Trades & Fades - James & will @ Astor Ridge

Fades post the ECB

- Keep trying to buy older bonds that are in the PEPP – or perhaps recent issues that are at the end of their tap cycle – Dbr Feb31, Bgb Oct31

- Fed and other reaction functions have become 'punch bowl' – the Fed will be slow to remove the punch bowl from the party. Therefore the reaction function is more swingeing when it comes – Look for very steep forward curves (pay flat or inverted) in longer tenors – beyond the point of expected inflation rises

- Value will out – implied bond forwards are steep then suddenly flat as a result of the anomalies – and if we can hold the structures via repo – then the cash of bonds should normalise in most market shifts

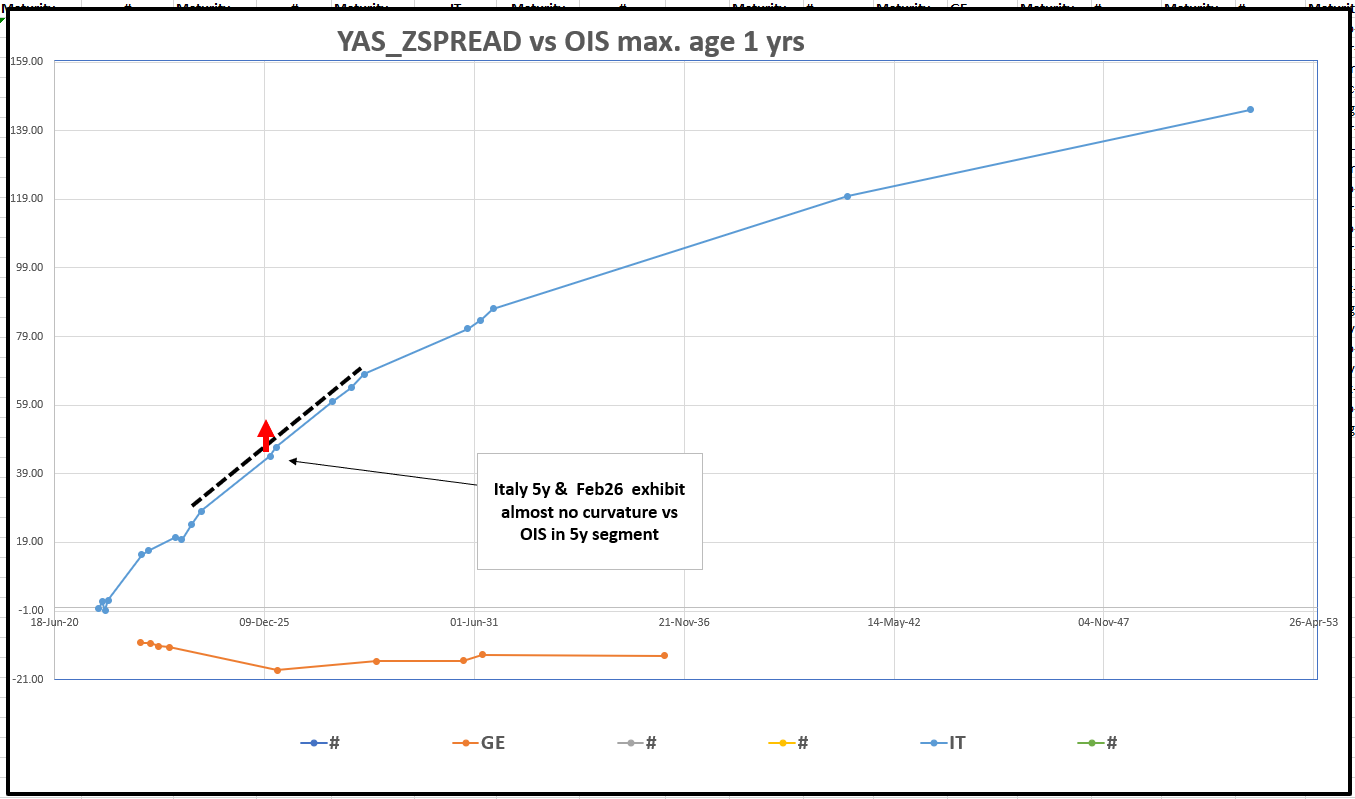

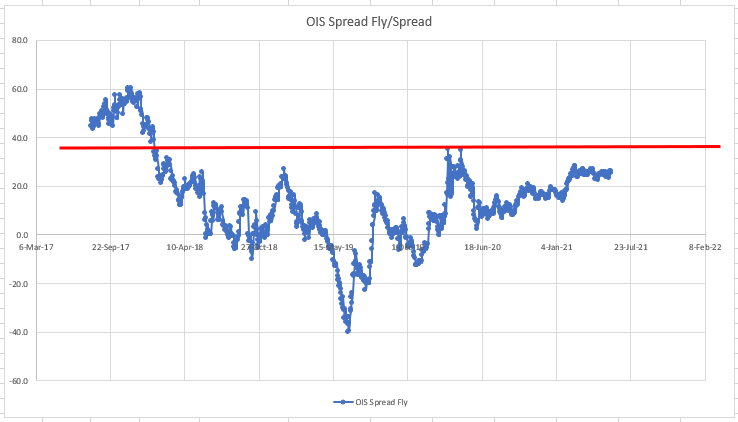

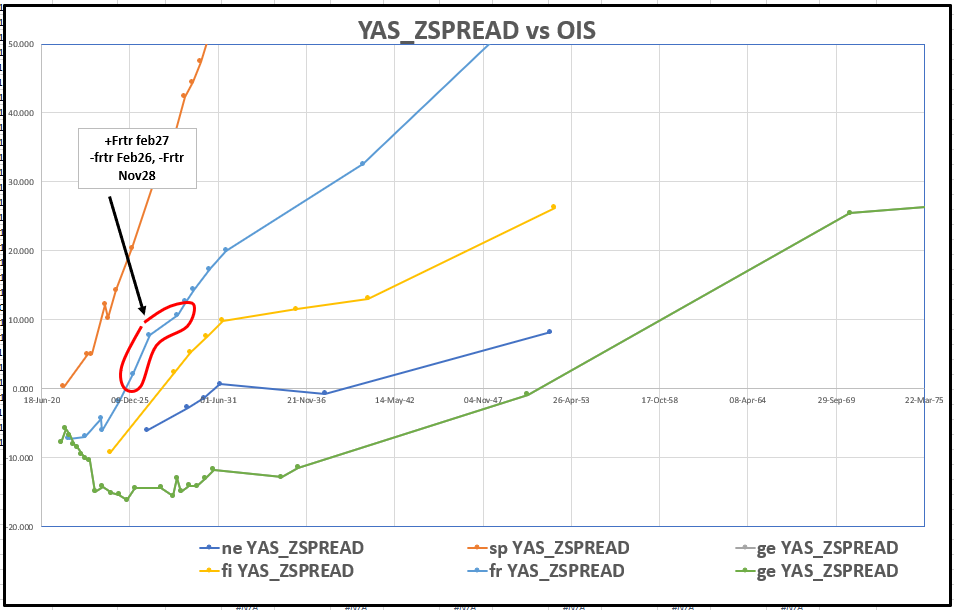

- Bond curves should not be as 'straight' as OIS curves – higher risk credit curves such as Spain and Italy should be steeper and therefore more curved than OIS curves – In particular we look at 3s-5s-7s vs OIS in Spain and Italy and

Trade

Italy –

Sell rich 5yrs

vs cheap 5y and 7y

vs OIS

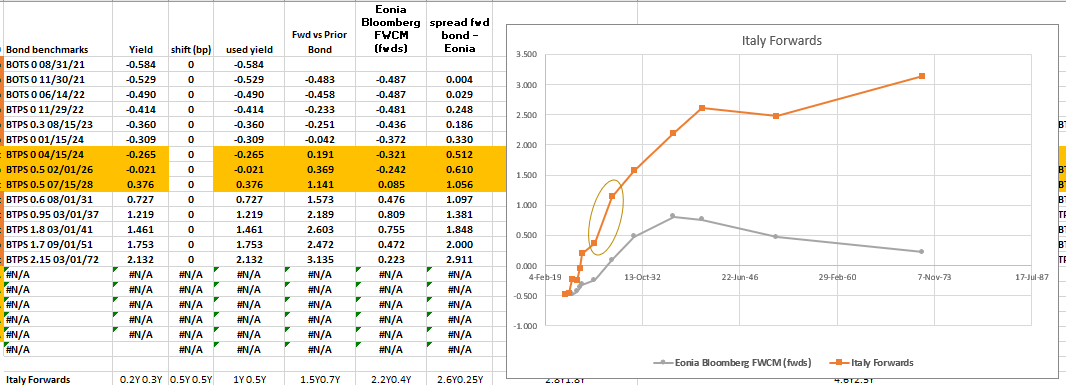

Call for bonds and Levels

CIX:

2 * (p2509[BTPS 0.5 02/01/26 Govt]-0.6*p2509[BTPS 0 04/15/24 Govt]-0.4*p2509[BTPS 0.5 07/15/28 Govt])

Graph: (on yield)

Bonds with more history: (on OIS)

2 * (P2509[BTPS 0.5 02/01/26 Corp] - 0. * P2509[BTPS 0 01/15/24 Corp] - 0.5 * P2509[BTPS 0.95 09/15/27 Corp])

Rationale

- The knee jerk reaction to the ECB was to buy bellys in Europe – but there is almost no curvature in Italy vs the less Risky OIS curve

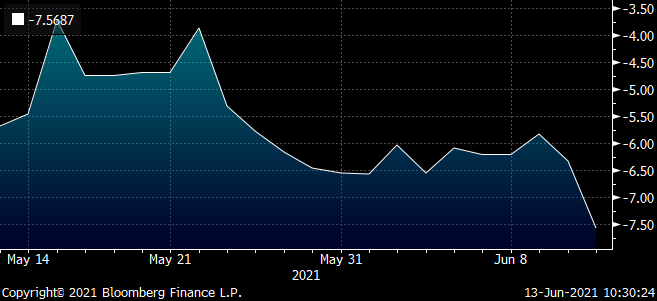

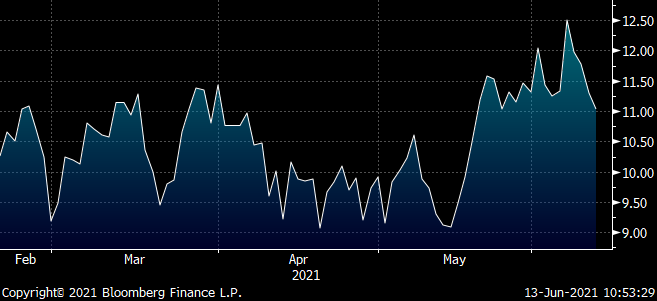

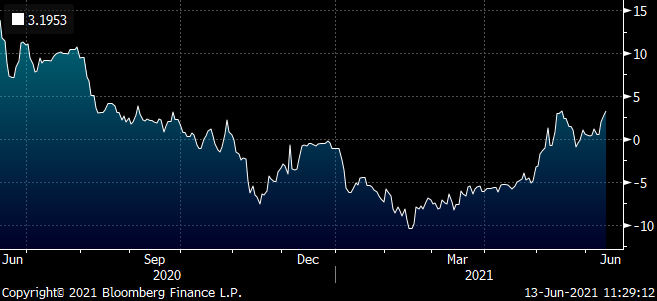

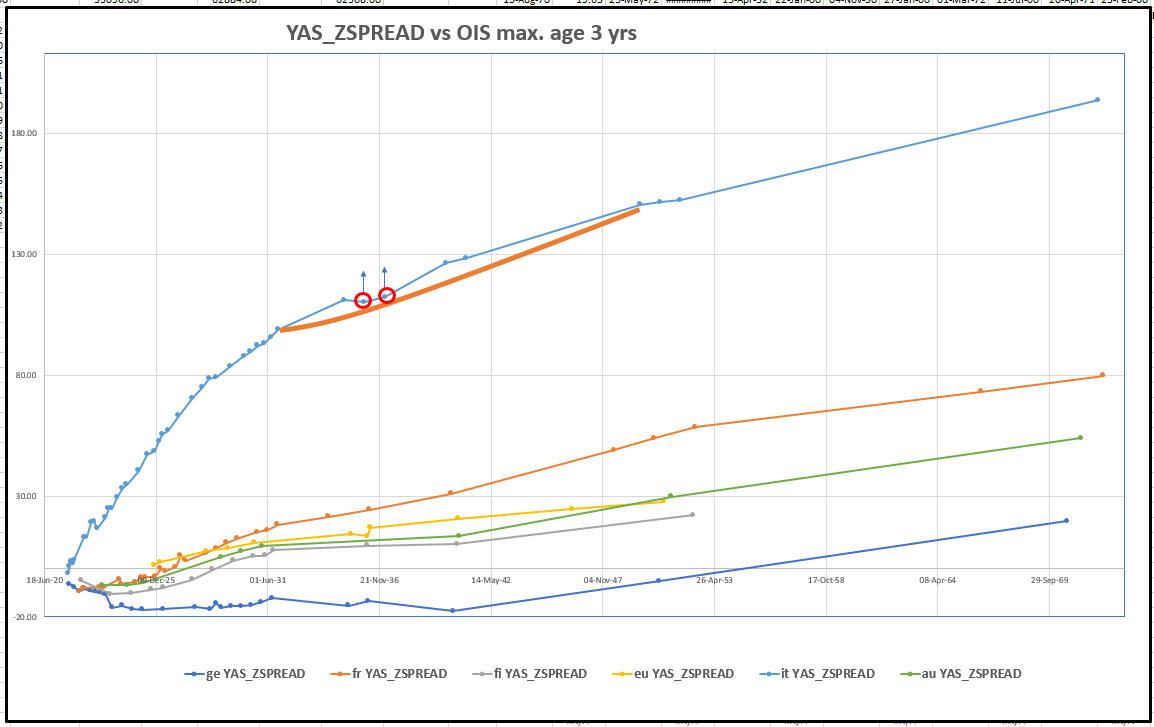

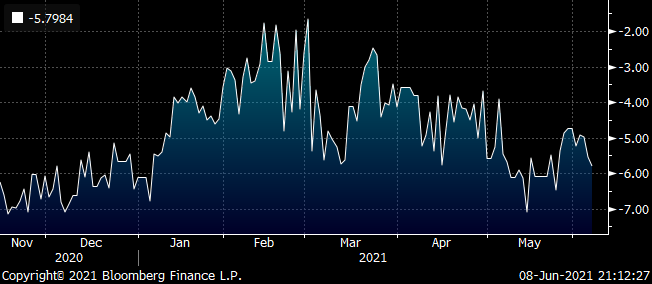

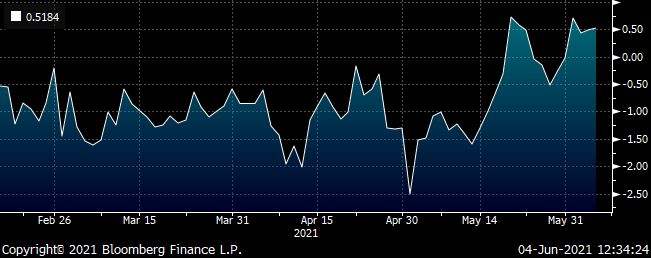

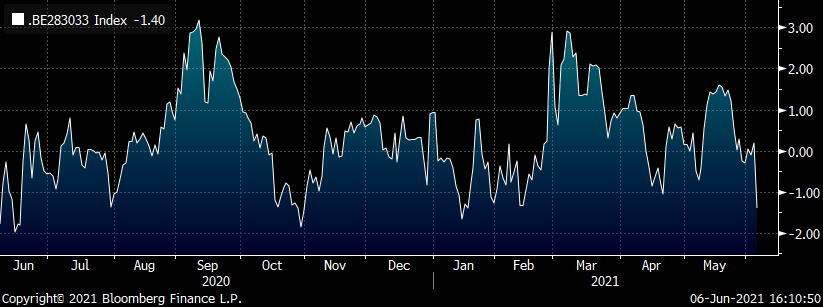

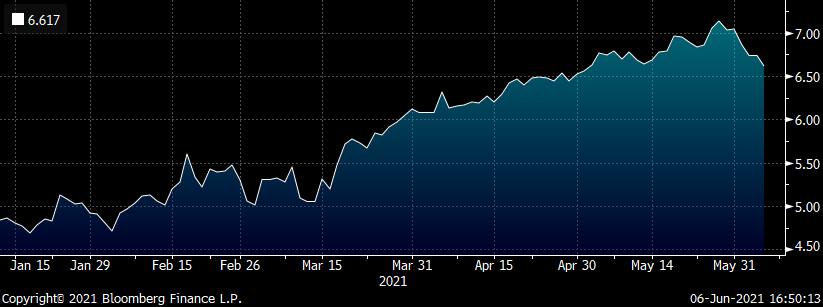

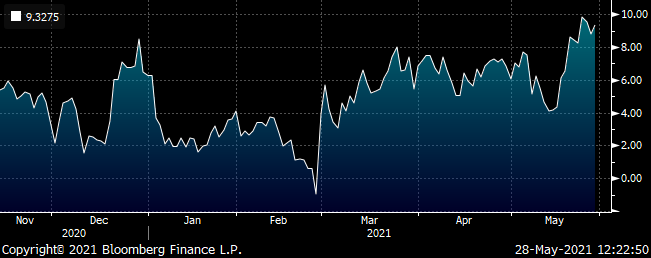

Graph of Italy Z-Spreads vs OIS

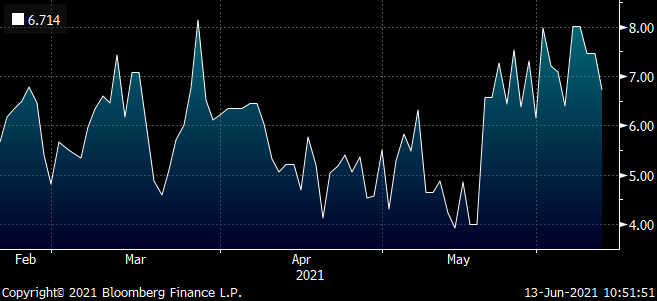

- The removal of curvature in Italy has outpaced the contraction of IKA invoice spreads – as Italy recovers yes the curve flattens and straigtens – but in 5ys it seems like we have all 'run to the other side of the ship'

