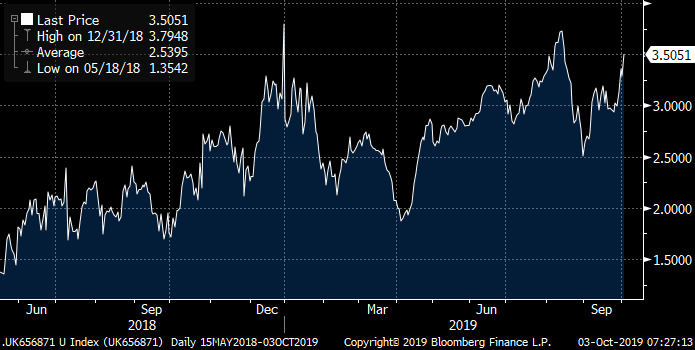

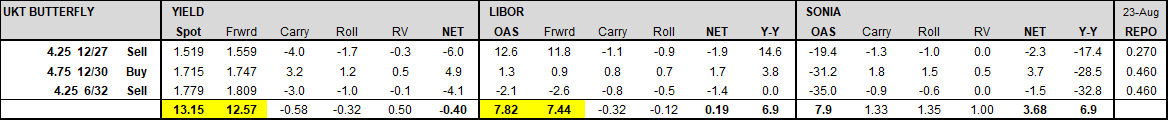

UKT 26s28s30s - Belly Cheap

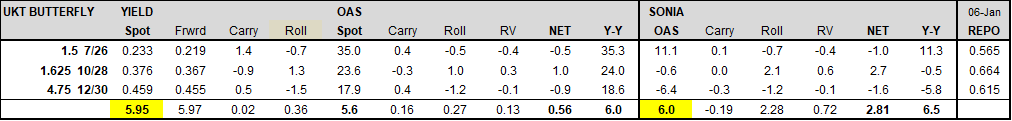

TRADE: Buy belly of UKT 26s28s30s @ +6bps (with 0.25bp discretion):

Stop: +8 bps

Target: +2 bps

Rationale: Recent richening of UKT 26s and 30s in micro RV has left the UKT 28s looking cheap on bfly. With the severe concavity in the UKT 5s7s9s curve, the 9yr point stands out as very cheap given sharp rolldown, especially in the current reach for yield environment.

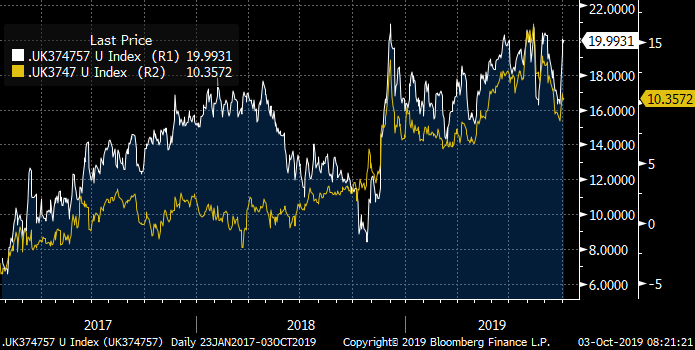

UKT 26s28s30s bfly – recent trend correction:

Drivers:

UKT 2.75 9/24–1.5 7/26–1.625 10/28 bfly – 26s richening into APF selling:

UKT28s30s32s – 30s also trending richer as they become CTD to March 2020 contract for 9 cycles:

The 26s28s30s will roll down to the the 24s26s28s in 2 years time – which trades over 21bps richer and is near recent wides:

UKT 26s28s30s bfly minus 24s26s28s bfly:

Carry on the UKT 26s28s30s fly is relatively flat assuming a repo spread of -11bps and -6bps on each wing.

Jim Lockard

Founder / Managing Partner

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th Street, New York NY 10017

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

UK ultra long richening driving bellies cheap

LDI de-risking activity (see below) in the ultra long end coupled with recent 37s supply and yesterday’s 7-15yr final APF have caused the 20-30yr sector to look cheap, as well as micro RV dislocations in the 50yr sector.

“Allied Domecq agrees £3.8bn buy-in with Rothesay Life to take 2019 deals past £30bn”:

“This week has been a significant week for the insurer, as it announced two mammoth bulk annuity transactions, one of which is the biggest ever transaction to date. It announced yesterday that it agreed a £4.7bn buyout of the GEC 1972 plan, which made 2019 officially, a record-breaking year. Meanwhile, today it agreed a £3.8bn buy-in with the Allied Domecq Pension Fund in the market's largest deal to cover both pensioner and deferred members.”

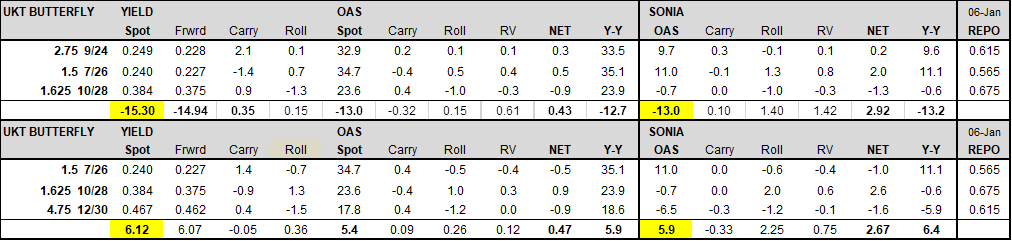

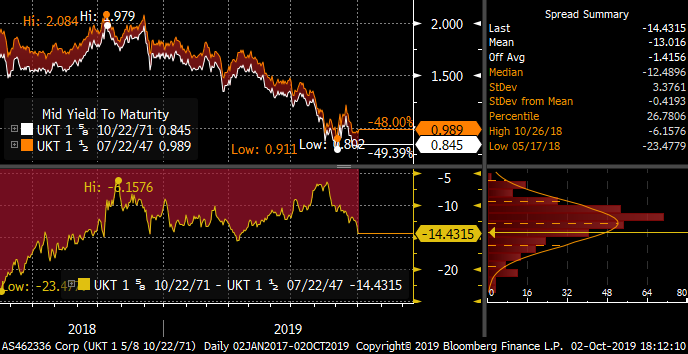

UKT 30s50s (47s71s) reinverting to 1yr lows, conversely at much lower yield levels:

TRADES (in order of VAR):

- Buy belly of UKT 65s68s71s @ +3.3 bps:

Stop: 4bps

Target: 2bps

Rationale: In DMO consultations we recommend a nominal syndication (likely week 18 Nov) in 54s or 71s, either of which could cheapen the wings to the belly of this fly, which has been relatively stable and near multiyear extremes. The recent richening of 71s is likely due to pension de-risking and shifting out of RPI (linkers) into nominals. Given recent rise in mortality rates, flexible drawdown pensions, uncertainty around the future of RPI, and the scope to upsize 71s, I view the recent richening as an event driven aberration which presents an opportunity to fade.

