Summer lovin' part 2 - trade rec in France from James Rice @Astor Ridge

French long anomaly trade for August

France long end trade combines both excess steepness of France 10s30s and localised anomaly

Mechanics:

Bond Spread

Buy €50k (€18,9MM) Frtr 4.5% Apr41

Sell €50k (€21,9MM) Frtr 4% Oct38

&

Curve hedge

Buy €5k RXU8 (40 contracts)

Sell €5k UBU8 (16 contracts)

History:

BBG Cix: 100 * ((YIELD[FRTR 4.5 41 Corp] - YIELD[FRTR 4 38 Corp]) - 0.1 * (YIELD[DBR 2.5 7/44 Corp] - YIELD[DBR 0.5 27 Corp]))

Levels:

Trade: +4bp

Add: +5.5bp

Target: +2bp

Stop: +7.5bp

Rationale:

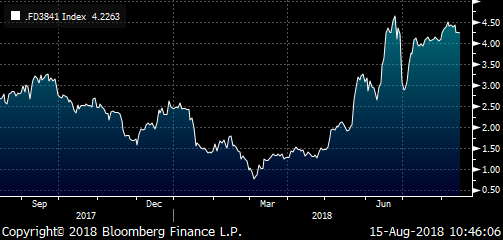

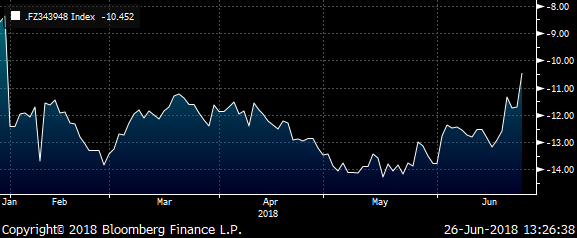

- The French curve 10s30s is 32% steeper than Germany on average – the 10s30s segments is over 41% steeper – this is a recent historical high. See graph of generic France 10s30s vs Germany

BBG cix:

(RV0004P 30Y BLC Curncy - RV0004P 10Y BLC Curncy) - (RV0002P 30Y BLC Curncy - RV0002P 10Y BLC Curncy)

French 10s30s minus German 10s30s - generics

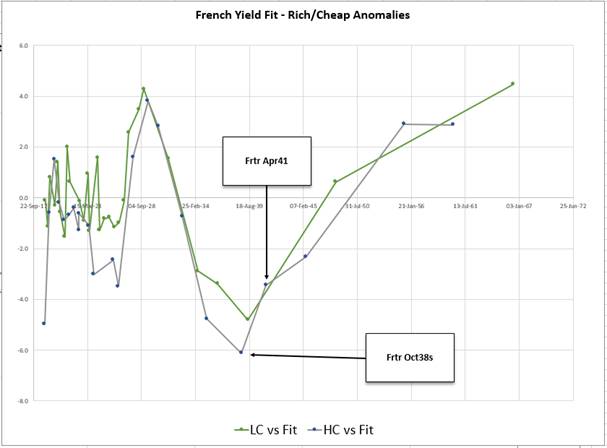

- The anomaly of 38s 41s is out of line with other, local, French issues – see graph of French Anomalies

*Second order, exponential curve fit to yields adjusted for coupon

- We use the 10% +RXU8 / -UBU8 combination to hedge out the generic curve risk

Carry & Roll (per 3 months):

- French segment (10bp spread): -0.4bp

- German segment: +0.25bp

- Nett: -0.15bp / 3mo

Risks:

- The French long end continues to out-steepen the German curve

- The repo goes tight on the Frtr oct 38 (issue sizes: Frtr 38s €26,5Bln vs Frtr Apr 41s €33,7Bln)

- Buying in the 20y sector of France is targetted at the Frtr 38s

Any thoughts / comments always welcome

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Summer Lovin' - Italian trade from James Rice @ Astor Ridge

Some trades over the summer period – generally supply is light and the main themes are driven by what’s going on In Turkey

Italy first, more to follow – any thoughts do let me know

Italy – High Coupon Anomaly in longs

20+ years get offered cheaply as high coupons suffer in the Italy sell-off

Mechanics:

Buy €50k Btps 5% Sep40

Sell €25k Btps 4% Feb37 & Sell €25k Btps 3.45 Mar48

weights: -0.5 / +1 / -0.5

History:

cix:

200 * (YIELD[BTPS 5 09/01/40 Corp] - 0.5 * YIELD[BTPS 3.45 03/01/48 Corp] - 0.5 * YIELD[BTPS 4 02/01/37 Corp])

Levels:

Current +40bp

Entry: from +36 to +40bp

Add: +45bp

Target: +27bp

Stop: +55bp

Friction: 2/3 bid offer approx. 4bp

Rationale:

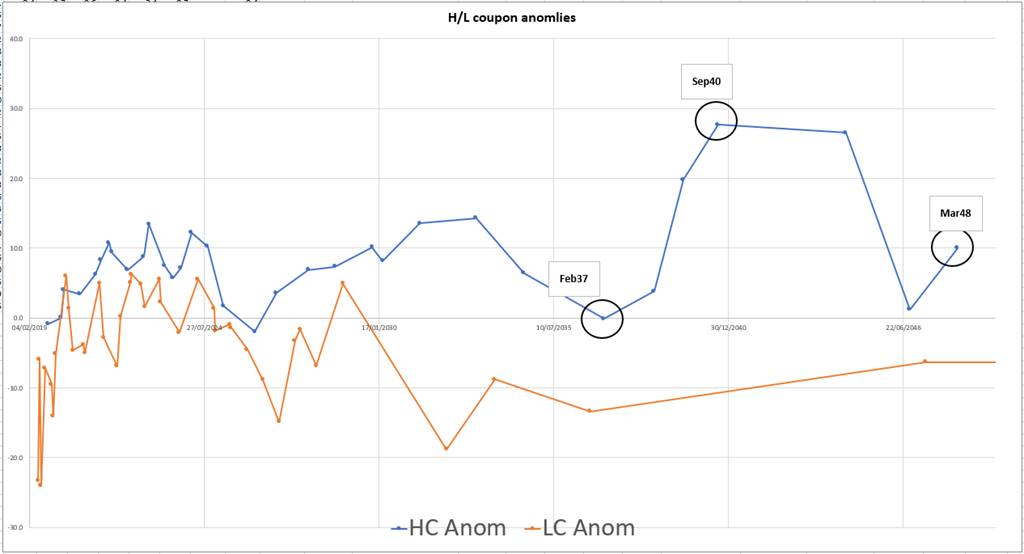

- The sep40s are a perma-cheap bond on the Italian curve – see Italian Anomaly RV graph. The feb 37s are also high coupon but are stubbornly and historically rich

- As we come into September there will be renewed focus on supply in mid-month 3s and 7s and possibly some longs for September

