France - 55s rich

Am looking at Frtr 55s

See them as rich on the curve and no prospect of being in pepp

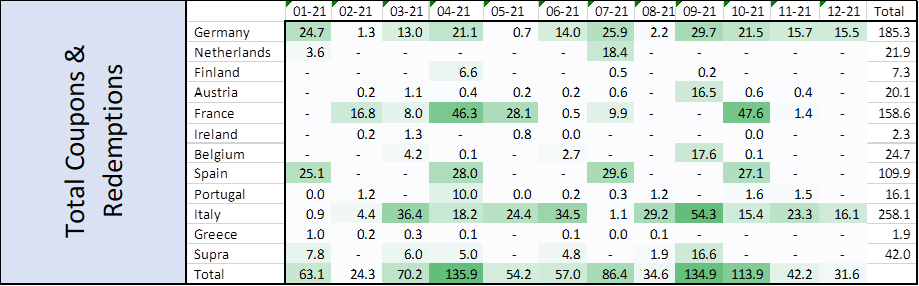

Whereas Frtr 52 go into PEPP in May

I also think that the 66s are cheap and fully represent the prospect of the new 50y syndic in France, which more than likely be massively over subscribed…

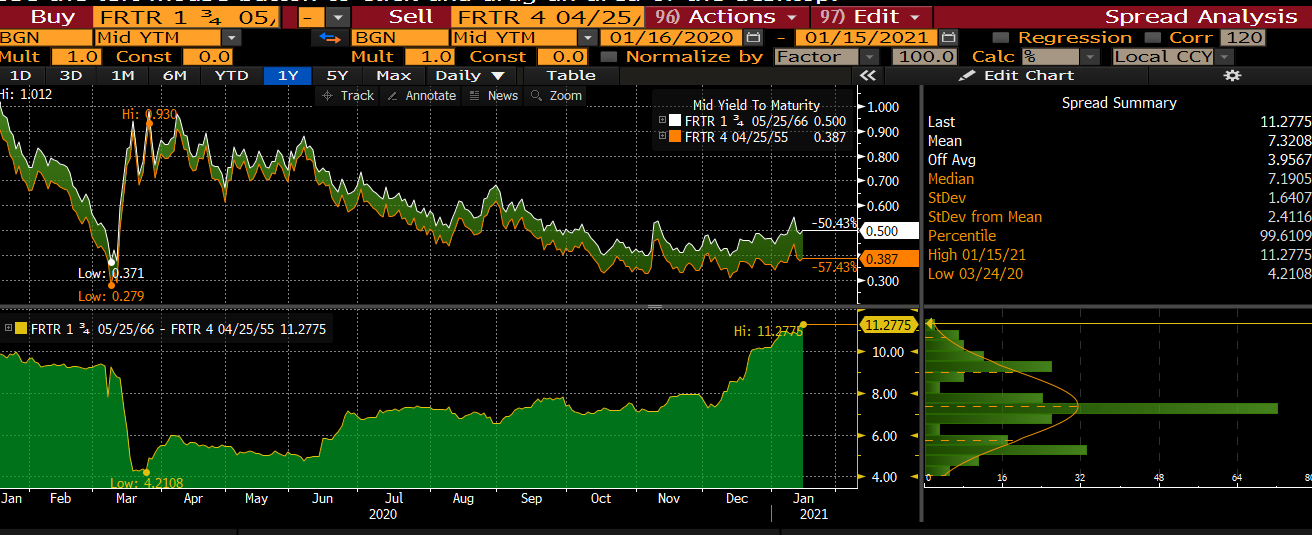

Looking at -frtr 55 into frtr 66 as too steep at +11.25bp

Or butterfly

+52s -55s +66s…

– with softer play buying the 50% 66s ahead of new 50y in France –

- – 'AFT will also examine, together with the primary dealers, the prospect of a syndicated issue of a new 50-year bond depending on market conditions'

https://www.aft.gouv.fr/en/publications/communiques-presse/20201209-State-financing-programme-2021

200 * (YIELD[FRTR 4 04/25/55 Corp] - 0.5 * YIELD[FRTR 0.75 05/25/52 Corp] - 0.5 * YIELD[FRTR 1.75 05/25/66 Corp])

Best

Will and James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

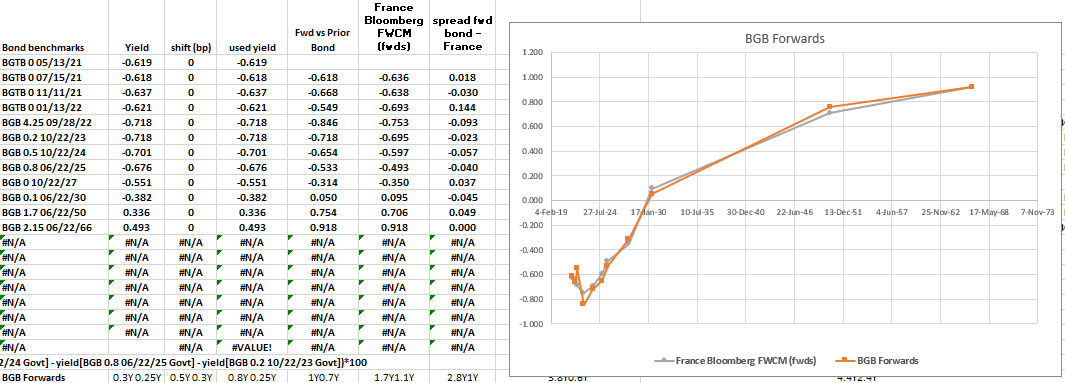

Trade Radar BGB 66's - Preparing for the 50y Syndication in France

On our Trade Radar – not quite at my level….

Belgium 66's – Cheapened by expectations of 50y Belgium & France syndications

Belgium the smaller Issuer the better pick of the two…

'Tis better to travel than to arrive…

- France announced a 50y syndication in its 2021 supply communique – 'AFT will also examine, together with the primary dealers, the prospect of a syndicated issue of a new 50-year bond depending on market conditions'

https://www.aft.gouv.fr/en/publications/communiques-presse/20201209-State-financing-programme-2021

- While the French 50y has cheapened, and taken Belgium with it too - the 30y20y is now above the 10y20y, indicating in absolute terms the move is close to over

- Versus Austria 50y, Belgium & France have value – we can hedge the slight credit difference with Italy both issuers have positive cashflow characteristics after allowing for the PEPP

- We expect Belgium will bring a longer 50y OLO – 'Given the objective to lengthen the average life of the debt portfolio, but taking into account the starting point of the average life and possibly a new very long syndicated transaction, the BDA will have options to issue OLOs in the auctions in any part of the curve.'

