Today's BREXIT BARRAGE...

BBG: Nissan Deals Brexit Blow to Britain as May Starts Work on Plan B

BBC: Brexit: Talks on backstop ‘alternative arrangements’

BBC: Brexit: Theresa May ‘determined’ to leave EU in March

BBC: Brexit: John McDonnell rejects any funds deal for votes

FT: Nissan U-turn is a no-deal Brexit ‘warning sign’ says Clark

FT: Banks fret over investor inaction over Brexit

FT: Varadkar beset by backstop worries as Brexit no-deal risk rises

FT: Theresa May is warned of ‘trouble ahead’ by Tory Eurosceptics

FT: The EU should listen to Theresa May to get the deal over the line

FT: Munchau: How to play a winning Brexit game

TEL: Backstop: The politics and economics of Brexit’s most important, but most eminently solvable, riddle

TEL: Rebel Labour MPs ‘plan breakaway party’ as anger grows over Jeremy Corbyn’s leadership

TEL: Fragile Tory truce over Brexit starts to crack as Eurosceptics suspect backstop back-pedalling

TEL: Brexit deal could see UK economic growth hit 1.5pc, says EY Item Club

TEL: With just 53 days to go, Britain still needs to know what Brexit will look like

Enjoy!

M

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Astor Ridge Rates Data, Supply and Events Calendars - Feb 4-8

Astor Ridge Rates Data, Supply and Events calendars for week of Feb 4-8...

Highlights:

> US refunding dominates supply while China talks continue. Powell speaking on Thurs.

> Eyes on Europe re: supply and Brexit...

> UK's got the 2041 syndication, BoE meeting and more Brexit!

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Jan US Payrolls - Quick Rundown

NF Payrolls... Mixed...

> Jan payrolls rose 304k but there was a net downward revision of 133k between Oct-Dec.

> Jobless rate rose to 4.004%, highest since June last year as household employment fell 251k and the labor force dipped 11k. Pool of available labor rose 168k, however.

> Avg hrly earnings up just .1, well below the .3 ests and .4 last month. Fell from 3.34% to 3.18% YOY.

> Avg duration of jobless fell to 20.5 from 21.8, lowest reading in years. This seems to suggest that if you’ve got the skills in demand, you have no problem finding a job.

> Not in labor force fell a whopping 639k – shutdown driven one would think.

On balance, this is a tough report to read much from, especially given the uncertain net impact of the govt shutdown during the survey period. This nebulous reading helps explain why TYH9 has recovered from the initial post-release selloff, now only 3/32 lower on the day.

Best,

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's BREXIT BARRAGE... 'Disorderly Exit' fears growing...

May’s digging deep into her handbag for something to sweeten the pot for Labour. Let the horse-trading commence!

BBG: Brexit Bulletin: Could She Pull it Off?

BBG: Dublin is Bursting at the Seams

BBG: May Sets Out to Win Labour Rebels’ Support Over Brexit Deal

BBG: U.K. Lays Ground for Brexit Delay as Parliament Holiday Canceled

BBG: Brexit Overshadows Review Meant to Herald the End of U.K. Austerity

FT: Brexit-blemished UK assets look cheap – but investors are wary

FT: Will the UK’s jobs boom survive Brexit?

FT: UK faces daunting task to meet Brexit deadline

TEL: German anger builds over dangerous handling of Brexit by EU ideologues

TEL: ECJ will block lawsuits against Britain for not paying Brexit bill after no deal

TEL: Could the EU force Britain to pay the £39bn Brexit bill after no deal? And would it cost even more?

TEL: Sajid Javid admits Brexit may be delayed as clock ticks for May

TEL: If Theresa May is robust with Brussels now, she may finally be able to get Brexit right

Sorry for late arrival… busy morning!

Best

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's BREXIT BARRAGE... No one said it would be easy...

This could get uglier folks…

TEL: This ‘unicorn’ could make the backstop vanish, but Parliament needs to stick to its guns

TEL: Theresa May toys with Labour customs compromise as her Brexiteer pitch unravels

TEL: No-deal Brexit would push Europe back into deep-recession, with explosive consequences

TEL: Oliver Robbins warned Theresa May against Tory plan to go back to Brussels and renegotiate deal

TEL: Brussels orders Britain to pay £39bn Brexit bill even if there is no deal

BBG: Brexit Bulletin: Europe Says No

BBG: EU Ready to Push U.K. Near Point of No-Return on Brexit, Diplomats Say

BBG: Jeremy Corbyn Is Worse Than a ‘No-Deal’ Brexit

BBG: U.K. Auto Investment Drops Almost 50% as Brexit Chills Spending

BBG: Labour’s ‘Fraying’ Brexit Compromise Shows May a Path to Victory

FT: The EU cannot rescue Britain from Brexit chaos

FT: May considers extra spending to woo Labour MPs

BBC: Brexit: Backstop is ‘part and parcel’ of the deal, says Barnier

BBC: Brexit: A staring match of one against 27

BBC: How ready is UK government for a no-deal Brexit?