Graph of Constant Maturity Bond Italy/OIS invoice spreads: 100 * ( EUSWE10 Curncy -RV0005P 10Y BLC Curncy)

- The tap 3y (apr24) and 7y (jul28) are cheap, the old 5y Feb26 are a recent issue (issue Date: Sep2020) but rich

- Carry is only -0.2bp /3mo @ 5bp repo spread

- 5 yr Supply is expected at the end of the month

- Italian forwards confirm that 3y2y vs 5y2y (proxy for the fly) are too steep – the belly should cheapen

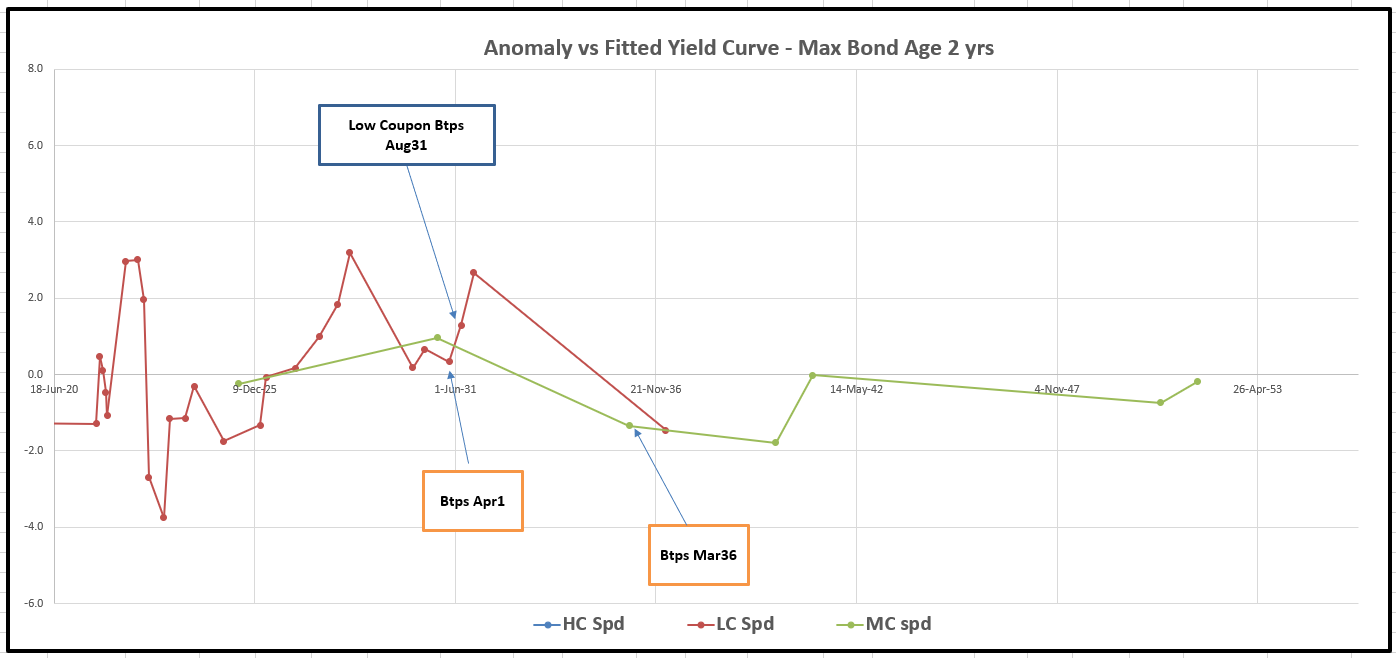

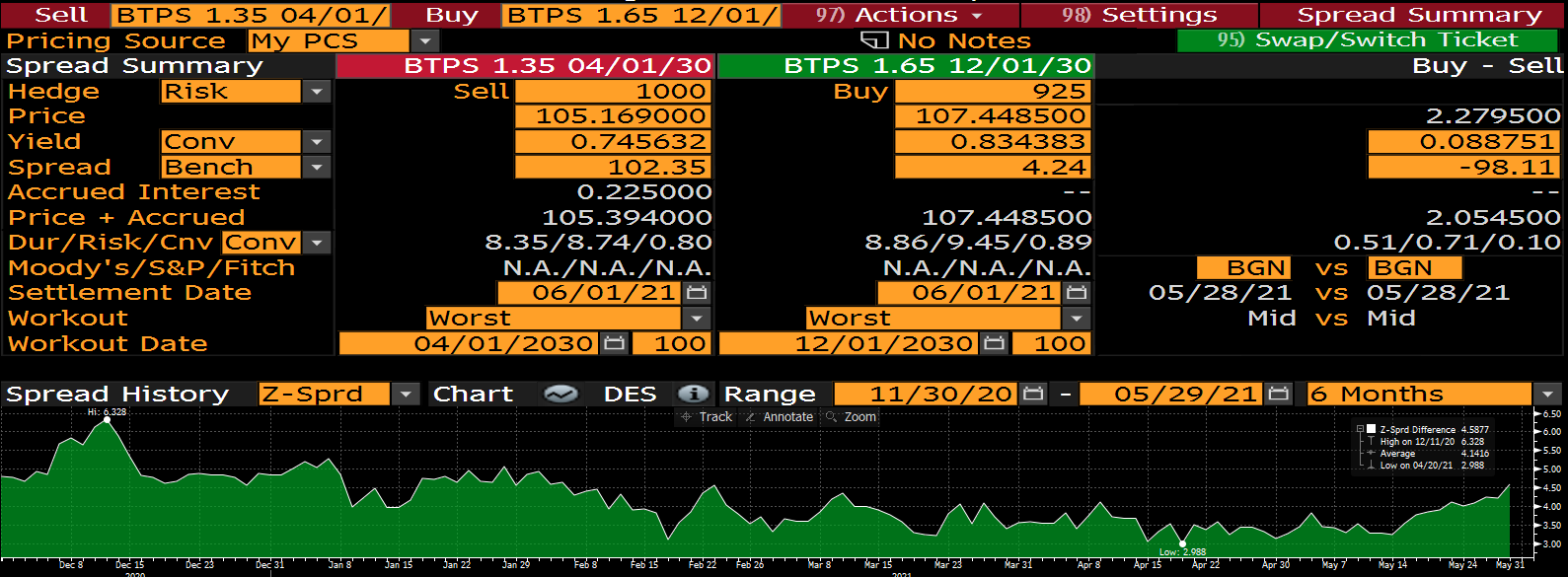

Italy 10y Btps Aug31 goes off the run and should richen more – old 10y roll too steep vs 10s/15s steepener

Has super low coupon – in any down trade this bond could vanish into sub-par buying before others

Buy Italy Btps Aug31

vs

Sell mis-weighted Btps Apr31 and Btps Mar36

Call for weightings

Graph vs ois

Graph in yield space

Rationale

- The Btps Aug31 now goes off the run with the advent of the new Btps Dec31 – with no more taps the street float should diminish as any PEPP buying might soak up the bond

- Aug31 still looks cheap and rolls well – plus has the added benefit of the lowest coupon (0.6%) and trading sub par

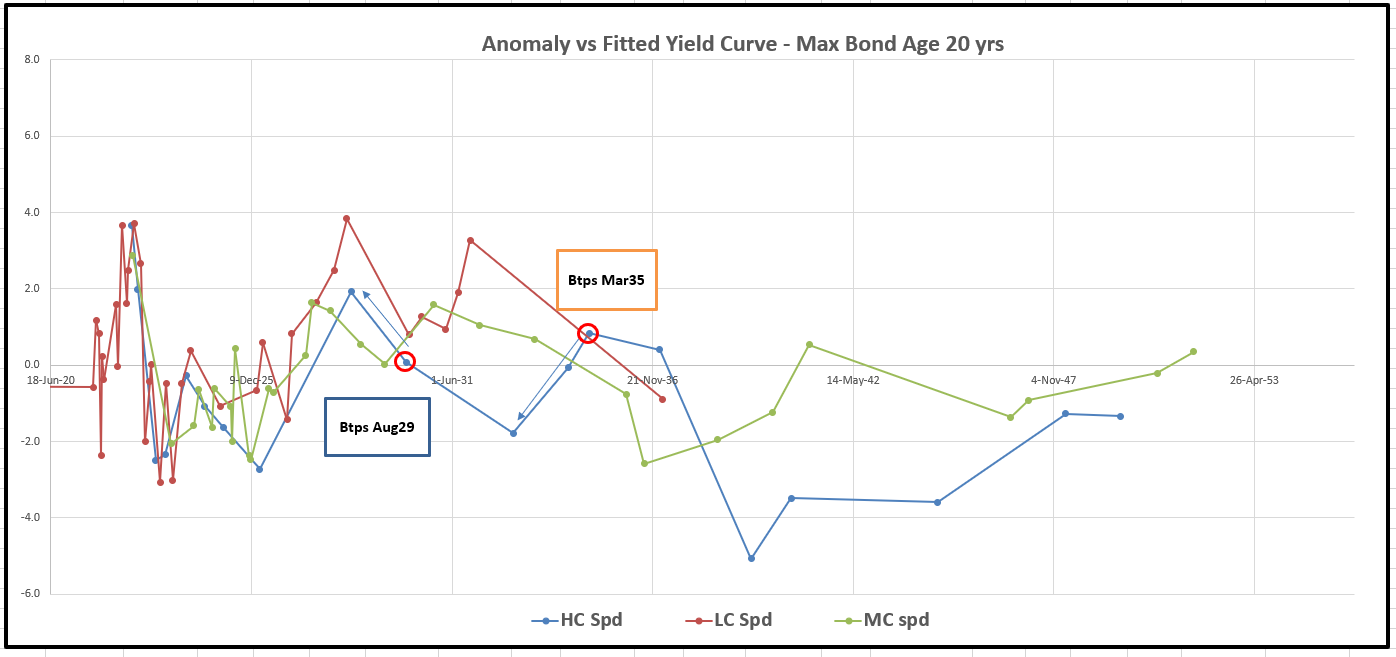

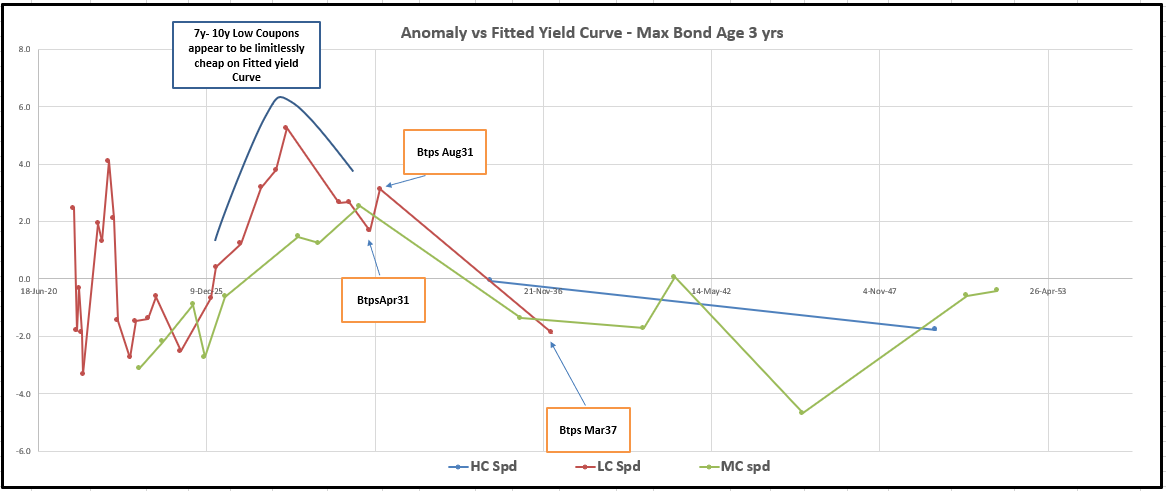

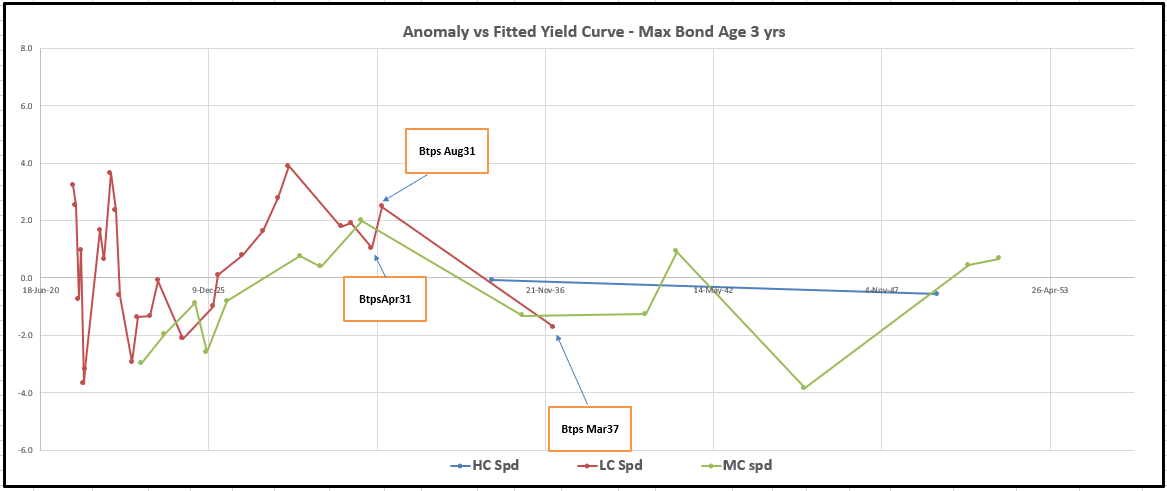

Graph of Btp Anomalies vs fitted curve

- The Mar36 is a more benign old 15y inhabiting a rich sector & gaining its bid via empathy from the sub-par on run 15y Mar37

Italian off the run 8s 15s flattener

Italian Curve was expected to flatten as the 'big call' from IB's a the beginning of the year

If the first rule of Fight club is 'we do not talk about tapering'…

Then we could see both a compression of invoice spreads and a re-flattening of the curve over the next few months

