MICROCOSM: GILTS > UKT 0F35s/0F50s Tap Tomorrow - Quick Rundown

GILTS > Quick Thoughts

> 0F35 & 0F50s taps tomorrow are this week's main risk event in the conventional Gilts market. The £2.5bn 35s and £1.75bn 50s are close to 70,000 G H1 equivalents so expect a bit of last minute jockeying on the curve by the GEMMs to make room for them.

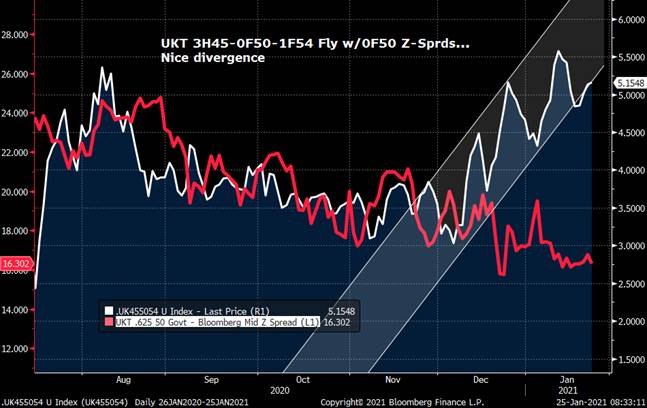

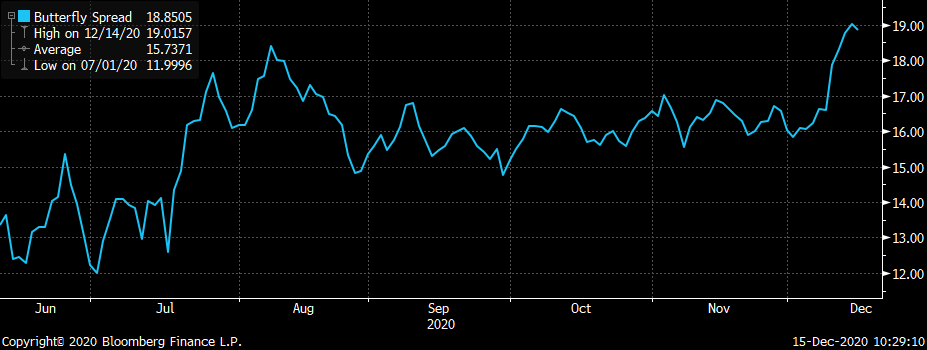

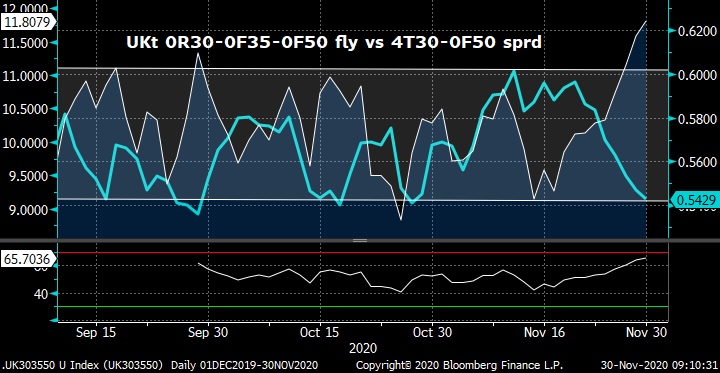

> As noted in our rundowns last week, the 0F50s look cheap to us on flies like 45-50-54s, having given back the .5bp post-46s richening by the end of the week. At £26.3bn we're closing in on the end of their cycle.

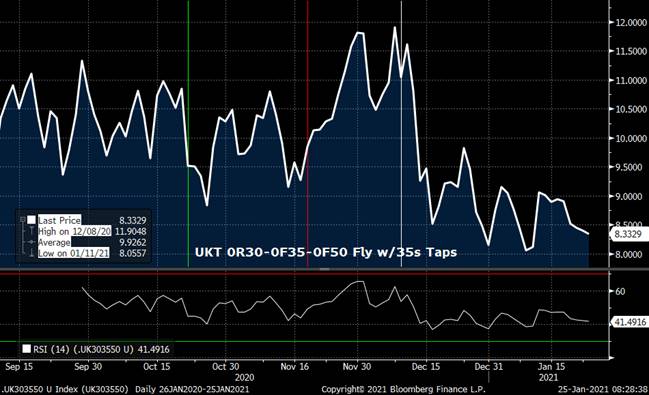

> The 0F35s have traded relatively well, showing few signs of the sharp cheapening we saw into their last tap on Dec 9th. There's a tap of them every month this qtr as we build from their £16bn total. With the 0R30-0F35-0F50 fly (our core posn) at +8.4bps mid (just .2bp off their richest level), they're holding in well on the curve.

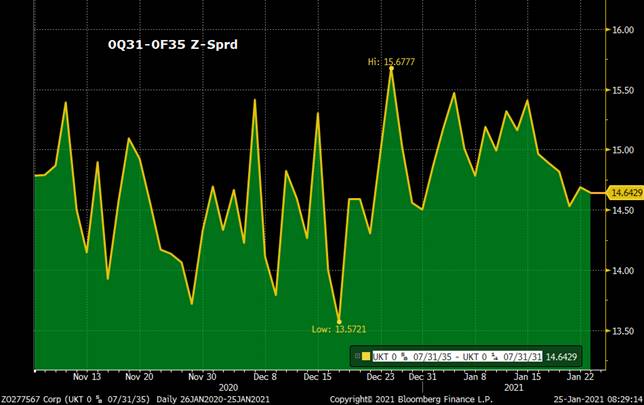

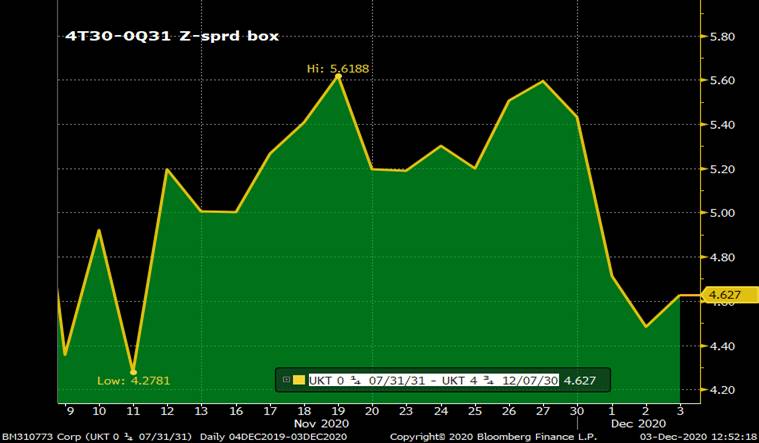

> The 0Q31-0F35 Z-sprd has flattened 0.9bps in the last 3 days with the range low 13.5bps. We're watching this sprd closely, not just for a chance to buy the 35s cheaply but because the 31s will be tapped next week and could generate some selling into the event.

