MACROCOSM: Quick Rates Technicals Update > W/Graphs

Quick Technicals Update…

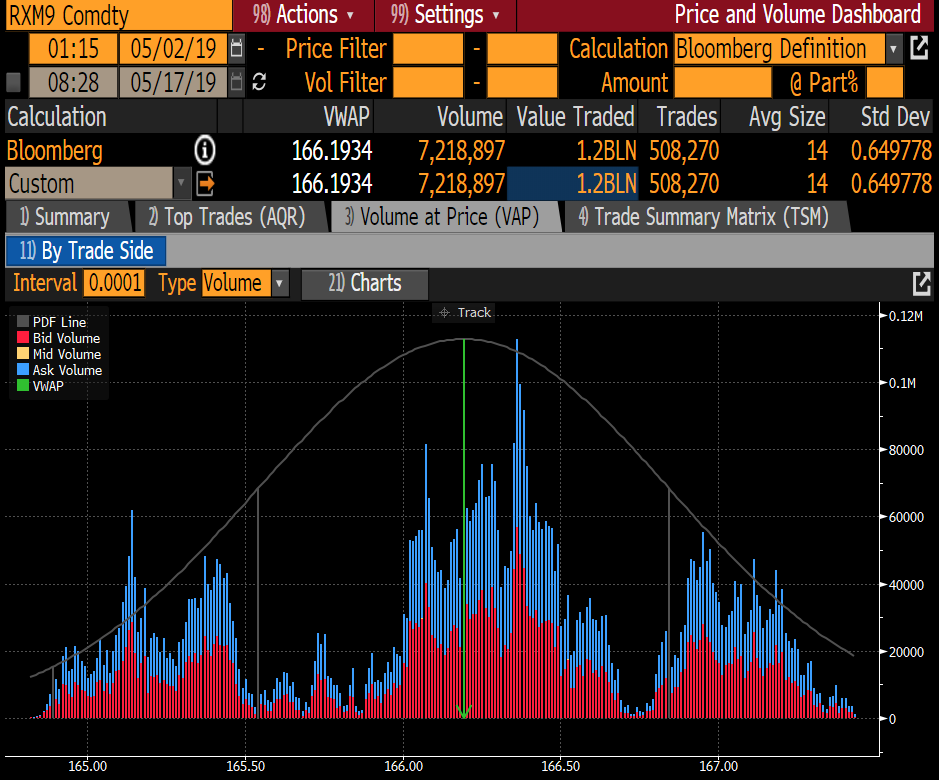

- RXM9 > Our ‘rounding top’ formation, highlighted last week, continues to play out as momentum in RXM9 reverses (albeit at a snail’s pace) amid erosion in aggregate open interest. As noted previously, there’s a good deal of bad news built into the markets into the start of the EU elections and with European data showing signs of stabilizing, there’s little urgency to reach for DBRs at 3yr highs.

- Spain’s still en fuego… How tight can they trade? Take a look…

SPGB 28s vs FRTR/BTPS blend at extremes…

However, the OATS vs DBR and SPGB 28s blend (64% DBR 2/28, 100% FRTR 5/28 and 36% SPGB 7/28) shows OATs cheapening back to a ‘BUY’ level.

- Aggregate non-comml hedging positioning in UST futures (in TY terms) has tracked the rally in TY very closely, longs building as we rally. Makes one wonder how many shorts are left…?

- DXY index of the USD and TUM9 invoice spreads (inverse) have tracked each other well – both looking toppy here…