- Buy belly of UKT 34s37s40s @ +11.75 bps:

Stop: 13 bps

Target: 8 bps

Rationale: We have seen the last tap of 37s which will eventually make room for a new 20yr. The 37s roll down a very steep part of the 10s30s curve and should be favoured in the current reach for yield environment. Location – the fly is approaching Nov 2018 highs, when UK cabinet resignations caused FTQ bid in 10yr futures at the same time as a 37s tap drove the 10s20s curve sharply steeper (purple line below). The fly is near Nov 2018 highs despite 15 bps flattening in 4q27s37s curve since then.

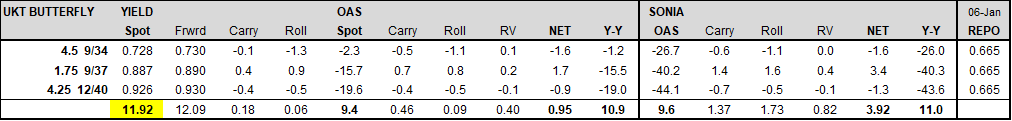

- Buy belly of 37s47s57s @ +19.75 bps:

Stop: 21.25 bps

Target: 16.5 bps

Rationale: The 47s are even cheaper than the 37s on this fly, due to recent richening of 50yr sector. Location – we are near all time highs of 21 bps, which occurred during FTQ and supply driven steepening of 10s30s in Nov 2018 coupled with year end de-risking in 50yrs (white line below). UKT 37s47s57s is also cheap to the 37s47s wing (yellow line below). In 2019, the fly has shown mean reverting tendencies; over the last 6 months the fly has traded in a well defined 16-20 bps range:

The UKT 47s57s leg of this fly is also approaching 1yr extremes:

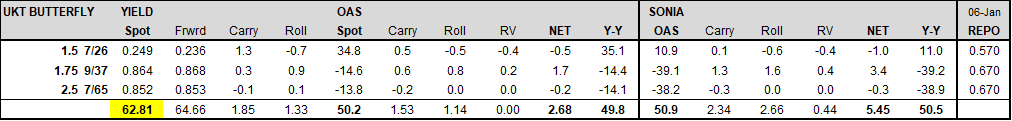

- Buy belly of UKT 26s37s65s bfly @ +62.5 bps:

Stop: 66 bps

Target: 55 bps

Rationale: The 26s37s65s fly has cheapened nearly 20bps from August lows, much of it in the last 1.5 weeks, due to 37s tap (and exclusion from last 2 APFs) coupled with recent LDI de-risking in the 50yr sector. We are back near the 65 bps level which has held since May. The fly also enjoys positive carry of close to 8bps per annum.

Jim Lockard

Founder / Managing Partner

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th Street, New York NY 10017

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FW: GERMAN Insurers Exiting Bund Mkt - Quick Colour

From: Mark Funsch <mark.funsch@astorridge.com>;

Sent: 06 September 2019 07:47

Subject: GERMAN Insurers Exiting Bund Mkt - Quick Colour

Good note from one of our dealers worth passing along.

{GE} Bunds: In a research piece yesterday, Commerzbank highlights that German life insurers are increasingly turning their back on German Bunds due to negative yields. Both Allianz’s CEO and Talanx’s CFO have expressed in recent newspaper interviews that German Bunds are no longer a viable investment option for them. Another insurer, Munich Re has also highlighted their disinterest in buying Bunds at these yields while the chief economist of the German Insurance Association stated in a recent interview that ‘hardly any German insurers are buying Bunds anymore’ and he highlighted that some are insurers are presently investigating the potential of simply storing money in safes as an alternative.

The piece also highlights that German life insurer’s back book guaranteed rate is 2.8% while the Zinszusatzreserve (ZZR) which is approximately €65bn for the industry reduces that rate to about 2%. Buying Fixed Income securities that have negative yield is simply not compatible with their required returns. The research piece highlights that assets such SSA’s such as KFW, corporate bonds and promissory notes (Schuldscheindarlehen) are all benefitting from the move away from negative yielding assets but even these now have yields that are too low for the insurers to meet their desire return requirements. Mortgage bonds and alternative asset classes are now targeted.

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: OATs RV - What About the FRTR 10/27s? RV in the 5-10yr Sector

From: Mark Funsch <mark.funsch@astorridge.com>;

Sent: 11 July 2019 12:03

Subject: MICROCOSM: OATs RV - What About the FRTR 10/27s? RV in the 5-10yr Sector

Importance: High

- Our RV guys have been asking whether the FRTR 2.75 10/27s will cheapen on the Z-sprd curve, normalizing to where the lower coupon issues trade. There are a few angles here worth examining, both in terms of how we got here and, more importantly, where we’re going.

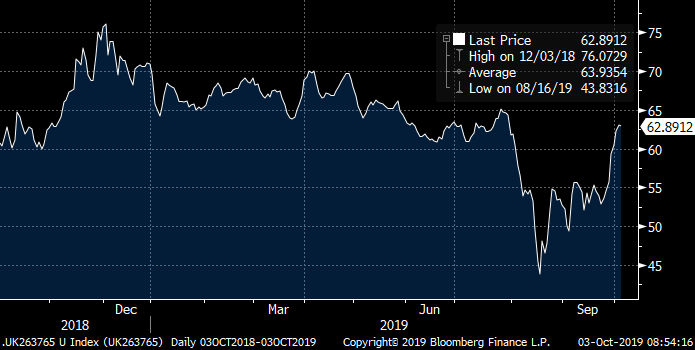

- The fun started with the FRTR 3.5 4/26s. From October 2016 to February 2017, open interest in OATA contract rose an extraordinary 182% while the FRTR 3.5 4/26s were CTD. The first few deliveries into the OATM6-OATZ6 contracts were modest, from 3k to about 12k contracts. By March 2017, however, we saw an extraordinarily huge delivery of 62,411 contracts, followed by 26,373 in June and another huge 53,746 in September before falling out of the basket into OATZ7. Talk about going out with a bang! Not only did the FRTR 3.5 4/26s repo trade at extraordinarily rich levels but the issue became very difficult to trade and remains rich to the curve almost 2yrs after the last delivery.