UKT 0F50-DBR 0 8/52 sprd has been capped at +100bps for most of the last 2 months so with the sprd at +98.25bps, location looks good here to add to long UKTs. Long-end supply in Europe this week is relatively light with the exception of the EU SURE deal (TBC).

More to come...

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: EU SURE vs EGBs > Where's the Demand?

E-zone> EGBs vs EU SURE

- This BBG Article was posted around 5am today:

EU's Bond Spree Risks Chipping Away at Demand for Members' Debt

- Huge issuance of EU joint paper to create allocation upheaval

- Investors looking to drop French, Belgian debt to make room

- If you missed it, have a quick read. It got me thinking about demand for the EU SURE paper vs EGBs so I asked a friend who trades SSAs at a big bank the following: "When EU paper gets big enough, does it get included in the EGB indexes?"

- Well, I opened up Pandora's Box with this one. On the outside looking in, the EU SURE program doesn't get automatic support from the powerful EGB-indexed real money community who are the EU's target audience. As an off-index bet each purchase of these EU issues requires special permission and plays havoc with their portfolios. As a non-EGB issuer their SSAs are supposed to have ample alpha to make the purchase worthwhile but the AAA rating of the EU SURE program and it's relative liquidity versus most smaller issuers has them trading at spreads that are through OATs and cheap to DBRs. That's hallowed ground that will be tough to hold onto unless their status morphs into a quasi-sovereign issue.

- As the article details, demand for this new EU SURE program is coming from all over the place. Covered bond buyers are shifting some of their risk into EU paper as a more liquid, similarly rated alternative at similar yields. SSA desks are handing over trading of them to EGB desks to be traded alongside OATs and OLOs. Hedge funds are in the wings, waiting for a few more issues to fill in the gaps so they'll have ample liquidity to trade them in size.

- In order for the EU program to be welcomed into the government bond indexes, the index providers have to re-write their rule books to include an issuer that IS a sovereign, technically speaking, only it's an amalgamation of ALL of the EU's issuers. There are a few potential potholes to consider:

o Do the end-users WANT EU bonds in their index? The short answer appears to be a resounding 'YES!' given the ECB's perpetual QE program and its impact on liquidity and volatility. A new, liquid, AAA name that will give them a viable alternative to OATs and DBRs? Why not?

o Do the other EGB issuers want the EU program in the index? This is a little more complicated. The smaller issuers like Ireland, Finland, Austria, Holland and Belgium already have very small weights relative to the majors within these indexes so it's not clear that going from 5% to 2.5% (for example) will make much difference. The EU's program shouldn't change their capital key much so QE demand should remain enough to prevent a material cheapening of their bonds vs DBRs. Perhaps most importantly, however, the funds the SURE program raises will be distributed to ALL the EU nations which in most cases will mean less issuance.

Ø If so, when? Do the index providers wait until there's a viable curve or do they adjust their allocation every month until the curve's fully constructed?

Ø Access to EU SURE bonds… The inaugural SURE syndication broke records for the size of its book, well above Eur 130bn. Despite the enormous demand, much of the market was shut out of the syndication process where the 'easy money' can often be made as the issues tighten post pricing. The article above says the EU SURE program will conduct AUCTIONs to supplement their existing issues. So, a nice syndication followed by taps via auctions. This is not only a more inclusive approach to their issuance but will only improve demand and liquidity, especially among the hedge fund community.

Ø The mere fact that this EU SURE program warrants an email like this one is surely positive for the program and its relevance for the rates market in the years to come. In a back-door way, it could even help keep the European Union from financial collapse altogether. The EU has to be mindful of the crowding out of other issuers, however, for the next year (at least), the ECB will likely buy the OATs that are sold to roll into EU SURE issues. From a relative-value perspective, however, we're looking forward to the opportunities this issuance will provide our clients.

Charts:

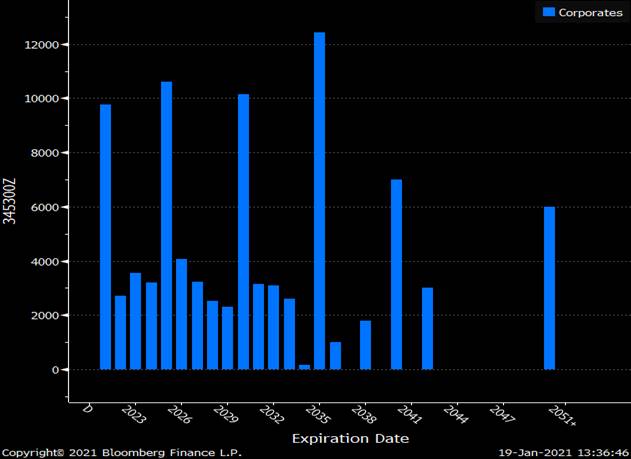

Current outstanding EU issues. Expect those gaps to be filled in due course.

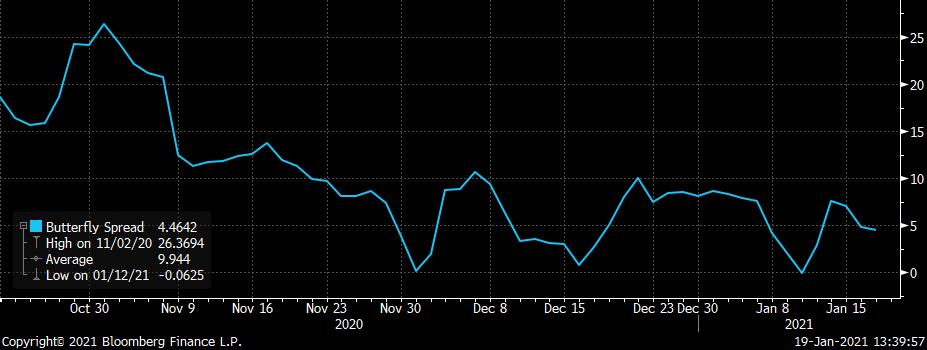

DBR 8/30-EU 10/30-FRTR 11/30 1-2-1 blend is a mere +4.4bps.

