Bloomberg Bond News Summary > Tues Oct 22

Business Briefing

1) Trudeau Claims `Clear Mandate' Despite Losing Majority: TOPLive

2) Facebook, Amazon Set Lobbying Records Amid Washington Scrutiny

(Bloomberg) -- Facebook Inc. and Amazon.com Inc. set federal lobbying records in the third quarter as Washington ramps up oversight of the tech giants’ business practices. Facebook spent $4.8 million, an increase of almost 70% from the same period the year before. The world’s largest social-media company is grappling with a mushrooming list of challenges, including federal ...

3) China’s Central Bank Boosts Liquidity Ahead of Tax Payment Surge

(Bloomberg) -- China’s central bank used open-market operations to inject the largest amount of cash into the banking system since May, as upcoming corporate tax payments tighten liquidity conditions. The People’s Bank of China on Tuesday net injected 250 billion yuan ($35 billion) via seven-day reverse repurchase agreements, according to a statement. There were no ...

4) Climate Change ‘Defining Issue of Our Times,’ Singapore Says

(Bloomberg) -- Land-scarce, low-lying and increasingly hot Singapore is going to have to find room for more than a quarter of a million new trees and shrubs as the city-state steps up measures to respond to climate change. “Citizens around the world have come to recognize climate change for what it is -- the defining issue of our times,” Masagos Zulkifli, minister for the ...

5) Infosys Dives Most in 6 Years as Whistle-Blowers Target CEO

(Bloomberg) -- Infosys Ltd.’s shares plunged to a 10-month low after whistle-blowers accused Chief Executive Officer Salil Parekh of leading an effort to shore up profits through irregular accounting, turning up the heat on an IT services giant that endured internal turmoil just two years ago. The stock fell as much as 16% Tuesday, wiping out 2019’s gains via its biggest intraday ...

World News Briefing

6) Boris Johnson Finally Gets to Put His Brexit Deal to the Vote

(Bloomberg) -- Prime Minister Boris Johnson will find out Tuesday evening whether he has any chance of getting his Brexit deal through Parliament -- and whether he can do it ahead of his Oct. 31 deadline. Having twice been denied a vote on whether members of Parliament support his deal, Johnson has introduced the Withdrawal Agreement Bill, which would implement the deal in ...

7) Trudeau Overcomes Scandals to Win Second Term in Canada Election

(Bloomberg) -- Canadian Prime Minister Justin Trudeau won a second term in national elections, displaying once again a remarkable ability to overcome scandal and controversy to remain in power. Trudeau’s Liberal Party won or was leading in 155 of Canada’s 338 electoral districts, losing his majority in parliament but gaining enough seats to secure a stable government with ...

8) Democrats Seek Insider Trading Probe After ‘Trump Chaos’ Article

(Bloomberg) -- Democratic lawmakers are increasingly demanding that U.S. authorities investigate allegations raised in a recent magazine article that traders might be using non-public government information to reap huge illegal profits, even as the exchange where the transactions purportedly took place called the story “patently false.” In a Monday letter, 14 Democratic senators urged the heads of the Justice Department, FBI, ...

9) Latin American ‘Oasis’ Shaken by Worst Unrest Since Dictatorship

(Bloomberg) -- Just weeks before the worst civil unrest since Chile returned to democracy 29 years ago, President Sebastian Pinera described the country as “a true oasis” amid Latin American turmoil. The billionaire investor-turned-politician isn’t alone in his glowing assessment of a country that regularly tops regional prosperity metrics. However, the deadly upheaval of ...

10) Juul Spent Record $1.2 Million Lobbying as Regulators Stepped Up

(Bloomberg) -- Juul Labs Inc. spent a record $1.2 million on federal lobbying during the third quarter as the largest U.S. e-cigarette maker faced threats that many of its products would be banned following an increase in lung illnesses linked to vaping. The company’s lobbying spending during the three months ending Sept. 30 more than doubled from $560,000 in the same ...

Bonds

11) Chinese Luxury Giant’s Troubled Bonds Rally on Debt Cut Plan

(Bloomberg) -- Dollar bonds of Chinese luxury clothing giant Shandong Ruyi Technology Group Co. extended a rally amid plans by the company to reduce some of its debt burden. Shandong Ruyi plans to buy back some of its dollar bonds at an “appropriate time”, Su Xiao, president of Ruyi Holding Group, a shareholder, said at an investor meeting held in Hong Kong on Monday. This ...

12) Treasury Futures Steady, Cash Markets Closed For Japan Holiday

(Bloomberg) -- Treasury futures flat from the open after sliding on Monday on weakness in gilts and with S&P 500 hitting 3,000 amid positive signs on trade talks. Cash USTs and JGB markets closed in Asia due to holiday in Japan. Large Aussie government bonds redemption may continue to support front-end.

- Cash USTs to open at 7am London. U.S. supply kicks off Tuesday with new 2-year for $40b ...

13) Citadel Securities Hires Citigroup’s Wang for Treasuries

(Bloomberg) -- Citadel Securities hired Citigroup Inc.’s Kelly Wang to spearhead fixed-income sales from Hong Kong as billionaire Ken Griffin’s market-making behemoth further expands its Treasuries trading reach in Asia. Wang spent over six years as Citigroup, most recently as head of greater China investor foreign-exchange sales in Hong Kong. Prior to that she worked at ...

14) JPMorgan Warns U.S. Money-Market Stress to Get Much Worse

(Bloomberg) -- JPMorgan Chase & Co. says the money-market stress that sent short-term borrowing rates surging last month is likely to get much worse despite the Federal Reserve’s attempts to inject billions of dollars into the financial system. The Fed has offered overnight loans and started buying up to $60 billion of U.S. Treasury bills a month in an effort to ease ...

15) Currencies Mixed as Trump Trade Comments Weighed: Inside Asia

(Bloomberg) -- Emerging Asian currencies consolidated after recent gains as investors wait on details from U.S.-China trade talks.

- President Donald Trump said China has indicated that negotiations over an initial trade deal are advancing, raising expectations the nations’ leaders could sign an agreement at a meeting next month in Chile

- China’s central bank added 250 billion yuan ($35 billion) into the banking system, the ...

16) Emerging Markets Are Next ‘Asset Bubble’ Amid Yield Hunt, Debt

(Bloomberg) -- A look at the price action and you’d be forgiven for thinking all was well in emerging markets. Far from it. While indexes of stocks, bonds and currencies hover around their strongest levels since early August, political crises from Ecuador and Argentina to Turkey, South Africa and -- most recently -- Chile and Lebanon ...

Central Banks

17) PBOC Injects Largest Amount in Open Market Operation Since May

(Bloomberg) -- The People’s Bank of China will inject 250b yuan into the banking system using 7-day reverse repurchase agreements, according two traders at primary dealers.

- The net injection of 250b yuan in open market operation is the largest amount since May 29: Bloomberg calculation

- PBOC gauges demand for 7-day, 14-day, 28-day and 63-day reverse repos for Oct. 23, ...

18) Bonds at Risk as Central Banks Eye End to Easing: Markets Live

19) Hungary to Hold Policy in Wait for CPI Trend: Decision Day Guide

(Bloomberg) -- Hungary’s central bank will probably stay put after a modest easing step last month, as a slowing world economy tempers the impact of a tight labor market. The Monetary Council is set to keep its overnight-deposit interest rate and the base rate at -0.05% and 0.9% respectively, according to a Bloomberg survey. With rate setters in a self-defined “data-driven” ...

