More... Trades & Fades - Will & James @ Astor Ridge

Overview

- On the Street – house views on the street are bearish –

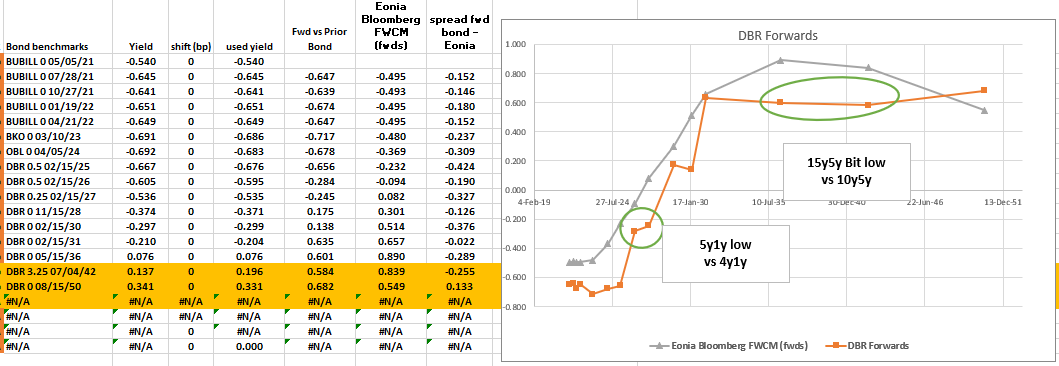

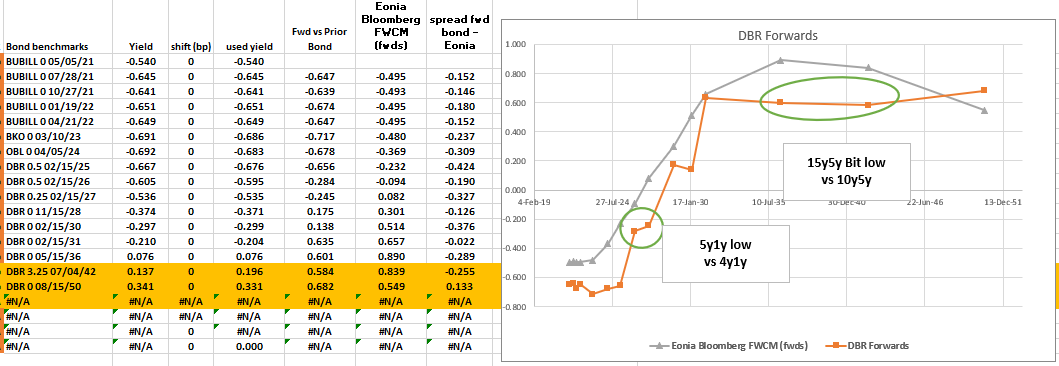

Am on the hunt for parts of the curve that don't reflect a re-growth – so quite simply the shortest toners I can find, where the risk-free rate declines rather than rises

- Actually found it quite hard to find forward rate steepeners that didn't relay on crossing the boundary between tradeable, curve representative issue and anomalous bonds

- Long OEM1, Short Dbr Feb25 and Dbr Feb27

I just want to be long the Bobl Contract (Ctd - dbr Feb26). Though I like the back month too the CTD is an old Dbr which I like to accumulate

In RV space the old Dbr Feb25 can only roll cheaper imho and the likewise the old Dbr feb27 should cheapen…

History is pretty dull – but that's good – just wait patiently in the weeds and work an order to sell the basis on the two wings @ > +0.3bp with a view to this having its move end of May

Entry: -0.25bp

Target: -2bp for mid-June

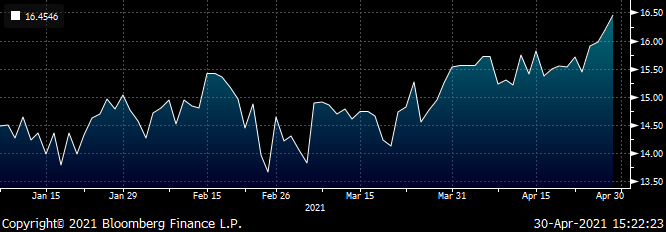

Here's what happened last time

OEZ0 / OEH1 / OEM1

200 * (YIELD[BK306463 Corp] - 0.5 * YIELD[DBR 1 08/15/25 Corp] - 0.5 * YIELD[DBR 0.5 02/15/26 Corp])

March17th just after OEH1 expired, the outgoing CTD reached its richest level

In that case it was an OBL (original Maturity 5y)

We're expecting the same behaviour as short pressure from CTA's is no longer present, that Dbr Feb26 reached their Zenith in Mid-June – see green bit of the graph…

