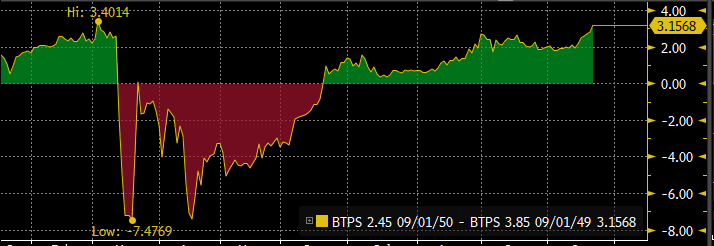

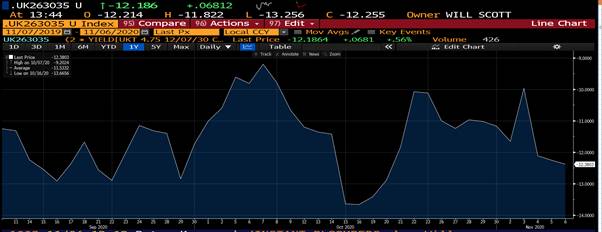

Taking profits in half of short Gilts

We went out with this trade over the weekend in Gilts…

Taking off half of this trade from our shadow p/f – still has bags of value – but monetising half of it

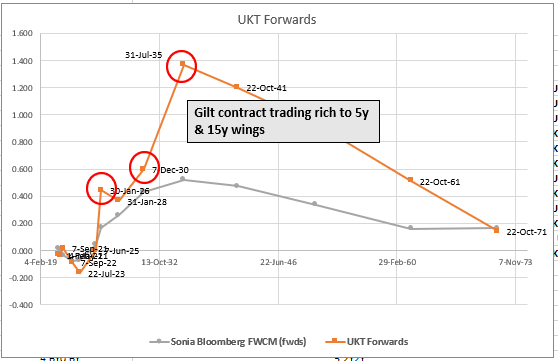

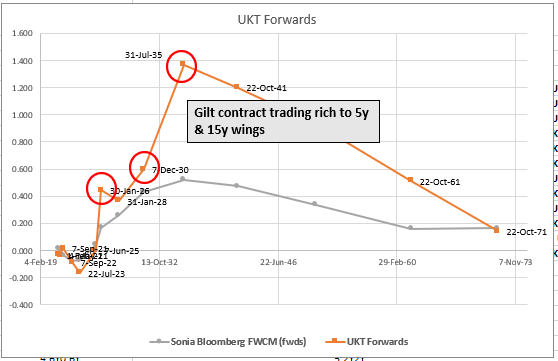

- Gilt contract vs +26s and 35s

(2 * YIELD[UKT 4.75 12/07/30 Corp] - YIELD[UKT 0.625 07/31/35 Corp] - YIELD[UKT 0.125 01/30/26 Corp]) * 100

UK DMO to issue new Gilt 7/31 next Thursday 12th November in 3bn

New gilt roll is at the cheaper end of the range, but the sector is rich

We see room to perform even from these levels, but dealer and client feedback would imply that there is some room to steepen further.

In light of this and whilst the 10y tap is indeed quite small at 3bn we like setting up for an auction concession via short 10y long 5y and 15y wings.

Sell UKT 4.75 12/30 into UKT 0.625 7/35 and UKT 0.25 1/26 : (2 * YIELD [UKT 4.75 12/07/30 Corp] – YIELD [UKT 0.625 07/31/35 Corp] – YIELD [UKT 0.125 01/30/26 Corp]) * 100

- Gilt contracts trading too rich to the curve

- 5y & 15y exhibiting too much of an on the run concession

- Weak demand will cheapen the belly, whereas strong demand should see buying of the wings given the small issue size.

Levels:

Curr -12.3bpt

Enter: -12.5 bpt (33%)

Add: -15bp

Initial Target: -9

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - week of 9th - 13th November, James & Will @ Astor Ridge

As of this morning…

On the Radar at the moment based on some following pointers

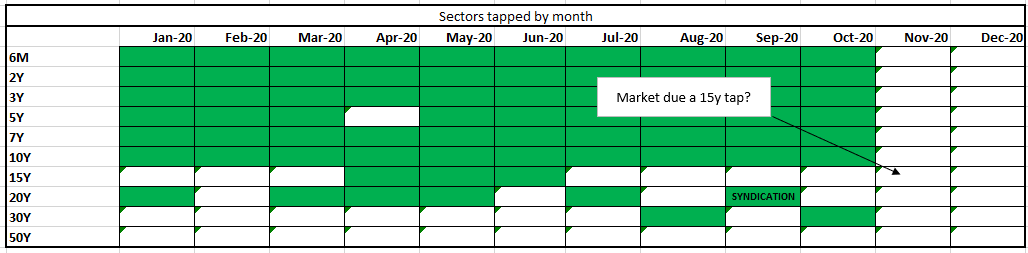

- Expecting 5y & 30y EU bonds for next week – strong reception for 1st EU 'SURE' taps on October20th – cheap triple 'A' credit

- Italy 3y & 7y & ? Longer issuer 15y or 20y – for supply on Thursday (TBA on Monday)

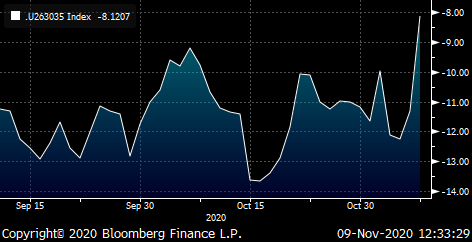

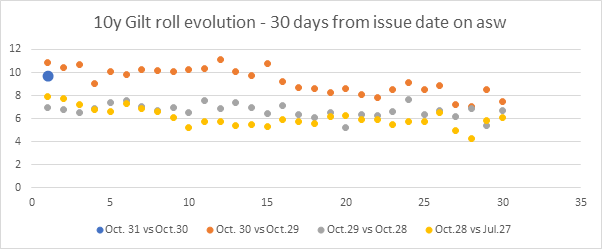

- New Gilt 10y 31s – traded yesterday @+11.5bp vs Gilt CTD – steep and high part of the forward curve

- Despite the value in the new 10y we look for an auction concession in the gilt future via the even cheaper 2026 and 2035 wings.

- Ireland Bond Auction on Thursday 12th (TBA on Monday)

Fades & Trades

Seems there's talk about Italy 10s30s – we'll take a look a how that stacks up in terms of actual value

Thinking about positioning for January supply vs QE imbalances

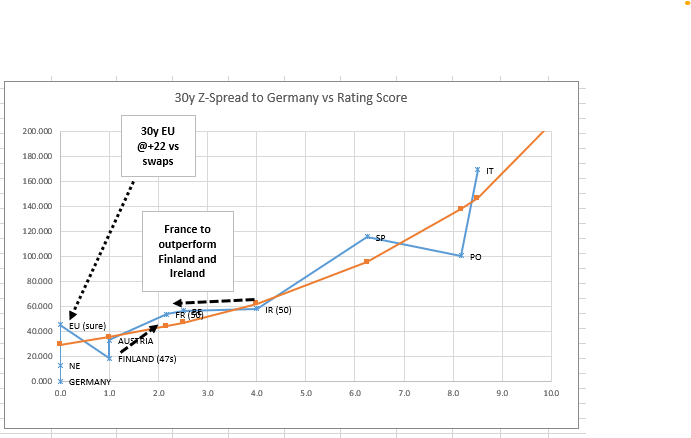

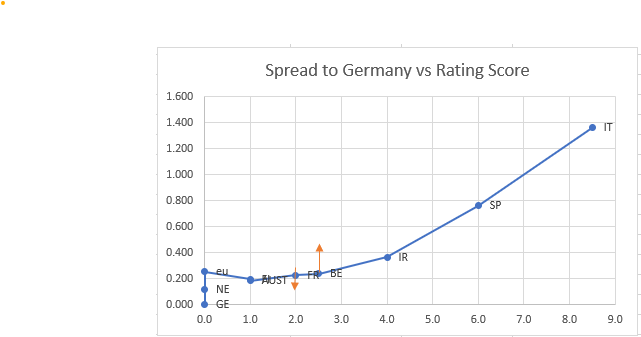

With the prospect of EU and Irish issuance we look at 30y spreads to Germany as a function of credit

