French Trade - exploiting steep France 20s30s vs Germany

Trade – France 20s30s flattener, hedged vs +RX/-UB

Mechanism

- Sell €50k Frtr 1.75% 39, €26,2MM

- Buy €50k Frtr 2% 48, €19,7MM (possibly also use new cheaper frtr ’50)

- & Buy €10k RXM9 (69 cts), Sell €10k UBM9 (27 cts)

Cix: 100 * ((YIELD[FRTR 2 05/25/48 Corp] - YIELD[FRTR 1.75 06/25/39 Corp]) - 0.2 * (YIELD[DBR 2.5 07/04/44 Corp] - YIELD[DBR 0.5 02/15/28 Corp]))

Levels

- Current: @ +16.3 bp

- Target: @ +13.5 bp

- Stop: @+18 bp

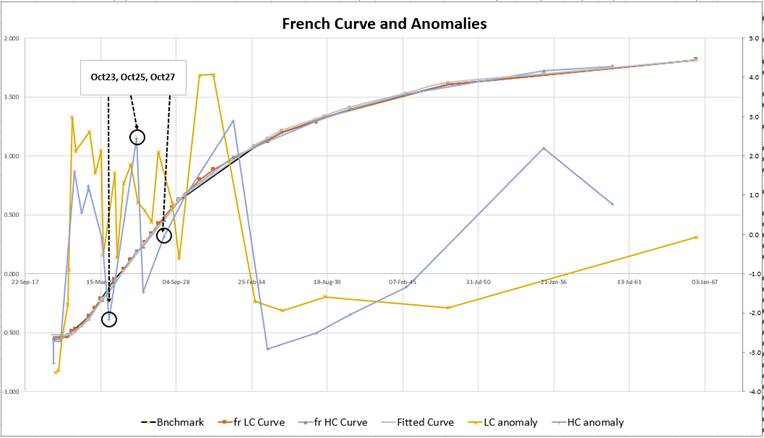

Rationale

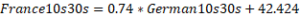

- Euro Curves are similar shapes. Typically weaker credits are thematically steeper

- The French curve is on average 55% steeper than the German curve. (*regression France & German Curve Benchmark Yields vs Tenor)

- In certain areas the French slope is exaggerated – that’s where we can observe true anomalies that are excessive to the general context

Graph of France 20s 30s vs Germany

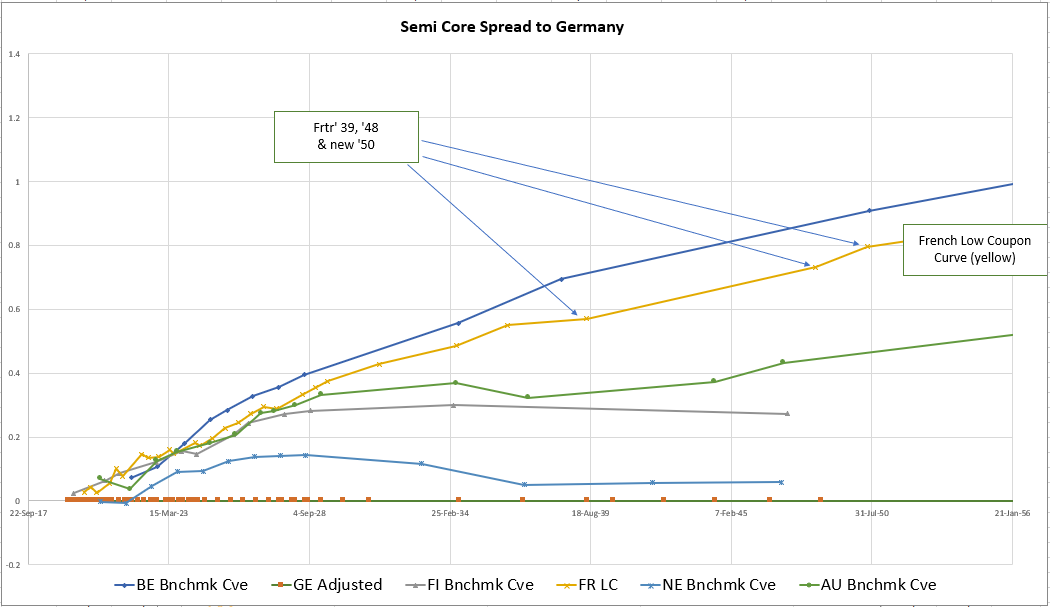

- Thematically the 10s30s French curve is at a recent steep vs Germany – this is the best value ‘fade’ of that theme

See graph of generics 1030s Box Fr v Germany

Cix: (RV0004P 30Y BLC Curncy - RV0004P 10Y BLC Curncy) - (RV0002P 30Y BLC Curncy - RV0002P 10Y BLC Curncy)

CMS France 10s30s minus CMS 10s30s Germany

Carry & Roll – net roll & carry, Nett -1.2bp /3mo

- French C&R: Carry -0.3bp, Roll -1.4bp /3mo (5bp repo spread)

- German Hedge Carry: Carry 0bp, Roll +0.5bp /3mo (even implied repo spread)

Risks

- French long end continues to underperform – on further supply

- French 20y increases its anomaly on the curve

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade in New Italy Btp 3% Aug29 - James Rice @Astor Ridge

Any thoughts, pls

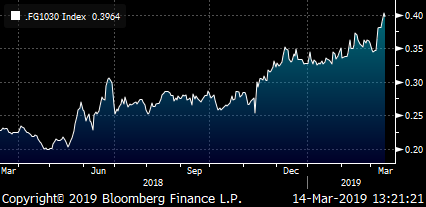

New Btp 10y – 3% Aug 29

Via Auction – Wednesday, expect €4Bln

- Italy announced for Q1 a new 10y Btp – Btps 3% Aug-1-2029

- Typically new issues in recent months have traded poorly – they have higher coupons than prior issues and suffer more in a redenomination or default scenario

- European new issue RV is all about clean up on aisle 3 -

where are the boundary conditions for this issue?

