MICROCOSM: GILTS > Z9-H0 Rolls & a Busy DEC on Tap - Quick RV

- GILTS > Calendar Sprds 10yrs and other Stuff…

- Reminder - first notice day for G Z9 is Nov 28th and 1st delivery Mon Dec 2. With the US Thanksgiving holiday on Thurs, we'd expect much of the Z9-H0 flows to be wrapped up by Wed's close. We'll get the updated OI levels at 11am for Friday's close but as of Fri's open there was still 743.6k Z9 outstanding, leaving lots of wood to chop.

- As we highlighted late last week, recent flows in the sector (sellers of 4T30s basis, for ex), helped to drive a sharp increase in G Z9 open interest, peaking just above the 800,000 contracts level. These recent flows appeared to shift the G Z9 contract from a leveraged net-short to a more neutral stance, muddying the waters on where ‘fair value’ really is on the spread (currently -62 ticks), the richest so far.

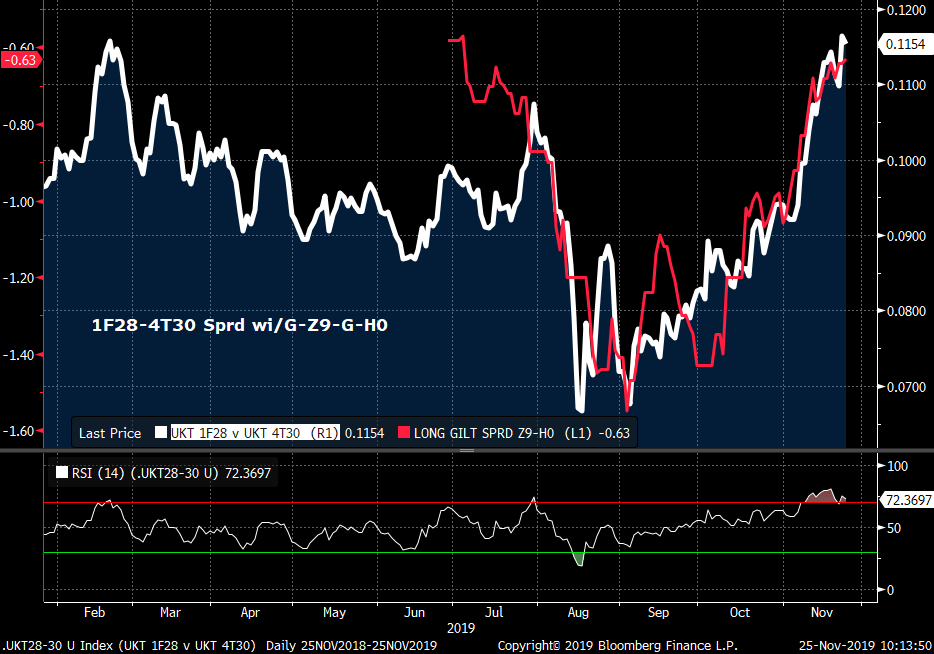

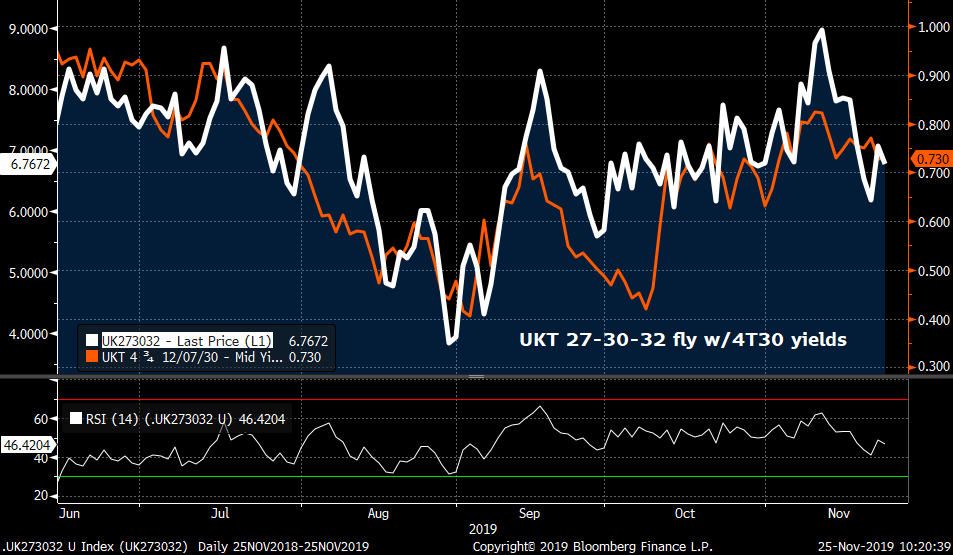

- Aside from the implications for the futures side of the equation, shifts in the calendar spread are driving moves in the underlying cash spread and their basis. The charts below show that there has been a knock-on effect of the calendar spread that impact parts of the curve that don’t involve the UKT 1F28s (G Z9 CTD) or even the new CTD, the UKT 4T30s. There has been a modest directionality over the last 4-5 sessions, 1F28s outperforming in a rally, however, we’re seeing signs that current yield spread levels in the 1F28s-4T30s (+11.5/6) and 0S29-4T30 (+2.3/4) are proving ‘sticky’, offering attractive location to scale into flatteners.

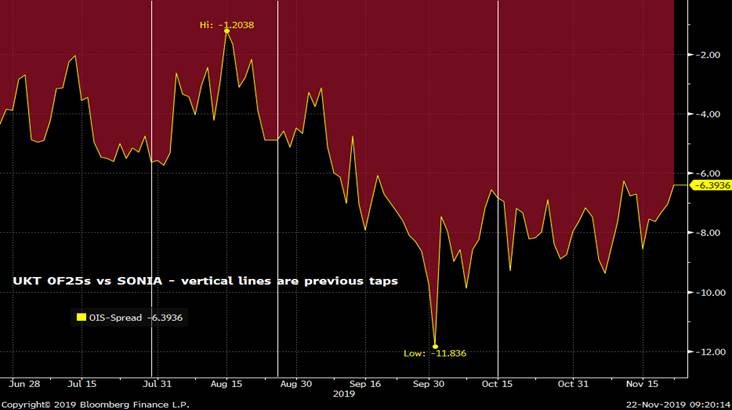

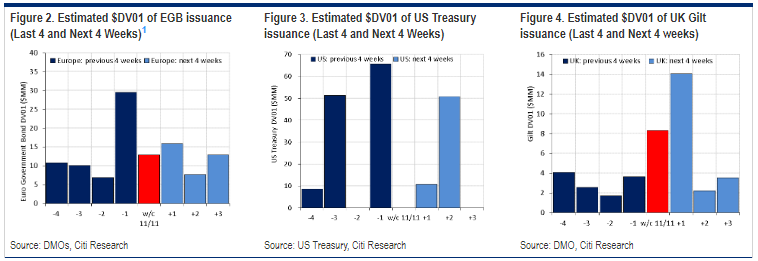

- Spicing up the outlook for gilts some more, we’ve got a very busy December on tap after tomorrow’s 0F25s tap, just in time for the markets’ shift into balance-sheet reduction mode.

- Nov 26 - £3.00bn tap of the 0F25s

- Dec 3 - £2.75bn tap of the 0S29s (Size TBC)

- Dec 5 - £2.25bn tap of the 1T49s (Size TBC)

- Dec 7 - £3.2bn cpn payments due Dec 7th

- Dec 11 - £2.25bn tap of the UKTi 48s (Size TBC)

- Dec 12 – Parliamentary Election

- Dec 17 - £3.00bn tap of the UKT 225s

UKT 1T37s have sprung back to life, our UKT 37-42s steepener now 8.8bps mid vs ~6.0bps area entry. That’s richened the 32-37-42 fly 2.2bps in the last couple weeks and the UKT 1F28-4Q32-1T37 fly is off its cheapest but still sharply cheaper than it was 2 weeks ago.

4Q32 vs 1F28/1T37

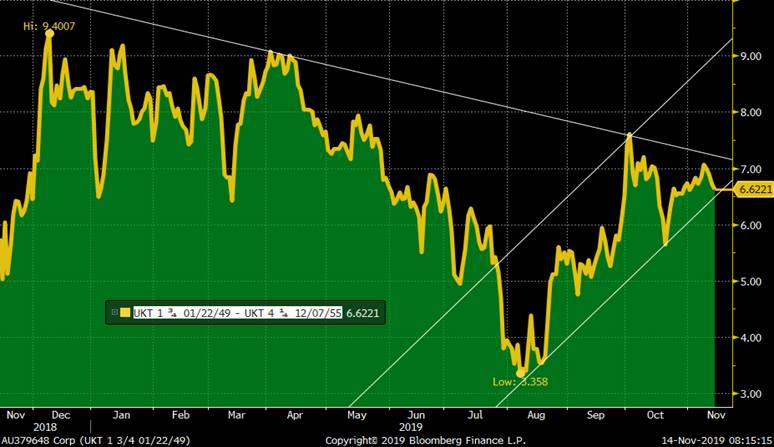

The announcement of more 1T49s on Dec 17th granted a reprieve to UKT 52s-71s longs who were concerned ultras could be tapped. We’ve seen a re-inversion of the 1T49 vs 52s/54s/57s sprds ion response, taking 49s-52s back to the recent richest at -4.2bps which has been solid support on the charts.

