MICROCOSM: Gilts - Tidying Up Before the Meaningful Vote... Quick Comment

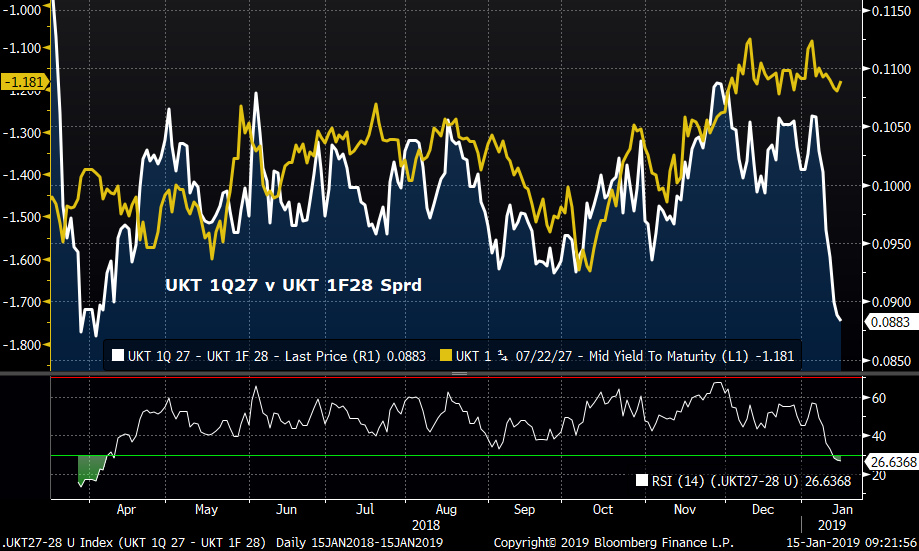

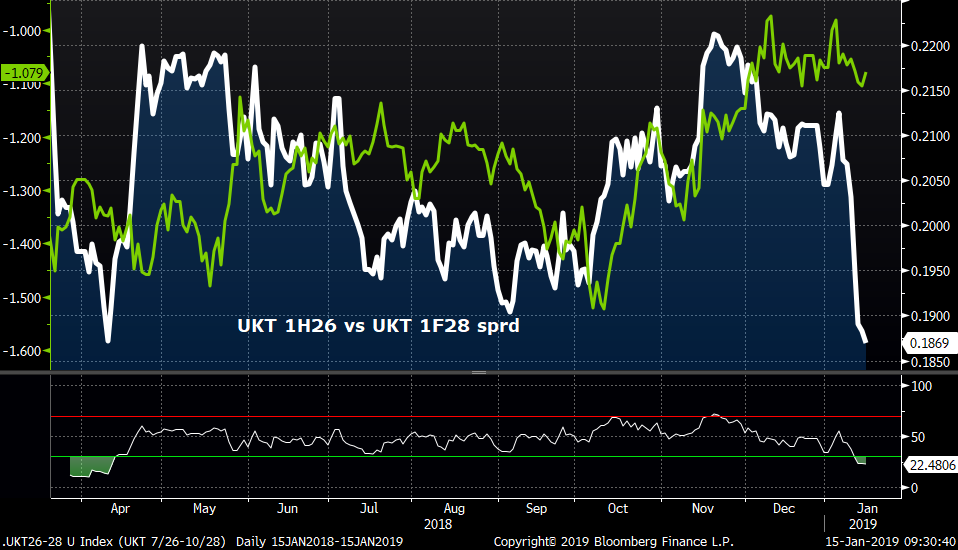

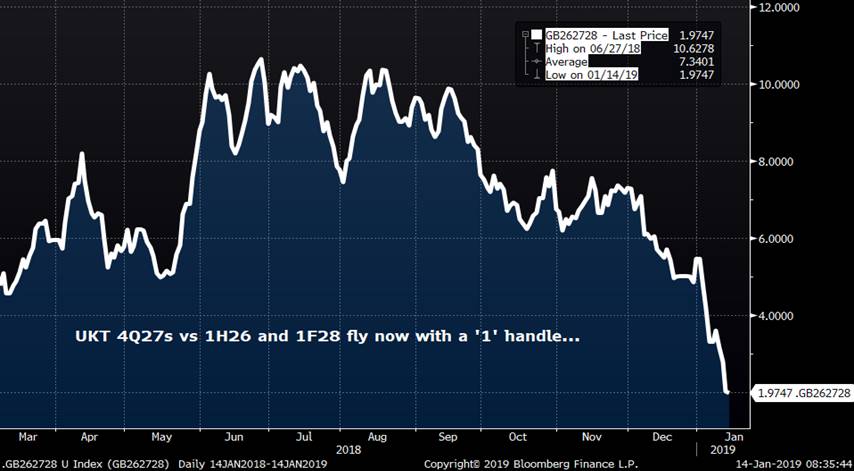

GILTS... 1Q27-1F28 and 1H26-1F28 spreads…

> Into the last tap of the 1F28s we highlighted the +10.5bps area as a good place to add to 27-28 flatteners, leap frogging over the 4Q27s. Along the same lines, we also advocated a 26-28 flattener in the +21.25bps area.

> To be frank, our recommendations fell on deaf ears as most clients preferred to remain short the 4Q27s. While the 4Q27-1F28 sprd has flattened more than the 1Q27 version by ~.5bp since Jan 4, the flattening vs the 1Q27s has been significant, taking the sprd back to levels seen briefly last March, when 1Q27 yields were 20bps higher and the 1F28s were just getting going. More importantly, the low cpn 26/27-28 versions aren’t complicated by the machinations of the 4Q27s falling out of the gilts basket, making them a more ‘pure’ call on the gilts curve.

> The chart below shows how both spreads have completely detached from any directionality as the 28s create their own orbit in a bull-flattening move.

> Our concerns, as we head into the 'Meaningful Vote' is the 1F28s are now a crowded long, held by the majority of our clients in various fashions. If, by some shock outcome, gilts sell-off sharply, we'd expect these sprds to re-steepen. In other words, if you've had the flattener on vs 4Q27 and/or 1Q27 and 1H26s, we think it's time to take 1/2 the posn off and book some nice profits. Conversely, these steepeners also look like good tactical bearish positions if you need that exposure.

