UKT 42s60s Steepener

From: Jim Lockard

Sent: 01 March 2018 18:48

|

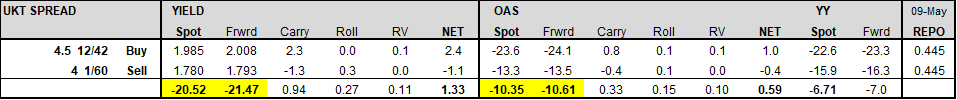

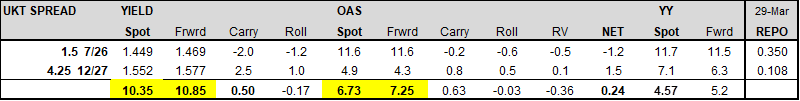

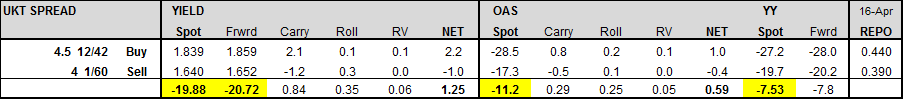

UKT SPREAD |

|

YIELD |

|

|

|

|

|

OAS |

|

|

|

|

|

YY |

|

29-Jun |

|

|

|

Spot |

Frwrd |

Carry |

Roll |

RV |

NET |

Spot |

Frwrd |

Carry |

Roll |

RV |

NET |

Spot |

Fwrd |

REPO |

|

4.5 12/42 |

Buy |

1.881 |

1.908 |

2.7 |

0.0 |

0.2 |

2.8 |

-21.5 |

-22.2 |

0.9 |

0.1 |

0.1 |

1.2 |

-20.9 |

-21.8 |

0.525 |

|

4 1/60 |

Sell |

1.679 |

1.694 |

-1.5 |

0.3 |

0.0 |

-1.2 |

-11.8 |

-12.1 |

-0.5 |

0.1 |

0.0 |

-0.4 |

-14.6 |

-15.2 |

0.525 |

|

|

|

-20.21 |

-21.35 |

1.14 |

0.30 |

0.20 |

1.64 |

-9.70 |

-10.05 |

0.37 |

0.21 |

0.14 |

0.72 |

-6.27 |

-6.6 |

|

Entry: -20.0 bps or better

Target: -14 to -16 bps

Stop: -22.0 bps

We’ve held current levels post Brexit referendum in June 2016, during massive de-risking episode, and 4 times since:

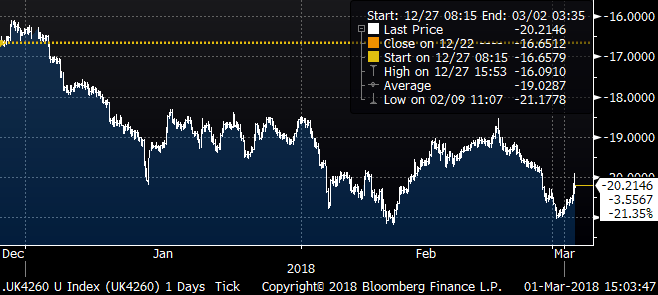

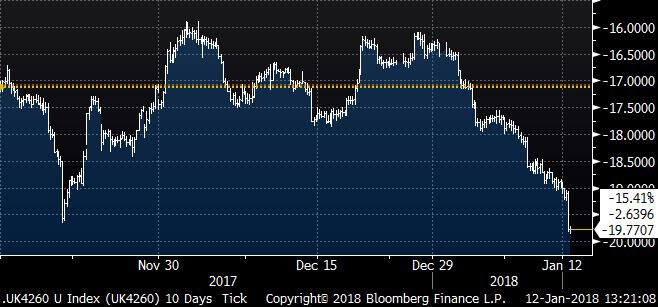

2018 tic chart:

RATIONALE:

- 20yr point set to outperform in 2018 due to Solvency II rollback post Brexit (which will incentivise UK insurers to repatriate liability hedges concentrated in 15-30yr back to Gilts; currently Gilts are not eligible for EU CSA collateral)

- LDI needs shortening with flexible drawdown pensions

- Ultras are being richened by the dealer community in anticipation of APF reinvestment later this month

- The 42s60s has exhibited mean reverting behaviour with the 2yr range mostly between -13 to -21 bps

- The -20/21 area has previously held 4 times, the last time during November’s massive linker index extension; it also held in the aftermath of Brexit

- The trade earns positive carry of nearly 1bp per quarter (i.e. UKT 42s60s 1yr forward = -24.0 bps)

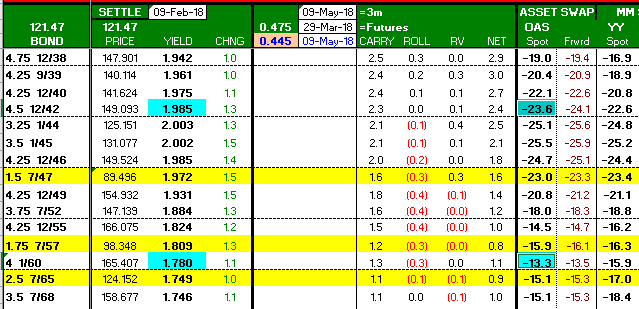

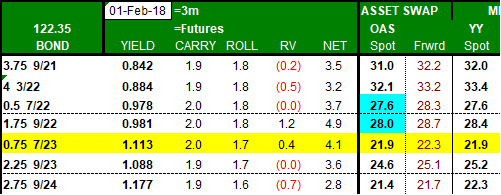

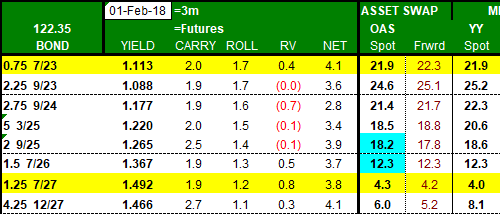

- The 42s are near the peak of the curve and enjoy positive roll, whereas 60s roll negatively and are the richest ultra long on Z spread:

|

|

SETTLE |

02-Mar-18 |

|

|

04-Jun-18 |

=3m |

|

|

|

ASSET SWAP |

|

|

MM SWAP SPREAD - Semi6's |

|

|

|

122.55 |

122.55 |

|

|

0.555 |

29-Mar-18 |

=Futures |

|

|

OAS |

|

YY |

|

LIBOR |

|

|

|

BOND |

PRICE |

YIELD |

CHNG |

0.525 |

29-Jun-18 |

CARRY |

ROLL |

RV |

NET |

Spot |

Frwrd |

Spot |

Chnge |

Carry |

Roll |

|

1.75 9/37 |

97.979 |

1.874 |

-7.7 |

|

|

2.7 |

0.5 |

0.7 |

3.9 |

-17.7 |

-18.3 |

-18.1 |

-0.9 |

0.7 |

0.4 |

|

4.75 12/38 |

149.856 |

1.848 |

-8.4 |

|

|

3.0 |

0.4 |

(0.0) |

3.3 |

-17.1 |

-17.8 |

-15.6 |

-0.3 |

0.9 |

0.4 |

|

4.25 9/39 |

142.085 |

1.866 |

-8.4 |

|

|

2.8 |

0.3 |

0.5 |

3.6 |

-18.7 |

-19.4 |

-17.6 |

-0.3 |

1.0 |

0.3 |

|

4.25 12/40 |

143.770 |

1.878 |

-8.6 |

|

|

2.8 |

0.2 |

0.2 |

3.1 |

-20.3 |

-20.9 |

-19.4 |

-0.2 |

0.9 |

0.2 |

|

4.5 12/42 |

151.506 |

1.887 |

-8.6 |

|

|

2.7 |

(0.0) |

0.2 |

2.8 |

-21.9 |

-22.5 |

-21.3 |

-0.3 |

0.9 |

0.1 |

|

3.25 1/44 |

127.490 |

1.901 |

-8.8 |

|

|

2.5 |

(0.1) |

0.5 |

2.9 |

-23.3 |

-23.9 |

-23.3 |

-0.1 |

0.9 |

0.1 |

|

3.5 1/45 |

133.580 |

1.899 |

-8.8 |

|

|

2.4 |

(0.2) |

0.2 |

2.4 |

-23.6 |

-24.3 |

-23.7 |

-0.1 |

0.9 |

(0.0) |

|

4.25 12/46 |

152.250 |

1.888 |

-8.3 |

|

|

2.4 |

(0.3) |

0.1 |

2.2 |

-23.4 |

-24.0 |

-23.5 |

-0.5 |

0.9 |

(0.1) |

|

1.5 7/47 |

91.600 |

1.873 |

-8.4 |

|

|

1.9 |

(0.4) |

0.4 |

1.9 |

-22.1 |

-22.5 |

-22.5 |

-0.4 |

0.5 |

(0.1) |

|

4.25 12/49 |

158.050 |

1.832 |

-8.5 |

|

|

2.1 |

(0.5) |

(0.2) |

1.5 |

-19.4 |

-19.9 |

-20.2 |

-0.2 |

0.7 |

(0.2) |

|

3.75 7/52 |

150.200 |

1.789 |

-8.2 |

|

|

1.9 |

(0.5) |

(0.0) |

1.4 |

-17.2 |

-17.6 |

-18.4 |

-0.5 |

0.7 |

(0.3) |

|

4.25 12/55 |

169.652 |

1.730 |

-8.2 |

|

|

1.7 |

(0.5) |

(0.1) |

1.1 |

-13.7 |

-14.0 |

-15.8 |

-0.5 |

0.6 |

(0.3) |

|

1.75 7/57 |

101.210 |

1.708 |

-8.8 |

|

|

1.4 |

(0.4) |

(0.1) |

0.8 |

-14.5 |

-14.8 |

-15.1 |

0.1 |

0.3 |

(0.2) |

|

4 1/60 |

169.380 |

1.685 |

-8.5 |

|

|

1.5 |

(0.4) |

(0.0) |

1.2 |

-12.2 |

-12.6 |

-15.1 |

-0.1 |

0.6 |

(0.1) |

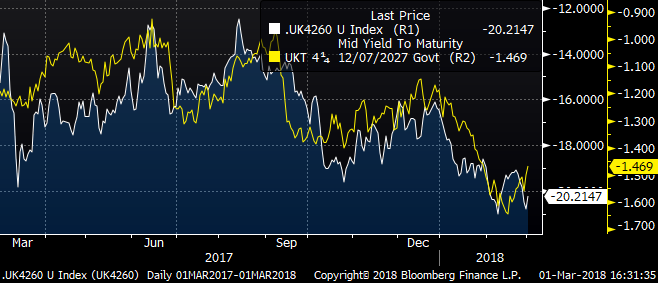

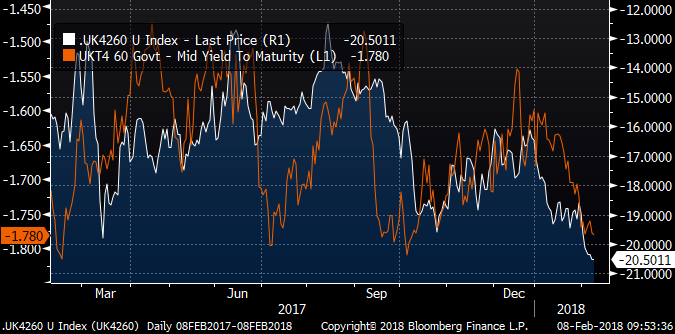

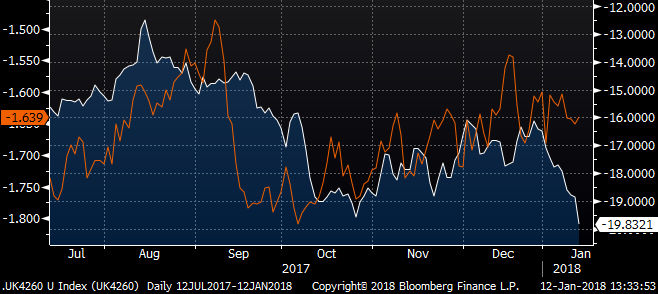

RISK: Over the last year there has been some correlation between 42s60s and Gilt futures (i.e. steepener has bullish bias):

White line – 42s60s

Yellow line – CTD 4q27 yield (inverted)

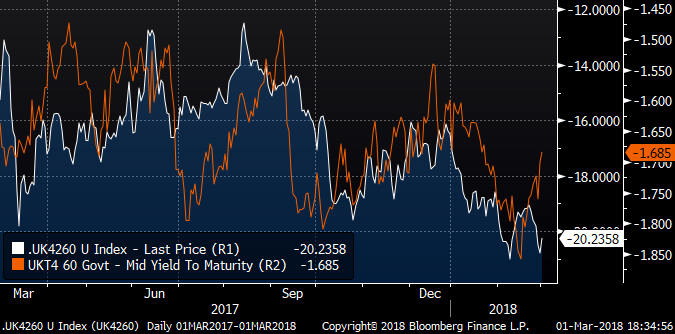

However the 42s60s curve looks too flat vs UKT 60s yield:

White line – 42s60s

Orange line – UKT 4 60 yield (inverted)

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

UKT42s60s Steepener into 57s Tap

Trade: Buy UKT 4.5 12/42 vs UKT 4 1/60 @ +20.3 bps:

Stop – 21.3 bps

Target – 17.0 bps

Rationale:

- The 42s60s has exhibited mean reverting behaviour with the 2yr range mostly between -13 to -20 bps

- The -20 area has previously held 4 times, the last time during November’s massive linker index extension; it also held in the aftermath of Brexit

- We have the UKT 57s tap on 15th Feb which should cheapen up the 55s and 60s around it

- The trade earns positive carry of nearly 1bp per quarter (i.e. UKT 42s60s 1yr forward = -24.0 bps)

- The DMO held back £600mm from the UKTi48s syndication; this could be used for a mini-tender before the end of March (68s a likely candidate given recent DMO meeting minutes)

- The 42s are near the peak of the curve and enjoy positive roll, whereas 60s roll negatively and are the richest ultra long on Z spread:

Risks / Characteristics of Trade:

- Dovish – the Sonia curve is currently pricing 40% chance of May hike and 80% chance of hike by August – should Carney reiterate his “2 hikes in 3 years” endorsement from November at today’s MPC meeting, or focus on economic uncertainty around Brexit, we could see a corrective steepening of the 20bps flattening of UKT 10s30s since beginning of January (which should also steepen 30s50s)

- Bullish – the chart below shows the fairly close correlation between UKT 42s60s and yield levels on UKT 60s:

White Line – UKT 42s60s (rhs)

Orange Line – UKT 60s yield (lhs – inverted)

Should UKT 60s break the 1yr highs of 1.80, this 42s60s curve could invert further.

