German 30y Auction: James Rice @Astor Ridge

Zeros and Coupons in a positive yield curve…

Germany 30y tap on Wednesday 18th - €1.8 Bln

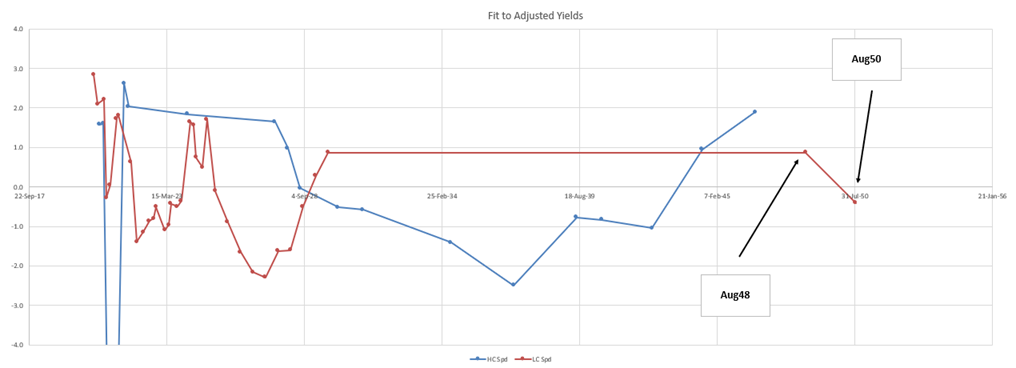

German 30y, Dbr 0% Aug50

so it’s a zero…

The previous 30y issue is

Dbr 1.25% Aug48

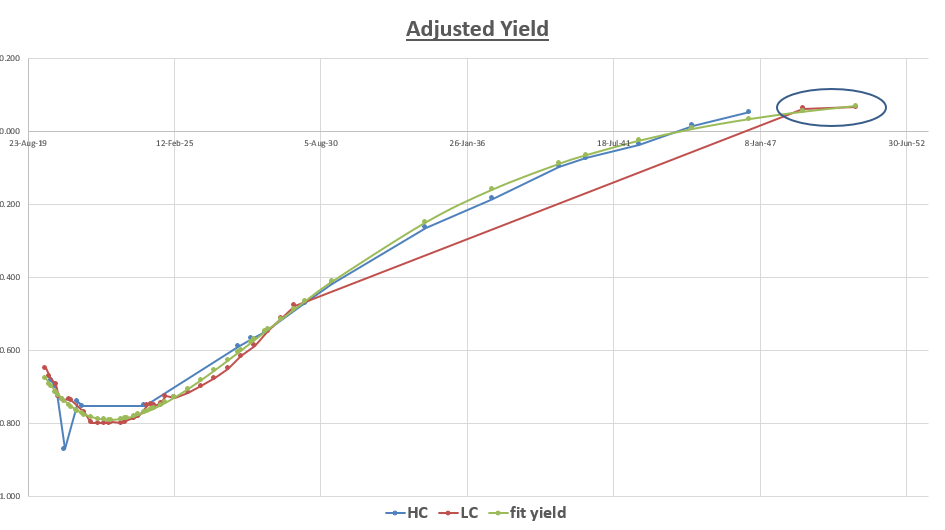

In a positive yield curve zeros ‘should’ trade at higher yields than coupon bonds. Due to how we discount cashflows

That difference in value is revealed when we look at the z-spread – where all the cash flows are discounted by an appropriate rate for the coupon drop

Bond Swap Spread (bp) Z-Spread (bp)

Aug50 -20.1 -21.2

Dbr48 -23.1 -21.5

So although the 48s appear richer on a simple spread vs MMS, they have are as cheap on Z-Spread

Furthermore – there’s a gradient to Germany vs Z-spread curve which isn’t reflected here

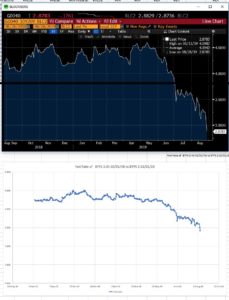

Here’s what I do to ‘modify’ or ‘adjust’; the yield curve

I take the yield, subtract the swap spread and add the z-spread. This generates an adjusted yield curve…

Now if we look at the anomalies – we see more accurately how rich cheap in the 15yrs and longer looks in Germany…