Best,

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: NEW BTPS 15yr Benchmark...! Some Quick Pre-Syndication Comments

BTPS... NEW 15yr!

> The main event in the Eurozone today is the BTPS 3/35s syndication.

> We expect price talk to be released early this am (probably before 9am). As outlined in our preview from last week (attached), we expect the new issue to be spread off the current 15yr, the BTPS 2.45 9/33s and should come with a coupon in the 3.25%-3.40% range.

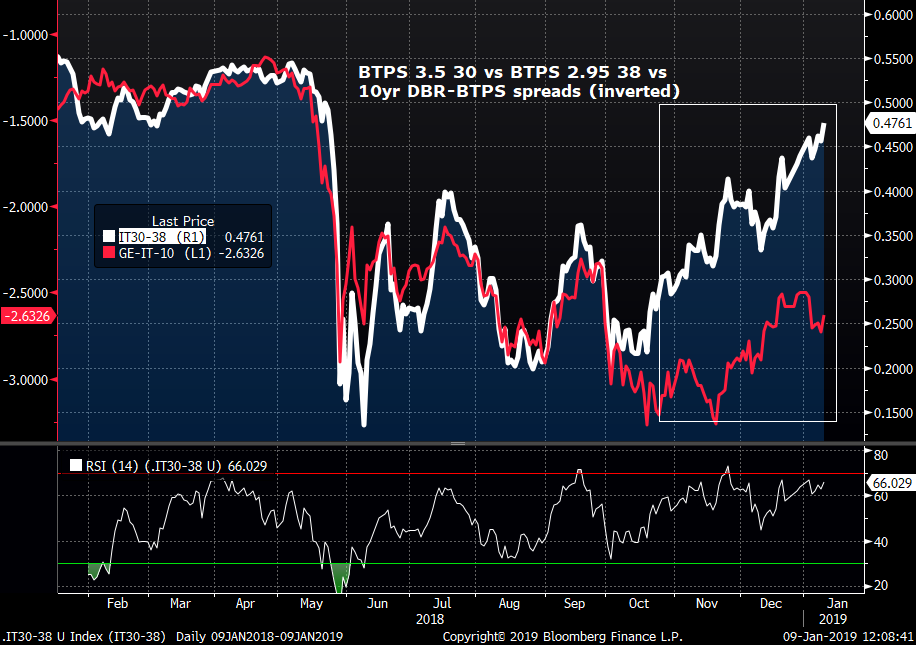

> The big questions are how generous will they be with the spread AND how big a deal will it be? Our analysis took a look at the current spread of neighbouring issues with similar coupons (3.5 30s and 2.95 38s) and came to the conclusion that, in order to make them cheap enough to the curve it'd have to be around +19bps to the BTPS 9/33s. Anything tighter than that would put them richer than the 9/38s (an old 20yr) which look cheap to us here.

> The primary reason the BTPS 9/38s traded cheap for much of the first 6mos post pricing was the Italian Tsy got a bit ambitious, bringing EUR 9bn of the issue. We're hoping they don't make the same mistake this time, capping the deal at Eur 7bn.

