MACROCOSM: Rates/FX/Equities Technicals Rundown

- We’re closing in on the end of Q3 of what’s been a fascinating year in the markets – rightly or wrongly! Politics and policy continue to drive the markets, the unpredictability this creates driving volatility that has created opportunities but also impaired liquidity and the economic outlook. As we head into Q4, here are the market’s primary focal points (in no particular order):

- TRUMP! “A trade deal with China is closer than you think!” Uh-huh. Impeachment imminent?

- Brexit’s just 35 days away and we still have no idea what the outcome will be.

- Boris Johnson’s been rebuked but soldiers on. Election soon?

- The ECB has kick started QE amid remarkable resistance and, as of this am, resignations. Fiscal stimulus on tap in Europe and UK?

- Economic momentum has plummeted in Europe, the UK’s been softening and the US holding on for dear life as Fed members say “No more rate cuts!”

- Equities continue to defy gravity – and logic – the S&P 500 lingering just off the all-time highs. Is this sustainable?

- The Euro’s sub-$1.10, Cable’s recent reversal looking ominous. Will Trump force intervention to weaken the USD?

- Corporates/credit issuance has been massive – where is this money going and is this leverage a worry if recession looms?

- Ratings upgrades in Europe driving further spread narrowing in Spain et al…

- Charts:

- It’s no mystery that Trump’s positive US-China trade tweets can help his ratings – see below.

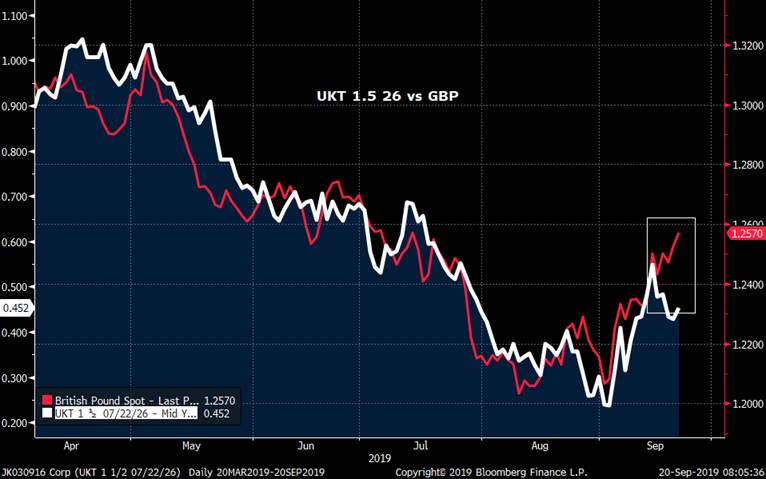

- Cable/Sonia continue to wax and wane with events in Parliament – the recent bounce failing at 50% retracement.

- Bull flattening across EGB curves in advance of QE as Mftg PMIs sink…

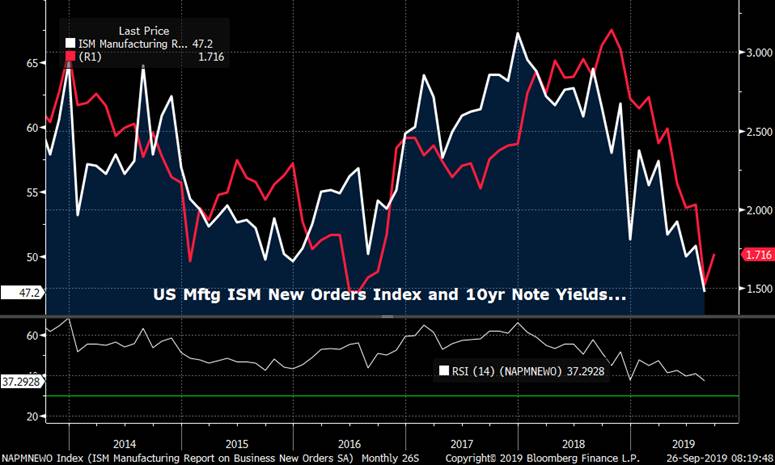

- UST 10yr yields and ISM Mftg New Orders… ‘What? Me Worry?’

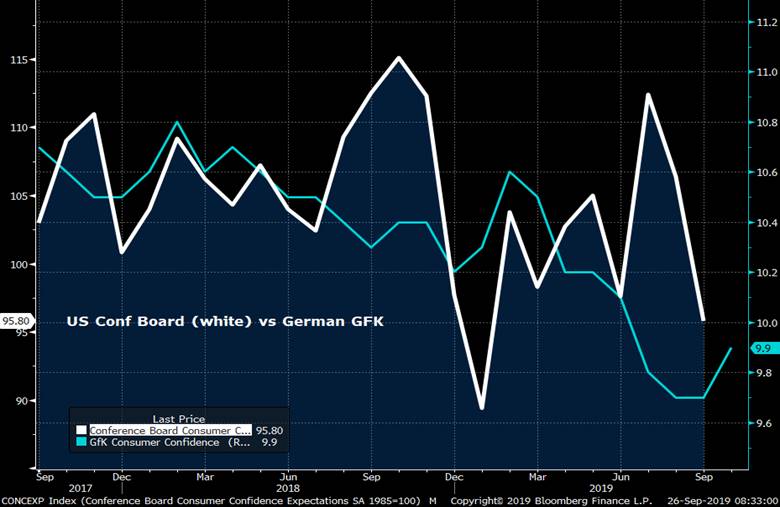

- Will the consumer save the day? Not so sure – German consumer confidence #s leading the US lower…

- ITRX Eur 10yr XOVER index has thundered tighter this year but the post-summer surge in issuance has brought in some spread widening. BTPS remain at their tightest speads, however, amid soft data that has bull flattened EGB curves.

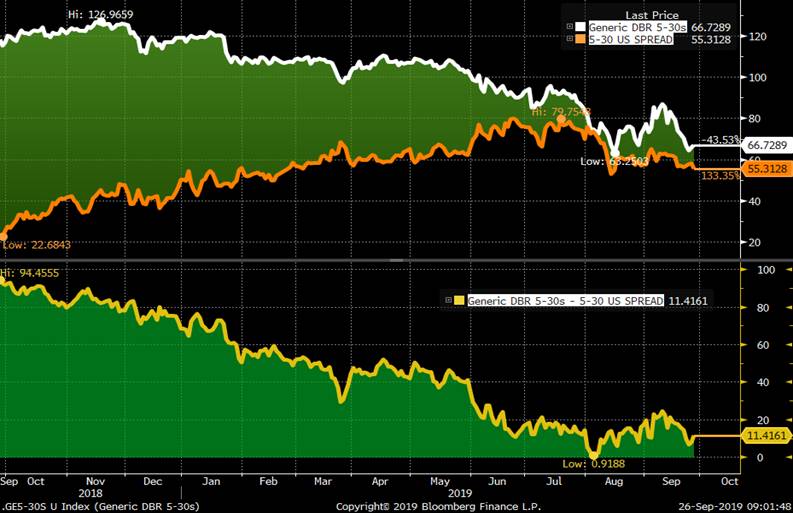

- A tale of two curves… Convergence between US and GER 5-30s curves has come from two different angles. What impact does the fiscal outlook have on this relationship?

More to come!

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Bloomberg Bond News Summary > Thu Sep 26th

Business Briefing

1) ABN Amro Investigated by Dutch Prosecutor

Bank subject to probe relating to requirements under the act on the prevention of money laundering and financing of terrorism.

- Will fully cooperate

- Statement

2) Attorney General Barr Seeks DOJ Facebook Antitrust Probe

The Justice Department intends to investigate Facebook Inc. after prodding from U.S. Attorney General William Barr, according to a person familiar with the matter, even though the Federal Trade Commission already has an inquiry underway. The social-media giant now faces parallel probes by two federal agencies over whether it has harmed competition in ...

3) Sabine Lautenschläger Resigns From ECB Board

Sabine Lautenschlager informs Mario Draghi that she will resign from her position as a member of the Executive Board and Governing Council of the European Central Bank on October 31, 2019.

- Lautenschlaeger’s eight-year term was scheduled to run through January 2022

Link to Statment: ECB: Sabine Lautenschläger resigns from ECB Board

4) U.S. Can Sanction Nearly $8 Bln of EU Goods Over Airbus Aid

The World Trade Organization will authorize the U.S. to impose tariffs on nearly $8 billion of European goods due to illegal state aid provided to aircraft maker Airbus SE, according to people familiar with the decision, a move that will likely trigger retaliatory measures from the European Union.

