The EU & US opportunity Set

The Macro / RV opportunity set…

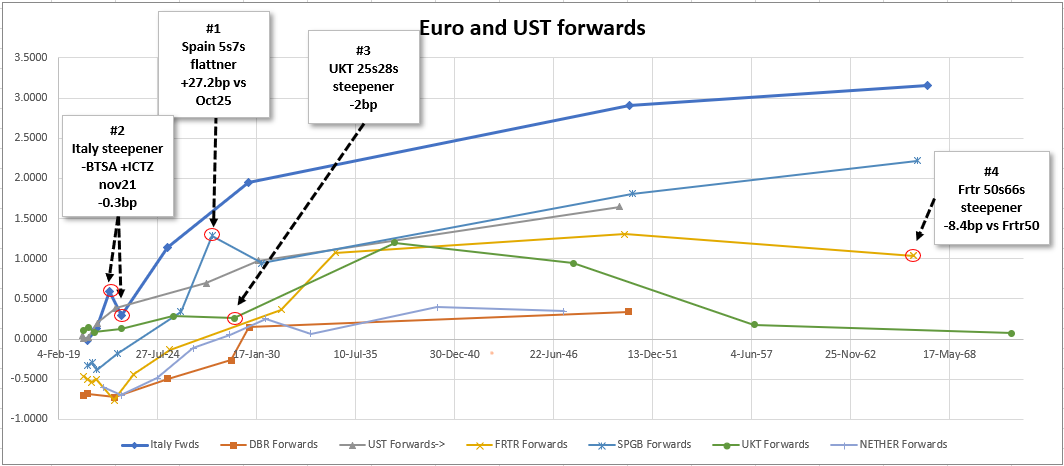

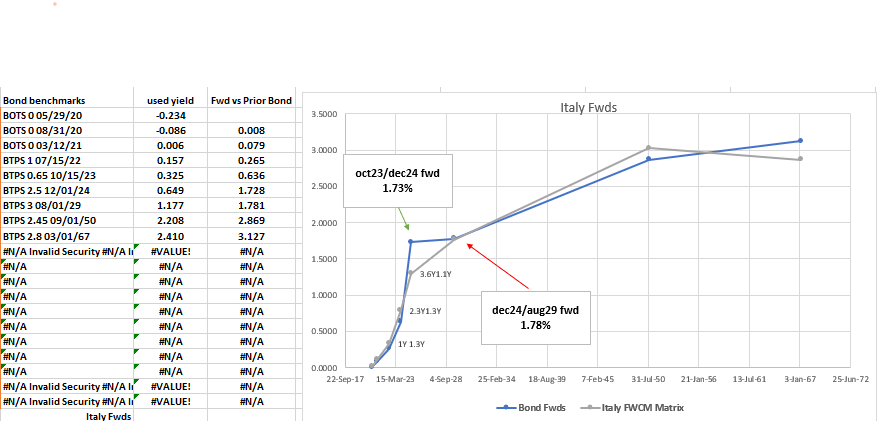

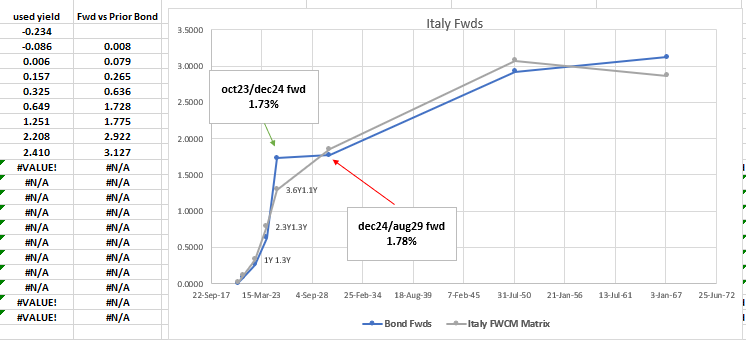

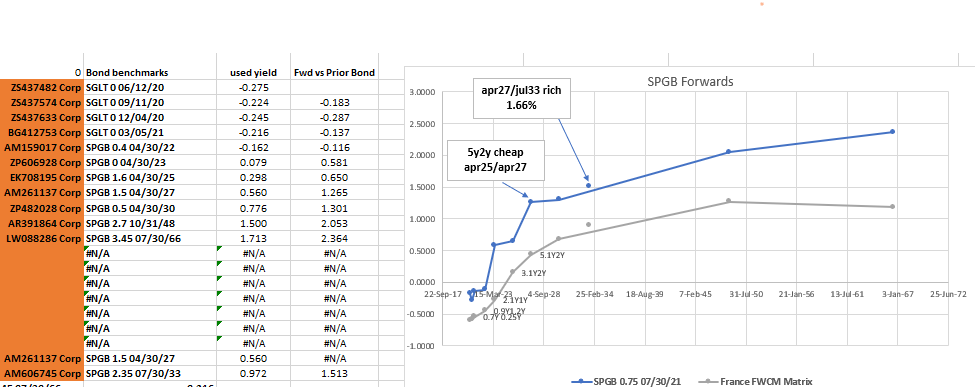

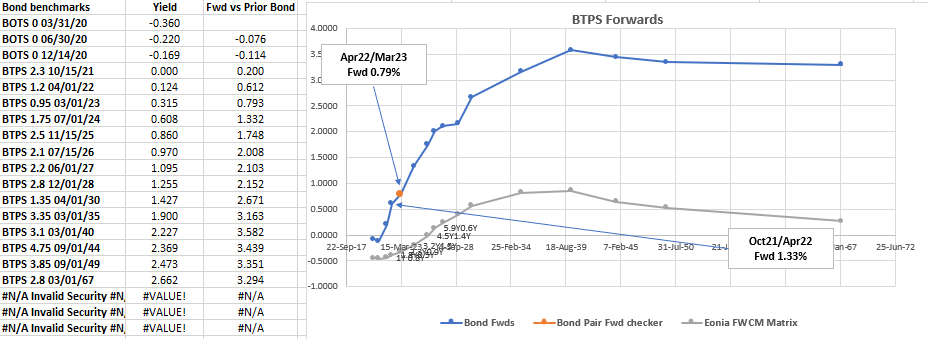

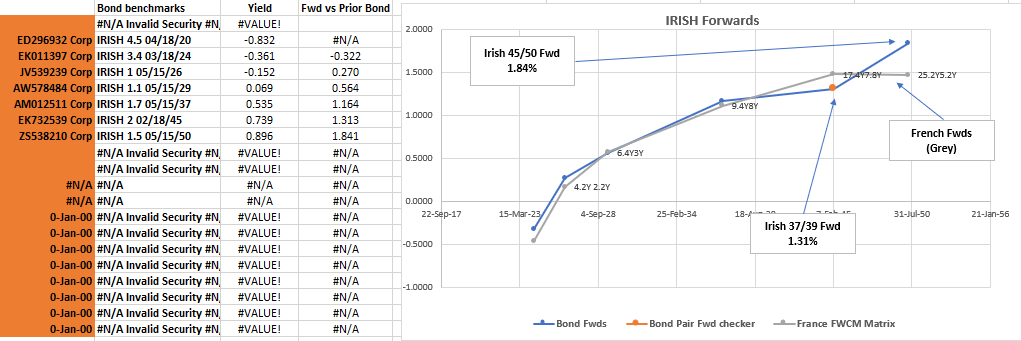

Consider the context of bond specific Forwards in Europe

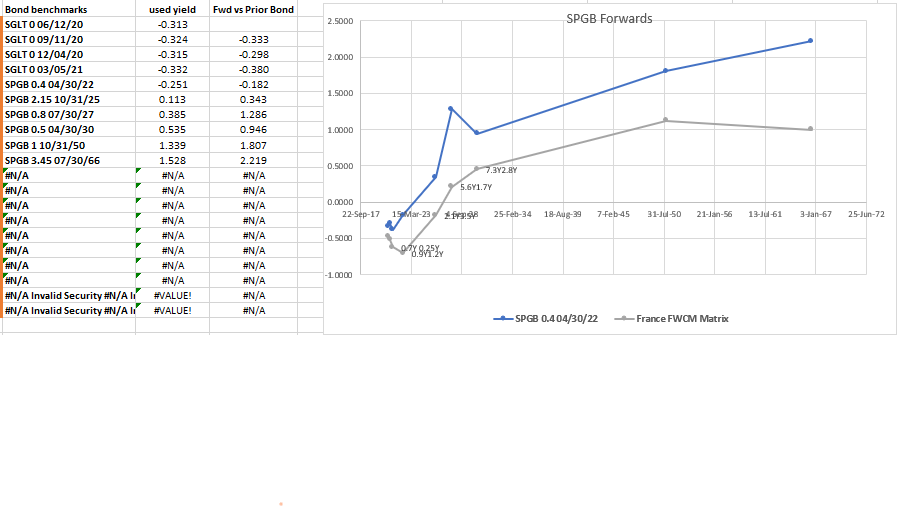

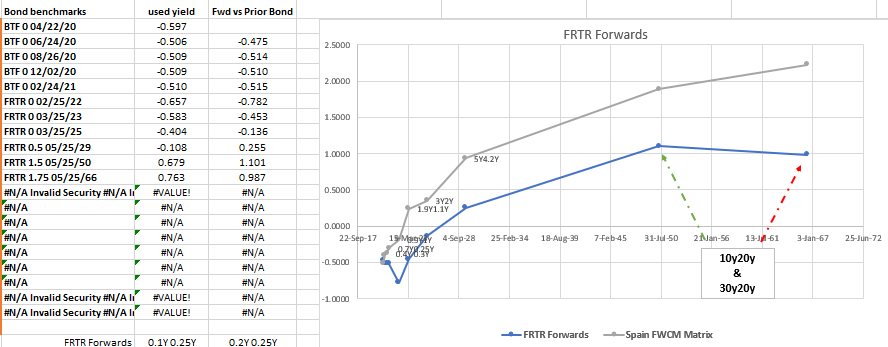

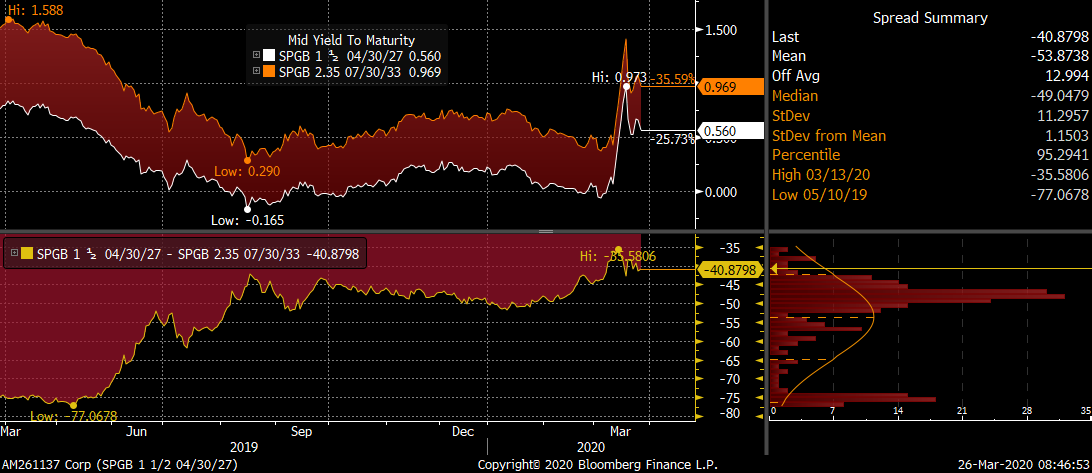

#1 New 7y Spain Spgb 0.8% Jul27, +27.2bp vs Spgb 2.15% Oct25

- Last Tuesday’s new Spanish 7 yr came cheap, as they issued €10Bln

- Flatteners and Steepeners both look good – the 5yr point is also rich, so going with the flattener

- The Bond Forward 5y2y is pushed way over the fitted curve, towards Italian levels

- This is a good 12bp away from fair

Bloomberg History of 5y vs old 7y…

Spanish Forwards

- Risks: The Spgb Jul27 as a new bond stays cheap. A wholesale curve steepening erodes the RV. The Oct25 gets rich on repo.