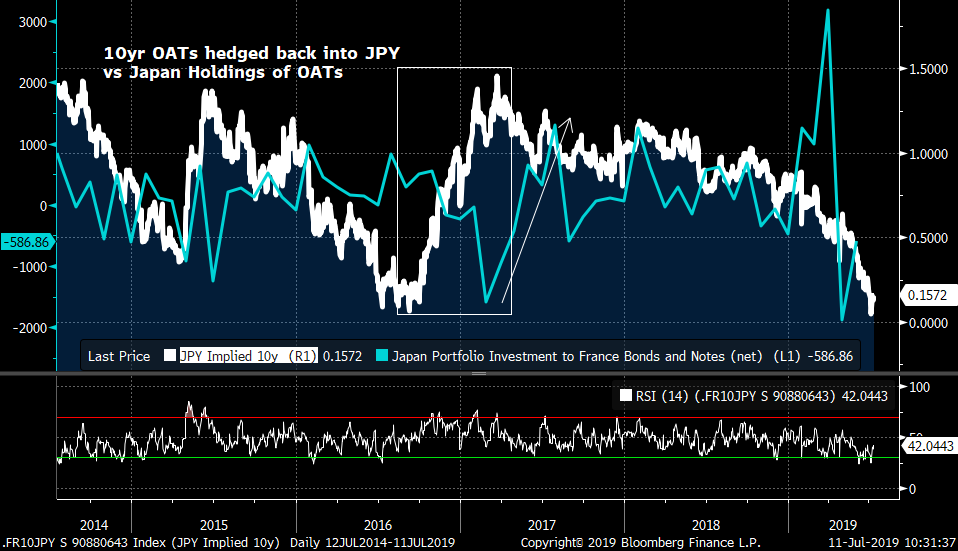

- We can assume from the chart below that the bulk of the demand for OAT contracts (and by extension the FRTR 4/26s) emanated out of Japan. The dramatic cheapening of 10yr OATs vs JPY in the late ’16 to early ’17 period coincides almost perfectly with the sharp rise in open interest and the huge deliveries into the contract which we’d have to presume were held in the accounts of Japan’s pensions.

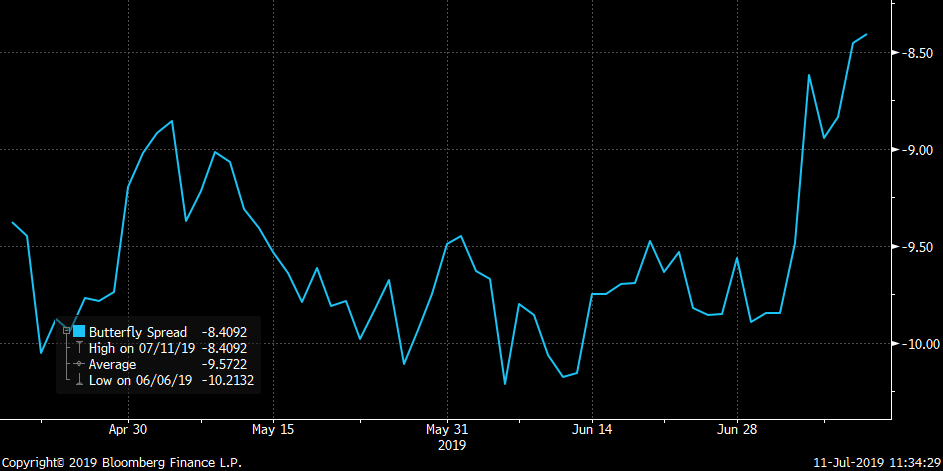

- Over the course of the ensuing 18 months, open interest has risen and fallen but remains about where it peaked in early 2017 at ~600k contracts. Deliveries of the FRTR 2.75 10/27s from late 2017 and in 2018 were fairly modest, peaking at 26.4k in September which foreshadowed a rally in OATs vs JPY (see above). That big spike in holdings of OATS in the 1st qtr of 2019, however, not only presaged a 50-60bps richening of OATs vs JPY but culminated with a delivery of 33,911 FRTR 2.75 10/27s. The chart below shows the performance of the FRTR 5/25-10/27-5/30 fly with the OATA deliveries highlighted. We can see rather clearly that the 33k delivery helped generate further outperformance of the FRTR 2.75 10/27s on the curve and an overall richening vs JPY.

- In both cases, we have Japanese investors with long-term investment horizons controlling large blocks of high coupon issues on a curve with current coupons that are at least 200bps richer than the bonds they own. From a tactical perspective, these CTDs also had a duration that, at the time, was +/- .5yrs of the duration of most OATs indexes. Even now, most indexes have a duration of around 8.75yrs which is just longer than the soon to depart FRTR 5/28s and a touch shorter than the new CTD into OATZ9 FRTR 11/28s.

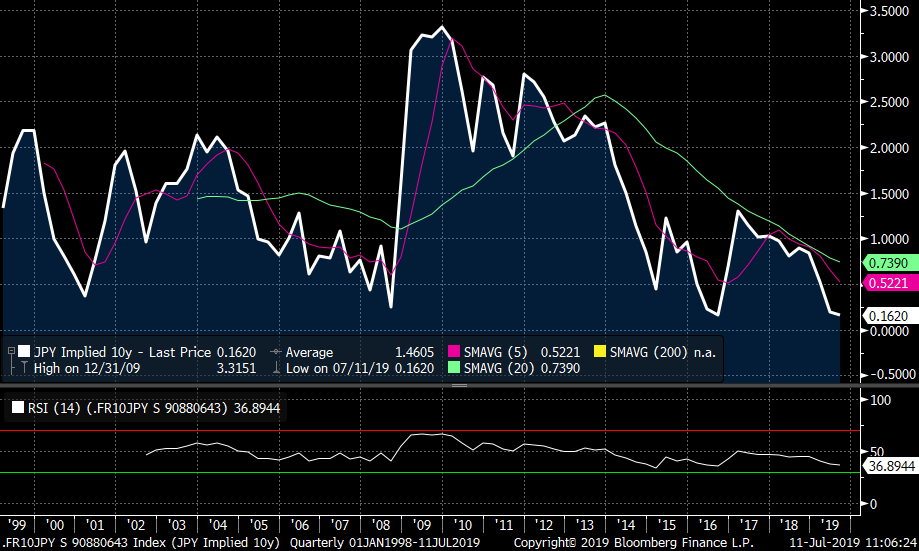

- So, given the experience of the FRTR 3.5 4/26s – which have consistently traded 3-5bps rich to the lower cpn Z-sprd curve – and what we presume to be substantial holdings of the FRTR 2.75 10/27s, it seems to us best chance of these issues cheapening meaningfully on the curve would happen if Japanese investors have a reason to sell them. From the long-term chart below of 10yr OATs into JPY, we can see that we’re back to the richest levels they’ve traded in the last 20yrs which could prompt one of two things: outright selling on a profit taking move if the ECB disappoints and the rate cut cycle isn’t as aggressive as hoped OR continued recycling of OATs into SPGBs and even BTPS as the race to the bottom continues. The odds of one of these outcomes occurring have risen in our view and either will spell trouble for the FRTR 10/27s.