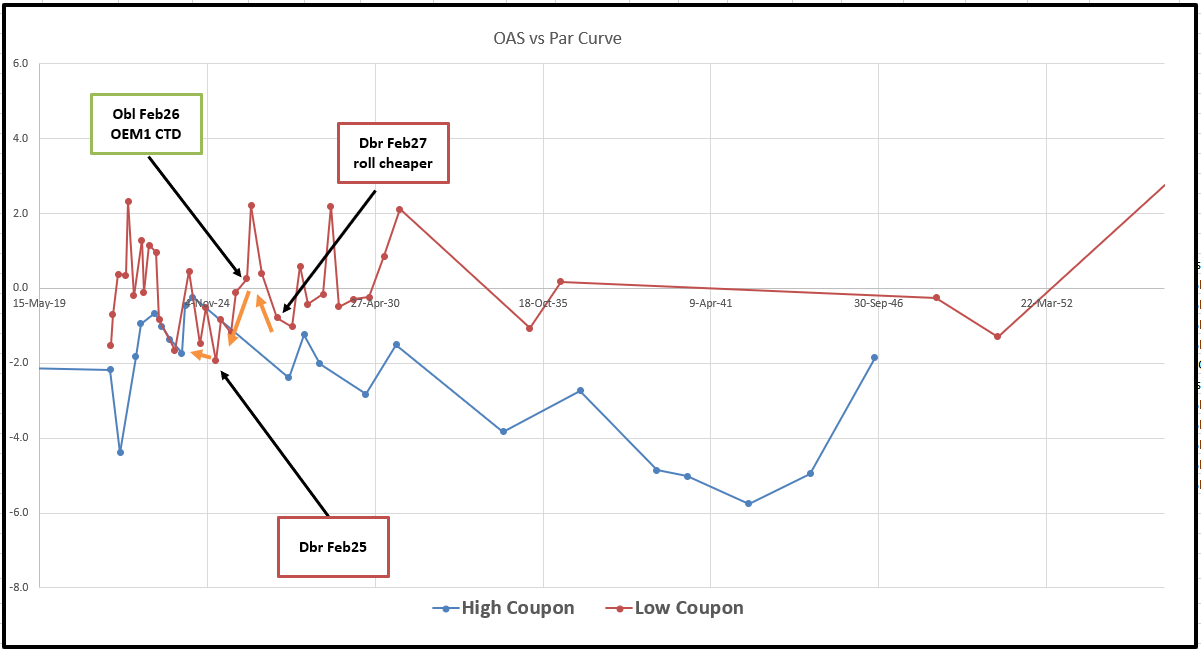

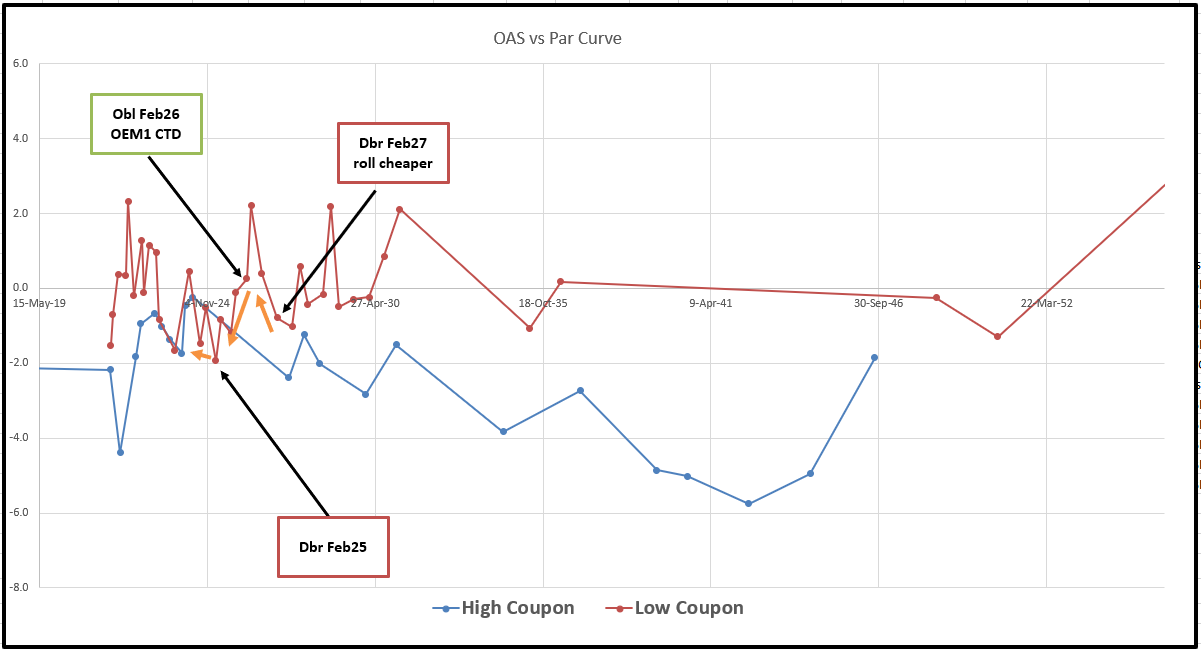

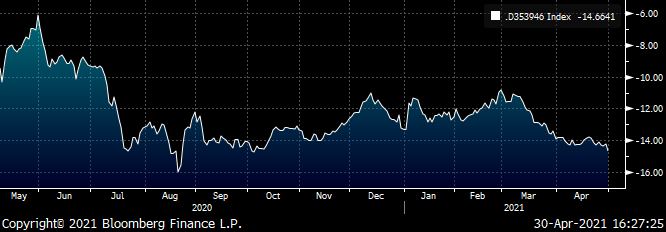

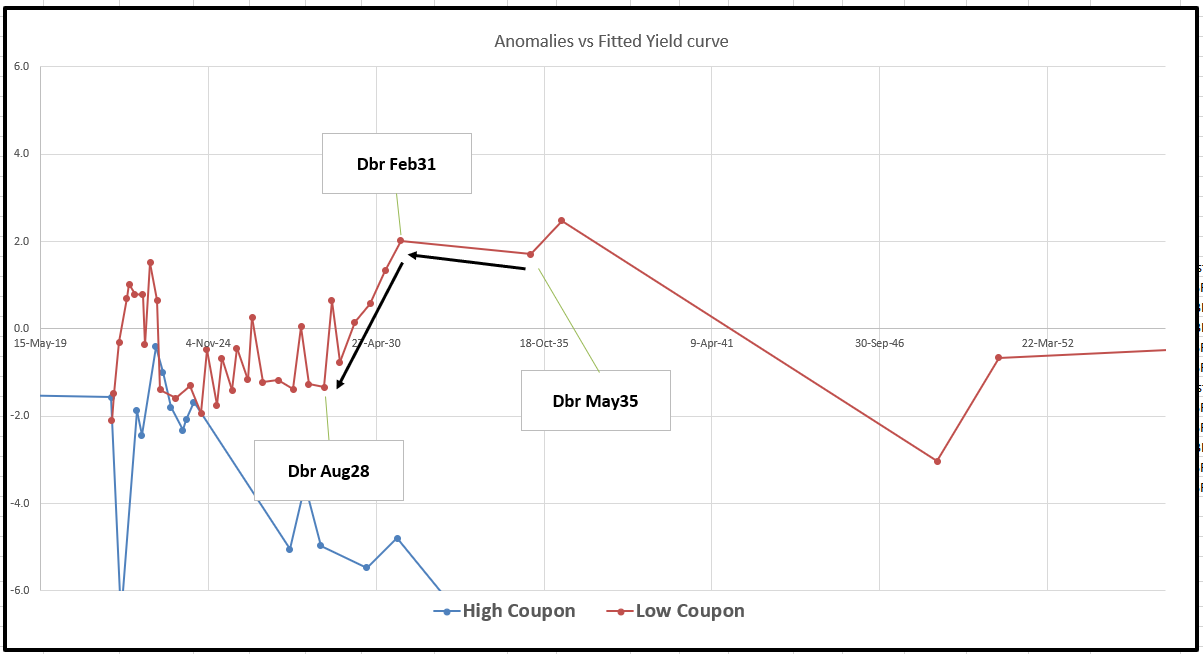

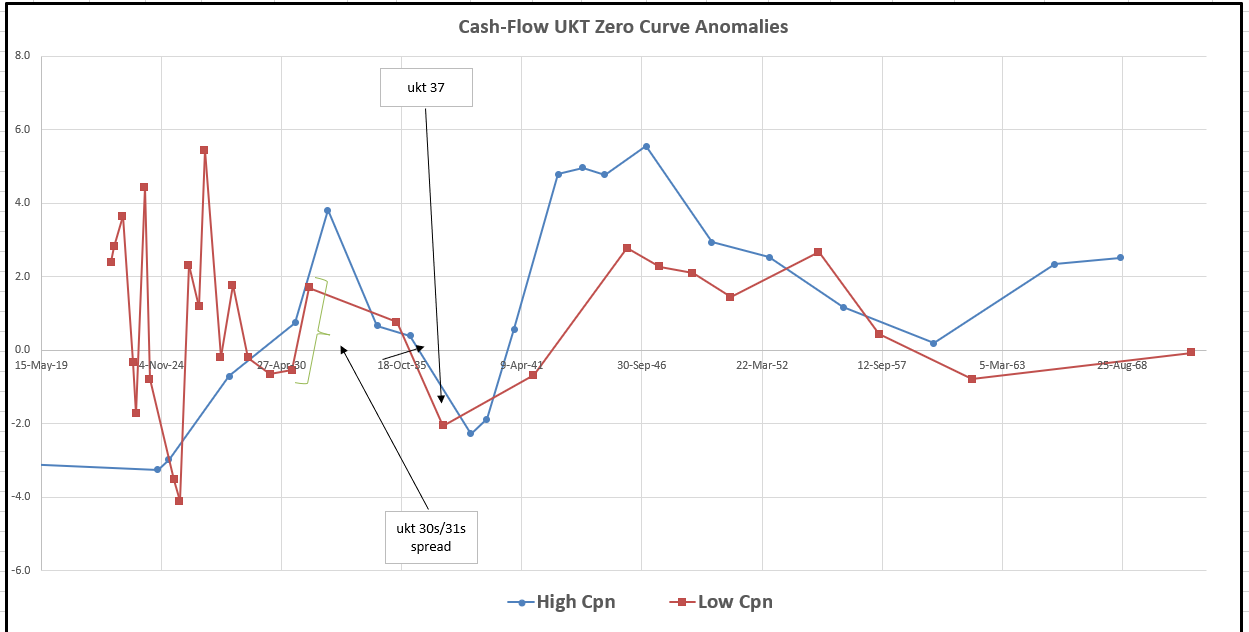

- Here's an old favourite of ours – it seems the High coupons rattle from rich to cheap with the Street struggling to contend with the RV as they run from one side of the ship to the other

Sell Dbr 4.25% Jul39

Buy Dbr 0% 35

Buy Dbr 2.5% 46 (UBA CTD)

Levels

Current: -14.5bp

Enter: Am actually holding off for -15bp for my first piece

Add: -18bp

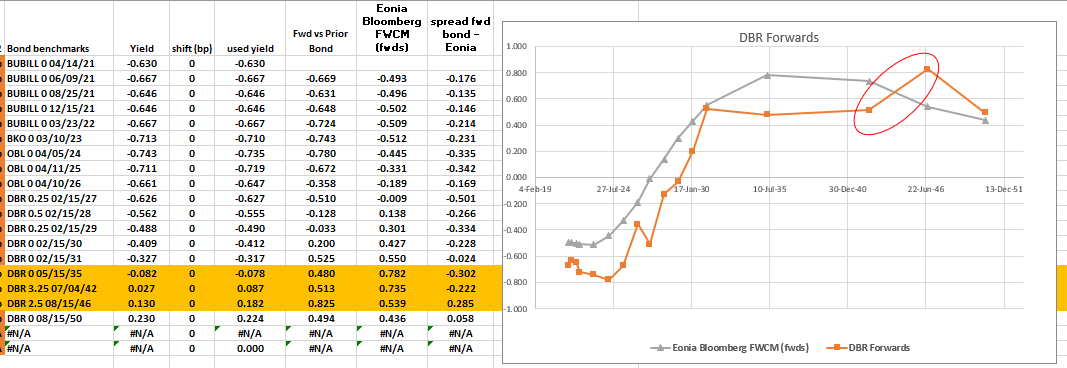

I don't use history to establish my entry/exit levels – (we use that to tells us our risk and our probability stats) – but my greed on the levels is based on how the forwards curve looks right now, which is a function of both the absolute level and the slope of the yield curve around these points

Rationale

- 35s not a tap bond, serve as an anchor

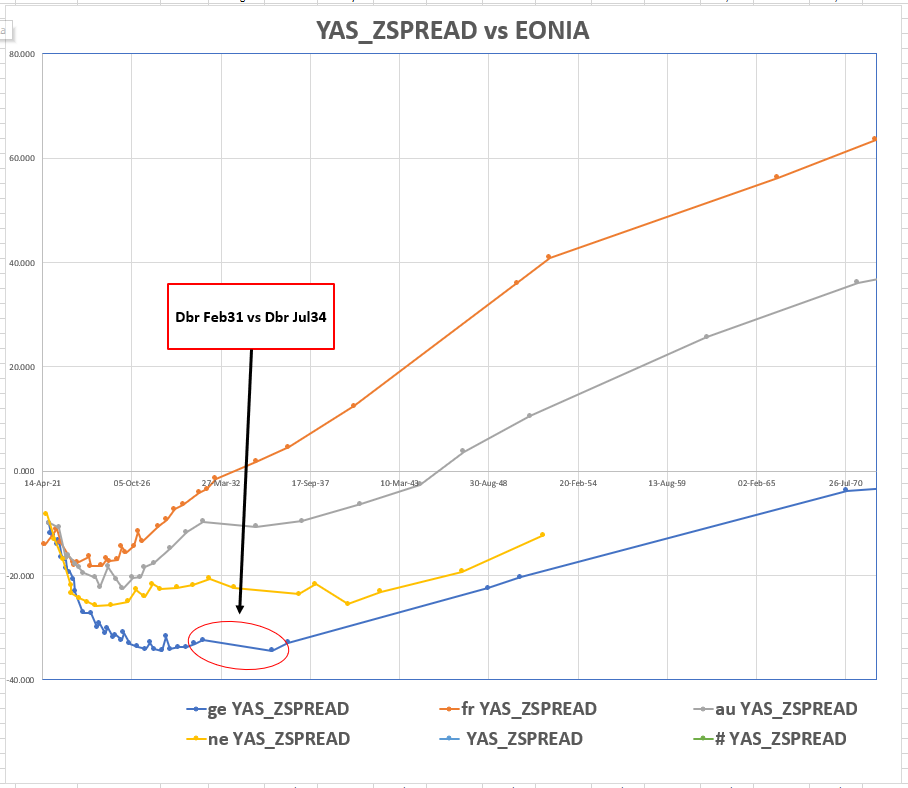

- 39s – German High coupons are about the only truly rich high coupons in Europe. I recreated the Maths to strip all European bonds down to their cash flows versus the cashflows – you'd be surprised at how wrong Z spread feels as a means for valuing high/Low coupons – or better still for knowing when to hold and when to fold – gimme a holler if you'd like a run through on that

- 46s – nice and liquid yet relatively high coupon – I still expect that when they drop out of the basket, the PEPP will start buying more – they may have been cautious not to disrupt the float while contract CTD. The drop out is Jun/Sep next yr