20) Three Words, 11 Million Jobs: Draghi’s Euro-Area Economic Legacy

(Bloomberg) -- Three words -- whatever it takes -- defined Mario Draghi’s time as European Central Bank president, but he’s prouder of another number: 11 million jobs. Hardly a public appearance goes by without Draghi mentioning employment growth in the euro zone as a justification for the extraordinary monetary stimulus he’s pushed through since 2011. ...

21) GERMANY INSIGHT: Trouble Ahead as Economy Skirts With Recession

(Bloomberg Economics) -- Growth has slumped in Germany reflecting a turn in the global investment cycle, a lack of clarity over global trade and turmoil in the autos industry. Leading indicators suggest 2020 will begin on a weak footing and the risk is of a deeper downturn. If U.S.-EU trade negotiations flounder, Germany would take a big hit -- a recession worthy of the name could be unavoidable. ...

22) [Delayed] European Daily Focus: Tuesday, 15th October 2019

Abstract: TOP STORIES COCA-COLA EUROPEAN PARTNERS (CCEP.N) - Proving growth is sustainable Andrea Pistacchi: Tgt EUR62.00 to EUR65.00. Last Close EUR56.51, Buy. The soft drinks space in Europe is vibrant and innovation in the Coke ...

Economic News

23) Political Risk Revived in Latin America as Protests Spread

(Bloomberg) -- Latin America, the traditional poster child for political risk in financial markets, is back as a source of concern for investors. Chilean President Sebastian Pinera on Saturday became the second leader this month to declare a state of emergency, his hand forced by violent protests in South America’s wealthiest country after an increase in transportation ...

24) RBI Easing, Tax Cuts to Bring India’s 2020 Recovery : Economics

(Bloomberg Economics) -- India’s growth recovery, which has been a long time coming, finally seems to be around the corner. By next year, the economy should see rising rural incomes, better transmission of central bank’s easing, and higher post-tax corporate profit. Combined, these should aid a revival of consumer and investor sentiment. The turnaround in the economy is likely to show up from the October-December quarter, ...

25) Taxing the Rich to Fund Welfare Is Nobel Winner’s Growth Mantra

(Bloomberg) -- How do you spur demand in an economy? By raising taxes, not cutting them, says this year’s winner of the Nobel prize for economics. Reducing taxes to boost investment is a myth spread by businesses, says Abhijit Banerjee, who won the prize along with Esther Duflo of the Massachusetts Institute of Technology and Michael Kremer of Harvard University for their ...

26) Riksbank to Cling to Hiking Plan in Bet Recession Will Be Dodged

(Bloomberg) -- Swedish central bank policy makers are intent on leaving negative interest rates behind after almost half a decade. But faced with a barrage of bad economic data, Governor Stefan Ingves and his colleagues will on Thursday likely delay a plan to tighten at the turn of the year further into 2020. They’re betting the largest Nordic economy will avoid an outright recession as the Federal ...

27) GM Workers at Tennessee Plant Narrowly Reject UAW Contract Deal

(Bloomberg) -- United Auto Workers members at a General Motors Co. plant near Nashville, Tennessee narrowly gave a thumbs down on a proposed contract to end a more than five-week old strike — an early indication that rank-and-file approval of the tentative deal could be close. In one of the first votes by a major union local, the Spring Hill assembly’s 3,300 unionized ...

European Central Bank

28) 11 Million Jobs May Be Draghi’s Euro-Area Economic Legacy: Chart

(Bloomberg) -- Three words -- whatever it takes -- defined Mario Draghi’s time as European Central Bank president, but he’s prouder of another number: 11 million jobs. Hardly a public appearance goes by without Draghi mentioning employment growth in the euro zone as a justification for the extraordinary monetary stimulus he’s pushed through since 2011. The focus on jobs might be understandable given that, ...

29) ECB Added Three New Securities to CSPP Last Week

(Bloomberg) -- The ECB added three new securities to its CSPP program during the week ended Oct. 18, according to central bank data analyzed by Bloomberg.

- Four securities were removed and the value of the CSPP portfolio decreased by EU6m, at amortized cost

New Holdings Removed Holdings

- CSPP ISINs as determined by Bloomberg using ECB website data at 2:45am London on October ...

30) Draghi’s Homeland Among Worst on Growth During His Term: Map

(Bloomberg) -- When analyzing the economic successes and failures of Mario Draghi’s eight-year term as European Central Bank president, regional differences are striking. Aside from Greece and Cyprus -- both deeply scarred after years of austerity and a near-collapse of their financial system -- no country has done worse than Draghi’s native Italy in terms of total output per head.

31) Draghi: the Words and Actions Which Defined His Tenure (Video)

32) ECB's QE Restart to Require More Private Debt Buying

(Bloomberg Intelligence) -- The European Central Bank is running low on sovereign bonds to buy -- that undermines the credibility of its pledge to keep going until inflation picks up. The easiest way to ensure the program can run without changing its self-imposed guidelines is to lean more heavily on private debt. If inflation takes two years to firm, the ECB could face a shortage of about 60 billion euros in debt during the ...

Federal Reserve

33) Federal Reserve ‘the Largest Driver’ of Mortgage Weakness: Pimco

(Bloomberg) -- The Federal Reserve is ‘the largest driver” of weakness in the MBS market, Pimco’s Mike Cudzil and Dan Hyman wrote in a blog post.

- Since October 2017 the central bank has been allowing MBS on its balance sheet to run off at a maximum of $20b/month

- Should it end this process and reinvest the roll off proceeds back into MBS, it would benefit homeowners, buyers ...

34) Fed’s Bowman Says Central Banks Should Lead Push for Diversity

(Bloomberg) -- Federal Reserve Governor Michelle Bowman says central banks have a responsibility to be leaders in increasing diversity and inclusion in the fields of economics and finance.

- Bowman delivers pre-recorded closing remarks to a joint Bank of England, Federal Reserve Board and European Central Bank conference on gender and career progression in Frankfurt

- Bowman doesn’t comment on monetary policy or her outlook for the U.S. economy in the ...

(Business Insider)

- Money market stress isn't likely to be calmed by recent Federal Reserve capital injections, and will likely get worse through the end of the year, JPMorgan Chase analysts wrote.

- The Federal Reserve began monthly purchases of $60 billion worth of Treasurys, but the capital will likely remain with primary lenders when non-primary firms are the ones that need it most, the ...

36) U.S. Prime-Age Worker Wage Growth Is Welcome Sign for Fed: Chart

(Bloomberg) -- The American consumer remains king of an economy that received another piece of bad news last week on the manufacturing front. A look at full-time prime-age workers’ earnings helps explain why. The labor market’s tightening is generating faster wage growth, with minorities enjoying the largest year-over-year pay improvements. Such increases are likely to be welcomed by Federal Reserve policy ...

First Word FX News Foreign Exchange

37) Hedge Funds Use Brexit Delay to Top Up Option Cover, Traders Say

(Bloomberg) -- Hedge funds have been using the delay in a planned Brexit vote by the U.K. parliament to load up on topside cover as their conviction that there will be a deal increases, Asia-based FX traders say.

- Many funds are carrying large long gamma positions via call spreads and outright calls should spot GBP/USD rise between 1.31 and 1.34

- GBP/USD options with a combined notional face value of GBP2.46b at strike 1.3150 expire ...

