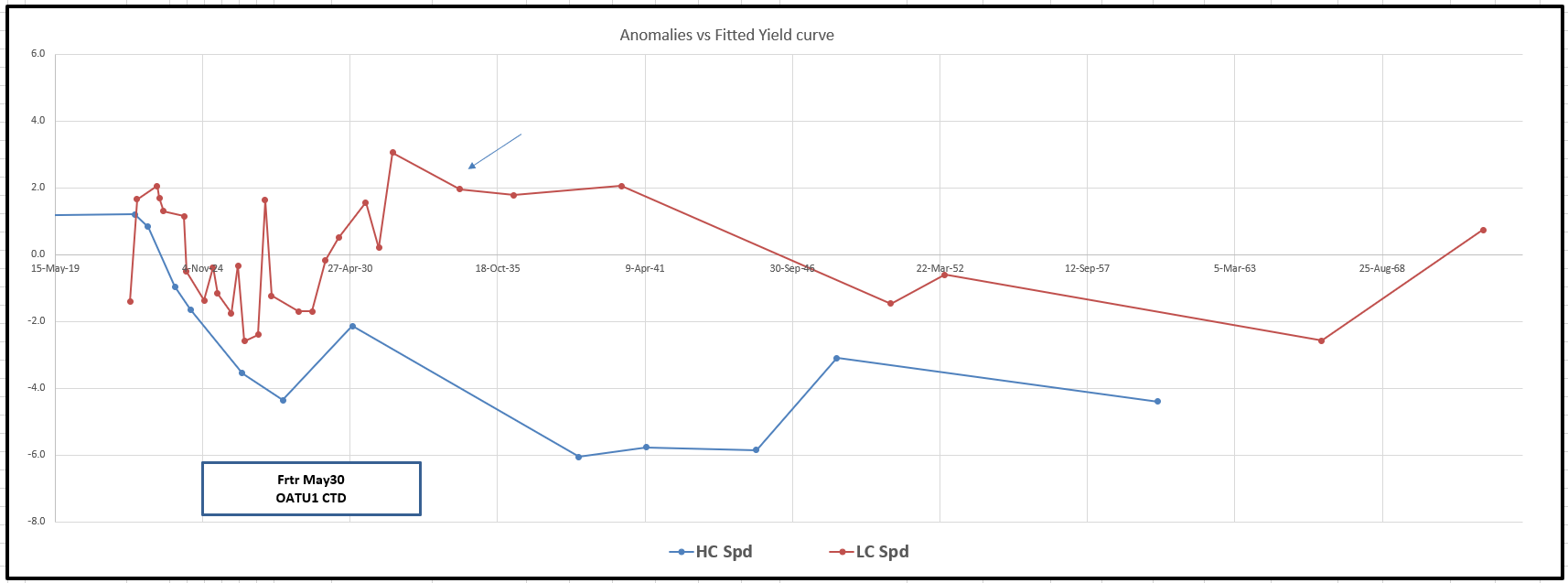

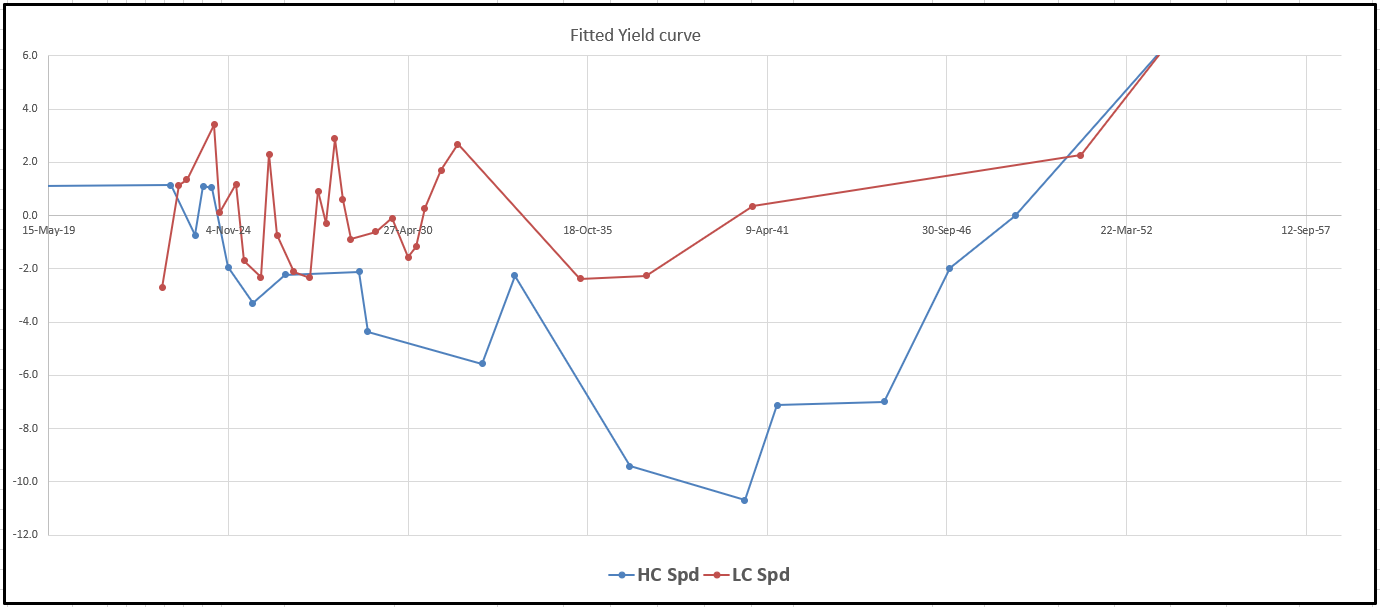

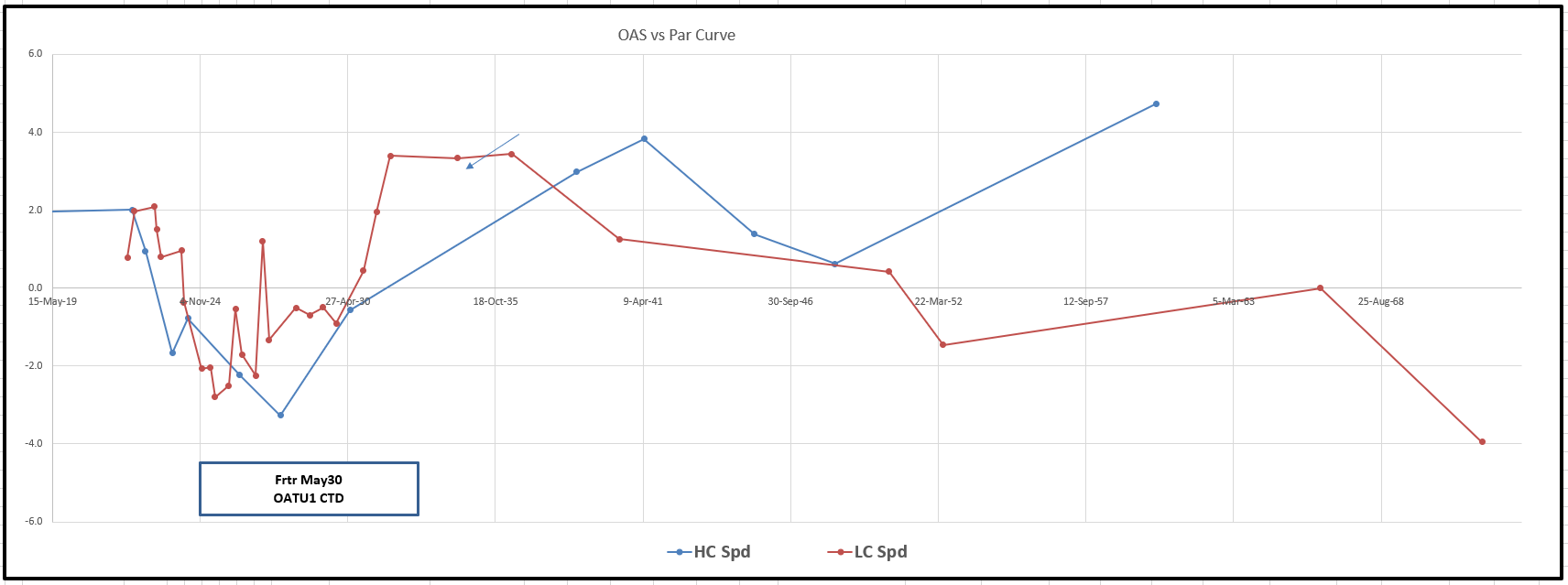

France – High vs Low Coupon anomalies

Spain - High vs Low Coupon anomalies

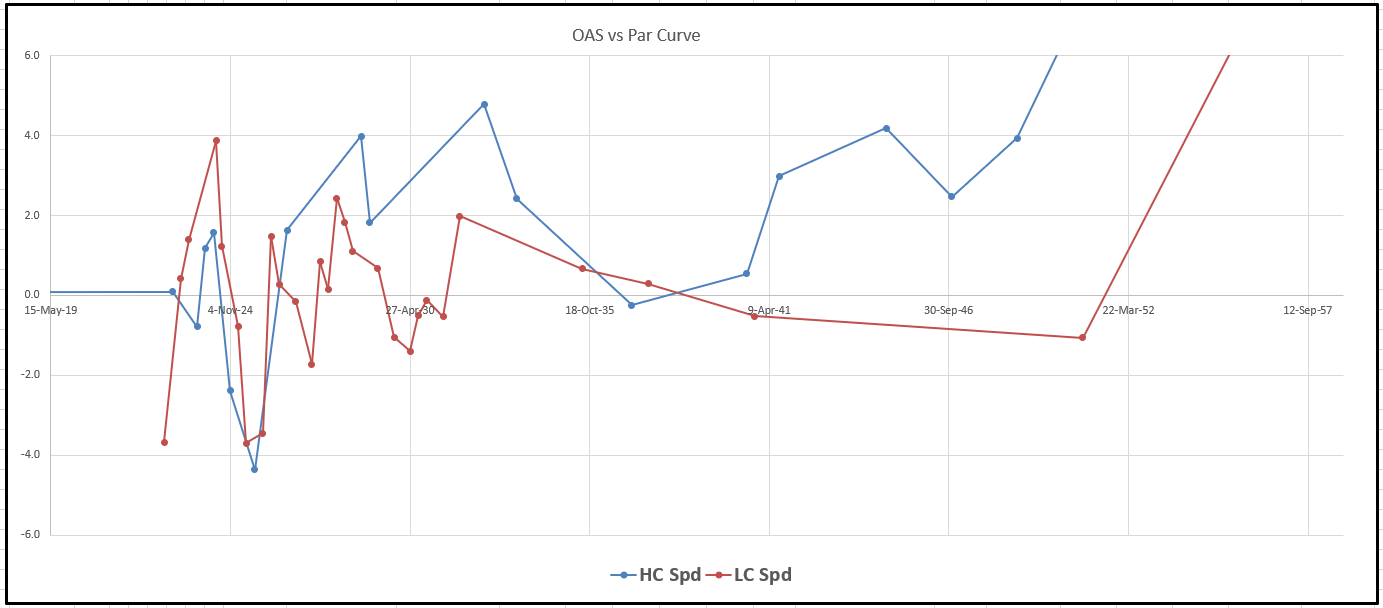

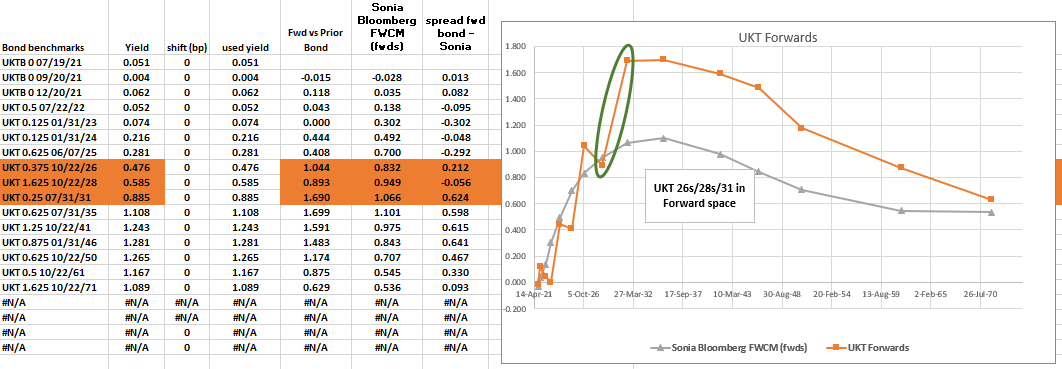

But this belies a problem that even Z-Spreads doesn't fully reveal – that High Coupon, low Modified Duration bonds in a steep yield curve have a lot more 'value' than is show by looking at the yield anomaly versus a fitted yield curve

We really need to Discount all the cashflows of each bond vs a fitted, smooth zero curve to extract a value of the high coupons vs low coupons.

When we do this we get a starkly different contrasting perspective of value in these issuers – and it's even more pointed in curves that are very steep vs the swaps curve – in that situation Z-Spread I woefully inadequate as it ascribes an 'average' spread to swaps of the bond's cashflows. Yet in credit risky issuers, particularly in the presence of PEPP – the spread to swaps of earlier cashflows is dramatically lower than later ones – so that means that high coupons are worth far more than even Z-spreads would display because we get our yield via earlier cashflows