Trade

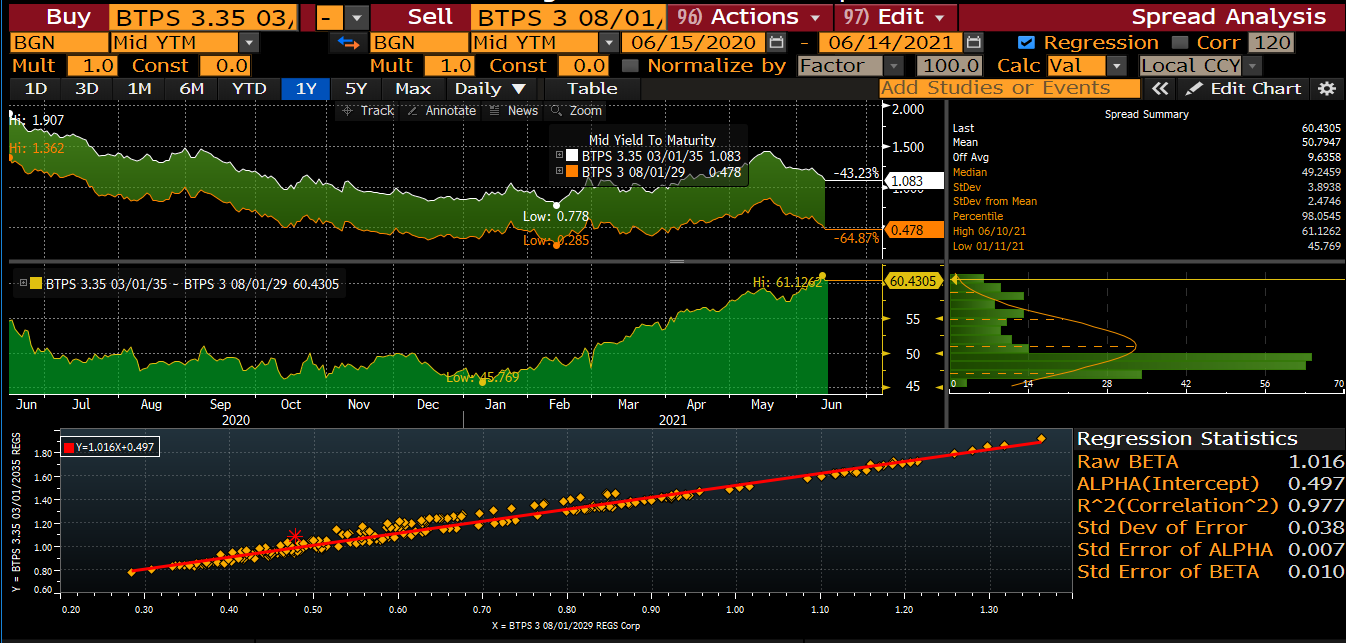

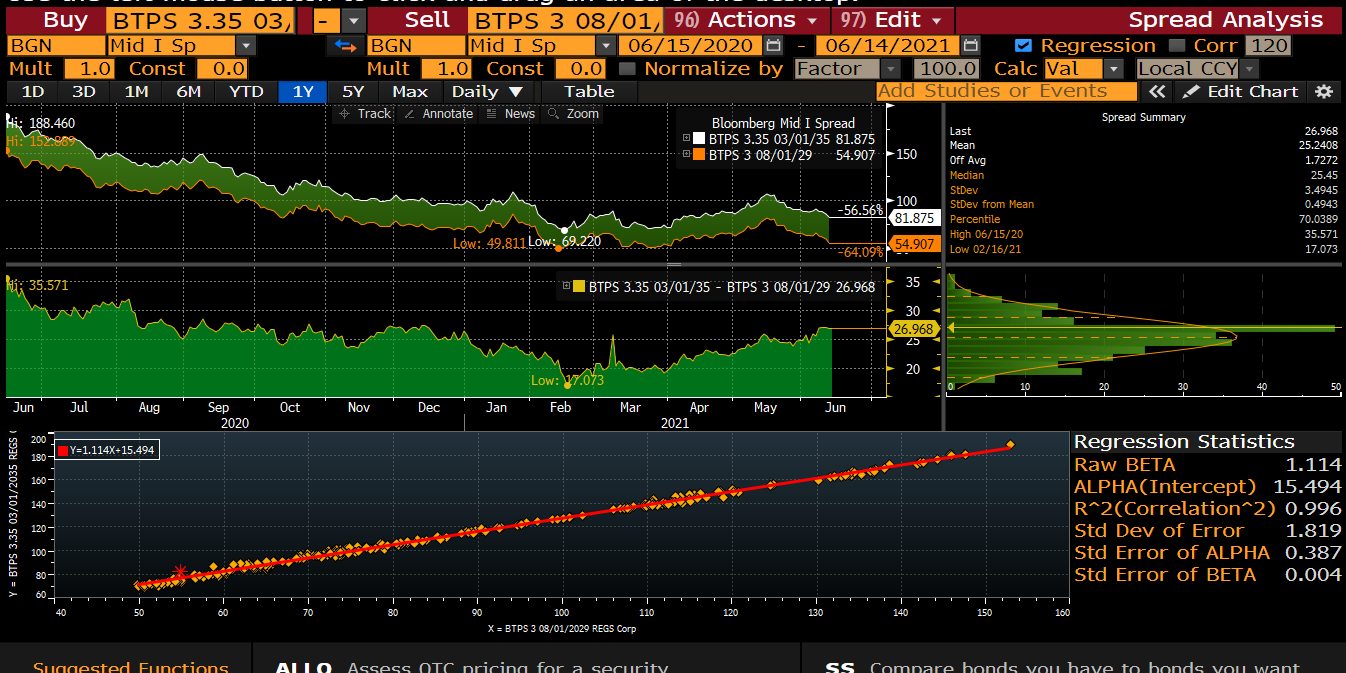

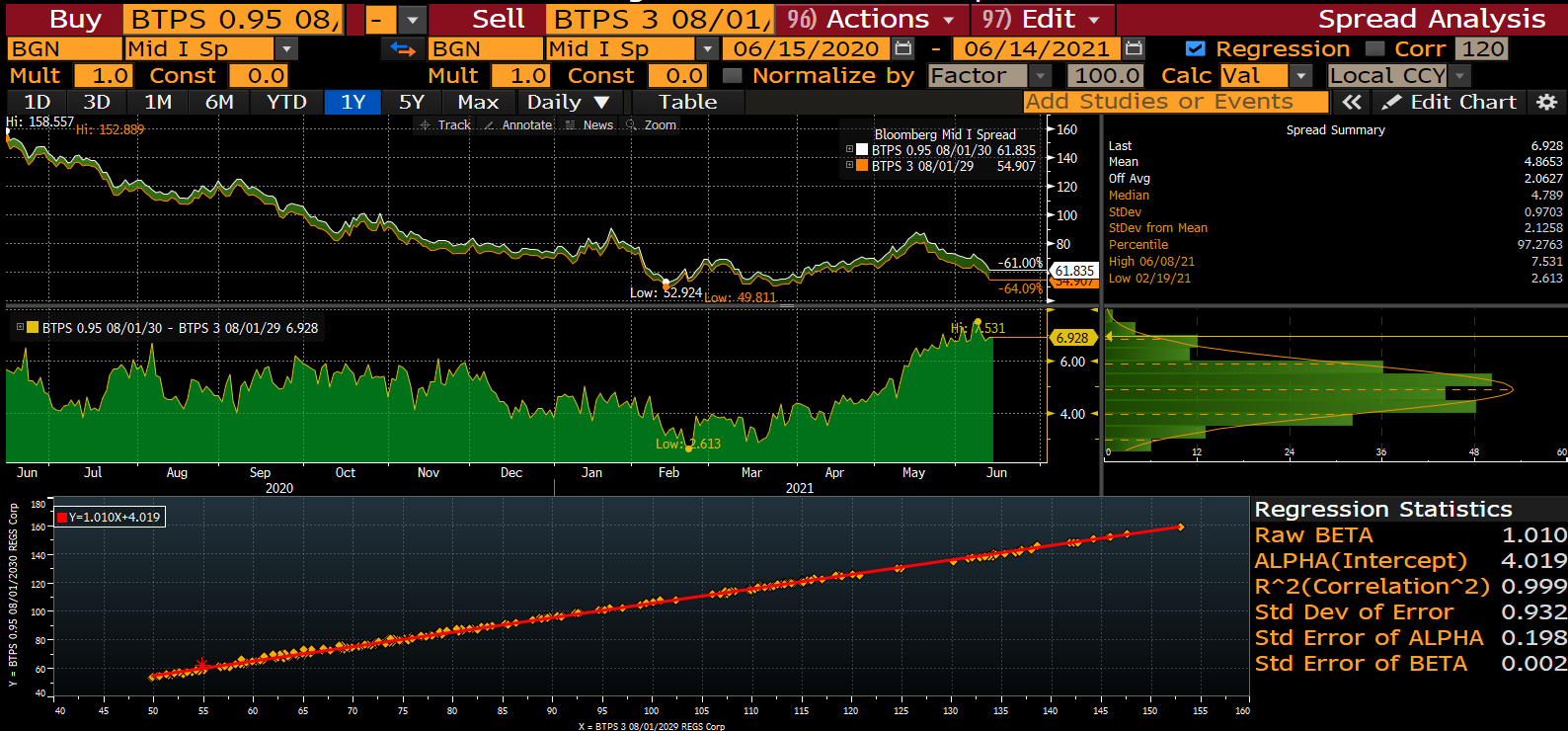

Sell Btps Aug29 to buy Btps Mar35

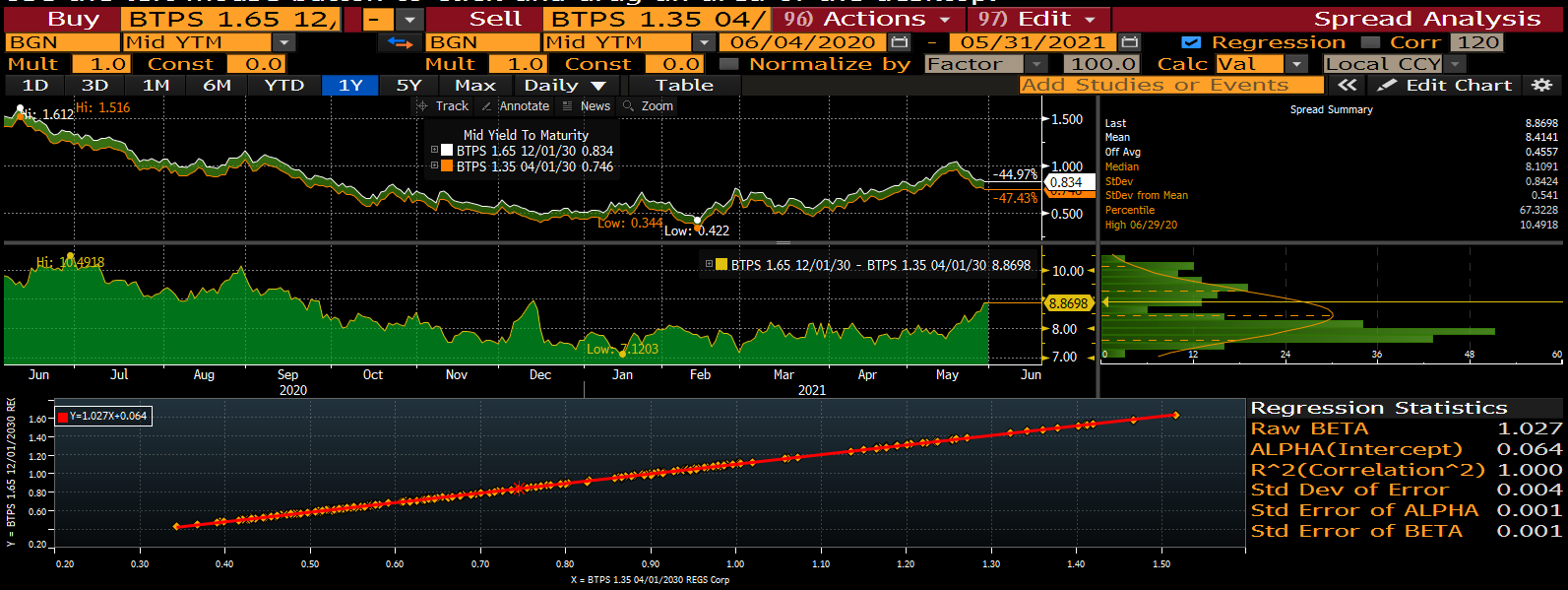

Regression stats for yield

Regression stats vs Swaps

The old 8yr surfs to the cheaper 7y sector

The Mar35s are a cheap bond when viewed form a cash flow perspective – the steep curve favours the longer, medium to high coupon bonds as their shorter modified duration vs 15y low coupons gives them better carry

Graph of Anomalies vs fitted Yield Curve

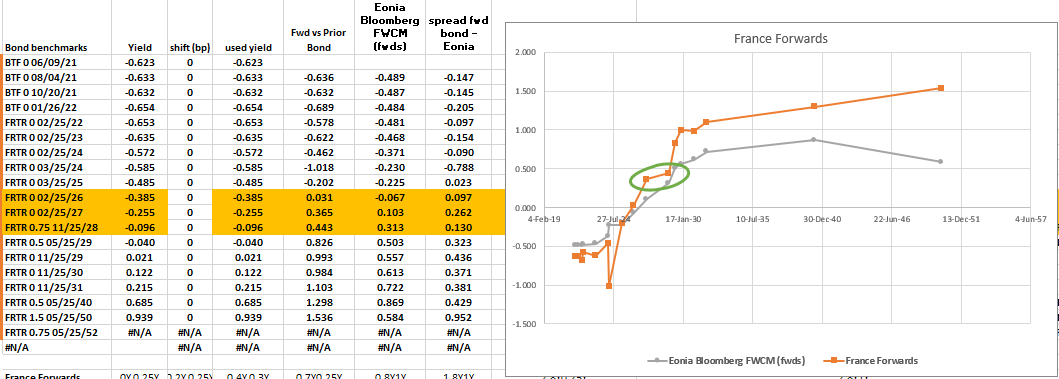

A similar feature persists in the French Curve

Flattener old 7s vs 30y

7yr Spreads have recovered largely from the recent sell off, 30yrs have not

On our radar is the increased gradient in spreads from 7y France to 30y – talk of a more imminent new French 30y, as telegraphed in the Annual Supply briefing and a need to Hedge the NGEU supply (3 new issues in July) has forced the French curve out to steep levels

7 yr spreads have recovered, but 30y hasn't

Orange Line on the top graph is 7y spread

White Line (goes a long way!) is the 30y spreads

So..

Trade Structure

Deriving the sensitivities to each, from looking at changes in swap spread levels going back 1 yr…

We would actually trade these with a 25% spread beta

Long 100 units of 30y Spreads, & short 75 units of 7y spreads

So a net long of OAT spreads of 25%

And the residual looks like this…

One to keep an eye on this one – both for the dynamic to ignite change and/or the level at which the value is so strong we can hold this for a long period – any thoughts? Gimme a shout!