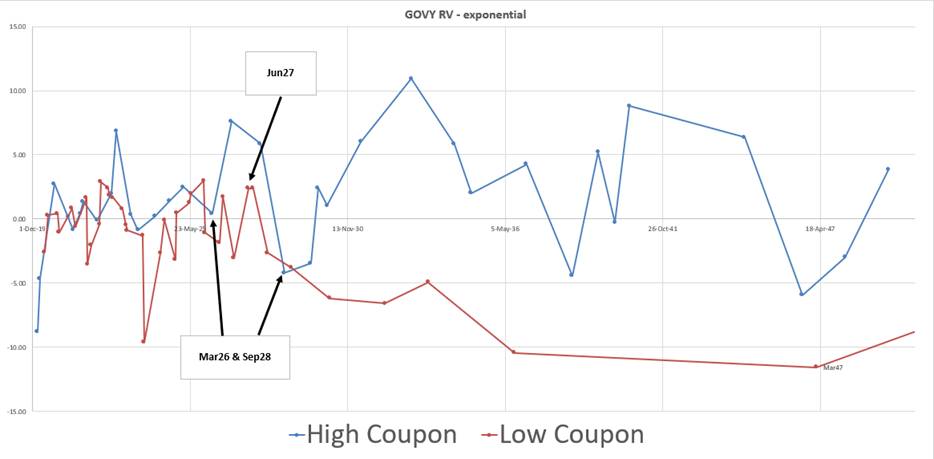

German Govt Bond Anomalies in adjusted yield –

* vs double exponential yield curve fit

Red = Low Coupon curve

Carry

+0.1bp /3mo @ -5bp repo

Roll

Flat

History

the bond came at this level (+3bp) but as at 31yr new issue it doesn’t seem to have enough discount as the issue size grows in a QE environment

Future taps

September 18th €1.5Bln – 2050

October 16th €1.0Bln – 2048

November 20th €1.5Bln – 2050

Risks

- 2050 stays bid

- 2048 remains offered

- Repo in 2050 goes special and funding parameters change

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - Sep16, James Rice @Astor Ridge

Trade Radar – Euro RV structures for the week

Italy – ‘No Default Buyers run to the other side of the ship’ – Very low cost default structures…