- Syndications have massive oversubscription and we expect any discount in these tenors to be short lived – notwithstanding they are not part of the PEPP

Trade Structure

Buy Belgium 2.15% Jun66

Sell 90% Austria 3.8% Jan62

Sell 10% Italy 2.8% Mar67

Levels:

Current: +15.5bp

Enter: +17bp (33% risk)

Add: +23bp (67% risk)

Target: +7bp

I've set Enter and Add around absolute value to the credit surface – the add level is where there is no premium for Belgium even vs France and Spain – given the paucity of issuance relative to PEPP

Cix:

100*(yield[BGB 2.15 06/22/66 Govt]-0.9*yield[RAGB 3.8 01/26/62 Govt]-0.1*yield[BTPS 2.8 03/01/67 Govt])

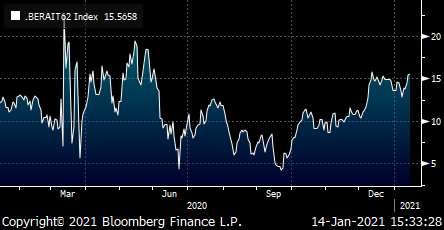

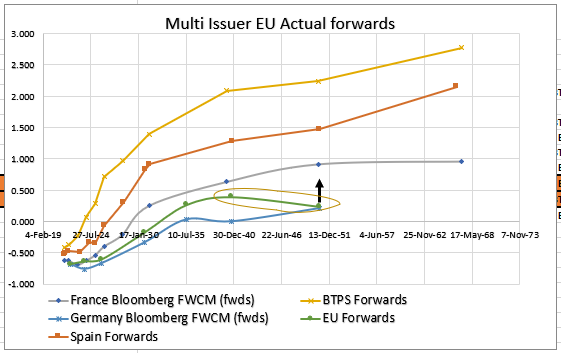

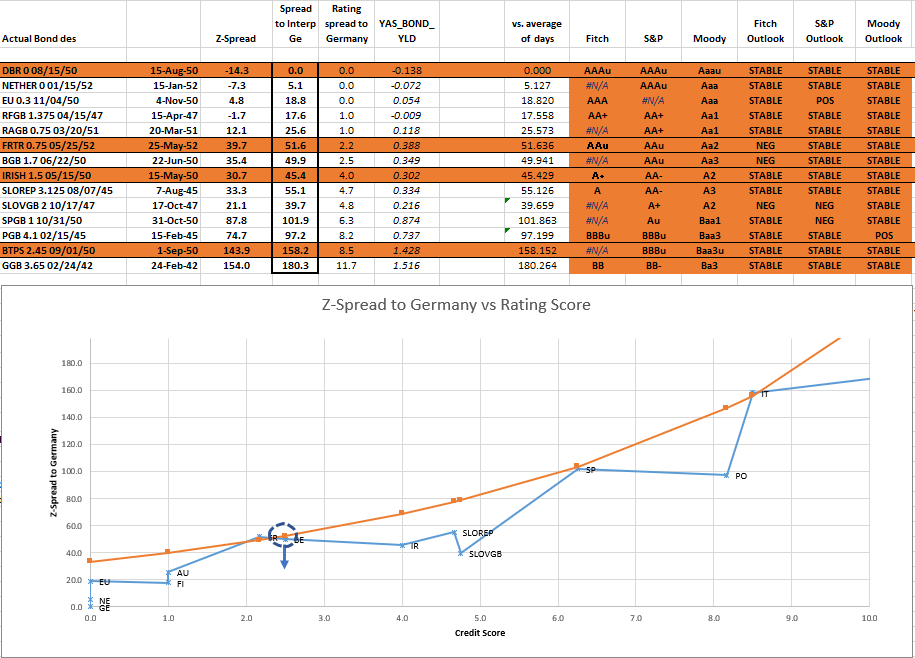

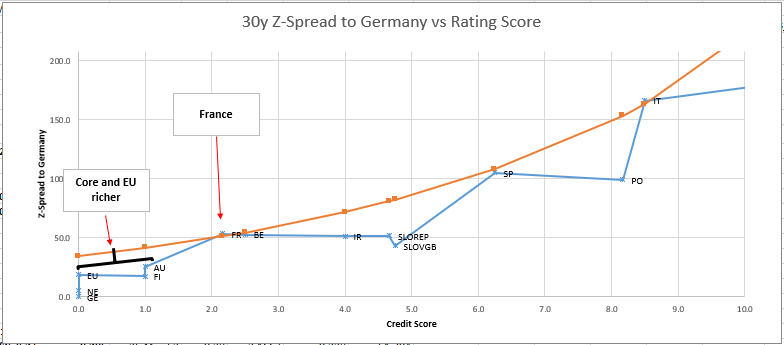

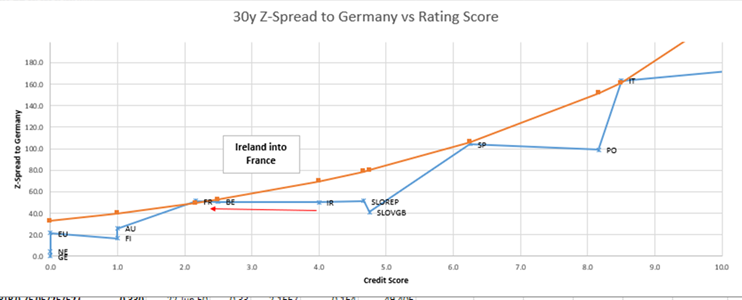

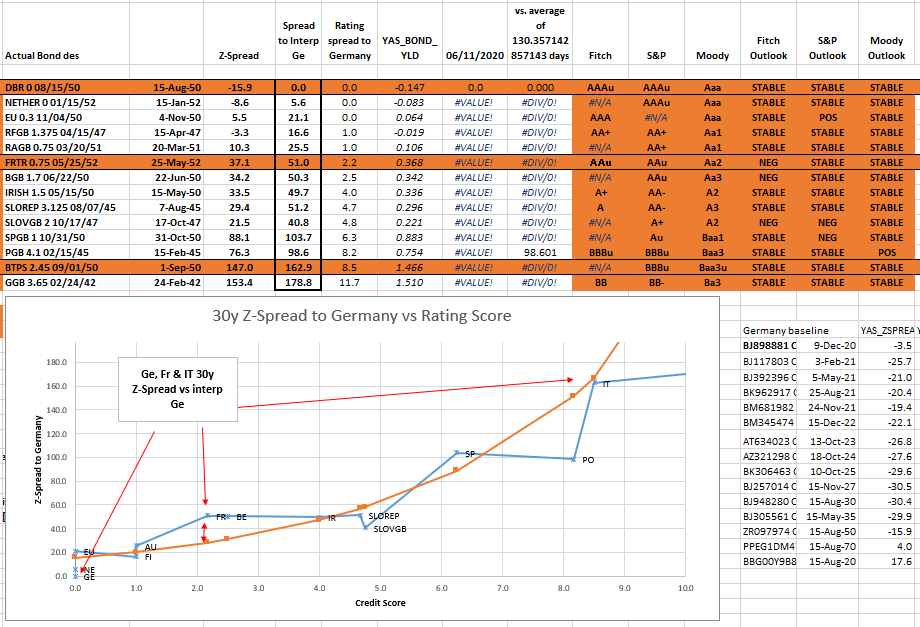

Graph 1 – Belgium vs 90% Austria and 10% Italy

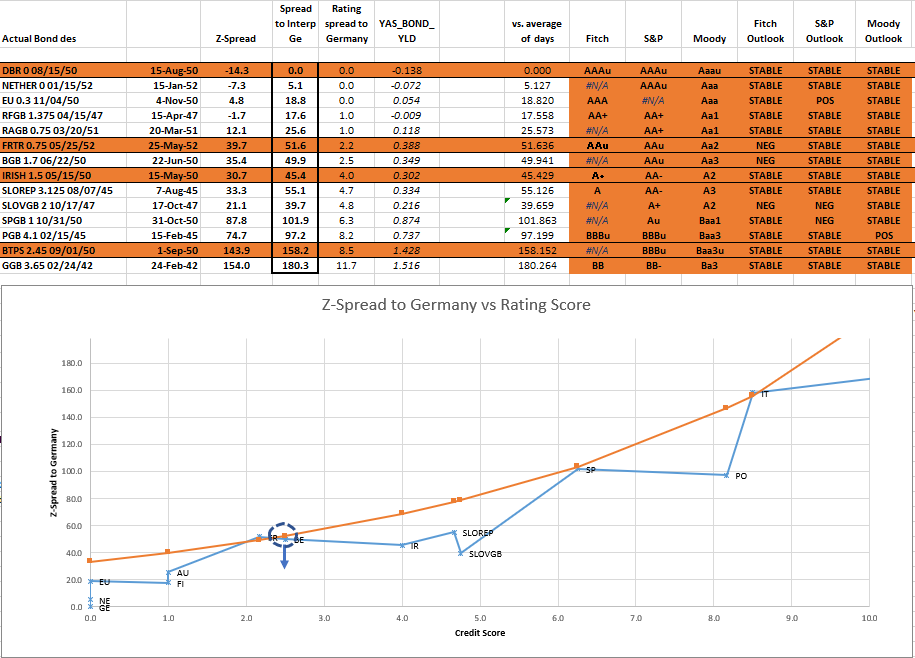

Credit Surface – Z-spread to Interpolated German Curve

Orange – Fitted Curve

Blue - Actual Credit spreads

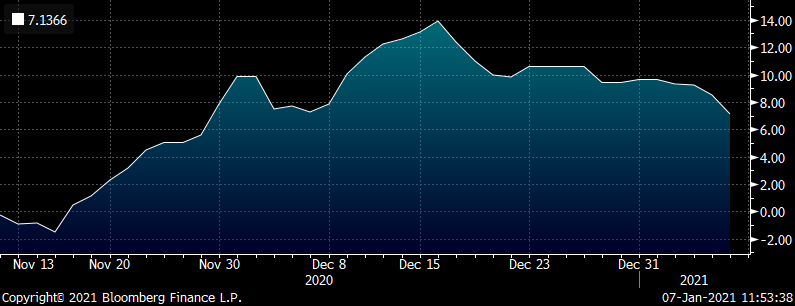

Graph 2 – European 50y Z-Spread to Germany*

*Hypothetical German 50y @ -0.04% yield for valuation purposes (needed for interpolation)

Typically we see Germany as a special case and not part of the Credit Curve fit – more it forms the baseline of the valuation for spreads as the issuer least likely to default / redenominate

Fit is performed to Fit the Major issuers with nett cash requirements in Europe – Italy, France, Spain

Rationale

- Austria has is rich

- Belgium is Fair (it's a small / scarce issuer)

- Italy is slightly rich and provides a credit anchor / hedge

- Once we get past the 50y issuance

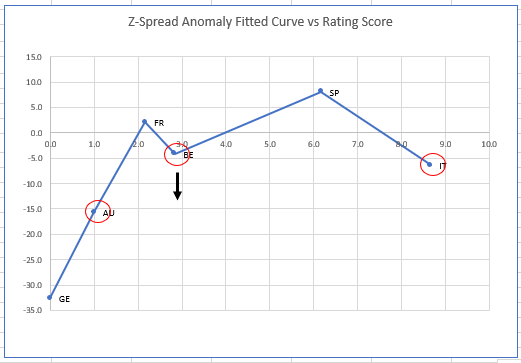