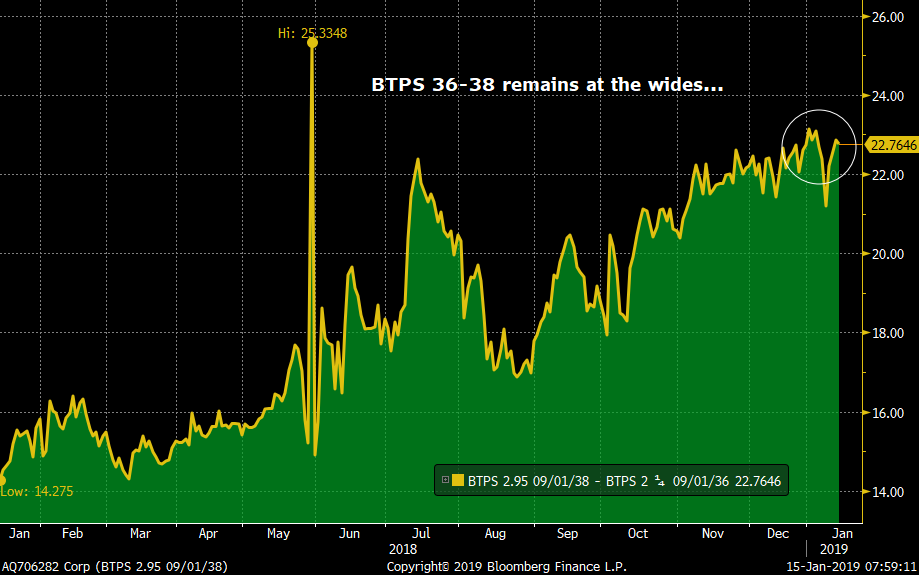

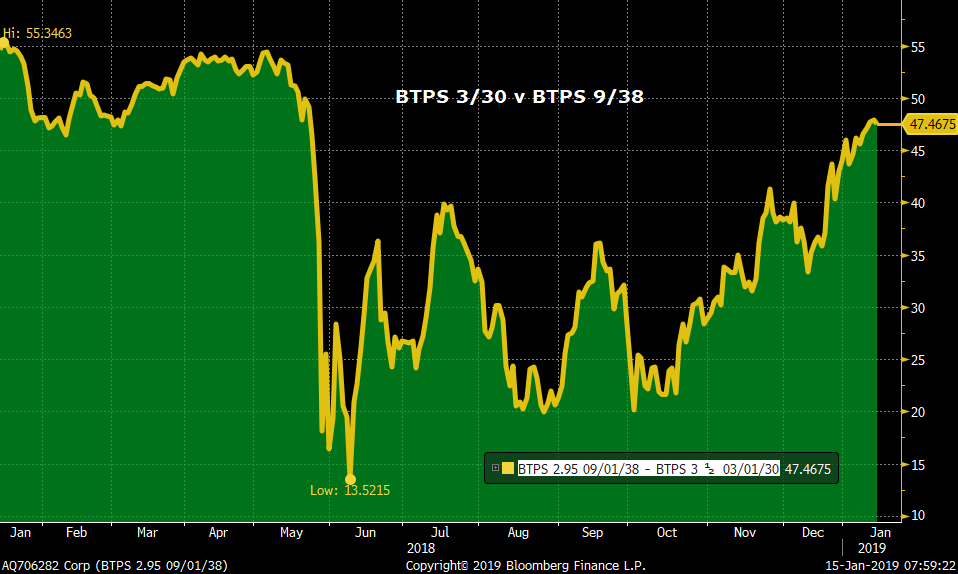

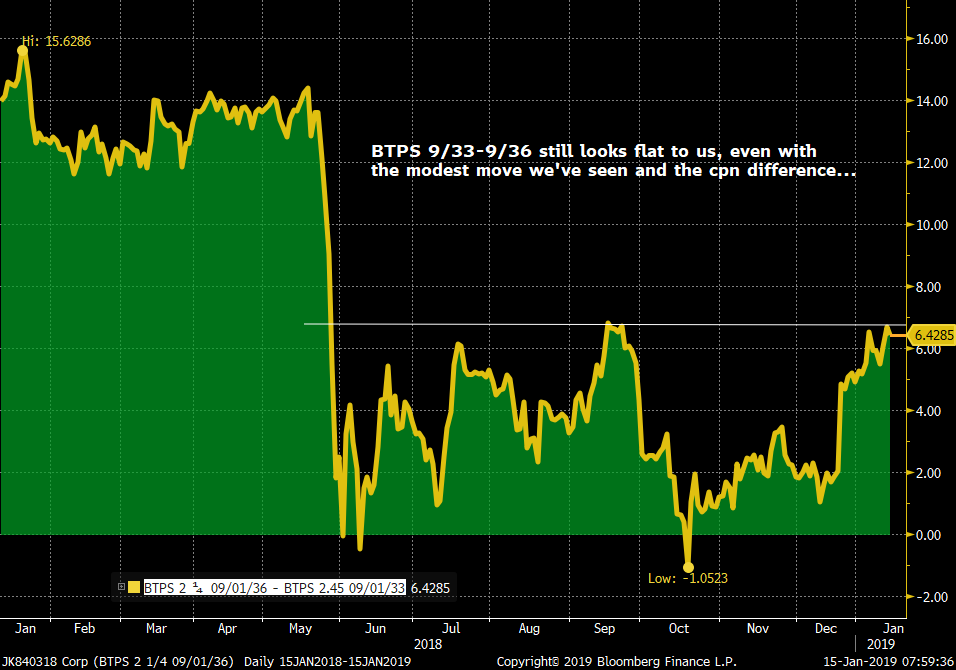

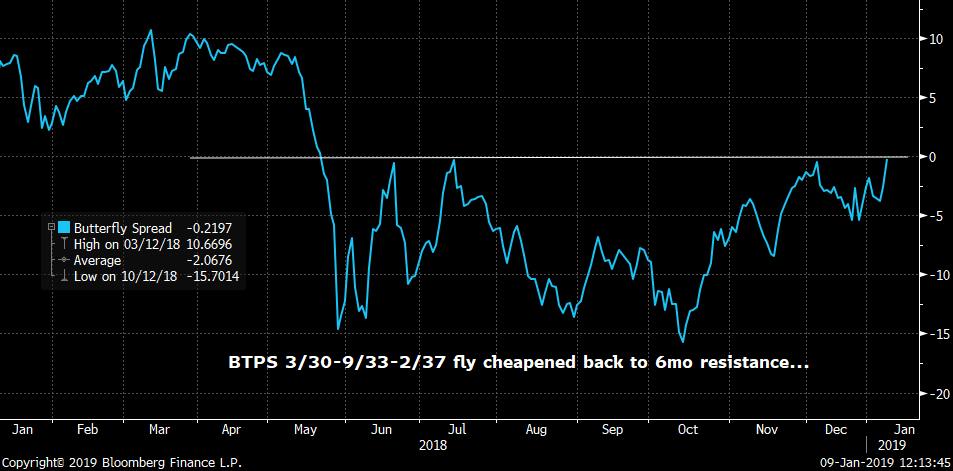

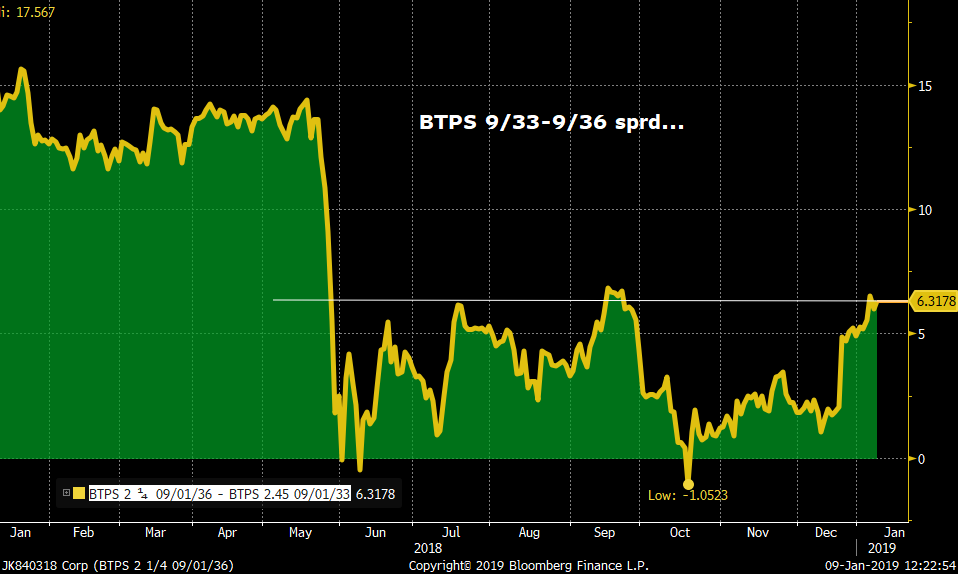

> From an RV perspective, the BTPS curve remains steep in the 10yr-30yr sector with the 15yr lagging in anticipation of this deal. The BTPS 36-38 spread remains at the wides (see below), as does the BTPS 30-38s (see charts below). The BTPS 9/33 vs 3/30 and 2/37 fly we mentioned has richened 2.2bps since last week but remains at the cheap end of it’s range. Lastly, the BTPS 9/33-9/36 steepener is a smidge wider but still looks too flat to us which could become glaringly obvious if they bring the new 3/35s at a generous spread, even factoring in the 100bps+ cpn difference.

