Update on Italian curve supply and RV implications

Hi,

Just doing some work on the Italian curve in preparation for RV themes over the next few months

- Italy Supply normally: 3y & 7y mid-month and 5y and 10y at end of month

- Italy cancelled mid-August 3y and 7y auctions

- End of June, Tesoro announced two new issues for Q3;

A new 10y Btps 01-Apr-2030

A new 3y Btps 01-Jan-2023

- The current 10y Aug29 (€16bln) is close to the sizes of prior benchmarks (Dec28 - €19,2Bln & Feb28 €22,5Bln)

So we expect the last tap to be the end of July – still scheduled - In August & September respectively, we expect the new 10y and the new 3y to come and to have a v low coupon of approx. 1.60% and 0.4% (estimated)

So what does this mean for Italy RV?

- New issues typically trade cheap on the curve

Not only in yield, but even when we look at the value of a high coupon in a steep curve (short modified duration)

- The new issues will have a double whammy of value..

The recent rally means that from a default perspective they could have tremendous value –

good yield, stripped value, reasonable carry but most of all strong default value due to their low coupons

New bond Insertion

As new issues have come cheaper than ‘fair’, I’ve tried to postulate the cheapest levels that these bonds could come at

This should help us see more clearly the effect on the existing term and anomaly structure