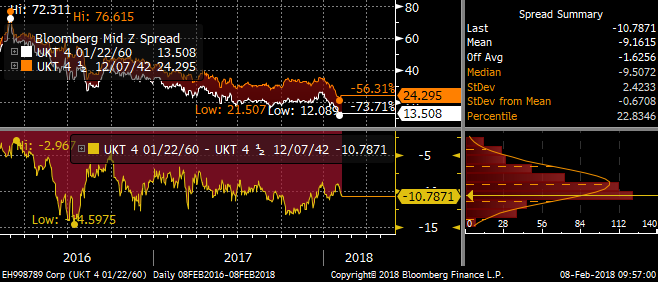

- Z spread – the 42s60s has been more inverted on Z spread in the past:

This is mainly due to the recent richening of ultra long end ASWs resulting from the unwinding of LDI receiving hedges.

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Sell UKT 1.5 7/26 basis

The 1h26-4q27 yield spread peaked at 10.8 bps into Sep ’17 delivery, but worth scaling in at current levels given how much flatter the curve is now…

While I think a May rate hike is unlikely, this would have the added benefit of richening futures (via higher IRR) and flattening the curve.

The main risk to the trade is exclusion of the CTD 4q27s from the March APF redemption reinvestment, although this is well advertised.

Trade: Sell UKT 1.5 7/26 basis at -10.2 bps vs G H8 (CTD 4q 12/27) at IRR of .12:

Borrow the 1h26 at 0.35 in term repo to 29th March (current market 0.38/0.35)

è> Long UKT 4q27 @ +10.7 bps vs UKT 1h26 on 29th March

2yr History

Red – UKT 1h26-4q27 Yield Spread (rt axis)

Blue – CTD 4q27 Yield (lt axis)

Violet – UKT 1h26-4q27 Z Spread

Rationale:

- You enter the 1h26-4q27 flattener at recent highs near 11 bps

- The last time the spread was steeper (12 bps) was in Aug-Nov 2016, when QE was announced (4q27s were excluded) and BEFORE 4q27s became CTD in March 2017

- 4q27s will continue to be CTD until March 2019, which should give them a repo premium, liquidity premium, and squeeze risk premium in delivery months

- 4q27s are a very low float bond, which increases their scarcity value into delivery months

- The March Gilt contract is very cheap to 4q27, trading near .10 IRR, which is the effective repo floor on the 4q27 (given GEMMS can borrow the issue from the DMO at this rate)

- Positive carry at the current repo spread of 25 bps = 0.25 bps per month

- The trade performs well into a delivery squeeze, with an option to roll contracts to June at attractive levels, should the deferred IRR trade rich

- The UKT 4q27 are at cheapest level on the curve since 2016 QE announcement:

UKT 25s27s30s bfly:

RISKS:

The 4q27s will be excluded from the upcoming 5’18 redemption APF reinvestment, which may cause it to stay cheap on the curve. Offsetting that is the scarcity of the 4q27 (7.6bn tradeable float, compared to 19.9bn of 1h26) as we enter March delivery. It is noteworthy that 13.5bn 4q27s have already been delivered into the contract since March 2017, potentially increasing the scarcity value.

Short term, the 1h26-4q27 spread is directional, with the contract leading the way (e.g. 26s27s have recently bear steepened). This can be seen in graph above (blue line = 4q27 yield).

Prior to 4q27 being CTD, the correlation was reversed, with 26s27s bull steepening and bear flattening.

If you think we could make new highs in yields above the 2016 1.80 peak in 4q27, then it might make sense to wait for better entry levels.

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 60 Cannon Street, London, EC4N 6NP

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 207-002-1341

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

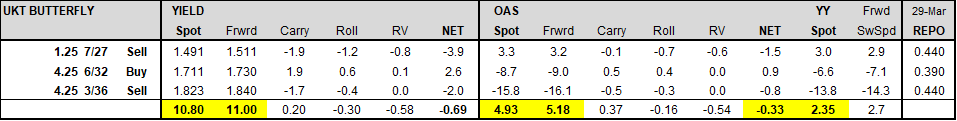

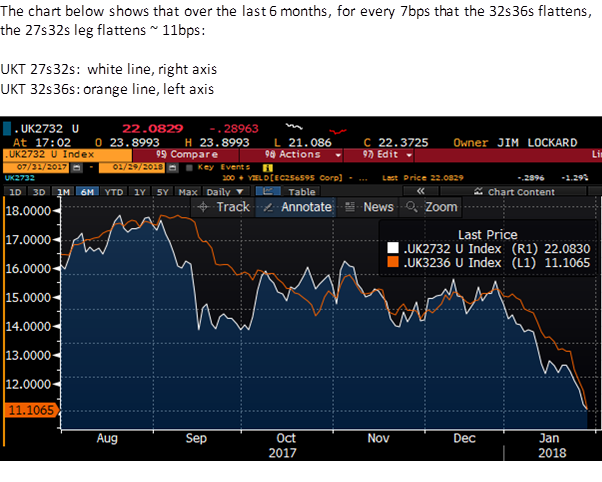

Sell belly of UKT 1q27-4q32-4q36

This is a trade we’ve been scaling into over the last week. There has been very poor dealer demand for the belly, increasing the charge for liquidity, as it is difficult to rely on screen prices.

However, dealer bias only increases our conviction in the trade, especially if there is an opportunity to fade any mechanical intraday richening which is not backed by apparent flows in the market.

Trade: Sell belly of UKT 1q27-4q32-4q36 bfly at 11.0 bps:

Target: +15.0 bps (4bps profit)

Stop: +9.0 bps (2bps loss)

Rationale:

Short term: the UKT 4.25 6/32 have recently performed on the curve into the the 22nd Jan coupon reinvestment (over £2bn paid in >15yr Gilts). Given UKT 32s represent the average duration of the FTSE All Stocks Gilt Index, they are a popular reinvestment vehicle for index managers. UK managers reinvest around the coupon date, while international index managers wait until month end, after which we would expect support for the UKT 32s to wane.

Intermediate term: The UKT 5 3/18 mature on 7th March (returning £18.4bn cash to the BoE); the APF will reinvest this across the curve in 3 buckets of over £6bn. The UKT 32s will be excluded as the BoE and APF already own 78% of the free float. Conversely, the BoE/DMO own almost none of the 1q27, 50% of the 4q36s, and only 7% of the 1T37s, leaving ample scope to purchase the 10yr and 20yr sectors. Moreover, as the UKT 32s roll down the curve, the UKT 4.5 9/34 will replace it as the neutral duration bond for the FTSE All Stocks Gilt Index later this year. The shift to the UKT 34s will be hastened by next month’s index extension, when all Gilt supply will be in longs and ultra longs (UKTi 36s, UKTi 48s syndication, and UKT 57s).

Positioning: Recent richening of UKT 32s to the curve appears to be driven by dealer anticipation of global month end rebalancing flows, which we would expect to dissipate later in the week.

RISKS: The trade has a steepening bias and is therefore at risk of richening during any sharp selloffs in the Gilt contract, when the 1q27s would be expected to lead the way down.