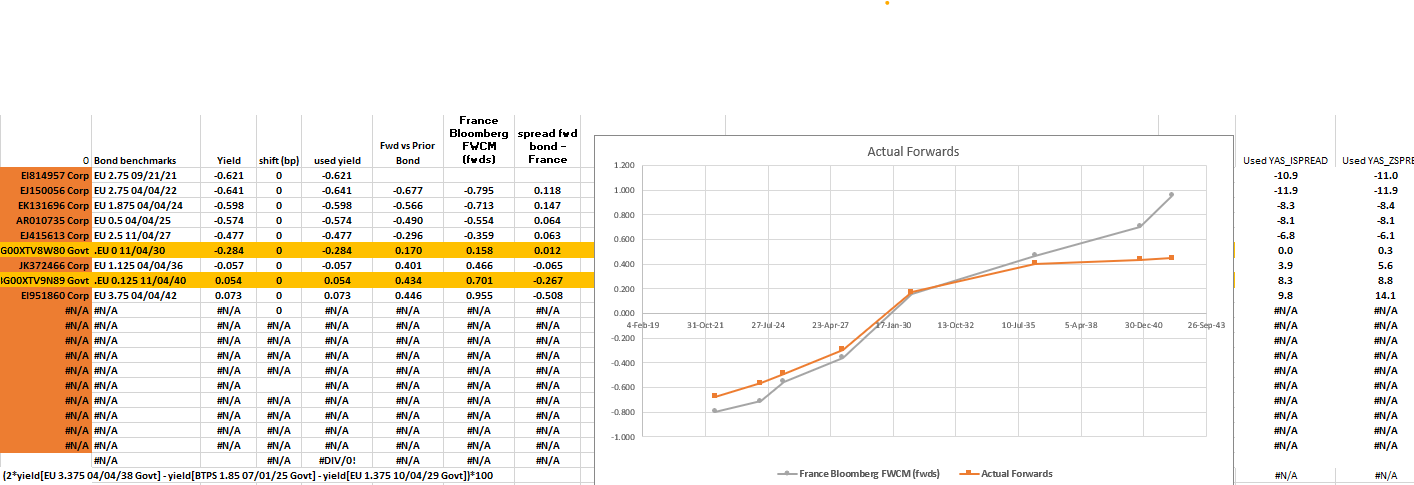

With Eu in the 20y trading about -7bp through the French 20y on z-spd, we can look at a theoretical 30y EU bond

We're hypothesising at 30y EU bond at about MS +22bp, about -9bp vs France

The corollary is that

Finland could cheapen from the EU issuance

Ireland could cheapen as a result of supply expectations

The natural hedge might be to buy France longs here,

We use a credit 'curve' model rather than a simple linear regression to derive value and hedge ratios

The trade looks as follows – we want to receive the belly

100*(yield[FRTR 1.5 05/25/50 Govt]-0.7*yield[RFGB 1.375 04/15/47 Govt]-0.3*yield[IRISH 1.5 05/15/50 Govt])

Location looks decidedly average – so strategically am looking to do small amounts of total risk with the prospect of adding at significantly better levels should that arise. The thought being that, from a valuation perspective the lesser credits could underperform as QE pauses late December and I don't want to miss some of that opportunity

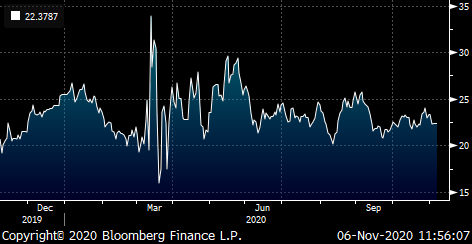

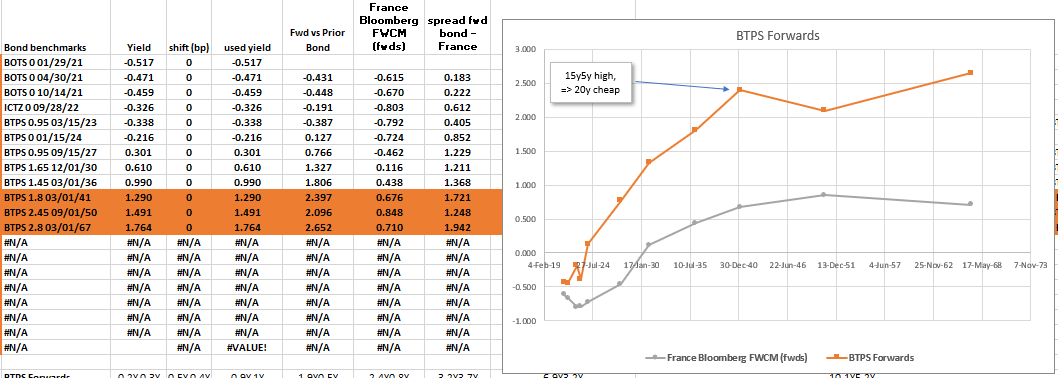

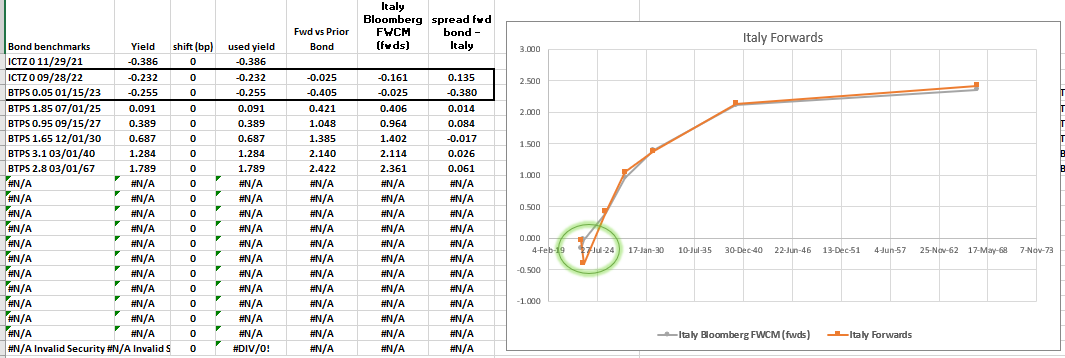

In italy we're expecting 3y, 7y & ?y supply next Thursday, to be announced on Monday night

