Bloomberg Bond News Summary > Thur Sep 12

The following are today's top stories from Bloomberg on your My News Page categories:

Business Briefing

1) Trump to Move China Tariff Increase to Oct. 15 From Oct. 1

Story to Follow

2) Oracle 1Q Adjusted Revenue Misses Lowest Est.; Shares Fall 2.4%

Oracle reported adjusted revenue for the first quarter that missed the lowest analyst estimate.

- 1Q adjusted revenue $9.22 billion, +0.2% y/y, estimate $9.29 billion (range $9.25 billion to $9.36 billion) (Bloomberg data)

- 1Q adjusted EPS 81c vs. 71c y/y, estimate 81c (range 78c to 83c) (BD)

- 1Q service revenue $786 million, -3.3% y/y, estimate $807.9 million (Bloomberg MODL) ...

3) Eric Vallat to Join Rémy Cointreau as New Group CEO

Rémy Cointreau announces that Eric Vallat will join the group as its CEO.

- He will take up his duties on December 1 and succeed Valérie Chapoulaud-Floquet on this date

To view the source of this information click here

4) Barclays Activist Slams British Bank’s ‘Destructive Strategy’

Barclays Plc’s activist investor Edward Bramson has taken a fresh swipe at the bank, telling his investors that its new chairman must address the lender’s “destructive strategy.” Bramson, who became one of Barclays’s top investors last year, said in a recent letter seen by Bloomberg News that the securities unit is still far from competitive. However, it’s ...

5) Bouygues Plans to Sell 13% Stake in Alstom

Bouygues says it will sell a 13% stake in Alstom.

- After the stake sale, Bouygues will own a 14.7% stake in Alstom

- Co. to sell Alstom shares through accelerated book build

World News Briefing

6) China, U.S. Are Showing a Little Good Will as Trade Talks Near

The U.S. and China are taking baby steps to ease tensions in their trade war, as negotiators prepare for the resumption of face-to-face talks in Washington in the coming weeks. On Wednesday, U.S. President Donald Trump said he was postponing the imposition of 5% extra tariffs on Chinese goods by two weeks, meaning Chinese officials can celebrate their Oct. 1 ...

7) U.K. Warns of Protests, Chaotic Border Scenes in No-Deal Brexit

The full scale of the damage a no-deal Brexit could cause to the U.K. was revealed when Boris Johnson’s government published its worst-case scenario -- a document it tried to keep secret. The paper warned of food and fuel shortages, disruption to the supply chain, public disorder and intense pressure to return to the negotiating table if the U.K. crashes out ...

8) Trump Administration Can Curb Asylum Bids, Supreme Court Says

Bolstering President Donald Trump on one of his signature issues, the U.S. Supreme Court cleared his administration to enforce a new rule designed to sharply limit who can apply for asylum at the U.S.-Mexico border. The justices said Wednesday the administration can apply the policy while a legal challenge goes forward. A series of lower court rulings had put ...

9) Purdue Opioid Plan Pits State Against State on Epidemic Cost

Purdue Pharma LP, maker of the highly addictive Oxycontin painkiller, is pitting state against state with its offer of about $12 billion to resolve the company’s liability for the massive public-health crisis tied to opioid abuse that’s swept the U.S. Almost half of the states that are part of the consolidated litigation against Purdue and its billionaire ...

10) Attacks on Chinese-Australian MP Show Fears of Beijing’s Sway

Australia’s first Chinese-born lawmaker is under intense political scrutiny over her former ties with Communist Party-linked groups -- a saga that reveals growing sensitivities about Beijing’s perceived meddling in national affairs. Gladys Liu, who’s lived in Australia for more than 30 years and was elected to parliament in May, this week acknowledged she ...

Bonds

11) Longest Slide in India Credit Quality Since 2014 Pressures Modi

The financial health of Indian firms is worsening, adding pressure on Prime Minister Narendra Modi to come up with more measures to kick-start a sputtering economy. Debt quality deteriorated for the fourth straight month in August, the Care Ratings Debt Quality Index showed. That’s the longest losing streak for the gauge that tracks 1,601 domestic firms since ...

12) Neiman Marcus Secures $100 Million FILO to Pay Down Revolver

Neiman Marcus Group Inc. completed a $100 million first-in-last-out facility that it will use to pay down the company’s revolver. The luxury retailer plans to use proceeds from the facility, also known as a FILO, to reduce its revolving credit facility and create $100 million in liquidity the company can access in the future, according to people familiar with ...

13) New Zealand Bond Sale Draws Lowest Demand in Eight Months: Chart

Demand at a New Zealand bond sale fell to an eight-month low Thursday with investors deterred by the outlook for further kiwi dollar weakness and shrinking yield premiums. The auction of NZ$250 million ($161 million) of debt due in April 2029 drew a bid-cover ratio of 1.32, the least for any tenor since January, based on data from the nation’s debt management office. While New Zealand’s bonds have ...

14) Stearns Bondholders Approve Blackstone-Backed Bankruptcy Plan

Stearns Holdings LLC’s largest bondholders have agreed to support a tweaked reorganization plan backed by Blackstone Group Inc. for the bankrupt mortgage lender. Pending court approval of the plan, Blackstone will contribute $65 million in new capital to Stearns -- a $5 million increase -- plus more cash to pay down claims in exchange for full ownership, ...

15) China Tianjin LGFV Pays Up in Dollar Bond Sale Amid Debt Worries

A Chinese local government financing vehicle from Tianjin succeeded selling dollar bonds this week, but not before investors extracted big price concessions from the borrower. Tianjin Binhai New Area Construction & Investment Group Co, priced a $300 million three-year dollar note Wednesday at 6%, a considerably higher premium compared with other LGFV ...

16) Meet the Lone Wolf Who’s Skeptical About Gold’s Bullish Outlook

In a world awash with gold bulls, Guy Wolf is something of a lone wolf when it comes to bullion. The global head of market analytics at Marex Spectron is skeptical about the precious metal’s appeal as it doesn’t pay yields and is battling against the headwind of a rising dollar. “During the financial crisis, it was seen very much as a safe haven,” Wolf said in an ...

Central Banks

17) Trump Delays China Tariff Increase as Trade Talks Approach

President Donald Trump said he was postponing the imposition of 5% extra tariffs on Chinese goods by two weeks, a move that delays the next escalation of the trade war and brightens the backdrop for upcoming negotiations. “At the request of the Vice Premier of China, Liu He, and due to the fact that the People’s Republic of China will be celebrating their ...