- Carry: -0.4bp /3mo using 10bp repo spread

- Roll: -0.3bp /3mo

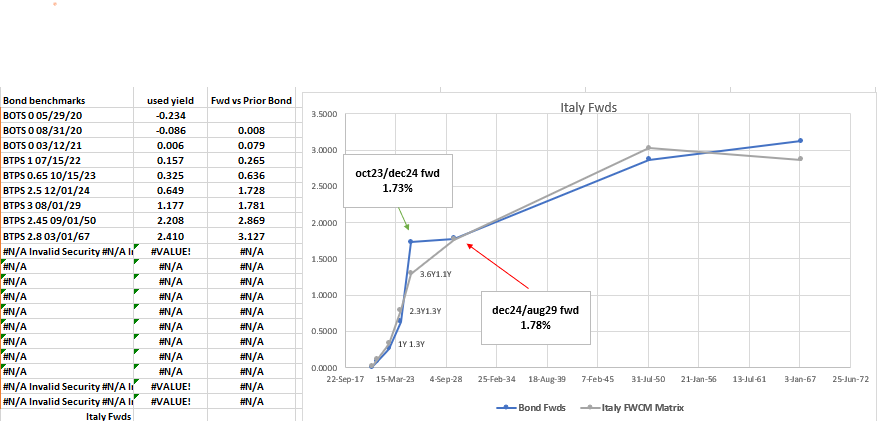

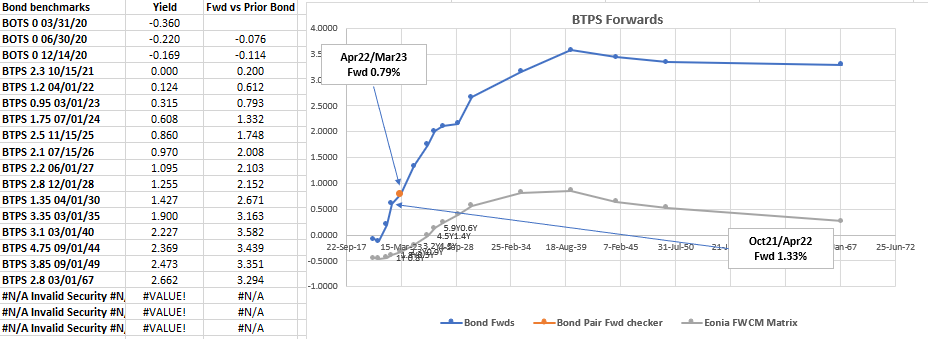

#2 Italy: Sell BTSA contract (Ctd = Btps 1% Jul22) +ICTZ 0% Nov21

Nov21 CTZ left cheap by 2y rally

Target +1bp & +4bp (33% and 67% risk respectively)

Bloomberg

- The CTZ 0% Nov21 have been left behind in the recent rally, but with a softer Italian market on Friday, we expect the bond to outperform the 2y Futures contract (CTD Btps 1% Jul22)

- In terms of forwards a flat or inverted curve makes no sense. Here we see the forwards curve with a spread of -0.3bp

- Risks: a significant rally in the 2y futures could lead to a flattening in 1s2s spread and the RV is eroded in the context of the wider curve

- Carry +1.8bp /3mo @-15bp spread

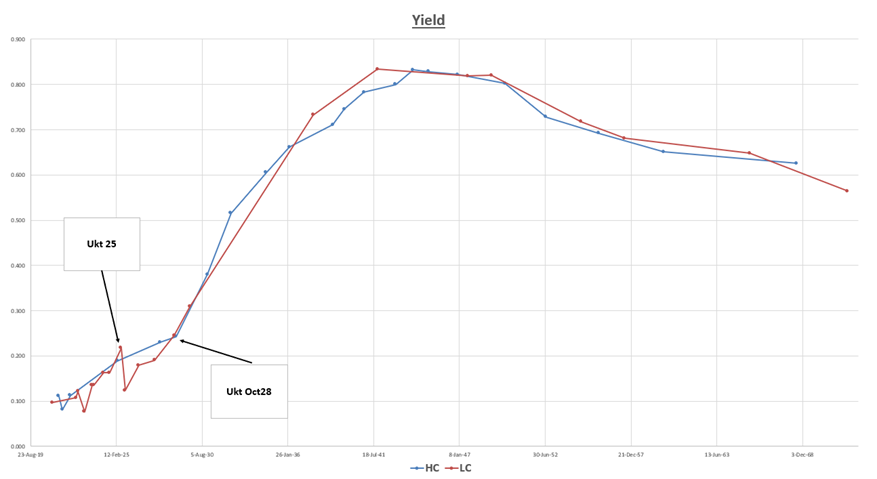

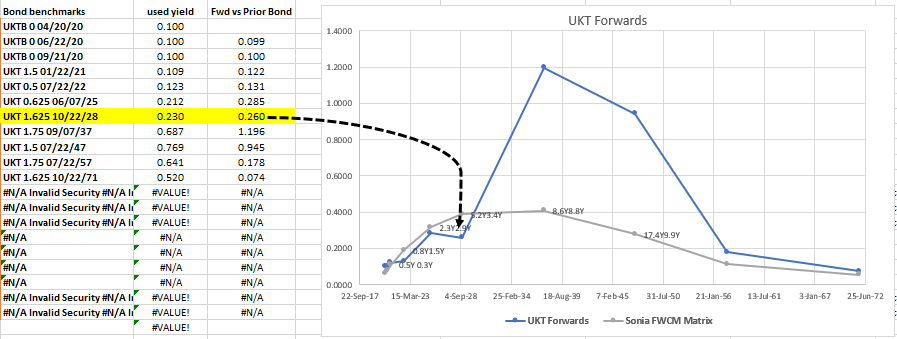

#3 UKT flattener: -Ukt 1.625% Oct28, +Ukt 0.625 6/25

The Flows in the UK are idiosyncratic at the moment – the APF is engaged in Buybacks yet issuance is set to increase and the Recent Fitch downgrade to AA- from AA could cause a steepening of the curve.

