IK delivery #2 - James Rice @Astor Ridge

Hi Greg and Dan,

Updated the IK delivery analysis to include the LC bonds as deliverable –

the NEW info is marker lower AFTER the bar lower (like the one below this line) in the message that reads AMENDED PORTION, but give the whole thing a read through if you can pls

can I follow up with a call next few days?

What happens to a bond dropping out of Ik Delivery?

How can we profit from understanding the drop out process for the CTD to the IK?

What happened to Btps Mar26 and what do we expect for Btps Sep28?

Method

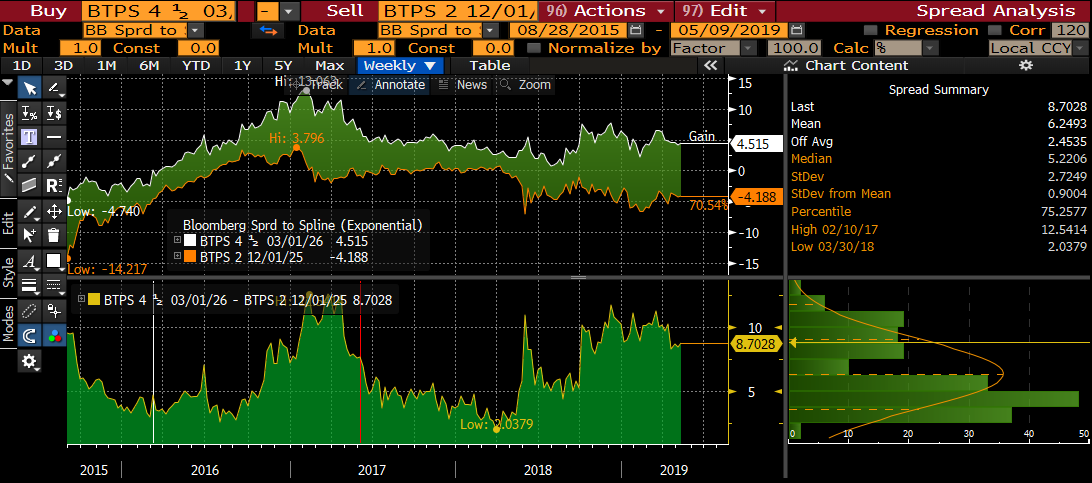

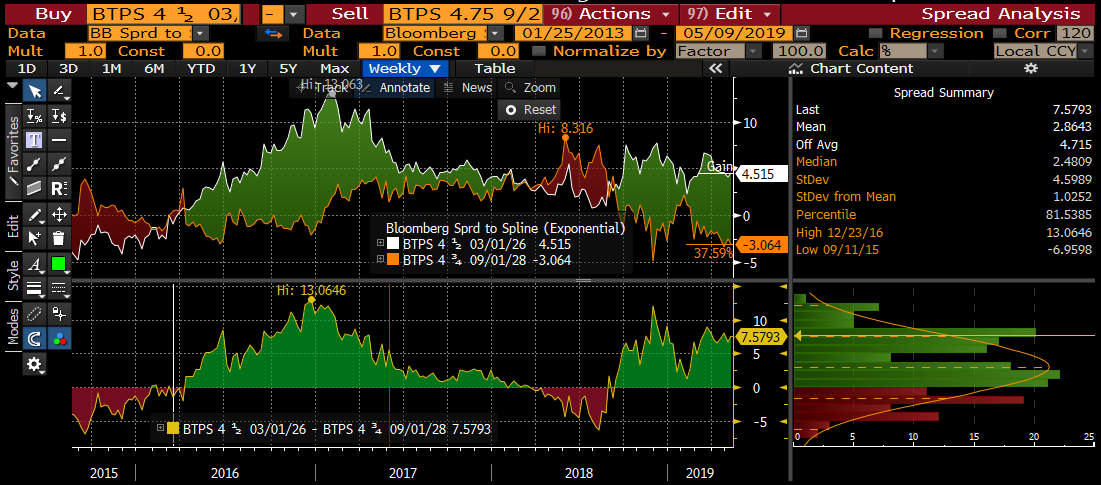

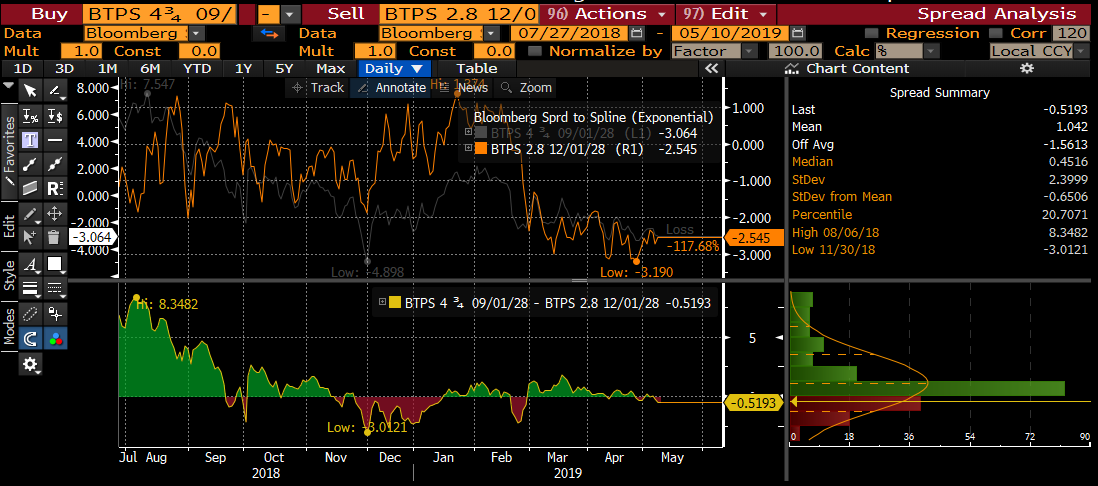

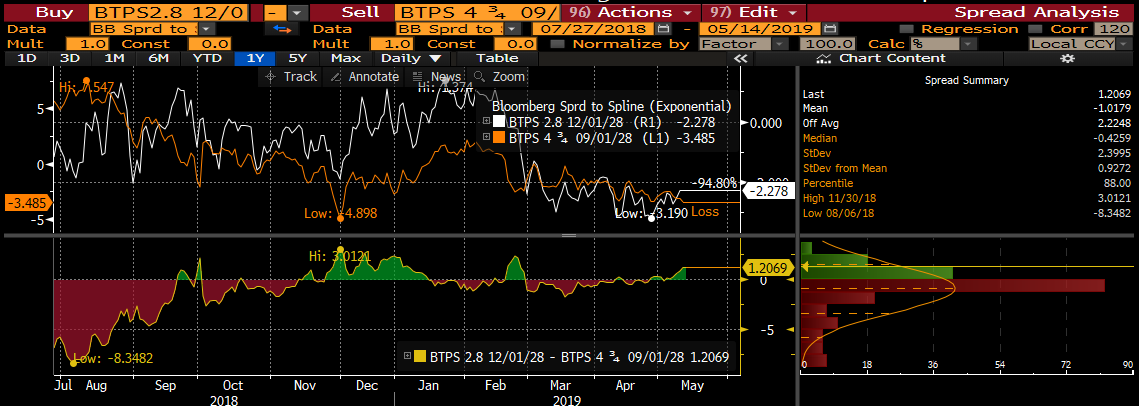

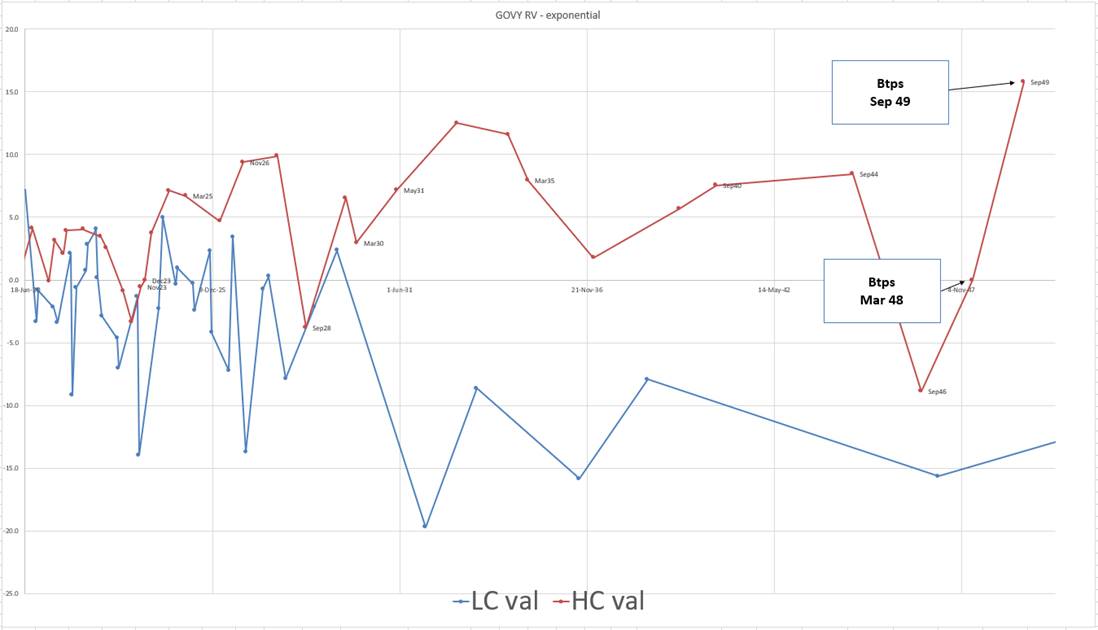

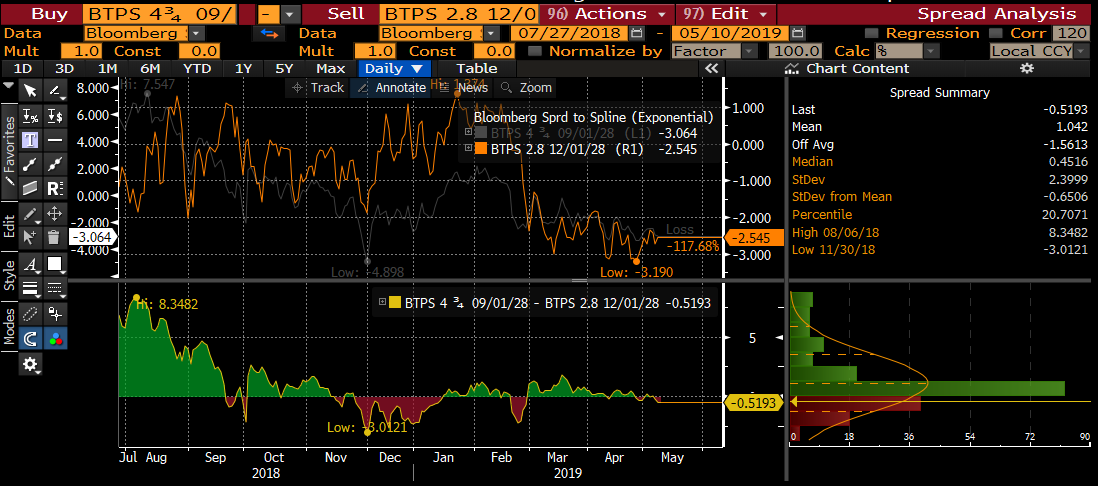

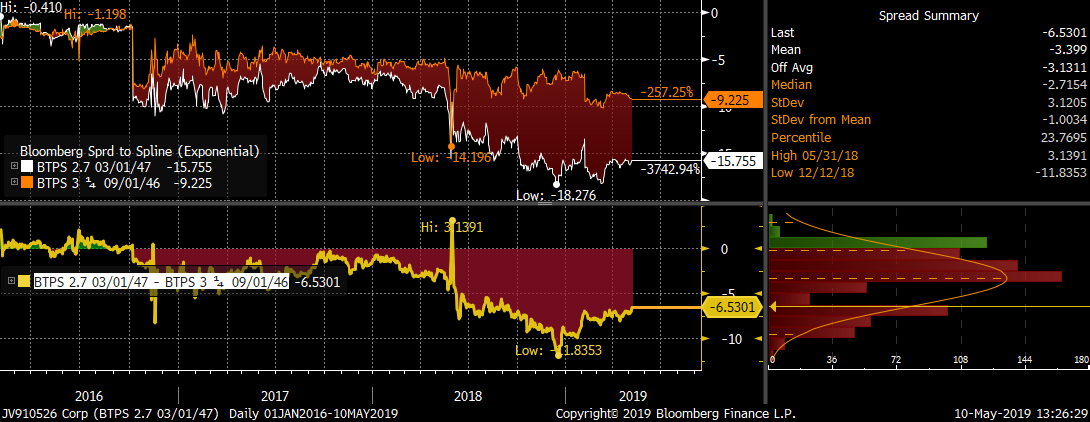

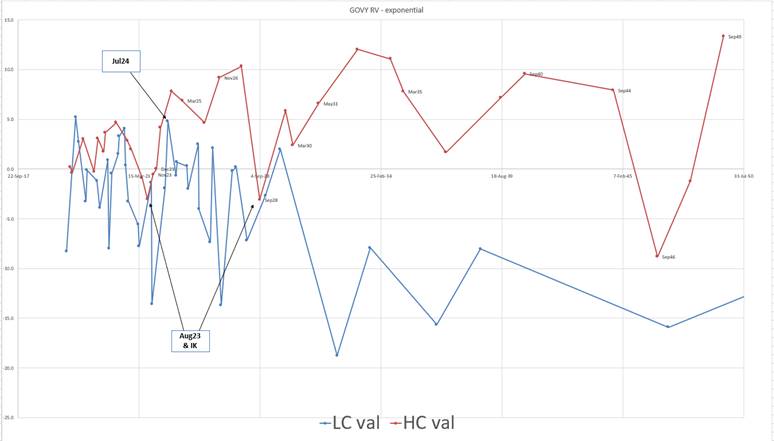

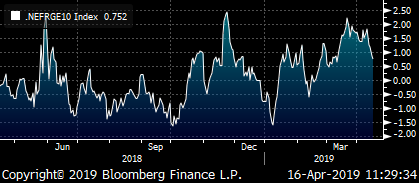

I have compared the Bloomberg spline Spread (exponential) here to remove some coupon effect and all the risk free curve component

Conclusions

- A current CTD has traded +2 to +13bp vs old LC issues

- They have traded cheap at the back end of their delivery cycle

- They have richened after dropping out – up to -6.5bp through the current CTD , but not vs other non – ctd’s

- Sep 28 look to have already done more than what Mar26 did when it dropped out (trade 1.2 bp richer than Dec28)

Trade theme

We got used to the theme…

expect a cheapness as a CTD, Expect a richness out of the basket – but that is contextual to neighbouring bonds

but that was dominated by the prevailing ik/rx mood and the use of ik as a hedging mechanism

Sep28 confounds – it has already travelled its journey..

- Sep28 is already (and has been flat in RV to slightly shorter LC issues

- Sep28 is already trading as rich in drop out terms to the next CTD Dec28

Hence the theme can be two parts

- when is the delivery ‘pull’ of ik over for sep28

- how can dec29, Aug29, Mar30 trade v each other when they constitute three deliverables that are quite close

- Ergo - Storm warning for the Dec/Mar futures roll

- Feb28 become the soft underbelly if the 9-10y market as they are unlikely ever to make CTD