18) Turkey Can Go Big on Rate Cut Without Erdogan’s Iconoclast Nudge

Don’t just blame President Recep Tayyip Erdogan if Turkey’s central bank decides again to err on the side of lowering interest rates more than anticipated. Governor Murat Uysal may not quite match the record cut he delivered during his first meeting at the helm in July. Most of the economists surveyed by Bloomberg forecast a reduction of 275 basis points on ...

19) Fed Loath to Follow ECB on Negative Rates Despite Trump’s Demand

Federal Reserve Chairman Jerome Powell and his colleagues are loath to follow Europe and Japan into negative interest rate territory -- no matter what President Donald Trump might want or how bad the U.S. economy might get. Not only could such a move be deemed illegal, it’s also unclear how much of an economic gain it would yield given the likely disruption ...

20) Serb Central Bank Poised for Tight Rate Call: Decision Day Guide

Europe’s most unpredictable central bank is leaving investors on tenterhooks again as they wonder if Serbia’s interest-rate decision augurs the third surprise cut in as many months. The prospect of two down and one to go would leave policy makers repeating a feat of confounding economists’ predictions last achieved in ...

21) Europe Fiscal Hopes May Revive Trump Trade Playbook: Macro View

A sea change in European fiscal stimulus would see a continental redux of the Trump trade, and sharpen investor focus on machine-makers, industrial commodities and banks.

- Look beyond Mario Draghi’s penultimate European Central Bank meeting and toward the reign of Christine Lagarde, who seems to view a push for fiscal spending as core to her strategy

- And governments appear to be listening. In Germany, the bastion of fiscal prudence, ...

22) Five Things You Need to Know to Start Your Day

(Bloomberg) -- Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. It's European Central Bank day, the trade war front is looking slightly brighter and Operation Yellowhammer is here for all to peruse. Here’s what’s moving markets. We don’t always get to say this, but today’s European Central Bank meeting is one to get ...

Economic News

23) Draghi Gears Up for ECB Showdown on Stimulus: Decision Day Guide

Mario Draghi faces one of the most contentious policy meetings of his European Central Bank presidency on Thursday as he prepares to ramp up monetary stimulus again despite skepticism from the euro area’s biggest economies. The mood is expected to be tense when the 25-member Governing Council discusses how to respond to fading growth and inflation, according ...

24) Piketty Is Back With 1,200-Page Guide to Abolishing Billionaires

Thomas Piketty’s last blockbuster helped put inequality at the center of economic debates. Now he’s back with an even longer treatise that explains how governments should fix it –- by upending capitalism. The French edition of “Capital and Ideology,’’ weighing in at 1,232 pages, comes out on Thursday (English speakers will have to wait till next year for a ...

25) Nice Gesture, But a Delay in Tariff Hike Not Enough: Economics

(Bloomberg Economics) -- OUR TAKE: President Donald Trump’s decision to delay by two weeks an increase in tariffs on $250 billion of imports from China raises some hope for progress in upcoming trade talks. The yen’s drop and yuan’s rise in the wake of Trump’s tweeted announcement suggests that market players are, for now, looking on the bright side. The track record in the negotiations, though, suggests it’s prudent to ...

26) China, Malaysia Agree to Deepen Belt and Road Cooperation

The two countries will “properly handle” disputes to maintain stability, Chinese Foreign Minister Wang Yi says as he and Malaysian counterpart Saifuddin Abdullah brief in Beijing during Abdullah’s visit to China.

- Two sides will work for peace, stability in South China Sea: Wang

- They will step up multilateral cooperation: Wang

- China happy to see Malaysia play greater role in China-Asean relations: Wang ...

European Central Bank

27) Traders Pin Hopes on Draghi for the Next Leg of EM’s Bond Rally

What emerging-market bonds do next depends on whether Mario Draghi plays ball. Provided the European Central Bank president lowers borrowing costs deeper into negative territory and restarts a bond-buying program, high-yielding debt in the developing world may see its popularity soar among investors desperate for returns, according to Union Bancaire Privee. ...

28) European Banks Seen in Need of ECB Break to Sustain Month’s Gain

European bank investors anticipate the European Central Bank will take measures Thursday to soften the impact of an interest-rate cut on lenders. If that help isn’t forthcoming, an 8.6% rally in the sector’s equities this month may be abruptly halted. Bank stocks are the best-performing sector in September as rising bond yields fueled a rotation of investment ...

29) ECB PREVIEW: One More Round of QE for the Road

(Bloomberg Economics) -- The European Central Bank Governing Council was unusually forthright when it met in July about its intention to introduce a large stimulus package in September. We expect it will deliver on that promise by cutting the deposit rate and announce a new round of asset purchases. Hawkish policy makers may not be on board, but the central bank has enough reason to act anyway. ...

30) JAPAN INSIGHT: Euro/Yen - More Prone to Move as ECB Meets

(Bloomberg Economics) -- Keep an eye on the euro/yen – the cross rate has the most potential to move with major central banks lined up to make policy decisions in the days ahead. Our exchange rate model indicates that the yen is more sensitive these days to changes in Japan’s yield differentials with Germany than with the U.S. This means the European Central Bank’s policy decision ...

31) ECB day is upon us, only one thing to say.........

Little more to say this morning ahead of the ECB event of the year, with markets assured of action, and confident also of their ability to adjust curves and rates rapidly following the announcement to compensate for any disappointment, or pleasant overshoot. Having covered the elements of potential actions comprehensively in yesterdays’ e-mail ...

Federal Reserve

32) Fed Wary of Negative Rates, Thailand Currency Challenge: Eco Day

Welcome to Thursday, Asia. Here’s the latest news and analysis from Bloomberg Economics to help get your day started:

- Federal Reserve Chairman Jerome Powell and his colleagues are loath to follow Europe and Japan into negative interest rate territory -- no matter what President Donald Trump might want

- Meanwhile, Trump triggered a swift and skeptical reaction with his demand Wednesday for ...

33) Senate Advances Nomination of Bowman for Full 14-Year Fed Term

The U.S. Senate advances the nomination of Federal Reserve Gov. Michelle Bowman to serve a full 14-year term on the central bank’s Board of Governors.

- Vote to limit debate is 62-31; move sets up final confirmation vote

- NOTE: Bowman, a former Kansas banking regulator, was confirmed last year to fill a seat on the board that expires in 2020

- NOTE: The Senate next votes to advance the nomination of Thomas Feddo to be assistant ...