Graph 3 –

Rich / Cheap Credits: Anomaly of Z-spread vs Fitted Curve (50yrs)

Bid/Offer

33% of Structure Bid/Offer estimate: 1bp

.9 / 1 / .1 weightings to the bid offer

French & Belgian Forwards

30y20y vs 10y20y is positive in both Belgium and France

Risks

- A wholesale de-risking could drag Belgium cheaper with Spain and Italy and the 10% Italy hedge may not be sufficient for extreme credit pressures

If you'd like to discuss further, or set a level that makes sense (see Entry Level above) please let us know. Further details on request

Will & James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

EU 20s30s steepener for an issuer with supply

EU 20s30s too flat vs RX/UB

- EU (SURE) is an issuer, along with France, Italy & Spain set to require cash from the market even after PEPP estimates

- Major Supply issuers have forwards curves that are upward sloping that represent a need to raise debt under credit constraints – Don't be deceived by 'swap blindness' with Eonia forwards – the receiving, margining and marginal operators are quite different in that market

- That slaveish following of the swap market can be to our advantage – further issuance in long EU bonds makes them look rich to shorter tenors – In short EU 20s30s is too flat, forcing forwards to be too low

- The fade from last year is 'pay long forwards at flat or inverted to shorter ones', for issuers that must still raise funds. This still makes sense, particularly in those issuers where issuance outweighs the capital key based, PEPP buying

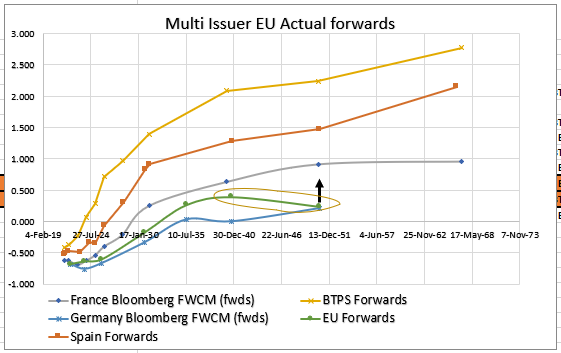

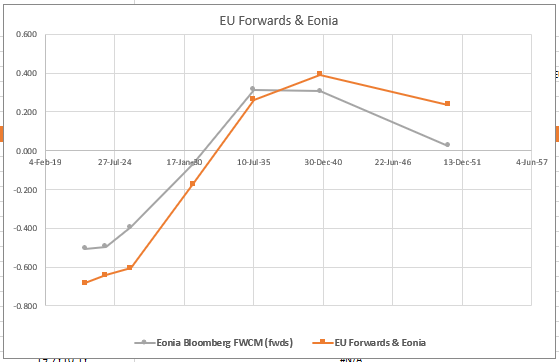

Graph 1 – European Forward Rates

Germany, EU, France, Spain and Italy

The EU forwards rates are dragged lower in the long tenors by the use of Eonia as a valuation metric….