We’ll be in touch post spread announcement…

Best,

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: BREXIT > What a Long, Strange Trip It's Been... Pre-Vote Snapshot of the UK

- Here in London, tomorrow’s Parliamentary vote on Theresa May’s much-derided deal will dominate the newswires and the markets focus. We thought it timely to provide an update on the latest news, where we’ve been and thoughts on where we’re headed.

- A snapshot of today’s headlines:

- FT: May to warn Eurosceptics that MPs could ‘block Brexit’ https://www.ft.com/content/99879042-1714-11e9-9e64-d150b3105d21

- FT: Plan B options narrow ahead of historic vote https://www.ft.com/content/57258d66-15a8-11e9-a581-4ff78404524e

- BBC: Theresa May says no Brexit more likely than no deal https://www.bbc.co.uk/news/uk-politics-46856149

- BBC: Brexit: What's next if MPs reject May's deal? https://www.bbc.co.uk/news/uk-politics-46858903

- TEL: What time is the Brexit ‘meaningful vote’ in Parliament tomorrow, and what will happen if Theresa May’s deal is rejected?

- FT: May to warn Eurosceptics that MPs could ‘block Brexit’ https://www.ft.com/content/99879042-1714-11e9-9e64-d150b3105d21

- CITI’s Daily ‘What’s Priced In’ report is a favourite of mine. Here’s what’s priced in for the UK:

![]()

![]()

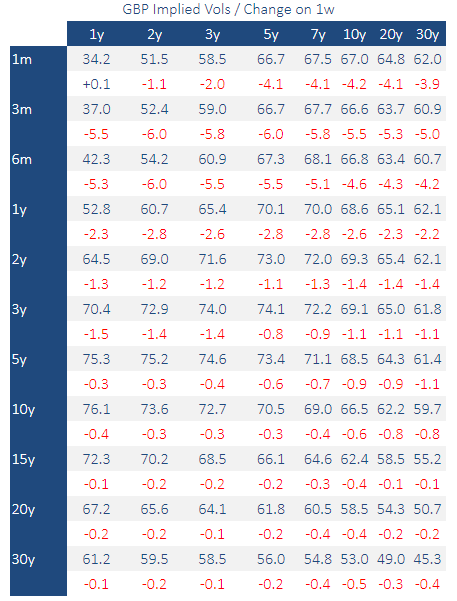

- What, me worry? GBP rates vol markets have seen considerable unwinds of ‘Armageddon’ trades as a no-deal scenario becomes less likely (at least in terms of the news flow last week). As a result, vol has taken a substantial hit into tomorrow’s vote.

Change on the week (borrowed from CITI):

- Charts of major & minor UK markets over the last year…

The FTSE was dragged lower by G-10 market moves but remains over 11% lower than the May highs nonetheless…

Cable’s support at the 1.25 level was tested in earnest into year-end and remains a key trigger for additional losses if breached. The post-Brexit vote lows of 1.20 would be broadly considered the ‘first stop’ but from there it’s uncharted territory. Given the sense of urgency to avoid a ‘no-deal’ outcome, some pundits argue another test of 1.20 would be a buying opportunity.