34) Trump Calls for Fed’s ‘Boneheads’ to Slash Interest Rates Below Zero

(New York Times) -- WASHINGTON — President Trump urged Wednesday for the Federal Reserve to cut interest rates to zero or even usher in negative rates, suggesting a last-ditch monetary policy tactic tested abroad but never in America. His comments came just one day before European policymakers are widely expected to cut a key rate further into negative ...

35) How Presidents Should Talk About the Fed: Narayana Kocherlakota

Donald Trump’s persistent attacks on the Federal Reserve raise an important question: What should and shouldn’t presidents say about the central bank? The key is to understand the difference between the concepts of independence and accountability. It’s crucial that the Fed enjoy independence from elected officials in deciding how to pursue the goals that ...

First Word FX News Foreign Exchange

36) Yen Falls to 6-Week Low on Goodwill Trade Gestures: Inside G-10

The yen dropped to a six-week low and Treasuries declined amid signs of improving goodwill between the U.S. and China before they resume trade talks in coming weeks.

- Japan’s currency weakened beyond 108 per dollar for the first time since Aug. 1 after President Donald Trump said he would delay the introduction of extra tariffs on Chinese imports by two weeks, ...

37) Trump Says China Tariff Increase Moved to Oct. 15 from Oct. 1

“We have agreed, as a gesture of good will, to move the increased Tariffs on 250 Billion Dollars worth of goods (25% to 30%), from October 1st to October 15th,” Trump says on Twitter.

38) Treasuries Drop, Aussie Climbs on China Goodwill Trade Offering

Treasuries and the yen extend losses and risk-sensitive currencies such as Aussie gain following a report China is considering allowing companies to resume purchases of U.S. farm products in a show of goodwill before trade talks between the two countries.

- Treasury 10-year yields rise 2bps to 1.76%. Treasury futures drop 8 ticks

- USD/JPY gains as much as 0.3%; AUD climbs 0.4%; S&P E-mini futures tick higher ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

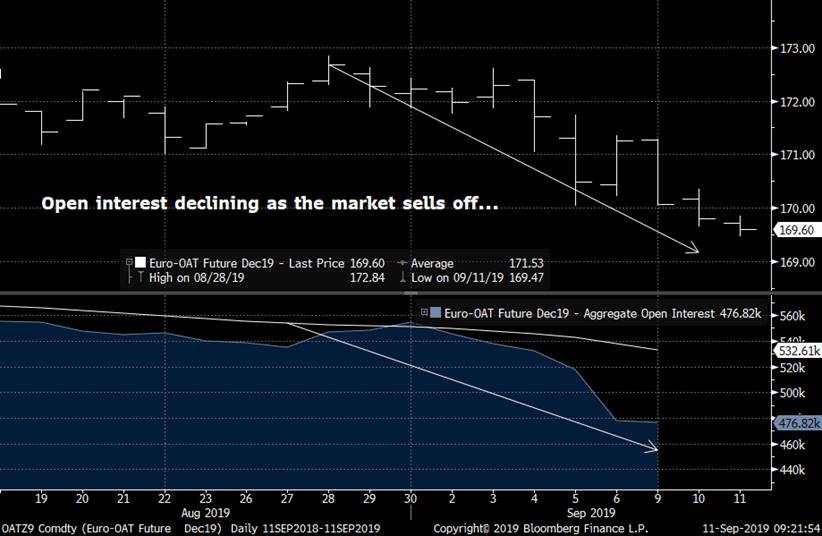

MACROCOSM: EGB/UKT Futures Open Interest As Sentiment Barometer

EGBs - FUTURES OI Levels - canary in the coalmine?

> One potentially mitigating factor in our bearish call in EGBs and UKTs is the sharp decline we've seen in aggregate open interest in Europe. This decline doesn't mean the market isn't vulnerable to a sell-off, it just means the 'weak hands' may have already bolted for the exits.

Here are some numbers:

> RXA 1.507mm > lowest level in 5yrs and off 14.8% since early Sep.

> OEA 1.102mm > lowest since June 2016 and off 16.8% in Sep.

> DUA 1.52mm > back to early Aug levels and off 9.3% in Sep.

> UBA 222k > lowest since Oct 2018 and off 21%.

> OATA 476.8k > lowest level since Mar 2018 and off |15% in Sep.

> IKA 419k > lowest since Feb 19 and off 24.8% since early Sep highs.

> G A 680k > still within the 650k-700k range that's held for most of Mar-Sep period but off 19% from the pre-roll spike.

These % changes were skewed somewhat by volumes into the Sep-Dec roll but the current levels remove that distortion and in most cases are well below pre-roll levels. In other words, we've cleared the decks a bit - the next move in an increase in OI could be rising spec shorts.

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

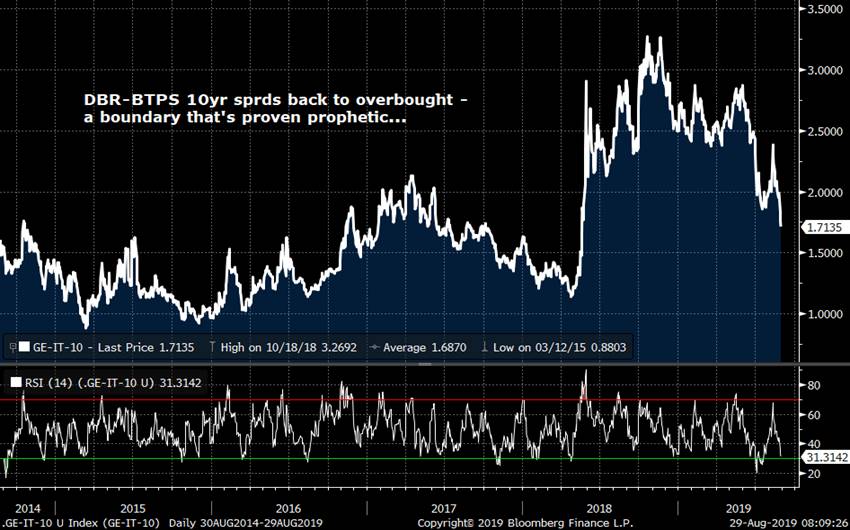

MACROCOSM: TECHNICALS Still TILTED BEARISH Into ECB Tomorrow

EGBs... TECHNICALS Still TILTED BEARISH into tomorrow's ECB meeting.

> Between the double-top in 10yr DBRs, the grind cheaper of DBRs vs swaps, the bear steepening of 10-30s from the Aug lows and the grind wider of EGB core vs semi/periphs spreads, it's clear the market's been in profit taking mode after an extraordinary rally.

> While the moves thus far have merely been corrective in nature, they are still largely in line with the theme of my note from last week, calling for higher rates and steeper curves (see attached).

