MACROCOSM: Rates Markets Yin and Yang > Comment Into Year-End

Happy Friday the 13th - may it bring us luck.

First, a quick definition for those not familiar with 'Yin and Yang': two complementary principles of Chinese philosophy: Yin is negative, dark, and feminine, Yang positive, bright, and masculine. Their interaction is thought to maintain the harmony of the universe and to influence everything within it.

Most friends and colleagues agree that 2020 has been the year we'd all like to forget, 'It can't end fast enough!' is a common refrain. With just over 6 weeks left in 2020 we are still faced with a considerably larger number of 'Yin vs Yang' forces than usual, each driving the markets on a daily, weekly and even monthly basis. While the adage 'Time heals all wounds" is likely to apply to all of the Y v Y events below, it's not merely how long a resolution takes but whether it's an outcome the market expects or not.

Our Yins vs Yangs:

- Covid-19 vs the Vaccine

- Pfizer's announcement of a vaccine breakthrough on Monday sparked the biggest developed rates market selloff in months, a euphoric response to news we've all been waiting for. As the reality of the vaccine's cost and its delivery limitations sank in, the air leaked out of the balloon and as of this morning's open, US bond futures have clawed back ~3 of the 4 point sell-off (173-24 > 169-16 > 172-12).

- Cases across Europe and the US continue to rise with California passing 1 million infections and France at 1000 cases per 100k. Restrictions are becoming more stringent despite much of Europe already in lockdown. Trump remains silent on the surge in US cases.

- "We do see the economy continuing on a solid path of recovery, but the main risk we see to that is clearly the further spread of the disease here in the United States," Federal Reserve Chair Jerome Powell said during a panel discussion at a virtual conference hosted by the European Central Bank. "With the virus now spreading, the next few months could be challenging."

- Will there be a vaccine successful in turning this tide? Yes. When? Who knows? Handicapping the timing of the vaccine against the eventual economic impact is perilous at best.

- Biden vs Trump

- The outcome of the Nov 4 Presidential election remains contested as Trump claims voting irregularities that jeopardize the authenticity of Biden's apparent victory. While the federal, state and local election commission continues to assert that the 2020 election "was the most secure in American history" and that "there is no evidence" any voting systems were compromised, Trump is littering the country with lawsuits and demands for recounts. To add insult to injury, Biden was declared the winner in Arizona last night, the first time a Democrat has won since 1996.

- While the presidential melee carries on, Georgia will hold a runoff for its two senate seats on Jan 5, 2021. The Republicans are expected to take one or both of these seats, maintaining control of the Senate. However, if the Democrats win, the split will be 50-50, leaving the vice president to cast the deciding vote. A 'blue wave' has implications for everything from taxes and infrastructure spending to US trade and defense policies.

- While it seems remote now, there are wild cards here, laid out very clearly by Van Jones in this TED TALK. What if Trump doesn't concede? What if there's a special election that nullifies the first one? Scary stuff indeed.

- The by-product of this stalemate is far-reaching. It will delay the signing of a much-needed covid-19 stimulus bill that Pelosi and Mnuchin tried in vain to pass, slowing the US economic recovery. It will also detract from vital coordination needed to battle the surge in coronavirus hitting much of the country. Lastly, a long, drawn-out battle in the courts dents the US's reputation globally, potentially driving USD weakness.

- Sovereign Supply vs Quantitative Easing

- FED, ECB and BoE officials have been very vocal about the need for fiscal spending to drive support for pandemic-driven economic challenges after their base rates were cut to record lows. While most argue more needs to be done (neg rates still in play in the UK?), the year-to-date fiscal spending on a myriad number of programs (especially in the UK) has been at a record pace, driving a surge in UST, UKT and EGB issuance, including the ponderous new EU program expected to dominate the EUR SSA market in 2021.

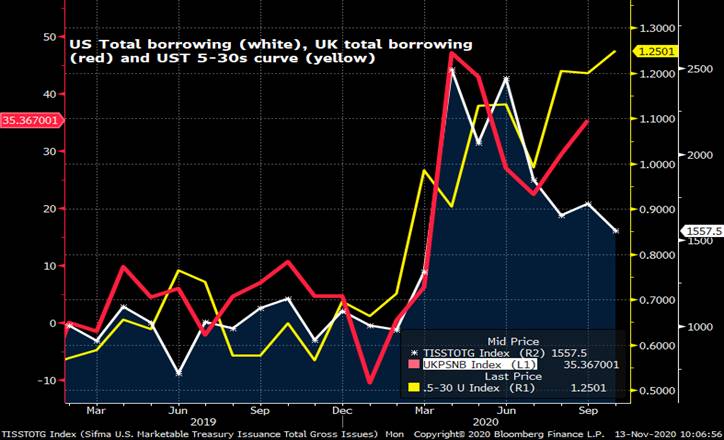

- We can see below that anchoring base rates at/through zero while cranking up bond issuance has helped drive a steepening of the UST curve and, to a lesser extent, the gilts curve.