UKT 27s32s36s bfly vs UKT 4.25 12/27 (CTD) price:

Bfly – white line right axis

4q27 – blue line left axis

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

UKT 22s26s ASW Box Steepener into March Redemptions

Please distribute selectively given limited liquidity…

Trade: Buy UKT 1.75 9/22 vs Sell UKT 1.5 7/26 on MMS @ 16.5 bps:

Target: 22.0 bps (+5.5 bps)

Stop: 14.5 bps (-2.0 bps)

Rationale:

- The UKT 5 3/18 will be redeemed on 7th March, for £35bn (APF holds £15.8bn face = £18.4bn cash).

- £13bn face value of privately held bonds will likely be reinvested in the 0-5yr sector

- Historically, front end swap spreads richen vs long end spreads into redemptions (ceteris paribus)

- The 22s26s MMS is testing historic lows as we approach the redemption

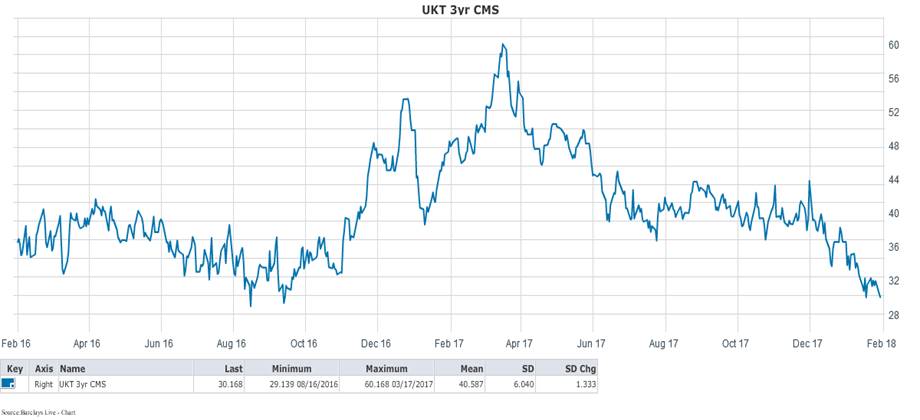

- UKT 3yr CMS is also testing 2yr historic lows:

Bond Selection:

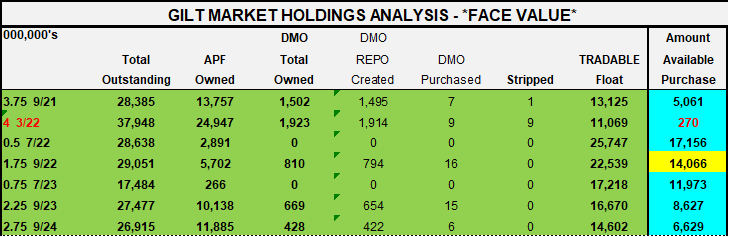

UKT 1.75 9/22 still have plenty of scope to be purchased by the APF in the 3-7yr basket:

UKT 1.75 9/22 are also historically cheap on Z spread, nearly flat to 0.5 7/22:

Conversely, UKT 1.5 7/26 are at the rich end of the range vs its neighbours:

UKT 2 9/25- 1.5 7/26 - 4.25 12/27 bfly:

While the UKT 2 9/25 appear richer and roll better on Z spread, they are trading very special in repo (~ .10-.15 vs GC repo of 0.44):

RISKS:

More hawkish BoE: The recent MMS flattening has been driven by bear flattening of the UKT 5s10s curve; during this time 1y1y Sonia cheapened 18 bps:

If the market were to price in more than 2 hikes to 1.00 bank rate over next 2 years, front end Gilt yields @ 1.00 could become vulnerable.

Overall the 22s26s box is long tail risk, as any flight to quality would favour front end spreads, while a GBP selloff would pressure 10yr spreads.

For example, during the French elections the UKT 22s26s box peaked at 34 bps.

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Sell belly of UKT 1q27-4q32-4q36

This is a trade we’ve been scaling into over the last week. There has been very poor dealer demand for the belly, increasing the charge for liquidity, as it is difficult to rely on screen prices.

However, dealer bias only increases our conviction in the trade, especially if there is an opportunity to fade any mechanical intraday richening which is not backed by apparent flows in the market.

Trade: Sell belly of UKT 1q27-4q32-4q36 bfly at 11.0 bps:

Target: +15.0 bps (4bps profit)

Stop: +9.0 bps (2bps loss)

Rationale:

Short term: the UKT 4.25 6/32 have recently performed on the curve into the the 22nd Jan coupon reinvestment (over £2bn paid in >15yr Gilts). Given UKT 32s represent the average duration of the FTSE All Stocks Gilt Index, they are a popular reinvestment vehicle for index managers. UK managers reinvest around the coupon date, while international index managers wait until month end, after which we would expect support for the UKT 32s to wane.

Intermediate term: The UKT 5 3/18 mature on 7th March (returning £18.4bn cash to the BoE); the APF will reinvest this across the curve in 3 buckets of over £6bn. The UKT 32s will be excluded as the BoE and APF already own 78% of the free float. Conversely, the BoE/DMO own almost none of the 1q27, 50% of the 4q36s, and only 7% of the 1T37s, leaving ample scope to purchase the 10yr and 20yr sectors. Moreover, as the UKT 32s roll down the curve, the UKT 4.5 9/34 will replace it as the neutral duration bond for the FTSE All Stocks Gilt Index later this year. The shift to the UKT 34s will be hastened by next month’s index extension, when all Gilt supply will be in longs and ultra longs (UKTi 36s, UKTi 48s syndication, and UKT 57s).

Positioning: Recent richening of UKT 32s to the curve appears to be driven by dealer anticipation of global month end rebalancing flows, which we would expect to dissipate later in the week.

RISKS: The trade has a steepening bias and is therefore at risk of richening during any sharp selloffs in the Gilt contract, when the 1q27s would be expected to lead the way down.

UKT 27s32s36s bfly vs UKT 4.25 12/27 (CTD) price:

Bfly – white line right axis

4q27 – blue line left axis

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

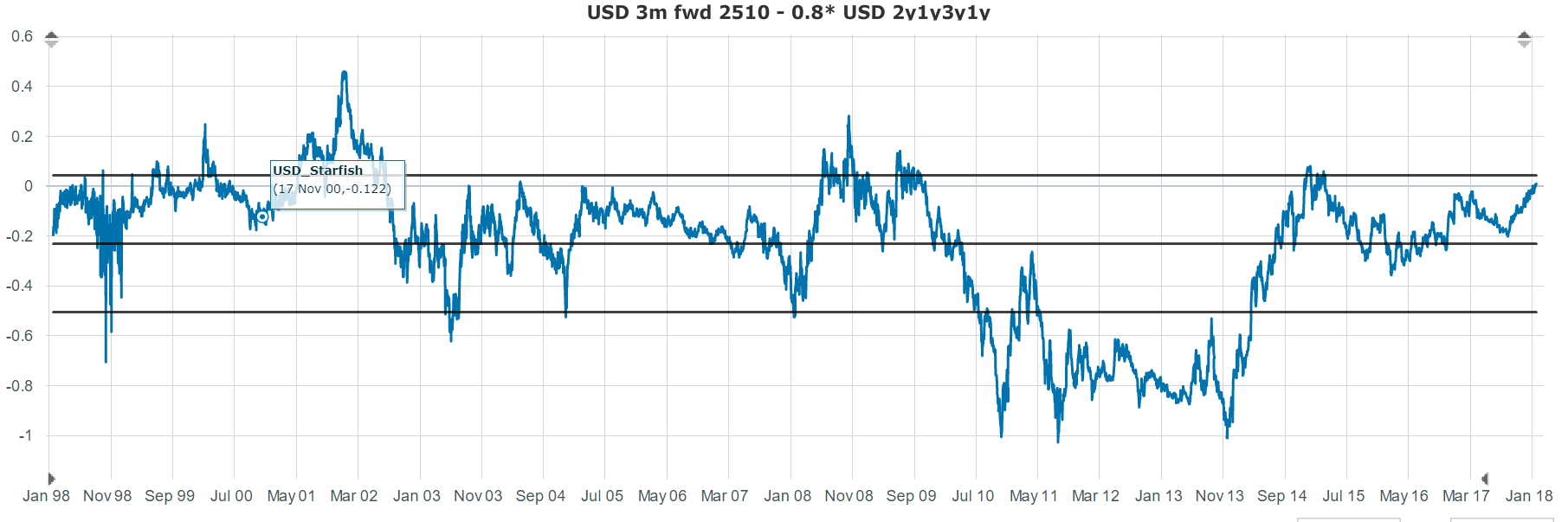

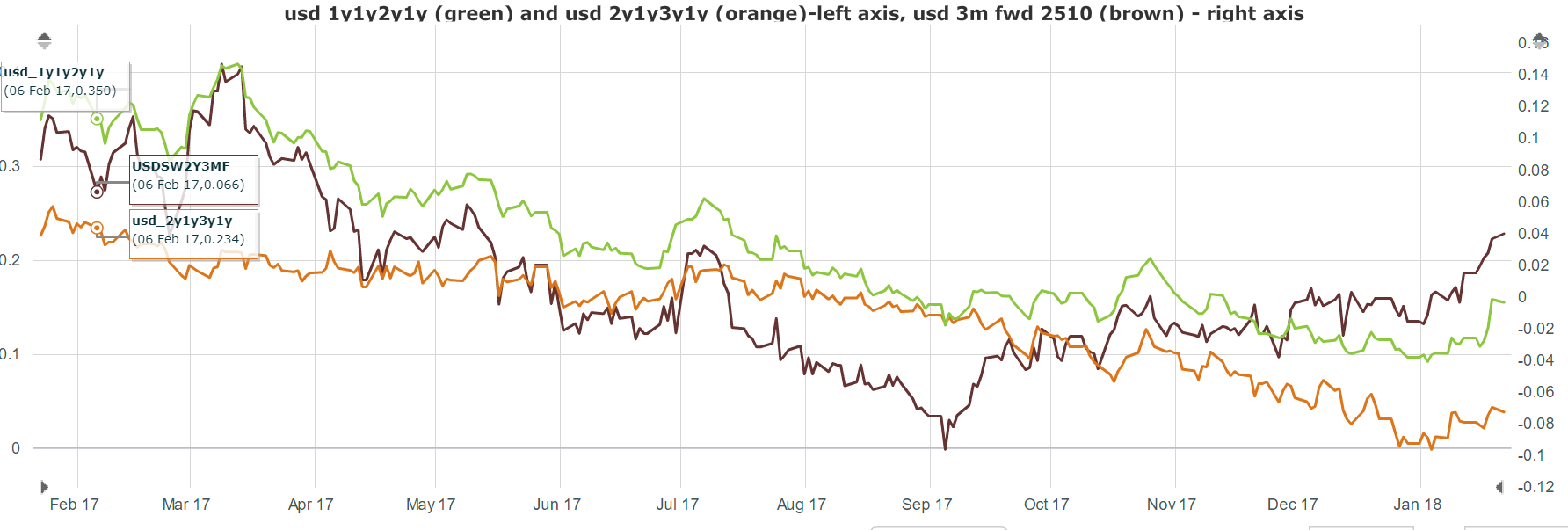

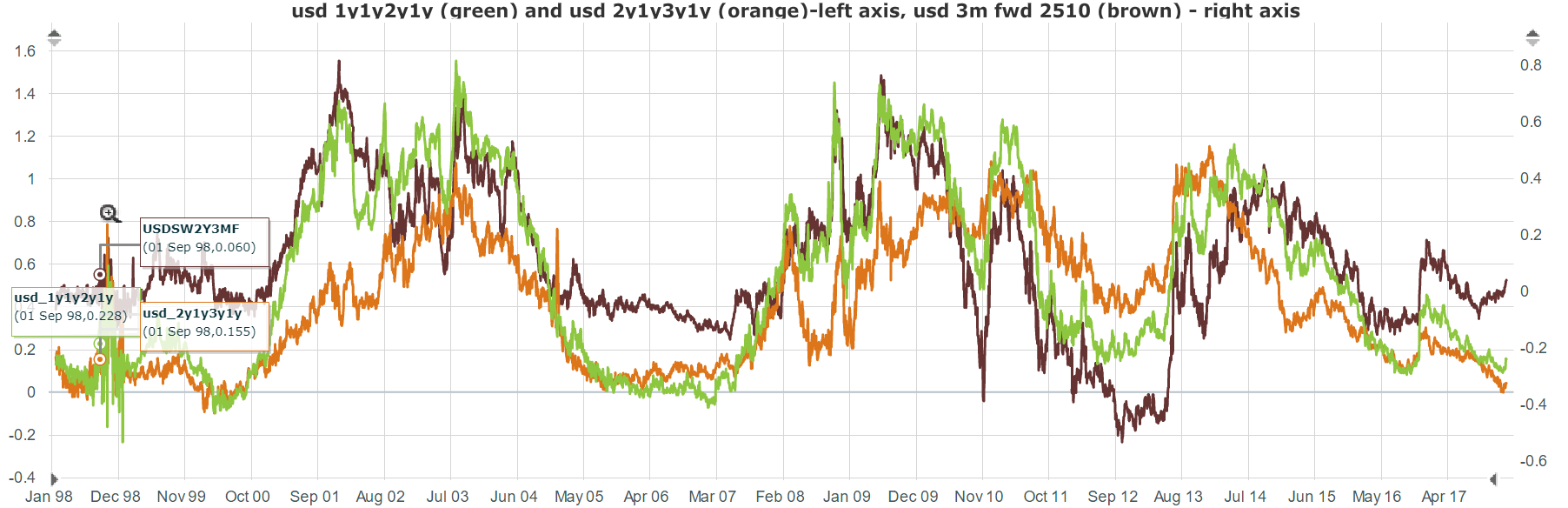

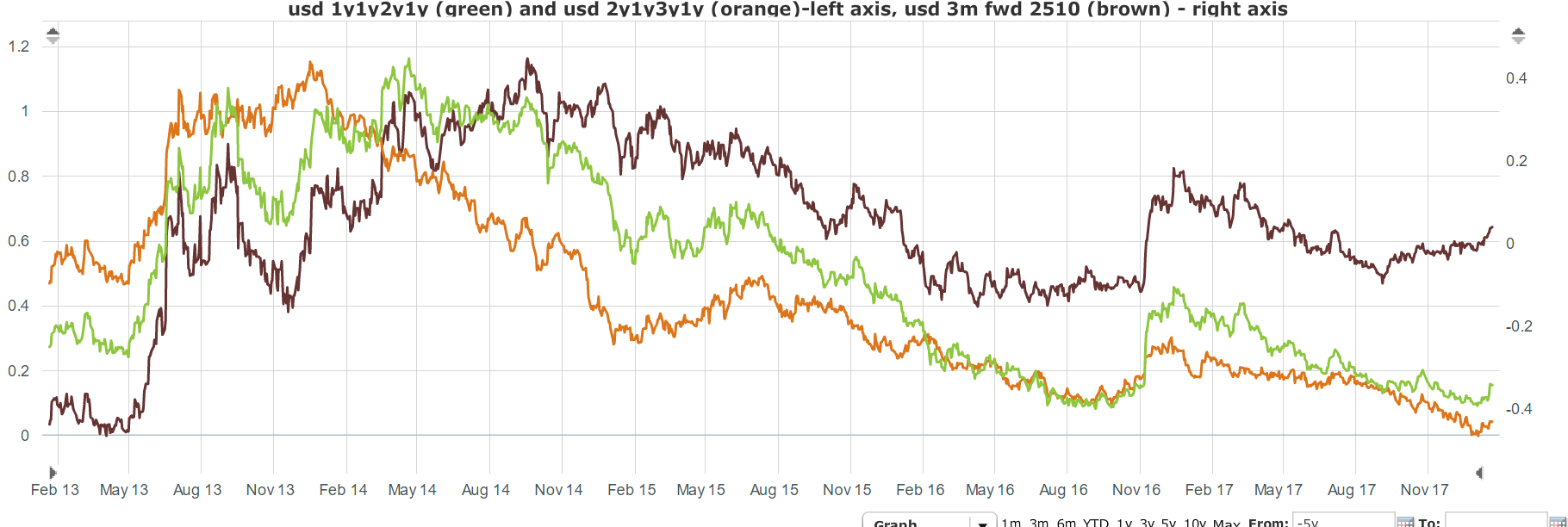

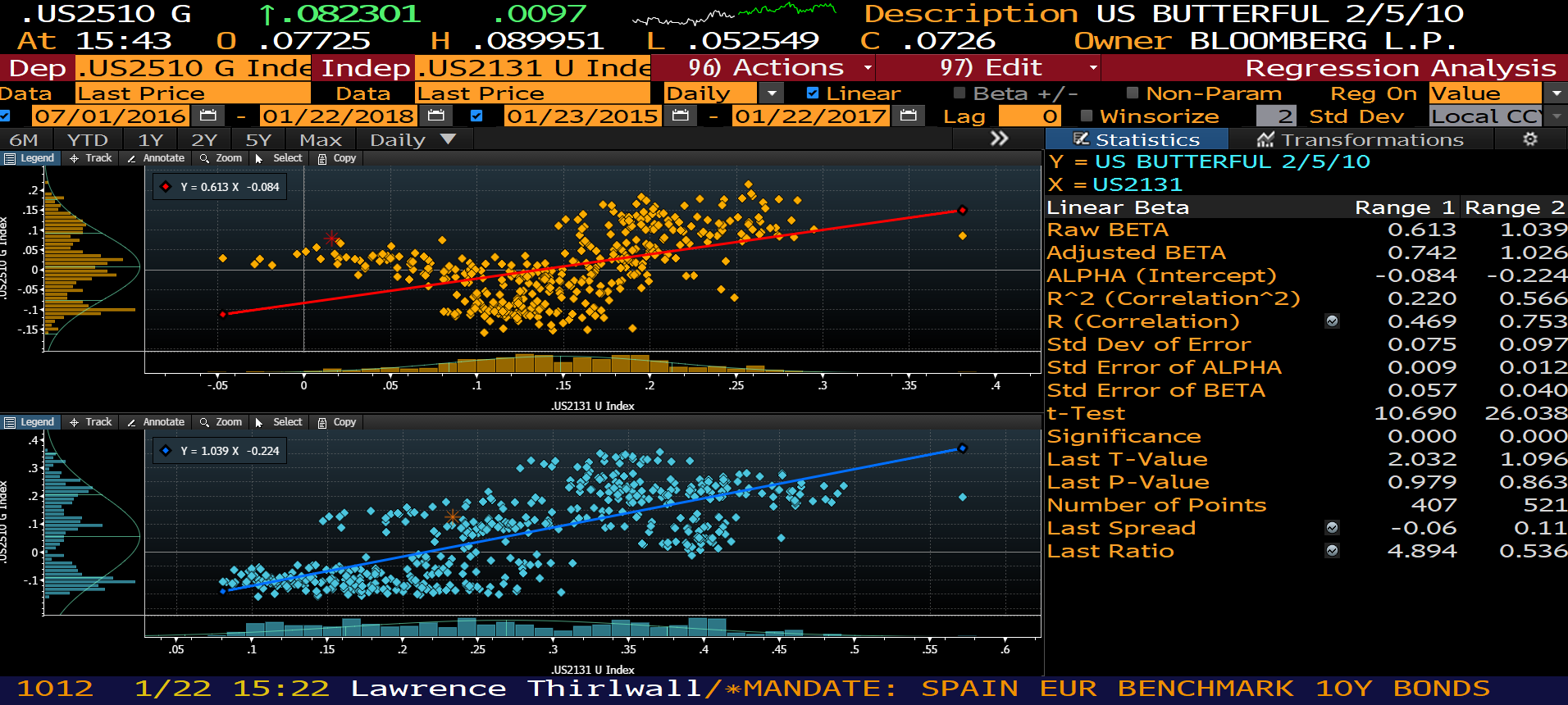

Trade idea: receive 3m fwd USD 2s5s10s vs paying 80% beta weighted 2y1y3y1y (so called starfish)

Mean reverting structure at compelling levels from my colleague Egor…

From: Egor Avdeev

Sent: 22 January 2018 16:00

To: Jim Lockard <Jim.lockard@astorridge.com>;

Subject: FW: trade idea: receive 3m fwd USD 2s5s10s vs paying 80% beta weighted 2y1y3y1y (so called starfish)

Trade Idea: Receive usd starfish (which is receiving USD 2y5y10y vs paying 80% beta weighted USD 2y1y3y1y)) @ 0 (e.g. receive fly @ +3.5 bps, pay 2y1-3y1 @ 4.4 bps)

- Target is -9; add level is +3 implying roughly 5:1 risk reward ratio

- The US 2y1y vs 3y1y is now around 4.3 and US 1y1y2y1y around 14.8 that level suggests that the market thinks the Fed will be done a year or two from now and is looking ahead to cuts. Should the new Fed chair (Powell) will trade will work even better.

- I think paying 2y1y3y1y curve by itself is a good trade, but also on the other side the curve is likely to reprice higher risk premia while the Fed continues with gradual hikes. This means that 5s/10s should steepen in a sell-off, while Fed hikes exert a slight flattening bias at the front end making further steepening of the 2s/5s less likely. Hence receiving USD 2510 against paying green/blues (USD 2y1y3y1y) 80% beta weighted is a good trade if you not comfortable with outright 2y1y3y1y steepener.

- The risk to the trade is much more hawkish Fed when is priced in the market now (one of the reason for which could devaluation of USD caused for instance for start of the oil pricing in renminbi, increase in treasury issuance and foreign buyers moving away from USD debt causing Fed to hike rapidaly). However I think we are not in this situation now. Ie rate hike cycle more akin to 1993-1994 or 2000s which I believe is unlikely given current economic situation.

- The point to note is that while the trade is flat carry on 1y horizon the carry on USD 2s5s10s is more ‘front loaded’, while in USD 2y1y3y1y more backloaded, so if you like to be more cautious on the trade you might choose to do 6m or 9m 2510 forward against 2y1y3y1y steepeener.

