Trade Radar - James Rice, Dec 17th

Trade Radar – Euro RV

Italy

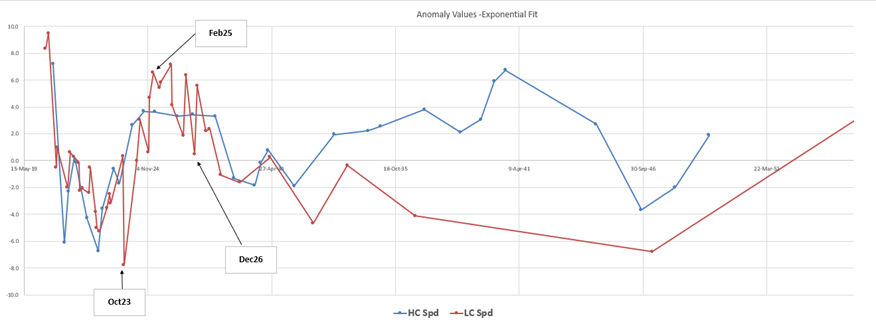

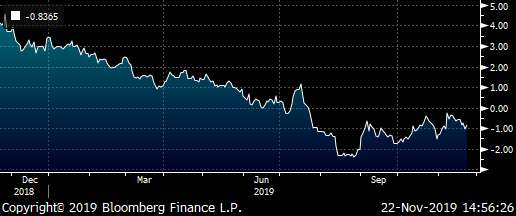

-LCoct23 +feb25 -dec26

receive the belly

@+13.3bp

like it here, recent high > +15bp

Potential to roll to < +5bp in medium term

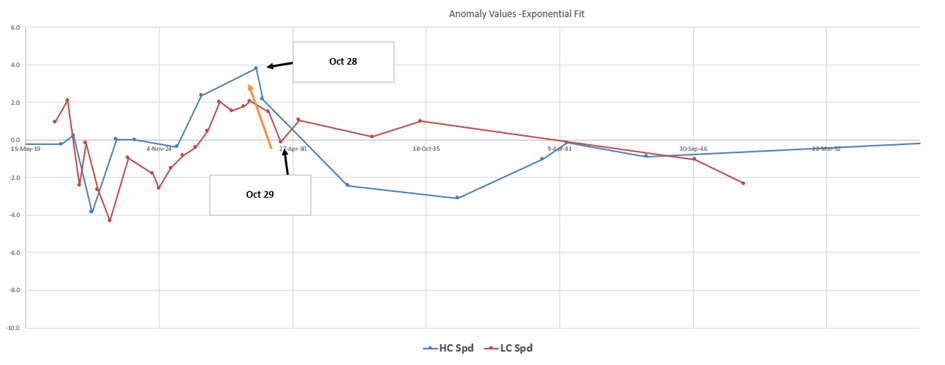

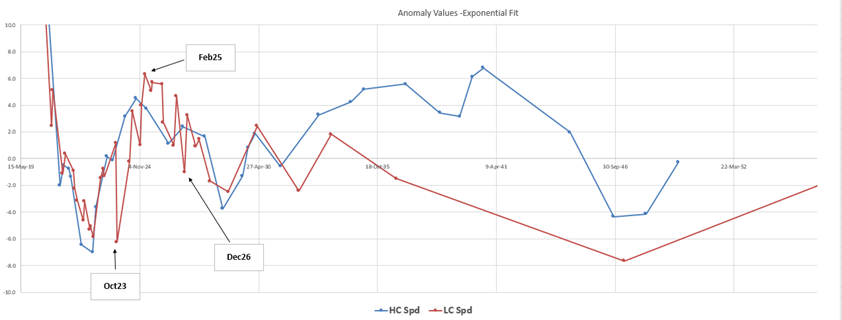

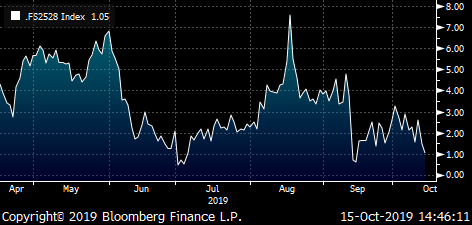

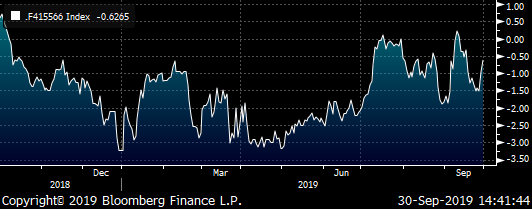

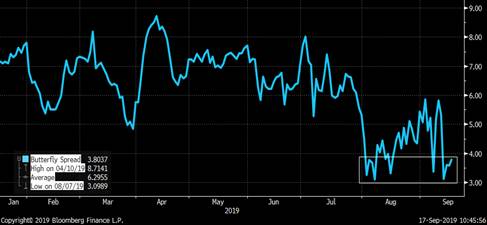

Anomaly Values on Fitted curve

BBG History

200 * (YIELD[BTPS 0.35 02/01/25 Corp] - 0.5 * YIELD[BTPS 0.65 10/15/23 Corp] - 0.5 * YIELD[BTPS 1.25 12/01/26 Corp])

2)

UK

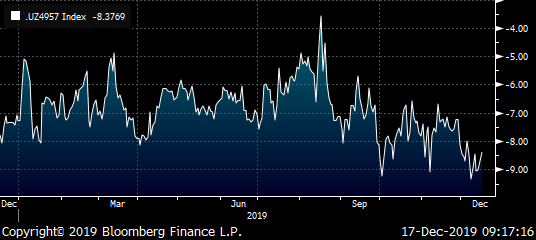

+1t49 -1t57 vs Sonia

Yield spread is so inverted that the forward is approximately flat to the Sonia Curve yet other bonds are Sonia Plus