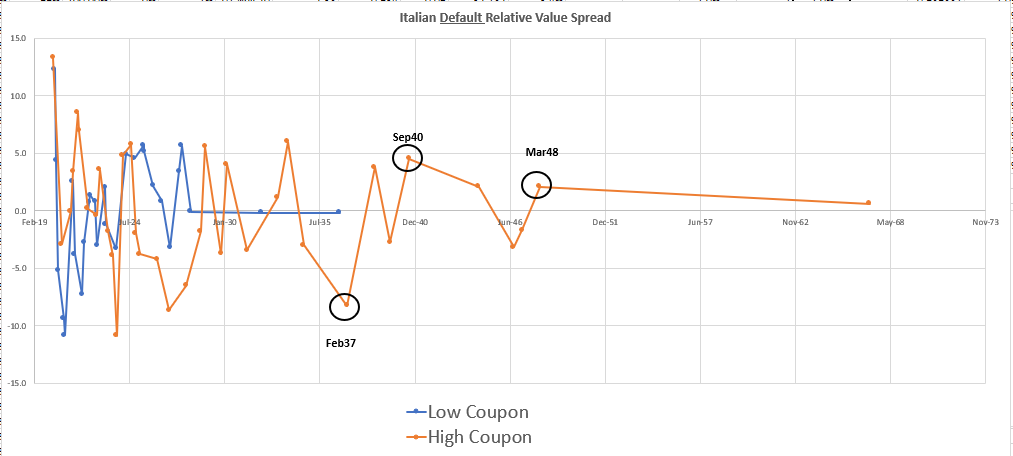

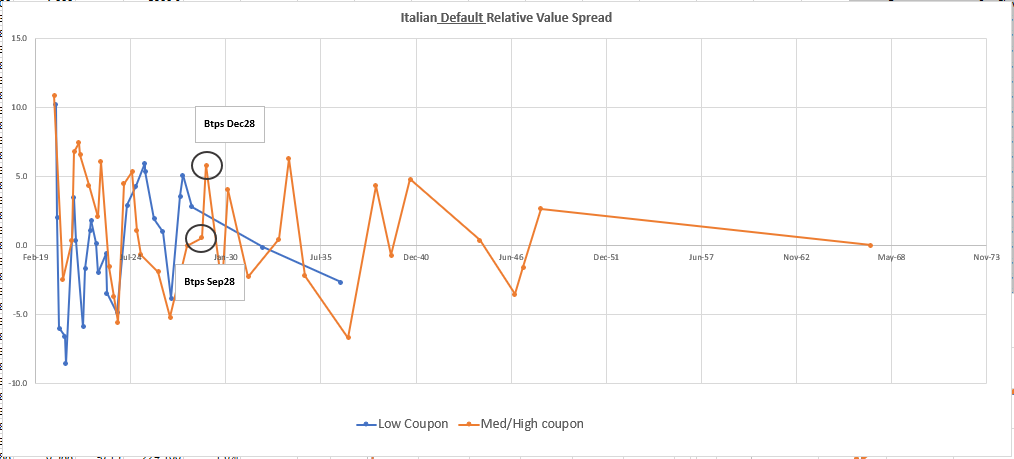

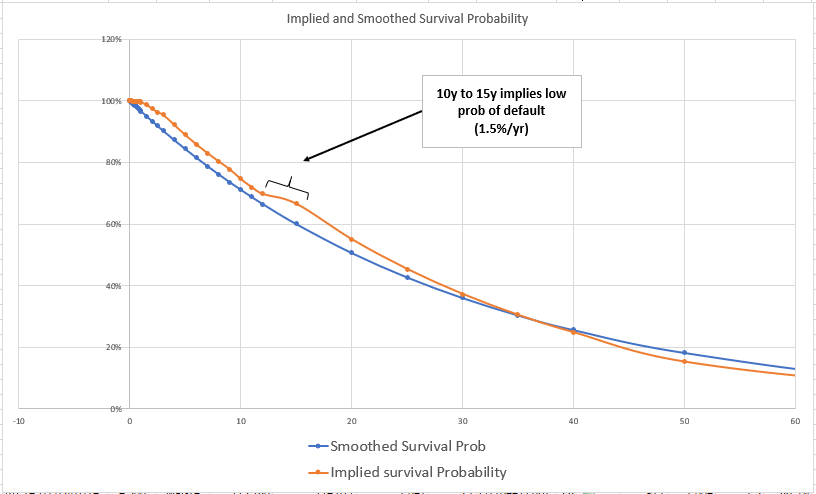

- Even after adjusting for a default process (which takes a pernicious viewpoint on high price / high coupon bonds) the Btps sep 40 are cheap relatively – see Default anomaly Graph

Graphs:

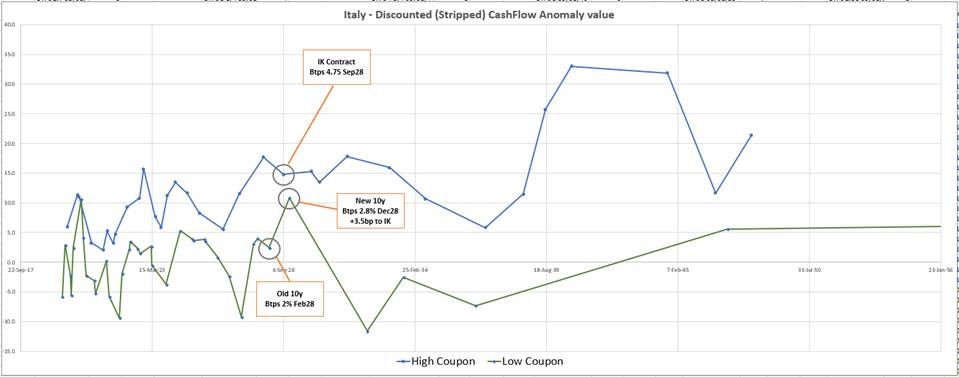

High and Low Coupon Anomalies – Btps curve

Btps Default Curve

High and Low Coupon Default Anomalies – Btps curve

Carry and Roll (10bp repo spread):

Carry: +1.7bp /3mo

Roll: Flat

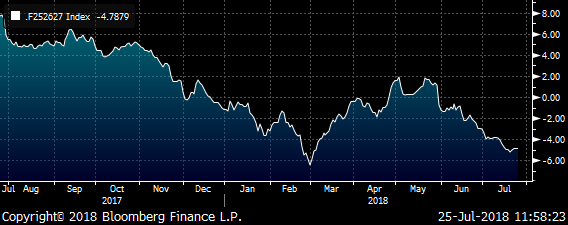

Regression to the market: (1yr history, Daily index vs generic Italian 10y yield)

Correlation 92.9%

Slope 23% - index can move 23bp for every 100bp in the Italian 10y

Graph of regressed index (subtracting the directional component and the intercept)

200 * (YIELD[BTPS 5 09/01/40 Corp] - 0.5 * YIELD[BTPS 3.45 03/01/48 Corp] - 0.5 * YIELD[BTPS 4 02/01/37 Corp]) - (23 * RV0005P 10Y BLC Curncy) + 37.313

Risks:

The Feb 37 could stay bid as it is closer to the 20y demand point

The mar 48 could get richer before any further supply event

A prolonged and extreme sell-off in Italy could be more punitive for the higher coupon Sep 40s – given the directional component

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

France 5s 7s - thoughts and observations

Dev,

I took a look at France 5s 7s vs swaps

These trades are a structural view that France gets infected by what’s going on in Italy

Location is average to fair right now – I think if you really like the theme, I’d have a small amount to be involved with a view to adding if France were to flatten further to the swap curve

The ranges are 3bp to 8bp

Best

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FW: Italy Trade opportunity - New Medium Cpn 10y offers cheap default option

Italian Trade Idea

New 10y Btps 2.8% Dec28 – Has value even to the High Coupon Curve

Italy launched today the new Btps 2.8% Dec28 – 4Bln first tranche

Trade Mechanics

Buy €115MM Btps 4.75% Dec 28

vs

Sell 973 contracts IKU8 (Ctd Btps 4.75% Sep28)

Low Coupon & High Coupon RVS (Relative Value Spread)