BBC: Coveney warns Brexit deal bid is ‘running out of road’

Tip of the iceberg!

Best,

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: Crunch-Time for Gilts... Rates Rundown...

- You’ve got this am’s Brexit Barrage so you know what’s going on in Westminster but what’s the response in the gilts/GX market?

- Here’s a snapshot of moves in the UK since last Friday’s close:

Jan 25 Now Comment

G H9 122.79 123.14 Muted but cautious response to Brady’s amendment passing.

Sonia 1y1y .9743 .9333 We’ve pushed the next 25bp hike back to 2yrs from now again.

Cable 1.3196 1.3109 Bit of profit taking after a nice rally we think.

G H9 inv sprd 24.25 25.50 Modest bounce back to mid range.

UKT 2-10s 52.25 50.70 Bull flattening

UKT 2-10-30 +1.7bp -.75bp Modest bullish reaction.

US-UK 10yr 145bp 145bp Unched!

GE-UK 10yr 111.25bp 107.1bp Well off the 98bps Jan 9 lows but bullish move nonetheless.

- The point of the snapshot above is that the market’s response to the latest developments is a collective ‘So, what?’. The good news is Parliament agreed on a plan that, if approved by Juncker and co, would be passed by the government. The bad news is the EU has been steadfast in their insistence that the deal won’t be reopened for negotiation (at least in public), so there’s no guarantee they’ll budge and, as we know, the clock is ticking.

- And there’s another head scratcher we’d love an answer to. Parliament, in theory at least, has committed themselves, both publicly and privately, to avoiding a no-deal outcome at all costs (hence, Corbyn’s agreement to help May fashion a deal). But they also rejected Cooper’s amendment to extend Article 50 and they’ve basically given May 2 weeks to come up with ‘legally binding changes’ to the Irish backstop that Tusk said weren’t on the table. Talk about a game of ‘chicken’ with the UK’s future.

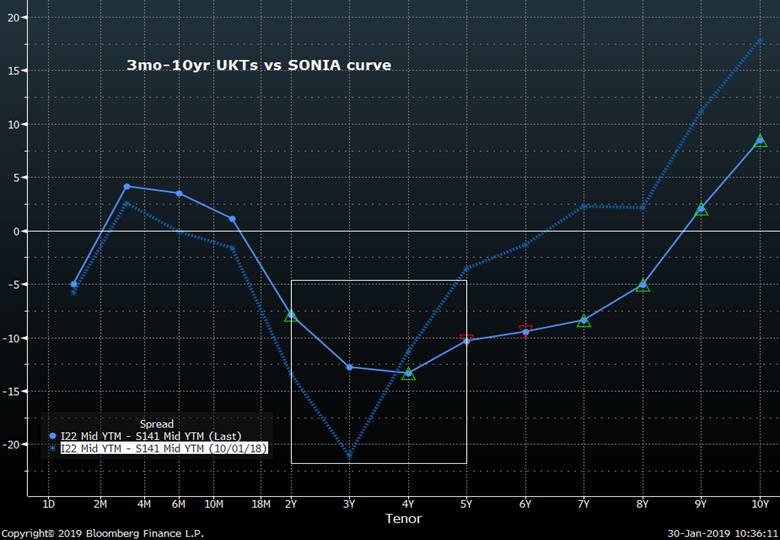

- The next supply in the UK is on Feb 14th, what’s likely to be the last tap of the UKT 1F 28s before they’re replaced by a new 2029 issue in Q1 2019/20. In the attached note ‘GILTS RV Update – Leaning Bearish, I highlighted a handful of factors that could/should contribute to higher UKT yields. While I was a tad early on the broader view, the observations and positions we highlighted still hold water. Even with SONIA rebounding, 2-7yr gilts have under performed swaps (ois and libor) with 3yr/4yr vs 7/8yr flattening. And the UKT 1F 28s have now taken hold of the status of ‘fulcrum’ of the 10yr sector, leading the 10yr sector richer or cheaper as yields fall or rise. That adds an element of directionality to any curve/yield concession for the 28s into their tap in a couple weeks. Given the recent cheapening of the 4Q27s on the curve, there’s little juice in many 8-11yr RV trades, although any meaningful cheapening of the 28s into their tap will be snapped up ahead of the APF demand and their CTD status into G M9. In addition, despite the bullish tone of the market of late, our UKT 26-27 steepener continues to grind wider.

