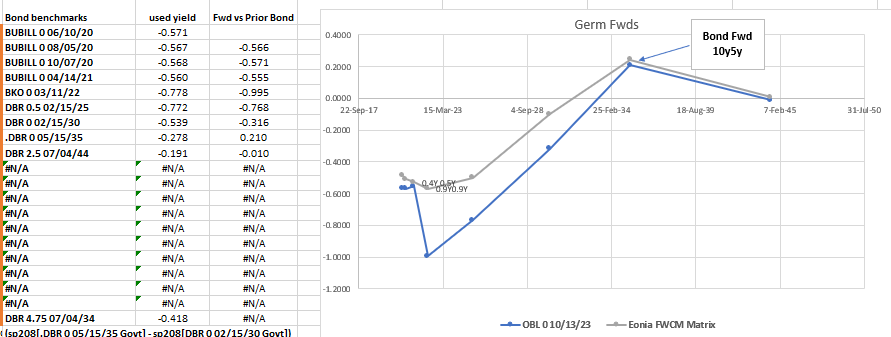

Basic work on German 15y

German syndicated 15Y coming this May

Preliminary work on May35s

- I modelled a 0% coupon May/15/35, that had already gone past one notional coupon date (even though it's 0% cpn). That allows me to play around with it in Bloomberg and model it in forward rates

- @ +4bp to Jul34 it looks kinda in-line with German forwards (disregarding what swaps curve for a sec)

To me - I'd get excited about it @ +14bp

at that point it would be only 9bp though 44s and the forwards from 35s to 44s would be as inverted as the swap curve

Given that we've wrestled with 10s30s Germany being close to new extremes vs swaps 10s30s, it would be a massive get out of jail free for those trades AND just a great level to have…

-RXA +35s -UBA

previously, I'd never have thought it could come that cheap - but seeing Spain and other syndics - I'm a bit 007 - 'Never Say Never'

Graph: Forwards with +14bp spread of 35s to 34s

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Euro RV Week Ahead Part2 - James Rice @Astor Ridge

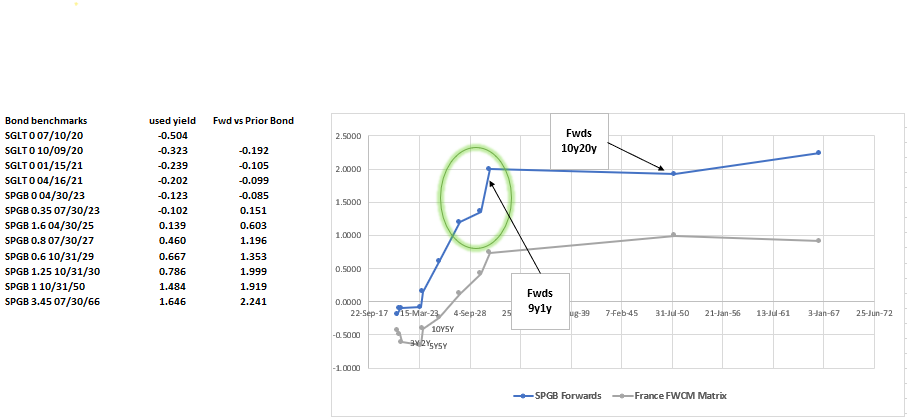

Thursday 7th May – Spain Tap 2023, 2025, 2027 & 2050

I would let go of any tactical long in Spain as an issuer vs France and Btps

Not for fundamentals – just country relationships feel broken and this got really stretched on April 22nd, when Spain syndicated the 2030 €15bln issue at an inordinate discount

Trade has done well since that point but is by no means over

Spain 9y vs OAT and BTPS futures

100 * ((YIELD[SPGB 0.6 10/31/29 Corp] - 0.6 * YIELD[FRTR 0.5 05/25/29 Corp] - 0.4 * YIELD[BTPS 3 08/01/29 Corp]))

Sell 2029s and buy 2030s

- The new Spgb 1.25% 2030 has done well but still looks cheap – the 9y1y is so exaggerated that it’s as high as the 10y20y

- Essentially all the issuance in 7y and 10y Spain has left the 9y looking rich – and again as RV traders we’re left intermediating at what we hope are extremes

Forward Rates for Bonds in Spain

Comparison curve: French Forwards -

- Trade:

- Sell Spgb 0.6% 29 to Buy Spgb 1.25% 2030

- Cix:

(YIELD[SPGB 1.25 10/31/30 Corp] - YIELD[SPGB 0.6 10/31/29 Corp]) * 100

- Levels

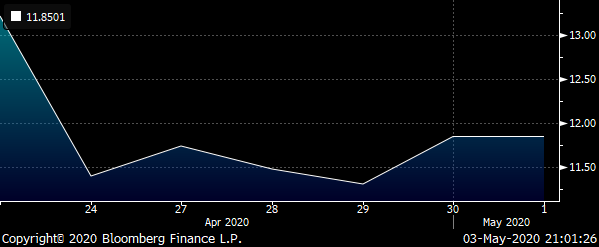

Curr: +11.8bp

Entry: +13bp (50%) – holding back from the current market given this came so cheaply originally and we need a decent target pnl after friction

Add: +16bp (50%)

