MACROCOSM: Quick RATES/FX Techs into FOMC Day... Charts

“What a long, strange trip it’s been…” – The Grateful Dead

- Today’s month-end and, more importantly, likely to be the first time the FOMC cuts rates in 10yrs. Here’s a snapshot across the major US, UK and EUR markets into this morning. We’ll stick to the ‘keep it simple’ method.

- But first, here’s a good BBG opinion article that provides an excellent summary (in my view) of the situation facing the market and where sentiment is going into the big event. Fed Day Has Bond Traders Feeling Giddy: Robert Burgess The bottom-line is the market’s pretty pumped up for continued accommodation after today and not just from the FED.

USA

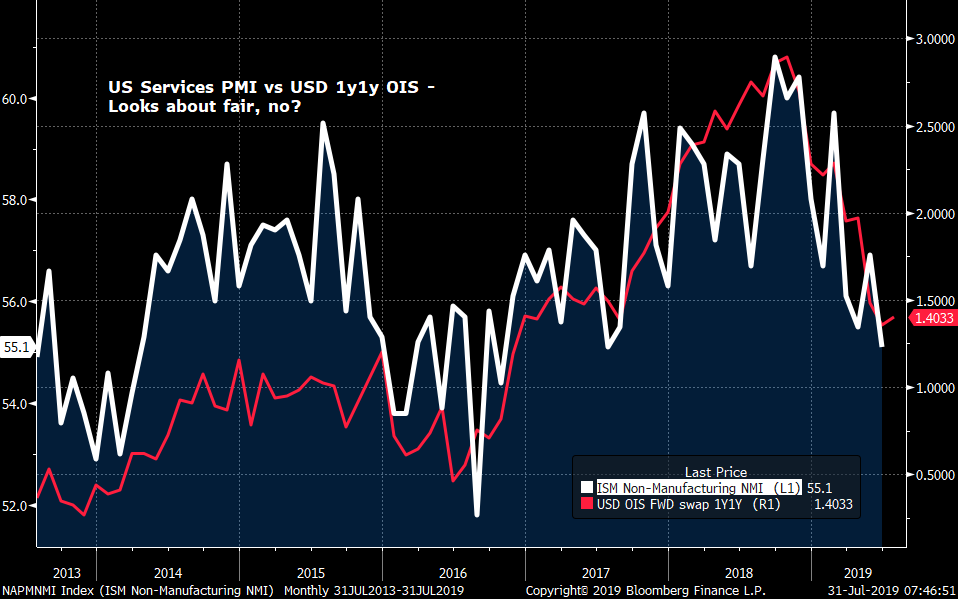

- The US is primarily a services economy, right? Here’s USD 1y1y OIS vs US services PMI.

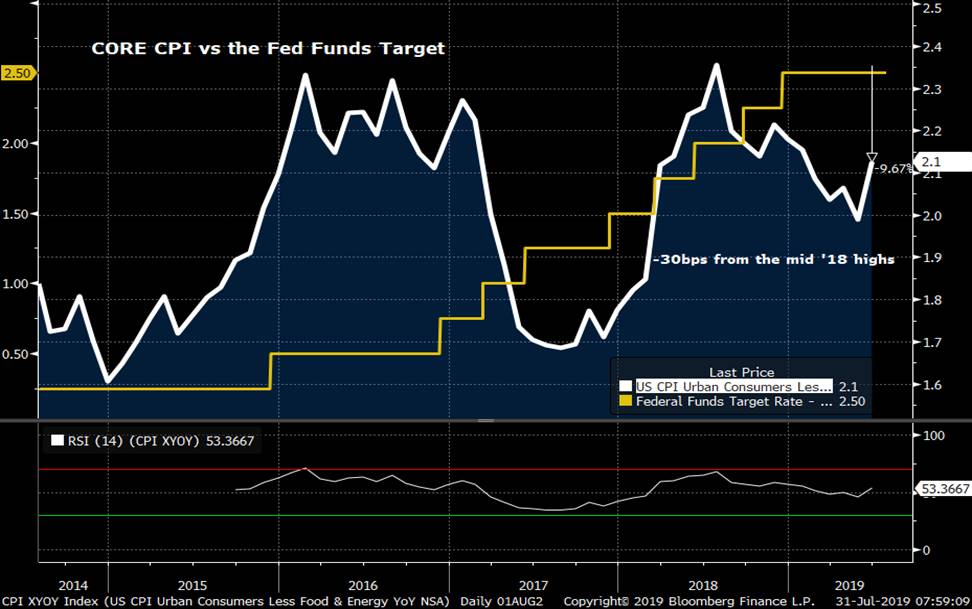

- Core CPI vs the Fed Funds target rate. The Fed’s ‘new and improved’ inflation analysis method is meant to provide them with more flexibility around their target funds rate. We get that. Unless we see a reversal in this latest bounce in core YOY CPI (and GDP, consumer confidence and retail sales!) we will struggle with the idea that the FED should be embarking on a rate cut cycle. Dudley could be right – maybe this is a one-and-done 25bps cut?

- Our back of the envelope measure of UST positioning shows that the market was in shorts-reduction mode as TYA rallied but when the rally stopped, the market got short (hence the divergence in the chart), anticipating a pull-back. Perhaps we’re better positioned for disappointment on the rate cut front from Powell than we thought?

- S&P 500 vs the Fed Funds target rate… Over simplification? Maybe not.

Europe

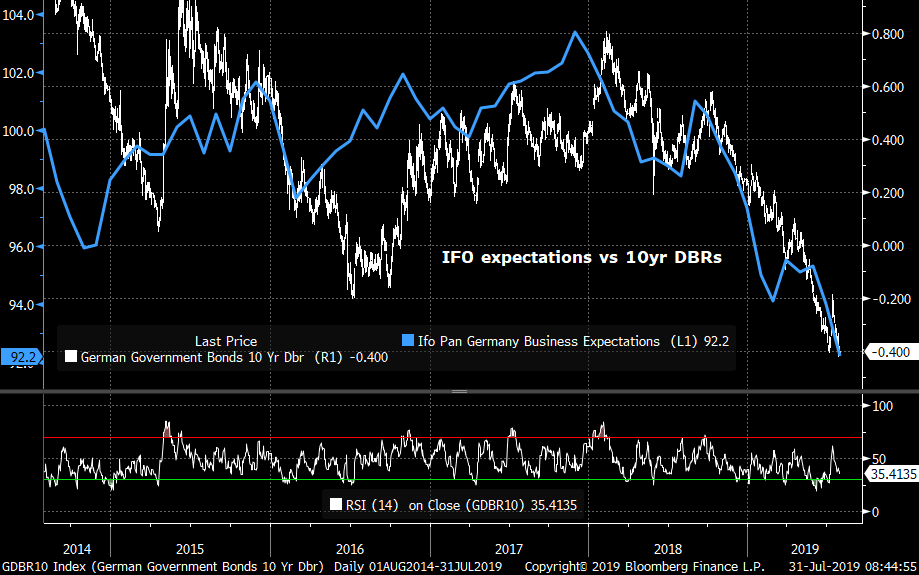

- Germany’s rapid decline has been the most alarming element in the recent erosion of European activity. This IFO expectations index (blue) vs 10yr DBRs suggests that these yield levels are justified given the previous correlation.