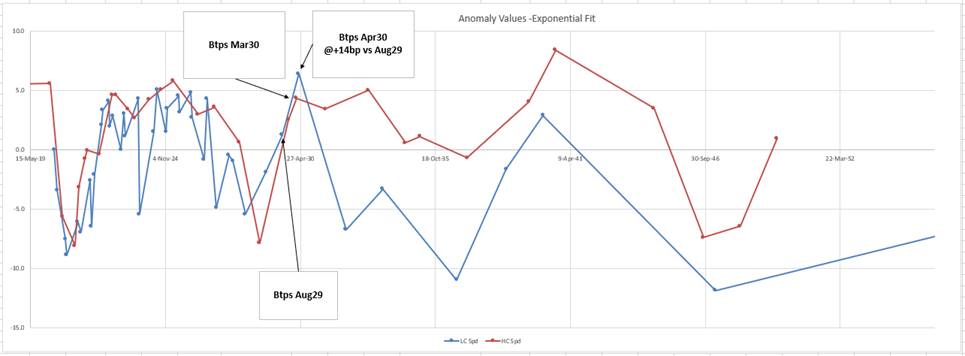

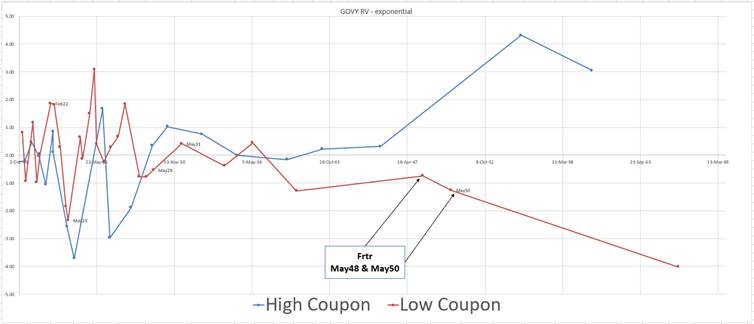

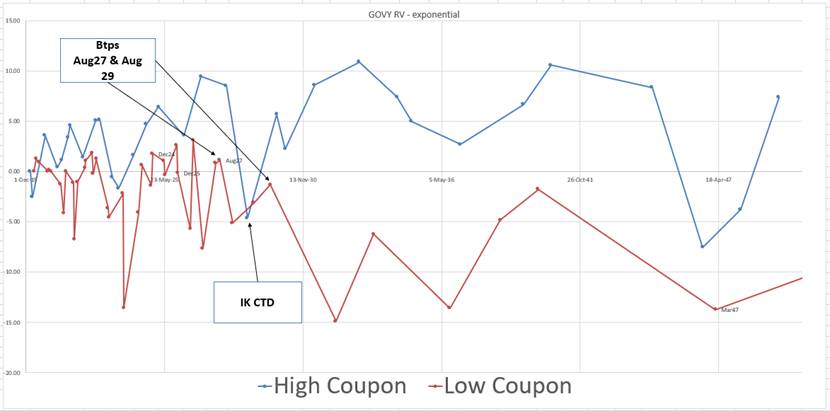

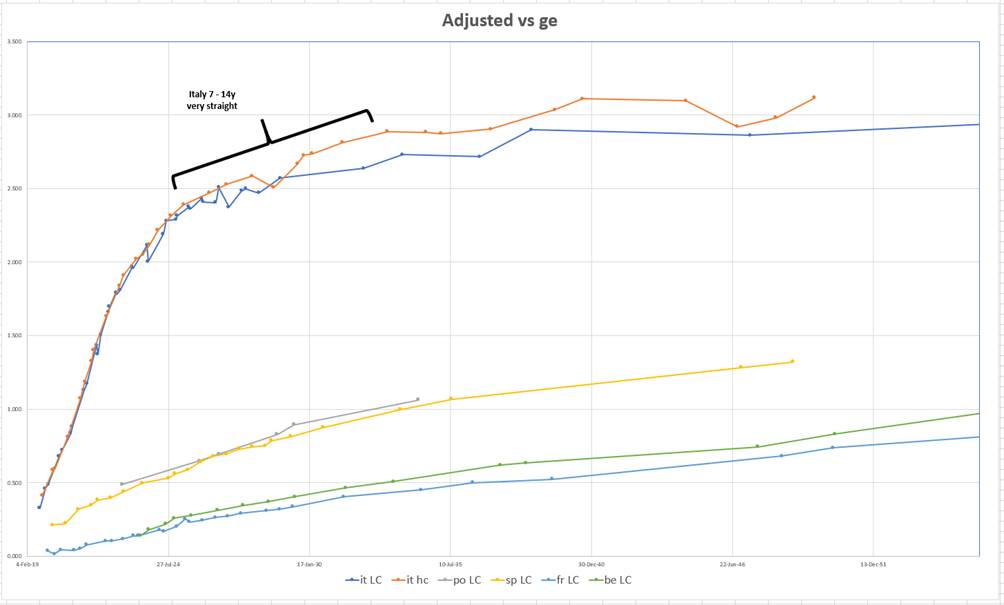

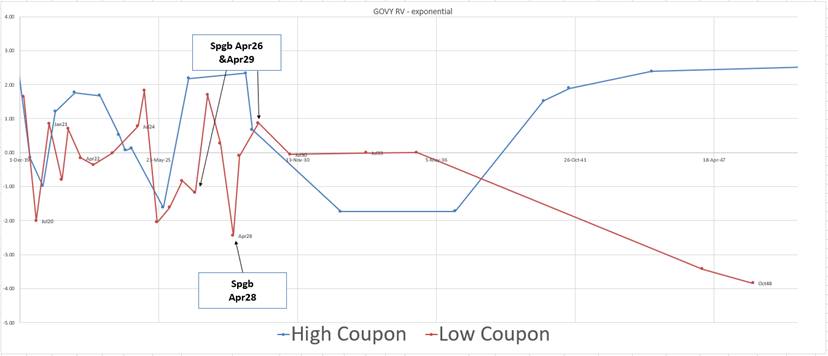

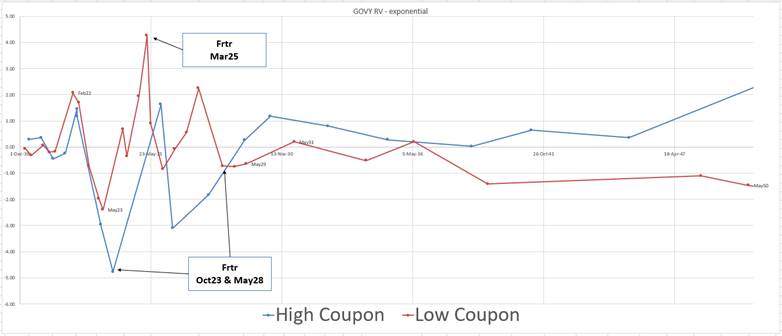

here’s a graph of the yield (bp) anomalies of the Italian curve vs a smooth, double-exponential, fitted curve…

So I have two observations

- if, as before, the new issue comes cheap vs local High Coupons (such as Mar30) then until it does we can treat them as a ‘proxy purchase’ for the forthcoming new 10y

- The VLC (very low coupon) nature of this new ten year, should act to contain & suppress the value of other low coupons – we want to be short the Btps 1.65% Mar32 and the Btps 1.25% Dec26

Trades on my radar…

Italy

+7y -current 10y +Mar30

- The 7y Btps Jul26 has no tap during August

- The 10y Aug29 has ‘travelled’ a long way since issuance

- The Mar30, we are treating as a proxy for the new Apr30 10y

- Carry is slightly positive: +0.1bp /3mo @5bp repo spread

In mitigation we can only assume that the new 10y will come +14bp to the Aug29 and +3bp to the Mar30 –

E.G

Recent Btps Mar40 are +1.7bp over HC Btps 5% Aug39

Recent Btps Jul26 are +7.4bp over the HC Btps 4.5% Mar26

Relatively recent Btps Dec28 are +9.2bp vs the Sep28 (admittedly this is a rich CTD to the IK contract)