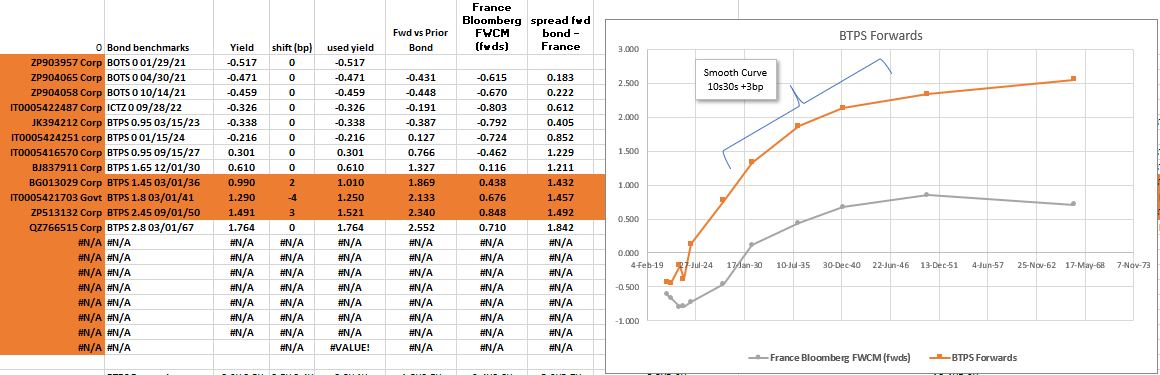

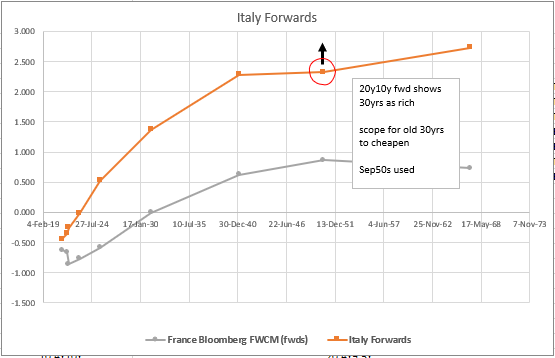

The 20y in forwards looks cheap

The fly -15y +20y -30y looks attractive historically

cix:

(2 * YIELD[BTPS 1.8 03/01/41 Corp] – YIELD[BTPS 2.45 09/01/50 Corp] – YIELD[BTPS 1.45 03/01/36 Corp]) * 100

Notwithstanding there could be a tap in the 20y – I'd have some here and scale accordingly on the chance that it does get cheaper

I estimate that for a smooth fwd curve mar36/mar41/sep50, the mar41 should be 6bp richer, worth 12bp on the fly – with the possbility of a tap in the 15y this trade would have a tailwind

Lvls

Curr +9.7bp

Enter: +9.5bp (33% risk)

Add: +15bp

Target: Less than Flat long term, short term +6bp

Forget history, 10s30s italy looks too flat by 3bp just to be 'fair'…

If we these yield shifts to 'normalise' the forward curve

15y: +2bp

20y: -4bp

30y: +3bp

with the rest of the curve unchanged – here's how forwards would look…

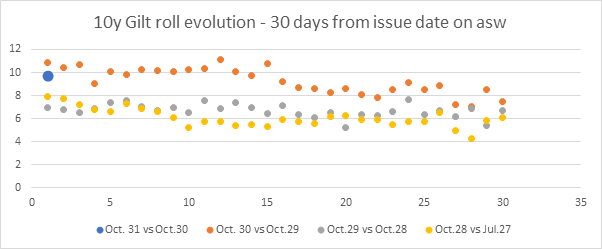

UK DMO to issue new Gilt 7/31 next Thursday 12th November in 3bn

New gilt roll is at the cheaper end of the range, but the sector is rich

We see room to perform even from these levels, but dealer and client feedback would imply that there is some room to steepen further.

In light of this and whilst the 10y tap is indeed quite small at 3bn we like setting up for an auction concession via short 10y long 5y and 15y wings.

Sell UKT 4.75 12/30 into UKT 0.625 7/35 and UKT 0.25 1/26 : (2 * YIELD [UKT 4.75 12/07/30 Corp] – YIELD [UKT 0.625 07/31/35 Corp] – YIELD [UKT 0.125 01/30/26 Corp]) * 100

- Gilt contracts trading too rich to the curve

- 5y & 15y exhibiting too much of an on the run concession

- Weak demand will cheapen the belly, whereas strong demand should see buying of the wings given the small issue size.

Levels:

Curr -12.3bp

Enter: -12.5 bp (33%)

Add: -15bp

Initial Target: -9

Any thoughts or feedback please let us know

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - week of 2nd - 6th November, James & Will @ Astor Ridge

As of this morning…

Here's a few things that we're looking at currently

Generally tough time for RV – not a lot leaping out at us and seems a bit of de-risking going on in positioning. Btps and credit in general on the extreme tight vs core but the ECB sending more signals in the vein of 'do whatever it takes'

Fades & Trades

Our fades revolve around the structural components of each market that tend to persist but have the good fortune to be close to extremes – that said, trades are mostly 'on our radar' rather than at executable levels at this point but we wanted to let you know what we were thinking of

