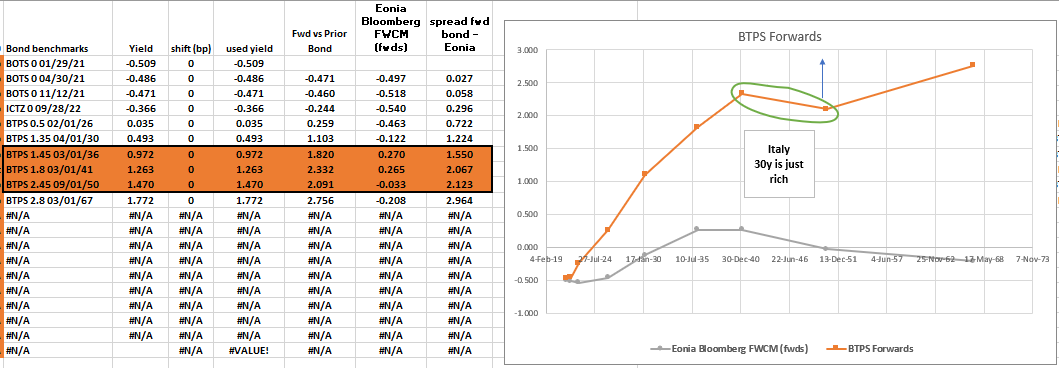

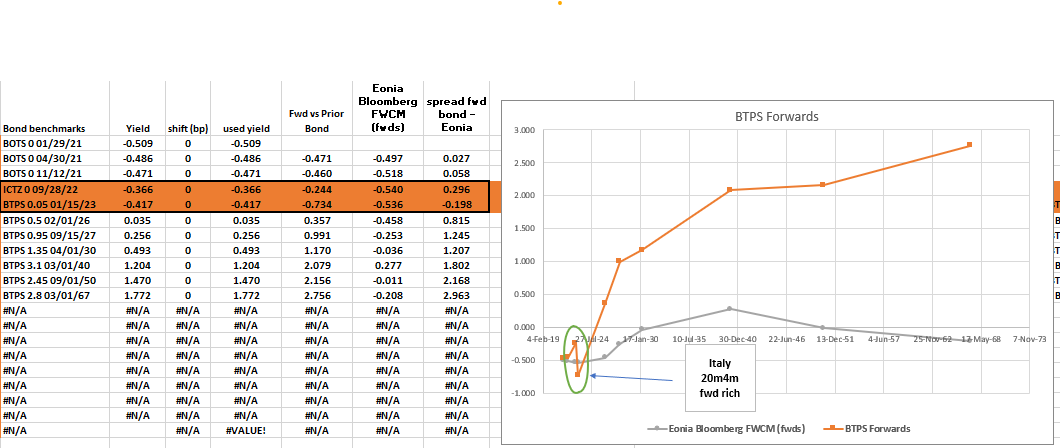

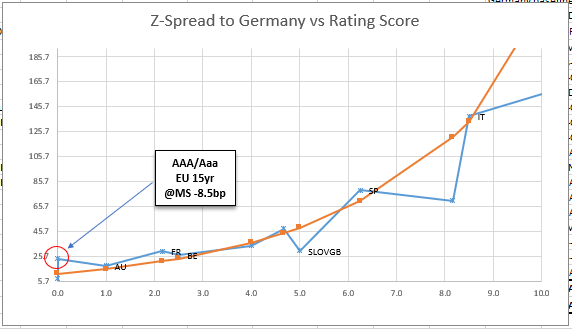

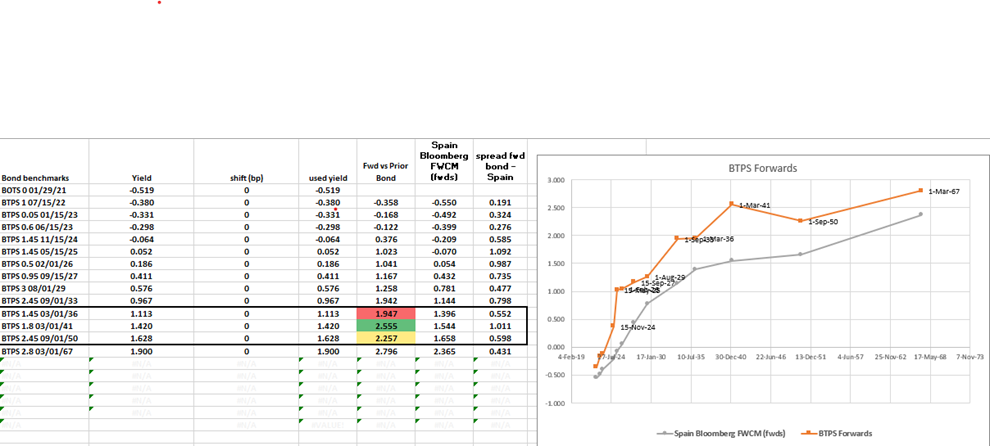

forwards / roll and carry in Italy in the 2y-7y

Thinking about the Italian curve 2 – 7yrs and how that all looks to me – as per our convo

