Trades & Fades - some Euro RV stuff on My Radar

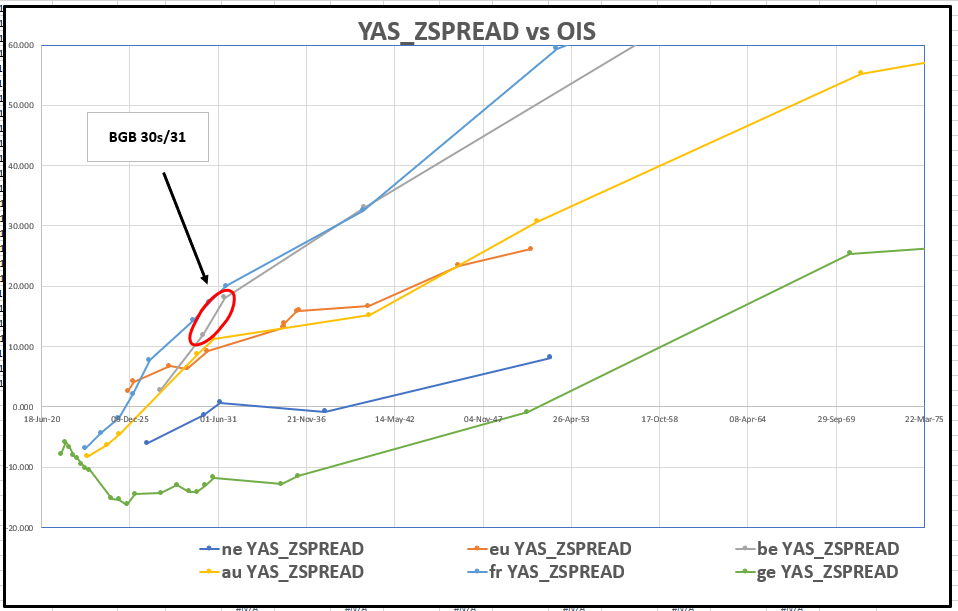

Belgium flattener -9y +10y

Trade

Sell Bgb June 30

Buy Bgb Oct31 (otr 10y)

vs OIS

Rationale

- Belgium 30s31s is one of the widest, steepest semi-core spreads vs OIS in more recent issues

- Current 10y is €8bln, the old 10y is €15Bln, could add which might be a headwind

- Las tap of BGB 30s was in August of 2020

CIX: 1 * (SP210[BGB 0 10/22/31 Corp] - SP210[BGB 0.1 06/22/30 Corp])

(vs Libor)

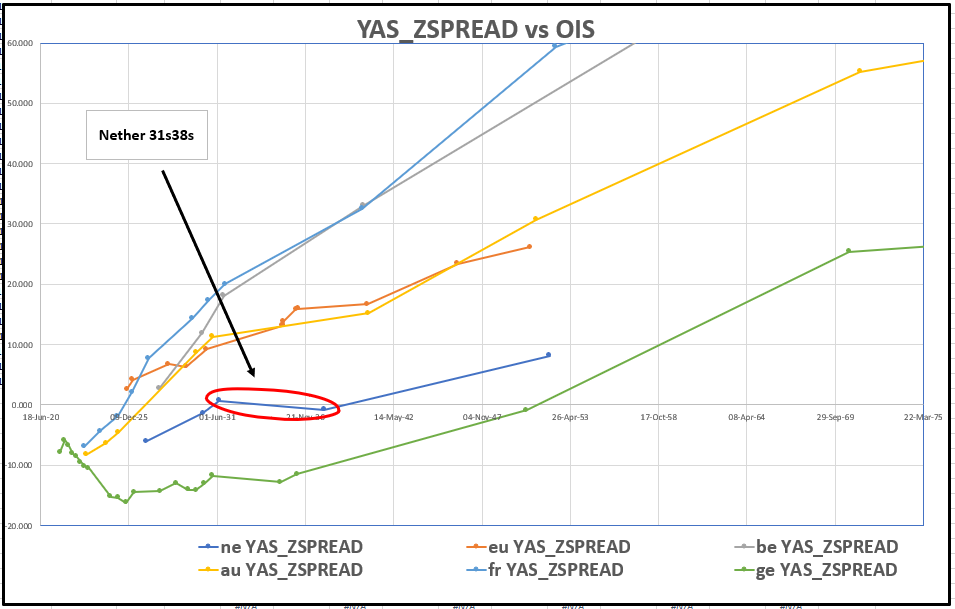

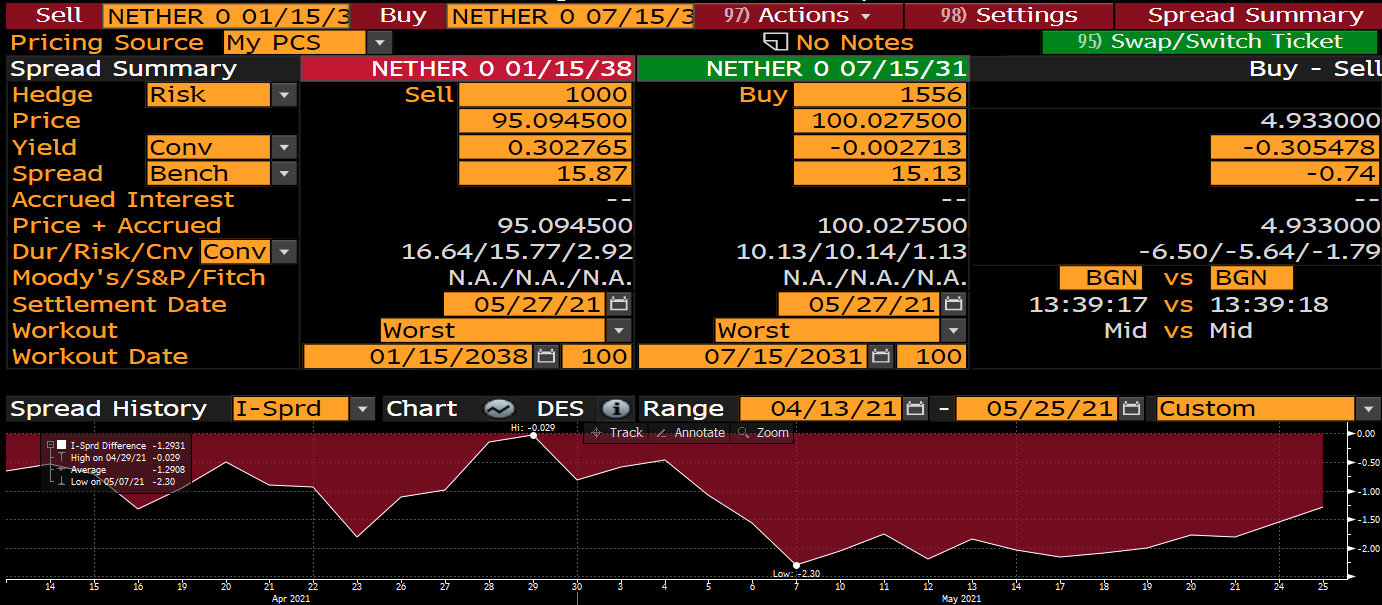

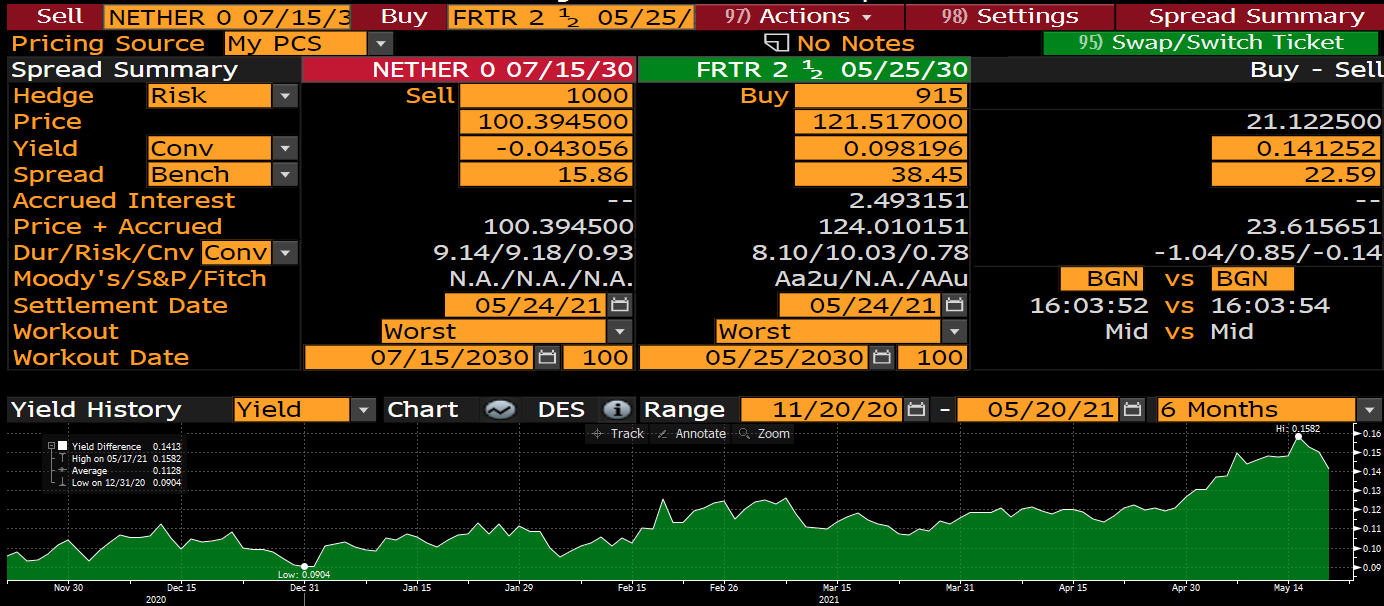

Nether 31s 38s steepener vs OIS

-0.5bp vs OIS, currently +1.5bp on Z

Entry @ Flat and add @ +0.75bp

Rationale

- Recent re-flattening of 10s30s Germany vs swaps has dragged the 10s15s & 10s20s curve flatter in Core – the value is worth fade in Dutch 38s which are only €6yds in size and should get tapped along with Nether 31s, which is the current 10y

- This is the antithesis of the Belgium flattener – whereas in the recent FI sell-off the 5s10s got steepened, similarly 10s cheapened vs 15s on the move causing the 10y to be idiosyncratically cheap

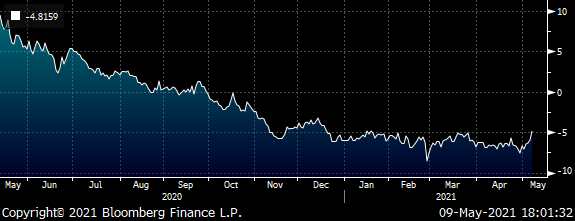

BBG History vs Swaps…

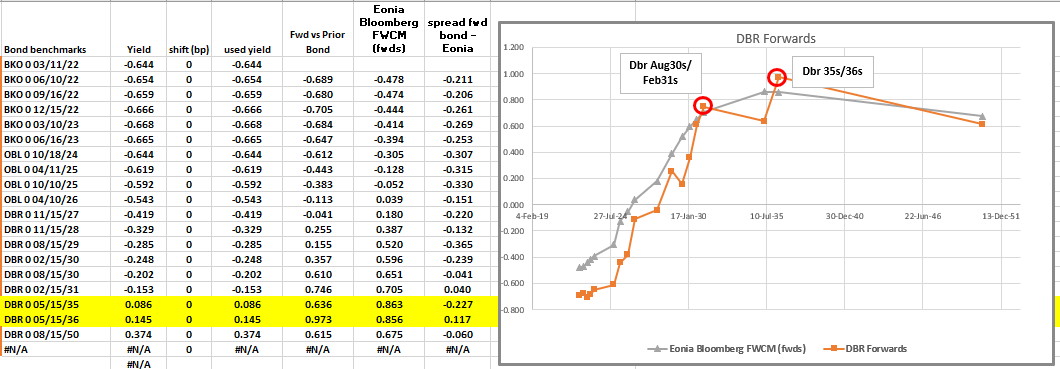

German 15y supply – not a buy quite yet!!!

