Trades & Fades. Movers & Shakers - Will & James at Astor Ridge

Belgium Supply next week 5y, 10y and 20y

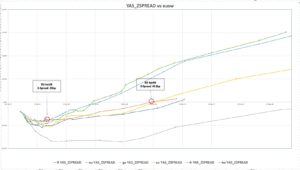

Our fade is to always be trying to buy Belgium as a credit vs France or in a more micro sense a flattener in Belg vs France

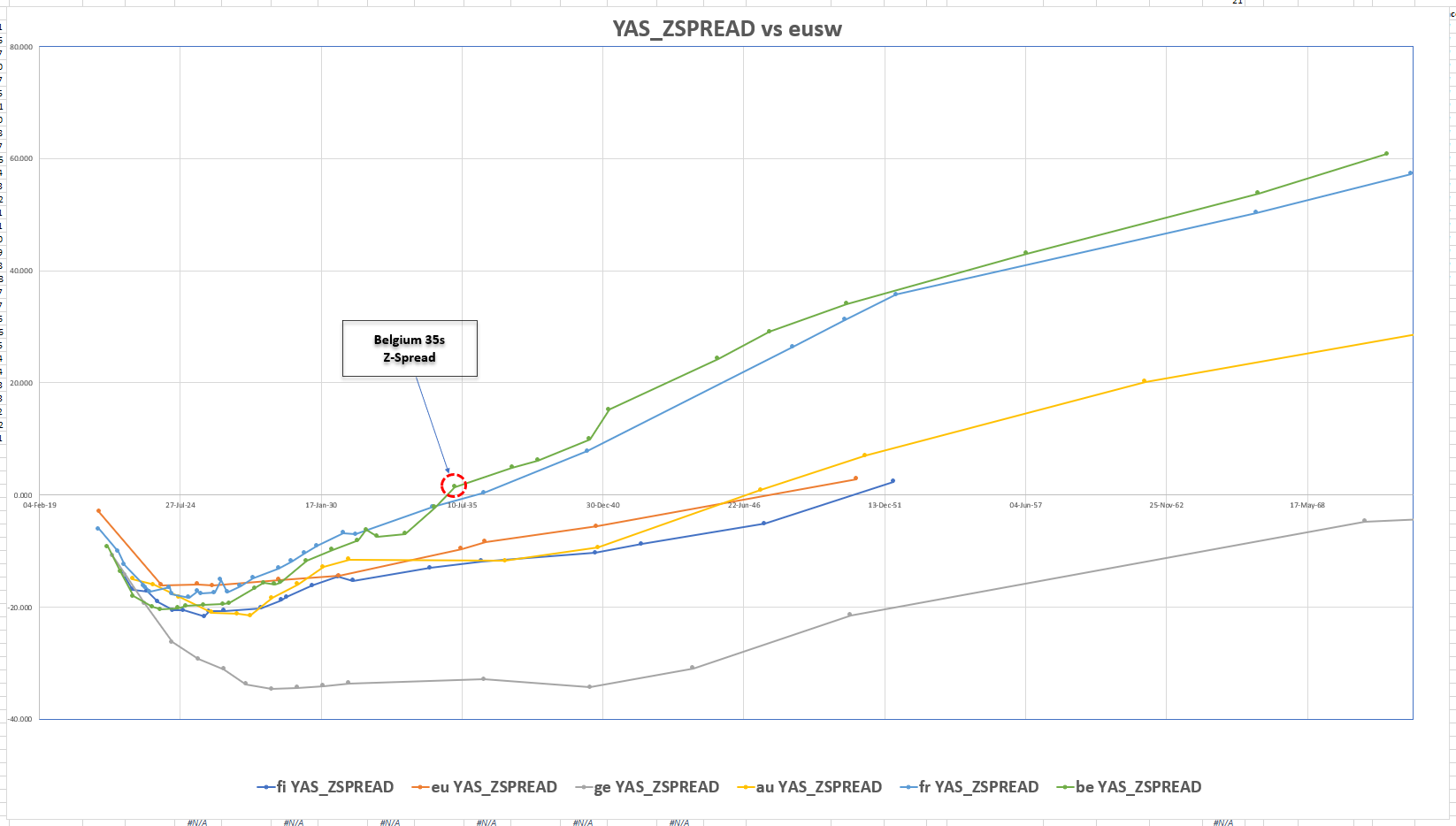

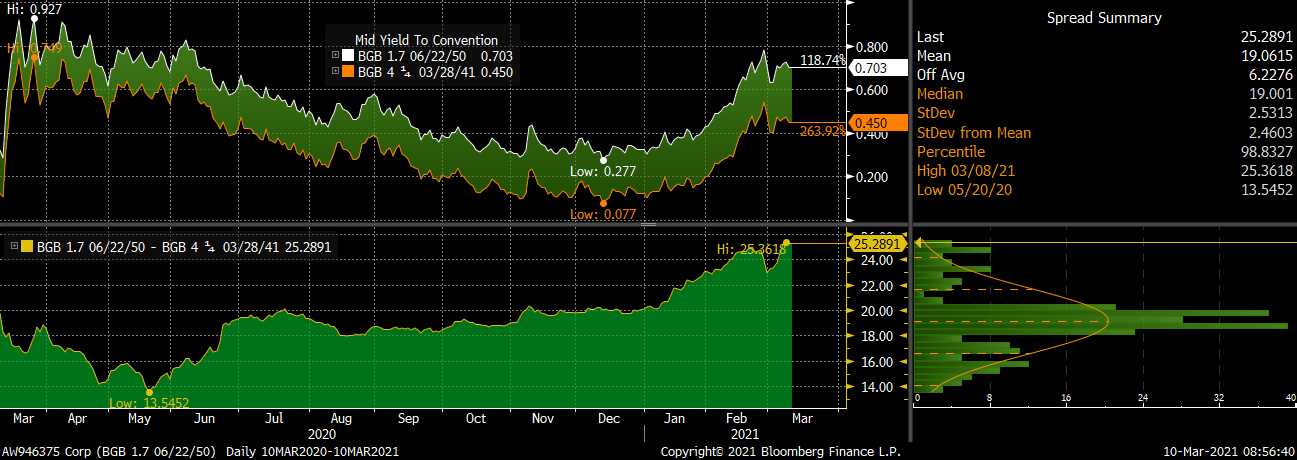

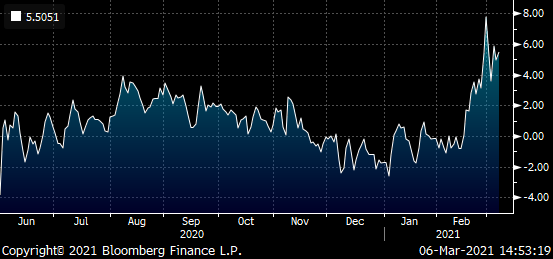

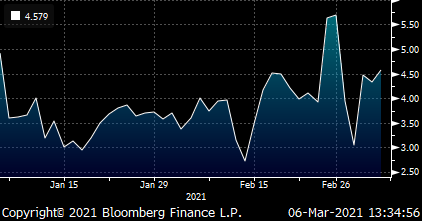

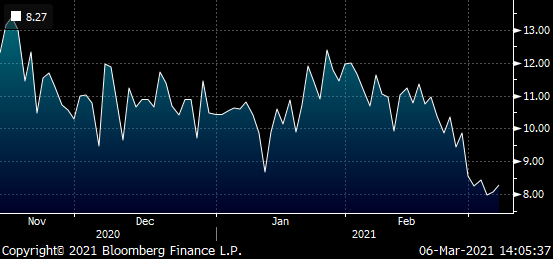

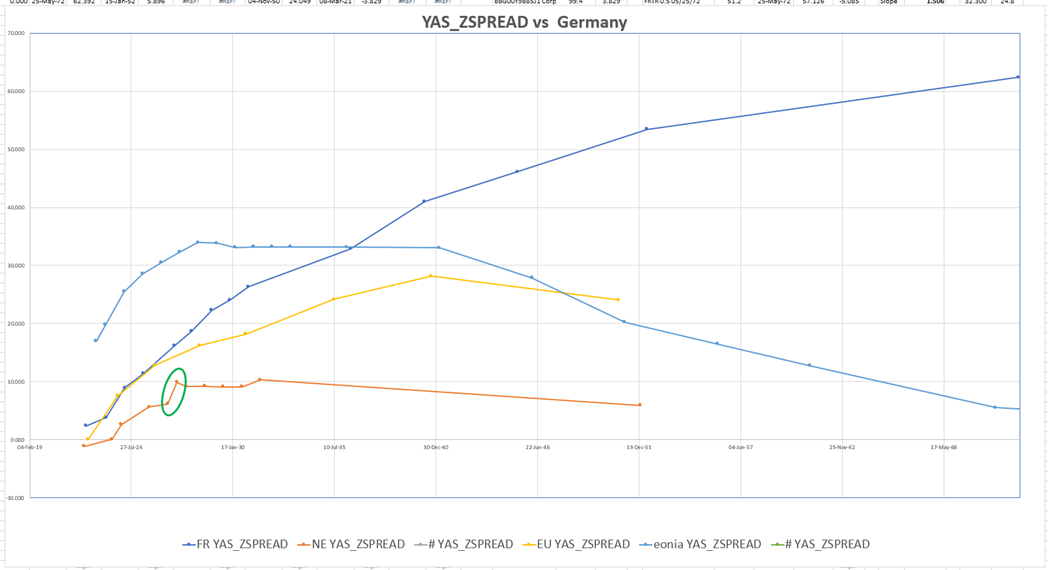

this is how Belgium vs France looks on relative Z-Spreads

For the best roll we like long 15y Belg vs short 9y relative to France

We're hoping that the issuance in the 20y cheapens the old high coupon 15y

We are looking at

-9y Belg +14y Belg

Vs

35% of (+OATA -Frtr 20y)

100 * ((YIELD[BGB 5 03/28/35 Corp] - YIELD[BGB 0.1 06/22/30 Corp]) - 0.35 * (YIELD[FRTR 0.5 05/25/40 Corp] - YIELD[FRTR 2.5 05/25/30 Corp]))

Lvl: +10.3 bp

We're Looking for +11.3 for 35s to be almost as cheap as any other Belgium long tenor but still have the best roll as a box vs the 9y

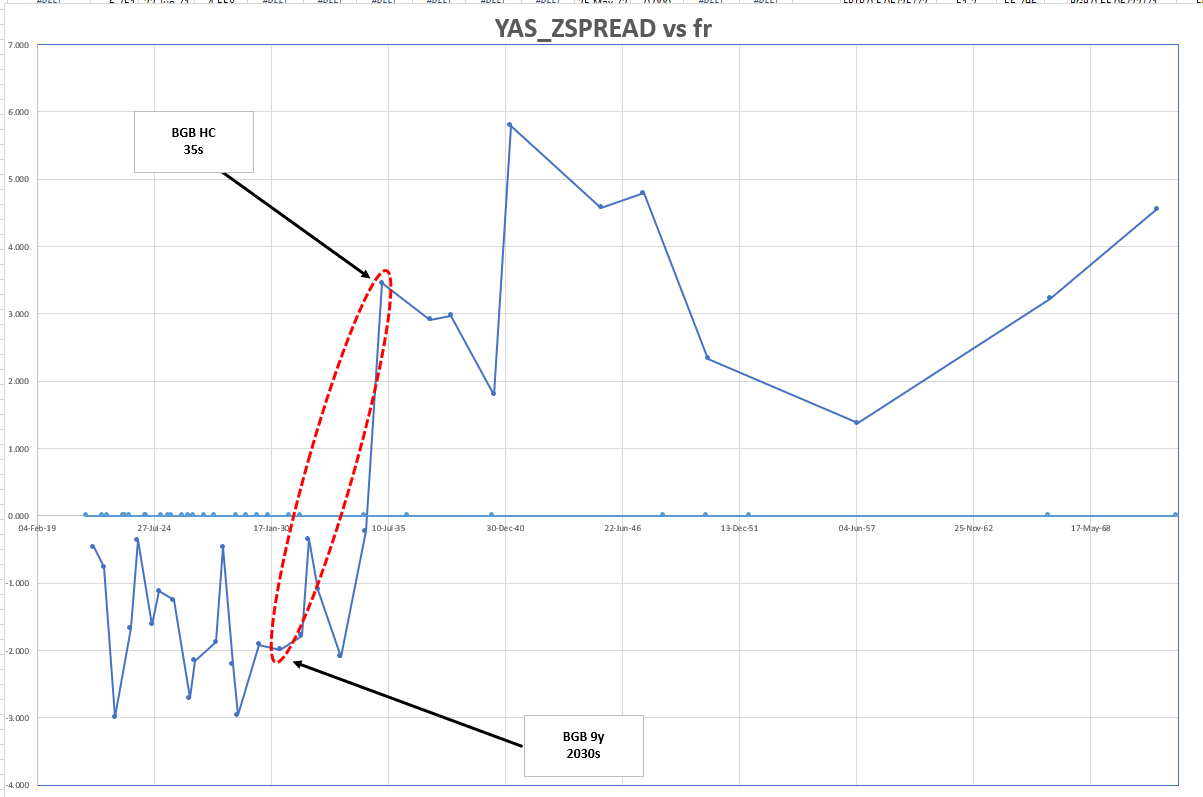

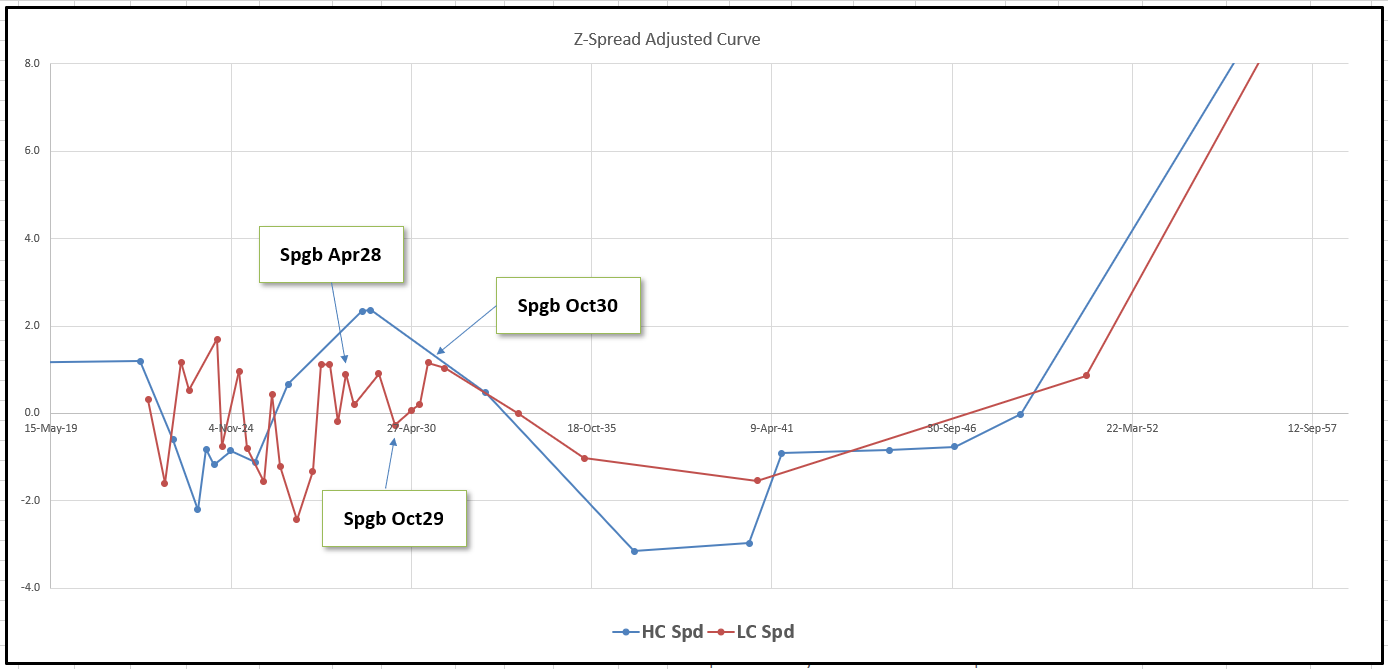

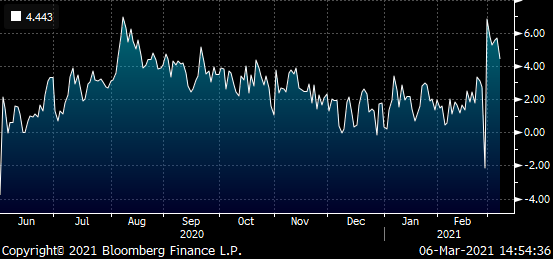

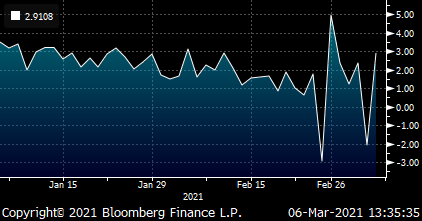

We're also watching Spain 20y vs 30y steepenenr relative to France

Have sympathy with both side of that trade but the illiquidity means we'er looking for another 1bp to get in

100 * ((YIELD[SPGB 1 10/31/50 Corp] - YIELD[SPGB 1.2 10/31/40 Corp]) - 1 * (YIELD[FRTR 0.75 05/25/52 Corp] - YIELD[FRTR 0.5 05/25/40 Corp]))