Target: +8.5bp

- Bloomberg Graph

- Risks

the 30s remain cheap as an ongoing tap bond

the 29s remain rich

Alternatives

- As a straight alternative switch into the High coupon 6% 29s, which have been forced cheap –by switching in recent issuance and by a desire to reduce proceeds exposure to Spain as an issuer

If we are generally bullish Spain as a credit, another trade is to simply

Sell Spgb 0.6% Oct29 to buy Spgb 6% Jan29

Currently -4.3bp

Positive 0.6bp carry /3mo @ -10bp repo spread

Currently on z-spread: approx flat

But versus a stripped curve (Bloomberg: BB_SPRD_TO_SPLINE_EXPONENTIAL): +9.1bp

The sprd to spline exponential field takes into account discounting all the cashflows vs a theoretical Spanish zero curve – in a positive curve, this accentuates the advantage of receiving cashflow early on the shorter Duration 6% bond

Graph, Bloomberg BB_SPRD_TO_SPLINE_EXPONENTIAL for Spain:

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Euro RV Week Ahead - James Rice @Astor Ridge

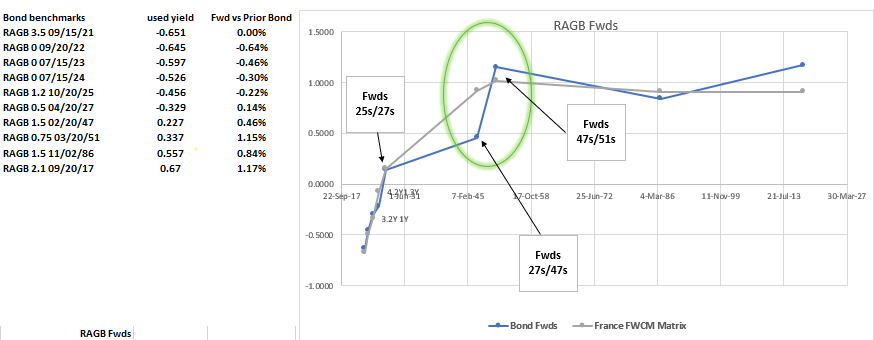

Tuesday May 5th – Austria Tap Ragb 0% 2030 and Ragb 0.75% 2051

Sell 47s, buy 27s & 51s

- The 51s here are cheap to 47s. Conversely 7y (Apr27s) to the 47s (old 30y) is very flat

- Although I like steepeners – given the ongoing supply, the less liquid 62s only come up as a sell candidate if they remain out of scope to the PEPP ( worth a look too)

- All the forwards in the back end of Austria trade rich vs France. So generally we want to find a steepener – selling a bullet and buying wings. When we shorten up to the 7y it looks like we can get a nice steepener 7y vs old 30y (10% of risk), to hedge out the main 47s/51s flattener

Forward Rates for Bonds in Austria

Comparison curve: French Forwards -

- Trade:

Sell Ragb 47s to buy 51s (90% of risk)

&

See Ragb 47s to buy 27s (10% of risk)

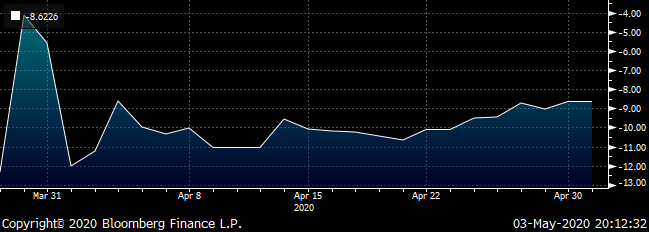

- Cix:

200 * (yield[RAGB 1.5 02/20/47 Govt]-0.1*yield[RAGB 0.5 04/20/27 Govt]-0.9*yield[RAGB 0.75 03/20/51 Govt])

- Levels

Curr: -8.6bp

Entry: -7.5bp (50% of size)

Add: -12bp

Target: +5bp *, Target PnL +12.5bp

*similar fly and weighting in France is +5.7bp: (200 * (yield[FRTR 2 05/25/48 Govt]-0.1*yield[FRTR 1 05/25/27 Govt]-0.9*yield[FRTR 0.75 05/25/52 Govt]) )

- Bloomberg Graph

- Tailwinds – the 51s should also be part of index extension at month end

- Risks

the 47s remain rich

the 7y is tapped

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Euro RV update and Shadow portfolio - James Rice @Astor Ridge

Euro RV and Shadow portfolio over the next few days

I thought I’d add a portfolio of trades to my comments. If nothing other than for a sense of integrity in owning one’s winners and losers

It’s all too easy for people to draw circles around where their arrows land!

If you have any thoughts about what you need to see on the shadow portfolio – Sharp Ratio, Mean reversion, Balance sheet usage, friction – pls let me know

I think there’ll be some great opportunities over the next few years – to paraphrase Harold Macmillan - ‘you never had it so good’

But with that comes a downside. We have to understand value and not simply observe changes. We have to scale and we have to be diverse. If I were running risk, I’d try to be ever more conscious of those things.