Currently: +8.3bp

Looking for close to +9bp

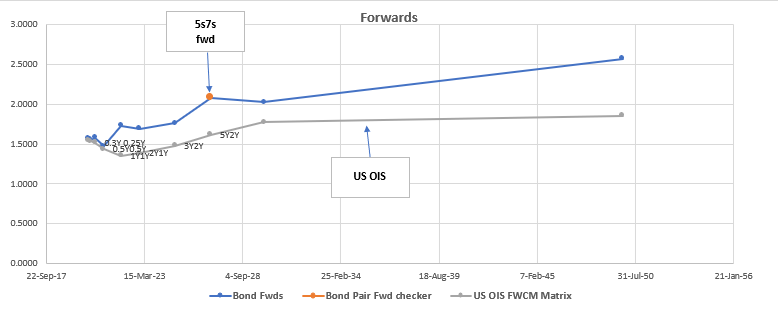

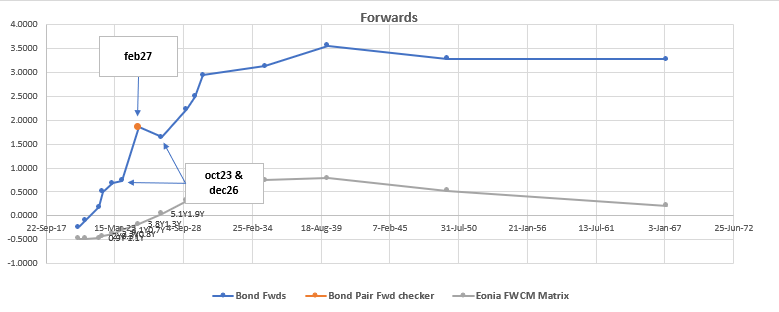

UKT Forwards Curve…

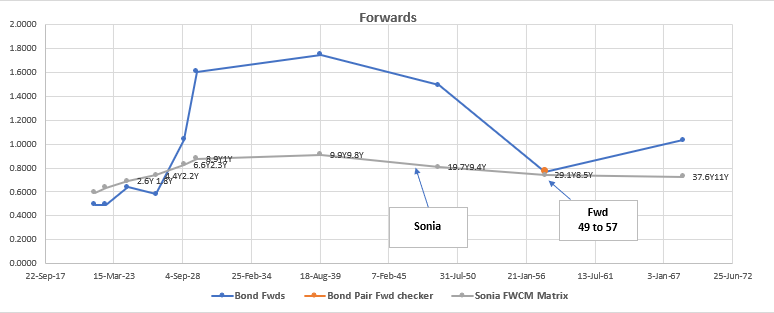

UK Bond Curve – Bonds Vs Sonia

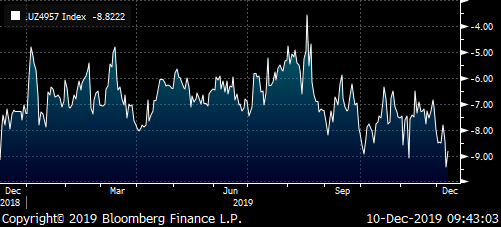

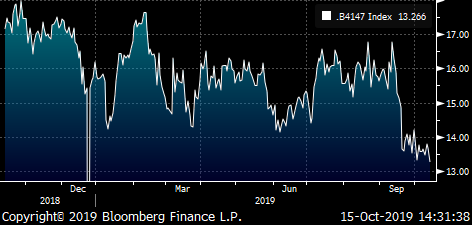

History of swap spreads

(SP037[UKT 1.75 07/22/57 Corp] - SP037[UKT 1.75 01/22/49 Corp])

3)

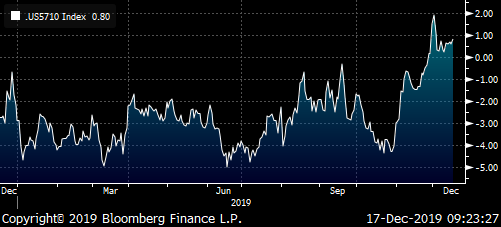

US

-5s +7s -10s

Underperformance of the 7yr point leaves forward looking at little out of what and the 7y cheap

Forwards curve…

History of constant Maturity Bonds (Bloomberg)

100 * (2 * RV0001P 7Y BLC Curncy - RV0001P 5Y BLC Curncy - RV0001P 10Y BLC Curncy)

More details on levels, etc on request

Best

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - Euro RV Dec 10th, James Rice @Astor Ridge

Euro RV – like this trade in Italian RV & UK Sonia Trade

Trade Radar – 1

Italian 5years remain cheap

Trade Structure

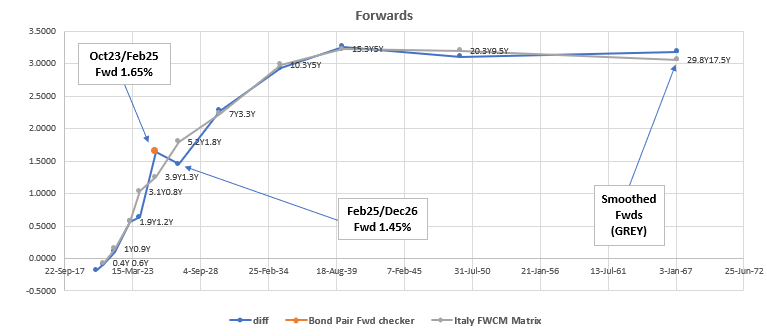

{IT} Italy

-LowCpn Oct23 / +feb25/ -Dec26

Weights (2x middle) : -.5 / +1 / -.5

Levels

Current Fly level: +14.2bp

Entry: +13.5bp

Add: +17bp

Target short term: +6bp

Target long term: -5bp

Rationale

- Feb25 and 5yrs in general trading cheap ahead of Xmas and light dealer inventories