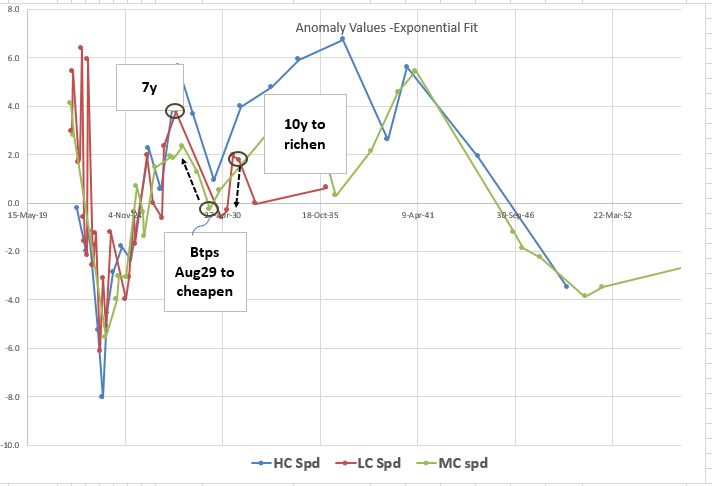

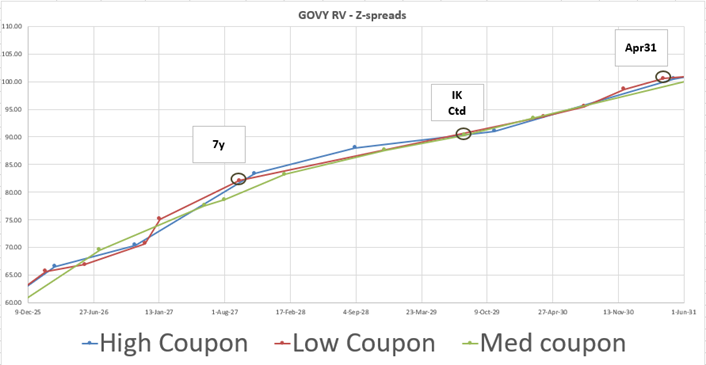

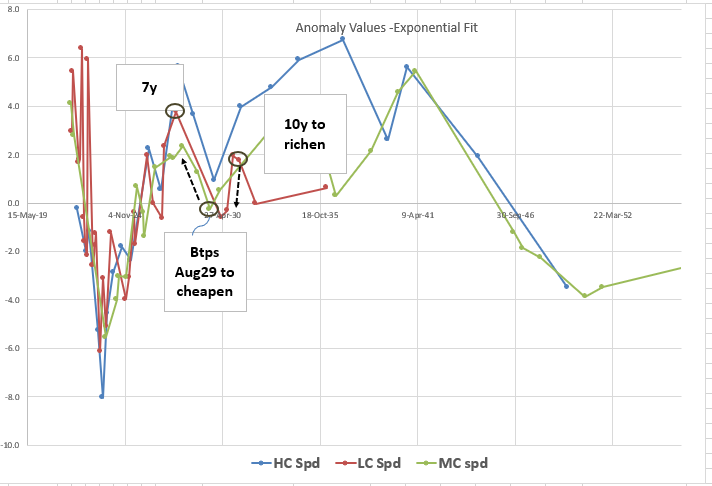

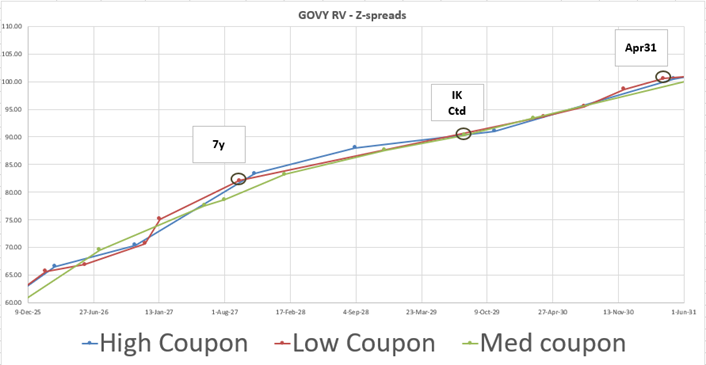

Italy: +7y -ik +10y

- The CTD, Btps Aug29 drops out of the basket in early December and surfs into the cheap 8y zone. The 10y has a low coupon that could fare well in a flattening sell-off

Levels

Curr: -1.4bp

Range: -5.5bp / -1bp

Target: +5bp

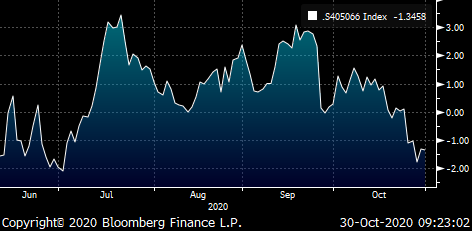

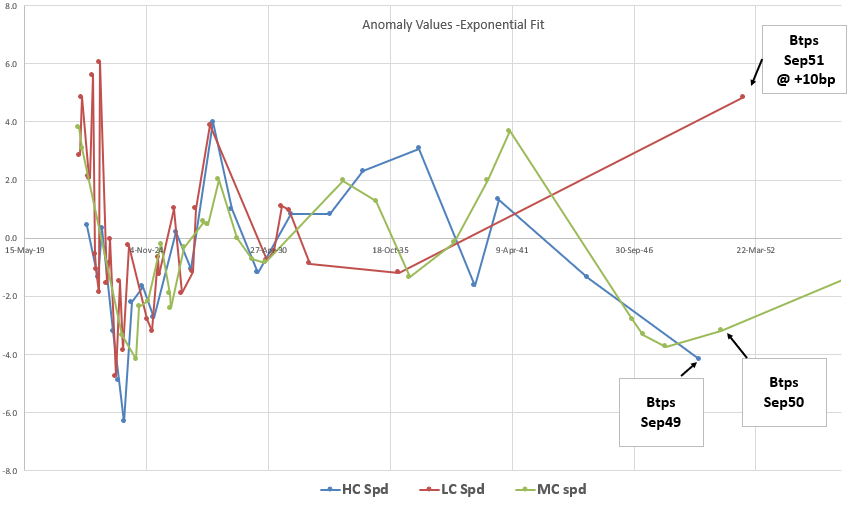

Graph of anomalies..

Graph of Z-Spreads

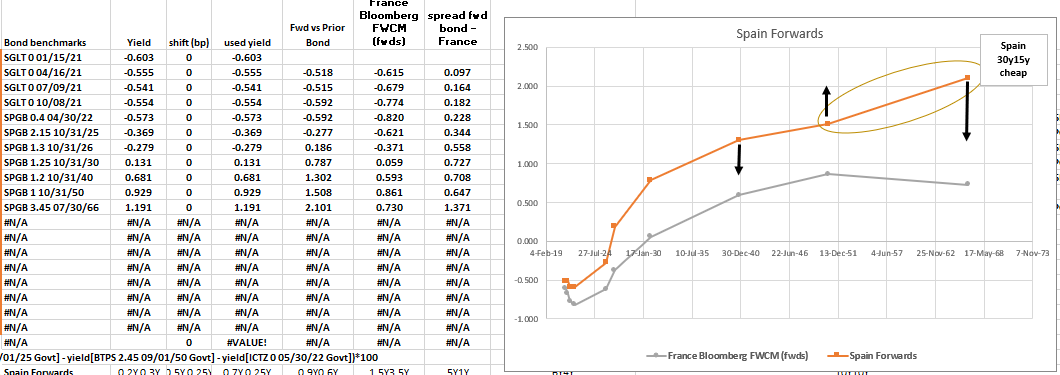

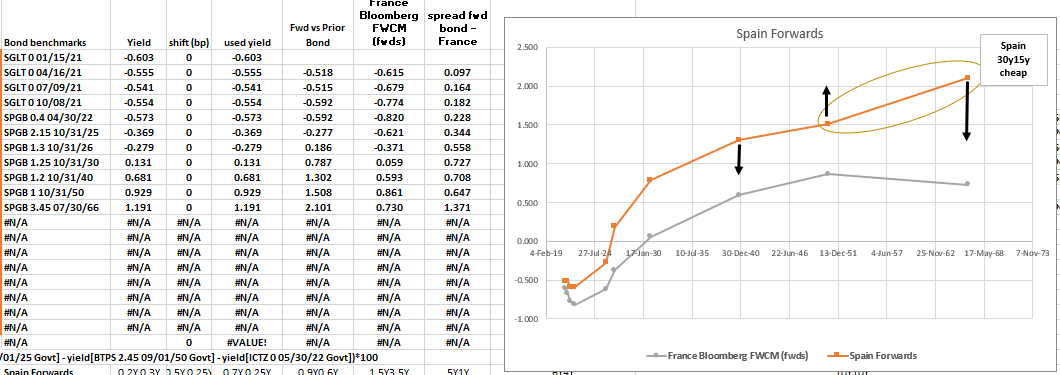

Spain: +20y -30y +50

- The on the run 20y in Spain remain cheap to the curve fit and too flat vs the 30y, recently the 30s x 50s curve has steepened as Spain 50y has cheapened after supply

Graph of Forwards

Cix: (2 * YIELD[SPGB 1 10/31/50 Corp] - YIELD[SPGB 3.45 07/30/66 Corp] - YIELD[SPGB 1.2 10/31/40 Corp]) * 100

Levels:

Curr: -1.3bp

Enter: -1bp

Add: -3bp

Target: +3bp short term, Long term +6bp

Graph of Cix

- The market has struggled to absorb supply in the recently tapped 50y and we see a similar disconnect, but less pointed in Italy too. Although long term value suggests the fly should be > +5bp a move back to the top end of the range makes sense after the street clears its overhang in 66s