Issuance to pay for Corona & increased QE are forcing trades to extreme boundary conditions. While I’m truly respectful of those forces, I still live by the Mantra that ‘Value Will Out’

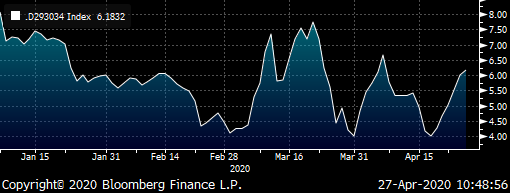

In Germany on Wednesday we have a tap in the 10y Dbr 0% 2030

We're still looking for decent forward rate steepeners and this one might bear fruit. The ten yr is also scheduled to be tapped again on the 20th May

The issuance point vs the liquid future (29s30s) is pretty steep so much so that the Fwd is up bouncing against the Eonia ceiling. Yet we have a syndicated 15y for Germany in May - and of late syndications have come at almost grotesque discounts to current so that 10s15s should steepen out too

{GE} -rxa +feb30 -old15y

weights: -.8 / +1 / -.2

current: rcv +6.1bp, 25% risk on here

add: rcv +7.5bp 75% risk on there

Fwds look solid and expect the May syndication to steepen out that king from on the run 10y to 15y

cix:

200 * (YIELD[DBR 0 02/15/30 Corp] - 0.8 * YIELD[DBR 0.25 02/15/29 Corp] - 0.2 * YIELD[DBR 4.75 07/04/34 Corp])

Forwards

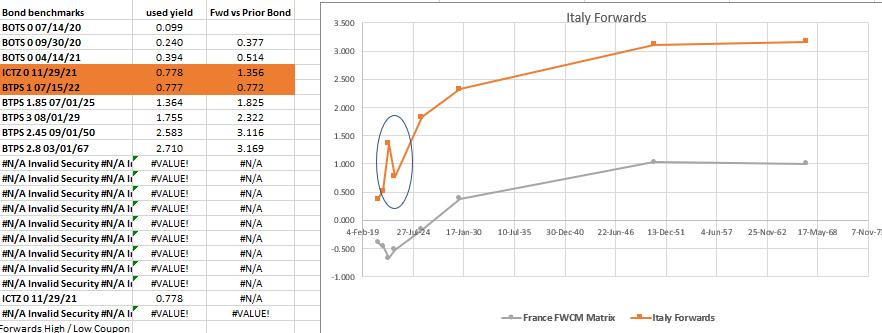

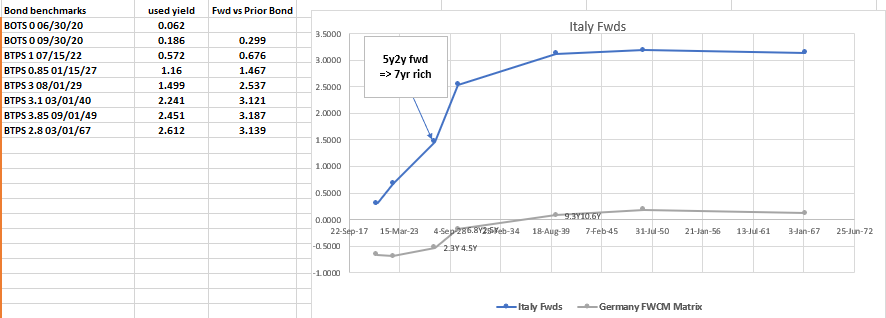

Last week in Italy we had a new 5y (Jul25) and a tap of CTZ 0% nov21

Both the Nov21 and the Jul25 are cheap –the market has rallied on the 2y on generally positive news. And the supplied issues have been left behind

Here we can see quite a disproportionate jump in forwards to accommodate for the yield difference

ICTZ nov/21 0.767%

BTS CTD 1% jul22 0.777%

I like

{IT} +nov21 -BTSA +5y

+.8 / -1 / +.2

here I've used old 5y (feb25) for some history, but the new guy (jul25) looks pretty good too

BTS CTD is Btps 1% jul22

Levels

Enter: pay sprd @-20.5 bp

Add: @ -22.5 bp

Target: -13 bp

C&R:

Carry: just checking as it seem strongly positive carry !

Guessing cos it's a nett add of cash, 18%

cix: pay this spread…

2 * (yield[BTPS 1 07/15/22 Govt]-0.8*yield[ICTZ 0 11/29/21 Govt]-0.2*yield[BTPS 0.35 02/01/25 Govt])*100