38) Benchmark Bonds Decline on RBI Stock Switch: Inside India

(Bloomberg) -- Benchmark sovereign bonds drop as govt is set to switch 200b rupees of shorter debt to longer tenor paper via an auction. Rupee gains most among Asian peers after an extended weekend.

- Govt to switch 200b rupees of bonds to 6.45% 2029 debt via auction on Oct. 24

- RBI’s monetary policy minutes released late Friday was unanimous in keeping rates lower for longer ...

39) Cautious Optimism Supports Holiday-Thinned Stocks: Macro Squawk

(Bloomberg) -- S&P futures inch 0.2% higher as most Asian indexes gain; Kospi jumps 1.2%, ASX 200 index 0.4% stronger. T-note futures flatline with cash Treasuries closed for Japan holiday; Aussie curve bear steepens after 10-year yield adds 3bps. Bloomberg dollar index hovers near three-month low; kiwi extends recent outperformance, loonie little changed after Canada election. Yuan marginally softer after PBOC injects 250b yuan ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Bloomberg Bond News Summary > Mon Oct 14th

Business Briefing

1) Tencent Airs Two NBA Games as Chinese State TV Blackout Persists

Tencent Holdings Ltd. live-streamed two National Basketball Association games played outside of China Monday, even as the nation’s top broadcaster shuns the league because of a controversy around Hong Kong’s pro-democracy movement. The Chinese social media giant aired a game between the Chicago Bulls and Toronto Raptors and another between Maccabi Tel Aviv ...

2) Ecuador Reverses Fuel Price Hikes After Eleven Days of Violence

Ecuador will reverse the fuel price rises which triggered nearly two weeks of violent unrest, while the leaders of the nation’s indigenous organizations called off protests which have paralyzed swathes of the country. The government of President Lenin Moreno agreed to repeal its Oct. 1 decree to end subsidies on diesel and gasoline, said Arnaud Peral, a UN ...

3) Assad’s Forces Move North Amid Turkish Incursion: Syria Update

Syria said forces loyal to President Bashar al-Assad deployed northward on Sunday in response to Turkish troop movements. President Donald Trump said the U.S. is ready to impose sanctions if Turkey does anything off-limits in its cross-border operation in northeastern Syria. The Turkish army captured Tal Abyad, a strategic town, while reaching its target of ...

4) WeWork Is Said to Weigh Bailout That Hands Control to SoftBank

WeWork is considering a bailout that will hand control of the co-working giant to SoftBank Group Corp., according to a person familiar with the matter, one of two main options to rescue the once high-flying startup. The Japanese investment powerhouse controlled by billionaire Masayoshi Son is convinced it can turn around the cash-strapped American company ...

5) Santos Targets Asia LNG Growth With $1.4 Billion Conoco Deal

Santos Ltd. agreed to buy ConocoPhillips’ northern Australia business for $1.4 billion in a deal that will boost the Adelaide-based oil and gas producer’s position in the growing Asian liquefied natural gas market. The transaction may allow Santos to become the country’s largest independent energy producer and capitalize on a push by Asian consumers, ...

World News Briefing

6) Johnson Stumbles in Bid for Brexit Deal as EU Demands Answers

Boris Johnson’s attempt to secure a Brexit deal ran into trouble after the European Union warned the talks were still a long way from a breakthrough and the British prime minister’s political allies distanced themselves from his plans. The pound fell. After a weekend of intensive negotiations in Brussels, the EU’s chief Brexit negotiator, Michel Barnier, ...

7) Trump Says ‘Ready to Go’ on Turkey Sanctions as Troops Leave

President Donald Trump said the U.S. is “ready to go” with more sanctions on Turkey in response to its incursion into Syria, after his defense secretary said the president ordered a deliberate withdrawal of troops from northern Syria to keep them out of harm’s way. Trump said in a Sunday tweet that he’s dealing with Republican Senator Lindsey Graham of South ...

8) Hong Kong Police Officer Slashed in Neck as Violence Continues

A Hong Kong police officer was slashed in the neck by a protester as clashes continued following an escalation of violence earlier this month in demonstrations that began in June. Demonstrators spread out across 18 districts on Sunday in scattered, pop-up protests to pressure the government to meet their remaining demands, including the right to choose and ...

9) As One Massive Blackout Ends, California Is Bracing for Next

An unprecedented blackout that plunged millions of Californians into the darkness for days is over. And nobody can say when the next will hit. Even as PG&E Corp. declared an end to last week’s shutoffs -- a deliberate move to keep power lines from sparking the kind of blazes that forced the utility into bankruptcy -- ...

10) Video of Fake Trump Shooting Media, Critics Shown at His Resort

(New York Times) -- WASHINGTON — A video depicting a macabre scene of a fake President Trump shooting, stabbing and brutally assaulting members of the news media and his political opponents was shown at a conference for his supporters at his Miami resort last week, according to footage obtained by The New York Times. Several of Mr. Trump’s top surrogates — including his son Donald Trump Jr., his former ...

Bonds

11) Looming Rate Cut, Foreign Inflows, Belie Weakness in Korea Bonds

Huge foreign inflows into South Korean bonds belie returns that are among the lowest in Asia -- and an expected interest rate cut by the central bank may not be enough to change the picture anytime soon. Despite a consumer price index that’s dropped below zero, most economists see the Bank of Korea standing pat after a likely reduction in benchmark borrowing ...

12) Treasury Futures Gain, Dip Buying Emerges in Aussie Bonds

Treasury futures tick higher as yen climbs and S&P E-mini futures unwind initial gains. Volumes are low with cash markets closed. Aussie bond futures rise amid heavy volumes, suggesting appetite to buy the dip after yields rose at the open while long-end remains supported.

- UST yields implied by futures are around 1bp lower across the curve. Futures volumes ...

13) Singapore’s Central Bankers Know Something We Don’t: Daniel Moss

Singapore offers a small ray of light in a faltering global economy. The country that's so intimately tied to the rhythms of global commerce dodged a recession in the third quarter, figures Monday showed. Singapore simultaneously eased monetary policy, the first such step since 2016, as anticipated. That it did so cautiously suggests at least some of the ...

14) LEBANON INSIGHT: Doomsday Clock Ticking Louder for Currency Peg

(Bloomberg Economics) -- Lebanon is flashing red. Average dollar yields have almost doubled since February and are well into distressed territory. Financial markets are right to be worried -- the country could deplete its international reserves within 10-24 months if it doesn’t get financial support from the Gulf.

- The peg between Lebanon’s pound and the dollar is under threat: international reserves can ...

15) U.S.-China Trade Deal: JPM Sees Stocks Upside, BofA Watches Yuan

The U.S. and China agreed Friday to the contours of a partial trade deal that Presidents Donald Trump and Xi Jinping could sign as soon as next month, but there’s still a lot for investors to chew on. Questions remain on everything from whether the deal will actually be completed to the import taxes on all remaining Chinese shipments due to start Dec. 15. ...

16) Money Market Funds Still Pay a Pretty Decent Yield: Macro View

Stocks are struggling to reclaim their highs. Bonds are looking blah. A lot is probably priced into markets: Brexit, slowing global growth, a Fed rate cut this month, a partial trade deal -- all things we’ve been talking about for weeks or months. One place to look now: money market funds.

- By some measures, the flight to safety is in full swing. Commercial bank holdings of ...