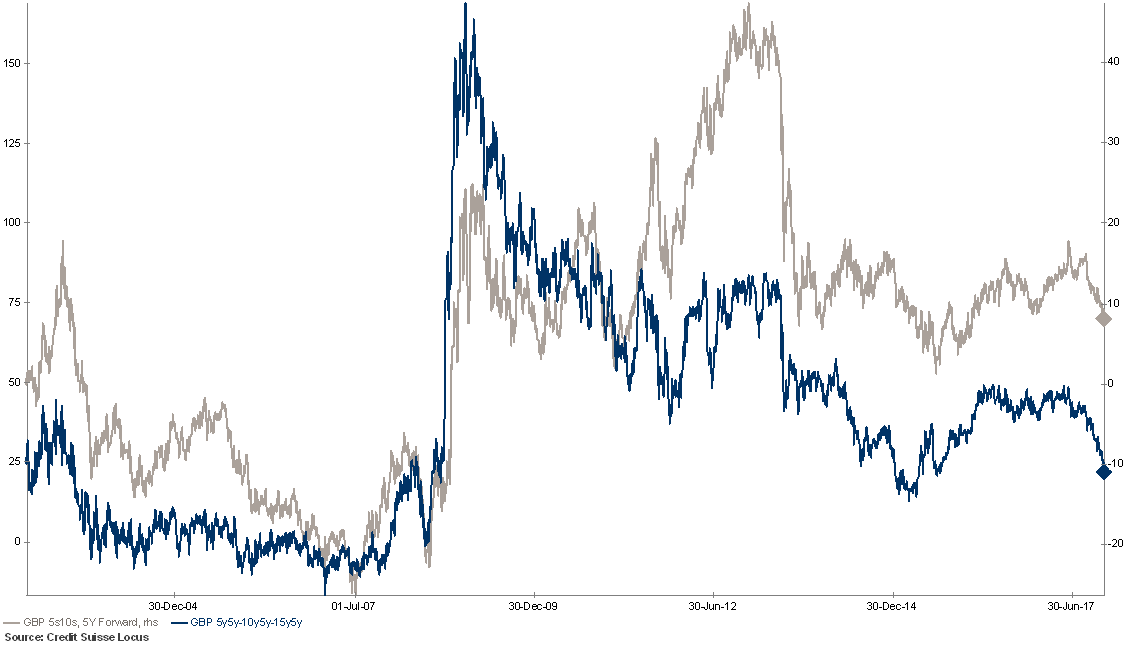

GBP 5y5y10y5y15y5y fly (pay the belly)

Reasonable expression for fading the richness of the GBP 15yr point from my colleague Egor…

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 207-002-1341

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

From: Egor Avdeev

Sent: 19 January 2018 11:41

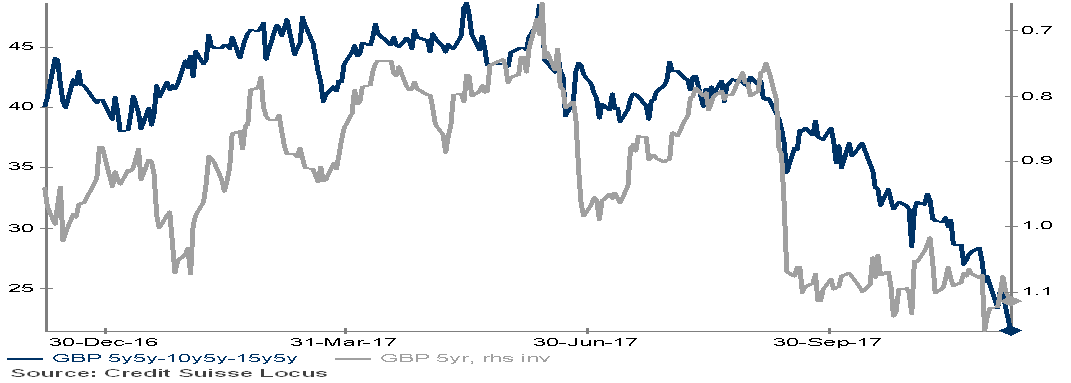

Trade Idea: GBP 5y5y10y5y15y5y fly (pay the belly)

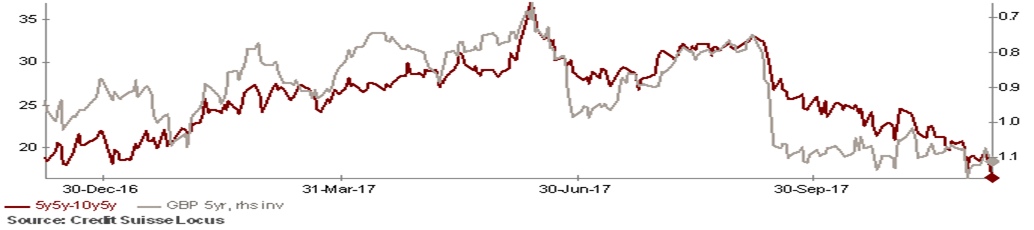

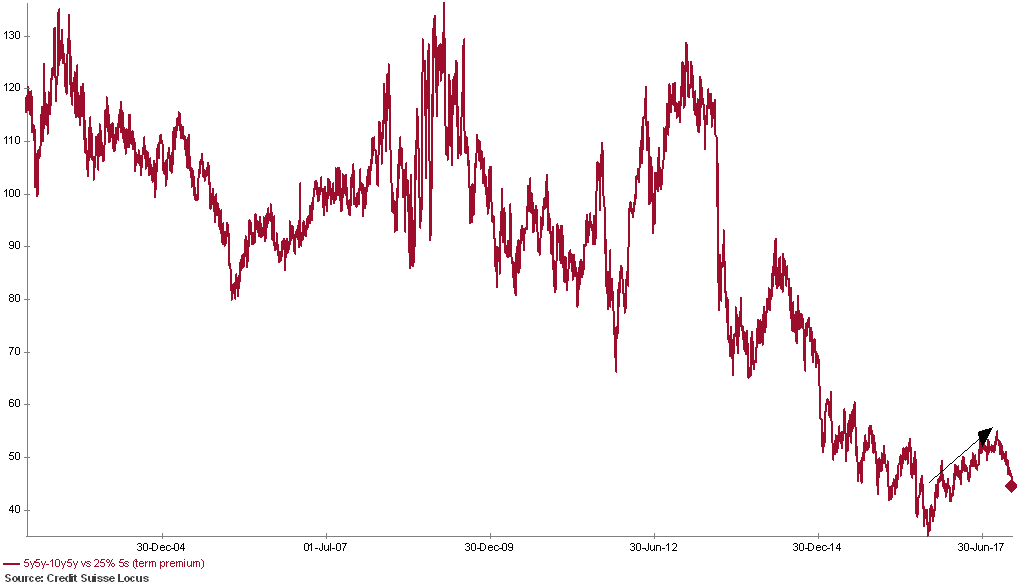

- Pay GBP 5y5y 10y5y 15y5y fly (around 21 now, low 19-20, should go to 30+ so roughly 5:1 risk reward) or receive GBP 10y5y20y5y curve – both reflecting underlying richness of 15y point on GBP curve which likely to be unwound given coming libor reform of switching from libor to Sonia

- 5y5y-10y5y-15y5y is looking around 5bp-10bp too flat on various metrics/regressions, driven by the richening of 15y point.