But like the roll -35s +36s: @ +5.8bp

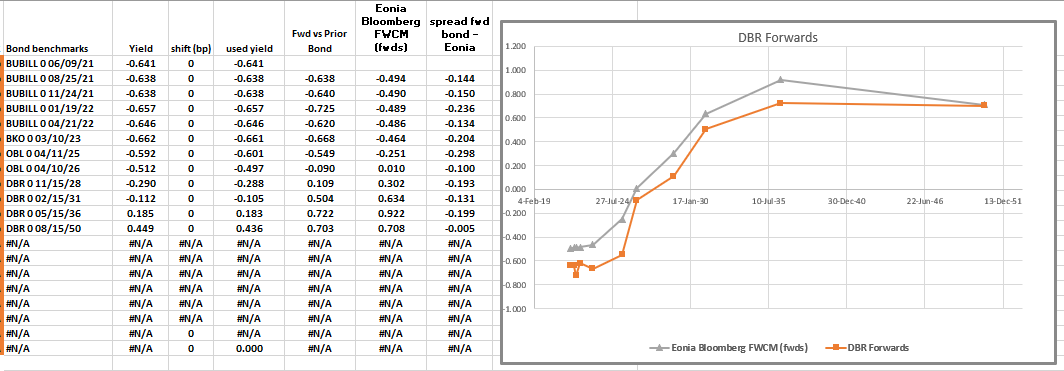

with the recent sell-off in swap spreads, the same yield spread in bonds produces a cheaper ‘forward’ vs Eonia / Libor

So for example in spread contraction for high quality issuer such as Germany, I would expect anomalously cheap bonds to compress to the curve as a result of swap related activity

The best anomaly in Germany, of more liquid issues vs Eonia is -Dbr35 +Dbr36

To capture the FORWARD vs Eonia we should alter the hedge to be..

Sell 95% May35 vs Eonia

Buy 100% May36 vs Eonia

So all duration matched but less of the 35s short than one might expect

Here’s how that looks vs OIS -

(P2509[DBR 0 05/15/36 Corp] - 0.95 * P2509[DBR 0 05/15/35 Corp])

IF WE CAN GET THIS @ > +1BP INTO TOMORROW’S SUPPLY I THINK IT MAKES A LOT OF SENSE

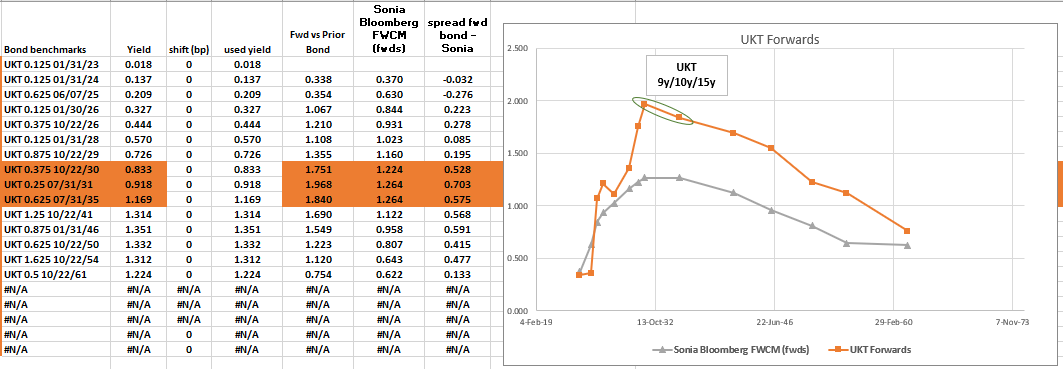

UK

Short 9y: 90%

Long 10y (on the run): 100%

Short 15y: 10%

Weighted Fly +10.3bp, enter here

On forwards this looks pretty compelling, the 9y1y is on a precipice waiting to roll down the curve – it’s these distortions that pretty much set the condition at which tap issues find a RM bid

Rationale

- On the runs cheapen to a point where they are not just ‘fair’ – but their forward rate, the metric by which a cash for cash investor might see value, is appealing in the context of the curve of implied forward rates

- The roll on the 9y1y rate in Bonds – is elevated vs Sonia ( it always is to some degree) – but here the 10y5y looks a reasonable hedge

UK forwards with Sonia

BBG History

2 * (YIELD[UKT 0.25 07/31/31 Corp] - 0.1 * YIELD[UKT 0.625 07/31/35 Corp] - 0.9 * YIELD[UKT 0.375 10/22/30 Corp]) * 100

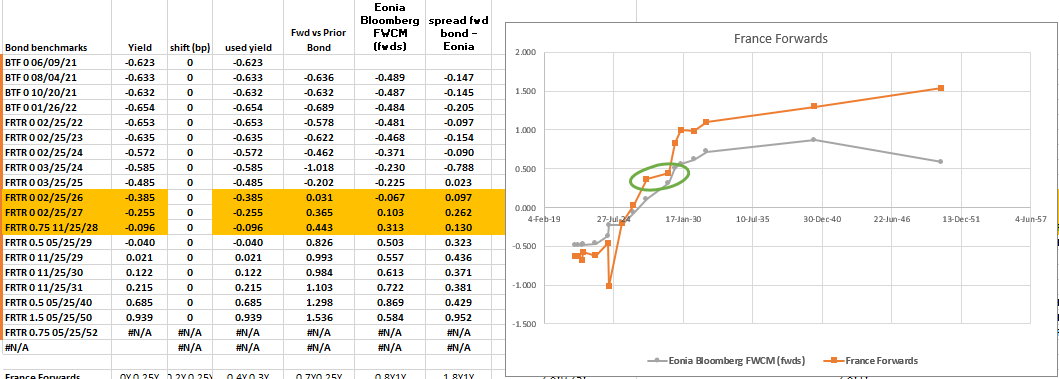

Long On The Run 5yr France vs old 5y and 8y

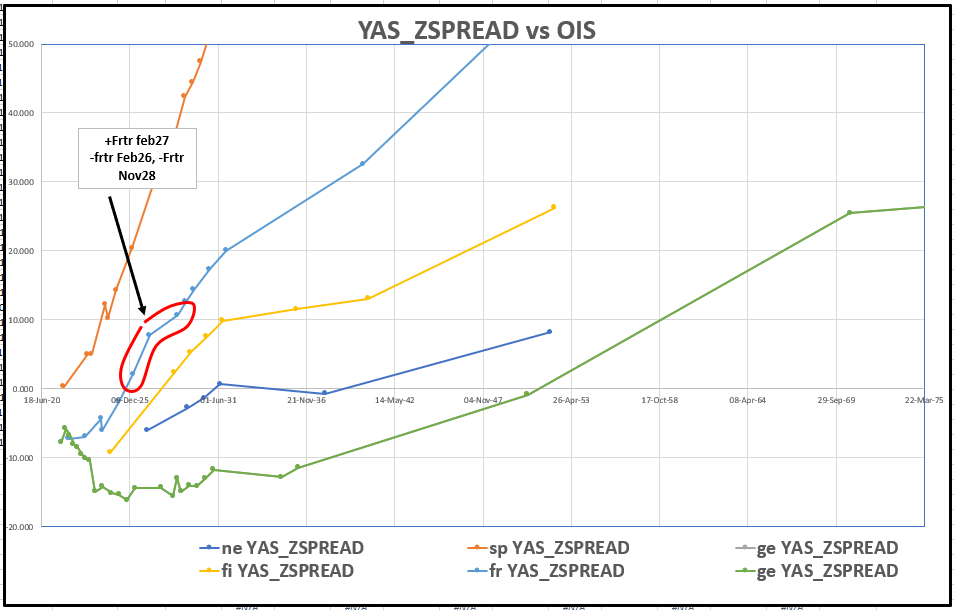

If we look at Z-Spreads vs OIS we can see how the new issue discount in Frtr Feb27 causes a ‘bowing out’ of the curve

(2*yield[FRTR 0 02/25/27 Govt] - yield[FRTR 0.75 11/25/28 Govt] - yield[FRTR 0 02/25/26 Govt])*100

On forwards it just looks wrong – forwards rise, the level off – overly informed and a result of supply nothing more

Best Will & James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades & fades from the weekend - James & Will @ Astor Ridge

Just some thoughts on the markets and the moves of late…

Italy 5s10s too steep when compared to 2s30s…

100 * ((RV0005P 10Y BLC Curncy - RV0005P 5Y BLC Curncy) - 0.33 * (RV0005P 30Y BLC Curncy - RV0005P 2Y BLC Curncy))

Also true when I look vs OIS as well

100 * (((RV0005P 10Y BLC Curncy - EUSWE10 Curncy) - (RV0005P 5Y BLC Curncy - EUSWE5 Curncy)) - 0.33 * ((RV0005P 30Y BLC Curncy - EUSWE30 Curncy) - (RV0005P 2Y BLC Curncy - EUSWE2 Curncy)))

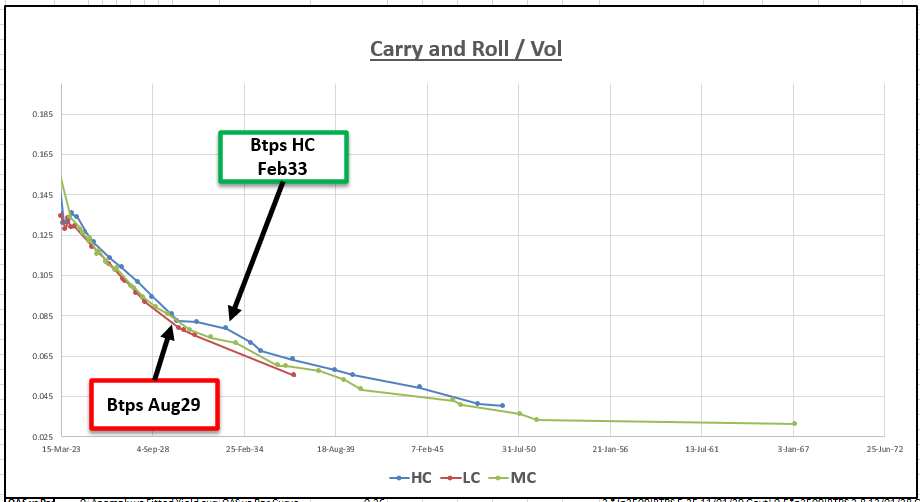

So am thinking of doing the straight flattener in something like 5s10s, but am gonna use vol adjusted Carry and Roll to pick the points…