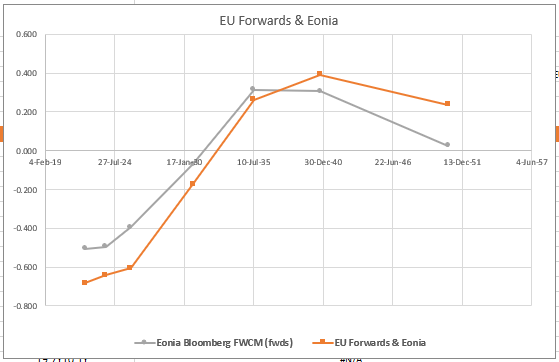

Graph 2 – Eu forwards and Eonia forwards

Trade Structure

+EU20y -EU30y

vs

30% -RXH1 / UBH1

Levels

Current: -2.4bp (pay)

Add: -4bp

Target: 0

Carry

EU 20s30s: carry +0.1bp /3mo @-10bp repo spread

RX/UB expressed in futures – no carry

Cix: 100*((yield[EU 0.3 11/04/50 Govt ]-yield[EU 0.1 10/04/40 Govt ])-0.3*(yield[DBR 2.5 08/15/46 Govt ]-yield[DBR 0 02/15/30 Govt ]))

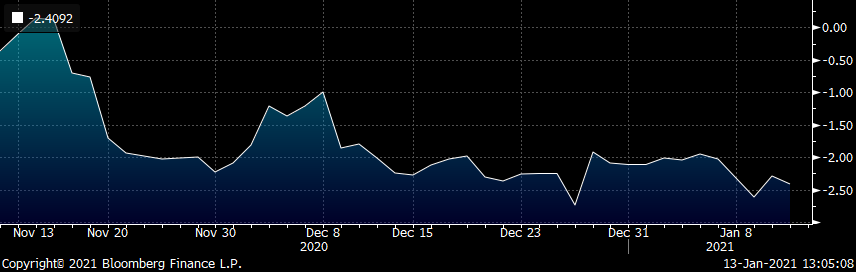

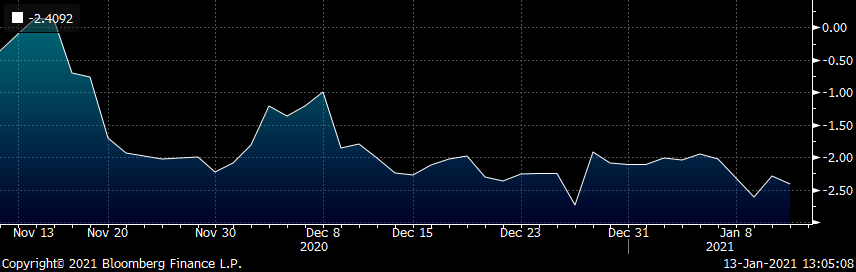

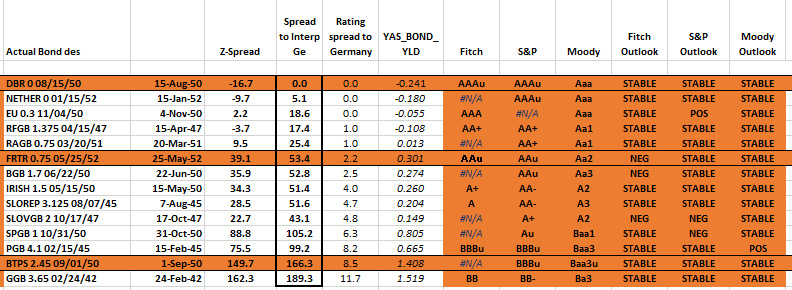

Graph 3 – Cix history – shows EU 30y outperforming the EU 20y in the context of a 30% RX/UB hedge

Rationale

- At this level the curve is almost inverted as the Eonia forwards

- The add level equates to the same fwd rate of inversion

- As more EU supply comes on board this curve should normalise

More Details on request

Best

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

EU 20s30s steepener for an issuer with supply

EU 20s30s too flat vs RX/UB

- EU (SURE) is an issuer, along with France, Italy & Spain set to require cash from the market even after PEPP estimates

- Major Supply issuers have forwards curves that are upward sloping that represent a need to raise debt under credit constraints – Don't be deceived by 'swap blindness' with Eonia forwards – the receiving, margining and marginal operators are quite different in that market

- That slavish following of the swap market can be to our advantage – further issuance in long EU bonds makes them look rich to shorter tenors – In short EU 20s30s is too flat, forcing forwards to be too low

- The fade from last year is 'pay long forwards at flat or inverted to shorter ones', for issuers that must still raise funds. This still makes sense, particularly in those issuers where issuance outweighs the capital key based, PEPP buying

Graph 1 – European Forward Rates

Germany, EU, France, Spain and Italy

The EU forwards rates are dragged lower in the long tenors by the use of Eonia as a valuation metric….

Graph 2 – Eu forwards and Eonia forwards

Trade Structure

+EU20y -EU30y

vs

30% -RXH1 / UBH1

Levels

Current: -2.4bp (pay)

Add: -4bp

Target: 0

Carry

EU 20s30s: carry +0.1bp /3mo @-10bp repo spread

RX/UB expressed in futures – no carry

Cix: 100*((yield[EU 0.3 11/04/50 Govt ]-yield[EU 0.1 10/04/40 Govt ])-0.3*(yield[DBR 2.5 08/15/46 Govt ]-yield[DBR 0 02/15/30 Govt ]))

Graph 3 – Cix history – shows EU 30y outperforming the EU 20y in the context of a 30% RX/UB hedge

Rationale

- At this level the curve is almost inverted as the Eonia forwards

- The add level equates to the same fwd rate of inversion

- As more EU supply comes on board this curve should normalise

More Details on request

Best

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Selling the Big Issue - Belgium 30y Trade idea as a credit

Buy 30y Belgium as a Credit vs EU and Spain

- ‘Sell the Big Issuers’ –has to be one of the main leans or ‘fades’ for trading in 2021 has to be long the rare issuers and short the big issuers

- The backdrop of the PEPP in powerplay mode has dragged all credits tighter to the risk-free rate. The smaller issuers , favoured by the Capital Key – Ireland, Belgium, Finland, Austria & Portugal will continue to outperform

- Now, the thought of buying rich bonds to sell them even richer, is nothing other than the ‘greater fool theory’ writ large. And as a value trader that makes me feel somewhat queasy. So we have to tread carefully – we still have to eke out value – by looking at the credit surface – see below

- The ‘Big Issuers’ – Italy, France, Spain, Germany and EU are names that will continue to define the fair value curve and the weight of their issuance, less QE means they’re much less likely to go walkabout