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303 –

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

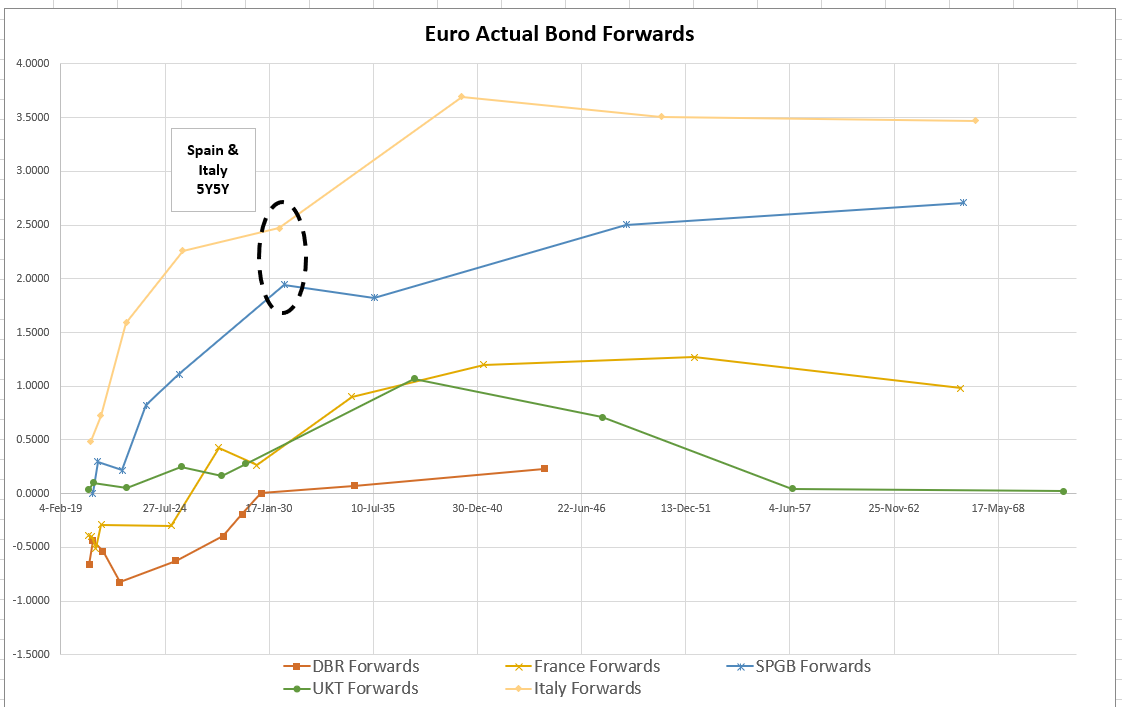

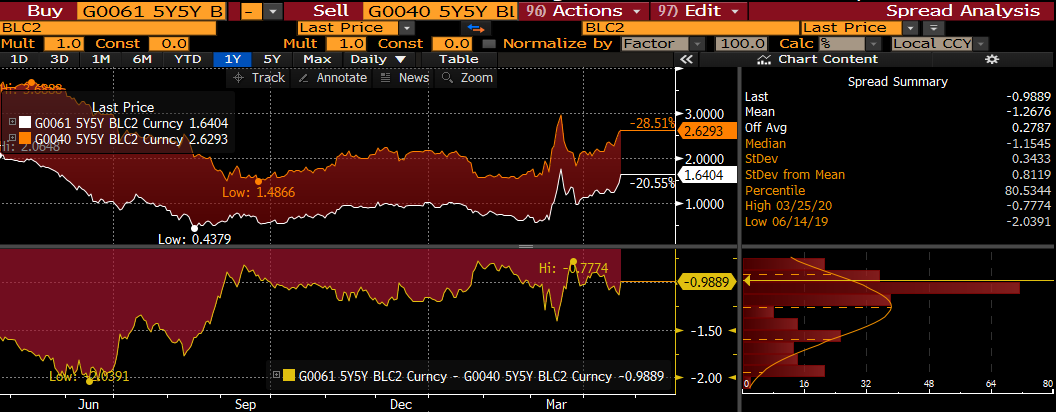

Trade checking numbers for pricing tmrw - Spain vs Italy 5s10s

Am I missing something here ?– this trade looks out of whack and

Spain Flattener 5s10s vs Italy Steepener 5s10s

Waiting on firm pricing after the syndicate…

Rationale

- recent new issues have come with significant new issue discounts to clear

- 5y Italy & 10y Spain have forced the 5y5y forwards to be out of line

Graph of Forwards (using new issues)

History of 5s10s Spain vs Italy using old benchmarks…

Spain

100 * (YIELD[SPGB 0.5 04/30/30 Corp] - YIELD[SPGB 0 01/31/25 Corp])

Italy

100 * (YIELD[BTPS 1.35 4/30 Corp] - YIELD[BTPS 0.35 2/25 Corp])

Levels using new issues – subject to syndicate pricing…

Spain

SPGB 1.6 04/30/25 vs

Estimated .SPGB 1.2 10/31/30 – should be secondary market tomorrow

+66bp

Italy

BTPS 1.85 07/01/25 vs

BTPS 0.95 08/01/30

+33bp

so an additional 33bp vs old benchmarks!!!

On forwards…

Using Generics – I get -99bp but using my calculations including the new bonds I see the forward spread much closer to -59bp

Something seems wrong here – do you see these numbers?