Take a look at 1T49s vs 1H47s and 3T52s – back to their cheapest levels since August. The fly has cheapened more than the level of rates would imply.

More to come!

Mark

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS > Preview of Tuesday's UKT 0F25s Tap

GILTS > 0F25s Tap Preview

- £3bn tap on Tuesday takes the issue to ~16bn (after post-auction takeup) which likely leaves 2 more taps before a new 5yr in Mar/Apr.

- The surprise announcement of the UKT 225s tap on Dec 17 sparked a sharp cheapening of 225s vs 0F25s from ~-7bps to -6.0bps where it is this am.

- While this additional 225s supply should be net-bearish short-term, the additional £3bn supply means the issue will be eligible for the reinvestment of the APF account’s ~15.4bn (face value) of the UKT 4T20s after falling out of the basket post September’s operation. This puts the issue back ‘in play’ for both GEMMs and RV players and will likely delay any further cheapening of the issue in repo and/or on Z-sprd. It also means the UKT 1H26s won’t be ‘the only game in town’ and could/should cheapen them up a touch in response. So, bottom line is this cheapening of the 225s looks like a buying opportunity to us, despite how rich the issue still appears on the curve.

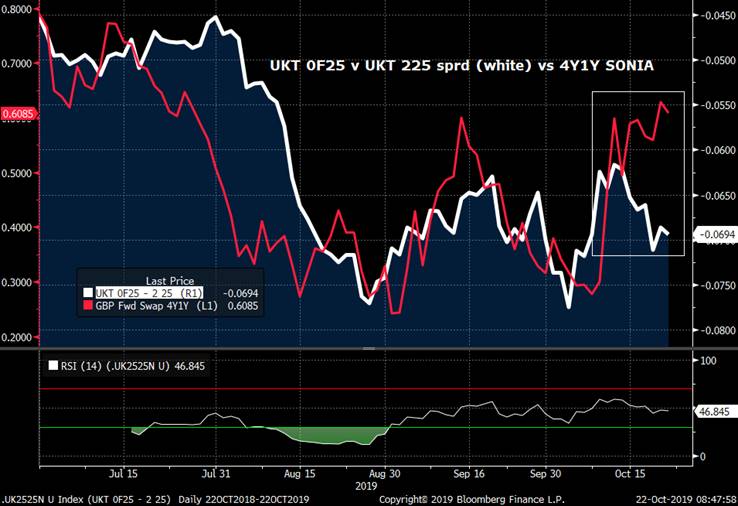

- On its own merits, however, the UKT 0F25s didn’t show signs of an obvious auction concession vs SONIA until the last two taps (see chart below) and it looks like we’ll likely take them down at similar levels to where we were at October’s tap.

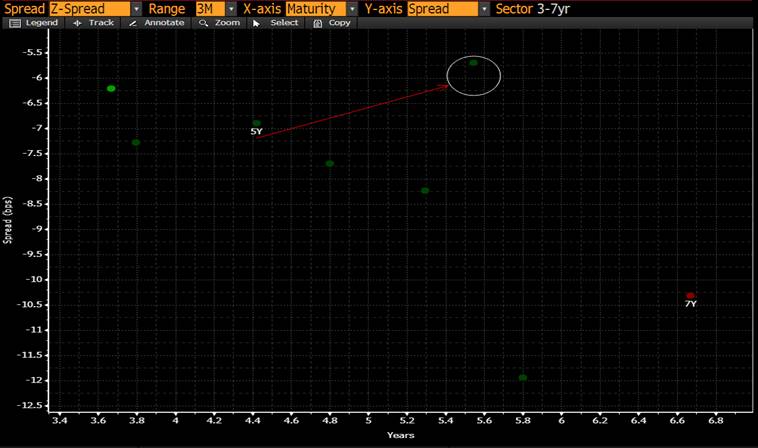

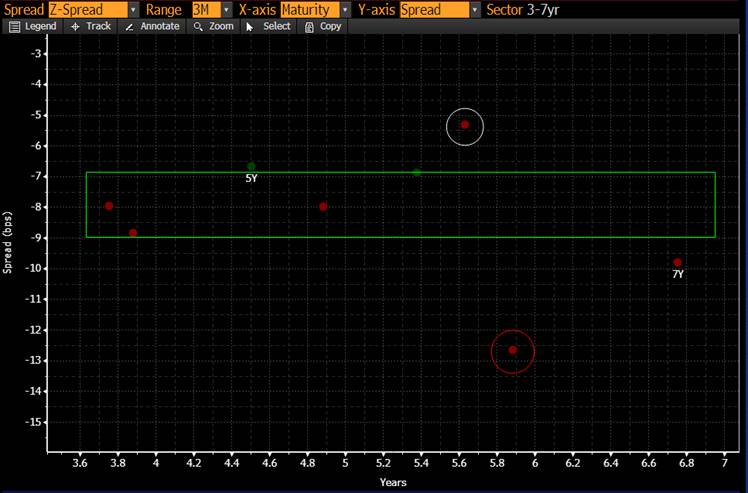

We can see from the BBG Z-Sprd chart of the 3-7yr sector below that the 0F25s remain the cheapest issue in the sector by a comfortable margin which should eventually tighten in close to where the 124s trade. With 3 more taps left (including Tues) and an APF on the horizon where the BoE owns none of the issue, this event is approaching and won’t go unnoticed by the central banks community who drive much of the demand in the 1-5yr sector.

Some wood to chop before Tuesday but it looks to us like this tap should go smoothly…

Mark

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: BUSY Morning for Spain and France - Quick RV Colour

SPAIN & FRANCE

- BUSY morning for mostly intermediate sector in Spain and France with the following supply on tap:

09:30am Ldn - Bonos - 3-4bn of:

SPGB 0.25% 7/24

SPGB 0.60% 10/29

SPGB 3.45% 7/66

09:50am Ldn - OATs - 7-8.5bn of:

FRTR 0% 3/23

FRTR 0% 3/24

FRTR 0% 3/25

Quick RV:

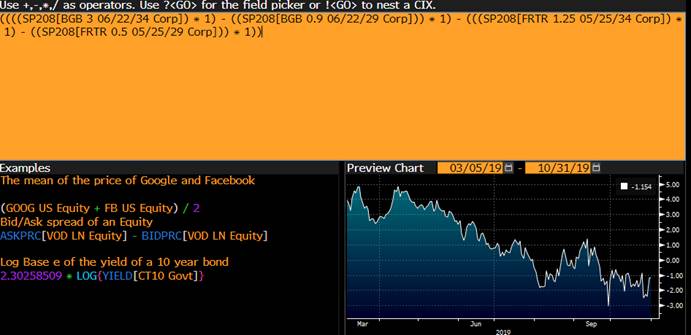

- SPGB 7/24s have cheapened 10+bps vs OBLs and 11bps vs swaps post Spain's election which could be a source of demand this am. We've also seen a nice cheapening of SPGB 7/24s vs 7/23s and 4/25s, the fly back to its widest since May/Aug.

7/23-7/24-4/25 fly

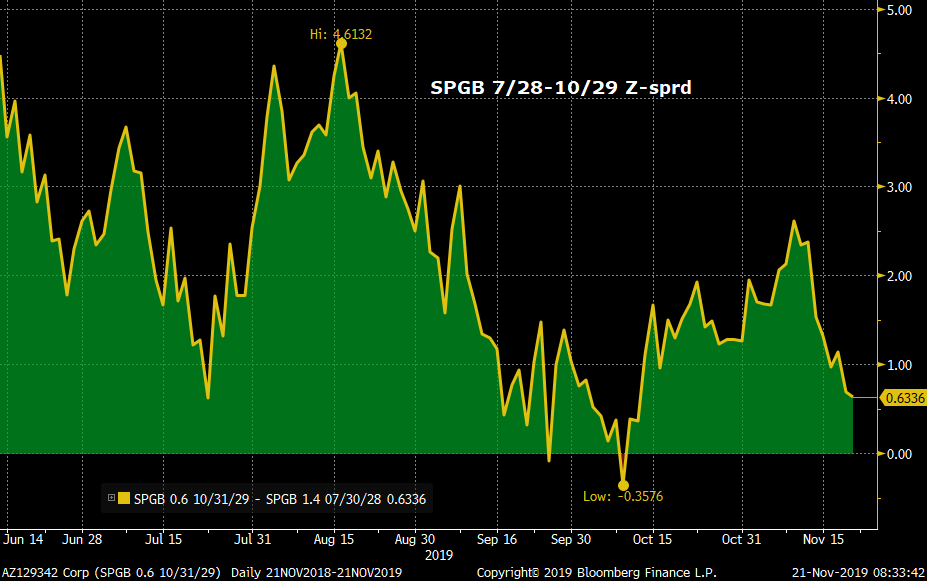

- While the SPB 7/24s look a bit cheap, the SPGB 0.6% 10/29s have richened on the curve into this am’s tap. The SPGB 7/28-10/29 sprd has flattened 2.25bps in both yield and Z-sprd and while we’re nearing the end of their issuance cycle (1-2 more taps left), these SPGB 10/29s have no auction concession priced in, relying on their benchmark status for demand.