Graph of Spain on Z-Spread vs France

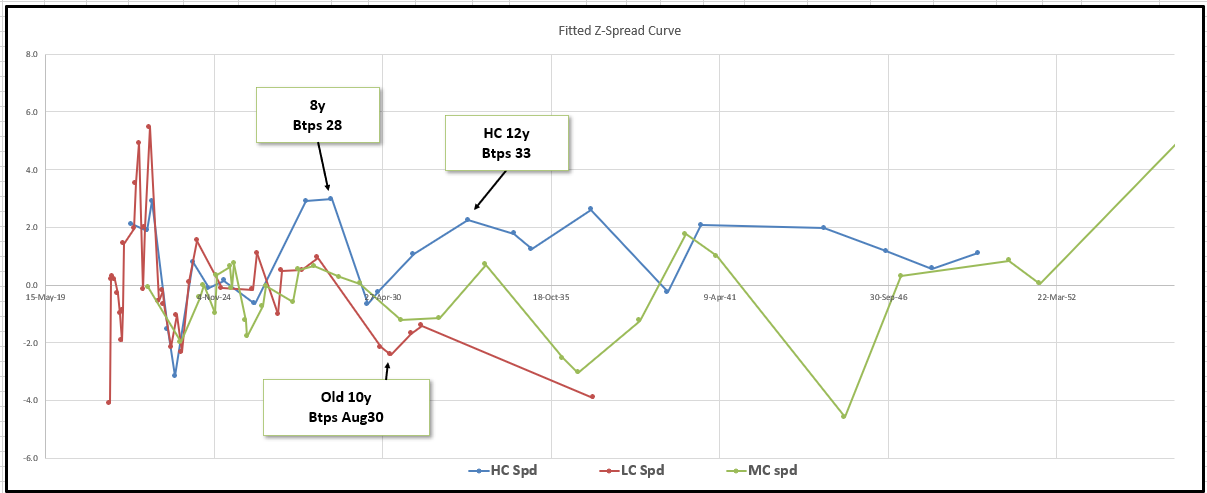

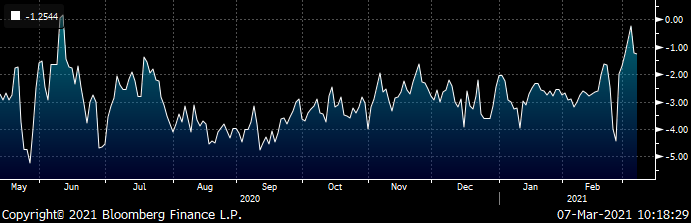

On our Radar is the Expensive , relatively low coupon Aug30 – all these itlaian 10 – 15y should get a shot at being CTD into IK

But Btps Dec30 is shorter in modified duration vs Aug30 & is equally cheap for delivery on a contract trading so far above par

So if Aug 30 never gets a shot at being CLEAR CTD, the only downside in being short this bond is its low coupon – which we can ameliorate somewhat buy buying the longer LC apr31 or ineed the very low coupon Aug31

Strat: We want to sell Aug30 vs its neighbours when rich and accumulate dec30 vs neighbours when cheap

2 * (yield[BTPS 0.95 08/01/30 Govt]-0.7*yield[BTPS 1.35 04/01/30 Govt]-0.3*yield[BTPS 0.9 04/01/31 Govt])*100

Level – I want to see this lower to pay this structure – something like -0.5bp to start

This will be a key theme for IKZ1 going forward

Btps -jun25 +jun26 -jun27

Looking for that to be a touch cheaper over quarter end – long slightly lower coupon in the belly than the wing average

2 * (yield[BTPS 1.6 06/01/26 Govt]-0.5*yield[BTPS 1.5 06/01/25 Govt]-0.5*yield[BTPS 2.2 06/01/27 Govt])*100

Has cash-flow value

Best

Will & James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

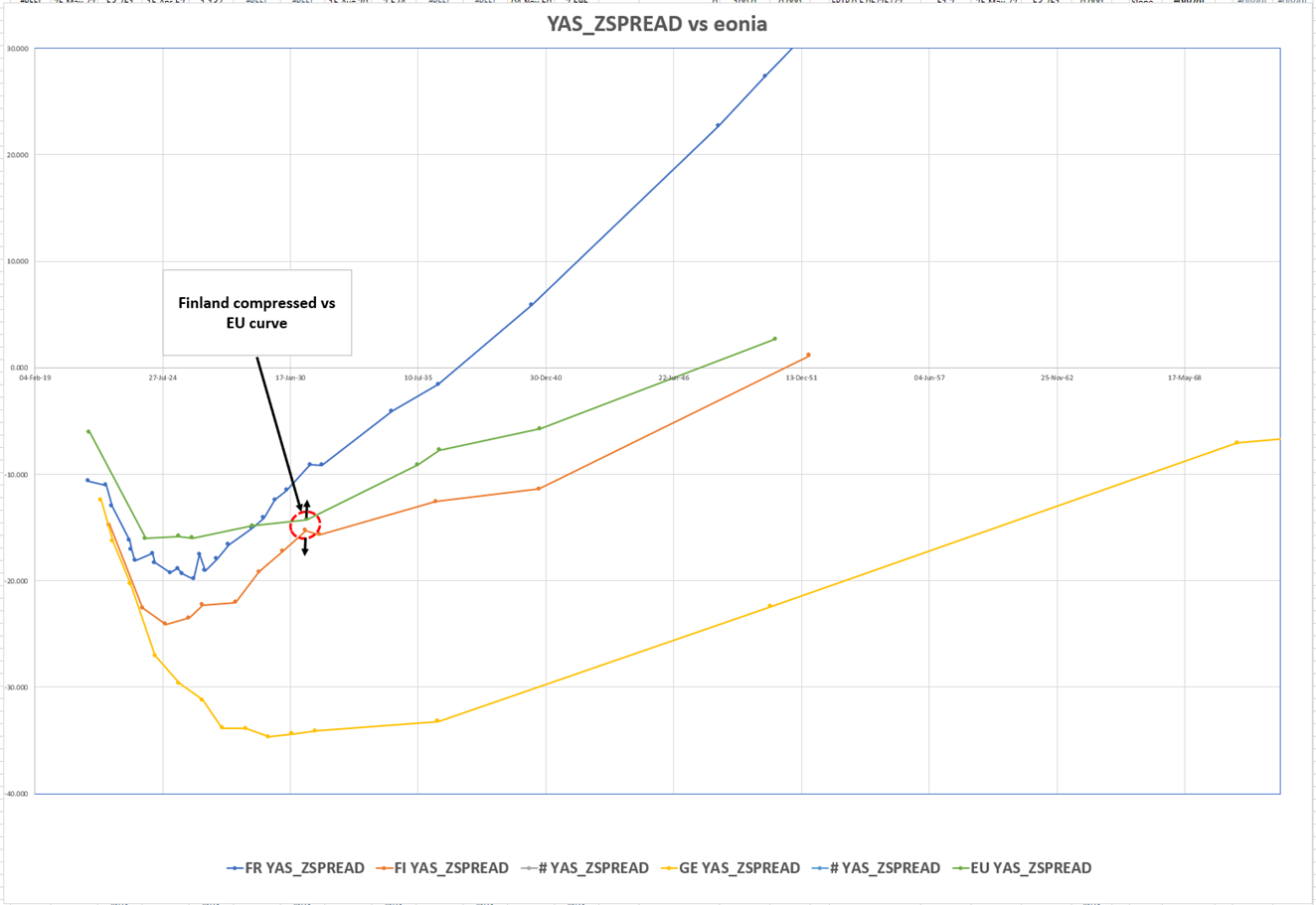

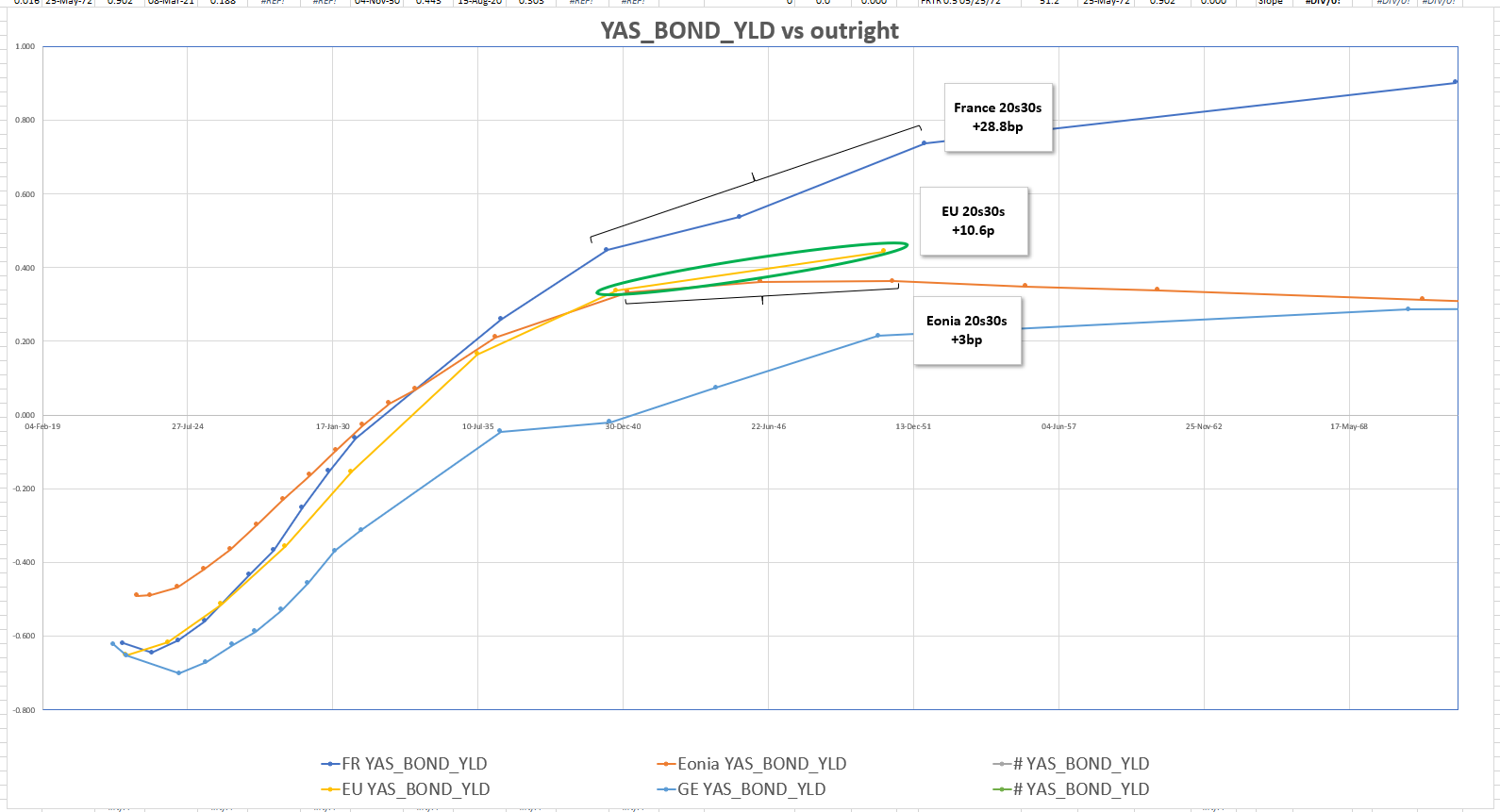

EU supply

Fwiw - am guessing a 5 (ish) y and 25y EU bond may come

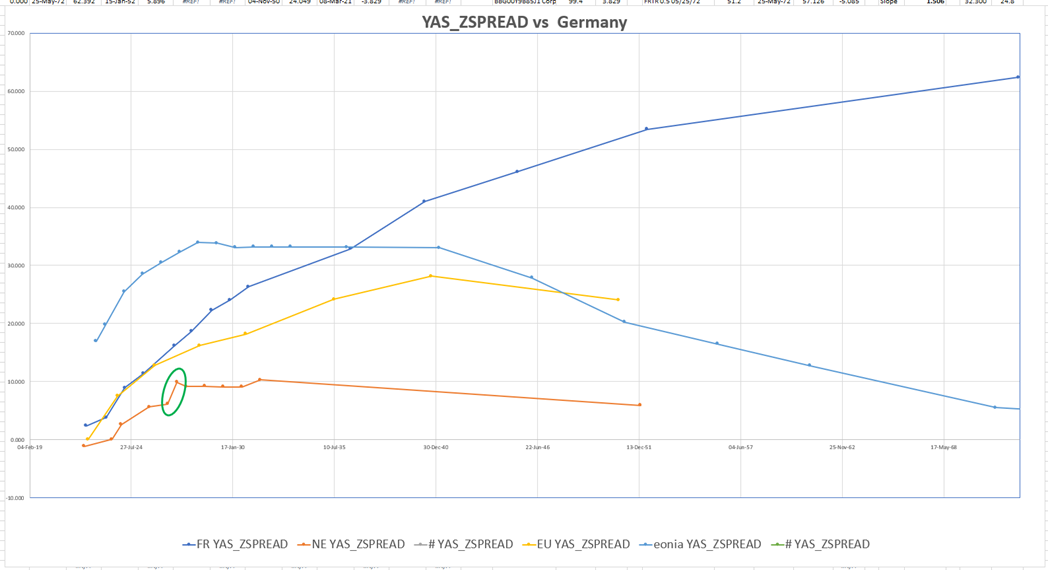

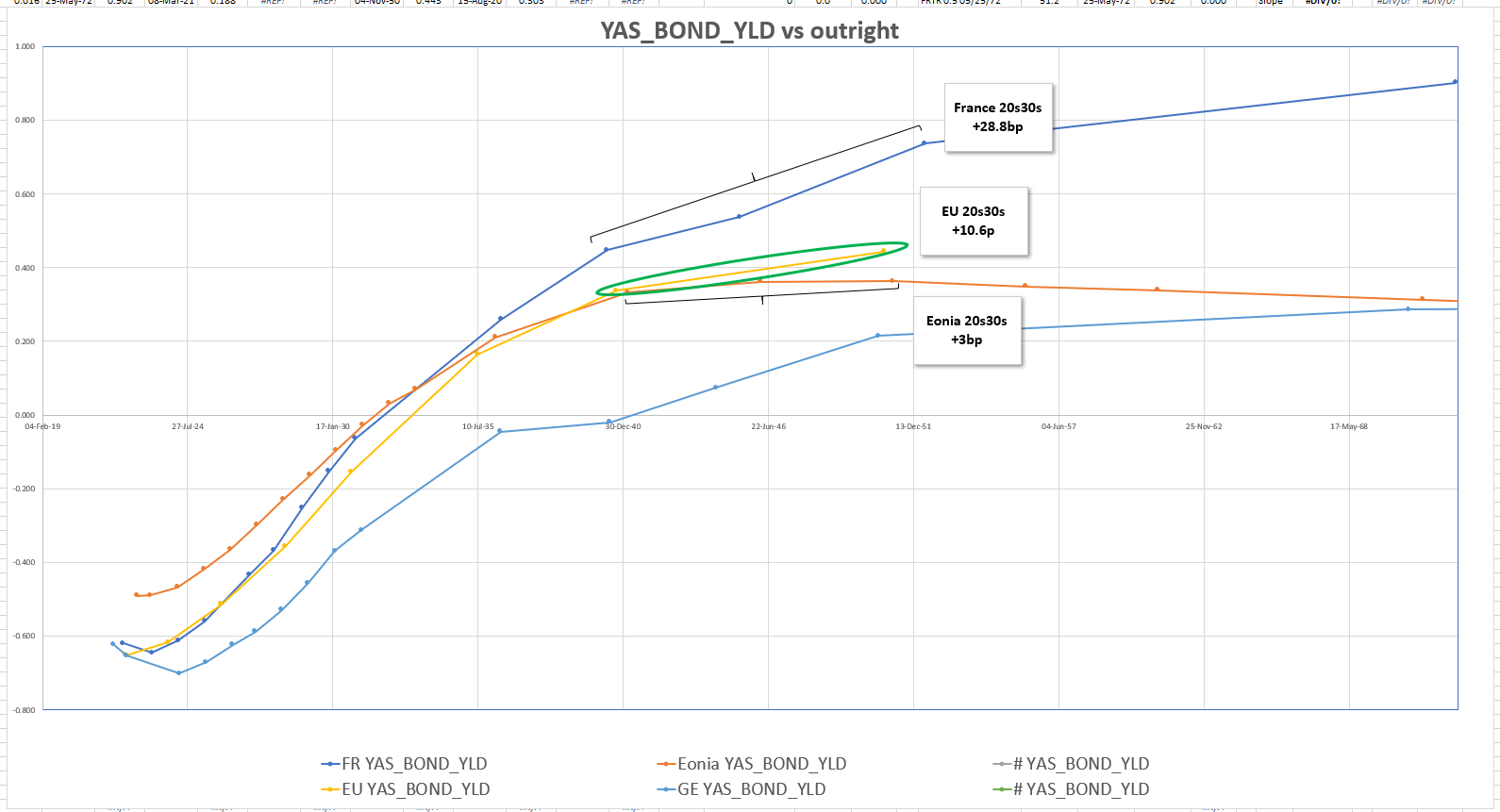

Here's how the EU curve (and others) might look given some notion of 'fair' for the possible EU issues

Makes me want want to sell May26 France - old 10y that will look rich - large issuer and EU in that segment trades super cheap - (the Feb26 otr 5y is much cheaper)

Also can;t help thinking it makes the RFGB 2047 as a little rich - given that rfgb 2030 vs EU30 is Flat - even give n the fact the the EU curve is generally a flatter

Will & James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Movers and Shakers - Euro RV, Will & James Astor Ridge

A few things we're looking at in Euro RV

Belgium 2035s have popped up cheap after the supply announcement

Supply: Next Monday 5y, 10y and 20y

Belgium is a scarce issuer favoured by the Capital Key / France a more frequent borrower

Belgium is through France in the sub 10y space. In longer tenors it has cheapened recently. Our puck would be to do the extension out of OAT contract s and maybe hedge the curve too

Oat contracts into BGB 2035s…

Belgium + Europe Z-Spreads

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades & fades, Movers & Shakers - James & Will @ Astor Ridge

Stuff we’re looking at… !!!!

