The week ahead - James Rice @Astor Ridge

Monday 23rd April

Monday – Belgian Supply; 24s, 28s, 47s, 57s

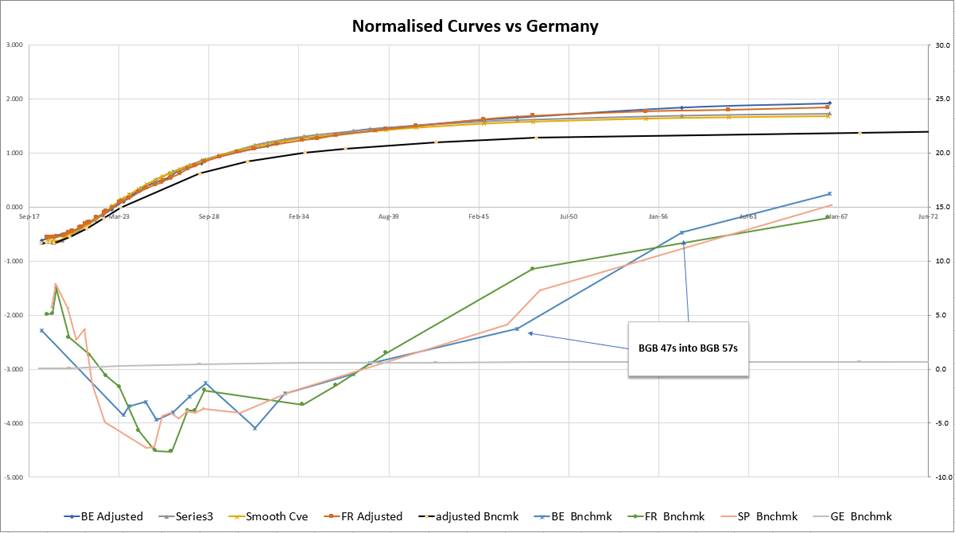

Improving credits across the board leave Belgium 47s -57s one of the steepest curves vs Swaps, vol. adjusted

Looking for >+20bp

By applying a linear transformation to all Euro curves we can compare them ‘vol adjusted’ to the German and Swap curves

Structurally, the curves should flatten vs the least risky issuers as credit concerns wane – as represented broadly by the narrowing of France and Italy vs Germany

Normalised Actual and R/C curves vs Germany….

Italy 5y & 10y supply (exact details TBA tonight, Monday)

Tonight Italy will formally announce the Italian supply tonight – I expect the usual 5y and 10y for this Friday

I can’t see any compelling structures there at the moment

Additionally this week we have US supply 2y, 5y & 7y

Next week

5y Germany, Spain and Long Term France

More to follow on general Euro RV

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Radar Trade - Astor Ridge, James Rice

On my Radar is the following idea

Trade Mechanics

- Sell Btps 4% Feb/37

- Buy Btps 5% Aug/39

- +15% contract curve hedge +RX/-UB

- €50k/DV01, Sell €29.5MM Feb/37 into €25.1MM Aug/39

- And +54 RXM8 contracts & -25 UBM8 contracts

Levels

- Current @ +7.8 bp

- Enter @ +8 bp

- Add @ +10 bp

- Target @ +6 bp

- Stop @ +12 bp

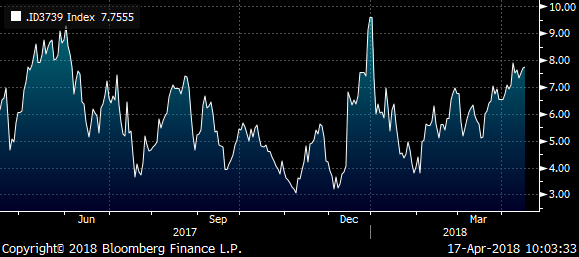

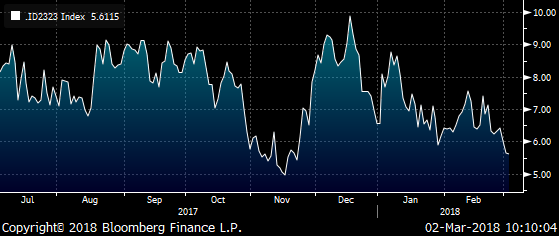

Cix & History

100 * ((YIELD[BTPS 5 39 Corp] - YIELD[BTPS 4 2/37 Corp]) - 0.15 * (YIELD[DBR 3.25 7/42 Corp] - YIELD[DBR 0.25 2/27 Corp]))