Central Banks

17) Pound Slides From Three-Month High on EU Warning: Inside G-10

The pound dropped from a three-month high after European Union negotiators said U.K. Prime Minister Boris Johnson’s plans were not yet good enough to form the basis of an exit agreement.

- Sterling fell versus all its major peers after Chief EU Brexit negotiator Michel Barnier was said to have briefed the bloc’s government envoys that the U.K.’s proposals were ...

18) EM Review: U.S-China Trade Accord Halts Three-Week Stock Decline

Emerging-market stocks halted a three-week slide last week and currencies rose as the U.S. and China agreed on the outline of a partial trade accord. As part of the deal, China will significantly step up purchases of U.S. agricultural commodities, while the U.S. will delay a tariff increase due this week. President Donald Trump said the deal was the first phase of a broader agreement. ...

19) Sizzling Onion Prices Unlikely to Alter India’s Easy Rate Cycle

A more than 200% surge in onion prices is expected to push India’s headline inflation rate to its highest level in more than a year, but is unlikely to keep Asia’s most aggressive rate cutter from further easing monetary policy. The price-spike is likely to add at least 30 basis points to September’s headline inflation. A Bloomberg survey ahead of a report ...

20) Finance Chiefs Head to IMF Amid Slowdown Concerns: Economy Week

The guardians of the world economy head to Washington this week under the cloud of a slowing world economy. The annual meetings of the International Monetary Fund and World Bank kick off with the new leaders of both expressing concern over the outlook. IMF Managing Director Kristalina Georgieva is already hinting her economists will on Tuesday cut their ...

21) China’s Daily Yuan Fixing Hasn’t Been This Steady Since 2011

China’s central bank is continuing to keep its yuan fix flat as signs of progress emerge in trade talks with the U.S., with strategists divided on how the currency will fare. The People’s Bank of China set the daily reference rate around 7.073 per dollar for a fifteenth straight trading day on Monday, pushing the fixing’s 10-day volatility to the lowest since ...

Economic News

22) Is the World Economy Sliding Into First Recession Since 2009?

The global economy is wobbling and whether it topples over is the big question in financial markets, executive suites and the corridors of power. Investors cheered Friday as the U.S. struck a partial trade agreement with China and there were even signs the U.K. may strike a divorce deal with the European Union. But the debate over how close the world is to ...

23) Singapore Central Bank Signals More Easing as Growth Risks Mount

Singapore’s central bank signaled it’s ready to adjust monetary policy further after easing Monday for the first time since 2016 as risks to the economic growth outlook persist. The Monetary Authority of Singapore, which uses the exchange rate as its main policy tool, reduced “slightly the rate of appreciation” of the currency band and said it’s prepared to ...

24) Finance Chiefs Head to IMF Amid Slowdown: Economy Week

The guardians of the world economy head to Washington this week under the cloud of a slowing world economy. The annual meetings of the International Monetary Fund and World Bank kick off with the new leaders of both expressing concern over the outlook. IMF Managing Director Kristalina Georgieva is already hinting her economists will on Tuesday cut their ...

25) China Trade Slumps, Mini-Deal Yet to Lift Outlook: Economics

(Bloomberg Economics) -- China’s September trade data showed greater contractions as the U.S. imposed further tariffs on Chinese exports from the month. Both exports and imports undershot expectations. The ‘phase one deal’ between the U.S. and China raises hopes for a de-escalation in the trade war, but doesn’t materially change China’s trade outlook yet.

- Exports fell 3.2% year-on-year in September, bigger than the 1.0% drop in August. This was ...

26) China’s Imports, Exports Both Worse Than Expected in September

China’s exports and imports shrank more than expected in September, as existing U.S. tariffs and the ongoing slowdown in global trade combined to undercut demand. Exports decreased 3.2% in dollar terms from a year earlier while imports declined 8.5%, leaving a trade surplus of $39.65 billion, the customs administration said Monday. Economists had forecast ...

European Central Bank

27) ECB’s Holzmann Says Draghi’s QE Policy Is Counterproductive

Several members of the European Central Bank’s Governing Council are against the ECB buying more bonds, the Austrian central bank Governor Robert Holzmann said. “The view was that the attempt to inject even more liquidity isn’t good, even counterproductive,” Holzmann told Austrian public TV broadcaster ORF in an interview. “Several governors didn’t consider ...

28) Jean-Claude Trichet Mario Draghi critics [...]

Preview text not available for this story.

29) Draghi's critics are misguided

Preview text not available for this story.

4-hour timeframe Amplitude of the last 5 days (high-low): 43p - 39p - 55p - 37p - 64p. Average volatility over the past 5 days: 48p (average). The European currency in the confrontation with the US dollar ended the week of October 7-11, relatively calmly, with an increase, but not too strong. In total, the bulls managed to push the pair away from two-year lows by almost 200 points. Yes, this is not ...

As Mario Draghi’s tenure at the helm of the ECB draws to a close, he becomes (slightly) more pointed and looser with his public statements. On Friday (October 11, 2019), he gave a speech – Policymaking, responsibility and uncertainty – at the Università Cattolica in Milan on the occasion of receiving the Laurea Honoris Causa (honorary degree). He broadened the scope of his policy ambit by saying ...

Federal Reserve

32) Yield Curve Flips to Positive Again. Celebrate?: John Authers

To get John Authers' newsletter delivered directly to your inbox, sign up here. A real scientist has some big advantages over economists and investors. None is bigger than the ability to conduct a controlled experiment — hold all other variables equal and see what happens when one is changed. Such an experiment would have been very useful at the end of last week when several things ...

33) Risk Appetite Diminishing as Trade Woes, Recession Worries Bite

(Bloomberg Intelligence) -- Growing fears of a U.S. recession and the nation's ongoing trade woes with China are suppressing the appetite for risk. Global crude is the worst-performing asset, while energy stocks on MSCI Asia Pacific lag constituent peers.

Real Time Economics

@WSJecon

Minneapolis Fed leader Neel Kashkari said the time has probably passed for to use a supersize rate cut to boost the economy, but he remains on board with the idea that cheaper borrowing costs are still warranted on.wsj.com/2pkY8II

Sent via SocialFlow. View original tweet.

35) Fed New York: Repo and Reverse Repo Operations - 2019-10-14 - XML

First Word FX News Foreign Exchange

36) China Sept. Exports -0.7% Y/y in Yuan Terms; Est. 1.5%

China customs administration announces data in yuan terms in statement; median est. +1.5% y/y (range -0.1% to +1.6%, 4 economists).

- Sept. imports dropped 6.2% y/y; median est. -2.3% (range -3.8% to -1.4%, 4 economists)

- Customs didn’t give Sept. trade balance figures in yuan

37) Trade Truce Welcome in Asia, EU Cools Brexit Hopes: Macro Squawk

Shanghai Composite jumps 1.4% and MSCI Asia ex-Japan index gains 1.2% as markets chew over U.S.-China trade progress; S&P futures edge up 0.3%. Onshore yuan strengthens 0.5% against the dollar and China’s 10-year yield hits three-month high. Bloomberg dollar index rises for first time in four days as cable retreats 0.5% after EU negotiators pour cold water on Boris Johnson’s Brexit proposals. ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Astor Ridge Rates Supply Calendar - Week of Oct 14-18

US holiday on Monday

Next week's US, EUR and UK Rates Supply Calendar.