Apols

James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

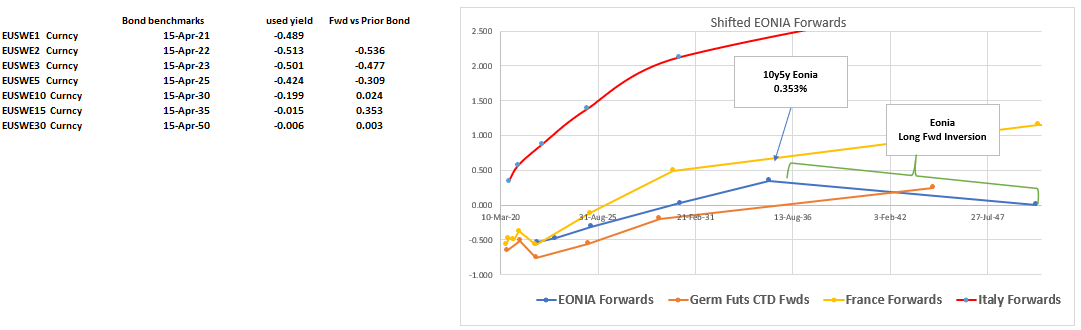

Euro RV - April 14, James Rice, Astor Ridge

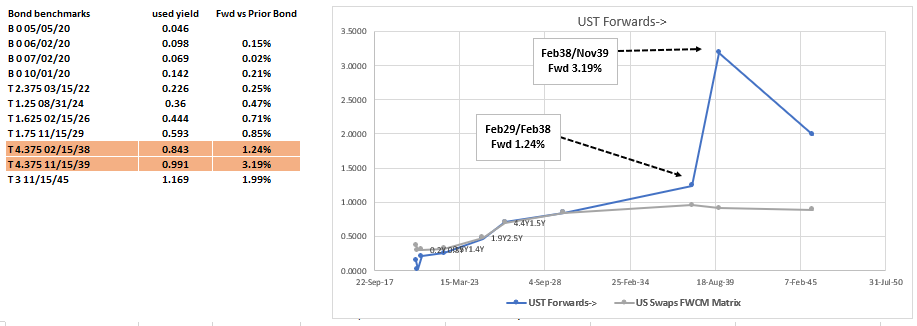

The Shape of things to come…

Bond curves and swaps curves have started to reflect very different expectations in the long end

Consider the Forward curves For:

German Futures (CTDs), French Benchmarks, Italian Benchmarks and Eonia Swaps…

Observations

- The Swap curve has a forward rate inversion that could be attributed to convexity, ALM receiving or credit quality

- The bond curves all have upward sloping forward rate curves – not only an expectation of economic recovery and Inflation but also the weight of long end supply from the issuers arising from COVD-19 stimulus packages

- With swaps now collateralised on a mark to market basis – we could view swaps as a very different credit prospect in longer tenors.

Dislocations and Themes

- The theme in ‘Bond-land’ would be to find Fwd rate steepeners at flat or close to 0 – using the discounts from Syndications and other large flows to give us edge

- My fade in Swaps is to find the reverse – to find points on the swap curve where the forward rates rise at a constant or excessive rate and then suddenly invert – for example the 10y5y vs the 15y15y

- And our best edge will be at the confluence of these two themes

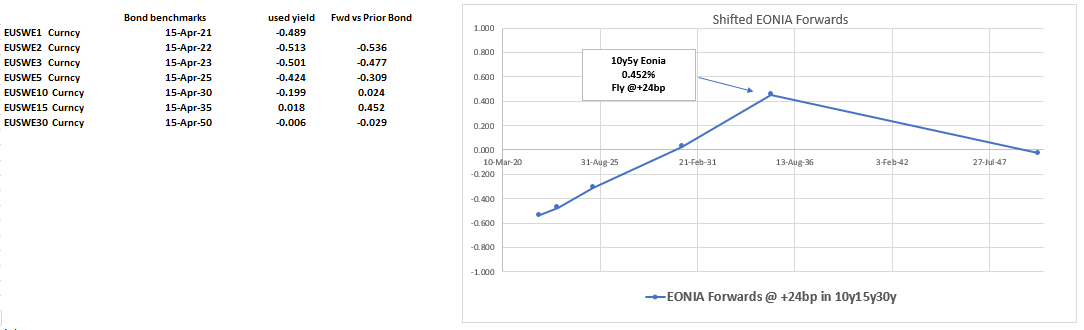

Trade #1 -Eonia Swaps

Receive the top of the fwd rate Curve

Receive 15y vs Pay 10y and 30y

Cix:

(2 * EUSWE15 Curncy - EUSWE10 Curncy - EUSWE30 Curncy) * 100

Levels:

Current: +17.5 bp

Entry: +17 bp (25% risk)

Add: +24 bp (75% risk)

Target: +5.5 bp

How does the Value look at the major Add level of +24bp?

- If we get to the Major add level- we have set is at a point where the slope of the forward curve from 5y5y to 10y5y would be greater than prior points on the curve.

- Also the inversion in forwards from 10y5y to 15y15y would be even more inverted – that would seem an ‘overly-informed’ is dislocated shape of the curve

- So for Risk management we put some on here and add at the extremes in the knowledge of the value rather than pure history

Graph of forwards but with 10y shifted such that the 10y15y30y fly is @ +24bp

Risks

- These tenors remain disconnected for protracted periods of time

- The 15y cheapens relatively

More to follow

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FW: fwd steepeners

Apols – I missed the may addition of 2035 (15yr) Germany as pointed out by David Sansom

New maturity segments for Bunds

The Federal government intends to introduce two new maturity segments for the Federal bond instrument in the second quarter of 2020.