- 50yr+ EGBs from Spain, France, Italy, Belgium and Austria have been popular longs vs 28-30yrs as defensive positions on both yield and spread space. While the BTPS sprd remains elevated, we’ve seen a reasonable correction in these spreads in the other countries and we expect that this momentum will attract demand for this morning’s SPGB 66s tap, the last we’ll likely see for the next 4-6 mos.

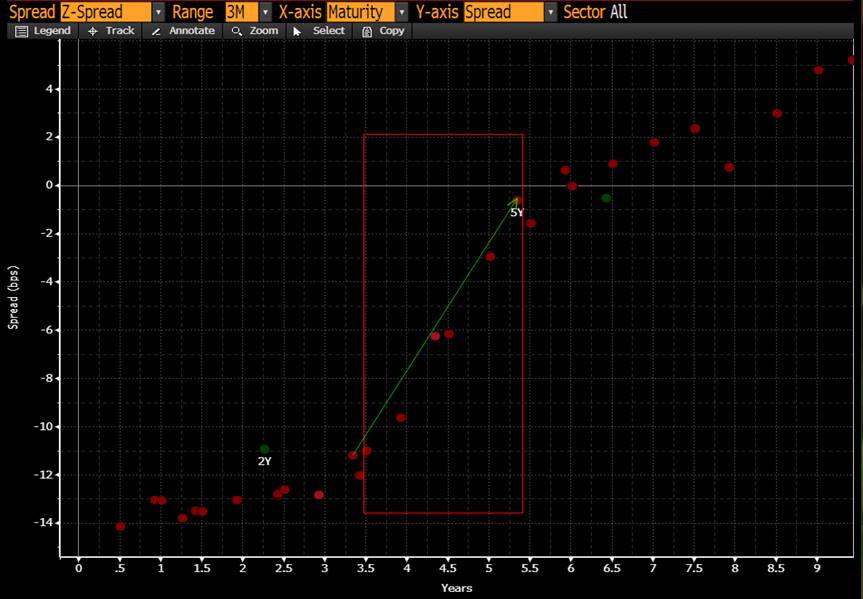

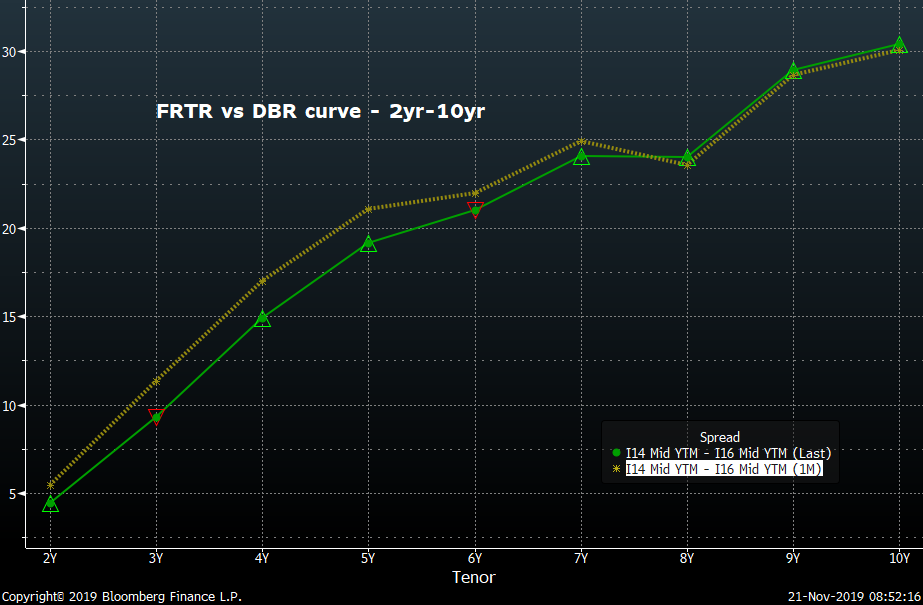

- The BBG chart below of the French Z-sprd curve out to 9yrs shows this am’s OATs supply is coming in the steepest part of the curve, which helps explain why the FRTR 3/24s and FRTR 3/25s have been well bid lately. As one would expect, carry and roll is attractive and with the curve steep vs DBRs, we expect to see interest in FRTR flatteners vs DBRs. We expect these to be the last taps of the FRTR 3/23s and 3/24s and the penultimate tap of the FRTR 3/25s.

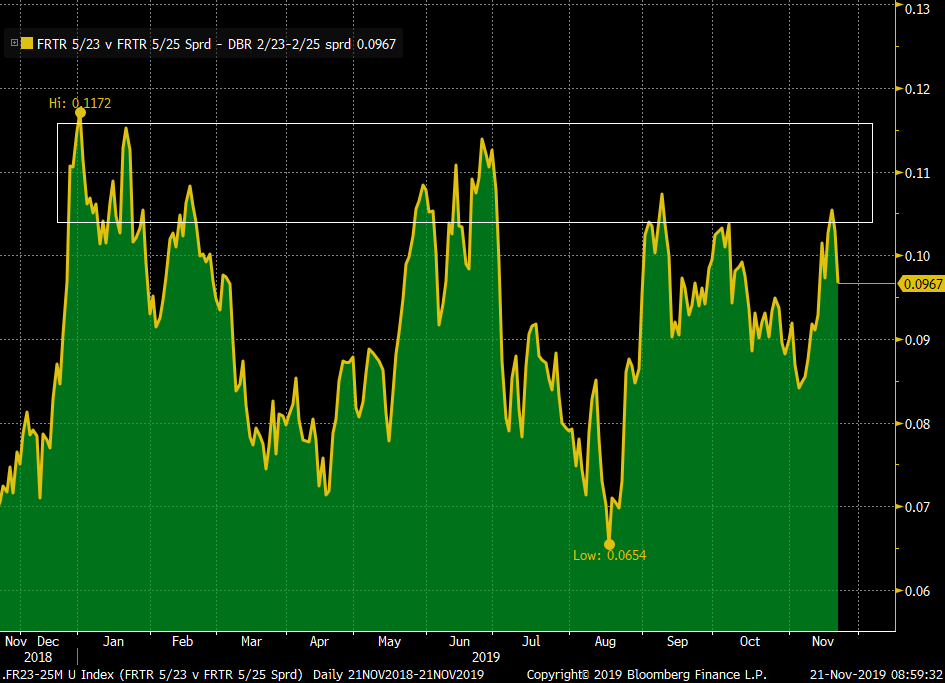

DBR 2/23-2/25 vs FRTR 3/23-3/25 sprd box

More to come…

Mark

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: £2.25bn UKT 1T49s Tap at 10:30am - CHEAP Enough to Go Well - Ideas

GILTs... 1T49s Tap @ 10:30

> £2.25bn tap is worth ~53k G Z9 and is the last scheduled tap of the issue this year - unless they decide to tap them again in Dec (in lieu of 54s or 71s, etc).

> Yield levels have risen, the 1T49s are a touch cheaper vs swaps but 10-30s looks a tad flatter than rate levels would suggest.

> On a micro level, we think these 1T49s look attractive here.

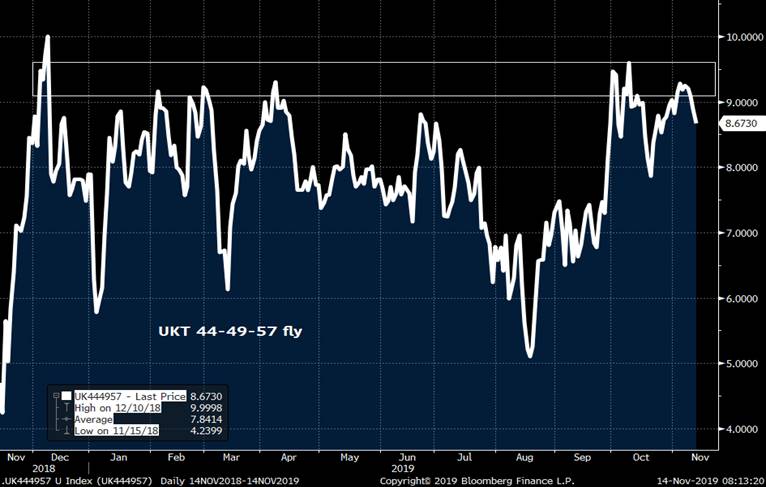

- The UK 44-49-57 fly we highlighted a few times in the last week has richened from +9.3bps to 8.7bps this am - still room to richen tho.