- Locally it’s cheap – on anomaly taking into account yield, carry and default value

- But it’s a rich sector – 10yrs have been a stellar performer of late

Trade Radar:

- Buy Btps 3% Aug 29 - €50k, €56.2MM

- Sell Btps Mar 30, (67%), €33,5k €35.1MM

- Sell IKM9 June Btp contract, (back month 33%), 166 contracts

Levels:

- Currently @ +15bp 2 X ( Aug29 – 0.67 * Mar30 – 0.33 * Sep28)

- Entry @ +16bp

- Cix: 200 * (YIELD[BTPS 3 08/01/29 Corp] - 0.67 * YIELD[BTPS 3.5 03/01/30 Corp] - 0.33 * YIELD[BTPS 4.75 09/01/28 Corp])

- Target @ +9bp

- Stop @ +20bp

Carry:

- Carry: -2.25bp/3mo – using 10bp spread on the mar30 and -1% implied on the IKM9

Curve:

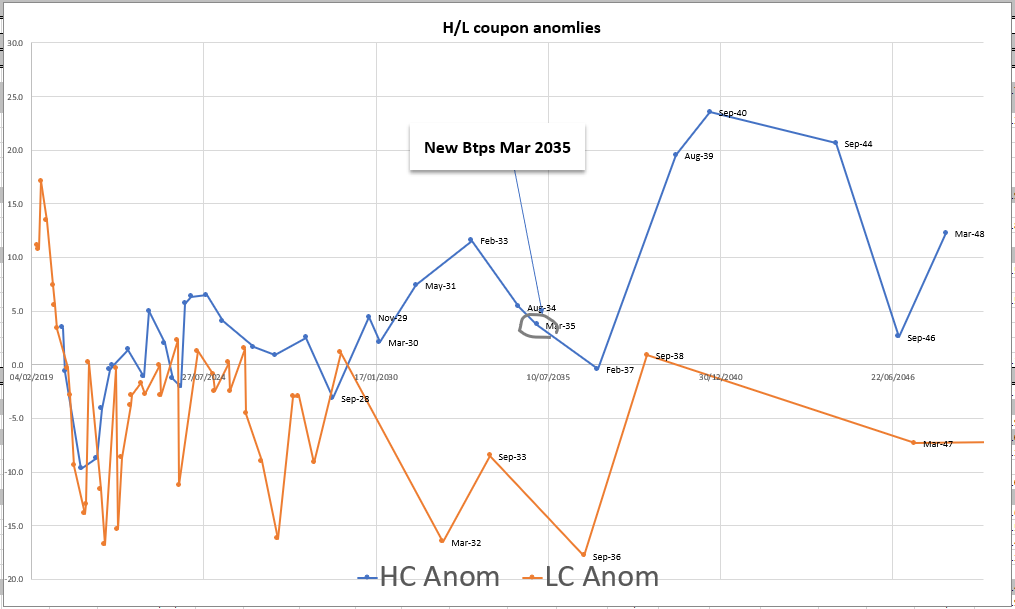

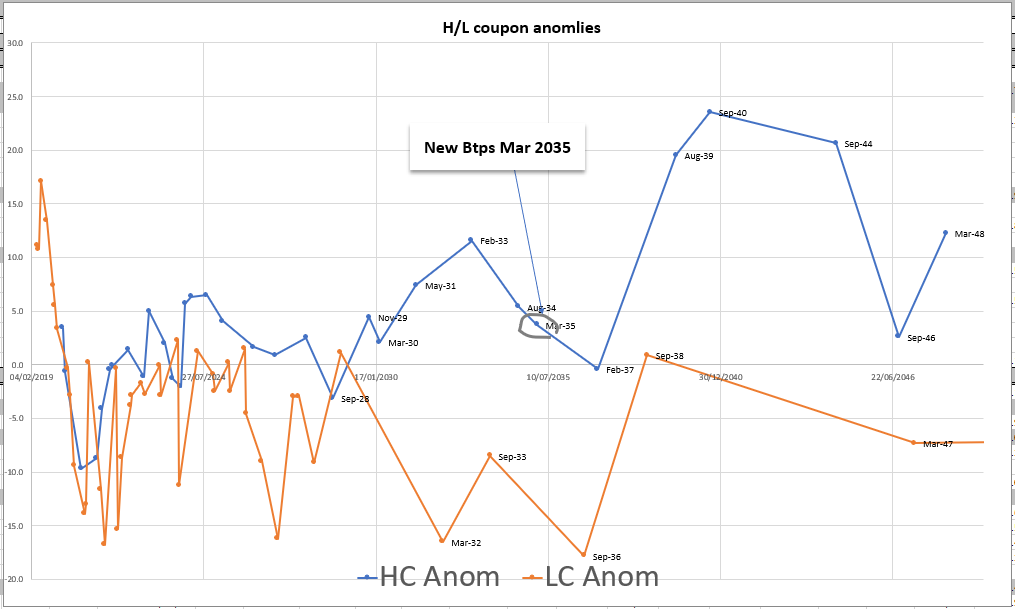

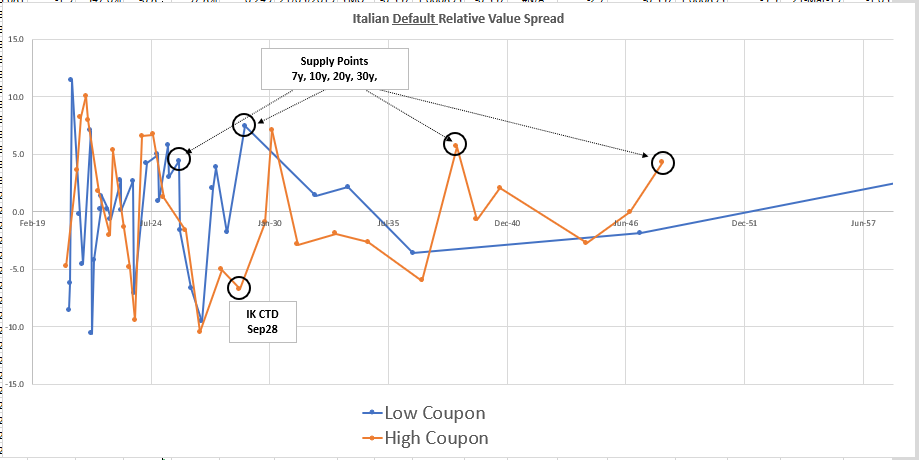

- See below the anomalies on the Italian Curve – vs fitted single exponential in yield space

Rationale:

- Pure RV

- value – the anomaly is worth some 10bp (20bp on the fly) but we concede a decent amount of that by selling the back month contract wich trades cheaper (implied is approx -60bp vs GC)

- The new bond is an ‘average’ coupon – curent average on my curve build including ICTZs is 2.94%. In this instance we are short issues with higher coupons – 4.75% and 3.5%

Risks:

- The sep28 stay bid as CTD all the way to Dec 2019

- The new Aug29 stays offered as an ongoing tap bond, without the protection of other lower coupon bonds

- The Mar30 become anomalously richer

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Part 2 - Trade Radar - Q1 structural trades on the radar in Euro Govts

Q1 structural trades on the radar in Euro Govts

French High coupon Anomaly – Buy Frtr 6% Oct25

Over the second half of last year the Frtr 6% Oct-25 cheapened relative to surrounding bonds- this high coupon, large issue

Trade Mechanics

Buy Frtr Oct-25 €100k

Sell Frtr Oct-23 €50k and sell €50k OATA (CTD Frtr 2.75% Oct-27)

Cix: 2 * (YIELD[FRTR 6 10/25/25 Corp] - 0.5 * YIELD[FRTR 4.25 10/25/23 Corp] - 0.5 * YIELD[FRTR 2.75 10/25/27 Corp])