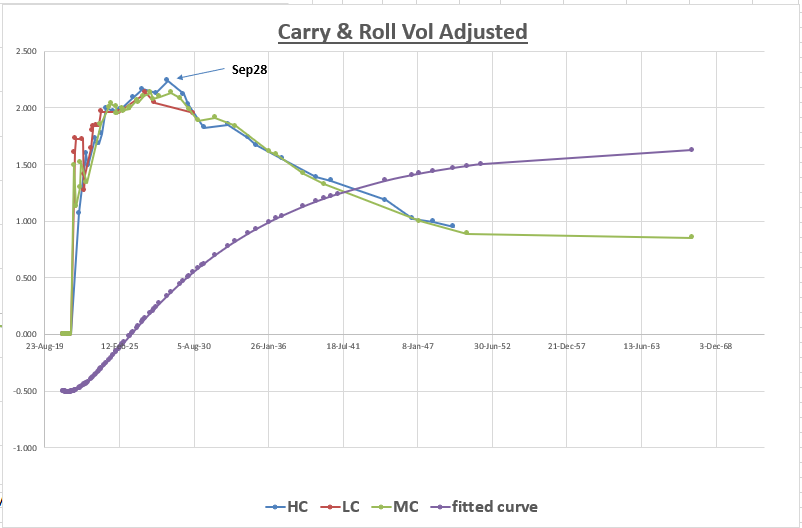

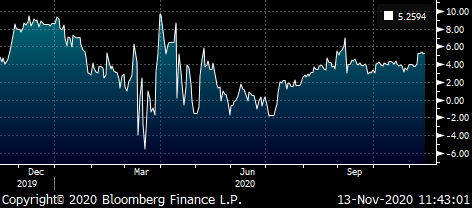

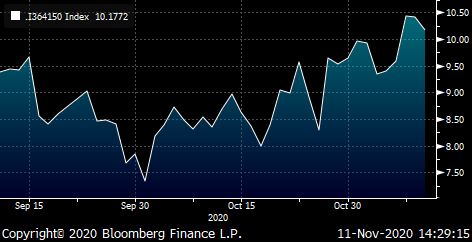

Carry and roll 90 day vol adjusted

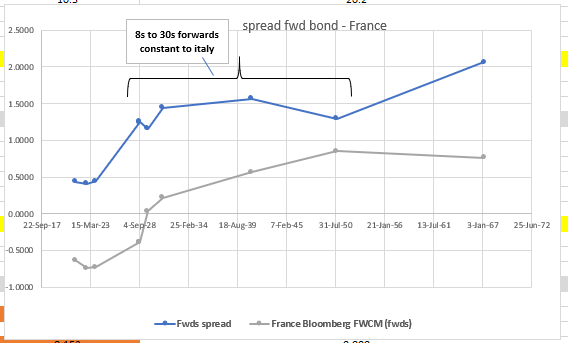

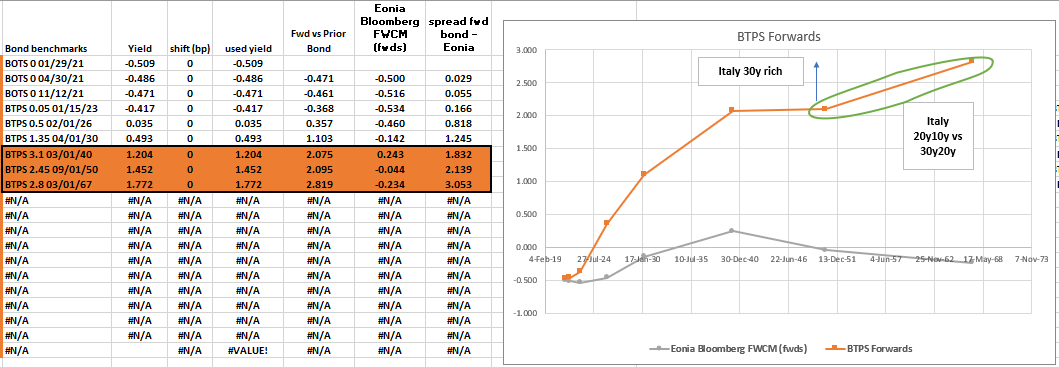

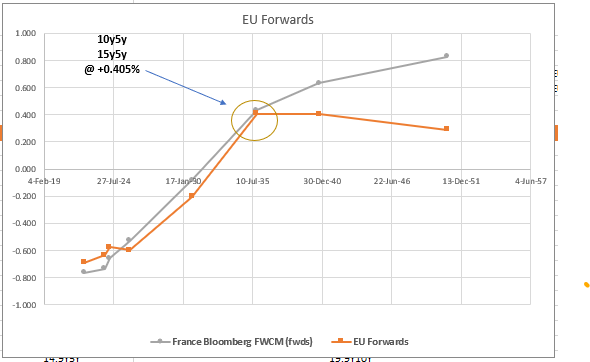

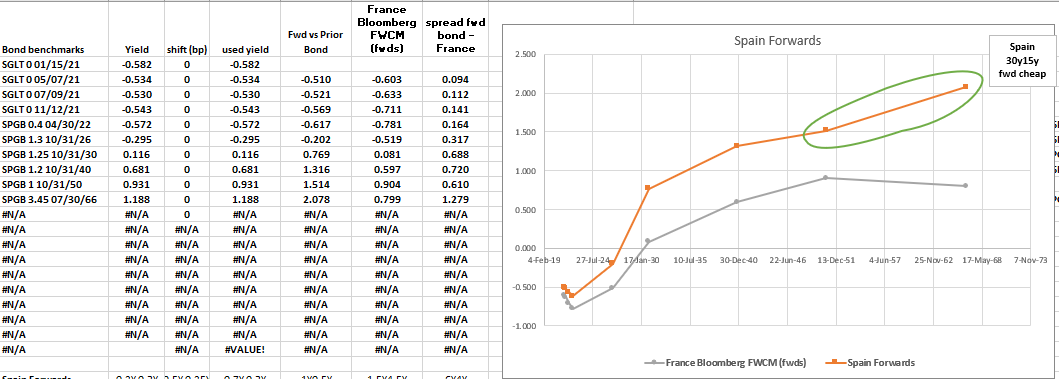

I see 8yr to 30yr on forwards constant spread to France – which am using as a more 'bond type' benchmark than the swap curve

Spread of Italian bond forwards vs same dates on French curve….

To me there can be two things that can happen crudely – Italy narrows or widens!

- In a narrowing I cannot see how the longer forwards from 10y to 30y can narrow more than things like 3y2y or 5y2y. This would more likely happen in a credit event scenario at much more stretched spread levels – which implies to 5y and 7y should do better in narrowing

So to me 10s30s steepener here is actually a widening trade because the short end is benign and because of forward spread levels – unlike previous widenings we have witnessed where 10s30s flattens

- In a narrowing the forwards that can narrow the most are 3y2y and 5y2y as they have much better roll into the richer segments - so yeah, I like long 5years and long 7yrs in the absence of any shock negative event / news

- Conclusion - In terms of value both 20s30s steepening and 18month / yr flattening are solid roll and carry trades – and are borne out by the vol adjusted roll and carry chart – which really likes Btps 4.75 sep28 – the old ctd (HC nov 27 actually had a great run as they fell into the 7y area so I don't mind sep28 as a decent purchase here)

- What's interesting is that although the Ctz May22 and sep22 are locally cheap – even they still look a sell when you look longer in the curve – if we issue select I'd go for selling something like HC 2.45% oct 23 vs buying sep28

In short, I like

Duration matched oct23 -> sep28

(YIELD[BTPS 4.75 09/01/28 Corp] - YIELD[BTPS 2.45 10/01/23 Corp]) * 100

Forward weighted it would look more like short 40% of the oct23 vs 100% of sep28

Gotta say timing/location doesn't look epic – so I'd be of a mind to wait for more of a sell-off

So, taking the average of duration and forward weighted gives 70% short in oct23 – net delta of 30% - pretty much where your mind is at

but tbh I would hedge the delta in another issuer as they are all, as we agreed becoming like rates markets – maybe a cheeky short in the Portugal 28s which are just plain rich?

Apols if there's nothing hugely concrete still looking

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades & Fades - week of 30th Nov - 4th Dec

Trades and Fades

looking for clever ways to get short the 10y -15y sector – looks cheap so the search is real!

30y hedge bond looking cheap and goes into QE next May

100 * (YIELD[FRTR 0.75 05/25/52 Corp] - 0.7 * YIELD[DBR 2.5 08/15/46 Corp] - 0.3 * YIELD[BTPS 2.45 09/01/50 Corp])

- Futures – Calendar Rolls, more on that later

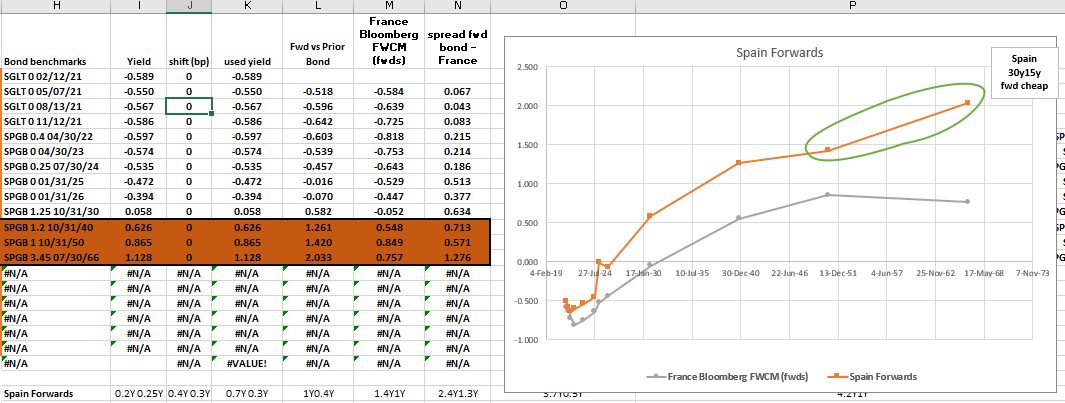

{SP} / {IT}: 20s 30s 50s

30y looking rich on Fly in both issuers

Could the ECB take off the 30y cap at the December meeting?