> US sees 5yr TIPS

> GER, FRA and SPA busy with supply across the curve (SPA issues TBC)

> 10yr Gilts tap coming

More colour shortly…

M

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

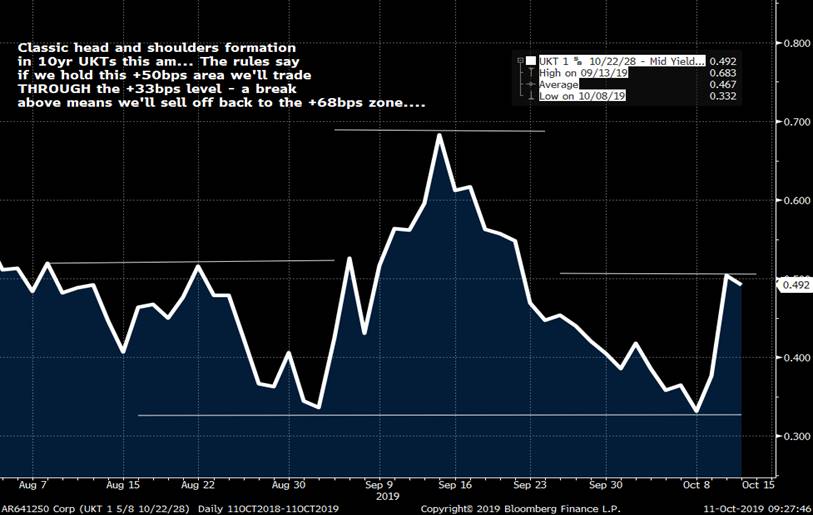

MICROCOSM: Chart Du Jour > 10yr GILTS Yield > Head & Shoulders

BIG level at 0.50%... M

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: G-10 Pessimism Persists > Quick News/Technicals

It’s getting pretty tough to get out of bed in the morning for us rates market folks. There’s no sugar-coating the news out of the US, China, UK and the central banks community – things look pretty lousy.

In the last 24hrs hopes of a breakthrough in the US-China talks this Thurs/Fri have been dashed with stories like these hitting the tapes:

The U.S. – China Relationship Is Swiftly Deteriorating by the Day

Only Donald Trump Can Save the Global Economy

U.S. Farms Face Long-Term Losses From Trump Trade War, BCG Warns

Then there’s the fiasco in London as the finger-pointing kicks off with a mere 22 days to go before the Brexit deadline:

Johnson steps up election preparations as hopes fade for Brexit

Tories face split over any no-deal election manifesto

Boris Johnson Plays a Shameless Game With Merkel

Irish PM Says ‘Very Difficult’ to Seal Brexit Deal Next Week

And now the FED’s talking about resuming purchases of T-bills – but it’s not QE! And the ECB’s a mess as Draghi’s tenure comes to a close…

Powell Sees Fed Resuming Balance-Sheet Growth, But It’s Not QE

Former Draghi Lieutenant Appeals for Calm in ECB Stimulus Row

Christine Lagarde Has a German Problem

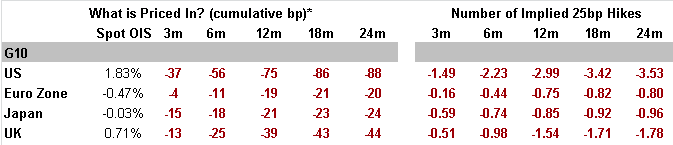

So, when we throw all of this rubbish into a blender, we get the following:

Which leaves us with:

What’s remarkable is, despite the rather depressing tone of the Brexit chatter, the betting lines continue to price in low odds of a no-deal Brexit.

Ostensibly, the market’s betting that there will be another extension of the deadline, despite Johnson’s assertions otherwise.

Brexit betting from betfair..surprisingly little change (7 Oct in brackets)

Article 50 to be revoked? 29% (28%)

No Deal Brexit in 2019? 18% (16%)

EU referendum before 2020? 1.5% (1.5%)

UK to Leave on or before 31 Oct 2019? 19% (20%)

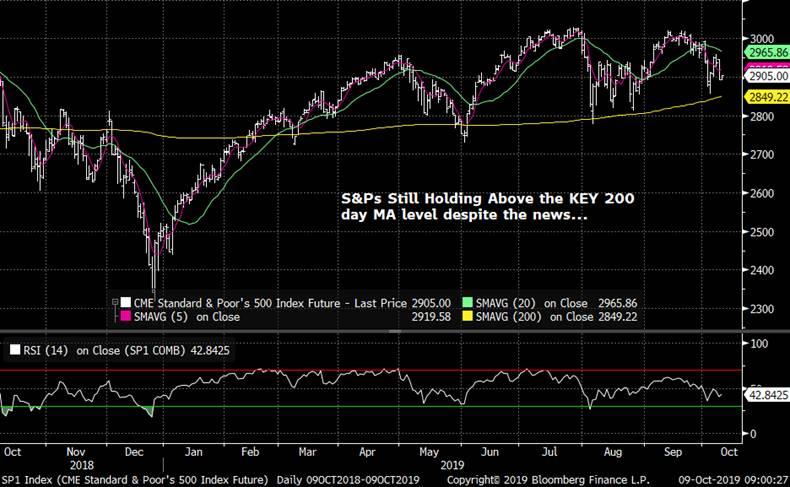

Stocks still defying gravity…

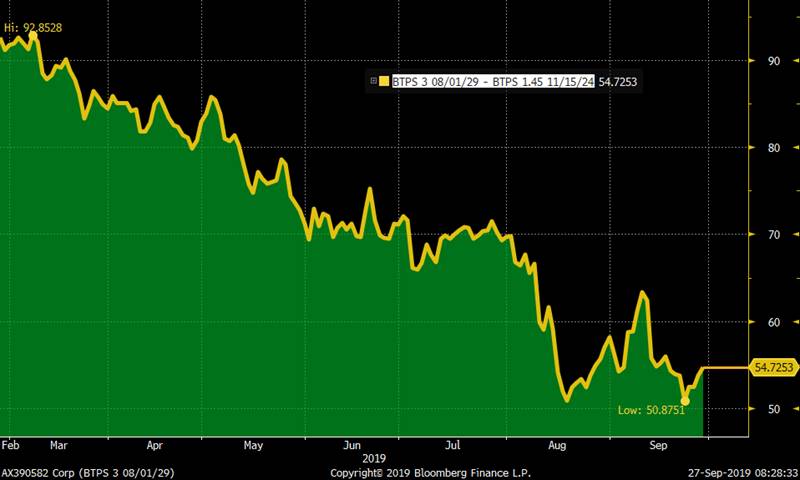

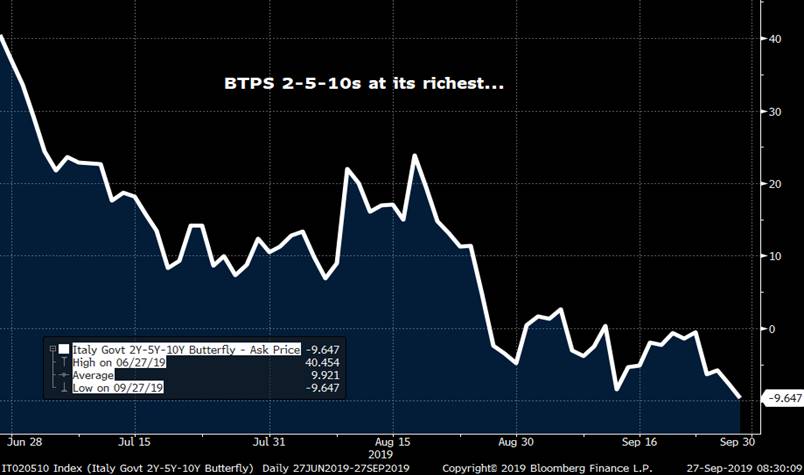

But BTPS remain at their richest level vs DBRs this year as ITRX pulls back…

More to come….!