Weights: +.15 / -1 / +.85

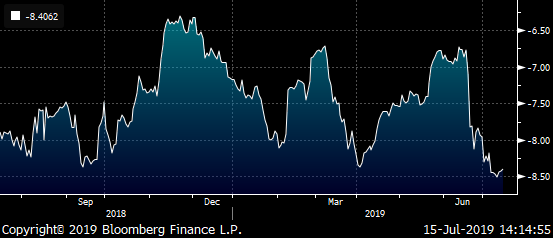

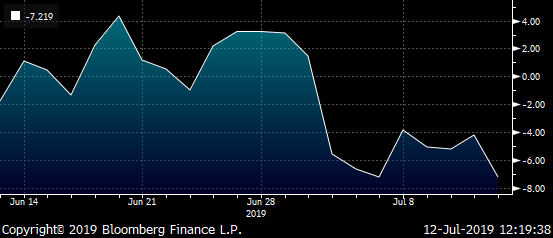

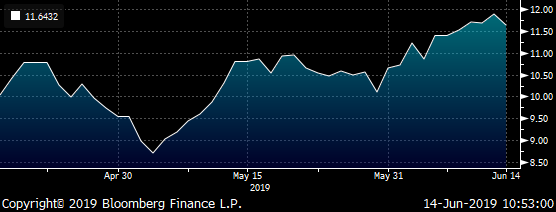

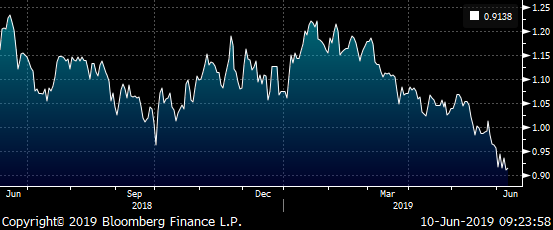

Cix:

200 * (yield[BTPS 3 08/01/29 Govt]-0.15*yield[BTPS 2.1 07/15/26 Govt]-0.85*yield[BTPS 3.5 03/01/30 Govt])

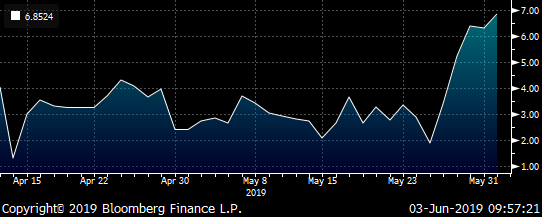

Graph (BBG)

Italy

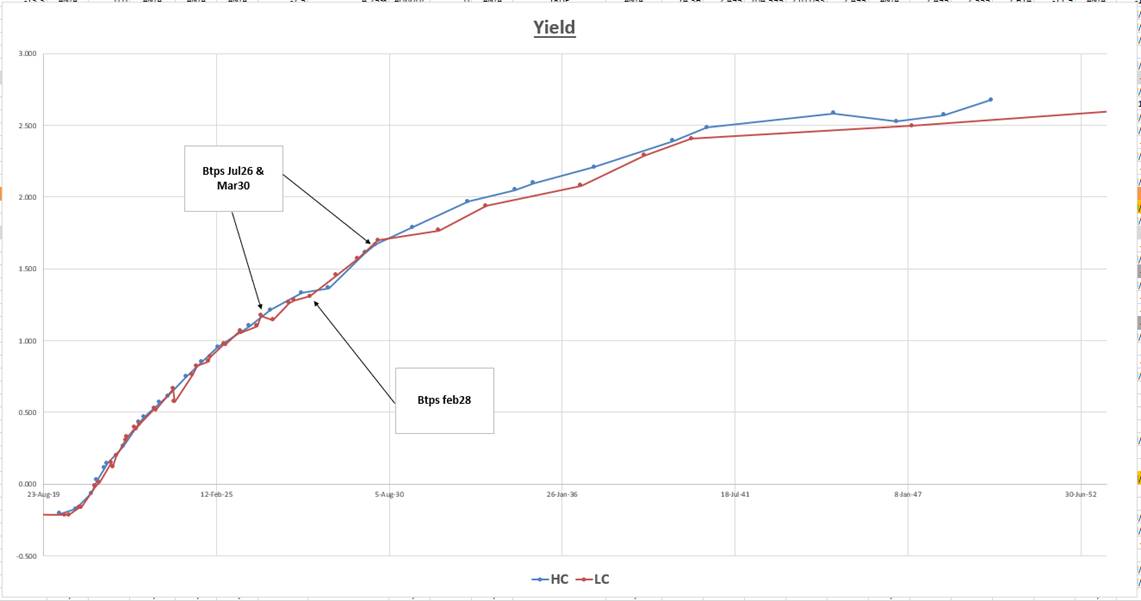

+7y -Feb28 +Mar30

- Similar logic to the prior trade but more balanced in terms of weightings 50/50

- Not so strong in terms of history – expect Feb28 to continue to cheapen due to low coupons getting ‘suppressed’ by the new 10y

- Positive Carry: +0.7bp /3mo @5bp repo spread

- ‘looks’ more anomalous in terms of generally shape of the curve

Yield Curve High & Low coupons - Italy

200 * (yield[BTPS 2 02/01/28 Govt]-0.5*yield[BTPS 2.1 07/15/26 Govt]-0.5*yield[BTPS 3.5 03/01/30 Govt])