- Low coupon Oct23 now represent an anomaly that is as rich as the 2yr sector

- Previously sought after low coupons (oct23 and dec26) can be supplanted by recent low coupons in a default/widening scenario

- The relative forwards suggest this anomaly is among the most extreme in the context of the curve

Carry and Roll

Carry: +0.4bp @ 5bp repo spread

Roll: 0bp

Cix (2x middle, x100 to make it basis points):

(YIELD[BTPS 0.35 02/01/25 Corp] - 0.5 * YIELD[BTPS 0.65 10/15/23 Corp] - 0.5 * YIELD[BTPS 1.25 12/01/26 Corp])

BBG History

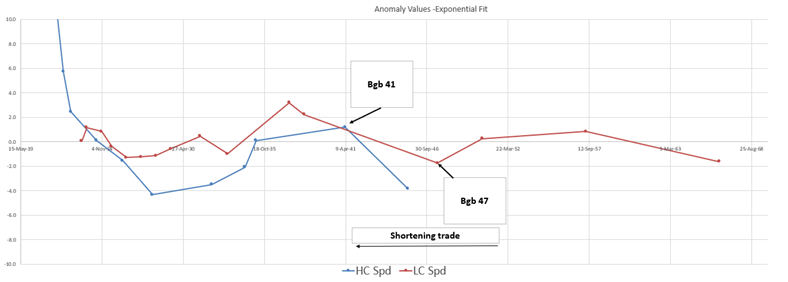

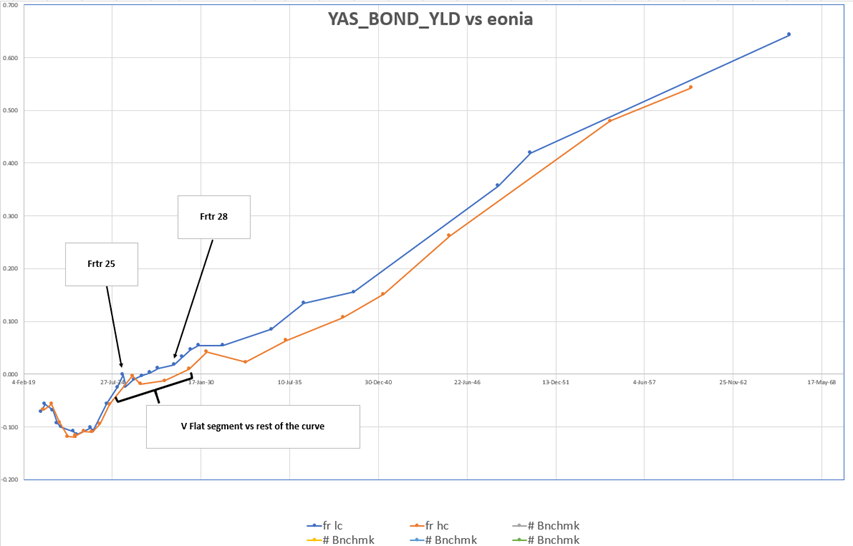

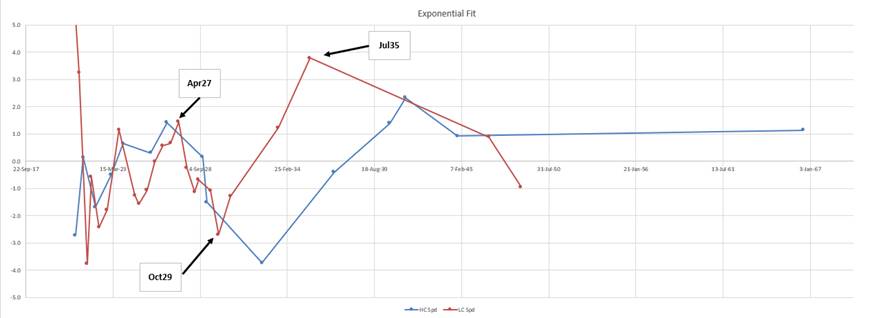

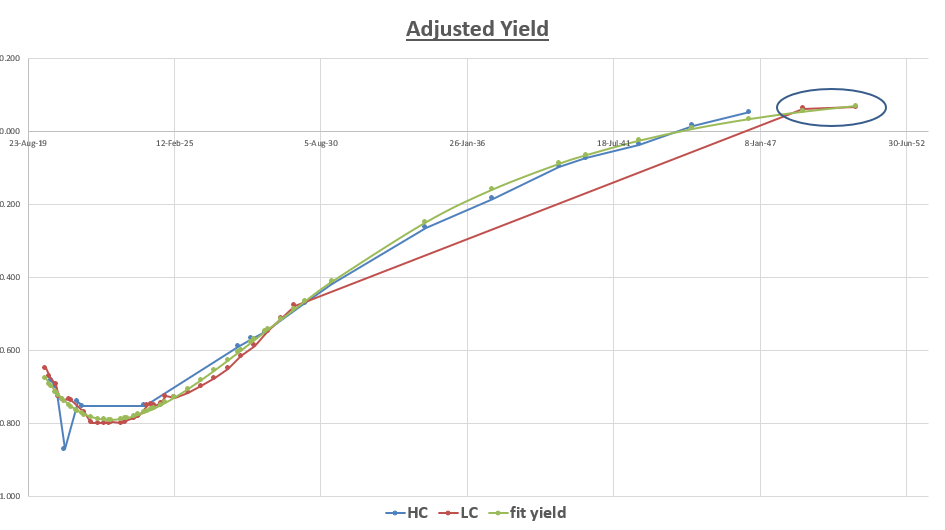

Italian anomaly curve fit

Italy Forward Curve

Unadjusted yields – looks more extreme when we compensate for coupon

Risks

- As a tap bond the feb25 stay offered

- The oct23 and dec26 stay rich as anomalous and well-placed issues

- The repo on the short sides gets sticky over yr end or beyond

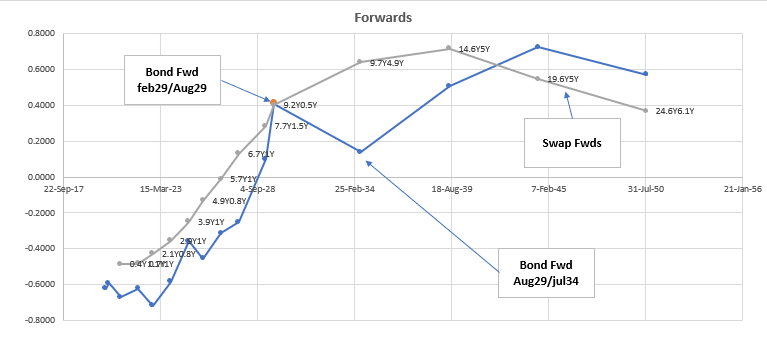

UK – 30s40s looks too inverted, forcing the forward to Sonia levels

Trade Structure

{GB} UK

+UKT 1.75% 49 / -UKT 1.75% 57

vs MMS (Sonia)

Weights : +1 / -1

Levels

Current Spd vs MMS: +9bp

Entry: +8.5bp

Add: +11bp

Target: +4bp

Rationale

- 57s have outperformed in yield and swap space with buying in that sector

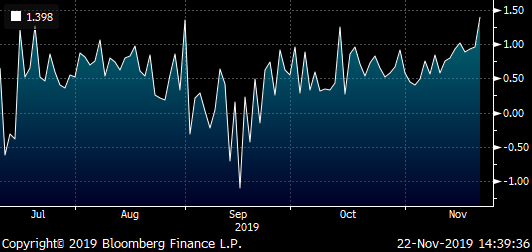

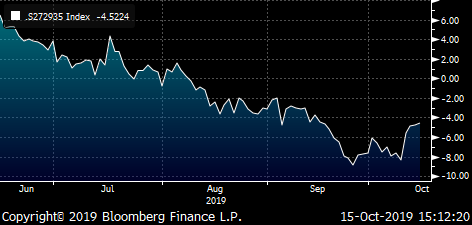

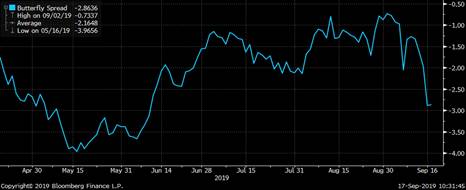

BBG spread history +57s -49s