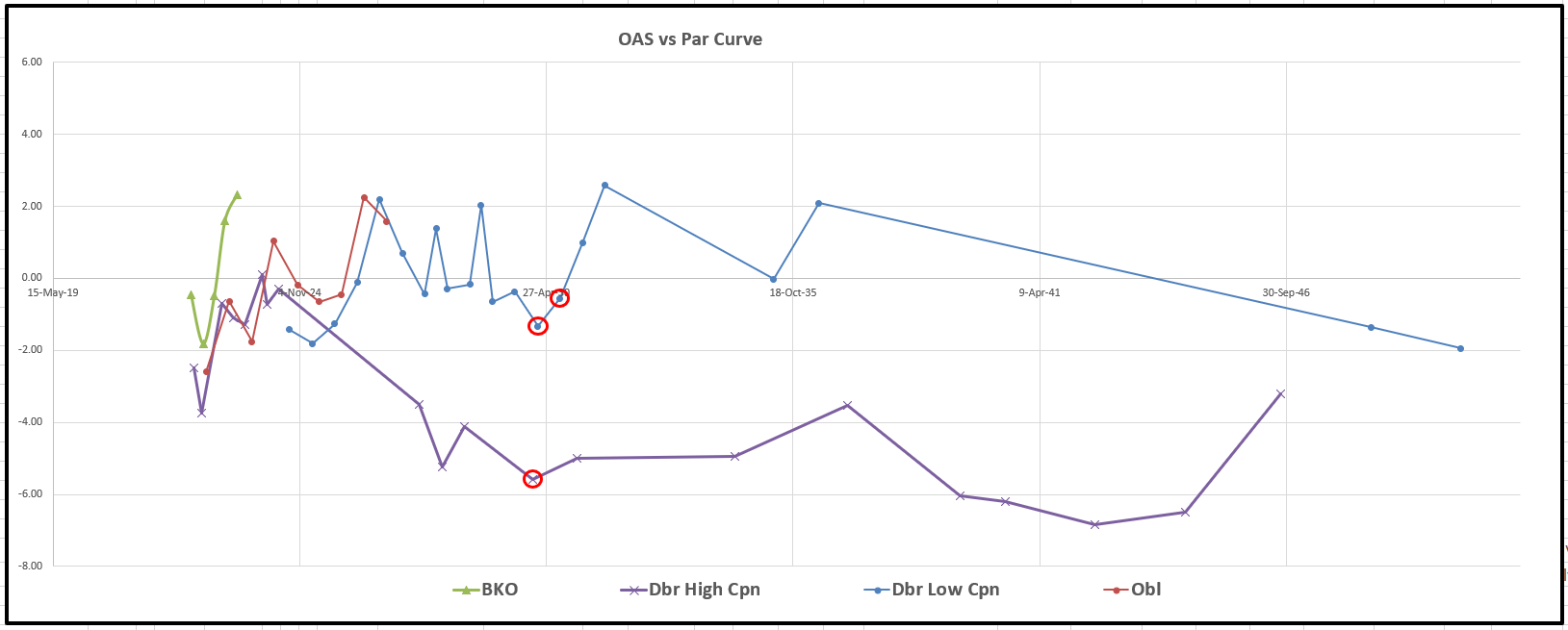

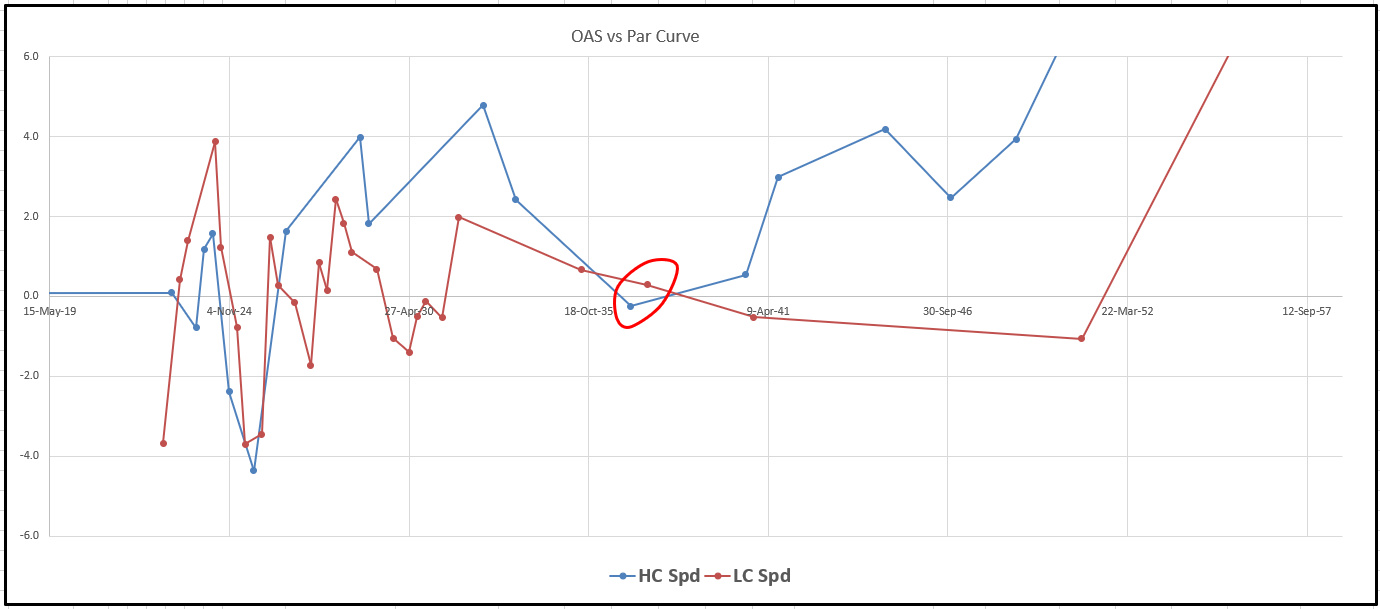

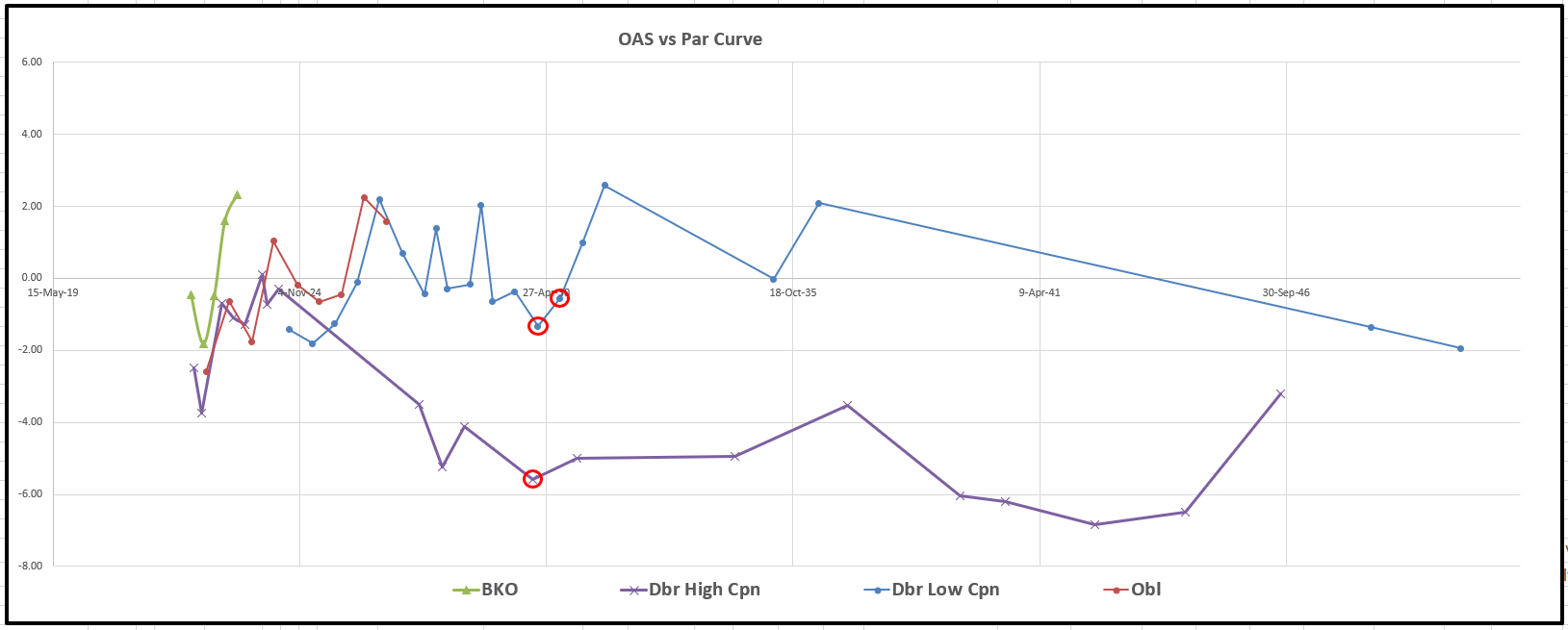

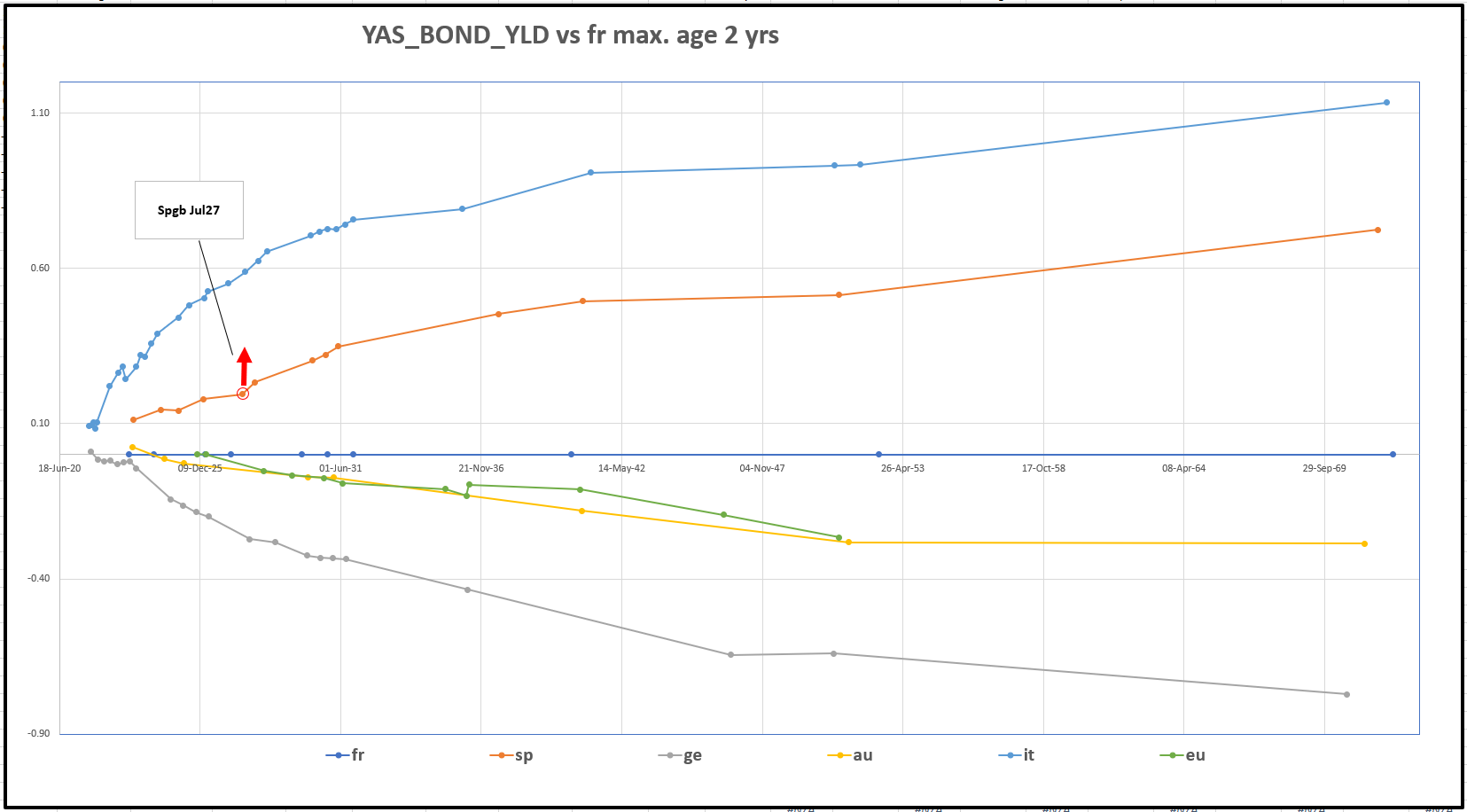

So now – take a look at how these curves look when we use a smoothed fitted zero curve for each of the issuers

Germany – High vs Low Coupon anomalies using OAS - the bonds are still rich – Dbr 6.25 Jan30 highlighted along with Dbr feb30 & Dbr Aug30 (CTD to RXU1)