Any thoughts let me know

Best

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Belgium supply ann. late Monday pm - 29s & 33s

Quick trade idea – on Monday pm supply announcement for Belg

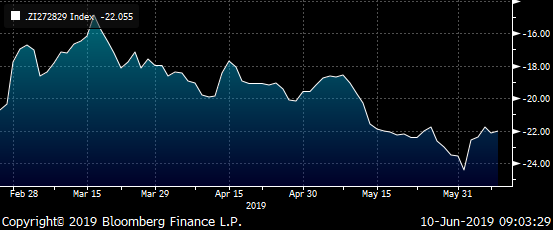

rationale – I see Belg as very flat 8s10s vs Germany

also good on history - check out below – more detail t0morrow….

Belgium supply next week 29s and 33s

Sell 29s and buy 27s vs

45% -oea / +rxa

100*((yield[BGB 0.9 06/22/29 Govt]-yield[BGB 0.8 06/22/27 Govt])-0.45*(yield[DBR 0.25 08/15/28 Govt]-yield[DBR 1.5 05/15/24 Govt]))

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar, Germany - Euro RV - James Rice, Astor Ridge

Trade Radar Euro RV – Monday Jul15th

Continued from Friday…

Some trades on my radar in Europe

Germany

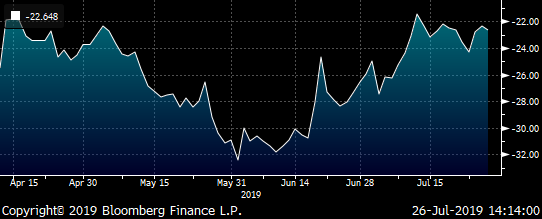

Short Dbr 3.25% 42, Long Dbr 2.5% 46 & RXA cts (CTD Dbr 0.25 Aug28)

Weights: +0.1 / -1 / +0.9

Rationale

- Tap in 30y this week may have caused recent re-steepening in 25s30s

- Anomaly value pick up of +1.8bp

- RXA produces some curve balance (with liquidity) to the structure

Carry: -0.2bp /3mo (@same repo)

Roll: -0.1bp /3mo

Cix:

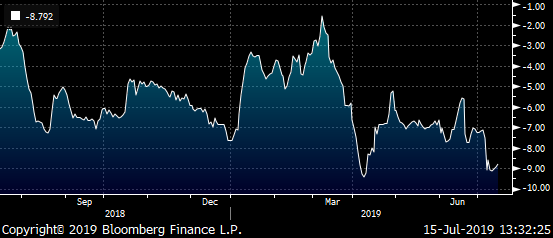

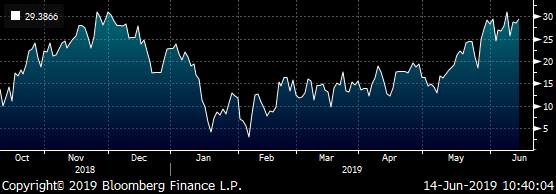

200 * (yield[DBR 3.25 07/04/42 Govt]-0.1*yield[DBR 0.25 08/15/28 Govt]-0.9*yield[DBR 2.5 08/15/46 Govt])

BBG Graph

Any thoughts feedback welcome

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - Euro RV - James Rice, Astor Ridge

Trade Radar Euro RV – Monday Jul15th

Continued from Friday…

Some trades on my radar in Europe

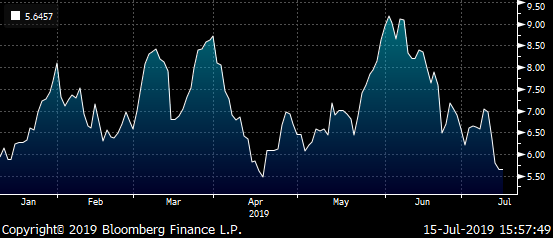

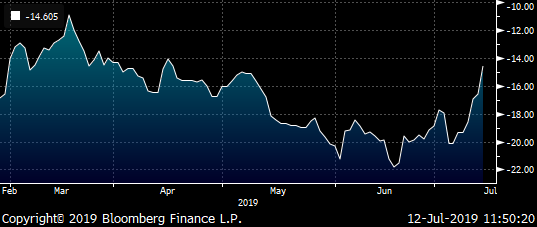

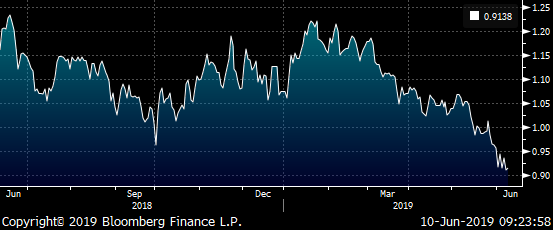

France, Reverse Roll 30y

Long May48, Short May50

May48 better carry & better cashflow value (see BBG GOVY spread values).

