Trade Radar Spain this week

Apols

I sent that las trade radar from my home email address

Just including the disclaimer beneath for good order

Hi there – on my Radar this week…

Trade Radar

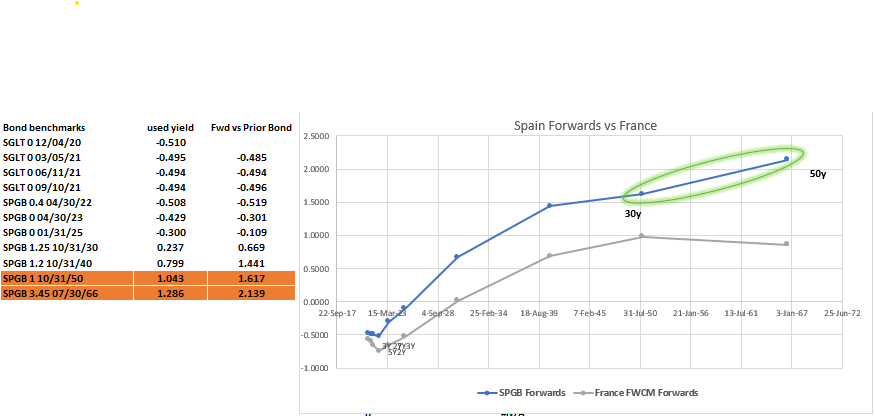

Spain 50y supply, announced for this Thursday morning

30s50s steepened…

The forwards now look steep from 30yrs to 50yrs

- Typically we see forwards levelling off in Euro RV curves – getting steeper after the 30y point implies a heavy discount for the 50y point

(Spain has always traded somewhat cheap in the 'ultra' tenor)

Levels:

Current: +24.4bp

Target: +20.5bp

Enter: +25bp (33% of total risk),

work order into supply, need to clear 4.5bp profit on first piece

Add: +28.5bp (balance of total risk)

at which point the 10y10y and the 20y10y would be totally flat implying an idiosyncratic richening of 5bp in the 30y

Range: +14.9bp / +24.4bp

Sizes:

SPGB 1% Oct50: 10MM notional

vs

SPGB 3.45% Jul66: 5.1MM notional

Roll & Carry

Carry: -0.1bp /3mo @-10bp repo spread

Roll: -0.25bp /3mo

Risks

- As a tap point the 66s stay cheap

- As a PEPP buy tenor - the 50s remain rich

- The repo on the Spanish 50s gets tighter, having an adverse impact on the carry of the trade