Italian excess return vs Germany

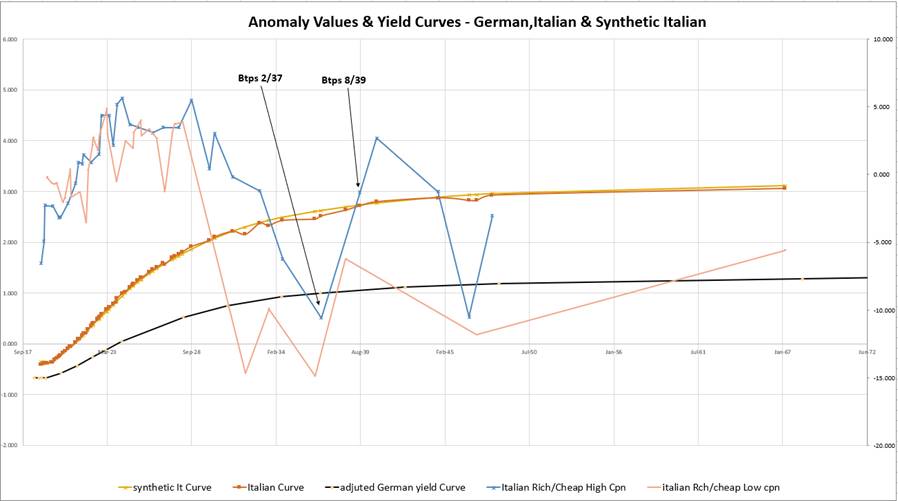

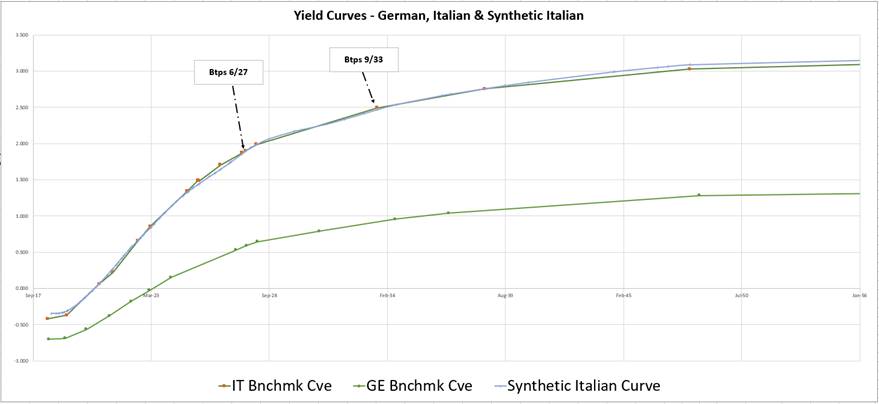

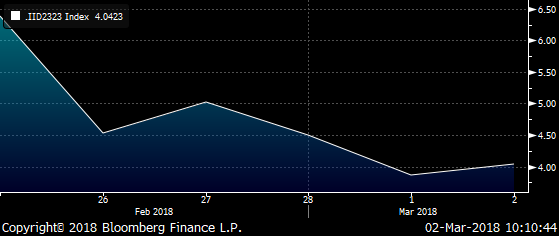

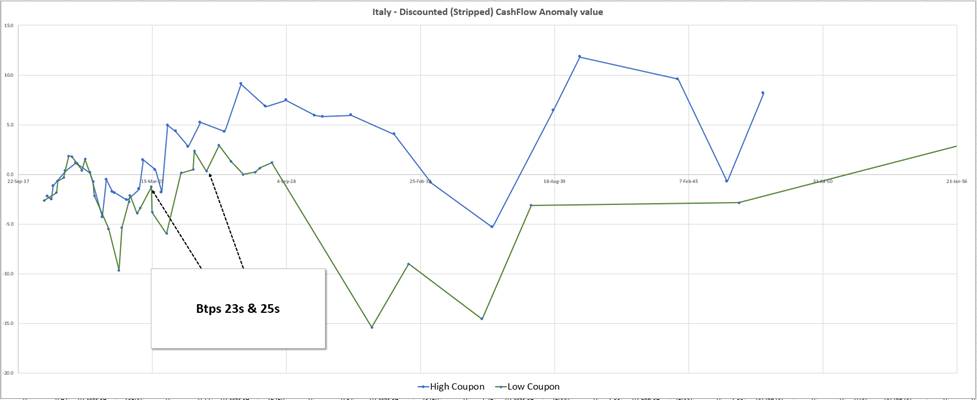

Below is a graph of Anomaly value of Italian curve

- we create this by taking the German curve and multiplying it by a constant and adding a shift – this represents the best fit Italian curve as a marginal excess return function over German bonds

- We then subtract actual Italian bond values from their expected value using this form

- Yields are adjusted to compensate for coupon differences by adding the difference between z-spread and i-spread

Rationale

- After creating a ‘synthetic’ Italian curve using an amplified shape of the German curve we can elucidate the wide range, relative opportunities on the Italian curve

- Generally the Italian curve is approx. 1.8 times as steep as the German curve, and that’s reasonably consistent throughout the curve

- Although the Italian 10s30s segment isn’t quite as steep, we can see that the gradient between high coupon Btps 4% Feb 37 and Btps 5% Aug 39 is significantly steeper than elsewhere

- These specific issues are 1.37 Standard dev rich and 1.16 Standard dev cheap with respect to the Bloomberg GOVY model (Spline Cubic fit, 3M History)

- We use an amount if +RXA vs -UBA to hedge the generic curve movements of European Govt long end -and for hedging efficiency

Carry & Roll

- Btps segment (using 10bp repo spread)

Carry -0.1bp/3mo, Roll -0.3bp/3mo

- RXA/UBA segment (weighted by 15%, using contract implieds)

Carry +0.2bp/3mo, Roll +0.3bp/3mo

- Nett C&R +0.1bp

Risks

- The Btps Feb/37 stay bid due to market shorts

- The Btps Aug/39 stay offered until they hit a wider range notion of cheap

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Week Ahead - James Rice, Astor Ridge

Euro Govts, the week ahead – 16th April to 20th April

Supply

Germany 10y, Wed 18th April - €3Bln 10y

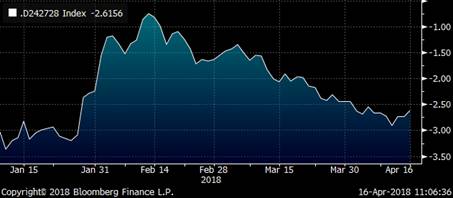

Contract Trade

Seeing 10y as cheap and Rx contracts as rich – like the structure that really revolves around the richness of rx contracts