Here’s how delivery looked historically in terms of CTDs

|

Yrs to mat. For each bond |

||||||||

|

contract |

delivery |

poss ctd |

1-Mar-26 |

1-Feb-28 |

1-Sep-28 |

1-Dec-28 |

1-Aug-29 |

1-Mar-30 |

|

Mar-16 |

10-Mar-16 |

1-Mar-26 |

9.97 |

11.89 |

12.48 |

12.73 |

13.39 |

13.97 |

|

Jun-16 |

10-Jun-16 |

1-Mar-26 |

9.72 |

11.64 |

12.23 |

12.47 |

13.14 |

13.72 |

|

Sep-16 |

12-Sep-16 |

1-Mar-26 |

9.46 |

11.38 |

11.97 |

12.22 |

12.88 |

13.46 |

|

Dec-16 |

12-Dec-16 |

1-Mar-26 |

9.22 |

11.14 |

11.72 |

11.97 |

12.63 |

13.22 |

|

Mar-17 |

10-Mar-17 |

1-Mar-26 |

8.98 |

10.90 |

11.48 |

11.73 |

12.39 |

12.98 |

|

Jun-17 |

12-Jun-17 |

1-Mar-26 |

8.72 |

10.64 |

11.22 |

11.47 |

12.14 |

12.72 |

|

Sep-17 |

11-Sep-17 |

1-Sep-28 |

8.47 |

10.39 |

10.97 |

11.22 |

11.89 |

12.47 |

|

Dec-17 |

11-Dec-17 |

1-Sep-28 |

8.22 |

10.14 |

10.72 |

10.97 |

11.64 |

12.22 |

|

Mar-18 |

12-Mar-18 |

1-Sep-28 |

7.97 |

9.89 |

10.47 |

10.72 |

11.39 |

11.97 |

|

Jun-18 |

11-Jun-18 |

1-Sep-28 |

7.72 |

9.64 |

10.23 |

10.47 |

11.14 |

11.72 |

|

Sep-18 |

10-Sep-18 |

1-Sep-28 |

7.47 |

9.39 |

9.98 |

10.23 |

10.89 |

11.47 |

|

Dec-19 |

10-Dec-19 |

1-Sep-28 |

6.22 |

8.14 |

8.73 |

8.98 |

9.64 |

10.22 |

|

Mar-20 |

10-Mar-20 |

1-Dec-28 |

5.97 |

7.89 |

8.48 |

8.73 |

9.39 |

9.97 |

|

Jun-20 |

10-Jun-20 |

1-Aug-29 |

5.72 |

7.64 |

8.23 |

8.47 |

9.14 |

9.72 |

|

Sep-20 |

10-Sep-20 |

1-Aug-29 |

5.47 |

7.39 |

7.97 |

8.22 |

8.89 |

9.47 |

|

Dec-20 |

10-Dec-20 |

1-Mar-30 |

5.22 |

7.14 |

7.72 |

7.97 |

8.64 |

9.22 |

|

Mar-21 |

10-Mar-21 |

1-Mar-30 |

4.98 |

6.90 |

7.48 |

7.73 |

8.39 |

8.98 |

NB

|

Underlying Instrument: |

|

Notional long-term debt instruments issued by the Republic of Italy with an original maturity of no longer than 16 years and a remaining time of maturity of 8.5 to 11 years and a coupon of 6 percent |

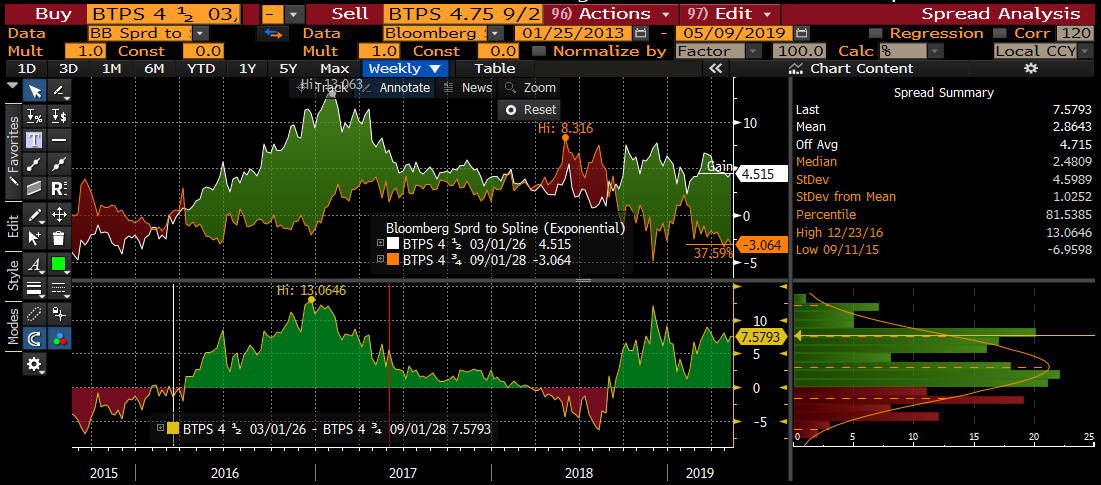

Btps 4.5% Mar26 – CTD Mar 2016 (estimated) – exited the delivery basket after Jun 17

vs OLD 8YR bond – see white line and red line

- As a CTD it never traded rich cs the older 10y

- It actually got to +13bp cheap as CTD – the was at the wide of the ik/rx spread

- Out of the basket it richened to other off the runs – but did not trade through (bond richened as it lost its CTD status in June 2017)

- Max +13bp, min +2bp

Vs incoming CTD Sep28

- bond cheapened vs the sep28 from mar 2016 to mid 2016 – but it started to richen at hallway through its delivery cycle. Again I think this is more a function of ik/rx

- After it dropped out in Jun 2017 it continued to richen all the way to Q3 2018

- Q3 of 2018 mar26 was richest to sep28 – again this is a function in my mid of sep 28 suffering as a hedge instrument with a wide ik/rx

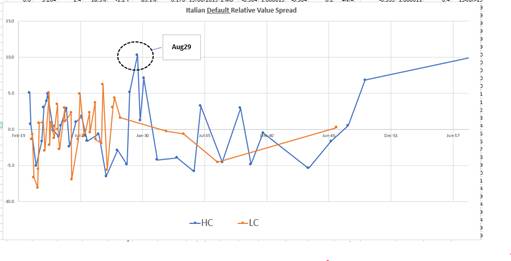

Btps 4.75% Sep28 – CTD Sep 2017 – expecting to exit the delivery basket after Dec 19

vs old local LC bond (Dec28) – the bond has traded fairly ‘flat’ in Rv terms throughout the last 9 months since Oct

I would expect the sep 28 to be bounded vs Dec28 at -3bp – another 2.5bp richer from where we are

AMENDED PORTION….

So now we see that in all likelihood the Dec28 will be the next CTD

Vs incoming CTD

The bond is slightly rich to the Dec28, but with the exception of the fact that the former is high coupon and the latter is low – this could distend further

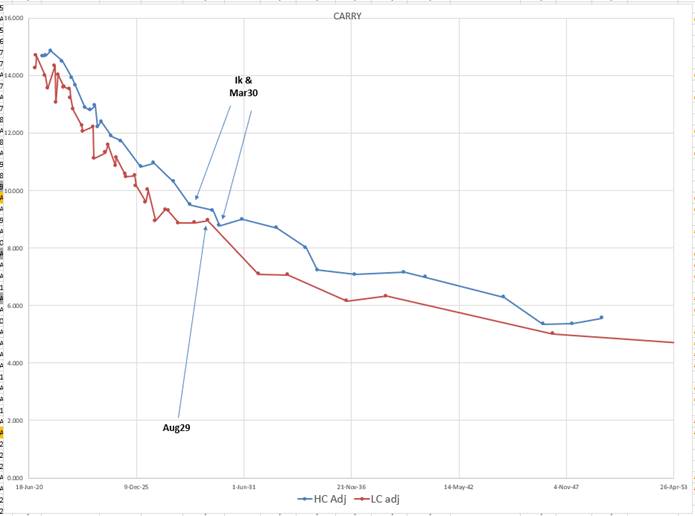

Delivery Structure -

Let’s take a look at the delivery structure into Dec – with exception of sep 28 which drop out in dec – the relative desirability of delivery will be

(*with the market at the current levels – there is directionality in the basis and curve and anomaly optionality – all of which makes the Mar2020 contract in determinate in its value – negatively convex)

Btps Dec28 clear CTD at the moment

Btps Aug29 25 cents richer than CTD (≈ 3bp)

Btps Mar30 50 cents richer the CTD (≈ 6bp)

*estimated from the dec19 delivery structure

SO……..

What does this mean?