(YIELD[UKT 1.75 07/22/57 Corp] - YIELD[UKT 1.75 01/22/49 Corp])

- The 57s are so rich now that the forward (29Y8.5Y) is now down to Sonia levels – fwd. 0.77%, Sonia for that term is 0.74% (+3bp to Sonia)

- The 57s roll to ma much cheaper part of the curve (30yrs) – for example the 20Y10Y is +68bp to Sonia

- The relative forwards suggest this anomaly is among the most extreme in the context of the curve –

- The spread of spreads history is at the best levels

(SP210[UKT 1.75 07/22/57 Corp] - SP210[UKT 1.75 01/22/49 Corp])

*sp210 is BBG code for swap spread

- There is some talk of a new 65 in feb or reopening 71s via syndication, which could re-steepen the bond curve

Risks

- 57s stay anomalously rich

- The 49s stay offered

- The repo on the short sides gets sticky over yr end or beyond

Any feedback, always grateful

Thanks

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - Euro RV Dec 5th, James Rice @Astor Ridge

Trade Radar - 1

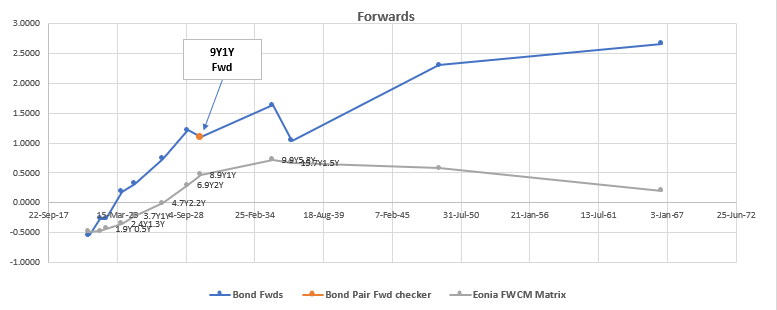

Spanish 9yr oversold, high coupon funds well… cheap vs 10y

Trade structure

Buy Spgb 5.15% Oct28

Sell Spgb 0.6% Oct 29

vs MMS

Trade level

Current: -1bp

Target -5bp

History

BBG 28s 29s vs MMS

Rationale

- The high coupon oct 28 is oversold in terms of anomaly

- The forward 9Y1Y forward (between the two bonds) now looks too low in the context of the yield curve

- The high coupon Oct28 funds positively relative to the LC on the run 10y, which could be tapped again in the new yr (issue size €19bln, prior 10y €21bln)