Green France

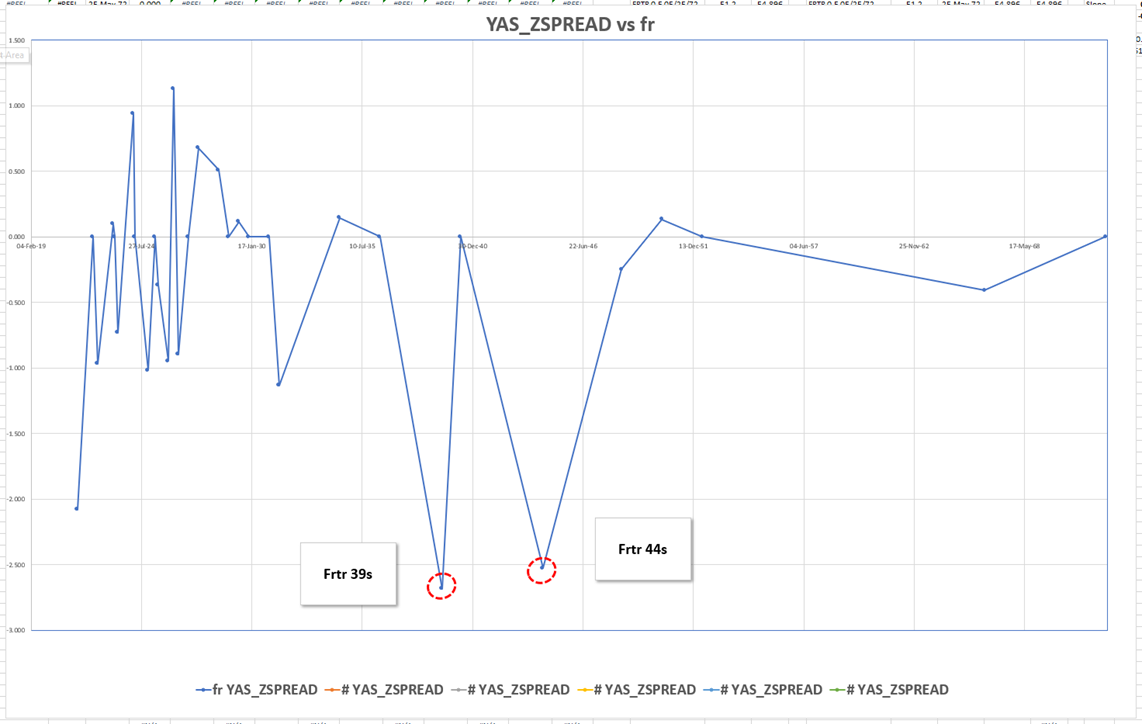

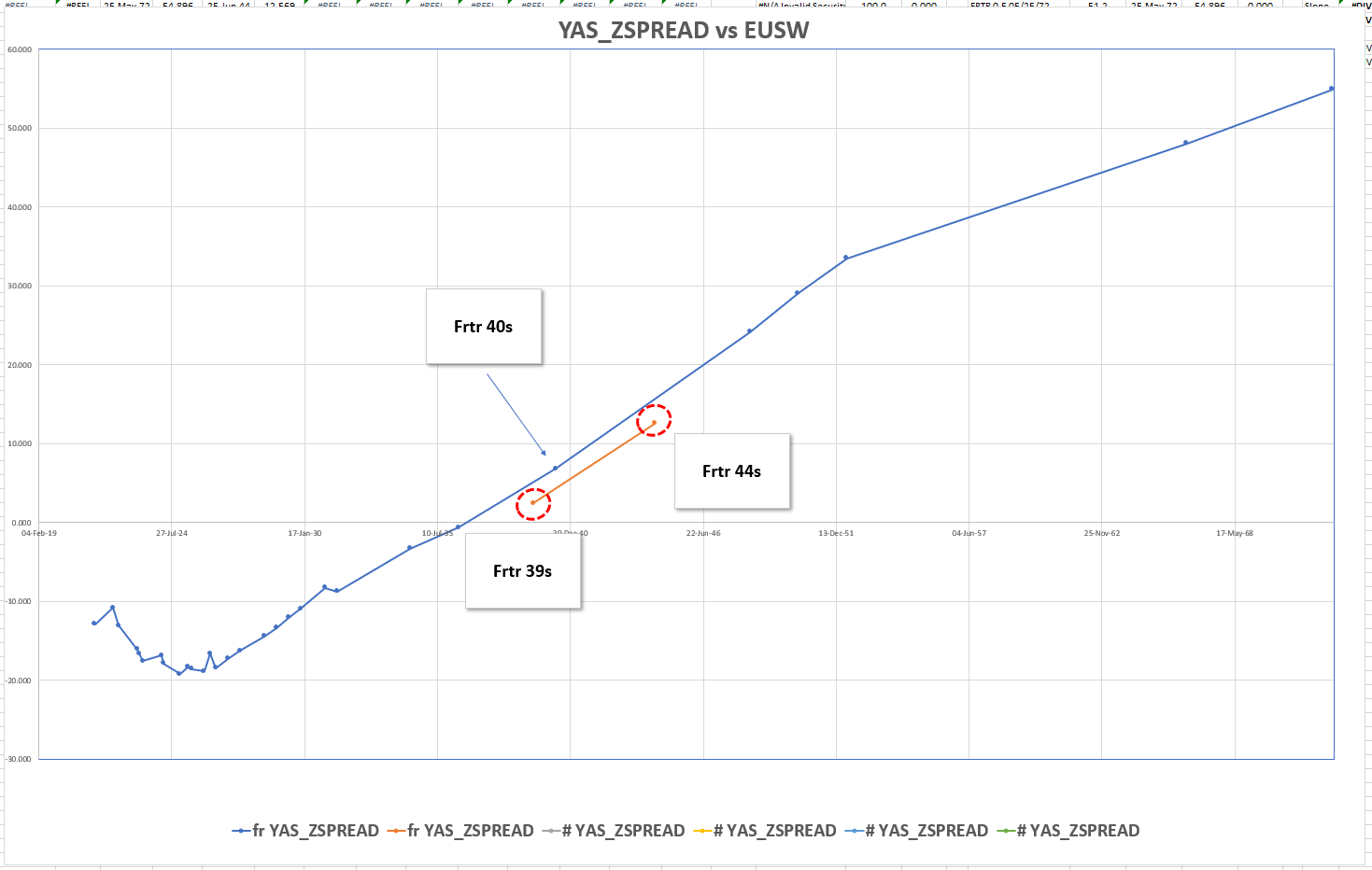

Trade – buy 20y France vs 10y and 30y

France announced a new bond – Frtr Green 25th June 2044

Initial Price Talk: Frtr Green Jun 39 +20bp, MS +14.4bp

Fair: Frtr May40 +18.5 bp

I’m expecting a 0.5% coupon. There’s already a Frtr 1.75% June 39 green issue of €28,9Bln, which trades rich to the curve from which it is being priced

Pricing

Let’s cut to the chase – we’re expecting the bond to settle @ Frtr Green Jun39 +18.5 bp. The pricing seems a bit tight given its initial guidance

Fair: Frtr Jun39 +18.5 bp

Premium to curve: -2.5bp (approx)

Value: scarcity as Green bond, MS +12.7 bp, Z-Spread +13.1 bp

Graph of Z-spread anomalies vs French Benchmark curve…

@ Jun39 +18.5bp

Summary

Decompose this trade into

a) 23y France

b) green premium

- I don’t mind the 20y point in France

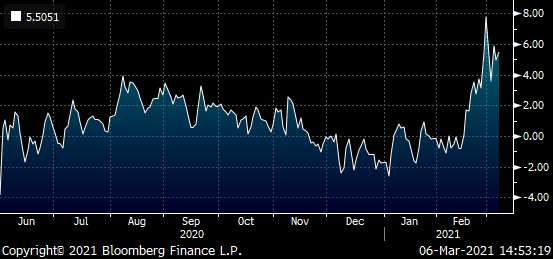

On a .3 / 1 / .7 fly (var weighted, all x2)

It looks ok vs Oat contracts and the 30y…

200 * (YIELD[FRTR 0.5 05/25/40 Corp] - 0.3 * YIELD[FRTR 2.5 05/25/30 Corp] - 0.7 * YIELD[FRTR 0.75 05/25/52 Corp])

And the same fly vs swaps shows it has cheapened a bit more than the generic curve – so there’s a bit of edge

2 * (SP210[FRTR 0.5 05/25/40 Corp] - 0.3 * SP210[FRTR 2.5 05/25/30 Corp] - 0.7 * SP210[FRTR 0.75 05/25/52 Corp])

France vs Swaps

Graph of Z-Spreads for France

Arguably we could see the French 20y cheapen another basis point – although it looks ok on the curve, switch hedging could push it another 1 – 1.5bp cheaper as the lead mgr prepares the market orders on spread and outright

- Green Premium – not a big fan – given it’s 2-3bp elsewhere am a tactical buyer @ -1.5 bp and go flat @ richer than -2.5bp

Buy Frtr May40 vs OATA and Frtr 52

Levels – I think this is two-fold. 20y France is a bit sold with recent supply in 15y – 20y in Europe

- I’d buy 33% of my risk on the timing of the new issue

+20y -OATA and -30y

.3 / 1 / .7

- and the balance with this fly @ -2.5bp ,at which point the Frtr may40 are cheap vs yield / Z-spread / cash-flow discounting on a zero curve

If you want to mutate that into the new bond then you need to tweak the weightings as we fully expect the 2044 green bond to track the 30y a little more than the on the run 20y – call me for those weightings to keep the var low as curve has been a bit hairy

All the best

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades & Fades, Movers & Shakers Week of Feb March 15th, James & Will at Astor Ridge

Some thoughts for the week ahead

The Big Fade

Dead simple – we’re looking for steeper forward curves – typically in the 3y to 10y range. As an approximation, this would be buying cheap bullets and selling wings, which at first seems counterintuitive in a bear steepening.

Trick is, I want to pay zero premium for this trade. So we’re looking for structures where forwards are flat and then as high as than the longer tenors. It’s bit of a tall order, but then what’s the point in having your cake and not eating it, really?