Essential

- Sep 28 as an off the run are rich

- Mar26 richened because they were uber cheap as a CTD

- Mar26 NEVER traded through the low coupons once they dropped out

- Sep28 are through the low coupons now

- Sep28 are CTD for two more contracts – sep19 and dec19 – NB xmas CTD will be tough to short over the turn possibly

- The mar 30 will not be CTD unless things change hugely until Mar2021

- The Mar20 contract will have 3 CTDS that are a lot closer on CTD status than the jun, sep & dec contracts this year

- The Mar20 contract is riddled with indeterminacy – increasing the chances of a dec/mar roll squeeze

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

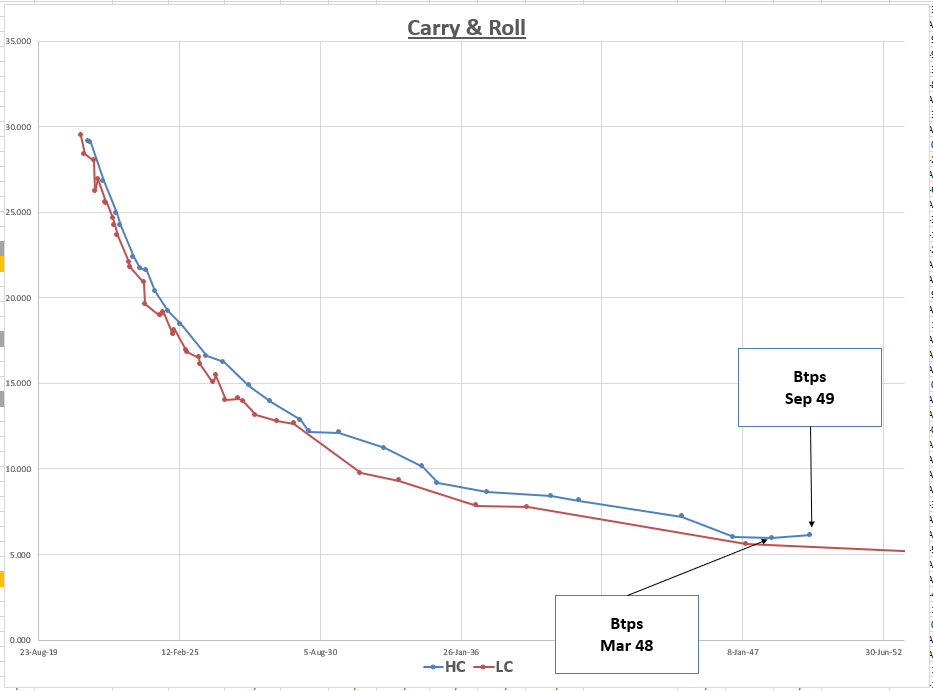

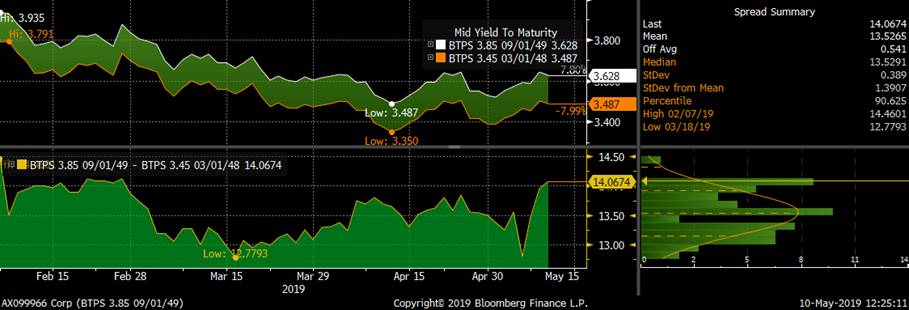

Trade Radar, Italy long bond - 14th May James Rice @ Astor Ridge

– just some thoughts on the Italian 30y today

– this is a 7/10 conviction for me – trade is generally good in RV terms but in mitigation is that we’re buying a tap bond that will remain so

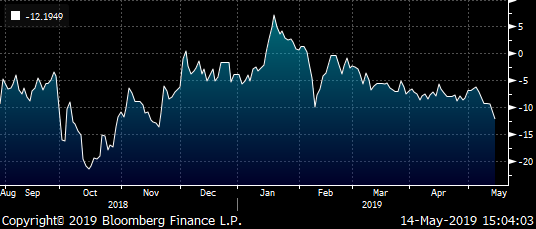

Italian Tap – Tuesday 14th May

€ 1 – 1,5 Bln Sep49s

Recent cheap on yield spread

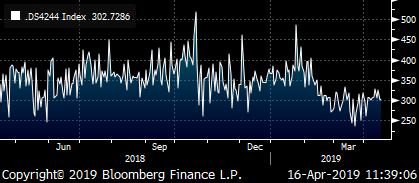

Cheap on Anomaly (BBG exponential spline)

Slight positive Roll and Carry (@same repo) in a curve that is generally a give to extend

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

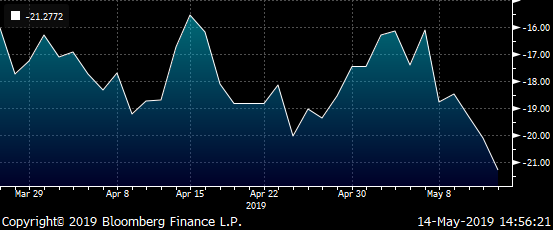

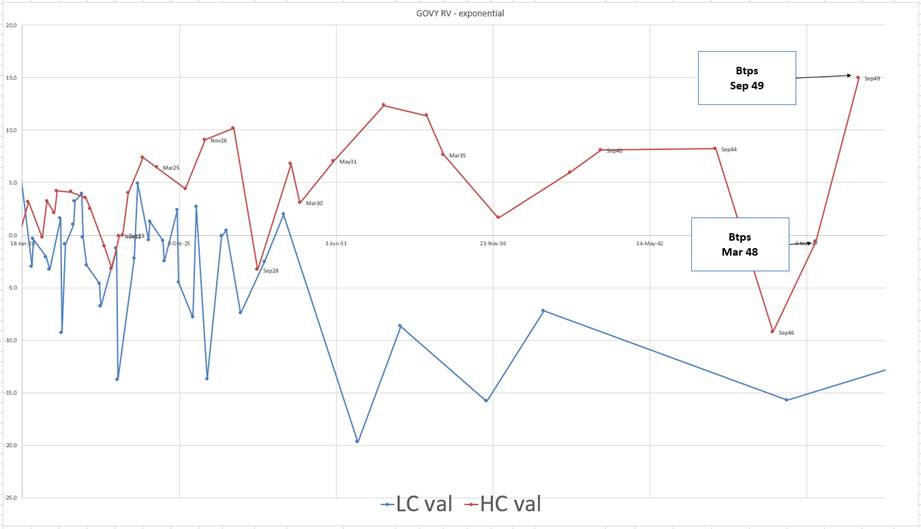

FW: Trade Radar 2 , - 14th May James Rice @ Astor Ridge

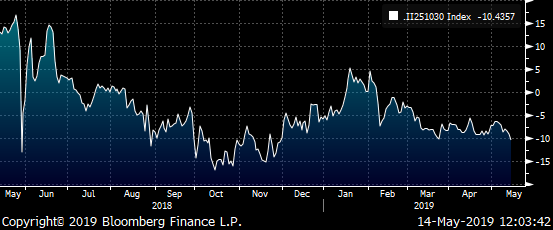

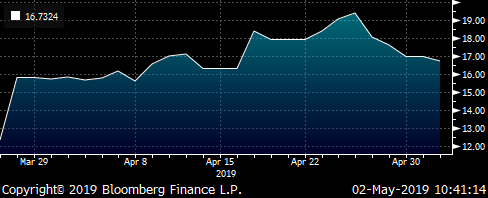

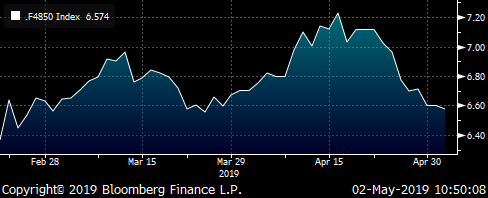

Italy 5s10s too flat

vs 2s30s

Italy 5s10s has out-flattened 2s30s

Trade

Sell €50k Btps 2% Feb 28, €65,6MM

Buy €50k Btps 1% 7/22, €163,4MM

Hedge with 25% risk in 2s30s…(based on curve shape)

Buy €12,5k Btps 3.85% sep49, €6,8MM

Sell €12,5k BTSA Italian 2 yr futures contract, 528 lots (CTD Btps 3.75% Aug21)

Entry: -21.3bp

Add: -24bp

Target: -10bp

Stop: -27bp

Roll and Carry:

History

Using actual issues

100 * ((YIELD[BTPS 2 02/01/28 Corp] - YIELD[BTPS 1.75 07/01/24 Corp]) - 0.25 * (YIELD[BTPS 3.85 09/01/49 Corp] - YIELD[BTPS 3.75 08/01/21 Corp]))

Using older issues

very approx. 1y older

oct20 / oct23 / jun27 / mar48

100 * ((YIELD[BTPS 2.2 06/01/27 Corp] - YIELD[BTPS 2.45 10/01/23 Corp]) - 0.25 * (YIELD[BTPS 3.45 03/01/48 Corp] - YIELD[BTPS 0.2 10/15/20 Corp]))