More to come.

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS > Quick Update - UKT 0E28s Tap Tomorrow

GILTS... UKT 0E28s

> UKT 0E28s £3bn Tap tomorrow - ONLY one this qtr.

> Tone of Gilts market is bullish:

* Several dealers now looking for an MPC rate cut in Feb or ramping up of pace of QE flows as lock down weighs on activity and vaccine rollout proves slow.

* Tenreyo's speech @ 2pm today likely to be neg-rates positive which helps to explain bid to front-end this am.

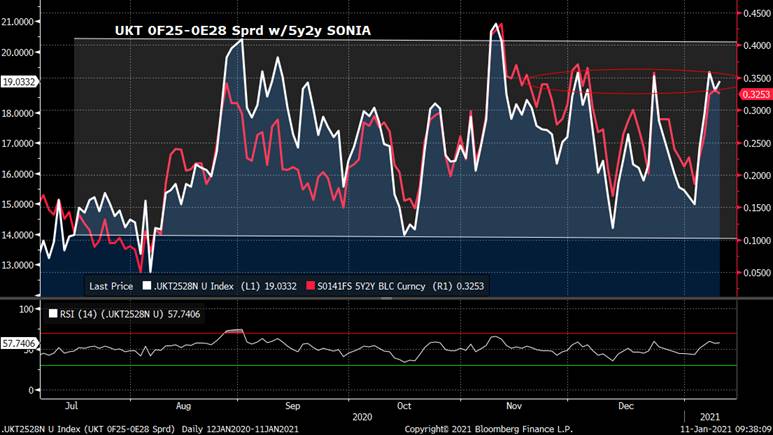

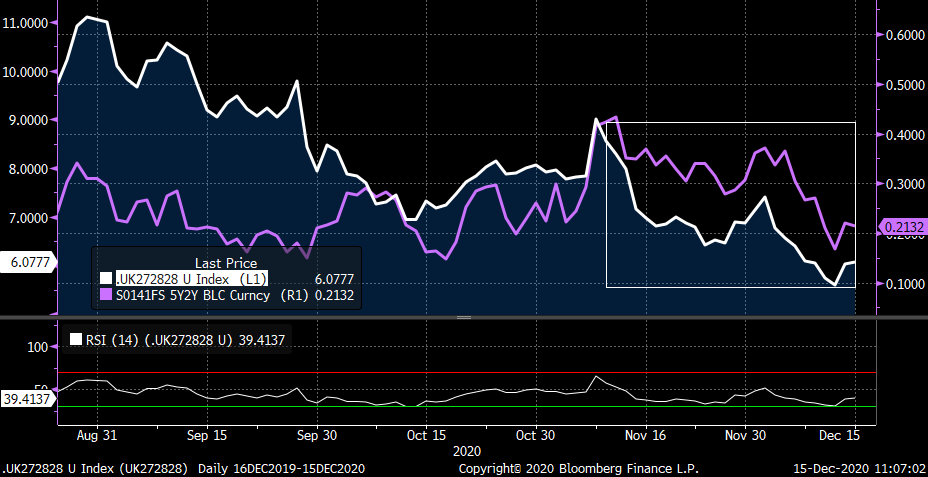

> UKT 0F25-0E28 (or 0E26-0E28) flattener. We're still at the cheap end of the range, despite the .5bp flattening since last Thur's note. Chart below shows the strong correlation to fwd SONIA levels.

> Buy 0E28 vs MM Sonia - last at +3.4bps mid. Off the wides but still 3bps cheaper than the end of 2020.

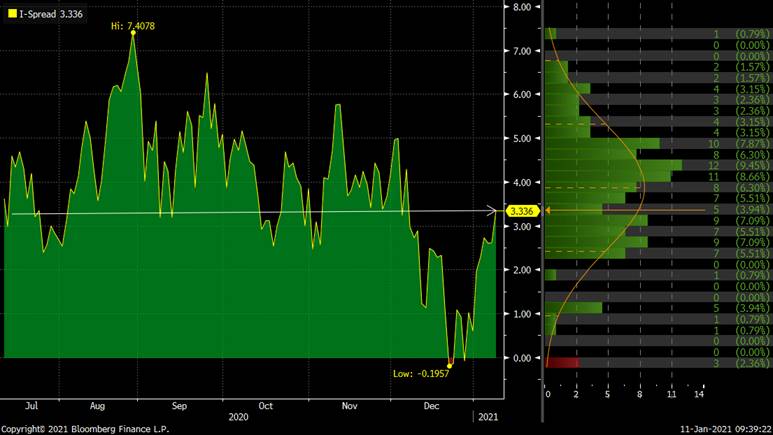

> UKT 124-0E28-0Q31 fly. Chart below shows the fly making new wides (cheap) as the 31s have traded very well since the start of 2021. This 4.5bps cheapening of the fly looks overdone here, especially with the 10yr sector lagging.

Copy of last Thursday's note attached.

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: GILTS > Supply, Cash Flows and Covid... Quick Rundown

GILTS Supply - Reminder

> Between today and Feb 2nd we have 8 conventionals auctions and a 2046s syndication (expected Jan 19th).

> Here's the list:

Jan 6 0Q31s

Jan 12 0E28s

Jan 12 1F54s *

Jan 21 0E24s

Jan 19 New 46s Deal *

Jan 26 0F35s *

Jan 26 0F50s *

Feb 2 0E26s

Feb 2 1F71s *

So, 5 of these 8 are 15yrs+.

> So, while this supply calendar looks awfully long-end heavy, our friends at the DMO have a few £££ up their sleeves that will mitigate much of the impact:

1) Of the £2.731bn cpn flows hitting the mkt on Jan 22nd (non-DMO/APF), £1.966bn of them are paid to 20yr-ultras issues.

2) We have 5 20y+ APF operations of £1.48bn each over that span.

3) The 1H21s mature on Jan 22nd, returning ~25.3bn to the market, much of which will end up in the short-end but, at the margin, is still gilts supportive.