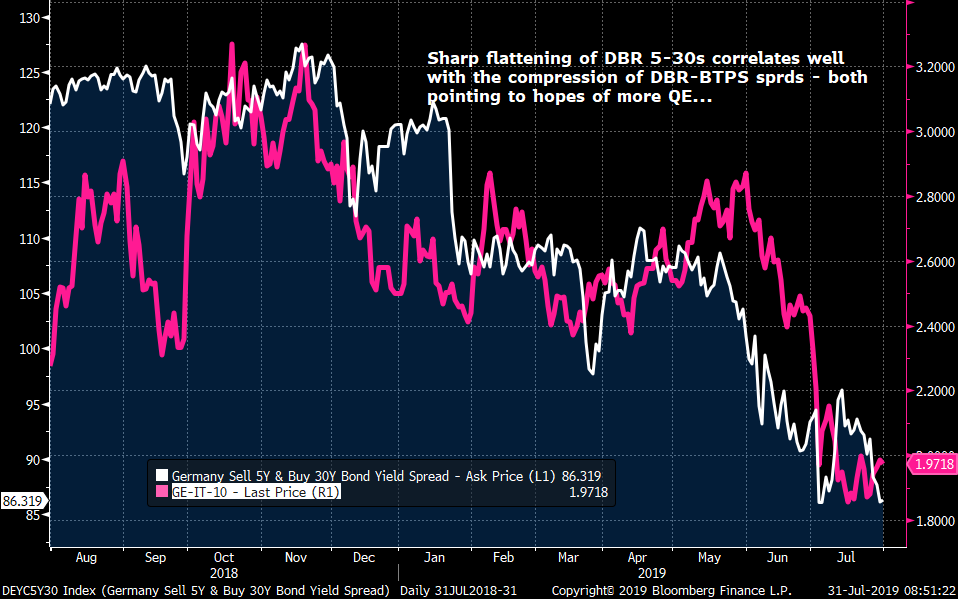

- DBR 5-30s sprd vs DBR-BTPS 10yr sprds… No great shock that these are well correlated, however, they both point to a market that’s dying for more QE and already well-priced for it.

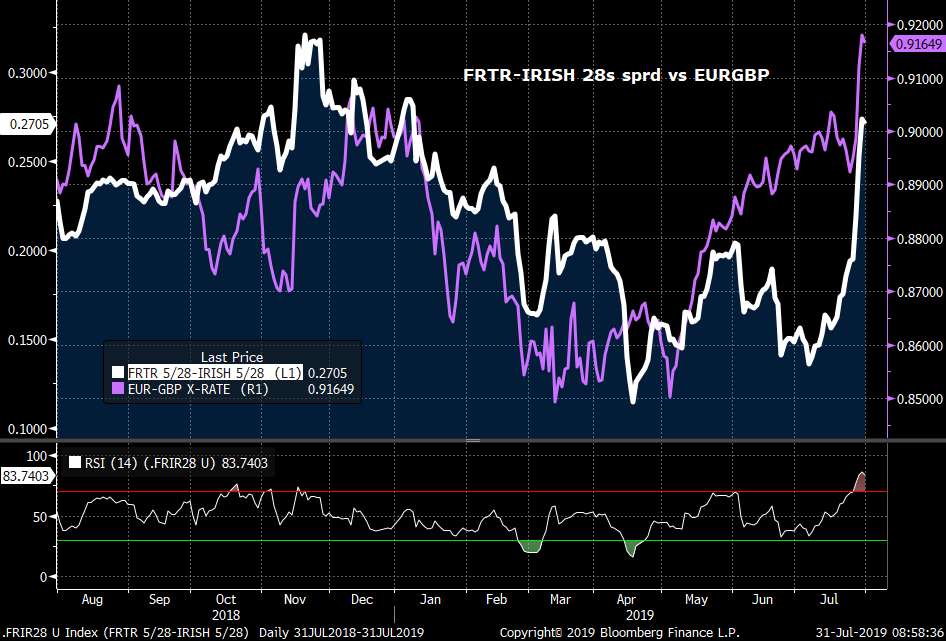

- EGBs immune from the Brexit mess? Well, not if you live in Dublin…

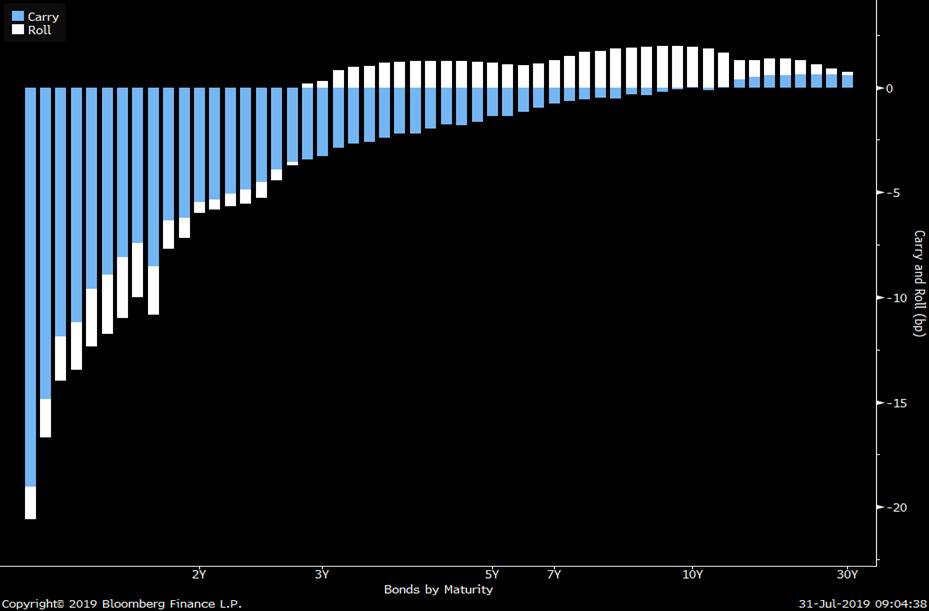

- Here’s the carry and roll chart of the DBR curve. No wonder why we don’t spend more time on DBR RV…

- Eonia out to Mar 2020 pricing in almost two 10bps cuts to the depo rate… We’re not convinced that’ll do much but it would help alleviate some of the neg carry issues above…

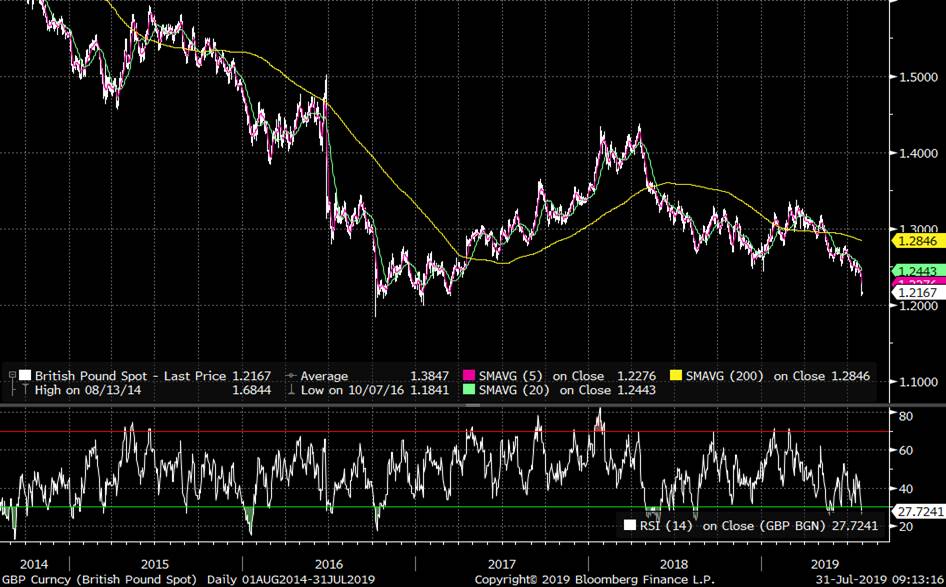

United Kingdom

- Right now, this is the only chart that you need to assess the state of the UK’s outlook. Boris Johnson’s ‘come hell or high water’ approach to the Oct 31 deadline has driven a dramatic selloff in cable that has taken us back within a sneeze of the post-Brexit lows in 2016.