> Tons of articles opining on the outcome of tomorrow's ECB meeting with sentiment still leaning cautiously for more stimulus. We'd be surprised if Draghi did nothing, however, we maintain the odds of disappointment outweigh the dovish calls.

> Last night’s US 3yr note auction tailed, G Z9 sold off into the close post 1F54s tap (which went well by all accounts) and we still have 10s, 30s, BTPS and IRISH paper to digest. It'll be interesting to see what demand is like for the BTPS pre-ECB tomorrow.

> PGBs this am - 29s and 34s - bids go in at 10:30am.

10yr DBR Yields – Fibo level at -43bps. 30-day RSI still overbought…

FRTR 10-30s

But BTPS spreads to DBRs still tight, with 30yr supply coming tomorrow…

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

GERMAN Insurers Exiting Bund Mkt - Quick Colour

Good note from one of our dealers worth passing along.

{GE} Bunds: In a research piece yesterday, Commerzbank highlights that German life insurers are increasingly turning their back on German Bunds due to negative yields. Both Allianz’s CEO and Talanx’s CFO have expressed in recent newspaper interviews that German Bunds are no longer a viable investment option for them. Another insurer, Munich Re has also highlighted their disinterest in buying Bunds at these yields while the chief economist of the German Insurance Association stated in a recent interview that ‘hardly any German insurers are buying Bunds anymore’ and he highlighted that some are insurers are presently investigating the potential of simply storing money in safes as an alternative.

The piece also highlights that German life insurer’s back book guaranteed rate is 2.8% while the Zinszusatzreserve (ZZR) which is approximately €65bn for the industry reduces that rate to about 2%. Buying Fixed Income securities that have negative yield is simply not compatible with their required returns. The research piece highlights that assets such SSA’s such as KFW, corporate bonds and promissory notes (Schuldscheindarlehen) are all benefitting from the move away from negative yielding assets but even these now have yields that are too low for the insurers to meet their desire return requirements. Mortgage bonds and alternative asset classes are now targeted.

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: SIGNIFICANT Further Correction in G-7 RATES on TAP > Quick Rundown

BEARISH Tone PERSISTS...

- What started as a pre-supply concession this AM is gathering steam. As noted in the attached rundowns, this week’s resumption of supply was a key litmus test for the market. Demand this morning, despite a reasonable concession from the open until the bids went in at 9:30 for the Bonos, was sketchy with bid to cover ratios sub-par. Were it not for the Spanish Tesoro’s announcement right after the bids went in that their net debt issuance will decline by another 10bn in 2019, SPGBs would likely have languished too.

- Dealers are reporting significant selling across the EGB universe this afternoon, especially in the ‘core’ countries – Germany, France and Italy – where their futures contracts are providing vital liquidity. The charts below show just how significant these moves are in technical terms as this two day pullback in RX contracts is the biggest we’ve seen since March. We’ve taken out key supports in the process and perhaps most importantly, aggregate open interest in RXA contracts has fallen almost 5.5% as core longs hoping to be rescued by the ECB next week throw in the towel.

- Here’s ammo for the bears:

- Boris Johnson is losing and his No-Deal leverage is gone. BoE now suggesting there’s no need to cut rates.

- ECB continues to beat their ‘no more QE drum’ with Muller and Villeroy joining the chorus this week.

- Trump planning to meet China to talk trade and even extending an olive branch to Iran. Could change in a heartbeat but stocks like it.

- Supply in rates continues unabated with US 3s, 10s and 30s, the UKT 54s syndication and Netherlands, Italy, Portugal, and Irish all next week with the ECB meeting Sep 12.

- Deutsche Bank’s CEO says another rate cut will hurt European banks further.

- FT article bemoans the untradeable German bund market.

- What to expect next, in our view >

- Bear steepening across most curves, liquidations in most significant in the 10yr point given futures longs.

- BTPS and OATs will come under fire if the ECB decides to not extend QE, even if the consensus has shifted more neutral now. We like ‘blends’ that underweight them (long NETHER vs DBR/OAT, long SPGBs vs OATs and BTPS).

- Swaps curves should bear steepen too, 5-10s in GBP is way too flat if this no-deal trade comes unglued. It’s already on its way.

- The pummelling of GBP will reverse course further, with the EUR joining in.

- The ‘Yang’ to the ‘Yin’ above?

- Cash flows in the UK are very supportive for the UKT market over the next 4-5 weeks. Best to express bearish views in Sonia or GBP swaps. The 30yr sector in the UK has gotten VERY cheap and if gilts get hit, 10-30s could bear flatten post 54s tap.

- The ECB dangles the carrot – no QE or rate cut but a message of ‘significant maybe’ that prevents a complete dump of risk. Not sure even Draghi’s up to that challenge…

- Liquidity will get worse. Keep it simple.

- Trump and Bojo wave their magic hair tongs and create more mischief and we’re back to where we started.

- At the very least, it’s time to take profits on longs.

More to come – comments always welcome…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

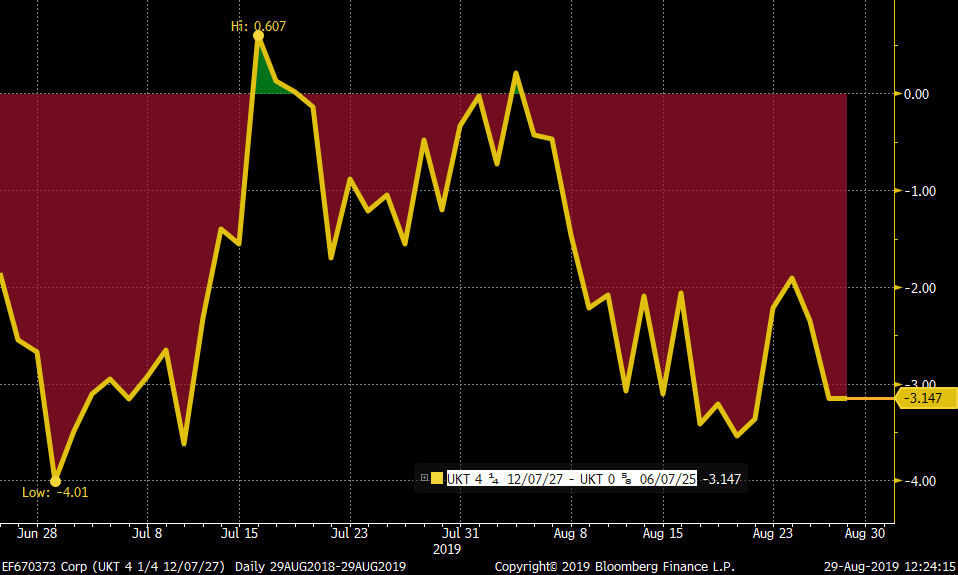

MICROCOSM: GILTS Market Set to Kick Into Overdrive > Colour & TRADES

As they say on TV, ‘Don’t touch that dial!’ Fans of the gilts market won’t want to miss what’s coming over the next couple months. See below for our take on the strategy angle here…