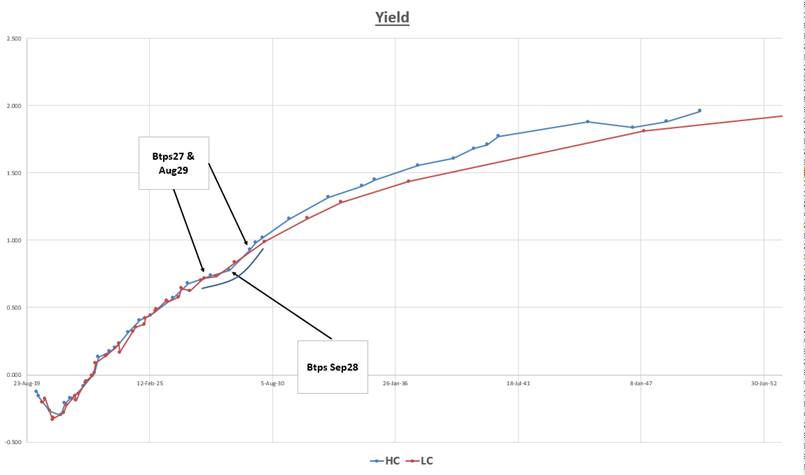

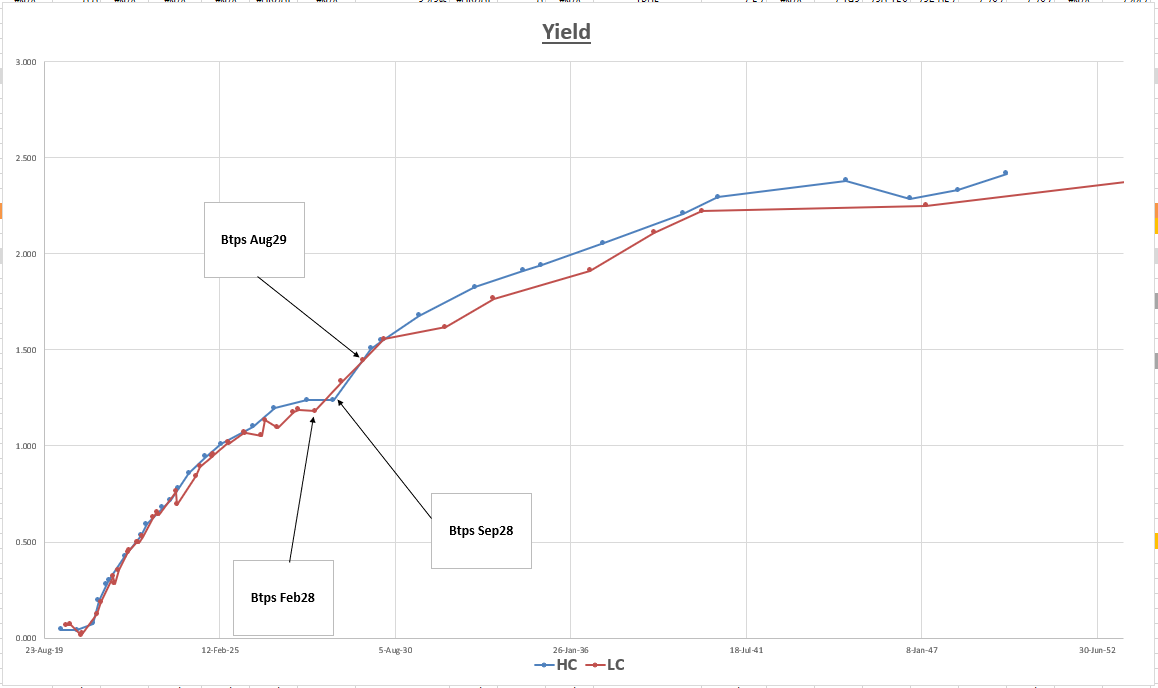

Buy Italy Low coupon Btps June27 to sell Btps mar26 and IKZ9 (CTD Btps 4.75% Sep28)

The tightening of Italy over August and Sep implies low default and/or redenomination probabilities

- This rising tide has lifted higher coupons much faster than low and mediums

- Euro RV is often about intelligently, sifting through the wreckage of broad, sweeping themes and finding robust nuggets of value

One such, is the boundary condition for High vs Low coupons. Typically in simple, IRR yield space, we see that high coupons already trade through the low coupon curve. So the tendency is to assume that there is no boundary condition. We assume that buying low coupon bonds with a lower mitigating lost to recovery (under default) does not underpin the value of low coupons any more

Students of RM flows over the long haul will observe cash for cash switches, that signal that a broad rationale that still prefers low coupon bonds but that timing is everything

The problem is not that this metric is broken, it’s that we need to view it through the right lens – if we discount all the cashflows at an appropriate rate for the Italian curve we get a much better perspective of RV value than by using yield. Luckily we can bootstrap onto the Bloomberg GOVY curve

Here is the Bloomberg GOVY exponential stripped cashflow anomaly graph…

The trade…

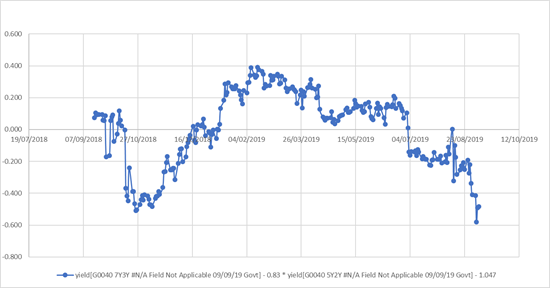

History on CIX…

- (YIELD[BTPS 2.2 06/01/27 Corp] - 0.5 * YIELD[BTPS 4.5 03/01/26 Corp] - 0.5 * YIELD[BTPS 4.75 09/01/28 Corp])

Risks

- The shorts go more special on Repo

- The trade doesn’t turn while running at negative carry

- RE-steepening will favour the high coupons (they receive cashflow earlier and benefit from a steeper gradient in the bond curve ,when viewed in value terms)

Under this new narrow scenario for Italy we’re gonna see opportunities like this. Am scouring through looking for the best carry (taking out cash will almost always be slightly negative) – but that’s just the theta on the trade. The nugget is that the stripped value is better for the low coupon than the high

Take a look

let me know

Have a fab week

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

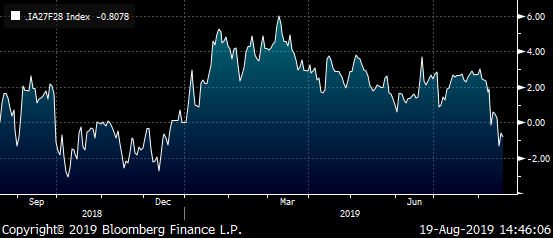

Euro RV - Sep 5th James Rice : Astor Ridge

Some RV thoughts for Euro RV

Italian curve 5s7s10s – not quite there but mid-month supply may offer the trade to us