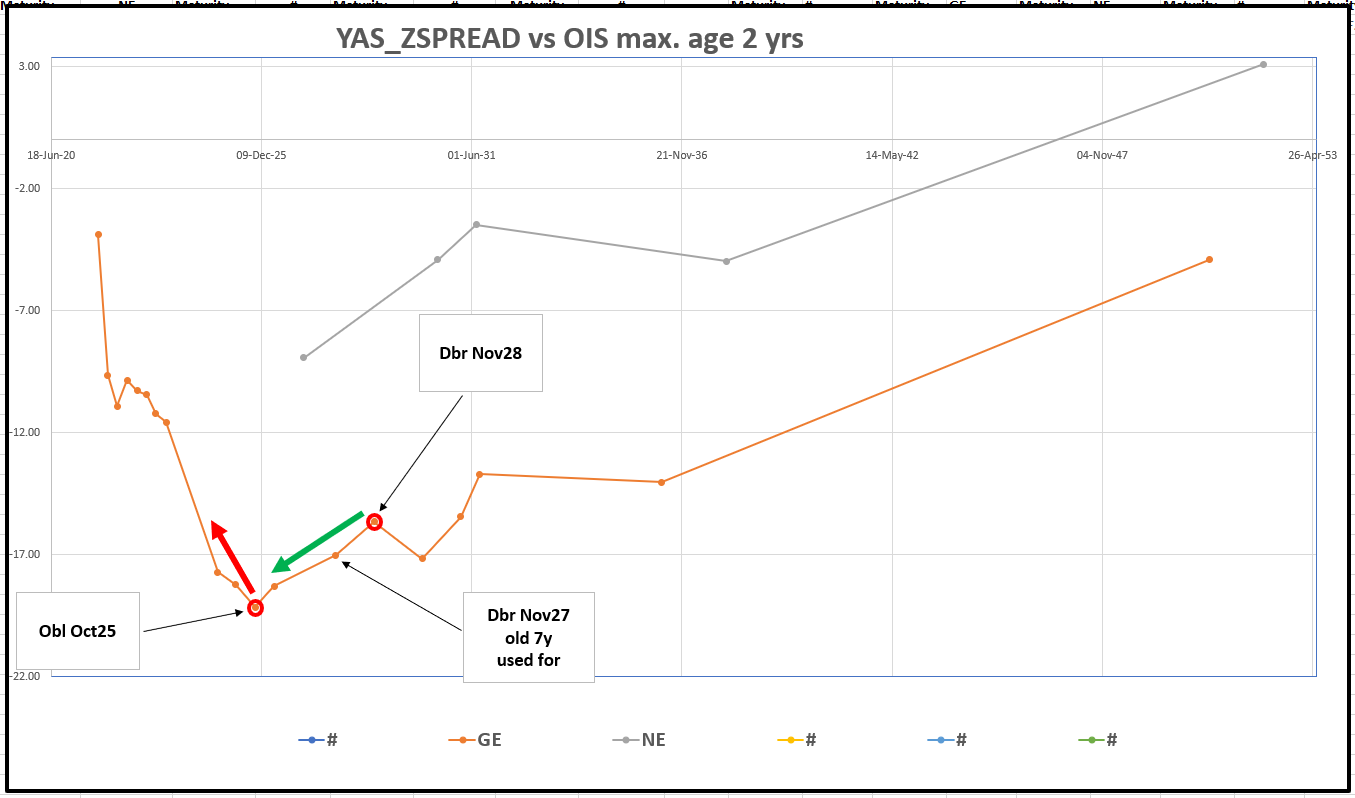

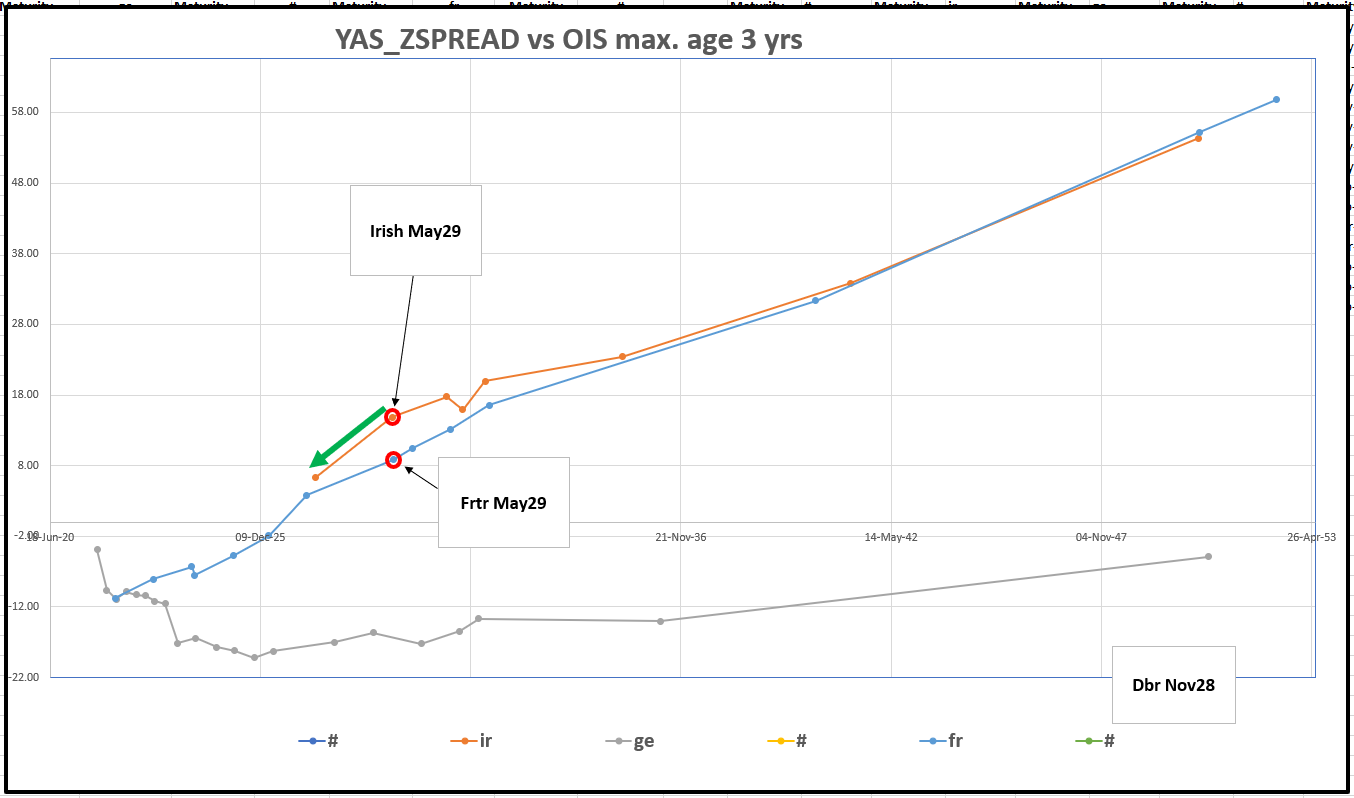

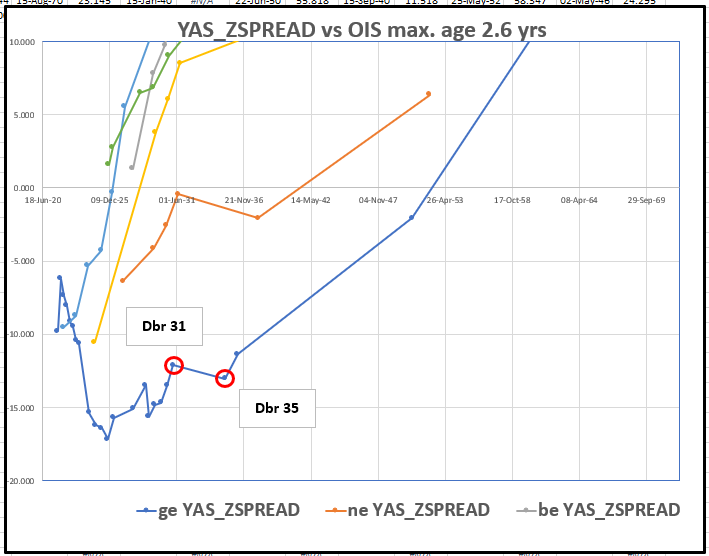

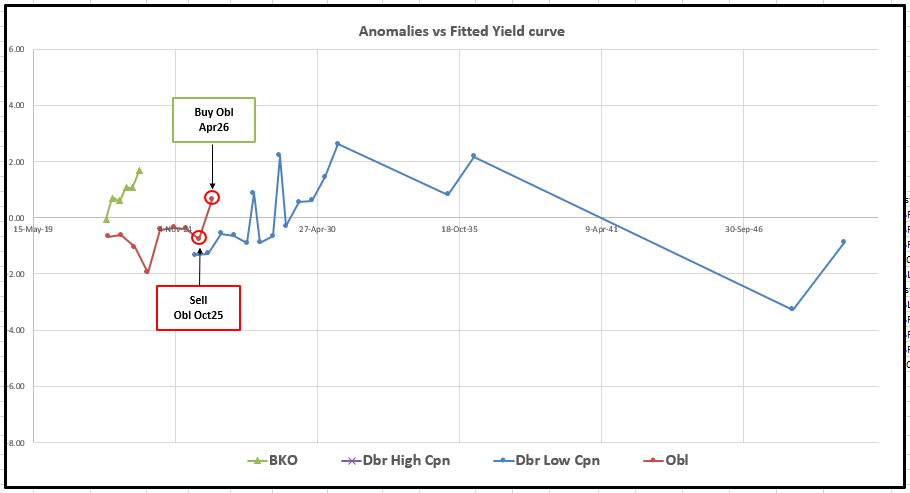

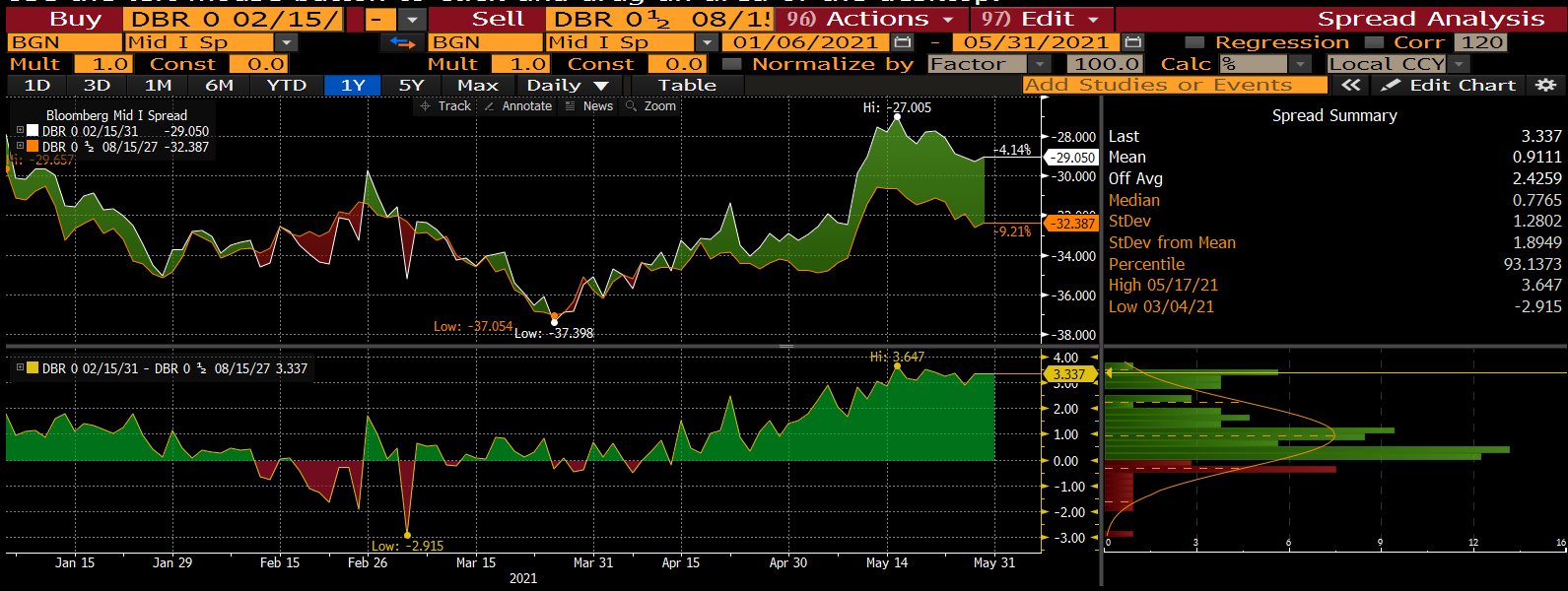

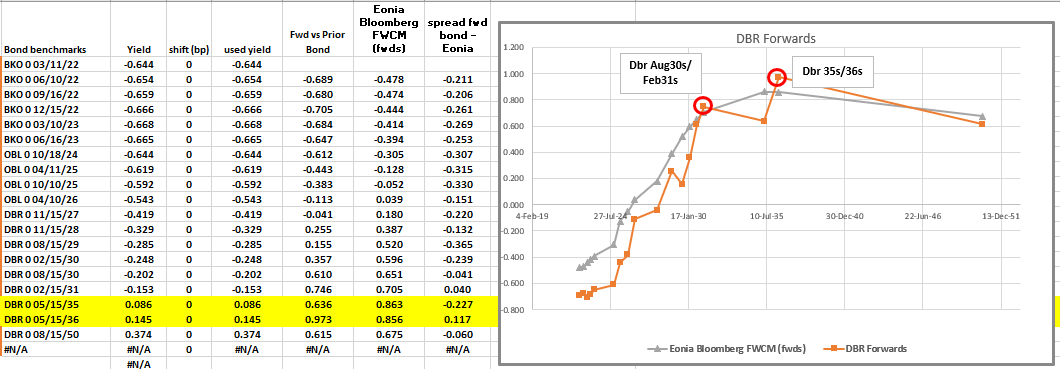

German old 5s vs 7s too steep – great roll trade vs OIS

We highlighted before the rally that 5s10s was too steep vs 2s30s

This has started to re-balance

We're running short the old 5y vs the OEU1 contract (ctd Apr26) – that's worked for a good 1.5bp and now we like to increase our flatteners out of the Oct25 with an OIS hedged 5s7s flattener

Here's the history using the old 7y (nov27) – for more history…

It's a bit 6 of one / half a dozen of the other as top whether we extend out of Obl Oct25 into Old 7y Nov2q7 or the Cheaper on the run 7y Nov28 – the nov28 keep being tapped until November this yr

German Z-Spreads: Bonds younger than 2yrs

alternatively we can mutate what we have on and sell the OEU1 to buy Nov28

It's basically a bullish structure – As for delta, although the US looks the wrong side of fair historically, I feel that Germany has some work to do – purely based on the historical, 65day Sharpe Ratio. If vol drops falls over Summer , we'll probably narrow the ranges over which we trade the outright – basically we might still buy Europe but am starting to get Bearish for the U.S.

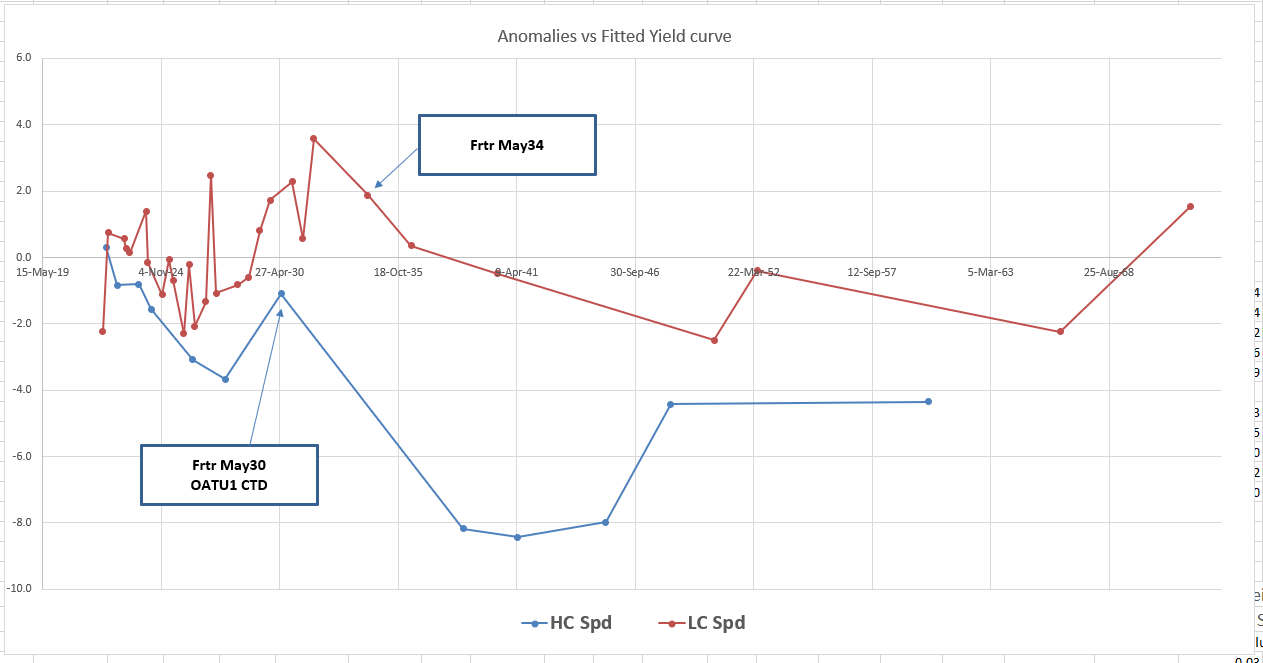

On my Radar – Oat May34 basis

-OATU1 +Frtr 1.5% May34

+35.5bp

Thinking about the value way to control the steepening but statistically this looks good – any thoughts gimme a call – it has been a perennial leveraged short and it now rolls to the very cheap supply point in France – personally I think that cheapness in cheap 10y Europe could diminish over the summer – the supply dunamic swongs the other way – with the PEPP still running and a more bullish tone to the markets we could see this 9s10s flatten and that could have a knock on effect to 9s into old 13y

In value Terms…

French Rich/Cheap vs Fitted yield Curve

Irish May29 Best Buy in cheap, small issuer vs France – favoured by the PEPP

I would have expected a contraction in the Irish / France spread as invoice spreads re-traced – elsewhere Ireland trade pretty tight to the French Curve – if you'e systemtaically looking to favour the smaller issuers that the PEPP just can't get enough of then this is an opportunity