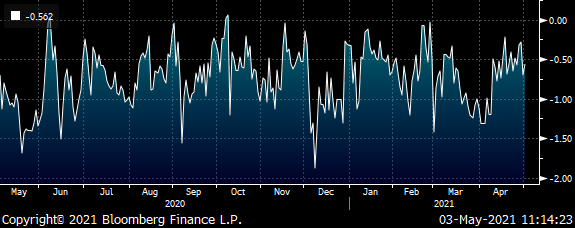

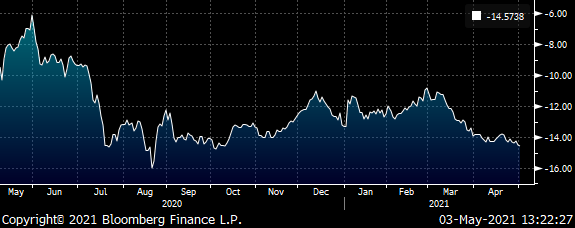

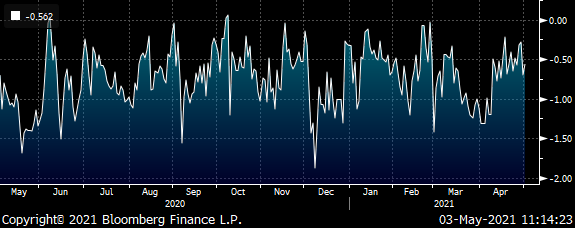

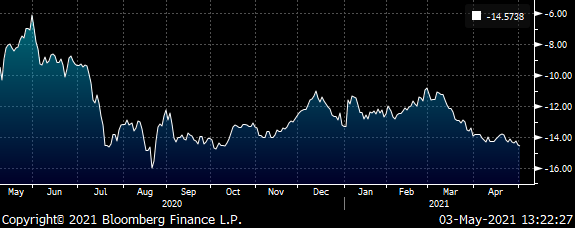

BBG history

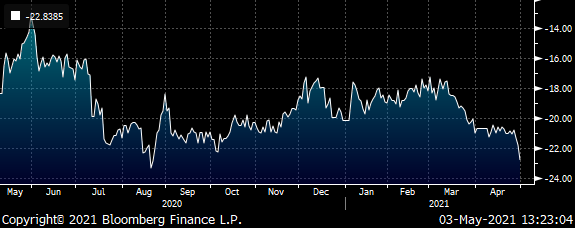

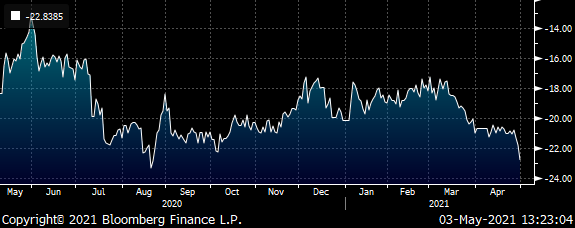

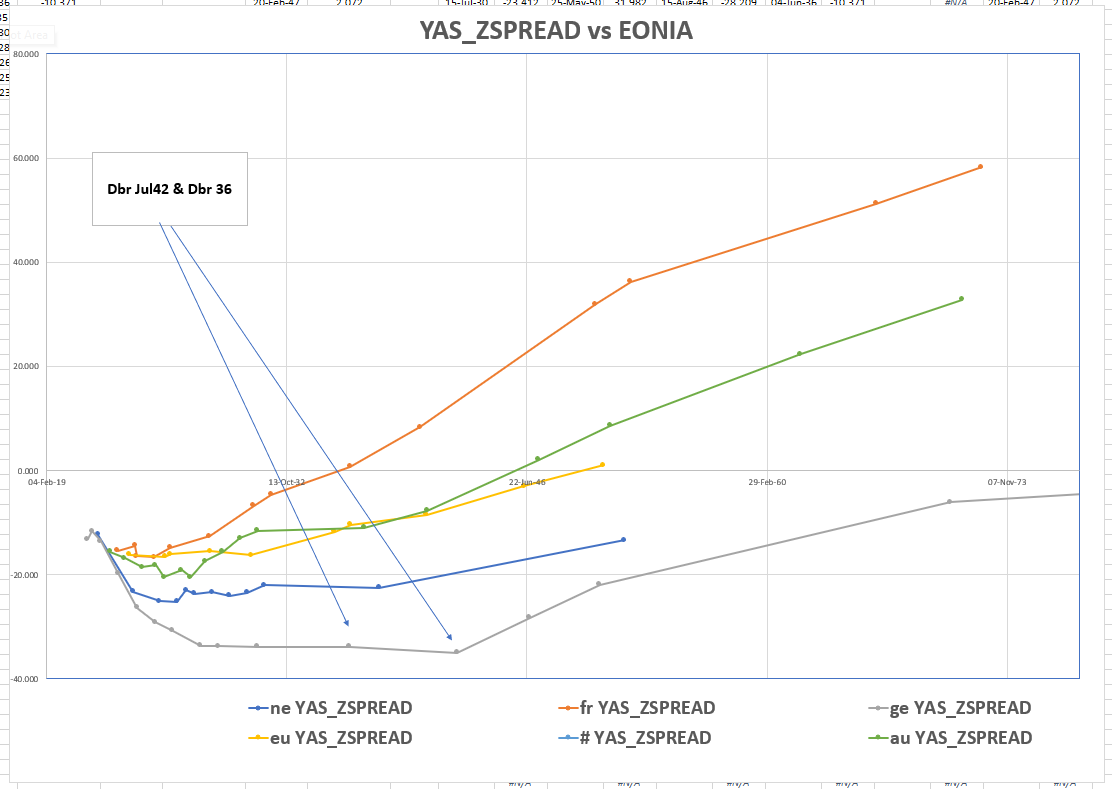

BBG history on OIS – jut to show it has edge vs the same structure in swaps

Bearish Structures

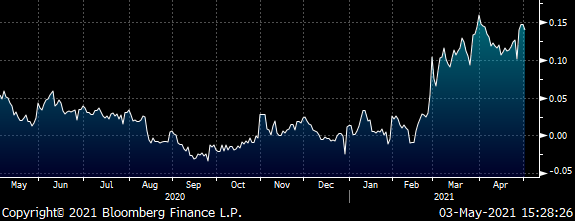

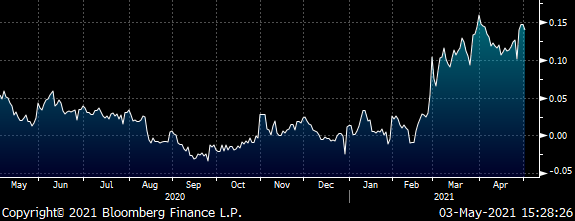

In trying to find a bearish structure I wanna find a steep curve that rolls over (flattens) too quickly. If the Fed or Yellen think inflation isn't a problem, then I want to receive forwards that roll from the very top of the curve. Similarly as per Powell's comments last year about the 'average' of inflation being a more precise definition of the target – then I see a Policy Committee prepared to kick the can down the road… let Inflation repair the damage to economy of Covid but ultimately having to respond with hikes later and stronger – so to me that mean forwards should really be upward sloping much further out the curve than we are used to.

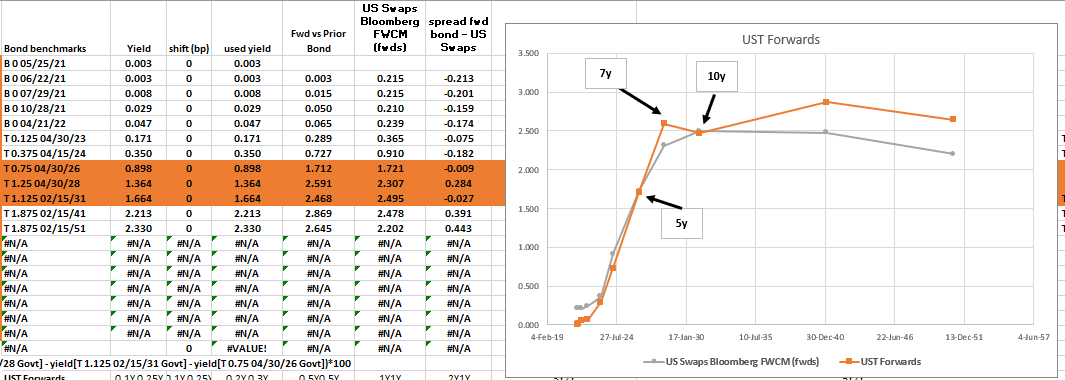

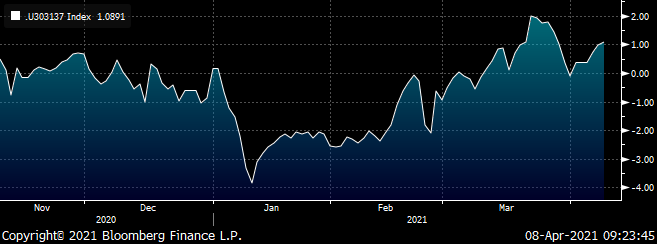

In the US, a decent representation is the 5y2y which is higher than the 7y3y – this is just an overly informed expectation to rates as a function of supply rather than a probable outcome

In bond space that's buying the 7y vs selling 5y and 10y

Trade UST

Receive 7y

Pay 5y and 10y

Levels

Enter: +14bp (100% risk here)

Target: < +8bp

2 * GT7 Govt - GT5 Govt - GT10 Govt

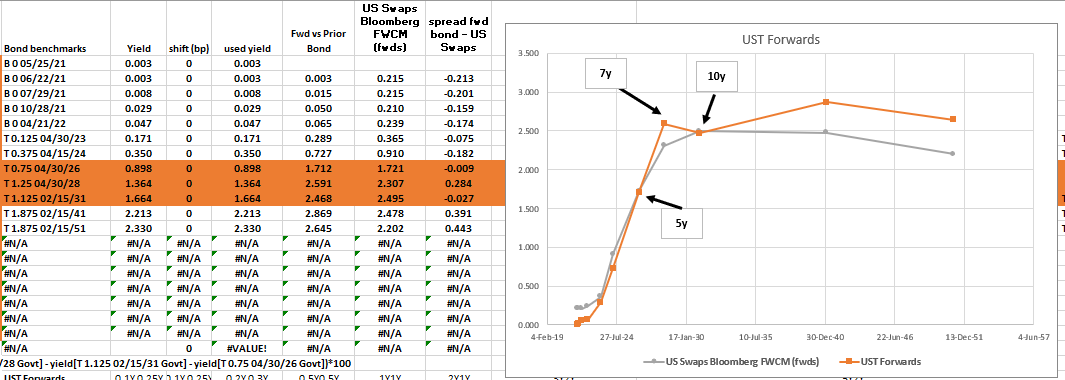

Here's how US bond specific forwards look

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

More... Trades & Fades - Will & James @ Astor Ridge

Overview

- On the Street – house views on the street are bearish –

Am on the hunt for parts of the curve that don't reflect a re-growth – so quite simply the shortest toners I can find, where the risk-free rate declines rather than rises

- Actually found it quite hard to find forward rate steepeners that didn't relay on crossing the boundary between tradeable, curve representative issue and anomalous bonds

- Long OEM1, Short Dbr Feb25 and Dbr Feb27

I just want to be long the Bobl Contract (Ctd - dbr Feb26). Though I like the back month too the CTD is an old Dbr which I like to accumulate

In RV space the old Dbr Feb25 can only roll cheaper imho and the likewise the old Dbr feb27 should cheapen…

History is pretty dull – but that's good – just wait patiently in the weeds and work an order to sell the basis on the two wings @ > +0.3bp with a view to this having its move end of May

Entry: -0.25bp

Target: -2bp for mid-June

Here's what happened last time

OEZ0 / OEH1 / OEM1

200 * (YIELD[BK306463 Corp] - 0.5 * YIELD[DBR 1 08/15/25 Corp] - 0.5 * YIELD[DBR 0.5 02/15/26 Corp])

March17th just after OEH1 expired, the outgoing CTD reached its richest level

In that case it was an OBL (original Maturity 5y)

We're expecting the same behaviour as short pressure from CTA's is no longer present, that Dbr Feb26 reached their Zenith in Mid-June – see green bit of the graph…