> So, while there's likely to be a bit of slippage between supply DV01 vs APF/Cpn flows, this looks fairly close to a neutral outlook.

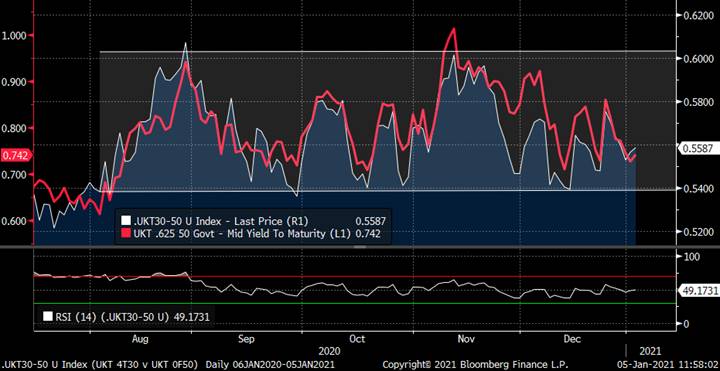

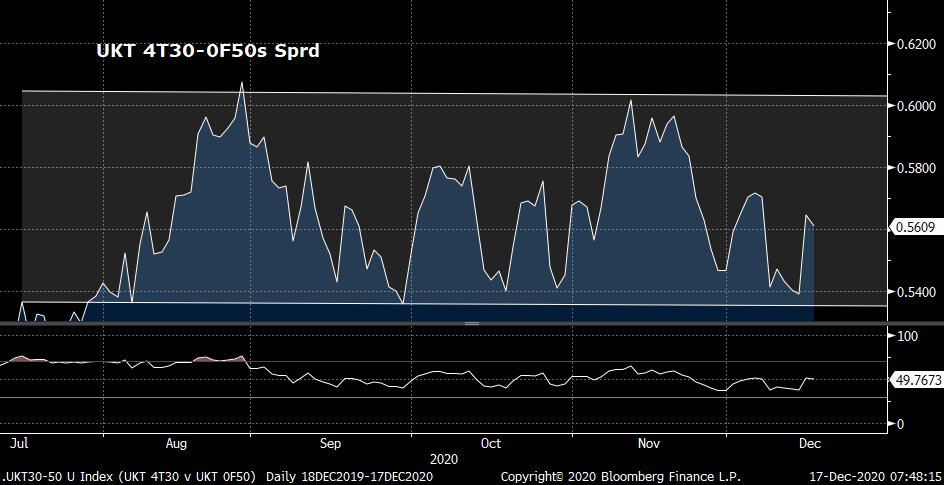

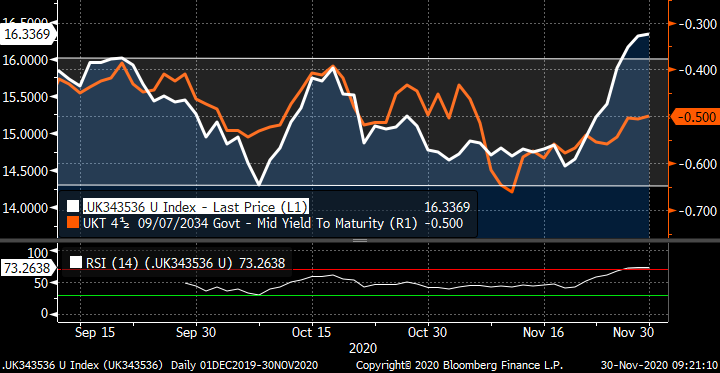

> The chart below of the UKT 4T30-0F50 yield sprd vs 0F50s yields shows there's still an embedded directional bias on the curve which has kept the sprd in a 6bps range since August. Given the random walk Covid is now, directional calls are very tough, even at these levels.

> What we CAN count on, in varying degrees, however, is for GEMMs to work their magic on the curve (micro mainly), cheapening issues and sectors in advance of the supply. We're seeing this already with 45s-47s and will likely see it in 34s-36s, ultras and 49-50s...

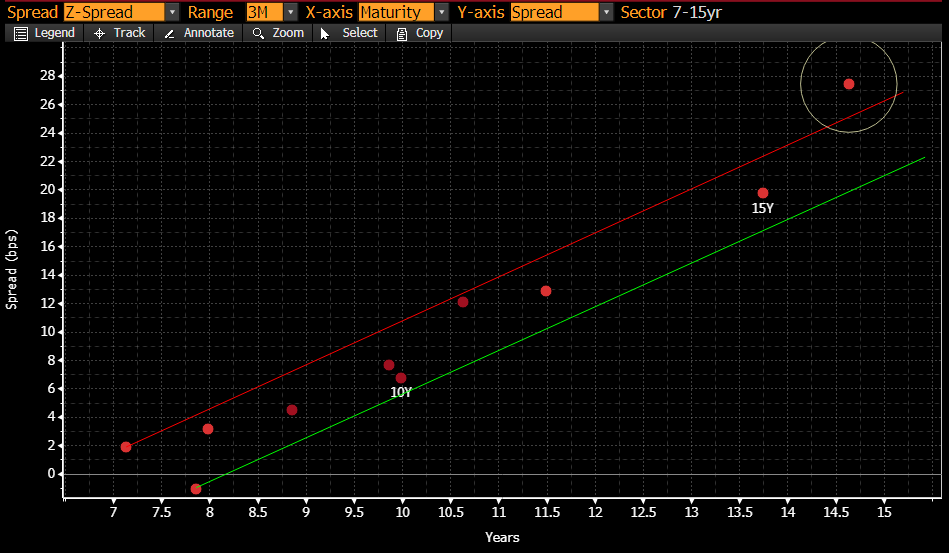

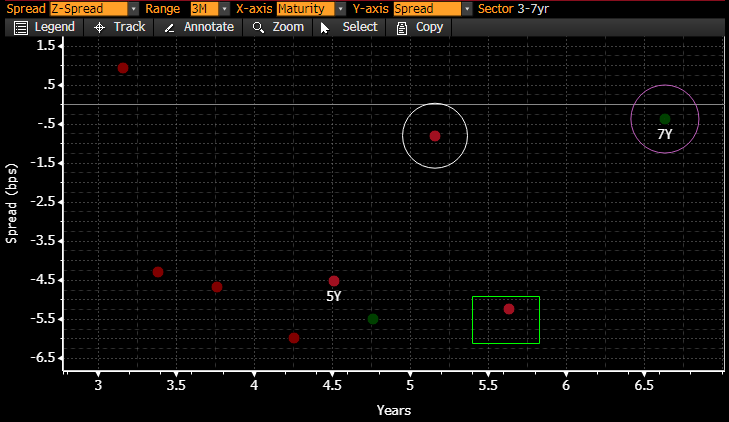

As an illustration, here's the BBG GOVY Spline page with the 4Q46 circled. We can see that the market's already cheapened up the issue in anticipation of the syndication, one of the biggest risk events in the UK this qtr.