- Germany: 5y Wednesday

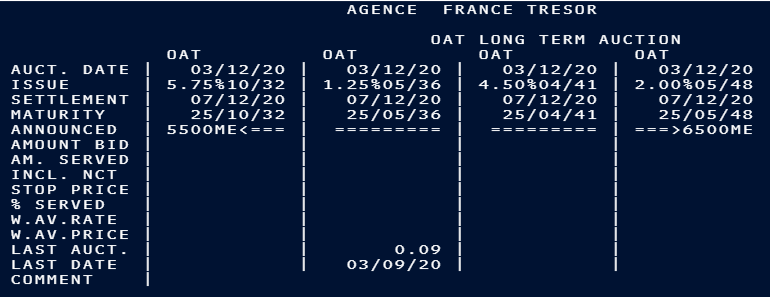

- {IT} Italy: Friday 4th Dec – announcement for Dec 10th supply – expecting cancellation

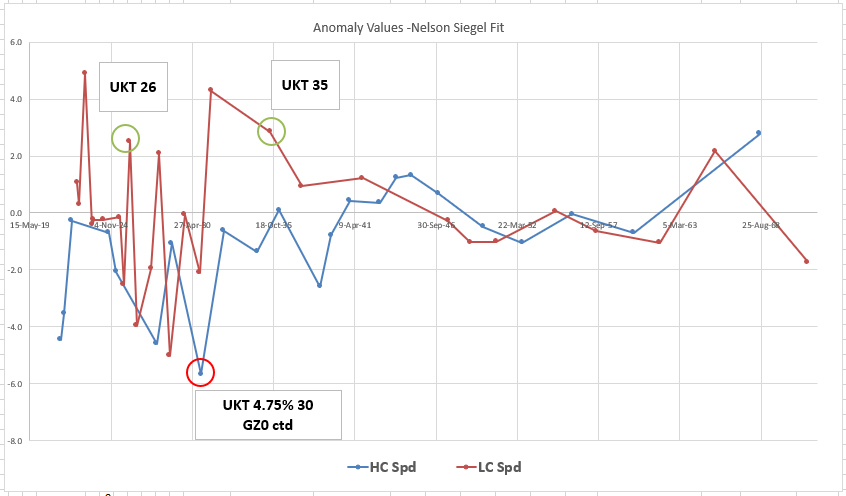

UK – the UKT sees two taps this week – both are cheap in forwards

Tough to find a structure ahead of supply – after the event we want to come out with something that looks like

+ UKT26 / -GZ0 / +UKT35

Cix

(2 * YIELD[UKT 4.75 12/07/30 Corp] - YIELD[UKT 0.625 07/31/35 Corp] - YIELD[UKT 0.125 01/30/26 Corp])

Trade History

Rationale

– GZ0 fully prices its anomaly and should see pressure from the cheaper 31s being tapped

- UKT 35 represents the top of the forwards curve vs shorter bonds

- Butterfly of long 26s short gilt futures and long 35s is an approximation of the extreme slope of forwards from 2026 thru' 2030 to 2035

UKT Anomalies vs Fitted curve (coupon adjusted* by => plus 'Z' spread minus Swap spread)

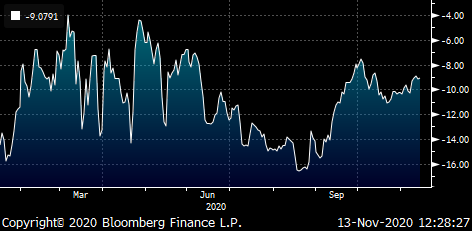

Forwards

Levels

Current: -11.2bp

Enter: -11bp (25% risk)

Add: -14bp (50% risk)

These levels are derived not from history – we choose not to let the market define value for us – but take it the shape of forward rates

@ -14bp and below the trade looks really appealing in terms of slope of the fwd rate curve.

Given that we're going for a social 25% risk @ -11bp means it's a tactical trade to absorb supply. We don't want to miss the trade – but want to be involved more deeply at -14bp and below and need to hold some fire back for that

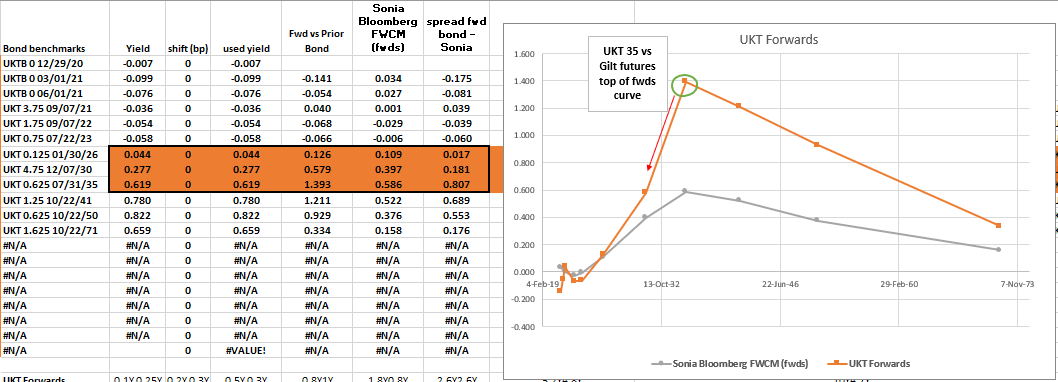

France supply in long end this Thursday

- Right here we feel the opportunity is in the cheapening in 30y France rather than in the individual issues

Good timing to put on 52s QE drop in trade

- French May52 are a cheap 30y

- They will go into QE buying next May

- French long end supply next week gives us an entry

- Spectre of increased issuance in Germany means its premium could be diluted

Trade Structure

Buy 30y France – 100%

Sell 30y Germany (UB Futures) – 70%

Sell 30y Italy – 30%

Cix

100 * (YIELD[FRTR 0.75 05/25/52 Corp] - 0.7 * YIELD[DBR 2.5 08/15/46 Corp] - 0.3 * YIELD[BTPS 2.45 09/01/50 Corp])

History

Levels

Current: +8.8bp

Enter: +8.25bp

Add: +11bp

Target +2.5bp

Rationale

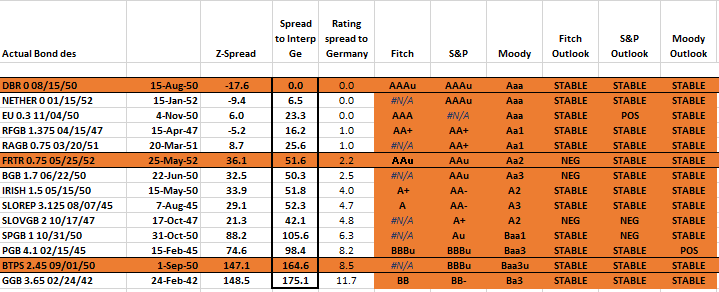

- The Natural hedge for long supply is French 30y – we still see this as cheap on the curve and France has cheapened as a credit

- The gap between France and Germany is still wide despite other semi-core and core spreads tightening