Spain anomaly curve fit

(* Yields adjusted for coupon by subtracting swap spread and adding z spread)

Spain Forward Curve

Unadjusted yields – looks more extreme when we compensate for coupon

Risks

- The oct28 as a high coupon less liquid bond stay offered

- The Oct29 stay bid as a benchmark over the year end

- The repo gets tight on the Spgb Oct29

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

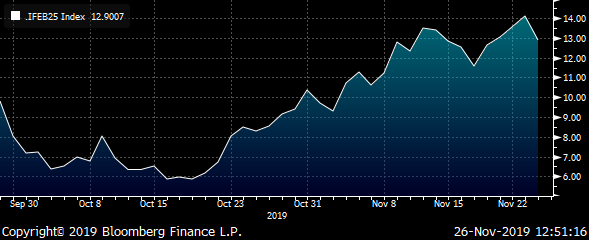

Trade Radar 2 - RV trades in Europe 26th Nov, James Rice @Astor Ridge

Trade – {IT} Italy... - Absorbing cheap 5y Italian supply on Thursday

5s are cheap on the curve and in micro too.,,

Italy taps the 0.35% feb25 along with the 10y on Thursday

Trade Structure

The anomaly

{IT} Italy

-LowCpn Oct23/+feb25/-Dec26

Weights (x2) : -.5 / +1 / -.5

Cix (x 200): (YIELD[BTPS 0.35 02/01/25 Corp] - 0.5 * YIELD[BTPS 0.65 10/15/23 Corp] - 0.5 * YIELD[BTPS 1.25 12/01/26 Corp])

BBG history

Bond forwards vs Eonia Forwards (using relative bond maturities for exact comparison)

Swap forwards are for Eonia (BBG Page - FWCM)

Rationale

- Feb25 and 5yrs in general trading cheap ahead of Thanksgiving and light dealer inventories

- Low coupon Oct23 now represent an anomaly that is as rich as the 2yr sector

- Previously sought after low coupons (oct23 and dec26) can be supplanted by recent low coupons in a default/widening scenario

- The relative forwards suggest this anomaly is among the most extreme in the context of the curve

(*forwards are calculated using the two bond yields only, assuming a flat curve structure as a first approximation)

Curve Anomaly Values:

Proprietary double exponential fit

Levels

Current Fly level: +13bp

Entry: +13bp

Add: +17bp

Target short term: +6bp

Target long term: -5bp

Carry and Roll

Carry: +0.4bp @ 5bp repo spread

Roll: 0bp

Risks

- As a tap bond the feb25 stay offered

- The oct23 and dec26 stay rich as anomalous and well-placed issues

- The repo on the short sides gets sticky over yr end or beyond

Any feedback is welcome

Speak Soon

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - RV trades in Europe 26th Nov, James Rice @Astor Ridge

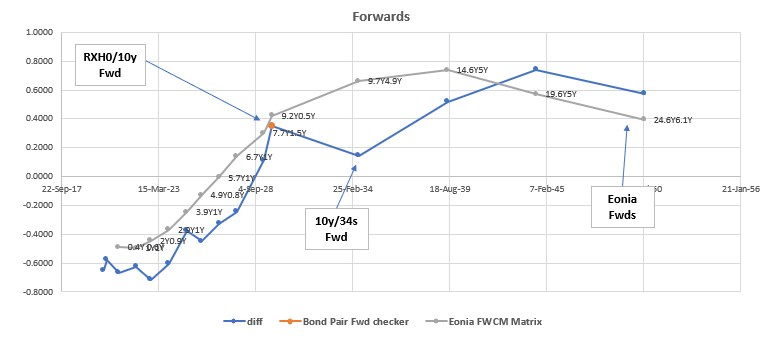

Trade – Steep supply gradient is forcing the 9Y6M bond forward* too close to Eonia…

(*Bond forwards are calculated from yields – discounting using the first and the second yield only)

Trade Structure

Sell dbr Feb29 & dbr Jul34

Buy dbr Aug29

Weights: -0.9 / +1 / -0.1

Cix: 200 * (yield[DBR 0 08/15/29 Govt]-0.9*yield[DBR 0.25 02/15/29 Govt]-0.1*yield[DBR 4.75 07/04/34 Govt])

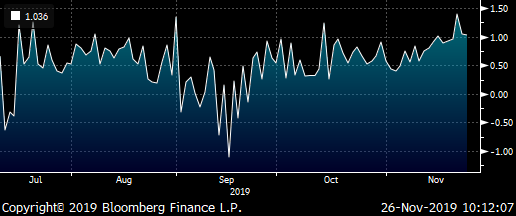

BBG history

Bond forwards vs Eonia Forwards (using relative bond maturities for exact comparison)

Swap forwards are for Eonia (BBG Page - FWCM)

Rationale

The supply profile of negative yielding bonds in Germany forces the on the run segment to be cheap and 9s10s to be very steep

RV in Europe is often a ‘clean-up in aisle 3’ exercise, where we need to find the boundary condition for cheap, recent issues

- The Aug29 will be tapped by €3bln on the 4th Dec – This year the Finanzagentur started 2019 with a new 10y. Similarly we expect in January 2020 a new 10y, allowing the Aug29 to roll down the curve with only this one last tap event

- Cash / repo often gets tight over year end – hence the optimal expression of this trade is to sell Back Month RX (RXH0 – ctd feb29) & Dbr jul34 as a blend vs the long of Dbr Aug29

- The dbr jul34 as it heads into the 25y space starts to look rich vs the extrapolation of shorter tenors, but is a relatively small component of the short blend