- 5y5y-10y5y is the slight dominant leg within the fly, which does look too flat relative to short rates (term premium metric).

- The term premium metric (5y5y-10y5y vs 25% 5s) had been gently rising post Brexit by 15bp, but has recently quickly fallen by 10bp thus close to the all time lows. There is 5bp-10bp in the trade even without any significant repricing of term premium.

- The fly carries +2.5bp/annum whilst being flat convexity.

- Overall, the fly is more ‘protected’ (bounded) relative to the straight 5y5y-10y5y steepener which also makes sense.

Egor avdeev

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 207-002-1333

Email: egor.avdeev@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Egor Avdeev, an Introducing Broker at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

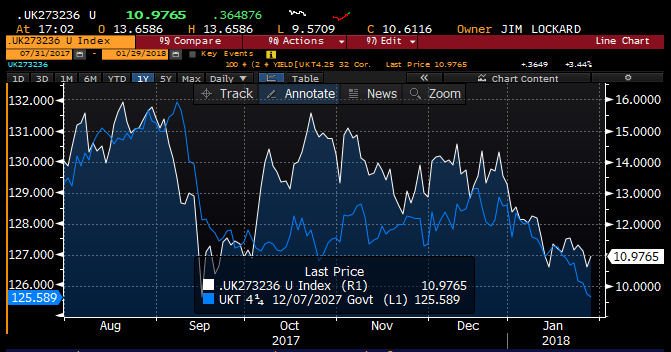

UKT 42s60s back to post Brexit extremes into coupon payment

The Gilt 22 Jan coupon payment will be concentrated in the 30-50yr sector; with these bonds having recently gone ex-dividend, we’ve seen richening of ultras to extremes last seen during the large linker index extension in mid November, when the UKT 42s60s inverted intraday to -19.6 bps before correcting back to -16 bps:

-20bps was the post Brexit low into June 2016 quarter end de-risking; it has held 4 times since then:

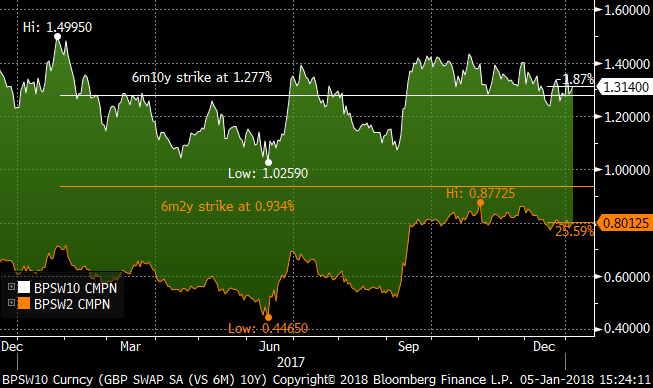

There is a loose correlation between 42s60s and UKT 60s yield over the last 6 months; recently there has been a buyers strike at 1.50 yields:

UKT 42s60s (white)

UKT 60s yield (inverted – orange)

The recent bull flattening of 30s50s makes the 42s60s curve stand out as too flat (inverted) vs the level of ultra yields by ~3.75 bps.

We have a UKT 57s tap in on 15 Feb which should provide an exit opportunity.

Moreover, we expect a new 73s ultra to be announced after the DMO consultation on 29 January to satisfy RM demand (for the new fiscal year).

One word of caution: On a Z spread basis, the 42s60s is still 3 bps off the lows (i.e. the cash curve has lagged the flattening in GBP 30s50s on the back of LDI receiving):

Trade:

UKT 42s60s steepener at -19.7 bps:

3mo carry = +0.9bps + 0.35 roll = 1.25 bps

Stop: 21.5 bps (-1.8 bps)

Target: 16.25 bps (+3.5 bps)

Regards,

Jim

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 60 Cannon Street, London, EC4N 6NP

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 207-002-1341

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

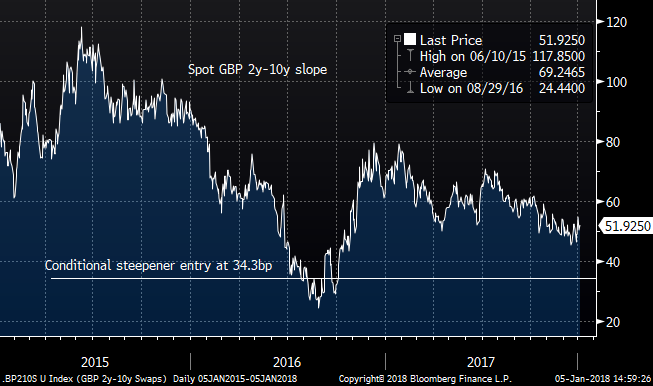

Trade: GBP 2y-10y bull-steepener on a 6m horizon

Bottom line: With a year to go before BREXIT it is likely that talks will go down to the wire before the market is able to determine an outcome for the UK economy. Over the next 6 months it makes sense to harvest roll-down, and on this theme 2y-10y bull-steepeners offer a good risk-reward.

Trade:

Buy GBP 507mm 6m2y receiver atmf (k=0.934%)

Sell GBP 108mm 6m10y receiver atmf-10bp (k=1.277%)

For zero cost indicative

Equivalent to GBP 100k/bp on the underlying 2y-10y curve.

Spot 2y-10y at 51.8bp

6m fwd 2y-10y at 44.3bp

Strike entry at 34.3bp

Rationale:

The market is pricing higher short rates from the MPC in 2018, but only grudgingly: the Jun meeting SONIA is priced at 56bp, so just a 40% chance of seeing a single 25bp hike by then. This reflects the dovish rhetoric that surrounded last November’s hike, and the ongoing uncertainties over BREXIT outcomes. The GBP curve on 2y-10y has gently flattened with this higher-rate outlook, but with the BREXIT date still a year away it seems unlikely we will be much clearer on the final outcome in six months’ time than we are today. In this equivocal environment it makes sense to look for strategies that maximize carry / roll.

The roll-down on GBP rates is highest at the short-end, so I’m looking at a steepener to harness this: in this case 2y-10y. The 6m-fwd is 7.5bp below spot, which represents the net roll-down. Given the differential in implied vols between 2y and 10y tails, structuring the trade via receivers (buying 6m2y, selling 6m10y) allows you to move the 6m10y strike out-of-the-money by 10bp for a costless structure. This improves the entry level over the same steepener in vanilla swaps.

So while the 10y tail is struck slightly below atm spot, the 2y tail is struck some 13bp above atm spot. Thus even with a gentle rise in short-rate expectations, the trade can also make money on a small bearish move.

In terms of expiry, I’ve chosen 6m to maximize the roll (compared to a 3m expiry), but I don’t want to go longer as events could get more volatile as we get closer to the date on which the UK is expected to leave the EU. As an aside, moving the 10y strike out of the money gives you a long gamma position at inception, with a net delta (for 100k/bp underlying) of 28k/bp received.

The main risk is a major bull-flattening move. This dynamic would require a rapid collapse in the UK data, and the raising of recession fears. This is not my scenario, as first the UK numbers have been holding up surprisingly well of late, and as I have said, I don’t see enough progress being made on BREXIT decisions to be able to forecast a severe weakening (or any other outcome) within the six-month horizon of this trade.

As always, I’d love to hear your thoughts on this.

Best wishes,

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 60 Cannon Street, London, EC4N 6NP

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 207 002 1346

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796