We'll be back with trade strategies shortly… stay tuned.

Best,

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: The Fed and The BoE > Today's MPC Meeting - Quick Comment

The FED and the BoE

> "We don't think the economy suffers from a lack of highly accommodative financial conditions, we think it's suffering from the pandemic," Powell said (at yesterday's FOMC meeting).

> This comment was in response to doubts cast on whether the Fed was missing an oppty by not extending the maturity and size of their $120bn QE program that's currently in place.

> The Fed's forecasts for next year are solid/strong for the second part of the year and with another stimulus bill imminent (we think!) they decided they could stand pat while assuring they CAN do more if needed.

> The BoE's MPC meets today with their announcement due at noon. While the UK has the double-whammy of both Covid AND Brexit, the BoE's job is a bit more tricky than the FED's and surely explains the recent volatility of gilts vs USTs and DBRs.

> That said, the actions of the FED and BoE are often in 'sympatico', suggesting that Powell's patient approach could be reflected in Bailey & Co's stance today. With odds of a pre-Xmas Brexit deal the best we've seen yet, the odds have risen that the MPC does nothing today while repeating the 'we'll do what we have to' mantra yet again.

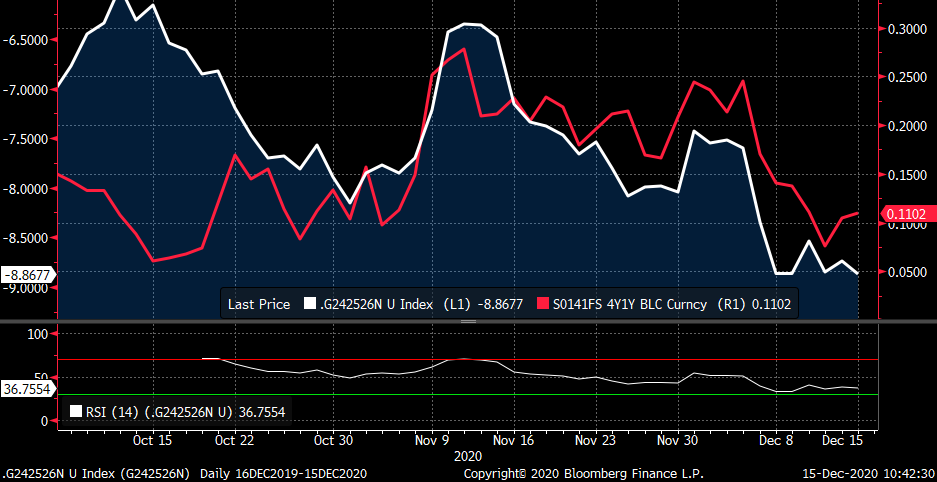

> The FX markets have placed their bets on the outcome of today's MPC meeting as cable climbed to new 2020 highs of 1.3574 on the open this am. This is being reflected in the bear steepening of the SONIA fwds (like 2y1y – see chart below) but has yet to be reflected to the same degree on the gilts curve.

> The knee-jerk reaction will probably be a modest bear-steepening of the gilts curve, continuing the bias seen since the start of the week.

More later...

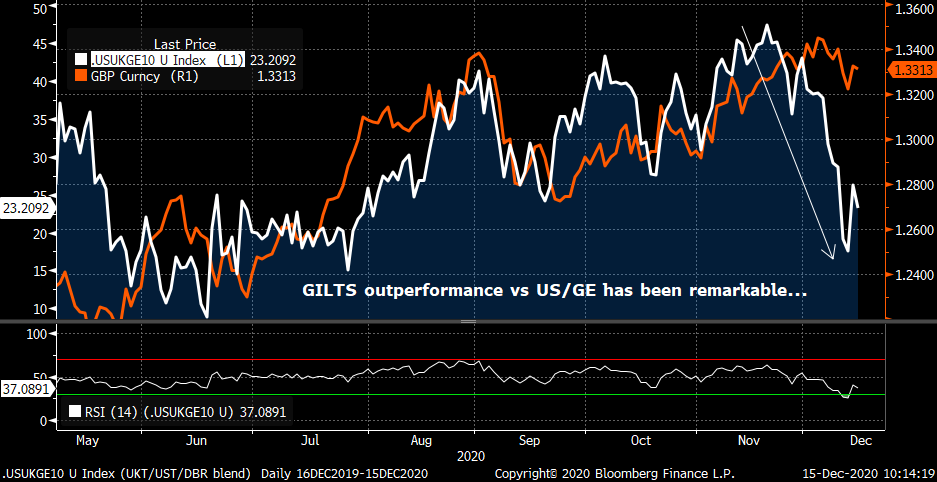

US-UK-GE 10yr Blend – Volatile couple weeks with gilts outperforming sharply into Dec…

More soon….

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: The Next Two Days in the GILTS Market are KEY... CHART BOOK

- Despite the market's eagerness to put 2020 behind us and move on, there's still too much going on to close up shop yet. Here's a quick rundown:

- London enters into Tier 3 restrictions as of tomorrow which means pubs and bars are shut (again), mingling with friends and family is limited and the Christmas hiatus we were all looking forward to is in doubt. Aside from the dispiriting affect this is having on sentiment, it's also going to whack economic activity in the UK in December, the most important month of the year for the economy.

- Reports on the state of the Brexit negotiations out of London/Brussels continue to taunt the markets as they veer from utter dismay to hopeful enthusiasm. Yesterday's bear steepening (in very thin volumes) unwound some of last week's bull flattening but risk appetites are waning as the market loses patience with the stagnation.

- With a 20Y+ APF today and a 7-20yr operation tomorrow, the bulls still have the upper hand from a gilts risk perspective. We've given a bit of it back but SONIA for the June meeting is still slightly negative at -1.3bps mid this am so we're still pricing in a dovish BoE.