Levels

Current: -1.8bp

Entry (33%): -2bp

Add (66%): Flat

Target: -7.5bp

Graph – UK Yield Curve

As with most yield curves am looking for steepeners either in yield or forwards rate space – I chose this one as it accentuates the anomalies vs the fitted curve but maintains some width as to not be wiped out by dealing costs

Furthermore the very high forwards caused by the persistent cheapness of the 20y and 30y should put some constraint on how flat 25s 28s can go

BBG Spread history..

In terms of forward rates the steep curve 10s20s and 20s30s implies high forwards. This is at odds with the 8y – 10y segment.

Graph of Ukt Forward rates

Risks: Whole curve collapses / flattens to Sonia

Ukt Oct28 stay bid from APF buying of the sector

Repo goes tight on Oct28 (*BoE maintains repo facility on Ukt issues to constrain excessive squeezes)

#4 France – Butterfly

-OATA (Ctd Frtr 0.5% May29

+Frtr 0.5% May50

-Frtr 1.75% May60

The long end, 30y tenor of France cheapened from the extreme flat levels of mid-March

France 10s30s

We are also anticipating heavier supply in long ends in general as deficits blossom. Yet PEPP plans so far have not announced buying intentions beyond the 31y maturity limit

We are looking for forward rate structures where we can receive the 10y20y at a rate higher than the 30y20y – fwd rate steepeners

An approximation of the fwd rate steepener would be the butterfly:

-10y +30y -50y

-0.15 / +1 / -0.85

CIX: 200 * (YIELD[FRTR 1.5 05/25/50 Corp] - 0.15 * YIELD[FRTR 0.5 05/25/29 Corp] - 0.85 * YIELD[FRTR 1.75 05/25/66 Corp])

*Weighted as per the gradient of the fitted curve

Using the OATA Futures (Ctd May29) for the short bond

Levels:

Current: +9.3bp

Entry: +8.5bp

Add: +10.5bp

Target: +1bp

Target where the forward curve is mildly upward sloping as per Spain & Italy – (arguably as weaker credits they could be flatter)

Graph of Butterfly

Carry: +0.2bp /3mo @repo spread od 10bp

Roll: -0.1bp /3mo

Forwards (with Spanish Bonds as a reference)

Correlations / Regressions

the 30y20y has a string correlation to the 10y20y

BBG stats on CMB (1y Data)

Beta: 104%

R2: 0.965

Graph of residual

Graph of Regression

Risks:

- as an ongoing supply point, the 2050 stays offered (next long supply is Thursday 2nd April: Nov28, Nov29 and Jun39)