{DE} +24 -RX +28

Cix: ((YIELD[DBR 0.25 2/27 Corp] - YIELD[DBR 1.75 2/24 Corp]) - 0.8 * (YIELD[DBR 0.5 2/28 Corp] - YIELD[DBR 1.75 2/24 Corp]))

Weighting: 20/100/80

Currently: -2.6bp,

Target: -3.0 bp, pay the spread

Objective: -1.5bp

Ask for further details and write up

Supply

Spain 4y, 10y & 15y, Thurs 19th April – Est. €4-5Bln

15y trade

15y – micro locally rich on the model, but much better value as a 15y point on the curve relative to Italy or France – generally with an improving credit, the 15y should do well vs 10y and 30y…

For a quick turn like

{ES} -27 +33 -46

cix: 200 * (YIELD[SPGB 2.35 7/33 Corp] - 0.5 * YIELD[SPGB 1.45 10/27 Corp] - 0.5 * YIELD[SPGB 2.9 46 Corp])

Weighting: 100/200/100

Currently: +11bp

Target: +11.5bp receive the spread, (timing by Wednesday)

Objective: +8bp

Ask for further details and write up

Supply

France 3y, 5y & 6y plus linkers, Thurs 19th April – Est. €6-7Bln

Special tap in Frtr 11/24 (6y)

The 6y to 8y tenor in core trades rich on any fitted curve so not much to say there

France is historically flat 5s10s and on box versus Germany 5s10s, but again this is not wholly inconsistent with ongoing narrowing of the France / Germany credit spread (OAT/RX)

RV 11/24 vs 5/26 trade

Even after accounting for the richness of the German 6y – 8y France still looks over priced here and just see this micro opportunity

{FR} {GE} +frtr nov/24 -frtr May/26 & 28% -OEA/+RX

Cix: 100 * ((YIELD[FRTR 0.5 5/26 Corp] - YIELD[FRTR 1.75 11/24 Corp]) - 0.28 * (YIELD[DBR 0.25 2/27 Corp] - YIELD[DBR 1.5 2/23 Corp]))

Weighting: +100/-100/-28/+28. 24s/26s/oea/rxa

Currently: +5.2bp

Target: +5.0bp pay the spread, (timing by Wednesday)

Objective: +8bp

Ask for further details and write up

More details on the ongoing themes

Love to catch up

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su20th Spril

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

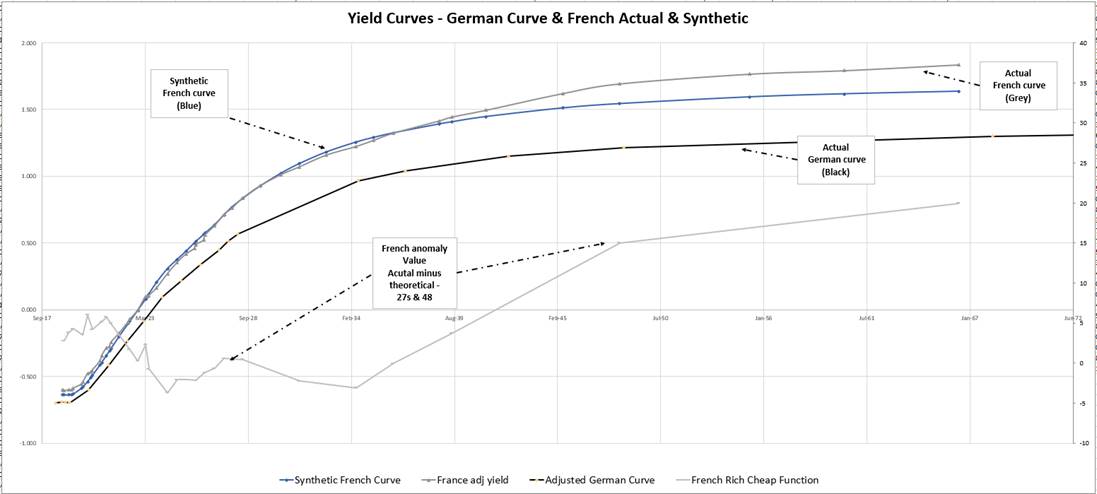

French 10s30s flattener vs Germany

Trade idea – Monday 19th March

French 10s30s flattener Box vs Germany

Trade Mechanics

- Buy 20,2MM Frtr 2% 5/48 vs sell 377 cts OAT Future €50k/01 (ctd Frtr 2.75 10/27)

- Sell 19,7MM Dbr 1.25% 8/48 vs buy 360 cts RXA futures €50k/01 (ctd Dbr 0.25% 2/27)

History

- Bloomberg History

- Cix:

100 * ((YIELD[FRTR 2 5/48 Corp] - YIELD[FRTR 2.75 10/27 Corp]) - 1.0 * (YIELD[DBR 1.25 8/48 Corp] - YIELD[DBR 0.25 2/27 Corp]))

Levels

- Entry: @ +19bp

- Add: @ +20.5bp

- Target: @ +16bp

- Stop: @ +23.5bp

Rationale

- We conflate the 0-10y French term structure with the German Yield curve to produce a synthetic French yield curve. With the French credit this tight, we would expect the gradient of the French 10s30s to more closely mirror that of Germany. See Graph below – the spread mapping in the long end is too wide for such a narrow credit

*Curves are normalised for H/L coupon feature by the diff between Swap spread and Z-spread

- The next long maturity supply in France will be on April 5th . Further supply in 48s is possible but we favour 15s and 20s as preferred choices. The 30y was last tapped end of February, taking it to >€18,45Bln in issue size. When the prior Frtr 5/45 reached €17,7Bln in issue size (January 2016) it wasn’t tapped again until the following May and after that only twice more.