In May 2020, a 15-year Federal bond maturing in May 2035 (ISIN DE0001102515) will be issued. A reopening of € 2.5 billion in size is planned Number 2 on 7 April 2020 Page 3 of 9

in June. The new issue in May is intended to be carried out via syndicate, while the reopening in June is to take place by auction as usual.

explains the cheapness – still like it but on hold for the best level

From: James Rice

Sent: 09 April 2020 11:46

Subject: fwd steepeners

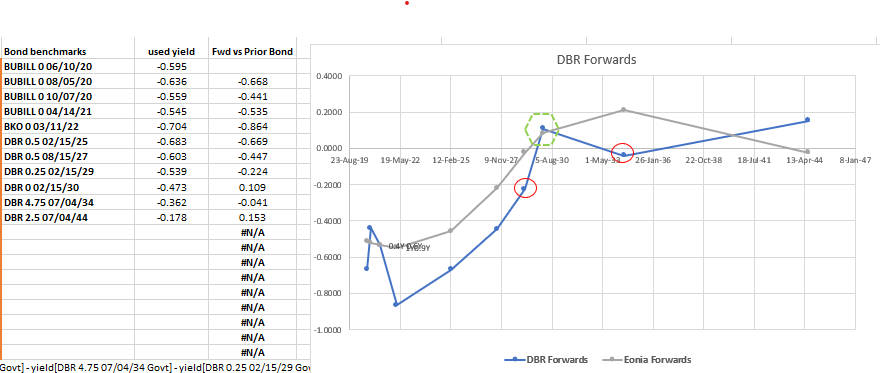

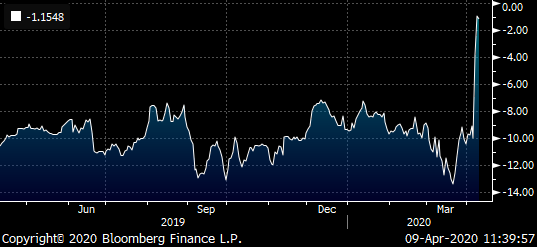

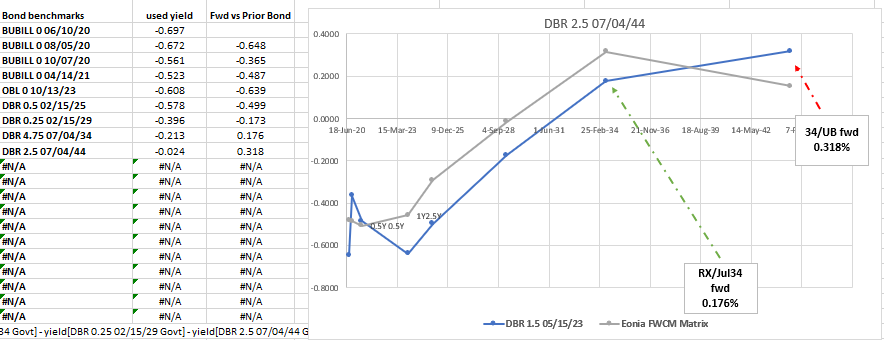

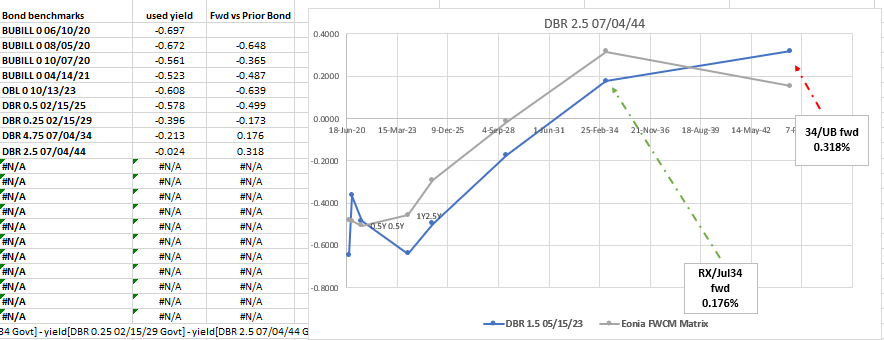

- I like this trade

{GE} -rx +2034s -ub

weights: -.5 / +1 / -.5

cix:

(2*yield[DBR 4.75 07/04/34 Govt] - yield[DBR 0.25 02/15/29 Govt] - yield[DBR 2.5 07/04/44 Govt])*100

so a proxy for a fwd rate steepener and relatively liquid too (futures on the wings)

there's been talk of tapping the old high coupons but nothing shown in quarterly planning

We're at a level I would have 15-20% on

current: -1.1bp

entry : here (20%)

add : +3bp (80%)

Target: -7bp

forwards look decent

Forwards:

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

fwd steepeners

- I like this trade

{GE} -rx +2034s -ub

weights: -.5 / +1 / -.5

cix:

(2*yield[DBR 4.75 07/04/34 Govt] - yield[DBR 0.25 02/15/29 Govt] - yield[DBR 2.5 07/04/44 Govt])*100

so a proxy for a fwd rate steepener and relatively liquid too (futures on the wings)

there's been talk of tapping the old high coupons but nothing shown in quarterly planning

We're at a level I would have 15-20% on

current: -1.1bp

entry : here (20%)

add : +3bp (80%)

Target: -7bp

forwards look decent

Forwards:

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Macro RV, April 6th - James Rice @Astor Ridge

“Two Bonds Good, One Bond Better”

Taking a lead from Animal Farm, by George Orwell

“Four legs good, two legs better! All Animals Are Equal. But Some Animals Are More Equal Than Others.”