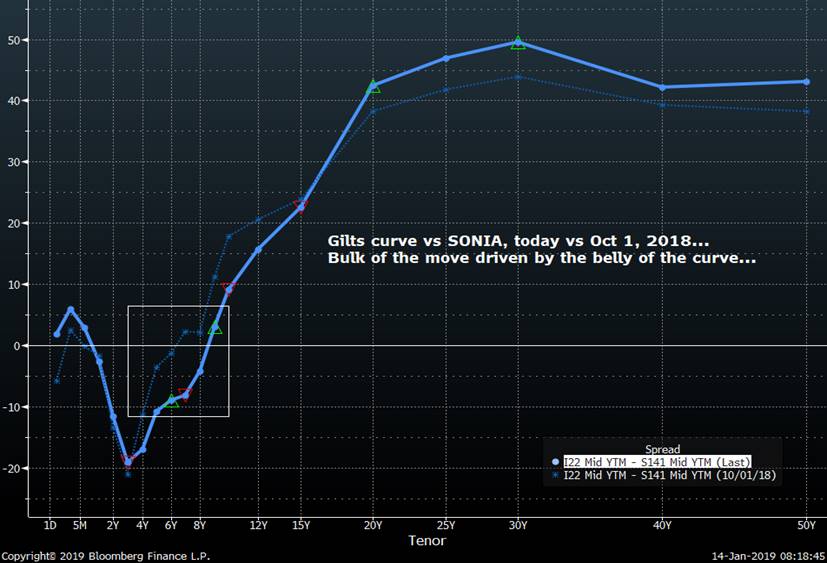

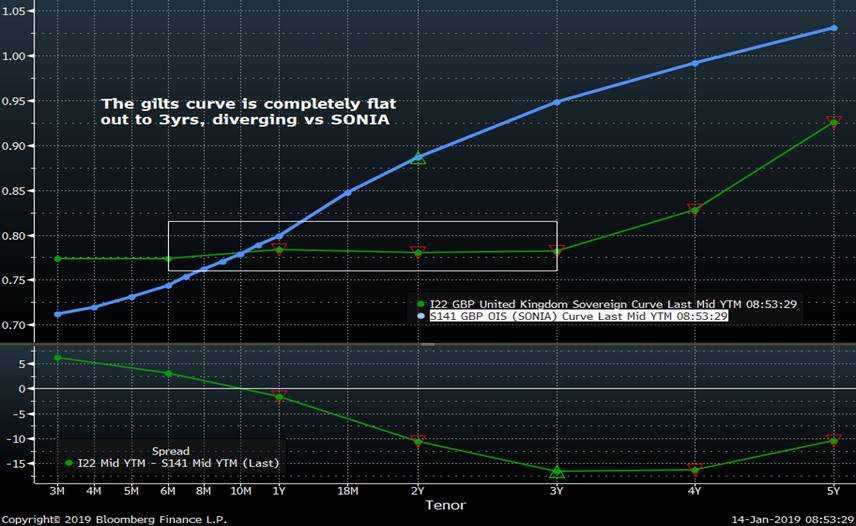

Gilts curve vs SONIA since Oct 1, 2018 (before the Brexit outlook deteriorated)…

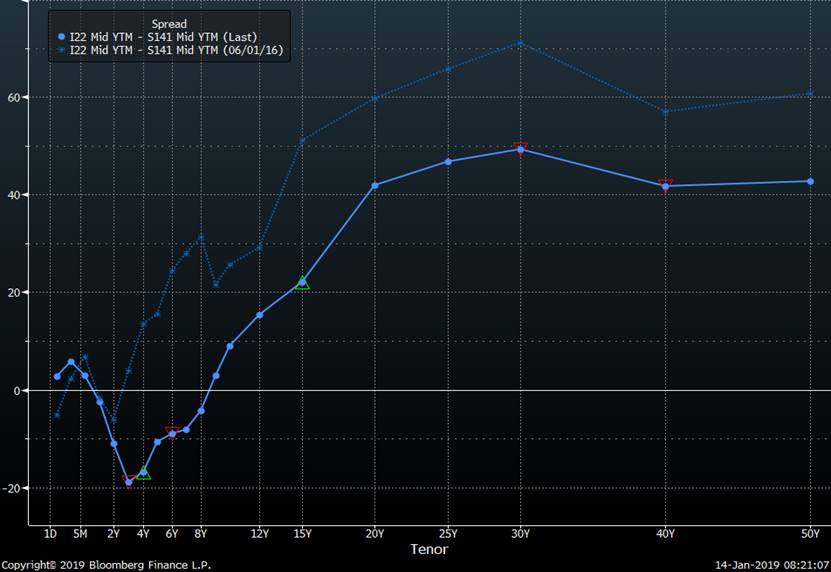

And today vs June 1, 2016…

SONIA has been a roller-coaster ride over the past couple years with Brexit fears battling with inflationary pressures in determining the rates outlook for the MPC. Despite all the volatility, 1y1y SONIA has traded in a 30bps range for most of the last year and is about 8bps off the recent ~90bps floor into today.

UKT 2-5-30 fly vs UK CPI YOY. I’ve shifted the CPI data forward by 275 days to show how well correlated the curve ultimately is – only with a considerable delay. In other words, if we remove the BREXIT fears from the equation, the 2-5-30s fly should be a lot cheaper.

UKT 4Q27s have been battered on the curve on their way to relinquishing their CTD status into G M9… Cheapest this fly has ever been…

The short-end of the GILTS curve is completely flat, looking rich to SONIA here…

- Sentiment… We head into tomorrow’s vote with the market ‘walking on eggshells’. On the one hand, mounting efforts to avoid a no-deal Brexit outcome provide some comfort that a complete implosion in the UK markets is less likely. On the other hand, there have been NO indications of what an alternative deal would look like if/when May’s deal is rejected. Does this shift in the outlook raise the odds of another referendum and hence, higher odds of no Brexit at all? Hard to argue it doesn’t. So, while the balance back in Oct/Nov priced in a 33% no deal/33% Brexit/33% remain outlook, it seems we’re shifting more to 20%/40%/40% odds. One could argue CABLE and VOL has gotten the joke and is trading as such but the rates market still looks a tad rich, especially in the front-end. Balance sheet is a royal pain, making steepeners there a bit painful to put on, however, they’re clearly pricing in a BAD outcome here. We have a tap of the UKT 1 4/24s this week too which we’re not priced for yet in our view. So, on balance, we’re leaning neutral/bearish here, sellers into strength in 2-5yr sector of the curve.

We’ll be in touch to discuss.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Astor Ridge - Updated Data/Supply and Events Calendars - Week of Jan 14-18

Supply calendar is a shadow of this week’s deluge…

Parliament vote on May’s deal on Tuesday will paralyze gilts early week…

Another busy week for Fed speakers…

Pls see attached.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: BTPS 15yr Syndication Imminent? Trade Ideas In Anticipation...

THE TRADES:

We need to answer a few questions:

What spread level to the BTPS 9/33s do we think a new 15yr needs to come at to attract ample demand?

What are new 15yr buyers likely to sell to buy this new issue?

How best to position for this deal in anticipation of a curve/spread concession?

We’ll answer them below.

Recap of a quick note I posted in our chat yesterday pm…

BTPS...

> Ok, we got the Italy 15yr syndication announcement (well, more like an unofficial ‘sources’ comment) but it raises more questions than it answers. Despite the ambiguity of the situation, most dealers/clients expect the deal to be announced early next week for Tues/Wed pricing. Friday’s 3yr, 10yr and 30yr size will be around 6.5bn, smaller than initially expected, we assume in anticipation of the 15yr deal.

1) What's the maturity? Our guess is 2035, largely because it's the only maturity in the sector not already taken and it gives them ample time to build the issue. The last few 15yr & 20yr benchmarks were Sep maturities but the 15yr sector is becoming a bit crowded and it might be time for another March issue. For the sake of consistency we’ll assume another Sep maturity.

2) How about a coupon? With issues from 2033 to 2036 ranging from a 3.26 to 3.44, there's a window there but a 3.3% cpn is closer to the low cpns than the higher ones, we're thinking 3.25% at a nice discount.

3) The trouble with this is the BTPS 2.45 9/33 (current 15yr) vs BTPS 2.25 36s spread is only 6bps. How much interest are they likely to drum-up for a €6-8bn syndicated deal at +5bps to the 33s...? The BTPS 2.45s 9/33 came at +18bps over the BTPS 3/32s! So, with this in mind, what would u rather own, a new 2035 issue that they'll have to price fairly generously or a 2036 issue that's likely to be at least 8bps richer than the new issue? Seems to me the BTPS 33-36 spread is way too flat...