- The Tresor has scope to tap the recently launched 15y Frtr 5/34. The prior 15y, Frtr 5/31 was tapped again the month after it was first launched (Sep/Oct 2015).

- The Tresor has also scope to tap the 20y bond. The Tresor announced it would continue to tap the 2039 ‘Green’ Bond during 2018 – it was last tapped Dec 2017. ‘AFT will also continue to tap the green bond first issued in January 2017 to meet market demand, up to the limit of eligible green expenditures for 2018’ - Indicative State financing programme for 2018, http://www.aft.gouv.fr/articles/indicative-state-financing-programme-for-2018_13109.html

- On balance, unless we see a significant cheapening of the French credit relative to Germany, in the current issuance environment, we could see the French 10s30s contract closer that of Germany

Carry and Roll

- French leg (8bp spread)

Carry -1.1bp /3mo

Roll -2.5bp /3mo

- German leg (14bp spread)

Carry +2bp /3mo

Roll +2.5bp /3mo

- Nett Carry and roll +0.9bp /3mo

Risks

- The 10y sector in France stays rich – possibly as a liquidity point in further tightening

- The German curve continues to out flatten the French curve

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FW: Trade - Spain 30y Roll 46s 48s

Spanish Trade – Long end Roll too steep, Spanish Rating Update due shortly from Standard and Poor’s

Trade Mechanics

- Sell Spgb 2.9% Oct 46

- Buy Spgb 2.7% Oct 48

- €50k/DV01, €23MM into €23MM

Levels

- Current @ +9.4 bp

- Enter @ +9 bp

- Add @ +11 bp

- Target @ +6 bp

- Stop @ +14 bp

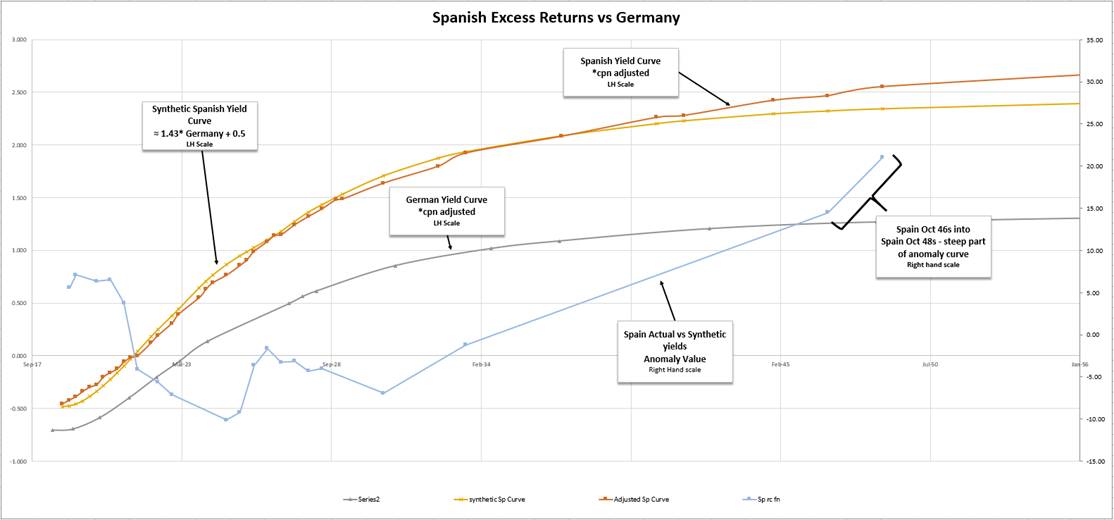

Spanish excess returns vs Germany

- We create a Synthetic Spanish yield curve by plotting its excess returns vs the German curve.

- Simply, the Spanish Curve is approximated by: ‘German Curve * 1.43 + 0.525’ – best fit

- Segments of the Spanish curve have a gradient of approx. 1.43 times the gradient of the German Curve

- We plot the difference between our synthetic and actual Spanish yields

- One of the steepest parts of the Spanish curve (Actual vs Synthetic) is Oct 2046 vs Oct 2048s

Yield curves are coupon adjusted to compensate for the value of high vs low cpns in a steep yield curve, ceteris paribus

Rationale

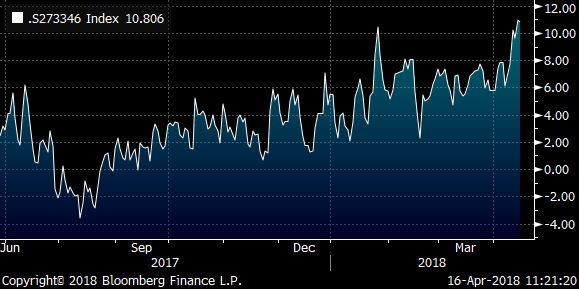

- The Spanish F.I. market has recovered its losses from the Catalonia Separation issues prevalent Q4 last year (see Graph of Spain vs France hedged with 50% -ik/+rx)

- S&P next Rating Publication Date due shortly – 23rd March 2018

- In an improving environment for Spanish credit – I am would favour flatteners vs other top rated countries (e.g. Germany)

- The model of excess returns does highlight the long standing steepness in long and ultra-tenors