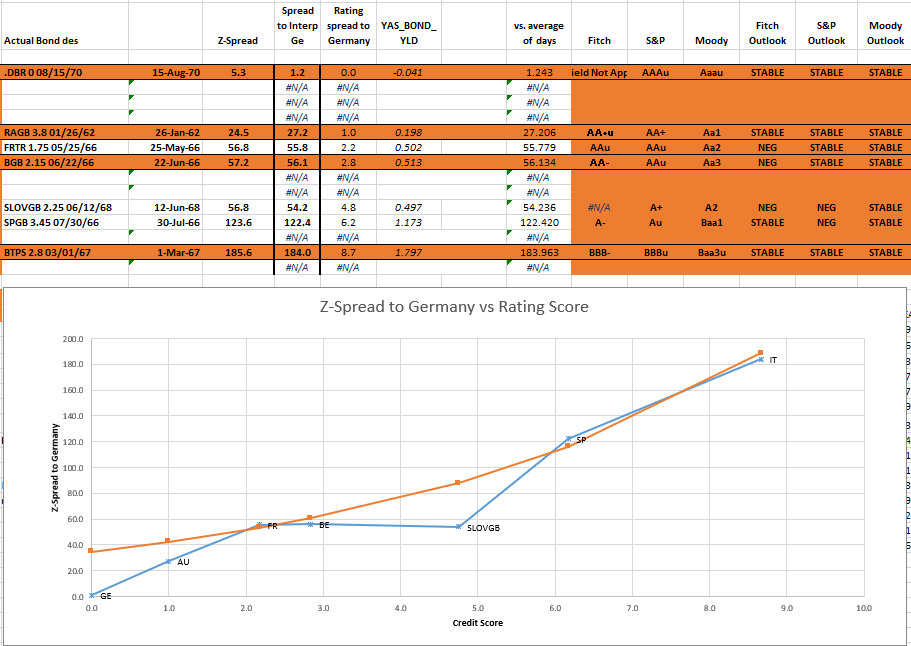

Here’s the credit surface in 30 years – it’s really one on of the last games in town, as the 30y at least still has some tangible vestiges of credit / rating risk for each issuer. We have plotted Euro Z-spread vs Interpolated Germany on the y-axis and ‘Credit Score’* on the x-axis

*Credit Score is an amalgamation of the rating for an issuer under Fitch, Moody’s and S&P with minor adjustments for ‘credit outlook’ too

The Credit Surface (30yrs)

In this fit we have allowed France, Spain and Italy to define the credit curve – as you can see the smaller issuers all trade rich to that Orange (fitted) line

The exception is 30y Belgium - It has been dragged cheaper by its major comparator, France – However the flows for Belgium post PEPP are still positive with a modest 9yd cash requirement (Citi recent estimate)

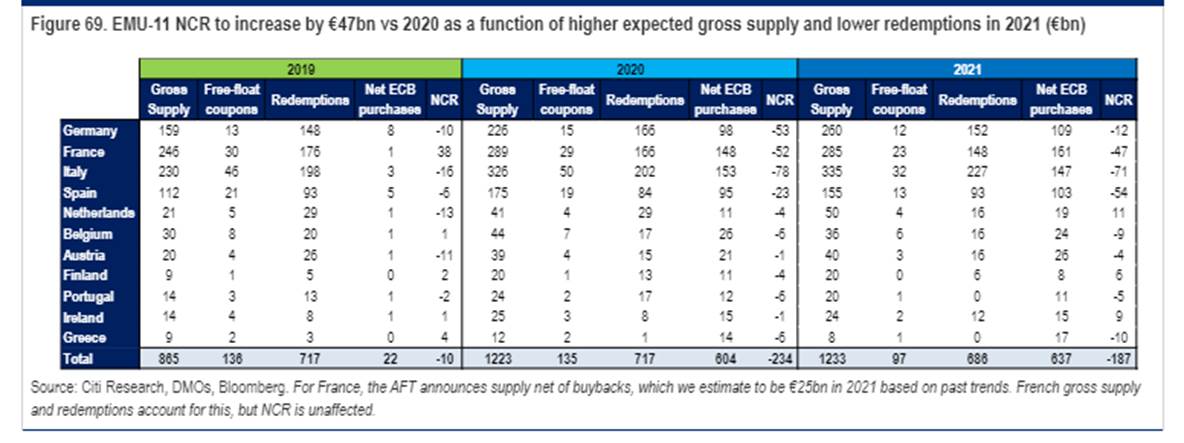

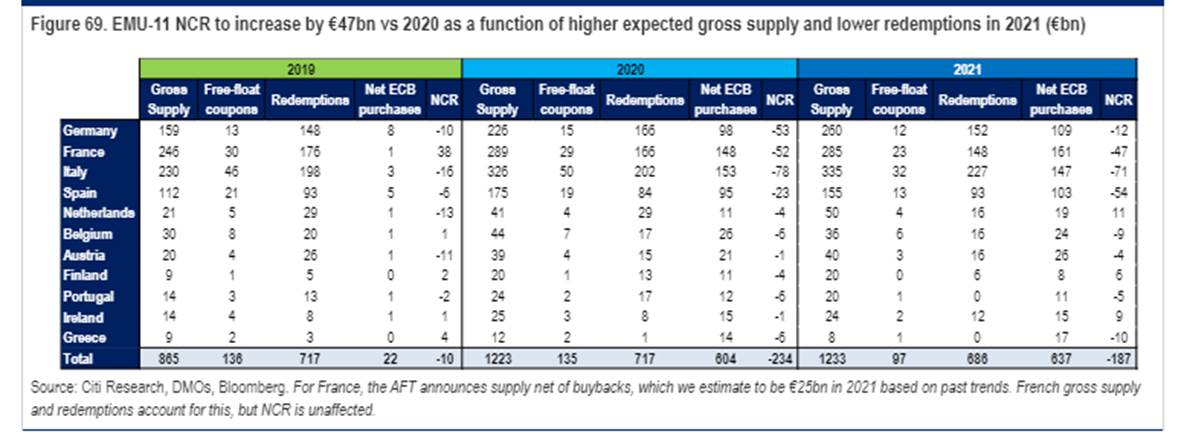

Net Cash Requirement (as per Citi)

- Belgium has a tiny requirement of 9bln – witness what the €9bln surplus did for the recent Irish 10y syndication!!!!

- Conversely the EU 30y has the property of trading rich to the rest of the curve, which we account to a dearth of issuance of a AAA nature in that Tenor – yet they will continue to supply and issuance at close to zero yield in long tenors is as closed to debt forgiveness as we can get!