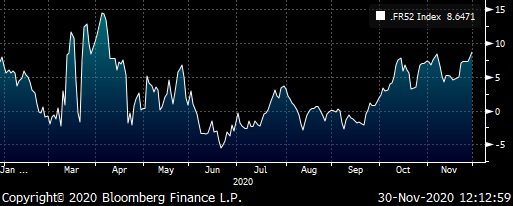

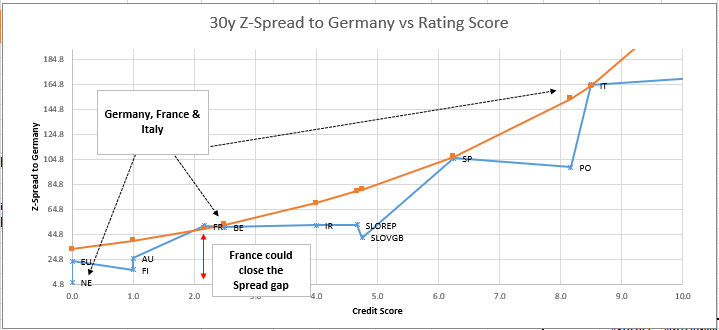

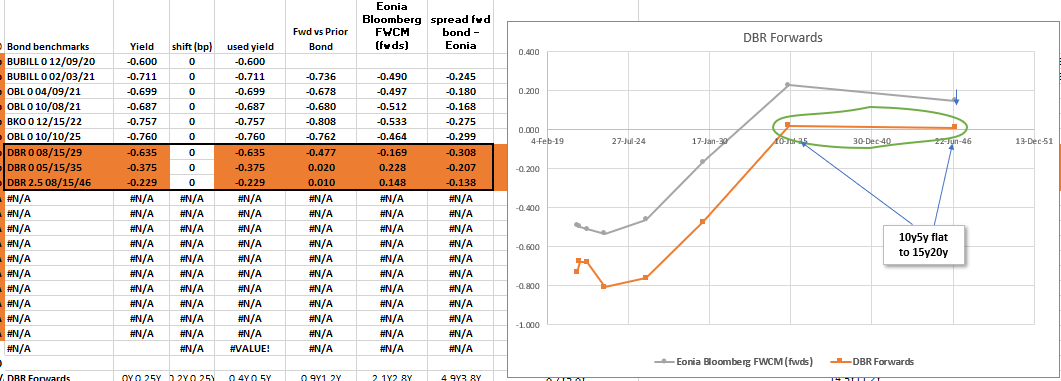

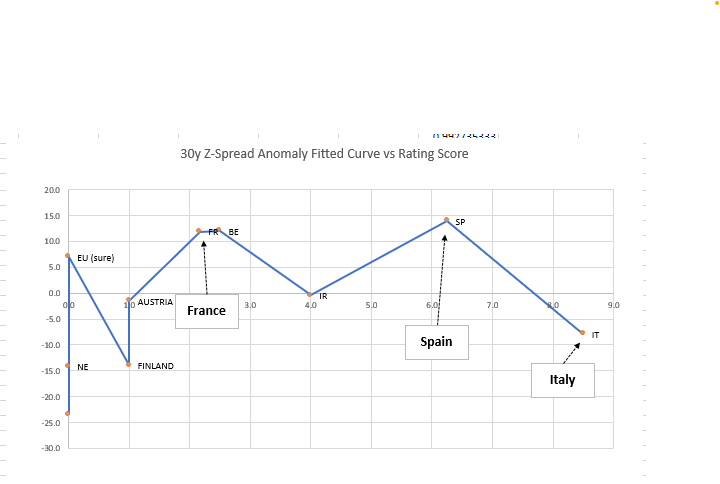

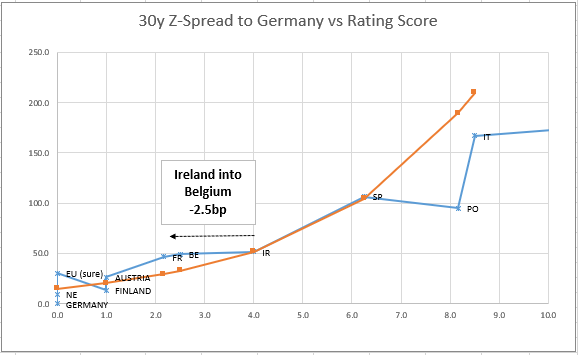

30yr Euro Credits – Graph

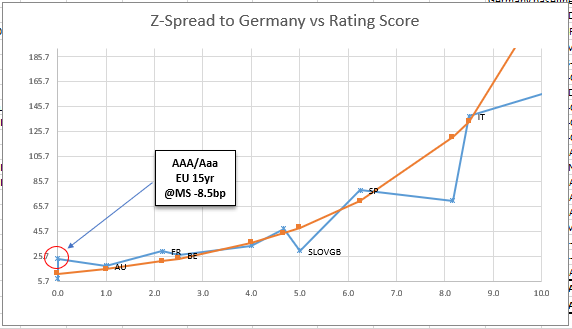

Z-spread to Germany plotted against Credit Score*

*Credit score is a proprietary amalgam of Fitch, S&P and Moody's rating and outlook

Worth taking a better look at 50y as we head into the ECB meeting.

- Market consensus seems to be overwhelmingly that the 30y buying limit for APP will remain intact

- Whilst we neither agree, nor disagree, the fact is that the market didn't expect 30y either when QE started, and look what happened there

- ECB meeting aside, 50y does offer some value in both the Spanish and Italian curves, so now is as good a time as any to take a further look:

- Spain and Italy +20y / -30y / +50y

30y looking rich on Fly in both issuers

Italy

+Mar40, -Sep50 +Mar67

Cix:

(2 * YIELD[BTPS 2.45 09/01/50 Corp] - YIELD[BTPS 2.8 03/01/67 Corp] - YIELD[BTPS 3.1 03/01/40 Corp]) * 100

History

Forwards

Rationale

- QE has reached along the curve and left 50yrs behind

- Any further rally could see a flattening of 30s50s

- A sell off similarly would hopefully steepen the 20y 30y spread

Spain

-10/50, +10/40, +7/66

Cix

(2 * YIELD[SPGB 1 10/31/50 Corp] - YIELD[SPGB 3.45 07/30/66 Corp] - YIELD[SPGB 1.2 10/31/40 Corp]) * 100

History

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

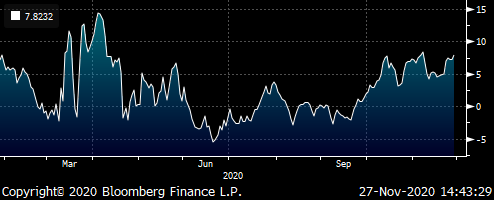

Trade Radar - Friday 27th November James & Will @ Astor Ridge

French Supply – Good timing to put on 52s QE drop in trade

- French May52 are a cheap 30y

- They will go into QE buying next May

- French long end supply next week gives us an entry

- Spectre of increased issuance in Germany means its premium could be diluted

Trade Structure

Buy 30y France – 100%

Sell 30y Germany (UB Futures) – 70%

Sell 30y Italy – 30%

Cix

100 * (YIELD[FRTR 0.75 05/25/52 Corp] - 0.7 * YIELD[DBR 2.5 08/15/46 Corp] - 0.3 * YIELD[BTPS 2.45 09/01/50 Corp])

Graph

Levels

Current: +7.8bp

Enter: +8bp

Add: +11bp

Target +2.5bp

Next week (Thursday) brings supply in France

The Natural hedge for long supply is French 30y – we still see this as cheap on the curve and France has cheapened as a credit

Generally the credit curve is too 'shallow' at semi and core levels

–France / Germany is too wide given France / Italy

The Italian credit gives context to the credit curve and provides a credit hedge

Here's how credits look in 30yr Euro

Z-spread to Germany plotted against Credit Score*

*Credit score is a proprietary amalgam of Fitch, S&P and Moody's rating and outlook

Data…

This is borne out in the credit butterfly trade as shown in the graph above

Trade Mechanics

Please give us a call for details

Best

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - James & Will @ Astor Ridge

Click the links below to take you to the idea..

This fly one of the last decent PV kinks in the forwards curve…

Working nicely….