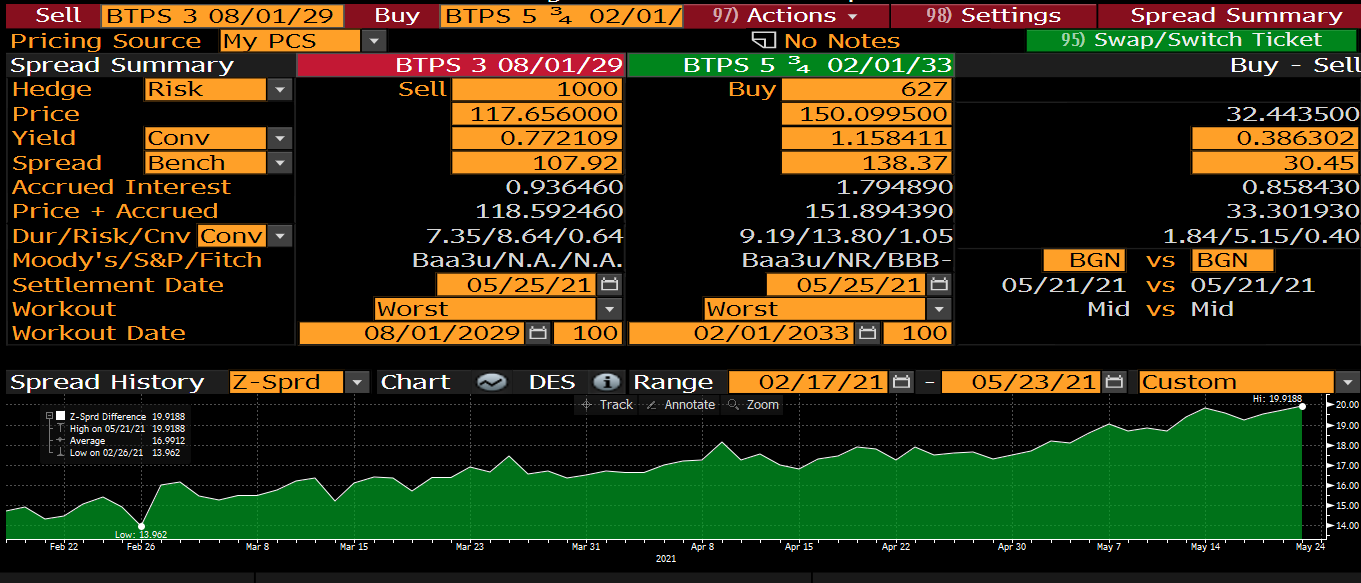

On Z-sprd it looks good…

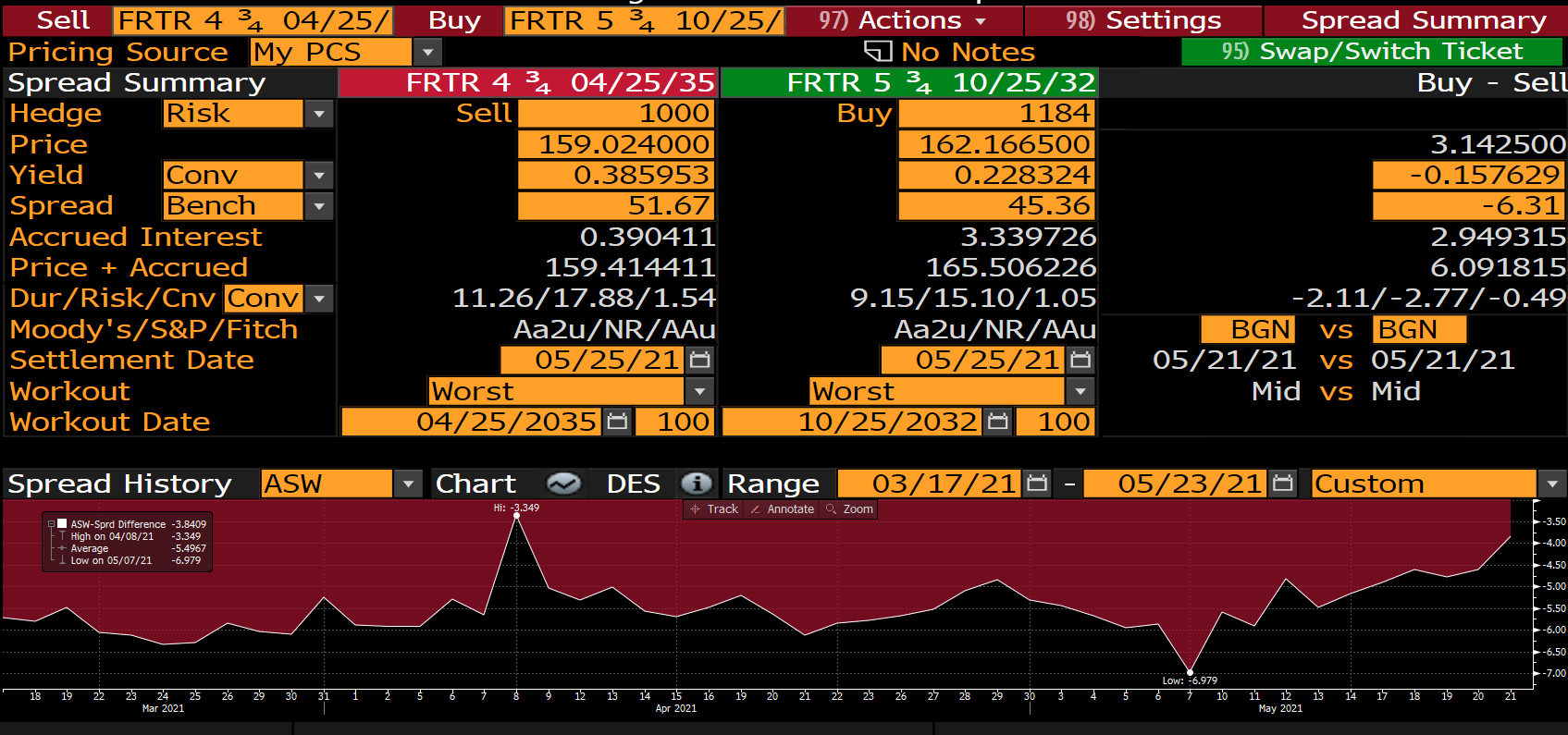

In France – if you think we should see continued spread widening in a possible continued tapering move..

Then the old HC apr35 still look rich and the HC Oct32 have already cheapened to reflect the Frtr Nov31, new cheap 10y…

We see Low Coupon 9yrs as having cheapened too much given the context of the curve – if you feel that Italy could bounce here then this segment should be the Major beneficiary – also like the short in the high coupon Aug34 - - this is also a solid High into low coupon type of risk

Buy Btps Aug30 vs wings….

200 * (yield[BTPS 0.95 08/01/30 Govt]-0.5*yield[BTPS 0.95 09/15/27 Govt]-0.5*yield[BTPS 5 08/01/34 Govt])

Or even Long Aug30 and short old 15yr and Old 5y

(2 * YIELD[BTPS 0.95 08/01/30 Corp] - YIELD[BTPS 1.45 03/01/36 Corp] - YIELD[BTPS 0.35 02/01/25 Corp]) * 100

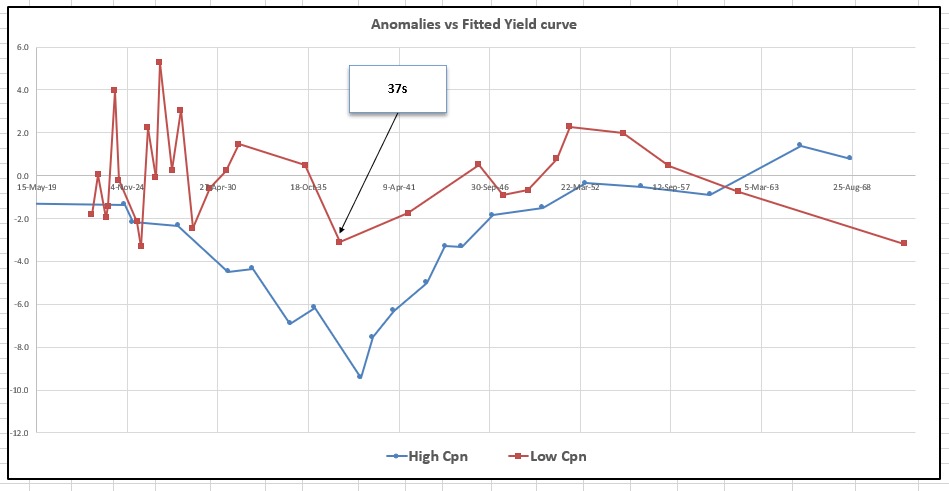

In the UK am seeing a similar feature in old 20yrs UKT 37s – I see they have cheapened a fair bit – but imho – they're not cheap

Ukt 37s vs old 10y and old 30y

(2 * YIELD[UKT 1.75 09/07/37 Corp] - YIELD[UKT 0.625 10/22/50 Corp] - YIELD[UKT 0.375 10/22/30 Corp]) * 100

But vs OIS…

(2 * P2509[UKT 1.75 09/07/37 Corp] - P2509[UKT 0.625 10/22/50 Corp] - P2509[UKT 0.375 10/22/30 Corp])

But as an anomaly vs the fitted curve….

So am guessing that receiving the 20y swap point in Sonia looks good

2 * BPSW20 Curncy - BPSW10 Curncy - BPSW30 Curncy

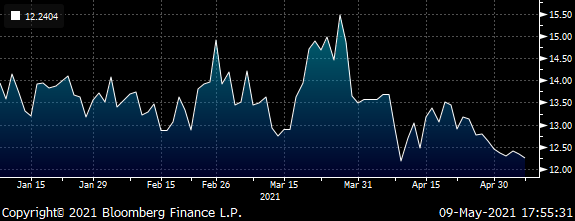

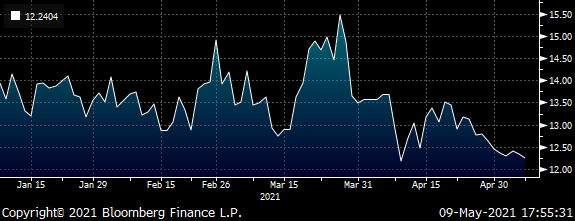

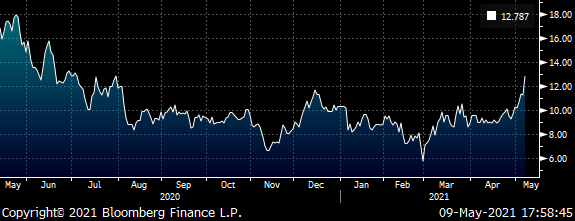

In Germany we have a little squeeze going on in the RXA CTD – I think as the primary means of delta expression there are probably many shorts that are exogenous to Bund RV

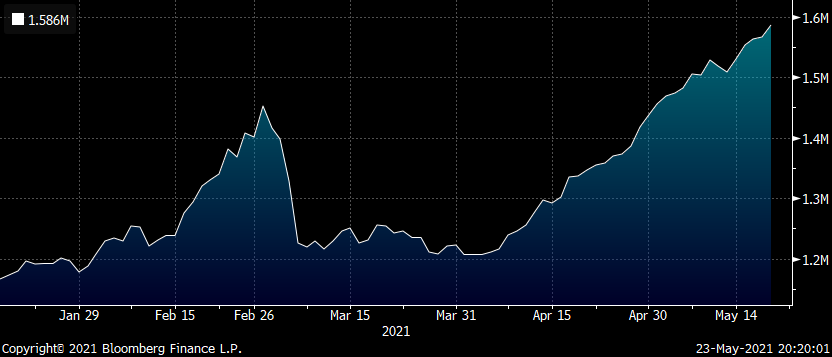

Here's the total combined Open interest of Mar + June + Sep altogether….