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS - UKT 1H26s Repo - Our thoughts

Thanks to GW for pitching in on this one…

GILTS > UKT 1H26s Repo

> RV guys we talk to have been watching 1H26s repo levels like hawks over the last 3-4 weeks as the issue has shown '225-esrue' behaviour, trading at GC-25 or more at times.

> The issue is trading GC-20bps this am so, while still well through GC, it's the first sign that the issue may not vanish from the mkt.

> Given the decline in the float of the issue to £13.5bn after the Sep/Oct APF purchases some are suggesting this will present a major problem going fwd and accounts are loathe to be short these 26s.

> We'd counter this view with the following:

1) It's no coincidence that the 1H26s repo heated up over the last 3 weeks of the APF. You know why? It's because THE BOE CAN NOT BE FAILED to. If you sell an issue to them during the APF you'd better come up with the bonds.

2) Here are some actively traded issues that have smaller floats than the 26s and show little sign of repo value:

2T24 £10.9bn

4Q27 £7.7bn

4T30 £7.8bn (H0 CTD)

4H34 £12.75bn

4Q36 £12.9bn

1T49 £8bn (tap soon)

4Q55 £11.8bn

1F71 £9.2bn

3) The next APF is in Mar/Apr '20 where the 26s will likely feature again. However, by then the 0F25s will be at/close to the end of the cycle and a new 26s issue will be on the horizon. No scarcity of eligible issues for the APF in 3-7yr bucket.

4) Lastly, the 1H26s's repo bid has been a relatively new phenomenon, contrary to the perma-bid the 225s have had. This is a different situation which we see as unlikely to be repeated, even with the 1H26s' proximity to the 225s.

So, if you're long the 1H26s because you expect them to stay rich in repo, we'd suggest it's time to lighten up.

Thanks,

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

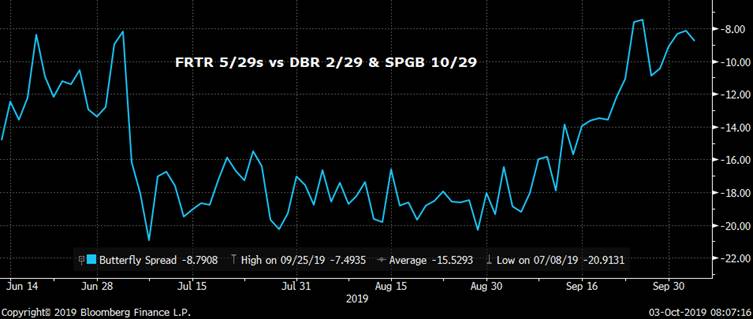

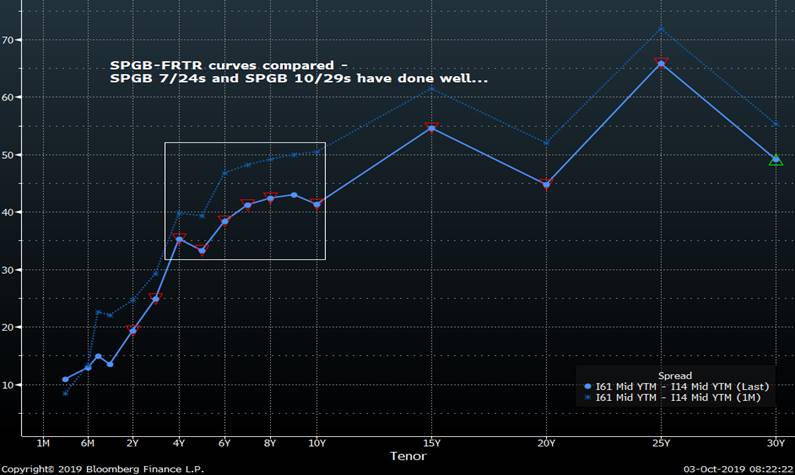

MICROCOSM: FRTRs and SPGBs > Busy Morning on Tap - Quick Charts

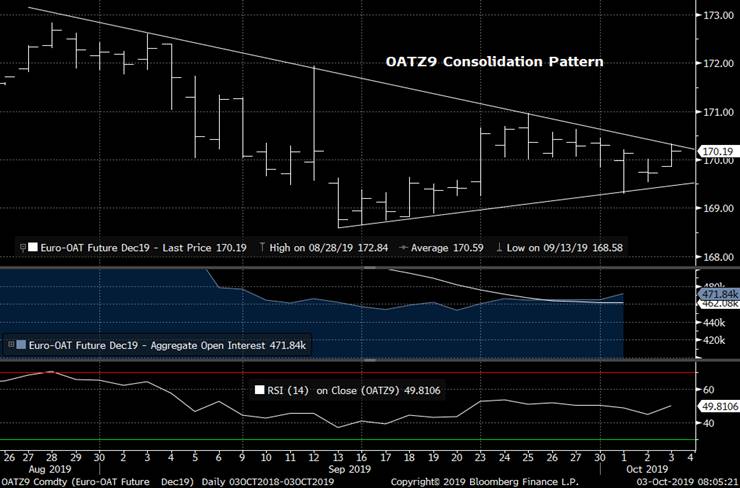

OATs/SPGBs Into Supply - Few charts for you:

- OATZ9 daily - pennant formation after a period of consolidation. Current levels are first resistance before 171.00 and support at 169.50 before 168.60 area.

- FRTR 5/29s vs DBR 2/29s and SPGB 10/29s... Here's a chart of the 1-2-1 fly for brevity's sake (s/b -1.1/2.0/-.9 but close enough) - shows OATs are back to the cheapest levels since June. Between Oct and Nov the OATs market will have 60bn in redemptions and ~25bn in cpns to digest.

- FRTR 5/26-5/29-5/34 fly – The 10yr sector has been trading on the cheap side of fair for the last couple weeks as the market anticipates a new 10yr. This should help attract some demand for this am’s new FRTR 11/29s (which have been trading around +4bps on the roll thus far).

- Spain has been grinding tighter vs DBR/FRTRs/NETHER, etc since their upgrade. One would think positioning is pretty long by now and with equities struggling to hold, we’re a tad concerned credit worries could surface, attracting profit taking sales. Check out this chart of the SPGB 4/26-10/29-7/33 fly – similar to the OATs one above. Looks like 10yr Spain is a tad richer, no?

- SPGB vs FRTR curves compared… Bull flattening in SPGBs more pronounced from 5-10s than in France…

We’ll be in touch…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS > UKT 1T37s Tap This AM and Last 15yr+ APF This PM... RV Colour

GILTS... 1T37 Tap & Last 15yr+ APF Today...

- Last Tuesday we sent out a note entitled 'Time to Start Buying UKT 1T37s' into this am's tap (see attached).

- Since then...

UKT 37-38s went from +3.4bp to +2.2bps this am

UKT 4Q27-1T37-4Q46 wtd fly richened from +1.9bps to +.8bps

UKT 4Q36 into 1T37 z-sprd flattened from +8 to +7.6bps

UKT 4H34-1T37-4Q46 fly (-.8/2.0/-1.2) has richened from +2.6bps to +1.0bps this am.