France will continue to tap the May50

BBG Govy Spread values - spline exponential

Not a huge amount in it @-6.4bp

maybe 1bp but certainly if it gets to -5.75bp

I’d look to add

R&C +0.1bp @same repo

aggress ahead of next long end tap..

cix:

-yield[FRTR 1.5 05/25/50 Govt]+yield[FRTR 2 05/25/48 Govt]

Also in France

Long Oat contracts, short Jun39 Green Bond, Long old 30y

+OATA -20y +old30y

weights +.25 / -1 / +.75

R&C: -0.3 /3mo

the 20y trades rich but we at the ex...

Cix in swap space:

2 * (sp210[FRTR 1.75 06/25/39 Govt]-0.25*sp210[FRTR 0.75 05/25/28 Govt]-0.75*sp210[FRTR 2 05/25/48 Govt])

BBG History

Any thoughts feedback welcome

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - Euro RV - James Rice, Astor Ridge

Trade radar Euro RV – Friday Jul12th

Italy 10y contract rich – ON HOLD, working

+ Btps Aug27, -IK (Btps Sep29 CTD), Long Btps Aug29

Weights: +0.5 / -1 / +0.5

R&C: -0.4

cix:

200 * (yield[BTPS 4.75 09/01/28 Govt]-0.5*yield[BTPS 2.05 08/01/27 Govt]-0.5*yield[BTPS 3 08/01/29 Govt])

BBG history

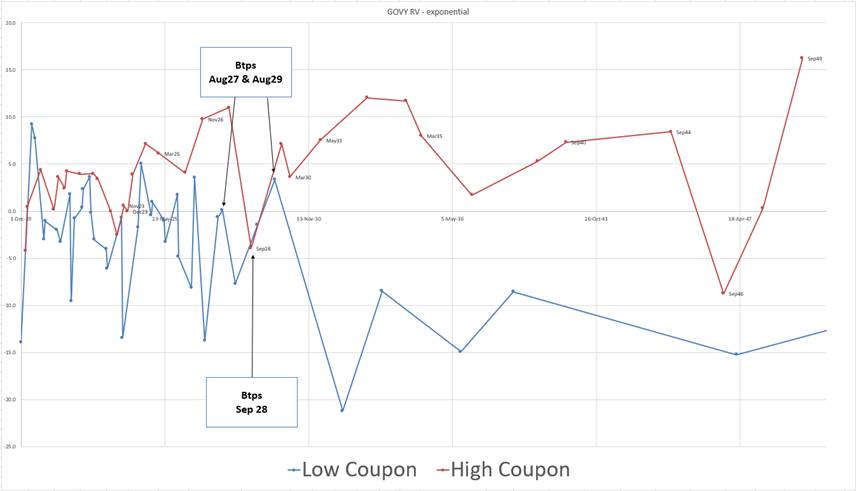

RV: Anomaly values – full cashflow, BBG GOVY RB exponential fit

Possible mutation in prep for 10y supply,

+old 7y –10y +old 20y

+nov25 -aug29 +sep38

Weights: +.55 / -1 / +.45

R&C: -0.2 bp/3mo

cix: 200 * (yield[BTPS 3 08/01/29 Govt]-0.55*yield[BTPS 2.5 11/15/25 Govt]-0.45*yield[BTPS 2.95 09/01/38 Govt])

BBG History

More to follow Spain etc…

Any thoughts feedback welcome

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar Euro RV, June 14th James Rice @Astor Ridge

Trade Radar – Euro RV

Week starting June 17th

European supply next week

Belgium 24s, 29s, 38s, 66s

UK 10y

German old 30y – 46s –1bln

France 22s, 23s & 25s

Italian 6y cheap to 2y & 10y

Buy Btps May25

Sell 35% BTSA and 65% IKA

200 * (YIELD[BTPS 1.45 05/15/25 Govt] - 0.35 * YIELD[BTPS 2.3 10/15/21 Govt] - 0.65 * YIELD[BTPS 4.75 09/01/28 Govt])

C&R -1bp /3mo (@ same repo)

Rationale

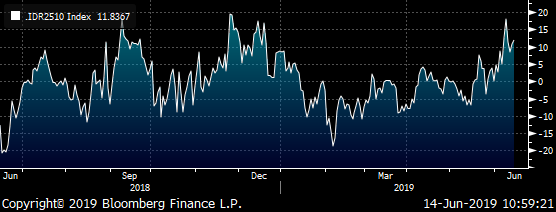

- Trade has ‘edge’ – the regression weighted Italy CMB 2s5s10s relative to Germany 2s5s10s, regressed vs the It/Ge 10y country – see graph

- The spread implies that the 5yr is too cheap given the level of the Italy/Germany country spread