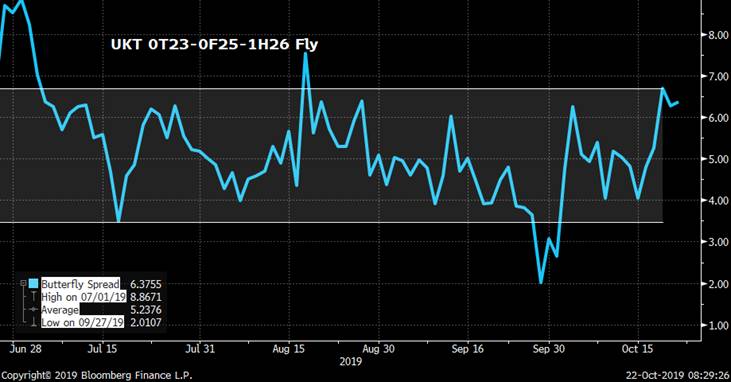

An even more micro fly - the UK 47-49=52 fly also looks good, holding the 4.5bps level and richening a touch.

- A simplified position that is still at attractive levels is the 1T49 steepener vs 1F54s -1F71 issues which will keep us in a core steepener into the election but should also do well if the DMO decides to tap the 54s or 71s in Dec. Here's 4Q55 into 1T49 as an example...

More closer to the time…

Best,

Mark

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: How Much Is Enough? Quick Rates Rundown W/Charts

- Well, that didn’t go so well now, did it? Yesterday morning’s SPGB and FRTR supply – all ~150k RXZ9s worth – was taken down with aplomb, only to be regurgitated by a market caught long and wrong as we took out key supports in RXZ9, OATZ9 and IKZ9. Even the rally in G Z9 on the MPC’s surprise dovish dissention (7-2 vote with dissenters calling for a rate cut) didn’t last as new intraday lows traded into the close. BTPS were battered badly, despite the risk-on tone, closing 8bps cheaper to DBRs in the move as longs were cut across the curve. Volumes on the day were far larger than usual – a combination of supply hedging and stops triggered. It’ll be interesting to see whether open interest levels changed much yesterday.

- It wasn’t all carnage yesterday though. After the hefty intraday concession the shiny new T 2.375 11/49s sputtered out of the gates with a small tail but roared ahead into the NY close, rallying 4+bps, the bid has continuing into this morning, 10-30s another bp flatter this morning.

- So, how much is enough? This age-old conundrum is no easier to answer now than ever, especially given the opaque nature of the market-moving influences we’ve got to contend with. That said, we can venture an educated guess based on some objective measures and perhaps come up with some trade ideas.

- Let’s take a look at some charts:

DBR 10yr yield chart with ZEW indicators. Handful of things worth a mention here:

- Current situation index remains depressed – which was well correlated with the rally in DBRs.

- The expectations bounce off the lows has, arguably, been a solid driver of this pullback in DBRs., however.

- We’re now at the 200 day MA and momentum indicators like RSIs are at their cheapest levels since Sept 2018.

DBR 10yrs vs DBR 5yr-10yr sprd. The cheapening of DBRs hasn’t been met with a commensurate steepening of the curve which suggests RXZ9 et al are too rich here. If we stay up here the curve should steepen over time, even with QE resuming. DBR 10yr supply on tap next week too.

Japan’s been at the heart of much of this year’s rally in rates, driving the spread tightening of SPGBs too. Chart below of 10yr benchmarks hedged back into JPY is interesting as it shows USTs (green) have cheapened most, followed by OATs and then Bonos. A ‘buy the dip’ move in EGBs would likely target OATs here. Even after the ~35bps tightening of 10yr USTs vs OATs since July, one would have to think it’ll continue though.

SPAIN has a big election coming up on Sunday and there are pundits who are concerned it could get messy. We’re going into the event with 10yr SPGB-DBR/FRTR spreads at their tightest levels of 2019 after an extraordinary performance this year. The chart below of FRTR 5/29s vs DBR 2/29s and SPGB 4/29s shows OATs remain at their cheapest on this blend since March but showing signs of a modest reversal. We’ve got 22.2bn FRTR redemption on Nov 25th and 10.1bn SPGB redemption Nov 30th. A shift out of SPGBs into OATs is a natural profit taking move into year-end if things get dicey.

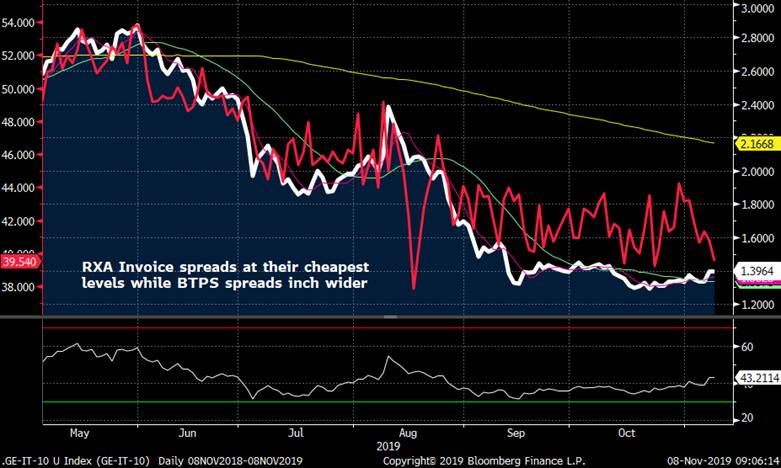

RXZ9 invoice spreads are well correlated with DBR-BTPS 10yr spreads. We’re currently back to the cheapest level in RXA invoice spreads this year. DBR-BTPS spreads are showing classic signs of bottoming out on the charts – yesterday’s 8bps widening seemed ominous. If BTPS start to wobble, get long invoice spreads as a low balance sheet, more liquid proxy. Given the flatness of the curve, BOBL spreads make more sense here.

Gilts have cheapened nicely over the past few weeks but the divergence with Cable remains intact. We’re seeing some signs this could converge but we need to take out the 1.28 support in GBP and/or the 0.70% yield level.

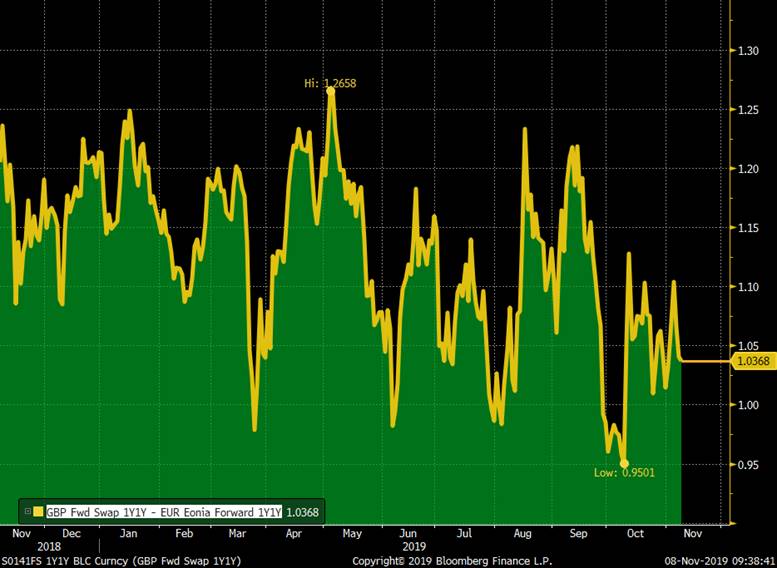

Is the dissension within the MPC mean a rate cut is in the cards? Not necessarily, but it wouldn’t hurt to be positioned for it. SONIA 1y1y has been capped by the 60bps level in this recent pullback and while the back-up in EONIA 1y1y makes the location of the narrower trade (REC GBP 1y1y vs PAY EUR 1y1y) less than optimal given the recent range, a 25bps rate cut would certainly tighten this spread through the 95bps lows seen in early Oct.

Rates supply much less busy next week with no USTs, 1-2bln NETHER 29s, some BKO 12/21s, DBR 29s, intermediate maturity BTPS and a tap of the UKT 1T49s, the last 10yr+ supply of 2019. Nice chart from our friends at CITI below. At the very least, this week’s selloff should provide some enticement for those who need to buy the mkt. Italy has a 12.4bn redemption next Friday.

UKT 1T49s – last long-end supply of 2019 next Thursday. As noted in my note earlier this week, we think they’re cheap on the curve and like buying them vs UKT 44s and 57s – 1-2-1 or curve weighted.

DBR-UKT spreads – 10yr vs 30yr sprds… Both spreads are just north of 100bps…

USZ9 back to their cheapest levels on momentum indicators like Bollingers. Open interest surged higher here too… The 10-30s flattening move post 30yr auction makes sense here.