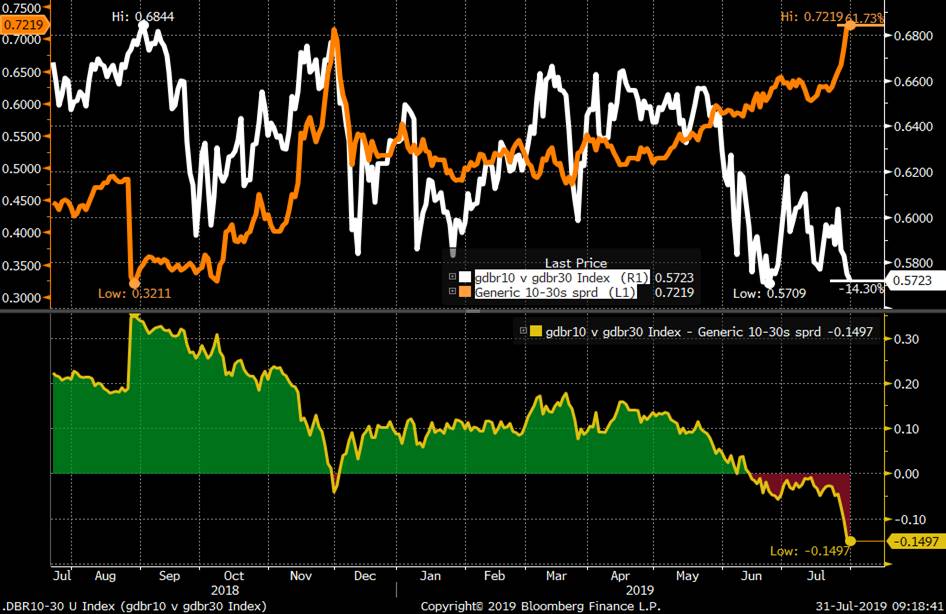

- The weaker pound, hopes of help from the BoE if things get ugly and talk of a dramatic round of fiscal spending this autumn (more cops, tax cuts, NHS spending, etc) that would mean more gilts issuance have combined to drive a relentless steepening of the gilts curve, in start contrast to the flattening in Europe. As noted previously, this looks stretched but there seems little desire to fade either leg of this box yet.

DBR 10-30 vs UKT 10-30

We will be in touch to discuss…

Thanks

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: Spain's Sanchez Faces the Music and BONOs getting Hit - Quick Colour

SPAIN... Politics prompting some profit taking

*PODEMOS WON'T SUPPORT SANCHEZ IN FIRST INVESTITURE VOTE: EFE

From a dealer:

SPAIN POLITICS: to succeed in this vote, Sanchez would need an absolute majority (176 out 350) which was always unlikely to happen even if Podemos would have supported him (PSOE and Podemos together have less than 176 votes). 2nd vote will follow on Thursday where Sanchez would need a simple majority (more votes in favour than against).

We're seeing a rare spread widening of SPGBs vs DBRs on the same day BTPS tighten (+3.0 vs -2.5). With the ECB meeting a couple days away and the market arguably the longest they've been in Bonos risk than they've ever been (relative to benchmarks and on various blends) the timing of Sanchez's political purgatory offers the market a convenient reason to take some profits into what could be a volatile end to the week.

The recent re-richening of SPGBs vs FRTR/BTPS in the chart below has stalled this am as BTPS take back a few bps of their recent selloff. Broadly speaking, this price action in SPGBs isn’t surprising, especially given their performance and to be frank, we suspect that a ‘meaningful’ cheapening of Bonos vs France/Italy would likely attract solid demand, especially with continued talk of smaller issuance and sizeable C&R/Index flows at the end of the month.

More below:

Spanish PM Sanchez faces parliamentary vote to stay in office

Madrid (DPA) -- Lawmakers in Spain are to vote on Tuesday on whether to keep Prime Minister Pedro Sanchez in office, almost three months after his Socialist Workers' Party (PSOE) came out on top in national elections but without an outright majority. It remains unclear whether Sanchez, 47, can win the required number of votes in the Madrid parliament for re-election. In the first round, expected early in the afternoon, he is not expected to get an absolute majority of 176 votes, in which case a second round will follow on Thursday where a simple majority -more Yes votes than No votes - would suffice.

Sanchez's social democratic PSOE has been in talks with Unidas Podemos (UP) for weeks now, after having initially ruled out a coalition with the leftist coalition. UP is demanding four ministerial posts, according to local media.

PSOE and UP together have 167 seats in parliament. Several other smaller groups, including the Basque National Party (PNV) and Bildu, also from that region, have said they would not stand in the way of a new term for Sanchez in the second vote. Sanchez has been in office since June 2018 when he toppled his conservative predecessor Mariano Rajoy in a vote of no confidence.

He called April's early election after the Catalan separatists withdrew their support for his budget proposal.

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Bloomberg Bond News Summary > Mon Jul 22nd

Business Briefing

1) Asia Stocks Decline; Oil Gains Amid Iran Tensions: Markets Wrap

Stocks in Asia kicked off the week on a cautious note as traders dialed back expectations on the size of a Federal Reserve easing later this month. Oil gained amid tensions in the Persian Gulf. Stocks slipped from Sydney to Mumbai, though European equity futures pointed to a more muted start. Futures on the S&P 500 Index were flat after U.S. markets fell Friday. Treasuries were steady after traders pared bets the Fed will slash rates by a half-point this month. ...

2) Tear Gas, Attacks and Beijing’s Warnings Fuel Hong Kong Anxiety

A night of protests and clashes in Hong Kong -- including tear gas volleys and roving groups of masked men attacking protesters -- prompted the strongest warnings yet from the Chinese government and fanned fears of escalating violence. Police fired smoke canisters to clear Hong Kong’s streets late Sunday after demonstrators defied government requests to cut short another large and otherwise peaceful march through the Asian ...

3) Philadelphia Energy Files Chapter 11 Bankruptcy in Delaware

Philadelphia Energy Solutions LLC filed for bankruptcy protection as the fuel-making company grapples with the aftermath of a June explosion and fire at its oil refinery that forced it to shut operations. The company has submitted Chapter 11 petitions at the U.S. Bankruptcy Court for the District of Delaware, according to new filings at the court. It will be the company’s second trip to bankruptcy court in less than two years, after emerging from ...