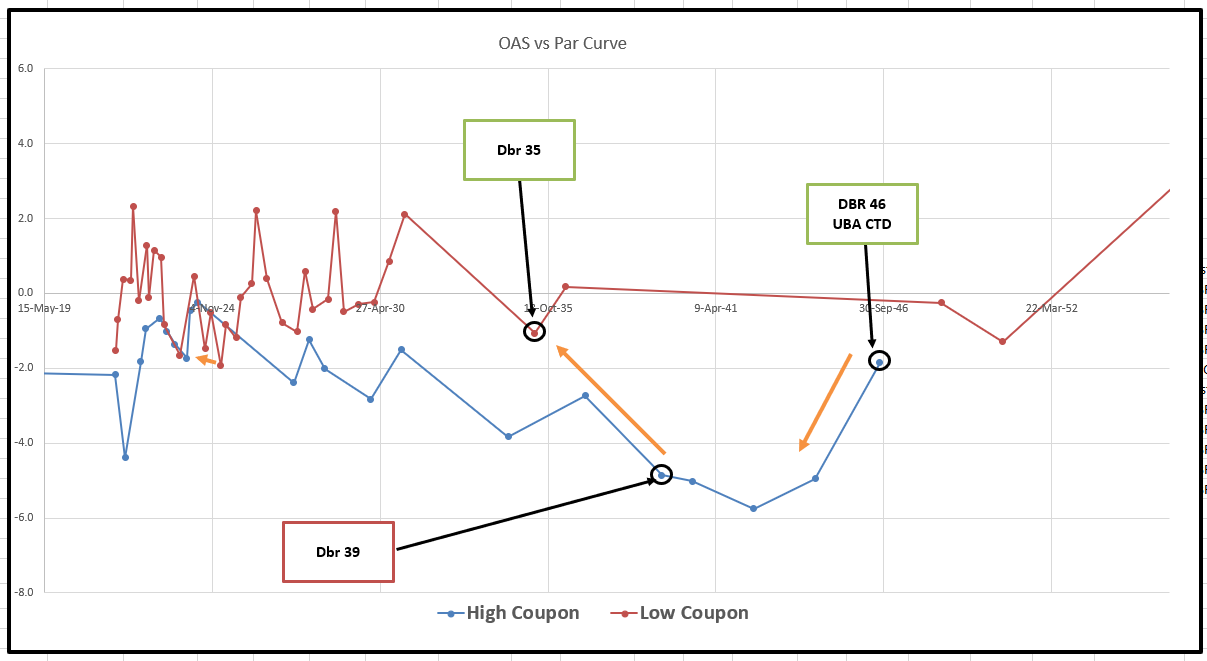

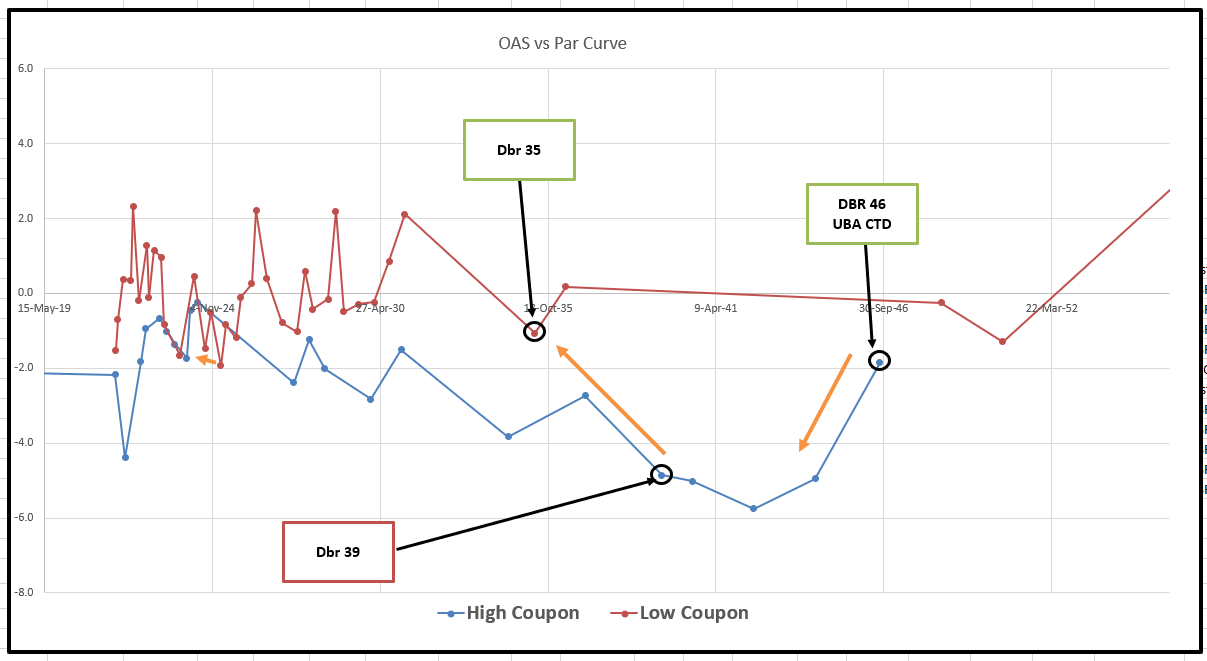

- Here's an old favourite of ours – it seems the High coupons rattle from rich to cheap with the Street struggling to contend with the RV as they run from one side of the ship to the other

Sell Dbr 4.25% Jul39

Buy Dbr 0% 35

Buy Dbr 2.5% 46 (UBA CTD)

Levels

Current: -14.5bp

Enter: Am actually holding off for -15bp for my first piece

Add: -18bp

I don't use history to establish my entry/exit levels – (we use that to tells us our risk and our probability stats) – but my greed on the levels is based on how the forwards curve looks right now, which is a function of both the absolute level and the slope of the yield curve around these points

Rationale

- 35s not a tap bond, serve as an anchor

- 39s – German High coupons are about the only truly rich high coupons in Europe. I recreated the Maths to strip all European bonds down to their cash flows versus the cashflows – you'd be surprised at how wrong Z spread feels as a means for valuing high/Low coupons – or better still for knowing when to hold and when to fold – gimme a holler if you'd like a run through on that

- 46s – nice and liquid yet relatively high coupon – I still expect that when they drop out of the basket, the PEPP will start buying more – they may have been cautious not to disrupt the float while contract CTD. The drop out is Jun/Sep next yr

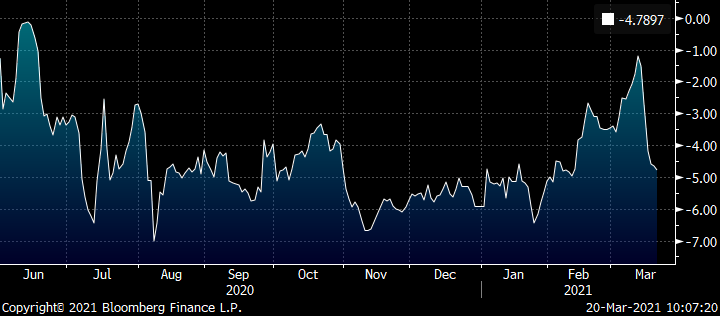

BBG history

BBG history on OIS – jut to show it has edge vs the same structure in swaps

Bearish Structures

In trying to find a bearish structure I wanna find a steep curve that rolls over (flattens) too quickly. If the Fed or Yellen think inflation isn't a problem, then I want to receive forwards that roll from the very top of the curve. Similarly as per Powell's comments last year about the 'average' of inflation being a more precise definition of the target – then I see a Policy Committee prepared to kick the can down the road… let Inflation repair the damage to economy of Covid but ultimately having to respond with hikes later and stronger – so to me that mean forwards should really be upward sloping much further out the curve than we are used to.

In the US, a decent representation is the 5y2y which is higher than the 7y3y – this is just an overly informed expectation to rates as a function of supply rather than a probable outcome

In bond space that's buying the 7y vs selling 5y and 10y

Trade UST

Receive 7y

Pay 5y and 10y

Levels

Enter: +14bp (100% risk here)

Target: < +8bp

2 * GT7 Govt - GT5 Govt - GT10 Govt

Here's how US bond specific forwards look

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades & Fades, Will & James @Astor Ridge

Overview

- Consensus is Bearish (Higher Rates)

This is a strong consensus - We saw the exact reverse of this in January when the same strategists were calling for lower rates forever! Don’t mind a tactical long here?...

- Some thoughts towards Tapering – although not discussed at the ECB meeting

- Base Case is curve should be steep – we look for forward rate steepeners where that’s not priced in

- ECB can’t control longer dated spreads and curve without PEPP increase

Our feeling is that QE bonds are sustained by the rate at which they are drained less so by the absolute amount – like an addict chasing ever higher highs, some of these rich bonds are unsustainable once the music stops

- Semi-Core Bonds start to converge in credit terms around the 2y & 3y point.

At slightly longer tenors the credit differentials offer roll opportunities.

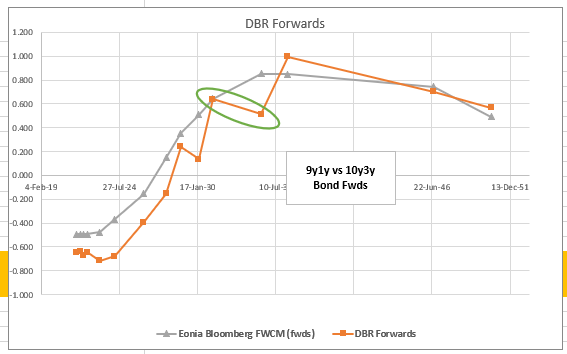

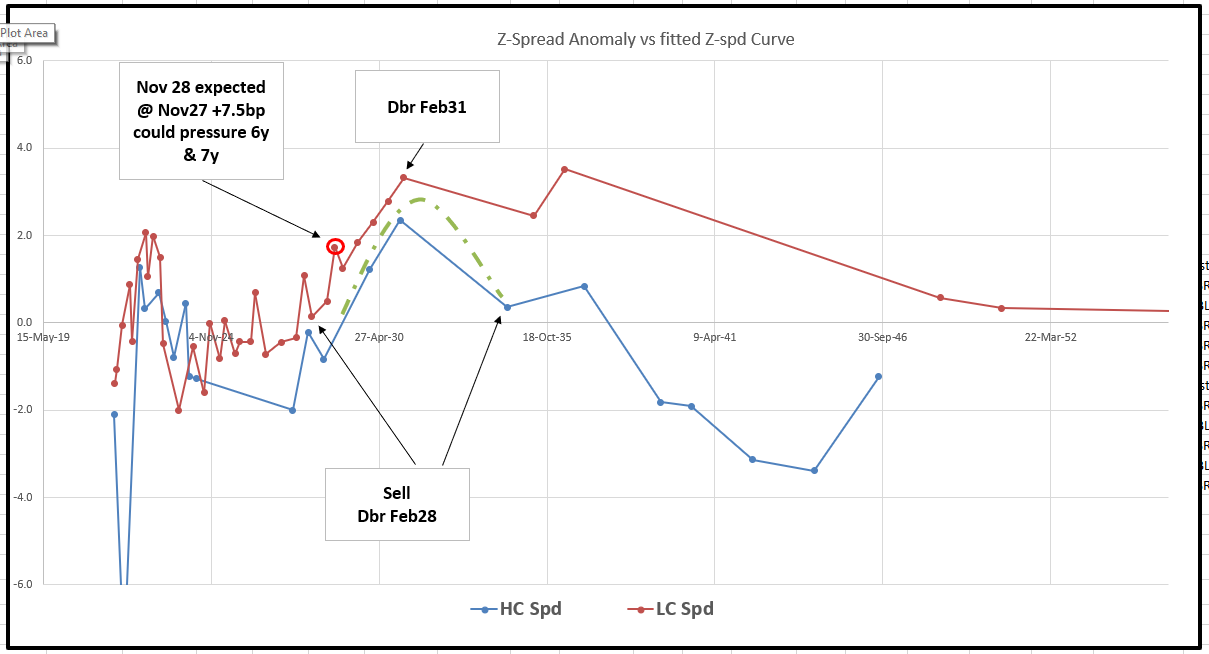

Trade – German 10s 13s steepener vs swaps

Sell HC Dbr 4.75% 7/34

Buy Dbr 0% Feb31

VS OIS

Trade: +11.5bp

Target:

History

Curve View

Rationale

- On most forms of analysis the 10y points looks oversold vs shorter and longer tenors (curve fit, forward rates, relative OIS spreads)

- In the context of the rest of Europe this trade feels like it should be steeper given that longer tenors experience more directionality

- Although there’s a notion that PEPP could buy more of the high coupon in a sell-off there are loose boundary conditions for ECB buying – they don’t just buy bonds off the face of the planet – when implied forward rates from the 10y to the 13y are flat -then we think that’s enough for buying to focus on other tenors/issues

- There is an implicit anti PEPP component, which is overpriced in Germany unlike High coupons in almost all the other European Markets

- Just one more tap left in Dbr Feb31 before we get a new Dbr Aug31 issue – May 19th

Fwd rates…

- Even if we remove some of the directionality by weighting the trade as two forwards (10y3y in bonds vs 10y3y Eonia) the trade still looks good..