All cash-flows are discounted using a smooth, Italian discount curve

Green = RVS for Low Coupons, Blue = RVS for High Coupons

On a correctly discounted basis, the High coupons still have a higher (cheaper) cashflow RVS relative to the low coupons

Levels

Current: @ +3.5bp (has been out to +4bp)

Enter @ +4bp (initial)

Scaled additions to the trade: 15% @ +4bp, 25% @ +5bp, 25% @+6bp, 35% @ +7bp

Target @ -1bp

Stop @ +10bp

History

As we don’t have a history of the new 10y, see below a graph of the old 10y vs the contract

Rationale

- The New issue trades cheap due to its higher coupon relative to older 10yrs

- The boundary condition for buying new issue Italy is when the low coupons trade ‘fair’ to the high coupon curve – thereby getting the ‘default option’ at zero cost

- The discounting process to assess value requires an idiosyncratic Italian discount curve – see graph above of RVS for Italian bonds (Relative Value spread)

- No further Issuance in 10yrs until end of August – as per usual 3s, 7s and bonds for August are cancelled – current issue size only €4.0bln (pre non-comp)

- Adjusting for coupon / bond price in a default scenario the bond still has value – see graph 2

Graph of default RVS spread – value of the bond after adjusting for some probability of default

Displays the RVS (Relative Value Spread) under the fitted default expectations implied by the yield curve spreads between Eonia and All Italian bonds

Roll & Carry (3mo)

Carry: -1.2bp

Roll: -0.1bp

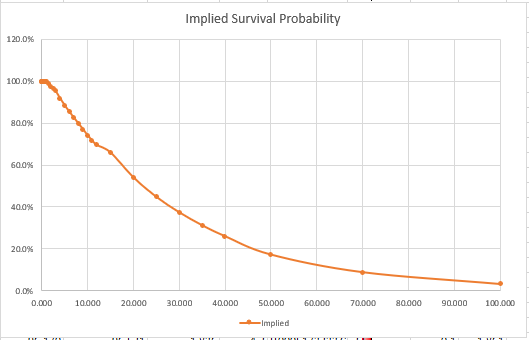

Graph of Expected Probability of Default for Italy (used to derive the anomaly/RVS values above)

Risks

- In a risk-on environment the BTPS 4.75 9.28 could outperform

- The Btps repo could go special as a CTD to the Eurex Sep 2018 contract

- The Btps Dec28 could remain under-pressure during August due to lack of buying interst

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

French trade - Frtr Apr 26 old CTD rich vs HC curve (cpn adjusted)

France Sell Frtr 3.5 Apr/26

Vs Buy HC Oct25 and OATA Ctd

Bloomberg History and CIX

200 * (YIELD[FRTR 3.5 26 Corp] - 0.3 * YIELD[FRTR 2.75 27 Corp] - 0.7 * YIELD[FRTR 6 25 Corp])

Mechanics

Sell €114,4MM Frtr 3.5% Apr26 (€100k)

Buy €78,6MM Frtr 6% Oct25 (€70k)

Buy €29,9MM Frtr 2.75% Oct27 (€30k)

Levels

Currently: -4.9bp

Entry: @ -4.5bp (pay the spread, trade works as spread goes higher)