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FW: Belgium

From: James Rice

Sent: 08 September 2020 16:05

Subject: Belgium

Just a quick one on my radar on Belgium

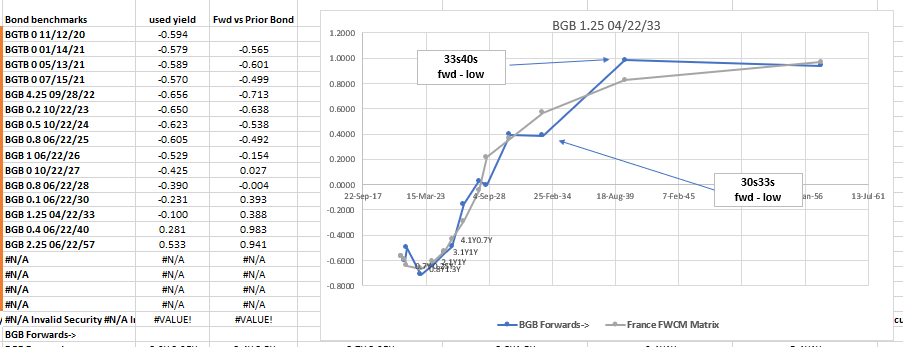

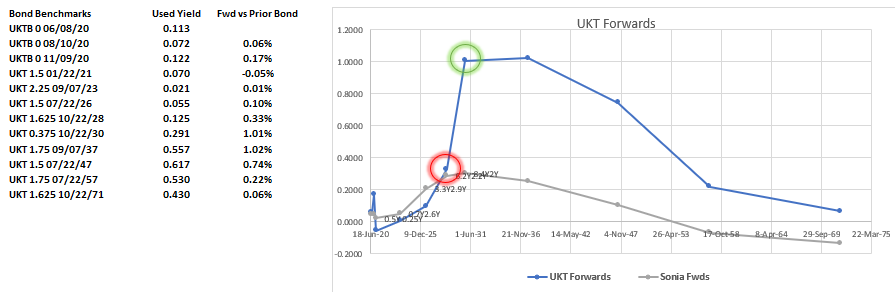

{BE} - looking at ways to get steepeners on in Belgium where the forwards are through France

-BGB 33s, +BGB 30s & +BGB 40s

(2 * YIELD[BGB 1.25 04/22/33 Corp] - YIELD[BGB 0.4 06/22/40 Corp] - YIELD[BGB 0.1 06/22/30 Corp]) * 100

On my radar - or if you have a position in apr33 BGB...

Belgium

{BE} +30 -33 +40

curr: -25bp

work entry : -25bp

target: -16bp, short term back to -20bp

range: -25.5bp (L) / -18.7bp (H)

essentially the 33s is now revealed as a rich bond - with a slightly higher coupon -

gonna have to be patient to work our way in on this , but think it has value in fwds above and beyond this year's range (cheaper than we've seen before) -

in terms of value we're getting Belgium out the door in the 10y3y @ 0.39% whereas French forwards are around 0.57% for that gap

See Graph of Bond forwards...

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

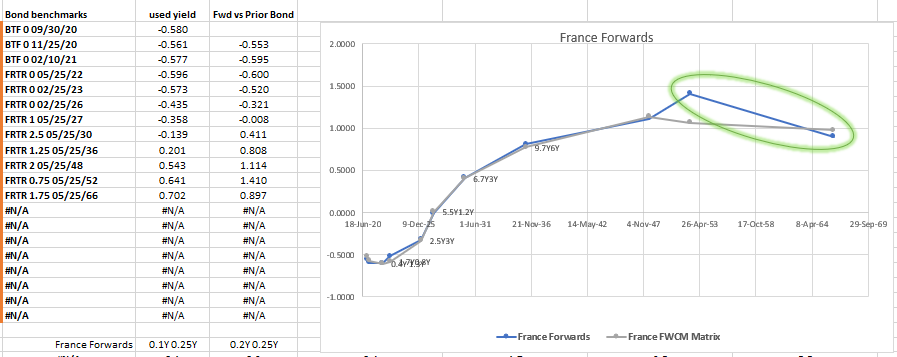

France 20y / 30y / 50y fwd steepener

With US long rates edging higher and the Powell’s comments about average inflation leave me looking for steepeners throughout the back end of Euro Curves – indeed we saw WNA (25y) vs 30y steepen 1.5bp over the last few days in the US

To me the best expression is to be long bullets vs wings as an approximation of a forwards steepener.

In France on Thursday we have supply in Frtr – there’s a couple expressions I like – but chiefly

Buy Frtr May52

Sell Frtr May48 & Sell Frtr May66

Cix:

2 * (yield[FRTR 0.75 05/25/52 Govt ]-0.5*yield[FRTR 1.75 05/25/66 Govt ]-0.5*yield[FRTR 2 05/25/48 Govt ])*100

Levels

Curr: +3.75bp

Enter: work +4bp (50% of risk, up to end of day before supply)

Add: +6.25b (50% risk, it’s not been there, but at this point the Stand Deviation times by the r2 of the wings is almost +2, which would be my aggressive target

Target: 0bp (Long Term Target, -2bp)

Graph (BBG)

Forwards

Rationale

- Although 52’s are a tap bond, they are at cheap level

- It suite my view that I’m looking for forward rate steepener – approximated by long bullet short wings

- Forwards are out of line to the fitted curve

- The forwards suggest positive roll. The prior fly 45s/50s/66s is at +0.5bp

- The penultimate day coming into supply (Wednesday) is often the nadir for these structures as Dealers make room

Carry & Roll

Carry: -0.1bp /3mo @-10bp spread

Roll: Flat

VAR & optimisation

using 155 days of data

We used 50/50 weightings

FYI..