France into Ireland – 2029s

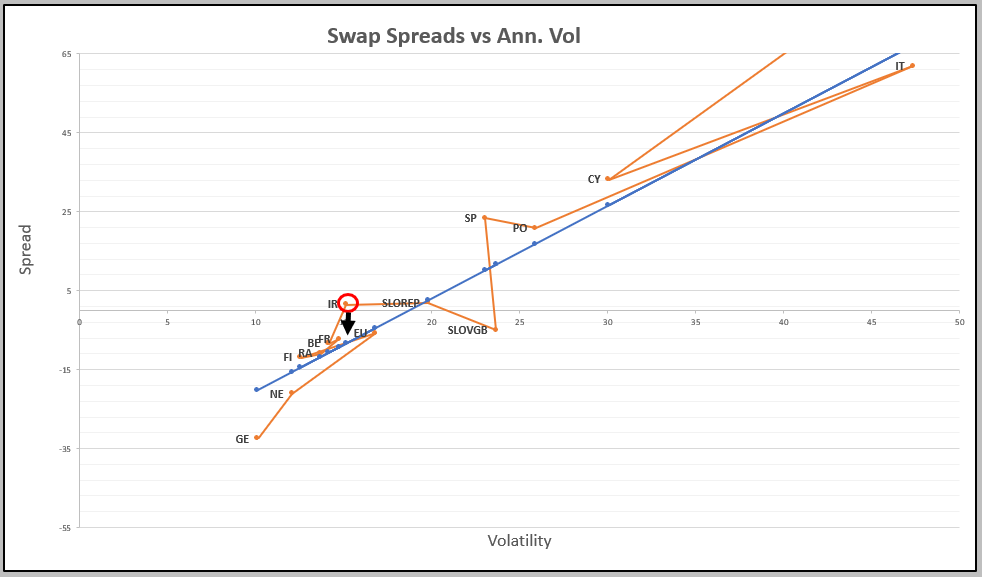

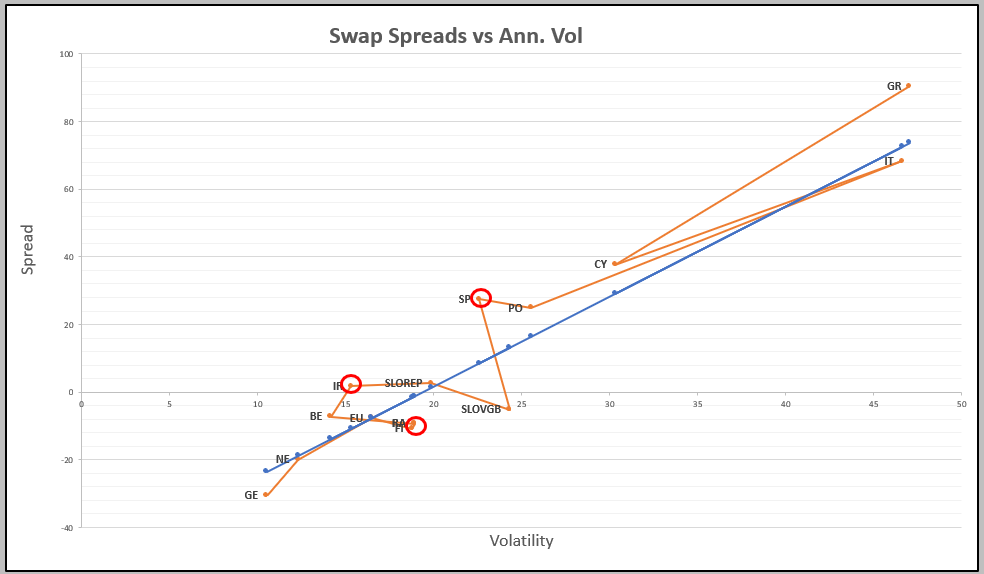

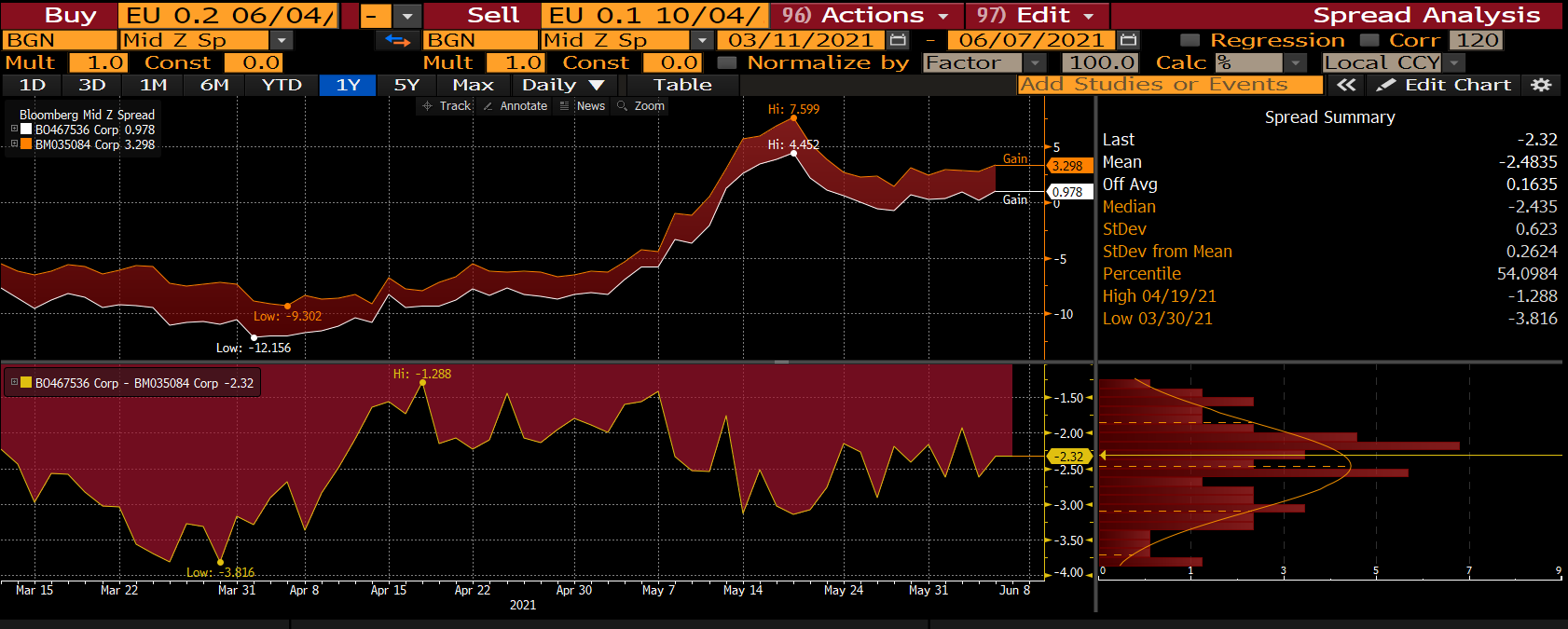

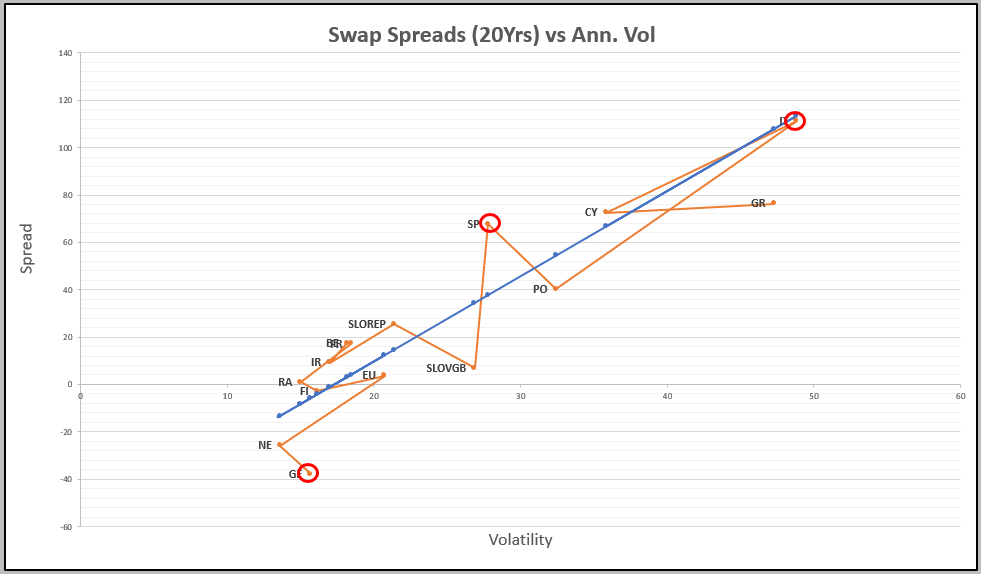

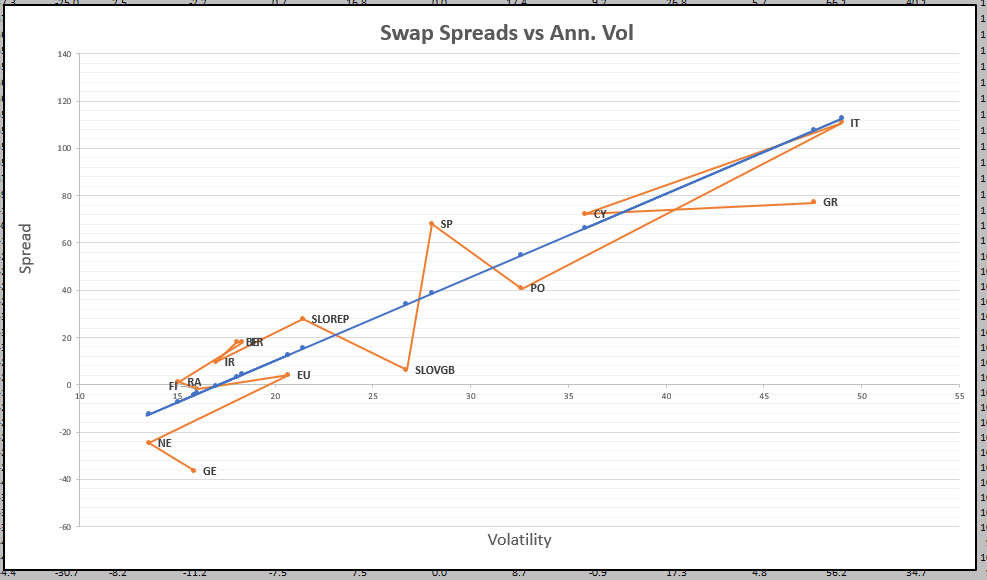

Under our Vol analysis we plot Swap Spreads as a function of Vol - a

Although Ireland is a slightly weaker issuer it trades with a similar vol – due to the compression of the perceived credit – a result of PEPP buying into a favourable capital key

We think the issuer could normalise and more profoundly in the 8yr tenor

Vols on changes vs Swaps, 120 days history – 9yr tenor

If you'd like to see the UK trades and many more please give Will and I a shout

Have a solid week

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Quick Note

Carl – I was just running some regressions on Italian OIS spreads on the weekend

Constrained to:

issues under 4yrs

Removing 0.5% of published bd/offer from the residual – to remove impossible anomalies

Min# 1.9 standard deviations

These filters are pretty powerful and the only trade that came up was

-Btps Aug29 +Btps Aug30

I know we'd spoken about how the Aug30 would never get CTD status and look relatively rich

But this simple spread trade might be a way to spread shorts around a bit – and indeed it moves the short into Aug29 which is closer to the Jul28 which is becoming a long concentration point

Jut a though and purely a historical chart trade rather than stuffed full of mean reverting value

Best

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades & Fades - James @ Astor Ridge

Fades

- Getting close to Flat Delta on UST 30y

- Germany 2s5s10s30s – 5s10s too steep

- Invoice Spreads – Slightly bullish for a bit more retracement

Germany 10s30s vs Eonia too flat – trying to find the best steepener

- Issue specific – Like the new Dec31s in Italy – but really love the 7y point – supply on Thursday in the latter

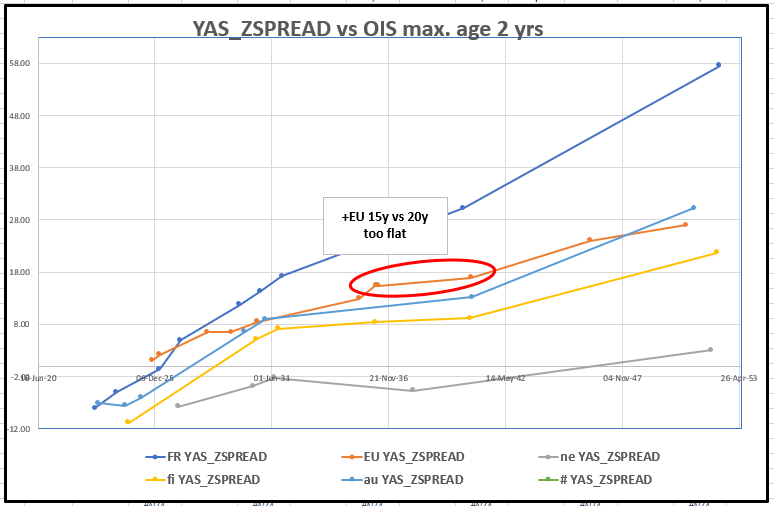

- European 20 years generally look a bit rich

- Credits: see Spain and France as a Bit cheap on spread vs vol metric

- All eyes on ECB

We 're shifting our business model somewhat – and are looking to continue transacting – please let us know if this research is of value or how we might improve it to make it relevant – your comments are important to us to guide our approach

James & Will

Italy 15y Supply on Thursday, 10y Syndication went well but still looks value as a low coupon bond

– like being short 15y Italy vs 10y waiting for better level

Short Btps Mar37

Long Btps Aug31 and Btps Sep 40

vs OIS

Maturity weighted – the Italian bond curve should not be as straight as (i.e. a straight line) the Swap Curve!!!, co the boundary on this trade is 0bp for me

CIX:

2 * (P2509[BTPS 0.95 03/01/37 Corp] - 0.7 * P2509[BTPS 0.6 08/01/31 Corp] - 0.3 * P2509[BTPS 3.85 09/01/49 Corp])

Levels

Curr: +2.1bp

Entry: < +1bp

Target: > +5bp (see Graph of Z-Spreads vs OIS)

Italy Z-Spreads

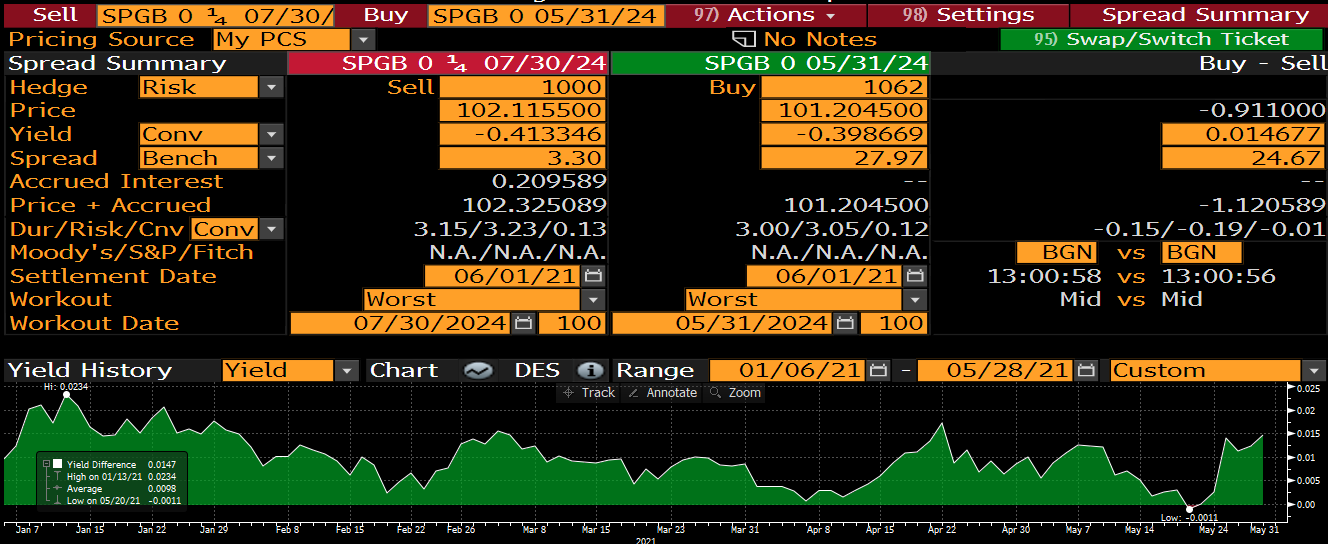

Pay Spanish 26s vs 28s and 23s: vs OIS

Spainish curve has no curvature vs OIS – the weker the issuer the more the default / Hazard rate process should cause the credit curve to have more curvature

Waiting for better levels

Target < -3.2bp

(P2509[SPGB 0 01/31/25 Corp] - 0.8 * P2509[SPGB 0 05/31/24 Corp] - 0.2 * P2509[SPGB 0 01/31/28 Corp])

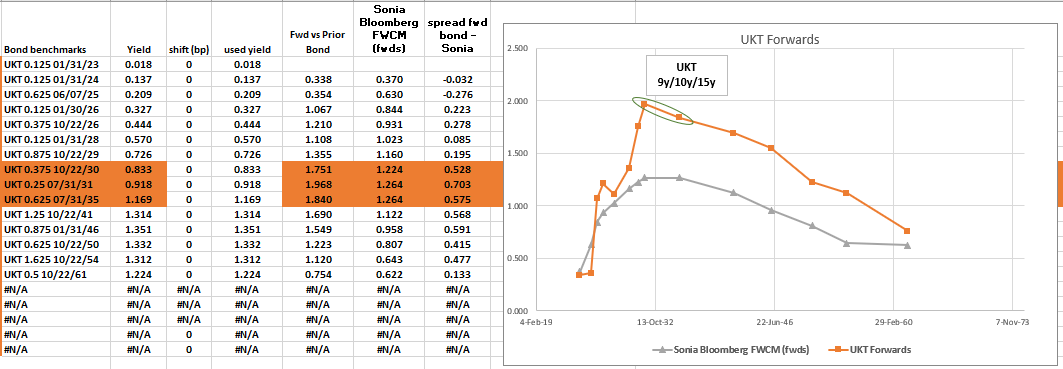

UKT – rich Oct29 with a new Jan29 coming

Sell UKT 29 vs

Buy Ukt 28 and Ukt 31

vs Sonia

Levels

Current: -5.8bp

Enter: < -6bp

Target: -2bp would look more fair with a new issue coming into the curve

cix:

2 * (p2509[UKT 0.875 10/22/29 Govt]-0.5*p2509[UKT 0.125 01/31/28 Govt]-0.5*p2509[UKT 0.25 07/31/31 Govt])

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades & Fades - James & Will @ Astor Ridge

Supply on the Horizon:

Holland 10y

Austria 4y & 10y

Germany 7y & 30y

Italy – 3y, 7y & XXXX? TBA Monday night

Ireland XXXX?