Let’s focus on the market dynamics we know are happening – and leave Brexit to the end…

GILTS SUPPLY

- Supply for the Oct-Dec qtr will be announced tomorrow morning. There are no conventional syndications expected with uncertainty surrounding whether they will announce plans for a new 20yr benchmark or another tap of the UKT 1T37s. The maturity of a new 20yr is likely to be 2041 which, at current yield levels, would give it a coupon sub-1% and duration/convexity in 4Q46 territory. 2040-42 gilts trade cheap in anticipation.

- Sajid David’s speech Sep 4th will be closely watched to see how big a cheque the new government is willing to write to appease the masses ahead of what could be a No-Deal Brexit on Oct 31. The bigger the cheque, the more gilts we’ll get which could mean the sizes of the auctions next qtr and beyond will be increased. We’d expect modest increases on a per-auction basis across the curve rather than a few lumpy syndications that could test demand for gilts at a sensitive time for the market. This could be one of the reasons the current 5yr and 10yr benchmarks trade cheap to the curve.

- Gilts supply from Sep 3-10 will be the largest concentration of risk this fiscal year so far:

- Sep 3rd – UKT 0F25s £3bn tap 15,000 G Z9 equivalents

- Sep 5th - UKT 0S29 £2.75bn tap 24,100 “ “

- Sep 10th – UKT 1F54 Est £4.5bn Syndicated tap 128,500 “ “

- Totalling 167,600 G Z9.

- If we’re wrong about the syndication date, the next likely slot is Sep 23rd which changes the risk dynamics above.

- Last scheduled gilts conventionals supply this qtr is Sep 5th so no supply post the 54s tap.

- The next tap of the UKT 0S29s isn’t expected until mid-October.

SEPTEMBER C&R AND INDEX MOVES

- You’ve read this before but here are the numbers you need to know:

- £28.7bn redemption of the 3T19 generates a £15.2bln cash APF that means 3 operations per week of £1,268bn per operation from Sep 9 until Oct 2nd.

- Coupon payments for Mar/Sep maturities (today’s the ex-div date) will total £7.59bn (conv and linkers) which is the largest cpn flow for the rest of this fiscal year. The 0-7yr sector benefits most with £5.2bn of the cash hitting the sector. When we combine the redemption flows we can see why GEMMS are seeing consistent buying of the 1H26s.

- September’s cpn date also coincides with significant basket-shifts as issues roll down the curve. The UKT 1T22 roll sub-3yrs, UKT 2T24 roll sub-5yrs, UKT 4H34s roll sub-15yrs and the UKT 4Q39s roll sub-20yrs. This will drive a FTSE all stocks index shift of +.24yrs with the 0-5yr extending 0.35yrs, 5-15yr extending 0.83yrs and 15yr+ index extending 0.64yrs.

- These issue-specific shifts matter to different investors depending upon their mandate. Central banks and money-mkt accounts care most about the 0-5yr while pensions are 15yr+. Either way, these shifts can be bullish or bearish for the issues that shift, depending upon the basket. Typically speaking, for example, an issue falling sub 15yrs would underperform the curve as pensions no longer need them but in this case, the UKT 4H34s fall into the intermediates APF basket and add a significant £6bn of free float to a small number of issues which has brought in significant demand for them from the leveraged community.

- Historically speaking, there’s a seasonality to these flows as one would expect. The 2yr and 5yr benchmarks typically outperform the swaps curve in the 2-3 weeks leading into the event then begin cheapening about half-way through the APF.

PARLIAMENT, BORIS and BREXIT

- These are the best articles I’ve read on the latest drama on Parliament, Brexit and Bojo:

- FT: Parliament is about to be suspended: what happens next?

- FT: What is Boris Johnson trying to achieve?

- FT: Boris Johnson’s move to prorogue parliament is forcing the hands of no-deal Brexit opponents

- Over the past week 1y1y SONIA has rallied 9bps, GBP/USD has cheapened a couple ticks and the betting shops now put the odds of a no-deal Brexit at 44%. We should know by the time of the UKT 1F54 syndication whether Johnson’s Parliamentary shenanigans are as benign and he insists or if they carry the anti-democratic, sinister intentions that the opponents of a No-Deal outcome are so convinced of. That could have implications for all the UK’s markets but especially gilts and FX where the markets have been leaning ‘worst case scenario’ for the last two months. The fact is, with Gilts repo general collateral around 70bps and 7yr gilts yielding ~25bps, there’s a vested interest in not having the whole curve at negative carry. Add to that a rather large short base in Cable and one could see an impressive bolt for the exits if the signs begin to point towards a deal. In other words, we’ve got a lot of bad news built into the market.

1y1y SONIA

STRATEGY ANGLES

- So, to summarize:

- Cash flows very supportive for gilts over the next 6 weeks, especially the 0-7yr sector.

- Index moves lend a flattening bias that could be mitigated by increased fiscal spending.

- GBP markets are pricing in a lot of bad news and feel positioned for it.

- The shift in sentiment since Johnson became PM makes a smooth Brexit outcome the outlier.

- With cash flows most supportive for the front-end (where the carry and roll is most negative), risks of increased gilts supply, bflies like the UKT 23-28-37 fly at their richest and positioning long, we think the most prudent positioning over the next couple weeks is a steepener, preferably 5s-10s.

The tap of the cheap 0F25s next Tuesday could provide a nice entry point to buy them versus issues like the 1F28s, 0S29s or even the 4T30s where the Z-sprd boxes have flattened sharply and although carry and roll is costly, the potential volatility over the next several weeks makes the C&R dynamics a footnote here in our view.