Add: @ -6bp

Target: -1.5bp

Stop : -8bp

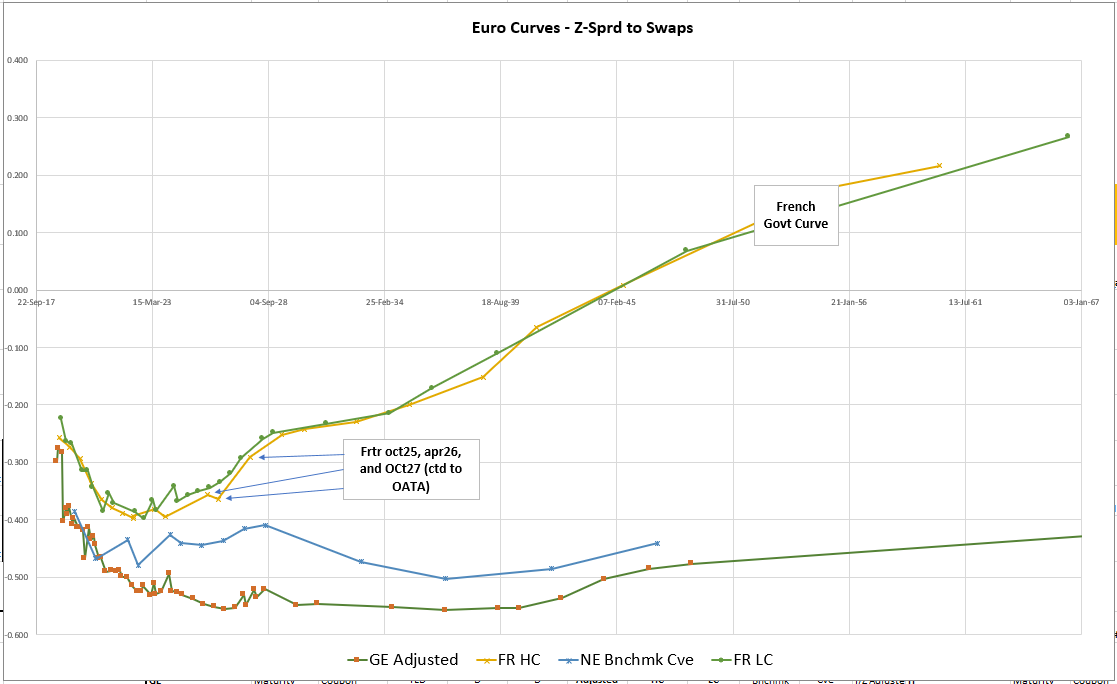

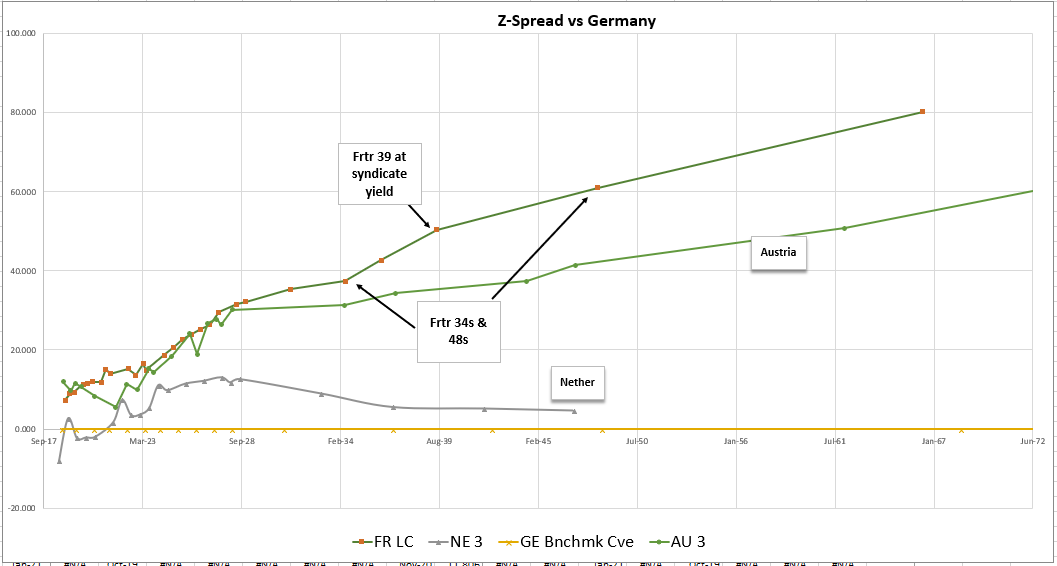

Graph of French RV - *Z-spread to swaps

(Bonds on the Yellow data series)

Rationale

- Frtr April 26s have richened since being a CTD

- As a deliverable, during the pre-Macron era they traded cheap to the curve. The bond has come full circle and is now rich vs other high coupons (and Low)

- The OATA contract CTD Frtr 2.75% Oct 27 is also a higher coupon Bond

- The Frtr 6% Oct 25 have strong positive due to their high coupon

- The Trade is on a low in spread Historically

- The trade looks good in Z-spread terms – so we are not arguing with a structural move in the generic (swap) curve

- Trade has a bearish fade in that it is a short of the belly vs wings

Carry & Roll (3months)

- Carry: +0.4bp, (10bp repo spread)

- Roll: -0.1bp

Risks

- The Apr 26 could stay bid as a leveraged short

- The Market could rally/Curve could flatten aggressively increasing the chances of the belly outperforming

- The futures contract (Oct 27) could cheapen significantly

Best

Speak soon

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Week ahead - James Rice, Astor Ridge