It's climbing

PR016[RXM1 Comdty] + PR016[RXH1 Comdty] + PR016[RXU1 Comdty]

So ultimately the trade I wanna mutate into is -Dbr feb30 +Dbr Feb31

Dbr feb30 drop out of the basket, but it seems like there's a squeeze situation developing. My sense is the CTA's rolling the front month will cause it to divorce from the cash market

So my plan is to

1) sell gross basis of CTD vs Front month (downside is it collapses into delivery for a bit of funding cost

2) if futures squeeze versus all cash then we sell our futures and buy the Outgoing 10y (had its last tap this week) and get into this trade at much better levels by dint of the futures leg…

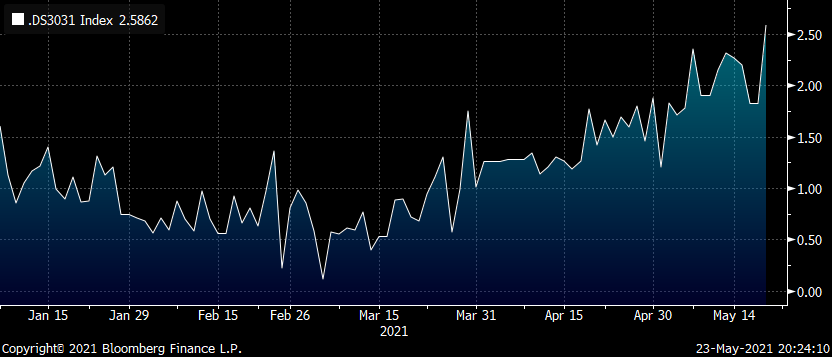

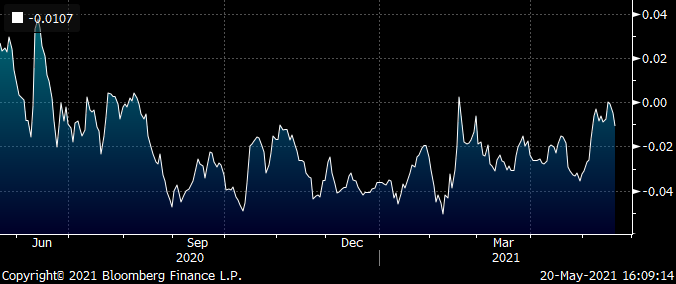

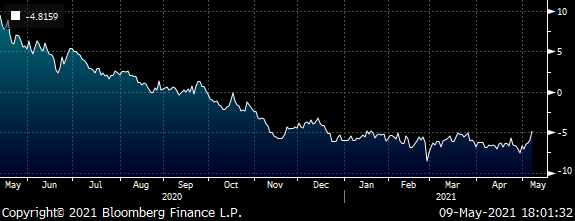

-feb30 +feb31 vs OIS

(P2509[DBR 0 02/15/31 Corp] - P2509[DBR 0 02/15/30 Corp])

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

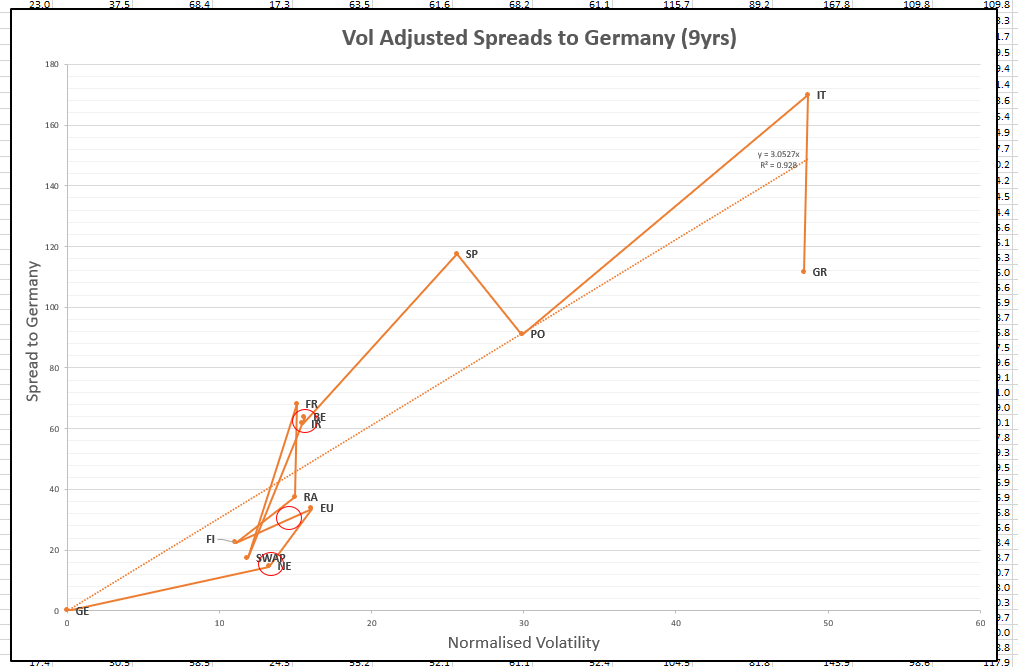

Vol Adjusted swap spreads in Europe

Just updated my sheet – plotting swap spread vs vol

Am looking at -Neth + France in 30yrs s as decent – with no other credit hedge

Same in 9yrs

When I look at Finland on a vol hedged credit fly with France and Germany – I wanna sell it from a value perspective, but looking at history not here – maybe in 3bp time…

1 * (YIELD[RFGB 1.375 04/15/47 Corp] - 0.65 * YIELD[DBR 1.25 08/15/48 Corp] - 0.35 * YIELD[FRTR 0.75 05/25/52 Corp])

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

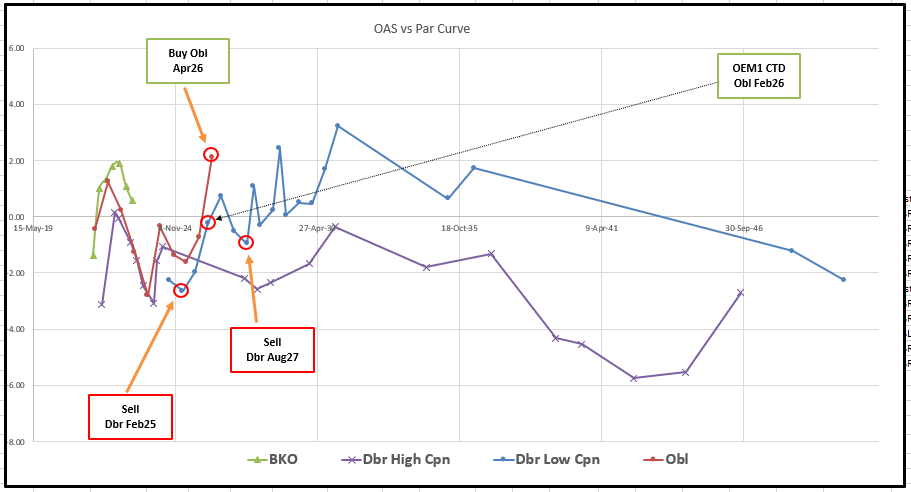

German Obl trade for Delivery

CTAs rolling Bobl shorts could cause squeeze – cheap bonds in the basket will get a boost

Trade

Buy €200MM Obl 0% Apr26 (€100,5k /01)

Sell €129MM Dbr 0.5% Feb25 (€50,1k /01)

Sell €77,2MM 0.5% Dbr Aug27 (€50,4k /01)

Levels

Current: +1.8bp

Enter: +1.5bp (33% risk)

Add: +2.25bp (67% risk)

Graph:

Rationale

- Our Open Interest indicator suggests speculative shorts in the OE contract – (CTD Feb26)

- The CTAs may well roll early and will care less about the RV and want to run their short into back months (CTD Obl Apr26)

- however the Apr26 has already been pushed to cheap on the curve – we feel this is at its limit and could well richen versus the wider curve – in short both front month AND back month will richen in a bobl delivery squeeze

- The OEM1 CTD, Dbr Feb26 bond is a touch cheap to the ‘Fair’ Low Coupon Bund curve – The OEU1 CTD, Obl Apr26 is cheap full stop

- We believe the dynamic could be; OEM1 richens most, followed by Dbr Feb 26 with some basis lag, followed by OBL Apr26. The off the run longer and shorter bonds 4y to 7yrs could get left behind

- Risk-Adjusted, the best way to play any move would be to be long the Apr26 and short the old Feb25 and Aug27

- The Obl Apr26 has its last tap on 2nd June. After which the BUBA will switch to a new Oct26 5yr Bond starting on July 7th

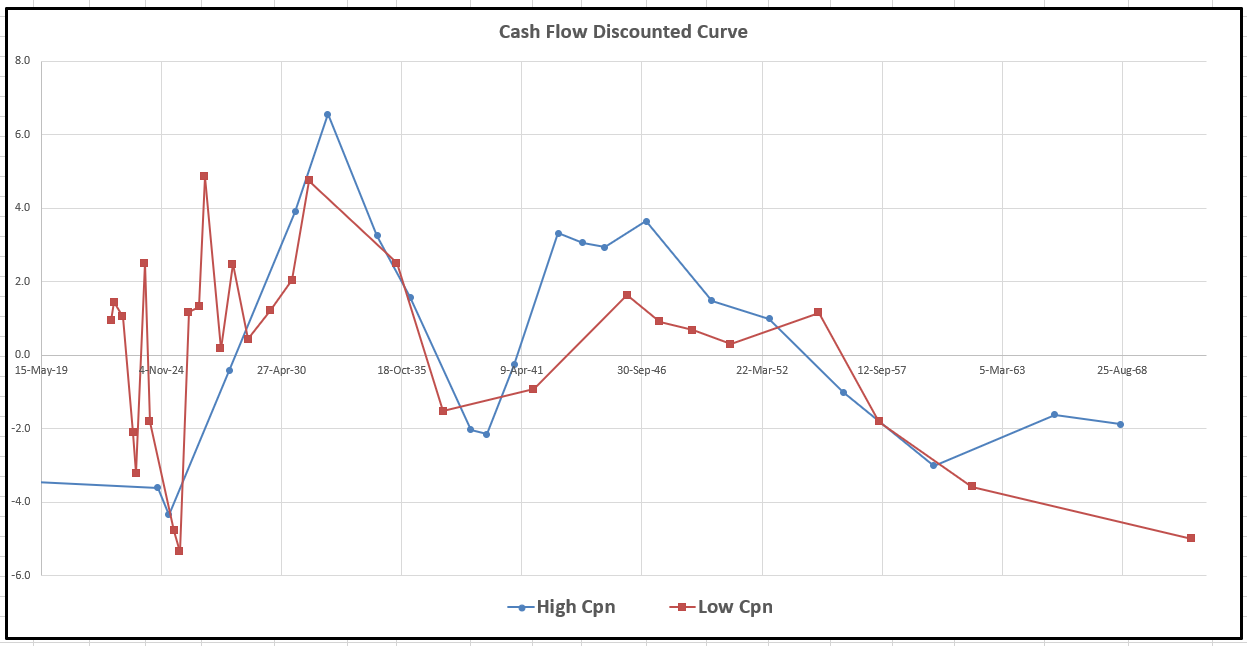

Curve value

– to correctly value bonds on the curve, we discount the cash-flows versus a smooth zero curve. The result gives us the following graph of anomalies

Carry & Roll

Carry: -0.3bp /3mo @-5bp repo spread

Roll: +0.2bp /3mo (not including any resumption zero anomaly value for given issue type: obl/dbr)