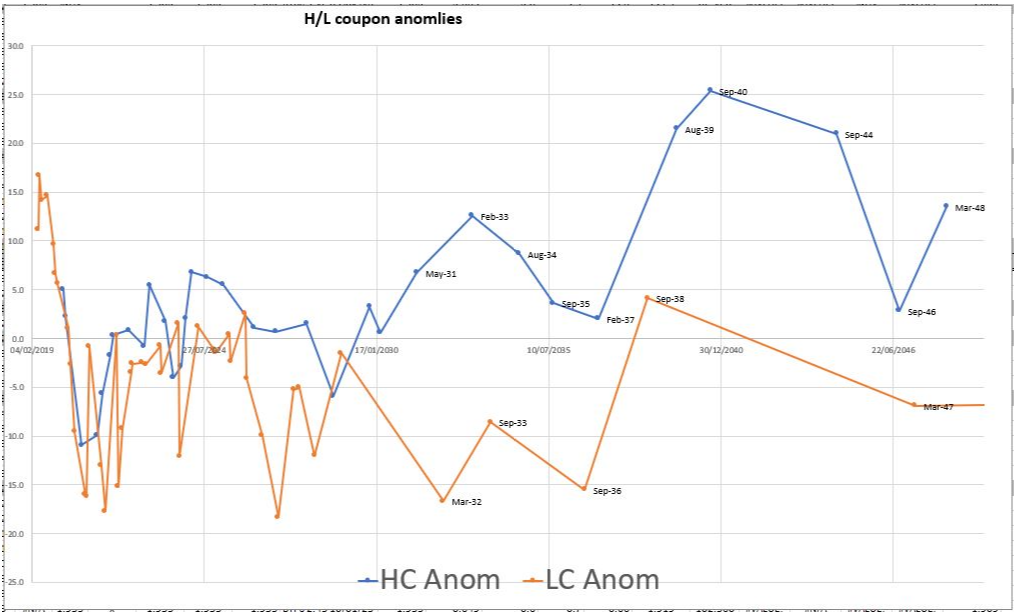

Let’s dig a bit deeper. Here’s a chart my pal James monitors that shows the potential anomalies along a fitted BTPS curve, separated by low and high coupons. You can see we’ve inserted a BTPS 9/35 issue on the curve where we think it should come relative to it’s neighbours.

Some observations:

- Even after the tightening of BTPS spreads from the wides, the high cpn issues still trade cheap to the fitted curve although there’s considerable variability among both.

- The BTPS 1.65 32, BTPs 2.45 9/33 and BTPS 2.25 36 issues are the richest in the sector, a reflection of their coupons but also how crowded the sector is with higher cpns.

- Take a look at the BTPS 3.5 3/30 and BTPS 2.95 9/38s. They trade at the same rich/cheap level vs our fitted curve and given our anticipation of a 3.25% cpn, we would expect that a new BTPS 3.25% 3/35 issue would trade right around the same level on the curve, making them the defacto ‘wings’ in any fly against the new issue. In order to make them cheap enough vs similarly specc’d issues, a new BTPS 3.25% 9/35 would need to come at +19bps to the BTPS 2.45 9/33s.

- Interestingly, the BTPS 4 37s remain a sticky issue on the curve, trading richer to our model than the much smaller coupon BTPS 2.95 38s do.

- At the other end of the spectrum, the BTPS 5 9/40 trade very cheap to the curve, the 36s vs 40s yield sprd within just 3bps of it’s all-time wides at +42.2bps.

- Spreading a new BTPS 3.25% (or higher) 9/35 issue against the benchmark BTPS 2.45 9/33, an 80bps coupon difference, will likely prove different for the performance of the new 15yr issue than the same 80bps cpn difference between the BTPS 1.65 32 and the BTPS 2.45 9/33s, simply because even at 2.45%, the coupon of the 9/33s is far smaller than their high coupon neighbours. A 3.25% area coupon puts this new issue in ‘limbo’ which suggests to us that demand will hinge on how generous the Tesoro wants to be and where it comes vs the 3/30s and 9/38s.

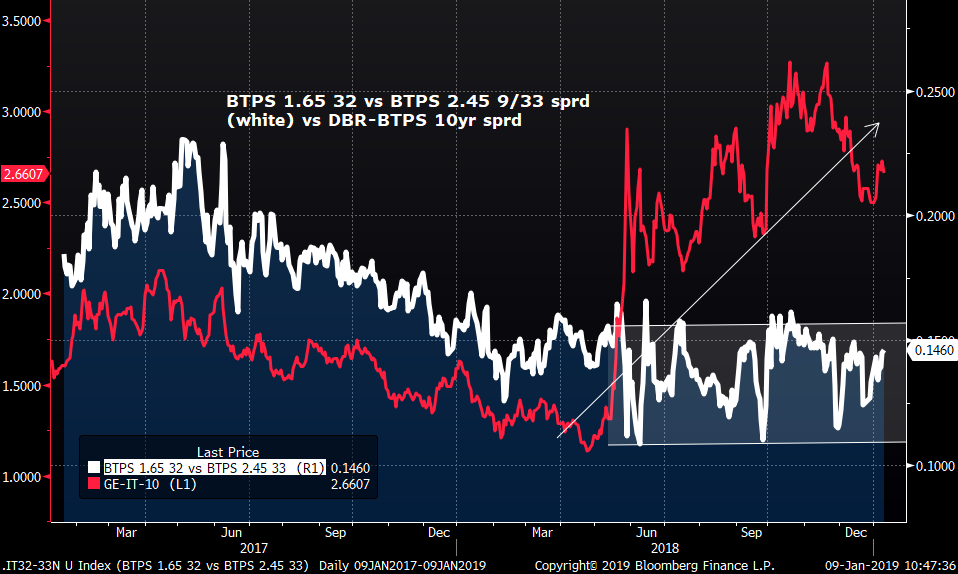

We can see the sensitivity of the 32-33 sprd to BTPS sprds has been small compared to sister spreads.