4) Powell Preference and FOMC Split Support Quarter-Point July Cut

Federal Reserve Chairman Jerome Powell and his colleagues look primed to cut interest rates by a quarter percentage point later this month, eschewing a bigger move in what would be their first reduction in borrowing costs in more than a decade. Faced with slow global economic growth and elevated trade tensions, the policy makers are also likely to leave open the possibility of further cuts down the road as they seek to sustain the record-long ...

5) Spiking Hong Kong Hibor Keeps HKD Shorts on Toes: Markets Live

World News Briefing

6) U.K.’s May to Lead Emergency Meeting on Persian Gulf Security

Prime Minister Theresa May will lead a meeting of the U.K. government’s emergency committee on Monday to discuss the security of shipping in the Persian Gulf after Iran seized a British oil tanker in the Strait of Hormuz last week. May and the committee of top officials and ministers, dubbed Cobra, is to meet at 10:30 a.m. in London, her office said. The U.K. has demanded the immediate release of the Stena Impero and over the ...

7) Robert Morgenthau, Longtime Manhattan Prosecutor, Dies at 99

Robert M. Morgenthau, New York’s longest- serving district attorney, who fought crime in executive suites and violence on city streets for 35 years, has died at the age of 99. Morgenthau’s wife, Lucinda Franks, said he died at Lenox Hill Hospital in New York on Sunday after a short illness, the New York Times reported. First elected as Manhattan district attorney in 1974, Morgenthau won eight more four-year terms before retiring in 2009. He was known ...

8) U.K.’s Hammond to Quit If Boris Johnson Wins Race to Succeed May

Chancellor of the Exchequer Philip Hammond said he’ll quit should Boris Johnson become the next U.K. prime minister, suggesting he’ll be a thorn in the new leader’s side if he pursues a no-deal Brexit. Hammond told the BBC TV’s "Andrew Marr Show” on Sunday that Johnson’s requirement that members of his government be prepared to accept leaving the European Union without a deal on Oct. 31 meant he had to rule himself out of staying in the cabinet ...

9) Jeffrey Epstein Pitched a New Narrative. These Sites Published It.

After Jeffrey Epstein got out of the Palm Beach County jail in 2009, having served 13 months of an 18-month sentence resulting from a plea deal that has been widely criticized, he began a media campaign to remake his public image. The effort led to the publication of articles describing him as a selfless and forward-thinking philanthropist with an interest in science on websites like Forbes, National Review and HuffPost. The Forbes.com article, posted in 2013, ...

Bonds

10) Europe’s Rocket-Fueled Bond Sales Surpass $1 Trillion: Chart

Europe’s primary-bond market has racked up 900 billion euros ($1 trillion) of issuance this year, two months quicker than in 2018 and the earliest in recent years, according to data compiled by Bloomberg. Record-low euro borrowing costs have stoked sales, along with the return of U.S. borrowers after tax changes, and a rush to get deals done before potential Brexit upheavals. Investors have lapped up the flood of new notes as expectations for further cuts in sub-zero ...

11) Dollar Climbs as Bets Pared on Half-Point Rate Cut: Inside G-10

The dollar rose against the yen as traders unwound bets for an aggressive rate cut by the Federal Reserve this month. Haven assets were also sold on signs that Chinese companies are looking to buy U.S. agricultural products. * St. Louis Fed President James Bullard, one of the central bank’s most dovish policy makers, downplayed talk of an easing cycle on Friday and said he favored a quarter-point reduction. Some traders had speculated that the Fed ...

12) EM Asia Currencies Edge Lower, Won Drops on Exports: Inside Asia

Most emerging Asian currencies edged lower as a stronger dollar weighed after traders scaled back bets for a half-point rate cut by the Federal Reserve this month. The Korean won fell after exports declined in the first 20 days of July. * St. Louis Fed President James Bullard, one of the central bank’s most dovish policy makers, on Friday downplayed talk of an easing cycle and said he favored a quarter-point cut. Some traders had speculated that the central bank ...

13) Credit Suisse Clients’ Top Worry Is Twin Rally in Stocks, Bonds

The top current talking point for Credit Suisse Group AG clients is the simultaneous rally in equities and bonds in recent months that suggests two potentially incompatible narratives, according to strategist Mandy Xu. In the stock market, optimism about Federal Reserve interest-rate cuts has sent prices higher. While in bonds, the narrative is one of concern about a lasting economic downturn, she said. “We’ve seen interest in playing a ...

14) Auditors in India Drop Corporates Fast as Own Penalty Risks Rise

Accountants are fleeing Indian companies at a rate of one in every three days after the nation’s regulators tightened penalties for auditing lapses, and more companies find themselves in financial stress. About 74 Indian companies, most of them publicly-traded, have filed notices to the Indian stock exchange so far in 2019 to inform investors that statutory auditors have quit. Reasons for resignation given ranged from unsatisfactory responses to accountant ...

15) Emerging Markets Weekly Podcast: Turkey Rate Decision, CPI Watch

In today’s emerging markets podcast, Tomoko Yamazaki discusses the following: * The impact of dovish central-bank rhetoric on EM * Turkey, Russia and other upcoming EM policy meetings * Last week’s highlights including China data, trade war * China’s new tech stock board, upcoming economic data to watch out Listen to EM podcast, here. To contact the reporter on this story: Christine Burke in Dubai at charvey32@bloomberg.net To contact the editors ...

Central Banks

16) Rate Discord Pits Goldman, JPMorgan Against Israeli Central Bank

The Bank of Israel’s own forecasters have trouble knowing what policy makers may do next. Soon after its researchers surprised this month by maintaining their forecast for an increase in interest rates by the end of September, Governor Amir Yaron said a hike could come “at a later date,” depending on a range of factors. Last October, the department pushed off its call for rates to rise before year’s end -- then, just a month later, the central bank ...

17) Turkey’s Mission to Lower Rates Could Take Longer After Shake-Up

President Recep Tayyip Erdogan may end up losing the long game of bringing Turkish interest rates lower after installing a new central bank governor. The ouster of Murat Cetinkaya just over two weeks ago all but clinches deeper monetary easing in the quarters ahead, according to analysts surveyed in July. But while new Governor Murat Uysal could push the benchmark to 19% by the end of this year, 3 percentage points below the median forecast a ...

18) India Stocks Decline After Central Bank Cautions on Shadow Banks

Indian stocks extended declines to a third day as the central bank said it’s seeing “signs of fragility” in some lenders after key indexes closed last week at their lowest level in two months. The benchmark S&P BSE Sensex Index fell 0.7% to 38,067.08 as of 10:00 a.m. in Mumbai. The NSE Nifty 50 Index dropped 0.6%. Both measures were set for their lowest levels since mid-May. The Reserve Bank of India is monitoring non-banking finance companies ...

19) Modi’s Budget Seen Driving Bond Rally With Room for Rate Cut

India is seeking to lower borrowing costs for companies with its latest budget, a policy shift that will help extend a bond rally, according to Aditya Birla Sun Life AMC Ltd. By announcing plans to sell debt overseas for the first time and promising fiscal restraint, the government may trim weekly domestic bond auctions by almost 30%, said Maneesh Dangi who oversees $23 billion of debt assets. That will help reduce competition companies face ...