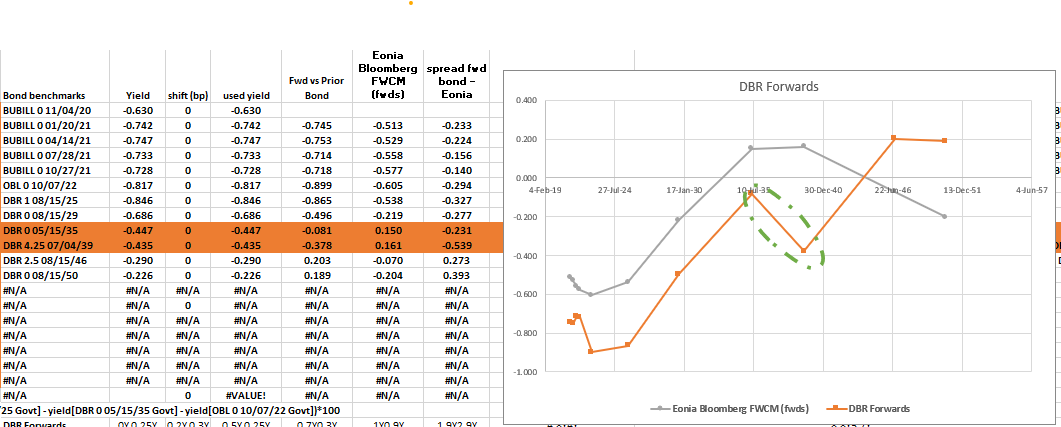

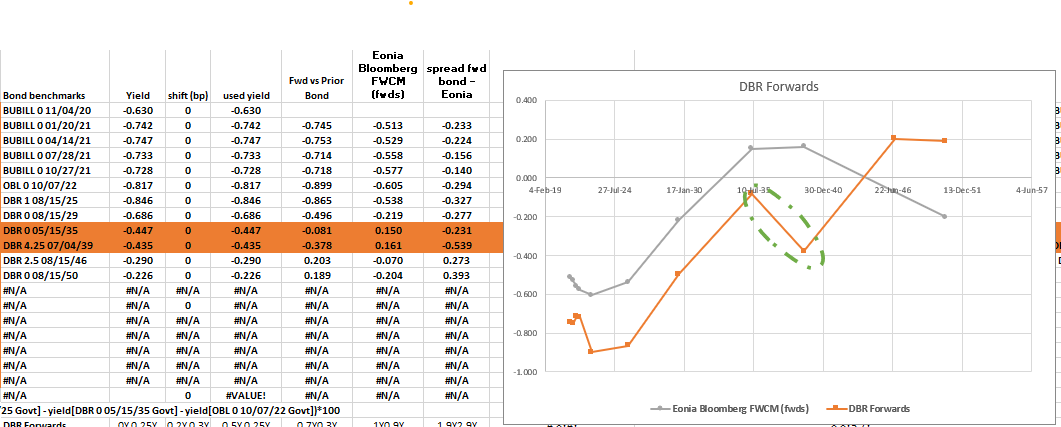

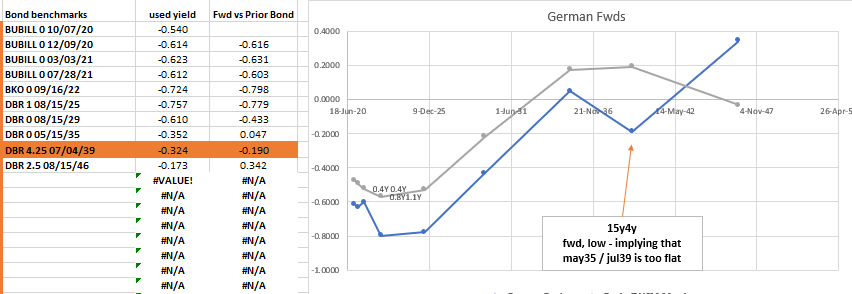

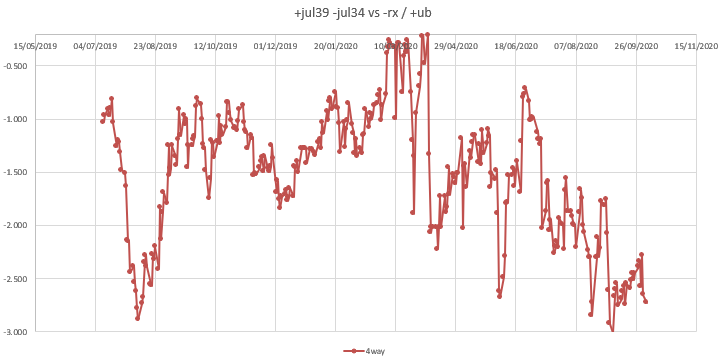

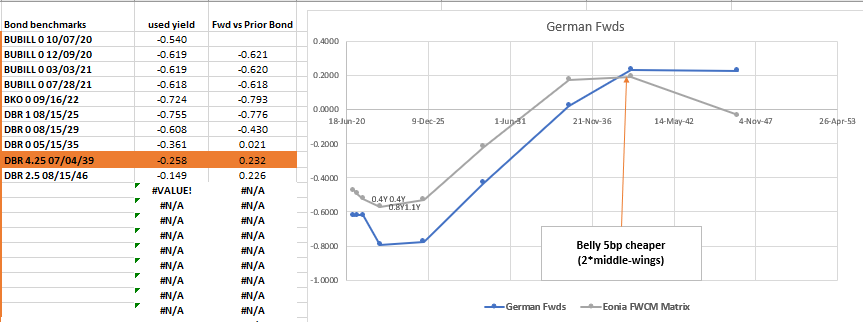

Germany : Steepener +35s -39s

Vs 15% -rx / +ub

Amazingly, with lower yields the High coupon 20yrs are no longer positive carry to low coupons – that's a function of the simple yield vs the repo rate being inverted

We're through the prices at which QE has bought the 39s and I struggle to see how they can continue to buy that segment

No more scheduled supply in 35s this year and a tap in the 30y (which gives us sympathy with the hedge) on November 11th

CIX: 100*((yield[DBR 4.25 07/04/39 Govt]-yield[DBR 0 05/15/35 Govt])-0.15*(yield[DBR 2.5 08/15/46 Govt]-yield[DBR 0 08/15/29 Govt]))

Levels

Curr: -4.8bp

Enter: -4.75bp, -6.5bp

Range: -5.5bp, -0.4bp

Target: -0.5bp

Forwards…

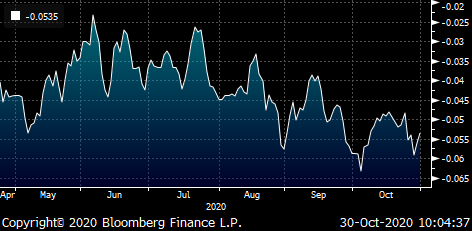

BBG history

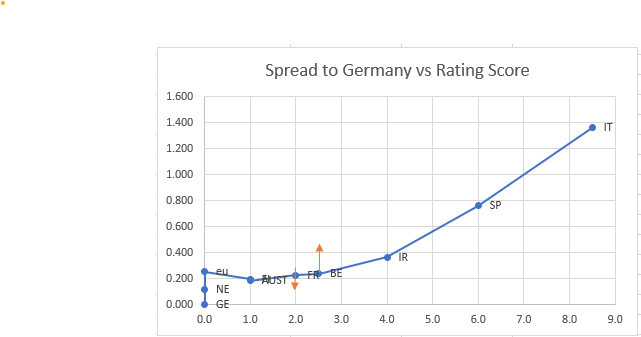

Short Belgium / Long France & Spain on Credit Spread

Moodys now rates Belgium Aa3 but France Aa2

As such, the rising tide of credit contraction has lifted all boats and Belgium and Ireland look tight to France