- This am's Oct UK jobs data was soft at -143k and with Nov and Dec seeing tighter restrictions than October, we can surely expect a worsening of the data.

- Thursday's MPC Meeting

- The MPC's decision to extend QE by another £150bn in 2021 was driven largely by the lingering economic effects of the Covid-19 pandemic and a broader view that, deal or no deal, the impact of Brexit will be a significant drag on the economy in the next 1-2yrs. That said, the consensus among our strategist friends is that a no-deal Brexit outcome is still unlikely, even with the gloomy mood of the talks, so unless a no-deal outcome is announced in the next two days, the MPC is unlikely to announce any changes to the levels of accommodation already in place.

- If a no-deal IS announced, however, the consensus is for an immediate move to zero base rates and an additional £100bn QE, taking the remaining total to £250bn AND a likely increase in the frequency and size of each operation, akin to what we saw in March-May this year. Talk of negative rates – both among MPC members and the market – will accelerate and the market will likely price in a cut to -10bps by the Feb/Mar meetings.

- Where there is a bit less agreement, however, is with the details of the QE operations. Assuming Johnson & Barnier sign a deal, do the APF operations remain at the same pace or are they reduced somewhat to ensure the £150bn extends further into 2021? Do they make the much-debated move to realign the APF buckets to better match gilts liquidity/risk with their buying needs.

- Market Snapshot

UKT 40-50-60 fly – 30yr point cheapening sharply on the curve

The 0F35s remain cheap on the curve…

But they've done well since their last tap…

0E24-0F25-0E26 fly has richened sharply in line with 4y1y SONIA… 0E24s coming under pressure as balance sheets are reduced into year-end. The 24-24 sprd is now at it's cheapest, the 0E24s +5.6bps mid…

UKT 1Q27-0E28-1F28 fly has come a long way since September. The 26-28s sector becomes very interesting in early 2021. By the end of January, the 0E28s slide into the 3-7yr bucket, adding some much-needed liquidity to the short bucket. Then on March 2nd we get the new UKT 10/26s which will likely impact 1H26s most, along with the 1Q27s. The 0E24s slide sub 3yrs so fall out of the basket too (which explains why they're cheap). The 1Q27s trade cheap to the curve and while they've have competition within the sector, they still have £7.9bn in APF eligibility into 2021 and should, in theory, outperform issues like 2T24, 225s, 1H26, 4Q27s and 1F28s going fwd. The 1H26-1Q27 sprd still looks steep to us although the recent flattening is in line with the move in Sonia.

UKT 27-28-28 fly – until mid-October the richening of the 0E28s was part of the new issue normalization to the curve. Since then their performance has been more directional, dictated by the level of rates. While the 0E28s still look on the cheap side to us they're more prone to selling pressure now.

Will be in touch…

Thanks

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: Quick AM Note on UK/Gilts... Brexit and the BoE

Good note from my colleague Marc (with a couple embellishments of my own):

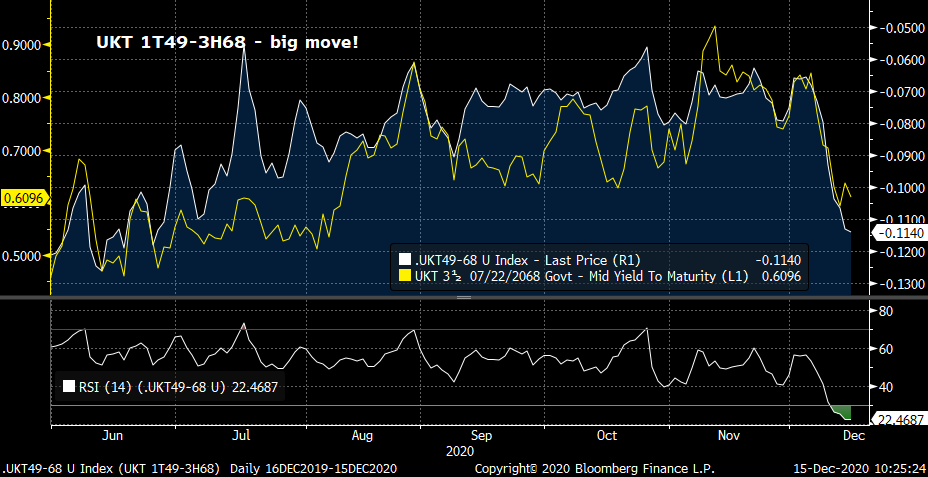

Good morning {GB}. Last night the BoE confirmed the APFs for next week, schedule as usual 3-7y Mon, >20y Tues, 7-20y Wed. Long gilts continue to squeeze vs bund led by the ultra long-end, I see several reasons for this:

1) Brexit negotiations struggling

2) RM/ LDI buying ultra gilts

3) No supply + APFs next week means net bullish bias

4) ECB less dovish than expected yesterday.

I still think the dynamics are for gilts to outperform in the new year, but would look to reduce at these levels given the speed and magnitude of the move.

** Chart below of 10yr UK vs US and DBRs shows the UK at the richest levels on a momentum basis all year - quite an achievement given the Covid emergency in both the US and Europe right now. The gilts market is clearly positioned for the worst which leaves little room to manoeuvre if Bojo comes up with a 'Christmas Miracle'.

Chart below of 4T30-0F50 yield sprd (10-30s) shows we're about to take out the key support that has held since August but, perhaps more telling, the divergence of Cable vs the curve is correcting with GBP selling emerging. The resumption of this correlation gives a green light to the market to take the curve flatter.

And what about the MPC meeting next Thursday? If the deadline this Sunday is to be believed (what CAN we believe about Brexit these days?!) then the MPC will have a clear(er) understanding of where the UK stands going into January 1st.

MPC members like Saunders have been very vocal about the BoE's willingness to provide further monetary policy support via a cut of the base rate to zero and yet another extension of QE beyond the current package. While not a substantial move, a 10bps cut to zero means the next move is negative rates and would force 1y1y SONIA to new cycle lows. This could help mitigate some of the flattening bias although it'll certainly mean further UK outperformance vs US and Germany.