(0.8 * P2509[DBR 0 02/15/31 Corp] - P2509[DBR 4.75 07/04/34 Corp])

* OIS spreads weighted as a forward trade

(Bbg Field P2509: Matched maturity swap yield from the overnight index swap (OIS) curve using OIS dual curve discounting, minus the yield to maturity of the bond.)

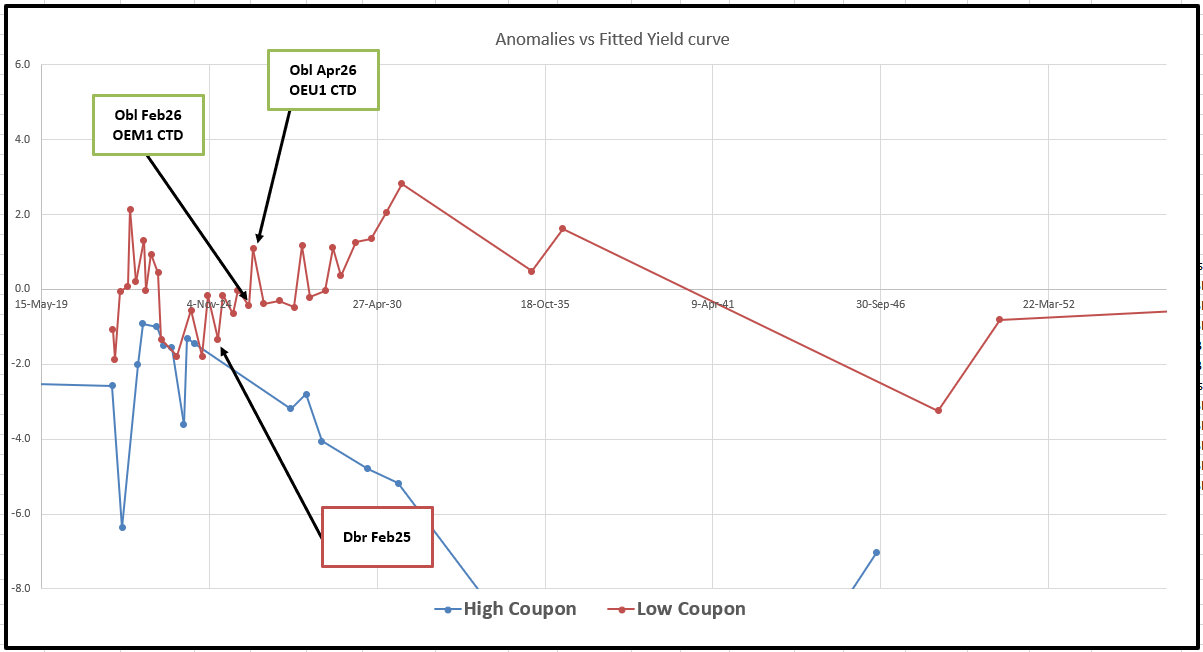

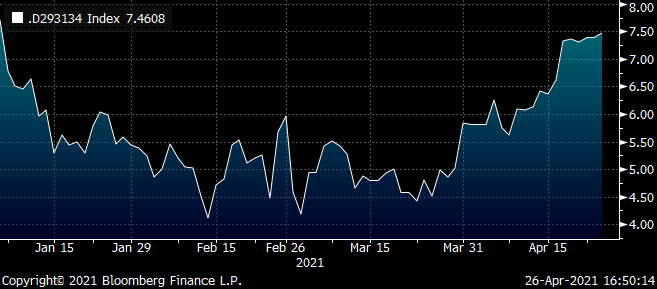

Looking at the Obl Futures – buy either for a contract squeeze

June CTD – Dbr 0.5% Feb26

Sep CTD - Obl 0% Apr26

- I see both bonds as fair/cheap

- IF CTAs roll early, I wanna be long front months but back months are cheap

- Sell off the run 4y vs Jun or Sep CTD

Graph of Yield Anomaly vs Fitted Curve

- If we buy the roll we might catch the front bond richening, but we’ll be forcing the back month (apr26 into an even cheaper level – already cheap on the curve)

- In turn that will cause switch activity because the off the runs will look even richer

- So concatenating those two trades I like Front month vs Dbr Feb25

- I like the fact that the CTD is an OLD issue Dbr (better placed, less float, harder to recycle for delivery, will probably gets scarce and tight on repo over the delivery period in June)

History vs OIS..

Levels

Entry +0.2bp

Target: -1.5bp

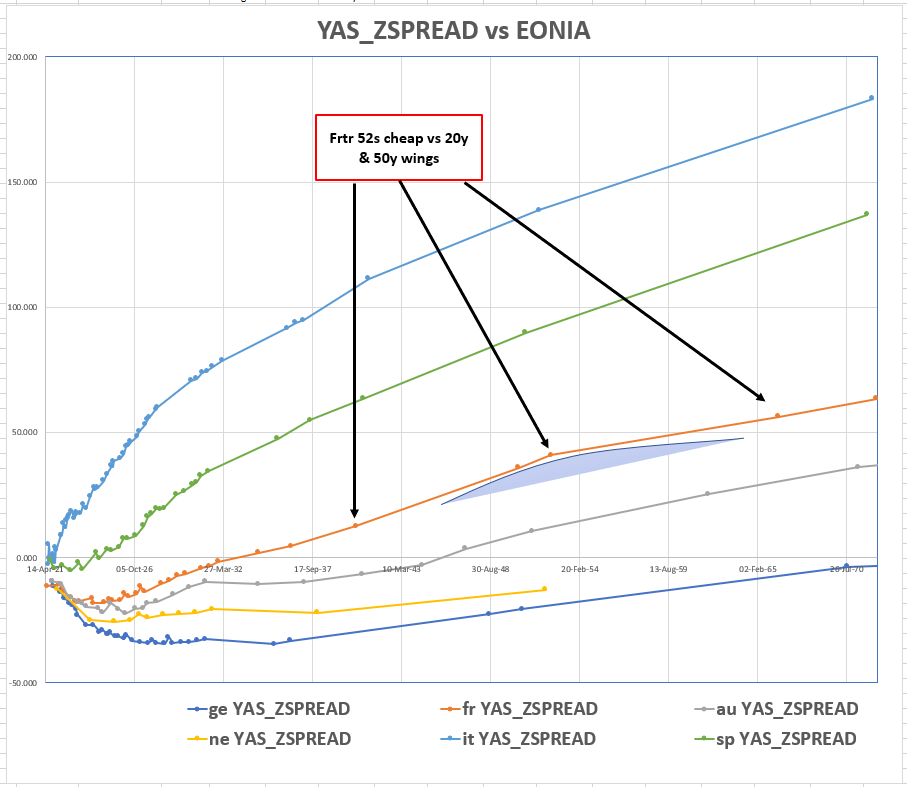

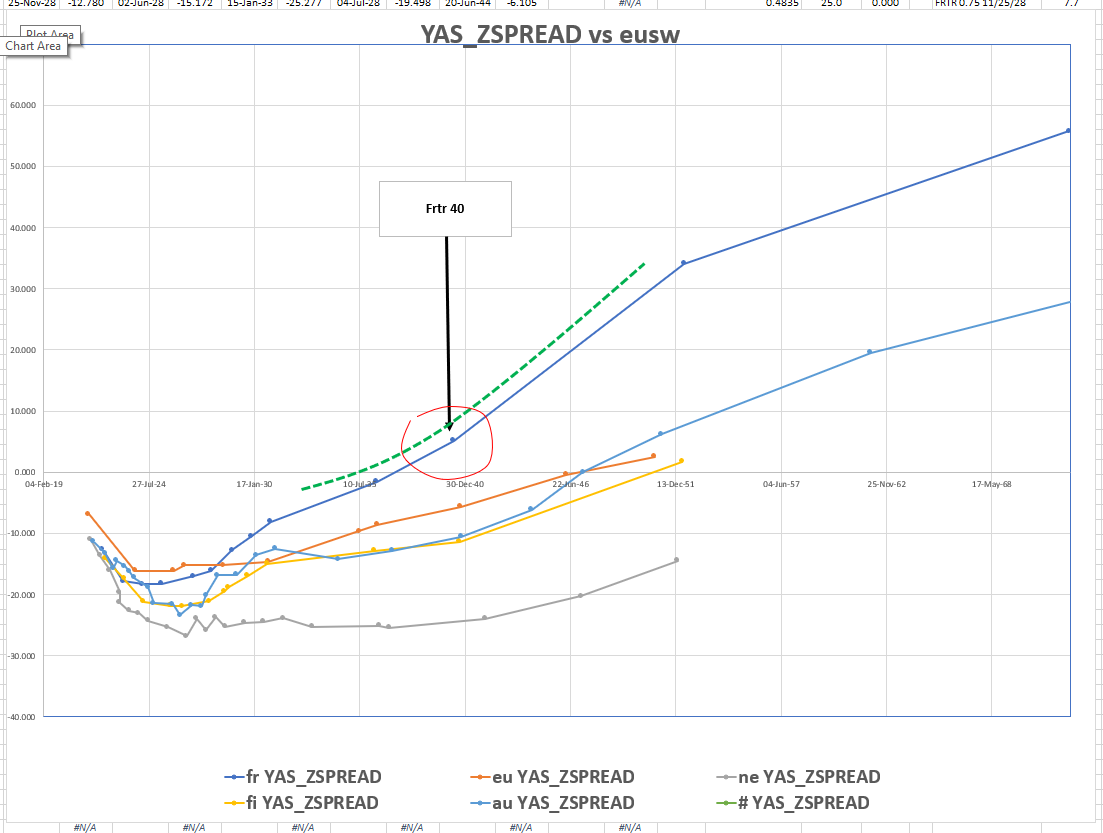

French Supply Trade

-20y +30y -50y fly

Today France announced the supply for next Thursday

€10 – 11Bln of Nov31, May40 & May52

Trade

Buy Frtr 52 in any discount into supply vs

Sell Frtr 40 & Frtr 66

BBG History

200 * (YIELD[FRTR 0.75 05/25/52 Corp] - 0.5 * YIELD[FRTR 0.5 05/25/40 Corp] - 0.5 * YIELD[FRTR 1.75 05/25/66 Corp])

Levels

Enter: +21.5

Target: < -17bp, Long term based on forward rates

- May40 are a rich 20y whose Low coupon means they carry poorly – on Cash Adjusted Spread we see them as rich – sustained somewhat by they very sought after Gerrn 39s and 44s