DESPITE these richening moves we still think there's further room for the 1T37s to richen from here.

1) 1T37s still have the best C&R on the curve.

2) Last week's 15yr+ APF operation saw selling of 38s and 39s which appear to have been shifted into 37s.

3) This is likely to be the last tap of the 1T37s before a new 20yr is announced.

4) Fiscal spending chatter should keep the 30yr point under pressure into Oct/Nov.

5) Nov syndication should be long-end conventional in our view.

6) Tomorrow's last 27-34s APF is likely to be the last hurrah for 34s in our view.

- The last 15yr+ APF is a crapshoot in our view. The RICHEST issues from the 4Q36s and longer are the 4H42s, 3Q44, 1T57s and 4 60. To date, none of these issues have featured at all in this 3T19 APF operation and with the 1T37s tap looming, there are several directions we could take: Sell MORE 47s>49s to raise some money to shift down the curve into 37s (and hope the curve doesn’t steepen much between 10:30am and 2:45pm); Sell more 38s and 39s, adding to last week’s totals; pre-empt the conventional syndication by dumping some 1F54s (even if they still look cheapish). Regardless of the direction the market takes, this is clearly the last time the market can dump a big chunk of UKTs DV01 onto the BoE before the Oct 31 Brexit deadline and the resumption of the DMO’s supply calendar.

Still like:

1) Selling 34s and 36s into 37s (yield flattener or boxed vs swaps)

2) Buy 37s vs .30 4Q27 and 11.7 X 46s... Still elevated given where 10y5y Sonia trades.

3) buy 1T37s vs 4Q36 & 4Q40 on 1-2-1 fly, Still cheap vs SONIA even with 1bp+ richening.

Charts below.

We’ll be in touch…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Bloomberg Bond News Summary >Tues Oct 1st

Business Briefing

1) Credit Suisse COO Bouee Resigns, Names James Walker COO

Story to follow

2) WeWork Bonds Hit Record Low After Company Pulls IPO Prospectus

WeWork bonds dropped to their lowest level on record Monday after the company said it’s formally withdrawing its prospectus for its initial public offering.

- The office-sharing company’s 7.875% notes due 2025 fell as much as 2.2 cents on the dollar to 85 cents, according to Trace

- At current level, bonds yield 11.3%

- NOTE: WeWork Puts ‘Official Pause’ on IPO to Focus on Core Business

3) Holiday Shoppers Weighing Carbon Footprint in Delivery Decisions

Mother Nature is figuring into consumers’ holiday spending plans this year. The environmental impact of fast-delivery options, which may include using planes and shipping multiple items separately, is a concern resonating with Americans, according to Accenture’s Annual Holiday Shopping Survey. Half of respondents said they’d choose options that leave a ...

4) Trump Allies Giuliani, Pompeo, Barr Drawn Into Impeachment Focus

Donald Trump’s personal lawyer, Rudy Giuliani, his Secretary of State Michael Pompeo and Attorney General William Barr were all drawn deeper into the House impeachment inquiry after new details of the administration’s foreign contacts emerged on Monday. Three House committees said they had subpoenaed Giuliani for records of his dealings with Ukraine on ...

5) U.S. Utility That Overcharged $380 Million Now Wants to Spend It

Dominion Energy Inc., the U.S. utility giant that came under fire a month ago for overcharging its customers by almost $380 million, wants to keep the money and spend it on grid upgrades. On late Monday, the Virginia power company proposed to use some of the extra cash to help install almost a million smart meters, create an online “customer information ...

World News Briefing

6) Xi Says China’s Rise Unstoppable in Face of Protests, Trade War

President Xi Jinping declared that no force could stop China’s rise, exuding confidence during a key anniversary as he faced unprecedented challenges from protesters in Hong Kong and Donald Trump’s trade war. Speaking at the start of grand parade marking 70 years since the founding of the People’s Republic, Xi called for stability in Hong Kong, unity among ...

7) Giuliani Subpoenaed by House Democrats in Impeachment Inquiry

President Donald Trump’s personal attorney Rudy Giuliani was subpoenaed for documents Monday by Democrats on the House Intelligence Committee, as the impeachment inquiry into the president accelerates. The Democratic chairmen of the House committees on foreign affairs, intelligence and oversight gave Giuliani a deadline of Oct. 15 to turn over documents he ...

8) Johnson Confronts Moment of Truth for U.K.’s Brexit Strategy

British Prime Minister Boris Johnson is facing the moment of truth for his Brexit strategy as he prepares to present his blueprint for a deal to the European Union in days. The reception his plan receives in Brussels and among pro-Brexit members of his ruling Conservative Party will determine whether there is any hope of securing an orderly exit for the U.K. ...

9) Tens of Thousands Take to Hong Kong Streets for Holiday Protests

Hong Kong pro-democracy protesters began gathering for a series of protests, including a march through the city center, hours after celebrations for a holiday marking 70 years of Communist rule in China began in Beijing. President Xi Jinping oversaw a military parade through the center of the capital that featured some of China’s most advanced weaponry, ...

10) Trump Taps FERC General Counsel for Republican Seat on Regulator

President Donald Trump has nominated the general counsel of the Federal Energy Regulatory Commission to one of two open seats on the panel, which oversees the U.S. power grid, approves utility mergers and grants permits for natural gas pipelines. If confirmed, James Danly, the general counsel, would fill the Republican slot on the commission, which has been ...

Bonds

11) Investors Binge on Record $308 Billion of Company Bond Sales

Companies globally sold a record amount of bonds in September as investors hungry for yield poured into debt, betting that major central banks can keep the global economy out of a recession and the worst can be avoided in the U.S.-China trade war. Firms from Apple Inc. to Japan’s SoftBank Group Corp. sold more than $308 billion of notes, the first time ever ...

12) Japan’s GPIF Positions Itself for More Foreign Debt Buying

The world’s biggest pension fund is giving itself leeway to buy billions of dollars more of bonds outside its home market, as negative rates in Japan drive down returns. Japan’s Government Pension Investment Fund will consider currency-hedged overseas bond holdings as similar to domestic debt investments, it said in a statement on Tuesday. This will allow ...

13) Indiabulls Seeks Earlier Hearing After Record Share Slide

Indiabulls Housing Finance Ltd., a major Indian shadow lender that’s caught in the crosshairs of the troubles plaguing the industry, is seeking to bring forward a court hearing on fraud allegations after a record share slide. The development represents an effort to get out ahead of recent headlines that contributed to its share price losing about 8% today ...

14) Bond Traders Sound Alarm in Japan With Weakest Auction in Years

Japan’s government bonds slid across the curve Tuesday following weak demand at a 10-year note sale amid concern the nation’s central bank and pension fund will cut purchases. Ten-year bond futures slumped as much as 0.76 yen to 154.26, triggering a margin call at the Japan Securities Clearing Corp. The auction drew the lowest bid-to-cover ratio since 2016 ...

15) Aussie Sinks as RBA Cements Bets for Further Easing: Inside G-10

Australia’s dollar fell against all its major peers after the Reserve Bank lowered interest rates and signaled it may ease again. The greenback climbed as mixed U.S. economic data cast doubt on the need for more rate cuts.

- Aussie dropped to a one-month low as option desks and macro funds sold the currency after the central bank said it’s prepared to ease ...