- At this point, the short to medium term picture in the UK becomes less clear. Here’s why:

- The divergence between Cable and G H9 won’t last forever and longs will need to stand their ground amidst some very tense talks.

- The gilts market ALWAYS rallies into the APF reinvestment operations and the one in March is a big one with about £18.5bn to spend. That influence won’t prevent a sell-off if the Brexit outcome dictates rates are too low, however, it could put a lid on how big a move we get.

- Gilts supply next fiscal year is set to grow by £16bn vs 2018/19 (given what we know now) which will weigh on the market medium term and could grow if Hammond’s promise of a fiscal bail-out post Brexit is needed. That would steepen the curve massively.

- The CPI/RPI fiasco is still bubbling below the surface which could come to light post-Brexit.

- So, while we maintain a relatively sanguine view of the Brexit outcome (naïve, gullible or misguided perhaps?) with a bias towards higher rates, we are mindful of the potential for a return of the volatility we saw last October and November.

I’ll be in touch to discuss.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Market Absorbs a Ton of UST and EGB Supply Without a Hitch

- In the attached supply calendar we highlighted the wave of sovereign and supra supply in the US and Europe scheduled for this week, much of it on Monday and Tuesday. Aside from what’s listed we also had a surprise EUR 5bn BGB 2050s syndicated deal (11 of their 28 bln scheduled for this year is already done), the rumoured Austria 10yr deal came (5bn at -19 vs swaps) and KFW brought 5bn 5yrs. Throw in a 2.5bn 5yr Greece deal and you’d expect that the market would have built in a hefty concession somehow, yields or spreads. While we still have 3bn DBR 2/29s and 5.25bn BTPS (23s and 28s) this morning, we’ve still managed to devour a ton paper already this week.

- Well, take a look at the charts below. RXH9 prices are saying ‘Bring it on!’ although RXA invoice spreads have dipped in sympathy with the bid in periphs.

- BTPS have held in very nicely vs DBRs, despite this am’s EUR 5.25bn 23s and 28s…

- TYH9 has consolidated this week around the 121-16 > 122-00 area into this week’s supply. FOMC meeting today looming large even though most expect them to continue to preach a wait and see view…

Even the UST curve has barely budged, 2-5-10s richening into this week and 5-10s range bound…

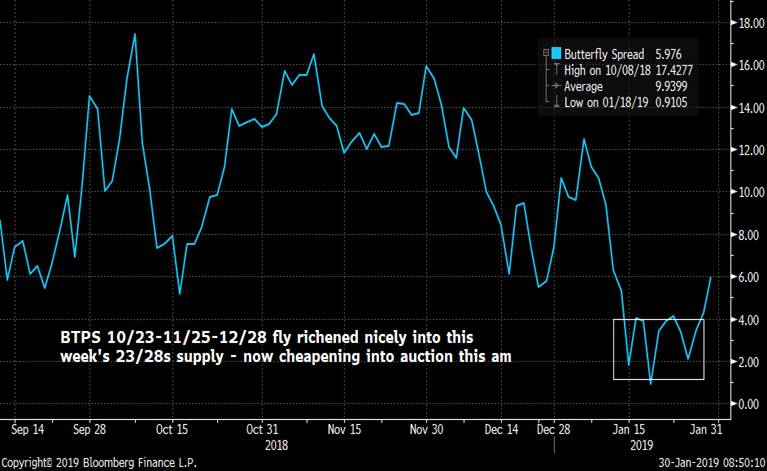

- BTPS supply this am has prompted some movement in the 10/23-11/25-12/28 (5-7-10) fly, richening to 6mos ‘highs’ before cheapening yesterday pm and this am into the supply. This fly could cheapen further from here, back to the 8/9 area.