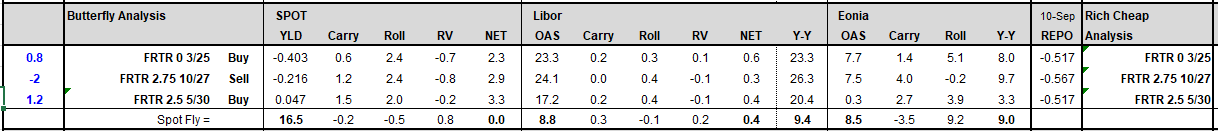

- From a micro-perspective, shorting these high coupon issues isn’t as costly as it once was. Repo, especially short dates, is close to GC so the incentive to ‘feed the monster’ isn’t there anymore. In addition, we expect the FRTR 5/28s to trade better on the curve as they fall out of the basket, prompting some extensions out of both the FRTR 11/26s and FRTR 10/27s into them. The FRTR 5/27s stand out as one of the cheapest issues in the sector, as do the FRTR 0 3/25s (new 5yrs) . On the other side of the curve, the higher coupon FRTR 2.5 5/30s will be on the market’s radar as they’ll likely be CTD into the June 2020 contract and as we’ve seen from the 4/26s and 10/27s, these high cpn issues attract attention (even considering its big size).

- So, if you’ve got a longer term horizon and are willing to bet the directional bid won’t surge sharply richer again, then check out this fly:

Sell FRTR 2.75 10/27 to buy FRTR 0 3/25 and FRTR 2.5 5/30 . The chart below is of the .8/-2.0/1.2 weighted position that has shown signs of turning.

History of FRTR 10/27 vs FRTR 0.5 5/25 and FRTR 2.5 5/30 for longer history:

FRTR 10/27 vs FRTR 0 3/25 and FRTR 2.5 5/30 in a .8/-2.0/1.2 weighting – we see this cheapening move continuing.

- On a cross-market basis, we’ve been fans of the DBR-NETHER-FRTR blends as a way of isolating EGB spread narrowing/tightening moves with relatively low beta. With the FRTR 10/27s still rich on the curve we can sell DBRs and FRTRs to buy NETHER in a sprd weighting of -.7/2.0/-1.3 that makes NETHER look cheap, even with DBR-NETHER sprds near their tightest levels. We think this is an interesting way to fade the spread narrowing trend and is at historically cheap levels.

We’ll be in touch to discuss.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Tactical trade: EUR 5y-20y bear-flattener as zero-cost fade to current rally

Bottom line: As I outlined on Friday, the EUR curve is being driven from the short end, however the implied volatility surface does not reflect these realized moves. As a consequence, bull-steepeners/bear-flatteners can be set as zero-cost structures. Since Friday, the curve in all sectors has bull-steepened aggressively, so zero-cost bear-flatteners are very attractive as a way to fade the rally, but with limited downside (compared to outright rate positions).

Trade 1:

Buy EUR 201mm 1m5y payer atmf (k=0.279%)

Sell EUR 58mm 1m20y payer atmf (k=1.446%)

For a premium take-out of 0.5bp (indicative mid)

Trade 2:

Buy EUR 201mm 1m5y payer atmf (k=0.279%)

Sell EUR 48.9mm 1m20y payer atmf (k=1.446%)

For zero cost (indicative mid)

Net delta at inception: 7k/bp short (for 100k/bp of underlying 5y)

Forward curve ref: 116.7bp

Spot curve: 117.9

Rationale: We are seeing a strong directionality in all sectors of the EUR curve: currently a sharp bull-steepening. Previously large market moves have caused the opposite mode (bull-flattening, bear-steepening) as the ECB has been solidly on hold for some time, and the implied volatility on short-dated tails has been suppressed as a result. Now that at least some movement is priced for the ECB, short rates are also able to join in, and reflect market sentiment on the rate outlook.

The chart is the EUR 5y-20y spot spread. This sector has steepened around 8bp since last week, with the 5y rate moving further than 20y (though to be clear, both have rallied).

The trade is to fade this steepening with a conditional flattener on a short expiry. This is a tactical play for a simple reversal of the price action, without the exposure to a continued bull-steepening move.

Why 1m expiry? Steepeners are negative carry trades currently, so a short expiry limits the carry/rolldown overhead. Also this is a trade for a quick reversal, so we want to capture as much of the intrinsic value of any move in the near term (and not have to wait longer to see the move in the underlying fully reflected in the value of the options).

Why 5y-20y? Spot 2y rates are still anchored (as even the most hawkish commentators see little action before autumn 2019), so the 5y rate has more scope to react to changing rate expectations. The largest curve move (and hence the largest potential P&L on a reversal)

The table shows the current implied volatility on 1m options, together with the move in the spread vs the 5y rate. What we are looking for is the largest potential P&L from a flattening reversal together with the largest differential in implied vols.

|

1m2y |

14.2 |

Curve steepening in latest rally |

|

1m5y |

28.7 |

Vs 5y rate |

|

1m10y |

34.8 |

3bp |

|

1m15y |

34.4 |

5bp |

|

1m20y |

34 |

8bp |

|

1m30y |

32.4 |

10bp |

The largest curve move has been in 5y-30y, however the vol differential is not the best, and the 30y has seen less of a rally than shorter tenors. The second point is important as the only way to lose money on this trade is for the long rate to sell off more than the short rate. The risk of this is highest for the 30y, as it is not unheard of to have idiosyncratic swap flows at the long of the EUR curve. For that reason more than others, I prefer to use 20y as it a compromise between potential P&L, implied vol differential and the correlation with the 5y rate.

I’ve put two alternatives above: the first where the net premium is taken out of the trade; the second where the premium differential is used to buy more than the DV01-neutral amount of the 1m5y payer, allowing the curve to possibly make some money in a parallel curve shift to higher rates.