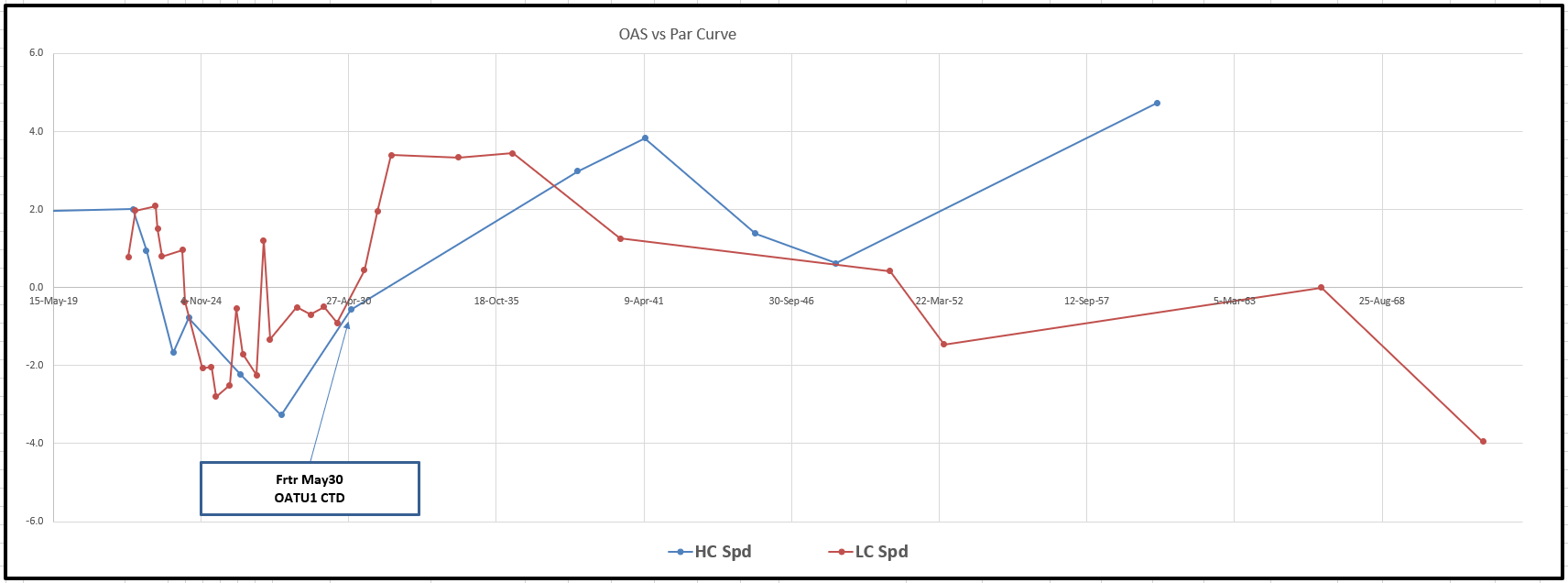

France – High vs Low Coupon anomalies using OAS, generally high coupon France is not rich in the longer tenors. The exception being Frtr oct27. The May30 CTD to the OAT has 'hidden' cheapness that could cause it to squeeze like Oct27 and Apr26 did when they dropped out of the basket