Using CMBS

Italy 5s10s has out-flattened 2s30s

Use this move to express some anomaly trades without having to take significant curve risk

put on a steepener 5s10s with a smaller 2s30s flattener to hedge the generic curve risk

In simple terms the sum of two flys,

long 2s5s10s plus short 5s10s30s gives us

-0.33* 2y + 5y -10y -0.33*30y

100 * ((RV0005P 10Y BLC Curncy - RV0005P 5Y BLC Curncy) - 0.33 * (RV0005P 30Y BLC Curncy - RV0005P 2Y BLC Curncy))

Very long term history…

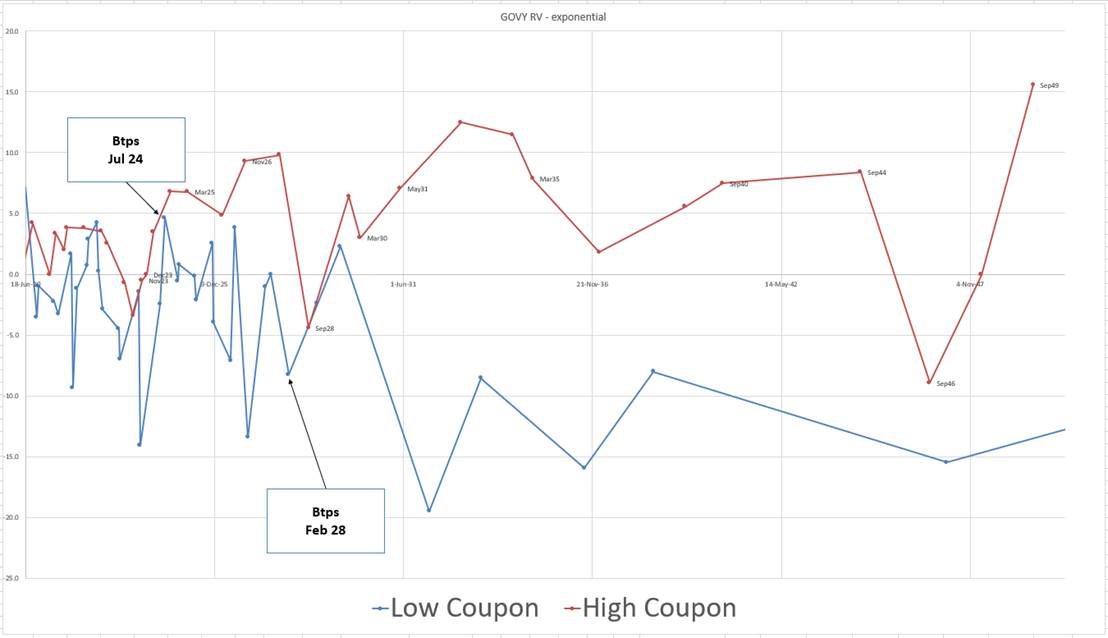

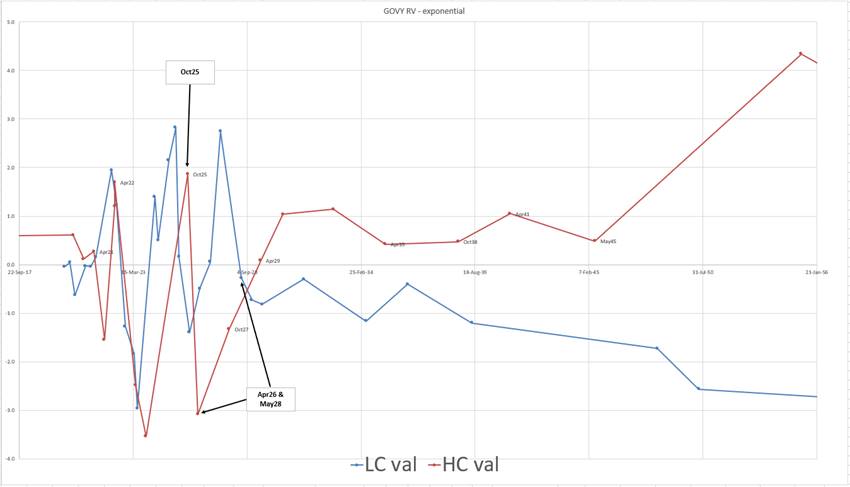

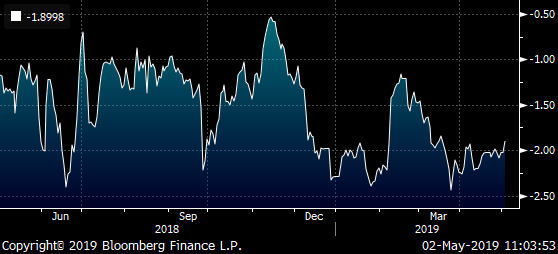

Anomalous Issues, anomaly in your favour – Jul 24 and Feb 28

Bloomberg GOVY Spline Spread values – Exponential Fit

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

IK delivery - James Rice @Astor Ridge

What happens to a bond dropping out of Ik Delivery?

How can we profit from understanding the drop out process for the CTD to the IK?

What happened to Btps Mar26 and what do we expect for Btps Sep28?

Method

I have compared the Bloomberg spline Spread (exponential) here to remove some coupon effect and all the risk free curve component

Conclusions

- A current CTD can trade +2 to +13bp vs old LC issues

- They have traded cheap at the back end of their delivery cycle

- They have richened after dropping out – up to -6.5bp through the current CTD

- Sep 28 look to have already done what Mar26 did when it dropped out (trade approx 5bp richer than the incoming CTD)

Trade theme

Expect a cheapness as a CTD, Expect a richness out of the basket

However Sep28 confounds – it has already travelled its journey..

- Sep28 is already (and has been flat in RV to slightly short LC issues

- Sep28 is already trading as rich in drop out terms to the next CTD Mar30

Here’s how delivery looked historically in terms of CTDs

|

Yrs to mat. |

|||||

|

contract |

delivery |

ctd |

1-Mar-26 |

1-Sep-28 |

1-Mar-30 |

|

Mar-16 |

10-Mar-16 |

1-Mar-26 |

9.97 |

12.48 |

13.97 |

|

Jun-16 |

10-Jun-16 |

1-Mar-26 |

9.72 |

12.23 |

13.72 |

|

Sep-16 |

12-Sep-16 |

1-Mar-26 |

9.46 |

11.97 |

13.46 |

|

Dec-16 |

12-Dec-16 |

1-Mar-26 |

9.22 |

11.72 |

13.22 |

|

Mar-17 |

10-Mar-17 |

1-Mar-26 |

8.98 |

11.48 |

12.98 |

|

Jun-17 |

12-Jun-17 |

1-Mar-26 |

8.72 |

11.22 |

12.72 |

|

Sep-17 |

11-Sep-17 |

1-Sep-28 |

8.47 |

10.97 |

12.47 |

|

Dec-17 |

11-Dec-17 |

1-Sep-28 |

8.22 |

10.72 |

12.22 |

|

Mar-18 |

12-Mar-18 |

1-Sep-28 |

7.97 |

10.47 |

11.97 |

|

Jun-18 |

11-Jun-18 |

1-Sep-28 |

7.72 |

10.23 |

11.72 |

|

Sep-18 |

10-Sep-18 |

1-Sep-28 |

7.47 |

9.98 |

11.47 |

|

Dec-19 |

10-Dec-19 |

1-Sep-28 |

6.22 |

8.73 |

10.22 |

|

Mar-20 |

10-Mar-20 |

1-Mar-30 |

5.97 |

8.48 |

9.97 |

|

|

|

|

|

|

|

NB

|

Underlying Instrument: |

|

Notional long-term debt instruments issued by the Republic of Italy with an original maturity of no longer than 16 years and a remaining time of maturity of 8.5 to 11 years and a coupon of 6 percent |

Btps 4.5% Mar26 – CTD Mar 2016 (estimated) – exited the delivery basket after Jun 17

vs OLD 8YR bond

- Here’s BBG RV spread value vs the old on the run bond (dec25)

- bond richened as it lost its CTD status in June 2017

- it NEVER traded through (low of about +2bp) vs the olds

- it did not cheapen on that metric until the credit blow up H2 2018

- Max +13bp, min +2bp

Vs incoming CTD Sep28

- bond cheapened vs the incoming CTD from mar 2016 to mid 2016 – but it started to richen at hallway through its delivery cycle

- After it dropped out in Jun 2017 it continued to richen all the way to Q3 2018

- The cheapest the bond got to on RV anomaly spread was +13bp, the richest was -6.4bp

Btps 4.75% Sep28 – CTD Sep 2017 – expecting to exit the delivery basket after Dec 19

vs old local LC bond (Dec28) – the bond has traded fairly ‘flat’ in Rv terms throughout the last 9 months since Oct

I would expect the sep 28 to be bounded vs Dec28 at -3bp – another 2.5bp richer from where we are

Vs incoming CTD

The bond is already 5 richer then the incoming CTD – Mar30!