- Other expressions would be -RXH0 +dbr Aug29 vs MMS – see graph

- On the run 10y has the capacity to be scarce in December with a lighter issuance schedule

Cix: (SP210[DBR 0 08/15/29 Corp] - SP210[DBR 0.25 02/15/29 Corp])

SP210 is the BBG code for Swap spread (MMS)

- If we look at how this has behaved in the past – (a 6m Gap vs HC 15y trade) that would be 3.5yrs shorter…

-Aug25 / +Feb26 / -Jan31

This fly is currently -0.8bp and evolved as follows…

Hence the Long Terms target of -1bp

Levels

Current Fly level: +4.1bp

Entry: +3.8bp

Add: +5bp

Target short term: +2bp

Target Long Term: -0.5bp

Carry and Roll

Carry: +0.1bp @same repo

Roll: 0bp

Risks

- Back month contracts stay bid into December and beyond

- The on the run ten year stays cheap

Any feedback is most welcome

Speak Soon

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - RV trades in Europe, James Rice @Astor Ridge

Trade – Steep supply gradient is forcing the 9Y6M bond forward* too close to Eonia…

(*Bond forwards are calculated from yields – discounting using the first and the second yield only)

Trade Structure

Sell dbr Feb29 & dbr Jul34

Buy dbr Aug29

Weights: -0.9 / +1 / -0.1

Cix: 200 * (yield[DBR 0 08/15/29 Govt]-0.9*yield[DBR 0.25 02/15/29 Govt]-0.1*yield[DBR 4.75 07/04/34 Govt])

BBG history

Bond forwards vs Eonia Forwards (using relative bond maturities for exact comparison)

Swap forwards are for Eonia (BBG Page - FWCM)

Rationale

The supply profile of negative yielding bonds in Germany forces the on the run segment to be cheap and 9s10s to be very steep

RV in Europe is often a ‘clean-up in aisle 3’ exercise, where we need to find the boundary condition for cheap, recent issues

- The Aug29 will be tapped by €3bln on the 4th Dec – This year the Finanzagentur started 2019 with a new 10y. Similarly we expect in January 2020 a new 10y, allowing the Aug29 to roll down the curve with only this one last tap event

- Cash / repo often gets tight over year end – hence the optimal expression of this trade is to sell Back Month RX (RXH0 – ctd feb29) & Dbr jul34 as a blend vs the long of Dbr Aug29

- The dbr jul34 as it heads into the 25y space starts to look rich vs the extrapolation of shorter tenors, but is a relatively small component of the short blend

- Other expressions would be -RXH0 +dbr Aug29 vs MMS – see graph

- On the run 10y has the capacity to be scarce in December with a lighter issuance schedule

Cix: (SP210[DBR 0 08/15/29 Corp] - SP210[DBR 0.25 02/15/29 Corp])

SP210 is the BBG code for Swap spread (MMS)

- If we look at how this has behaved in the past – (a 6m Gap vs HC 15y trade) that would be 3.5yrs shorter…

-Aug25 / +Feb26 / -Jan31

This fly is currently -0.8bp and evolved as follows…

Hence the Long Terms target of -1bp

Levels

Current Fly level: +4.1bp

Entry: +3.8bp

Add: +5bp

Target short term: +2bp

Target Long Term: -0.5bp

Carry and Roll

Carry: +0.1bp @same repo

Roll: 0bp

Risks

- Back month contracts stay bid into December and beyond

- The on the run ten year stays cheap

Any feedback is most welcome

Speak Soon

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar: October 15th 2019

Trade Radar: 14th Oct

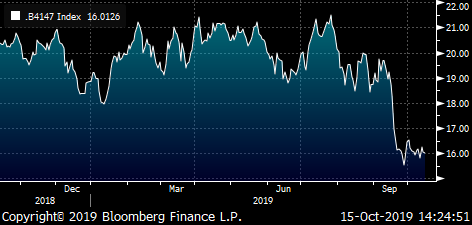

Belgium

Sell BGB 47s to buy BGB 41s @-16bp

Levels:

@-16bp

100 * (YIELD[BGB 1.6 06/22/47 Corp] - YIELD[BGB 4.25 03/28/41 Corp])

Stop @-18bp

Profit: @-20bp

Carry: +0.2bp /3mo (@5bp repo spread)

- On the run 30y trades rich

- The 41s as a high coupon is cheap

- The 41s have strong positive carry due to their high coupon

- The HC 41s also have a better anomaly value when viewed on a ‘Z’ style basis - (high coupons have enhanced value in a positively sloped curve vs Low)

- Trade is on recent best terms on both yield and spread of spreads

Anomalies vs Fitted Curve

History of Spread vs MMS

(SP210[BGB 1.6 06/22/47 Corp] - SP210[BGB 4.25 03/28/41 Corp]) – *erroneous data eoy 2018

Friction

- Enter on an order around -16bp yld spread

- Expect 3/4bp friction on exit

Risks

- 10s30s continues to flatten in Belgium

- The Repo on Bgb 47s starts to tighten – get expensive

France

Thursdays 2y & 5y supply has 5s10s almost flat to Eonia

SP210[FRTR 0.75 5/28 Corp] - SP210[FRTR 0 3/25 Corp]

Trade:

Buy Frtr Mar25, Sell Frtr May28

vs MMS

Level: -1bp

Target: -5bp

Stop: +1bp

French Curves (High and Low coupon vs Eonia) vs Eonia

Rationale

- 5s10s looks v flat relative the rest of the curve

- 5s10s flat historically

- 5s roll down aggressively – will prob cease tapping Q1 next yr

Risks:

- The whole French curve continues to flatten

- The Repo on the French May28s gets tight - €33,3 Bln issue

Spain

trade working

Spanish curve a ‘straight line’ – 10y rich vs 8y and 15y

Trade:

Sell Spgb Oct29

Buy 65% Apr27, Buy 35% jul35

* curve weighted according to curve shape

Cix:

200 * (YIELD[SPGB 0.6 10/31/29 Corp] - 0.65 * YIELD[SPGB 1.5 04/30/27 Corp] - 0.35 * YIELD[SPGB 1.85 07/30/35 Corp])

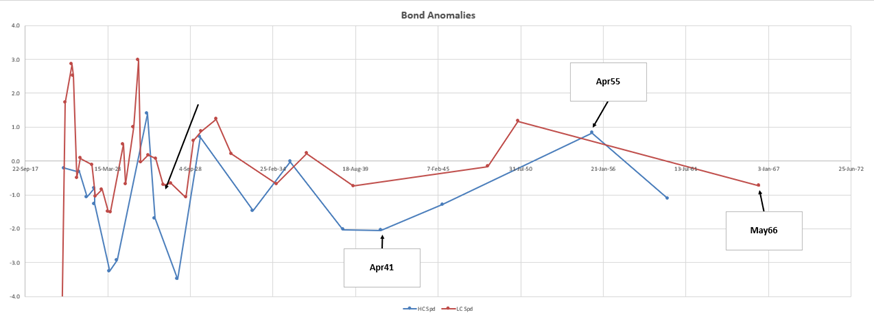

Graph of Spanish Anomalies – exponential fit to adjusted* yields

(*adjusted for coupon by removing the swap spread and adding the z-spread)

This is a trade from a couple of weeks ago – it’s working nicely and we stick with it

Rationale:

- Just looking at the shape of the Spanish curve – the rally has removed any ‘curvature’ from expectations –

- The Oct29 is €14,6bln in size, it will continue to be tapped as the prior Apr29s is €21bln in size

Risks

Oct29 stays tight on repo with no post tap ease

A continued bullish edge to Spain benefits the 10y sector more than others

Speak soon

James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar: for the week 30th September, James Rice @Astor Ridge

Trade Radar: 30th Sep – 4th Oct

Italy

High coupons at extremely stretched levels

Trade:

- Sell Mar26s High coupon old CTD

- Buy and/or Nov25s / Jul26

Cix:

200 * (YIELD[BTPS 4.5 03/01/26 Corp] - 0.55 * YIELD[BTPS 2.5 11/15/25 Corp] - 0.45 * YIELD[BTPS 2.1 07/15/26 Corp])

Rationale

- The rally in Btps vs core has lifted all the high coupons

- Valuation of the boundary condition vs Low coupons is not clear – in that at the same yield and no default, High Coupons still have extra value – due to their modified duration in an upward sloping curve

Risks

- The repo goes tight on the Mar26

- High coupons continue to outperform in a Italy credit-positive scenario

France

Thursday’s tap in Apr55’s offers chance to get cheap high coupons

Trade:

Buy Frtr Apr55s

Sell 25% Apr41, Sell 75% May66

* curve weighted according to curve shape

Cix:

200 * (YIELD[FRTR 4 04/25/55 Corp] - 0.25 * YIELD[FRTR 4.5 04/25/41 Corp] - 0.75 * YIELD[FRTR 1.75 05/25/66 Corp])

History:

Rationale

- On a fitted curve basis (*adjusting for the benefit of H/L coupons in positive curve) the Apr55s show up as cheap and conversely the May66 and Apr41 are rich

- Positive carry +0.4bp /3mo @same repo (+0.2bp @10bp repo spread)

- Apr55s are a little cheap just from supply but were possibly a request from the dealer market which may still be short

Levels

- Enter at 0bp

- Target -3.5bp (loss of relative anomaly value vs wings)

- Stop @ +2bp

Risks:

- Apr 55’s stay offered

- A much steeper curve means this level of curvature could persist

Spain

Spanish rally makes the curve a ‘straight line’ – 10y rich vs 8y and 15y

Trade:

Sell Spgb Oct29

Buy 65% Apr27, Buy 35% jul35

* curve weighted according to curve shape

Cix:

200 * (YIELD[SPGB 0.6 10/31/29 Corp] - 0.65 * YIELD[SPGB 1.5 04/30/27 Corp] - 0.35 * YIELD[SPGB 1.85 07/30/35 Corp])

Graph of Spanish Anomalies – exponential fit to adjusted* yields

(*adjusted for coupon by removing the swap spread and adding the z-spread)

Carry:

Repo has ben tight on the Spgb oct29 -

@ repo spread of -20bp the trade is -0.8bp /3mo carry – expectin gthe repo to ease with the next supply

@ same repo the trade is negative carry of -0.3bp /3mo

Rationale:

- Just looking at the shape of the Spanish curve – the rally has removed any ‘curvature’ from expectations –

- Apr27 to Oct29 is +6.3 bp /yr

Oct29 to Jul35 is +7.2bp /yr

generally the longer tenor gaps should be flatter than the shorter ones - The Oct29 is €12bln in size, it will continue to be tapped as the prior Apr29s is €21bln in size

Risks

Oct29 stays tight on repo with no post tap ease

A continued bullish edge to Spain benefits the 10y sector more than others

Hope this is interesting

Speak soon

James Rice

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FW: MICROCOSM: OATs Supply - Quick RV Thoughts/Ideas

Message from Mark here – I do see the May28 as rich in France

From: Mark Funsch <mark.funsch@astorridge.com>;

Sent: 17 September 2019 11:03

Subject: MICROCOSM: OATs Supply - Quick RV Thoughts/Ideas

OATS... SUPPLY-Driven RV

> We have a tap of the FRTR 0 3/25s and a rare tap of the FRTR 3.5 4/26 coming on Thursday.