- The people asked not to be identified because the confidential WTO decision isn’t due to ...

5) EIA: Crude +2,412k Bbl, Median Est. -600

EIA inventory report also shows these changes for last week:

- Gasoline +519k vs est. -564k

- PADD 1B gasoline +1,758k

- Distillates -2,978k vs est. -400k

- PADD 1 Distillates -2,964k ...

World News Briefing

6) Trump’s Attempt to Talk His Way Out of Impeachment Backfires

Donald Trump tried to squelch the latest threat to his presidency with the release of a transcript of his call with Ukraine’s president. It’s a trick that’s worked for him before, allowing him to claim exoneration and take the attack to Democrats. Yet this time, the gambit backfired. Trump didn’t anticipate that, even in the absence of an explicit quid pro ...

7) Boris Johnson Comes Out Fighting and Demands a Brexit Election

Boris Johnson sparked uproar during angry exchanges in the House of Commons after he was dragged back to Parliament to explain why he broke the law and tried to suspend the legislature in the run-up to Brexit. The defiant premier refused to resign or even apologize. Instead, Johnson came out fighting. He challenged his political opponents to trigger an election through a no-confidence vote ...

8) Saudi Prince Says Khashoggi Murder Happened on His ‘Watch’: PBS

Saudi Crown Prince Mohammed Bin Salman said the murder of government critic and Washington Post columnist Jamal Khashoggi “happened under my watch,” but without his knowledge, Frontline PBS reported. “I get all the responsibility because it happened under my watch,” the prince was cited as saying in a documentary by PBS’s Frontline. ...

9) Schumer Wants Whistle-Blower Claim Released: Impeachment Update

House Democrats have launched an impeachment inquiry into President Donald Trump over his interactions with a foreign leader. The proceedings threaten to slow work in Washington on other crucial policy matters and overshadow the 2020 election. The White House Wednesday released a rough transcript of a call between the president and Ukraine President Volodymyr Zelenskiy that is at the center of the ...

10) Ericsson Expects to Pay $1 Billion in U.S. Corruption Probes (2)

Ericsson AB said it expects to pay $1 billion to resolve investigations by U.S. authorities into business ethics breaches in six countries including China in one of the costliest corruption cases on record. The Sweden-based telecommunications equipment maker has made a provision of 12 billion kronor ($1.2 billion), which will dent third-quarter earnings, it ...

Bonds

11) The Worst Asia Junk Bond Shows How Rapidly Fortunes Can Turn

Investors on a call in July with distressed Indonesia textile firm PT Delta Merlin Dunia Tekstil were confounded -- how could the company’s fortunes have turned so fast? They’re still searching for answers, in a case that’s revived concerns about a lack of transparency in corners of Asia’s credit markets. The saga has also highlighted risks of more scares ...

12) ‘Massive Snowball’ Effect to Spur China Bond Defaults Abroad

A record pace of defaults hit China’s domestic bonds this year. In 2020, it could be the offshore market’s turn. That’s because of a looming wall of dollar debt, issued by now-stressed borrowers, that comes to maturity. There’s $8.6 billion of offshore bonds coming due next year that currently have at least 15% yields -- classifying them as stressed, ...

13) BOJ Tapering Suggests Steeper Yield Curve Preferred to Rate Cut

For those looking to ascertain the Bank of Japan’s policy intent, the central bank’s bond purchases may be a more telling indicator than Governor Haruhiko Kuroda’s rhetoric on negative rates. That’s the view from Takenobu Nakashima, a senior rates strategist at Nomura Securities Co., after the monetary authority further cut buying of bonds in the key ...

14) Kiwi Gains as RBNZ Damps QE Policy Expectations: Inside G-10

The New Zealand dollar rose against all its major peers as traders trimmed bets for more easing after the central bank governor said interest-rate cuts are working.

- Funds covered short positions on the kiwi after Reserve Bank of New Zealand Governor Adrian Orr said he’s pleased with the outcome of an August rate cut. He also played down the need for ...

15) Yen is Weakening And Its Worst Quarter is Around the Corner

The yen looks set to end September as the worst-performing Group-of-10 currency. And those betting on a turnaround by the end of the year have the weight of history against them. The fourth quarter has proved a bane for yen bulls over the last decade, with the currency weakening an average 3.6%, and falling in seven out of 10 years. JPMorgan Chase & Co. ...

16) India Tax Cuts Make Rupee Carry Trade Returns More Lucrative

A $20 billion tax break is leading to gains in the Indian rupee, helping raise the allure of investing in the nation’s high-yielding assets with the money borrowed at lower interest rates overseas. The corporate tax reduction announced on Friday has spurred $374 million of inflows into Indian stocks in three days, and strengthened the rupee by 0.6% against ...

Central Banks

17) POLAND DAYBOOK: JSW, Monetary Policy, Energy Forum, Minutes

Current resources of Poland’s biggest coking coal producer aren’t enough to increase output to 18.2m tons in 2030 from 15m tons now, Dziennik Gazeta Prawna says, citing report by Polish Academy of Sciences and AGH university ordered by previous JSW mgmt. (Click here to subscribe to Poland Daybook)

- What to Watch

- 10am: OSG energy congress starts in Siedlce ...

18) HKMA Expects Some Virtual Banks to Start Service in 4Q: Yuen

Virtual banks are likely to start rolling out their services through soft launches in the fourth quarter, said Arthur Yuen, deputy chief executive of the Hong Kong Monetary Authority.

- The process is expected to be gradual, Yuen said Thursday at a banking conference in Hong Kong

- HKMA has not set a timeline for virtual banks’ commencement of business in response to ...

19) Rate Intrigue Returns to Egypt With Protests: Decision Day Guide

A rare bout of anti-government protests -- and fear of more to come -- is an unexpected hurdle in Egypt’s path toward lower interest rates. A surprise slowdown in inflation to its lowest level since 2013 should all but ensure that policy makers follow their first rate cut in six months with another on Thursday. But the market fallout from last weekend’s ...

20) BOJ Cuts Buying of Key 5-10 Year Bonds Fourth Time in Six Weeks

The Bank of Japan reduced purchases of bonds in the key five-to-10 year maturity zone, continuing to take steps to lift yields that have dropped past its targeted levels.

- The central bank offered to buy 350 billion yen ($3.3 billion) of the notes on Thursday, down from 380 billion yen at its previous regular operation

- This marks the fourth reduction in this sector in six weeks. Japan’s five-year yield ...

21) 20190924_BSC_Vietnam Daily Review_EN_Rebound session_TA_ SSI_ Positive signal

Future contracts: Future contracts decreased following VN30. Investors should prioritize selling and buying back with target price around 900 points for medium-term contracts. Covered warrants: In the trading session on September 24, 2019, the market was negative as the majority of coverred warrants decreased following downward movement of underlying securities. Trading volume decreased. MBB opearated around resistance level of 22. Liquidity remained below the 20-day average. MBB may have short-term downward correction in the coming sessions, creating downward pressure on its warrant in the coming sessions.

Technical analysis: SSI_ Positive signal ...

Economic News

22) Lautenschlaeger Resigns From ECB Executive Board in Shock Move

European Central Bank board member Sabine Lautenschlaeger unexpectedly resigned more than two years before her term ends, a shock move in the wake of unprecedented dissent over President Mario Draghi’s latest stimulus drive. While the ECB gave no reason for her departure, Lautenschlaeger had been one of the strongest opponents of the Governing Council’s ...

23) Chinese Economy Weakens Across the Board, Early Indicators Show

China’s economy continued on a slower trajectory in September, with weakness in manufacturing and retailing combining with the trade war to undercut growth. Bloomberg Economics’s gauge aggregating the earliest available indicators from financial markets and businesses showed the economy cooling for a fifth month, with indicators for trade, factory prices, and ...

24) What Do You Do With 24 Tons of Beetroot Stockpiled for Brexit?

To imagine the dilemma companies face when preparing for Brexit, think of 24 tons of beetroot. After the U.K.’s departure from the Europe was delayed in March, Nimisha Raja was forced to rent a chilled container to store the 20,000 kilogram mountain of the crimson vegetable she’d ordered in anticipation of disruption. “It was an absolute nightmare,” said the chief executive officer of snack producer Nim’s ...