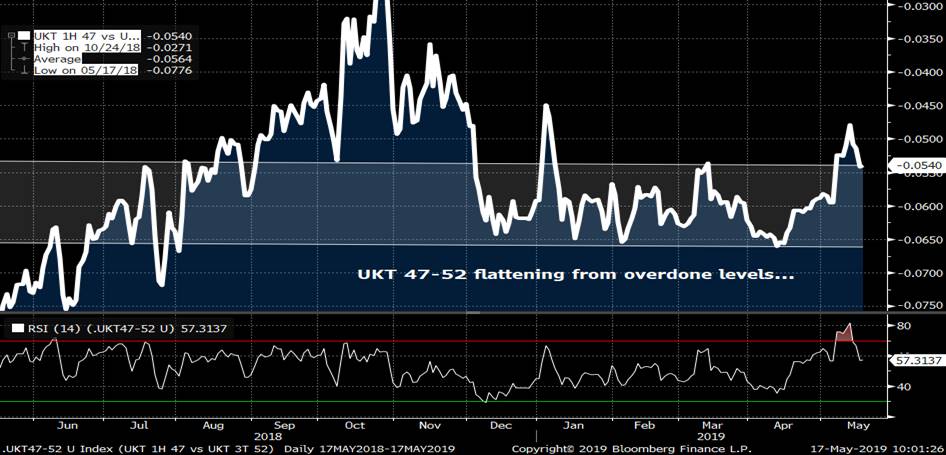

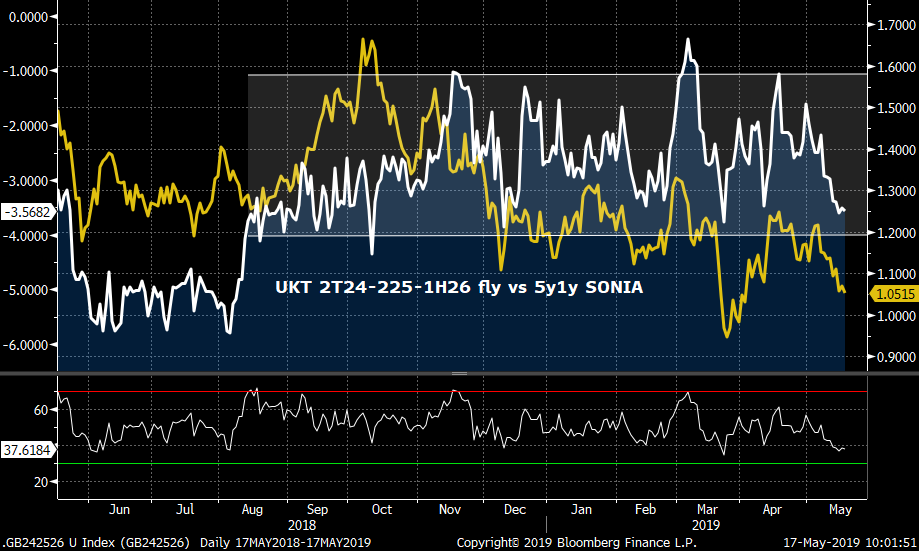

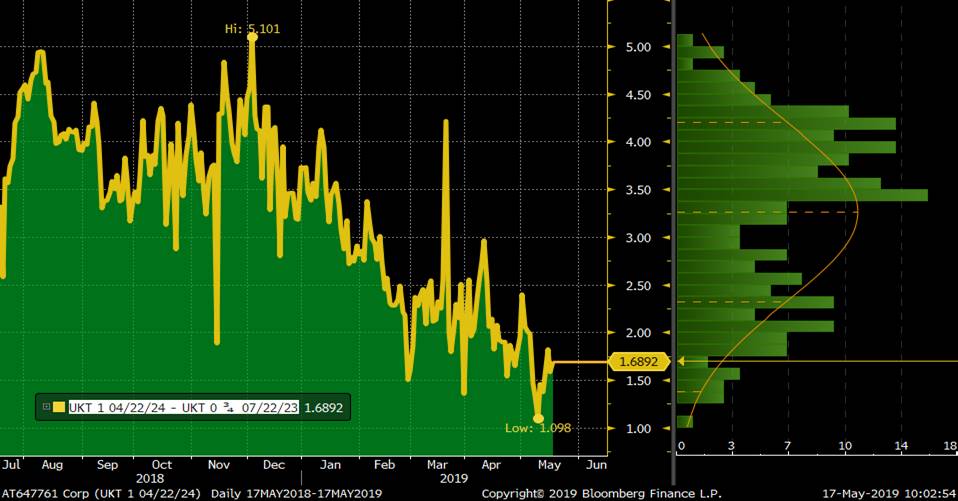

- GBP still has no friends and the gilts curve is making new extremes…

More to come!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Quick Rates Technicals Update > W/Graphs

Quick Technicals Update…

- RXM9 > Our ‘rounding top’ formation, highlighted last week, continues to play out as momentum in RXM9 reverses (albeit at a snail’s pace) amid erosion in aggregate open interest. As noted previously, there’s a good deal of bad news built into the markets into the start of the EU elections and with European data showing signs of stabilizing, there’s little urgency to reach for DBRs at 3yr highs.