Levels

Curr: +3.7bp

Entry: here

Add: +7.25bp

Target: -1.75bp

Stop: +9bp

History

2 * (YIELD[FRTR 6 10/25/25 Corp] - 0.5 * YIELD[FRTR 4.25 10/25/23 Corp] - 0.5 * YIELD[FRTR 2.75 10/25/27 Corp])

Rationale

- Anomalies (see graph) – are among the best in the context of all Frtr anomalies

*coupon adjustment by removing the swap spread and adding the z-spread

- Oct25 cheap – the wing Oct23, Oct 27 drop out as CTD after March Contract

Carry & Roll

Carry: +0.3bp /3mo (5bp repo spread)

Roll: +0.1bp /3mo

Trade in Swap Space

Cix: SP210[FRTR 6 10/25/25 Corp] - 0.5 * SP210[FRTR 4.25 10/25/23 Corp] - 0.5 * SP210[FRTR 2.75 10/25/27 Corp]

Risks

The two short bonds stay special/expensive

The Long Frtr oct25 fails to richen

All bullets cheapen on the curve – possibly due to sell-off /steepening

Let me know - thanks

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

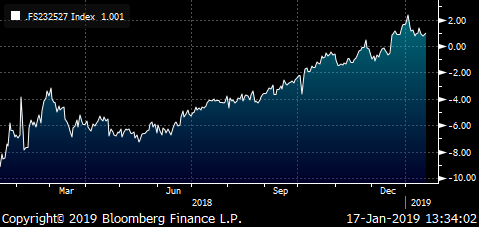

Trade Radar - Q1 structural trades on the radar in Euro Govts

Q1 structural trades on the radar in Euro Govts

Flatteners Germany et al 25s 30s…

In Europe 25s -30s is steep relative to the general theme - flatteners

See graph of Germany, Netherlands, Finland and France on swap spread – see graph

- This is a common feature despite bond curves out-flattening the swap curve in shorter tenors – see graph of 10y German swap spreads vs German 2y swap spreads (generics)

(RV0002P 10Y BLC Curncy - EUSA10 Curncy) - (RV0002P 2Y BLC Curncy - EUSA2 Curncy)

- We could see a sympathetic flattening of the 25s30s in other Euro markets

Trade - Sell dbr 42s to buy dbr 46s

Currently: @+9.8bp

R&C: -0.3bp /3mo (@5bp repo spread)

Target: +2bp – in line with extrapolation of shorter tenors

Add: +12bp

Stop: +15bp

Yield spread cix: YIELD[DBR 2.5 08/15/46 Corp] - YIELD[DBR 3.25 07/04/42 Corp]

To check that this has not outperformed the swap curve look at the swap spread – that hasn’t moved unlike shorter tenor spreads