Structure

-Sell Btps Mar36

+Buy Btps Mar41

-Buy Btps Sep50

Lvl:

Incepted +10.25bp

Current: +8.3bp

Target Short term: +7.5

Target Long Term: +3bp

Cix:

(yield[FRTR 2 05/25/48 Govt]-yield[RFGB 1.375 04/15/47 Govt])-0.1*(yield[SPGB 2.9 10/31/46 Govt]-yield[EU 3.75 04/04/42 Govt])

Graph

20y supply out of the way

Don’t be fooled by history – this has intrinsic value all the way +2.5bp

First stop is to take some off at +7.5 and run the rest

Forwards

New Eu 15yr priced cheap as a credit and 15yrs cheap on in core curves

Structure

€50MM 15y EU 0% Jul35 (€75.75k /01)

Sell 243 RXZ0 contracts

Sell 78 UBZ0 contracts

Lvl: +55.4bp mid

Cix of Trade:

(2 * YIELD[EU 0 07/04/35 Corp] - YIELD[DBR 2.5 08/15/46 Corp] - YIELD[DBR 0 08/15/29 Corp]) * 100

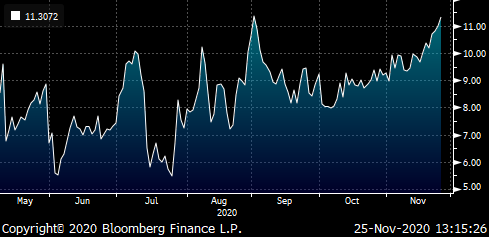

Looking at just the German curve…

Here’s the history of 15y Ge vs RX and UB…

The 15y German point is cheap

Cix:

(2 * YIELD[DBR 0 05/15/35 Corp] - YIELD[DBR 2.5 08/15/46 Corp] - YIELD[DBR 0 08/15/29 Corp]) * 100

The German 15y is cheap in real value terms on forward rates – the 10y5y, 0.02% (RX vs 15y) forward from the bond curve is flat to the 15y10y, 0.01% (15y vs UB)

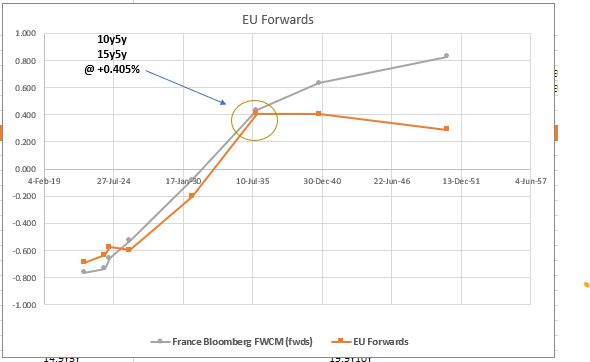

So what about the credit? - EU vs Germany

Major Rating Agencies (Fitch, S&P, Moody’s)

EU: n/a, AAA, Aaa

Germany: AAA, AAA, Aaa

Here’s how the 15y Tenors in Europe trade in Z-Spread over interpolated Germany

Z-Spread vs Rating Score*

*Rating Score is a proprietary culmination of current Agency Ratings and Outlooks

Blue – Actual Z-Spread

Orange – Fitted Credit Curve

So for this new issue we see EU as a cheap way of shortening into a triple A name from other core and semi-core credits

Putting the two together we like sell RX and UB to buy the EU 15y

More to follow

Let us know

James Rice, William Scott

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - Will & James @ Astor Ridge