- Using weightings derived from our smooth Credit Curve and selecting optimal issues…

Trade Structure

Buy Belgium 30y sell 75% EU 30y and 25% Spain 30y

cix:

100 * (YIELD[BGB 1.7 06/22/50 Corp] - 0.75 * YIELD[EU 0.3 11/04/50 Corp] - 0.25 * YIELD[SPGB 1 10/31/50 Corp])

Graph

I see this as having the prospect of richening up to 15bp from current levels to represent a scarce issuer in a low supply / high PEPP environment

Let me know your thoughts

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Selling the Big Issue - Belgium Long Trade idea

Buy 30y Belgium as a Credit vs EU and Spain

- ‘Sell the Big Issuers’ –has to be one of the main leans or ‘fades’ for trading in 2021 has to be long the rare issuers and short the big issuers

- The backdrop of the PEPP in powerplay mode has dragged all credits tighter to the risk-free rate. The smaller issuers , favoured by the Capital Key – Ireland, Belgium, Finland, Austria & Portugal will continue to outperform

- Now, the thought of buying rich bonds to sell them even richer, is nothing other than the ‘greater fool theory’ writ large. And as a value trader that makes me feel somewhat queasy. So we have to tread carefully – we still have to eke out value – by looking at the credit surface – see below

- The ‘Big Issuers’ – Italy, France, Spain, Germany and EU are names that will continue to define the fair value curve and the weight of their issuance, less QE means they’re much less likely to go walkabout

Here’s the credit surface in 30 years – it’s really one on of the last games in town, as the 30y at least still has some tangible vestiges of credit / rating risk for each issuer. We have plotted Euro Z-spread vs Interpolated Germany on the y-axis and ‘Credit Score’* on the x-axis

*Credit Score is an amalgamation of the rating for an issuer under Fitch, Moody’s and S&P with minor adjustments for ‘credit outlook’ too

The Credit Surface (30yrs)

In this fit we have allowed France, Spain and Italy to define the credit curve – as you can see the smaller issuers all trade rich to that Orange (fitted) line

The exception is 30y Belgium - It has been dragged cheaper by its major comparator, France – However the flows for Belgium post PEPP are still positive with a modest 9yd cash requirement (Citi recent estimate)

Net Cash Requirement (as per Citi)

- Belgium has a tiny requirement of 9bln – witness what the €9bln surplus did for the recent Irish 10y syndication!!!!

- Conversely the EU 30y has the property of trading rich to the rest of the curve, which we account to a dearth of issuance of a AAA nature in that Tenor – yet they will continue to supply and issuance at close to zero yield in long tenors is as closed to debt forgiveness as we can get!

- Using weightings derived from our smooth Credit Curve and selecting optimal issues…

Trade Structure

Buy Belgium 30y sell 75% EU 30y and 25% Spain 30y

cix:

100 * (YIELD[BGB 1.7 06/22/50 Corp] - 0.75 * YIELD[EU 0.3 11/04/50 Corp] - 0.25 * YIELD[SPGB 1 10/31/50 Corp])

Graph

I see this as having the prospect of richening up to 15bp from current levels to represent a scarce issuer in a low supply / high PEPP environment

Let me know your thoughts

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Thoughts on the new bund - feb 31, coming today

Apols – I forgot the attachment – see above tks

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Apols I mee

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

New Bund - trade idea

Hi – some thoughts on the New Bund Dbr feb31 – coming today

Will and James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

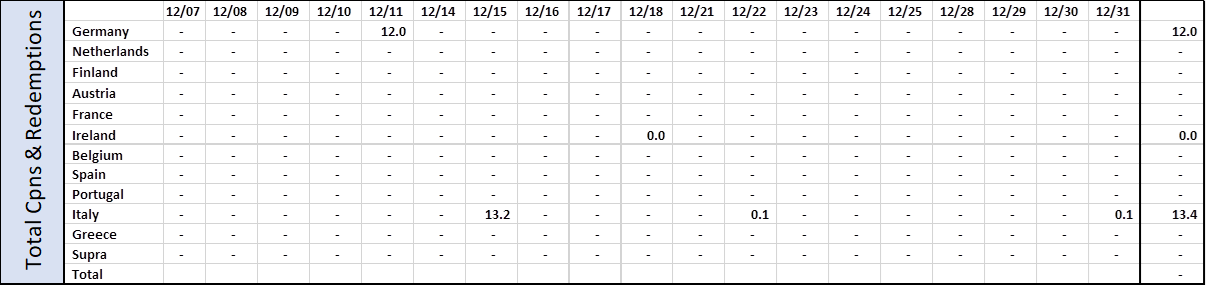

Trades and Fades - Week of 14th to 18th December, James & Will at Astor Ridge

Trades and Fades for next week Euro RV plus our thoughts on January syndications

Best Will & James

The week ahead:

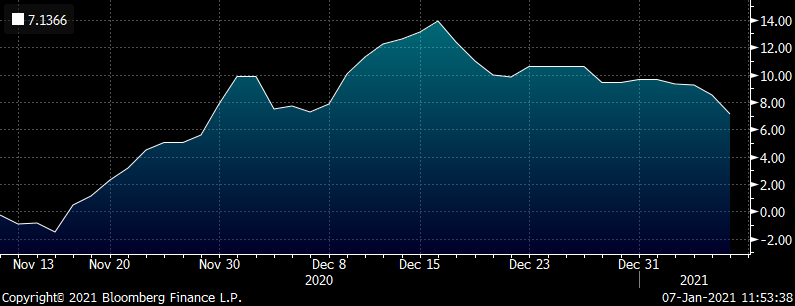

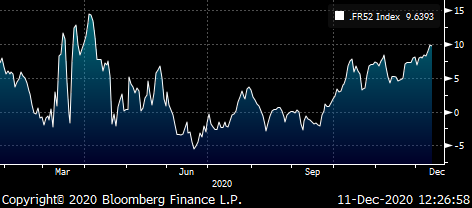

· Coupons and redemptions supportive for Italy for the rest of the month. Note Italian redemption is a CCT. Germany to see further support in January with 24.7 bn in C&R

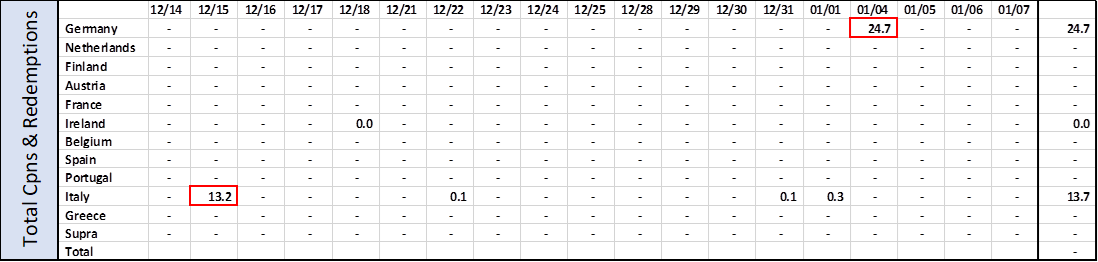

· Looking further ahead January sees support for Germany and Spain in terms of C&R flows. Full year schedule below:

· Yesterday's ECB meeting and the general lack of supply likely clearly supportive for bonds, but it is not unreasonable to question how much further we can rally in outright Bund yields.