These comments just hit the tapes:

*BAILEY: BOE DOING QUITE EXTENSIVE WORK ON IMPACT OF NEG RATES

*BAILEY: BOE HAS A LOT IN ARMORY IN CASE OF BREXIT DISRUPTION

On the other side of the coin, a Brexit-Breakthrough, however paltry, would remove a huge source of stress and angst for the UK economy AND the MPC. It means the only game in town is Covid and while that also remains a monumental challenge, there are reasons for optimism given the vaccines are now being administered. From a policy perspective, it's unlikely to mean the MPC pulls the plug on QE, at least until June (in our view), HOWEVER, they could slow the pace of buying from the current ~£1.4bn per op which will shift the net gilts supply for Jan-Mar to a net cash need that would likely steepen the curve and drive a correction in the sharp inversion of the long-end this week.

We're hopeful, like the rest of the market, that cooler heads prevail and a deal can be struck in time. However, they've given us little reason to think a deal is imminent.

We'll be in touch.

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS > Jan-Mar Supply Calendar Announced - Quick Recap/Thoughts

GILTS > Jan-Mar Supply

Please click HERE for the DMO's press release

> DMO Announcement at 7:30 this am has a couple surprises and taps of the usual suspects:

1F71s tap on Feb 2

1T57s tap on Feb 16 (!?) Why do they keep tapping these…?

NEW 10/26 5yr on Mar 2

0H61s tap Mar 2

NEW linker 31s Mar 10

Tap of 1T49s (!?)

Only ONE short gilts auction in January!

Sizes will be:

1-5yr £2.75bn-£3.5bn

5-7yr £2.5-3.25bn

7-15yr £2.25-3.0bn

15-30yr £1.75-2.5bn

30+yr £1.5-2.25bn

Linkers £750mm-1.5bn

SYNDICATIONS!

Tues Jan 19 (TBC) a NEW Jan 31 2046 Maturity

Feb 9th a NEW LONG Linker

Linker tender also announced for Dec 9th, a tap of the linker 48s.

So! No new 30yr but lots of other longs to keep us busy. Not sure why they're tapping 57s and 49s again (although 49s will be back in play for APF for a bit).

The 46s syndication was called for but not a slam dunk - new 51s will have to wait for the new year.

Quick GILTS RV... New 0ct 26

> In yesterday am's note (in our chats) we talked about the potential for a new UKT 1/27 issue that could weigh heavily on the 1Q27s, hampering their performance on the curve as we head into Jan-Mar.

> This 10/26 maturity is closest to the 1H26s - an issue whose days as the richest issue in the sector were numbered in our view. This announcement is the 'nail in the coffin' for the issue, the only saving grace for them is the new 26s don't arrive until March 2 and front-end supply is very light in Jan-Feb.

> We expect the 0E26-1H26-1Q27 fly to cheapen, all else equal. Now that the DMO has confirmed there is only 1 more tap of the 0E26s coming (Feb 2), any remaining new issue premium they have left will be drained from the issue. It'll also be available for more APF ops too which will likely mean they'll richen to the 0F25s too.

UKT 3-7yr sector Z-sprd scatter plot… The 0E26 and 1Q27s are circled and 1H26s in the green box. The 5yr is the 0F25s which, all else equal, should see spread compression, especially with the 1H21 redemption in January and the only short end auction in January is the 0E24s.

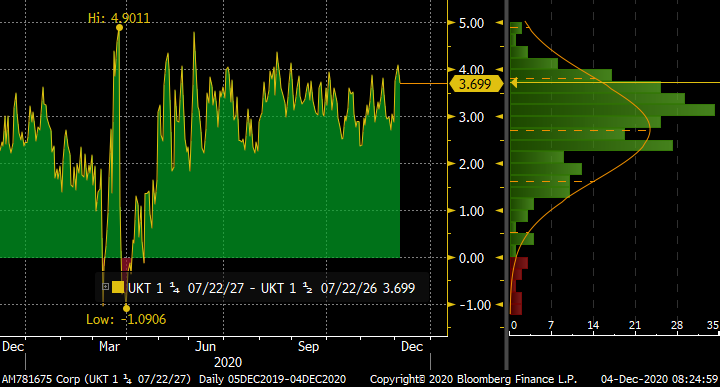

UKT 1H26-1Q27 Z-sprd… This spread will remain sensitive to moves in SONIA, however, the 1H26s should lose their premium on the curve.

More soon…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS > An RV Focus on the 10yr Sector (Chart package)

GILTS... 10yr sector

> As the 'bus driver' for the whole gilts curve, the performance of the G A contract and its CTD/surrounding issues is extraordinarily important to the performance of the whole gilts market.

> We keep an eye on a handful of gauges that reflect positioning and performance of the benchmark.

5-10-15 (0F25-4T30-4Q36) – back to its cheapest levels…

1F28-4T30-4Q32 – cheapening…

Invoice spreads vs SONIA (modest cheapening) – still range bound…

Cross market vs UST and DBRS… (US-UK-GE 10yr blend with GBP/USD overlaid). Correlation remains solid with some oscillations.

4T30-0Q31 Z-sprd box… Yield spread was new lows into 31s tap, now 9.6 mid. Reports of 1-2 large buyers vs swaps.

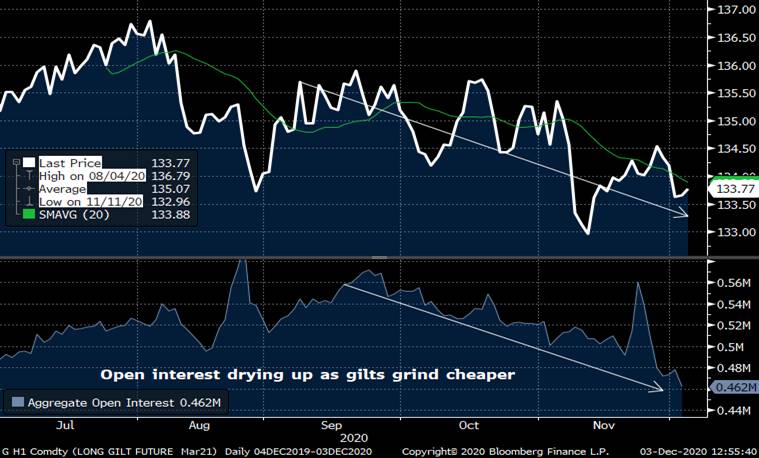

G A contract on a bearish trajectory with open interest steadily declining as we head into Brexit and the market begins to price in the vaccine boost…

Here's a chart of US 10yrs vs Fed Funds target vs the UKT 10yr vs UK base rate… On a relative basis, the UK trades a lot richer than the UST curve and that's with the USD under pressure. The combination of Covid, Brexit and APF has kept gilts contained…

So, what can we glean from this exercise?