25) Trump, Abe Ink Trade Deal as U.S. Withholds Auto Tariffs For Now

President Donald Trump and his Japanese counterpart Shinzo Abe touted a limited trade agreement on Wednesday, as the U.S. withdrew the threat of imposing auto tariffs on the Asian nation for now. Trump and Abe signed the “first stage” of an initial pact after meeting at the United Nations General Assembly in New York. In an emailed statement, the U.S. Trade ...

26) Orr Says RBNZ Pleased With Outcome of 50bp Rate Cut in August

Reserve Bank of New Zealand Governor Adrian Orr comments in speech posted on RBNZ website.

- On 50bp rate cut in August, says: “We are pleased with the outcome of our decision to date. Interest rates have declined across the board, as retail banks have passed lower lending rates to many businesses and consumers. The New Zealand dollar exchange rate also eased, ...

European Central Bank

27) Brussels Edition: Trade Woes, ECB Divisions, Compliant Italy

Welcome to the Brussels Edition, Bloomberg’s daily briefing on what matters most in the heart of the European Union. Sign up here to get it in your inbox every weekday morning. Transatlantic relations may be heading south fast. The World Trade Organization is poised next week to authorize the U.S. to impose tariffs on nearly $8 billion of European goods due ...

28) Italy’s Panetta Poised to Join ECB’s Top Panel Succeeding Coeure

Italian central banker Fabio Panetta is poised to replace Benoit Coeure as one of the European Central Bank’s top policy makers. The 60-year-old was the only name submitted for the post by Wednesday’s deadline, said Mario Centeno, who leads the group of euro-area finance ministers that will decide who joins the ECB’s six-member Executive Board. Panetta will ...

29) Italy Said to Propose Fabio Panetta for ECB Executive Board

Italy has proposed veteran central banker Fabio Panetta as its candidate to replace Benoit Coeure as one of the European Central Bank’s top policy makers, according to a government official familiar with the matter. The Italian finance ministry sent Panetta’s candidacy to Mario Centeno, who leads the group of euro-area finance chiefs that will decide who ...

30) ECB’s German board member quits over loose monetary policy

Preview text not available for this story.

31) AmBank Fixed Income Daily - 25 Sep 2019

Best regards, AmBank Research, AmBank (M) Berhad +603 2036 2255 (DL) +03 2031 7218 (Fax) Level 15, Bangunan AmBank Group, 55 Jalan Raja Chulan, 50200 Kuala Lumpur ...

Federal Reserve

32) Kaplan: Bond Markets Signaling Monetary Policy Needs Backup

Federal Reserve Bank of Dallas President Robert Kaplan said the message from debt markets around the world is that monetary policy isn’t going to be sufficient on its own to lift growth.

- “The marginal return in lowering the fed funds here has got diminishing returns. QE in the future may well have diminishing returns"

- Kaplan speaks at an event with business leaders in Dallas ...

33) Fed’s Evans, Often a Dove, Doesn’t See Need for Another Rate Cut

One of the Federal Reserve’s usually more dovish policy makers doesn’t see the need to cut interest rates again because two recent reductions should be enough to lift inflation above the central bank’s 2% target. “We’re pretty well positioned now to see how things play out from here,” Chicago Fed President Charles Evans said Wednesday in Lake Forest, ...

34) Fed’s Kaplan Sees Solid Growth Even Without China Trade Deal

“The trade deal with China by itself -- I think even if we didn’t make one we could still have solid economic growth. Trade uncertainty is another matter,” Federal Reserve Bank of Dallas President Robert Kaplan says at event on Wednesday.

- Odds are “relatively low” of a recession in the next 12 months; a bit higher in the next 24 months: Kaplan

- The Mexico tariff threat from 2 months ago was a significant event for this region. “After ...

35) BE: Who’s Who on the 2019 Fed Dot Plot

(Bloomberg) -- Knowing who’s who on the Fed’s dot plot of interest-rate projections can provide important guidance about the future path of monetary policy. Bloomberg Economics attempts to identify policy makers on the otherwise anonymous dot plot based on a careful analysis of public comments. Assignments are broadly consistent with the Bloomberg Economics Fed Spectrometer, which ...

First Word FX News Foreign Exchange

36) U.S. Imposes Sanctions on Certain China Cos. Over Iranian Oil

U.S. is “imposing sanctions on certain Chinese firms for knowingly engaging in a significant transaction for the transport of oil from Iran, including knowledge of sanctionable conduct, contrary to U.S. sanctions,” Sec of State Michael Pompeo says in statement.

- Action is “aimed to deny the Iranian regime critical income to engage in foreign conflicts, ...

37) Trading Impeachment Threat Is Mission Impossible for Wall Street

With a statement lasting only a few minutes, House Speaker Nancy Pelosi unleashed an impeachment inquiry that has the potential to move the price of everything from soybeans to stocks, bonds and the U.S. dollar. The only problem? Figuring out in which direction all those prices will move. Traders will have their work cut out for them when assessing the impact ...

38) Here’s What Parliament Could Do Next to Stop a No-Deal Brexit

Britain’s Supreme Court has overruled Boris Johnson’s decision to suspend Parliament in the run-up to Brexit. Now MPs are back in Westminster, plotting their next assault on the prime minister’s strategy. Johnson says he is determined to ensure the U.K. leaves the European Union on time on Oct. 31, whatever the cost, and without a deal if necessary. That idea ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: Cable rallying but APF holding back SONIA/Gilts... Charts

GBP vs SONIA - Quick Chart...

> Take a look at the chart below pls. The news that Juncker could see a deal happening has prompted further gains in Cable, knocking on the 1.26 level for the first time since early July.

> What's interesting is the correlation of GBP to SONIA has broken down, SONIA trading richer than GBP levels say it should be.

> We attribute most of this to the impact of APF demand, pinning gilts at richer levels than they'd normally trade at given the correlation.

> Sonia-Libor basis (4y1y for ex) has been relatively stable around the -25bps level for the last couple months so the impact of recent cash shortages don't appear to be at work in the UK.

> We are at the mid-point for the APF with the 3-7yr bucket on Monday. As noted in our rundown below, issues like the 1H26s still trade very rich to the curve which we don't see as sustainable post APF, especially if GBP continues to rally. Paying SONIA here makes sense too...

More soon…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS - Half-Way Point For Sep APF - What now?

GILTS... Another APF round completed – what now...?

> The Mar/Apr 19 APF was pretty similar to this Sep one in size and a reasonable comparator, even if 10yr gilts were about 70bps cheaper on Mar 11th when that op began than where we were on Sep 9th.

> Back in Mar, the most popular purchases other than the 225s were the 1H26s, 1Q27s, 4H34s/4Q36s, 1T57s and 1F71s. This time around we've seen lots of 1H26s, 4H34s and 1T49s. In the case of the 1H26s and 4H34s it’s safe to say, in our opinion, that the market (GEMMS) has done a rather aggressive job of positioning for these operations given where both issues trade on the curve and the efforts made to ensure the BoE buys them both.

> There were £2.073bn UKT 4H34s offered into the BoE yesterday vs a take-up of all £1.268bn. That’s a good news/bad news because there were holders of ~£800mm 34s who are still holding onto them at very rich levels. No wonder they were better offered post the APF.