Hi,

Just some trades week(s) ahead…

|

Supply for Week Ahead |

Following Week |

|

Tuesday, Jul 03 |

Tuesday, Jul 10 |

|

{AU} Austria 28s & 37s |

{NE} Nether 10y |

|

{GB} UK 10y Gilt, Oct 28 £2.5bln tap |

{US} 3y $32Bln |

|

Wednesday, Jul 04 |

Wednesday, Jul 11 |

|

US HOLIDAY - take time off! |

{GE} Germany 10y |

|

{PO} Portugal TBA Jul 6th |

|

|

{US} 10y $22bln |

|

|

Thursday, Jul 05 |

Thursday, Jul 12 |

|

{SP} 3y, 12y, 23y & 10y€i 4-5bln est. |

{IT} Italy TBA exp 3y & 7y |

|

{FR} France 28s, 31s, 34s €7-8bln est. TBA |

{US} 30y $14bln |

France

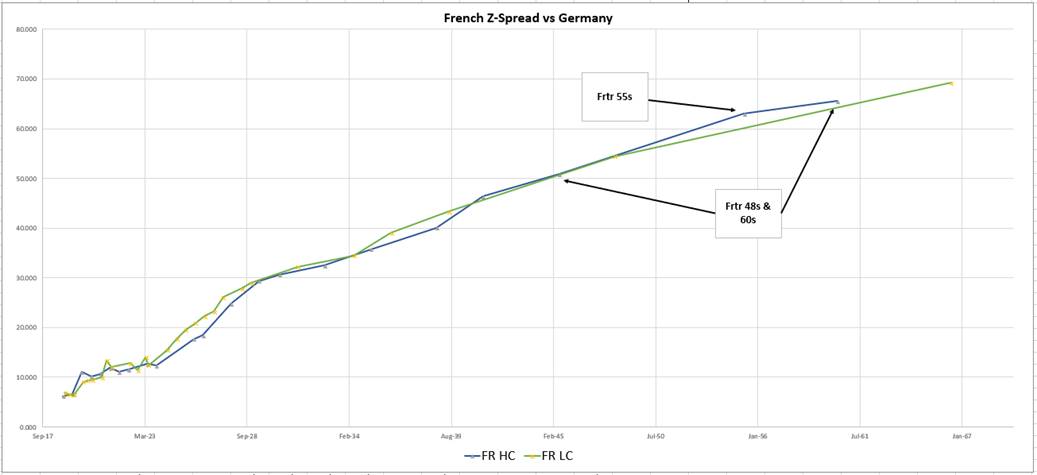

Buy 2055s vs 2048s & 2060s

Long end anomaly – mopping up quarter end balance sheet

Graph & CIX (BBG):

200 * (YIELD[FRTR 4 55 Corp] - 0.7 * YIELD[FRTR 4 60 Corp] - 0.3 * YIELD[FRTR 2 48 Corp])

Trade Mechanics:

Buy €25,9MM Frtr 4% 55 (€100k)

Sell €16,2MM Frtr 4% 60 (€70k)

Sell €11,8MM Frtr 2% 48 (€30k)

Weightings:

2 x (-0.3 / +1 / -0.7)

*multiplied by two, to normalise to standard convention for butterflies – 2 x middle minus wings

Levels:

Current: @ -0.7bp

Enter: @ -0.5bp

Add: @ Flat

Target: -3bp

Stop: +2bp

Carry & Roll (per 3mo., 10bp repo spread)

Carry: Flat

Roll: Flat

Rationale

- The higher coupon 55s have hidden value in a steep curve relative to the 48s

- The Long spread 55s vs 60s (same coupon) is reverting despite the continued steepness of the short leg

- On a graph of z-spread vs Germany – we can see the dislocation/mis-pricing

Risks

- The supply point 48s could stay bid

- A significant steepening of the curve could cause the belly (55s) to underperform

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FW: Portugal trade opportunity - James Rice, Astor Ridge

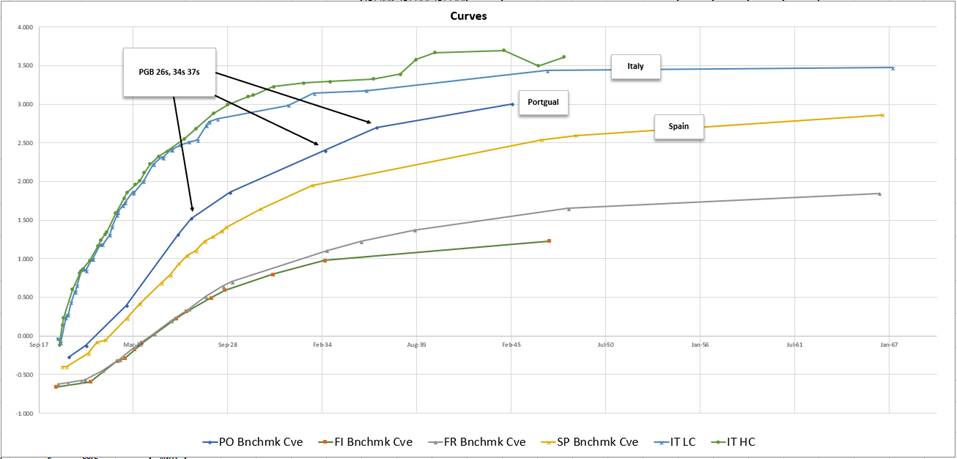

Just looking at Euro Yield curves and what is going on in the Italy / Portugal /Spain segment

This trade seems to jump out at me even if I look at pictures of yields curves without having to break it down into the shape of the spread curves

Looking at the current structure

Portugal

{PO} +26 -34 +37

BBG graph and CIX:

200 * (YIELD[PGB 2.25 34 Corp] - 0.85 * YIELD[PGB 4.1 37 Corp] - 0.15 * YIELD[PGB 2.875 26 Corp])

Trade Mechanics:

Sell €20k PGB 34 (15,5MM)

Buy €17k PGB 37 (10,2MM)

Buy €3k PGB 26 (3,75MM)

weights: 2 X (+0.15 / -1 / +0.85)

carry: +0.3bp with 15bp repo spread

roll: flat

cix:

200 * (YIELD[PGB 2.25 34 Corp] - 0.85 * YIELD[PGB 4.1 37 Corp] - 0.15 * YIELD[PGB 2.875 26 Corp])

Rationale:

- Essentially the 8y to 20y Portuguese curve seems to exhibit almost no curvature at all

- the long leg looks steeper than almost any 15 to 20y curve in Europe despite the higher yielding markets (such as Italy) trading much flatter

- Conversely the small amount

- of 26s provides a great 'anchor' to neutralise curve risk and it rolls aggressively down the curve

- pay the spread here at -15bp - currently @-15.8bp with a view to taking profits at -5bp

Euro Curves Graph

*Ylds on the graph are coupon adjusted by subtracting swap spread and adding z-spread

Risks

- the 34s continue to outperform – more likely in an extreme curve flattening / spread narrowing environment

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Ideas - James Rice, Astor Ridge

French trade idea

I’ll give you a call and follow up

Message or call me, if I can help in any way

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

France

Tap of Frtr 39s, (pricing indicated +3bp to secondary) have cheapened

- The final spread for the tap of the Frtr 1.75% 39 is +16bp (vs Frtr 1.25% 36)

- This is +3bp to the secondary market!

- The settlement is reg +5d, which has a negatvie carry value of -0.15bp on the bond (repo used -0.55%)

Mechanics

- Buy Frtr 39 in syndication or as secondary market cheapens: €100k, 53,3MM

- Sell frtr 34s (€50k, 34,2MM) and Frtr 48s (€50k, 20,4MM)

- Bfly

2x 39s / -34s / -48s

Levels

- Currently in secondary @ -1.8bp

- Execute @ +1.5bp – assuming half of the primary percolates into the secondary market

- Add @ +3bp

- Take Profit @ -4bp

- Stop @ +7bp

CIX & Graph

200 * (YIELD[FRTR 1.75 39 Corp] - 0.5 * YIELD[FRTR 2 48 Corp] - 0.5 * YIELD[FRTR 1.25 34 Corp])

Graph 1

And Z-Spread history…

2 * (SP208[FRTR 1.75 39 Corp] - 0.5 * SP208[FRTR 2 48 Corp] - 0.5 * SP208[FRTR 1.25 34 Corp])

Graph 2

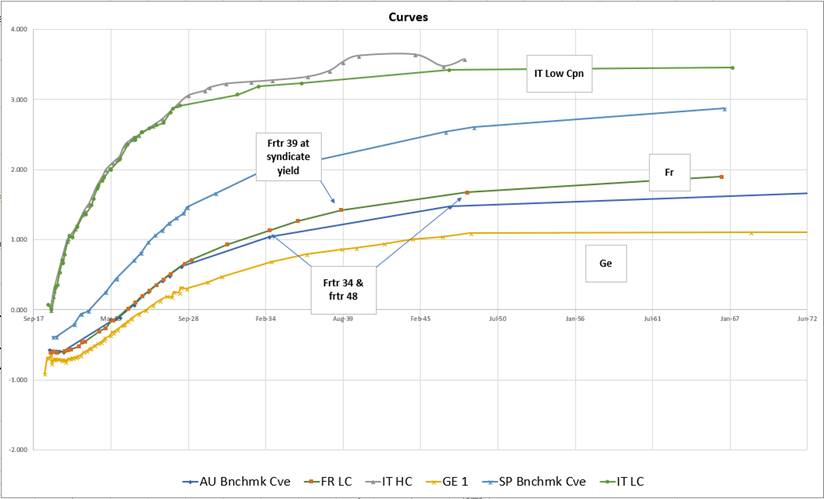

Below is a graph of the French yield curve showing the Frtr 36s

with a yield +15.85bp higher (syndicated discount minus negative funding)

Graph 3

Rationale

- French curve has steepened 10s30s adding curvature, cheapening long belly structures

- This is a soft play on France re-flattening

- The discount for syndicated 39s tap is significant to the secondary market (3bp minus carry)

- By looking at Z-Spreads vs Germany, we get a more accurate coupon-adjusted perspective of value on the French curve…

Graph 4 - French and Semi-Core Z-spreads vs Germany

Baseline is German Z-Spreads

Risks

- 39s stay offered after supply

- 34s and/or 48s remain bid relative to the curve

- If the curve steepens dramatically further – the belly may underperform the wings

Have fun!