Let me know

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

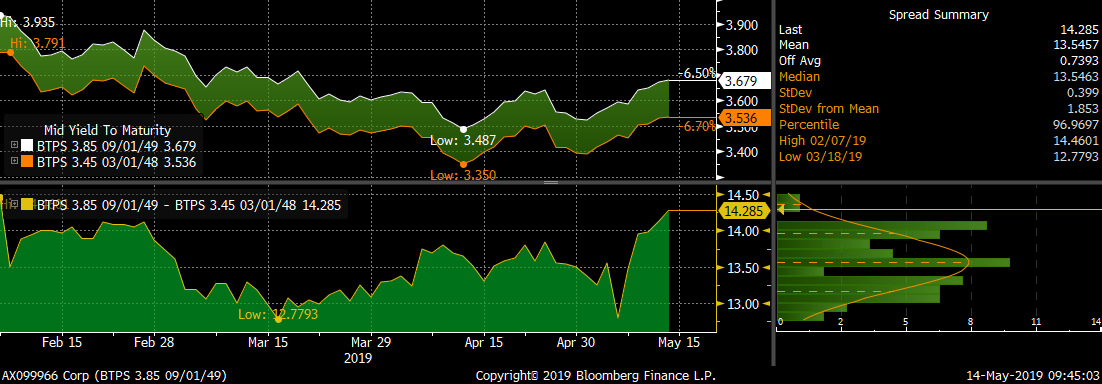

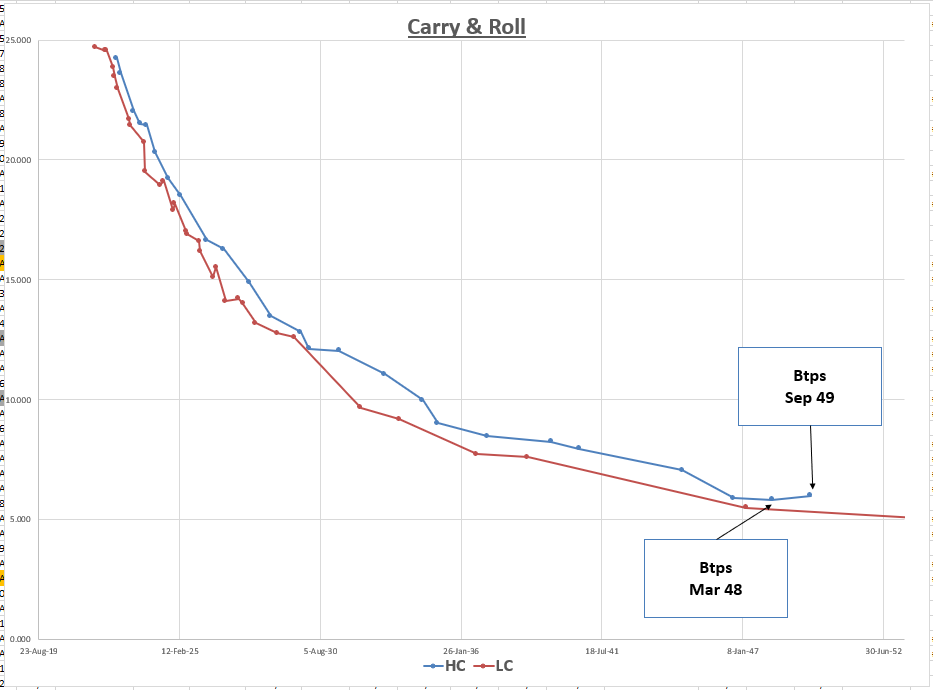

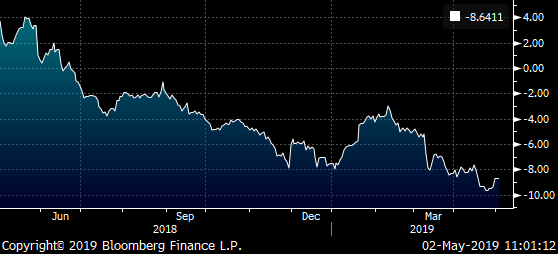

Italian long bond Roll - James Rice @Astor Ridge

Italian Long Bond Roll Trade

Sell Btps 3.45% Mar48, €56.1MM (€100k/bp)

Buy Btps 3.85% Sep49, €53.7mm (€100k/bp)

+14.1bp

Bbg History

Currently @+14.1bp,

Add @ +15.6bp

Average entry +14.85bp

Long Term Target +9bp (PnL 5.85bp)

Stop @ +17.3bp (Loss to Avg – 2.45bp)

Italy announced on Thursday 10th May a tap of the Italian 30y

Btps 3.85 % Sep49 - €1 -1.5 bln

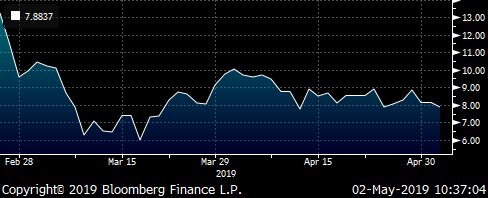

The bond looks cheap on RV – Bloomberg Spline Exponential Spread values

Roll and Carry is slightly positive (@same repo) for a curve where the context is giving carry and roll to extend…

As with buying cheap tap issues the key is determining NOT that they trade cheap but how cheap is too much…

Let’s look at the prior two thirty year issuances.. btps 3.45% Mar 48 and Btps 2.7 Mar 47

The question we pose is

‘During the whole issuance cycle and beyond, how cheap can the 30y role run get?’

Method

We use the Bloomberg spline exponential Spread value between two issues.

This gives an accurate anomaly value that we can compare old vs new 30y

Btps 47 vs Btps 48

The widest this spread anomaly got to is +24.3bp (at the recent wide in It/Ge spreads) – for an increase in coupon of 75bp

Btps 46 vs Btps 47

The wide this actually got to a pick-up of only 3.1bp – because here we were surrendering 55bp in coupon

Interpolation to figure out the right value for the coupon change…

If we linearly interpolate these two point we can estimate what we expect the extreme might be (in BBG spline spread terms) we might observe

Btps 48s -> 49s +40bp in coupon, max spread ??

Btps 47s -> 48s +75bp coupon, max spread +24.3bp

Btps 46s -> Btps 47s -55bp coupon, max spread +3.1bp

so by linear interpolation …

Theoretical Max Spread for 48s 49s to be

+18.6bp, which equates to a yield spread right now of +17.1bp

– stop positioned @ +17.3bp

NB the current yield spread equates to a BBG spline spread of another 1.3bp

Hence

Yield Spread +14.1bp ≡ Spline Spread +15.4bp

For further details please let me know

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - 2nd May 2019 James Rice @Astor Ridge

A few trades on my Radar for the coming weeks

Italy

Trade

Long on the run 10y vs short IK and mar30

Mechanism

-ik +aug29 -mar30

-0.1bp /3mo carry (@same repo)

high coupon into low coupon

buying the tap bond

200 * (yield[BTPS 3 08/01/29 Govt]-0.35*yield[BTPS 4.75 09/01/28 Govt]-0.65*yield[BTPS 3.5 03/01/30 Govt])

3mo Carry Curve…

Italy

Trade

Long cheap 5y vs richer wider wings, cheap sector, cheap bond

Mechanism

-aug23 +jul24 -ik

HC -> LC

buying otr 5y

200 * (yield[BTPS 1.75 07/01/24 Govt]-0.75*yield[BTPS 4.75 08/01/23 Govt]-0.25*yield[BTPS 4.75 09/01/28 Govt])