Risks: As mentioned, the risk is a sudden move to a bear-steepening mode, without a transition through bear-flattening. This could occur if rates stabilize at these levels and we see significant paying flows in 30y. In my view the first market move will either be a bearish rate reversal or a continuation of the rally, but the risk is there.

As always, I’d love to hear your thoughts on this!

Best wishes,

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

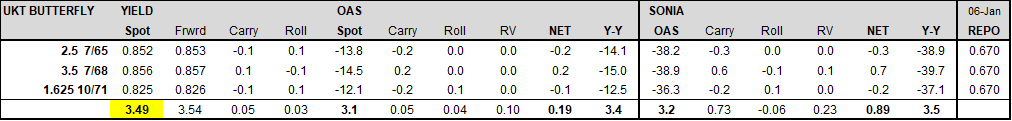

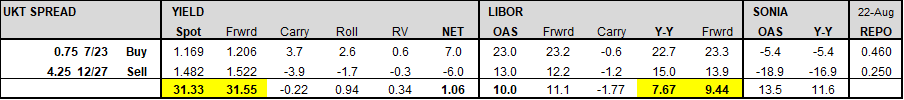

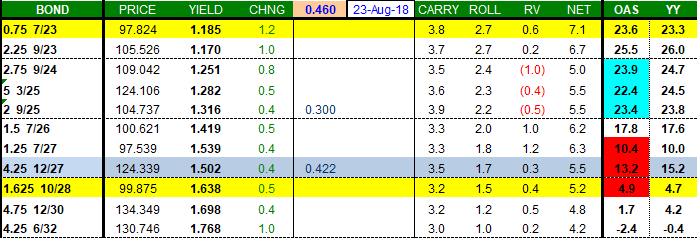

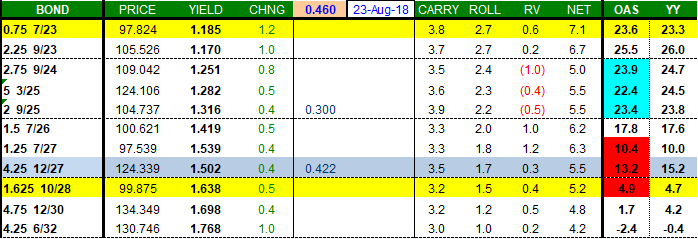

UKT 0.75 7/23 - 4.25 12/27 MMS into July Redemptions

Trade:

Buy UKT 0.75 7/23 vs UKT 4.25 12/27 on YY ASW @ 8 bps:

Stop: 5bps

Target: 14 bps

Blue – UKT 7/23-12/27 MMS

Purple – UKT 7/23-12/27 Yld Spread

Rationale:

On 22 July, the UKT 1.25 7/18s will mature (34.8bn total, of which 30.6bn privately held). While the APF will reinvest its 2.9bn across the curve, the private sector will reinvest its 30.6bn predominantly in the 0-5yr sector. This should substantially benefit the 0T 7/23 5yr issue, which is cheap on the curve and and is nearing its final expected tap on 6 June, when it will reach its full benchmark size, to make room for a new 2024 5yr maturity (the outgoing benchmark typically richens as Asset Managers avoid the new issue until it gets tapped up to benchmark size).

Moreover, Central Bank reserve managers (holding predominantly <5yrs) will need to buy Gilts into month end rebalancing to account for the recent drop in Sterling.

As a result UKT 5yr ASWs are expected to outperform vs longer issues. The 4q27 (CTD to Gilt futures) is an ideal hedge as it is a rich and fairly liquid bond which will fall out of the CTD basket on 28 Feb (causing it to lose its deliverable premium). The 4q27s has been rich because it is a low float bond which tends to richen into delivery due to squeeze risk. This risk disappears after March 2019 delivery.

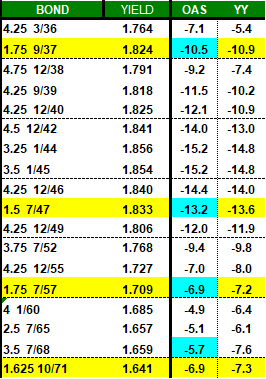

Z Spread (OAS) Curve – The last high coupon CTD, 5 3/25, trades cheap on Z spread (OAS) to surrounding low coupon bonds; conversely, the current CTD 4.25 12/27 trades rich to surrounding low coupon bonds. On a simple interpolated maturity basis, the 4.25 12/27 are nearly 6 bps richer on Z spread than the 5 3/25.

History:

For extended history, we look at the UKT 2q23-4q27 Z spread into the 1% 9/17 and 4% 9/16 redemptions:

While the UKT 2q23 ASW richened into the 9/16 redemption, it moved sideways into the 9/17 redemption while the 4q27 ASW cheapened.

Given we are in the middle of the range in UKT 5yr ASWs, the ASW box is the preferred expression for the upcoming redemption.

Timing:

Typically the front end richening starts 3 months before the redemption event, and peaks by the ex-dividend date of the maturing bond (10 business days before delivery).

So it makes sense to enter the UKT 0.75 7/23-4.25 12/27 MMS now, and look to exit the trade by 9 July ex-dividend date for UKT 1.25 7/18.

UKT Curve overview and bond selection:

(0.75 7/23 and 4.25 12/27 OAS = Z spread is highlighted in blue):

0.75 7/23 is locally cheap

4/25 12/27 is locally rich

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

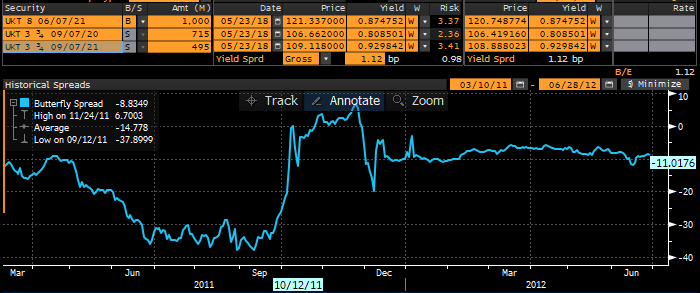

UKT 27s30s32s bfly

Trade: Buy the belly of UKT 4q27s-4t30s-4q32s @ +13.25 bps:

Add: 14.25bps

Stop: 16.0bps

1st Target: 10.0bp

2nd Target: 5.0bps

Rationale:

- The 4q27 will lose their CTD status on 28 Feb, when June 2019 becomes lead contract

- The 4q32s have enjoyed neutral duration status for the Gilt All Stocks Index; this status will shift to 4h34s by Q3 (as 32s roll down and index extends with 71s syndication)

- The 4t30 will eventually be CTD vs March 2020 contract (i.e. by Dec 2019; at current yield spreads, the 1.625 10/28 will be CTD into Jun/Sep/Dec 2019)

Z Spread (OAS) Curve – The last high coupon CTD, 5 3/25, trades cheap on Z spread (OAS) to surrounding low coupon bonds; conversely, the current CTD 4.25 12/27 trades rich to surrounding low coupon bonds. On a simple interpolated maturity basis, the 4.25 12/27 are nearly 6 bps richer on Z spread than the 5 3/25.