- The syndication spread came at approx 11-12bp, but we believe this was an erroneous comparison to 46s 48s in Italy. Firstly Btps 46s is an anomalously rich bond for its coupon status, secondly generally as a weaker issuer the Italian curve is thematically steeper than Spain ( approx 20%). The fitted curve for Italy suggests that a fair value for Btps 46 vs 48 spread should be <3bp, (44’s vs 48s is 4bp!). Hence as a credit comparison if Spain were to be 20% flatter then this spread could also be <3bp

- As a syndication and further tap bond , one could argue that the 48s could remain cheap – yet we see no signs of that in the recently syndicated 2028 10y bond, indeed the issuer has empirically re-tapped older high and low coupon issues as market demand has arisen – the prior 46s was re-opened three times in the four months after its syndication in early 2016 and the spread remained in a 1.7bps range – see Graph

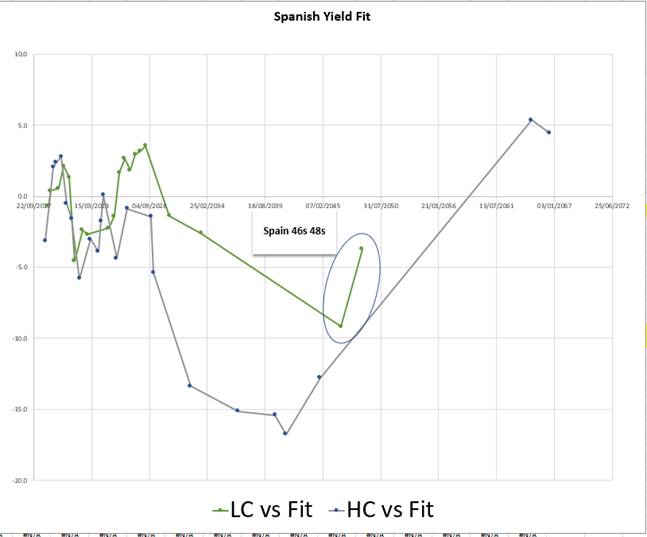

- Even when we fit a curve to include the cheaper Spanish Ultras (>30yrs) we still see that the 46s 48s spread is too steep in that context – see graph

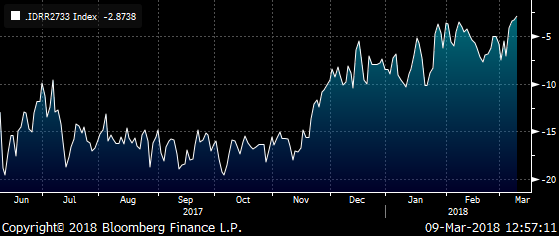

Graph of Spain vs France hedged with 50% -ik/+rx

Spain as an credit play in the context of if Italy, France and Germany has returned to the levels pre-Catalonia crisis of Q2 and Q3 2017

(+Spain vs -France) plus 50% of (Short Italy vs Long Germany)

100 * ((YIELD[SPGB 1.5 4/27 Corp] - YIELD[FRTR 2.75 10/27 Corp]) - 0.5 * (YIELD[BTPS 4.75 9/28 Corp] - YIELD[DBR 0.25 2/27 Corp]))

Graph of old 30y spread during re-issuance after syndication – historically spread not severely impacted by further taps

Graph of Anomalies on the Spanish Yield Curve – despite steep gradient of 30s50s the 46s 48s spread still appears steep

Risks

- The 2046s stay rich

- The 2048s stay offered as a potential tap bond

- A significant steepening in all European yield curves causes the relative value of this trade to diminish

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Italy Trade 10s15s flattener & German vol weighted hedge

Italian 10s15s flattener with German vol. weighted hedge on the radar

Mechanics

- Buy Italy 15y, Btps 2.45% 9/33

- Sell Italy old 10y, Btps 2.2% 6/27

€50k/01

- Hedge curve with Eurex contracts +RX/-UB

€50k/01

Levels

- Current: @ -2bp

- Entry: @ 0bp, based around timing of next Thursday’s tap of 9/33

- Target: -8bp

- Add: +2bp

- Stop: +5bp

History

- Cix:

100 * ((YIELD[BTPS 2.45 9/33 Corp] - YIELD[BTPS 2.2 6/27 Corp]) - 1 * (YIELD[DBR 3.25 7/42 Corp] - YIELD[DBR 0.25 2/27 Corp])) - Bloomberg graph

Rationale

- The notion of excess returns indicates that on average the Italian Curve is 1.74 times steeper that the German Curve (see Graph)

- On that metric versus German the 6/27 vs 9/33 spread is historically steep, despite a flattening in Germany (see Graph)

- Using vol. based hedging we can use RX and UB futures to hedge to the exposure to the risk free-rate – N.B. we hedge 10s15s Italy 1:1 vs the German futures – the Italy component is a smaller duration gap than Germany, but we expect Italy to be 1.74 times more volatile than Germany currently, hence a 1:1 ratio

Graph of Curves

Germany, Italy and Synthetic Italy (Synth Italy ≈ 1.74 * Germany + 0.88)

..idr1015

..idr1015

Correlations/Regression

- Is this trade correlated to the Italy/German spread?

1y history Trade Index vs ik/rx spread

Correlation -0.74, r2 0.56: implying this trade would at the margin, favour a spread widening

Carry & Roll

- Italian leg

Carry /3mo: -1.4bp

Roll /3mo: -2.7bp

- German leg

Carry /3mo: +0.7bp

Roll /3mo: +2.4bp

Nett carry and roll /3mo: -1bp

Risks

- The German curve flattens ahead of Italy

- A further spread narrowing of It/Ge could cause the Italian curve to steepen ahead of Germany

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Italy Trade 7s 10s 15s - vol. weighted

Any thoughts please?