Bloomberg 3mo exponential spline model spread/anomaly values…

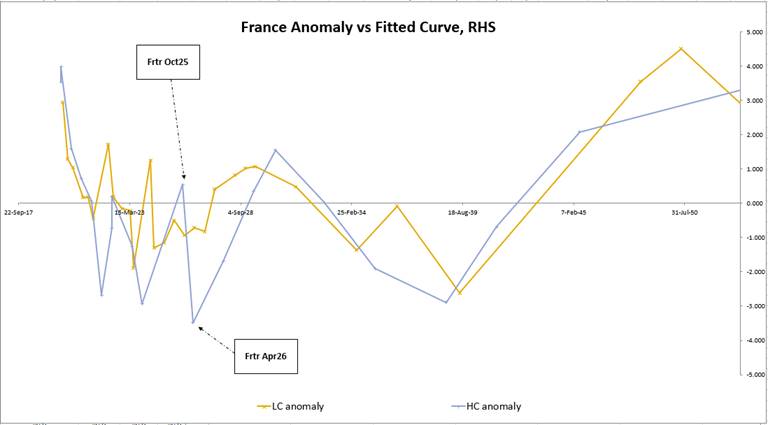

France

Trade

Reverse 30y roll – long Frtr48 short Frtr50

Mechanism

+frtr48 -frtr50

Selling on the run to buy old 30y

counter-intuitive trade - I see 50s still cheap by 1.6bp using conventional analysis, but as a new 50y and using BBGs govy spread value (taking into account the steep curve) it looks rich

Spread has come from +7.2 to +6.6bp - at less than 6.3bp we're supposed to take a look at the reverse roll here

Additionally there could be selling pressure in the 2050s benchmark from the 50yrs which have cheapened to the 30y and cause the fitted curve to get steeper from 2048 to 2050 and beyond…

100 * (YIELD[FRTR 1.5 5/50 Corp] - YIELD[FRTR 2 5/48 Corp])

France

Trade

Long anomaly HC oct25 vs

Short Apr26 & OAT future

Mechanism

+Frtr 6% oct25 / -3.25% apr26 / +OATA

+.8 / -1 / +.2

+ve carry @ +0.4bp @same repo

Leveraged community is gun shy on short apr26 but I think that was a function of being premature and looking only at yield (IRR). Even on a stripped valuation now, apr26 looks rich. This trade sells a rich medium coupon to buy a super cheap high coupon (usually they trade rich) - the OATA component (20%) provides some liquidity and curve 'anchor' to the structure

BBG 3mo exponential spline model spread/anomaly values…

CIX & history

200 * (YIELD[FRTR 3.5 04/25/26 Corp] - 0.8 * YIELD[FRTR 6 10/25/25 Corp] - 0.2 * YIELD[FRTR 0.75 05/25/28 Corp])

Germany

Trade

Short old CTD vs 204 and buxl contract

Mechanism

+jul40 -jul42 +uba

.45 / -1 / +.55

cix:

200 * (yield[DBR 3.25 07/04/42 Govt]-0.45*yield[DBR 4.75 07/04/40 Govt]-0.55*yield[DBR 2.5 07/04/44 Govt])

jul42 are rich - just need slightly better than flat carry to get into this one

42s are rich but carry in the shorter longs is too good vs uba - hence the need for the jul40 component

Look for -2.25bp to pay this structure

History

More to follow

If you’d like any further detail please let me know

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Taking down French supply - Thursday 18th -James Rice @Astor Ridge

Tomorrow, Thursday brings the mid-month French Supply

€7.75 – 9.25 Bln of

New Issue Frtr 0% Mar-25

Expecting > €4bln of the Frtr 25

&

Frtr 1.75% May23

Frtr 0% Feb22

Trade Mechanics

Sell OATA contracts to buy Frtr 0% 3/25 vs MMS

-3bp

target -8bp

stop: flat

Value

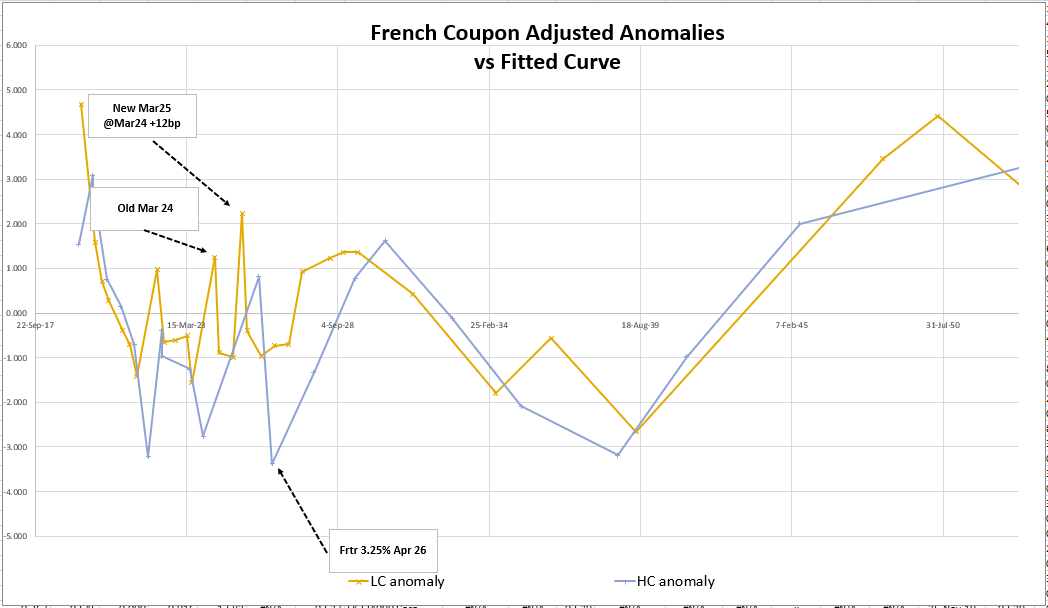

The new French Mar-25 is priced on the roll at +12.8bp over the outgoing 5y, Mar-24

As with most core, Euro on the runs, this makes it looks cheap

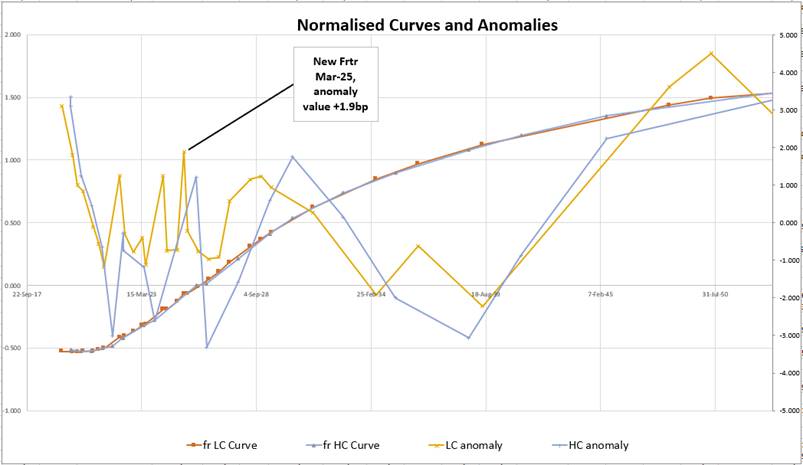

Here’s the French anomaly values versus a fitted curve…

Graph 1 – French Anomaly Values vs fitted curve

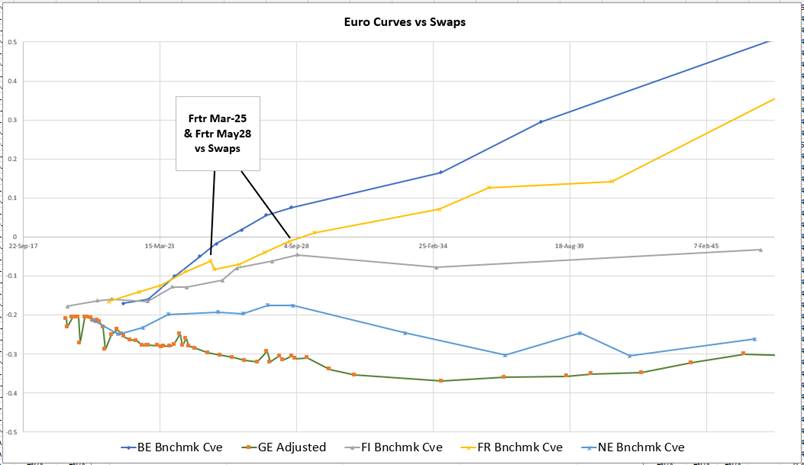

Relative to Swaps

- Shorter French bonds have seen a significant cheapening vs longer tenors relative to the swap curve in the run up to this supply