Correlation (Beta) based wing weightings: 40/60

r2 of wings: 0.51

minimised VAR weightings: 45/55

Risks

Issue size could increase by an additional 15bln including Thursday’s tap, prior issue is €28Bln

The two wings could richen further

Any feedback or thoughts – love to hear it

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

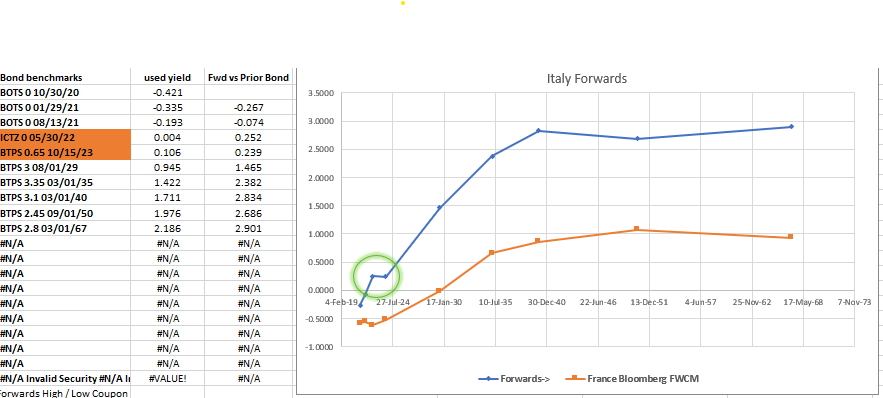

Italy short 3y trade vs CTZ May22 and IK - James Rice @Astor Ridge

Short Italy Low Coupon 0.65% Btps Oct23,

Long CTZ May22 and IKU0

BBG CIX:

2 * (YIELD[BTPS 0.65 10/15/23 Corp] - 0.8 * YIELD[ICTZ 0 05/30/22 Corp] - 0.2 * YIELD[BTPS 3 08/01/29 Corp]) * 100

Trade Mechanism

Sell 50MM Btps 0.65% Oct23 (€15,9k / bp)

Buy 71,5MM Ictz 0% May22 (€12,7k / bp)

Buy 27 IKU0 Sep Btp Futures

Levels

Current: -17.4bp

Entry: -17bp

Target: -8bp

No leaning into this one in pieces, I like this trade here

Forward Rates (including France for reference)

Rationale

- The forward rates suggest no increase in credit risk from 2y to 3y , but then a rising risk thereafter – an overly ‘informed’ situation and a dislocation of forwards rates due to flows

- We have on going 3y taps in the Aug23 segment and Oct23s are rich on the fitted curve

- The IK component acts as an ‘anchor’ in case of further performance from the overall Italian credit

Carry & Roll

- Carry: +0.8bp /3mo (@ -10bp repo spread)

- Roll: +0.1bp /3mo

Risks

- The Oct23 remain rich or get tighter on repo – possibly from ECB buying

- The tap bonds ICTZ May22 cheapen into further issuance (expected 26th August)

Scaling

- For scaling to normalise this versus your other risks pls give me a shout

- Data used for scaling could use the prior CTZ (nov21)

- +CTZ nov21 – oct23 +ik (total of 210 days data available)