5s7s10s is also a reflection of the forwards

5y2y vs 7y3y

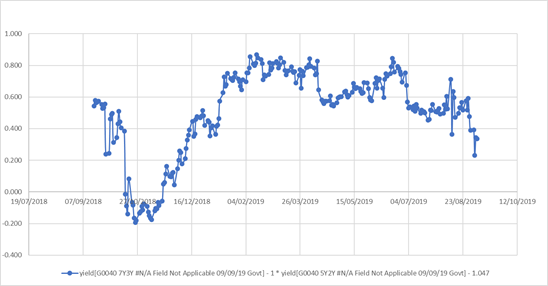

In straight spread space that looks as follows…

Generic Italian BBG CMB forwards:

7y3y – 5y2y

In regression space it looks a little more compelling…

Generic Italian BBG CMB forwards:

7y3y – 0.83* 5y2y – 1.047

So in cash terms the approximate expression of

-5y +7y -10y should look good

let’s issue select….

- On the short 5y years side am looking at selling the recently rich nov24

- On the 7y the jul26 looks decent value but has had some erroneous price closes of late

- On the ten yr I have moved the short to the feb28 – they drop out without being CTD and were only rich in absence of other low coupons – that’s no longer the case now that we have btps 1.35% Apr30

BBG Cix:

200 * (YIELD[BTPS 2.1 07/15/26 Corp] - 0.5 * YIELD[BTPS 1.45 11/15/24 Corp] - 0.5 * YIELD[BTPS 2 02/01/28 Corp])

Levels

Curr: @+17bp

Target Entry: @ +20bp

Supply mid-month in 7y

Exit: +13bp

Stop: +23bp

Supply

Thursday 12th – announcement on 9th September

Risks

The ten year retains a bid

The 7y as a tap point stays offered

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Europe RV Trade Radar : James Rice @Astor Ridge

Euro RV on my radar – Sep 3rd

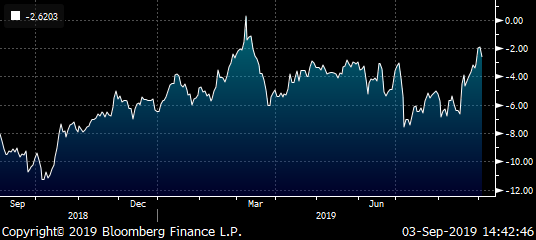

Italy, still short IK vs +/-1y

CIX: 200 * (YIELD[BTPS 4.75 09/01/28 Corp] - 0.5 * YIELD[BTPS 2.05 08/01/27 Corp] - 0.5 * YIELD[BTPS 3 08/01/29 Corp])

- Rich IK, Ctd one more time (Dec)

- Wings Cheap

- Bullet is high cpn (futures CTD)