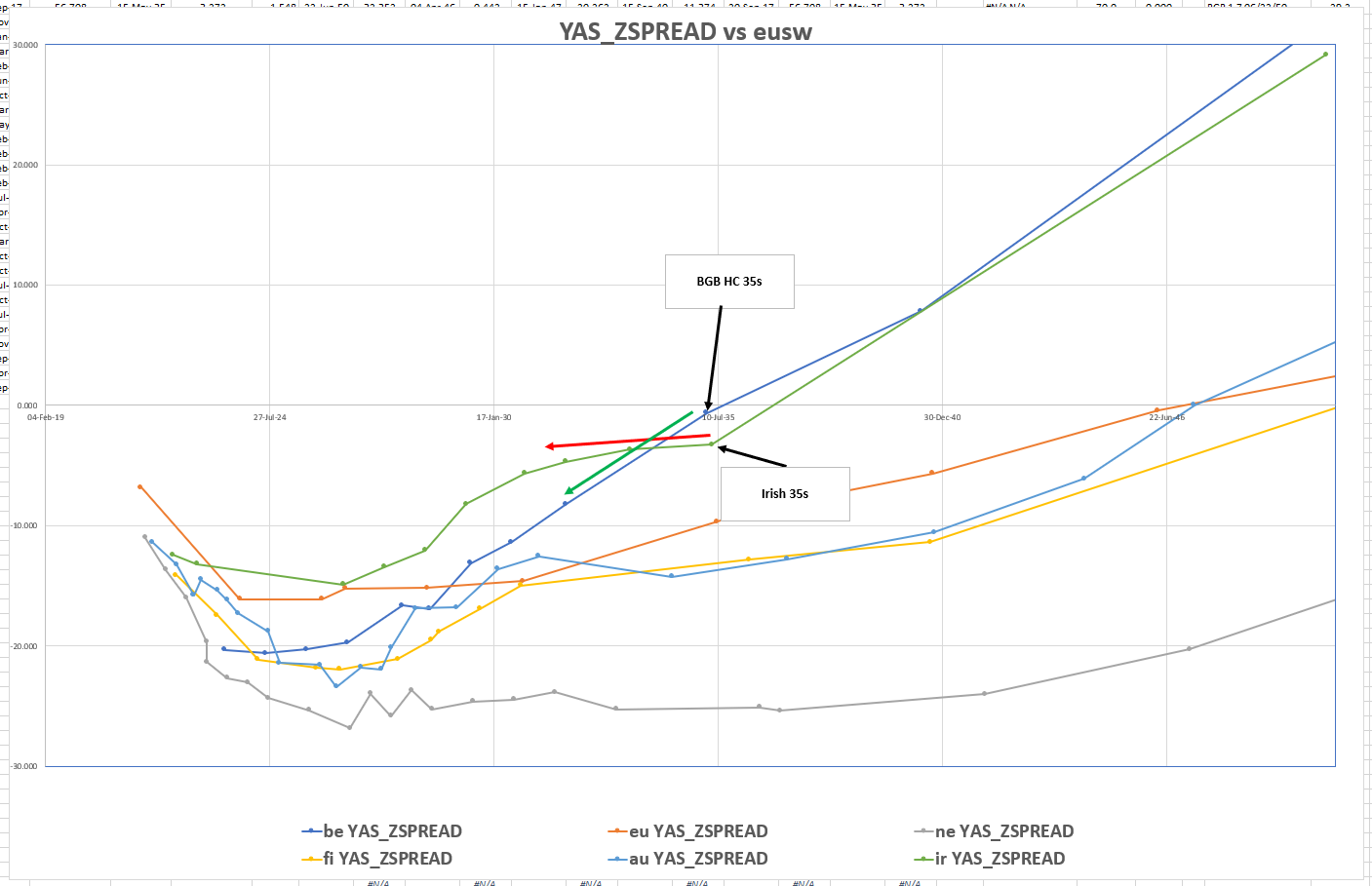

- May52 are the on the run 30y that go into the PEPP (<31yrs) next month and look cheap vs 20y and 50y in the context of other European 20s30s50s structures – see Graph of Z-Spreads vs Eonia

Movers and Shakers – some stuff we’ve been watching

Short Irish 35s vs Belg 35s – decent credit / value trade – hits first Target: -7.9bp

Long Italy 20y vs 15s and 30s – mis-weighted keeps working – cut it way too soon!!!!!

2 * (YIELD[BTPS 3.1 03/01/40 Corp] - 0.7 * YIELD[BTPS 0.95 03/01/37 Corp] - 0.3 * YIELD[BTPS 1.7 09/01/51 Corp]) * 100

Getting interested again in +dbr35/–Dbr39/ +UBA

Have Fun

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

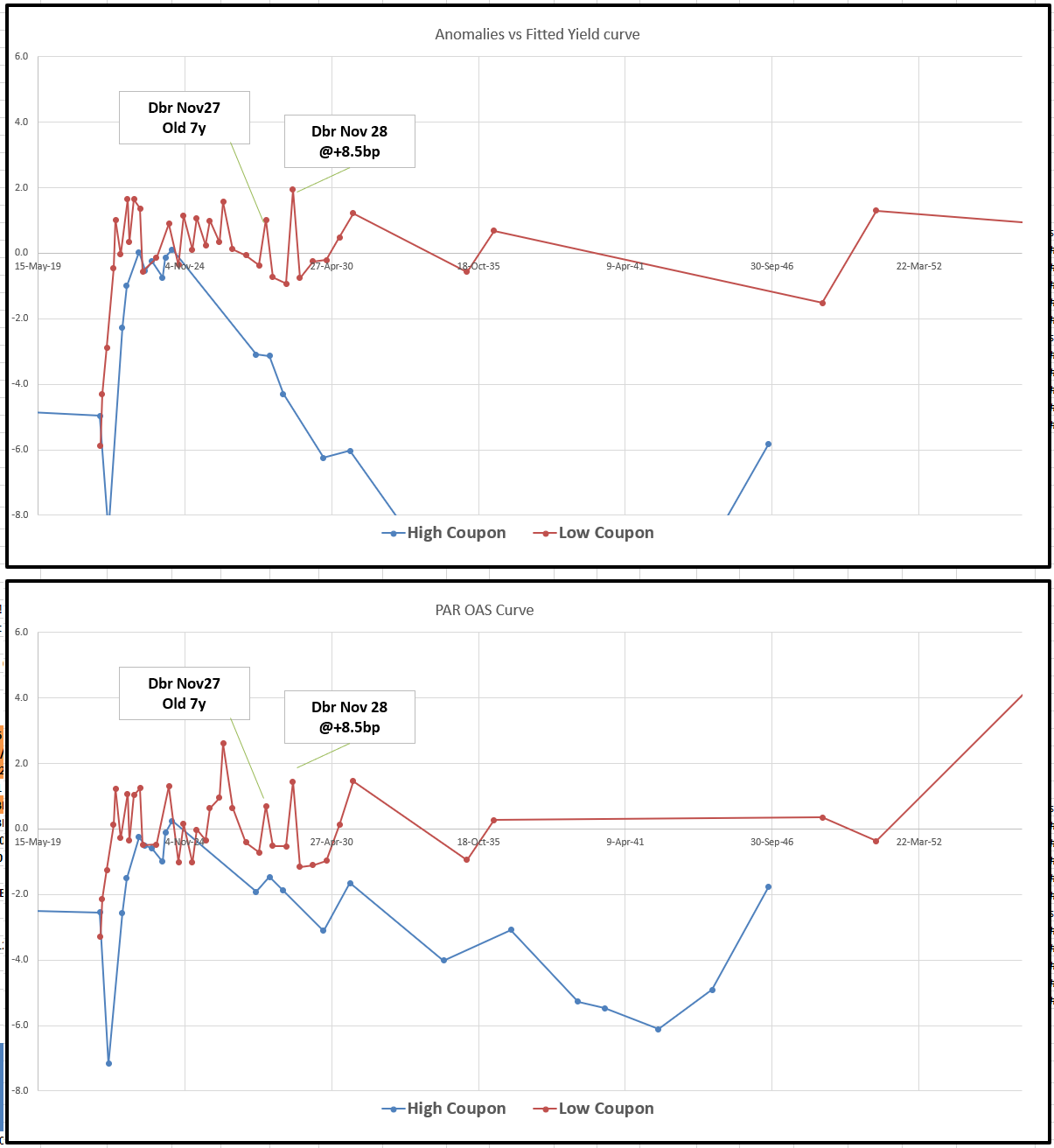

New Germs 7y and German 10y still cheap

Tomorrow brings a new German 7y – this is only the second issue on what is a more recent tenor for German issuance

Dbr 0% Nov28

Mid-market indicated +8.5bp vs outgoing dbr 0% Nov27

Here's how we see value vs

i) top graph, vs simple fitted yield curve

ii) second graph, va Par bond OAS curve

Pretty similar to be honest – both fits are centred through the low coupon bonds

In short – it's yield looks appealing

On a discounted cash-flow curve (PAR OAS) I'd like it a little cheaper

At anything north of +9bp we'd actually like to have the tight anomaly -dbr 0.35% Feb29 and long this bond – as it's a cheap bond in a rich sector and then trad ethe hedge if it cheapens vs wider issuers

Additionally we still like the on the run 10y vs selling old 8y Germany and old German HC 34s

Sell Dbr 0.25% Feb29 and Dbr 4.75% 34vs

Buy Dbr Feb31

Lvl: +7.5bp

Add: +8.5bp

Target: +4.5bp

This has a little bit of everything

- short the forthcoming 7y segment on the front leg

- Long the cheap rolldown 10y

- Short the old HC 34s – genuinely rich and HCs could ease in a taper tantrum

Cix:

200 * (YIELD[DBR 0 02/15/31 Corp] - 0.5 * YIELD[DBR 0.25 02/15/29 Corp] - 0.5 * YIELD[DBR 4.75 07/04/34 Corp])

Graph

If we can get any of this of for you, please give us a shout

Best

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Vol adjusted Spreads to Germany - James & Will @ Astor Ridge

Taking a quick look at 'how credits trade' in Europe

A while back we decided to re-vamp how we look at different Euro Issuers

Two parts

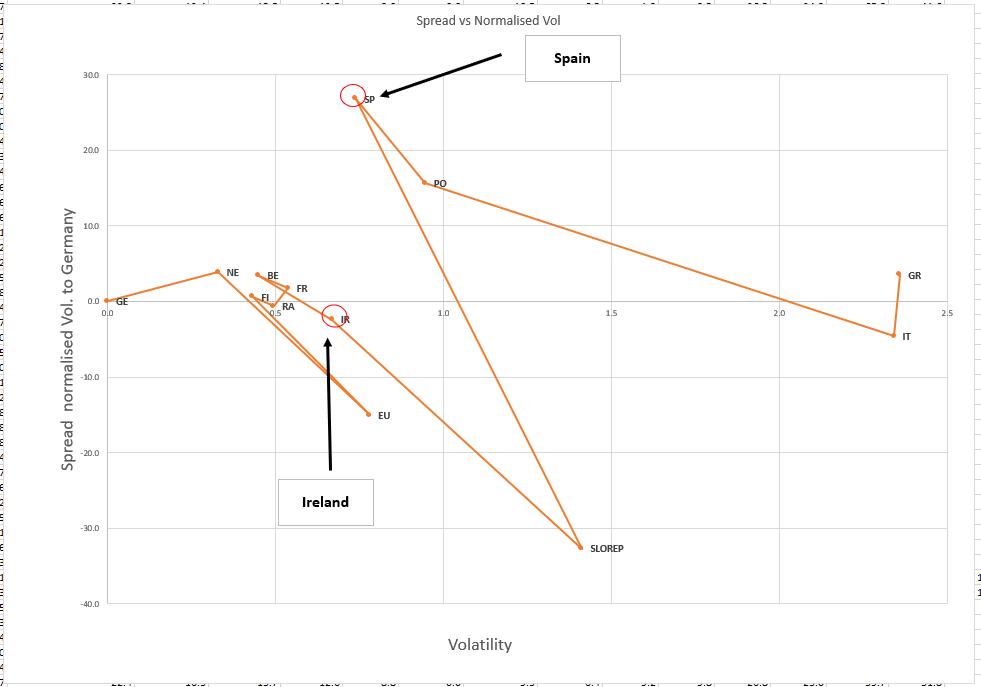

1) 'How it Trades' – looking at a vol adjusted – spread to Germany model

2) a Rating / Spread to Germany model

1 'How it Trades'