Fades

- Moderately Bullish FI (10 yrs) purely on recent Sharpe Ratio – oops – wrote this before Friday’s numbers – but still not at fair imho, so sticking with it

- Neutral Credit Spreads

- Like France on the blend vs Italy and Germany in 30yrs

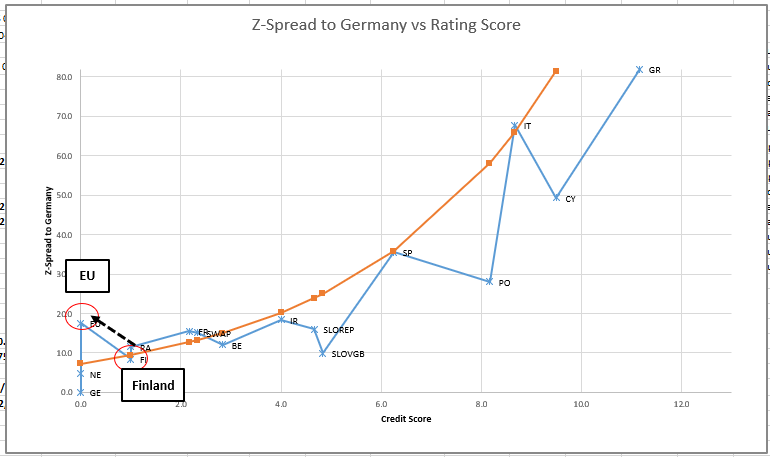

Specific Credits vs Vol

– see Spain and Ireland as Cheap. Austria and Finland as Rich

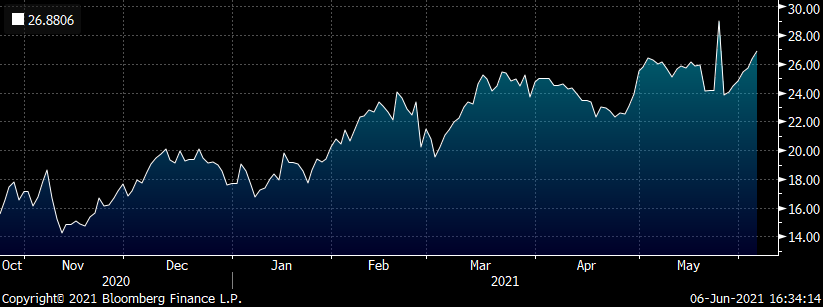

swap spread vs Vol perspective (9yr Tenor, vol of changes 120 days)

Trade 1)

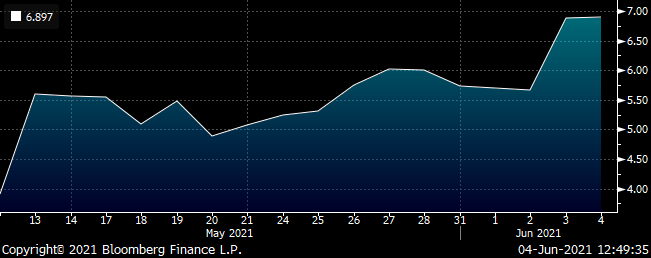

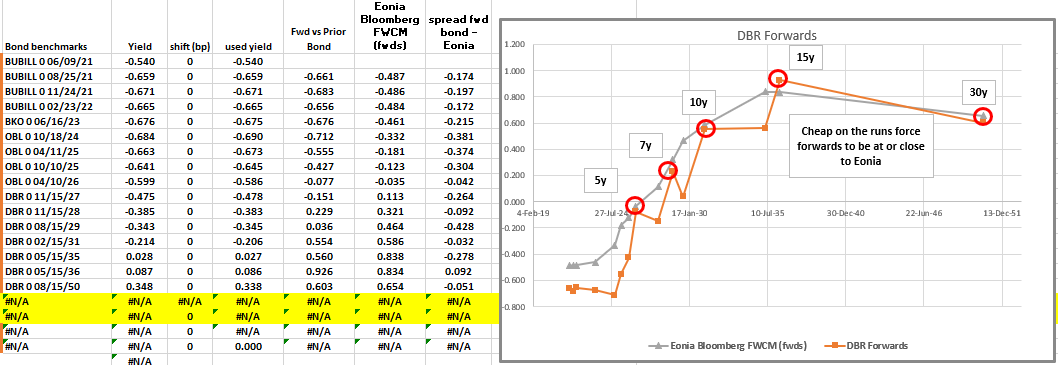

Italy 10y roll cheapens – Low coupon on the run comes close to the boundary condition of value vs Medium & High coupons

The Italian 10y roll moved out to +5.5bp – the on the run 10y is a lower coupon, They tend to trade richer from a true value perspective after they cease being a tap bond – same is true for the 7y

The Btps 0.6% Aug 31 is already a €20bln issue – equal in size to the old 10y Btps 0.9% Apr 31

The Btps 1.65% Dec30 got to €13 bln and Btps Aug 30 got to €17bln – so we haveto start thinking about buying this bond as it rolls out of the tap space

If we look in simple yield anomalies the Low coupons ‘appear’ to trade cheaper

Graph of yield anomalies vs Fitted Yield Curve

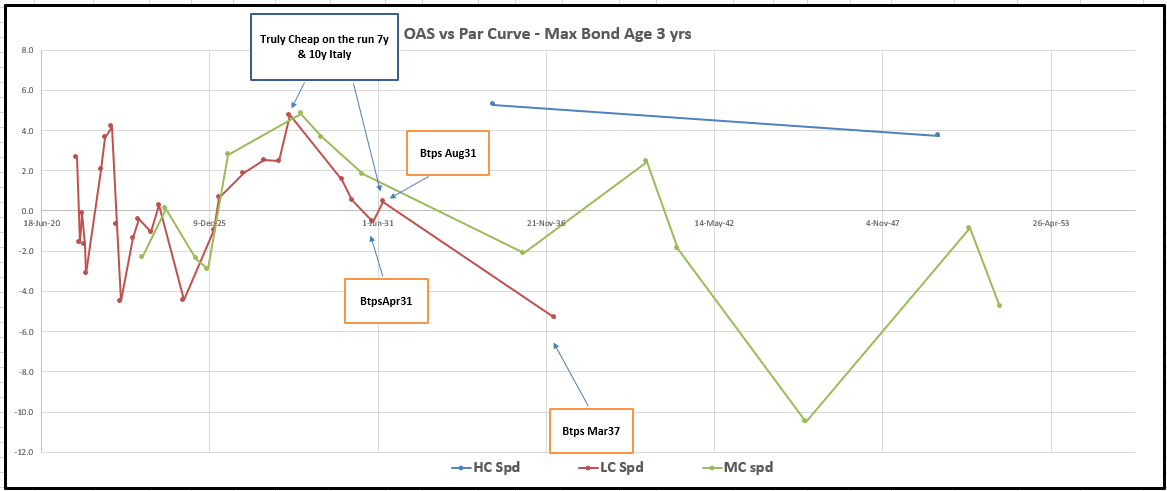

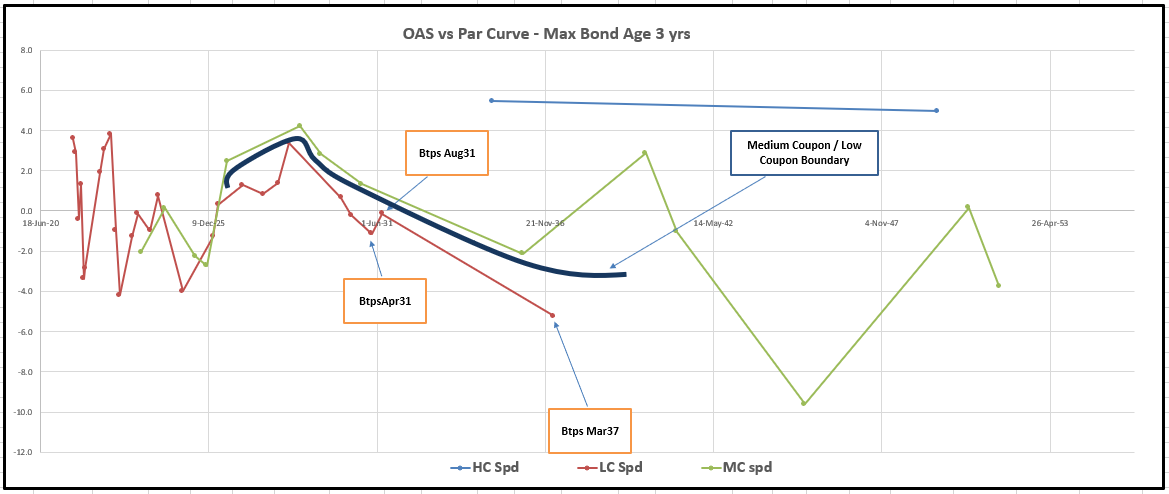

Thing is – we’re just looking at it wrong and to be honest Z-Spread ain’t much better either – with bond curves that are markedly different to their respective swap curves then we really need to look at OAS vs a smooth, Bond Zero Curve

New look…. Using OAS vs Bond Curve

When we use this, we can see that typically even the Low coupons only ever get as cheap as higher coupon, older bonds in the same Tenor… this view better values what is going on in terms of where to put these trades on

So why is this? –

there is a preference for lower price bonds when we view it this way – they suffer much less in a redenomination / default scenario – now you could argue that this feature is totally benign at the moment – and it is to some extent, but the 108bp spread between Italy and Germany in 10yrs isn’t just a collateral difference – that perception of the credit still has a correlation to high/low coupon differentials. But what we can see is the fact that the low coupons ‘TRADE NO WORSE THAN MED AND HIGH COUPON BONDS WHEN WE USE OAS TO CORRECTLY VALUE CASHFLOWS’

We all like buying free options – and to me, that’s what buying a low coupon vs a medium coupons at the same OAS PAR BOND spread is – this is the true turning point for low vs high coupons – it’s a much better metric than looking at yield histories and is often the point at which the neg carry on low coupons ceases

So we’re look at two options – we’ve got supply in 7y next week btw

- Buy Btps Aug31 (10y)

Sell Btps Apr31 & Btps Mar37

Weighting: -.9 / 1 / -.1 (x2)

CIX: 200 * (yield[BTPS 0.6 08/01/31 Govt]-0.9*yield[BTPS 0.9 04/01/31 Govt]-0.1*yield[BTPS 0.95 03/01/37 Govt])

Levels

Current: +0.5 (50% risk)

Target: -3bp (med Term)

Add: +1.5bp

Rationale

- Apr31 rich

- Aug31 cheap and low coupon – potential to go off the run and be locked away, partic in higher rate environment

- Mar37, still poss tap issue (€12,4bln vs Mar36 €14,4Bln)

- Mar37 roll poorly and provide Anchor

- On default pricing the Aug31 are priced almost the same cashflow value (~1bp richer) than medium coupons, hence should reach some boundary for yield spread

Risks

- Ten yr stays cheap on this structure

- Buy Btps 7y vs

Sell Btps Aug29 and Btps Feb25

I really like this roll structure

Weighting:

-.2 / 1 / -.8

Cix:

200 * (YIELD[BTPS 0.5 07/15/28 Corp] - 0.2 * YIELD[BTPS 0.35 02/01/25 Corp] - 0.8 * YIELD[BTPS 3 08/01/29 Corp])

Same principal as before – roll down is excellent on the 7y & the Aug29 is only 2 yrs old as an issue and a medium coupon so not too illiquid

Carry: -0.4bp /3mo @ -5bp repo spread

Roll: +0.2bp /3mo – rolled off the smooth curve not the extreme slope of the low coupons, so could be even better

Levels

Enter +6.75bp (Ease in up to next Thursday’s supply)

Target: +3.5bp

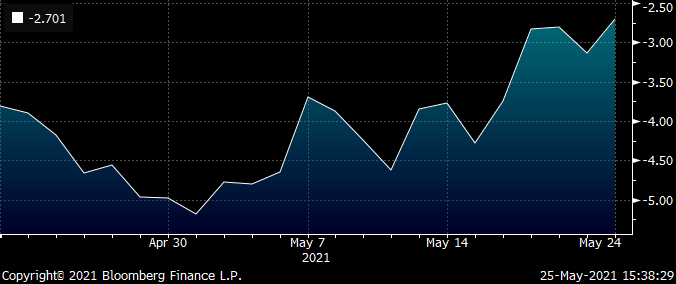

EU - Fears that NGEU brings a new swathe of issuance to the market in July cause for credit Steepening – as a credit EU has always traded with a relatively flat term structure vs other Sovereign issuers

We’re looking for either the credit to widen and/or steepen

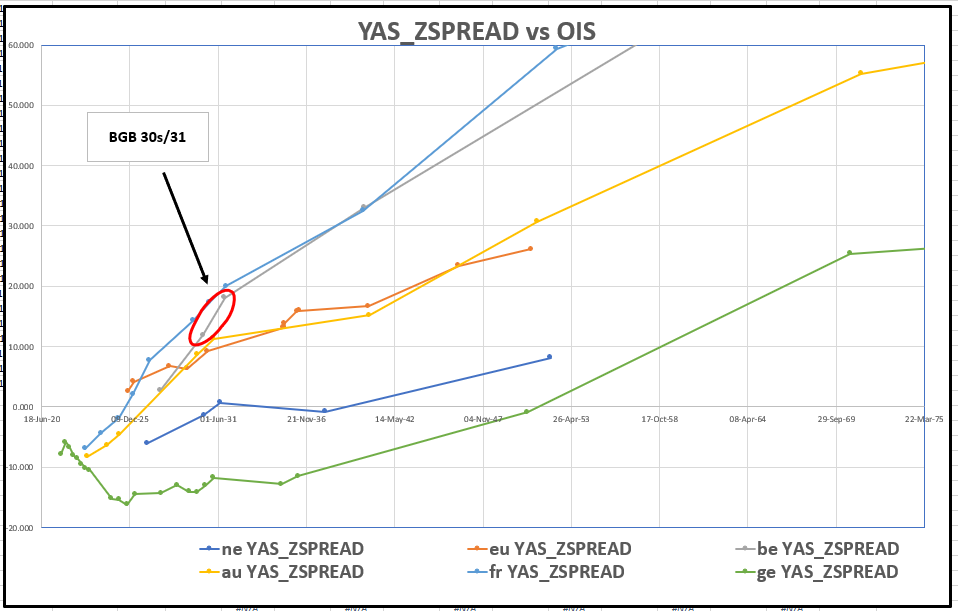

Here’s how EU looks vs other European issuers on Z-Spread vs OIS

Trade

Sell EU 0.2% 2040 to buy EU 0.25% 2036 vs OIS

Levels

Current spread: -2.7bp

Target: <-8bp

History on Z

Risks

General bid for all Euro 20yrs persists vs 15 yrs

The EU curve does not experience a generic steepening in line with other European issuers

Belgium – sell rich Bgb 9y – BGB 2030 and grab relatively cheap Green 2033…

We recently saw Belgium Sep30 outperform it’s neighbours and we highlighted how rich it was vs other recent issues – leapfrogging the cheap Oct31 which was tapped last Monday we can

Sell Bgb Sep30

Buy Bgb June 28 and Green Apr33

the Richness of the 2030s allows us to buy the Green 33s as a wing on what is not a bad fly in forward space

CIX:

200 * (YIELD[BGB 0.1 06/22/30 Corp] - 0.5 * YIELD[BGB 0.8 06/22/28 Corp] - 0.5 * YIELD[BGB 1.25 04/22/33 Corp])

Normally I wouldn’t go for such a low var index, but I think this thing belongs much higher than the history suggests– I think that the 33s have been dragged cheaper by the 10y 31s and it could reverse fully and then some

I like the strategic way of leaning on the Oct31s (cheap 10y) re-richening AND the 33s getting more of a premium also as the trade works – I just like buying ‘greenness’ for as cheap as I can, but like BitCoin, it’s not free !!!