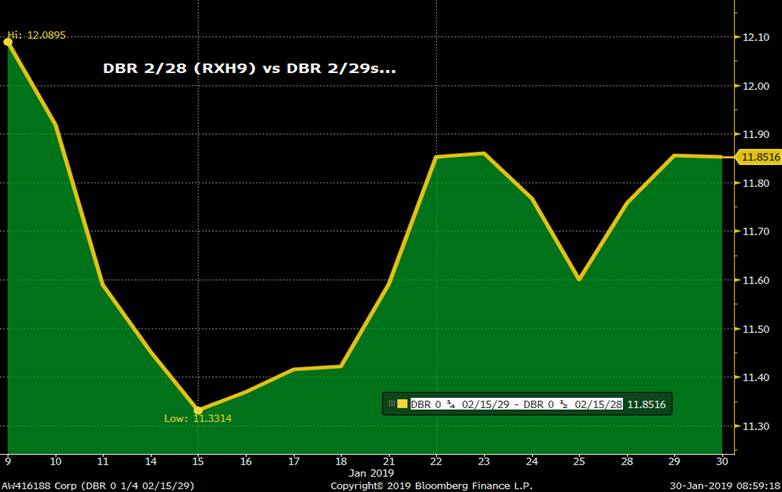

- The DBR 8/28-2/29 roll has steepened into this am’s tap which should attract some forward roll interest given the large index extension in Germany tomorrow of .22yrs. There are a bunch more taps of the DBR 2/29s to come, however, this is an easy, low risk way to grab a bit more risk for EGB players. The DBR 8/28s won’t be CTD into RXU9 so less risk of them vanishing. We’d also expect some interest to buy the DBR 2/29s basis vs RXH9.

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's BREXIT BARRAGE... Progress...?

May vs Tusk & Juncker… again.

BBG: Brexit Bulletin: A Fleeting Victory

BBG: May Wins Backing to Reopen Brexit Deal as EU Prepares to Dig In

BBG: Brussels Edition: The Irish Candidate

BBG: Brexit Will Probably Split BOE Policy Makers on How to Respond

BBG: Theresa May’s Disastrous Dithering

BBG: U.K. Parliament Rips Up Theresa May’s Brexit Deal

FT: Parliamentary backing sets May on Brexit collision course with EU

FT: The votes: Theresa May wins out on (most of) her Brexit plan B

FT: UK slow making progress to replace EU’s global deals before Brexit

FT: Brexit delivers government contract ‘bonanza’ for consultants

FT: Brussels rules out backstop renegotiation – for now

FT: Brexit timeline: key dates in UK’s divorce from EU

TEL: What next for the Brexit deal? How the Brady amendment vote will shape negotiations

TEL: Door shuts as EU doubts Theresa May’s powers of persuasion

And so it goes…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's BREXIT BARRAGE... Another Brick in The Wall...?

Today’s got the potential to be another big day on the road to Brexit with significant amendments to the Brexit legislation likely to be tabled…

BBG: Brexit Bulletin: A Fork in the Road

BBG: May Faces Losing Control Over Brexit Despite Gamble on Backstop

BBG: Some EU States Are Weighing Conditions for Brexit Extension, Sources Say

BBG: Brussels Edition: Brexit Blues

BBG: How Parliament Is Trying to Control Brexit and What It Means

FT: Theresa May seeks to split Tory hardliners with bid to amend Brexit backstop

FT: Can the Brexit backstop be renegotiated?

FT: Brexit: the key amendments by MPs to May’s deal

FT: MPs line up against no-deal Brexit ahead of Commons vote

FT: MPs’ chance to take control of Brexit

TEL: Brexit latest news: Theresa May’s Plan B in chaos amid open revolt from Tory Brexiteers

TEL: Brexit explained: All your questions answered about the UK leaving the EU

TEL: Brexit latest odds: Best bets on how (and if) Brexit will happen

TEL: Brexit and the Irish border explained: why the headache is not going away any time soon

TEL: Theresa May’s draft Brexit withdrawal agreement – read in full

TEL: Brexit deal: What time does Parliament vote on Theresa May’s Plan B today?

TEL: John Bercow warned ‘history will judge him’ if he snubs amendment to save Theresa May’s Brexit deal

BBC: Brexit: Will MPs find agreement in their plans?

Enjoy!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's BREXIT BARRAGE... 'Same as it Ever Was'

Some good articles ahead of tomorrow’s Parliamentary vote…

BBG: Brexit Bulletin: Changing Direction?

BBG: Parliament to Challenge May for Brexit Power in Crucial Votes

BBG: How the U.K. Parliament Is Trying to Seize Control of Brexit

BBG: Brexit ‘Game of Chicken’ Played Before Crucial Week for Votes

BBG: May Heads Into Crucial Vote Seeking Common Ground: Brexit Update

FT: How will the EU respond to a request to delay

FT: MPs should take a ‘no-deal’ Brexit option off the table

FT: Ireland dashes May’s hopes of breaking Brexit stalemate

TEL: Theresa May’s Brexit deal: how the impossible parliamentary maths breakdown

TEL: The five key Brexit amendments that could radically alter Theresa May’s plan

TEL: How a second Brexit referendum could work: the question, when it will happen and who would win

TEL: No deal vs no Brexit: How Britain could end up staying in the EU after all

TEL: Delaying Brexit would open up a new can or worms for our economy

BBC: Brexit: May urged to secure backstop concessions from EU

Enjoy…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796