Using our proprietary Credit Score (amalgamating Ratings) this is how we see the Euro Issuers Spread vs Germany

Belgium looks tight to France in the context of rising spreads for diminishing credit quality

|

Actual Bond des |

Yield |

Yield spread to Germany |

Rating spread to Germany |

|

YLD_CNV_MID |

YLD_CNV_MID |

||

|

DBR 0 08/15/30 |

-0.630 |

0.000 |

0.0 |

|

NETHER 0 07/15/30 |

-0.515 |

0.114 |

0.0 |

|

EU000A283859 Govt |

-0.375 |

0.254 |

0.0 |

|

RFGB 0 09/15/30 |

-0.435 |

0.195 |

1.0 |

|

RAGB 0 02/20/30 |

-0.445 |

0.184 |

1.0 |

|

FRTR 2.5 05/25/30 |

-0.404 |

0.226 |

2.0 |

|

BGB 0.1 06/22/30 |

-0.391 |

0.239 |

2.5 |

|

IRISH 0.2 10/18/30 |

-0.266 |

0.364 |

4.0 |

|

SPGB 1.25 10/31/30 |

0.133 |

0.762 |

6.0 |

|

BTPS 1.65 12/01/30 |

0.706 |

1.336 |

8.5 |

Short Belgium, Long 87.5% France, Long 12.5% Spain

Levels

Curr: -5.4bp

Enter: -6.5bp

Looking for 1bp richer in Belgium…

Credit Notch Weighted

Cix: yield[BGB 0.1 06/22/30 Govt]-0.875*yield[FRTR 2.5 05/25/30 Govt]-0.125*yield[SPGB 1.25 10/31/30 Govt]

Graph..

Any thought or feedback please let us know

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - week of 2nd - 6th November, James & Will @ Astor Ridge

Here's a few things that we're looking at currently

Generally tough time for RV – not a lot leaping out at us and seems a bit of de-risking going on in positioning. Btps and credit in general on the extreme tight vs core but the ECB sending more signals in the vein of 'do whatever it takes'

Fades & Trades

Our fades revolve around the structural components of each market that tend to persist but have the good fortune to be close to extremes – that said, trades are mostly 'on our radar' rather than at executable levels at this point but we wanted to let you know what we were thinking of

Italy: +7y -ik +10y

- The CTD, Btps Aug29 drops out of the basket in early December and surfs into the cheap 8y zone. The 10y has a low coupon that could fare well in a flattening sell-off

Levels

Curr: -1.4bp

Range: -5.5bp / -1bp

Target: +5bp

Graph of anomalies..

Graph of Z-Spreads

Spain: +20y -30y +50

- The on the run 20y in Spain remain cheap to the curve fit and too flat vs the 30y, recently the 30s x 50s curve has steepened as Spain 50y has cheapened after supply

Graph of Forwards

Cix: (2 * YIELD[SPGB 1 10/31/50 Corp] - YIELD[SPGB 3.45 07/30/66 Corp] - YIELD[SPGB 1.2 10/31/40 Corp]) * 100

Levels:

Curr: -1.3bp

Enter: -1bp

Add: -3bp

Target: +3bp short term, Long term +6bp

Graph of Cix

- The market has struggled to absorb supply in the recently tapped 50y and we see a similar disconnect, but less pointed in Italy too. Although long term value suggests the fly should be > +5bp a move back to the top end of the range makes sense after the street clears its overhang in 66s

Germany : Steepener +35s -39s

Vs 15% -rx / +ub

Amazingly, with lower yields the High coupon 20yrs are no longer positive carry to low coupons – that's a function of the simple yield vs the repo rate being inverted

We're through the prices at which QE has bought the 39s and I struggle to see how they can continue to buy that segment

No more scheduled supply in 35s this year and a tap in the 30y (which gives us sympathy with the hedge) on November 11th

CIX: 100*((yield[DBR 4.25 07/04/39 Govt]-yield[DBR 0 05/15/35 Govt])-0.15*(yield[DBR 2.5 08/15/46 Govt]-yield[DBR 0 08/15/29 Govt]))

Levels

Curr: -4.8bp

Enter: -4.75bp, -6.5bp

Range: -5.5bp, -0.4bp

Target: -0.5bp

Forwards…

BBG history

Short Belgium / Long France & Spain on Credit Spread

Moodys now rates Belgium Aa3 but France Aa2

As such, the rising tide of credit contraction has lifted all boats and Belgium and Ireland look tight to France

Using our proprietary Credit Score (amalgamating Ratings) this is how we see the Euro Issuers Spread vs Germany

Belgium looks tight to France in the context of rising spreads for diminishing credit quality

|

Actual Bond des |

Yield |

Yield spread to Germany |

Rating spread to Germany |

|

YLD_CNV_MID |

YLD_CNV_MID |

||

|

DBR 0 08/15/30 |

-0.630 |

0.000 |

0.0 |

|

NETHER 0 07/15/30 |

-0.515 |

0.114 |

0.0 |

|

EU000A283859 Govt |

-0.375 |

0.254 |

0.0 |

|

RFGB 0 09/15/30 |

-0.435 |

0.195 |

1.0 |

|

RAGB 0 02/20/30 |

-0.445 |

0.184 |

1.0 |

|

FRTR 2.5 05/25/30 |

-0.404 |

0.226 |

2.0 |

|

BGB 0.1 06/22/30 |

-0.391 |

0.239 |

2.5 |

|

IRISH 0.2 10/18/30 |

-0.266 |

0.364 |

4.0 |

|

SPGB 1.25 10/31/30 |

0.133 |

0.762 |

6.0 |

|

BTPS 1.65 12/01/30 |

0.706 |

1.336 |

8.5 |

Short Belgium, Long 87.5% France, Long 12.5% Spain

Levels

Curr: -5.4bp

Enter: -6.5bp

Looking for 1bp richer in Belgium…

Credit Notch Weighted

Cix: yield[BGB 0.1 06/22/30 Govt]-0.875*yield[FRTR 2.5 05/25/30 Govt]-0.125*yield[SPGB 1.25 10/31/30 Govt]

Graph..