Thanks for reading…! Feedback always welcome…

Mark

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

EGB conventional supply for the week to the 4th, November.

Thanks Creo…

From: Stephen Creaturo <stephen.creaturo@astorridge.com>;

Sent: 04 November 2019 07:58

To: Peter Joos <Peter.Joos@astorridge.com>;; Chris Williams <Chris.Williams@astorridge.com>;; George Whitehead <George.Whitehead@astorridge.com>;; David Sansom <David.Sansom@astorridge.com>;; Mark Funsch <mark.funsch@astorridge.com>;; Gareth Edwards <gareth.edwards@astorridge.com>;; James Rice <James.Rice@astorridge.com>;; Robert Baida <robert.baida@astorridge.com>;; Mike Ohr <Mike.ohr@astorridge.com>;; Jim Lockard <Jim.lockard@astorridge.com>;; John Wentzell <John.wentzell@astorridge.com>;; Chris_Brighton <chris.brighton@astorridge.com>;; Brice Janney <Brice.Janney@astorridge-na.com>;

Cc: Research <research@astorridge.com>;

Subject: EGB conventional supply for the week to the 4th, November.

Tues: Finland taps 15y - 4/34s, 30y - 4/47s Total 1bl euros

Wed: Austria taps 5y - 10/24s, 10y - 2/29s Total 1bl euro

Thur: Spain taps 5y - 7/24s, 10y - 10/29s, 15y -7/35s Total 3.5bl euros

France taps 10y - 11/29, 15y - 5/34s, 30y - 5/50s, 50y - 5/2066s Total - up to 10bl euros

UK tap 10y - 0.875% 2029 total - approx. £3bl

Of the 5 lines of supply, most compelling - 15y Finland within the broader Finnish curve - either 10/15y both in YLD and ZCM, 10/15/30y curve, 15y Finland vs Germany

- 30y Finland in ASW at at a multi-year cheap level vs swaps

- 15y France vs 15y Belgium has value but my preference is for 10/15y ASW box which I struggle to see why the Belgium curve is flatter than France(ex-supply dynamic)

Generally supply points in smaller and much less liquid markets such as Finland and Austria, give one good opportunities to reduce friction cost for one side of the entry/exit cost.

As for the other markets, I see little in the way of RV trades at the moment. Lack of volatility and range trade mentality persist for the time being and offers up fewer distortions on the curve. That may change as

we get closer to year end.

So for what is worth, here is my take:

France: One big duration event for the day - historical pattern into and out of supply for large duration events well documented, but apart from duration event - not much to do on the micro RV side.

10yrs - roll has moved out to +8.5bps(1bps wider) vs 11/28s(ctd) - part directional, but in ASW terms very stable at +2.4bps - maybe 1bps in the trade vs Futures

15y - Fair value on the french curve at the moment - middle of tight ranges - only consideration for myself - 10/15y ASW box vs Belgium(chart below) - not sure Belgium curve should trade rich in this metric v France

30y - nothing to do, tight range in YLD and ASW locally.

50y - with the exception of one spike higher in ASW terms 30y/50y, the 50y in ZCM towards the higher end of a 3bps range.(chart below)

Spain: 5y - marginally expensive locally, and mid-range on wider flys

10y - marginally expensive locally, expensive vs France, cheap vs larger credit trade German/Italy blend vs Spain - possibly look for risk off trade into year?

15y - 10/15/30 fly in Spain - middle of the range - locally cheap vs other High Coupons taking into account duration differential

Austria: 5y - has come back quite quickly from cheap valuation to slightly through Fair Value, looks at the expensive of the range vs Germany.

10y - Nothing to do -mid range on all metrics.

Finland: 15y - cheap in 10/15/30 Finnish Curve, 10/15y both Yld and ZCM, cheaper end of range vs Germany in an environment whereby semi-core has been compressed into low and tight range generically.(chart below)

30y - cheap in ASW(chart below)

UK: 10y - we see good value in the 10y roll in LC UK gilts and as we get closer to expiry of the DEC futures(our thoughts on performance of new ctd 2030s) and the lead up to a new 10y in early 2020, seasonally the

issue is nearer its cheaper end of cycle range.

France/ Belgium ASW Box 29s vs 34s (34 Belgium Expensive vs France)

30/50y France 5/50 vs 5/66 - ZCM

Finland 10/15/30y Fly - 15y back to the cheaper end of the range

15y Finland vs Germany - 34s - spikes wider for supply announcement

10y/15y Finland 29s vs 34s Yield - possible directional bias - but relatively all curves in EGB space looking even flatter relative to the back up in yields of late

Finland 10/15 ASW Box rarely seen the side of positive in 2019

30y Finland ASW YY - back to multi year cheaper end of the range.

![]()

Stephen Creaturo

O: +44 (0) 203 - 143 – 4175

M: +44 (0) 7 809 575 890

E: stephen.creaturo@AstorRidge.com

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This marketing was prepared by Stephen Creaturo, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: US/UK/EUR Rates Supply > Quick Rundown w/Comments

Happy Monday…

- Please find attached our weekly rundown of upcoming US, UK and EUR supply. You’ll see that this week’s supply is very light across the board with a handful of auctions in Europe and some linkers in the UK.

- We’ve added a new table at the bottom which highlights the coupon and redemption flows due this week. As the US is in a league of it’s own in terms of the size and scope of coupon and redemption flows we’ve lumped them together for simplicity’s sake. European issuers’ C&Rs are less frequent and, generally speaking, has a less pronounced impact on short-term RV and month-end index extension levels.

- The cash flow ‘champion’ this week is clearly SPAIN where Bonos investors will have a whopping Eur 28.4bn in cash hitting their coffers on Halloween. Since the cash flows hit their accounts for settlement of tomorrow’s trades we’d expect Bonos holders with a windfall will be inclined to spend them tomorrow/Wed, even if the complexities of index creation may mean that the index extension in Spain doesn’t fully reflect this negative net supply (depending upon your provider).

- Let’s use BAML’s month-end numbers as a reference:

Country Extension New Eff Dur Closest EGB

Germany +0.12yrs 8.27yrs DBR .5 2/28

France +0.26yrs* 8.98yrs FRTR .75 11/28

Italy +.09yrs 7.28yrs BTPS 2.05 8/27

Spain +.06yrs ** 8.22yrs SPGB 1.4 7/28

Netherlands +.07yrs 8.92yrs NETHER .75 7/28

Belgium +.04yrs 10.38yrs BGB 4.0% 3/32

- French cash flows will help drive a large extension into month-end. Long-end supply resumes next week, however, so we’re looking to sell into the late-week bid as the monthly ‘cushion’ on the curve/spreads is built in to take down the duration.

- We can see that the index move in Spain is rather small given the cash flows which is due to the timing of the payment – too late for inclusion in October. Either way, however, we’d expect Spain to be well supported this week.

- ECB’s QE resumes on Friday. There’s been a great deal of strategist coverage discussing the viability, duration, distribution and net market impact of the buying. We’ve sifted through a substantial amount of it and the conclusions we come to can be distilled down into a handful of bullet points:

- Of the Eur 20bn per month of buying, the market expect 14bn of it to be spent on EGBs.

- With the usual December lull already scheduled, the ECB is likely to front-load their purchases in Nov to cover the gap in December.

- The capital key was adjusted in late 2018 to reflect smaller net purchases of BTPS, SPGBs and FRTRs but even with these changes, the proportion of BTPS and FRTRs will remain high, especially when liquidity in the smaller issuers (RFGB, PGB, etc) is scarce.

- Lagarde has her hands full with the ECB’s hawkish contingent who have been challenging both the need for additional stimulus (both monetary and fiscal), suggesting heightened sensitivity to any signs of an improvement in the economy outlook and a shorter QE lifespan than expected. (Most dealers see at least 1year of operations.)

- With a handful of exceptions (JPM and MS this am) most pundits see renewed QE as a ‘sell vol, stay long flatteners and periphs’ trade. Question then becomes, how much is already priced in? (More on this soon)

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Bloomberg Bond News Summary > Mon Oct 28th

Business Briefing

1) HSBC Profit Misses Estimates; Bank Drops Profitability Goal (3)

(Bloomberg) -- HSBC Holdings Plc posted profit that missed analysts’ expectations, abandoned a key target for returns and flagged “significant” restructuring charges as it contends with a worsening global outlook. Europe’s largest lender, reporting results for the first quarter since the ouster of former chief John Flint, said adjusted pretax profit fell 12% to $5.3 ...

2) LVMH Bid for Tiffany Would Make Sense, Analysts Say; Watch Peers

(Bloomberg) -- LVMH making a bid for Tiffany would make strategic sense to most analysts as it would give the French group a much stronger presence in a jewelry market with the potential to grow quickly.

- Watch for any read-across from the potential deal for European luxury names -- particularly Richemont, given that a purchase could lead to more competition; also watch ...