The PEPP and investor credit preference force issuers to trade away from simple credit valuation metric

We plot the spread to Germany (relative z-spread) vs the vol of their spread. We're trying to model how the reduced vol as the Pepp scoops up an issue makes them trade like better names

Here's 9 years - we choose 9years as there are CTDs and lots of history

In this instance Spain over the last few months has a vol similar to that of Ireland. As such it 'trades' better. Ireland for the same vol offers a much narrower spread. This methodology of var based returns is the very essence of RM so maybe it helps us understand the point at which the PEPP runs into the boundary condition at which RM will let it have as much of any given name

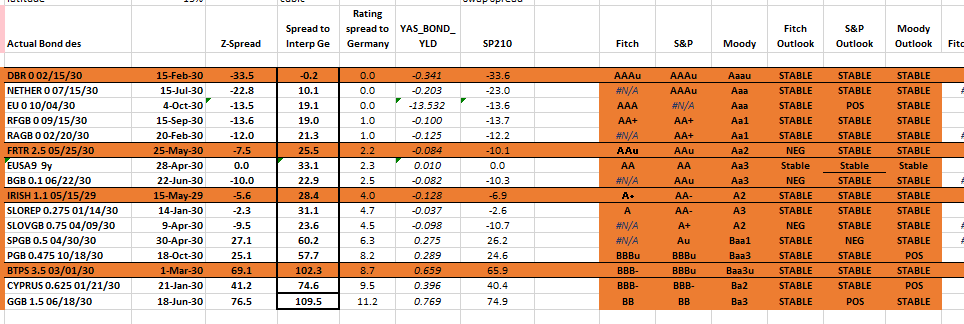

2 Rating / Spread to Germany model

Here we're looking at the spread to Germany vs the rating score of the issuer. The score is made out of the current rating from Fitch / Moody's and S&P plus the near term outlook

And we can graph Spread vs Rating score

We have drawn a curve through the major credit issuers – France / Spain / Italy

So as opposed to 'how it trades' – here we're looking at absolutes and we see that the smaller issuers trade through the fit

Results -

there's a whole bunch more analysis to do and we can do much more but there are some stand out thoughts. If I'm looking for trades that makes sense from both perspectives, I'm thinking that despite being favoured by the PEPP, Ireland and Slorep look rich

Also EU has had a greater spread vol of late – so yes it's cheap as a triple AAA but it's not stable and that's borne out by method 1

Relative Swap Spreads

Ireland into Spain vs MMS

(sp210[SPGB 0.5 04/30/30 Govt]-sp210[SLOREP 0.275 01/14/30 Govt])

Let me know if you have any questions on the other issuers

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

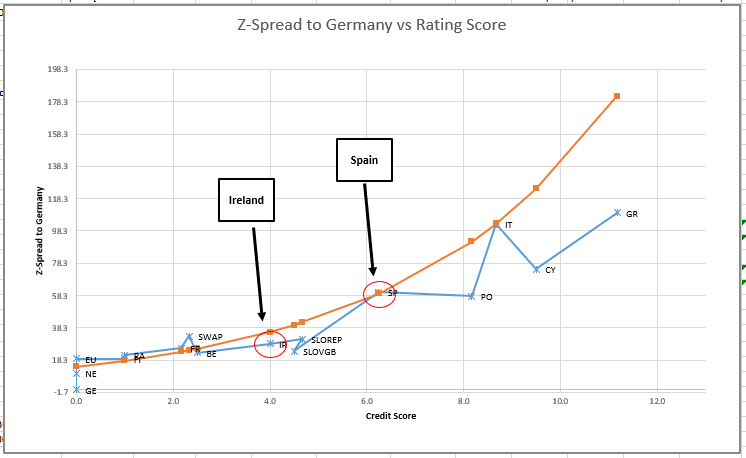

Finland 6s/9s flattener vs OIS

Sell Finland 6y vs 9y vs Swaps

Sell Rfgb 0.5% Sep27 / Buy Rfgb 0% Sep30

vs either MMS or OIS

OR

Vs OE/RX

Rationale

- Since the recent Sep30 Tap (Mar 12th) , 9y Finland has hung around as cheap

- The roll to the 6y point is compelling vs other Core issuers ( See Graph of Z-Spreads to Germany, Netherlands & EU)

- Unless we get a dramatic steepening in the other Euro curve vs swaps, then this structure should capture the roll nicely and further PEPP buying of the rare issuer. Finland should be a tailwind

Levels

Entry: here +8.6bp vs OIS / +7.4bp vs MMS (33% risk)

Add: +10.5bp vs OIS / 9.3bp vs MMS (67% risk)

Target: sub 3bp

Unless we get a dramatic steepening, Finland flattener 6s/9s looks a great way to absorb the supply overhang in a scarce issuer

Levels:

+7.4bp vs Swaps

+8.6bp vs OIS

BBG history vs Swaps

Here's how Finland looks on Z-spread vs other Core Issuers,,,

Friction

Expect at least 0.8bp (0.33% of total published B/O) to extract ourselves from this – that means we have to slip into the trade on middles. We should scale here and add under stressed conditions to get the right expected outcome. I like here – and love it at

So to some degree the trade Target incorporates the fact that we need to see this Spread to flatten at least 3bp to justify having our first piece on here

Additionally..

Trade can be hedged with 70% OE/RX

cix:

100*((yield[RFGB 0 09/15/30 Govt ]-yield[RFGB 0.5 09/15/27 Govt ])-0.7*(yield[DBR 0 02/15/30 Govt ]-yield[DBR 0.5 02/15/26 Govt ]))

Also as a left field hedge, I quite like the -dbr34s +dbr31s as an alternate hedge…

Any Feedback let us know

Best

Will & James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

German RV - 10y roll down trade

German Dbr 0% Feb31 penultimate tap on Wednesday – roll nicely and age down the curve

Trade

Buy the Dbr 0% Feb31

Sell Dbr 0.25% Aug28 and Sell Dbr 0% May35

Rationale

- This is the second to last tap of the Dbr Feb31 after which they roll rapidly down the curve (Last tap on May 19th , New 10y on June 16th )

- New 7y (Nov 2028) coming on April 27th could cheapen the Dbr Aug28

- The Dbr 35 are looking a little rich, serves a curve anchor to the structure. Supply in the cheaper dbr2036 on the 27th April

- All in all strong value of flow dynamic

- Forwards suggest rates would have to rise rapidly from 7y to 10y and then level off which is a function of the supply dynamic not a reasonable expectation of fwds

Levels

Currently: 2.3bp

Enter -2.3bp

Add: -0.3bp (based on fwds)

Carry & Roll /3mo

Carry: Flat @ -5bp repo spread

Roll: +0.3bp

I like a third of my risk here as I feel this is a strong story – but want to be able to add if we get a disconnect and the forward curve looks even more kinked

Here's How German anomalies look vs a fitted curve

Here's the history of the trade

If you need a hand getting this on please let us know

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Germany 15s20s steepener vs MMS

Trade:

Buy Germany 15y / Sell Germany 3.25% 2042

vs MMS

Level: +6.75bp

Target: +3bp

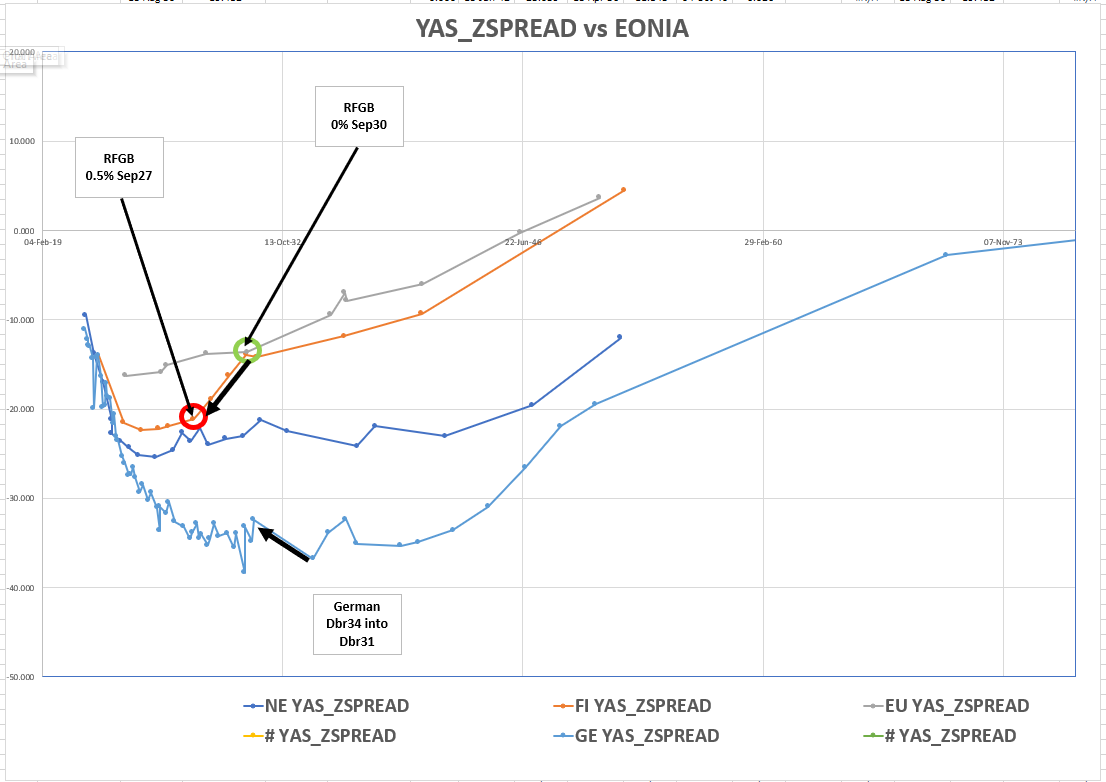

If I look at the relative Z-Spreads of Core and Semi core Germany, it looks like this….