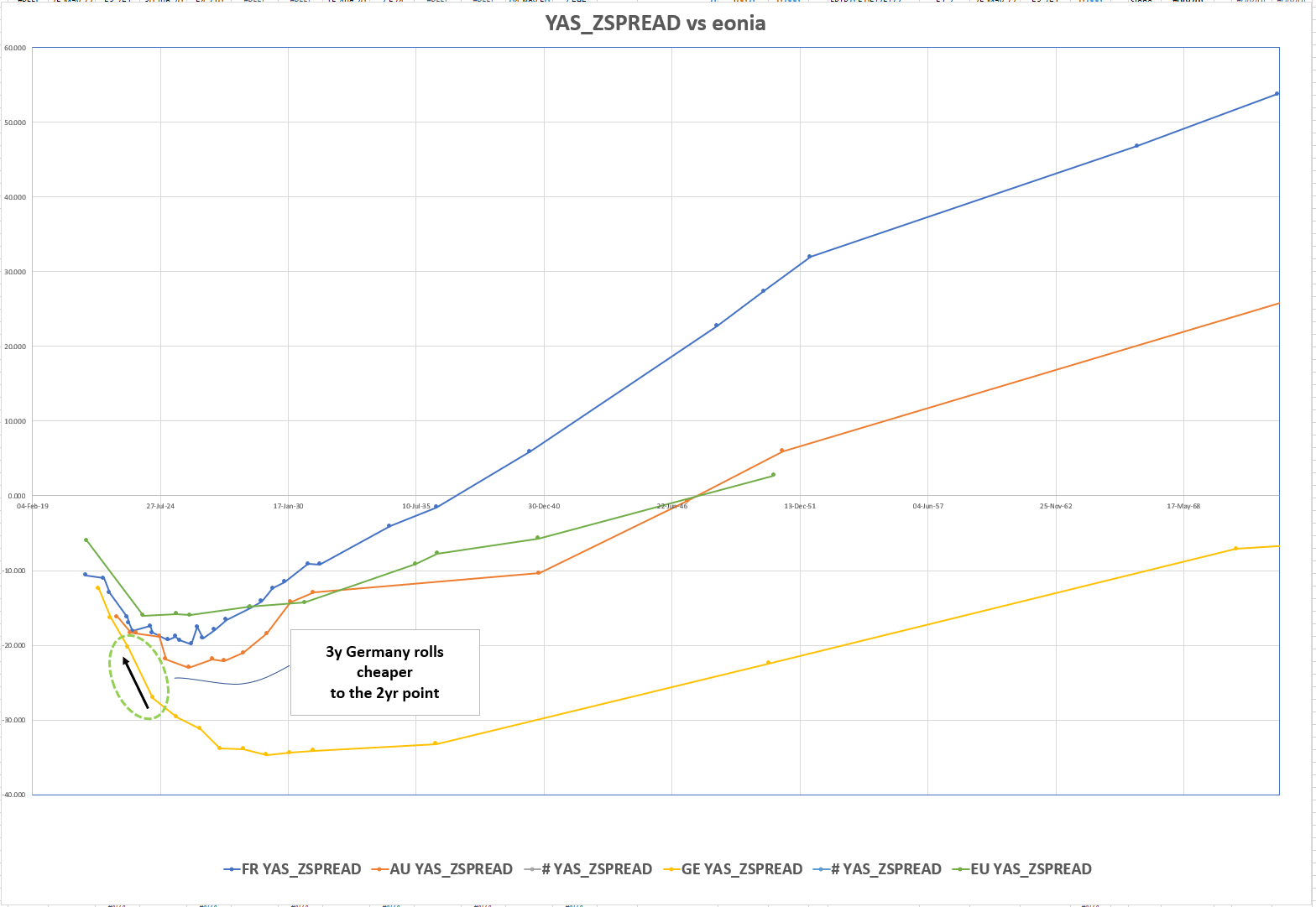

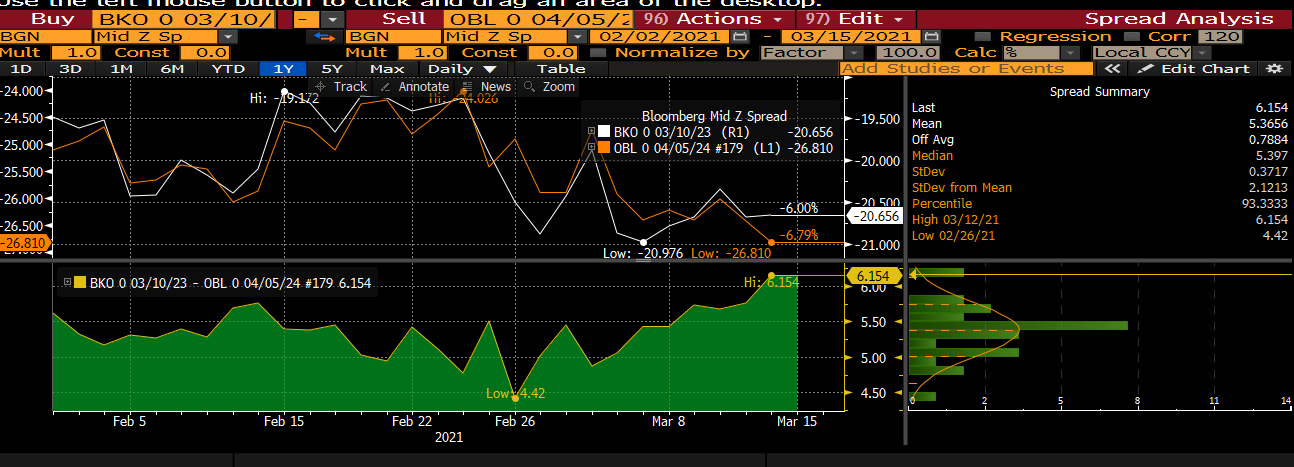

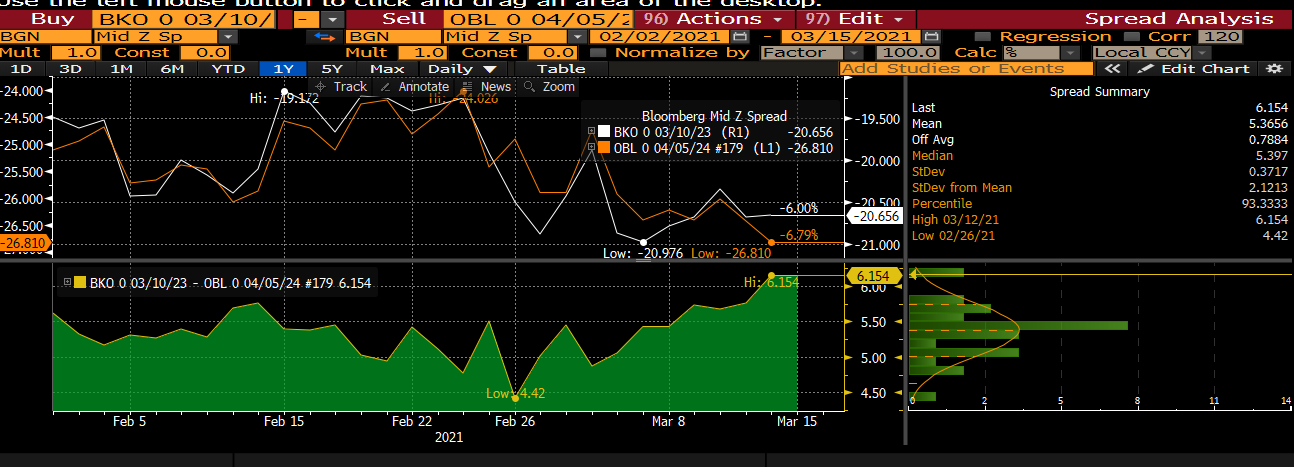

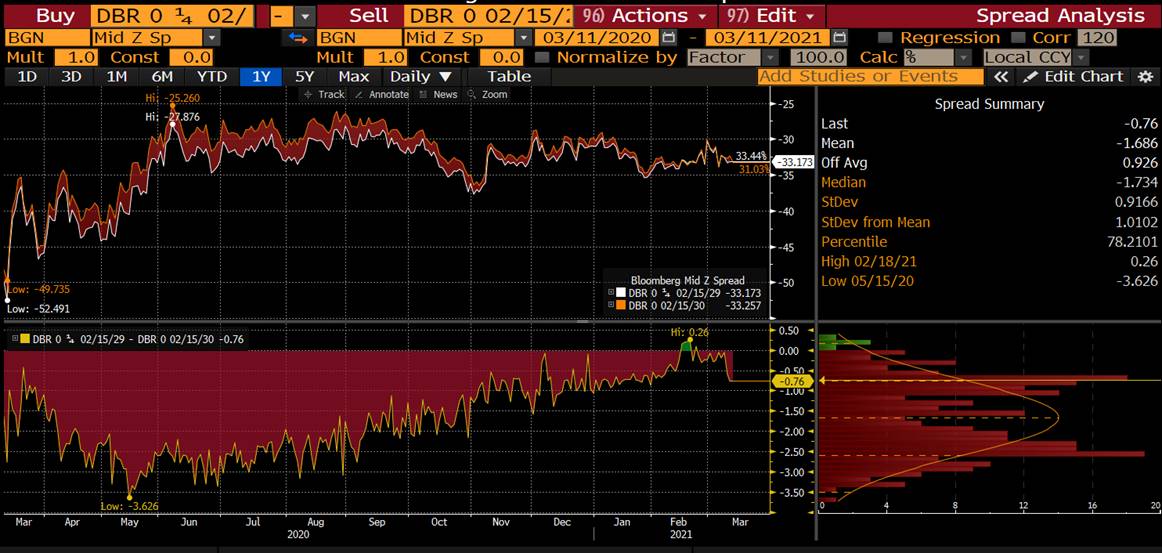

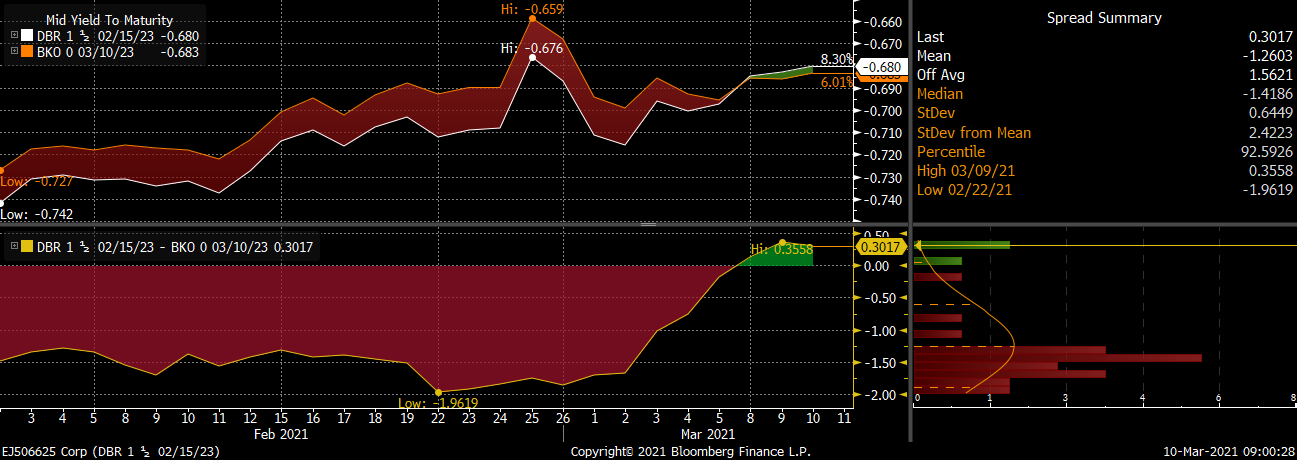

Germany 2s 3s steepener vs swaps

- We have supply in the German 2y on Tuesday 16th March, €5Bln Schatze (BKO ticker) Mar23, CTD to the German 2year contract

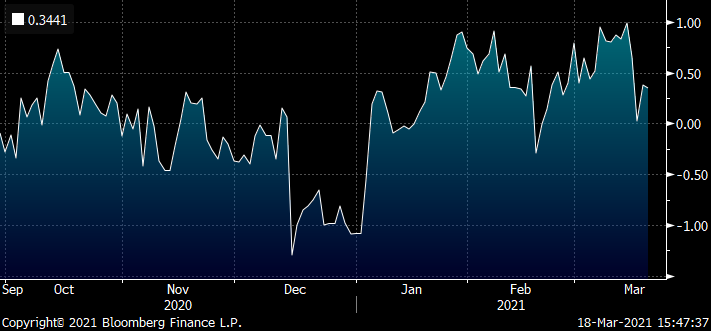

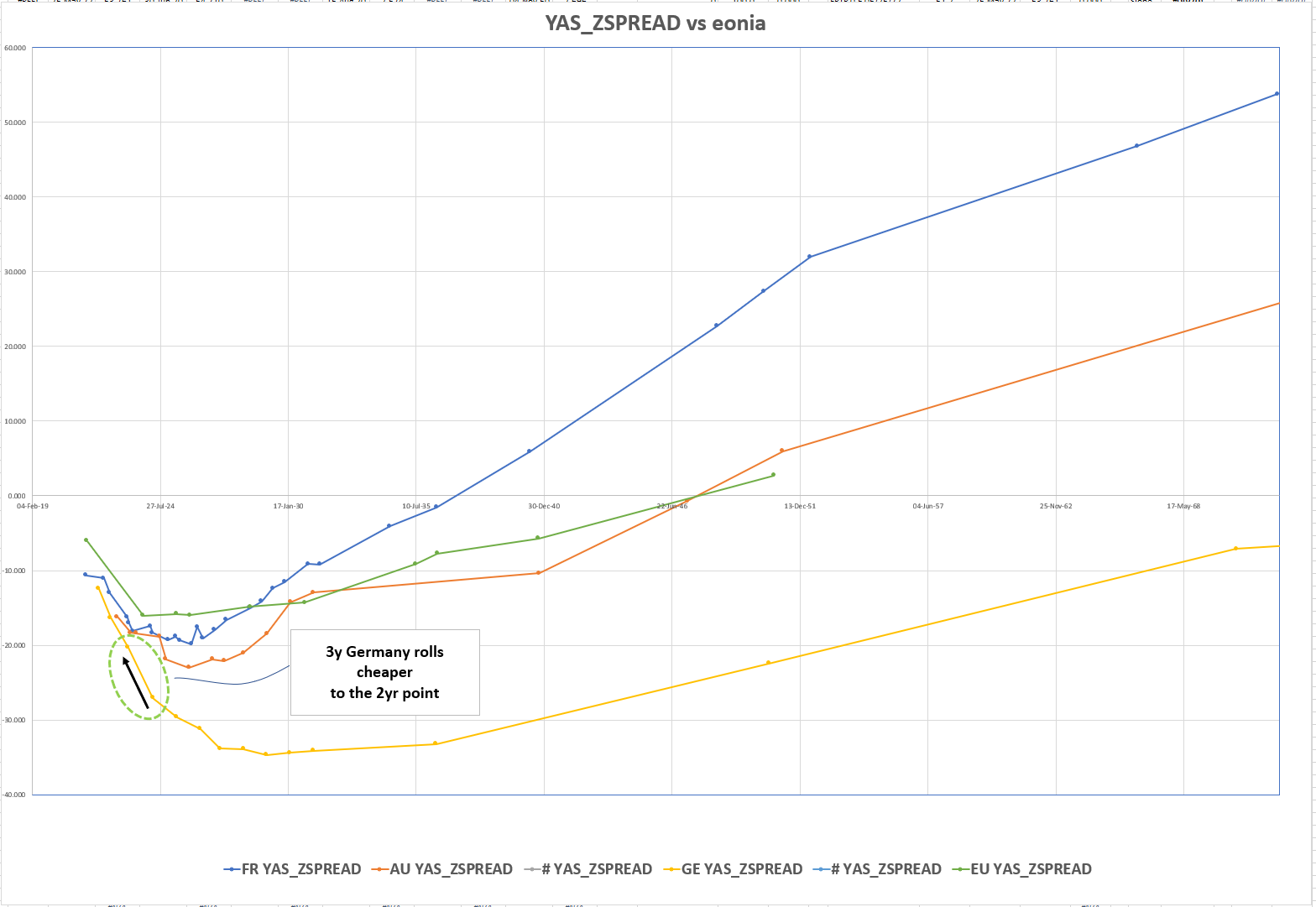

- The roll is most punitive in the 3y to the 2y – see graph below of Euro Z-Spreads vs Eonia – 2y vs 3y looks contextually out of line (3y rich and 2y cheap) and generally I like this then as I think it’s a relic of this sense that ECB could cut

Trade – buy 2y Schatze, sell 3y obl vs swaps

History on Z-Spread…

Targets

Target is slim: 1.5 to 2bp brings it back into line

But I like the theme across the whole curve as we could lose any rate cut expectations in Germany and that could give it another 1 to 2bp

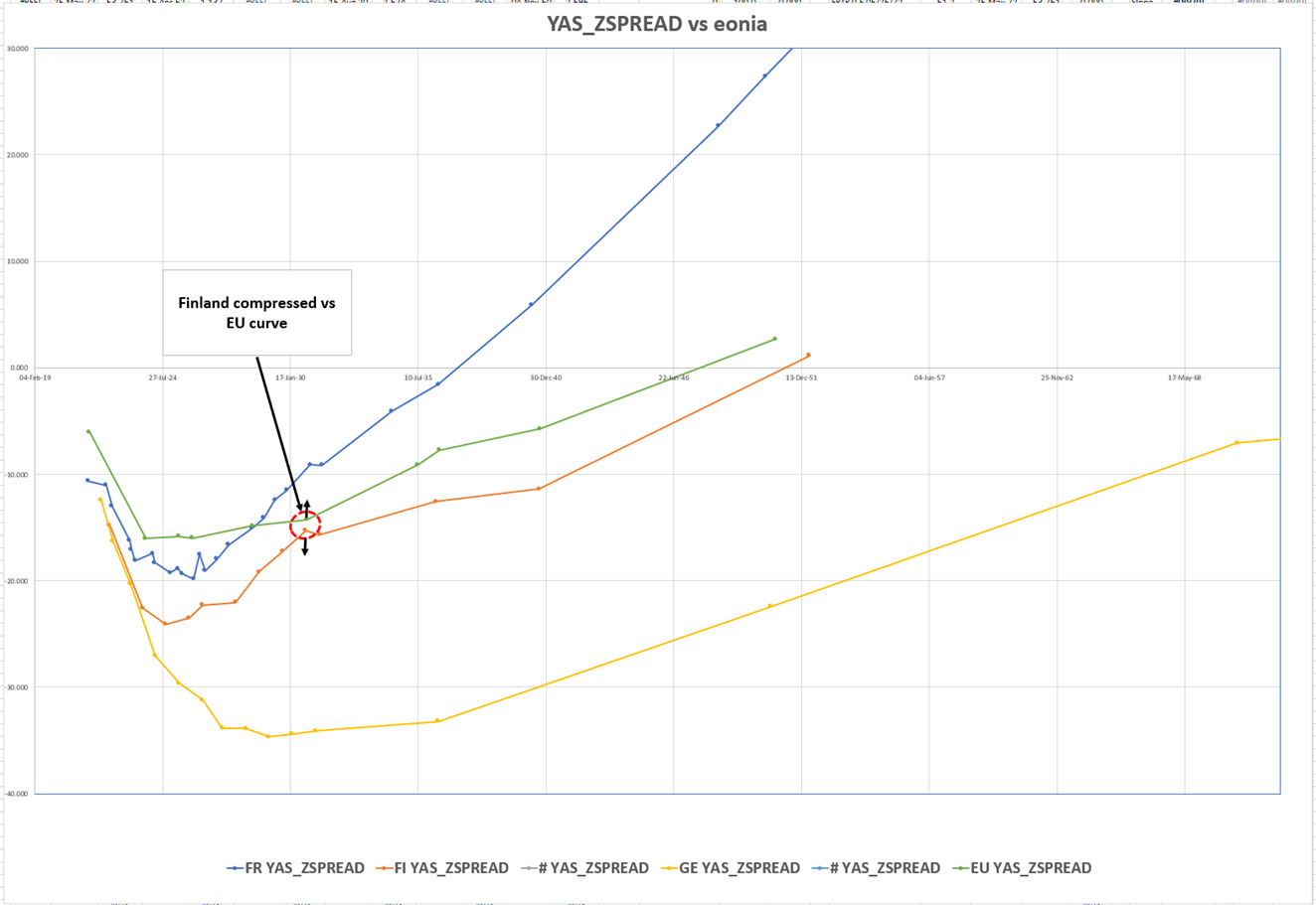

Sell 10y EU, buy Finland 10y, spread widener

On Tuesday we have supply in Finland 10y (Sep2030) and 30y: Total €1bln

Always a small and scarce issuer, Finland trades with a modest premium to France in that tenor: -Frtr30 / +Rfgb30 is -7.4bp

You can spin this two ways, yeah it’s scarce and favoured by the Pepp capital-key but also it’s a bit less liquid and it’s only these liquidity events, however small, that let you get in

Conversely the EU program has approx another €28 Bln to issue to finish the quarter. Now although 5y and 25y might be possibilities, this should impact the EU across the curve.

I see 10y EU as rich and the 9y (2030 maturity) Finland as cheap and over these events we could see a widening – large issuer vs small, with the back drop of the term premium being wider elsewhere