Swap spread cix: SP210[DBR 2.5 08/15/46 Corp] - SP210[DBR 3.25 07/04/42 Corp]

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

New Italian syndicated 15y - Btps Mar 35 - James Rice, Astor Ridge

Errata apologies – amended fly levels

Levels

Weighted Fly currently @ 7.3bp – (2 X middle minus weighted wings, -1.5 / +2 / -0.5)

Enter: @ +7.3bp

Add: @ 10.5 bp

Exit: @ Flat bp

Stop: @ +13 bp

Syndication today in New Italian 15yr – priced at +18bp over Btps sep33

Btps March 2035

Coupon – TBA

Could present value opportunities versus high coupon curve

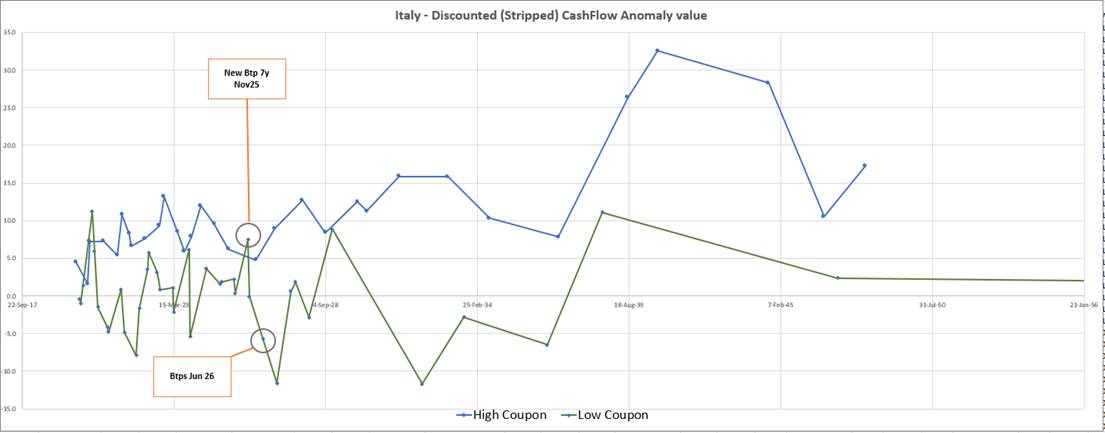

Italian Anomaly Values

Graph – of Value vs Fitted Italian Curve

*Yields adjusted partially for coupon in a steep curve by subtracting swap spread and adding z-spread

Trade Mechanics

Buy New Btps mar 2035, €100k

Sell Btps 5% Aug 34, €75k

Sell Btps 4% Feb 37, €25k

Levels

Weighted Fly currently @ 0bp – (2 X middle minus weighted wings, -1.5 / +2 / -0.5)

Enter: @ Flat

Add: @ +3bp

Exit: @ -5bp

Stop: @ +6bp

Trade Rationale

· New issues trade cheap on the curve – see graph above – the bond is cheap to the high coupon curve (curve avg. coupon is 3.06%)

· With a medium coupon (expected approx. 3.35%) the bond has cashflow value in a steep curve

· As a medium coupon bond the Btps mar35 have reasonable default value – see default anomalies (estimated from expected coupon and accrued details)

· High into medium coupon bonds at Flat is also optically getting the default option on Italy for little premium (just the carry)

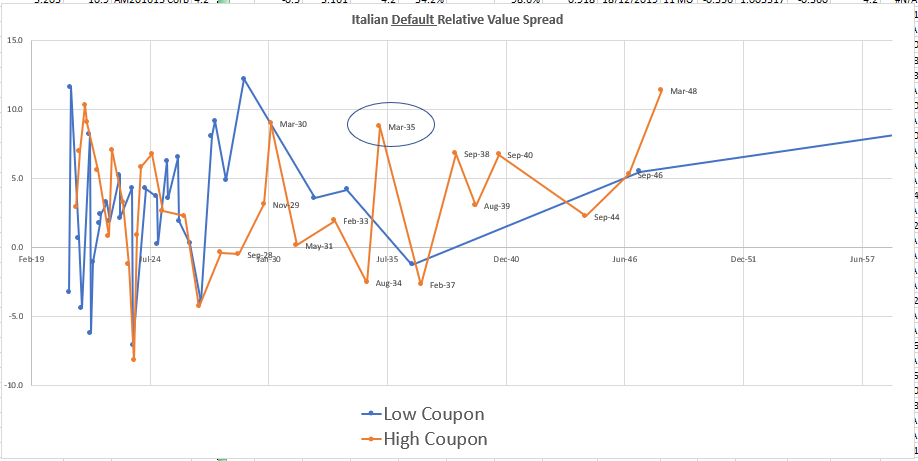

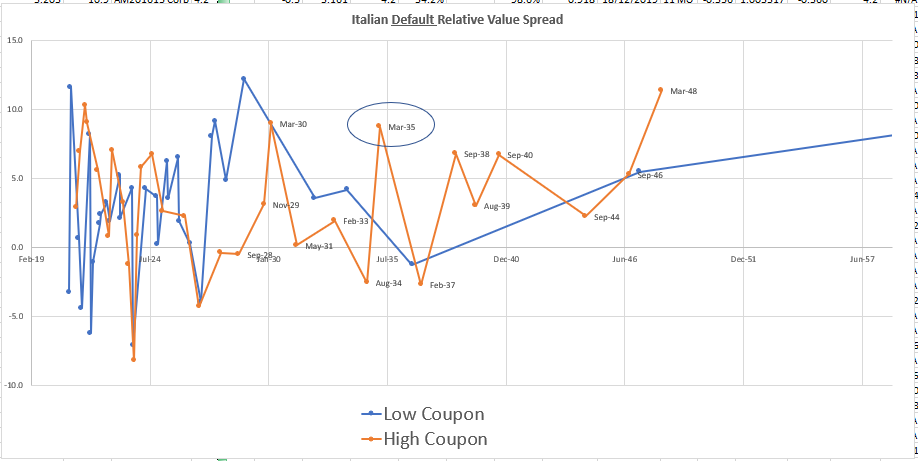

Default Anomalies

Graph of default anomalies as implied by the generic shape of the Italian curve vs Eonia and various H/L coupon differentials