- Oat contracts & 66s get richer on the curve

If you’d like to see the US stuff or more on these themes drop me a line

James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar #1

Trade #1 on my Radar

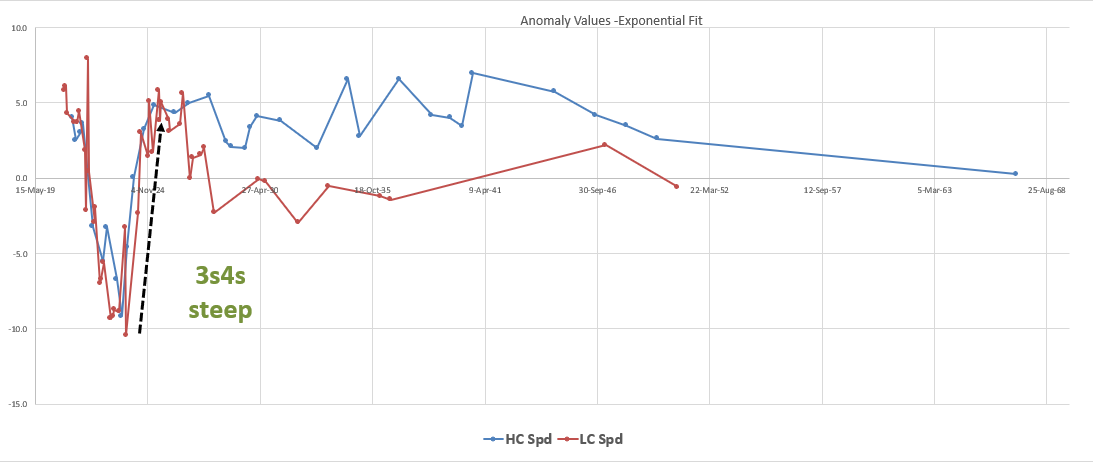

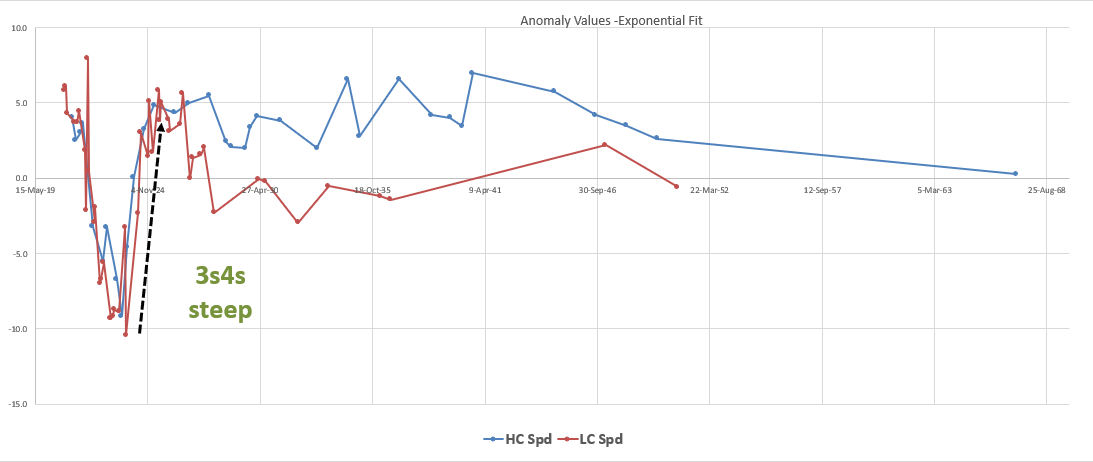

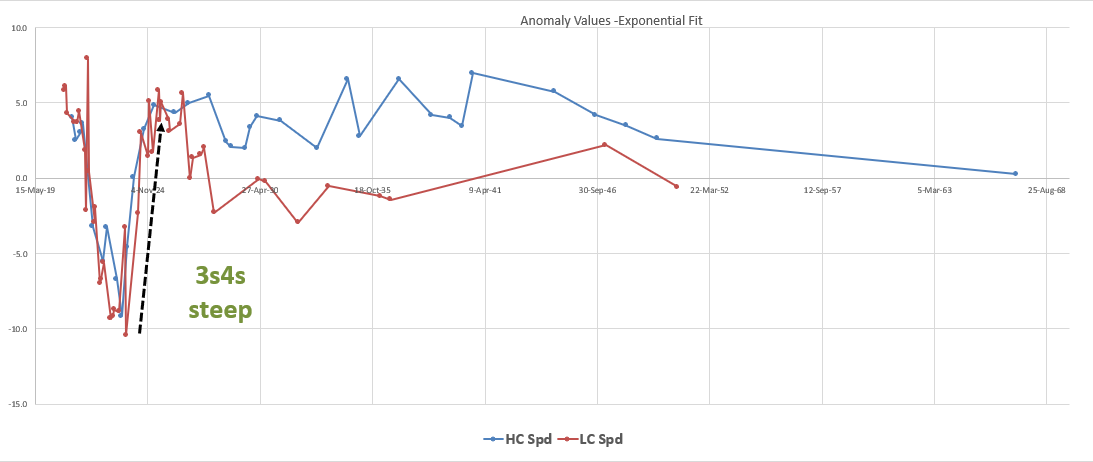

Italy 3s4s gets stretched, 3y1y forward cheap to IK futures

Structure

- Sell LC Btps 0.65% Oct23, Buy Btps 2.5% Dec24, Sell IK futs

- Weights: -0.75 / +1 / -0.25

- CIX: 200 * (YIELD[BTPS 2.5 12/01/24 Corp] - 0.75 * YIELD[BTPS 0.65 10/15/23 Corp] - 0.25 * YIELD[BTPS 3 08/01/29 Corp])

- Current: +22bp

- Target: +8bp

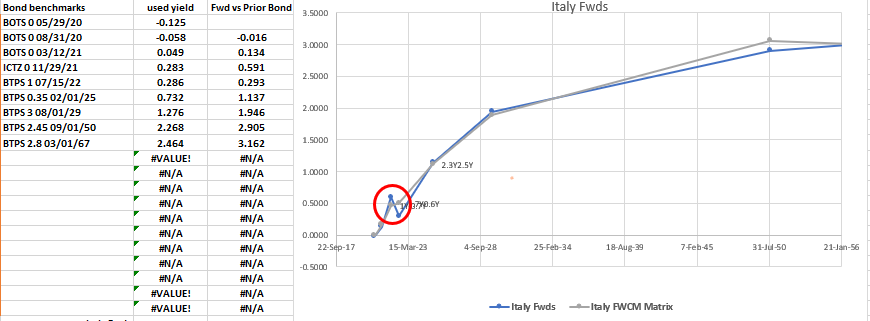

Rationale

- In the recent rally curve longs have left the 5y segment offered

- Similarly the rally has been led by the 2y & 3y (BTSA Ctd => jul22) as the BOI fought to sustain the level of the 2y - *Bank of Italy exchange transaction issued Oct23, May24, and Nov24 vs Buying Jul22 on 20th March

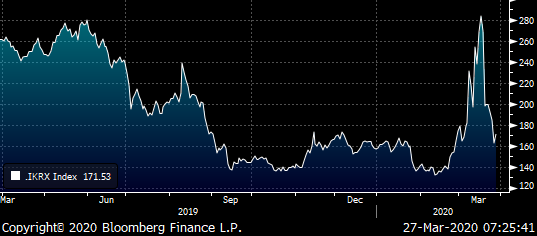

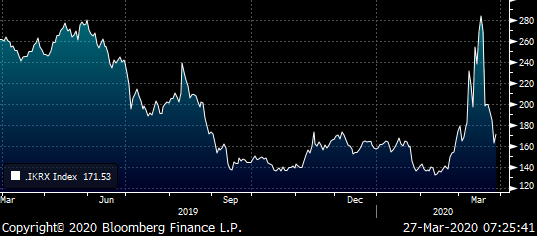

- The credit environment is now one of ‘whatever it takes’ – so we wish to buy shorter forwards at levels as cheap as or close to longer ones – 3y1y is almost as high as the 5y5y (using IK). This flatness to the curve is redolent of an ik/rx spread > +250bp not the current +168bp

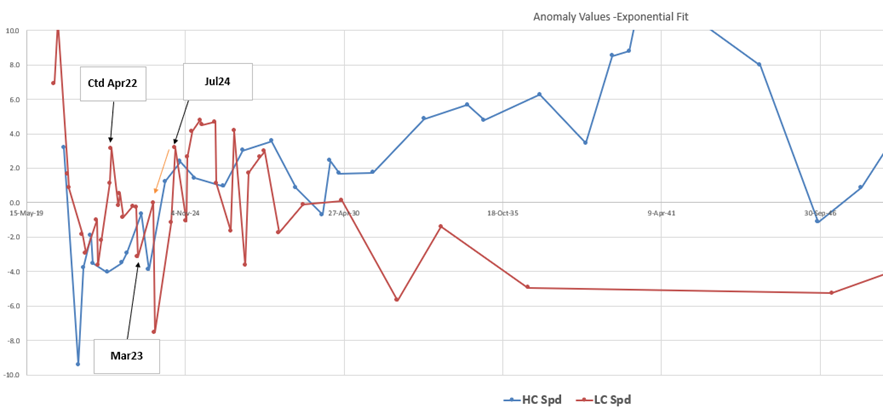

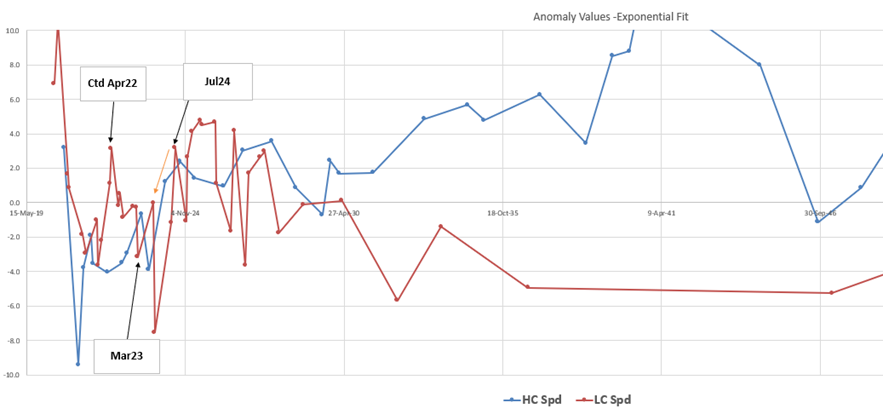

Graph of Forward rates (including smooth fwds from FWCM on BBG)