Animal Farm, George Orwell

Thoughts

Liquidity has been and will continue to be a major challenge

Many relationships in the RV world hit new extremes in the second half of March. Until that rolls out of recent memory, Bid / Offer friction and Var will remain high

How do we combat this?

- Sparse Curve Builds – looking to build forward curves from a very sparse set of points

- Using Futures – maximising liquid futures and benchmarks in trade expression

- Waiting for trades to be at value extremes using much ‘wider’ (disparate tenors) constructs

- Allowing for Friction – we need to not only expect friction on entry – working with the dealer community, but need to expect that on exit too

- Scaling – as var of relationships increases, it seems that a portfolio approach of with trades coming and going makes sense. Just a handful of trades will get to the extreme levels where they start to become a very strong conviction trade. That doesn’t mean that we don’t make money with the others – we express and take off without getting deep into adding territory

- Comparison – when the vol of value trades increases , we need to be conscious of how big the opportunities are elsewhere to maximise relative Sharpe Ratio

- Leaving orders – if you leave a mess outside someone’s door and tell him to clear it up you’ll get short shrift. If you ask someone to work with you to tidy up a mess you, might get somewhere. So it is with trading. It’s not that dealers lack appetite. They are economic agents. The system is strained with many working from home. So we have to sacrifice some probability of getting done in return for getting an acceptable level at which we may get done – leaving an order

What remains the same?

- Value – the boundary conditions dictated by forward rates still determine the entry points

- ‘fair’ – we’re still seeing a mean reversion to value

- Themes – two major these are in play; QE and issuance. QE is undoubtedly sub-optimal but can be large. John W puts out an excellent piece on the UK when it is ‘full’ on certain issues. that seems to be the nadir in value terms. Issuance means steeper curve. So we buy forwards at flat to longer ones, where it’s out of context to the curve.

- Polarisation – Hedging instruments still to reflect extremes – witness the rich / cheap in the Italian IK and BTS futures at either side of the credit cycle. But for every futures buyer, there’s a seller. These distortions come out in the wash eventually

- Balance Sheet – using futures for as many legs as possible we can get more liquid and lower balance sheet structures – our sacrifice is to accept that we will trade less often

Italy – One Bond, Two Futures

+2yFut, -7y, +10yFut

Pay the belly

Weights: +0.3 / -1 / +0.7 (*as per the shape of the fitted curve)

Cix:

2 * (YIELD[BTPS 0.85 01/15/27 Corp] - 0.3 * YIELD[BTPS 1 07/15/22 Corp] - 0.7 * YIELD[BTPS 3 08/01/29 Corp]) * 100

Levels

Current: -3.3bp

Entry: -7.5bp (20%)

Add: -25bp (80%)

Target: +18bp

In forward space this is how the curve looks…

Rationale

- Tuesday will see the announcement of Italian supply for Thursday April 9th

Regular 3y, 7y & longer tenor possible

- Generally the forward curve should be steeper but looks out of line at the 7y point

- As a very wide fly this can move around and recent extremes dictate our small entry amount and a desire to see the trade either mean revert next week or achieve the distortions of mid-March

- The Market seems to struggle with the absorption of new risk – witness Spanish and Belgian 7y syndications. With dealers running at reduced staffing, it is my sense that the market will demand a discount for all new risk

Carry & Roll

- Carry: +2.6bp /3mo (@10bp repo spread)

- Roll: Flat

Risks

- As a wide expression of tenor risk this fly has large Var and large range. Extreme value is around -25bp

- A very strong flattening of the forward curve – heading towards default, could cause the bullet to outperform wings

- The low coupon nature of the 7y causes it to stay bid vs the higher coupon ik ctd – 3% Aug 29

At the Extremes, how does it look to add?

How do forwards look at the extremes… - shifting the 7y by 10bp richer, all other things being equal…

At this point the gradient would be so steep from 7s to 10s ,that the 9y5y would be almost flat to 10y10y. That would seem an exceptionally unlikely or ‘over-informed’ scenario for the path of rates