Carry and Roll

Carry: TBA – given unknown coupon – expect small negative

Roll: -0.1bp /3mo

Risks

- The Feb 37 med coupon stay bid

- The new tap bond 2035s remain cheap

- The trade stays constant in yield spread and the trade loses small over time in carry

Let me know your thoughts

Thanks

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

New Italian syndicated 15y - Btps Mar 35 - James Rice, Astor Ridge

Syndication today in New Italian 15yr – priced at +18bp over Btps sep33

Btps March 2035

Coupon – TBA

Could present value opportunities versus high coupon curve

Italian Anomaly Values

Graph – of Value vs Fitted Italian Curve

*Yields adjusted partially for coupon in a steep curve by subtracting swap spread and adding z-spread

Trade Mechanics

Buy New Btps mar 2035, €100k

Sell Btps 5% Aug 34, €75k

Sell Btps 4% Feb 37, €25k

Levels

Weighted Fly currently @ 0bp – (2 X middle minus weighted wings, -1.5 / +2 / -0.5)

Enter: @ Flat

Add: @ +3bp

Exit: @ -5bp

Stop: @ +6bp

Trade Rationale

· New issues trade cheap on the curve – see graph above – the bond is cheap to the high coupon curve (curve avg. coupon is 3.06%)

· With a medium coupon (expected approx. 3.35%) the bond has cashflow value in a steep curve

· As a medium coupon bond the Btps mar35 have reasonable default value – see default anomalies (estimated from expected coupon and accrued details)

· High into medium coupon bonds at Flat is also optically getting the default option on Italy for little premium (just the carry)

Default Anomalies

Graph of default anomalies as implied by the generic shape of the Italian curve vs Eonia and various H/L coupon differentials

Carry and Roll

Carry: TBA – given unknown coupon – expect small negative

Roll: -0.1bp /3mo

Risks

- The Feb 37 med coupon stay bid

- The new tap bond 2035s remain cheap

- The trade stays constant in yield spread and the trade loses small over time in carry

Let me know your thoughts

Thanks

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - James Rice @Astor Ridge, Dec 18

Trade Radar

A few trades on my radar coming into year end

As with all these structures @ year-end, timing is key. I tend to think that things have to look glaringly obvious and resist the temptation to go too early. That said scaling any trade into two or more pieces makes sense

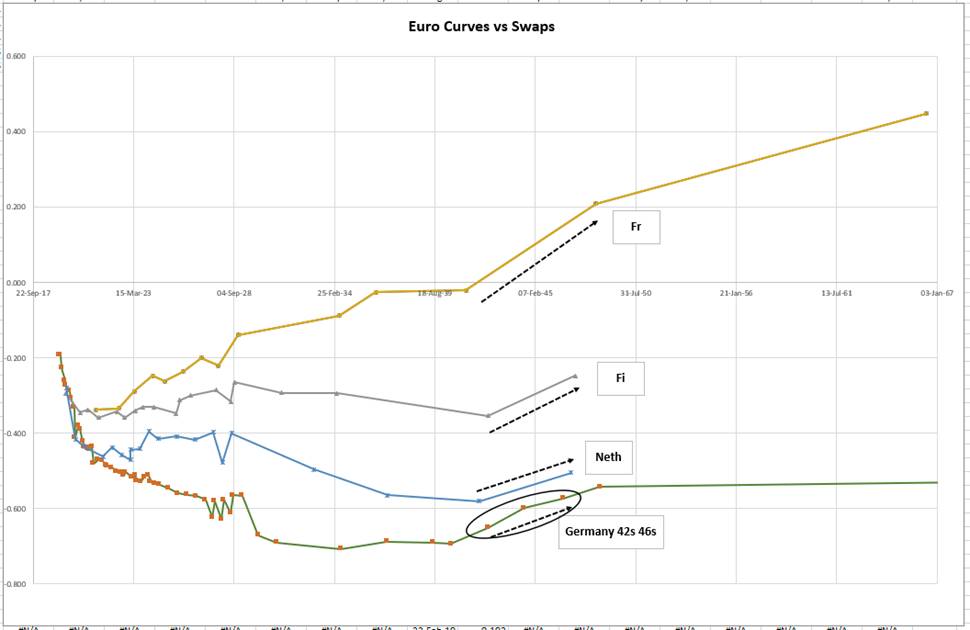

Theme, Italy Supply

– the only supply of any consequence left this year is the Italian 5y and 10y at year end, Friday December 28th

Since end of May this year, the Italian curve in shape and in coupon dynamic has become highly directional. In so much as the absolute level of the market is the dominant single factor in pricing relationships along the curve

A ‘Bond Default Model’ prices cashflows as contingent on whether the issuer survives to pay any liability or indeed a recovery event occurs. The level of Italian yields is a crude representation of the probability of default.