20) Sovereign Debt Rally in India Halts as RBI Flags Data Dependency

Sovereign bonds slid after the Reserve Bank of India Governor Shaktikanta Das said further rate cuts will depend on incoming data, forcing traders to dial back expectations of large easing in monetary policy. Future action will rely on economic data and three reductions this year are cumulatively equivalent to 100 basis points of cuts, Das said in an interview. The benchmark 10-year bond yield jumped seven basis points to 6.43%, halting ...

21) Europe’s Bank Earnings to Offer Glimpse Into Negative-Rate Abyss

If you thought U.S. bank earnings were worrisome, wait for the Europeans. As top Wall Street banks warn of zero Treasury yields and falling income from lending, their European peers have been dealing with negative rates for half a decade, with an end looking increasingly far off. The drought has left them without a cushion to fall back on when income from trading dries up, as it did in the first half, and it’s one reason why once-mighty Deutsche Bank AG ...

Economic News

22) RBI Easing Is More Than India’s Rate Cuts Suggest, Das Says

India’s central bank Governor Shaktikanta Das said policy makers have effectively delivered more easing than the three interest-rate cuts this year suggest, signaling a more cautious stance on future action. In one of his first interviews with media since taking office seven months ago, Das said he sees signs of a recovery in economic growth and further monetary policy steps will depend on incoming data. The central bank’s switch to an ...

23) ASIA WEEK AHEAD: South Korea GDP -- Canary in the Coal Mine

South Korea’s 2Q GDP will be the main event in a relatively quiet week ahead in Asia. After a surprise contraction in 1Q, the performance of the export- dependent economy will give an indication on overall global demand. The latest data from Singapore -- another trade-oriented economy in the region -- suggest there is some scope for a downside surprise. * In Southeast Asia, inflation data from Singapore and Malaysia will be in the spotlight. We ...

24) China Hints at Trade Talks Restart After Making ‘Goodwill’ Moves

Face-to-face negotiations between the top Chinese and U.S. trade negotiators could happen soon, according to Chinese state media, after a number of goodwill gestures by Beijing over the weekend. Chinese companies asked U.S. exporters about buying agricultural products and also applied for exemptions from China’s retaliatory tariffs on the goods, state-run Xinhua News Agency reported Sunday. That shows China’s “goodwill” and its commitment to fulfill ...

25) No Data, No Problem? Oman’s Budget Keepers Go Silent for Months

Oman is giving its troubled finances the silent treatment. Downgraded by all three major rating companies and facing speculation whether a bailout might be needed, the sultanate quietly stopped providing data on its budget performance this year. A monthly bulletin published by the central bank July 15, which includes a breakdown of government revenue and expenditure, only covers a period through November 2018. Oman’s budget deficit has been among the largest ...

26) Tumbling Korea Exports Signal Another Bad Month for Global Trade

South Korea’s exports, a bellwether for global trade, appear set for an eighth straight monthly decline as trade disputes take a toll on global demand. Exports during the first 20 days of July fell 14% from a year earlier, data from the Korea Customs Service showed Monday. Semiconductor sales plunged 30%, while shipments to China, the biggest buyer of South Korean goods, fell 19%. The early July data come after Asia’s fourth-largest economy, which relies on ...

European Central Bank

27) Draghi Prepares His Legacy for Like-Minded Lagarde as ECB Meets

Mario Draghi is entering the final three months of his European Central Bank presidency with a plan that will see his influence linger well after he’s replaced by Christine Lagarde. The ECB chief will this week lead a policy meeting that’s widely expected to set the stage for a September interest-rate cut and a possible resumption of quantitative easing. His staff have also started work on a potential revamp of the inflation goal in a move that could ...

28) Why Mario Draghi Should Cut Rates Sooner: Ferdinando Giugliano

If Mario Draghi had hoped for a quiet summer before he retires from the European Central Bank in November, his wish hasn’t come true. The ECB chief will preside over his antepenultimate monetary policy meeting of the Governing Council on Thursday at a disappointing time for the euro-zone economy. Many economists expect the ECB to hold fire until September, perhaps only hinting that more easing is coming soon. But at a time of lackluster growth ...

30) EuroEco Brief: ECB to Set Tone as Russia Cuts, Turkey Shocks

Here's your daily Economics Europe Brief. ECB President Mario Draghi is likely to light the fuse on fresh monetary stimulus at the Governing Council meeting this week by changing the wording of its forward guidance to signal imminent easing; Draghi is entering the final three months of his presidency with a plan that will see his influence linger well after he’s replaced by Christine Lagarde; Fed Chairman Jerome Powell and his colleagues look primed to cut interest rates by a quarter percentage ...

31) All eyes on ECB chief to see if forward guidance lives up to investor expectations

When Mario Draghi speaks on Thursday, the market will be hanging on his every word. Eurozone bond markets have staged a powerful rally since the European Central Bank chief... <p>The full story is available on Bloomberg to Financial Times corporate subscribers.</p>

Federal Reserve

32) Powell seeks a cure for the disease of low inflation

Jay Powell this month stressed the Fed’s determination to fight the sluggish inflation numbers dogging the US economy, warning Congress that... <p>The full story is available on Bloomberg to Financial Times corporate subscribers.</p>

33) Fed poised to lower rates for first time in a decade with cut of 25bp

The Federal Reserve is set to cut interest rates by 25 basis points at its policy meeting this month, as the US central bank settles on a cautious... <p>The full story is available on Bloomberg to Financial Times corporate subscribers.</p>

34) Powell seeks a cure for the 'disease' of low inflation

Jay Powell this month stressed the Fed's determination to fight the sluggish inflation numbers dogging the US economy, warning Congress that downbeat... <p>The full story is available on Bloomberg to Financial Times corporate subscribers.</p>

35) Investing.com: Bitcoin Falls; James Bullard Says Crypto Are Changing U.S. Currency System

Investing.com - Prices of major cryptocurrencies traded lower on Monday in Asia. Bitcoin was last at $10,703.4 on the Investing.com Index, down 0.32% at 1:10 AM ET (5:10 GMT) and Ethereum was trading at $224.08 on the Investing.com Index, a loss of 0.77%. Litecoin dropped 0.37% to $98.284. St. Louis Federal Reserve President James Bullard said at an academic conference on Friday that the possible illegal activities and instability brought by cryptocurrencies are changing the U.S. currency system. “The ...

36) Citywire: Monday Papers: US Fed sets sight on quarter-point rate cut

Top stories Financial Times: The US Federal Reserve is set to cut interest rates by 25 basis points at its policy meeting this month. The Times: The City regulator knew Lendy had been mis-selling loans when it granted the peer-to-peer lender regulatory approval before its collapse. Daily Mail: HM Revenue and Customs has awarded £22 million of contracts to provide IT support until 2021 to an arm of Amazon based in tax haven Luxembourg, despite controversy over its tax affairs. The Guardian: The internet ...

First Word FX News Foreign Exchange

37) Bank Indonesia Sees Better 2H Growth Amid Warjiyo’s Room to Ease

Low inflation and the need to push growth momentum will provide room for accommodative monetary policy, according to central bank Governor Perry Warjiyo. * The policy could be in form of liquidity easing or further rate cuts, Warjiyo tells lawmakers in a hearing in Jakarta on Monday * Govt expects the rate cut would boost investment growth in 2H and stabilize the rupiah, says Finance Minister Sri Mulyani Indrawati * “We hope that the rate cut and the future ...