5th worst day -6bp

Vol of Data: 8.2bp

Best

James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

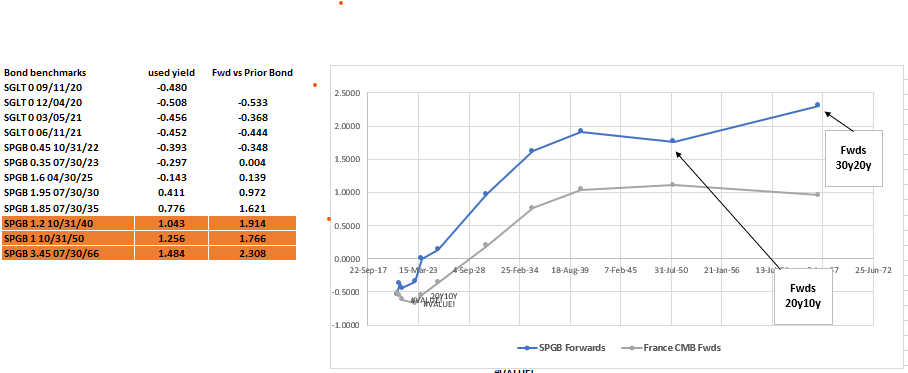

Spanish long end Fly - Trade Radar, James Rice @Astor Ridge

Sell Spanish 30y

Buy Spanish 20y and Spanish 50y

Trade Structure

Sell Spgb 1% Oct 50

Buy Spgb 1.2% Oct 40 & Buy Spgb 3.45% Jul 66

Weightings:

20y / 30y / 50y

+0.33 / -1 / +.67

Levels:

Current: -14.7 bp

Entry: -14 bp (50% risk)

Add: -2bp (50% risk)

Target: +1 bp (15bp expected profit)

Cix:

200 * (yield[SPGB 1 10/31/50 Govt]-0.35*yield[SPGB 1.2 10/31/40 Govt]-0.65*yield[SPGB 3.45 07/30/66 Govt])

History

using older High Coupon 20y Issue

200 * (yield[SPGB 1 10/31/50 Govt]-0.35*yield[SPGB 4.7 07/30/41 Govt]-0.65*yield[SPGB 3.45 07/30/66 Govt])

Graph of History (using old HC 20y)

Carry: +0.4bp / 3mo (using -10bp repo spread)

Roll: +0.1bp / 3mo

Forwards

Rationale

- The new syndicated LC 20y has come cheap to the Curve

- The 20s30s is very flat - in Spain 20s30s is +21.3bp (+21.7bp in France, +28.7bp in Italy)

- The 30s50s is steep – Spain +22.8bp (+10.9bp France, +16.7bp Italy)

- As an ongoing tap point the 30y could cheapen – 1st issued Feb20, Tapped: Mar20 and Apr20 – total issue size €8,7bln, prior 30yr Spgb 2.7% 48 is €14,5bln

2048s were tapped 6 times during 2019

Risks

- The 30y remains rich or richens further

- Additional taps to the 20y and 50y cause them to cheapen

- The repo on the 30y goes tight

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Shadow portfolio update - James Rice @Astor Ridge

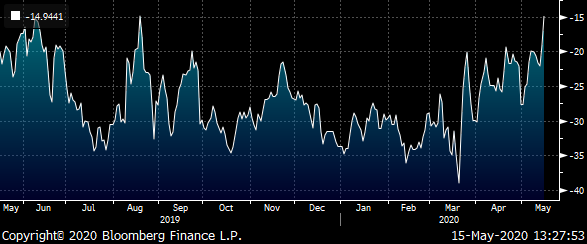

A mixed bag this week on the shadow portfolio – although we nearly got to an add scenario on the 28s30s gilt flattener vs Sonia it wasn't quite there and it bounced all the way back