Spain – High vs Low Coupon anomalies using OAS. Because of the steep curve and the very High coupons – the Spanish high coupons are still not rich except jan37

Conclusions

Spain High coupons

The only truly expensive Spanish high coupon is Spgb jan37 +13.8bp

-spgb jan37 +Spgb jul37 is the best high into low coupon trade

German High coupons – Dbr 6.25 1/30 are now finally, rich both on true value and on location vs History

-dbr 6.25 1/30 +dbr 0 Aug30 (CTD to RXU1)

Frtr May30 – high coupon CTD that rolls out of the basket and could richen dramatically..

We need to accumulate this thing as it could go missing after Sep delivery

Buy Frtr May30 vs Frtr May40 and Frtr Oct 27

weights: -0.7 / +1 / -0.3 (all x2 to compare with standard flys)

cix:

2*(yield[FRTR 2.5 05/25/30 Govt ] + -0.35 * yield[FRTR 0.5 05/25/40 Govt] + -0.75 * yield[FRTR 2.75 10/25/27 Govt])

I think this keeps going and is a real risk of richening further – I think I should have some but always be overjoyed to add at a much better location should the market afford such

Best

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

High coupons rich in Europe?....

Why is a rich bond rich?

'Cos to someone it's cheap

Generally, The high coupons throughout Europe trade on lower yields vs their interpolated par-bond, local equivalents

Germany – High vs Low Coupon anomalies

France – High vs Low Coupon anomalies

Spain - High vs Low Coupon anomalies

But this belies a problem that even Z-Spreads doesn't fully reveal – that High Coupon, low Modified Duration bonds in a steep yield curve have a lot more 'value' than is show by looking at the yield anomaly versus a fitted yield curve

We really need to Discount all the cashflows of each bond vs a fitted, smooth zero curve to extract a value of the high coupons vs low coupons.

When we do this we get a starkly different contrasting perspective of value in these issuers – and it's even more pointed in curves that are very steep vs the swaps curve – in that situation Z-Spread I woefully inadequate as it ascribes an 'average' spread to swaps of the bond's cashflows. Yet in credit risky issuers, particularly in the presence of PEPP – the spread to swaps of earlier cashflows is dramatically lower than later ones – so that means that high coupons are worth far more than even Z-spreads would display because we get our yield via earlier cashflows

So now – take a look at how these curves look when we use a smoothed fitted zero curve for each of the issuers

Germany – High vs Low Coupon anomalies using OAS - the bonds are still rich – Dbr 6.25 Jan30 highlighted along with Dbr feb30 & Dbr Aug30 (CTD to RXU1)

France – High vs Low Coupon anomalies using OAS, generally high coupon France is not rich in the longer tenors. The exception being Frtr oct27. The May30 CTD to the OAT has 'hidden' cheapness that could cause it to squeeze like Oct27 and Apr26 did when they dropped out of the basket

Spain – High vs Low Coupon anomalies using OAS. Because of the steep curve and the very High coupons – the Spanish high coupons are still not rich except jan37

Conclusions

Spain High coupons

The only truly expensive Spanish high coupon is Spgb jan37 +13.8bp

-spgb jan37 +Spgb jul37 is the best high into low coupon trade

German High coupons – Dbr 6.25 1/30 are now finally, rich both on true value and on location vs History

-dbr 6.25 1/30 +dbr 0 Aug30 (CTD to RXU1)

Frtr May30 – high coupon CTD that rolls out of the basket and could richen dramatically..

We need to accumulate this thing as it could go missing after Sep delivery

Buy Frtr May30 vs Frtr May40 and Frtr Oct 27

weights: -0.7 / +1 / -0.3 (all x2 to compare with standard flys)

cix:

2*(yield[FRTR 2.5 05/25/30 Govt ] + -0.35 * yield[FRTR 0.5 05/25/40 Govt] + -0.75 * yield[FRTR 2.75 10/25/27 Govt])

I think this keeps going and is a real risk of richening further – I think I should have some but always be overjoyed to add at a much better location should the market afford such

Best

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

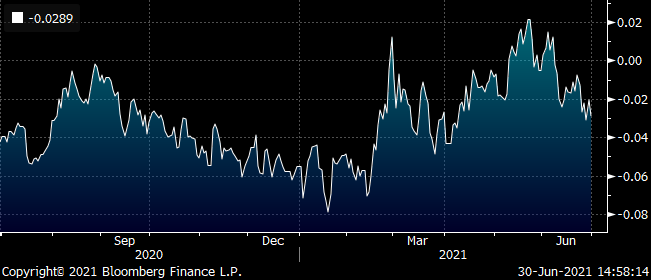

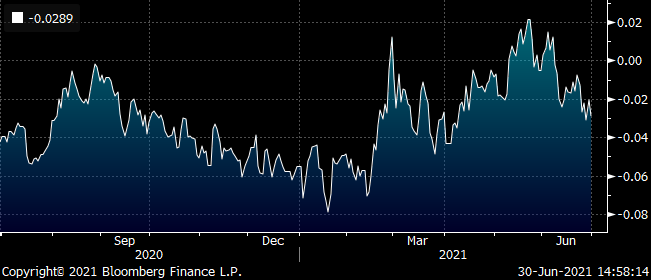

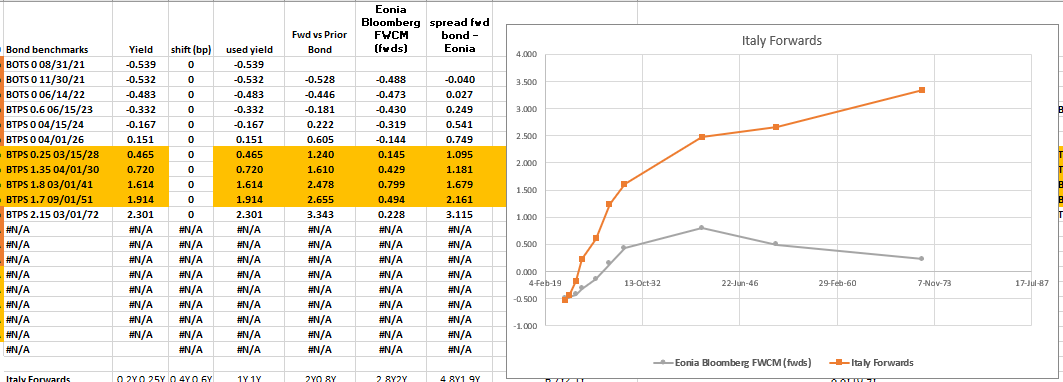

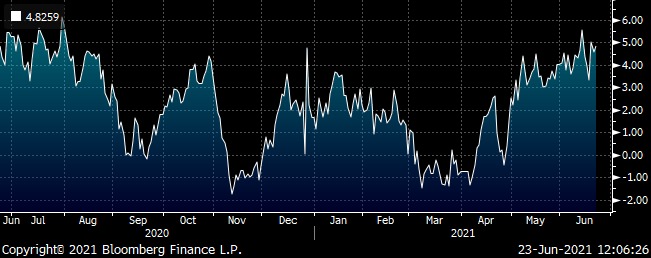

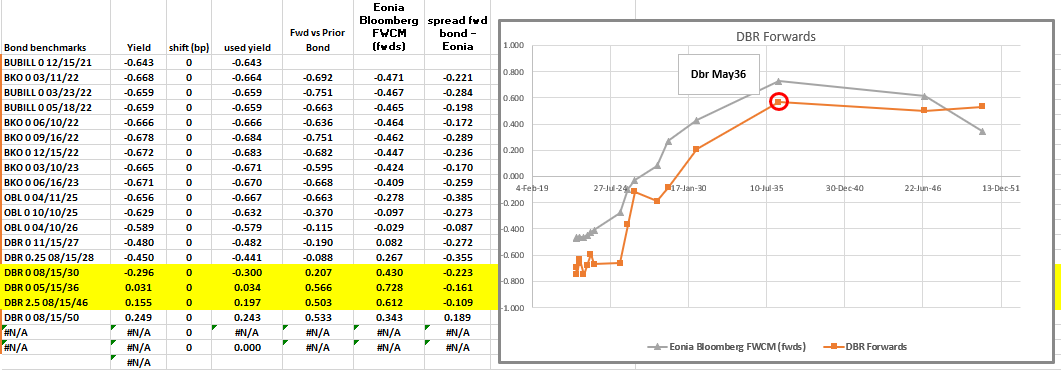

Italy 7s 10s 30s

Trade: +old 7y -ik +30y

Weights: 0.9 / 1 / 0.2 (all x2)