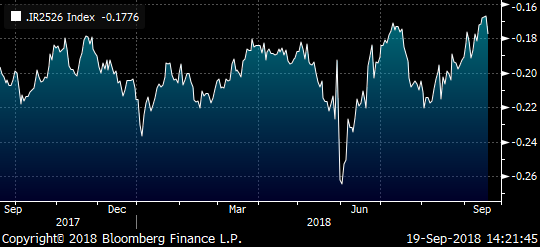

Using this method we get a much better prediction and understanding of Italian bond anomalies. Here’s how they look as of Dec 18th

Italian trading reduces into

- Trading these supply points as some homogenous curve

- Finding times when the supply bonds are simply at an extreme cheap to local non par issuers and capturing that difference

As you can see the Dec28 10y being tapped this month looks cheap

Given that contracts have now rolled to Mar (CTD Sep28), selling the contract (proxy Sep28) makes an interesting prospect to run the trade until March

The trade on my radar is

Sell Btps 4.75 Sep28, Buy Btps Dec28 close to supply

Timing: close to supply at year end

Currently level: +10bp

Entry: +9bp to +12bp depending on pricing close to the supply event

History (Bloomberg) :

For full details, let me know

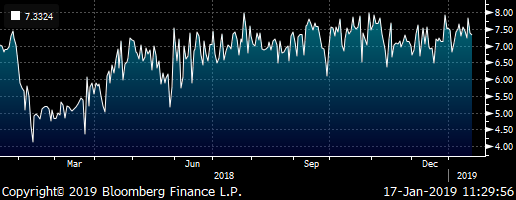

Theme,

French Curve steep vs other core issuers

Trade:

Flattener 10s30s France

Steepener 10s30s Germany (74%)

Levels expressed in terms residual calculation below

Currently: +7.2bp

Entry: here

Exit: 0bp

Add: +12bp

Stop: +16bp

The Semi core issuer curves have steepened vs the German curve this year

See below France 10s30s vs Germany 10s30s

Generally the gradients of the Euro issuers tend to be a simple multiple of the more secure, richer issuers – in this case Germany. France is about 44% steeper than the German curve. A fear of reduced PSPP buying has led to this extreme state notable in the back end. It would imply an ever increasing prob of default of France relative to Germany in the long end. This contrasts with say Italy, where if default or Euro break down is expected, it’s expected to occur predominantly in the first ten years.

Over the long haul the regression of France 10s30s to Germany gives us France10s30s moving at 74% as fast as Germany10s30s

Therefore using that mechanism to tactically trade the dislocation…

![]()

So the residual looks as follows

From BBG

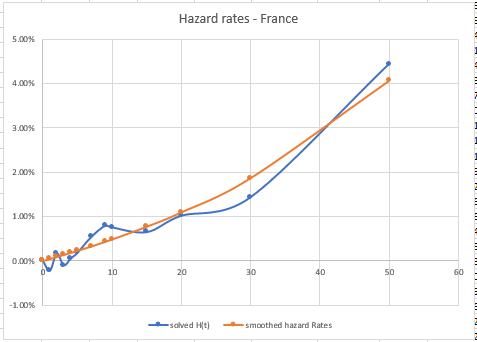

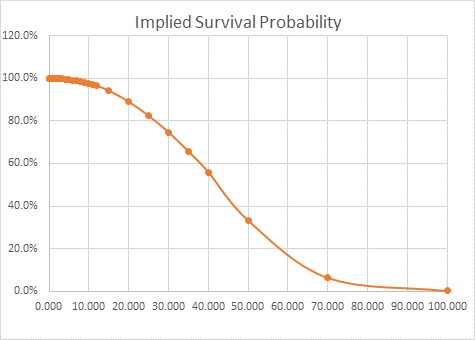

The heavy discounting of 30s and indeed 50yrs looks to have exaggerated fears of prob of default – as the Hazard Rate (the gradient of the probability of default) increases exponentially over time, which seems an incredibly over-informed perspective of the market

So much so, that the prob of default for 30y and 50y cashflows falls dramatically – and indeed these cashflows are so discounted that the bonds should start to exhibit ‘credit convexity’ – that state where long tenors start to outperform in any further spread widening

Again – we’re close, and If you’d like me to keep you posted on these and other ideas – please let me know

More to follow

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar: James Rice @Astor Ridge November 23rd