- To the extent that despite the French curve being steeper than the swap curve – parts of the 2025 to 2028 curve appear anomalously flat

May28 back into Mar25 is a give of just 4p relative to the swap curve

- Here’s the history of selling OAT contracts and buying the Frtr May25 (older bond and hence has history) vs swaps

(SP210[FRTR 0.75 5/28 Corp] - SP210[FRTR .5 5/25 Corp])

For more levels and details drop me a line or call

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

The Fortnight Ahead 16th - 26th April

A few brief ideas on my Radar for the next fortnight…

+UK 10y vs Short Germany and Short US

Political and Brexit pressure abound in UK FI, but for those who see it as a value asset in the context of Europe and US FI…

UK 10 years looking cheap historically vs RXA & old US ten yr

CIX: YIELD[UKT 1.625 10/22/28 Corp] - 0.75 * YIELD[DBR 0.5 02/15/28 Corp] - 0.25 * YIELD[T 2.75 02/15/28 Govt] - 0.483

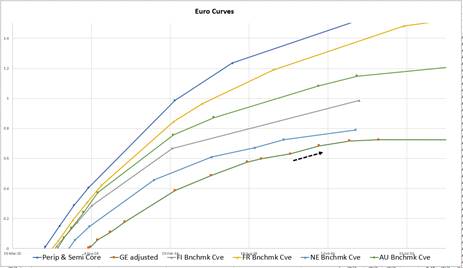

+Nether 10y vs -France (OATA) and -Germany (RXA)

Holland went through supply today with good demand for a rare issuer - this one is close to fair and taking off…

CIX: 100 * (YIELD[NETHER 0.75 07/15/28 Corp] - 0.3 * YIELD[FRTR 0.75 05/25/28 Corp] - 0.7 * YIELD[DBR 0.5 02/15/28 Corp] - 0.074)

+German Buxl CTD Dbr Jul44 vs Short old Ctd Dbr – supply in the jul44 on Wednesday 17th April

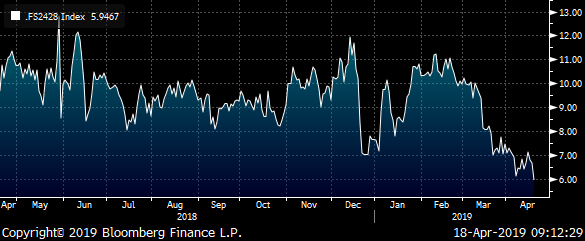

Looks good on stripped value in the context of the rest of the anomaly curve

CIX: 100 * (YIELD[DBR 2.5 7/44 Corp] - YIELD[DBR 3.25 7/42 Corp])

However the swap/z-spread is not on the high a am a bit more greedy on the level – from the graph below on the spread of z-spreads then we need another .75 – 1bp on the yield spread or spread of spreads

Italy – Long Aug29, Short Feb28, with 10% hedge in Long Italian 2y and short Italian 30y

With the carry curve almost flat between these two the only detractor for the cheaper Aug29 is the fact it’s an on-going tap issue

But under almost any metric and particularly under my default model (each cashflow weighted by the probability of receipt or default payment) then Aug 29 are a fantastic value, long in a down market with a relatively low coupon

CIX: 100 * ((YIELD[BTPS 3 08/01/29 Corp] - YIELD[BTPS 2 02/01/28 Corp]) - 0.1 * (YIELD[BTPS 3.45 03/01/48 Corp] - YIELD[BTPS 3.75 08/01/21 Corp]))

Any clawback into month end 10y supply (30th April) is a possible buying opportunity

Long HC Oct25 France (or new long 5r, frtr Mar25 coming on Thursday)

Short Old CTD frtr Apr26

Plus curve Hedge 10% of -oea/+rxa

Straightforward cashflow discounted anomaly – the HC oct25 are cheap & the Apr26 remain rich since their CTD status in the pre-Macron era

Cix: 100 * ((YIELD[FRTR 6 10/25/25 Corp] - YIELD[FRTR 3.5 04/25/26 Corp]) - 0.1 * (YIELD[DBR 0.5 02/15/28 Corp] - YIELD[DBR 1.75 02/15/24 Corp]))

For full details, sizing and levels drop me a note

Best

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

New French 6y James Rice @Astor Ridge

France announced this am supply for next Thursday

Including

New Frtr 0% Mar25 – 6 yr Bond

The challenge is how will this fit into the curve and what opportunities will it throw up?

From the French Tresor page TREX on Bloomberg…

OAT OAT OAT

| 18/04/19 | 18/04/19 | 18/04/19 |

| 0.00%02/22 | 1.75%05/23 | 0.00%03/25 |

| 24/04/19 | 24/04/19 | 24/04/19 |

| 25/02/22 | 25/05/23 | 25/03/25 |

|7750ME<==== | ========== |===>9250ME |

The Frtr 0% of Mar25 is a new issue and will roll into being the benchmark 5y in the same way that the prior 5y, Frtr mar24 was launched in June 2018 also with almost 6 year to maturity

The tap bonds typically trade cheap and I’m starting my pricing / valuation as follows…

Mar23 vs Mar23 is +12bp

Pricing

Mar24 vs Mar25 @ +12bp

Valuation

- See Graph of coupon adjusted yields * - (yield is adjusted for H/L coupon by removing the swap spread and adding the z-spread)

- Adjusted yields are then plotted vs a fitted curve

Suggest Trade

- So one potential trade is the new cheap long 5yr (almost 6 yrs) will have an impact on the richer bonds in the 6y-7y sector

- The Frtr 3.25% Apr26 was cheap (given its coupon as a CTD two years ago, and has richened after dropping out of the basket

- it’s only relatively recently the Apr26 been fully priced or indeed rich after factoring its coupon

- Short the Apr 26 and long the OAT contract seems to capture that expression that 7 yrs should cheapen on the back of this new issue

Trade Mechanics

For further details and trade mechanics gimme a shout…

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FW: Trade Radar - James Rice @Astor Ridge

From: James Rice

Sent: 11 April 2019 11:05

Subject: Trade Radar - James Rice @Astor Ridge

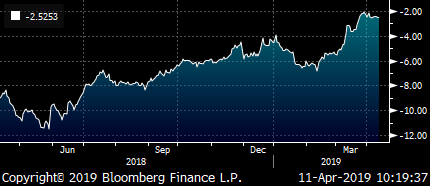

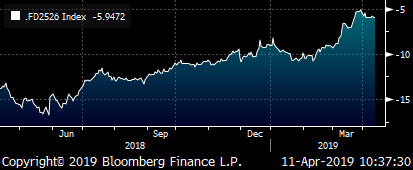

Trade –

Short France 3.25% Apr26

Long Frtr 6% Oct25

Potential for curve hedge also

10% short bobl contract / long bund contract

Graph 1 – yield spread

CIX: 100 * ( YIELD[FRTR 6 10/25/25 Corp] -YIELD[FRTR 3.5 04/25/26 Corp] )

Graph 2 – yield spread hedged with -oea/+rxa

CIX: 100 * ((YIELD[FRTR 6 10/25/25 Corp] - YIELD[FRTR 3.5 04/25/26 Corp]) - 0.1 * (YIELD[DBR 0.5 02/15/28 Corp] - YIELD[DBR 1.75 02/15/24 Corp]))

Mechanics

Buy €50k Frtr 6% Oct25

Sell €50k Frtr 3.25% Apr26

€5k short Bobl (-79 cts) / long Bund (+35 cts)

Levels on regular spread

Enter: -2.8bp

Target: -6.5bp

Stop: -1bp

Rationale

- Frtr 26 moved into an anomalous, rich period after losing CTD status – The more recent drop out CTD Oct27 can now assume that roll and tenor

- On anomaly the oct25 trade cheap (coupon adjusted) – see graph

- The high coupon in the Oct25 gives it good funding characteristics

Graph 3 – France Anomalies vs Fitted Curve

Carry and Roll

Frtr spread (5bp repo spread)

Carry: -0.1bp /3mo

Roll: Flat

German Contract Hedge

Carry: +0.1bp /3mo

Roll: Flat

Risks

- The Frtr Apr26 continue to trade anomalously

- The Repo on Frtr Apr26 richens further

- The Frtr Oct25 cheapen further on the curve

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796