UKT 0T23-1F28-1T37 fly

UKT 0F25 vs UKT 1F28 Z-sprd box

UKT 0F25 vs UKT 4Q27 Z-sprd

I’ll be in touch to discuss…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

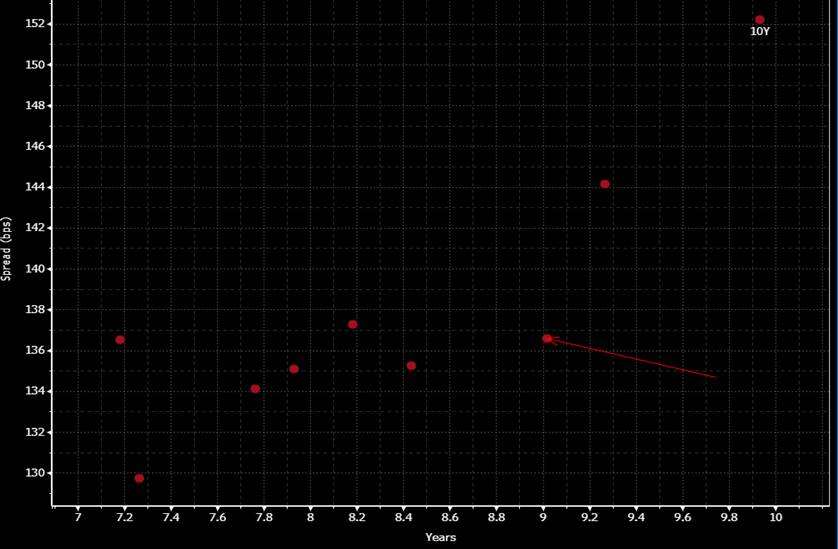

MICROCOSM: ITALIA! Politics and Supply... Quick Rundown

ITALIA! Politics & Supply

> Mattarella gives Conte a mandate to form a new govt - with Salvini nowhere to be seen...

> Keeping Salvini at bay became a priority and so far they've managed to pull it off. The sense of relative stability has been VERY bullish for BTPS, driving a 28bps tightening of 10yr sprds to DBRs since the start of this week.

> FINAL EGB supply of August comes this am as Italy taps €2.25bn of the BTPS 1.75% 7/24 and €4bn of a new BTPS 1.35% 4/30.

> BTPS 7/24s have rallied almost 80bps since Aug 9th and have richened about 8bps on the 23-24-25 fly. On a micro-basis 24-25s looks too steep to us, especially if we bull flatten into the sprd tightening, but as this is a relatively small tap and the benchmark is sought after, they should go fine.

BTPS 10/23-7/24-6/25 fly

> The NEW BTPS 1.35 4/30s started off at +14bps vs the BTPS 8/29s in the gray mkt on Monday (although not many traded) and have tightened all the way to 10.5bps at last night's close. We expect this issue TO TRADE VERY WELL as it's the second lowest cpn ever which makes them attractive from a credit/dur/convexity perspective. They won't be tapped until late Sep either. Don't be surprised if the roll is well inside 10bps by tomorrow's close. There’s also been a considerable debate over whether it’s time to take profits on IKU9 (BTPS 4.75 9/28s) longs after a demand-for-liquidity driven richening on the curve and in anticipation of the impending Sep expiration. The short answer is ‘YES’ in our view – in half your long. There’s been evidence that some of the delivery game has already happened given the moves in the basis, however, there could be a reasonably large delivery into this contract and with just one more cycle before it leaves the basket, taking delivery of a big chunk of these BTPS 4.75 9/28s would be a fairly simple way of getting one’s hand on a large chunk of Italian debt in a spread narrowing environment. We saw the Japanese do it with the OATs contract so why not IKA?

BTPS 7-10yr sector Z-sprds – (arrow points to BTPS 4.75 9/28s)

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Bloomberg Bond News Summary > Tue Aug 20th

Business Briefing

1) China Just Made Borrowing Costs a Tiny Bit Cheaper for Companies

Loans will get a little cheaper for Chinese companies after officials introduced a revamped market benchmark rate for the first time. China’s new one-year reference rate for bank loans will start at 4.25%, according to a statement from the central bank on Tuesday. That compares to the 4.24% median estimate in a Bloomberg survey of 11 traders and analysts. The ...

2) Twitter, Facebook Say China Fake Accounts Targeted Hong Kong

Twitter Inc. found and deleted hundreds of accounts it said China used to undermine the Hong Kong protest movement and calls for political change. The company said it took down 936 accounts that originated within China and attempted to manipulate perspectives on the pro-democracy movement in Hong Kong. Facebook Inc., acting on a tip from Twitter, said it also ...

3) White House Dismisses Payroll Tax Cuts as Slowdown Prevention

The White House dismissed the idea that the administration is looking to cut payroll taxes as a way to bolster consumer spending, as economic indicators increasingly point to a potential downturn. More tax cuts for individuals are being discussed, but payroll taxes aren’t under consideration at present, a White House official said Monday. ...

4) Finance Is Looking for Bankers Who Work Well With Robots

Today, it’s not just humans competing for work in banking. Machines are becoming a threat to warm-blooded number crunchers worldwide. Indeed, almost one-third of financial-services jobs could be displaced by automation by the mid-2030s, according to a report by PricewaterhouseCoopers LLP last year. Despite those stark forecasts, some optimists argue that the rise of machines at banks ...

5) Pursuits in Brief: Superyachts, Kylie Jenner, Bugatti Centodieci

This is a Bloomberg Pursuits look at luxury. As summer comes to a close, the superrich are squeezing the last rays out of it on superyachts. Italy currently has more than 100 yachts nestled in coves along Sardinia’s scenic Costa Smeralda, with the Amalfi Coast the second-most-popular location, according to Bloomberg’s ...

World News Briefing

6) Boris Johnson’s Bid to Renegotiate Brexit Starts on Irish Border

U.K. Prime Minister Boris Johnson made his first public attempt to renegotiate the Brexit deal by telling the European Union he wants to explore different ways to prevent a hard border on the island of Ireland. In a letter to European Council President Donald Tusk, Johnson said he wants to replace the so-called backstop provision in the divorce agreement with ...

7) Donald Trump Is Coming for Europe’s Most Important Alliance

In the end, they papered over the cracks. After months of increasingly acrimonious sniping, Emmanuel Macron and Angela Merkel set aside some of their differences last month, pushing through a deal on the next head of the European Commission. The rapprochement arrived just in time, with Donald Trump coming to Europe this week for the Group of Seven summit in ...

8) Epstein’s 11th-Hour Executor Says He Won’t Serve for Estate

Jeffrey Epstein had very few people he could turn to in his final days. When he needed a backup to handle his estate, he named a little-known biotech venture capitalist named Boris Nikolic in his will. But apparently without Nikolic’s knowledge. Nikolic said he was “shocked” after hearing from Bloomberg News of his inclusion in Epstein’s will. “I was not ...