Z-Spread differentials…

7y Finland / EU: -4.3bp

10y Finland / EU: -1bp

15y Finland / EU: -4.8bp

Target: -4.5bp

Graph of Z-Spreads Europe…

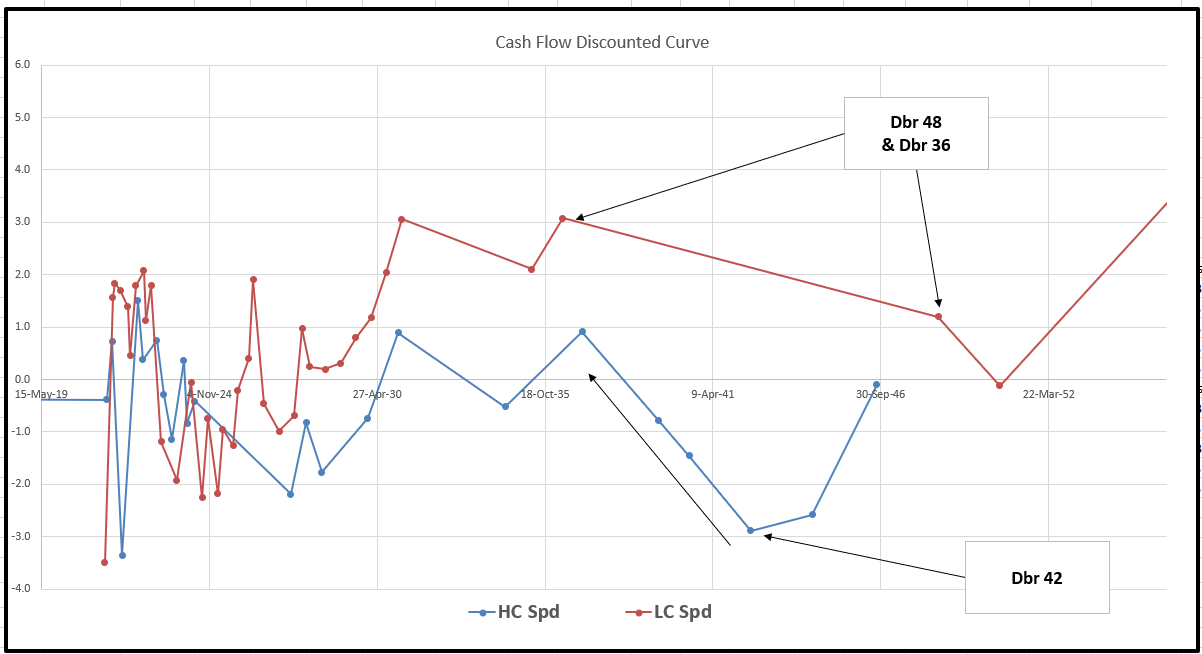

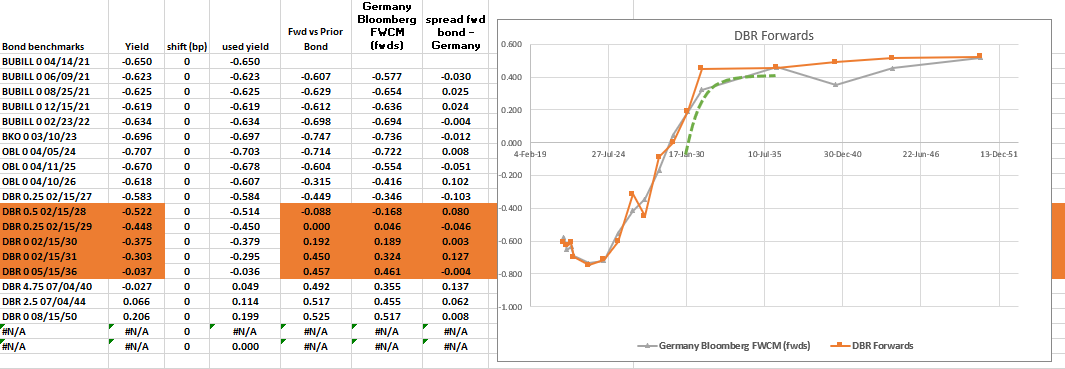

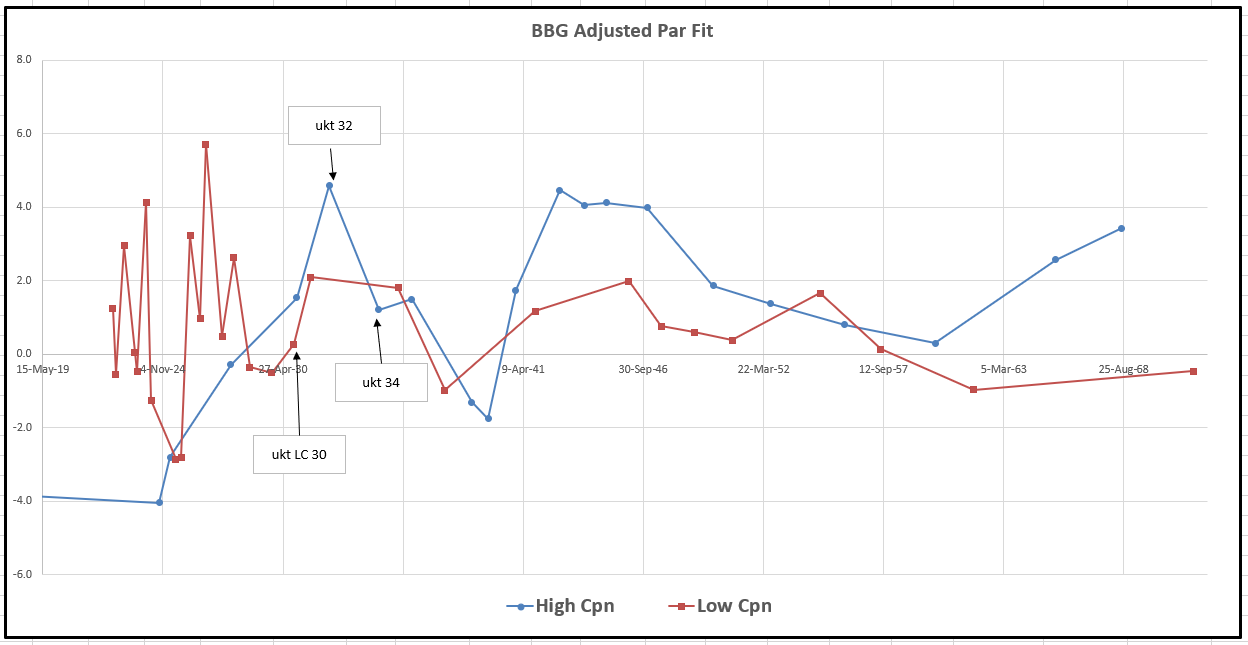

Germany

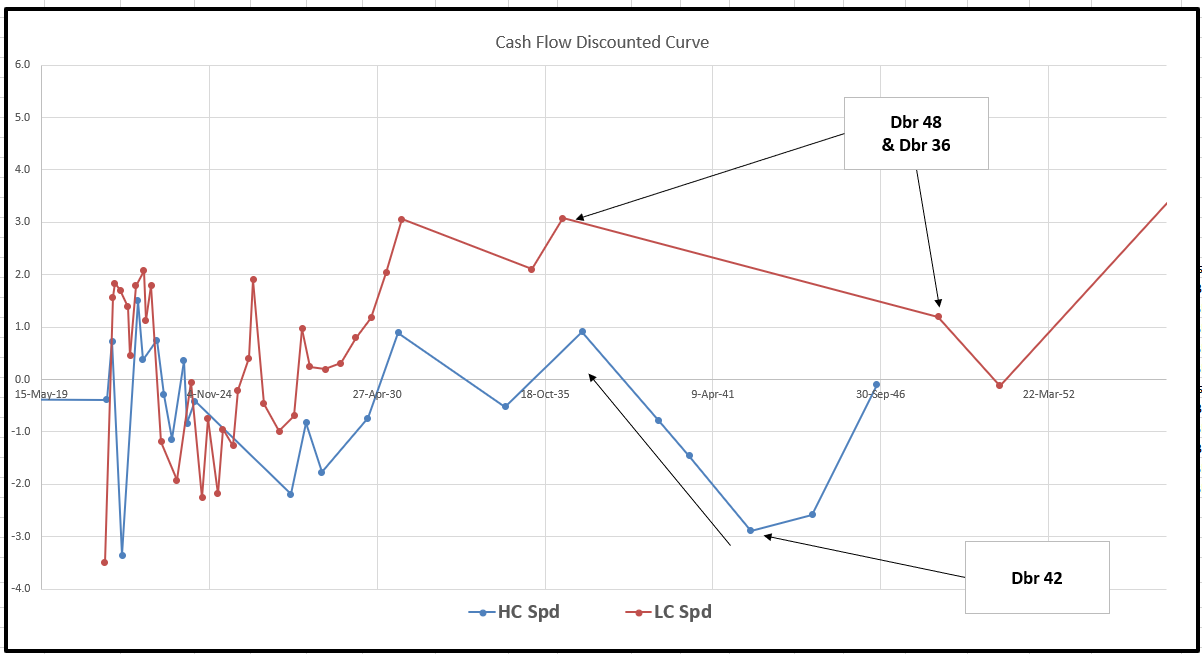

Sell Germany 21y vs 15y and old 30y

Supply

On Wednesday March 17th we have supply in Dbr 2050, we see both the 30y and old 30y Aug47 as cheap vs high coupons

Although 20s 30s has steepened in the last month, it has actually modestly flattened vs swaps

Here we’re looking at High coupon 20yrs vs on the run 15y and 30y

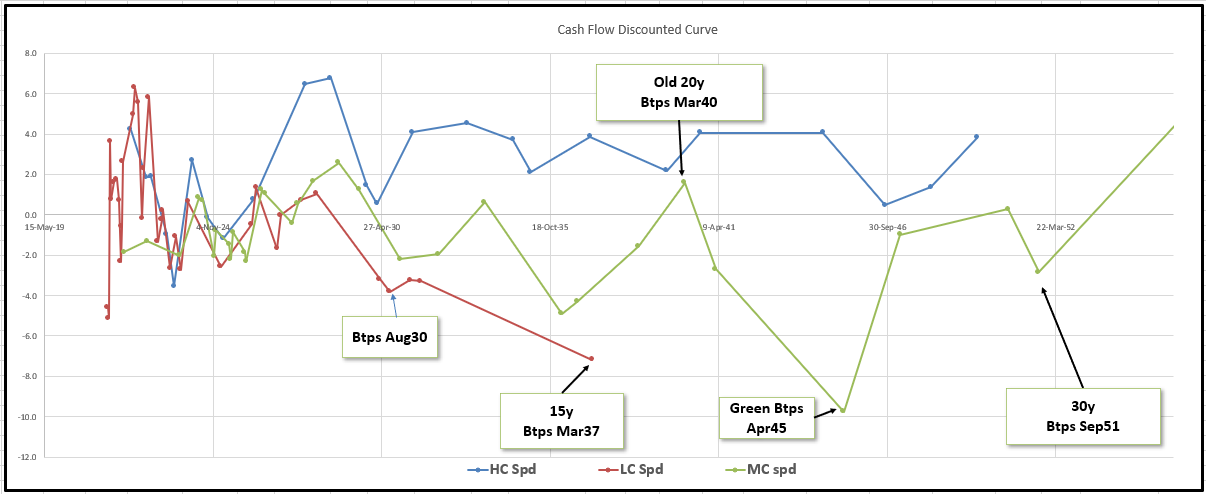

Generally high coupons ‘appear’ rich when subject to simple yield analysis. They can even appear so in Z-Spread terms. For a real confidence in shorting this stuff I really like to add the Cash-flow discounted spread (BBG: BB_SPRD_TO_SPLINE_EXPONENTIAL) just to be sure

So although the PEPP had been buying these issues, it doesn’t mean they’re gonna depart from the curve – the ECB makes them available for securities Repurchase and lending and we just have to sell them when they are truly rich, which we believe they are

Trade:

Sell Dbr 21y vs 15y and old 30y

Mis-weighted: call for weightings

Levels

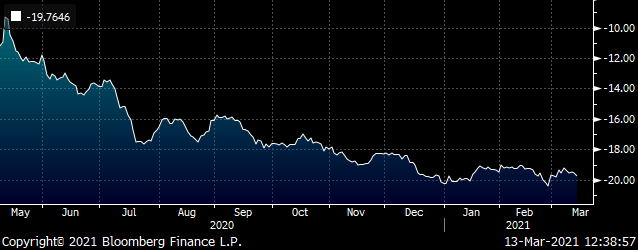

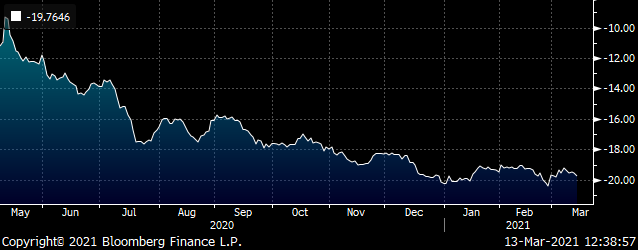

Current: -19.75 bp

Enter: -19.5 bp

Target: -12 bp (Long Term)

Graph of Anomalies in Germany (Fully discounted Cashflows vs German curve)

BBG

Cix: using old 15y dbr 35 (has more history)

Call for exact details

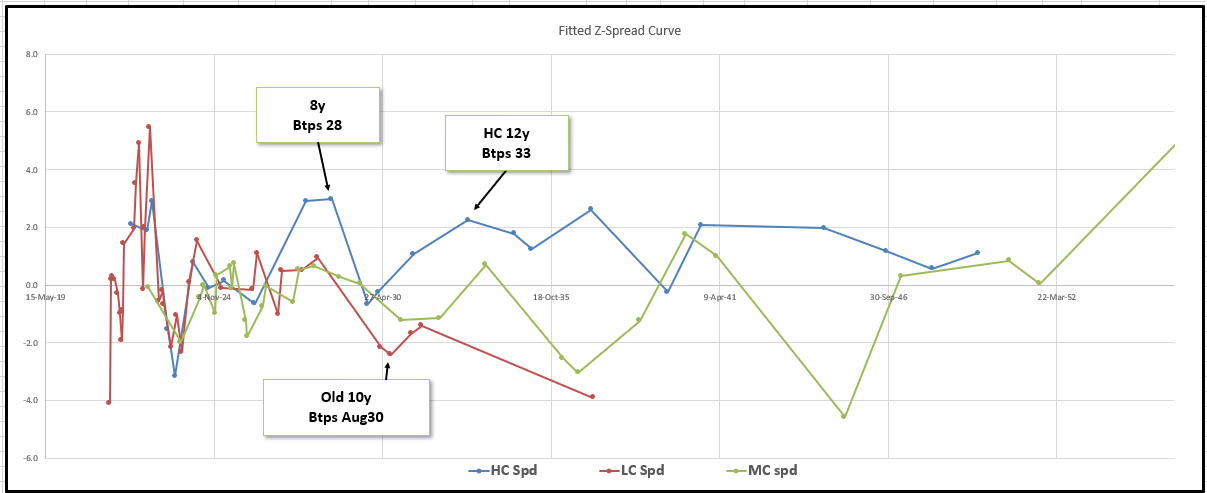

Italy

– on our Radar, with the ix/rx spread settling into what seems to be a benign phase – we want to grab as much carry as we can. Similarly, we expect buying to be find high coupons irresistible in terms of carry & true value, with lower coupons out of favour

Btps Aug30 are a rich low coupon (0.95%) bond, but whose position as lowest coupon 10y has been superseded by the newer Btps 0.9% of Apr31

Trade

Long High Coupon 8y and 12y vs rich Low Coupon 9 ½ y

Carry: +0.6bp /3mo after 5bp repo spread

Roll: Flat

BBG history is not stellar but we have to remember that bullets have been hit hard generically

But when we look at the structure vs swaps, to remove the generic movement in risk-free curves – it looks more compelling…

Levels

Am targetting 1bp richer in the belly / worth 2bp on the fly (double counting middles)

Keep you posted?

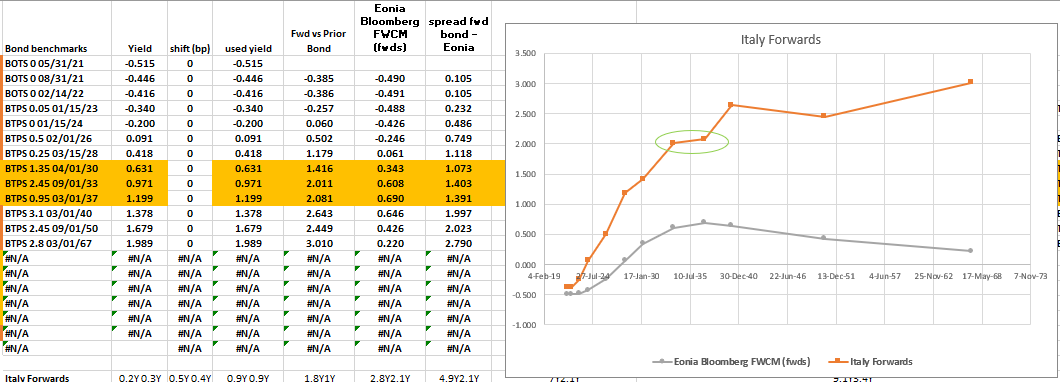

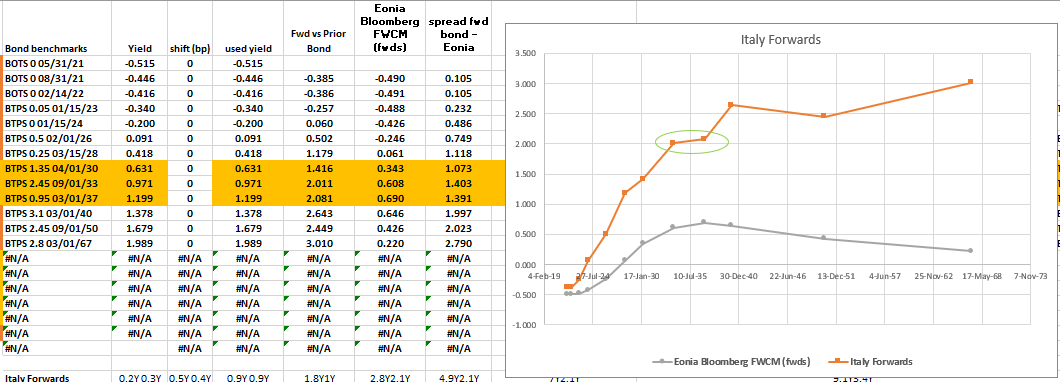

Italy

Forwards Flat in Italian Curve - otherwise positively sloped

If we’re kicking the Covid can down the road then forwards shouldn’t be inverted or even flat over larger non-highly leveraged gaps

Consider the forwards in the Italian bond curve..

This means that apr30 vs sep33 is too steep And/Or sep33 vs mar37 is too flat

Give us a call to see the exact structure but this fly should have 5-6 bp in it to get to fair

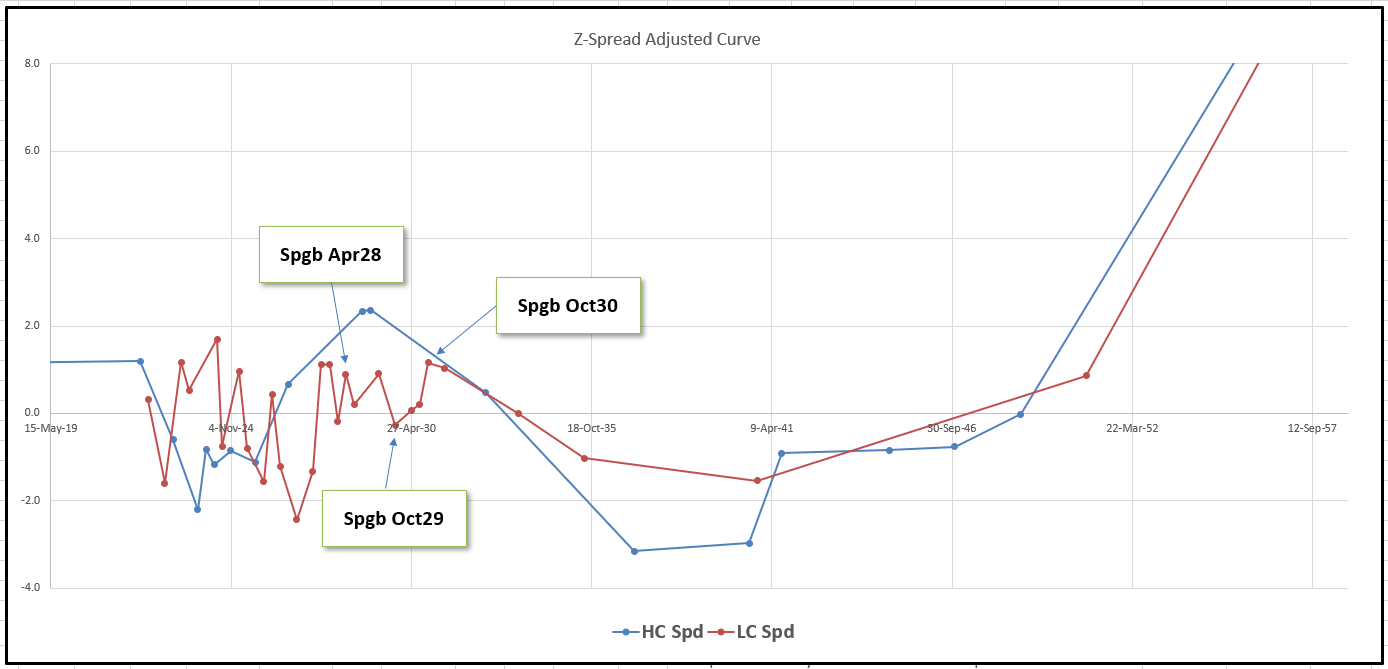

Spain

We’ve got a tap of the new 0% coupon 7y Jan28 on Thursday March 18th

we’re on the side-lines on this one, with an ugly 0% coupon it just doesn’t carry well and as a tap bond will probably stay cheap

What we do see is this is popping out the old 1.4% April 28 cheap and we like the roll of -Oct29 vs +oct30

Put ‘em together and what have you got?