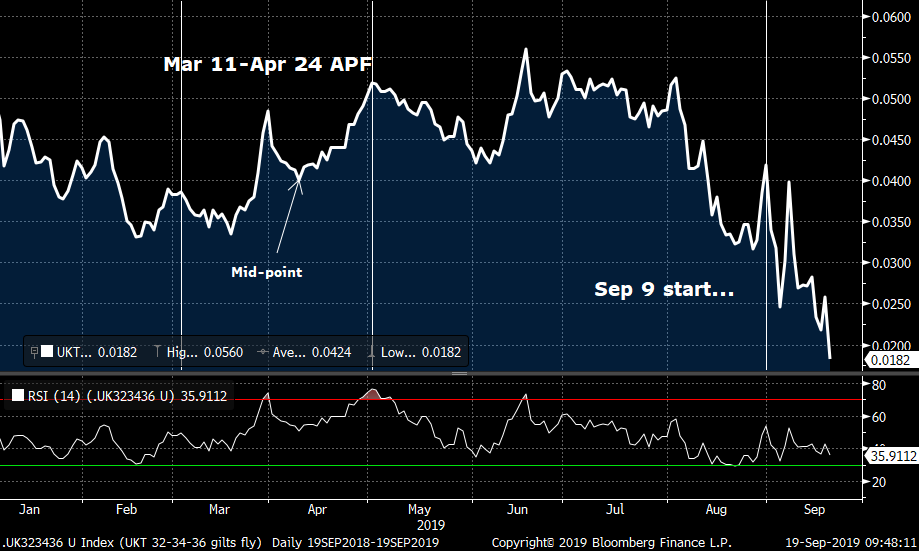

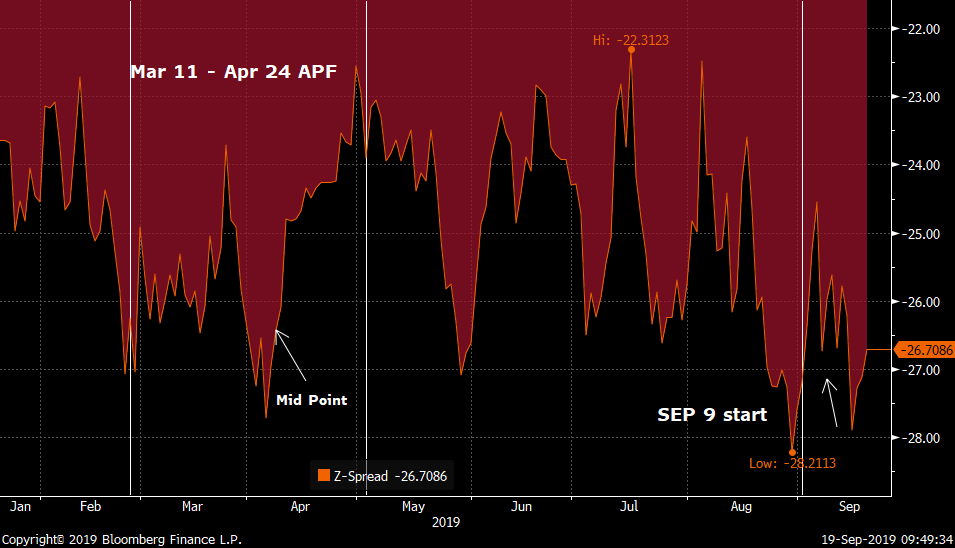

> Macro considerations apply first and foremost, however, there are seasonal patterns at work here. If we take the UKT 32-34-36 fly and 1Q27s Z-sprds as examples, we can see in the charts below that in both cases, by the mid-point momentum slowed and reversed course into the last couple weeks of operations.

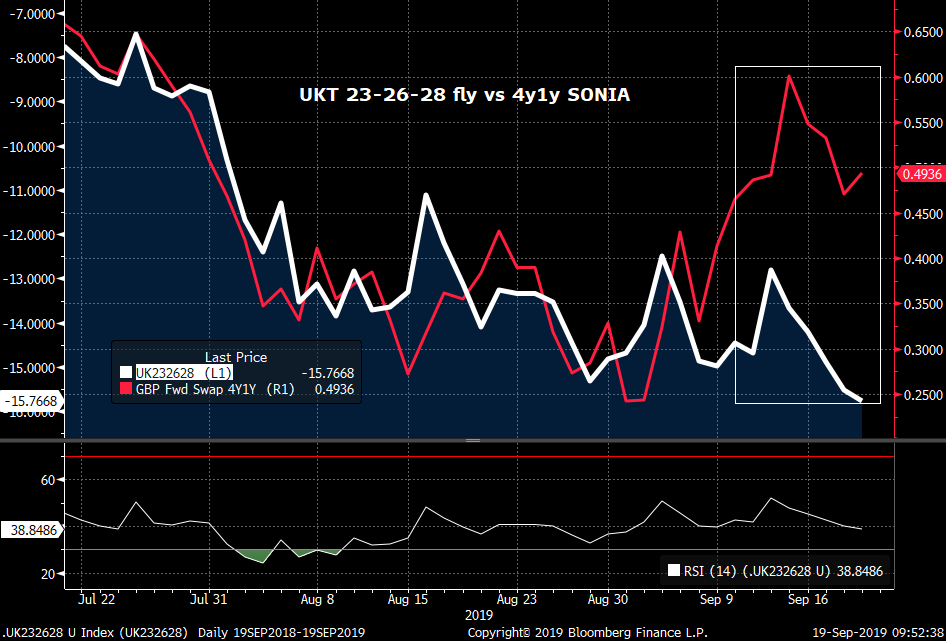

Granted, Brexit will continue to distort the gilts market but with no nominals supply until Oct 1st, this is a pretty ‘clean’ couple weeks in the UKT market. Given the market’s digestion of the index moves pre-APF on Sep 9th and the richening of flies like UKT 23-26-28, UKT 25-26-27 and UKT 32-34-36, we argue the market is MORE than priced for the remaining demand we’ll see from the BoE. Heaven-forbid they don’t buy these rich issues given current levels and positioning.

So, we continue to like selling into these richening moves on the above flies. We could have a couple more weeks of bumpiness but the tap of the 1T37s on Oct 1 is likely to offer some interesting opportunities within their sector, not to mention the macro-moves driven by Brexit, etc.

UKT 32-34-36 Fly…

UKT 1Q27 Z-sprd history…

UKT 23-26-28 fly vs Sonia

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Bloomberg Bond News Summary > Thu Sep 19

Business Briefing

1) U.S. Steel 3Q Adjusted Ebitda View Misses Lowest Est.

U.S. Steel forecast adjusted Ebitda for the third quarter; the guidance missed the lowest analyst estimate.

- Sees 3Q adjusted Ebitda $115 million, estimate $190.0 million (range $150.0 million to $247.0 million) (Bloomberg data)

- 3Q view excludes ~$53 million of estimated 3Q impacts from the December 24, 2018 fire at our Clairton coke making facility and ...

2) Trump: Federal Reserve Has No ‘Guts,’ No Sense After Rate Cut

"Jay Powell and the Federal Reserve Fail Again," President Trump says on Twitter.

- “No ‘guts,’ no sense, no vision! A terrible communicator!"

3) The Fed’s New Dot Plot After Its September Policy Meeting: Chart

The Federal Reserve’s so-called dot plot, which the U.S. central bank uses to signal its outlook for the path of interest rates, shows that policy makers are split on further easing action, based on median estimates. The Federal Open Market Committee on Wednesday cut its benchmark rate by a quarter percentage point for the second straight meeting.

4) U.S. Working With Allies on Coalition to Deter Iran: Pompeo

The U.S. is working with international partners on a coalition to deter Iran, U.S. Secretary of State Michael Pompeo said, reiterating that the Islamic Republic was behind a devastating attack on Saudi Arabian oil facilities over the weekend. Speaking to reporters en route to Saudi Arabia, where he will meet with senior officials, Pompeo said the attack was ...

5) EIA: Crude +1,058k Bbl, Median Est. -2,250

EIA inventory report also shows these changes for last week:

- Gasoline +781k vs est. -750k

- PADD 1B gasoline -3,198k

- Distillates +437k vs est. +500k

- PADD 1 Distillates +593k ...

World News Briefing

6) Judges Hem Boris Johnson in Further in Supreme Court Case

Supreme Court judges continued to narrow the British government’s wiggle room on the second day of hearings in a landmark legal challenge to Prime Minister Boris Johnson’s suspension of Parliament. On Wednesday, some of the 11 justices asked government lawyer James Eadie why the administration hadn’t submitted a signed witness statement as part of its case. ...

7) Weakened Iran Shows It Can Still Hold the Global Economy Hostage

Sun Tzu, the author of the 2,500-year-old The Art of War, is overquoted, but even in ancient China he knew the value of asymmetrical warfare—how smaller forces, such as guerrillas or today’s drones, possess advantages over huge ones, like standing armies or zillion-dollar fighter jets. He also knew to provide a battered opponent an escape, advising the conquering side to “leave an outlet free. Do ...

8) Formula One’s Singapore Grand Prix ‘Going Ahead’ Despite Haze

The Singapore Grand Prix will race through the streets of Singapore this weekend, despite the acrid pollution still wafting across the straits from Indonesia. “We’ve had experiences with the haze before,” Chase Carey, Formula One Group executive chairman and CEO, said in an interview on Thursday with Bloomberg TV’s Haslinda Amin. F1 will hold meetings on the ...