Italy Trade – Friday 3rd September

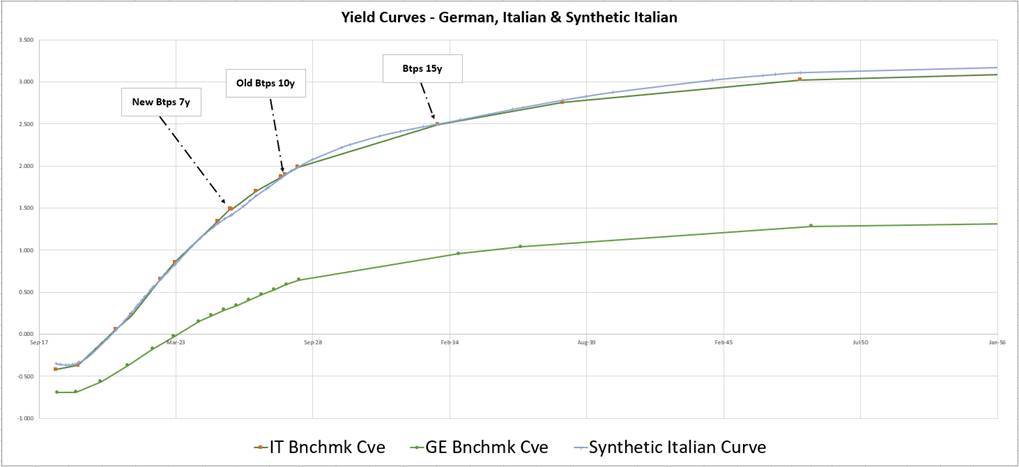

Trade – Italy, Sell 10y, Buy 7y & 15y, vol. weighted

Mechanics

- Sell: old 10y Btps 2.05% 8/27

- Buy: new Btps 1.45% 5/25 & Btps 2.45% 9/33

- Weighting: +1.2/-2/+0.8

- Cix: 200 * (YIELD[BTPS 2.05 8/27 Corp] - 0.6 * YIELD[BTPS 1.45 5/25 Corp] - 0.4 * YIELD[BTPS 2.45 9/33 Corp])

Trade levels – using the new 7y

- Current fly value: @ +1.7bp using new issue 7y

- First entry, pay spread @ +1.7bp

- Add: @ flat

- Target: @ +5bp

- Stop: @ -2.5bp

History – using the old 7y

- Using the older 1.5% 6/25 for history on the 7y portion

Cix used in graph

200 * (YIELD[BTPS 2.05 8/27 Corp] - 0.6 * YIELD[BTPS 1.5 6/25 Corp] - 0.4 * YIELD[BTPS 2.45 9/33 Corp])

Rationale

- Italian curve has a consistent gradient to the German curve of 1.75 times

- On that mapping, the old 10y point looks fairly priced and will have on the run, 10y supply at the eom (Feb 28s – Weed 28th March)

- The new 7y and that sector looks cheap

- The curve weightings of 60% short leg and 40% long leg are designed to insulate the structure from the higher volatility in the longer leg versus the short

- We see that long

Curves

Graph of German and Italian Benchmark Curves, also Synthetic Italian Curve

Synthetic Italian curve = German Curve * 1.76 + 0.87

Carry and Roll – (using 10bp spread)

- Carry /3mo: -1.6bp

- Roll /3mo: -0.1bp

Risks

- A continued rally in Italy causes the 10y to richen beyond the wings

- A rally in the German 10y point versus 7s and 15s, causes a removal of curvature in all other European curves

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

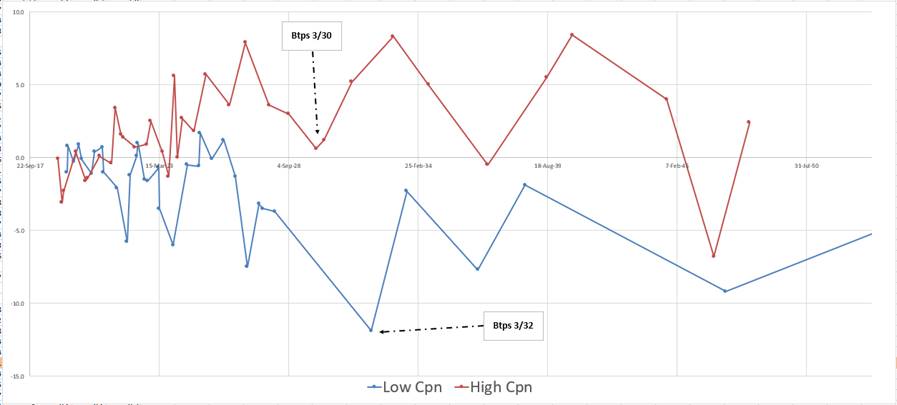

Italian Default Hedged RV

Gents at Nektar, any thoughts most welcome

Italian Default Hedged RV – Thursday 8th March

Buy Btps 3.5% 3/30 vs MMS

Sell Btps 1.65% 3/32 – excess to duration (default weighted), vs MMS 1.39 times short

Bloomberg History

Cix:

+SP208[BTPS 3.5 3/30 Corp] - 1.39 * SP208[BTPS 1.65 3/32 Corp]

N.B. code sp208 is the Bloomberg field for Bond vs MMS

Levels:

Target entry: @ -31.5bp

Add: @ -26.5bp

Target Exit: -37.5bp

Stop: -23bp

Rationale:

- The notion of default trading is still present in the Italian yield curve: in both the increasing yields spreads to swaps with tenor and the apparent richness of lower coupon/lower price issues vs high coupon bonds

- Generally the tenor curve and the pricing of anomalies can be well described by a contingent default model

- We can construct portfolios whose proceeds are generally insulated from a default event or spread widening

- This hedging methodology generates mean reverting series over some periods as the market adjusts for expected return and expected probability of default

- The potential advent of a 15y – 20y tap next Thursday from Italy should have a more negative impact for on the run, low coupon bonds

Analysis

- A full default model, with contingent probability of default of Italy vs Germany is beyond scope here

- Let’s look at the default process though – HC/LC anomalies AND the tenor curve of Italy both contain information about the expected probability of Italian default over time

- In default, a bond is typically marked down from its dirty price to an ‘all in price’: in this instance we have used 35 pts – typically default models use numbers between 30 and 40 points

- Let’s look at the two issues here, in the default scenario they get marked down to 35 points. That event generates different amounts of cash. So rather than hedging according to the duration, we have to back out a mismatched duration hedge, such that the nett cash loss on each bond, in the default scenario, is the same

|

Issue |

Dirty Price |

Duration |

Nominal Posn (MM) |

Proceeds |

Price loss to Recovery (35%) |

Position loss to 35% Recovery (MM) |

Posn duration |

|

BTPS 3 1/2 03/01/30 |

112.30 |

10.99 |

1.00 |

112.30 |

77.30 |

77.30 |

10.99 |

|

BTPS 1.65 03/01/32 |

91.14 |

11.07 |

-1.38 |

-125.49 |

56.14 |

-77.30 |

-15.24 |

|

Duration Ratio |

1.39 |

10.99 / 15.24 |

- So using the Price loss to Recovery column, we can generate two nominal positions that would have equal and offsetting cash losses under default. We then have to look at the relative durations of those positions to calculate our duration mis-weighting

- We then use swaps as an independent hedge for each leg, to neutralise risk-free rate exposure

Carry & Roll

- The characteristics of roll and carry will be slightly different from duration matched trades as the whole trade is hedged with swaps to be duration matched – but the amounts of the btps are not duration offsetting relative to each other

- 3/32s vs swaps position (scaled 1.39 times ,spread of 10bp)

Carry/3mo: -4.2bp

Roll/3mo: -1bp

3/30s vs swaps position

Carry/3mo: +3.8bp

Roll/3mo: +1.1bp

- Nett R&C -0.3bp/3mo

Italian RV – Anomalies to the Bloomberg Cubic Spline Curve

Risks

- The high coupon 3/32 stays persistently rich even account in a narrowing swap spread environment for Btps

- The Btps 3/30 gets cheaper as it approaches the delivery basket

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FW: Italy 5y anomaly, Trade Idea - James Rice @Astor Ridge

Italy Trade Idea –

Markets struggles to absorb new 5y Btps 0.95% Mar/01/2023

Trade

Sell Btps 0.65% 10/23 to Buy new 5y Btps 0.95% 3/23

Mechanics

- Sell Btps 0.65% 10/23 to buy New 5y Btps 03/01/2023

- 17% Hedge -OEA/+RXA

- Weighting +1/-1 in the Btp spread plus -0.17/+0.17 in the contract German Hedge

- Cix on OLD 5 YR Mar/15/23 (same coupon, maturity 2 weeks longer) history not available on new issue (trades approx +0.5bp over the old 5y)

100 * ((YIELD[BTPS 0.65 10/23 Corp] - YIELD[BTPS 0.95 3/15/23 Corp]) - 0.17 * (YIELD[DBR 0.25 2/27 Corp] - YIELD[OB176 Corp]))

- Cix on actual structure with new 5y issue

100 * ((YIELD[BTPS 0.65 10/23 Corp] - YIELD[BTPS 0.95 3/1/23 Corp]) - 0.17 * (YIELD[DBR 0.25 2/27 Corp] - YIELD[OB176 Corp]))

History

- Bloomberg Graph of CIX using Old 5y

- Using the actual new 5y that we propose…

Trade levels

- Current level @ +4.05bp (mid)

- Pay the Spread @ +4.1bp (50% size)

- Add @ +3bp

- Stop @ +1bp

- Final Target @ +7.5bp (approx. 4bp profit from average level)

Relative Value vs Smoothed Btps Zero Curve

Relative Z-spreads

- Btps 10/23: +50.3bp, +96.1bp vs interp. German z-sprd curve

- Btps 3/23: +45.9bp, +92.8bp vs interp. German z-sprd curve

Relative Z-spreads to German curve -3.3bp

Rationale

- The new 5y 0.95% Mar/01/23 continues to trade cheaply as it seems not to have been well placed after Tuesday’s auction and the bond remains offered

- The theme we’re trying to pursue is to always shorten from longer into shorter tenors at near to, or similar anomaly value vs the stripped curve and as close to as flat as the German curve

- The best Roll and Carry resides in the 5yr sector – 5yrs roll toward the richer 3y segment

- With Italian elections looming this weekend and a possible hung parliament, this is a bearish structure on the Italy/Germany spread – however on relative Z-spread analysis this is only 3.3bp steeper in z-spread terms than the Italian curve – used to determine the stop

Carry & Roll

- Carry/3mo: -0.4bp (on the Italian side assuming 10bp spread)

- Roll/3mo: +0.6bp (Italian side)