- Spain’s still en fuego… How tight can they trade? Take a look…

SPGB 28s vs FRTR/BTPS blend at extremes…

However, the OATS vs DBR and SPGB 28s blend (64% DBR 2/28, 100% FRTR 5/28 and 36% SPGB 7/28) shows OATs cheapening back to a ‘BUY’ level.

- Aggregate non-comml hedging positioning in UST futures (in TY terms) has tracked the rally in TY very closely, longs building as we rally. Makes one wonder how many shorts are left…?

- DXY index of the USD and TUM9 invoice spreads (inverse) have tracked each other well – both looking toppy here…

- GBP still has no friends and the gilts curve is making new extremes…

More to come!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

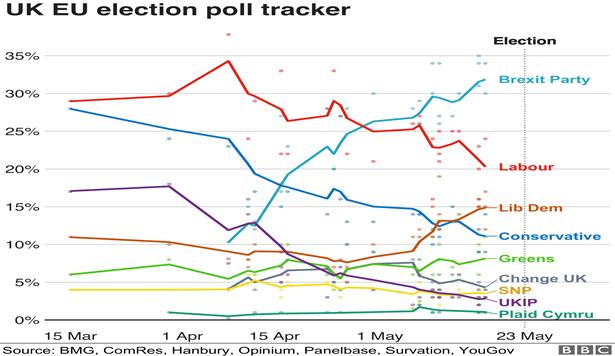

Today's BREXIT BARRAGE... Anyone really care about Brexit anymore?

Stagnation, frustration, exhaustion and now apathy… When we’ve got a clown like Farage taking over it’s time to turn the lights off and close the shop. The good news is there’s a lot going on elsewhere that will drive the rates markets – including gilts – for the near future.

This will be my last BREXIT BARRAGE until this update becomes meaningful again. Could be a while… Thanks for reading.

FT: Bridgepoint seeks upside from Brexit hit to sterling

FT: Bank deputy says businesses has unrealistic Brexit expectations

FT: Lord Heseltine has Conservative party whip suspended over Brexit

FT: Tory factions set out their stalls ahead of leadership battle

FT: Back to fears about a no-deal Brexit

BBG: May Faces Brexit Showdown as Ministers Jostle to Succeed Her

BBG: Brexit Targeted Foreign Workers. Now Robots Are Coming

BBG: U.K. Electoral Commission to Review Brexit Party Funding

TEL: The Brexit Party and Liberal Democrats could go from political underdogs to kingpins

TEL: Why Theresa May’s new Brexit offer is too little, too late for MPs

TEL: How refreshing to hear Conservatives talking about ideas

TEL: After Theresa May, the Tories could benefit from Andrea Leadsom’s Maggie-esque steel

BBC: Brexit: Hammond to warn Tories over no-deal ‘hijack’

Enjoy…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Quick Rates Technicals Update - Topping Pattern Still Intact...

- In Friday’s technicals update (attached), we highlighted how slowing momentum, overbought technicals and key bull trend supports were combining to signal a top is in, especially in RXM9.

- RXM9 > While that 166.86 support level in RXM9 is still holding, the price action (waning volumes, narrow ranges, ‘doji’ patterns) suggests we will need another deterioration of the political outlook and/or a sharp decline in the economic outlook to drive renewed buying from here.

- IKM9 > Friday was one of those rare days (of late) where all EGBs traded well – at least for part of the day – with IKM9 rallying back to the 20 day MA, taking the daily charts back to neutral and removing some of the oversold, short covering bias that drove this bounce. With the European Parliamentary Elections kicking off this week, it seems logical to suggest we’ll chop sideways from here. A puh back up to the range highs in April and May will require some good news both at the polls and in the data.

- USM9 > Similar read as above, only this chart looks even more convincing. The price action shows signs of turning, the March highs have held well and RSIs have run out of steam. Take profits on longs and/or put on shorts, looking for a break of 149-12/32 supports for a test of 148-07. Supply is light this week in the US so we’ll take our cues from politics yet again.