As France is drifting cheaper in Longs, it leaves some of the other, smaller Issuers cheap but with on-going chance of decent PEPP buying

IF we’re still believers in the residue of the PEPP – although that’s decreasingly the consensus view – than as France got dragged cheaper vs the Italy / Germany blend – some babies have been thrown out with the bath water

Namely, cheaper, semi-core issuers that benefit from a favourable Capital Key –such as Belgium & Ireland

We’re looking at buying 30y Belgium vs a blend of Nether (85%) and Italy (15%)

(SP210[BGB 1.7 06/22/50 Corp] - 0.85 * SP210[NETHER 0 01/15/52 Corp] - 0.15 * SP210[BTPS 1.7 09/01/51 Corp])

Swap spread equivalence (SP210)

Graph…

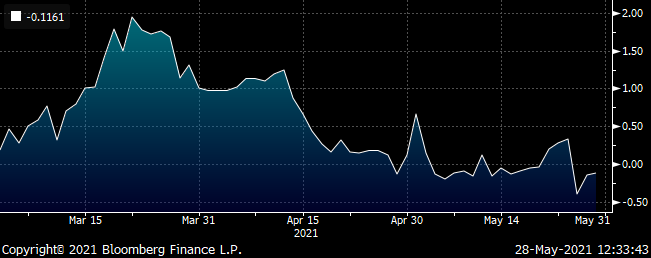

Belgium looks about 10bp cheap (part of that is systemic) when we plot swap spread vs vol – a return of this trade to sub 20bp would be our first stop but ultimately any pro-Pepp news should pull the Semi-Core names back into line

German Curve – Two Features are really interesting and worth a fade in Germany

- 5s10s (and sub-sections) too steep vs wider curve

Witness Germany 2s5s10s30s on CMB

100 * ((RV0002P 10Y BLC Curncy - RV0002P 5Y BLC Curncy) - 0.33 * (RV0002P 30Y BLC Curncy - RV0002P 2Y BLC Curncy))

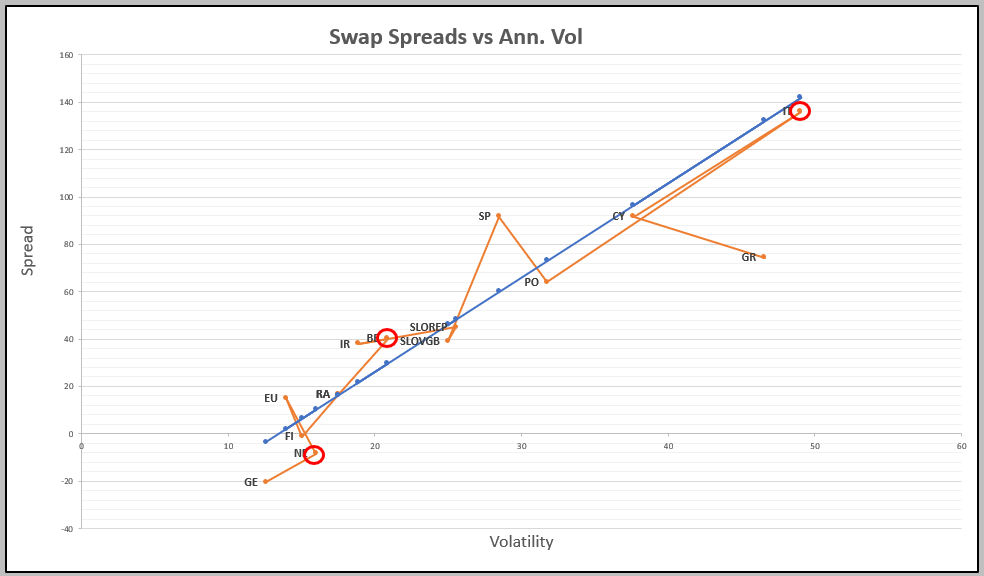

- On the run /Off the run is forcing some leveraged forwards to be so high as to meet the Eonia curve (which we see as a loose boundary condition)

I also really like the story that the on the run 10y is now done as it rolls inexorably towards being CTD to the RX contract in f– Germany telegraphs its supply way ahead and they are now set to move onto a new Dbr Aug31 on June 16th

On a var reduction hedge we like

-Dbr Aug29 +Dbr Feb31

Plus

10% of +OEM1 / - Dbr old 15y

This has the capacity to take a couple of bp of slope vs the wider hedge out AND the roll of the Dbr Feb31 down the curve as the new ten year comes – so our target for this is < 4.5bp

Speak soon and have a truly fab week

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

On my Radar

Btp 10y roll widens out – capturing that value…

Trade

Buy Btps Aug31

Sell Btps apr31 and Btps Mar37

Weightings

(-.8 / 1 / -.2) X 2

CIX

Yield: 200 * (yield[BTPS 0.6 08/01/31 Govt]-0.9*yield[BTPS 0.9 04/01/31 Govt]-0.1*yield[BTPS 0.95 03/01/37 Govt])

Graph

CIX

OIS: 2 * (P2509[BTPS 0.6 08/01/31 Corp] - 0.9 * P2509[BTPS 0.9 04/01/31 Corp] - 0.1 * P2509[BTPS 0.95 03/01/37 Corp])

Graph

Rationale

- Btps 10y roll has widened

- We have a better metric for valuing different coupons – OAS VS par Curve

- Btps Aug31 are close to the boundary of cheap to Medium coupons

- Btps Apr31 are richer, but a higher coupon (0.9% vs 0.6%)

- Btps Mar37 are not as low coupon as the on Btps Aug31 and are rich on the curve – revealed more completely when we perform OAS vs PAR curve

Risks

- On the run 10y remains cheap

Btp 10y has widened out to +5.5bp

On normal curve fitting the bond looks cheap

The problem with that methodology is it doesn't reveal the bonds true value in terms of cash-flows. All cashflows are discounted at the same rate when we use yield – in that sense it's an average. In the same way that swap traders don't use average returns but use forwards to compute value, the same applies to bonds

Here's how recent (max age 3yrs) bond anomalies look

This analysis leads us to want to buy the Low coupons

But what is we discount all the cashflows at different rates – at rates appropriate for each tenor of the Italian curve? The we see that in a steep curve the low coupons, with a longer modified duration are not so attractive

- Note this does not include Hazard rate analysis on the probability of default – it's relevant – but don't worry, we're gonna get that option for close to zero premium

if we

- Discount all cashflows using smooth zero curve

- Subtract the theoretical value from the bond Market Value and calc the number of basis points rich/cheap

Now look at Bond anomalies in this method

Under this analysis all bonds are more correctly valued (PV'd) and we can now see that Low coupons are 'bounded' by medium coupons

'Low coupons rarely trade cheaper than medium and high coupons – but only under full cash-flow discounting' *

- Again note – we're setting aside the default value of low price vs high price which his a benign issue here

So now we know when to buy these low coupons vs Medium coupons – if we buy them at the same cashflow value , we're actually getting them at truly the same discounted rich/cheap – and this is a much stronger boundary for trading on the runs vs off the runs

Extracting value

Is this method any better than Z-Spread ?

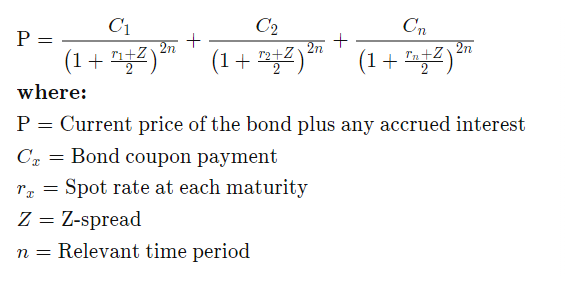

- Yes, here's the equation for Z-Spread – Source: Investopedia

As a metric it's trying to calculate the 'average' spread (Z) of a bonds cashflows to a given curve (usually swaps)

And there' the rub – it's ok, but flawed – when the swap curve and bonds curves are very different gradients or the credit risk is very low in short bonds but much higher in longer ones, - then the idea of an 'average' spread is

just plain insufficient

Again, we need to think about a Z-Spread curve of forwards, smoothed over time – and that's what OAS vs Par curve discounting does – creates a smooth, fitted Zero Curve over a Tenor range and properly evaluates each cash-flow – No 'averaging' here – when we do that we lose texture and we lose sight of the boundary conditions because we don't really know if a bond is rich or cheap, because our averaging is just a second rate method

How do we use it?

Going forward you wanna know whether UKT 1fe 28 is truly rich?

You want to understand why the low coupon 30y rolls always seem to trade steep ?

You want to know why Frtr May31 , old 15yr never quite falls back into the curve ?

You want to see why High coupon France and Spain trade so far through the on the runs in the long end?

You want to know whether UKT 38s are truly rich or why UKT 32s seem so well bid?

If you'd like to see some of your bonds under this new lens to help clarify whether we have OAS value on our side or the neg carry is trying to tell us something that we haven't fully calculated – we're here to run that analysis and show stuff that makes sense in both a traditional and an advanced framework – as such these trades should work more quickly and our entry levels better set

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

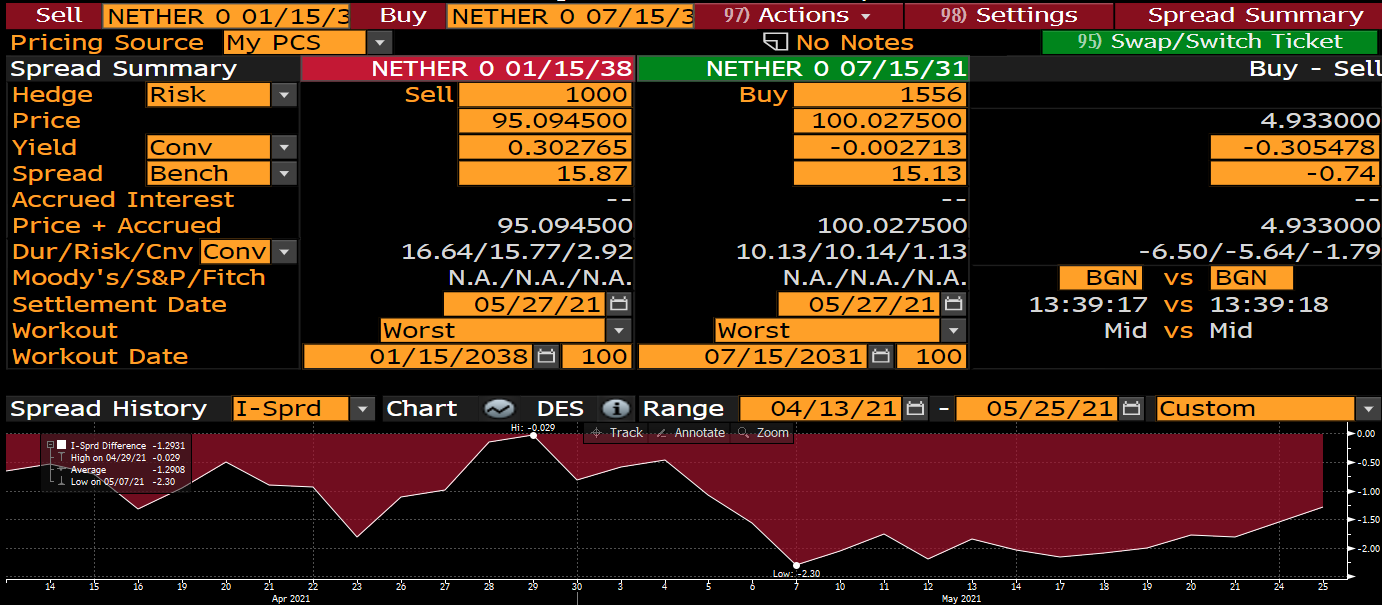

Holland 38s stand out as rich 30y, with Q3 tap potential

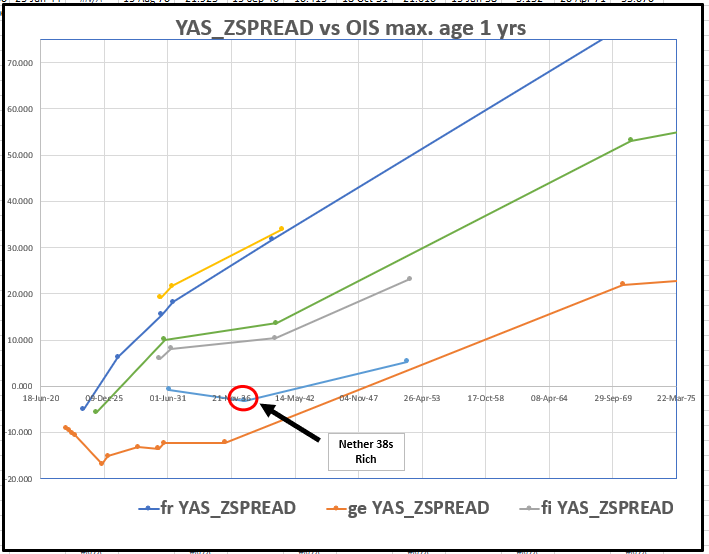

Let’s focus on bonds that are recent (max age 1y) – to avoid PEPP Landmines

Trade:

Sell Nether 38s, Buy Nether 31s and Nether 52

- Nether 38s are one of the richest 20y bonds - €6bln issue, expect a tap in Q3

- Nether 31s are to be tapped on Tuesday (currently €8.4bln expect tap of €2.5bln) – target size would be around €14bln as per the prior Nether 203

- Trade looks good on History in both Yield and Swap Space

- Trade in Yield Space creates infeasible rate expectations

Yield graph

200 * (YIELD[NETHER 0 01/15/38 Corp] - 0.5 * YIELD[NETHER 0 07/15/31 Corp] - 0.5 * YIELD[NETHER 0 01/15/52 Corp])

Swap Spread Graph

2 * (SP210[NETHER 0 01/15/38 Corp] - 0.5 * SP210[NETHER 0 07/15/31 Corp] - 0.5 * SP210[NETHER 0 01/15/52 Corp])

Euro Z-Spreads to Eonia (max issue age 1yr)

Carry & Roll

Carry: -0.1bp /3m @5bp repo spread

Roll: +0.3bp /3m

Sharpe Ratio

-0.66, 35 days History

Downsides

Further taps are not forthcoming in the Nether 38 and they richen

The 10y and the 30y cheapen further

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades & Fades - James & Will at Astor Ridge

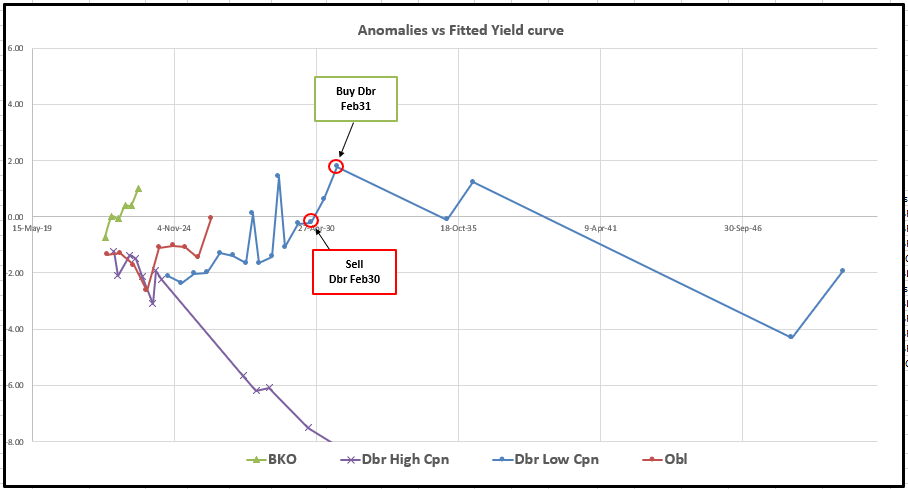

Trade: Preparing for 9s10s flattener in Germany

sell RXM1 basis @ -0.01

RXM1 – June Bund contract

Last trade: June 8th

Delivery: June 10th

Seems to me that there's a solid short base in RXM1 that's against a wider array if 'things' in terms of assets allocation. AS we role those shorts the front month will richen most, followed by the CTD and then other deliverables