(.I2510 U Index - .D2510 U Index) - 0.544 * .IKRX U Index + 85.805

Short Italian Bond Futures vs 1y wings

Short Sep28

Long Aug27 and Aug29

200 * (YIELD[BTPS 4.75 09/01/28 Govt] - 0.4 * YIELD[BTPS 2.05 08/01/27 Govt] - 0.6 * YIELD[BTPS 3 08/01/29 Govt])

Rationale

- The generic shape of the curve from 7y to 14y in Italy is pretty much a straight line, which looks anomalous in the context of a steep and curved (convex) curve

- Curve should have some degree of curvature – and indeed futures (9y point should cheapen)

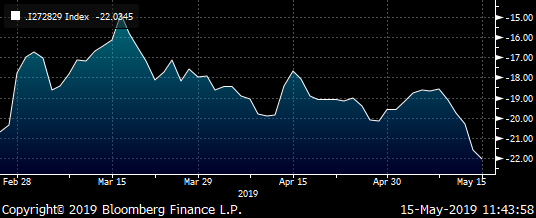

- Yield curves of H/L Italy spread vs Germany below

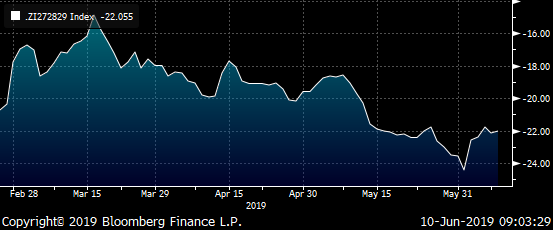

German steepener 10s30s

Short30y, Long 10y regression weighted in Futures

+1k RXA, -403 UBA

Extra 5% long in the Buxl – not duration matched

- Long Euro forwards have collapsed in tandem with both the US rally and the theme that the ECB may try various methods to force a flatter curve

- Feels like an overshoot and any bounce in stocks could cause a rebound

- we have a tap of Dbr 2046 next week

YIELD[DBR 2.5 07/04/44 Govt] - 0.95 * YIELD[DBR 0.25 08/15/28 Govt]

Trade has ‘edge’ – versus swaps the bond market looks extended… (too flat)

Spread of Z-Spreads for Rxa & Buxl Ctds

SP037[DBR 2.5 7/44 Govt] - 1.00 * SP037[DBR 0.25 8/28 Govt] - 1.2

SP037 is the code for Z-Spread in BBG fields

Spain – take off from last week, trade worked – has further value potential but looks close to mean

Anomalously rich Apr28 vs 26 and 29

-Spgb Apr28

+30% Apr26, +70% Apr29

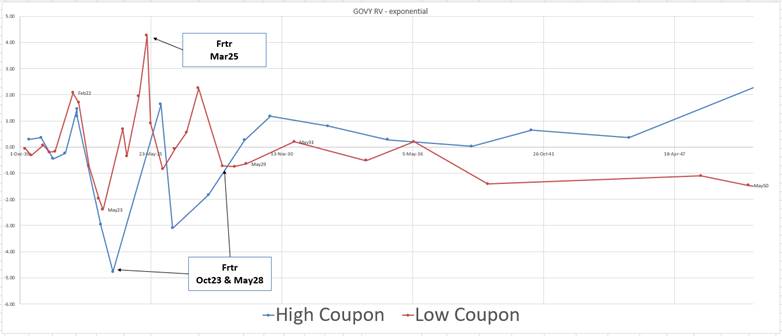

Long cheap French 5y vs Oct23 and Oat contracts

+Frtr Mar25

-70% Oct23, -30%OATA contracts (Ctd Frtr May28)

- Bond looks cheap vs oct23 and some long OAT anchor

- Current anomaly is >+4bp

- Prior issue, Mar 24s got to max cheap was +5bp anomaly, 4 months prior to its last tap in Mar 2019. After which it richened

200 * (YL017[FRTR 0 03/25/25 Govt] - 0.7 * YL017[FRTR 4.25 10/25/23 Govt] - 0.3 * YL017[FRTR 0.75 05/25/28 Govt])

Any feedback or thoughts are warmly welcomed

Let me know

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar Euro RV, James Rice @Astor Ridge - correction

Errata – second graph on French 5y – did get to +7.5bp cheap (prior graph was Frtr Mar23)

Trade Radar – Euro RV

Week starting June 10th

Short Italian Bond futures vs 1y wings

Short Sep28

Long Aug27 and Aug29

200 * (YIELD[BTPS 4.75 09/01/28 Govt] - 0.4 * YIELD[BTPS 2.05 08/01/27 Govt] - 0.6 * YIELD[BTPS 3 08/01/29 Govt])

Italian 5s10s Steepener Regression Hedged

Short IK (Sep 28), Long 80% delta Btps May24

- 5y & 10y no till end of month – market struggling to absorb the last on the run five yr

- flat carry regression weighted

- weakness in stocks should produce weakness in Italy and targeting selling of the ik contract