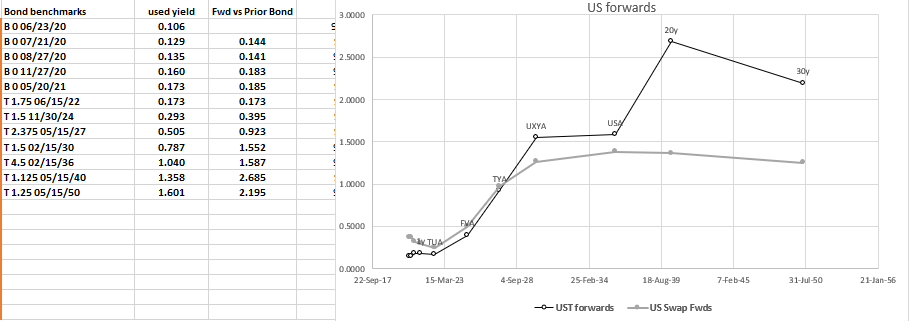

Mostly we've been stymied by the steepening in 10s30s and hence 10s20s in the US – forwards look pretty steep from 15yrs out and I have to believe that any further sell off led by stocks could see the 10s30s flatten – so for you delectation, I'm adding a graph of the actual US forwards from bonds (futures CTD's and benchmarks) plus Swaps in a graph below

|

Shadow Portfolio |

||||||||

|

Trade Idea |

P&L k (USD) |

Entered |

Level |

Size |

Status |

Exit/Current Level |

Exit date |

% of Max risk |

|

28s30s Gilt Flattener vs Sonia |

9 |

18-May-20 |

13 bp |

USD 18k/bp |

Open |

12.5 bp |

50% |

|

|

US Treasury 10s20s Flattener |

-55 |

20-May-20 |

50.7 bp |

USD 11k/bp |

Open |

55.7 bp |

100% |

|

|

2y CTZ vs BTSU0 steepener |

2.7 |

29-May-20 |

4.7 bp |

USD 9k/bp |

Open |

4.7 bp |

50% |

|

|

|

|

|

|

|

|

|

|

|

|

If you wish to see any of the write-ups or indeed think someone else should be included on this distribution pls let me know Best James |

|

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

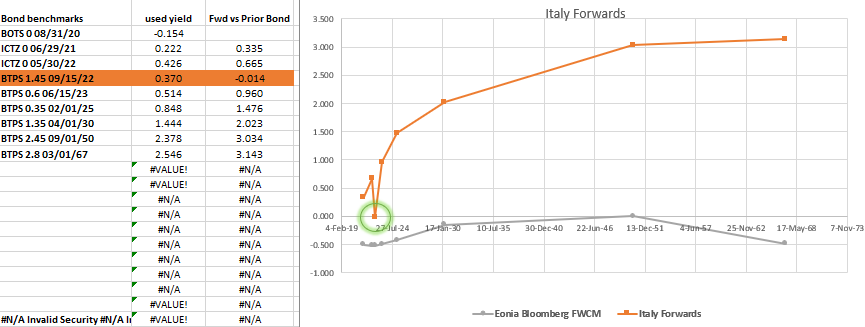

Italian 2y cheap to BTSU0

New Shadow Portfolio Trade #3

This Tuesday brought a New Italian 2y

ICTZ 0% May22

June will bring the Italian Jun/Sep futures rolls and with it the Btps 1.45% 9/22 will be CTD to the BTSU0, 2y Italian contract

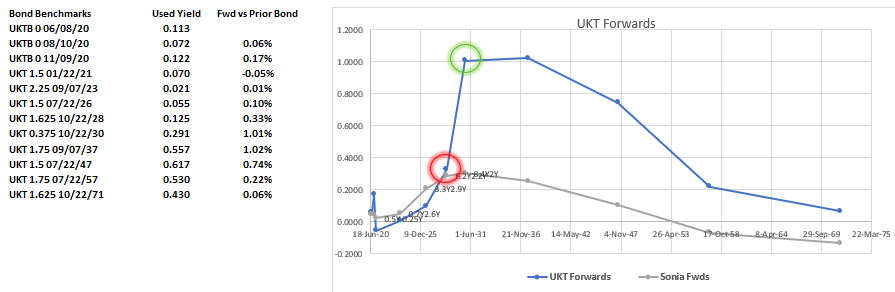

The Ctz 2y looks cheap to the 2y contract, making the 2y3m forward look rich (green circle on the graph)