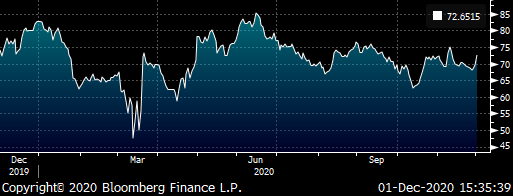

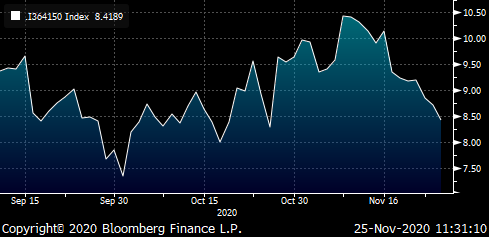

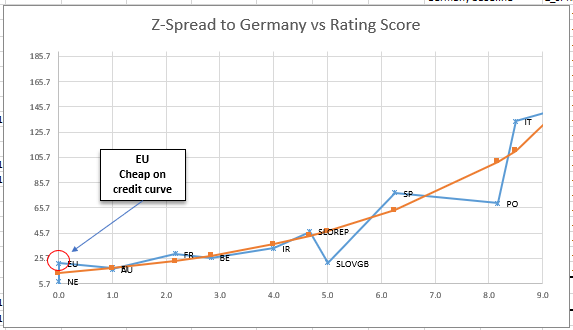

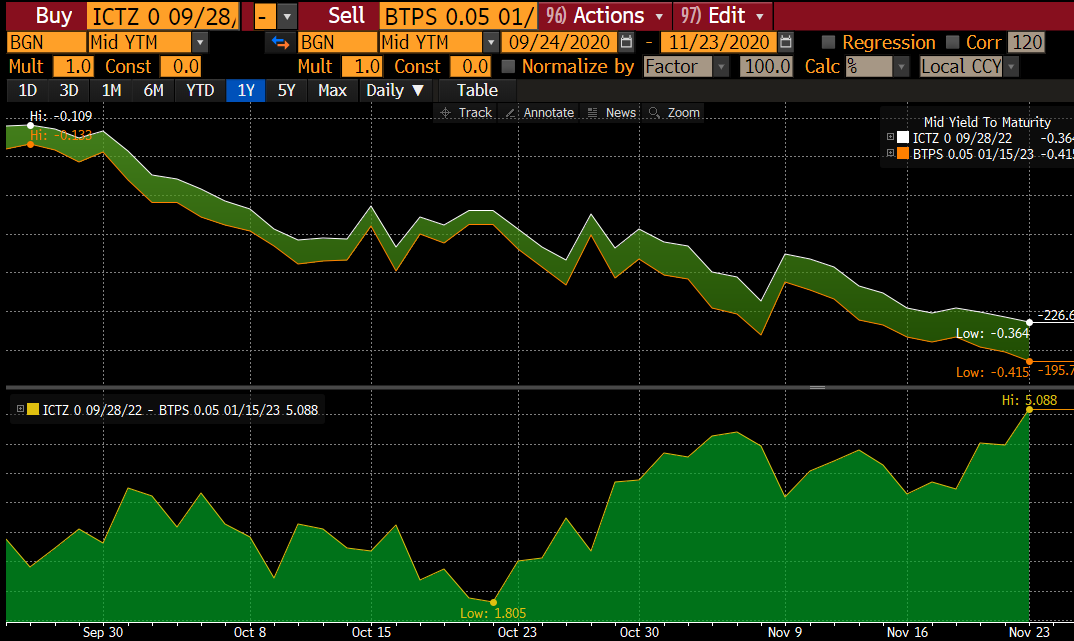

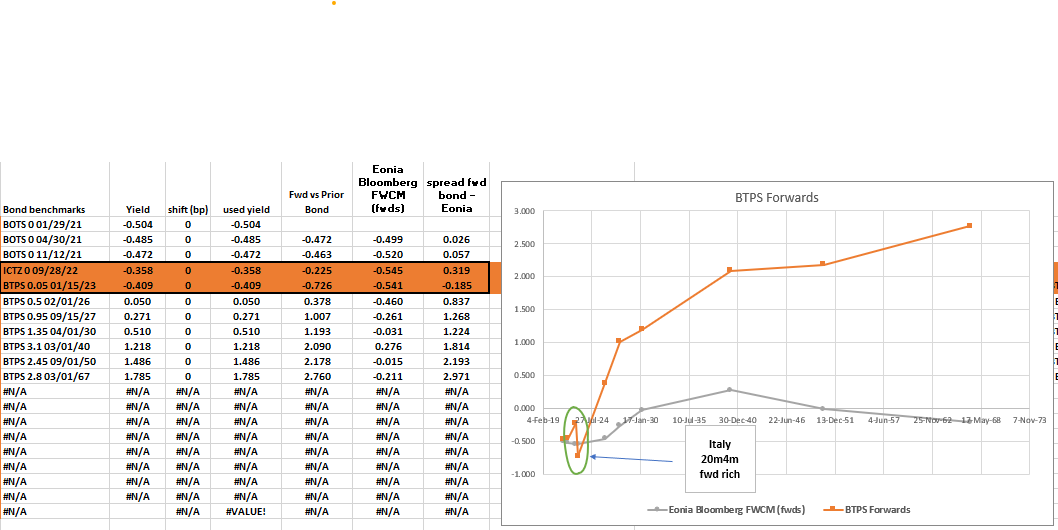

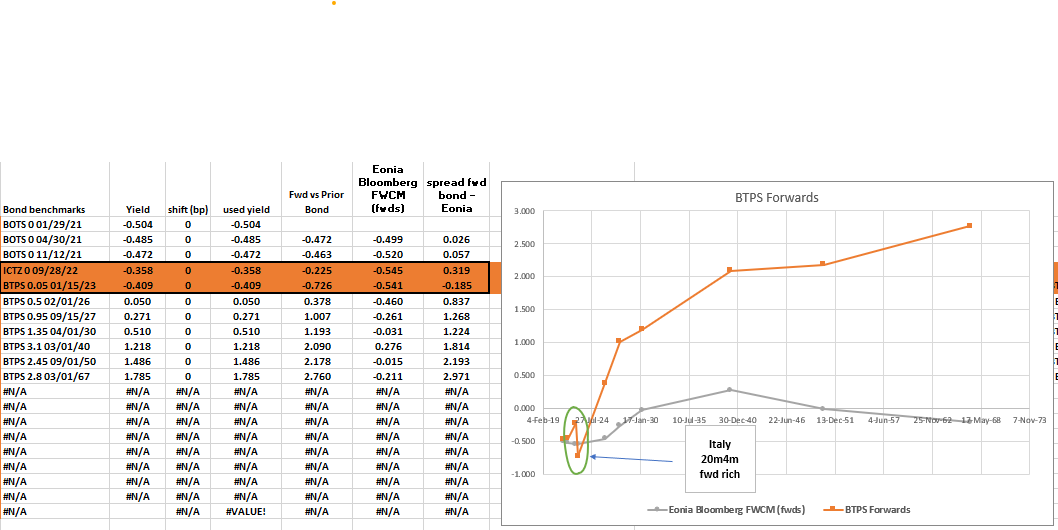

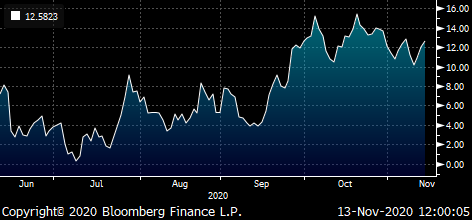

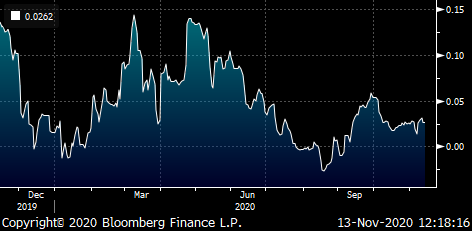

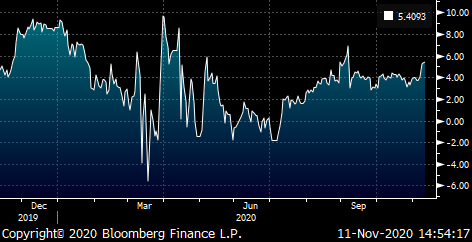

Italy +20 month -2y BTSZ0 contract steepener

Structure

+ €50MM ICTZ 0% sep22

-759 contracts, BTSZ0 (Ctd Btps 0.05% 1/15/23), €18,5k/01

Level: +5bp

Add: +7.5bp

Target: +2bp short term, Flat Long Term

Cix:

(YIELD[ICTZ 0 09/28/22 Corp] - YIELD[BTPS 0.05 01/15/23 Corp]) * 100

BBG Graph:

Rationale

- Tapping of the ICTZ Sep22 has made it cheap on the curve

- The forward between the two bonds (20m4m fwd) is below Eonia given the current spread and market level

- The rally in short end Italy has been expressed by CTAs in the BTS contract. The contract has outperformed neighbours on the curve.

- When the contract rolls off in early Dec we expect the CTD to cheapen

Thoughts

- Credit Wideners are ten a penny right now. Most fade a move that’s been a grind since March, but what I like about this one is the value – we’ve actually managed to get a forward below Eonia – so to me I’d have it in some size and roll contracts in early Dec as a value outlier that will prob works best in an Italy sell-off

- In mitigation, there’s a decent amount of Balance sheet being used – if I was Bal. Sheet ‘adjusting’ I’d probably be looking at +20y -30y +50y – let me know if that’s interesting

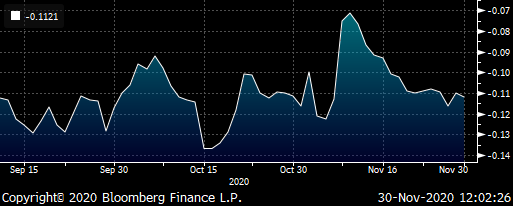

Forwards

Carry & Roll

-0.6bp /3mo @ -10bp repo spread

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - Week if Nov 23rd - Nov 27th James & Will @ Astor Ridge

Trades & Fades

- Thanksgiving & Black Friday Week

- Supply

Monday : Belgium 6/25, 4/33

Tuesday : Holland 1/27

Wednesday : ITALY ICTZ 9/22

Friday : ITALY 5y, 10Y & CCT

- Credit

Credit is on the narrow – looking to sell the larger issuers versus wings – France has richened but not quite rich enough in absolute terms

With rolls coming into focus, we are looking at structures to take advantage of the long positions in front months:

Sell BTS 01/15/2023 (front month BTS) into ICTZ Sep-2022 at 5 bpts (Tap on Wednesday)

- CTZ continues to be unloved, but at current levels we feel that long CTZ vs short BTSZ0 (or the underlying CTD) is a sensible way to play the roll:

Forwards:

_____________________________________________________________________________________________________________________________________________________