- GBP/G M9/SONIA, etc > Well, Brexit is rearing it’s rather ugly head yet again, this time amidst renewed fears of a No-Deal outcome despite Parliamentary legislation that was meant to prevent one. Cable had a terrible week which was the primary driver of a sharp rally in SONIA, cable at oversold RSIs into this week’s action. So, while we were on ‘alert’ into Friday’s session, we’re now in the ‘Yikes!’ zone. This precarious situation into the MEP elections Thursday (where the Tories and Labour are expected to be pummelled) is pricing in the worst, suggesting that, as we can see from this am’s G M9 open, we’re prone to a bearish move. We’ve seen this movie before and are keen to play the ranges we’ve seen develop. May’s deal won’t pass, the leadership contest will kick into gear in earnest and the job of getting this Brexit mess sorted will resume in earnest.

Looking to fade this move? UKT 0H22-0T23 sprd has pancaked to new lows at 4.75bps (-.6bps carry/roll over 3 mos)

UKT 2T24s have cheapened on the curve of late, the sprd versus 1Q27 and 4Q27 flattening back close to the range lows on this bullish move. If momentum is slowing these these steepeners will perform well.

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BBG FIRST WORD: Too Expensive to Buy But Too Risky to Short: EU Rates Roundup

Too Expensive to Buy But Too Risky to Short: EU Rates Roundup

(Bloomberg) -- Strategists have limited views on duration, although there is no real interest to short bunds with downside risks to the economic backdrop widely acknowledged.

- Lots of discussion of ECB rate-cut pricing; Morgan Stanley expect this to fade if Draghi rules out lower rates; BofAML see possibility this isn’t ruled out and recommend EUR 3m7y straddles

- Italian political risk is on market radar: Credit Agricole, Barclays hold on to BTP curve flatteners to protect against further widening; NatWest Markets fade political posturing and recommend steepeners

- Large Japan buying flow in France has market’s attention. Barclays suggest this should continue keep a lid on EGB yields; NatWest Markets expect this to soon spill over into Spain, and continues to like SPGBs

- Gilt views are mixed: Citigroup goes short 10-year, NatWest Markets goes long against bunds. Barclays sees support for long-end swap spreads from upcoming cash flows

Morgan Stanley (strategists including Tony Small)

- Bund yields have fallen into “oversold” territory, according to some technical indicators, though this is not enough to justify a large move higher in yields as near term outlook remains filled with possible negative developments

- Bunds typically see stronger performance in summer months coinciding with large coupon payment flows in July

- Euro front-end prices in small chance of rate cuts; likely ECB would prefer more favorable terms for TLTROs, pushback of forward guidance and extension of balance sheet reinvestment before moving to cut rates

- See room for longer-dated Euribor calendar spreads such as ERZ9/ERZ0 (Dec19/Dec20) to re-steepen as some risk factors subside and ECB maintains current guidance for rates at June meeting

NatWest Markets (Giles Gale)

- Continues to favor Spain. Latest Japan flow showed heavy buying in France, expect Spain to be next given data is resilient

- May and July are historically big buying months for Japanese flows

- Escalation in trade tensions and perceived ramp-up in Euroskeptic rhetoric from Italy’s Salvini ahead of European elections saw long 5-year BTP position stopped out. Now recommend 2s10s steepeners as a high-carry, more defensive option

- In the U.K., political risks are building and a new prime minister could adopt a harder stance toward the EU. Favor long gilts vs bunds in the 10-year sector and also expect 10-year gilts also to outperform swaps

Barclays (strategists including Cagdas Aksu)

- Stay bullish duration, expressed via EUR 5s30s flatteners; recent strong demand from Japan for European bonds, while focused in Spain and France, should continue to keep a lid on yields

- Stick with recent recommend Italy 10s30s flatteners versus Spain, which should work in cases where Italy risk premium rises. Also hold onto long Spain 5y5y fwd which has a bullish spread bias

- Long-end gilt swap spreads can remain supported by seasonal factors, supportive cash-flows and positive carry and roll available; June/Dec. coupon paying gilts go ex-dividend from May 30

Citi (strategists including Jamie Searle)

- Gilts already priced in significant amount of no-deal risk, which still seems unlikely, with 10-year yields near 1%; turn short duration targeting a move to 1.2-1.3%

Credit Agricole (strategists including Afsaneh Mastouri)

- Return of headline risks should be supportive for Bunds this week; however, appetite to buy Bunds at these lofty levels is limited

- Risk remains for the BTP-Bund spread to widen in near term, as political noise resurfaces, stick with Long BTP 03/2030 versus BTP 12/2025

BofAML (strategists including Ralf Preusser)