Here's forwards vs benchmarks

Trade

Sell BTSU0 contracts (Ctd Btps 1.45% 9/22)

Buy ICTZ 0% May22

Carry & Roll

Carry: +0.9 bp/3mo (@-10bp repo spread)

Roll: +0.1bp /3mo

Levels

Current +5.5bp

Entry: +5bp

Add: +9bp

Sizing

- Using 150 days of Data only on prior Spread between

ICTZ nov11 and Btps jul22 - #5 worst day: 3.2bp loss

- Risk %age: 50%

- Total Risk at this level: €9k

(normalised to 50k loss on 5th worst day when at 100% commitment)

A note on sizing – I’ve sized this trade according to the general normalisation of trades in the Shadow Portfolio – so that all trades get a similarly scaled risk expression

Namely, that at full size this would generate a loss of €50k if we had a move equal to the 5th worst day of a comparable trade. At this point we are entering into 50% of the trade

Rationale

- New issue low coupons CTZ’s are coming at a discount to the yield curve

- The BTS 2y Italian contract is rich by comparison

- The implied forward rate at this point -0.014% - below the three month bill rate (see green circle on Graph)

I may in the future adjust the shadow portfolio, normalised, risk number up to €100k per trade

Best and a fabulous weekend

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FW: Model Portfolio Trade #1 - 28s 30s Flattener UK vs Sonia

Model Portfolio Trade #1

Am putting 50% of final position risk in this trade into my model portfolio

Sell UKT 1.625 Oct28 vs new UKT 0.375% Oct30

Vs Sonia

Graph: UKT Forwards vs Sonia

Levels:

Current: +13.5bp

Entry: +13bp

Target: +3.5bp

Add: +16bp

Risk & Scaling (max. risk for each strategy is USD 100k for 5th worst day loss)

Observing similar switch 2yrs shorter: ukt26 +ukt28 vs Sonia

5th Worst (neg PnL) Day: -1.9bp

Total Risk at this entry point: 50%

Entry Risk (5th worst loss of USD100k): £21,75k /01

History of prior switch – UKT26s vs UKT28s vs Sonia

(P2324[UKT 1.625 10/22/28 Corp] - P2324[UKT 1.5 07/22/26 Corp])

Details

UKT 28s first issued as 10y March 2018

UKT 30s recent, new issue as 10y May 2020

Carry & Roll

Bond Switch C&R: +0.1bp /3mo

Sonia Switch C&R: -0.2bp /3mo

Rationale

- Bonds up to the 8yr period reflect the shape and level of Sonia – see Graph tenors up to red dot. After that the 10y issuance point is a 'ski-jump' of value

- The 2030s are so cheap that the forward from oct28 is cheaper than the traditionally very cheap forwards in the less loved 20y segment – see Graph tenors up to green dot

- The micro value in the 10y is bounded by its context as an asset in the context of the broader view of forward rates

- The history of the prior spread peaked at +12.5bp. We concede that RV environment can be more volatile and hence add 50% risk here

Risks

- Action of the APF can distend relationships against RV

- The 28s could stay bid into buybacks – Gov owns 50% of the 2028s, £7.4bln still available to purchase (max 70%)

- The 2030s could remain offered as an ongoing tap issue

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Model Portfolio Trade #1 - 28s 30s Flattener UK vs Sonia

Model Portfolio Trade #1

Am putting 50% of final position risk in this trade into my model portfolio

Sell UKT 1.625 Oct28 vs new UKT 0.375% Oct30

Vs Sonia

Graph: UKT Forwards vs Sonia

Levels:

Current: +13.5bp

Entry: +13bp

Target: +3.5bp

Add: +16bp

Risk & Scaling (max. risk for each strategy is USD 100k for 5th worst day loss)

Observing similar switch 2yrs shorter: ukt26 +ukt28 vs Sonia

5th Worst (neg PnL) Day: -1.9bp

Total Risk at this entry point: 50%

Entry Risk (5th worst loss of USD100k): £21,75k /01

History of prior switch – UKT26s vs UKT28s vs Sonia

(P2324[UKT 1.625 10/22/28 Corp] - P2324[UKT 1.5 07/22/26 Corp])

Details

UKT 28s first issued as 10y March 2018

UKT 30s recent, new issue as 10y May 2020

Carry & Roll

Bond Switch C&R: +0.1bp /3mo

Sonia Switch C&R: -0.2bp /3mo

Rationale

- Bonds up to the 8yr period reflect the shape and level of Sonia – see Graph tenors up to red dot. After that the 10y issuance point is a 'ski-jump' of value

- The 2030s are so cheap that the forward from oct28 is cheaper than the traditionally very cheap forwards in the less loved 20y segment – see Graph tenors up to green dot

- The micro value in the 10y is bounded by its context as an asset in the context of the broader view of forward rates

- The history of the prior spread peaked at +12.5bp. We concede that RV environment can be more volatile and hence add 50% risk here

Risks

- Action of the APF can distend relationships against RV

- The 28s could stay bid into buybacks – Gov owns 50% of the 2028s, £7.4bln still available to purchase (max 70%)

- The 2030s could remain offered as an ongoing tap issue

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

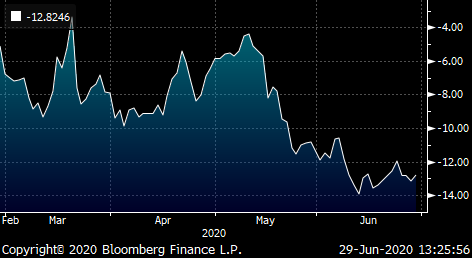

BUYING 4Y ITALY vs back months

Overview

4y forwards Italy starting to look cheap to Futures

+4y Italy

-Sep 2y Fut & -Sep 10y Fut

Forwards between bonds and also vs Spain

Coming up on the radar for initial piece…

This trade,

At my first level for…

{IT} -BTSU0 +jul24 -IKU9

weights: 50/50

Cix: 2 * (YIELD[BTPS 1.75 07/01/24 Corp] - 0.5 * YIELD[BTPS 1.45 09/15/22 Corp] - 0.5 * YIELD[BTPS 3 08/01/29 Corp]) * 100

Cix Graph

Levels

current: -15.6bp

entry: -16bp (25% risk)

add: -2bp (75% risk)

Target: -35bp

This is a volatile one (see Add and Target levels, scale accordingly) but we're at the first point where 4 & 5 yrs start to look cheap to wider hedge wings

Countered by the fact that 5y has supply is at end of month – I've gone for 4years – where the roll is even better than the headline number if you factor in that 3 ½ y sector trades richer than the interp

Rationale

- This trade is sufficiently out of line to perform in either a flattening or steepening – at the margin it is a steepener. A more vol weighted hedge would be 67% vs 33% in the short and long legs respectively

- The 4y is not a regular issuance sector

- Back months avoids the roll period in June - For liquidity and longevity am looking at Sep futures

- We have used like for like Med coupons

- The forwards simple imply an unlikely change in the path of Italian curve evolution

Carry & Roll

Carry: -1.6bp /3mo (@10bp repo spread)

Roll: -0.7bp /3mo

Tough to find bullets that are high carry given the very high Carry on short end bonds at the moment. Balance that with the fact that forwards are pointing to an ongoing rise in yield for the 2y2y and then a lower slope for the 4y5y

Risks

- The dislocation is insufficient to compensate the neg carry and roll

- The 4y stays offered

- The back month futures contracts richen, relatively

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796