9) Trump Speaks With Leaders of India, Pakistan as Tensions Simmer

U.S. President Donald Trump spoke separately on Monday with the leaders of India and Pakistan in a bid to calm tensions between the nuclear-armed neighbors over a territorial dispute. Indian Prime Minister Narendra Modi has kept Kashmir under lockdown for more than two weeks after scrapping the region’s autonomy, a move condemned by Pakistani Prime Minister Imran Khan ...

10) U.K. ‘Extremely Concerned’ by Reports Staffer Held on China Trip

The U.K. said it was “extremely concerned” by reports that a Hong Kong consulate worker was detained during a recent trip to mainland China, a case that threatens to add to strains between Beijing and London. The statement came after news site HK01 reported that the U.K. consular employee, Simon Cheng, 28, was reported missing after failing to return from an ...

Bonds

11) Getting Harder to Make Easy Money in Asia Bonds as Junk Hit

It’s getting harder to make easy profits in Asia’s bond market as the trade war and geopolitical tensions drag down junk debt. Speculative-grade bonds from the region have lost money for three straight weeks, their worst streak since late last year. That trend is threatening payouts for the rest of 2019, given that fund managers had loaded up on the riskier ...

12) Global Bond Rally Sidesteps India as Deficit Fears Mount

India’s fixed-income traders have swung from joy to misery within the span of two weeks as the global bond rally passes them by. Rupee-denominated sovereign bonds have lost more than half the gains they made since the government’s July 5 budget, as concern rises that authorities may sell more debt to finance further fiscal stimulus. ...

13) Omens of Another Asian Debt Crisis Seen by McKinsey in Stresses

More than two decades since the Asia debt crisis gripped the region, global consulting firm McKinsey & Co. is warning that signs of a rerun are “ominous.” Increased indebtedness, stresses in repaying borrowing, lender vulnerabilities and shadow banking practices are some of the concerns cited by McKinsey in an August report. Whether building pressures are ...

14) Trade Angst, More than a Reluctant Fed, Is Buoying the Dollar

Donald Trump has blamed the stubbornly strong dollar on the Federal Reserve’s reluctance to slash interest rates further. But real yields suggest investors fearful of the president’s trade war are what’s keeping the greenback strong. Consider the evidence: the U.S. currency has advanced against seven of 10 major peers this year even as the premium on ...

15) FX Volatility Drops as Investors Await Jackson Hole: Inside G-10

Volatility in major currencies declined as investors await the release of U.S. jobs data and a speech by Federal Reserve Chairman Jerome Powell in Jackson Hole, Wyoming later this week for more cues.

- JPMorgan G-7 Volatility Index closed at 7.72 on Monday, lowest since Aug. 8. Traders are waiting to see if Thursday’s jobless claims figures add to optimism over ...

16) HNA Group Repays Dollar Bond After Missing Yuan Note Payment

HNA Group Co. repaid a dollar-denominated bond on Monday amid a report China’s provincial government offered to help the debt-laden conglomerate meet payments to its offshore creditors. HNA Group International, a unit of HNA Group, repaid a $300 million bond due Aug. 18, a company spokesperson told Bloomberg, saying “we remain committed to meeting our ...

Central Banks

17) Turkey to Reward Banks That Lend More With Looser Reserve Rules

The Turkish central bank unveiled regulatory changes that determine the amount of cash lenders have to put aside as reserves depending on how much credit they extend. Required reserve ratios for banks with loan growth of 10% to 20% will be set at 2% -- with some exceptions -- while remaining unchanged for other banks, according to a statement on Monday. The ...

18) Trump Urges Fed Cut of 100 Basis Points, Cites World Economy

President Donald Trump stepped up his assault on the Federal Reserve, urging it to cut interest rates by a full percentage point to aid global growth while complaining the “dollar is so strong that it is sadly hurting other parts of the world.” “The Fed Rate, over a fairly short period of time, should be reduced by at least 100 basis points, with perhaps some ...

19) Fed’s Rosengren Wants Evidence of Slowdown to Justify Rate Cut

Federal Reserve Bank of Boston President Eric Rosengren continued to push back against further interest-rate cuts by the central bank, arguing he’s not convinced that slowing trade and global growth will significantly dent the U.S. economy. “We’re likely to have a second half of the year that’s much closer to 2% growth,” Rosengren said Monday in an interview ...

20) Trump Calls for ‘At Least 100 Basis Points’ Cut by Fed

President Trump kept up his criticism of the Federal Reserve, calling for the central bank to cut rates by “at least 100 basis points.”

- Trump also says the dollar is “so strong that it is sadly hurting other parts of the world”

21) GERMANY INSIGHT: Scholz Must Spend More or Risk Fresh Crisis

(Bloomberg Economics) -- Germany’s economy has hit the skids and risks a protracted downturn that reverses years of progress, especially in the labor market. The time for Olaf Scholz, Germany’s finance minister, to open the floodgates is now, not when a recession has already set in -- unfortunately, an early boost is verboten.

- We forecast that Germany will narrowly avoid a recession, but that depends on the services ...

22) Whiff of Baltic Noir Wafts Over Another Latvia Bank Suspension

The Baltic banking industry, ravaged by what’s become Europe’s biggest money-laundering scandal, has suffered another shock. The Latvian financial regulator suspended the operations of AS PNB Banka after the European Central Bank found that it had “significant capital shortfalls” and warned that it’s at the risk of failing. Latvia is confident it’s an ...

Economic News

23) PBOC’s Lower LPR Flags Material Easing On the Way: Economics

(Bloomberg Economics) -- OUR TAKE: The People’s Bank of China signaled intent to reduce borrowing costs to buttress growth, setting its new one-year Loan Prime Rate below the previous benchmark in the debut announcement. We see further room for the LPR to decline in the coming months, aided by other policy easing measures.

- The 1-year LPR recorded 4.25% on the first day under the new interest rate regime. That is ...

24) IMF Rumors May Be the Scare That South Africa Needs for Action

The threat of an International Monetary Fund bailout, unthinkable a few years ago, may force South Africa’s government to push through the reforms it needs to rescue the economy. An expanded bailout for struggling power utility Eskom Holdings SOC Ltd. and calls from other state companies for support have strained the nation’s budget, prompting business groups ...

25) Philippines Sets Record 2020 Borrowing Amid Infrastructure Push

Philippines President Rodrigo Duterte plans a record-high borrowing of 1.4 trillion pesos ($26.7 billion) for 2020, keeping a strategy of sourcing bulk of it locally to avoid foreign exchange risks. Next year’s proposed borrowing compares with 1.19 trillion pesos in fresh debt planned for this year. Of the total 2020 borrowing, about 1.05 trillion pesos or ...