- Recommend buying EUR 3m7y ATM straddle given risk of another dovish ECB surprise in June and/or risks thereafter; this covers various potential market moving events including June 1 for tariffs implementation, Brexit parliament vote on June 4/5, ECB meet on June 6, G-20 at the end of June, choice of next ECB president

- See possible ECB moves that could help extend the rally such as generous TLTRO, significant extension of forward guidance, and/or not ruling out further rate cuts

To contact the reporter on this story: Stephen Spratt in Hong Kong at sspratt3@bloomberg.net To contact the editors responsible for this story: Tan Hwee Ann at hatan@bloomberg.net Anil Varma

Alerts: THE RESEARCH ROUNDUP, EU RATES ANALYST WRAP

Source: BFW (Bloomberg First Word)

People

Afsaneh Mastouri (Credit Agricole SA)

Cagdas Aksu (Barclays PLC)

Giles Gale (Royal Bank of Scotland Group PLC)

Jamie Searle (Citigroup Inc)

Ralf Preusser (Merrill Lynch International)

To de-activate the "THE RESEARCH ROUNDUP" alert, click here

To de-activate the "EU RATES ANALYST WRAP" alert, click here

This message was sent from MARK FUNSCH via the Bloomberg Professional Service.

Today's BREXIT BARRAGE... Once More, With Feeling...

BBG: Tories Turn to Leadership Race as May Puts Up One More Fight

BBG: Theresa May’s Economic Legacy Dominated by Brexit Fallout

BBG: Labour’s Corbyn Moves Closer to Backing Second Brexit Referendum

BBG: Nigel Farage Is Winning the Brexit Cyber War

BBG: Brexit Blues Knock House Prices in Almost Every London Borough

BBG: U.K. Plc Counts Cost of Brexit as Politicians ‘Chase Rainbows’

BBG: U.K.’s Corbyn to Offer Public Vote on Any Deal: Brexit Update

FT: May makes final Brexit push despite Tory sense of doom

FT: Cabinet in no-deal Brexit row as Tories face election drubbing

FT: Brexit wrangles intrude on EU job allocation

FT: European elections: EU27 voters in UK seek to escape Brexit limbo

TEL: Theresa May’s ‘bold Brexit offer’ is just a ‘retread’ of old ideas, leaked document suggests

TEL: Why Britain is the most stable stock market in the world, despite Brexit

TEL: Brexit Party set to win more votes than pro-Remain parties combined, polling reveals

TEL: The Brexit Party: What do they stand for, and who are the MEP candidates running for election?

BBC: Does collapse of Labour talks spell end for Theresa May’s hopes?

More to come!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Astor Ridge Data, Supply and Events Calendars for Week of May 20-24

Comment

Will be a very interesting week given the level of G-7 rates, renewed weakness in GBP and the precarious price action in stocks…

Data calendars are mixed – the US is quiet while the UK and Europe are pretty busy. The tone of the estimates aren’t suggesting further deterioration in the outlook for Europe or the UK…

Supply-wise, the NETHER Green Bond will be a major focus, along with Spain’s supply on Thursday which the market can’t seem to get enough of. I’ve amended the supply calendar to reflect the SPGB 7/24s tap instead of the SPGB 10/21s we assumed initially.

TONS of events on tap next week with FOMC, ECB and UK central bankers all over the map. We also get the FED and ECB minutes.