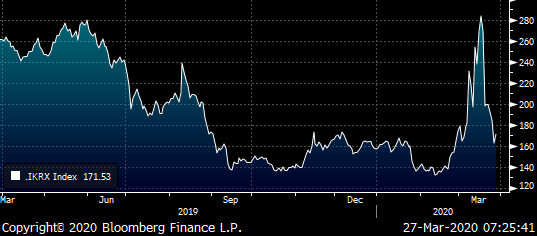

Graph IK/RX spread – Italy vs Germany 10y tenor

- Anomalies vs a fitted curve show 3s4s to be the greatest anomaly

Trade Properties

- Weightings: based on the shape of the fitted curve – 3x the weighting in the front leg vs the back

- Carry: -0.3bp /3mo using 15bp spread

- Roll: Flat

Risks

- Oct23 as a low coupon preserve an anomaly bid

- The Dec24 stay offered, (feb25 5y supply on Tuesday 31st March)

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar #1

Trade #1 on my Radar

Italy 3s4s gets stretched, 3y1y forward cheap to IK futures

Structure

- Sell LC Btps 0.65% Oct23, Buy Btps 2.5% Dec24, Sell IK futs

- Weights: -0.75 / +1 / -0.25

- CIX: 200 * (YIELD[BTPS 2.5 12/01/24 Corp] - 0.75 * YIELD[BTPS 0.65 10/15/23 Corp] - 0.25 * YIELD[BTPS 3 08/01/29 Corp])

- Current: +22bp

- Target: +8bp

Rationale

- In the recent rally curve longs have left the 5y segment offered

- Similarly the rally has been led by the 2y & 3y (BTSA Ctd => jul22) as the BOI fought to sustain the level of the 2y - *Bank of Italy exchange transaction issued Oct23, May24, and Nov24 vs Buying Jul22 on 20th March

- The credit environment is now one of ‘whatever it takes’ – so we wish to buy shorter forwards at levels as cheap as or close to longer ones – 3y1y is almost as high as the 5y5y (using IK). This flatness to the curve is redolent of an ik/rx spread > +250bp not the current +168bp

Graph of Forward rates (including smooth fwds from FWCM on BBG)

Graph IK/RX spread – Italy vs Germany 10y tenor

- Anomalies vs a fitted curve show 3s4s to be the greatest anomaly

Trade Properties

- Weightings: based on the shape of the fitted curve – 3x the weighting in the front leg vs the back

- Carry: -0.3bp /3mo using 15bp spread

- Roll: Flat

Risks

- Oct23 as a low coupon preserve an anomaly bid

- The Dec24 stay offered, (feb25 5y supply on Tuesday 31st March)

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Recall: Trade Radar, James Rice @Astor Ridge

James Rice would like to recall the message, "Trade Radar, James Rice @Astor Ridge".

Trade Radar, James Rice @Astor Ridge

Trade #1 on my Radar

Italy 3s4s gets stretched, 3y1y forward cheap to IK futures

Structure

- Sell LC Btps 0.65% Oct23, Buy Btps 2.5% Dec24, Sell IK futs

- Weights: -0.75 / +1 / -0.25

- CIX: 200 * (YIELD[BTPS 2.5 12/01/24 Corp] - 0.75 * YIELD[BTPS 0.65 10/15/23 Corp] - 0.25 * YIELD[BTPS 3 08/01/29 Corp])

- Current: +22bp

- Target: +8bp

Rationale

- In the recent rally curve longs have left the 5y segment offered

- Similarly the rally has been led by the 2y & 3y (BTSA Ctd => jul22) as the BOI fought to sustain the level of the 2y - *Bank of Italy exchange transaction issued Oct23, May24, and Nov24 vs Buying Jul22 on 20th March

- The credit environment is now one of ‘whatever it takes’ – so we wish to buy shorter forwards at levels as cheap as or close to longer ones – 3y1y is almost as high as the 5y5y (using IK). This flatness to the curve is redolent of an ik/rx spread > +250bp not the current +168bp

Graph of Forward rates (including smooth fwds from FWCM on BBG)

Graph IK/RX spread – Italy vs Germany 10y tenor

- Anomalies vs a fitted curve show 3s4s to be the greatest anomaly

Trade Properties

- Weightings: based on the shape of the fitted curve – 3x the weighting in the front leg vs the back

- Carry: -0.3bp /3mo using 15bp spread

- Roll: Flat

Risks

- Oct23 as a low coupon preserve an anomaly bid

- The Dec24 stay offered, (feb25 5y supply on Tuesday 31st March)

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Euro Spain Trade, James Rice @Astor Ridge

Trade Radar

Spain +7y -13y, looks ok at -41bp, best location @-36bp

+Spgb Apr27, -Spgb Jul33

I’d, have a little here, but to make the forward flat vs 5y2y, I would need the 27ss to be only -36bp vs the 27s, which explains the recent narrow in the yield spread…

Forwards…

And essentially that’s why I really like the -Apr30 +Apr27 steepener….

Best – keep firing requests, here to get whatever you need done

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FW: Trade Radar - Italy announces Q1 New Issues - James Rice @Astor Ridge

Amendment: Oct21/Apr22 fwd is 0.612% as per the table

Italy announces two New Issues for Q1 2020….