16) World’s Biggest Money Manager to Add Indian Bonds After Selloff

BlackRock Inc., the world’s largest money manager, plans to add to its holdings of Indian bonds, lured by one of the highest yields among emerging Asian nations and the promise of more monetary easing. “We are looking at some stabilization and would potentially look for adding exposure” after the risks from the likely increase in federal borrowings settle, Neeraj Seth ...

Central Banks

17) Australia Cuts Key Rate as Global Threats, Unemployment Rise

Australia’s central bank lowered interest rates for the third time this year as it tries to shield the economy from a slew of offshore risks, and signaled it may cut even further. Reserve Bank chief Philip Lowe reduced the cash rate by 25 basis points to 0.75%, as predicted by money markets and most economists, edging closer to a level where unconventional ...

18) Back to School: Program Offers Masters Degree in Central Banking

The work of central banking has become ever more complicated since the global financial crisis ushered in an era of unconventional policy tools a decade ago. Now the Kuala Lumpur-based Asia School of Business is launching a full-time Master of Central Banking degree to help meet the challenges. Aimed at mid-career central bank officials, the year-long residential program, slated to ...

19) Gloomier Japanese Manufacturers Unlikely to Move Needle at BOJ

Fears over the global economy and the impact of a sales tax have made Japanese manufacturers gloomier about business conditions, but not likely by enough to push the Bank of Japan closer to extra stimulus later this month. Confidence among the country’s biggest product makers, which include household names such as Toyota, Sony and Canon, fell to 5 from 7, ...

20) European Jobs Offer Some Joy Amid Manufacturing, Inflation Gloom

Europe’s job market is giving some hope to the region’s economic story, which has been dominated by a deepening slump in manufacturing that’s tipped Germany close to recession. Figures Monday showed the euro-area unemployment rate fell to 7.4% in August, the lowest in over 11 years. Italy reported an unexpected drop to 9.5% and Germany saw the number of people ...

21) RBA Cuts Key Rate to 0.75%, as Seen by Most Economists Surveyed

Reserve Bank of Australia announces policy decision in Melbourne Tuesday.

- Governor Philip Lowe: “It is reasonable to expect that an extended period of low interest rates will be required in Australia to reach full employment and achieve the inflation target. The Board will continue to monitor developments, including in the labour market, and is prepared to ...

22) TOPLive Starts: Follow Reserve Bank of Australia's Rate Decision

Economic News

23) Asia Factory Sentiment Remains Brittle Ahead of U.S.-China Talks

Manufacturing sentiment throughout Asia remained mostly bleak in September amid trade tensions and waning global demand. Purchasing manager indexes for South Korea, Japan, and Indonesia were still in contraction territory, with South Korea’s slipped by one point to 48. Elsewhere, the gauges largely lingered at subdued levels, with Taiwan proving to be the ...

24) Japan’s Abe Rolls the Dice on His Political Legacy With Tax Hike

Shinzo Abe will almost certainly become Japan’s longest-serving prime minister next month. Whether he’ll be remembered as a success could well hinge on how the country’s economy weathers what happens today. Legislation raising Japan’s sales tax to 10% from 8% took effect Tuesday, a long-planned step intended to help the government rein in the world’s largest ...

25) RBA Sees Economy Reaching ‘Gentle Turning Point’: TOPLive

26) India’s Big Fiscal Boost Leaves Many Questions Still Unanswered

India’s Finance Minister Nirmala Sitharaman has been announcing fiscal steps almost every week since August to help industries hit by the economy’s slowdown: from tax benefits for vehicle purchases to easing foreign investment rules. Yet while cheered by businesses, the moves have left investors with several unanswered questions and worries about the fiscal deficit ...

European Central Bank

27) Lane Blames Trade Unease as Key Factor for Slower Europe Growth

The euro area economy will keep expanding, though more slowly, as it’s held back in large measure by global trade uncertainty, according to the European Central Bank’s chief economist, Philip Lane. “For several quarters now, we have been facing a slowdown that can, in part, be ascribed to external factors,” Lane said in a speech in Los Angeles on Monday ...

28) EURO-AREA PREVIEW: Low Inflation to Support ECB’s Stimulus Plan

(Bloomberg Economics) -- Inflation in the euro-area will probably remain obstinately weak in September. The headline rate is likely to slip below 1%, lending support to the European Central Bank’s decision to restart bond purchases from November. The data has also taken on an added significance since the ECB chose in September to directly link its forward guidance to developments in realized inflation. ...

29) Draghi Says ECB Has Room to Do More, But Needs Fiscal Backup

European Central Bank President Mario Draghi said the institution can do more if needed to boost inflation, and repeated his call for euro-area governments to support this effort with fiscal spending. “All instruments from interest rates to asset purchases, to forward guidance are ready to be calibrated,” he told the Financial Times in an interview. He also ...

30) Lagarde Inherits ECB Tinged by Bitterness of Draghi Stimulus

When Christine Lagarde takes charge of the European Central Bank, she’ll inherit the policy disputes of her predecessors -- now with even deeper scars. The new president will have to confront the aftermath of an unprecedented revolt among officials over Mario Draghi’s plan to reactivate quantitative easing. In a move probably linked to that, Germany’s Sabine Lautenschlaeger ...

31) Draghi Calls for More Government Spending to Support Growth

Draghi was quoted Monday by the Financial Times as saying: ...

Federal Reserve

32) Bankers Advising Fed Board Describe Libra as a Monetary Threat

The Federal Reserve asked some of the nation’s biggest banks about Libra, the digital currency proposed by Facebook Inc., and the answer was simple: They don’t like it. “Facebook is potentially creating a digital monetary ecosystem outside of sanctioned financial markets -- or a ‘shadow banking’ system,” banks said, according to minutes of this month’s ...

33) U.S. Sept. Dallas Fed Manufacturing Outlook Survey (Table)

Following is a summary of Texas manufacturing activity from the Federal Reserve Bank of Dallas. Diffusion Index: Six Months From: To compare the Dallas Fed General Business Activity and ISM Manufacturing: see G ECO 64 <GO>. NOTE: Diffusion indexes represent the percentage of respondents indicating an increase ...

34) FastFT: US repo market pressure eases after Fed interventions

Preview text not available for this story.

35) Fed’s Williams Sees Need for More Reserves After Repo Spike (1)

New York Federal Reserve President John Williams said bank reserves will probably need to be higher in the future to limit the risk of money markets repeating their recent turmoil, the New York Times reported, citing an interview. “Despite there being a lot of reserves in the system, they weren’t moving around. They’re lumpy’’ Williams told the newspaper. “We ...

First Word FX News Foreign Exchange

36) Credit Suisse Says No Indication CEO Approved Khan Observation

Investigation by law firm Homburger found no indication that CEO Tidjane Thiam had approved the observation of star banker Iqbal Khan nor that he was aware of it before September 18, after observation was aborted, Credit Suisse says in statement.

- COO Pierre-Olivier Bouee resigns; to be succeeded by James Walker

- Bouee told investigation he alone initiated observation of Iqbal Khan; did not discuss it ...

37) Peru’s President Dissolves Congress as Opposition Cries Foul

President Martin Vizcarra dissolved Peru’s opposition-controlled Congress and called a parliamentary election after months of confrontation over anti-corruption measures boiled over. Vizcarra said Monday he used his constitutional right to dissolve Peru’s unicameral Congress after his cabinet lost a vote of confidence over the government’s bid to halt the ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.