Risk

Sharpe Ratio: +0.74 (90 calendar, 65 trading days to be long the belly – so the trade has performed with low var)

Var

Risk Measures:

5th Worst Day over 90 days: 0.6 bp

2.3 times Vol of 2yr of Data: 0.6 bp

1 unit of normalised risk = 0.6bp (for our model portfolio of trades)

Risks

- The Old Dbr 25s and 27s get even richer

- A squeeze in the roll does not impact the off the runs but causes the back month and the apr26 to get even cheaper – see this as unlikely since we see rich/cheap as asymmetrical around fair – bond scan only get ‘so’ cheap but are almost unbounded in how rich they can be

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

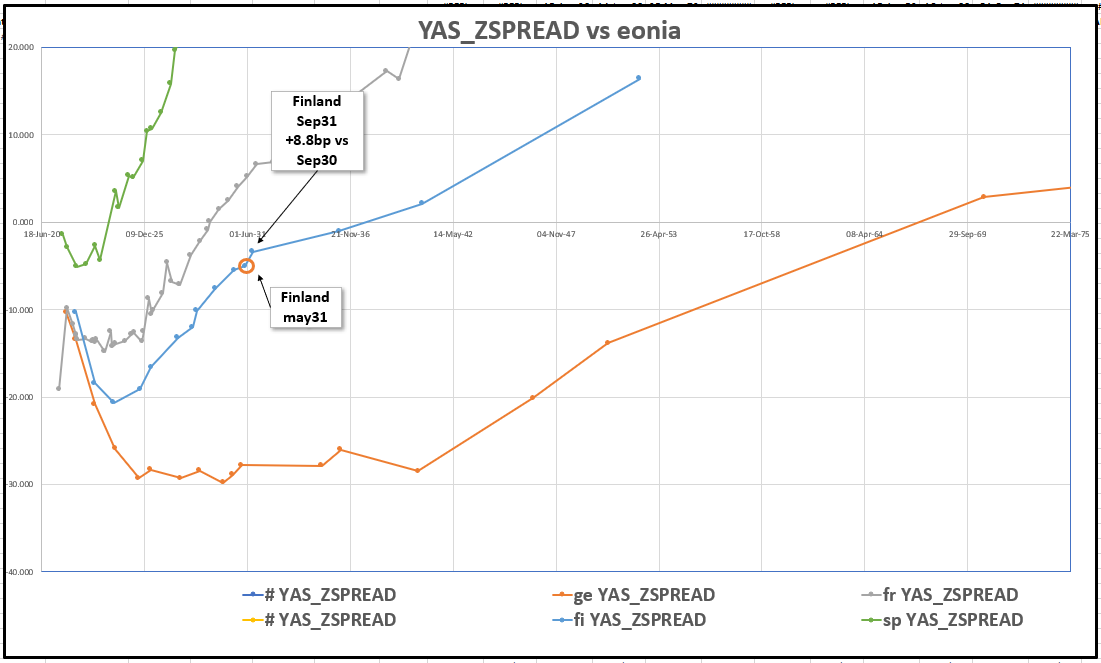

Finland new issue

Finland Sep31 @+8.8bp vs Sep30

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Update on Trades - James & Will @Astor Ridge

Hi

Good to catch up

Trades and Thoughts

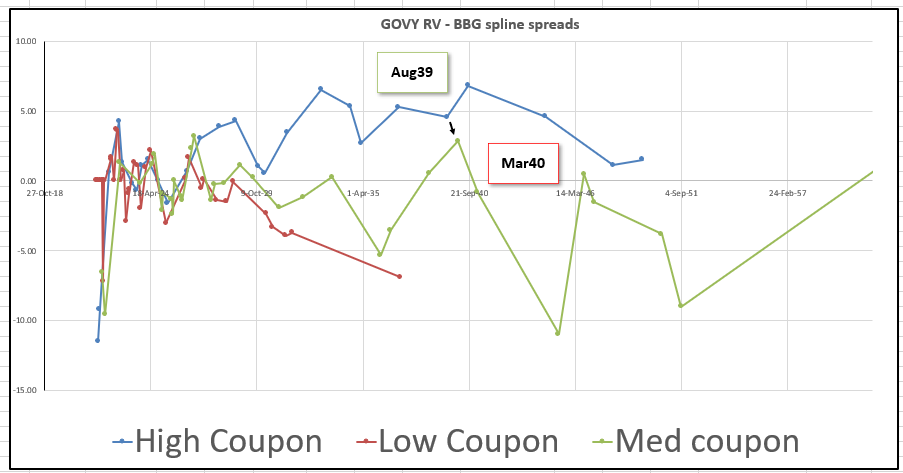

Hi / Lo coupon Italy

This is the OAS spread to the Italian Curve shows us real cash flow Value / anomaly spreads

…. – if we can go High coupon into Medium – Aug39 into Mar40 we're meant to do so - as it's the smallest bp give for the longest time value – approx 20yrs

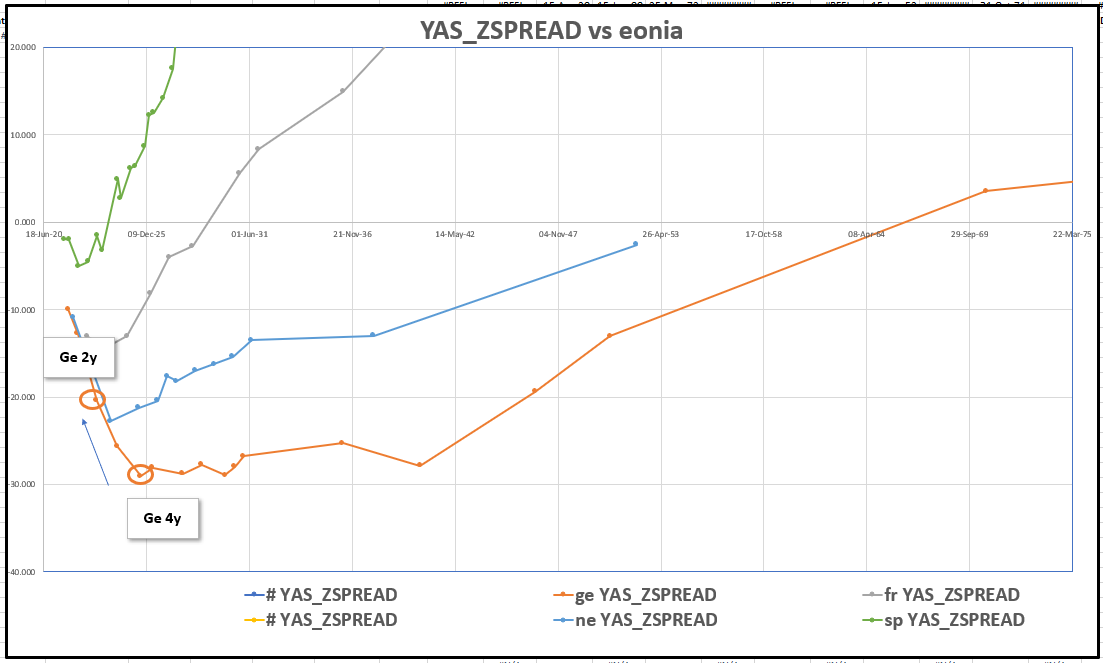

Germany +2y -4y vs OIS/Eonia

Credit – shortening from Be into Finland – should look even better after the new 10y announcement…

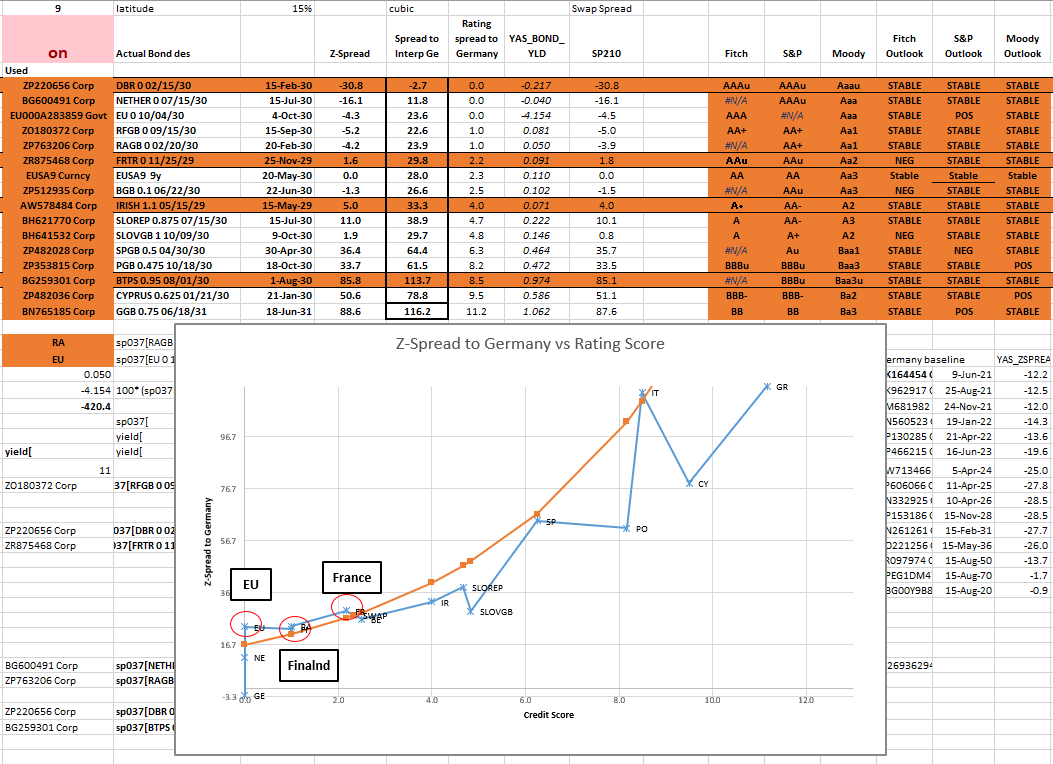

Here's 9 years in Europe…

Belgium into Finland Z-Spread hasn't really moved – but in a widening we see Belgium as a weaker credit – so in the generic Widening of France we thing Belg should have suffered somewhat

(SP037[RFGB 0 09/15/30 Corp] - SP037[BGB 0.1 06/22/30 Corp])

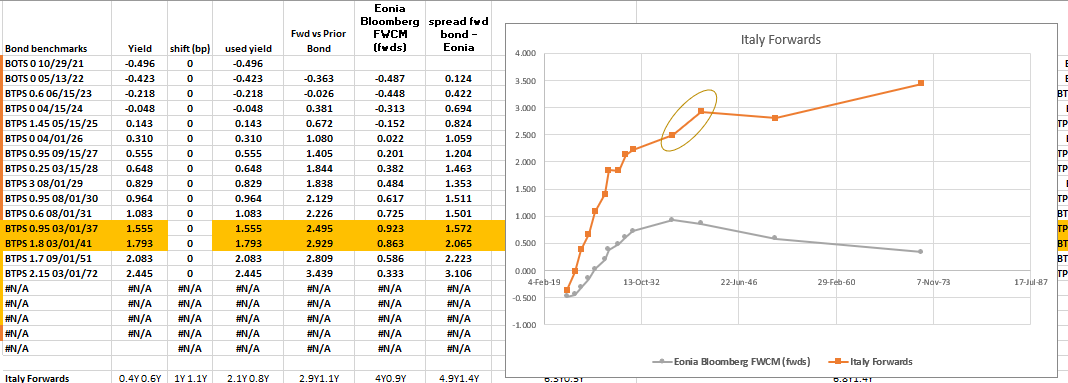

Italy forwards – here's our sheet – and can put any specific bonds in

We see 15s20s as too steep – maybe look at +10y -15y +20y?