Risks

- The ctd holds this premium into year end

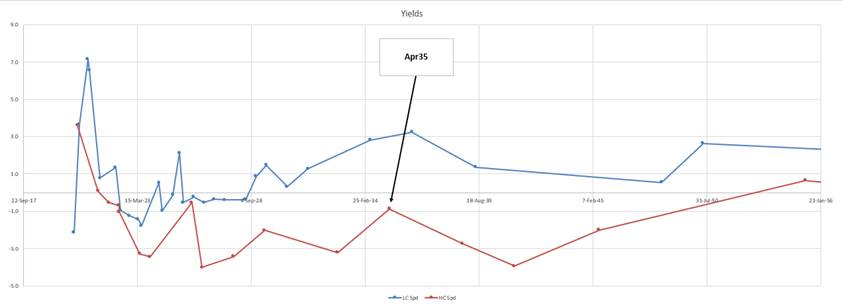

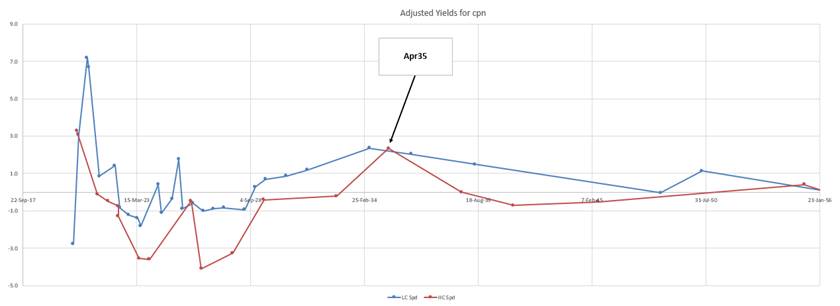

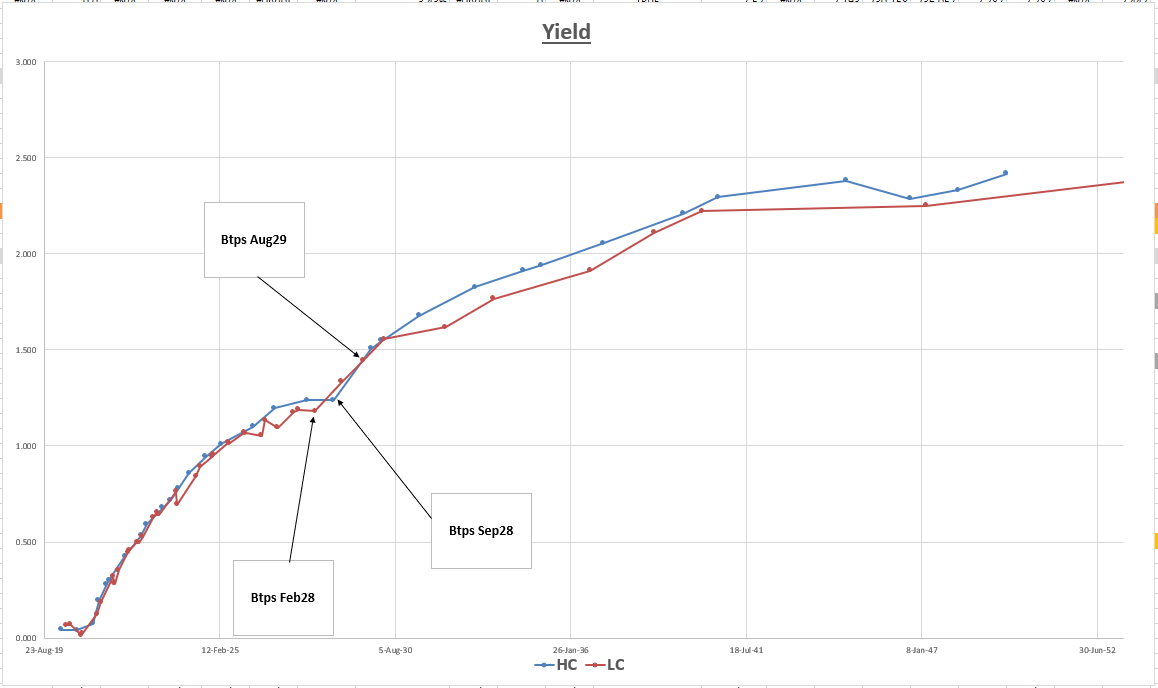

Buying HC French 15y vs wings going into Low Coupon taps on Thursday

-Frtr nov28, +2* Frtr Apr35, –Frtr May48

CIX: 200 * (yield[FRTR 4.75 04/25/35 Govt]-0.55*yield[FRTR 0.75 11/25/28 Govt]-0.45*yield[FRTR 2 05/25/48 Govt])

- -OATZ9, -Frtr Apr35, -Frtr May48

Ctd is Nov28

- French taps on Thursday are:

OAT Tap May-29, May-34, Jun-39, May-50 for EUR10.5bn

- The high coupons traditionally trade rich in France but this one is unusually cheap

- Flat carry even at 10bp repo spread

Yields

Yields, estimating coupon value in steep curve (by subtracting Swap spread and adding Z spread )

Risks

A wholesale cheapening of the 15-20y sector causes the Apr35 to cheapen further

Spain High Coupon 32s achieve apotheosis… but now seem rich

+Spgb Apr28, -2* Spgb Jul32, +HC Spgb Jul41

CIX: 200 * (yield[SPGB 5.75 07/30/32 Govt]-0.6*yield[SPGB 1.4 04/30/28 Govt]-0.4*yield[SPGB 4.7 07/30/41 Govt])

Fitted curve anomalies

- The HC Spain curve has done well, perhaps with expectations of QE buying – but yield levels of the market suggest we have travelled to that destination without intervention

- The apr41 high coupon provide some funding balance to the trade

- The Apr28 Spain was a short but has re-priced back into the curve

Risks

- Carry still negative (-0.5bp /3mo, with a 5bp repo spread)

- The 32s as an older issue don’t cheapen due to lower turnover and selling flows