Last few 15yr and 20yr syndications:

Mar 2015 BTPS 1.65 3/32 15yr +10bps vs BTPS 3.5 3/30 (+2yr difference) 8.0bn now 21.9bn

Apr 2016 BTPS 2.25 9/36 20yr +39bps vs BTPS 1.65 3/32 (+4.5yr difference) 6.5bn now 14.9bn

Jan 2017 BTPs 2.45 9/33 15yr +18bps vs BTPS 1.65 3/32 (+18mo difference) 6.0bn now 15.9bn

Jan 2018 BTPS 2.95 9/38 20yr +16bps vs BTPS 2.25 9/36 (+2yr difference) 9.0bn* now 13.4bn

** At the time, the 9bn syndication size was too much for the market, contributing to its underperformance on the curve for most of 2018.

Conclusions: There are several ways to skin this Gatto…

- The ‘middle of the road’ coupon we’ll likely get will complicate pricing. Sell a low cpn against them and you are taking a view on DBR-BTPS spreads and vice-versa if we sell high cpns against them.

- They have struggled to perform this year but it’s hard to argue the BTPS 2.95 9/38s aren’t cheap on the curve here.

- Conversely, the BTPS 2.25 9/36s (another 20yr) trade over 20bps through them and just 6bps cheap to the BTPS 9/33s.

- The BTPS 2/45 9/33s aren’t very cheap on the curve, however, they’ve cheapened vs the sector in anticipation of this deal.

- BTPS 4 37s have been perennially rich (for a higher cpn) but could struggle vs this new 15yr if they bring them cheap enough.

TRADES:

BTPS 2.25 9/36 vs BTPS 2.95 9/38 flattener at +21bps, targeting 17bps, stop at 23bps.

BTPS 3.5 30 vs BTPS 2.95 9/38 flattener at +46.5bps, targeting +35bps, stop at +51bps.

This curve had been well correlated to an inverse DBR-BTPS 10yr spread from Jan-Oct, breaking down when issuance slowed into year—end, vol declined and the widening spread to DBRs reversed. This sector looks very steep here, due in part to the anticipation of this 15yr supply in our view.

Buy BTPS 9/33 vs BTPS 3.5 30 and BTPS 4 37 at the -1.5bps level. Considerable cheapening of 15bps since October, back to a level that has held since June.

BTPS 9/33-BTPS 9/36 steepener… Testing top of the range at +6.3bps mid.

I’ll be in touch to discuss.

Thanks

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Updated Astor Ridge Data/Supply/Events Calendars for Jan 7-11

Happy New Year to you… Best of luck this year.

Please find updated calendars attached.

The year kicks off in earnest next week with a rather monstrous week of supply to digest, the renewal of Brexit talks, US meeting China and a barrage of Fed speakers.

Hope these calendars help.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: Time to Cover Some UKT 4Q27 Shorts.... Quick Update

GILTS...

> Modest dip in gilts as core rates react to overdone technicals. We'd expect some profit taking to emerge in some of the more curve sensitive posns we have on if this selloff gathers steam.

> Positions Update:

UKT 25-27-30 fly -7.45bp, cheapest since mid-Nov.

UKT 9/22-9/24-7/26 -.5bp mid, still reflecting bid in 5yr point.

UKT 26-27-28 fly -4.4bps, making another new 'low' as 27s cheapen further.

UKT 42-47-52 fly 7.8bps mid. Also doing well, even with half the street scrambling to cover shorts in 52s.

UKT 30-32-38 80/100/20 wtd fly 4.6bps mid - about unched. 4T30s still trade well.

UKT 38-44-49 fly 15.4bps mid - 44s still cheapest issue out there.

UKT 20-21 sprd -.17bp, still modestly inverted given rally in 1y1y SONIA back to .907bp.

UKT 7/26-10/28 now 20.5bp mid, little changed.

UKT 4Q27-1F28 12.45bp mid - holding.

UKT 4Q27-1Q27 now inside 2bps at 1.97bps mid, cheapest 4Q27s have been since late Feb last year.

We're staunch 4Q27s bears given all the dynamics we've been highlighting. With the market flashing 'LONG' here, the question now becomes, what are they most long now - G H9 or 1F28/1Q27s...? In other words, if the mkt turns, do 28s get hit too with a tap coming on Tuesday?

Time to lighten up a bit on some of our 4Q27s shorts here...

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: First SPGB Supply of 2019 Should Find Good Support... Quick Rundown

SPAIN... First Supply of 2019

> €4-5bn nominals between .05 10/21, .35 7/23 and 1.4 7/28.

> Between the political rumblings of the past month and continued equity mkt wobbles, SPGBs have cheapened vs DBRs, about 10bps in 10yrs over the last week.

> Each of the issues being tapped today have cheapened nicely into today, either on the curve, vs DBRs/BTPS or vs swaps.

> The SPGB .05 10/21s are clearly the lowest cpn issue on the whole curve and at 4.5bln, will be tapped for until Apr/May. That said, the z-sprd box vs the SPGB .75 7/21s is back to the early Nov wides at +10.1bps and the yield sprd is 5.5bps steeper at 12.25bps mid, even with a bull flattening bias in EGBs into year-end.

SPGB .75 7/21 – SPGB .05 10/21 Z-sprd box. Last taps were Dec 5 and Nov 8th – both marked near-term wides.

> As with the 10/21s, the SPGB .4 4/22 vs SPGB .35 7/23 Z-sprd box is back to the Nov wides, now +18.4bps. This level held nicely in Nov and both of the last two taps marked the s/term cheaps on the sprd. SPGB 7/23s have cheapened vs OATs and BTPS over the past week and at 13.8bn, they’re closing in on their last tap.