The structure I like is selling the CTD Feb30 vs buying the outgoing 10y Dbr Feb31…

But prepping for this during Roll time until the Delivery Date can be a bit like picking up pennies in front of a steam roller

My prep is sell the Dbr Feb30 basis vs the front month and suck up some negative carry – what I'm hoping for is the basis gets a bit more negative as RXM1 gets richer vs everything and then I can sell RXM1 to buy Dbr Feb31 at much better terms, leaving me with

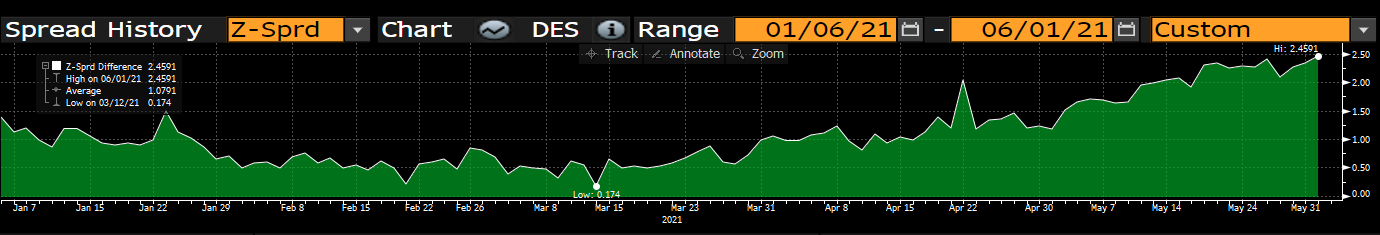

-Dbr Feb30 +Dbr Feb31 (vs OIS)

Here's the Z-Spread History

The downside is we simply take delivery for a small loss and manage the duration tail risk if the contract doesn't richen further and we don't get to mutate the trade into the Bond/Bond spread

Pay old 15y Germany vs 10y and 30y

- Essentially there's little to no curvature in the German curve in comparison to the Eonia curve and other European issuers – generally the 15y-20y tenors seems to be well sought after and in Nether and Germany that's particularly the case

Germany: +15y vs -10y and -30y

Issue selection: Dbr May35s rich, Dbr Feb31 cheap and Dbr Aug50 serve as an anchor

Trade CIX

2 * (SP210[DBR 0 05/15/35 Corp] - 0.5 * SP210[DBR 0 02/15/31 Corp] - 0.5 * SP210[ZR097974 Corp])

Need another 1bp on the middle (X2 on the fly calc) – so on hold for that one – let us know if you want a shout when it gets there

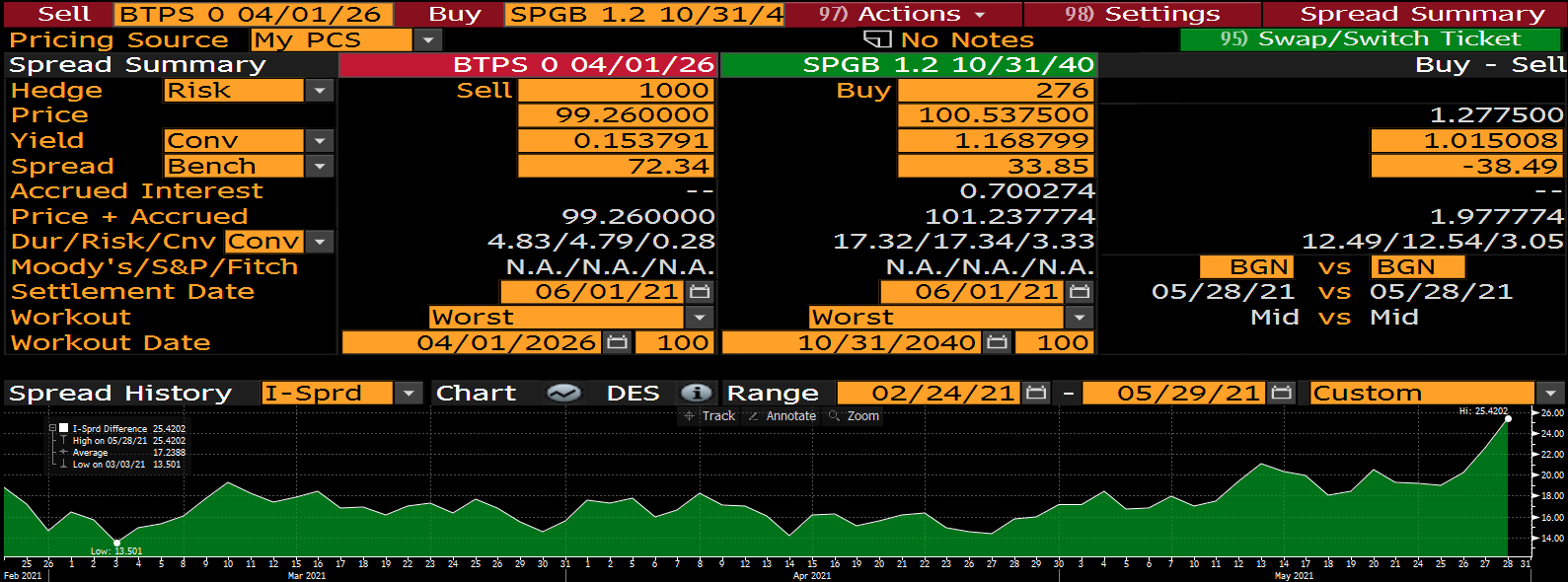

Buy Spanish 20y, Supply on Thursday

Vs Germany and Italy 20y

– looking at Euro Swap Spreads vs a Vol weighting in 20yrs – here's how we see Spread to Swaps vs Vol (on changes of spread to swaps)

Spain looks to be 10 – 20 bp cheap based on the regression of 'how the credit trades'

Running a regression on 20y Spain vs 50/50 weighting of Germany and Italy in Constant Maturity Bonds, I get that we are

@ +25.4bp – see Graph below of

The old high from last March is about +35bp at which point Spain was being unduly influenced by the wash out in Italian credit due to Covid

If that's our worst case then I like 255 of my risk here and another 75% closer to those levels – either we get to add or we take a turn on a more modest size, so scale accordingly

CMB/OIS SPREAD (vs EONIA) Long Spain 20y vs Germany and Italy

Germany – Last tap of Obl Apr26s and they become CTD to OEU1

Buy Obl Apr26 & Sell the old 5y Obl 0% Oct25…

Vs Swaps…

BBG History

As anomalies

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Further thoughts for the week ahead

Spoken to a lot of clients over the last few weeks in a real attempt to understand why we're not doing any business

In short as Dan says, a lot of the trades that the market seems to offer that have both value AND statistical/historical are minutiae – tiny trades where after friction there's maybe less than 1 to 1.5 bp and to be honest unless that reasonable for the Var it makes no sense at all

SO – Strategy

- cut down the issues to more recent ones – less than 2 yrs since issuance – less likely to be gobbled up by PEPP

- remove shorter than 4years – just too sheet intensive

- look at cross market spreads

- use OIS / Swap Spreads as a normalisation

- Look for true correlations

- Dilute the result by the quality of the r2 – if it's not well correlated it's ok but that needs to be factored

- Remove more bid offer – up to 60% of the published bid offer so that we don't obsess about proximate trades unless we can cross some spreads

Trades that get suggested….

Sell 5y Italy into 20y Spain

We have just had supply in the 5y and the 20y is coming in Thursday – I see Spain 20y as cheap vs the 30y – (OIS spread is almost as flat as France)

As a credit , as you know I see it as having a little extra spread given its VAR

Swaps Spreads vs Vol of Swap Spreads (120 Trading Days, Tenor – 20yrs, Vol. annualised vol on changes)

Cix of Spanish swap Spreads vs Germany and Italy – note there is a residual invoice spread of 30%

(SP210[SPGB 1.2 10/31/40 Corp] - 0.25 * SP210[DBR 4.75 07/04/40 Corp] - 0.45 * SP210[BTPS 1.8 03/01/41 Corp])

Or even a single spread regression to Italy of..

Long 100% Spanish 20y swap spread – short 50% Italy 20y spread

sp210[SPGB 1.2 10/31/40 Govt]-0.5*sp210[BTPS 1.8 03/01/41 Govt]

Sell Btps Apr30 into Btps Dec30

Essentially this is IKU1 CTD in IKZ1 CTD

On Z… in graph below (BBG)

For anyone overly concerned about being long IKU1 this is an interesting piece of diversity to the portfolio, the next LC along, Aug30 which have cheapened recently – Aug30 don't get a clear shot at CTD status and Dec30 are a better buy imho – Aug30 actually longer in Modified duration than the Dec30 – and it's that property that dominates delivery in Z1 (when a futures price is a long way from PAR)

So to me – if I've rolled my ik longs in Sep – but am short Aug30, then I'd do this switch above. Any sell-off in IkU1 would be more damaging for the Sep CTD and if Aug30 catch a bid I can see Dec30 responding in a similar fashion so it offer value protection and the kicker of being the next CTD

And on a regression of yiel d here's how the trade looks..

Seeing Germany 5s 10s as historically steep – I like the Dbr Feb31 but the Apr26, although a tap bond also seem cheap

Am tempted to fade that with something like…

-Dbr Aug27 into Dbr Feb31 – although the age of the shorter bond is of some concern, I cant see it as able to roll anywhere – indeed this stuff does cheapen (even older bunds) when they get to the 5y point

Will call to catch up – have a fab weekend

Knowing me, good chance I'll be in on Monday

PPS the output is close on ..

UKT -50 +UKT 54

-bgb 30 +nether 52

Back any Spanish back end vs 5-7y Btps

James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades & Fades

Nic – just a quick update on some small bits and bobs I'm looking at

If you have a sec can run through

Sell Finland Apr26 to buy EU Mar26

on Z spread..

On Spread to Interpolated Germany vs Credit Rating this looks reasonable and we see diminished risk to the EU name in sub 6yrs despite the prospect of July issuance in NGEU

Sell Germany old 15y

Sell Dbr May35

Buy Dbr Feb31 and Dbr May36

Weighting

2 X ( 0.2 / 1 / 0.8)

Cix:

200 * (yield[DBR 0 05/15/35 Govt]-0.2*yield[DBR 0 02/15/31 Govt]-0.8*yield[DBR 0 05/15/36 Govt])

The Edge vs OIS

2 * (p2509[DBR 0 05/15/35 Govt]-0.2*p2509[DBR 0 02/15/31 Govt]-0.8*p2509[DBR 0 05/15/36 Govt])

Spain

Sell Spgb jul27

Buy Spgb May24 & Spgb Oct30

Vs OIS

2 * (P2509[SPGB 0.8 07/30/27 Corp] - 0.5 * P2509[SPGB 0 05/31/24 Corp] - 0.5 * P2509[SPGB 1.25 10/31/30 Corp])

Spain

-Spgb Jul24 +Spgb May24

+1.4bp

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

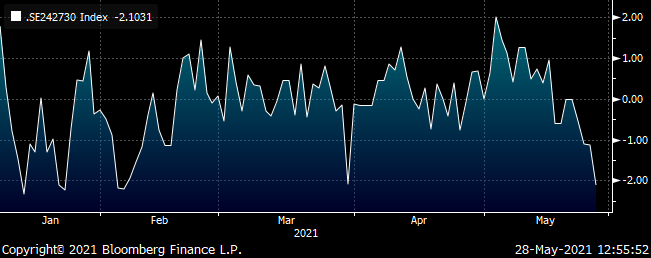

Trades & Fades - some Euro RV stuff on My Radar

Belgium flattener -9y +10y

Trade

Sell Bgb June 30

Buy Bgb Oct31 (otr 10y)

vs OIS

Rationale

- Belgium 30s31s is one of the widest, steepest semi-core spreads vs OIS in more recent issues

- Current 10y is €8bln, the old 10y is €15Bln, could add which might be a headwind

- Las tap of BGB 30s was in August of 2020

CIX: 1 * (SP210[BGB 0 10/22/31 Corp] - SP210[BGB 0.1 06/22/30 Corp])

(vs Libor)

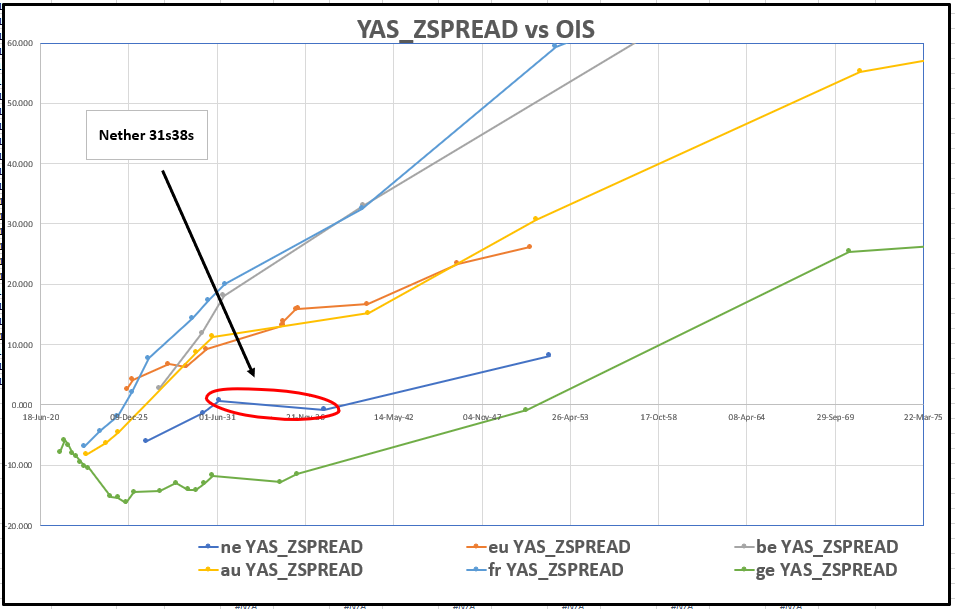

Nether 31s 38s steepener vs OIS

-0.5bp vs OIS, currently +1.5bp on Z

Entry @ Flat and add @ +0.75bp

Rationale

- Recent re-flattening of 10s30s Germany vs swaps has dragged the 10s15s & 10s20s curve flatter in Core – the value is worth fade in Dutch 38s which are only €6yds in size and should get tapped along with Nether 31s, which is the current 10y

- This is the antithesis of the Belgium flattener – whereas in the recent FI sell-off the 5s10s got steepened, similarly 10s cheapened vs 15s on the move causing the 10y to be idiosyncratically cheap

BBG History vs Swaps…

German 15y supply – new issue cheap

But like the roll -35s +36s: @ +5.8bp

with the recent sell-off in swap spreads, the same yield spread in bonds produces a cheaper ‘forward’ vs Eonia / Libor

So for example in spread contraction for high quality issuer such as Germany, I would expect anomalously cheap bonds to compress to the curve as a result of swap related activity

The best anomaly in Germany, of more liquid issues vs Eonia is -Dbr35 +Dbr36

To capture the FORWARD vs Eonia we should alter the hedge to be..

Sell 95% May35 vs Eonia

Buy 100% May36 vs Eonia

So all duration matched but less of the 35s short than one might expect

Here’s how that looks vs OIS -

(P2509[DBR 0 05/15/36 Corp] - 0.95 * P2509[DBR 0 05/15/35 Corp])

IF WE CAN GET THIS @ > +1BP INTO TOMORROW’S SUPPLY I THINK IT MAKES A LOT OF SENSE

UK

Short 9y: 90%

Long 10y (on the run): 100%

Short 15y: 10%

Weighted Fly +10.3bp, enter here

On forwards this looks pretty compelling, the 9y1y is on a precipice waiting to roll down the curve – it’s these distortions that pretty much set the condition at which tap issues find a RM bid

Rationale

- On the runs cheapen to a point where they are not just ‘fair’ – but their forward rate, the metric by which a cash for cash investor might see value, is appealing in the context of the curve of implied forward rates

- The roll on the 9y1y rate in Bonds – is elevated vs Sonia ( it always is to some degree) – but here the 10y5y looks a reasonable hedge

UK forwards with Sonia

BBG History

2 * (YIELD[UKT 0.25 07/31/31 Corp] - 0.1 * YIELD[UKT 0.625 07/31/35 Corp] - 0.9 * YIELD[UKT 0.375 10/22/30 Corp]) * 100

Long On The Run 5yr France vs old 5y and 8y

If we look at Z-Spreads vs OIS we can see how the new issue discount in Frtr Feb27 causes a ‘bowing out’ of the curve

(2*yield[FRTR 0 02/25/27 Govt] - yield[FRTR 0.75 11/25/28 Govt] - yield[FRTR 0 02/25/26 Govt])*100

On forwards it just looks wrong – forwards rise, the level off – overly informed and a result of supply nothing more

Best Will & James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796