· Similarly, we have been struggling to break to new lows in spreads

· What seems fair is to assume that in the wake of supply in Q1 and what could be a disconnect between issuance and PEPP buying, that we can sell against short term strength in spreads, whilst looking for micro opportunities to capture supply concessions

Trades of the week below:

Buy France vs Germany and Italy on Credit Weighted Fly

- French Longs 30y cheapened as a credit after French supply announcement

Structure

Long France 52

Short 30% Italy, 70% Germany 46s (UB contract)Cix:

100 * (YIELD[FRTR 0.75 05/25/52 Corp] - 0.7 * YIELD[DBR 2.5 08/15/46 Corp] - 0.3 * YIELD[BTPS 2.45 09/01/50 Corp]) -

BBG graph

Levels:

Enter: +9.6bp

Add: +12.5bp

Target: +2.5bp

Rationale

France has cheapened over last long supply and on the prospect of 50y syndic in Jan

Frtr 52 goes into QE next May

Longs in Core countries trade much richer, hence the pick up using our credit model ratios rather than simple PCA

Graph: 30y Z-Spreads vs interpolated Germany

Table 1 – Data on Relative 30y Z-Spreads

Roll / Carry (bp per 3mo)

Germany: -0.3 / -1.2 (-0.68% repo)

France: +0.4 / +0.9 (-0.55% repo)

Italy: -0.5 / -2.5 (-0.58% repo)

Weighted Sum: flat / -0.7 bp /3mo

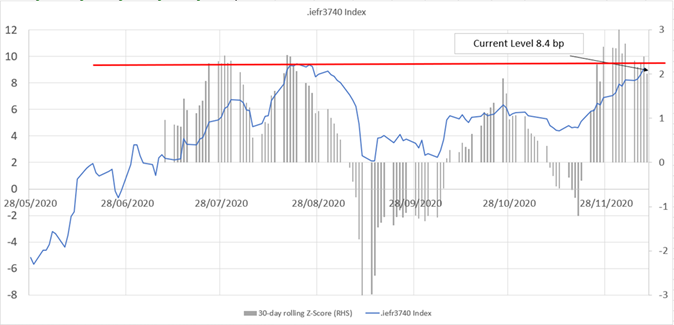

Sell Irish 5/37 vs FRTR 5/40 with a view to close out into syndicated supply

- Ireland structurally a rich credit vs France on our interpolated curves.

- This is even more exaggerated in longer tenors

- Ireland has limited funding needs this year, but tends to syndicate early January

- With no redemptions this year pressuring their issuance shedule we think they will opt for a 20y in January

- We think there will be QE demand for on the run bonds with a larger free float, so new issues should perform well in 2021

Graph 1: Irish 37 vs FRTR 5/40 at top end of the recent range

Graph 2: Distribution of Irish redemptions

Graph3: Ireland trades rich, especially in the long end, when compared to a ratings based curve

Sell BTPS 3/30 vs BTPS 1/27 & BTPS 4/31

- 4/31 has underperformed over the past week, despite the end of month tap having been cancelled

- Conversely, with little confidence of exactly what is being syndicated by Italy in Q1, we would like to run 7/10 steepeners into supply. Our only issue is that the levels are a little ambivalent in 7/10

- The cheapness of 4/31, however, makes the fly much more compelling, whilst retaining a steepening bias

- We have weighted the fly 60:40 in favour of 10y to take out a small amount of the directionality

- CIX 2 * (YIELD[BTPS 3.5 03/01/30 Corp] - 0.4 * YIELD[BTPS 0.85 01/15/27 Corp] - 0.6 * YIELD[BTPS 0.9 04/01/31 Corp]) * 100

James Rice & Will Scott

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice & Will Scott, consultants with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades and Fades - Week of 7th to 11th December, James & Will at Astor Ridge

The week ahead:

- Coupons and redemptions supportive for Germany and Italy for the rest of the month. Note Italian redemption is a CCT. CCTs currently at fair levels, but liquidity issues may mean this gets recycled short term into BTPS

- Supply schedule running on fumes, but Spain to announce bonds this afternoon and more clarity from Italy post close on whether they will cancel their mid-month supply (scheduled for 10th December). Not that they normally do but hey, this is 2020

- All eyes clearly on ECB next Thursday. Rhetoric somewhat tough to interpret, but any upside surprises to PEPP extension size likely to impact Italy and Spain, particularly in long ends

Trades of the week below (click on links)

- Buy 50y Spain on either 30/50 Box or 10/50 Box vs France

- Sell 10y Italy vs 7y and 15y Wings

- Buy France 30y vs Germany and Italian wings (as recommended last week)

- Sell Ireland vs France as January auction setup trade

- Sell Portugal 28 vs Spain 28

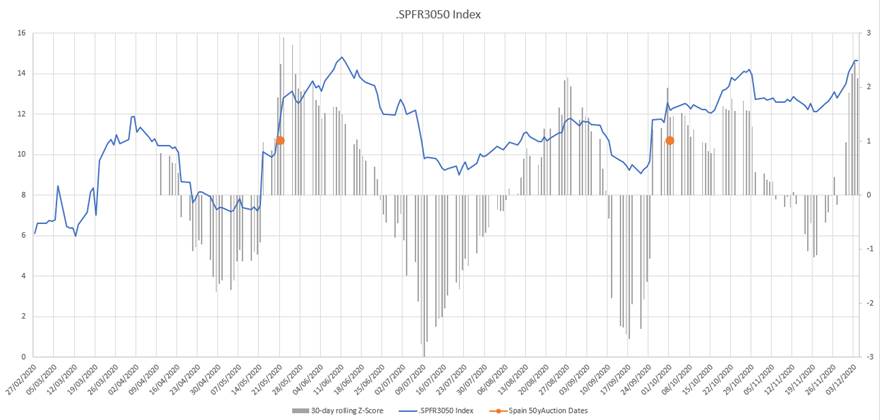

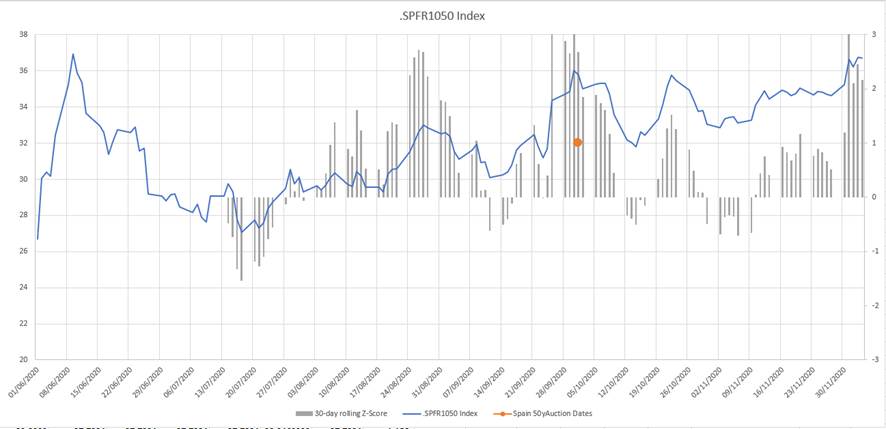

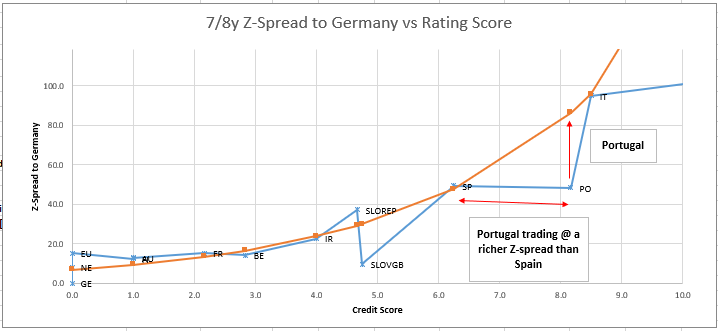

Buy 50y Spain on either 30/50 Box or 10/50 Box vs France

- 50y Spain looking cheap to us now and worth taking a look

- Positioning in Spanish 50y has weighted on Spain 30/50, steepening it up to 27 basis points