Buckle-up kids! It could be a bumpy ride…

Have a good weekend.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

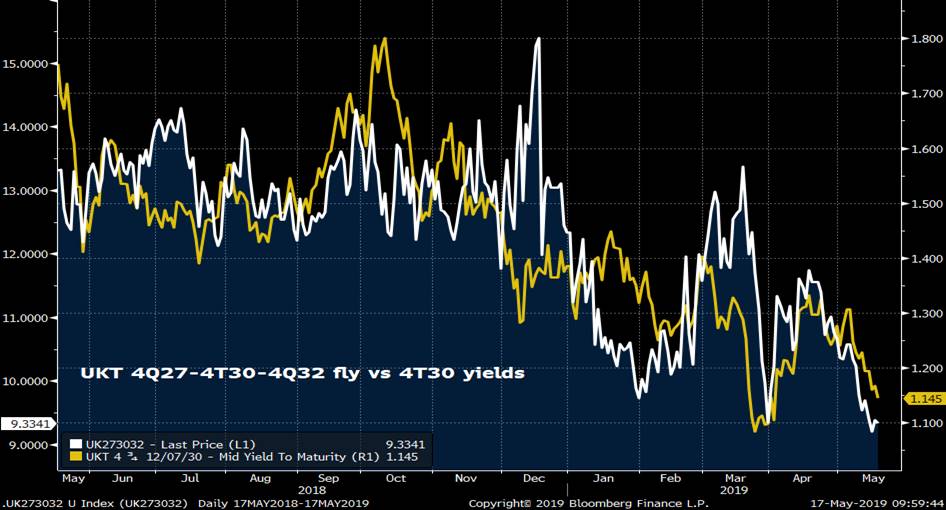

MICROCOSM: GILTS > Quick RV Thoughts... w/Charts

GILTS...

- We won't have any nominals supply in UKTs until the final tap of the UKT 124s on June 4th. That's a long hiatus following this week's 2054s syndication, especially from a DV01 perspective.

- The post-54s 'clean-up' of the pre-syndication cheapening of 52s-57s is underway as the 47-52-57 fly is about .75bps richer and 47-52s about 1bp flatter in the last two sessions, despite a bull steepening bias across the curve. Still not back to pre-syndication levels, however, which makes sense given the bull steepening bias in place for most of this week.

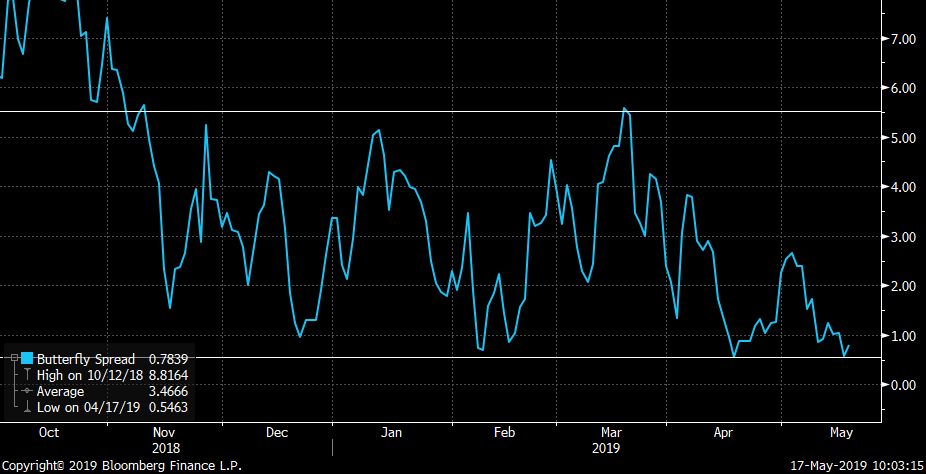

- The 4Q27-4T30-4Q32 fly remains pinned to its richest level since Jan 2017. Chart below shows this isn't unusual given the correlation to 5y5y SONIA says it's directional.

- UKT 2T24-225-1H26 fly is back to the rich end of it's range on the back of the rally and some recent heat in repo...