YIELD[BTPS 4.75 09/01/28 Govt] - 0.8 * YIELD[BTPS 1.85 05/15/24 Govt]

German steepener 10s30s

Short30y, Long 10y regression weighted in Futures

+1k RXA, -388 UBA

- Long Euro forwards have collapsed in tandem with both the US rally and the theme that the ECB may try various methods to force a flatter curve

- Feels like an overshoot and any bounce in stocks could cause a rebound

- After Wednesday’s 10y tap we have a tap of Dbr 2046 next week

YIELD[DBR 2.5 07/04/44 Govt] - 0.95 * YIELD[DBR 0.25 08/15/28 Govt]

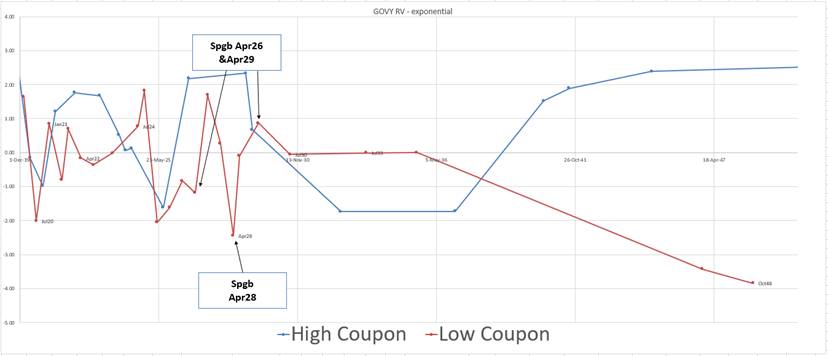

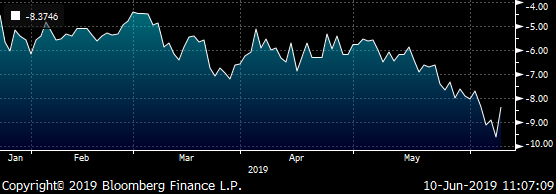

Spain

Sell anomalously rich Apr28 vs 26 and 29

-100% Spgb Apr28

+30% Apr26, +70% Apr29

- Simple anomaly on the Spanish Curve

- -0.1bp R&C @ same repo

Bloomberg GOVY Anomaly Spreads (exponential) - Spain

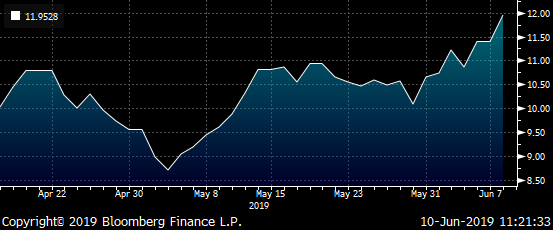

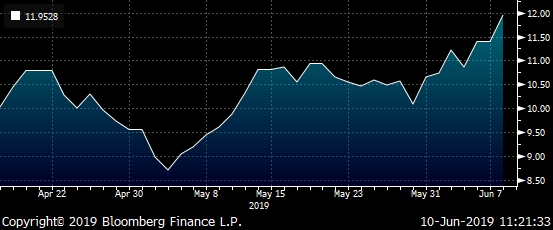

Long cheap French 5y vs Oct23 and Oat contracts

+Frtr Mar25

-70% Oct23, -30%OATA contracts (Ctd Frtr May28)

- Bond looks cheap vs oct23 and some long OAT anchor

- Current anomaly is >+4bp

- Prior issue, Mar 24s got to max cheap was +7.5bp anomaly, after which it richened

200 * (YL017[FRTR 0 03/25/25 Govt] - 0.7 * YL017[FRTR 4.25 10/25/23 Govt] - 0.3 * YL017[FRTR 0.75 05/25/28 Govt])

French Govy RV anomalies – Exponential Spline Spread

History of Frtr Mar25 anomaly spread…

Graph of prior 5y Mar24 and its long term historical R/C spread anomaly value

Any feedback or thoughts are warmly welcomed

Let me know

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar Euro RV, James Rice @Astor Ridge

Trade Radar – Euro RV

Week starting June 10th

Short Italian Bond futures vs 1y wings

Short Sep28

Long Aug27 and Aug29

200 * (YIELD[BTPS 4.75 09/01/28 Govt] - 0.4 * YIELD[BTPS 2.05 08/01/27 Govt] - 0.6 * YIELD[BTPS 3 08/01/29 Govt])

Italian 5s10s Steepener Regression Hedged

Short IK (Sep 28), Long 80% delta Btps May24

- 5y & 10y no till end of month – market struggling to absorb the last on the run five yr

- flat carry regression weighted

- weakness in stocks should produce weakness in Italy and targeting selling of the ik contract

YIELD[BTPS 4.75 09/01/28 Govt] - 0.8 * YIELD[BTPS 1.85 05/15/24 Govt]