Almost all the Issuers are steeper than the Eonia Curve, and that makes sense in a paradigm where duration extension of the debt profile is generally sought after

The standout to me is the on the run 15y Germany point vs the old high coupon 20y (dbr 3.25% 2042)

*Using a hypothetical 50y Germany

Here's the history of simple spread of spreads vs the old 15y, which is slightly rich (the newer 2036 only came out in March)

BBG Cix:

(SP210[DBR 3.25 07/04/42 Corp] - SP210[DBR 0 05/15/35 Corp])

Take a look, any feedback welcome and speak soon

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Things we're looking at... Euro RV

- Italy 30s50s flattener

Recent announcement of the new 50y steepened the back end:

btps 2.15% 2072

Here’s my regression of the old 50y vs the 30y

cix: (YIELD[BTPS 2.8 67 Corp] - 0.904 * YIELD[BTPS 2.45 50 Corp] - 0.41) * 100

Graph

So I think this is due a correction from pricing – but am nervous about the non-PEPP status of the 50y versus <31y maturities (within the PEPP envelope)

So, I don’t mind buying the 50y bond as a wing – and I do like selling the on the run 30y which has an ugly low coupon, is only €10bln in size (old long bonds got up to €16bln)

The on the run 30y is trading rich on repo – kinda has to be for this trade to present itself – 50bp special on that bond is worth about 0.6bp /3m on that bond , but please check repo for yourself

So the structure I like is

Sell 30y

Buy 20y and 50y

Weightings: +0.3 / -1 / +0.7

(all x 2 to make it comparable to other fly structures)

Lvl: -27bp

Target -23bp

cix:

2 * (yield[BTPS 1.7 09/01/51 Govt]-0.3*yield[BTPS 3.1 03/01/40 Govt]-0.7*yield[BTPS 2.8 03/01/67 Govt])*100

Graph

- Germany- Short the rich High coupon 20y

Since we that market stopped falling, the old High coupon German bonds have richened up again – unlike other high coupons in Europe they are genuinely rich versus z- or Zero coupon curve build

The Buxl CTD although a little cheap imho will also do what the 42s and 44s did when they dropped out of delivery – richen up, ultimately

Conversely the 15y tap point is cheap

On forwards the implied forwards are too steep from 20y to 30y – see forwards picture below

Trade

Buy 15y and Buxl CTD

Sell Dbr 2042

weights: 0.2 / -1 / +.8

(all X2)

Levels

Enter: -12bp

Add: -14bp

Target: -6bp (long term target to fair value), -9.5bp (short term target)

Cix: 200 * (YIELD[DBR 3.25 07/04/42 Corp] - 0.2 * YIELD[DBR 0 05/15/35 Corp] - 0.8 * YIELD[DBR 2.5 08/15/46 Corp])

Here’s how forwards look – can’t have Eonia so flat and the 42s into 46s be so steep – Do we feel this is what creates the boundary condition for the shape of the curve? 42s 46s forwards are too steep

(* Bonds yields are adjusted for coupon to make them par bonds)

- UKT 10y 2031s still cheap on local roll given old 20y is rich

The on the run 10y UKT is cheap – but will be tapped at the beginning of May and June so it’s just a question of finding a robust structure to hold it

Buy Ukt 2031

Sell 2030 & sell Ukt 2037

Weights: -0.8 / +1 / -0.2

Levels:

Enter: +1bp

Add: +2.25bp

Target: -2.5bp Target set as the 2031 should bed into the curve by November when a 2032 new 10y may come

cix: 200 * (YIELD[UKT 0.25 07/31/31 Corp] - 0.8 * YIELD[UKT 0.375 10/22/30 Corp] - 0.2 * YIELD[UKT 1.75 09/07/37 Corp])

Graph:

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades & Fades, Movers & Shakers, James & Will @Astor Ridge

Things we're looking at

There is a chance Ireland comes with a 15y – last taps were 10y & 30y and we have Belgian supply on Monday (5y, 10y & 20y) which has pushed the longer tenors cheaper

Trade:

Belgium/Ireland 15y switch

Sell Irish 15y to buy Belgium 15y – solid roll over next few yrs plus supply dynamic. Hidden value in the high coupon Belgium 35s

Lvl: -4.8bp

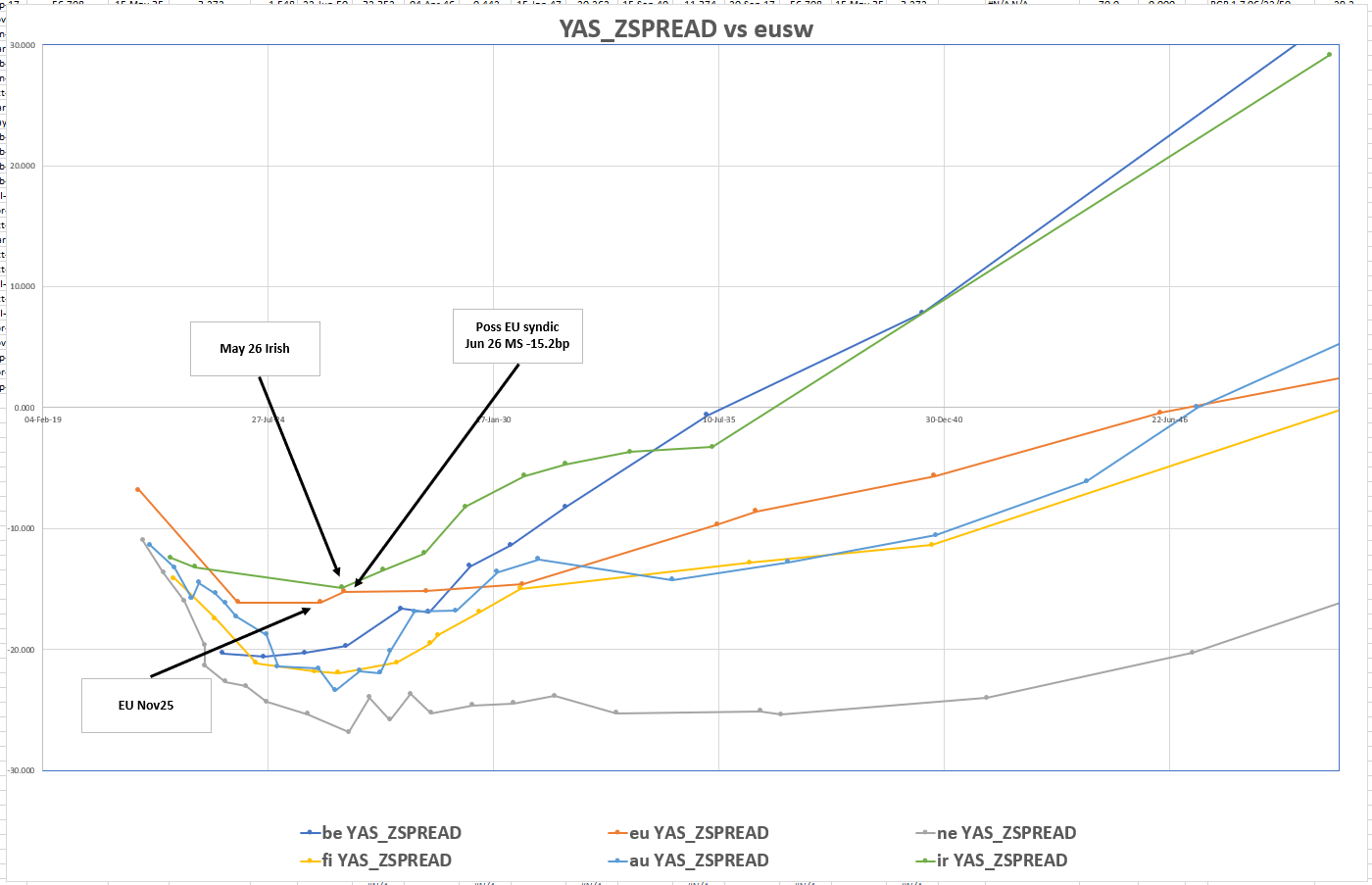

Here's European, semi-core Z-Spreads to demonstrate

Trade:

Ireland / EU 5y switch

Sell Irish May 26, Buy EU Nov25

On Z or vs MMS: -1.5bp (Z)

Prospect of a possible 5.5 y EU bond leaves us looking to sell rich 5.5 yrs – Ireland trades rich there and is compressed to the semi core curves – but this would leves us switching nov25 into a possible syndic 5.5y EU bond and the prospect of then having..

-5.3y Irish vs +5.5y EU for a pickup, AA+ into AAA

downside is that EU is an ongoing issuer – but this is at a point where I think RM might switch – just because there's PEPP doesn't mean Ireland richens forever?

Graph of Z-Spreads

French 20y Dragged rich by recent 23y Green Bond

Trade

Sell Frtr 20y vs 10y and old 30y

Weights: +.3 / -1 / +.7 (all x2)

Levels

Enter: -4.75bp (33% risk)

Add: -5.75bp (balance if risk)

Target: > -1bp

Stop: -8.5bp

BBG history

WE see 20y Europe and particularly France as being rich vs 10s and 30s

Here we have chosen to buy the French 10y which should go off the run in the next few cycles and the old Frtr 30y which still has a relatively high coupon (1.5%) and is inside the PEPP envelope

Here's how Z-spreads look in Europe with Frtr 40s highlighted…

At some point we should see a tap of the 20y Btps 1.8% Mar41

Long end 20y vs 30y has steepened in the last few sessions, in part during the pricing of the new Greek 30y

Trade

Sell Btps 1.8% Mar41

Buy Btps 2.45% Sep33 & Btps 3.85% Sep49

Looking to cover this around zero at a supply point

weights: +.3 / -1 / +.7 (all x2)

Graph:

New German 7y on 27th April

Want to get short expensive, old 7y

New 10y on the 16th June, last tap on current 10y is May

Kicker / Fade

Still looking for forward rate steepeners so want to be long a bullet short wings – on the run 10y is cheap and forms our bullet

Trade:

Dbr Feb31

Sell Dbr Feb28 & Sell Dbr Jul34

Levels

+12.75bp (25%) Risk

+15bp (25% Risk)

+18bp (50% Risk)

we've really scaled this one back in terms of levels – only because we need to be at +18bp to be close to our boundary condition where the curve is so steep 7s10s and so flat 10s14s such that forward Rate Shoots up and then levelsout

So this is a bit of a structure we're gonna trade around until the new 10y in June and we don't want to be too deep into this too early. Want to be happy to add and similarly we want to have SOME of the trade on going into the 7y

As always, we use history to evaluate risk but it tells us precious little about value

"1 Future Good, 2 Futures Better"

- Eric Arthur Blair, Bond RV punter

We're seeing the French 2.75 Oct27 richen up on the curve – nominally on BBG it's listed as the current 7y

In fact the -Frtr Oct27 vs +OAT Nov30 is pretty steep – we're a fan of the French credit here and as a corollary we like flatteners in France vs Germany

Put 'em together and what have you got…?

-Frtr Oct27, +Frtr nov30

& 50% +OE/-RX

… Two Bonds & a futures curve trade

Looking for 1.5 bp correction

Or more if I can get in @ > +19bp or am in for the longer play in being long France vs Germany (≈ flattener Fr vs Ge)

Alternatively…..

If you're not so sure about the credit and were lucky enough to get short Feb28 Austria (Ragb 0.75% Feb28) from last week – then we really like

-Frtr Oct27 into +Ragb Feb28

And hence mutate our 7s9s flattener in Austria (ragb28s +Ragb30) by doing this….

-Frtr Oct27 +Ragb 28….

Have a fantastic week

Look forward to trading soon

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796