Net delta: 10%

CIX: 200*(yield[BTPS 1.35 04/01/30 Govt ] + -0.2 * yield[BTPS 2.45 09/01/50 Govt] + -0.9 * yield[BTPS 0.25 03/15/28 Govt])

Graph:

Here's how Italian forwards look

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

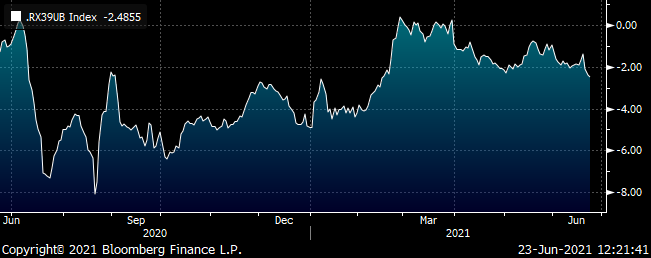

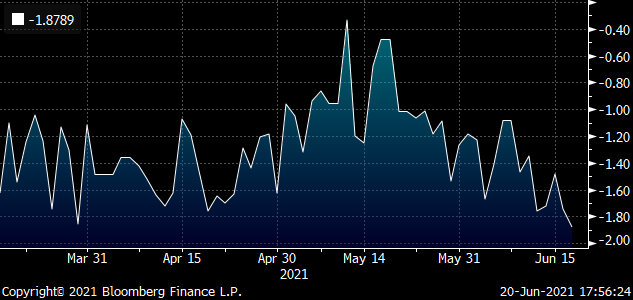

Spain 50yrs

Dan mentioned selling 50yrs in Europe

We have supply in Spain 30y on Friday

I ran a 1 yr regression on Spgb…

Trade: -apr30 / +oct50 / -oct50

Level: receive @ -18bp

weights: -0.15 / +1 / -0.85 (all x 2, to make it comparable to other flys)

cix: 200*(yield[SPGB 1 10/31/50 Govt ] + -0.85 * yield[SPGB 3.45 07/30/66 Govt] + -0.15 * yield[ZP482028 Corp])

Graph:

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

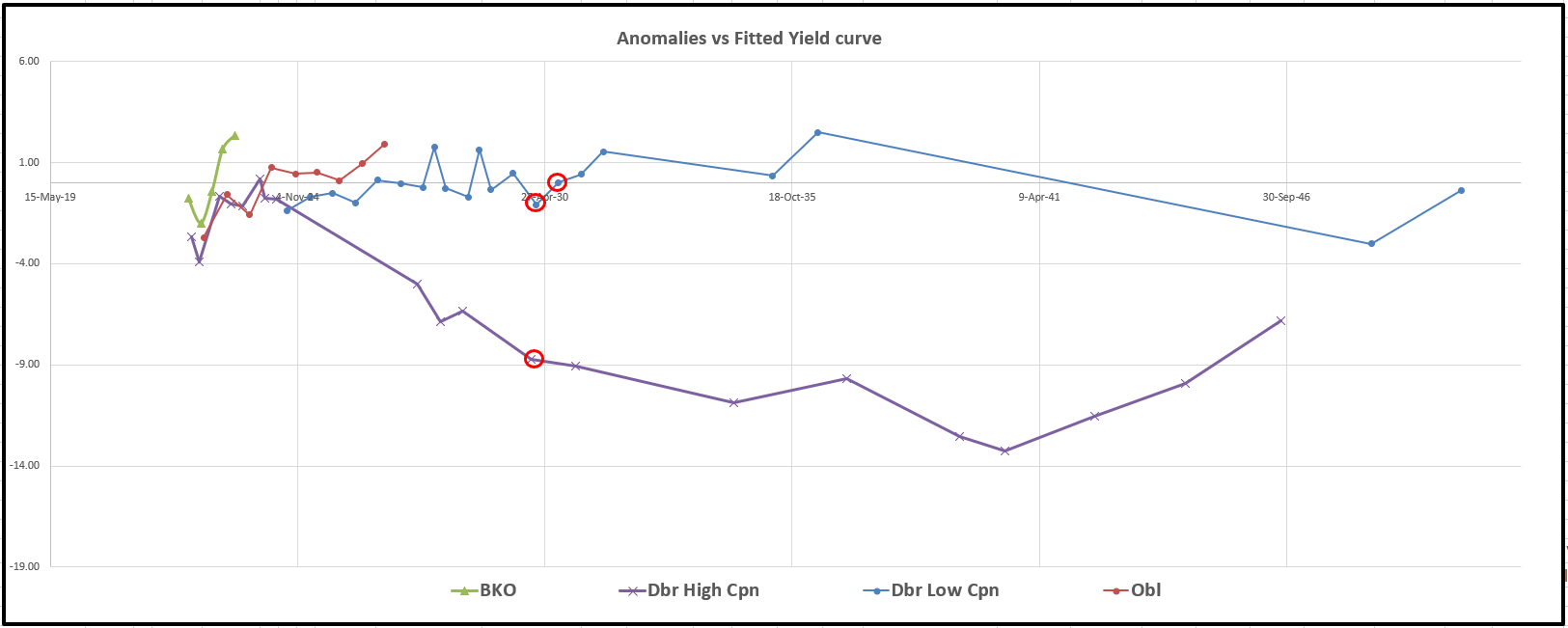

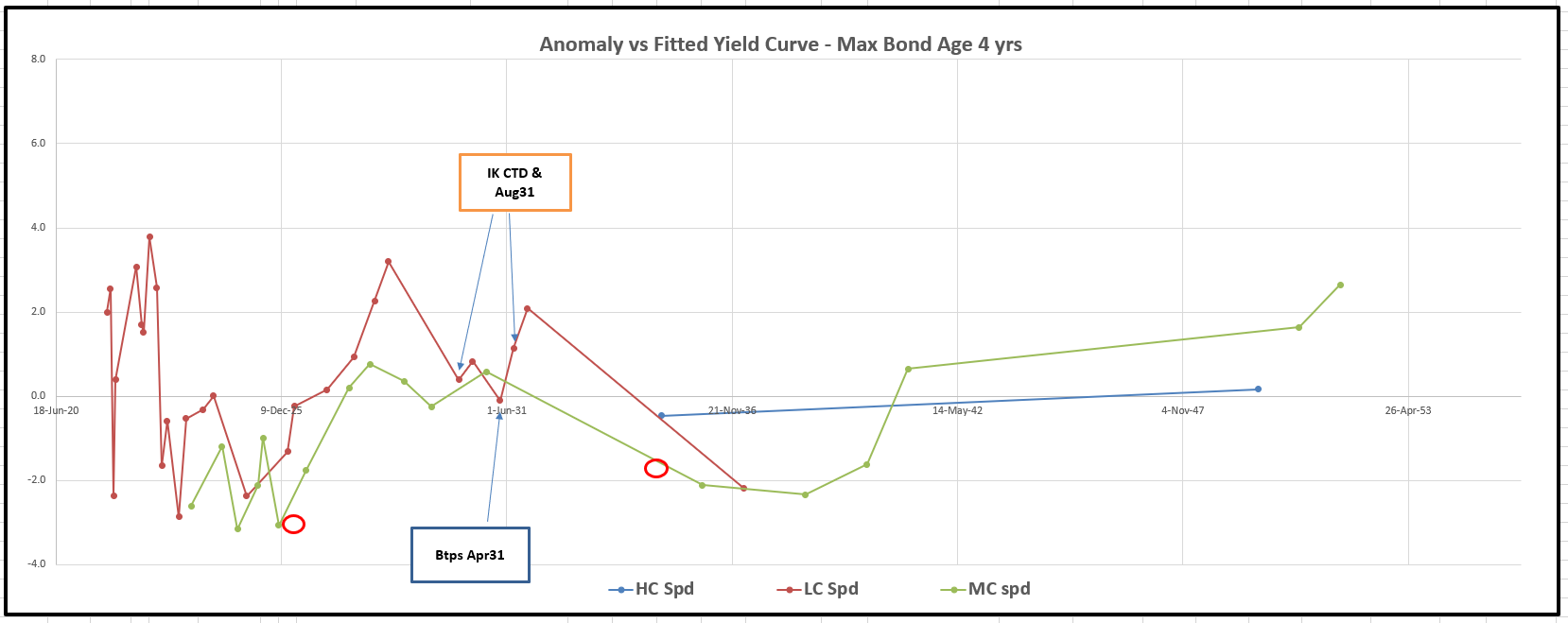

Italy - set up for Wednesday supply and beyond - anomaly basis

Setting up for supply and being short apr31

I just plain like

+IKU1 -apr31 +aug31

0.33 / 1 / .67 (all x2)

cix:

200*(yield[BTPS 0.9 04/01/31 Govt ] + -0.67 * yield[BTPS 0.6 08/01/31 Govt] + -0.33 * yield[ZR343798 Corp])

Level

Current: +0.8bp

Enter: +0.5bp

Target: +2bp

Graph:

Anomalies vs Fitted Curve

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

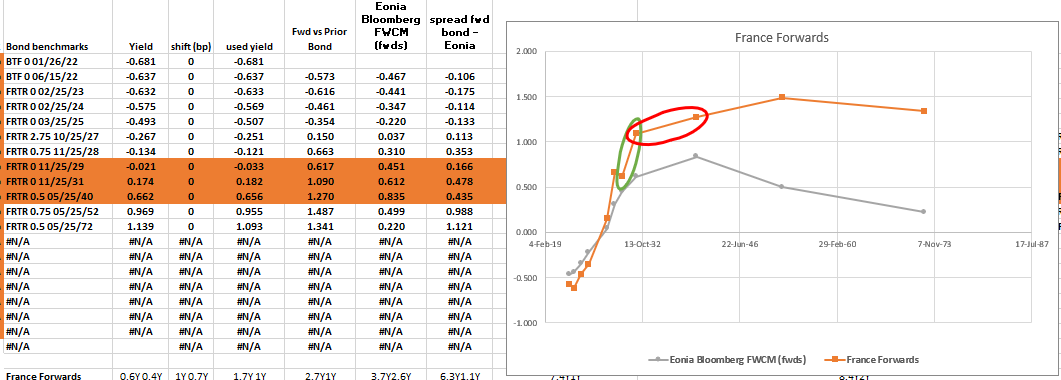

Mopping up bullets in European 10yrs

Am mildly bullish European FI over the Summer months – of global inflation is temporary and the first rule of fight club is we do not

talk about tapering then I don't mind buying some of the cheaper 10y supply points

For edge conditions we look to pure forward rates rather than spreads vs other curves – firstly as we need to squeeze a bit more out of the trades and we prefer to do that by expressing them in Yield space rather than OIS space

Consider the anomalies for France Frtr bonds – the super cheap supply point seems very pointed

Yields are adjusted to transform the bonds into par bonds

Cix:

200 * (YIELD[FRTR 0 11/25/31 Corp] + -0.15 * YIELD[FRTR 0.5 05/25/40 Corp] + -0.85 * YIELD[FRTR 0 11/25/29 Corp])

Targetting > +19bp in this one

Strong add @ +22bp, doubt it would ever get there as this would be 8y2y almost flat to 10y9y – I love that steepener

If you wanna add curvature to curves – consider the Spgb 35s – they look rich versus a combo of the new 10y ( and the old ) & the spgb 37s – which is a more recent issue

Here's the history using the old 10y apr31

Cix: 200 * (YIELD[SPGB 1.85 07/30/35 Corp] + -0.7 * YIELD[SPGB 0.85 07/30/37 Corp] + -0.3 * YIELD[SPGB 0.1 04/30/31 Corp])

In the long term I see the belly s having the prospect to cheapen by 3bp and the fly by 6bp!

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

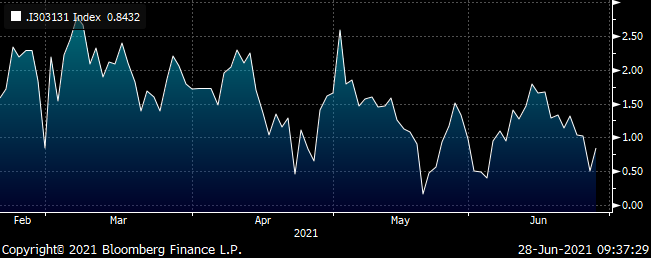

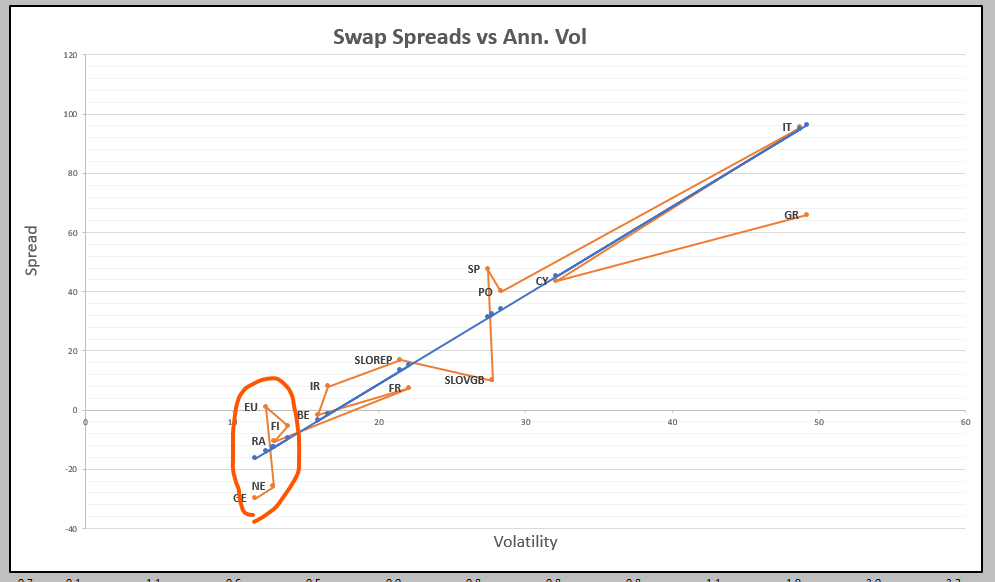

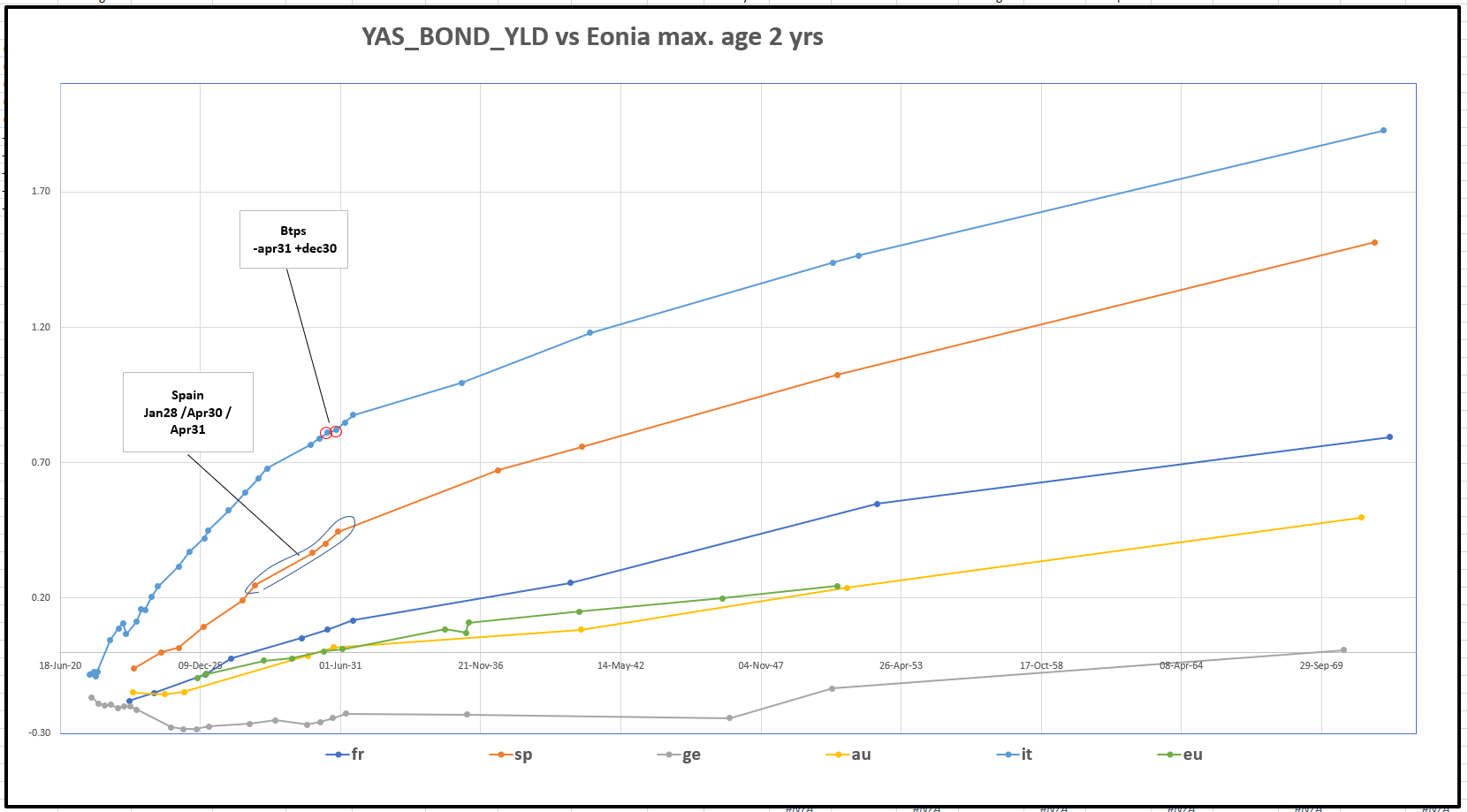

FW: Time to buy EU 15y vs Germany

Buy EU 15y vs 15y Germany

15 Swap spreads vs Vol of changes (=> 'how It trades')

We know this spread has moved out – but we've been waiting for EU to be at a decent spread to Germany 'vol adjusted' – with a calmness in both the market and the pricing of EU itself vs other sovereign issuers we now see value in

15y EU vs Germany -

Graph below – 15yr Europe Swap Spread vs Vol – EU now trades cheap in this tenor given the vol of changes (119 days used)

SP210[EU 0.5 12/04/35 Corp] - SP210[DBR 0 05/15/35 Corp]

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

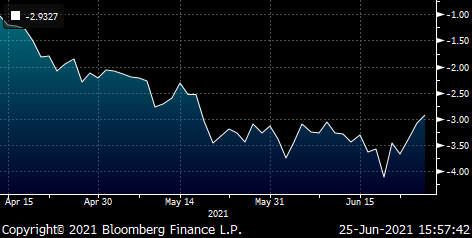

FW: RXU1 futures - rich

Wanted to alert you to this – am about to do some more comprehensive work on the structure….