3) Argentine Assets Hoping for Relief After Election: Markets Live

4) Stock Futures Flat; U.S. Yields at Five-Week High: Markets Wrap

(Bloomberg) -- U.S. and European stock futures were little changed in early European trading Monday. Ten-year Treasury yields hit five-week highs. Stocks in Asia began the week mixed after the S&P 500 Index climbed toward a record Friday. Benchmarks were little changed in Tokyo and Sydney, and edged up in Seoul. Hong Kong outperformed, though trimmed gains as HSBC ...

World News Briefing

5) Fernandez Wins in Argentina as Voters Rebuff Macri’s Austerity

(Bloomberg) -- Opposition candidate Alberto Fernandez swept Argentina’s presidential election on Sunday, ousting pro-market incumbent Mauricio Macri and tilting the nation back toward left-wing populism at a time of economic crisis. Fernandez, a political insider who has never held national office, won 48% of the vote with 95% of ballots counted, enough to avoid a runoff ...

6) EU Edges Toward Brexit Delay as Johnson Faces Vote on Election

(Bloomberg) -- Prime Minister Boris Johnson stepped up pressure for an early U.K. election, seeking to break the impasse over Brexit while the European Union considers another delay in a divorce he wants to expedite. The two strands converge Monday with a vote in the House of Commons that Johnson looks unlikely to win and talks among EU diplomats in Brussels, where the ...

7) Trump Says Islamic State’s Al-Baghdadi Killed in U.S. Raid

(Bloomberg) -- President Donald Trump said Abu Bakr al-Baghdadi is dead after a U.S. military raid in northwest Syria that left the Islamic State leader “in utter fear, in total panic and dread” in his final moments. The president said other countries should now fight Islamic State, and that removing al-Baghdadi was bigger for the U.S. then killing Osama Bin Laden, the al ...

8) Xi Uses China’s Biggest Annual Meeting for Politics, Not Economy

(Bloomberg) -- China’s economic challenges have proliferated in the almost two years since Xi Jinping last convened a full meeting of the Communist Party. But politics remain at the top of his agenda. The party’s Central Committee is expected to gather behind closed doors Monday for the first time since February 2018 -- the longest stretch the 200-plus-member body has gone ...

9) PG&E Starts Restoring Power While Another Mass Shutdown Looms

(Bloomberg) -- PG&E Corp. has begun restoring electricity to the almost 3 million Californians who lost power this weekend in the state’s largest deliberate blackout ever. Any respite, however, may be short. As the bankrupt utility began inspecting power lines for damage from wind storms sweeping through the northern part of the state, it warned that another round of ...

Bonds

10) SoftBank’s Financing for WeWork Rekindles Concern on Debt

(Bloomberg) -- Concern about SoftBank Group Corp.’s massive debt load has reared its head again after the company unveiled a $9.5 billion bailout for WeWork last week, hurting its shares and bonds. While the price tag for SoftBank to rescue the debt-riddled U.S. shared-office startup isn’t seen as big relative to its total investment portfolio, concern is growing about the ...

11) QE or Not, World’s Most Elite Bond Club Is Getting Its Mojo Back

(Bloomberg) -- Regardless of what you think about the Federal Reserve’s decision to get back into the business of buying Treasuries, one thing is clear: It’s a good time to be a primary dealer. While this elite-bond trading club may never fully regain its former glory, the prospect of the Fed once again purchasing hundreds of billions of dollars worth of U.S. government ...

12) Treasuries Dip, Short-Vol Remains in Vogue, Aussie Basis Tighter

(Bloomberg) -- Treasuries drift lower as bits of selling briefly emerge in 5- and 10-year futures in an otherwise muted session. Holiday in Singapore limits activity. Short-dated JGBs remain under pressure as rate cut pricing pulls back ahead of BOJ and overnight call rate remains elevated. AUD-USD 5-year basis tightens into deal flow.

- UST futures volumes running ~80%. Yields higher by 1-2bps across the curve. Activity ...

13) Emerging Markets Podcast: Argentina Vote, S. Africa Budget

(Bloomberg) -- In today’s emerging markets podcast, Tomoko Yamazaki and Ayesha Sruti discuss the potential market impact from Argentina’s presidential election and a busy week in South Africa with the upcoming mid-term budget and rating review. They also talk about key economic data and central bank decisions across emerging markets in the coming week. Listen to the EM Podcast here.

14) EM Review: Wave of Rate Cuts, Trade-Deal Optimism Spurred Rally

(Bloomberg) -- Emerging-market currencies and stocks advanced last week as expectations the U.S. and China can sign a trade agreement as soon as November boosted appetite for riskier assets. A wave of rate cuts also helped lift growth-led assets, with Russia speeding up the pace of easing and Chile lowering borrowing costs as the worst civil unrest in three decades dimmed the outlook for the economy. ...

15) Gulf’s Holdout on Rates Is About to Jump on Fed Easing Bandwagon

(Bloomberg) -- The only Gulf Arab central bank with an unpredictable monetary policy might finally fall in line this week. In a region where most countries usually track the Federal Reserve to protect their currencies’ pegs to the dollar, Kuwait split from the likes of Saudi Arabia and the United Arab Emirates, standing pat when U.S. interest rates were lowered in July and ...

Central Banks

16) BOJ Bond Tapering Drives Up Japan’s Overnight Call Rate: Chart

(Bloomberg) -- Japan’s unsecured overnight call rate is near the highest level since April 2016 as the Bank of Japan’s tapering of bond purchases curbs growth of the money supply. The rate is marching toward 0% as commercial banks find themselves with fewer bonds to sell to the BOJ, turning instead to borrowing more from each other to secure additional funds that they can park as reserves at the central bank, ...

17) Time to Get Picky in Emerging Markets in Grip of Political Risks

(Bloomberg) -- Emerging markets head toward the end of October with a spring in their step after currencies and stocks reached the strongest levels in three months. Optimism about a U.S.-China trade deal, coupled with the prospect of a third interest-rate cut this year by the Federal Reserve -- which would increase the scope for even lower rates in developing economies ...

18) Mario Draghi’s Roadmap for Europe's Future: Ferdinando Giugliano

(Bloomberg Opinion) -- Mario Draghi will give his last speech as president of the European Central Bank today, at a farewell celebration in Frankfurt. The audience will include many political leaders such as Germany’s Angela Merkel and France’s Emmanuel Macron. Both have have already expressed their admiration and support for the man who is widely credited with rescuing the euro zone. ...

Economic News

19) Lagarde to Get Harsh Snapshot of the ECB’s Economic Challenges

(Bloomberg) -- Christine Lagarde is about to get a harsh snapshot of the challenges that face her when she takes up the European Central Bank presidency this week. As the former French finance minister counts down to taking over from Mario Draghi, the deteriorating backdrop that pushed the ECB into a new round of monetary stimulus less than two months ago will be brutally ...

20) Majority of BOJ Watchers See No Additional Stimulus in October

(Bloomberg) -- Most economists expect the Bank of Japan to stand pat this week after continued signs of resilience in the economy and stability in markets cooled speculation that the central bank will ease in October. Some 60% of 47 economists expect stimulus to remain unchanged at the end of a two-day meeting Thursday, though an increasing number think the bank will lower ...

21) S. Africa May Lose Moody’s Stable Outlook. But It’s a Close Call

(Bloomberg) -- South Africa’s tenuous hold on the stable outlook on its sole investment-grade credit rating may slip with Finance Minister Tito Mboweni expected this week to show a marked deterioration in the state of the nation’s finances. Of the 17 economists in a Bloomberg survey, nine forecast that Moody’s Investors Service will change its outlook on the nation’s credit ...

22) China’s Profit Declines Signal Policy Support Needed: Economics

(Bloomberg Economics) -- OUR TAKE: A steeper decline in China’s industrial profits in September sends a clear signal of weakening economic conditions. We expect the central bank and government to step up stimulus to buttress the economy. Industrial profits have recorded year-on-year declines in four of the last six months, recalling weakness in 2015, when profits shrank for most of the year and the People’s Bank of China ...

23) Christine Lagarde Faces Peril on All Sides at the ECB

(Bloomberg Businessweek) -- Christine Lagarde will inherit two gifts when she takes over the presidency of the European Central Bank, both temporary and both from Mario Draghi. The first is a symbol that will be literally handed to her by the outgoing ECB president: a golden bell used to call the central bank’s policymakers to order. It’s an object that she will ceremonially pass on to her own successor in eight years. The ...

European Central Bank

24) Buy Schatz Puts as Impact of ECB Tiering Takes Effect: JPMorgan

(Bloomberg) -- With ECB’s tiering coming into effect on Oct. 30 and likely to exert upward pressure on ESTR fixings, JPMorgan recommends buying put options structures to target a cheapening of Schatz OIS spread.

- Recommend buying Dec. 2019 Schatz 112.10/112.00 1x2 put spread to target 112.00 as post tiering price (3bp cheaper than current levels), writes Sampath Vijay in a ...