New bonds to be issued The Ministry of Economy and Finance announces that during the first quarter of 2020 the following new securities will be issued:

BTP 3 years - maturity 06/15/2023 Minimum final outstanding: 9 billion Euros

BTP 10 years - maturity 08/01/2030 Minimum final outstanding: 12 billion Euros

Trade:

Fade the richness of old 3y, Mar23 vs cheap Italian 2y contract (BTSA)

Graph:

-2 X Mar23 +Apr22 +Jul24

200 * (YIELD[BTPS 0.95 03/15/23 Corp] - 0.5 * YIELD[BTPS 1.2 04/01/22 Corp] - 0.5 * YIELD[BTPS 1.75 07/01/24 Corp])

Structure:

Sell -€157MM (€50k /01) Btps 0.85% Mar-01-23

&

Buy +997 contracts of BTSA (€25k /01) (Italian 2y, CTD Btps 1.2% Apr22)

Buy €55MM (€25k /01) Btps 1.75% Jul24

Levels:

Current: @-14.5bp (Pay the belly)

First Target: -9bp (‘fair on forwards curve’)

Add: -17bp

Rationale:

- Apr22 CTD to 2y Italy are cheap due to hedging pressure in sell-off – this has to be unwound and is not a permanent diminution of its value

- Mar23 are rich and surf into cheap sector of Btp curve

- New Jun23 issue this quarter will be hedged with further selling in the old 3y Mar23

- The Jul24 are an old 5yr that roll well into untapped sector

Anomaly Graph (Btps):

Roll & Carry:

Carry: +0.2bp /3mo @-5bp repo spread

Roll: flat

Risks:

- Mar23 stay anomalous

- The Bts contract stays cheap

- An strong bid for Italian debt causes all bullets to outperform wings

Forwards:

Implied Forwards between Italian Bonds

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - Italy announces Q1 New Issues - James Rice @Astor Ridge

Italy announces two New Issues for Q1 2020….

New bonds to be issued The Ministry of Economy and Finance announces that during the first quarter of 2020 the following new securities will be issued:

BTP 3 years - maturity 06/15/2023 Minimum final outstanding: 9 billion Euros

BTP 10 years - maturity 08/01/2030 Minimum final outstanding: 12 billion Euros

Trade:

Fade the richness of old 3y, Mar23 vs cheap Italian 2y contract (BTSA)

Graph:

-2 X Mar23 +Apr22 +Jul24

200 * (YIELD[BTPS 0.95 03/15/23 Corp] - 0.5 * YIELD[BTPS 1.2 04/01/22 Corp] - 0.5 * YIELD[BTPS 1.75 07/01/24 Corp])

Structure:

Sell -€157MM (€50k /01) Btps 0.85% Mar-01-23

&

Buy +997 contracts of BTSA (€25k /01) (Italian 2y, CTD Btps 1.2% Apr22)

Buy €55MM (€25k /01) Btps 1.75% Jul24

Levels:

Current: @-14.5bp (Pay the belly)

First Target: -9bp (‘fair on forwards curve’)

Add: -17bp

Rationale:

- Apr22 CTD to 2y Italy are cheap due to hedging pressure in sell-off – this has to be unwound and is not a permanent diminution of its value

- Mar23 are rich and surf into cheap sector of Btp curve

- New Jun23 issue this quarter will be hedged with further selling in the old 3y Mar23

- The Jul24 are an old 5yr that roll well into untapped sector

Anomaly Graph (Btps):

Roll & Carry:

Carry: +0.2bp /3mo @-5bp repo spread

Roll: flat

Risks:

- Mar23 stay anomalous

- The Bts contract stays cheap

- An strong bid for Italian debt causes all bullets to outperform wings

Forwards:

Implied Forwards between Italian Bonds

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - James Rice @Astor Ridge, Xmas and the New Year

Trade Radar – Just a few things worth fading….

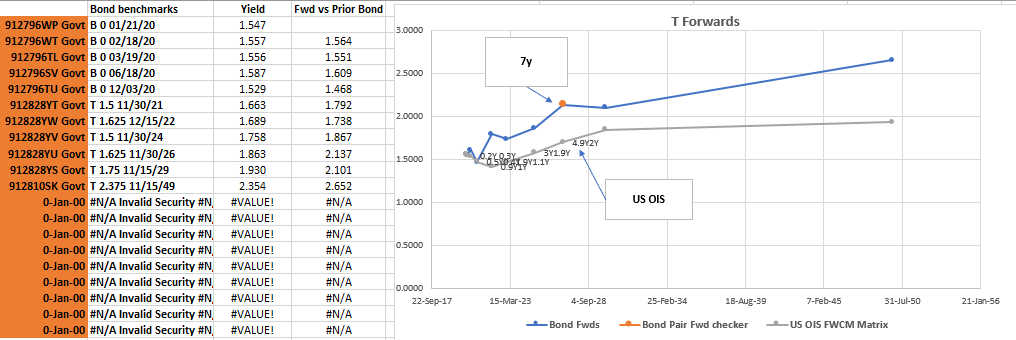

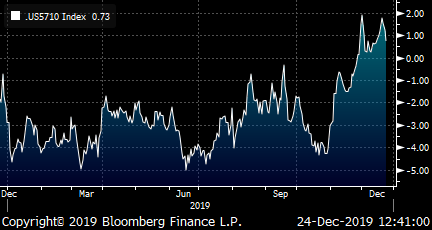

US 5s7s10s – Receive 7y

Forwards

History:

2 * 7y - 5y - 10y

100 * (2 * RV0001P 7Y BLC Curncy - RV0001P 5Y BLC Curncy - RV0001P 10Y BLC Curncy)