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

The week ahead - a look at some trades in the context of the coming week - James Rice, Astor Ridge

Hi there, a quick look at the week ahead and some trade(s)

Pls me if you’d like to see more of my thoughts

Office: +44 (0) 203 - 143 - 4178

Or email me

James.Rice@AstorRidge.com

Supply – just Italy coming next week in continental Europe plus a tap of the UK 20y 2037s

|

Supply for Week Ahead |

Following Week |

|

Tuesday, Jun 26 |

Tuesday, Jul 03 |

|

{IT} CTZ & Btp€i |

{AU} Austria TBA |

|

{US} US 2y, $34bln |

{GB} UK 10y Gilt, Oct 28 tap |

|

{GB} 2037s £2.25Bln |

|

|

Thursday, Jul 05 |

|

|

Wednesday, Jun 27 |

{SP} TBA €4-5bln est. |

|

{US} US 2y FR Notes |

{FR} France Longs €7-8bln est. TBA |

|

{US} US 5y Note |

|

|

Thursday, Jun 28 |

|

|

{IT} BTP Auction TBA 5y & 10y |

|

|

{US} US 7y, $30bln |

Italy

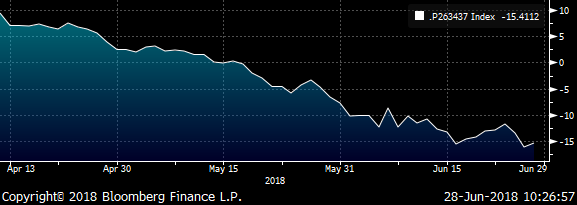

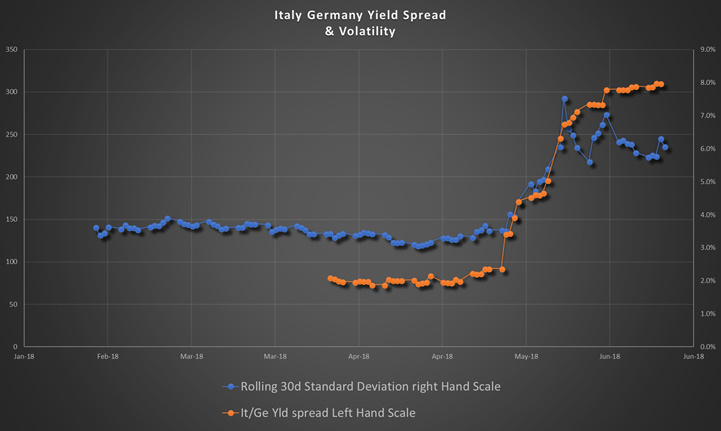

Italy has been a bumpy road this month. We look to be in a new paradigm of higher volatility

The key is to think about the boundary conditions but also scale accordingly for a high Var environment

Graph 1.1 - Italy vs Germany Yld spread and 30 rolling-day volatility (generics, source data BBG)

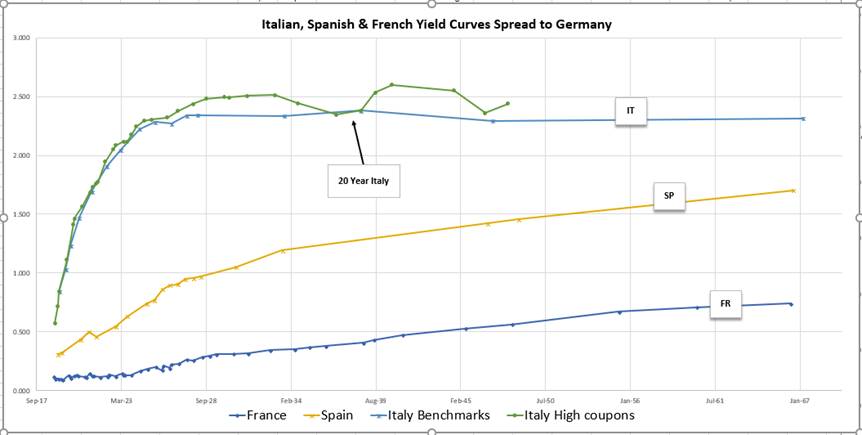

There is some logic to the flattening of the 10s30s curve in Italy

The back end of the Italian Curve has flattened out to reflect that the risk of default/Redenomination is packed into the front end of the curve

The 20yr remains anomalously rich

Graph 2.1 – Italian, Spanish & French Yield Curves on Spread vs Germany

*yields are adjusted for some coupon discounting effects by subtracting the swap spread and adding the Z-Spread

Trade – Fade the Italy cheapening by exploiting the exaggerated bid for Italy High coupon 20y

Pay this spread…

100 * ((YIELD[BTPS 4 2/37 Corp] - YIELD[BTPS 4.75 9/28 Corp]) - 0.65 * (YIELD[DBR 3.25 7/42 Corp] - YIELD[DBR 0.25 2/27 Corp]))

Mechanics:

Sell: Btps 4% 2/37 - €10k, 6.75MM Notional

Buy: IKU8 Future - €10k, 96 contracts

Hedge: Sell 45 RXU8 contracts / Buy 18 UBU8 contracts

Carry & Roll (per 3mo):

Italy: +5.4bp

Germany (ratioed portion): -2.0bp

Net C&R: +3.4bp/3mo

Risks: as per the History the Italian curve could push further into extreme flattening/inversion

This them is borne out as anomalous by looking at the Italian Prob of Survival Curve

By looking at spreads over various tenors AND H/L coupon relationships we can calculate the implied cumulative probability of default over time

More on France & Belgium

to follow…

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

French anomaly idea

Small Micro RV in France – French curve generally too steep vs Germany – this one has issue selection and carry characteristics that favour it over others

Best

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796