Best

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

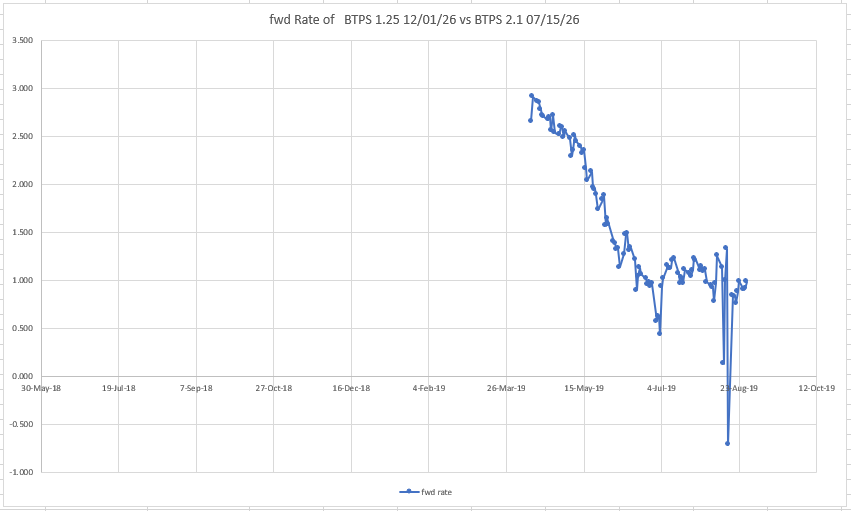

Forward Rates between bonds - James Rice @ Astor ridge

Life is full of questions… (particularly Btps)

How good is any anomaly in Italy?

What does it really mean?

How does that compare to other expression?

What do rates have to do for me to break even?

Team - I have built a proper forward calculator for Btps (can add other issuers)

Essentially my thinking is…

1) we trade the curve (bond spreads) - but really we want to express sets of forward rates versus others – we’re really expressing a view on where an intervening forward rate can be for us to breakeven

2) to compare forward rates - we need to accurately compute the histories..

3) once we can accurately assess the coupon differences in terms of forward rates - some of the pricing could make more sense

4) I am beta testing at the moment - but my intention is to be able to look at any pair of bonds - in terms of forward rates and compare them to any other pair or compare them to the fitted curve on FWCM (Bloomberg) this should be a more accurate way of proving and finding anomalies

5) please let me know of you have any thoughts about how you might use this analysis or any avenues you'd like to see developed

In the meantime some of the output – still very much checking the data…

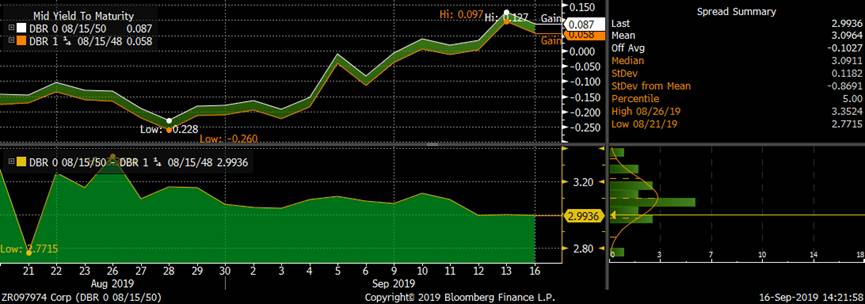

Attached is feb28 vs mar48 forward with the FWCM generic CMB fwd of 10y20 above

Have a think – tell me if any of this stuff is of use and what you might like to see. I’ll build something to look at any given forward minus the generic fwd – hence a true representation of the value of an anomaly

one of the interesting things for Italy could be – that some anomalies cannot imply forwards lower then the eonia rate for that period – as that would imply a zero probability of default. The beauty of this method is we can see the actual forwards that we trade rather than the generics – which don’t factor bond anomaly values

James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Btps switch -feb28 +Aug27: James Rice @Astor Ridge