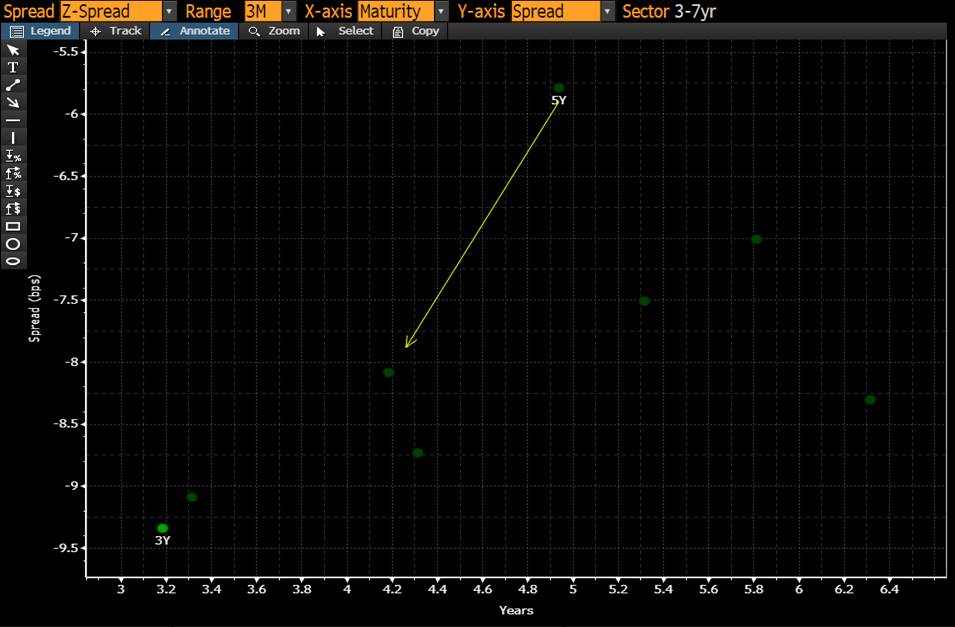

- As a 5yr gilts issue's auction cycle ends, the issue typically richens into tthe curve, removing any llingering cheapness continued taps create. The Z-sprd curve suggests the 124s are still 2bps cheaper than they should be given where the 0T23 and 1T22s trade so, in theory, we should remain long them on the curve. The trouble is, optically they already look on the rich side vs 1T22 and 1H26 given the rally in SONIA which could dissuade the market from buying them. Even the 0T23-124 Z-sprd box is only 1.7bps so, while the math says they've still got troom to rally, the charts say 'wait for a dip'.

0T23-124 Z-sprd box – already looking flat…

UKT 1T22-124-1H26 fly sitting at bottom of range…

UKT 3y-7y Z-sprd curve – 1 24s still look cheap vs 0T23s (see arrow)

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Quick Rates Technicals Update - A Top In the Works...

Quick Rates Technicals:

- RXM9 > Bullish break through H&S neckline resistance dragged in the last of the weak shorts but momentum has slowed as value has built around the 166.90-167.05 area. Two consecutive lower closes at overbought RSIs has the look of a top being formed and this morning’s open suggests it could have legs. At the very least, we'd take profits on half our longs here if you've caught the move. (Chart below)

- IKM9 > Last night’s note about the bullish ‘Dragon Fly Doji’ (see attached) seems to have wings (sorry, couldn’t resist) as this am’s open has IKM9 rallying 29 ticks, driving a bull flattening move. With no BTPS supply for the next couple weeks we’re in a nice little pocket risk-wise that could drive a handsome rally, especially if the elections next week come and go without any fireworks.

- USM9 failed at the March highs and is testing the bull channel support… RSIs are overbought here too – and as above – we’re inclined to lighten up here.

- SONIA 1y1y vs GBP/USD… The on-again, off-again correlation of 1y1y SONIA to GBP is back on again. Since Apr 15th the correlation has been very high, SONIA rallying as Cable comes under pressure. This is the ‘right’ relationship, one would think, especially since GBP was defying gravity for much of March despite the melee in Parliament. Perhaps May’s departure will produce some sort of breakthrough – or better yet – give the market an excuse to be optimistic. Either way, momentum has been negative here and we’ve seen little sign of relenting yet.

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's BREXIT BARRAGE... May Day on the Way

Not sure if we’re supposed to be relieved, saddened or elated about the news Theresa May’s finally on her way out… I am leaning ‘elated’.

BBG: Frustrated and Upset, Theresa May Was Told Her Time Is Up

BBG: Here Are All the Rivals Queuing Up to Try to Replace Theresa May

BBG: Boris Johnson Is Slim, Trimmed and Ready to Fight for Power

BBG: The EU Won’t Shed a Tear Over May’s Demise Amid the Brexit Mess

BBG: U.K. Brexit Drama Hurts European Car Sales for Eighth Month

BBG: Brexit Bulletin: The Final Days of May

FT: Theresa May’s allies insist cross-party Brexit talks are continuing

FT: Corbyn’s Labour squeezed by ardent Brexiters and Remainers

FT: UK Treasury prepared currency war chest for Brexit, says BofA

FT: Sterling strikes three-month low on flare-up in Brexit angst

FT: Theresa May offers herself up to save Brexit deal

FT: Channel 4 News claims Arron Banks funded Nigel Farage’s lifestyle

TEL: How the ‘men in grey suits’ called time on Theresa May’s premiership

TEL: Cross-party talks with Labour set to end without agreement

TEL: The Brexit Party: What do they stand for, and who are the MEP candidates running for election?

TEL: Tearful Theresa May forced to agree to stand down: PM out by June 30 at the latest

TEL: Theresa May leaves No 10 the way she ran it: in a cloud of mystery

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796