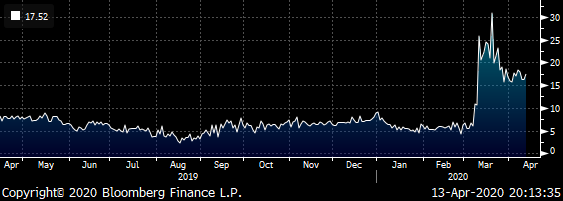

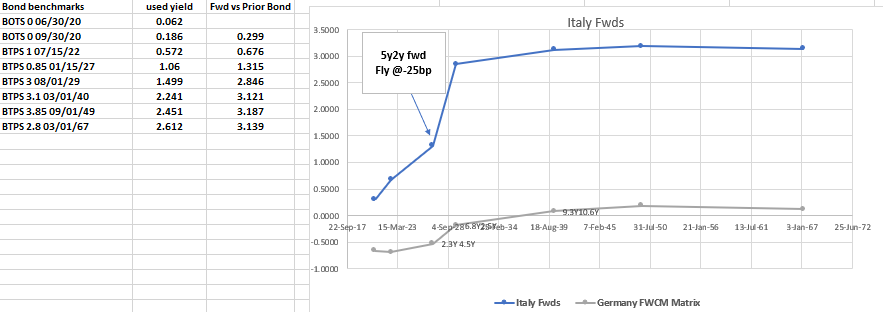

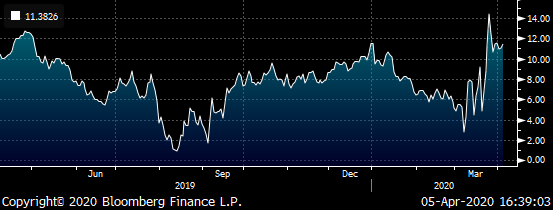

US

Sell T 4.375% Feb38, Buy 4.375% Nov39

Steep US curve at maturities longer than USA contract CTD (Feb36) implies forwards > 3.00%

Cix:

(YIELD[T 4.375 11/15/39 Govt] - YIELD[T 4.375 02/15/38 Govt]) * 100

Levels

Current: +14.9bp

Entry: +14.9bp (33% of risk)

Add: +20bp (67% risk), at which point the nov39 could be so cheap as to force the forwards from 2039 to 2045 to be back sub 2%

Target: +5bp,

Forwards

Rationale

- This is a fade of the steeply sloped UST curve, from the 2036 to 2045: from the USA contract to the WNA contract.

- It does not have quite the same risk of being short a CTD (UST Feb36), yet expresses that dislocation

- Feb38 -> Nov39 is one of the steepest parts of the US curve and implies a high forward: 3.19%

- This is one of the few relationships that is still on a high relative to mid-March, whereas many others have retraced some of those moves. See -USA +WNA in yield spread (T Feb36 into T Nov45) off the Mid-March highs…

Graph UST Feb36 into USTT Nov45

Carry & Roll

- Carry -0.1bp /3mo (@15bp repo spread)

- Roll -0.1bp /3mo

Risks

- The spread steepens due to

USA future outperforming WNA in further dislocations

The specific issues becoming more idiosyncratic

Generic steepening of the yield curve

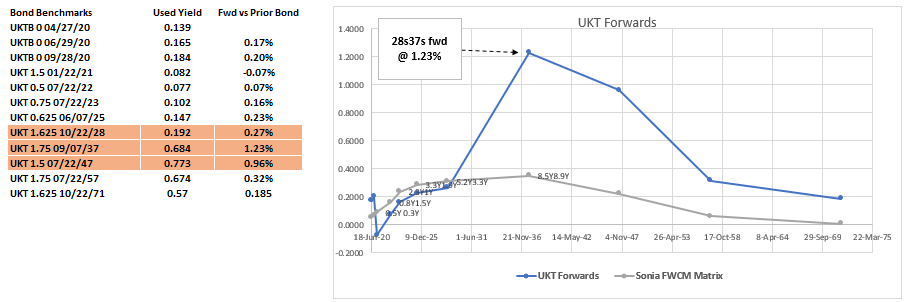

UK

-28s +37s -47s

Systemic cheapness in 20yrs, highlighted by last Tuesday’s £2Bln tap of 2041

Cix:

(2*yield[UKT 1.75 09/07/37 Govt] - yield[UKT 1.5 07/22/47 Govt] - yield[UKT 1.625 10/22/28 Govt])*100

Graph

Levels

Current: +40.4bp

Entry: +40bp

Add: +45bp, (compensates for any cheapness in the back leg)

Target: <30bp, long term target <10bp – stellar roll, but difficult bucket

Forwards

Rationale

- Systemic cheapness of the 20y sector – the Sonia curve predicts a much more benign pricing set for 20+ yrs

- 37s is shorter than the 20y point, next tap Wednesday 15th April

- Roll down is very strong – 37s roll at 5.5bp /yr

Consider the fly approx 3 yrs shorter: -26s +34s -44, trades at +17.3bp

- The 37s got pushed cheaper by the recent tap in UKT 1.35% 41s

- The long belly, short wings is an approximation of the long forward rate steepener trade, which we prefer in a higher supply environment

Mis-weighted Fly – as per curve ‘shape’ – similar to vol weighted…

100 * (YIELD[UKT 1.75 09/07/37 Corp] - 0.25 * YIELD[UKT 1.625 10/22/28 Corp] - 0.75 * YIELD[UKT 1.5 07/22/47 Corp])

Carry & Roll

Carry: +0.6bp /3mo (a10gp repo spread)

Roll: +0.1bp /3mo (fitted curve)

Risks

- Further Taps of the 37s cause it to remain cheap – next tap Wednesday April 15th,

- APF (asset Purchase Facility) – QE causes the shorts to stay bid, UKT28s have benefited from buying in QE from March 24th to day more so than 37s and 47s, which is one of the reasons the RV is so distorted

In general, my sense is market could still shake a lot of people out here. We have to scale accordingly and trust that Value will out. We need to pay attention to fresh issuance as the market is wounded in its ability to absorb. Liquidity is poor , but the counter is that the opportunity set is good.

Have an excellent week and let me know if there’s anything I can help with. Working from home ain’t so bad !

Ricey

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796