- Conversely supply in 30y France has flattened French 10/30 to 12.3 basis points

- The combination of the two has pushed the box to recent highs

- Given the relative illiquidity of this spread we think that both 30/50 and 10/50 iterations give us the best chance of execution, so choose to look at both possibilities

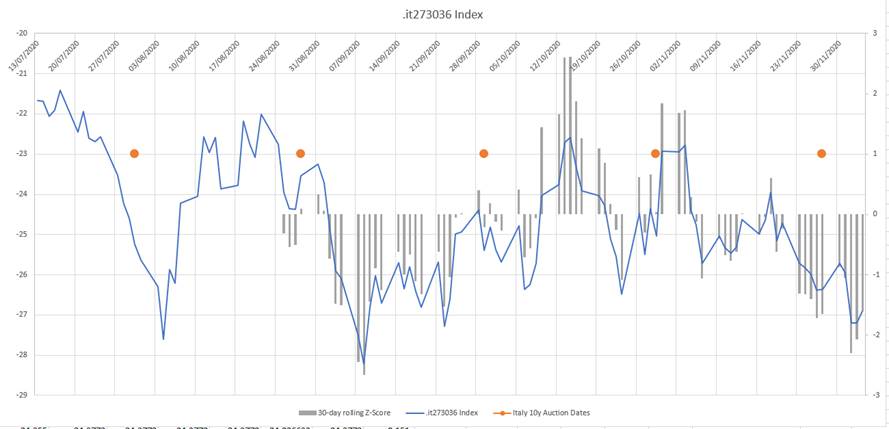

- What is clear from looking at the charts is that 1) Auction events see a substantial cheapening in 50y Spain and 2) It is value (as in a cheap z-score) that provides the catalyst for a reversion in the spread, rather than anything more cyclical. We think we are at this inflection point

- Current level: 14.4 basis points

- Entry level: 14 basis points

- Profit take: 11 basis points

- Any meaningful upsizing of the PEPP should help both Italian and Spanish long ends to flatten

- 30/50 CIX 100 * ((YIELD[SPGB 3.45 07/30/66 Corp] - YIELD[SPGB 1 10/31/50 Corp]) - 1 * (YIELD[FRTR 1.75 05/25/66 Corp] - YIELD[FRTR 1.5 05/25/50 Corp]))

- 10/50 CIX 100 * ((YIELD[SPGB 3.45 07/30/66 Corp] - YIELD[SPGB 1.95 07/30/30 Corp]) - 1 * (YIELD[FRTR 1.75 05/25/66 Corp] - YIELD[FRTR 0 11/25/30 Corp]))

History of Spain/France 30y50y box (auction dates in orange)

History of Spain/France 10y50y box (auction dates in orange)

Sell 10y Italy vs 7y and 15y Wings

- IK rally in recent days, coupled with general long end weakness in EGBs and selling of the Italian belly vs the long end has left this fly at attractive levels

- Looking at 10y auction dates there in a noticeable cyclicality to this fly, so we feel this this offers a stable auction concession trade into year end supply

- Longs should benefit on an upsized PEPP, whereas a more benign outcome should nevertheless see supply weigh on the belly

- Current level -26.9

- Entry level -26.9

- Target -24.0

- CIX: (2 * YIELD[BTPS 3.5 03/01/30 Corp] - YIELD[BTPS 0.95 09/15/27 Corp] - YIELD[BTPS 1.45 03/01/36 Corp]) * 100

History of Italy 7/10/15 fly (10y auction dates highlighted)

Buy France 30y vs Germany and Italian wings (as recommended last week)

Right here we feel the opportunity is in the cheapening in 30y France rather than in the individual issues

Good timing to put on 52s QE drop in trade

- French May52 are a cheap 30y

- They will go into QE buying next May

- French long end supply yesterday gave us an entry

- Spectre of increased issuance in Germany means its premium could be diluted

Trade Structure

Buy 30y France – 100%

Sell 30y Germany (UBH1 Futures) – 70%

Sell 30y Italy – 30%

Levels

Current: +8bp

Enter: +8bp

Add: +11bp

Target +2.5bp

Cix

100 * (YIELD[FRTR 0.75 05/25/52 Corp] - 0.7 * YIELD[DBR 2.5 08/15/46 Corp] - 0.3 * YIELD[BTPS 2.45 09/01/50 Corp])

History

Rationale

- The Natural hedge for long supply is French 30y – we still see this as cheap on the curve and France has cheapened as a credit

- The gap between France and Germany is still wide despite other semi-core and core spreads tightening

Sell Ireland vs France as January auction setup trade

- As we head into January's supply season, we like edging into supply hedges

- Given that Ireland tends to be a first mover in terms of syndication we like making use of current levels to get short the issuer in anticipation of a supply concession

Current level: 5.4

Enter: 5.4

Add: 4.0

Target: 9.0

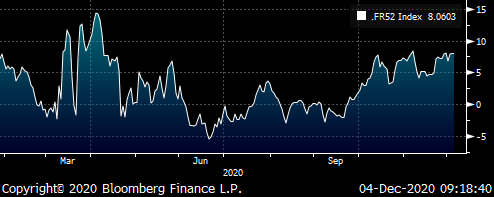

Sell Portugal 28 vs Spain 28

Portugal has been a huge beneficiary of QE flows – has moved beyond simple spread compression

Structure: Sell Portugal 28 to buy Spain 28

Lvl: -0.43bp

Enter: -1bp (25% risk)

Add: +3bp (50% risk)

Target: -6bp

Cix:

100 * (YIELD[SPGB 1.4 04/30/28 Corp] - YIELD[PGB 2.125 10/17/28 Corp])

BBG History

7y & 8y Euro Credit RV –

(interpolated Z-Spread vs Germany)

Rationale

In the rising tide of spread compression Portugal as a major beneficiary of the capital key allocation of QE look distorted

Any ease in QE over December or a generic credit widening leaves the Portugal Spain spread as looking most vulnerable to widen

Happy to get on the phone and discuss as always,

Will and James

![]()

Will Scott

O: +44 (0) 203 - 143 - 4800

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Will Scott. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796