Trade Radar

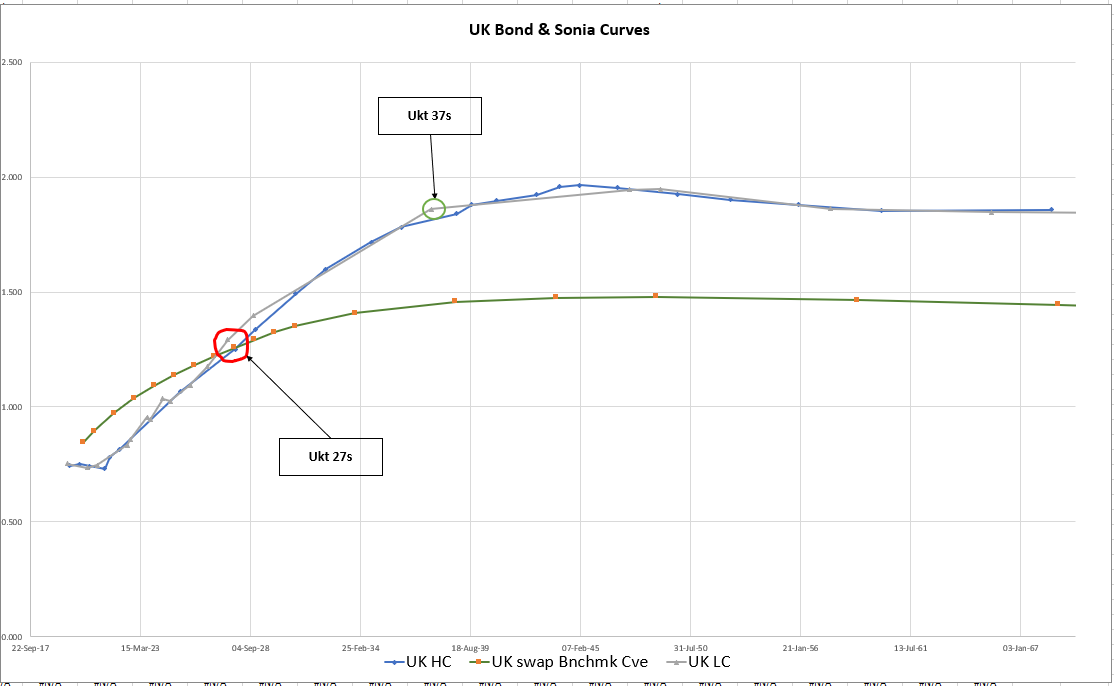

On my radar is the recent steepening & concomitant dis-inversion in the long end of the UK Gilt curve

This has been more pointed in the bond market expression than in swaps

UK 10s 20s vs swaps….

(UKT 27s vs UKT 37s vs OIS)

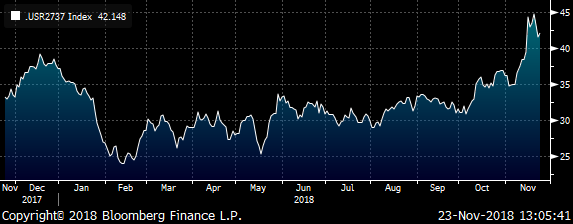

Graph 1 - UK Generics 10s 20s vs OIS

- Supply in 2037s have caused indigestion at the 20y point

- The natural hedge for dealers has been to sell the 10y

- Brexit concerns have caused the 10y Gilt future (CTD – UKT 4.25% 27 to out-perform)

- Consistently UK 10s20s is the steepest part of the curve relative to swaps – with the longer forward at a spread over Sonia and the shorter tenor below – the forward Sonia spread is a healthy positive

Trade mechanics:

Buy 6.4MM UKT 1.75% Sep/37 ( £10k/bp ), vs Pay Sonia Sep37

Sell 105 G Z8 Comdty, CTD 4.25% Dec/27 ( £10k/bp ), vs Rec Sonia Dec27

Weights: Risk weighted

Cix:

P2509[UKT 1.75 37 Corp] - P2509[UKT 4.25 12/07/27 Corp]

Current level: +42.3 bp

Entry Target: +44 bp

Stop: +50 bp

First Target: +35 bp

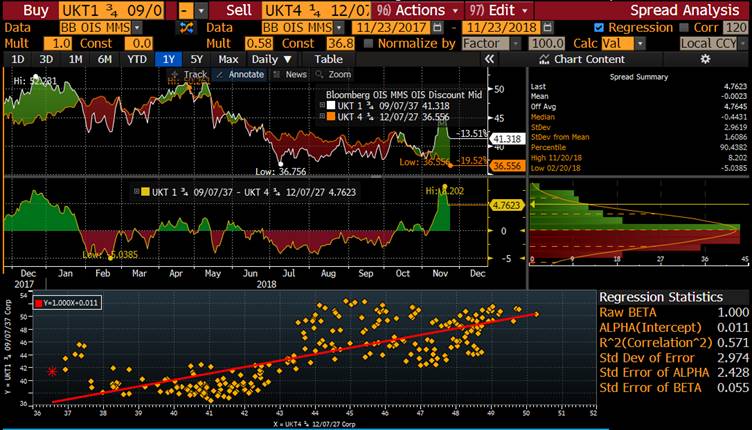

Graph 2:

– cix graph

Graph 3:

Regression of Ukt 37s OIS spread vs Ukt 27s OIS spread -

Beta – 58%

Intercept – 36.8

R^2 – 0.571

Residual is shown in middle graph

Rationale:

- 10yr plus tenors have steepened extraordinarily as Brexit fears have permeated the UK Bond market

- There is an overhang of the last supply in 37s – last re-opening mid-November

- The 27s37s curve in the UK is the most steep offering the best flattener vs the UK swap curve

- UKT 4q27s drop out of the back in June – on a z-spread basis they appear rich

- On a regressed basis the 37s look between 4 and 8 bp cheap vs a hedge of 58% of the 10yr spread

Graphs:

- UK Generics 10s 20s vs OIS

- CIX graph (as per 1)

- Graph of regression

- Graph of UKT Govt bond Curve and Sonia Curve

Graph 4:

Graph of UKT Bond Curve and Sonia Curve

Risks:

- Although the trade is curve hedged – the idiosyncratic move has been led by the bond market – if 10s30s continues to steepen that would probably NOT favour this 10s20s structure

- Continued supply in 37s could mean they do not outperform on this structure

- Sonia spreads in the 10y point continue to outperform all others in reaction to Brexit news

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar: James Rice @Astor Ridge November 18th