Trade

+Apr28 -Oct29 +Oct30

Apr28: cheap 7y (old 10y)

Oct29: Expensive 9y

Oct30: Cheap old 10y no more taps while they issue apr31s we think

It’s got intrinsic value – see Z-fitted anomalies..

Ugly History

But makes sense given what the curve has done – here’s vs swaps

2 * (SP210[SPGB 0.6 10/31/29 Corp] - 0.5 * SP210[SPGB 1.4 04/30/28 Corp] - 0.5 * SP210[SPGB 1.25 10/31/30 Corp])

We need the fly richer by 1bp for it to be solid vs swaps (even though am advocating just a bond fly – the whole curvature is in adifferent place now)

So we sit and wait for the wing to cheapen 2bp into supply

Interested?

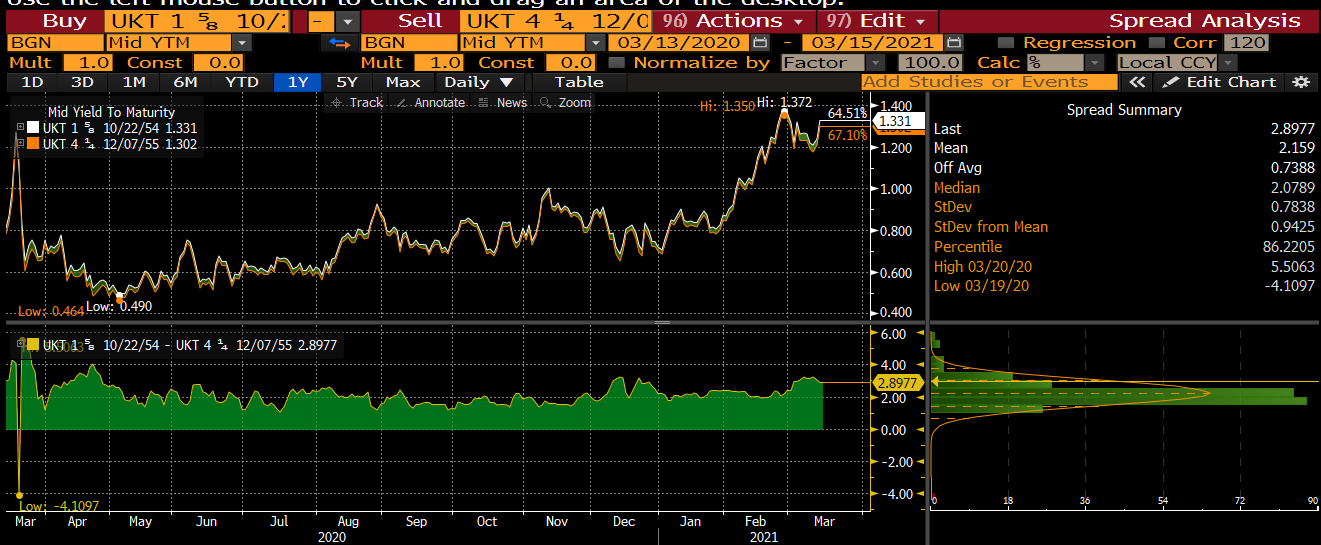

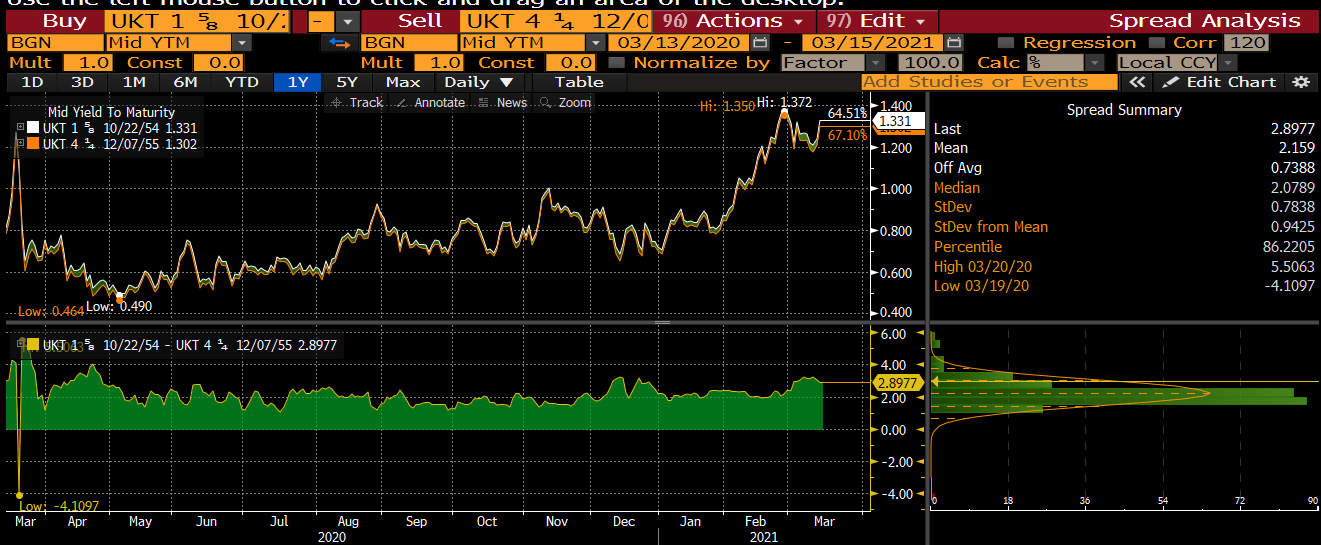

Never complete without the UK

Steepener -Ukt 55 +Ukt 44s

>+3bp

UK has supply in UKT 54s on Tuesday 16th March

As a low coupon curve they are over the high coupon curve

If I turn calc the forward between them and the 55s it comes out at -0.28%, even if I adjust for coupon (turn them into par bonds) the fwd is +0.55% which is lower than Sonia

In last week’s funding announcement they telegraphed and April & a June tap of 2071s – which to me makes me want to pay any long forwards which were both low and close to Sonia – so steepeners it is!!!

I flagged this one this week at +3bp – but > +2.75bp has intrinsic value above beyond the simple history and think it should be a touch lower at +1.5bp

Small beans but, hey…

As always have a fab week

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades & Fades, Movers & Shakers Week of Feb March 15th, James & Will at Astor Ridge

Some thoughts for the week ahead

The Big Fade

Dead Simple – we’re looking for steeper forward curves – typically in the 3y to 10y range. As an approximation, this would be buying cheap bullets and selling wings, which at first seems counterintuitive in a bear steepening.

Trick is, I want to pay zero premium for this trade. So we’re looking for structures where forwards are flat and then high as they might be in v longer tenors. It’s bit of a tall order, but then what’s the point in having your cake and not eating it, really?

Germany 2s 3s steepener vs swaps

- We have supply in the German 2y on Tuesday 16th March, €5Bln Schatze (BKO ticker) Mar23, CTD to the German 2year contract

- The roll is most punitive in the 3y to the 2y – see graph below of Euro Z-Spreads vs Eonia – 2y vs 3y looks contextually out of line (3y rich and 2y cheap) and generally I like this then as I think it’s a relic of this sense that ECB could cut

Spreads vs Eonia…

France, Austria, Germany, EU

Trade – buy 2y Schatze, sell 3y obl vs swaps

History on Z-Spread…

Targets

Target is slim: 1.5 to 2bp brings it back into line

But I like the theme across the whole curve as we could lose any rate cut expectations in Germany and that could give it another 1 to 2bp

Sell 10y EU, buy Finland 10y, spread widener

On Tuesday we have supply in Finland 10y (Sep2030) and 30y: Total €1bln

Always a small and scarce issuer, Finland trades with a modest premium to France in that tenor: -Frtr30 / +Rfgb30 is -7.4bp

You can spin this two ways, yeah Finland is scarce and favoured by the Pepp capital-key but also it’s a bit less liquid and it’s only these liquidity events, however small, that let you get in

Conversely the EU program has approx another €28 Bln to issue to finish the quarter. Now although 5y and 25y might be possibilities, this should impact the EU across the curve.

I see 10y EU as rich in the 9y (2030 maturity)& Finland as cheap and over these events we could see a widening – large issuer vs small, with the back drop of the term premium being wider elsewhere…

Z-Spread differentials…

7y Finland / EU: -4.3bp

10y Finland / EU: -1bp

15y Finland / EU: -4.8bp

Target: -4.5bp

Graph of Z-Spreads Europe…

Germany

Sell Germany 21y vs Buy 15y and Buy old 30y

Supply

On Wednesday March 17th we have supply in Dbr 2050, we see both the 30y and old 30y Aug48 as cheap vs high coupons

Although 20s 30s has steepened in the last month, it has actually modestly flattened vs swaps

Here we’re looking at High coupon 21yrs vs on the run 15y and 30y

Generally high coupons ‘appear’ rich when subject to simple yield analysis. They even appear so in Z-Spread terms. For a real confidence in shorting this stuffm I really like to add the Cash-flow discounted spread (BBG: BB_SPRD_TO_SPLINE_EXPONENTIAL) just to be sure

So although the PEPP had been buying these issues, it doesn’t mean they’re gonna depart from the curve and leave the building, you only have to see other high coupons in other names to see that just ain’t so – the ECB makes them available for securities Repurchase and lending and we have to sell them when they are truly rich, which we believe they are

Trade:

Sell Dbr 21y vs 15y and old 30y

Mis-weighted: call for weightings

Levels

Current: -19.75 bp

Enter: -19.5 bp

Target: -12 bp (Long Term)

Graph of Anomalies in Germany (Fully discounted Cashflows vs German curve)

BBG

Cix: using old 15y dbr 35 (has more history)

Call for exact details

Italy – Sell 9y vs HC 8y and 12y for carry

– on our Radar, with the ix/rx spread setlting into what seems to be a benign phase – we want to grab as much carry as we can. Similarly we expect buying to be find high coupons irresistible in terms of carry & true value, with lower coupons out of favour

Btps Aug30 are a rich low coupon (0.95%) bond, but whose position as lowest coupon 10y has been superseded by the newer Btps 0.9% of Apr31

Trade

Long High Coupon 8y and 12y vs rich Low Coupon 9 ½ y

Carry: +0.6bp /3mo after 5bp repo spread

Roll: Flat

BBG history is not stellar but we have to remember that bullets have been hit hard generally

When we look at the structure vs swaps, to remove the generic movement in risk-free curves – it looks a bit more compelling…

Levels

Am targetting 1bp richer in the belly / worth 2bp on the fly (double counting middles)

Keep you posted?

Italy

Buy Sep33 vs Apr30 and Mar37

Weighting 50/50:

Forwards Flat in Italian Curve - otherwise positively sloped

If we’re kicking the Covid can down the road then forwards shouldn’t be inverted over larger non-highly leveraged gaps

Consider the forwards in the Italian bond curve.. I’ve highlighted Apr30/sep33 vs Sep33/Mar37 => 2.02% vs 2.08% almost no slope – so the belly is cheap – this is what we’re looking for as a theme

This means that apr30 vs sep33 is too steep And/Or sep33 vs mar37 is too flat

Give us a call to see the exact structure but this fly should have 5-6 bp in it to get to fair

Spain

On Hold for

Sell Oct29 vs

Buy Apr28 and Buy Oct30

We’ve got a tap of the new 0% coupon 7y Jan28 on Thursday March 18th

we’re on the side-lines on this one, with an ugly 0% coupon it just doesn’t carry well and as a tap bond will probably stay cheap

What we do see is this is popping out the old 1.4% April 28 cheap and we like the roll of -Oct29 vs +oct30

Put ‘em together and what have you got?

Trade

+Apr28 -Oct29 +Oct30

Apr28: cheap 7y (old 10y)

Oct29: Expensive 9y

Oct30: Cheap old 10y no more taps while they issue apr31s we think

It’s got intrinsic value – see Z-fitted anomalies..

Ugly History.. am doubting myself

But makes a bit more sense given what the curve has done – here’s vs swaps

2 * (SP210[SPGB 0.6 10/31/29 Corp] - 0.5 * SP210[SPGB 1.4 04/30/28 Corp] - 0.5 * SP210[SPGB 1.25 10/31/30 Corp])

We need the fly richer by 1bp for it to be solid vs swaps (even though am advocating just a bond fly – the whole curvature is in adifferent place now)

So we sit and wait for the wing to cheapen 2bp into supply

Interested?

UK

Never complete without the UK!

Steepener -Ukt 55 +Ukt 54s

>+3bp

UK has supply in UKT 54s on Tuesday 16th March

As a low coupon bond they are over the interpolated high coupon curve in any metric

If I calc the forward between them and the 55s it comes out at -0.28%, even if I adjust for coupon (turn them into par bonds first) the fwd is +0.55% which is still lower than Sonia

In last week’s funding announcement they telegraphed an April & a June tap of 2071s – which to me makes me want to pay any long forwards which were both low and close to Sonia – so steepeners it is!!!

I flagged this one this week at +3bp – but > +2.75bp has intrinsic value above beyond the simple history and think it should be a touch lower at +1.5bp

Small beans but, hey…

As always have a fab week

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Movers & Shakers - Euro RV, James & Will at Astor Ridge

Germany starting to see Dbr feb29 basis as cheap – in that sense we're seeing the RXM1 contract as richening but not rich enough vs wings

Here it is vs contracts on Z-Spread, RXM1/dbr feb29on Z-Spread

France -

Still like Frtr Nov 30 basis – bond is cheap

Italy – we're getting close but not quite on shorting Btps May31 back into medium coupons –The Nov29 as a former long bond, were never deliverable but richened when Aug 29 were ctd. So...

Btps May31 are well on the same journey – if I had them I'd roll them into longer, high coupons or back into something like the idiosyncratic Btps Mar32

High coupon Spain looking cheap and too steep

-Spgb 10/25 +Spgb jul26

UKT -HC 36 to buy LC 35s – looking for +1.75bp – on full cashflow discounting this finally has value, tap in 35s on the 17th March

As we get ready for new Green 20y France – Frtr May34 have cheapened

Looking at BGB 32 (high coupon) rolls into cheaper 10y sector vs Frtr May34

Ireland

with supply in 10y and 30y it's hardly surprising that 31s 33s is too flat in the context of other Euro Issuers but we see that starting to work vs Swaps

Ragb 28 into Finland 28

We're getting close here – but it's a tight trade so gotta work to get this on – but Austria is just not as rare as Finland but the ratings are similar

Germany Dbr 37 as a high coupon got a little over sold into the new Dbr36 issuance

somehow I want to get to…

-dbr 34 +dbr37

vs 20% of +rx / dbr 42

Have sympathy with all sides of that trade – but fear B/O may require a simpler expression – or we will have to leg into this

100 * ((YIELD[DBR 4 01/04/37 Corp] - YIELD[DBR 4.75 07/04/34 Corp]) - 0.2 * (YIELD[DBR 3.25 07/04/42 Corp] - YIELD[DBR 0 02/15/30 Corp]))

Just ask for any further detail on the analysis

Enjoy

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Movers and Shakers, Not Trades & Fades

Morning

Movers & Shakers

A quick run through of some of the bonds that have moved a lot – not necessarily new risk, but also taking stuff off that may have worked

France

Frtr Nov30 basis looking cheap

Straight yield spread vs OATA ctd Frtr May30

+7.1bp – switch futures into the value Nov30 – still feel it has to go off the run soon

Also am seeing Frtr May28 cheapen – locally not quite enough in it – I'd go flat if short – it has a coupon which makes it a little cheaper than some of the richer 0% coupon bonds nearby

But not quite buying it yet

Italy

1)

Moving High Coupon, non-deliverable Btps Feb33 back into Btps Sep33

On Z-spread…

2)

Selling old 5y Feb26 into the Jun26 – cheap as the current 5y without the tap risk and better coupon – curve steep

On Z..

Green Dbr Aug30 trading 4.5bp through the regular Dbr Aug30 - rich

Buying non-deliverbale German Basis (2yr) , Dbr Feb23…

EUSA – swaps

15y cheap after al the issuance there…. Rcv the belly vs 10y and 20y

(2 * EUSA15 Curncy - EUSA10 Curncy - EUSA20 Curncy) * 100

Belgium

I really like HC Bgb 41s – but they have done really well, as there was hidden value in them there high coupons!