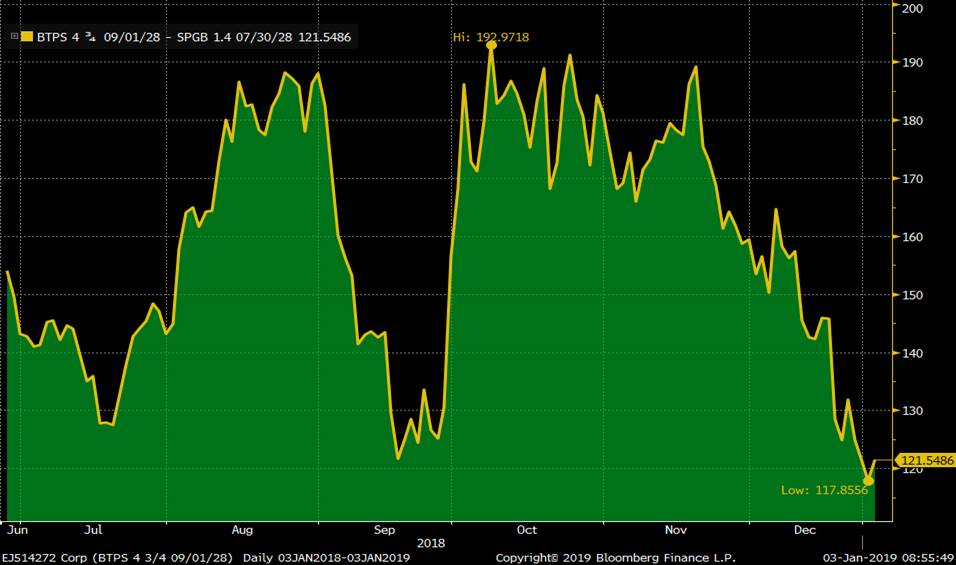

> SPGB 1.4 7/28s are just 4bps off their richest yield level since August. Were it not for RV implications, they would likely struggle this am. The SPGB 10/27-7/28 roll has widened back to the Jun-Jan wides at +7.6bps and IKH9 vs SPGB 1.4 28 sprds are at 121.5bps, their tightest level since these SPGB 7/28s were auctioned. If you've been waiting for a chance to put at BTPS-SPGB 10yr widener on, this is a good oppty...

BTPS 4.75 9/28 – SPGB 1.4 7/28 at new lows…

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: BTPS > 'You've Come a Long Way, Baby'

BTPS...

- 'You've come a long way, baby!'

- DBR-BTPS have corrected over 76bps from the Nov wides, closing in on the 38.2% retracement of the Apr-Nov move.

- As highlighted here the last few days, client flows remain two-way in 'RV' (we use the term loosely given the pain and suffering involved in getting anything done the past 2 weeks!), with some clients keen to jump on the spread tightener and others keen to put-on/add-to Hi-Lo cpn spread wideners. Interestingly, there are good versions of both wideners and narrowers on the curve right now, mostly created by bank-driven demand. Each of the current benchmarks across the curve trade on the cheaper side of fair (especially 3s, 5s and 7s), a reflection of the anticipated further taps and their ‘middle-ground’ coupons between the very low sub 1.5% and the higher 4%+ ones.

A couple examples…

- While it's a challenge to tell when 'enough is enough', we are sympathetic with the notion that the budget deal is a definite positive but it's just the beginning of a long journey towards a stronger economy, better run banks and political stability that will take all of 2019 and into 2020 to establish. That doesn't even take into account the uncertainty for BTPS now that PSPP is done and Italy's share of the cap key is smaller. The resumption of supply in Jan will be the first key litmus test for EGBs, especially OATs.

- So, given the sharp tightening of DBR—BTPS spreads, along with a rally in IKH9 that takes them well into o/bot RSIs, we are inclined to take profits on any tactical longs in BTPS here and given the richening we’ve seen in sov bonds overall, the absolute level of EGB yields looks overdone too.

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS - The Train Keeps A Rollin'!

GILTS... The Train Keeps a Rollin'

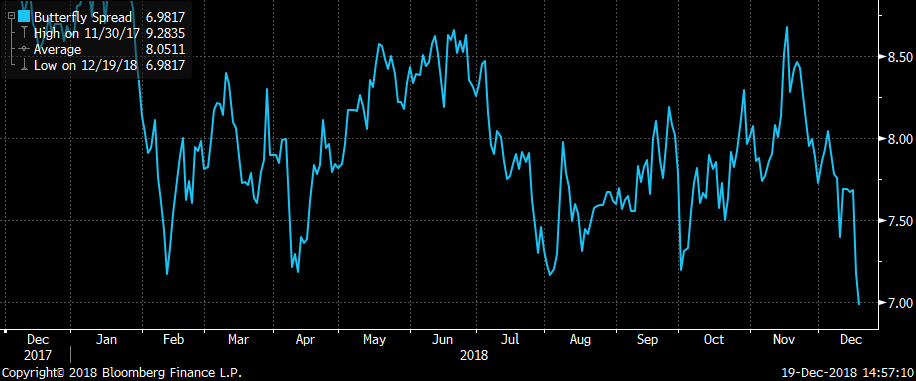

- Here's a thought...

- The ONLY thing keeping the UKT 4Q27s from completely getting smoked on the curve right now is the 'vol component' embedded in them as CTD. In other words, with Brexit still a hot topic, there are G H9 buyers who own them because when things get ugly in Parliament, the G H9 contract is the only game in town (as we saw when 27-47s shot steeper in November).

- See how the UKT 4Q27s have been trading the last three days? They're at new 'lows' vs both the 1Q27s and 1F28s for the last 9mos and G H9 invoice spreads have cheapened 2.5bps because the market knows that with Parliament on holiday from tomorrow until early January IT'S UNLIKELY we'll see anything MEANINGFUL on Brexit until 2019. So, a LONG VOL position of owning G H9 (or 4Q27s) suddenly looks less attractive, especially with the issue at GC in repo.

- What’s even MORE important here is the VALUE of our ‘vol’ position continues to ERODE because the directionality we’ve assumed is embedded in owning G H9 has been fading since G H9 became the front contract. (See bottom chart pls) Turn-off the lights on your way out please.

- So, while the market's been awaiting an 'inevitable' pullback in the 1H26s, 1Q27s and 1F28s to buy them against the 4Q27s, these trades have just continued to grind against the 4Q27s and barring a shock, are unlikely to reverse course soon. We are going to have a tap of the UKT 1F28s in January

1H26-4Q27-1F28

1H26-1Q27-4Q27

We’ll be in touch….

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796