Trade Rader

On my radar

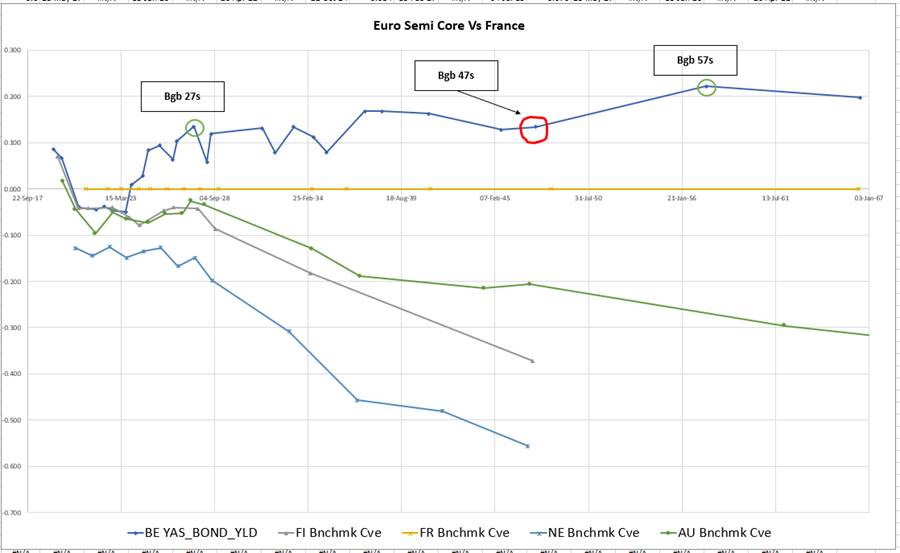

- Supply in Belgium on Monday 24s, 28s, 34s, 57s

- Want to be short Bullets longs wings in back end of Europe as soft play on steepening – post PSPP

Trade mechanics:

Sell 23MM Bgb 1.6% Jun47 ( €50k/bp )

Buy 15,3MM Bgb 2 ¼ % Jun57 ( €42,5k/bp )

Buy 9MM Bgb 0.8% Jun27 ( €7,5k/bp )

Weights: -0.15 / +1 / +0.85

weights taken from regression but forced to be duration matched

Cix:

yield[BGB 1.6 06/22/47 Govt] - 0.15 * yield[BGB 0.8 06/22/27 Govt] - 0.85 * yield[BGB 2.25 06/22/57 Govt]

Current level: -2.4 bp

Entry Target: -2.7 bp

Add: -4.0 bp

Stop: -6.0 bp

First Target: -0.5 bp

Graph:

Rationale:

- Belgian Supply in 47s on Monday, 19th Nov

- Bgb 47’s look rich vs other points - See graph of Euro Semi Core Curves vs France

- Bgb 27 roll down the curve well

- Post PSPP reduced buying may cause semi-core curves to steepen – a secondary effect of steepening could be that bullets underperform wings

Graphs:

- Euro semi core curves vs France as baseline (zero)

Carry:

- < -0.1bp /3mo @ -10bp repo spread

Risks:

- The 47s stay bid as the benchmark 30y

- The generic curve 27s to 47s does not steepen and the expected cheapening of 47s doesn’t occur on the structure

- The 57s as a less favoured 40y, do not receive buying support

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Italy trade idea - James Rice @ Astor Ridge

Trade idea – New Italian 7y Btps 2.5% Nov 25, cheap given medium coupon

One of the classic issues with Bond RV is ‘clean up on aisle 3’. By that, I mean finding value ways to absorb new supply as the marginal buyer when RM is somewhat absent from the market

Trade Mechanics

Buy €100,0MM Btps 2.5 Nov25 – Dv01 €64,7k/01

Sell €102,6MM Btps 1.6 Jun26 – Dv01 €68,6k/01

non duration neutral (≈6% diff) to compensate for curve and coupon diff

Actual yield spread: @ 2.1bp

Weighted index/spread: Nov25 – 1.06*Jun26 @ -12.4bp

Trade History – using dec25 instead of nov25 (new issue)

YIELD[BTPS 2 12/01/25 Corp] - 1.06 * YIELD[BTPS 1.6 06/01/26 Corp]

Rationale

- The trade evolved by stringing together two different trades –

- selling Btps 1.6% Jun26 to buy Btps 4.5% Mar26

– but then additionally

2) selling Btps 4.5% Mar26 to buy Btps 2.5% Nov25

- The new 7y Btps Nov25 is cheap on the curve based on its cashflows (vs smoothed strip curve) – see Italian Bonds vs Fitted Strip Curve

- The new 7y Btps Nov25 also has a lower coupon than similar maturity, richer issues – it embodies a default option at a lower cost than the higher coupons

- The low coupon 1.6% Jun 26 is rich after accounting for its lower coupon

- The duration difference is based on a 200 day regression to compensate for the directionality and coupon difference in how the more seasoned bonds trade

Graphs

Italian Bonds vs Smoothed Strip Curve – cash flows discounted at unique Italian discount rates

High coupons, when correctly valued by stripping their constituent cash-flows, trade cheaper than the low coupons. When a low coupon is cheaper, we are truly buying the default option at zero cost

Carry & Roll: /3mo

Carry: Flat (non-Duration neutral)

+0.7bp (Duration)

Roll: +0.2bp (non-Duration neutral)

+0.4bp (Duration)

Risks

- The modality of the curve and high coupon effects changes the correct hedge ratio away from 6%

- The Jun26 stay rich as a low coupon

- The Nov25 as an ongoing tap bond remain cheap

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796