Taking a bit off and moving back up the curve into BGB low coupon 30y 2050s

Nether

– getting closer but not quite there to shortening up for very low give relative to swaps and for example Germany – Nether curve is always too flat – but at its extreme I love fading that

Selling Nether jul26 into Nether jan24 – still about a bp away from having strong. Intrinsic value vs other curves but starting to get intersting

On Z – sell nether jul26 to buy nether 1/24 – probably need another 0.5 – 1bp – to get involved

Same with -Nether 42 into Nether 33s or even Nether 31s – we're just a couple away from doing that same steepener vs other curves – you can almost beat the German curve – which seems to be where the Nether curve stops flatenning

Ireland

Irish 31s vs 33s is working slowly – am leaving that there as a steepener – with all the 15y issuance I think the irish 33s and 35s are having a delayed reaction and should keep cheapening vs 10y – on credit they're a touch rich and we have supply tomorrow in 10y and 30y tommorow – short ireland 33s or 35s vs receiving… - that's got a fistful of bp in it , is my sense

Should be +3-4bp over swaps not -1.5bp – but we respect history…

Have fun

Will & James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades and Fades - Will Scott, James Rice at Astor Ridge week of March 8th

Some things in Europe that we're looking at in the forthcoming week

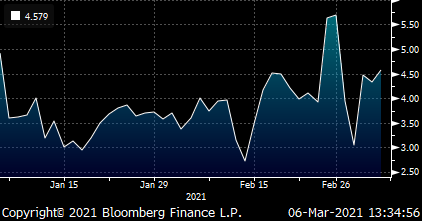

Thematically we're looking to trade the 'bounce' in FI – We do feel that the paradigm has changed and that the US economy will be allowed to run hot. So we think we'll see a very delayed reaction function from the FED and steeper forwards, further out the curve.

This is widely telegraphed – we're unlikely to find this theme for free – what we may find is the reverse, where the market reflects too much of the opposite. Specifically, if I can find forward curves that are very steep and then flat, it indicates an extreme outcome that's unlikely. Namely; Jacking rates sky high and then pausing. More likely this won't happen either and it presents itself as a spill-over from de-leveraging rather than feasible expectations

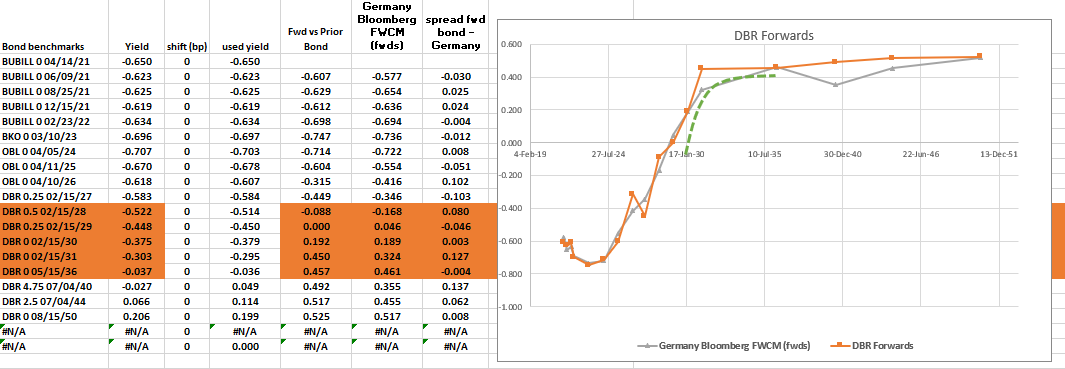

Trade

Buy Dbr 31

Sell Old Dbr 7y and Old Dbr 15y

Drop us a line for best issue selection

German forwards (actual, bond-specific)

*Bonds adjusted on yield to make them Par-Bonds equivalent as per BBG expo spline

So here's a great location where we can do the 7y3y or the 9y1y almost flat to the long term forwards – 10y5y and longer

It's telling us that the 10y point is oversold, which makes total sense as a liquidity point given the recent, rapid rise in yields

Cix: 200 * (yield[DBR 0 02/15/31 Govt]-0.6*yield[DBR 0.25 08/15/28 Govt]-0.4*yield[DBR 0 05/15/35 Govt])

Has it gone too far?...

The easy way is to look at the same cix vs swaps (in this case Z spread will suffice as a metric)

Cix: 2 * (SP208[DBR 0 02/15/31 Corp] - 0.6 * SP208[DBR 0.25 08/15/28 Corp] - 0.4 * SP208[DBR 0 05/15/35 Corp])

It is exaggerated

Current lvl: +4.6bp

Entry: here (33% risk) – we like this one

Add: +5.5bp (67% risk) where vs swaps it's truly got plenty of 'edge'

Supply:

7y (New) 27 April

10y taps March 24 and April 21

15y March 31 and April 28

Carry: Flat (@-5bp repo spread)

Roll: +0.3 bp /3mo

The regression on the two wings is low <0.1 using bonds with a longer history – we would expect this over periods when curvature is dislocated – but it is worth bearing in mind that the two spreads can be uncorrelated. And reconnection can happen when the forwards present an unlikely path for expectations

Same applies…

France

Buy Frtr Nov 2030

Sell Frtr Nov26 and Frtr May36

Curr Level: +5.5bp (50% risk)

Add Level: +6.75bp (50% risk)

Cix: 200 * (yield[FRTR 0 11/25/30 Govt]-0.5*yield[FRTR 0.25 11/25/26 Govt]-0.5*yield[FRTR 1.25 05/25/36 Govt])

It has edge to swaps..

cix: 2 * (sp210[FRTR 0 11/25/30 Govt]-0.5*sp210[FRTR 0.25 11/25/26 Govt]-0.5*sp210[FRTR 1.25 05/25/36 Govt])

Sp210 = spread to MMS

We're using this metric more and more in the swash out. Let's only select the structures that have moved above and beyond the generic moves in curvature

Supply:

Frtr 2030 after this week is a 45bln issue – we would expect this to go off the run soon – the prior 10y (Nov29) got to 40Bln in size

Short Tenor supply on the 18th March, TBA 12th March

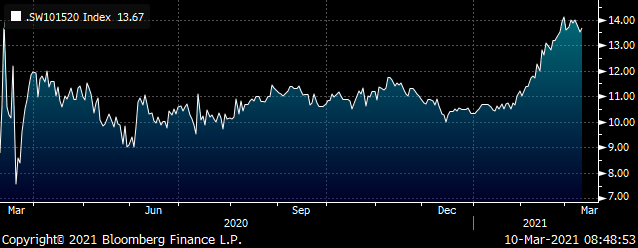

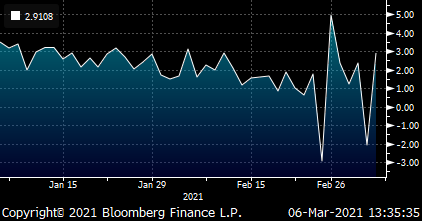

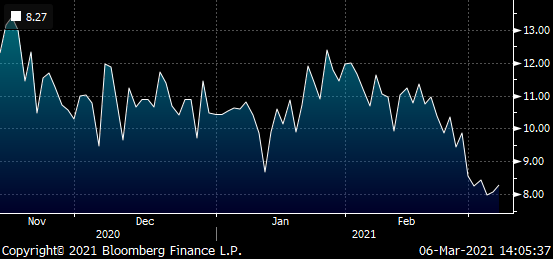

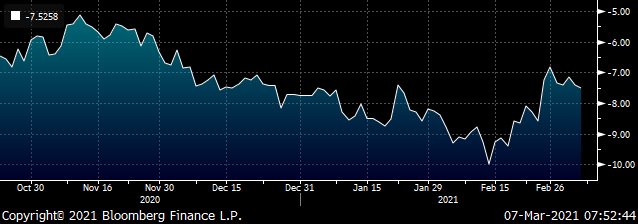

European Union – EU sure bonds

Long 20y, Short 30y steepener

vs MMS

Supply expected soon: Tenor unknown

Graph:

EU 30y minus 20y vs MMS

cix: (SP210[EU 0.3 11/04/50 Corp] - SP210[EU 0.1 10/04/40 Corp])

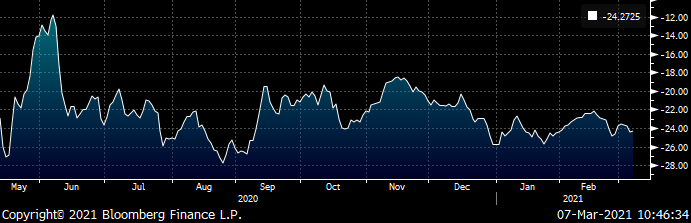

On the Graph of yield spreads with Germany as the baseline, the heaviest inversion is in the Swap Curve – there are some very idiosyncratic reasons for this, that arise from receiving in the back end to the funding nature of the reset process

As loose boundary condition, we think the most inverted a Bond curve should be in long tenors is equal to that of the Swap curve.

For any larger issuer, 20s30s generally stops forwards being inverted – because they all need to extend the maturity of their debt profile, to kick the recovery-can down the round in a low rate environment

So we're just 8bp away from being as Flat as swaps and on a historical low, with the prospect of a supply announcement in EU coming soon – RFP sent last week

On Monday night, the Tesoro will announce next Thursday's 'Medio y Lungo' supply - typically a regular 3y and 7y but the prospect of some longer issuance is always there – possibly 30y?

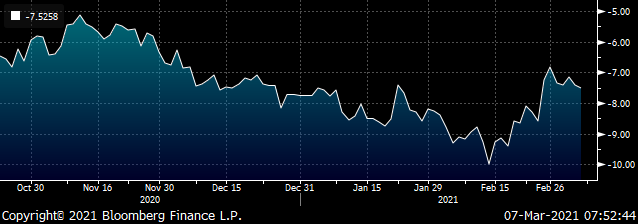

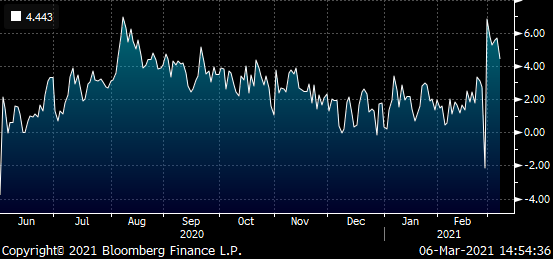

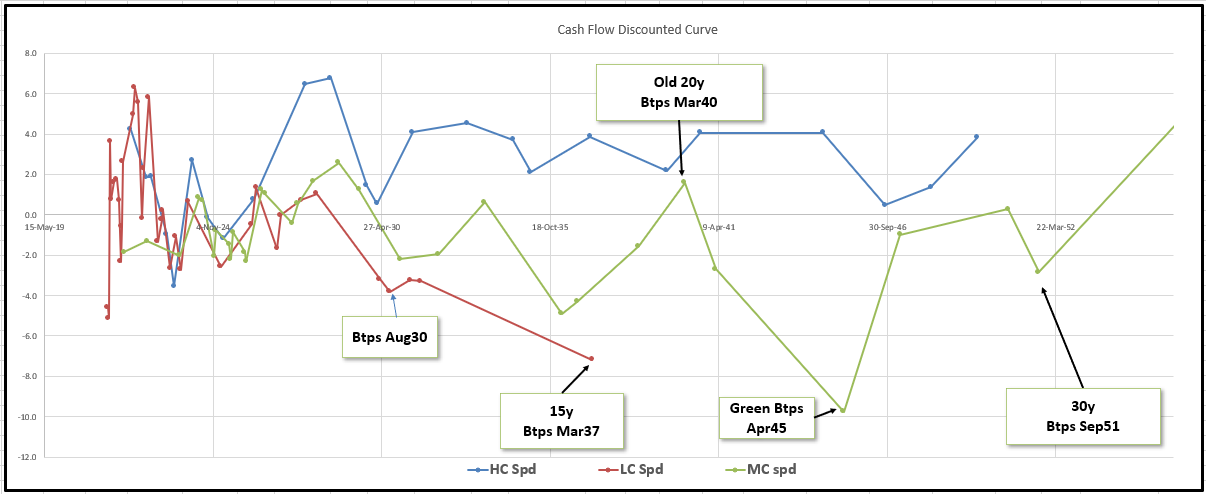

Buy old 20y Btps

Vs 15y and 30y

Level: -7.5bp

Target: -12.5bp

This week's new Btps Green 25y did very well going from +12bp over the 20y to +9.75bp and from the chart it looks rich – notwithstanding green premium

On Forwards & Anomaly we now see 15y and 30y as rich and 20y (specifically the old 20y) as cheap

Graph of Cash-flow discounted anomalies in Italy

*Bonds adjusted on yield to make them Par-Bonds equivalent as per BBG expo spline and the fitted curve is subtracted

Bloomberg History

Cix: 2 * (YIELD[BTPS 3.1 03/01/40 Corp] - 0.5 * YIELD[BTPS 1.45 03/01/36 Corp] - 0.5 * YIELD[BTPS 1.7 09/01/51 Corp]) * 100

We see the Italian curve as slightly steep on regression so we have sympathy with buying a bullet and selling wings in the long end – which can be favoured by a flatter curve

Btps 10s30s on regression…

Slope: 0.76 (derived from regressing differences Mar30/Sep50 1y data)

Tuesday sees a tap of the Nether Jan27s – 2.5Bln

The bond looks very dislocated vs its predecessor Nether Jul26

Normally we would look at anomalies this tight as this but the spread minus the friction divided by the var suggest it still has potential if we work with a dealer

Here's European Z-Spreads over Germany – with Eonia also (assumed zero z-spread value)

Trade

-Nether 26 +Nether 27

Vs small +oe/rx

And to keep friction low we've looked at hedging it with 10% +OE/-RX

100*((yield[NETHER 0 01/15/27 Govt ]-yield[NETHER 0.5 07/15/26 Govt ])-0.1*(yield[DBR 0 02/15/30 Govt ]-yield[DBR 0.5 02/15/26 Govt ]))

Trade started to turn on Friday as the market noticed this anomaly after sifting through the wreckage of the last few weeks. It seems to have further to go based on its intrinsic value – no point looking at the history to tell what it's worth

We're hoping to get this on back @ > +3bp over supply. But it does have intrinsic value all the way to 0bp which should give it a decent chance at normalising past the historical distribution. I feel I want to have some on