- Carry and Roll on hedge/3mo: -0.3bp (assuming 10bp on hedges & 50% delta in hedge)

- Total Package Roll & Carry /3mo: -0.1bp

Rich/Cheap, Z-score – Bloomberg GOVY Cubic Spline Model, 3mo. History

- Btps 1.5% 10/23, Z-score -0.7

- Btps 0.95% Mar/01/2023, insignificant number of observations since first issue Tuesday

- old 7yr Btps 0.95% Mar/15/2023, Z-score -0.1

Risks

- A positive environment for the Italian credit (post-election) causes a narrowing of spreads and a flattening of Italy vs Germany

- The Btps 3/23 stays as a cheap issue on the curve

- The Btps 10/23 richens in terms of anomaly

Always love to hear your feedback

Will also be taking a look at analysing the futures rolls – let me know if you’d like to see that too

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Italy 5s 7s steepener, Trade Idea - James Rice @Astor Ridge

Italy Trade Idea – Thursday, March 1st 2018

Absorbing Tuesday’s 5y supply, preparing for the new 7y in two weeks’ time

Sell 7y Btps 1.5% 6/25 to buy new 5y Btps 0.95% 3/23

Mechanics

- Sell Btps 1.5% 6/25 to buy New 5y Btps 03/01/2023

- 50% Hedge -OEA/+RXA

- Weighting +1/-1 in the spread plus -0.5/+0.5 in the contract German Hedge

- Cix on OLD 7 YR 03/23 (same coupon, maturity 2 weeks longer) history not available on new issue (trades approx +0.5bp over the old 7y)

100 * ((YIELD[BTPS 1.5 6/25 Corp] - YIELD[BTPS 0.95 3/15/23 Corp]) - 0.5 * (YIELD[DBR 0.25 2/27 Corp] - YIELD[OB176 Corp]))

- Cix on actual structure with new 7y issue

100 * ((YIELD[BTPS 1.5 6/25 Corp] - YIELD[BTPS 0.95 3/1/23 Corp]) - 0.5 * (YIELD[DBR 0.25 2/27 Corp] - YIELD[OB176 Corp]))

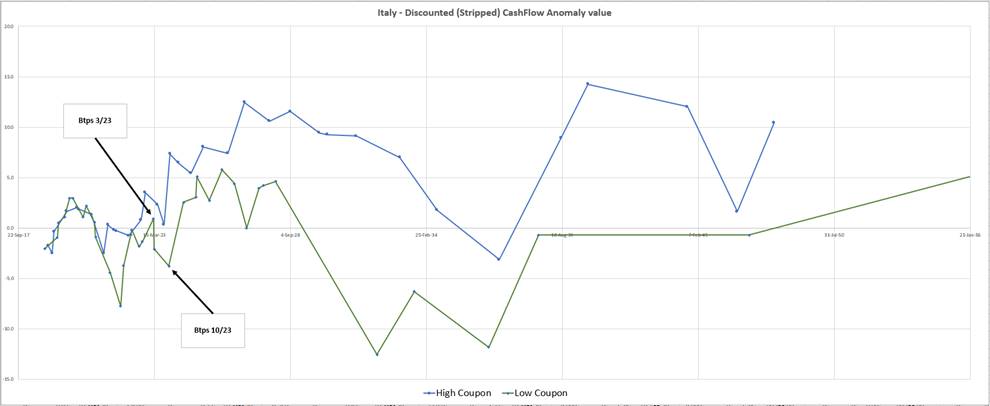

History

- Bloomberg Graph of CIX using Old 7y

- Using the actual new 5y that we propose…

Trade levels

- Current level @ +31.3bp (mid)

- Pay the Spread @ +30.5bp (50% size)

- Add @ +26.5bp

- Stop @ +24bp

- Final Target @ +34.25bp (approx. 3.7bp profit from first entry level)

Relative Value vs Smoothed Btps Zero Curve

Rationale

- The new 5y 0.95% Mar/01/23 continues to trade cheaply as it seems not to have been well placed after Tuesday’s auction and the sector remains offered

- The theme we’re trying to pursue is to always shorten from longer into shorter tenors at near to, or similar anomaly value vs the stripped curve – (trade target is set for this to equate to less that give 1bp)

- The best Roll and Carry resides in the 5yr sector

- In two weeks’ time we have a new low coupon (expected given current yields), 7yr - Btps XX% May 2025 as per the Tesoro announcement Dec 21st 2017, so we expect the lower coupon 7 years may soften into this supply

- With Italian elections looming this weekend and a possible hung parliament, this is a fundamentally bearish structure on the Italy/Germany spread – a widening in the country spreads would also imply a relative steepening of the Italian curve vs the German hedge

Carry & Roll

- Carry/3mo: -0.7bp (on the Italian side assuming 10bp spread)

- Roll/3mo: +2.0bp (Italian side)

- Carry and Roll on hedge/3mo: -0.9bp (assuming 10bp on hedges & 50% delta in hedge)

- Total Package Roll & Carry /3mo: +0.4bp

Rich/Cheap – Bloomberg GOVY Cubic Spline Model, 3mo. History

- Btps 1.5% 6/25, z-score -0.5

- Btps 0.95% Mar/01/2023, insignificant number of observations since fist issue Tuesday

- For comparison the old 7yr Btps 0.95% Mar/15/2023, z-score -0.12

Risks

- A positive environment for the Italian credit (post-election) causes a narrowing of spreads and a flattening of Italy vs Germany

- The Btps 3/23 stays as a cheap issue on the curve

- The Btps 6/25 continues to stay rich on the curve

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796