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

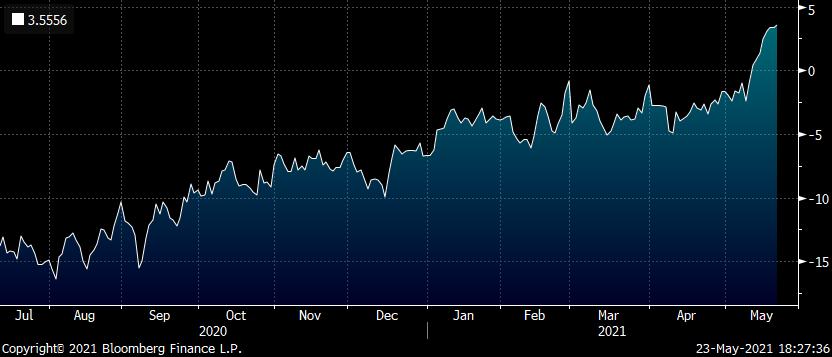

ITALY 50Y vs 30y

Am getting more and more convinced there could be appetite for 50y Italy

Here's 30y20y Italy vs the same fwd in Eonia…

Using BBG Spline fit

Unless we get more PEPP – then I can see how we get a widening in Italy and flattening in the back end as Italy has to finally come back to the market (if PEPP is exhausted)

In my thinking, PEPP will only cover prior transgressions – and won't support on-going fiscal laxity – and as such they have to come to the market like never before – the convexity / low coupon argument of Italian 72s means I'm starting to really like the 50y Italy

Further more in my regression basis (using 67s) it hasn't really moved vs 30y

(YIELD[BTPS 2.8 67 Corp] - 0.904 * YIELD[BTPS 2.45 50 Corp] - 0.41) * 100

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

To Serve

Hi,

Just touching base

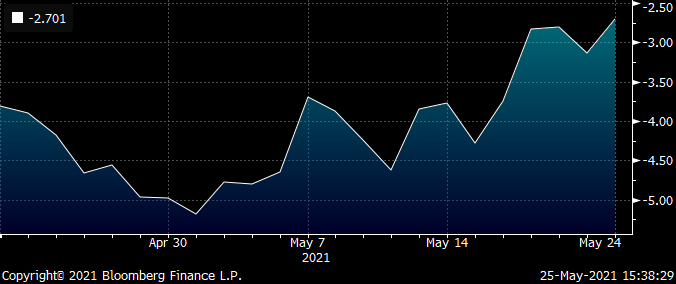

Swap spreads have been hit pretty hard of late… in Germany

(EUSA10 Curncy - RV0002P 10Y BLC Curncy) * 100

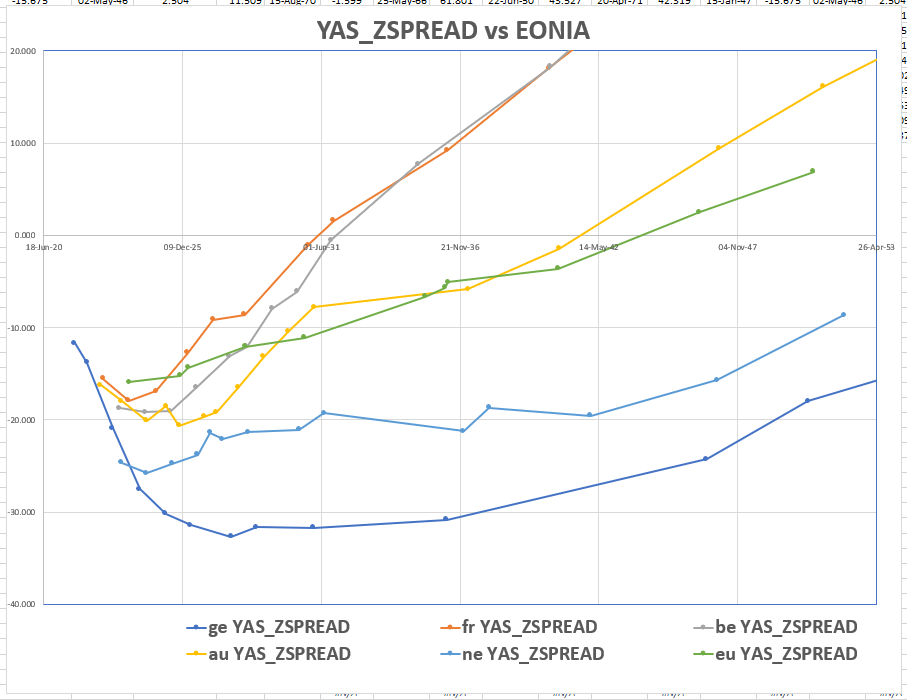

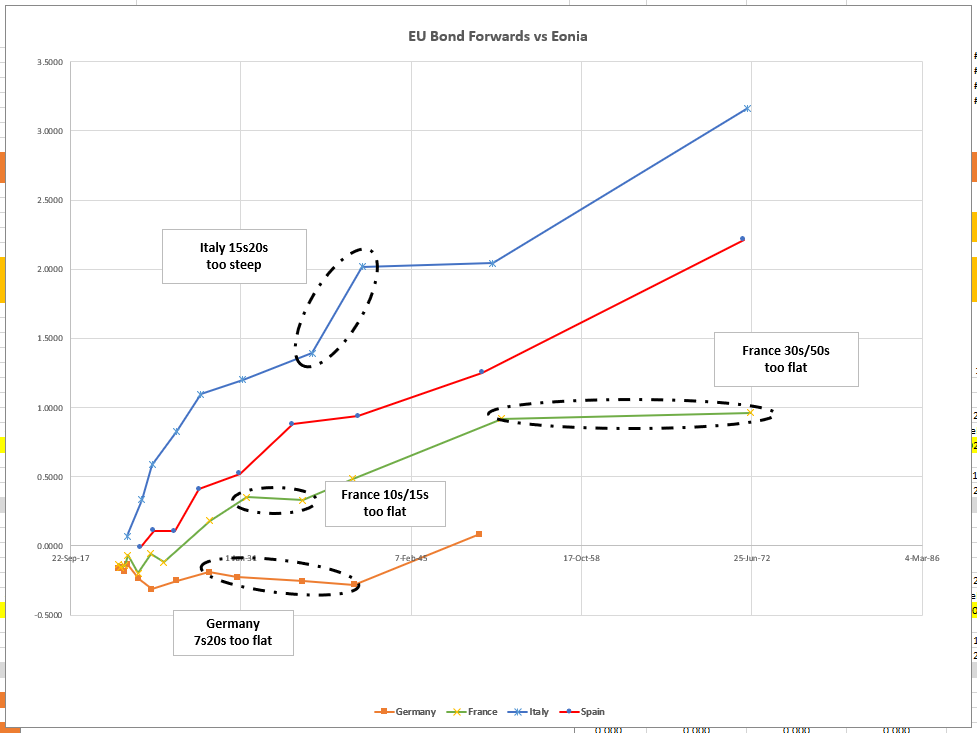

I though it might be handy to re-iterate how forwards in Germany look vs the Eonia curve…

Bond Yields modified to create Par equivalent bonds

What I think happens is that any sense of Taper or just plain higher rates forces bonds to cheapen more than swaps

So spreads narrow to Eonia and 'Bor – but it doesn't stop them being a boundary condition – wherever the Bond curve is steep relative to Swaps

, the forwards will be cheap to Eonia – coupled with the narrowing move then those fwds may be cheap to Eonia

The natural reaction of the market then is to compress rich vs cheap bonds – to cause the on-the-run vs off-the-run spread to reduce

Just a thought – let me know, agree, disagree or meh…

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades and Fades - Euro RV themes

We put together some thoughts on how Z-Spreads work and how we can improve on that analysis

Overview

The thing about banging your head against a wall, is it's lovely when you stop

It's been a super tough few weeks – I feel like I've been fighting the paradigm change. Now I'm starting to think about the obvious trades that jump on the back of the moves we've seen this yr without giving too much away for following the trend

- Equities Bullish in every scenario!!!! – despite disappointing payrolls, equities continue to rally. We think it's time to set some value markers where we start leaning into this one. We are hoping to see truly ridiculous expectations for the path of rates and want the firepower to argue with those. We need to be sure we hedge the directionality though

- CTAs short – Short FI seems to be the growing consensus – doesn't make it wrong but it does make it crowded. CTAs often roll early as they don't like going to delivery – that means front months can richen and back months and/or cash could cheapen – we look how to play that

- Spreads wider – we're thinking about how cheaper outright levels will attract RM buyers of previously unloved segments of the curve – such as 50 yrs

- Bond Curves steep vs Swaps – as Credit and risk-free bond curves out-steepen the Eonia curve, we go looking for value in boundary conditions

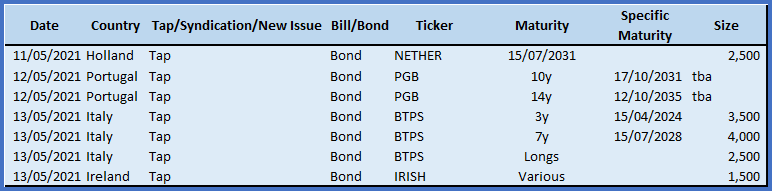

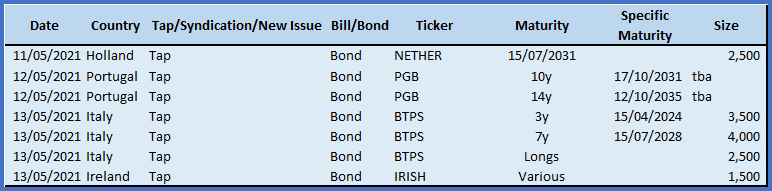

Supply

· Plus possibly new RFGB 10y, DBR Green 30y and (seems unlikely) BTP 30y tap. I say unlikely just because we have long end schedule already next week, but the sizes announced Monday will give us a better idea of the odds.

· Note the Italy should be a new 7y (tbc Monday) after the 3/28 was tapped via syndication

Fades

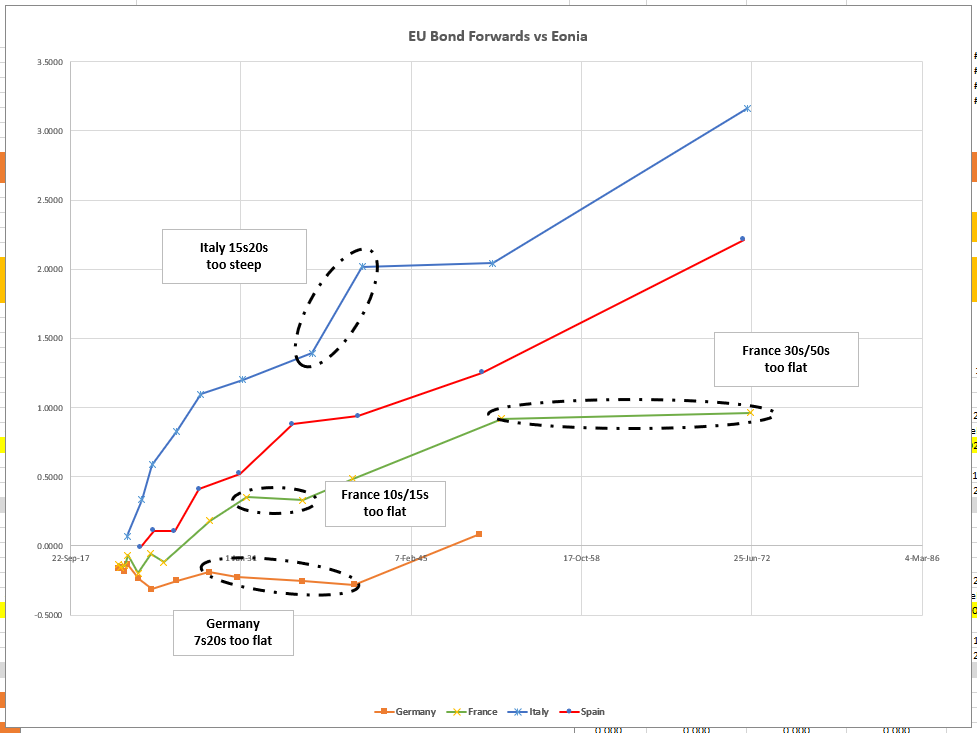

Consider relative Forward Rates vs Eonia in the Major European curves…

This guides us to our main Fades at the moment

Graph of: BOND Forwards NOT yields – so it tells us points where the curve slope is wrong….