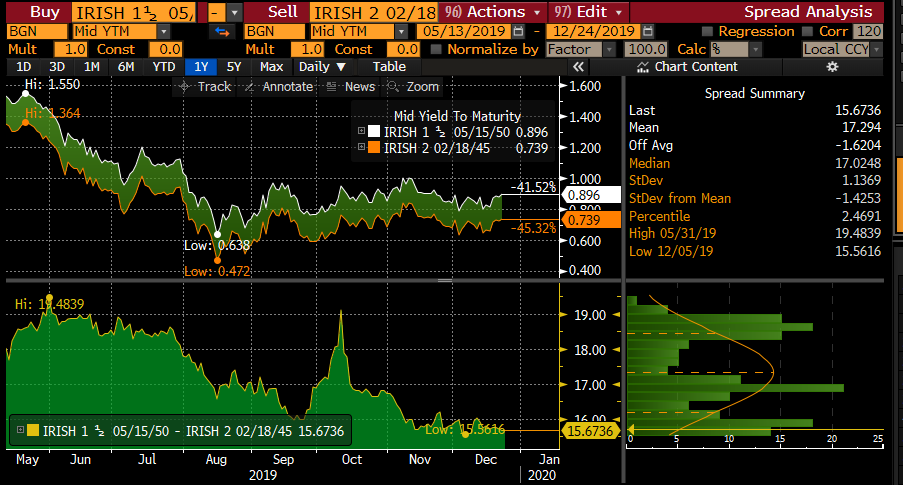

Irish Flattener 45s50s

Irish 45s50s forward still over France equivalent whereas close to flat elsewhere

As Ireland has compressed to France in Spot and Forward space - the anomaly Irish 45s into Irish 50s looks too steep (fwd too high – 45s rich)

This trade has moved flatter – but go with this momentum…

And Forwards suggest it’s still too steep…

Vs France…

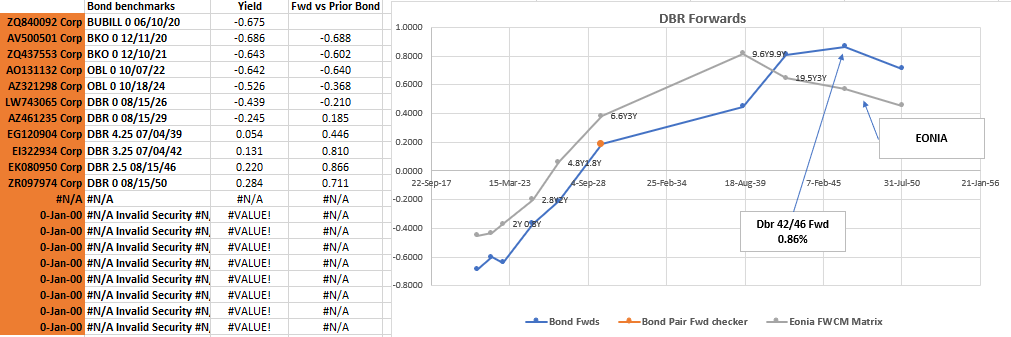

- German Flattener 42s 46s – long forwards suggest that the 20s25s segment of the curve is still too steep – the Eonia/swap curve has seen a decent inversion in longer tenors, which implies a strong bid for convexity

Supply…

With only the 2044s, 2048s and the 2050s planned to be tapped next year – the 42s 46s spread is a decent way to play this – spread is on the low but I think relative to the rest of the curve this could move lower – vs MMS it may insulate from generic curve moves

Yield Spread

Vs MMS

Forwards vs Eonia…

Let me know!!!!

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

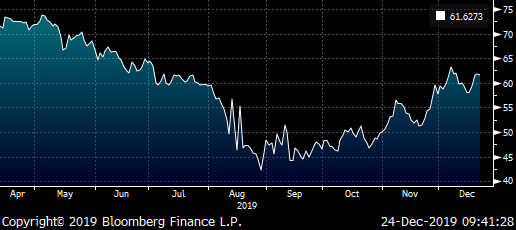

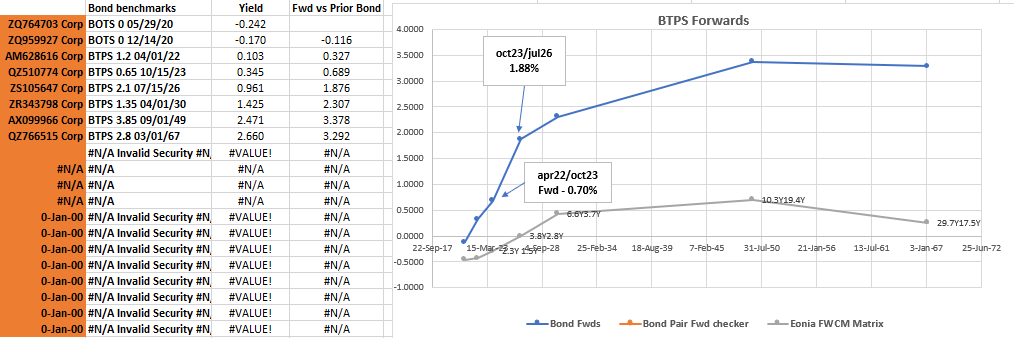

Trade Radar Italy flattener 4s7s- James Rice @Astor Ridge, Xmas and the New Year

Trade Radar – Xmas and New Year & beyond

Italy – 5y and 10y supply

€ 4.5Bln approx. 5s & 10s coming on Monday 30th December – fade the steepening in Italy 4s7s

Trade

Flattener, Sell Btps LC 0.65% Oct23 to Buy Btps 2.1% Jul26

Graph

100 * (YIELD[BTPS 2.1 07/15/26 Corp] - YIELD[BTPS 0.65 10/15/23 Corp])

Levels

Current: @ +61.5bp

Entry: @ +64bp

Carry & Roll

Carry: -0.3bp /3mo @same repo

Roll: -0.9bp /3mo

Rationale

- Forwards starting to look high in the 4y3y and with Year end on the agenda the roll is starting to look interesting

- The entry level is chosen at a level where the forwards look even more dislocated

- The 4y3y forward is 1.88% (feb25/jul26), which rolls to 1.20% (2y3y,Apr22/feb25) in 2 years’ time

- The LC Oct23 trades rich on both yield and default space

- Further widening in Italy could be at the detriment of shorter maturities relative to longer tenors. As credit fears could return despite yield value in the long end

Forwards

Friction

Full Bid offer on screens showing at 3bp

Entry on an order, estimate 1.5bp – 2bp friction on exit when trading terms

Risks

- Oct23 may stay bid

- Jul26 as an old 7y remain offered sue to ongoing supply in that sector

- Repo on Oct23 goes expensive vs GC

More to follow…

But have a great Chrimbo and drop me a note if you’re around!

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796