- Risk appetites are dwindling in the UK. Could be year-end driven but the unwind began in September. With gilts supply declining into the end of the fiscal year this probably won't present a problem for the BoE/DMO.

- Will be interesting to see how the supply dynamics affect the front-end. If a Brexit deal is announced and it's more than just a stop-gap measure to avoid a disaster, we could see central banks pile back into GBP which will be bullish for 0-3/5yr gilts.

- Relative to base rates, gilts still look rich with 4T30s just ~24bps cheap. Plenty of room to cheapen if vaccine accelerates a rebound in the economy.

- Momentum has been bearish but a slow grind rather than a vol spike. Steepeners aren't quite as toxic in gilts as they are in EGBs given the ECB's bias.

- The BoE's commitment to £150bn APF is a moveable feast but assuming it happens, it'll be a good deal easier to be short the UK via swaps than gilts.

Ideas to follow… Comments/feedback always welcome.

Best,

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: Another Busy Week in the UK... Quick Rundown w/RV Colour

GILTS... Busy Start to Dec as Nov comes to an end…

> Yet another 'Crucial Week for Brexit Talks' lined up as you can see from the headlines this am. The EU remains 'hooked' on the fishing rights dilemma which could be a deal breaker.

U.K. Urges EU to Move on Fish, With Brexit Deal Possible in Days

London 'Thrown to the Lions' as Brexit Finance Deal Unlikely

Worse Than Covid? Risks to U.K. Economy as Brexit Deadline Nears

England Lockdown Cuts Virus Cases 30%, Study Shows

BOE Splits Between Insiders and Outsiders Over Subzero Rates

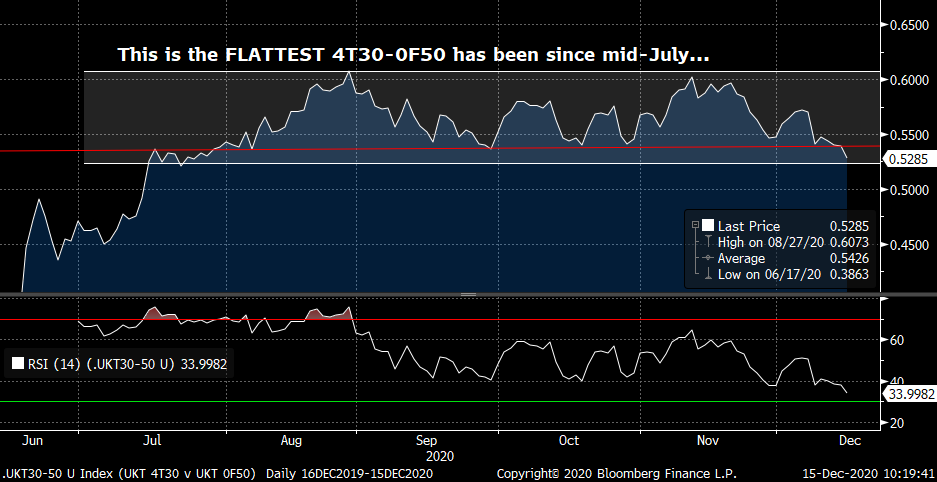

> The story above 'Worse than Covid?...' is at the heart of the divergence of UKT 10-30s and Cable (as we've been pointing our ad nauseum over the last week. We had a good call on the curve flattening bias as we've flattened sharply from +60bps to +54.5bps, the bottom of the range since August. This has happened with GBP stuck at key resistance, implying that the FX market expects a Brexit deal. The obvious question now becomes, do we have the momentum to continue this divergence?

> SUPPLY This week is 0E26s & 1Q41s tomorrow and UKTi 28s and 1Q31s Wed - nothing in the long-end at all. With the usual APF calendar Mon-Wed, the obvious assumption is there's ample BoE demand to mop up the DV01 and all else equal, the odds of a flattening through the 54.0bps support in 10-30s are solid. So, supply won't be the culprit if the gilts flattening stalls.

> Relatively speaking, the 15-20yr sector has lagged much of this flattening bias which we've been using as an oppty to add to longs. The last auction of this year is the 0F35s next Wed but we have 0F50s before then... Keep an eye on 10-15-30s

flies...

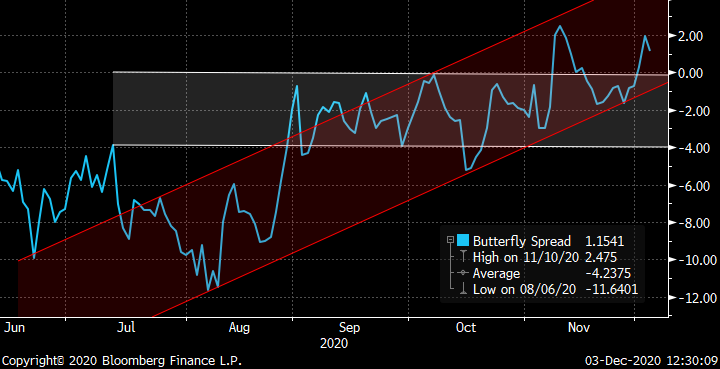

UKT 0R30-0F35-0F50 – Making new wides this am ahead of next week's 35s and 50s taps

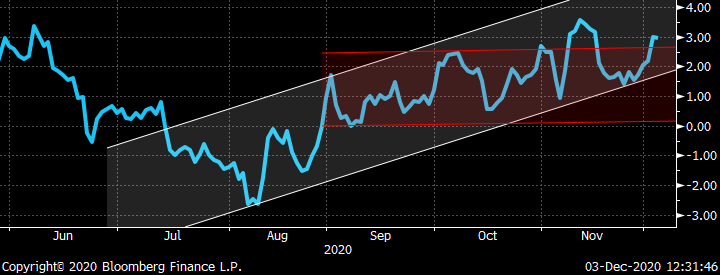

UKT 4H34-1Q41-0F50 fly – grinding richer into tomorrow's 41s tap but lagging 10-30s

UKT 34-35-36 fly back to its cheapest ever levels as the high cpn wings outperform in the rally. Inversely correlated to yield levels…

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796