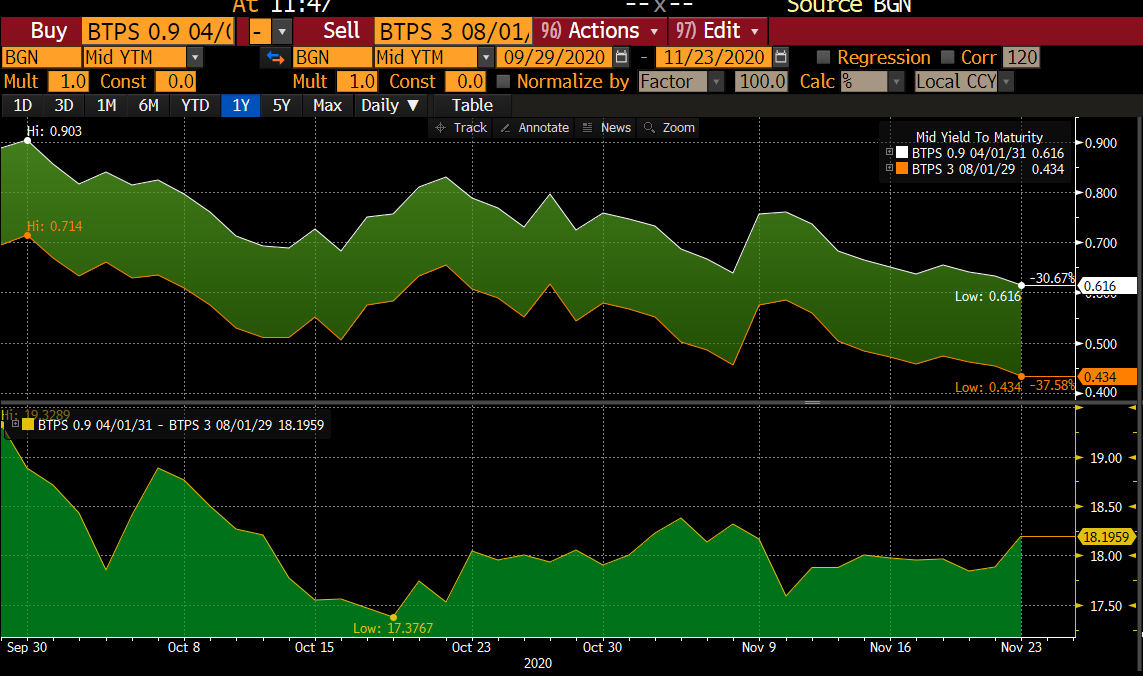

Sell BTPS 8/29 -> BTPS 4/31 ahead of the tap on Friday at 18.25 bpts

Similarly, whilst IKZ0 (So BTPS 8/29) has cheapened, we think that short front month IK vs the 10y tap bond offers good entry levels for a micro-flattener and allows us to be short the roll given what we see as long positioning in the front month contract.

________________________________________________________________________________________________________________________________________________________

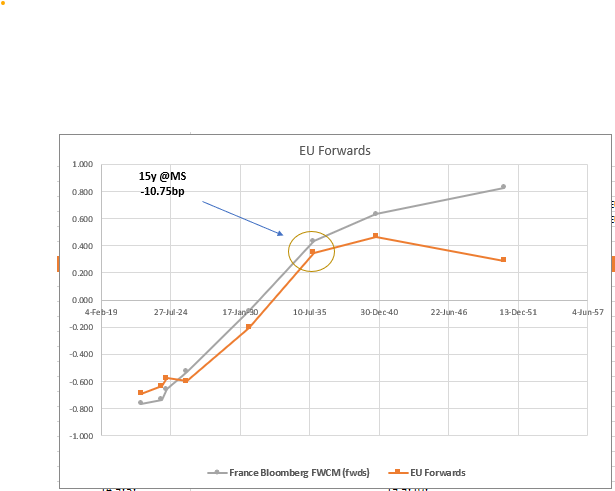

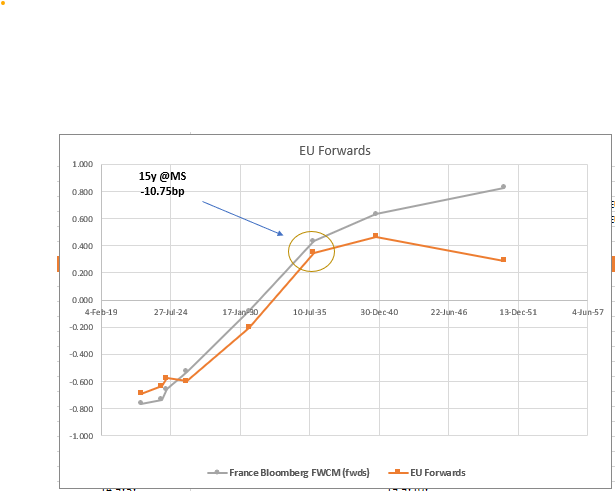

New 15y EU expected this week –

Trade: Buy 15y EU vs -RX & -UB

We have modelled EU 0% Nov 35

We see 'Fair Value' at MS -10.75bp

Here's how Forwards look in EU on that basis

To get the forward 10y5y vs 15y5y flat, which we think is a value level on the curve– we need the bond to be @ MS -8.5bp

And forwards would look as follows,, at which point the 10y5y and the 155y would be flat in an otherwise steep curve

*As a credit there's an a existing 1.5% 35s out there (trades MS -4.8bp), but the newer issues seem to create a richer curve of their own – being larger and more recent bonds

Here's how EU would look vs other 15y Credits on a Z-spread vs Germany….

Blue: Z-Spreads vs Germany

Orange: Fitted Curve

*Credit score is an assessment of rating and outlook Fitch, S&P and Moodys

Conclusion – as a flat credit trade vs Semi Core vs Germany, Austria, Finland, Belgium and France – these look attractive

Also the 15y in Germany has cheapened vs RX & UB…

Cix: 200 * (YIELD[DBR 0 05/15/35 Corp] - 0.5 * YIELD[DBR 0 08/15/29 Corp] - 0.5 * YIELD[DBR 2.5 08/15/46 Corp])

Graph

Adding this all together , we like +EU 15y vs -RX and -UB, contingent on pricing around the MS -9 bp mark

Let me know your thoughts – more to follow

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - Week if Nov 23rd - Nov 27th James & Will @ Astor Ridge

Trades & Fades

- Thanksgiving & Black Friday Week

- Supply

Monday : Belgium 6/25, 4/33

Tuesday : Holland 1/27

Wednesday : ITALY ICTZ 9/22

Friday : ITALY 5y, 10Y & CCT

- Credit

Credit is on the narrow – looking to sell the larger issuers versus wings – France has richened but not quite rich enough in absolute terms

With rolls coming into focus, we are looking at structures to take advantage of the long positions in front months:

Sell BTS 01/15/2023 (front month BTS) into ICTZ Sep-2022 at 5 bpts (Tap on Wednesday)

- CTZ continues to be unloved, but at current levels we feel that long CTZ vs short BTSZ0 (or the underlying CTD) is a sensible way to play the roll:

Forwards:

_____________________________________________________________________________________________________________________________________________________

Sell BTPS 8/29 -> BTPS 4/31 ahead of the tap on Friday at 18.25 bpts

Similarly, whilst IKZ0 (So BTPS 8/29) has cheapened, we think that short front month IK vs the 10y tap bond offers good entry levels for a micro-flattener and allows us to be short the roll given what we see as long positioning in the front month contract.

________________________________________________________________________________________________________________________________________________________

New 15y EU expected this week –

Trade: Buy 15y EU vs -RX & -UB

We have modelled EU 0% Nov 35

We see 'Fair Value' at MS -10.75bp

Here's how Forwards look in EU on that basis

To get the forward 10y5y vs 15y5y flat, which we think is a value level on the curve– we need the bond to be @ MS -8.5bp

And forwards would look as follows,, at which point the 10y5y and the 155y would be flat in an otherwise steep curve

*As a credit there's an a existing 1.5% 35s out there (trades MS -4.8bp), but the newer issues seem to create a richer curve of their own – being larger and more recent bonds

Here's how EU would look vs other 15y Credits on a Z-spread vs Germany….

Blue: Z-Spreads vs Germany

Orange: Fitted Curve

*Credit score is an assessment of rating and outlook Fitch, S&P and Moodys

Conclusion – as a flat credit trade vs Semi Core vs Germany, Austria, Finland, Belgium and France – these look attractive

Also the 15y in Germany has cheapened vs RX & UB…

Cix: 200 * (YIELD[DBR 0 05/15/35 Corp] - 0.5 * YIELD[DBR 0 08/15/29 Corp] - 0.5 * YIELD[DBR 2.5 08/15/46 Corp])

Graph

Adding this all together , we like +EU 15y vs -RX and -UB, contingent on pricing around the MS -9 bp mark

Let me know your thoughts – more to follow

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar, Nov 16th – Nov 20th: Will & James @Astor Ridge

A few trades on our minds coming into the week Nov 16th – Nov 20th

Main supply next week:

- Germany to tap 10y – Wednesday

- French supply 23s, 26s and 27s – Thursday 19th

- Spain to sell 26 & 27s – Thursday 19th

- Belgium supply TBA (5y & 10y), - Monday 23rd, positive news out on reduced supply

- Nether 7y - Tuesday 24th

Trades & Fades:

- Italian 20y too cheap? - Sell 15yr, Buy 20y, Sell 30y

- Buy Spanish longs on Blend vs Italy and France

- Sell Ireland 30y, Buy Belgium 30y

- Time to fade the tightening – Sell France vs Finland as a soft widener into year end

On our Trade Radar coming into what could have been the last piece of long end supply this year in Italy…

Italy

Sell 15yr, Buy 20y, Sell 30y

Rationale

- 20y trades cheap

- the 15y5y forward is actually higher than the 20y10y, which is unusual for a weaker credit such as Italy (BBB, Baa3, Outlook Stable)

- we had supply in the 15y this Thursday and this could be the last long tap before yr end

- For forwards to look like a continuous, smooth, upward sloping path – the fly could perform by 7bp in the belly (=14 on double counting) , so the structure has a lot of intrinsic value – the whole 20y sector is cheap

- The 36s are losing their historical premium arising from Low coupon/Low price status as there are more recent 10yrs, 20yrs and 50yrs with similar or lower coupons

The fly is an approximation of the expression of long 15y5y fwd vs short 20y10y

Cix:

(2 * YIELD[BTPS 1.8 03/01/41 Corp] - YIELD[BTPS 2.45 09/01/50 Corp] - YIELD[BTPS 1.45 03/01/36 Corp]) * 100

3mo Carry / Roll

Flat / Flat

Using -10bp repo spread

CIX of 1y older vs same bonds with more history

(2 * YIELD[BTPS 3.1 03/01/40 Corp] - YIELD[BTPS 3.85 09/01/49 Corp] - YIELD[BTPS 3.35 03/01/35 Corp]) * 100

So we see our current structure as at least 5bp to the rolled one – but more importantly in both circumstances the 20y point is cheap looking at forwards and we see more upside in the long term

Spain 20y and 50y versus blend of Italy and France 30y

Here’s how we see Spanish 30 years versus on credit anomaly vs other Euro 30yrs….

We can buy Spain cheap to Italy but use a short in France as a bit of balance to the credit hedge

But here’s how we see Spanish 30y on forwards rates versus the 20y and 50y…

*This also adds some colour as to why some operators in the 10s30s curve in Italy are confounded by its refusal to flatten further – essentially the Italian credit is now looking rich vs Spain and the forward rate spread of 10y20y it/ge is as tight as the forward rate spread 5y5y it/ge

So concatenating the two trades we get

Long Spain 20y and 50y vs

Short 60% France 30y

Short 40% Italy 30y

Cix:

100 * ((0.5 * YIELD[SPGB 3.45 07/30/66 Corp] + 0.5 * YIELD[SPGB 1.2 10/31/40 Corp]) – 0.6 * YIELD[FRTR 1.5 05/25/50 Corp] – 0.4 * YIELD[BTPS 2.45 09/01/50 Corp])

So this structure @ +14bp executable makes sense as a first entry

Sell Ireland 30y, Buy Belgium 30y

Here’s how we see Euro Credits on Spread to Germany with a fitted curve….

As a loose boundary condition we want to try and shorten up the credit curve for a minimal give in times when credit has tightened to core

Ireland into Belgium is -2.5bp on z spread

Ratings (S&P, Moody’s), Fitch has Belgium on neg outlook, other agencies have stable

Ireland: AA-, A2

Belgium: AA, Aa3

In yield space…

YIELD[IRISH 1.5 05/15/50 Corp] - YIELD[BGB 1.7 06/22/50 Corp]

Today’s Belgium funding headline was a modest cut… (Bloomberg)

Debt Agency cuts target for bond sales this year to EU44.5 billion from revised EU46.5 billion in June

· Debt Agency sees amount of outstanding treasury bills rising by only EU3.0 billion this year, saw EU10 billion increase in June

· In addition, Belgian Debt Agency expects to obtain EU2.0 billion from the European Union’s SURE bond issuance proceeds

· NOTE: Belgium has raised EU42.5 billion from bond sales so far this year

Supply expected in Belgium, Monday 23rd November – this may offer an opportunity to add to this trade

Lvls

Current: -2.6bp

Add: Flat

Target: -14bp, although that’s the extreme of the range that’s where I see credit flat vs Rating notch value – assuming generally other credits are unchanged

If we hedge the credit risk with Italy we get a sense of how this moves in sympathy with the Italian credit moves….

-Irish30y

+90% Belgium 30y

+10% Italy 30y

Cix:

100 * (YIELD[IRISH 1.5 05/15/50 Corp] - 0.9 * YIELD[BGB 1.7 06/22/50 Corp] - 0.1 * YIELD[BTPS 2.45 09/01/50 Corp])

Arguably on a fully credit hedged basis the Irish bond is in the middle of the distribution, given where Italy is – so the tailwinds for this trade may not be so strong, or similarly our first piece is in very social size and we use the fully hedged fly as an aide to add further should credit tighten

Is the spread tightening running out of steam? – looks towards opportunistic semi-core wideners to fade the move

Trade Idea: Buy RFGB 0% Sep-2030 vs. FRTR 0% Nov-30

Rationale:

- BTP/Bund, OAT/RX & Global equities all moving inexorably tighter and higher and importantly all in tandem, providing a good degree of validation to the move

- That said we have seen the market reject these spread levels again and again when a new risk event comes round the corner

- Whilst the Covid outlook has brightened considerably on the back of the vaccine news, the timing seems less clear, which could leave us spending more time back in the “new normal”

- Whilst we don’t necessarily see a reversal in spreads in the context of lower issuance into year end and cash on the sidelines, we do think that the market is more vulnerable to a negative shock than it has been for a while (extended lockdowns, vaccine issues, who knows?? – this is 2020!)

- As a result we like scaling into short France vs long Finland as a soft widener

- Move out of AA -> AA+ (Fitch)

- Supportive supply dynamic (Finland finished tapping for 2020)

- Finland cheap vs other core issuers

- Entry level 7 bpts (50%), 5 bpts (50%)

- Exit level 9 bpts (50%), run remaining 50% into January new issuance, which should favour spread widening

Spreads at historically key levels:

Finland spread to France trading very tight

Specific cheapness of Finland highlighted by the RFGB vs RAGB & FRTR (10y, 1:2:1 weighting)

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade radar - Italy Fly -15y +20y -30y, James & Will @ Astor Ridge

On our Trade Radar coming into what could be the last piece of long end supply this year in Italy…

Italy

Sell 15yr, Buy 20y, Sell 30y

Rationale

- 20y trades cheap

- the 15y5y forward is actually higher than the 20y10y, which is unusual for a weaker credit such as Italy (BBB, Baa3, Outlook Stable)

- we have supply in the 15y on Thursday and this could be the last tap before yr end

- For forwards to look like a continuous, smooth, upward sloping path – the fly could perform by 7bp in the belly (=14 on double counting) , so the structure has a lot of intrinsic value – the whole d20y sector is cheap

- The 36s are losing their historical premium arising from Low coupon/Low price status as there are more recent 10yrs, 20yrs and 50yrs with similar or lower coupons

The fly is an approximation of the expression of long 15y5y fwd vs short 20y10y

Cix:

(2 * YIELD[BTPS 1.8 03/01/41 Corp] - YIELD[BTPS 2.45 09/01/50 Corp] - YIELD[BTPS 1.45 03/01/36 Corp]) * 100

3mo Carry / Roll

Flat / Flat

Using -10bp repo spread

CIX of 1y older vs same bonds with more history

(2 * YIELD[BTPS 3.1 03/01/40 Corp] - YIELD[BTPS 3.85 09/01/49 Corp] - YIELD[BTPS 3.35 03/01/35 Corp]) * 100

So we see our current structure as at least 5bp to the rolled one – but more importantly in both circumstances the 20y point is cheap looking at forwards and we see more upside in the long term

Will & James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Live From The Field

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796