Any thought or feedback please let us know

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

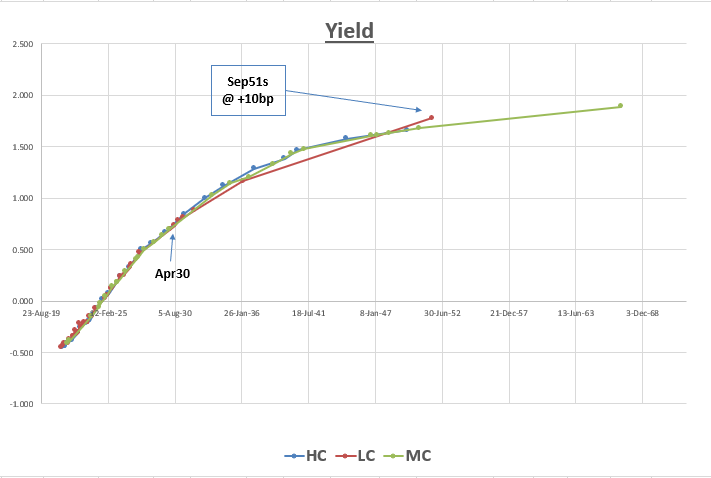

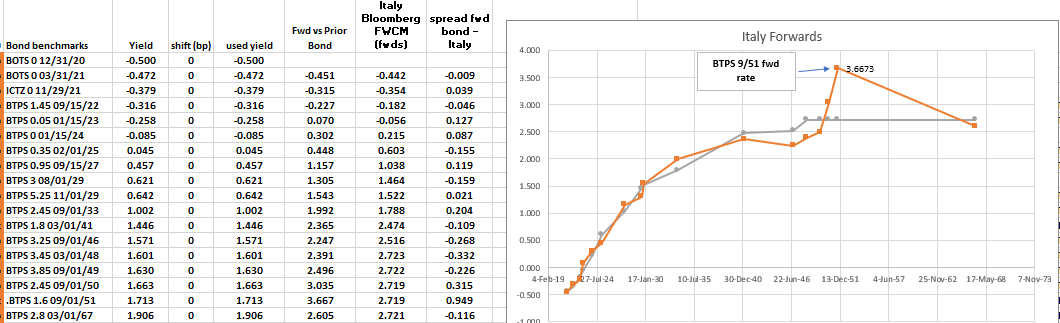

New Italy 30y

Italy announces new 30y

Syndication Btp Sep/51

Initial Price Talk BTP 09/50 +10bps area ***

Buy Btps 51s vs Btps 50 and/or Btps 49

Levels:

IPT: Btps Sep50 +10bp

Enter: +5bp (50% risk)

Add: +7.5bp, +10bp (25% risk)

Target: +3bp

Carry

Estimated -0.2bp /3mo @ repo spread of -10bp, estimated 1.75% coupon on the new issue

Graph 1 - Yield Curve plus sep51s…

The bond looks set to have a LOW COUPON AS WE'RE ARE AT THE LOW END OF THE RANGE OF Btp yields..

As such as a low coupon, coming at 'fair' or 'cheap' to the curve – this has tremendous scope to richen

Graph 2 - Anomaly Values for High, Low and Medium Coupons

If we look at 30ys on the forward curve in the context of 20y and 50y – the 30y is a rich point – so we want to sell local issues that should underperform

Rationale

- If we look at Italian bonds with low coupons , with the exception of 7yrs, they trade much closer to the 'zero' anomaly value to the fitted curve

- The time value of the credit risk option in Italy is at its greatest for long bonds – hence the premium for low coupons vs High should be at its greatest there

- 30yrs are rich on forwards vs 20y and 50y, hence we want to own this new bond vs local higher coupon 30yrs (see Graph3)

- Italy ratings due on Friday – consolidation into Low Coupons makes sense at fair value on a cash flow valuation

Graph 3 – Italy Forwards

Risks

- The tap bond Sep51 stays offered – during further issuance

- The two outstanding long bonds (49s and 50s) hold their value

- The carry doesn't not allow the trade to be held – carry estimates coming tomorrow with final coupon

Any thoughts or feedback let me know

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FW: New Italy 30y Sep-51 - Food for thought

- Italy to launch new Sep-2051 via outright and also via debt swaps. Sizes for the switch and outright are as yet TBD.

- Bonds to be bought back are:

- BTP 3.75% - 08/01/2021 (ISIN code IT0004009673)

- BTP 4.0% - 05/01/2023 (ISIN code IT0004898034)

- BTP 4.75% - 08/01/2023 (ISIN code IT0004356843)

- BTP 2.45% - 10/01/2023 (ISIN code IT0005344335)

- CCTeu - 01/15/2025 (ISIN code IT0005359846)

- Note the prevalence of high coupon issues here

- 10/30 has been steepening all week which had been attributed to an overhang to an overhang of long end supply from last week, perhaps also exacerbated by yesterday's headlines out of the treasury:

*ITALY TO DO DEBT SWAPS, BUYBACKS TO INCREASE AVG MATURITY

Nevertheless the swiftness of the issuance seems to have come as a surprise to most.

- In absence of a further grab to yield or indeed a sustained risk off move it seems difficult to quantify how much value there is in the new bond as a 10/30 flattening trade unless we see a further backup in the curve, given the relative cheapness of the 20y sector

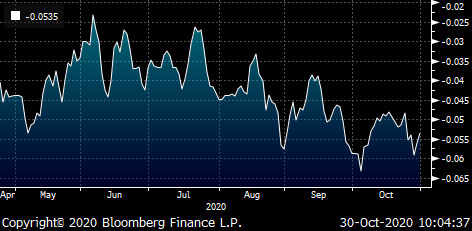

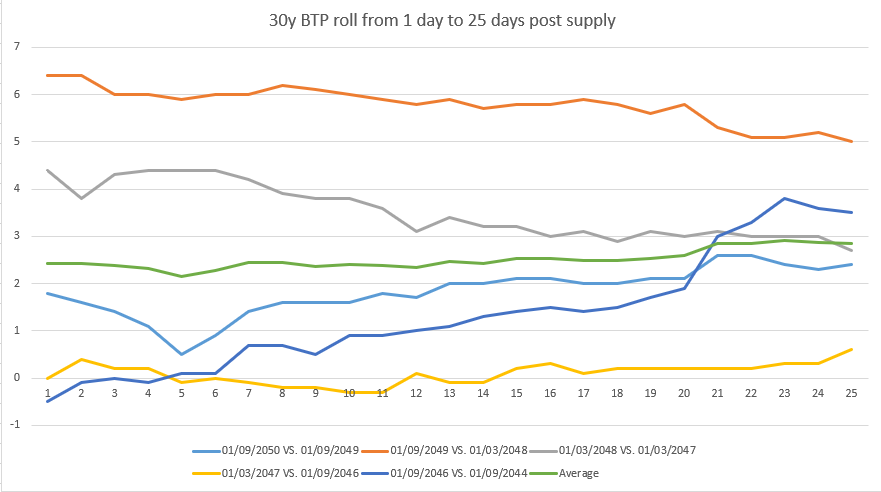

- Instead we see the micro forwards and therefore the rolls as offering the greatest value:

- Current 30y roll has cheapened from 1.9 -> 3.1 bpts, leaving the roll and the 1y gap at the steepest levels for some time:

- Assuming (and it is merely an assumption) that the new Sep-2051 prices at 5 bpts over the 2050 (i.e. 5 bpts on the new 30y roll) then we end up with a 1y fwd of 3.6%

- Whilst this is highly leveraged, it implies a reflattening of the current roll to 2 bpts and a fair value of the new roll of ~ 2 bpts

Implied forwards based on current roll at 3 bpts and new roll at 5 bpts:

Historical Performance post supply:

Tough to draw many conclusions here, but worth looking at. I think all we can say is that cheap issues rally and expensive issues have a habit of mean reverting back to average levels!

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

EU bonds - announced 10y and 20y - initial thoughts

' EU Hires Banks for Debut Social Bonds Under Pandemic Program (1)

Bloc to offer 10- and 20-year debt linked to SURE jobs package

(Bloomberg) -- The European Union has mandated banks for the sale of its

first social bonds, aimed at helping boost employment amid the coronavirus

crisis.

It hired Barclays Plc, BNP Paribas SA, Deutsche Bank AG, Nomura and UniCredit

SpA as joint lead managers of the offering, according to a person familiar with

the matter. The bloc plans to issue 10- and 20-year securities as part of a

100-billion-euro ($118 billion) program to finance a regional job support

program known as SURE.'