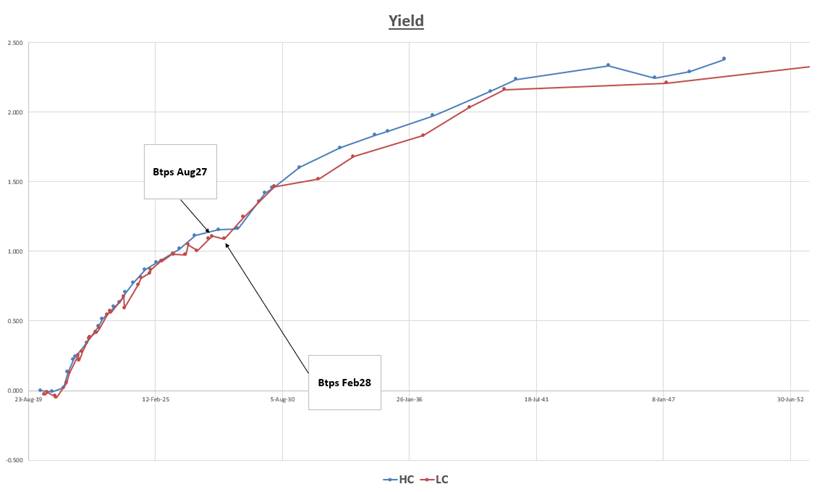

Btps Steepener 8y vs 8 ½ y

Sell feb28 to buy Aug27

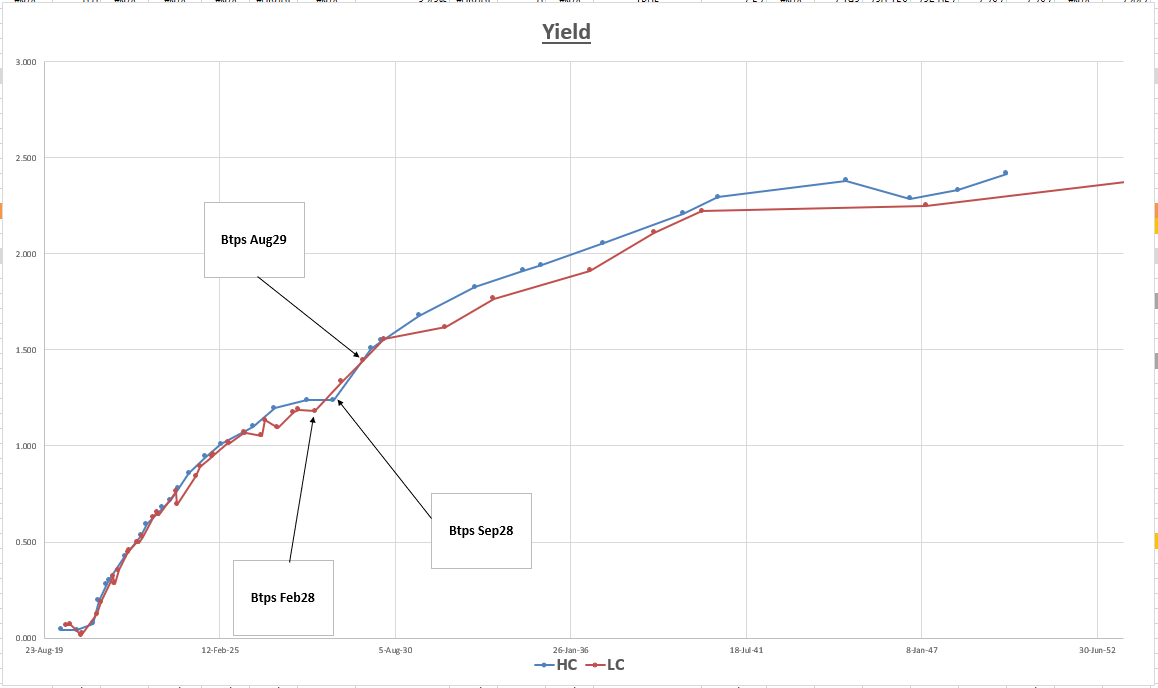

Italian Yield curve: 3mo forward

Trade History:

100 * (YIELD[BTPS 2 02/01/28 Corp] - YIELD[BTPS 2.05 08/01/27 Corp])

Rationale

- There will potentially be a new cheap 10y coming end of August (Mar30) with a low coupon

- The coupon differential is only 5bp

- The Feb28 are potentially only rich because they are close to the even richer CTD – Btps Sep28

- There has been a recent wholesale flattening of the Italian curve, which has impacted a segment already very flat from an anomaly perspective

- Trade also looks good when compared to other wider flatteners in Italy – see vs (wider curve hedge)

Feb28 vs Aug27

& 5% hedge -old5y vs +old20y

100 * ((yield[BTPS 2 02/01/28 Govt]-yield[BTPS 2.05 08/01/27 Govt])-0.05 * (yield[BTPS 2.95 09/01/38 Govt]-yield[BTPS 1.85 05/15/24 Govt]))

Carry and Roll

- Carry: +0.2bp /3mo

- Roll: +0.2bp /3mo

Risks

- Feb 28 continue to be bid in tandem with the IK contract during delivery and into the Dec expiry