9) Trump Revs Up Battle With California to Warn of Democratic Rule

President Donald Trump brought his fight with California to a boil during a two-day visit, casting the state as a cautionary tale for Democratic rule ahead of the 2020 election. In less than 48 hours, he singled out California over its burgeoning homeless problems, moved to eviscerate its authority to regulate auto emissions, and stopped at the border wall, ...

10) Trump Seeks New Iran Sanctions as Pompeo Consults Saudi Arabia

President Donald Trump said he wants tougher U.S. sanctions on Iran as his top diplomat arrived in Saudi Arabia to consult with leaders and build a case against Tehran following weekend attacks on the kingdom’s key oil facilities. “We’ll be adding some very significant sanctions,” Trump said Wednesday in Los Angeles. The administration will announce the new ...

Bonds

11) Jittery Repo Market Has Calmed, But Fed Plans to Intervene Again

Let’s do it again tomorrow. The Federal Reserve made crystal clear that it doesn’t want U.S. money market rates to spike again like they did early this week, announcing it will -- for the third day in a row -- inject cash into this vital corner of finance. On Thursday, the New York Fed will offer up to $75 billion in a so-called overnight ...

12) Top Shadow Banker Calls Time on India Credit Market Wariness

One of India’s top shadow financiers by assets is betting that central bank easing will bring an end to the nation’s prolonged credit crisis, even as fresh strains in the sector emerged this week. “Interest-rate cuts and infusion of liquidity by the RBI will give a boost to the bond markets and aid the credit market to return to normalcy by December,” Rashesh Shah ...

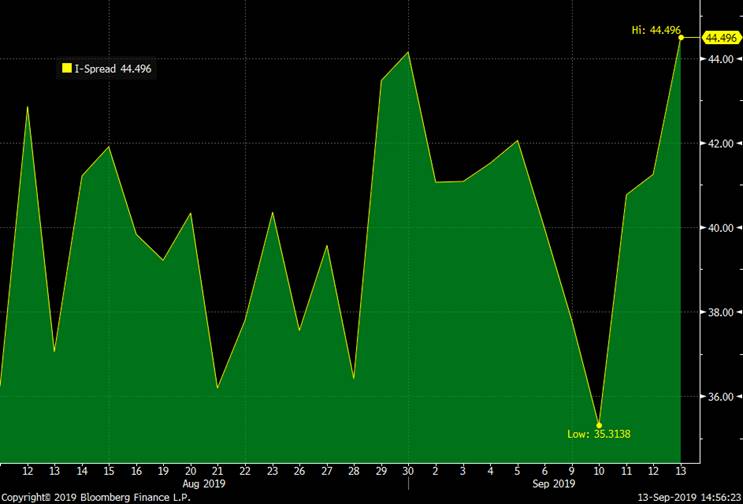

13) September European Bond Sales Race Past 100 Billion Euros: Chart

The September rush in Europe’s primary bond market has been even more hectic than usual this year, with issuers including AT&T Inc., the U.K. and KfW selling about 109 billion euros ($121 billion) of notes in just 13 trading days. Borrowers have flocked to market partly to get ahead of risks such as Brexit and worsening trade tensions, while investor appetite has been fueled by this year’s spread-tightening ...

14) Nomura Sees High Probability of BOJ Widening 10-Year Yield Range

The probability is high for the Bank of Japan to expand the targeted 10-year JGB yield range to about 30 basis points either side of zero, from around 20bps now, according to Takenobu Nakashima, a senior rates strategist at Nomura Securities Co. in Tokyo.

- Like in July 2018, such a change could be announced in Governor Kuroda’s news conference and not in the ...

15) BOJ to Review Prices and Economy After Standing Pat for Now

The Bank of Japan will review its assessment of prices and the economy at its October meeting, spurring speculation it may ease further then, but stopped short of following the Federal Reserve in adding to its monetary stimulus immediately. The BOJ said it needed to pay closer attention to the possibility of losing momentum toward its 2% inflation target as ...

16) Correction Looms for Korean Bonds as Rally Overdone, Fund Says

A rebound in South Korea’s yields may have only just begun as bonds relinquish gains spurred by excessive pessimism about the domestic economy, according to Eugene Asset Management Co. Ten-year sovereign yields could top 1.6% in the coming weeks as onshore bonds track a retracement in global peers, said Maeng Ju-Hyun, managing director at Eugene’s ...

Central Banks

17) Australia’s ‘Smoking Gun’ Unemployment Sets Up Another Rate Cut

Australia’s jobless rate unexpectedly climbed in August as the labor force swelled to a fresh record, signaling additional labor-market slack that sets the scene for further easing by the central bank. Unemployment climbed to 5.3%, the highest level in a year, and above the 5.2% forecast by economists, data from the statistics bureau showed in Sydney ...

18) Japan Stocks Pare Gains After BOJ; Aussie Slides: Markets Wrap

Japanese stocks pared gains and the yen climbed after the Bank of Japan left its policy settings unchanged while noting rising risks from overseas. Australia’s dollar slumped after the unemployment rate rose. U.S. stock futures retreated, Hong Kong shares slumped and China’s yuan dropped as investors took stock of the Federal Reserve’s interest-rate cut and ...

19) Powell the ‘Artful Dodger’ Declines to Signal What Comes Next

Federal Reserve Chairman Jerome Powell doesn’t like to show his hand, either to guide investors or to chart a path for a divided group of policy makers under his leadership. Powell, speaking after the U.S. central bank on Wednesday lowered interest rates for a second time this year, resisted several invitations during the press conference that followed to ...

20) Powell Stresses Solid U.S. Outlook After Fed Cuts Rates Again

Federal Reserve policy makers lowered their main interest rate for a second time this year and Chairman Jerome Powell said that “moderate” policy moves should be sufficient to sustain the U.S. expansion. “We took this step to help keep the U.S. economy strong in the face of some notable developments and to provide insurance against ongoing risks,” Powell told ...

21) Australia Coal Exports to Rise ‘Slowly’ as Demand Uncertain: RBA

Australian coal production and exports are expected to grow “fairly slowly” over the next few years as uncertain outlook for long-term demand is key challenge for investment decisions, Reserve Bank of Australia says in a report.

- Low exploration expenditure likely to curb future supply growth, particularly for thermal coal, despite long pipeline of potential ...

22) JAPAN REACT: BOJ Holds, Puts Post Sales-Tax Hike Meeting in Play

(Bloomberg Economics) -- OUR TAKE: The Bank of Japan is clearly growing more uneasy about the inflation outlook. We’re not convinced, though, that it’s about to pull the trigger on further stimulus. It set up its next policy board meeting as a critical event -- saying it will "reexamine" economic and price developments. This will be after the sales tax goes up on Oct. 1.

- If the BOJ determines that the risk of inflation momentum stalling outweighs potential ...

Economic News

23) Trump Is Biggest Risk to World Economy, Philippines’ Diokno Says

What’s the biggest risk to the world economy today? It’s the U.S. president, Philippine central bank governor Benjamin Diokno told a panel discussion in Singapore, with the audience bursting into laughter at his candid answer. A former economics professor who took the helm of the central bank in March, Diokno said the U.S. economy is growing due to the tax ...

24) Trudeau Apologizes for Wearing ‘Brownface’ Makeup in 2001 Gala

Justin Trudeau’s re-election bid was dealt a serious blow after the Canadian prime minister was forced to apologize for wearing “brownface” makeup at an “Arabian Nights” theme party in 2001, saying it was racist and a dumb thing to do. “I deeply regret that I did that,” a shaken Trudeau told reporters on his campaign plane late Wednesday. “I should have known ...

25) Climate Change and Low Interest Rates Could Derail Retirement

A new global survey of retiree well-being paints a bleak picture for Americans hoping for an old age free of financial stress. A separate report on the impact of global warming makes it even worse. The 2019 Global Retirement Index released Thursday by Natixis Investment Managers cites a trifecta of risks for retirees, policymakers and long-term global ...

European Central Bank

26) Why ECB Is Stuffing Free Cash Into Bank Pockets Again: QuickTake

The European Central Bank is throwing every tool it has at the sluggish euro zone economy. Starting on Sept. 19, it’s making a generous funding offer to lenders in the region, returning to an approach it used twice before in the past five years to stimulate growth. It has also tweaked its negative interest rate policy to limit the punitive side effects. It’s reviving a program called Targeted Longer-Term Refinancing Operations. TLTROs, as ...