> The market's been making room for them by cheapening both issues and their immediate neighbours.

> Take a look at the FRTR 1 11/25s vs the FRTR 0 3/25s and FRTR 0.5 5/26s fly (below). This fly has reversed course from cheap to fair-ish. If it richens another bp it's a sale into the taps.

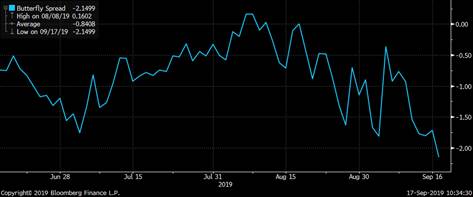

> Also - after languishing on the curve while CTD, the FRTR .75 5/28s have richened sharply post their falling out of the OATA basket. Take a look at the FRTR 5/27-5/28-5/29 fly. Given none of these issues has any repo value of consequence and the market's had a bearish bias, the richening of this fly is a tad odd.

See charts below for more pls…

FRTR 11/25 vs FRTR 0 3/25 and FRTR 0.5 5/26

FRTR .75 5/28 vs FRTR 1 5/27 and .5 5/29

These look like interesting flies into supply...

Also, take a look at FRTR 0 3/25s vs FRTR 1 11/25s sprd - Z-sprd flattening and yield sprd at its lows...

FRTR .75 5/28 vs FRTR 2.5 5/30 Z-sprd box steepening back

FRTR 1.25 34s have richened on the curve vs FRTR 2.5 5/30s and FRTR 1.75 39s

Lastly, FRTR 5/28s vs 0 3/25 and 2.5 30 fly - richer than it should be...

We'll be in touch...

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

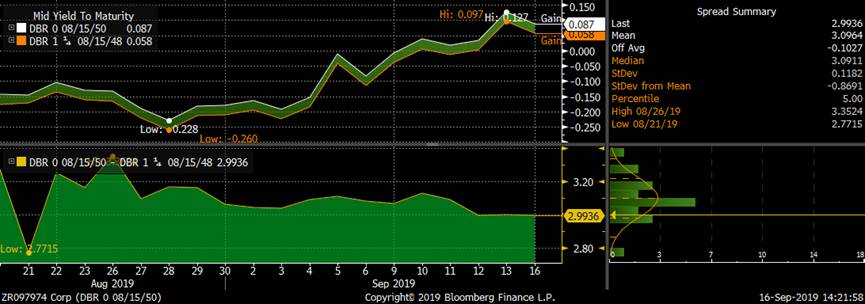

German 30y Auction: James Rice @Astor Ridge

Apols Tap is -1.5Bln

Zeros and Coupons in a positive yield curve…

Germany 30y tap on Wednesday 18th - €1.8 Bln

German 30y, Dbr 0% Aug50

so it’s a zero…

The previous 30y issue is

Dbr 1.25% Aug48

In a positive yield curve zeros ‘should’ trade at higher yields than coupon bonds. Due to how we discount cashflows

That difference in value is revealed when we look at the z-spread – where all the cash flows are discounted by an appropriate rate for the coupon drop

Bond Swap Spread (bp) Z-Spread (bp)

Aug50 -20.1 -21.2

Dbr48 -23.1 -21.5

So although the 48s appear richer on a simple spread vs MMS, they have are as cheap on Z-Spread

Furthermore – there’s a gradient to Germany vs Z-spread curve which isn’t reflected here

Here’s what I do to ‘modify’ or ‘adjust’; the yield curve

I take the yield, subtract the swap spread and add the z-spread. This generates an adjusted yield curve…

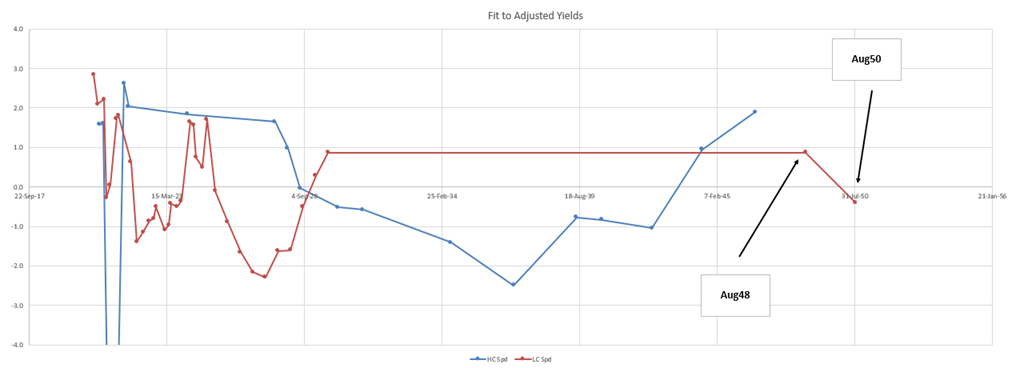

Now if we look at the anomalies – we see more accurately how rich cheap in the 15yrs and longer looks in Germany…

German Govt Bond Anomalies in adjusted yield –

* vs double exponential yield curve fit

Red = Low Coupon curve

Carry

+0.1bp /3mo @ -5bp repo

Roll

Flat

History

the bond came at this level (+3bp) but as at 31yr new issue it doesn’t seem to have enough discount as the issue size grows in a QE environment

Future taps

September 18th €1.5Bln – 2050

October 16th €1.0Bln – 2048

November 20th €1.5Bln – 2050

Risks

- 2050 stays bid

- 2048 remains offered

- Repo in 2050 goes special and funding parameters change

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796