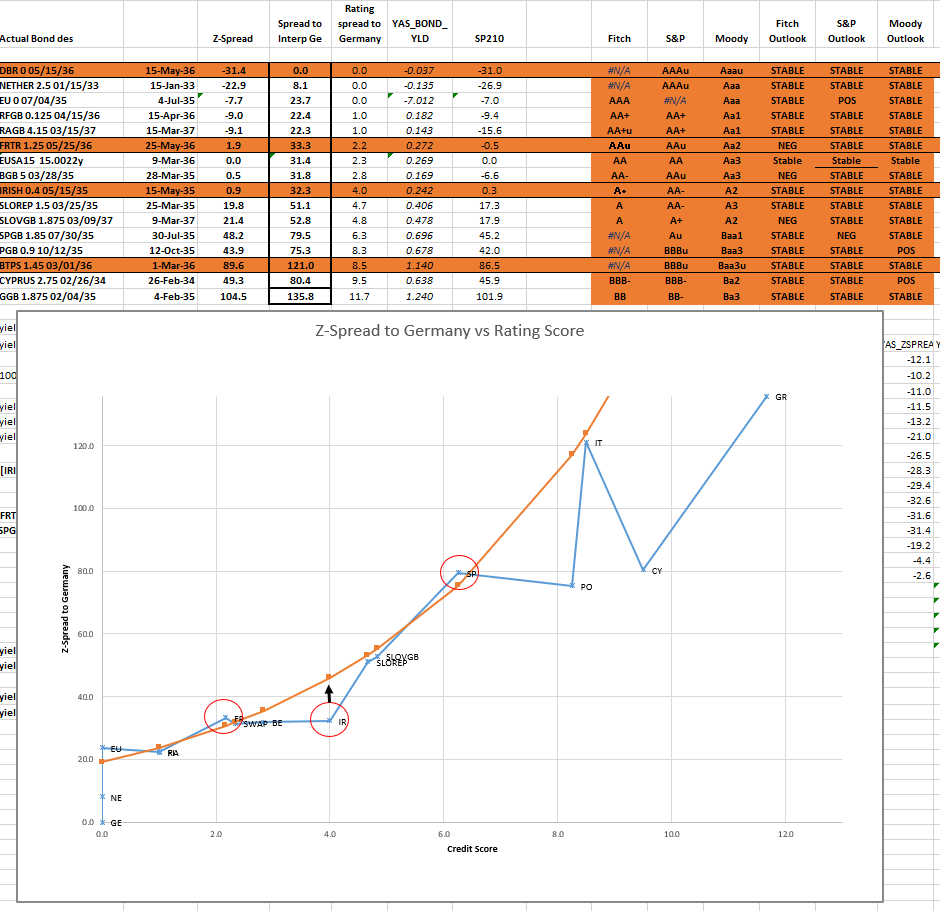

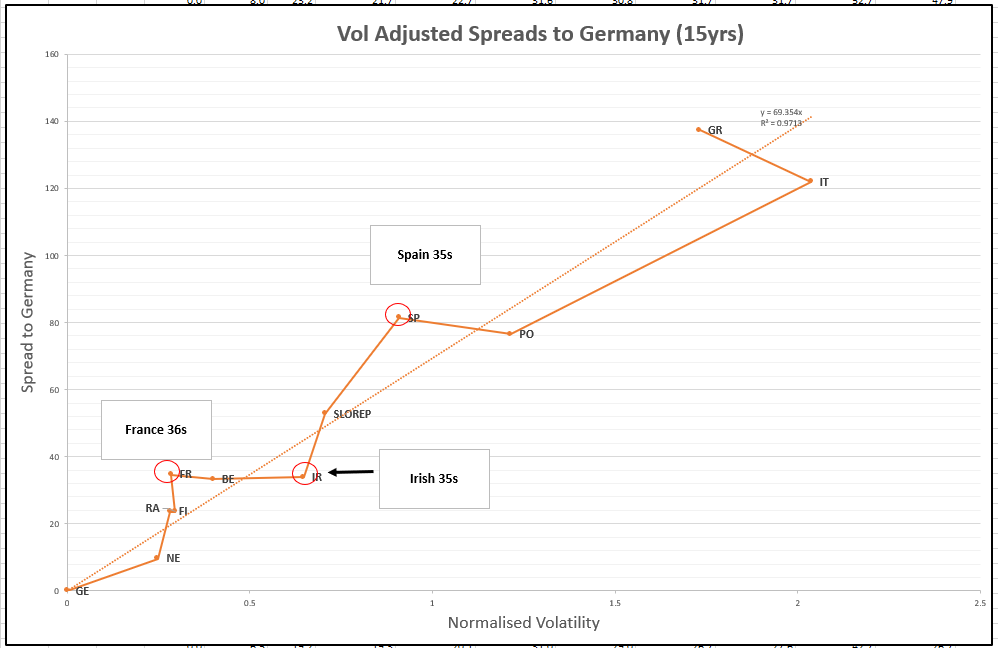

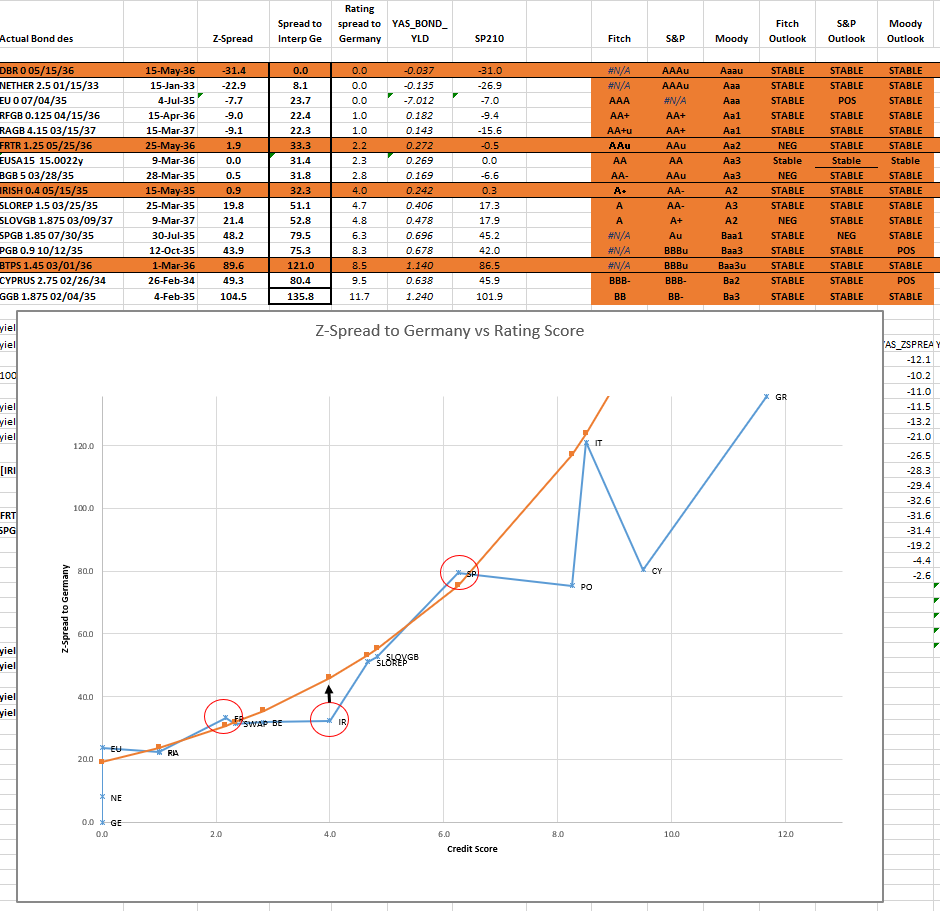

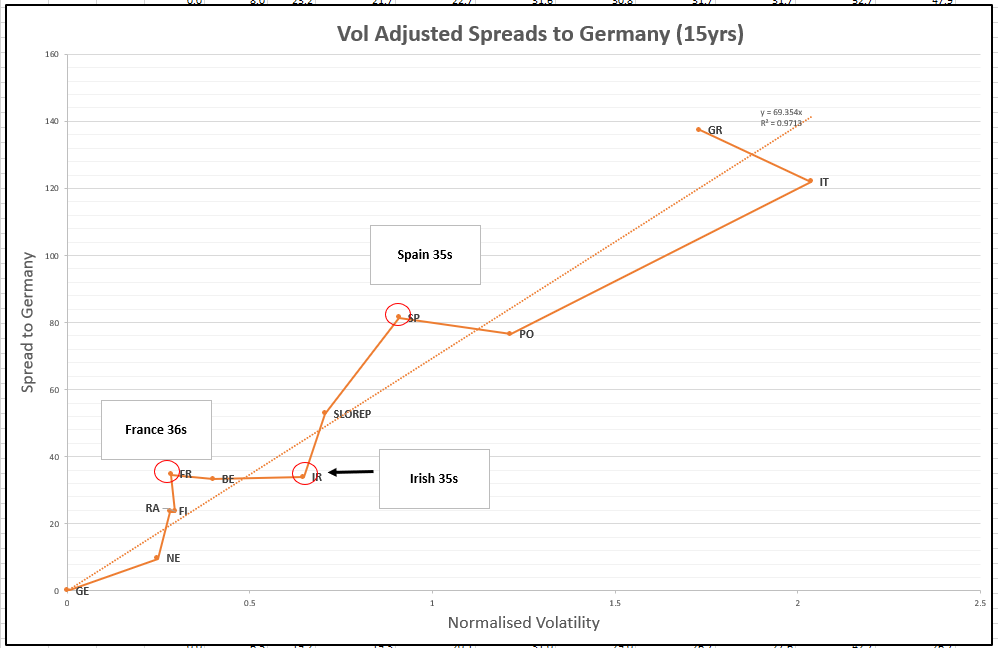

Irish credit looks rich both var adjusted and in absolutes vs other Euro names

Sell Irish 35s

Vs buy France and Spain 15y

Supply prospect – Ireland March 11th - TBA

cix: 100 * (YIELD[IRISH 0.4 05/15/35 Corp] - 0.5 * YIELD[FRTR 1.25 05/25/36 Corp] - 0.5 * YIELD[SPGB 1.85 07/30/35 Corp])

We always look for fundamental, intrinsic value in our trades – before looking in the rear view mirror to see how it traded

Firstly here's euro Credits with Germany as the baseline – the recent new 2036, 15y in Germany has accentuated how some Euro 15years now look rich

Z-spread to interpolated Germany vs Credit Score (*credit score derived from both Rating and Outlook)

Now, normally we wouldn't advocate selling a smaller Issuer like Ireland that benefits from the capital key and small issuance. The Pepp reduces the variance in these smaller credits making them trade like better names. If we normalise the Spread to Germany by the spread volatility we can see if even after spread compression from Asset Purchase buying, the credit still looks rich…

UK

Long HC Ukt 32

Short old ten yr and short HC 34s

High coupons cheap in the steep curve – 32s ultimately the CTD

200 * (YIELD[UKT 4.25 06/07/32 Corp] - 0.5 * YIELD[UKT 0.375 10/22/30 Corp] - 0.5 * YIELD[UKT 4.5 09/07/34 Corp])

UKT anomalies using UK Zero curve build

When we discount cashflows using a proper zero curve, rather than shifting Sonia (z-spread method) we get a much more accurate depiction and explanation of value in the UKT curve. Of course very few high coupons are genuinely rich and in fact some are glaringly cheap such as the UKT 32s – and their value is even greater in a steep curve

From Last week

Long Dbr 35s

vs Short RX (feb30) and Short UB (aug46)

Continuation

Working – moving shorts towards Dbr 42

200 * (YIELD[DBR 0 05/15/35 Corp] - 0.5 * YIELD[DBR 0 02/15/30 Corp] - 0.5 * YIELD[DBR 2.5 08/15/46 Corp])

Long Dbr 35s

vs Short RX (feb30) and Short UB (aug46)

– curvature was added which we can see on this graph

Belgium 47s vs Buxl and Btps 44s

cix: 100 * (YIELD[BGB 1.6 06/22/47 Corp] - 0.8 * YIELD[DBR 2.5 08/15/46 Corp] - 0.2 * YIELD[BTPS 4.75 09/01/44 Corp])

Came in from high 20s

Ragb vs France

(YIELD[RAGB 0 02/20/2030 Corp] - YIELD[FRTR 2.5 05/25/30 Corp]) * 100

In slightly – vol adjusted we still prefer Austria as a credit vs France

As always, have a fantastic week

Will and James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades and Fades - Will Scott, James Rice at Astor Ridge week of March 8th

Some things in Europe that we're looking at in the forthcoming week

Thematically we're looking to trade the 'bounce' in FI – We do feel that the paradigm has changed and that the US economy will be allowed to run hot. So we think we'll see a very delayed reaction function from the FED and steeper forwards, further out the curve.

This is widely telegraphed – we're unlikely to find this theme for free – what we may find is the reverse, where the market reflects too much of the opposite. Specifically, if I can find forward curves that are very steep and then flat, it indicates an extreme outcome that's unlikely. Namely; Jacking rates sky high and then pausing. More likely this won't happen either and it's there as a spill-over from de-leveraging rather than feasible expectations

Trade

Buy Dbr 31

Sell Old Dbr 7y and Old Dbr 15y

Drop us a line for best issue selection

German forwards (actual, bond-specific)

*Bonds adjusted on yield to make them Par-Bonds equivalent as per BBG expo spline

So here's a great location where we can do the 7y3y or the 9y1y almost flat to the long term forwards – 10y5y and longer

It's telling us that the 10y point is oversold, which makes total sense as a liquidity point given the recent, rapid rise in yields

Cix: 200 * (yield[DBR 0 02/15/31 Govt]-0.6*yield[DBR 0.25 08/15/28 Govt]-0.4*yield[DBR 0 05/15/35 Govt])

Has it gone too far?...

The easy way is to look at the same cix vs swaps (in this case Z spread will suffice as a metric)

Cix: 2 * (SP208[DBR 0 02/15/31 Corp] - 0.6 * SP208[DBR 0.25 08/15/28 Corp] - 0.4 * SP208[DBR 0 05/15/35 Corp])

It is exaggerated

Current lvl: +4.6bp

Entry: here (33% risk) – we like this one

Add: +5.5bp (67% risk) where vs swaps it's truly got plenty of 'edge'

Supply:

7y (New) 27 April

10y taps March 24 and April 21

15y March 31 and April 28

Carry: Flat (@-5bp repo spread)

Roll: +0.3 bp /3mo

The regression on the two wings is low <0.1 using bonds with a longer history – we would expect this over periods when curvature is dislocated – but it is worth bearing in mind that the two spreads can be uncorrelated. And reconnection can happen when the forwards present an unlikely path for expectations

Same applies…

France

Buy Frtr Nov 2030

Sell Frtr Nov26 and Frtr May36

Curr Level: +5.5bp (50% risk)

Add Level: +6.75bp (50% risk)

Cix: 200 * (yield[FRTR 0 11/25/30 Govt]-0.5*yield[FRTR 0.25 11/25/26 Govt]-0.5*yield[FRTR 1.25 05/25/36 Govt])

It has edge to swaps..

cix: 2 * (sp210[FRTR 0 11/25/30 Govt]-0.5*sp210[FRTR 0.25 11/25/26 Govt]-0.5*sp210[FRTR 1.25 05/25/36 Govt])

Sp210 = spread to MMS

We're using this metric more and more in the swash out. Let's only select the structures that have moved above and beyond the generic moves in curvature

Supply:

Frtr 2030 after this week is a 45bln issue – we would expect this to go off the run soon – the prior 10y (Nov29) got to 40Bln in size

Short Tenor supply on the 18th March, TBA 12th March

European Union – EU sure bonds

Long 20y, Short 30y steepener

vs MMS

Supply expected soon: Tenor unknown

Graph:

EU 30y minus 20y vs MMS

cix: (SP210[EU 0.3 11/04/50 Corp] - SP210[EU 0.1 10/04/40 Corp])

On the Graph of yield spreads, with Germany as the baseline the heaviest inversion is in the Swap Curve – there are some very idiosyncratic reasons for this that arise from receiving in the back end to the funding nature of the reset process

As loose boundary condition we think the most inverted a Bond curve should be in long tenors is equal to that of the Swap curve.

For any larger issuer, 20s30s generally stops forwards being inverted – because they all need to extend the maturity of their debt profile, to kick the recovery-can down the round in a low rate environment

So we're just 8bp away from being as Flat as swaps and on a historical low, with the prospect of a supply announcement in EU coming soon – RFP sent last week

On Monday night, the Tesoro will announce next Thursday's 'Medio y Lungo' supply - typically a regular 3y and 7y but the prospect of some longer issuance is always there – possibly 30y?

Buy old 20y Btps

Vs 15y and 30y

Level: -7.5bp

Target: -12.5bp

This week's new Btps Green 25y did very well going from +12bp over the 20y to +9.75bp and from the chart it looks rich – notwithstanding green premium

On Forwards & Anomaly we now see 15y and 30y as rich and 20y (specifically the old 20y) as cheap

Graph of Cash-flow discounted anomalies in Italy

*Bonds adjusted on yield to make them Par-Bonds equivalent as per BBG expo spline and the fitted curve is subtracted

Bloomberg History

Cix: 2 * (YIELD[BTPS 3.1 03/01/40 Corp] - 0.5 * YIELD[BTPS 1.45 03/01/36 Corp] - 0.5 * YIELD[BTPS 1.7 09/01/51 Corp]) * 100

We see the Italian curve as slightly steep on regression so we have sympathy with buying a bullet and selling wings in the long end – which can be favoured by a flatter curve

Btps 10s30s on regression…

Slope: 0.76 (derived from regressing differences Mar30/Sep50 1y data)

Tuesday sees a tap of the Nether Jan27s – 2.5Bln

The bond looks very dislocated vs its predecessor Nether Jul26

Normally we would look at anomalies this tight as this but the spread minus the friction divided by the var suggest it still has potential if we work with a dealer

Here's European Z-Spreads over Germany – with Eonia also (assumed zero z-spread value)

Trade

-Nether 26 +Nether 27

Vs small +oe/rx

And to keep friction low we've looked at hedging it with 10% +OE/-RX

100*((yield[NETHER 0 01/15/27 Govt ]-yield[NETHER 0.5 07/15/26 Govt ])-0.1*(yield[DBR 0 02/15/30 Govt ]-yield[DBR 0.5 02/15/26 Govt ]))

Trade started to turn on Friday as the market noticed this anomaly after sifting through the wreckage of the last few weeks. It seems to have further to go based on its intrinsic value – no point looking at the history to tell what it's worth

We're hoping to get this on back @ > +3bp over supply. But it does have intrinsic value all the way to 0bp which should give it a decent chance at normalising past the historical distribution. I feel I want to have some on

Irish credit looks rich both var adjusted and in absolutes vs other Euro names

Sell Irish 35s

Vs buy France and Spain 15y

Supply prospect – Ireland March 11th - TBA

cix: 100 * (YIELD[IRISH 0.4 05/15/35 Corp] - 0.5 * YIELD[FRTR 1.25 05/25/36 Corp] - 0.5 * YIELD[SPGB 1.85 07/30/35 Corp])

We always look for fundamental, intrinsic value in our trades – before looking in the rear view mirror to see how it traded

Firstly here's euro Credits with Germany as the baseline – the recent new 2036, 15y in Germany has accentuated how some Euro 15years now look rich

Z-spread to interpolated Germany vs Credit Score (*credit score derived from both Rating and Outlook)

Now, normally we wouldn't advocate selling a smaller Issuer like Ireland that benefits from the capital key and small issuance. The Pepp reduces the variance in these smaller credits making them trade like better names. If we normalise the Spread to Germany by the spread volatility we can see if even after spread compression from Asset Purchase buying, the credit still looks rich…

UK

Long HC Ukt 32

Short old ten yr and short HC 34s

High coupons cheap in the steep curve – 32s ultimately the CTD

200 * (YIELD[UKT 4.25 06/07/32 Corp] - 0.5 * YIELD[UKT 0.375 10/22/30 Corp] - 0.5 * YIELD[UKT 4.5 09/07/34 Corp])

UKT anomalies using UK Zero curve build

When we discount cashflows using a proper zero curve, rather than shifting Sonia (z-spread method) we get a much more accurate depiction and explanation of value in the UKT curve. Of course very few high coupons are genuinely rich and in fact some are glaringly cheap such as the UKT 32s – and their value is even greater in a steep curve

From Last week

Long Dbr 35s

vs Short RX (feb30) and Short UB (aug46)

Continuation

Working – moving shorts towards Dbr 42

200 * (YIELD[DBR 0 05/15/35 Corp] - 0.5 * YIELD[DBR 0 02/15/30 Corp] - 0.5 * YIELD[DBR 2.5 08/15/46 Corp])

Long Dbr 35s

vs Short RX (feb30) and Short UB (aug46)

– curvature was added which we can see on this graph

Belgium 47s vs Buxl and Btps 44s

cix: 100 * (YIELD[BGB 1.6 06/22/47 Corp] - 0.8 * YIELD[DBR 2.5 08/15/46 Corp] - 0.2 * YIELD[BTPS 4.75 09/01/44 Corp])

Came in from high 20s

Ragb vs France

(YIELD[RAGB 0 02/20/2030 Corp] - YIELD[FRTR 2.5 05/25/30 Corp]) * 100

In slightly – vol adjusted we still prefer Austria as a credit vs France

As always, have a fantastic week

Will and James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796