1.

Despite the curve steepening recently – we think this one keeps flattening – barring an issuance 'blip' – it just looks wrong and with the ik/rx spead widening – any increase in credit fears could flatten the back end

(P2509[BTPS 3.1 03/01/40 Corp] - P2509[BTPS 2.25 09/01/36 Corp])

P2509 = OIS

2.

(p2509[FRTR 0.5 05/25/72 Govt] - p2509[FRTR 0.75 05/25/52 Govt])*100

3.

French 10s15s too flat – there's a very good reason this one has been blown out of the water – we think it keeps going…

(P2509[FRTR 1.25 05/25/36 Corp] - P2509[FRTR 2.5 05/25/30 Corp])

4.

German 7s20s too flat – I like this one – its got a bit of tapering in it – as the 20years are high coupon – but to me the high coupons stop being bought when they get rich – but of course – rich isn't when Z-Spread says so – it's when Cash-flow discounting says so – love to run through this one with you

(p2509[DBR 3.25 07/04/42 Govt] - p2509[DBR 0 02/15/30 Govt])

For choice – given the robust nature of stocks and the nature that rates will be kept on hold for longer – then my conclusion is they go up harder, faster later. So I like the steepeners and they have only just started their move

Z-Spreads

I'll be honest I got really tired of looking at the markets in terms of yield curve and Z-Spread and running into trades that didn't turn. What's more, even using something like Z-Spread, we seem to still get caught in negative carry trades.

Gimme a couple of seconds and I'll try explain what I'm thinking…

Z-spread basically adds a spread to the swap curve to figure out the 'average spread' of a bond's cashflows over its life time. In that way, we think we've factored in coupon and the appropriate rate for all the cash flows. That's true but only to some degree..

Here's the rub…

when we look at these credit issuers, even France or Germany the Z-spread isn't constant over tenor

Italian Z-spreads are :

47bps in 5yrs

79bps in 10yrs

&

143bps in 30yrs

So really we shouldn't be valuing all the cashflows in a 30yr at the average of 143bps vs OIS

We should value the front cashflows closer to 47bps,

Then, if we do that, the 5 to 10y cashflows need to be valued at even higher spreads than 79bps and so on, so that the whole thing balances out

Why? How wrong is it? Does it matter?

If your book feels like a graveyard of poor location and negative carry think about this…

Why is this deficient vs using Z-Spread? We're just adding a spread, right? That's fine, we're just shifting the curve?

Well, the real issue comes when the swap curve and the bond curve are different slopes. It's more important when we compare Italy or France vs Eonia or UK Gilt curve vs Sonia. We are assuming that the slope of the swap curve must be the same as that in the bond curve – plus some spread. And you know what? It just ain't so…

So what we might need is a forward Z-Spread curve for the whole tenor range – a set of Z-spreads applicable for every cashflow, not an average from now to a certain point

But just how is wrong is our current analysis ? And how do we fix it?

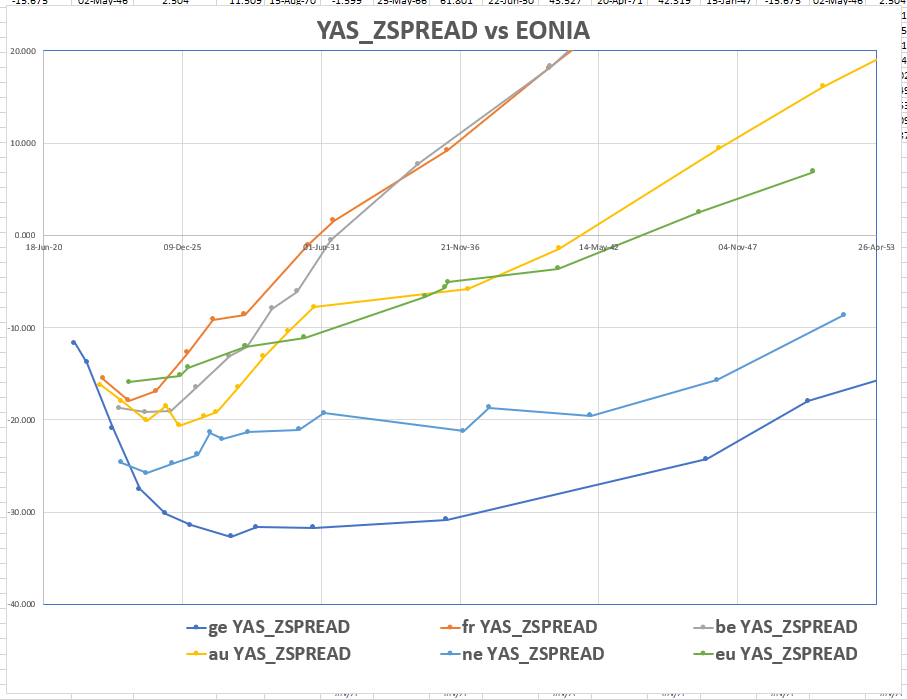

So here's how we went to look at things right now – we draw a graph of the Z-Spreads of Various European Government Bond Curves

With an assortment of High and Low coupons in the benchmarks, we're told by the mathematicians that we have fully adjusted for the coupon differences – but in reality only in so far that we have added a z-spread to the curve to make the PV of each bond equal to the market price. But we're making the assumption of a broad shift of the average spread, over the lifetime of a bond gives us a complete picture of the bond's value in the context of other issues

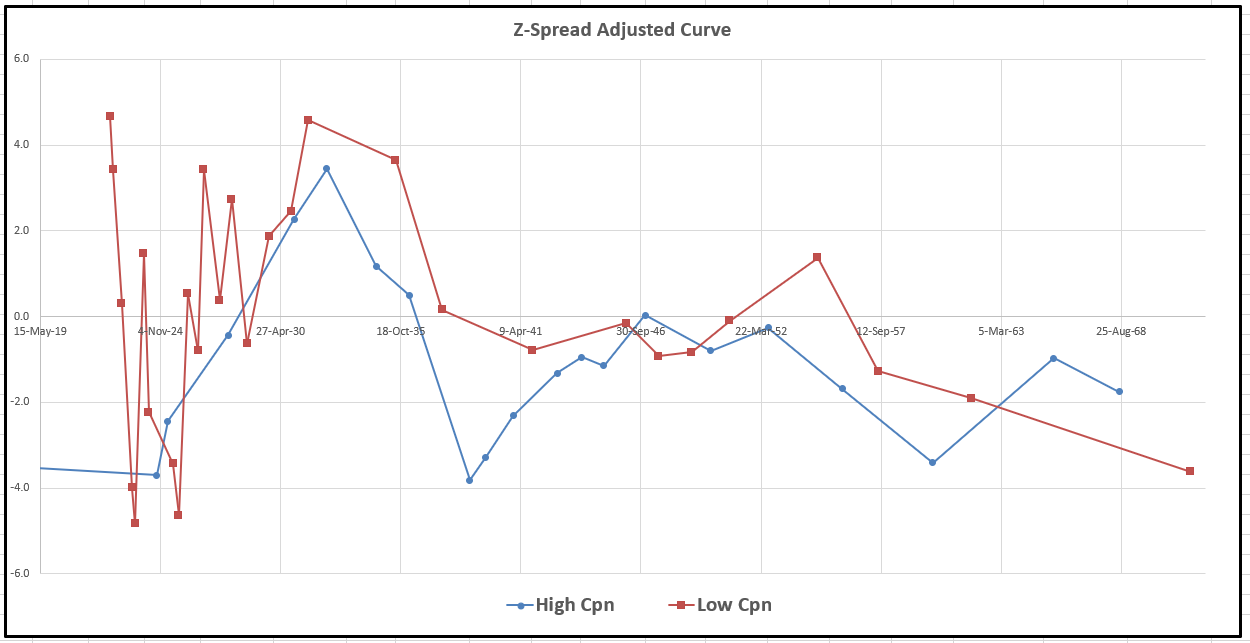

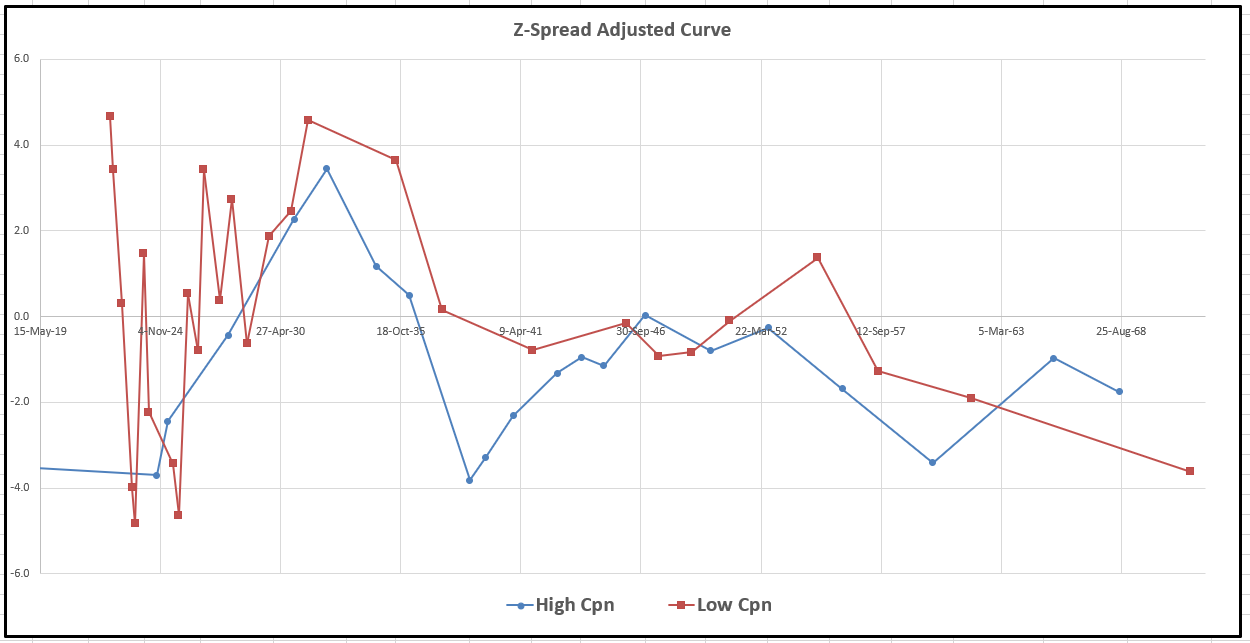

If we were to fit a Smooth Curve to these values (kind of removing the generic swap curve shape) and looked at the anomaly values vs this curve, we'd get something like this for the UK Curve