26) Asia Stocks Rise as Trade Talks, Stimulus Mulled: Markets Wrap

Most Asian stocks posted modest gains Tuesday as investors digested signs of progress on trade negotiations and speculation of government stimulus to shore up economic growth. Treasuries rose and the dollar traded near the year’s high. Shares pushed higher in Tokyo, Sydney and Seoul, and fluctuated in Hong Kong and Shanghai. S&P 500 Index futures edged ...

European Central Bank

27) ECB Added Three New Securities to CSPP With One Note Called

The ECB added three new securities to its CSPP program during the week ended August 16, according to central bank data analyzed by Bloomberg.

- One security was called and the value of the CSPP portfolio increased by EU77m, at amortized cost

New Holdings Redeemed Holdings

- CSPP ISINs as determined by Bloomberg using ECB website data at 2:45pm London on August 19 ...

28) Higher Bund Yields Need ECB, German Fiscal Easing Acting in Sync

German fiscal hopes and diminished tactical risk-reward on long-end USTs have halted the rally in bunds.

- It makes sense for Germany to be proactive and engage in fiscal easing to get ahead of the curve, which would be a powerful ingredient when combined with easing by the ECB to chase down the elusive inflation target

- However, immediate hopes should fade given it requires a change in fiscal rules, with the ...

29) Operation Twist Is Making Comeback as Option for ECB Stimulus

The European Central Bank would get more bang for its buck if it plowed its reinvestment into bonds with a longer maturity rather than restarting quantitative easing, according to Bank of America Merrill Lynch. An operation twist -- as a swap from short-term bonds into longer-dated securities is commonly referred to -- would allow policy makers to maintain a ...

30) ECB Says the Next European Bank Hack Is Just a Matter of Time

(Bloomberg) -- A senior official at the European Central Bank warned that banks embracing external data storage and other digital technology need to face an uncomfortable truth: there’s a good chance they’ll get hacked. “There will be accidents, especially in the cloud,” Korbinian Ibel, a director general at the ECB’s supervisory arm, said in an interview. “It’s not that ...

31) Bank of America Sees ECB Relaunching QE, Raising Bond Limits

Bank of America Merill Lynch predicts the European Central Bank will restart its quantitative easing program and cut forecasts for euro-area economic growth, its economist Ruben Segura-Cayuela and strategist Sphia Salim say in a note.

- Bank of America expects “small” QE program of 30 billion euros per months for 9-12 months and the ECB to raise its 33% limit ...

First Word FX News Foreign Exchange

32) Rupee Bond Selloff Deepens as Deficit Worries Rise: Inside India

Sovereign bonds decline for a second day on concerns the government may end up selling more debt as speculation increases over a potential stimulus package.

- Benchmark 10-year yields rises 2bps to 6.61% on Tuesday, adding to an increase of more than 20 basis points over the past two weeks

- READ: Global Bond Rally Sidesteps India as Deficit Fears Mount

- “The dichotomy between Indian bonds and the global rally can be attributed to local supply ...

33) Equities Steady as Hong Kong Leader Seeks Dialogue: Macro Squawk

S&P futures reverse early losses as Asian stocks grind higher; MSCI Asia Pacific index 0.5% firmer. Hang Seng steady after Carrie Lam pledges new effort at dialogue over Hong Kong protests. Treasury 10-year yield near 1.59%; Australian curve modestly steeper as 10-year yield edges 3bps higher. Bloomberg dollar index hovers near 2019 highs; Aussie better bid after RBA minutes. Onshore yuan 0.2% ...

34) Germany to Test Haven Demand as Ultra-Long Bond Coupon Set at 0%

Germany will sell an ultra-long bond at a 0% percent coupon for the first time on Wednesday, in a flurry of debt sales in the next two weeks offering negative rates. The nation has previously only sold debt with a 0% coupon up to 10 years of maturity, including sales in the past month during a global debt rally. This week’s 30-year auction will test the ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's Post-Holiday BREXIT BARRAGE! Less than 11 weeks to go...

Thought I’d send over a quick recap of recent developments in my post-holiday effort to get caught up…

FT: On the brink: Britain’s economy braces for Brexit ‘shock’

FT: Jeremy Corbyn will do ‘everything necessary’ to stop no-deal Brexit

FT: Business groups admit many companies are ill-prepared for no-deal Brexit

FT: Boris Johnson prepares to make debut as PM on world stage

FT: Leaked no-deal Brexit report should focus MPs’ minds

FT: UK chancellor backs away from stamp duty reform bill

FT: Punishing Ireland’s economy will backfire on Brexiters

BBG: Corbyn Gears Up for Election as Chaotic Brexit Fears Escalate

BBG: Johnson to Raise Brexit Stakes in Visits to Germany and France

BBG: U.K. Faces Fuel, Food Shortages, Port Delays Post-Brexit

BBG: Pound Wins Holiday From Selloff on Resistance to No-Deal Brexit

TEL: Boris Johnson accuses Philip Hammond and other ex-ministers of undermining Brexit ahead of EU trip

TEL: Forty Tory MPs ready to back Philip Hammond and David Gauke to stop no-deal Brexit

TEL: Firms told of new export opportunities in Brexit PR blitz

TEL: Britain should be more careful playing hardball on US trade

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: FRTR & SPGB Supply This AM... Quick Colour

EGBs - FRTR & SPGB Taps

- This am we'll get the last scheduled supply from both France and Spain until September given cancellation of their mid-month auctions.

- Yesterday's rally into the month-end index extensions saw strong outperformance of Spain and Italy vs core and a powerful bull flattening move, 10-30s OATs another 3bps flatter, just off the cycle lows.

- With the FED sending mixed messages last night (muddled press conf and 2 dissenters, calling for no cut) and the tailwinds of index demand behind us, this am's SPGB and FRTR supply isn't the slam dunk it could have been, especially given the yield levels and DV01 of about 90k RXU9.

- SPGBs have some room to tighten further given where sprds were in early July but further richening in absolute yield levels will need some help from the data, PMIs released this am pre-taps.

- FRTR 10/27s remain rich on the curve and the FRTR 5/30s basis has richened to new highs as the FRTR 5/28s cheapened on the curve. The 5/28-5/30 Z-sprd box has room to flatten further, however, so we could see HF interest on this. Needless to say, no ‘free lunches’ this am and there’s a real risk those who needed to buy the mkt have already done so.

FRTR-SPGB Sprds

FRTR 5/28-5/30 Z-sprd box – decent flattening but more room to go…

Data this AM…

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796