25) Draghi's Farewell, Brexit Delay, Death Canal: Brussels Edition

(Bloomberg) -- Welcome to the Brussels Edition, Bloomberg’s daily briefing on what matters most in the heart of the European Union. Sign up here to get it in your inbox every weekday morning. Everybody who’s anybody on this continent will be in Frankfurt this afternoon for Mario Draghi’s farewell ceremony. Following speeches by the likes of Angela Merkel and Emmanuel Macron ...

26) Lagarde to Be Greeted at ECB With Batch of Downbeat Data: Chart

(Bloomberg) -- Christine Lagarde is about to get a harsh snapshot of the challenges that face her when she takes up the European Central Bank presidency this week. Figures are due to show the euro area recorded its worst economic performance since 2013 in the third quarter. It’ll be another two weeks for data showing whether or not Germany, Europe’s largest economy, slipped into a technical recession.

Federal Reserve

27) Gulf’s Holdout on Rates Is About to Jump on Fed Easing Bandwagon

(Bloomberg) -- The only Gulf Arab central bank with an unpredictable monetary policy might finally fall in line this week. In a region where most countries usually track the Federal Reserve to protect their currencies’ pegs to the dollar, Kuwait split from the likes of Saudi Arabia and the United Arab Emirates, standing pat when U.S. interest rates were lowered in July and ...

28) Fed to Cut Rates Again, But What Comes After That?: Economy Week

(Bloomberg) -- Federal Reserve Chairman Jerome Powell is expected to deliver the third straight U.S. interest rate cut this week -- but the real news will be if he signals the end of the easing cycle or leaves the door open for more. Recent U.S. economic data has been mixed, with weakness among manufacturers contrasting with resilient consumers who contribute the lion’s ...

29) Federal Reserve Expected to Deliver Third Straight Interest Rate Cut

(Telegraph) -- The flagging US economy is a “sick patient” facing a one-in-three chance of recession, experts have warned, as the Federal Reserve prepares to cut interest rates for the third time in four months. Financial markets are pricing in a 90pc chance of a cut to 1.75pc from the Fed’s Open Market Committee on Wednesday as the world’s biggest economy ...

Click here to modify the categories included in your My News Page summary.

Click here to deactivate this subscription.

Bloomberg Bond News Summary > Thu Oct 24th

Business Briefing

1) Daimler Zeroes in on Costs, Diesel Risk After Earnings Beat (1)

(Bloomberg) -- Daimler AG said it will intensify efforts to cut costs to manage the industry’s shift to electric vehicles after third-quarter earnings exceeded forecasts, despite weaker profitability from the Mercedes-Benz cars unit.

- The world’s biggest luxury-car maker -- reeling from two profit warnings this year partly related to diesel-emissions investigations -- also ...

2) Big Eurodollar Blocks Bet Fed Goes Small on Cuts: Markets Live

3) Nokia Cuts Earnings Outlook and Pauses Dividend to Invest in 5G

(Bloomberg) -- Nokia Oyj lowered its earnings guidance for this year and next and halted dividend payments as the rollout of 5G mobile networks is turning out to be more expensive and competitive than previously expected.

- The Finnish equipment company took down its earnings and margin expectations and said it won’t distribute dividends for the third and fourth quarters of ...

4) Stocks Rise in Asia With Nasdaq Futures on Profits: Markets Wrap

(Bloomberg) -- Stocks in Asia were mostly higher as investors took solace from a raft of earnings that provided some optimism against a background of concern that global economic growth lacks momentum. Treasury yields and the dollar were flat. Shares edged up in Hong Kong, Tokyo and Sydney, though gains fizzled in Seoul and Shanghai. The S&P 500 Index earlier climbed to ...

5) Aramco Said to Explore Incentives to Reward Loyal IPO Buyers (1)

(Bloomberg) -- Saudi Aramco is exploring ways to reward loyal investors in its initial public offering to ensure the record share sale isn’t followed by a wave of selling, people with knowledge of the matter said. One potential measure that Aramco has discussed with Saudi regulators is whether it could offer bonus shares to retail stock buyers who keep their holdings for ...

World News Briefing

6) Trump-Sanctioned GOP Protest Disrupts Impeachment Hearing

(Bloomberg) -- A group of Republicans disrupted a hearing of the Democrats’ impeachment inquiry Wednesday by storming into a secure room at the Capitol in a protest carried out with the blessing of President Donald Trump. The two dozen or so GOP House members are among some of Trump’s staunchest defenders in Congress, and at least some of them met with the president Tuesday ...

7) Californians Go Dark in Blackout That May Affect 1.5 Million

(Bloomberg) -- Parts of Northern California have gone dark in the first stage of a mass blackout that could eventually leave more than a million people across the state without power. PG&E Corp. has cut service to customers in counties near Sacramento and Napa Valley in an attempt to keep its power lines from sparking wildfires amid high winds. The blackout is set to ...

8) China’s Information War on Taiwan Ramps Up as Election Nears

(Bloomberg Businessweek) -- Holger Chen cuts a fierce profile with his skull-tattooed biceps, each bigger than a human head, and the oft-broken nose of a fighter. A mixed martial arts fighter, ex-Marine, former gangster, and owner of a chain of fitness clubs in Taiwan named after Genghis Khan, Chen has become an emblem of what he calls “defensive democracy” against disinformation from China. In his YouTube broadcasts, ...

9) Pompeo Cornered as Ukraine Envoy’s Testimony Forces Hard Choice

(Bloomberg) -- The acting U.S. envoy to Ukraine said he was told President Donald Trump wanted Ukraine’s president “in a public box” in order to get him to investigate Joe Biden’s son in exchange for military aid. Instead, it was Secretary of State Michael Pompeo who got boxed in. After the White House disparaged the testimony Tuesday by Ambassador William Taylor as the ...

10) EU Keeps Johnson Waiting for Brexit Extension He Doesn’t Want

(Bloomberg) -- The European Union left Boris Johnson hanging on Wednesday night as officials in Brussels debated whether to grant him a third extension to the Brexit process. EU ambassadors meeting in the Belgian capital agreed that they should accept the British prime minister’s request for more time but couldn’t settle on how long he will get, according to officials ...

Bonds

11) Sizzling Bond Demand Boosts Deals From Philippines to China

(Bloomberg) -- The Asian dollar bond market is sizzling as yield-starved investors load up on offerings including from the Philippines’ oldest conglomerate and a Chinese investment holding firm. The region’s credit markets have been rallying as global central banks keep interest rates low and some optimism has emerged on U.S.-China trade talks. ...

12) Huawei Defies Trade War Angst with Strong Yuan Bond Debut

(Bloomberg) -- Huawei Investment & Holding Co. sold its first bond in China at the year’s lowest coupon for a Chinese private firm’s note with the same tenor, reflecting strong domestic support for the company caught in the country’s trade crossfire with the U.S. The parent of tech giant Huawei Technologies Co. priced a 3 billion yuan ($425 million) three-year bond at ...

13) Top Fund Manager Builds Credit Portfolio to Bear Recession

(Bloomberg) -- Joshua Lohmeier’s debt fund at Aviva Investors has outperformed 94% of peers over the past year. With signs that a recession is nearing, he is playing those concerns by investing in bonds better insulated from a downturn, while keeping some riskier debt. “We prefer to have more BBB rated securities in shorter maturities and more defensive, higher-quality ...

14) Bond Defaults Are Highest on Record as India’s Economy Slows

(Bloomberg) -- Indian companies have defaulted on a record 76 billion rupees ($1.1 billion) of local-currency and international bonds so far this year after the shadow bank crisis triggered a credit squeeze, and it doesn’t look like the worst is over. Those firms that delayed or missed debt payments in 2019 still have the equivalent of $17 billion of notes and loans ...

15) Yen Rises as Weak Manufacturing Stokes Growth Fears: Inside G-10

(Bloomberg) -- The yen edged higher as a slew of weak manufacturing data underscored the slowing momentum in global growth.

- Yen rose as manufacturing indexes in Australia and Japan slumped to the lowest in three years and traders awaited a speech by U.S. Vice President Mike Pence which could reignite tensions with China

- The greenback slipped while other currencies were range-bound with investors on watch for ...

16) Asia Bond Issues to Stay High - Indonesia in a Sweet Spot: BoS

(Bloomberg) -- Dollar bond issues from Asia will remain high as many companies will look to refinance their debt to benefit from lower borrowing costs, according to Bank of Singapore Ltd.

- “Indonesia is in a sweet spot as the new government aims to boost infrastructure spending, while we also expect bond issues from Chinese property developers and energy companies and banks ...

Central Banks

17) Facebook’s Libra Shows Banks Can Do More, Singapore MAS Says (1)

(Bloomberg) -- Facebook Inc.’s embattled bid to create its own digital currency has laid bare shortcomings in cross-border payments and financial inclusion that banks and regulators must address, according to Singapore’s top central banker. Central banks “need to answer” the challenge posed by Facebook’s attempt to create a faster and more affordable payments network via ...