- Negative news for Italy causes further flattening

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

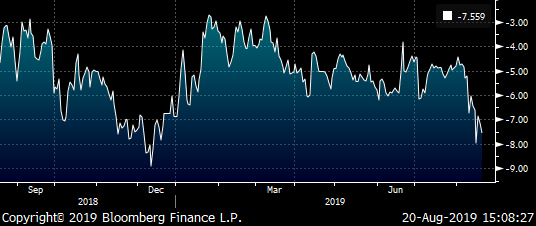

FW: Btp - roll - IKU9 vs IKZ9

Apols amendment – implied is -0.65%

Buy the Cash Btp Sep28 vs back months – implied @-0.48%

On balance buy the Btp Futures roll – some at each level @1.85

IKU9 / IKZ9

We’re coming up to the Btp roll – IKU9 going off the board and IKZ9 coming on as front month

Roll - @1.85, having been as low as 1.76 in July

To September

Implied Repo +0.25%

(not so meaningful this close to delivery)

Net basis using -0.40% repo, -3.6 cents net

- Thoughts: wait for more negative basis

– to me – ‘the double boxing condition’ –

where I buy the net basis, lend past delivery and then am prepared to very aggressively borrow back the bonds over the delivery window - that is when the nett gets to -8 cents

Only then would I would sell more front month in other structures, when that ‘pressure valve’ is tested (waiting to see -8 cents nett)

To December (using roll at 1.85)

Implied Repo -0.42%

Net basis using -0.60%, -4.8 cents net

Bond may well be cheap to contracts, but is rich spot and forward – hence the repo and maybe the implied should richen

Thoughts – buy cash bond implied to the back month

Seems that the Sep28 are still rich forward to Dec - so the back month looks rich

So the for the bond to cheapen forward then the repo and/or the repo can richen

Forward yield Curve (3 months) using 15bp special repo for sep28…

Any questions or thoughts as to how we can help with any structures – please give me a shout

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Btp - roll - IKU9 vs IKZ9

Buy the Cash Btp Sep28 vs back months – implied @-0.48%

On balance buy the Btp Futures roll – some at each level @1.85

IKU9 / IKZ9

We’re coming up to the Btp roll – IKU9 going off the board and IKZ9 coming on as front month

Roll - @1.85, having been as low as 1.76 in July

To September

Implied Repo +0.25%

(not so meaningful this close to delivery)

Net basis using -0.40% repo, -3.6 cents net

- Thoughts: wait for more negative basis

– to me – ‘the double boxing condition’ –

where I buy the net basis, lend past delivery and then am prepared to very aggressively borrow back the bonds over the delivery window - that is when the nett gets to -8 cents

Only then would I would sell more front month in other structures, when that ‘pressure valve’ is tested (waiting to see -8 cents nett)

To December (using roll at 1.85)

Implied Repo -0.42%

Net basis using -0.60%, -4.8 cents net

Bond may well be cheap to contracts, but is rich spot and forward – hence the repo and maybe the implied should richen

Thoughts – buy cash bond implied to the back month

Seems that the Sep28 are still rich forward to Dec - so the back month looks rich

So the for the bond to cheapen forward then the repo and/or the repo can richen

Forward yield Curve (3 months) using 15bp special repo for sep28…

Any questions or thoughts as to how we can help with any structures – please give me a shout

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Recall: Btp - roll - IKU9 vs IKZ9

James Rice would like to recall the message, "Btp - roll - IKU9 vs IKZ9".

Btp - roll - IKU9 vs IKZ9

Buy the Cash Btp Sep28 vs back months – implied @-0.48%

On balance buy the Btp Futures roll – some at each level @1.85

IKU9 / IKZ9

We’re coming up to the Btp roll – IKU9 going off the board and IKZ9 coming on as front month

Roll - @1.85, having been as low as 1.76 in July

To September

Implied Repo +0.25%

(not so meaningful this close to delivery)

Net basis using -0.40% repo, -3.6 cents net

- Thoughts: wait for more negative basis

– to me – ‘the double boxing condition’ –

where I buy the net basis, lend past delivery and then am prepared to very aggressively borrow back the bonds over the delivery window - that is when the nett gets to -8 cents

Only then would I would sell more front month in other structures, when that ‘pressure valve’ is tested (waiting to see -8 cents nett)

To December (using roll at 1.85)

Implied Repo -0.42%

Net basis using -0.60%, -4.8 cents net

Bond may well be cheap to contracts, but is rich spot and forward – hence the repo and maybe the implied should richen

Thoughts – buy cash bond implied to the back month

Seems that the Sep28 are still rich forward to Dec - so the back month looks rich

So the for the bond to cheapen forward then the repo and/or the repo can richen

Forward yield Curve (3 months) using 15bp special repo for sep28…

Any questions or thoughts as to how we can help with any structures – please give me a shout

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796