Here's how I see the Curve in forwards at 'Fair'…

10y MS flat

20y MS +8bp

So the real question is how much cheaper than fair do these come? – and is it enough to create forwards so distorted, that despite the prospect of further issuance, they roll at great levels

If you want to see further analysis on that basis please let me know

Best

James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

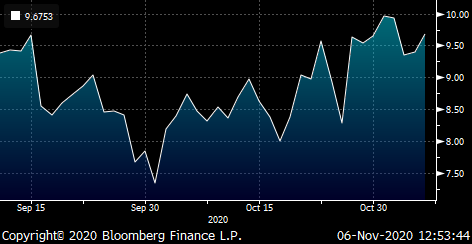

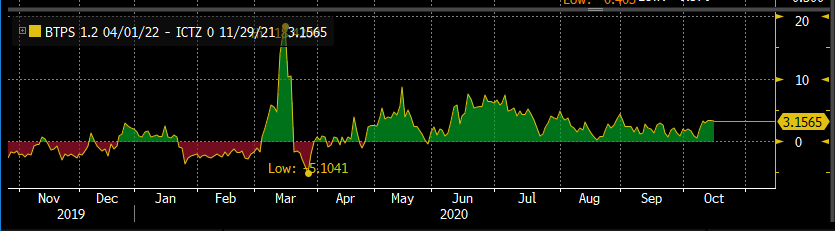

Buy ICTZ 9/22 vs BTSZ0 (CTD 01/15/2023)

Trade Rationale:

Buy ICTZ 9/22 vs BTSZ0 or the CTD (BTPs 01/15/2023) : CIX YL017[ICTZ 0 09/28/22 Corp] - YL017[BTPS 0.05 01/15/2023 Govt]

- ICTZ 9/22 launched last month has retained its auction discount despite the rally in the Italian front end, offering an 8 bpts pickup to the comparable BTP and nearly 4 bpts pickup vs the rest of the ICTZ vs BTP curve

|

BTP |

ICTZ |

Pickup (bpts) |

|

01/06/2021 |

29/06/2021 |

2.9 |

|

01/11/2021 |

29/11/2021 |

3.1 |

|

15/07/2022 |

30/05/2022 |

4.2 |

|

15/09/2022 |

28/09/2022 |

8.1 |

- As a bullish trade we look for the bond to roll back into the curve over the next few months, but as risk markets begin to soften we look for inexpensive blowup trades as well.

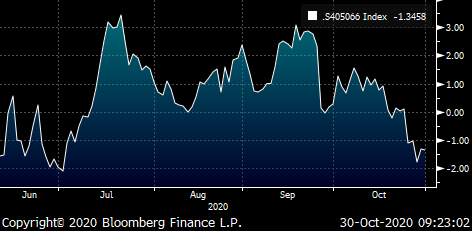

- Typically the 2y contract comes under pressure much more than the cash in a risk off environment, as evidenced by the move in the ICTZ 11/21 vs BTSH0 (CTD 1.2% 4/22) during the first COVID wave:

- Also this week on Friday we have ratings statement for Italy for S&P

Trade Mechanism:

Buy 100mm ICTZ Sep-2022 (22k DV01) vs 766 BTSZ0 or 96 mill BTPS 01/15/2023

Entry Levels:

Entry: +2.5 bp

Add: +5 bp

Target: -3 bp

Target Rationale:

Under a bullish scenario the front ends will continue to see demand, and the yield pickup will prove too tempting to allow the current anomaly to persist.

Plotting the bond specific forwards against the Bloomberg generic forwards shows how the cheapness of the ICTZ 9/22 is implying a NEGATIVE forward rate between the ICTZ and BTSZ0.

A move from to -3 bpts in this yield spread brings this forward back into line, hence our -3 bpts target

Under a bearish scenario we would expect significant underperformance of the BTS contract, as evidence in the ICTZ 11/21 vs BTSH0 chart above.

Risks:

- Risk off moves fail to materialise and further taps of the bond delay the correction in the spread

Carry/3m:

Roll: +.1bpts

Carry: +.7bpts

Germany 15s20s steepener vs -rx / +ub

Germany – Trade Radar

15s 20s steepener {+Dbr May35 / -Dbr Jul39}

Plus

25% -RXZ0 / +UBZ0

Trade Mechanism

Buy €50k Dbr May35, 32.5MM

Sell €50k Dbr Jul39, -17.7MM

Sell €12,5k RXZ0, -147 contracts

Buy €12,5k UBZ0, +49 contracts

The path of forwards rates in Germany from the 9y to the 15yand from the 19y and to the 26y look disjoint -

Generally we expect constantly rising forward rates inline in the context of increasing issuance post-Covid

Forward Rates, Germany

- Does not adjust for high vs low coupons – call for more detailed analysis

Cix:

100 * ((YIELD[DBR 4.25 07/04/39 Corp] - YIELD[DBR 0 05/15/35 Corp]) - 0.25 * (YIELD[DBR 2.5 08/15/46 Corp] - YIELD[DBR 0 08/15/29 Corp]))

Bloomberg Actual Trade History

History using older 15y (Dbr 34) in a like for like comparison of coupons – low indicates 15s20s is flat verses 35%* -rx / +ub

*35% used as a contract hedge as per the Beta of the Regression

Levels

Current: -9.4bp

Enter: -10.25bp (full allocation at this level)

Target: -5bp, (at which forwards look fair after adjusting for coupon)

Range: -4.5bp / -9.8bp

Target Forwards

Here’s how forwards will look at the Target Spread (even after adjusting for Coupon differential)

Carry: -0.1bp /3mo (@10bp repo spread between 35s and 39s)

Roll: Flat

Rationale

- The newer, low coupon 35s have traded cheap to the point where that mitigates their low coupon. Conversely the 39s as an old possible PEPP bond trade rich

- By adjusting for the coupon differential we still see the 39s as rich

- Light Balance sheet on the street has led to dislocations worthy of consideration from the leveraged community

- Forward rates suggest that even RM could see a preference in owning the new issue

- Ongoing supply, one more before yr end has kept the 35s cheap

Risks

- The 35s cheapen and the 39s richen

- The repo on the 39s goes more expensive relatively

- Supply on the 35s – next due Oct28th (last supply scheduled for the year), keeps them depressed

- The contract switch fails to hedge the inner spread curve risk

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Consuming Spanish Supply on Thursday - James Rice @Astor Ridge

Last week Spain announced is regular, fortnightly Thursday supply

At the moment the street sees Spain as 'cheap' as a credit vs other Euro issuers

Here's 30y Spain vs France with the generic broader credit risk hedged with -ik / +rx..

Trade:

Long Spgb 66, - Frtr 66

-IKZ0 / RXZ0 (25% of Spain France spread risk)

Cix:

100*((yield[SPGB 3.45 07/30/66 Govt ]-yield[FRTR 1.75 05/25/66 Govt ])-0.25*(yield[BTPS 3 08/01/29 Govt ]-yield[DBR 0 08/15/29 Govt ]))

For those with a bullish view on Spain but looking to have generic credit risk hedged this is a more solid way to consume the risk then the more frictional box trades

Levels:

Spain vs France @ +78bp

Carry: +0.6bp /3mo (@-20bp repo spread)

+rx/-ik @-129bp

Carry: -1bp (-4bp * 25%, @5bp spread of contract implieds)

Entry: +45.5bp (33% risk)

Add: +50bp (67% risk)

Risks

- Idiosyncratically Spain continues to cheapen

- The ik/rx fails to hedge Spain / France (1y r2 = 0.69)

Best

James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796