38) Salvini Mulls Replacing Conte as Prime Minister: Repubblica

Italy’s Deputy Prime Minister Matteo Salvini is considering replacing Giuseppe Conte with a new prime minister, Repubblica reports without citing the source of the information. * Replacing Conte would be alternative to snap elections * Salvini is dissatisfied with Conte, who has clashed with Salvini’s League over draft law that should grant wider autonomy to key northern regions * Salvini is comforted by League’s rising poll numbers, aims to reach 40% ...

39) Star Mania Leaves Rest of Asian Stocks in the Dark: Macro Squawk

China’s new Nasdaq-style Star board debut sees all 25 stocks open sharply higher, with some surging over 500%; mainland indexes retreat with Shanghai Composite 0.6% lower. S&P futures hover near Friday settlement, MSCI Asia Pacific index 0.5% softer. Treasury 10-year yield unchanged; Aussie curve flattens as 10-year yield eases two basis points. Rupee slips and Indian bonds slide after Governor Das says RBI policy is now data-dependent. Bloomberg dollar index ...

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: UPDATING This Week's EUR/UK RV Ideas/Recommendations

Morning...

- Back from a few days out, celebrating my daughter's birthday and my 20th wedding anniversary so thought I’d take a snapshot of how this week’s supply-driven RV ideas (published last Friday am) have fared so far (see attached for original) and to remind you of our calls for this am’s SPGB and FRTR supply.

- DBR 8/48s Tap: As expected, the DBR 48s supply was a RV snoozer, the issue 1.8bps richer vs swaps since the tap but cheaper on the DBR curve.

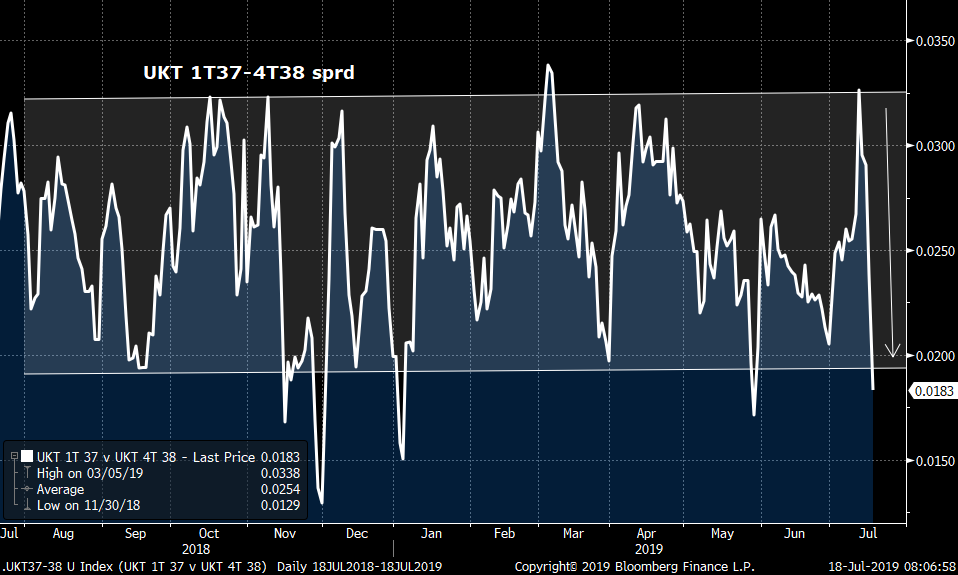

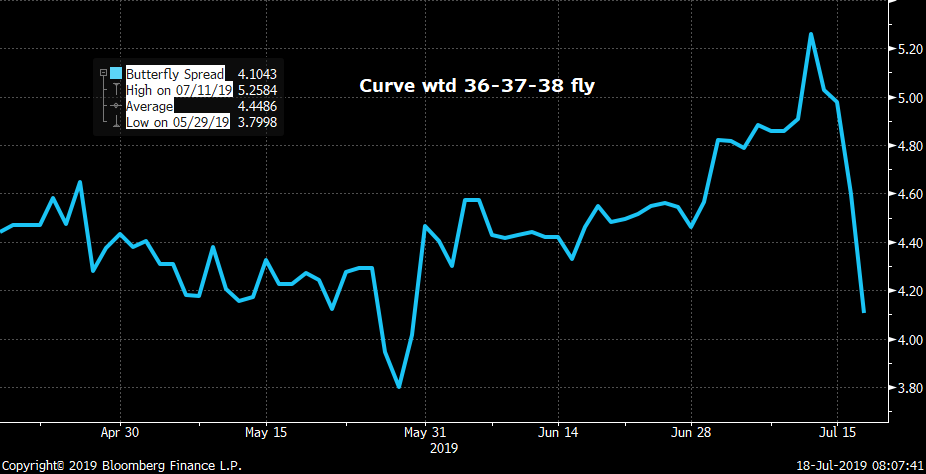

- UKT 1T37s Tap: Very pleased to see the UKT 1T37s have done well in RV terms since their (final?) tap on Tuesday. The long 1T37-4T38 sprd we recommended as a micro-sprd snapped back to the rich end of the range, +3.1bps to +1.8 at last night's close. The long 37s vs 36s and 38s fly (both 1-2-1 and curve wtd) did very well, richening 1.75 and 1.2bps respectively and even the curve wtd 27-37-42 fly richened 1.5bps. All of these were 'classic' auction plays that reinforces our view that these types of trades in the UK are still alive and well.

- SPAIN This AM:

- The SPGB 7/24 vs FRTR 3/24 & BTPS 7/24 blend has cheapened another 5bps from last Friday as BTPS remain well bid. Macro call here which doesn't really fall into the 'RV' category, however, momentum cheaper has slowed and we expect to see this blend settle down into the SPGB cash flows into month-end.

> SPGB 10/29s richened further vs 4/29s, the Z-sprd inverting to new 'lows' on this sprd which attracted some good selling interest in 10/29s.

> The trade I really liked (as per my note) was selling SPGB 4/29s into 7/30s which was at/near the range wides last Fri am around +13.75bps. It's now back to the +11bps lows which has removed the auction/curve concession. We're closing this one out into the tap.

- OATS supply

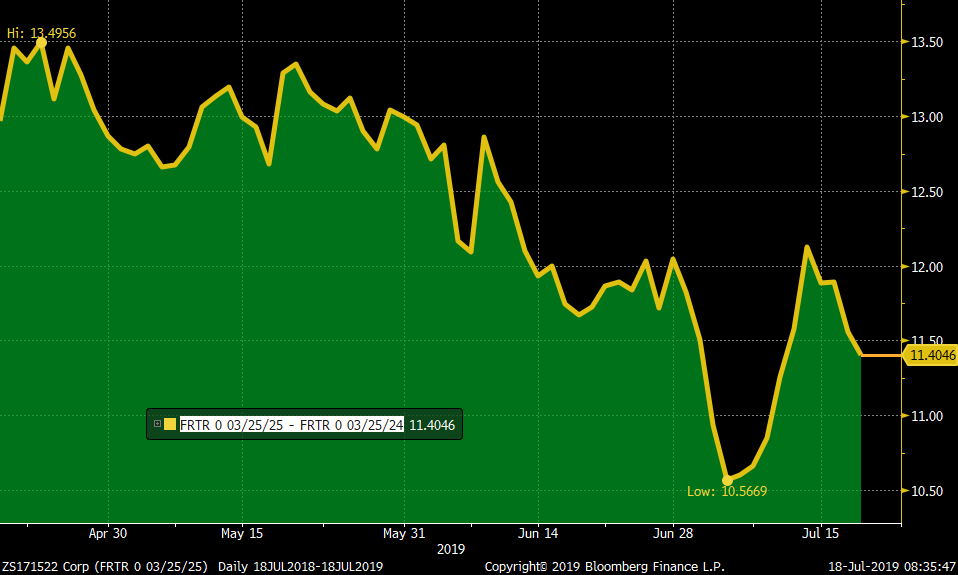

- The FRTR 0 3/25s tap this am is our primary focus given how cheap they looked on the curve and the trade-off between balance sheet usage and RV opportunity. We can see from the charts below that the FRTR 0 3/25s have cheapened a bit on the curve in both the yield and z-sprd curves since last Friday’s note which we expect will be ample enticement this am to get RV players involved.