- The FED's QE support hasn't been as forceful or effective as the BoE and ECB's has been in 2020 which is reflected in their curve. The BoE has already announced another £150bn for all of 2021 and the ECB has promised to 'wow' the markets with another dramatic dovish move at their Dec 10th meeting. QE will likely remain a key cog in the ECB's covid-19 response, especially given where base rates are.

- The question, across the board is, 'Will the FED follow suit with a more 'complete' QE effort once the next stimulus package is passed? Will the ECB roll-out a more formalized yield-curve control approach? Will the BoE adjust the APF buckets to reflect available liquidity across their curve? Time is of the essence but with year-end approaching, we're probably talking mid-Q1 at best.

- Boris Johnson vs Europe

- For those living in the UK since the Brexit vote in 2016, you probably share the same extraordinary sense of exasperation, frustration and impatience that I do. It's beyond comprehension that after almost 3 ½ years of negotiations, the same issues are preventing a deal. Without going into the minutiae, the bottom line is the clock is ticking towards the BIG Dec 31st deadline where the UK leaves the EU, deal or no deal. From this am's BBG article: "Another week of negotiations -- one that was supposed to be decisive -- will end Friday with little progress made in the main areas of disagreement, according to three EU officials familiar with the situation. While both sides can see what a final agreement would look like, Brussels officials insist that reaching one will require the U.K. prime minister to move first, a stance their British counterparts reject." Good grief.

- In the last week we've had a frosty call with Biden (Don't screw with the Good Friday Agreement Boris!) , Johnson's right hand man, the controversial Dominic Cummings is gone by year-end and the Europeans are sending their usual messages of both despair and hope.

- While the UK government has done its very best to make the outcome as baffling as possible (with little help from Barnier to be fair), most Brits expect there will be a deal. As always, the devil's in the details, but at this point the rally in Cable and the modest re-steepening of the curve suggest a deal will be done, one that gets them over the line and can be amended during the transition period.

- The mechanics of signing the deal aside, there isn't a soul from here to Hong Kong who expects the transition to go smoothly regardless of the deal's complexion. Johnson's administration has been taken to account by his own party for its shambolic handling of the pandemic and his own ratings have taken a severe hit. Fumbling the Brexit deal, the one he himself campaigned so actively for, would be a monumental failure and would likely cost him his job as PM. With his 'Joe Biden Problem' and time wasting, one would think the onus is now on Boris to blink first – and Europe knows this.

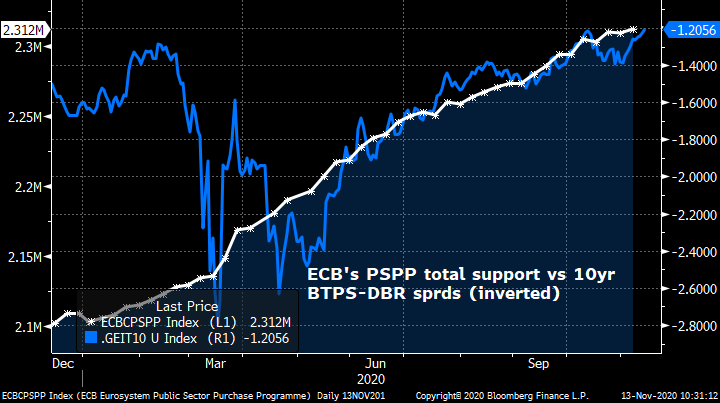

- The ECB vs Credit Risk

- The ECB's PSPP, ABB and PEPP programs have been at the heart of their response to the pandemic. Like them or loathe them, these programs have helped to not only lower overall yield levels across all EGB issuers but they've driven a tightening of peripheral vs core spreads to record tight levels. The chart below illustrates the high correlation since mid-May this year until now.