Graph 1 - Bond Anomalies using Z-Spread

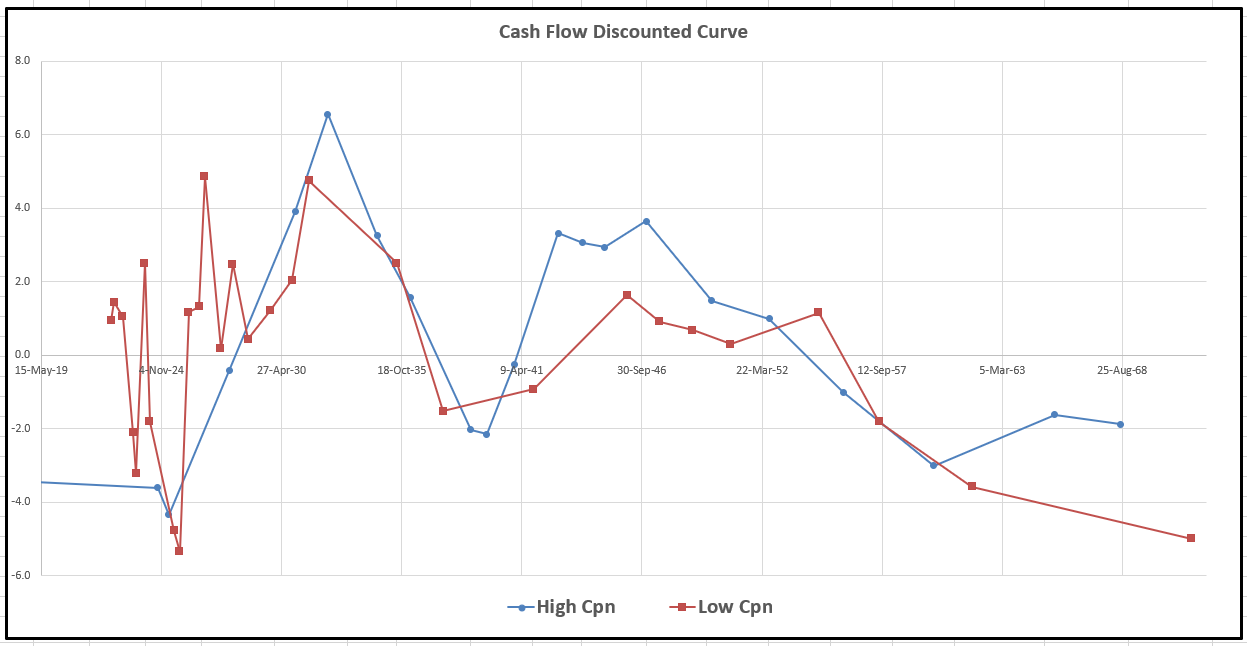

But in reality if we use a different Z-Spread for each tenor and cashflow for each bond we are using a much more accurate value of each cashflow in the context of the curve and the value of bonds is different

Graph 2 – bond Anomalies using Cash Flow discounting

~Let me know if you'd like me to highlight some of these bonds or indeed other curves

This is a subtle but very different description of Bond RV

For example

- a lot of the high coupons in the 15y - 20y are no richer than the low coupons

- the 32s are a very cheap bond – the excess slope of Bonds vs Sonia is the only way to truly reveal that

- the mid high coupon 25yrs have real value

We believe that this method is a much better indicator of Rich/Cheap and stops the casual observer falling into the crowded trades. It helps explain some of the more puzzling, persistent anomalies – and this is essential in picking RV trades that have long term real value as a tailwind as well as the optical value offered up by simply looking at yields and Z-spreads

We want to use this to help the process of issue selection and give the trades the highest chance of reversal

So what we need is a forward Z-Spread curve for the whole tenor range – a set of Z-spreads applicable for every cashflow, not an average from now to a certain point

Luckily this is none other than:

- deriving a smooth zero curve

- PV all the cashflows of each bond at the appropriate rate

- Comparing the Market price to the theoretical (expressed as BP Rich/Cheap)

There is a trick here to derive this which we can happily run through with you

"Does it matter? I mean, this only counts if you hold the bonds to maturity, right?"

Not sure what to say about that comment other than, if you think that's true then why even look at yield!!!

Of course it matters – RV is about entry, exit and carry. And your exit depends on the next guy's valuation and so on – until ultimately all valuations project far into the distance in assessing value. And if this is a better metric of value then ultimately we have to reference it

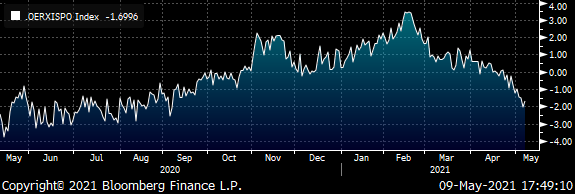

Bond and Swap curves are changing relative shape a lot at the moment – check out oe/rx vs Eonia…

This issue is becoming more significant as the curves change shape at different rates

RXAISPO Comdty - OEAISPO Comdty

So please forgive us, if we try to find trades that make sense in both spheres of reference. It's just that we observe too many people fighting the intrinsic value of a bond vs its neighbors by relying solely on Z-Spread

Best

Will & James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades & Fades - James & Will

Overview

The thing about banging your head against a wall, is it's lovely when you stop

It's been a super tough few weeks – I feel like I've been fighting the paradigm change. Now am starting top think about the obvious trades that jump on the back of the moves we've seen this yr without giving too much away for following the trend

- Equities Bullish in every scenario!!!! – despite disappointing payrolls, equities continue to rally. We think it's time to set some value markers where we start leaning into this one. We are hoping to see truly ridiculous expectations for the path of rates and want the firepower to argue with those. We need to be sure we hedge the directionality though

- CTAs short – Short FI seems to be the growing consensus – doesn't make it wrong but it does make it crowded. CTAs often roll early as they don't like going to delivery – that means front months can richen and back months and/or cash could cheapen – we look how to play that

- Spreads wider – we're thinking about how cheaper outright levels will attract RM buyers of previously unloved segments of the curve – such as 50 yrs

- Bond Curves steep vs Swaps – as Credit and risk-free bond curves out-steepen the Eonia curve, we go looking for value in boundary conditions

Supply

· Plus possibly new RFGB 10y, DBR Green 30y and (seems unlikely) BTP 30y tap. I say unlikely just because we have long end schedule already next week, but the sizes announced Monday will give us a better idea of the odds.

· Note the Italy should be a new 7y (tbc Monday) after the 3/28 was tapped via syndication

Z-Spreads

I'll be honest I got really tired of looking at the markets in terms of yield curve and Z-Spread and running into trades that didn't turn. What's more, even using something like Z-Spread, we seem to still get caught in negative carry trades.

Gimme a couple of seconds and I'll try explain what I'm thinking…

Z-spread basically adds a spread to the swap curve to figure out the 'average spread' of a bond's cashflows over its life time. In that way, we think we've factored in coupon and the appropriate rate for all the cash flows. That's true but only to some degree..

Here's the rub…

when we look at these credit issuers, even France or Germany the Z-spread isn't constant over tenor

Italian Z-spreads are :

47bps in 5yrs

79bps in 10yrs

&

143bps in 30yrs

So really we shouldn't be valuing all the cashflows in a 30yr at the average of 143bps vs OIS

We should value the front cashflows closer to 47bps,

Then

if we do that, the 5 to 10y cashflows need to be valued at even higher spreads than 79bps and so on, so that the whole thing balances out

Why? How wrong is it? Does it matter?

If your book feels like a graveyard of poor location and negative carry think about this…

Why is this deficient vs using Z-Spread? We're just adding a spread, right? That's fine, we're just shifting the curve?

Well, the real issue comes when the swap curve and the bond curve are different slopes. It's more important when we compare Italy or France vs Eonia or UK Gilt curve vs Sonia. We are assuming that the slope of the swap curve must be the same as that in the bond curve – plus some spread. And you know what? It just ain't so…

So what we might need is a forward Z-Spread curve for the whole tenor range – a set of Z-spreads applicable for every cashflow, not an average from now to a certain point

But just how is wrong is our current analysis ? And how do we fix it?

So here's how we went to look at things right now – we draw a graph of the Z-Spreads of Various European Government Bond Curves

With an assortment of High and Low coupons in the benchmarks, we're told by the mathematicians that we have fully adjusted for the coupon differences – but in reality only in so far that we have added a z-spread to the curve to make the PV of each bond equal to the market price. But we're making the assumption of a broad shift of the average spread, over the lifetime of a bond gives us a complete picture of the bond's value in the context of other issues

If we were to fit a Smooth Curve to these values (kind of removing the generic swap curve shape) and looked at the anomaly values vs this curve, we'd get something like this for the UK Curve

But in reality if we use a different Z-Spread for each tenor and cashflow for each bond we are using a much more accurate value of each cashflow in the context of the curve and the value of bonds is different

This is a subtle but very different description of Bond RV

We believe that this is a much better indicator of Rich/Cheap and stops the casual observer falling into the crowded trades. It helps explain some of the more puzzling persistent anomalies– and this is essential in picking RV trades that have long term real value as a tailwind as well as the optical value offered up by simply looking at yields and Z-spreads

We want to use this to help the process of issue selection and give the trades the highest chance of reversal

So what we might need is a forward Z-Spread curve for the whole tenor range – a set of Z-spreads applicable for every cashflow, not an average from now to a certain point

Luckily this is none other than:

- deriving a smooth zero curve

- PV all the cashflows of each bond at the appropriate rate

- Comparing the Market price to the theoretical (expressed as BP Rich/Cheap)

Bond and Swap curves are changing relative shape al lot at the moment – check out oe/rx vs Eonia…

This issue is becoming more significant as the curves change shape at different rates

RXAISPO Comdty - OEAISPO Comdty

So please forgive us, if we try to find trades that make sense in both spheres of reference. It's just that we seen too many people fighting the intrinsic value of a bond vs its neighbors by relying solely on Z-Spread

Fades

Consider relative Forward Rates vs Eonia in the Major European curves…

This guides us to our main Fades at the moment

1.

Despite the curve steepening recently – we think this one keeps flattening – barring an issuance 'blip' – it just looks wrong and as with the ik/rx spead widening – any increase in credit fears could flatten the back end

(P2509[BTPS 3.1 03/01/40 Corp] - P2509[BTPS 2.25 09/01/36 Corp])

P2509 = OIS

2.

(p2509[FRTR 0.5 05/25/72 Govt] - p2509[FRTR 0.75 05/25/52 Govt])*100

3.

French 10s15s too flat – there's a very good reason this one has been blown out of the water – we think it keeps going…

(P2509[FRTR 1.25 05/25/36 Corp] - P2509[FRTR 2.5 05/25/30 Corp])

4.

German 7s20s too flat – I like this one – its got a bit of tapering in it – as the 20years are high coupon – but to me the high coupons stop being bought when they get rich – but of course – rich isn't when Z-Spread says so – it's when Cash-flow discounting says so – love to run through this one with you

(p2509[DBR 3.25 07/04/42 Govt] - p2509[DBR 0 02/15/30 Govt])

For choice – given the robust nature of stocks and the nature that rates will be kept on hold for longer – then my conclusion is they go up harder, faster later. So I like the steepeners and they have only just started their move

Best

Will & James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796