28) ECB Policy Makers Push Back Against Attacks on Draghi's Stimulus

European Central Bank policy makers pushed back on Wednesday against criticism of their latest stimulus measures, saying that a big package was essential to boost sluggish inflation and growth. The ECB’s announcement last week “seeks to counteract the deterioration in growth and inflation forecasts through a package of measures that complement one another by ...

29) Deutsche faces threat of ECB debt probe

Preview text not available for this story.

30) Weidmann is mistaken — the ECB is right to restart asset purchases

Preview text not available for this story.

Federal Reserve

31) Repo Squeeze Gives Flight to Fed Doves’ Easing Bets: Macro View

This week’s disturbance in U.S. money markets should give investors another reason to expect the Federal Reserve to stay on a dovish tack through this year and next.

- The liquidity squeeze can be attributed to a coming together of idiosyncratic factors. Yet the sharp rise in the effective Fed Funds rate to just above the top of the central bank’s target band ...

32) Hong Kong Cuts Base Rate After Fed; Banks Seen Staying on Hold

The Hong Kong Monetary Authority cut its benchmark interest rate in line with the U.S. Federal Reserve, a mechanical outcome of the city’s currency peg that’s unlikely to be immediately passed on to the suffering economy. The HKMA on Thursday lowered its base rate to 2.25% from 2.5%, hours after the Fed’s quarter-point move, according to the monetary ...

33) Japanese Stocks Advance, Led by Exporters, After Powell Remarks

Japanese stocks advanced after Federal Reserve Chairman Jerome Powell left the door open to “a more extensive sequences of cuts” if needed. Electronics makers were the biggest contributor to the Topix index’s gain after the yen weakened against the dollar overnight on the view that the Fed was slightly more hawkish than economists expected, even though it cut ...

First Word FX News Foreign Exchange

34) Yen Gains After BOJ Decision; Aussie Drops on Jobs: Inside G-10

The yen rose against all its Group-of-10 peers after the Bank of Japan refrained from easing policy further even after the Federal Reserve cut interest rates on Wednesday.

- Japan’s currency headed for its biggest gain in three weeks as the BOJ sat tight and said it will review prices and economy in October. Australia’s dollar slid to a two-week low after the ...

35) New Zealand’s Economic Growth Slows to More Than Five-Year Low

New Zealand’s economic growth rate fell to a fresh five-year low in the second quarter, giving the central bank scope to cut interest rates again.

- Gross domestic product rose 2.1% from a year earlier, slowing from 2.5% in the first quarter and the weakest annual growth since the fourth quarter of 2013

- GDP climbed 0.5% from the previous three-month period, Statistics New Zealand said ...

36) Singapore ‘Ready to Do’ What’s Needed to Boost Economy: Heng

Singapore Finance Minister and Deputy Prime Minister Heng Swee Keat says government will do “what needs to be done, at the right time” in terms of potential stimulus, and next budget statement will address the issue.

- Says Singapore would welcome U.S. involvement to help meet infrastructure needs

- Singapore welcomes foreign investment

- Says “all of Asia continues to believe in free trade and globalization”; RCEP trade deal ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: FOMC Day - Preview of the Event w/charts

Great summary from one of our dealers:

FOMC: At 14:00EST/19:00BST - The Fed will announce its rate decision and release a statement with the updated Summary of Economic Projections (SEPs) which will include the Fed “dots”. Chair Powell’s press conference will begin at 14:30EST/19:30BST.

Summary of expectations:

-The Fed will deliver a second consecutive 25bps rate cut, moving the target range to 1.75-2.00

-With the rate cut almost fully priced/expected, most focus will be on forward guidance provided in the statement, SEPs, and press conference

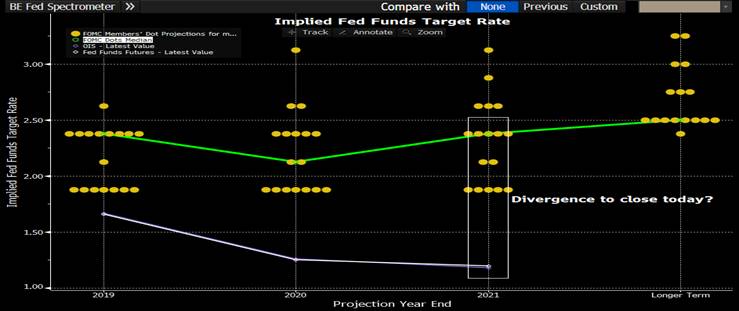

-In the SEPs, look for dots to be revised lower in 2019-2021. 2019 dot should fall, reflecting the July and Sept rate cuts but signal rates on hold through the end of the year though several dots (6?) will project an additional cut.

Dots could indicate rates on hold through 2020 before turning higher moving higher again in 2021 and 2022. Look for a wider dispersion of dots from the median, reflecting division among the Fed on the need for further easing.

-Powell's presser should strike a tone similar to that of his SNB appearance; maintaining an upbeat view of the US economy while highlighting risks from the slowdown overseas and trade policy uncertainty.

-Little change is expected in the statement; some see risk of more cautious language on employment but firming on household spending.

-No major changes to economic projections in the SEPs

**** A technical adjustment to the IOER is looking more likely after Monday's extreme moves in funding markets. With the EFFR fixing at the top of the target range (2.25%) on Monday, some see scope for IOER to be cut to +5 to the RRP (1.80% in the new 1.75-2.0% range) *****

The recent repo rate volatility may also drive the Fed to resume balance sheet expansion sooner to increase the level of reserves in the system.

Funding conditions may also warrant further conversation on a SRF which should appear in the minutes.

-Vote for the rate cut is unlikely to be unanimous as George and/or Rosengren likely to dissent again in favor of unchanged policy.

And our two cents:

1y1y USD OIS has cheapened off it's richest levels but stopped short of taking out the bull channel rate resistance...

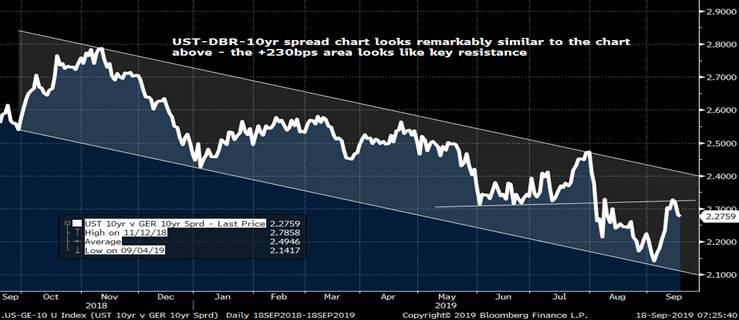

UST-DBR 10yr sprd

Divergence between the DOTS and Fed Funds remains wide...

UST 10-30s

Non-comml hedger positions in UST futures (weighted back into TY) shows fewest shorts since June...

More to come!

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Bloomberg Bond News Summary > Wed Sep 18th

Business Briefing

1) N.Y. Fed to Conduct Repo Operations for Second Straight Day

The New York Fed will conduct an overnight repurchase agreement operation from 8:15-8:30am ET on Sept. 18, according to statement.

- Repo operation will be conducted with primary dealers for up to an aggregate amount of $75b

- Securities eligible as collateral in the repo include Treasury, agency debt, and agency mortgage-backed securities

2) FedEx Cuts Year Forecast, Citing Trade Tensions; Shares Fall

FedEx shares fell 7.7% after the company forecast adjusted earnings per share for the full year; the guidance missed the lowest analyst estimate.

- Sees FY adjusted EPS $11.00 to $13.00, estimate $14.73 (range $14 to $15.85) (Bloomberg data)

- 1Q adjusted EPS $3.05 vs. $3.46 y/y, estimate $3.15 (range $2.85 to $3.30) (BD)

- 1Q revenue $17.05 billion, -0.3% y/y, estimate $17.06 billion (range $16.67 billion to ...

3) Japan Widens Lead Over China as Top Foreign Holder of Treasuries

Japan remained the biggest foreign owner of U.S. Treasuries in July with its holdings rising to a more than two-year high, while China’s stake fell slightly. Japan’s holdings of U.S. notes, bills and bonds increased by about $7.9 billion to $1.13 trillion, the Treasury Department said in a monthly data release Tuesday. That’s the largest amount held by Japan ...

