Gilt Trade - HC Micro RV 30-34-38 - Short Belly

No one will buy 38's. 2nd richest bond on the curve

John Wentzell

CEO / Founding Partner

Astor Ridge

O: +44 (0) 203 - 143 - 4800

M US: +1 (630) 965 - 3522

M UK: +44 (0) 779 - 505 - 0313

E: John.Wentzell@AstorRidge.com

UK: Dowgate Hill House, 14-16 Dowgate Hill, London, EC4R 2SU

US: 60 Rumson Road, Rumson, NJ, 07760

From: Stephen Creaturo <stephen.creaturo@astorridge.com>;

Sent: Thursday, January 7, 2021 9:05 AM

To: Jim Lockard <Jim.lockard@astorridge.com>;; John Wentzell <John.wentzell@astorridge.com>;; Mark Funsch <mark.funsch@astorridge.com>;; Marc Lamoureux <Marc.Lamoureux@astorridge.com>;; George Whitehead <George.Whitehead@astorridge.com>;; David Sansom <David.Sansom@astorridge.com>;; Robert Baida <robert.baida@astorridge.com>;; Chris Williams <Chris.Williams@astorridge.com>;; James Rice <James.Rice@astorridge.com>;; Will Scott <Will.Scott@astorridge.com>;; Gareth Edwards <gareth.edwards@astorridge.com>;; Peter Joos <Peter.Joos@astorridge.com>;

Cc: Research <research@astorridge.com>;

Subject: Gilt Trade - HC Micro RV 30-34-38 - Short Belly

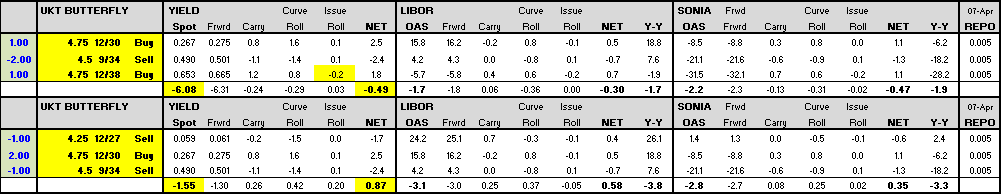

Trade: Sell 4.5% 34 vs buying 4.75% 30(ctd) & 4.75% 38 50x50wtd

Tactical 3mo hold to mitigate carry.

Rationale: Playing the Range – Spread at multi-year lows, currently +6.1bps(range ~4.5 – 15bps)

Curvature of HC rich relative to slope of 10/20 curve generically, but relationship has been less clear post March Covid event

10y CTD 30s underperformer in Q4 – hedge instrument for many locking in rates into year end, should reverse, 10y CTD cheap in curvature relative to level of rates

No imminent impact rolling into and out of DLV Basket, IE long way to go for consideration – range should prevail first before impact of CTD bonds influencing spread

APF has exhausted 30s, but only marginal float remains for both 34s and 38s ~2bl

3x35s taps this qtr will weigh on 34s

Risk: APF exhaust 34s first, similar to pattern of the HC 27s, then 30s.

10/20 curve Flattens on risk event,(but see marginal impact to fly as the level already reflects flatter curve)

AR Model approach suggest 38s from an RV perspective are richer on the curve and begins to adjust 1-2bps for this.

(much of the richness coming from maturity metrics – but when looking at mod duration which we are doing to

achieve a more symmetrical distribution of risk along the curve – this is sharply reduced)

Carry&Roll: Negative -.5bps/3mos – would highlight though half of this is coming from the negative roll-down of models input. Looking

at it another way, we are using 30/34/38s for symmetry in the distribution of risk along the curve, hence 10/20 curve wider

than what Fly implies, if you back out the bond specific roll – you get Neg C&R 1bps/Ann

Entry: +6.15bps(short belly)

Add: +4bps

Stop: +3.25bps

Target: +11.bp

Carry & Roll – 3mos

Spread below: Gilts 30/34/38(HC) vs 10/20 Gilt Curve – Generic Spline

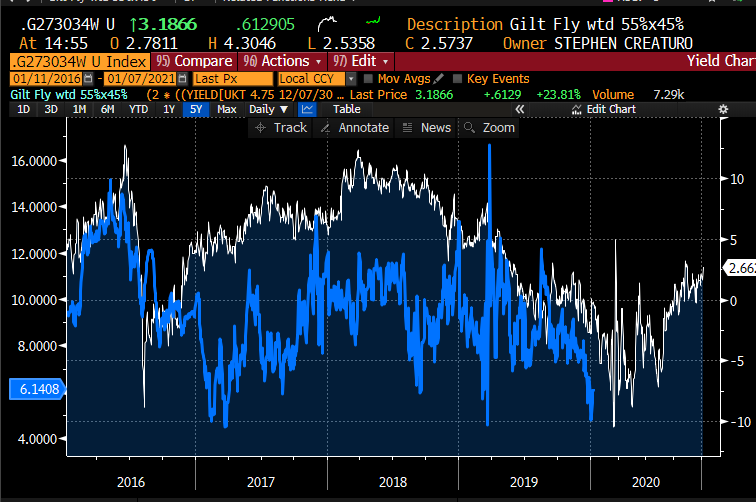

Graph Below: 30/34/38s LAGGED ONE YEAR. vs 27/30/34s wtd 55%x45% to maintain Duration Neutral to assess long term

rolling down of similar structure.

![]()

Stephen Creaturo

O: +44 (0) 203 - 143 – 4175

M: +44 (0) 7 809 575 890

E: stephen.creaturo@AstorRidge.com

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This marketing was prepared by Stephen Creaturo, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796