But the yield sprd has flattened about .8bps – still .9 cheap to the recent lows but not quite as enticing.

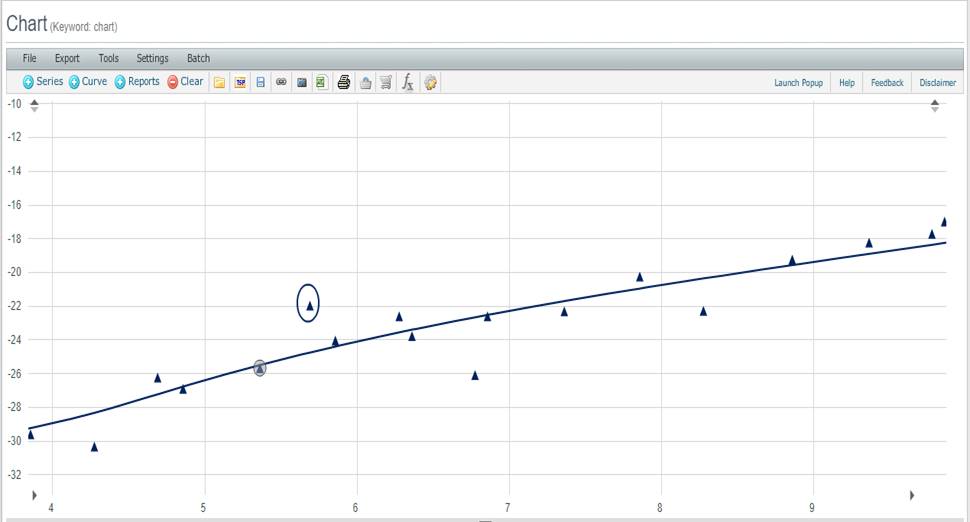

The FRTR 0 3/25s remain cheap on the Z-sprd curve (circled, below), however, so we expect them to remain a solid ‘long’ in the sector as their issuance cycle continues.

Lastly, the FRTR 0 3/23-0 3/25 flattener I recommended as a bull-flattener into the OATs cash flows and ECB meeting has worked nicely, flattening from +23.5bps to +21.65bps and should be on its way to re-testing the 19.6bps lows seen in early July.

More to come shortly… Comments and questions always appreciated and encouraged.

Best,

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Quick Technicals > Powell's On Board So Why the USTs Selling?

- Quick Macro/Technicals Rundown > Rates Markets in Transition

- Powell all but cut rates at the H-H testimony this week yet the rates markets have taken the ‘buy the rumour, sell the fact’ approach as yesterday’s CPI came in firmer than ests, following the robust June payrolls report. Maybe 3 25bps rate cuts is a bridge too far?

- A dovish FOMC should, in theory, help grease the wheels of renewed accommodation for the ECB yet 10yr DBRs are off almost 20bps in the last week, taking RSIs from overbought to oversold.

- Issuance in rates/SSA/corp markets has been huge with 100yr RAGBs and 50yr BTPS weighing on the long-end. UST 10-30s went from bull-flattening to bear steepening since Tuesday as last night’s UST 30yr tap tailed 3bps and closed the day 8bps cheaper.

- Cable continues to flirt with a break of the 1.25 level but SONIA’s grind higher off the lows suggests GBP longs are safe for now. Market certainly feels like it’s long here…

- Despite a barrage of corp/SSA supply, the ITRX index continues it’s risk-on rally, helping to drive yet more tightening of BTPS vs DBRs. A few well placed comments from Italian officials and the hopes of renewed QE have certainly helped. BTPS have gone from zeros to heros in short order.

- Our closely watched blend of SPGBs vs FRTR and BTPS (CIX = (YIELD[SPGB 1.4 7/28 Corp]) - (.7 * YIELD[FRTR 2.75 10/27 Corp] + .3 * YIELD[BTPS 4.75 9/28 Corp])) has seen a dramatic shift from SPGBs rich to cheap on RSIs as the BTPS leg has shifted into overdrive. We suspect that another 10bps of cheapening on this blend will attract renewed buying of Bonos.

Charts:

10yr DBRs

UST 30yrs struggling…

USU9 open interest grinding lower as the curve steepened…

USD DXY Index – Looking shaky…

Cable and 1y1y SONIA attached at the hip – SONIA off the lows…

DBR-BTPS 10yr sprd vs ITRX XOVER index – hand in hand and on a tear…

SPFRIT28 blend – big cheapening of Spain as BTPS rally…

- The conclusion here is that while the FED/MPC/ECB may end up being accommodative, the market is showing tell-tale signs that’s it’s been caught too long for its own good and demand for the additional paper at these levels has waned. Until there’s more definitive confirmation from the ECB and MPC on the path of rates and/or QE, it feels like we’ve seen the highs for the next couple weeks as we await the meetings at the end of this month.

Best,

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's BREXIT BARRAGE... It's BAAAAACK!

It’s been relatively quiet on the future PM/Brexit mess front lately (hence the hiatus), although we’re closing in on the final vote so thought time to send an update…

FT: Ireland steps up cross-border plans for no-deal Brexit

FT: No-deal Brexit poses ‘real risk’ of break-up of United Kingdom, cabinet told

FT: Tory leadership rivals face off in combative head-to-head TV debate

FT: Corbyn’s second referendum move a ‘shaft of summer sunlight’

FT: Jeremy Corbyn backs second referendum on Brexit

FT: Boris Johnson declares ‘good relationship’ with Donald Trump

FT: Boris Johnson vs Jeremy Hunt: who will be Britain’s next PM?