Just looking at RXU1 Futures on a regression – I see them as having richened and pretty rich here

I would advocate

{GE} +old 7y -RXU1 +old15y

Allows you to get long bonds that will be bought

Trads with 10% delta

you can cut the delta but am confident in the curve weightings

cix: 200*(yield[BJ948280 Corp ] + -0.4 * yield[DBR 0 05/15/35 Govt] + -0.7 * yield[DBR 0 11/15/27 Govt])

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - Astor Ridge, Ideas on our Radar

Ideas on Our Radar at the moment

Theme: get long old / Green bonds short on the runs that are to be tapped

Green Bond Belgium 2033s tapped next Monday – historically cheap vs 9y and High coupon 15y

The scarcity of Both Belgian and green issues is discounted by both Supply and the weakness of Belgium of an issuer – I have regressed delta and slope from the expression with this weighting

Trade

Buy Belgium 2033s vs

Sell Belgium June 2030 & Belgium 2035

Weights:

-.33 / 1 / -.67 (all X 2, to compare vs 1/2/1 structures)

Levels

Enter: +0.25bp, 33% of risk

Add: +1.75 (65 days Sharpe > 3), 67% of risk

Target: -2bp

Bbg History

Carry: -0.4bp /3mo @ -5bp repo spread

Roll: +0.1bp /3mo

vs Swaps (re-weighted)

2*(sp210[BGB 1.25 04/22/33 Govt ] + -0.2 * sp210[BGB 5 03/28/35 Govt] + -0.75 * sp210[ZP512935 Corp])

Violating the first rule of PEPP club, the only, truly rich high coupons in Europe are the German High coupons -

Trade

Buy RX and UB and

Sell High Coupon Dbr 39s

Call for weightings

High Coupon 39s are fundamentally rich on a cash-flow basis (OAS vs PAR curve rather than Z-Spread)

RX and UB are liquid components (use CTDs) and both roll well – the 39s roll inexorably to the 15y tap sector and could suffer in the same way that HC 37s did

Levels

Curr: -2.5 bp

Enter: -3 bp

Add: -3.75 bp

Graph In Yield Space

In Swap Space this looks more appealing as we added a lot of curvature in the swaps curve this year and that forced the yield bullet to shift to a structurally cheaper norm

Graph in Swap Space (re-weighted)

2*(p2509[DBR 4.25 07/04/39 Govt ] + -0.6 * p2509[DBR 2.5 08/15/46 Govt] + -0.3 * p2509[BJ948280 Corp])

That tells that we're right to wait for 0.5 to 1.25 bp on our yield fly

Here's the Bonds vs Par Bonds (Cashflows all discounted vs Smooth Zero Curve)

Italy – Long 7ys vs IK & 5y

Supply in 5y and 10y on June 30 – 7y still v cheap, still another 2-3 yds of supply in Apr26s expected

History vs old 7y

Level

Current: +6.3 bp

Enter: +7.25 bp

History in OIS space – so wait for another 1bp on the fly in yld space based on the indifferent history

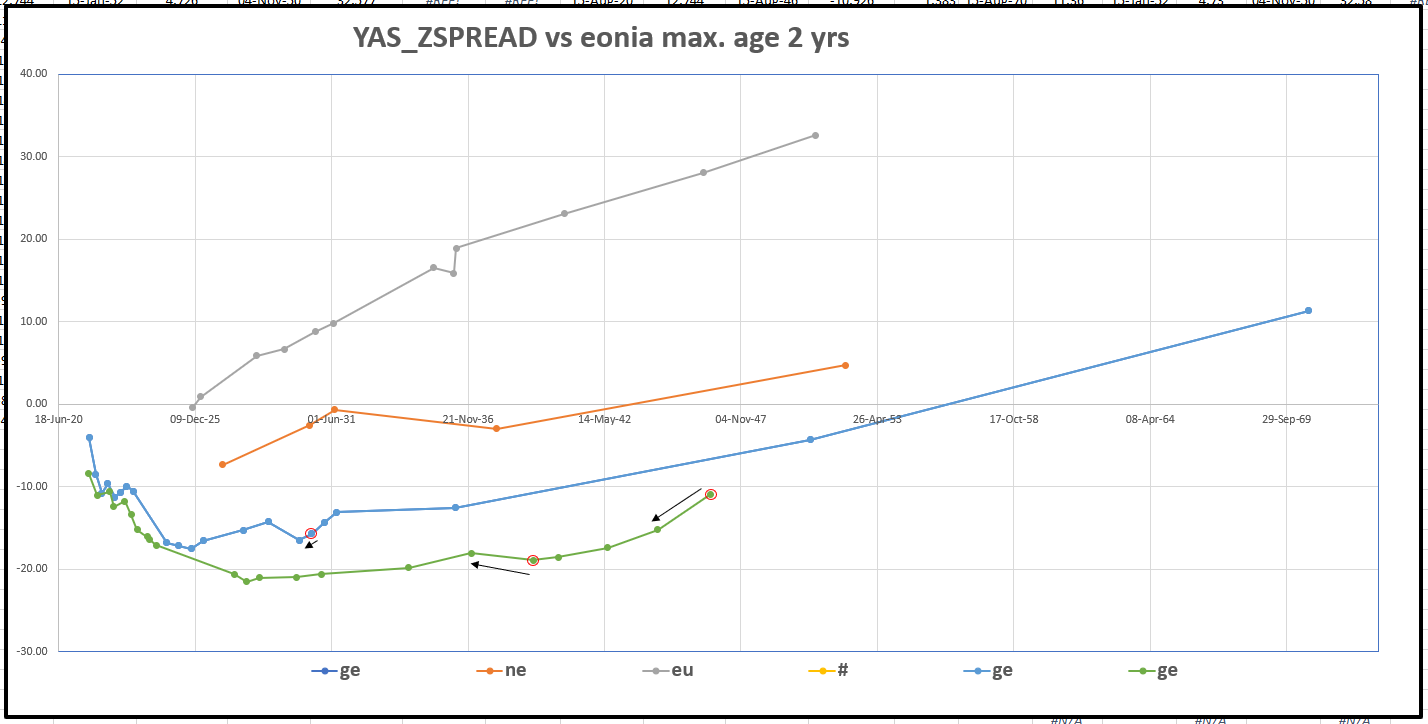

UK – Finally UKT 1.625% 28 reach their apotheosis

This bond looked rich but has a high coupon in a steep curve – if we discount the cashflows on a Bond zero curve rather than a Sonia Swap curve we get a better perception of RV value – on both metric the bond is now rich…

Trade: Sell UKT 1.625 28 vs

Buy UKT 0.375% 26 & UKT 31

Level: -27.25bp

Enter: -27bp (full size)

History

History vs Sonia

Carry & Roll

Carry: -0.1bp @-5bp repo spread

Roll: -0.4bp (off v smooth curve)

Forwards…

So the front leg is so flat it drives the forward below Sonia and the Back leg has a forward above the longer forwards – That seems a loose edge condition to me

I like this trade here

The advent of the new Jan29 on the 1st September should put some pressure on the issues +/- 1y in that segment. With £22.5Bln (63%) having been bought by the APF of what is a £36Bln issue we are coming towards the end of the capacity to buy this bonds – As the old adage goes – 'sell the buyer his last piece, not his first'

Would love to get some of these done

& if there's anyone else we need to be showing these to, please let us know

James & Will

(currently not accepting Bitcoin)

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

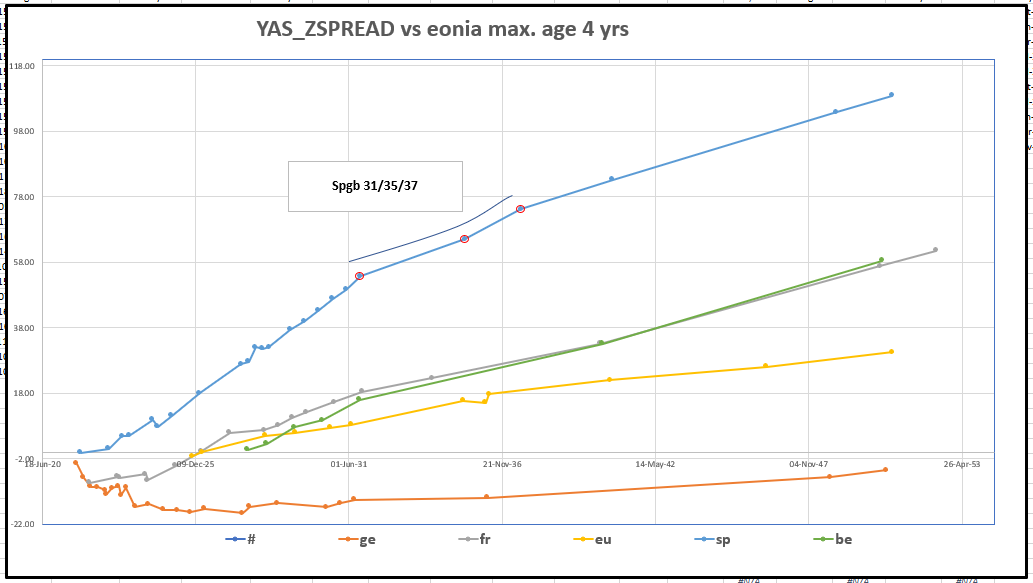

Trades & Fades - James & will at Astor Ridge

BTPS double deliverable vs double old 10y steepener

- Btps Dec30 get to be CTD twice over – Aug30 never make it

- Btps Apr31 are rich and not the lowest coupon in the neighbourhood

- Looking at the curve that spread is too flat

Trade:

Sell Btps Apr31 buy Btps Dec30 vs OIS

Chart:

Z-spread

Rumours of a Spanish 10y abound – the Apr31 has always traded poorly – its low coupon belies poor carry. That said, I wanna come out of any cheapening in Spain 10y with …

Trade – Short 9y Spain vs 7s and 10s

Short Spain Apr30

Long 7y and 10y

Outright or OIS, depending on timeframe

Cix:

(P2509[SPGB 0.5 04/30/30 Corp] - 0.3 * P2509[SPGB 0 01/31/28 Corp] - 0.7 * P2509[SPGB 0.1 04/30/31 Corp])

See graph of OIS spreads (above) for first trade level

Sell Spain 7y with a net delta long, vs France and Italy

Trade:

Short Spain Jul 27

Long Btp old 7y and France May27

Nett Delta 10% Long

Graph

Spain has had a huge comeback since the 50y syndication at the beginning of the yr – and rightly so we think, our swap spread vs vol metric showed it as cheap earlier in the year vs its peer group of similar volatility

Now Spain has come back a long way – and in particular we se the old 7y Jul27 as a rich despite being a recent issue (Mar 2020)

We asked the computer to be Short Spain vs France And Italy – we then asked it to reduce the variance of your portfolio – so that vol of changes of the portfolio is minimalised. This is equivalent to hedging spread and outright, optimally at the same time – because the two are correlated (not orthogonal) we must calculate these numbers simultaneously

Cix:

200 * (YIELD[SPGB 0.8 07/30/27 Corp] + -0.3 * YIELD[BTPS 0.95 09/15/27 Corp] + -0.6 * YIELD[FRTR 1 05/25/27 Corp])

Give me a call if you want to run through the Sharpe and return numbers – I like this trade if Spain gets any political weakness or indeed they try and come with a 10y syndic while Italy and Stocks are under pressure

Here's how Spain, Italy and other Credits look with France as a Baseline…

On our Radar

We're watching the ongoing cheapening of the French credit vs other – the notorious Blend!

Here's is the 'Blend' in constant Maturity Bond Format

100 * (RV0004P 10Y BLC Curncy - 0.25 * RV0005P 10Y BLC Curncy -0.75 * RV0002P 10Y BLC Curncy)

France – 25% Italy and – 75% Germany

On a 5y History – we're heading to the highs (France cheap) that occurred just prior to Macron's election. Am starting to think that after the regional elections this weekend gone and Presidential elections not until April 2022 this Cheapening seems overly cautious. With the ECB in firm support stance – this implies a widening of the credit and a steepening of the curve, which we have already witnessed. Indeed the prescient cheapening of the 30y point seemed to only be sustainable if another part of the curve cheapened further and that seems to be the 10y

In the meantime – I think the new 5y is sooo cheap – I don't mind jumping on the bandwagon and doing a steepener => +5y – 7y vs OIS but if this thing keeps going we have to go the other way……

So, at some point I want to start thinking about French flatteners – where the implied forward rates are just plain gaga – because everyone trading that stuff fixates on History without thinking about value.

The edge condition has to be French forwards being closer to Spain anywhere on the curve

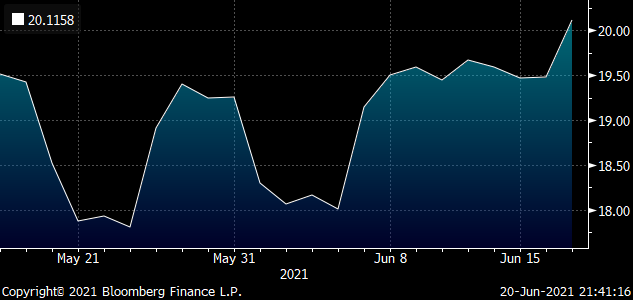

15 Yr Germany cheap vs RX and UB – supply this week

Here's the history using the old 15 (May35) vs OIS

Slight mis-weighting and Delta (10%)

cix: 2*(p2509[DBR 0 05/15/35 Govt ] + -0.55 * p2509[DBR 2.5 08/15/46 Govt] + -0.35 * p2509[BJ948280 Corp])

On the basis of the forwards curve we see the CURRENT 15y here

Cix:

(2 * YIELD[DBR 0 05/15/36 Corp] - YIELD[DBR 2.5 08/15/46 Corp] - YIELD[BJ948280 Corp]) * 100

History

Levels

I think we have small here at this level (+20.2bp, 20%), so as not to miss it and we get truly involved at

@ +25bp – don't care if it's never been there – trying not to let history tell me what a trade is actually worth!!!

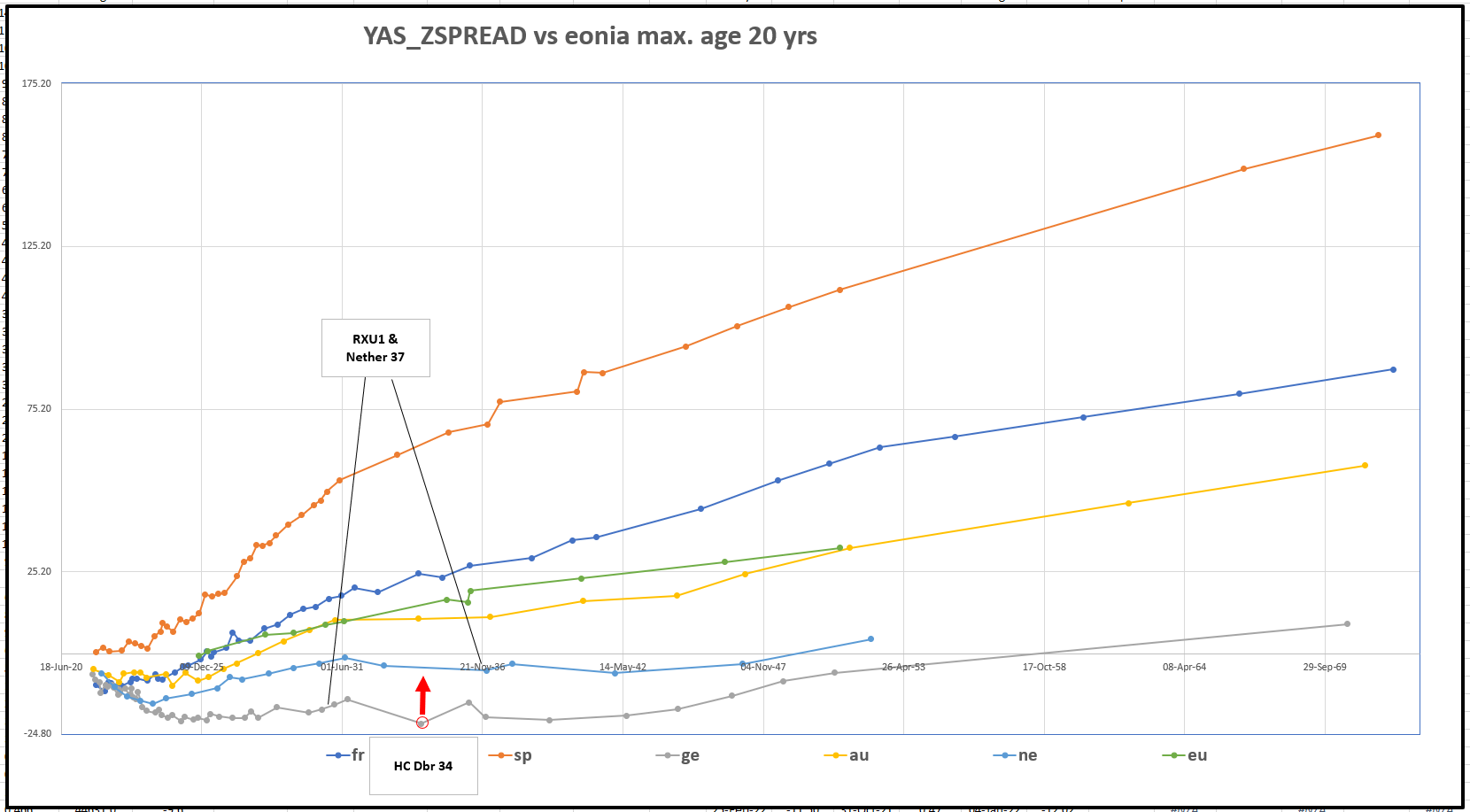

Widening Credit Spreads have flushed the Nether Baby out with the bath water

Nether has cheapened with sympathy to the semi-core – but our vol analysis and it's strong rating means it really should behave more like its peer, Germany. Any widening is a buying opportunity

There's a tap of the old High coupon 37s in Holland – so keeping it vs high coupons to some extent…

Trade

Sell High coupon Dbr 34

Buy RXU1 & Nether 37…

Levels: -14bp & -16bp

200 * (YIELD[DBR 4.75 07/04/34 Corp] + -0.5 * YIELD[NETHER 4 01/15/37 Corp] + -0.5 * YIELD[BJ948280 Corp])

How Relative Z-spreads look…

That's got a bit of credit buying (buying nether 50% vs Germany) and a bit of tapering obviously (nett short high coupons)

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796