18) Japan Authorities Are Said to Team Up on Bank Stress Tests

(Bloomberg) -- Japan’s central bank and financial regulator are teaming up to test major banks’ resilience to mounting risks at home and abroad, people with knowledge of the matter said. The first-ever joint stress tests by the Bank of Japan and Financial Services Agency will require five lenders to measure their ability to withstand shocks such as a sharp economic ...

19) Singapore Central Bank Sees Small Inflows Amid Hong Kong Unrest

(Bloomberg) -- Hong Kong’s political turmoil has prompted some capital to move to Singapore though there hasn’t been a flood of inflows from the former British colony, according to Singapore’s central bank. The city state’s banks have seen an uptick in those inquiring about how to re-allocate assets, which is reasonable to expect, Ravi Menon, managing director of the ...

Economic News

20) Draghi Reaches End of His Fight to Save Euro: Decision Day Guide

(Bloomberg) -- European Central Bank President Mario Draghi will hold his final policy meeting and press conference on Thursday, after eight years of leading the fight to stave off a euro-zone breakup and the threat of deflation. For all his successes, it’s likely to be a day in which any congratulations are mixed with tough questions about the region’s brittle economy. ...

21) ECB’s Draghi to Call for Fiscal Review Before Exiting: Economics

(Bloomberg Economics) -- Mario Draghi’s tenure as president of the European Central Bank has been undeniably successful -- saying he saved the euro from collapse isn’t much of a stretch. However, inflation continues to languish well below target. And with monetary policy reaching the limits of its efficacy, we expect him to make a final plea today for help from Europe’s governments. ...

22) With U.S. Help, Global Growth in 2020 May Be Up From Dismal 2019

(Bloomberg Businessweek) -- To avoid a recession in the U.S. in 2020, households need to keep spending, peace needs to break out in global trade wars, and investors can’t get spooked—by the U.S. presidential election or anything else. It would also help if policymakers in Europe and China did their part to shore up growth, even though the tools they have to do so are limited. It’s likely that all these things will happen. That’s why Bloomberg Economics is ...

23) ECB Gets Chance for German Reset With Lagarde-Schnabel Dual Act

(Bloomberg) -- The European Central Bank and Germany finally have a window of opportunity to start repairing their fractured relationship -- for the first time in years. The German cabinet’s proposal of Isabel Schnabel to join the ECB’s Executive Board will give the institution an academic economist with a track record of defending its monetary stimulus against attacks by ...

24) Singapore’s Central Bank Chief Sees Slow Economic Recovery

(Bloomberg) -- Singapore’s economy may be a few quarters away from a recovery as the decline in trade and manufacturing this year hasn’t really spread to other sectors, the central bank’s chief said. The Monetary Authority of Singapore’s baseline view is that “the current cycle should be bottoming out toward the end of the year and into next year,” Managing Director Ravi Menon ...

European Central Bank

25) Final Countdown to Draghi Features Five Rate Decisions in Region

(Bloomberg) -- Mario Draghi’s farewell press conference as European Central Bank president will cap a morning of monetary action across the region that illustrates the struggle for policy makers in coping with a worsening global outlook. The five decisions due on Thursday start with Sweden’s Riksbank, whose efforts in exiting the twilight zone of negative interest rates are ...

26) PRECIOUS: Gold Holds Advance Ahead of Draghi’s Final ECB Meeting

(Bloomberg) -- Gold held a gain as investors await European Central Bank President Mario Draghi’s final policy meeting and press conference on Thursday. Traders were also weighing the latest Brexit developments as well as a raft of earnings. About 80% of companies on the S&P 500 have topped expectations for profits, though Texas Instruments and Caterpillar both showed ...

Federal Reserve

27) Fed to increase repo market interventions again ahead of month-end

Preview text not available for this story.

28) Federal Reserve of New York: Statement Regarding Repurchase Operations

29) Fed New York: Statement Regarding Repurchase Operations Oct 23, 2019

Statements and Operating Policies Statements announcing changes to the operating polices for conducting open market operations. Oct 23, 2019 Statement Regarding Repurchase Operations END

30) Trump Fed Nominees Still Work in Progress: Senate Banking Chair

(Bloomberg) -- President Trump’s picks to serve in two slots at the Federal Reserve remain a “work in progress,” and it’s not certain when they will be formally nominated and sent to Capitol Hill, Senate Banking Committee Chairman Mike Crapo says.

- “I don’t have any update,” Crapo says in an interview when asked about the status of Trump’s Fed picks made last July

- “I would ...

First Word FX News Foreign Exchange

31) ANZ Is Constructive on Rupiah Bonds in Near Term Amid Low Rates

(Bloomberg) -- ANZ Bank is “constructive” on Indonesian bonds in the near term amid low rates globally, which help ease concerns of the nation’s structural issues, Jennifer Kusuma, co.’s senior rates strategist in Singapore, writes in a note.

President Jokowi’s cabinet choices have rekindled hopes for economic reform and the sale of the $1b of 30-year dollar bonds reduced ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS > Steepeners Into UKT 0F25s Tap This AM...

GILTS > 0F25s Tap @ 10:30

TRADES > STEEPENERS – 0F25 vs 225, 0F25 vs 1H26 and 0F25 vs 1Q27 – see below.

> Third tap of the issue takes them to £12.4bn, about 1/2 way through their cycle.

> 0F25s have cheapened almost 5bps vs SONIA since early Oct and the 0T23- 0F25-1H26 fly is +6.2bps mid, about .5bps richer than this time yesterday.

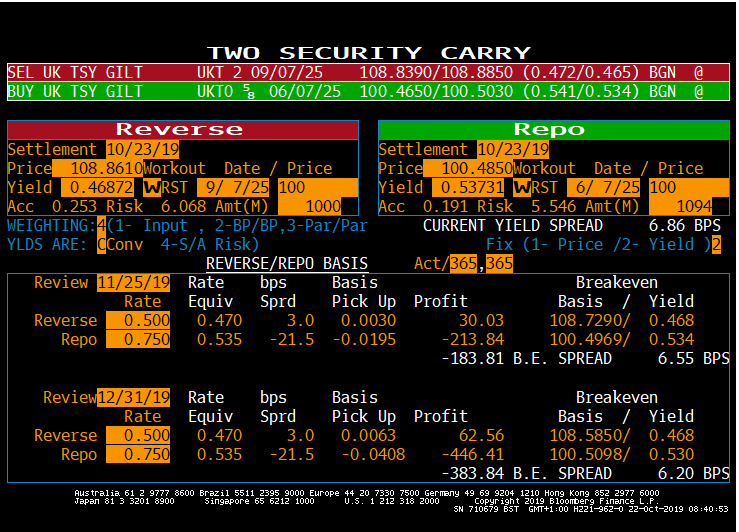

> Broadly speaking, we like steepeners in the 3-7yr sector, not just because it's still remarkably flat but with Brexit's outcome now between either a deal or an extension, rather than a deal or no-deal, the medium term bias for GBP/UKT rates should be higher which should steepen the curve. Add to that the easing in 225 and 1H26 repo over the last 2 weeks and shorting these issues isn't as punitive, opening the door for a normalization of the curve. Coming into this morning , 0F25 vs 225s is 6.9bps inverted and 0F25 vs 1H26s is 2.8bps inverted – both a reflection of the repo differentials. As we can see from the BBG CCS page below, a repo differential of 25bps (borrowing 225s at 0.50% vs lending 0F25s at 0.75%) costs .3bps over a month and .66bps until Dec 31st. Punitive, yes, but given the volatility we’ve seen in SONIA (4y1y cheapening over 30bps since Oct 10th) we’re willing to bet we won’t have time to worry about carry and roll. If you’d prefer to play it safe, sell the 1Q27s instead – also flat vs 0F25s on Z-sprd and close enough to the 1F28s (G Z9) to be dragged cheaper in a sell-off.

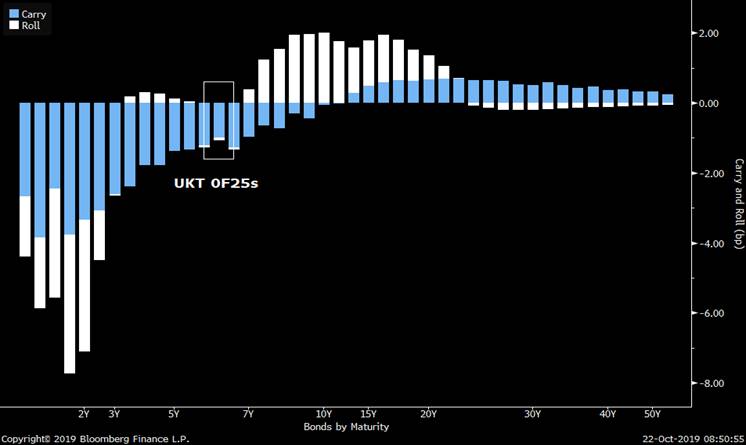

Gilts curve carry and roll…

3-7yr sector Z-sprds – 0F25s circled in white, 225s circled in red.

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796