BBG: U.K. Parliament Flexes Muscle as Johnson Doubles Down on No-Deal

BBG: U.K.’s Johnson Refuses to Back Envoy in Role Amid Diplomatic Row

BBG: U.K. Seeks Brexit Concessions, Saying Dublin Has the Most to Lose

TEL: Chris Grayling’s no-deal Brexit ferry debacle cost taxpayers £85m, watchdog finds

TEL: Brexit secretary warns EU that no-deal will hurt Ireland more than UK

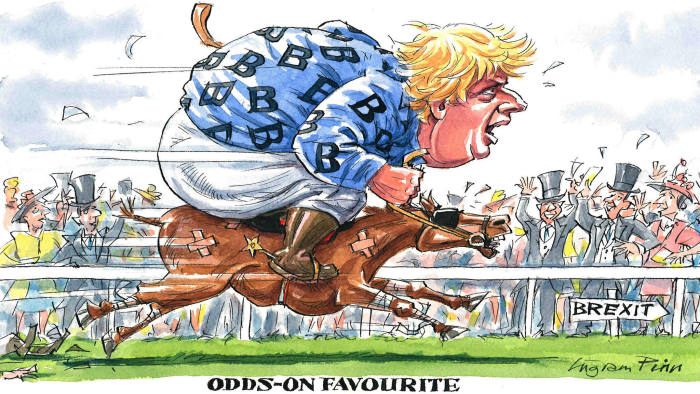

TEL: Boris Johnson’s lead over Jeremy Hunt looks unassailable

TEL: Corbyn’s grip on Labour – along with his constructive ambiguity on Brexit – is starting to unravel

More to come!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's BREXIT BARRAGE... Let's just get this over with now...

Raise your hand if you just want these shenanigans to come to an abrupt end. Time to get working on the Brexit…

BBG: No-Deal Brexit Takes Center Stage in Battle to Be U.K. Premier

BBG: Is Parliament Ready to Back a No-Deal Brexit? You Do the Math

BBG: Why Article 24 Is No Soft Landing for a No-Deal Brexit

FT: Team Boris: the four people behind Johnson’s bid for power

FT: Boris Johnson sparks election warning with ‘do or die’ pledge on Brexit

FT: Brexit bill for financial services reaches £4bn

FT: Ireland finance minister fears for 85,000 jobs in no-deal Brexit

FT: Boris Johnson on Brexit in 6 quotes

FT: The latest Brexit fantasy is the most absurd of all

TEL: Boris Johnson hires Iain Duncan-Smith as right-hand man as he seeks to get campaign back on track

TEL: Jeremy Hunt questions whether Boris Johnson can be trusted

TEL: At last, the old Boris Johnson is back. And it’s already chaos.

TEL: Crunch looming for Irish government in October Brexit denouement

TEL: Next Prime Minister latest odds and polls: Boris Johnson’s lead over Jeremy Hunt starting to narrow

More to come!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's BREXIT BARRAGE... Yes to No Deal?

From: Mark Funsch

Sent: 25 June 2019 07:36

Subject: Today's BREXIT BARRAGE... Yes to No Deal?

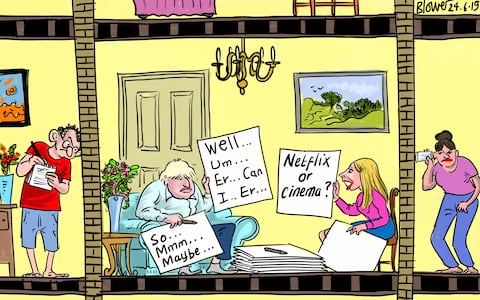

Calls of ‘Staged’ in the press as Bojo’s idyllic photo of him and his girlfriend mysteriously hit the airwaves – along with talk that Parliament would support a No-Deal Brexit… If only the public could vote on this…

FT: Boris Johnson tax cuts to cost £20bn and benefit rich more

FT: Boris Johnson refuses to talk about ‘private matters’

FT: Cracks start to appear in Boris Johnson camp over Brexit strategy

FT: Conservative MPs reveal latest plan to avoid Irish backstop

FT: Brexit party to launch challenge over Peterborough postal voting

FT: The real questions we should ask ‘game changer’ Boris Johnson

FT: Brexit is an idea for a bygone era

FT: Hunt tells Johnson to stop being a ‘coward’ and face questions

BBG: U.K. Parliament Ready to Support No-Deal Brexit, Johnson Argues

BBG: The Pound Could Fall to Record Lows Against the Euro

TEL: Boris Johnson tries to keep show on the road as he defends his right to privacy

TEL: Two realities hidden by excitement over Boris Johnson’s domestic life

TEL: Boris Johnson’s lead over Jeremy Hunt starting to narrow

TEL: Boris is our Trump candidate – choosing him is a risk, but it’s one we have to take

And so it goes…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's BREXIT BARRAGE! No One Said It'd Be Easy!

Yelling and screaming, cops arrive and a ‘No Comment’ follows. Just another night in the life of the UK’s next PM… Great timing!

TEL: Boris Johnson still planning to live with Carrie Symonds in Downing Street despite row

TEL: Boris Johnson renews commitment to leave EU on October 31 as he insists he will not ‘bottle’ Brexit

TEL: Jeremy Hunt: Boris Johnson could disappoint people very quickly if he gets into Number 10

FT: Johnson refuses to discuss domestic row at Tory hustings

FT: Howard Marks fears Tory leadership rush to ‘no-deal’ Brexit

FT: Philip Hammond decides against rapid naming of next BoE chief

FT: Mark Carney dismisses Boris Johnson’s no-deal Brexit claims

FT: Geoffrey Cox disputes Boris Johnson’s no-deal tariff claim

FT: Should the markets fear a Halloween Brexit?

FT: Steve Bannon says he advised Johnson on speech attacking May

FT: Conservatives should fear the Lib Dems as much as Nigel Farage

BBG: Hunt Says Johnson Dodges Scrutiny as Race for U.K. PM Heats Up

BBG: Boris Johnson Faces Fresh Scrutiny Amid Private-Life Turmoil

BBG: EU Plots Response to Boris Johnson Becoming U.K. Prime Minister

BBG: Boris Johnson Wins Cheers From Tories Amid Private-Life Turmoil

BBC: Jeremy Hunt tells Boris Johnson ‘don’t be a coward’ over scrutiny

BBC: Brexit: Labour MPs urge Corbyn not to go ‘full Remain’

BBC: ‘Time has passed’ for a Labour deal

BBC: Fox criticises Boris Johnson’s Brexit plan

BBC: Hunt would not allow UK to break up

More to come!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's BREXIT BARRAGE... Bojo vs Hunt...!

Apparently there was some back-room vote swapping going on that knocked Gove out of the race… Revenge is sweet…

FT: ‘Serious leader’ takes on ‘the two Borises’

FT: How Oxford University shaped Brexit – and Britain’s next prime minister

FT: Boris Johnson and Jeremy Hunt to face off in race to be UK prime minister

FT: Relief in Johnson camp as Hunt edges Gove

FT: Boris Johnson treads a fine line towards Downing Street

FT: Tory economic policy fails to pass muster

FT: A Brexit prime minister must offer more than glib slogans

TEL: Boris Johnson and Jeremy Hunt are confirmed as the final two

TEL: Boris is tragically mistaken if he thinks he can strike a deal with Brussels now

TEL: Vanguard Life Strategy: Brexit has stopped us cutting back British holdings

TEL: Sajid Javid auditions for role as chancellor as he bows out of leadership race

TEL: The Brexit plans of Boris Johnson and Jeremy Hunt – and what Brussels think of them

TEL: Can Jeremy Hunt beat Boris Johnson in the Conservative Party leadership election?

BBG: Johnson and Hunt Go Head-to-Head in Race to Be Next U.K. Leader

BBG: Boris Johnson Faces His Moment of Reckoning

BBG: When Boris Johnson Talks Brexit, MPs Hear What They Want to Hear

BBG: How the Two Tory Rivals for PM Reckon They Can Fix Brexit

Enjoy!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796