German steepener 10s30s

Short30y, Long 10y regression weighted in Futures

+1k RXA, -388 UBA

- Long Euro forwards have collapsed in tandem with both the US rally and the theme that the ECB may try various methods to force a flatter curve

- Feels like an overshoot and any bounce in stocks could cause a rebound

- After Wednesday’s 10y tap we have a tap of Dbr 2046 next week

YIELD[DBR 2.5 07/04/44 Govt] - 0.95 * YIELD[DBR 0.25 08/15/28 Govt]

Spain

Sell anomalously rich Apr28 vs 26 and 29

-100% Spgb Apr28

+30% Apr26, +70% Apr29

- Simple anomaly on the Spanish Curve

- -0.1bp R&C @ same repo

Bloomberg GOVY Anomaly Spreads (exponential) - Spain

Long cheap French 5y vs Oct23 and Oat contracts

+Frtr Mar25

-70% Oct23, -30%OATA contracts (Ctd Frtr May28)

- Bond looks cheap vs oct23 and some long OAT anchor

- Current anomaly is >+4bp

- Prior issue, Mar 24s got to max cheap was +5bp anomaly, 4 months prior to its last tap in Mar 2019. After which it richened

200 * (YL017[FRTR 0 03/25/25 Govt] - 0.7 * YL017[FRTR 4.25 10/25/23 Govt] - 0.3 * YL017[FRTR 0.75 05/25/28 Govt])

French Govy RV anomalies – Exponential Spline Spread

History of Frtr Mar25 anomaly spread…

Graph of prior 5y Mar24 and its long term historical R/C spread anomaly value

Any feedback or thoughts are warmly welcomed

Let me know

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar: Monday 3rd June - James Rice Astor Ridge

Some trades on my Radar in European RV at the moment, starting with Italy

Italy –

Short IK Future (Sep), Long wings

- Ik futures (Sep) still look rich as a high coupon

- Going through delivery next Monday so repo is tight

- Have 33% of my size on now – don’t want to miss this one but be prepared to add

- Aug29 potentially richen as off the run end of July

200 * (YIELD[BTPS 4.75 09/01/28 Govt] - 0.4 * YIELD[BTPS 2.05 08/01/27 Govt] - 0.6 * YIELD[BTPS 3 08/01/29 Govt])

Italy

Long 7y short off the run 5y and 10y

+Jul26, -Nov24 and -Dec28

- Following the regular cycle of Italian supply, we have 7y supply next week on Thursday 13th June

- The on the run 5y and 10y trade cheap so in this instance we short slightly richer off the runs nearby

- The 7y sector has cheapened recently in response to the surprise Dec25 6y tap but still represents value

- Roughly flat carry, pick up in anomaly value

- Trade @+7bp looking for it to move back down to <+4bp

200 * (YL017[BTPS 2.1 07/15/26 Govt] - 0.5 * YL017[BTPS 1.45 11/15/24 Govt] - 0.5 * YL017[BTPS 2.8 12/01/28 Govt])

Italy

Mar25 / Mar26 steepener vs 2’s10s

Btps: +Mar25 / -Mar26

& 10% Btps Aug29 / -BTSA

- The curve in this small anomaly looks too flat given the context of other yields

- Generally I would expect the 1y Gap to move roughly in line with a 2s10s hedge

- Our trade represents the difference between this gap and the wider hedge

- Trade here, pay the structure at -3bp

- Generally exploits the very wide anomaly that 5s10s is too flat vs 2s30s

100 * ((YL017[BTPS 4.5 03/01/26 Govt] - YL017[BTPS 5 03/01/25 Govt]) - 0.1 * (YL017[BTPS 3 08/01/29 Govt] - YL017[BTPS 2.3 10/15/21 Govt]))

More to follow

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar #3 - James Rice, Astor Ridge

IK contracts rich vs neighbouring bonds

Ongoing CTD for 2 more contract months – some chance of a squeeze, but looks rich as a high coupon in a down market

Mechanics

Short IKM9 – ctd btps 4.75% 9/28

Long Aug27 and Aug29

Rationale

- The Ik contract is a rich high coupon bond

- The aug29 are an on the run issue that trade cheap

- The aug27 provide a curve ‘anchor’ to the trade

- The Ik contract could squeeze more between now and the end of year (falls out of the basket after Dec19)

- On the basis of point 1. But mitigated by point 4. I would scale into this trade in approx. <15% of my total size at this point as the squeeze risk in delivery could cause Sep28s to richen further

Weightings: +.4 / -1 / +.6

Cix: 200 * (YIELD[BTPS 4.75 09/01/28 Corp] - 0.4 * YIELD[BTPS 2.05 08/01/27 Corp] - 0.6 * YIELD[BTPS 3 08/01/29 Corp])

Carry & Roll

-1.3bp /3mo (using 10bp repo spread)

Caution the sep28 may get richer on repo over the delivery cycle

Anomaly Value – BBG GOVY exponential 3mo spline

Anything else needed, pls let me know

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796