4) Israel Election Too Close to Call, Exit Polls Show

Israel’s general election is too close to call, according to 3 exit polls by local television stations.

- PM Benjamin Netanyahu-aligned bloc got between 54-57 seats vs Benny Gantz’s Blue and White-aligned bloc with 54-58, according to the polls

- Netanyahu’s Likud party gets 31-33 seats vs Blue and White’s 32-34

- NOTE: Forming a majority govt requires a coalition of 61 or more of the total 120 ...

5) Spanish King Decides There’s No Suitable Candidate to Form Govt

King Felipe VI concludes there’s no suitable candidate to form a new government for Spain.

- Monarch finds no one has gathered enough support to win a parliamentary vote

- King’s Office in Madrid comments Tuesday in statement

World News Briefing

6) Israel Heads Into Unknown as Netanyahu’s Election Gamble Fails

Benjamin Netanyahu’s gamble to hold elections for a second time this year backfired after a stunning deadlock left Israel rudderless and convulsed by a new wave of political turmoil. The inconclusive race against his centrist rival, former military chief Benny Gantz, was a blow for Israel’s longest-serving prime minister. At best, he’ll be returned to office ...

7) Netanyahu Deadlocked With Gantz as Israel Counts Votes: TOPLive

8) Lam Won’t Concede to Hong Kong Protest Demands, Top Adviser Says

Hong Kong’s government doesn’t see any benefit in conceding to more demands from protesters and the increasingly violent demonstrations are unlikely to stop anytime soon, according to a top adviser to leader Carrie Lam. Radical demonstrators -- some of whom have lobbed petrol bombs at police and vandalized subway stations in recent weeks -- won’t give up ...

9) Johnson Struggles in Supreme Court on Day One of Suspension Case

The opening day of an unprecedented legal challenge to the powers of the British prime minister ended with Boris Johnson on the back foot and his room for maneuver on Brexit shrinking. On the first of three days of hearings on the legality of Johnson’s decision to suspend Parliament, a Supreme Court judge asked Johnson’s attorney for a written statement ...

10) Saudis to Show Evidence of Iran’s Role in Attack, State TV Says

Saudi Arabia will show evidence of Iran’s involvement in the devastating attack against major oil facilities that caused global crude prices to soar, state television reported. A Saudi defense ministry spokesman said it will hold a news conference on Wednesday evening outlining Iran’s role as well as the weapons used in the attacks, the report said, without ...

Bonds

11) Fed Preps Second Blast of Cash With Repo Market Still on Edge

It had been more than a decade since Federal Reserve traders jumped into U.S. money markets to inject cash. And they seemed to get the reaction they wanted Tuesday morning, instantaneously driving down key short-term rates that had spiked to as high as 10% and threatened to muck up everything from Treasury bond trading to lending to companies and consumers. ...

12) More Investors Are Seeing Global Yield Lows in Rear View Mirror

Bond bulls had a great August, as a ferocious rally drove yields in the world’s biggest markets to record lows. Now some investors say that’s as low as they’ll go. The Federal Reserve will announce its next policy decision Wednesday, and the Bank of Japan on Thursday. Those events might normally stir up bond prices, even without this week’s upheaval in global money markets ...

13) Oaktree Looks to China, Private Debt Amid Distressed Drought

Oaktree Capital Group Co-Founder Howard Marks is seeking more distressed debt opportunities in China amid few places to put cash to work in the U.S. The investment firm, one of the biggest buyers of debt in companies that are struggling or already in bankruptcy, has been scooping up non-performing loans in China as dozens of companies struggle to repay debt. ...

14) Fed May Boost Balance Sheet But Evercore Warns It’s Not QE Redux

This week’s volatile moves in U.S. money markets raise the odds that the Federal Reserve will start expanding its balance sheet, just weeks after it stopped running down its portfolio of bond holdings. That’s the take of some Fed watchers ahead of the central bank’s policy announcement on Wednesday, when the Fed’s Open Market Committee is forecast to lower ...

15) Speaking of EM: Gulf’s New Normal After Oil Attacks (Podcast)

It’s been a busy week, with investors trying to weigh the long-term impact of attacks on Saudi Arabia’s oil facilities. Even if the kingdom restores production, which plummeted by 50%, investors are worried about future strikes. And with the threat of tensions between Saudi Arabia and Iran boiling over into military action, what was once a haven for bond ...

16) ‘This Is Crazy!’: Fed’s Repo Madness Sends Wall Street Reeling

The word went out even before the opening bell: the Fed had to step in. Up and down Wall Street, phones lit up Tuesday morning as a crucial market for billions in overnight borrowing suddenly started to dry up. What had begun on Friday, with tremors inside U.S. short-term funding markets, was escalating rapidly. At a small broker-dealer in New Jersey, Scott Skrym could sense the money draining away. ...

Central Banks

17) Stocks Mixed Before Fed Decision; Treasuries Flat: Markets Wrap

Stocks in Asia traded mixed Wednesday as investors awaited the outcome of the Federal Reserve’s policy meeting, where it’s widely expected to cut interest rates again. Treasuries were steady after recent gains. Shares slipped in Tokyo and Sydney, were little changed in Hong Kong and ticked higher in Seoul and Shanghai. U.S. and European futures edged lower. ...

18) Divided Fed Reluctant to Forecast More Cuts: Decision Day Guide

Under pressure from Wall Street and President Donald Trump, the Federal Reserve is widely expected to reduce interest rates on Wednesday for a second straight meeting, but its sharply divided policy panel may be reluctant to forecast further cuts. The Federal Open Market Committee is likely to lower rates a quarter percentage point to insure against risks ...

19) World Bank Chief Malpass Sees Steeper Global Growth Slowdown

World Bank President David Malpass said the global economy is poised to decelerate more than previously estimated, with the pile of negative-yielding debt indicating growth will be slower in the future. “The slowdown in global growth is broad based,” Malpass said Tuesday in a speech in Washington. Recent developments signal the 2019 world expansion will ...

20) Ukraine’s Ex-Central Bank Boss Says House Torched in New Attack

Ukraine’s former central bank governor, who purged the financial industry and helped bring the country’s biggest lender under state control, said her house near Kyiv was burned down in an arson attack. Valeriya Gontareva, who currently lives in London, said no one was in the property when an assailant set it alight on Monday night. She’s reported a string of ...

21) Gold Holds Line Near $1,500 as Central Bank Titans Decide Policy

Gold investors have gone into wait-and-see mode ahead of an expected interest rate reduction by the Federal Reserve later on Wednesday that will kick off a busy round of policy decisions from leading central banks. Prices were confined to a narrow range near $1,500 an ounce after a two-day gain following the weekend’s strike against critical oil facilities in ...

Abstract:

Economic News

23) Don’t Bank on a Global Recession Just Yet, BIS Chief Says

The world economy isn’t yet on the cusp of a global recession, according to the head of the Bank for International Settlements, often referred to as the central bankers’ central bank. “It has certainly slowed down. It has slowed down markedly,” BIS General Manager Agustin Carstens told Bloomberg Television Wednesday. “There are some models that show the ...

24) Fed’s First-in-a-Decade Intervention Will Be Repeated Wednesday

The Federal Reserve took action to calm money markets, injecting billions in cash to quell a surge in short-term rates that was pushing up its policy benchmark rate and threatening to drive up borrowing costs for companies and consumers. The central bank also said it’s willing to spend another $75 billion Wednesday. While the spike wasn’t evidence of any sort of imminent financial crisis, it highlighted ...

25) South Korea Removes Japan From Trade White List as Feud Deepens

South Korea removed Japan from its list of most trusted trading partners, the latest sign of unraveling ties between two U.S. allies mired in a series of disputes. The change means that exports of some strategic goods to Japan will receive greater scrutiny than shipments to 28 other fast-track destinations, South Korea’s trade ministry said early Wednesday in ...

26) U.S. Diesel Exports Poised to Rise If Saudi Fuel Flow Disrupted

U.S. diesel shipments could get a boost, particularly in Europe, if Saudi fuel exports sink in the wake of attacks on the kingdom’s oil facilities. Saudi Arabia may pull back half of its refining capacity to free up barrels for the country’s crude export commitments as it works to bring production back online, Citigroup Inc. commodities analysts said in a ...