History of high coupon CTDs:

- The UKT 5 3/25, a multiple cycle CTD, cheapened 20 bps on 2.75 9/24 - 5 3/25 - 2 9/25 bfly after they lost CTD status in June 2016:

- The UKT 8 6/21, another multiple cycle CTD, cheapened 40bps on 3.75 9/20 – 8 6/21 – 3.75 9/21 bfly nine months before losing CTD status in June 2012:

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

UKT 20s40s flattener

UKT 20s50s curve has disinverted over the last month due to 1) Italy FTQ flows, 2) International RM shifting out of UK long end into US/EUR, and 3) Concession and digestion of the recent 71s Syndication

It’s time to fade this with one of the following flatteners:

Selling 37s has the advantage of the upcoming 20 June tap, but has more punitive carry (so best for a short term tactical trade into July coupon flows).

From a risk reward standpoint, the best (and most liquid) expression is the UKT 37s57s flattener @ -12.0 bps:

TARGET:

1st – 16 (+4bps)

2nd – 20 (+8bps)

STOP:

10 (-2 bps)

RATIONALE:

- For the past few years ultras have richened into June month end rebalancing / window dressing (although June ‘16 was somewhat magnified by Brexit).

UKT 42s60s Curve:

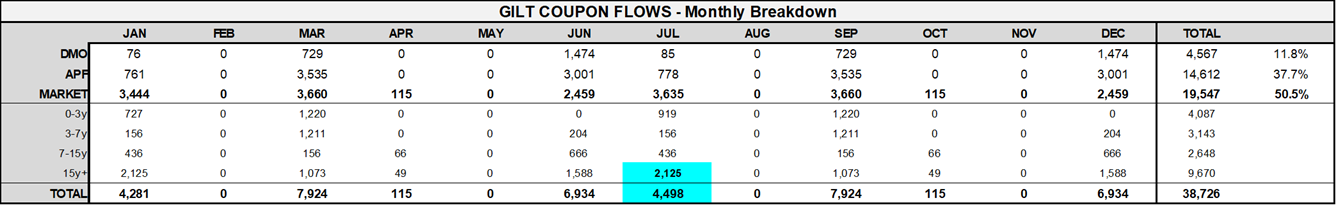

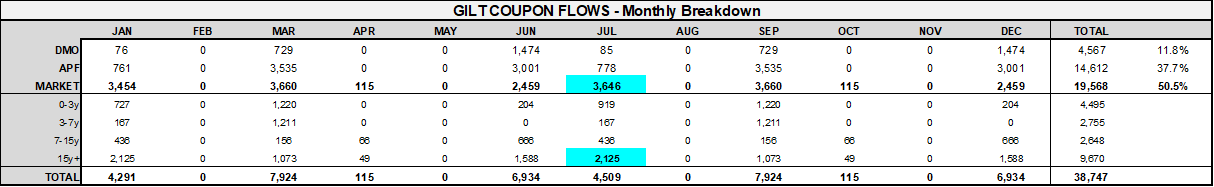

- In addition, the 22 July coupon payment (~ 8 July ex-dividend date) will also be well distributed in the long end.

£4.5bn coupon payments (£3.6bn privately held), of which £2.1bn (58%) are in the 15+yr basket:

- Looking at 42s60s implied forward rate, we are near the range highs:

- Outright 50yr yields tell a similar story:

- The supply calendar also favours 20s50s flatteners – we have 20yr supply in 12 days, while there is no ultra long supply after the 19 July auction of the 57s:

20 June – 28s Linker (10yr)

26 June – 37s Auction (20yr)

3 July – 28s Auction (10yr)

19 July – 57s Auction (40yr)

24 July – 24s Auction (New 5yr)

8 Aug - 28s Auction (10yr)

21 Aug – 28s Linker (10yr)

6 Sep - 24s Auction (New 5yr)

11 Sep – 49s Auction (New 30yr)

20 Sep – 28s Auction (10yr)

25 Sep – 48s Linker (30yr)

- Bond Selection – 37s and 47s stand out as rich on curve, while 57s and 68s stand out as cheap:

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

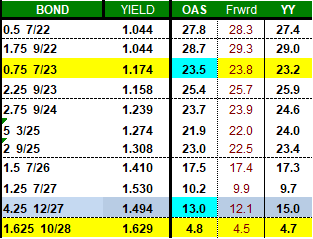

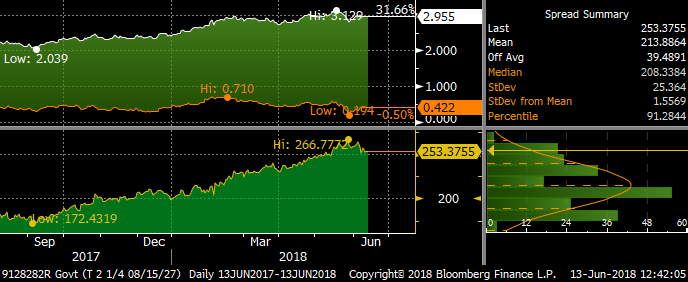

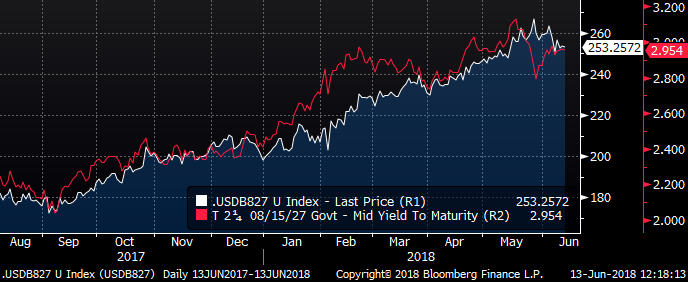

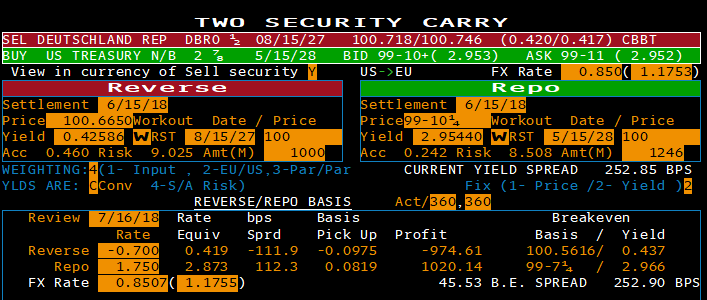

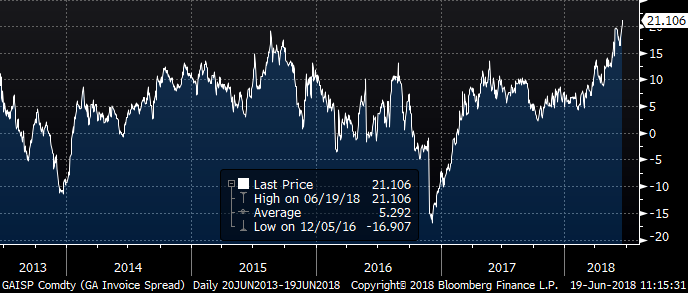

UST-DBR spread - Set to Narrow?

Trade:

Buy UST 10yr (T2.875 5/15/28) vs sell DBR 0.5 8/27 (CTD) or RXU8 @ +253 bps

History: T2.25 8/27 vs DBR 0.5 8/27:

Target: 233 bps (20bp profit)

Stop: 263 bps (10bp loss)

RATIONALE:

With risk of a less hawkish Fed at today’s FOMC meeting, and a less dovish ECB at tomorrow’s ECB meeting, the continuous widening of the UST-DBR spread may be set for a correction.

The spread is already 13 bps off its Italy blowout highs, when 10yr DBR yields briefly touched 19 bps.

Even with a more hawkish than expected Fed, there should be enough flattening pressure on UST 2s10s to keep 10yr yields from rising much further.

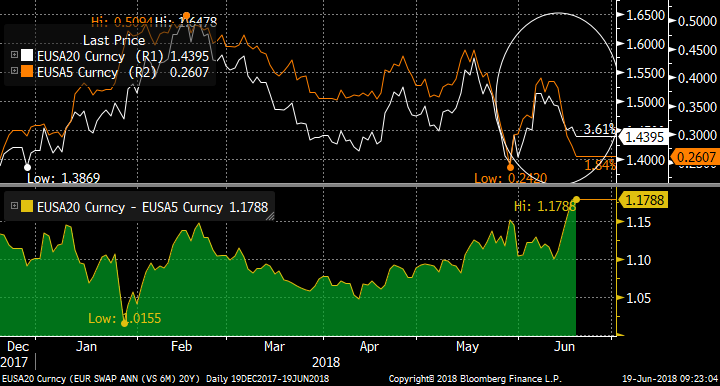

The UST-DBR 10yr spread has been driven by UST 10yr yields, as DBR 10yrs remain in a holding pattern:

1mo carry is flat assuming 245 bps repo spread (-.70 vs 1.75):

========================================================================================

USD-EUR 10y spread in rates is also at very attractive entry levels, just off its recent highs:

While this spread is less susceptible to flight to quality risk in DBRs, it does not benefit as much from the taper or conclusion of PSPP which may be discussed at the ECB meeting tomorrow.

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

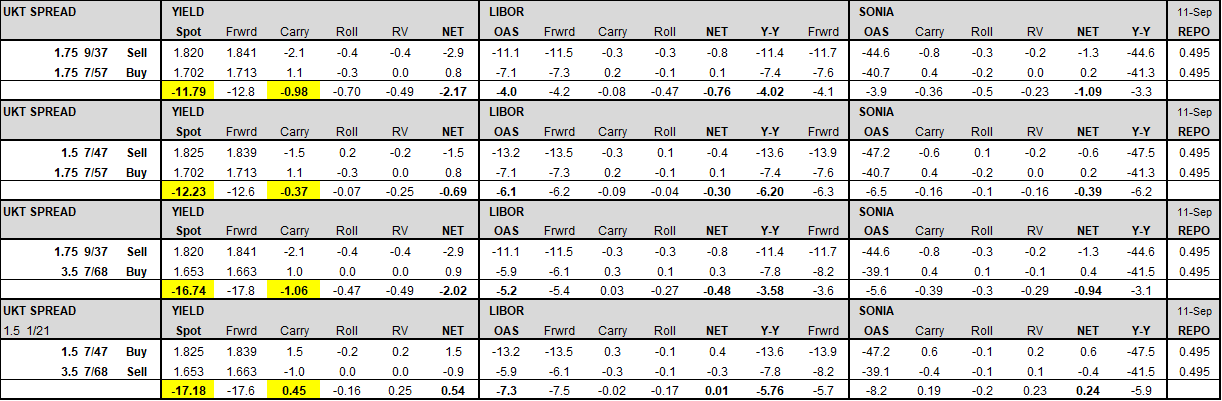

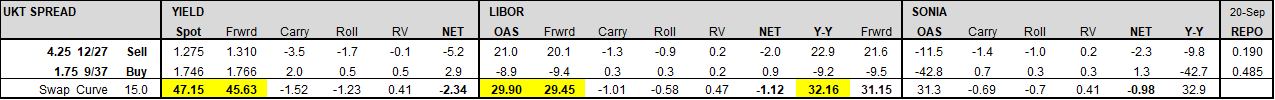

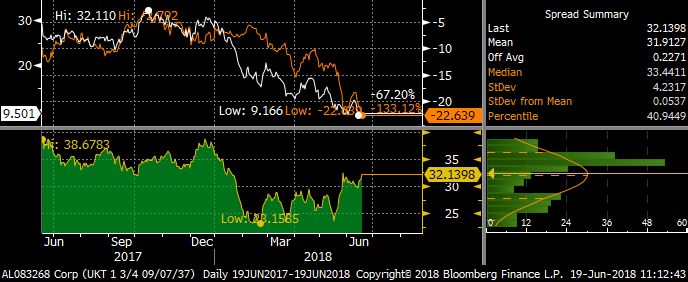

UKT 27s37s MMS flattener

Trade:

Sell UKT 4q 27 vs buy UKT 1T37 on YY ASW @ +32 bps:

Target: 26 bps (+6bp)

Stop: 35 bps (-3bp)

Rationale:

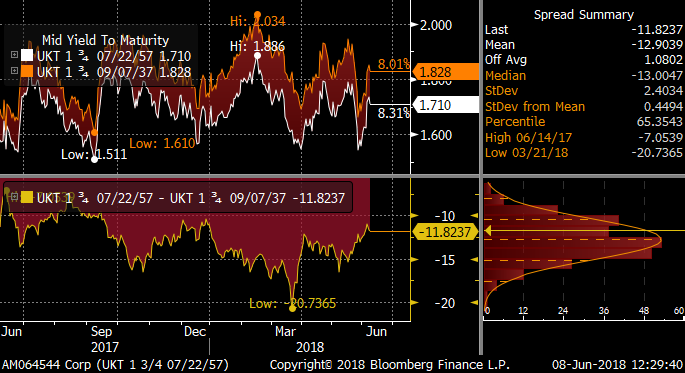

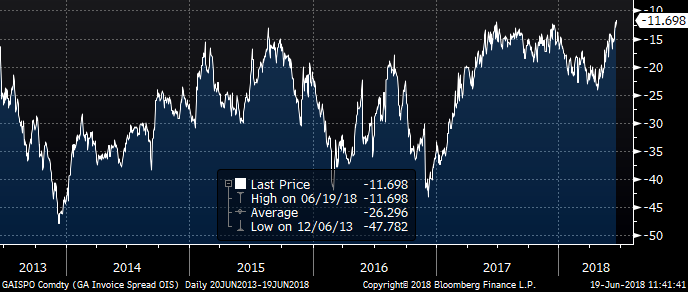

The 4q27s YY ASW (= Gilt invoice spread) is on 5yr highs on recent FTQ flows:

In addition, the Gilt-Sonia invoice spread, at -11.5 bps, has little scope to richen much further (given GC = Sonia flat) :

Moreover, the 1T37s have cheapened on the curve approaching next week’s 37s tap:

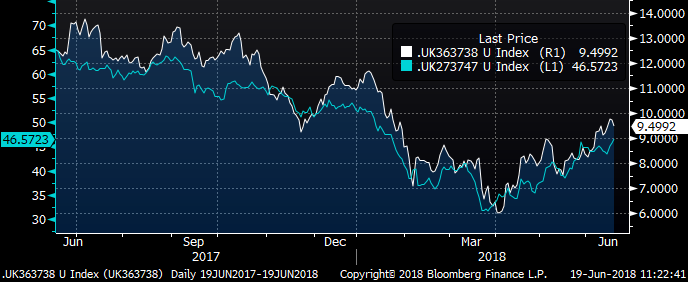

White line – UKT 36s37s38s micro fly (right axis)

Blue line – UKT 4q27s37s47s macro fly (left axis)

The long end has also steepened into the approaching 60yr Cambridge issuance.

We expect June quarter end rebalancing flows to favour the long end.

Moreover, the upcoming 22 July coupon payments are heavily skewed to 15yr+ paper.

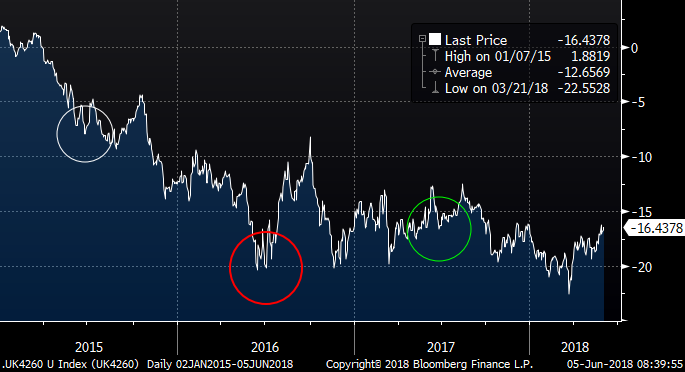

£4.5bn coupon payments (£3.6bn privately held), of which £2.1bn (58%) are in the 15+yr basket:

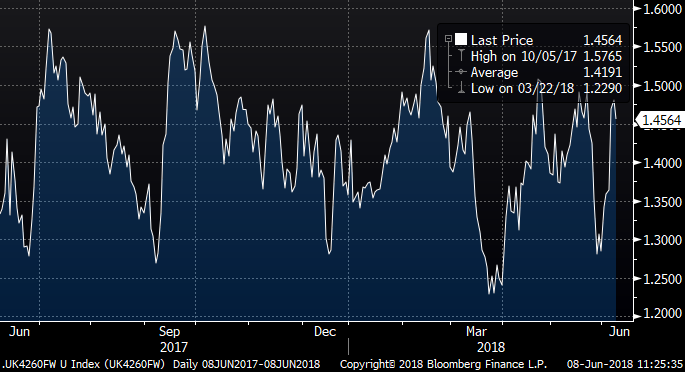

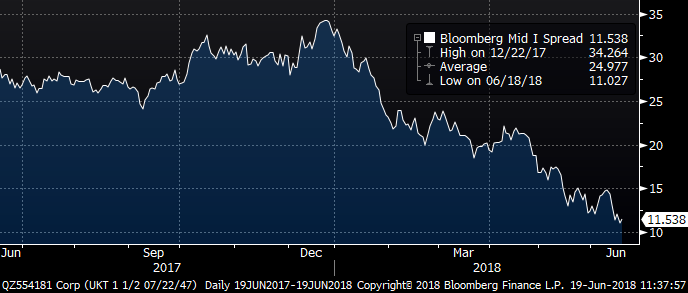

Finally, the trend for long end YY ASW richening has been relentless this year:

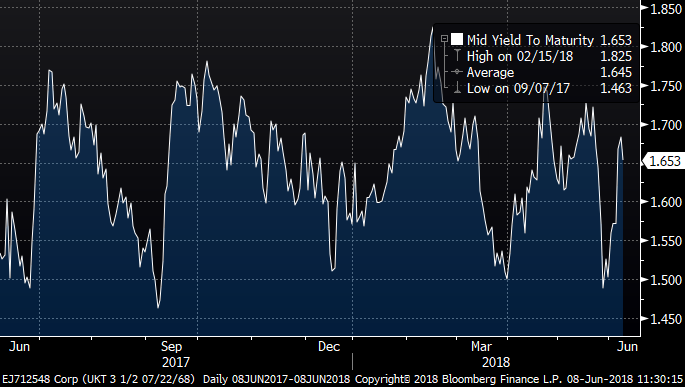

30yr (UKT 1.5 7/47) YY ASW:

This has the longer term effect of compressing/flattening the YY ASW spread curve.

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796