European Central Bank

27) Giant Nordic Pension Fund Cries Foul Over ECB ‘Discrimination’

First it was the Netherlands. Now, Finland is voicing annoyance over a new facility created by the European Central Bank. The worry is that the ECB’s latest stimulus package, which included a sweetener for commercial banks, essentially discriminates against the region’s pension industry. The model’s detractors point to the ECB’s decision to partly shield ...

28) ECB’s Villeroy Sees No Reason to Change Inflation Target

Bank of France Governor Francois Villeroy de Galhau says he sees no reason for the European Central Bank to change its inflation target at an upcoming strategic review.

- Speaking at the London School of Economics, Villeroy says there is an “acute debate” among economists about changing inflation targets

- ECB aims to maintain inflation rates below, but close to, 2% over the medium term ...

29) ECB Finds Some Bank Funding Plans Lacking in Quality, Enria Says

“We’ve noticed the quality is not particularly high sometimes,” ECB banking supervision head Andrea Enria says of bank funding plans.

- “That might be a problem” as monetary policy evolves

- “The market conditions are now particularly favorable. The fact that they’re not issuing some securities is worrying”

- NOTE: European Banks Face ‘Profitability Malady,’ ECB’s Enria Says

30) ECB Faces Bond Challenge as Companies Replace Costly Old Notes

The European Central Bank may have to sell some of its existing corporate-bond holdings due to companies refinancing -- just as it prepares to resume making new asset purchases. The bank has already sold all of its holdings in a Teollisuuden Voima Oyj note after a buyback by the Finnish power company reduced the March 2021 bond to just 154 million euros ($170 ...

31) EUR Rates Gamma Curve Faces Further Post-ECB Flattening Pressure

The sharp flattening of the EUR rates gamma curve following the ECB meeting may have scope to go further. The summer push higher in 30Y implieds still has room to unwind while the ECB’s introduction of a two-tier system has injected some uncertainty into front-end rates.

- The summer move higher in 30Y implieds on the back of aggressive real-money receiving and ...

Federal Reserve

32) Fed pumps $75bn into system after US overnight borrowing rate jumps to 10%

Preview text not available for this story.

33) Fed Likely to Cut Rates a 2nd Time as Economic Threats Loom

34) U.S. PREVIEW: At FOMC, Like It or Not, More Rate Cuts Are Coming

(Bloomberg Economics) -- OUR TAKE: The FOMC may be averse to using scarce policy reserves to offset the headwinds created by trade-war escalation, but the risk of being unnecessarily restrictive as the economy descends into either a growth recession or an outright recession is far less palatable. For this reason, Bloomberg Economics expects a steady stream of additional policy easing to occur through at least the end of ...

First Word FX News Foreign Exchange

36) Aussie, Kiwi Weaken on Risk Aversion Before Fed: Inside G-10

Australian and New Zealand dollars fell against all their Group-of-10 peers as investors sold commodity currencies ahead of a key Federal Reserve interest-rate decision.

- The kiwi approached a two-week low as oil prices edged lower on signs Saudi Arabia is partially restoring production at the facility damaged in the weekend attack, though progress has been ...

37) INR Bonds and Rupee Gain as Oil Fears Subside: Inside India

Sovereign Indian bonds gain the most in three weeks and the rupee advances after fears of a sustained oil-price surge subsided.

- 10-year yields fall 6bps, the most for the benchmark bond since Aug. 26, to 6.68%; yields had jumped 10bps over the previous two days when oil prices jumped by a record following drone attacks on a Saudi oil facilities

- NOTE: India ...

38) AUD/USD Capped Under 0.6865 Before Large Expirations: FX Options

AUD/USD is likely to remain under 0.6865 in the near term as investors seek to defend three large Wednesday option expirations on Wednesday.

- Notional A$584m of options expire at strike 0.6865, $1.6b at 0.6895 and $1.0b at 0.6900, according to DTCC data

- USD/JPY overnight implied volatility jumps as much as 9.1 vol to 15.19, the highest since Aug. 26, as ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Bloomberg Bond News Summary > Tue Sep 17th

Business Briefing

1) Blackstone Is Said to Be in Talks to Buy Bellagio and MGM Grand

Blackstone Group Inc. is in advanced talks to buy and lease back the iconic Bellagio and MGM Grand Las Vegas casinos from MGM Resorts International, according to people with knowledge of the matter. They have yet to agree on a transaction and one may not be reached, said the people, who requested anonymity because the talks are private. The terms of the ...

2) Saudi Oil Shock Unites China With Asia Rivals Worried About War

If anything could distract Asia’s top powers from sparring over disputed territory and crimes committed during World War II, it’s the need for cheap oil. Asia accounts for more than 70 percent of Saudi Arabia’s crude exports, with the four biggest economies -- China, Japan, India and South Korea -- leading the pack, according to consultancy Wood Mackenzie. ...

3) Disrepair of Oil Reserve May Hamper Value in Saudi Crisis

President Donald Trump said he may release oil from U.S. stockpiles to smooth out any price increases brought on by a strike at Saudi Arabian facilities, but the dilapidated state of the reserves and pipeline bottlenecks may limit the benefit. “It’s a real issue,” said Jason Bordoff, a former Obama administration official who has studied the Strategic ...

4) WeWork Signals Delay to Long-Awaited IPO as Valuations Plummet

WeWork signaled a delay to its much-awaited initial public offering, saying it expects to complete the listing by the end of this year as concerns doubts mount over the company’s valuation and business prospects. “The We Company is looking forward to our upcoming IPO, which we expect to be completed by the end of the year,” the company said in a statement on ...

5) A $45 Billion Bet on Narendra Modi’s India Is Unwinding

Global investors are starting to fall out of love with Narendra Modi. After pouring $45 billion into India’s stock market over the past six years on hopes that Modi would unleash the country’s economic potential, international money managers are now unwinding those wagers at the fastest pace on record. They’ve sold $4.5 billion of Indian shares since June, on ...

World News Briefing

6) Boris Johnson’s Brexit Plan Goes to Court With EU Talks in Chaos

Boris Johnson’s Brexit strategy has been on trial ever since he became prime minister eight weeks ago, and on Tuesday his lawyers will defend it in the U.K.’s highest court. Fresh from being lambasted by a fellow European leader after he opted out of a joint news conference Monday, Johnson will see his decision to suspend Parliament under scrutiny in the ...

7) Aramco Faces Weeks or Months Without Bulk of Abqaiq Output

Saudi Aramco is growing less optimistic that there will be a rapid recovery in oil production from the weekend’s attack and now faces weeks or months before the majority of output is restored at the giant Abqaiq processing plant. All eyes are on how fast the kingdom can recover from the devastating strike, which knocked out half its production, or roughly 5% ...

8) Trump Says He’ll Win New Mexico, a State That’s ‘Gotten Bluer’

President Donald Trump vowed that he’ll win New Mexico in his 2020 re-election campaign, boasting at a campaign rally near Albuquerque on Monday that his policies had led to a boom for the state’s energy industry and generated a budget surplus. “We will win the great state of New Mexico in 2020,” Trump declared. The state produced about 246 million barrels of oil in 2018, according to the Albuquerque ...

9) Purdue Pharma’s Bankruptcy Deal Has Holes the Size of 24 States

If Purdue Pharma LP wants its bankruptcy plan to work, it’ll have to find a way to halt the kind of government lawsuits that normally can’t be stopped by a Chapter 11 case. Purdue said the point of its court filing late Sunday night was to get protection from thousands of lawsuits tied to its aggressive sales of addictive opioids. To make that stick, it has ...

10) U.A.E. Says Attack on Saudi Arabia Is ‘Dangerous Escalation’

Saturday’s attacks on Saudi oil facilities is a “dangerous escalation” and it can’t be linked to the war in Yemen, the United Arab Emirates said. “Justifying the unprecedented terrorist attack on Aramco facilities by linking it to developments in Yemen is totally unacceptable,” U.A.E.’s Minister of State for Foreign Affairs Anwar Gargash said on Twitter. “The ...

Bonds

11) Aussie Falls on Dovish Minutes; Yen at Six-Week Low: Inside G-10

Australia’s dollar dropped for a second day as traders detected a dovish tilt in the central bank’s September minutes and also as Chinese stocks declined. The yen touched a six-week low as concern eased that higher oil prices will slow global growth.

- Aussie slipped versus all its G-10 peers after the Reserve Bank of Australia said wages growth appears to have ...

12) Wrightson Sees Chance of First Fed Overnight Repo in Decade