- While Europeans (especially Italians!) are grateful for this rates support at their time of need, this move to such tight levels not only ignores the sovereign credit ratings of countries like Italy, Spain and Portugal who have borne the brunt of the pandemic, it also creates an implied ECB-driven backstop that Lagarde and company may not be able to support once the pandemic's effects have waned.

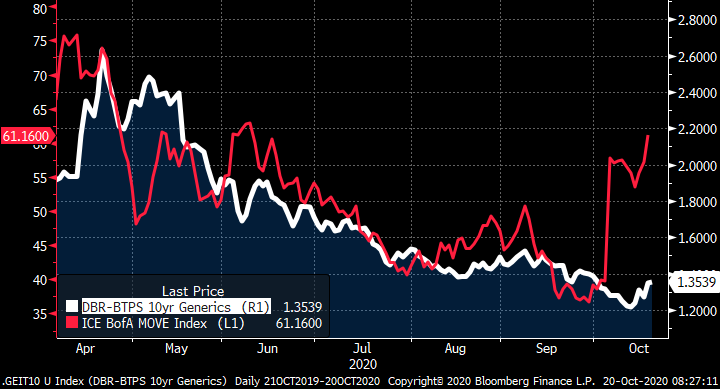

- Euro swaption vols are back near the lows seen in 2019 as a reflection of this spread compression and richening of yield levels. Is the market supposed to believe that there is no market-event on the horizon that could prompt a spike higher in rates or a widening of EGB credit spreads like DBR-BTPS?

- The short answer is 'No', we're not supposed to believe yields can't go up because we saw that up close and personal this week when RXZ0 sold off almost 3 points in 3 days. We had a little blip wider in BTPS spreads but that proved short lived and while RXZ0 hasn't recovered like USZ0 has, we're still 1.1 points off the lows.

- The ECB's 'bazooka' is meant to prevent an economic calamity. However, the collateral damage to the European pensions industry will be palpable if they persist with QE, etc longer than is necessary.

- And what about the EU program? Mutualization of debt among EGB issuers takes the load off investors at spreads deemed 'reasonable'. This is a plan that's been long in coming and a product that will be warmly received by end-users, provided there is ample access to the bonds in both the primary and secondary markets.

- Does the existence of this EU program make BTPS less interesting? While it all depends on the spreads they come at, the pool of money chasing European rates is finite, suggesting something's got to give.

- Conclusion

- Rates markets are facing a lopsided risk-reward profile that is ostensibly short volatility. The question is, are the options a 1 month expiry or 6 months? It we're long, we're prone to a vaccine headline, a Trump concession speech, a decline in Covid-cases or even a less dovish ECB than hoped. Get short and we're at risk if Trump takes this debacle to it's extremes, the pandemic gets really nasty or the wheels completely fall off the Brexit wagon. To say this is an extraordinary market in an extraordinary year is an understatement indeed.

- These are the approaches we're taking with positions into year-end:

- Stay in positive carry trades as we could remain range bound into year-end.

- Trade the ranges.

- Tactical supply-driven relative value continues to work albeit for modest gains.

- Net-neutral exposure across the curve with both flatteners and steepeners as RV affords.

- Vol is still relatively cheap (MOVE index back to 44 after pop to 65) – get long puts for those vaccine headlines.

More to come soon. Your feedback is welcome!

Thanks

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS > ADIOS 0R30s! Auction Preview...

GILTS > Adios 0R30s!

> LAST TAP of the 0R30s before the new UKT 7/31s arrive on Nov 12th.

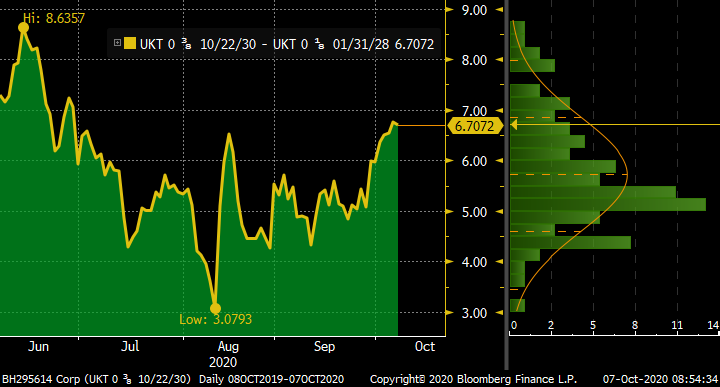

> As noted earlier this week, this issue is well on its way to normalizing on the curve.

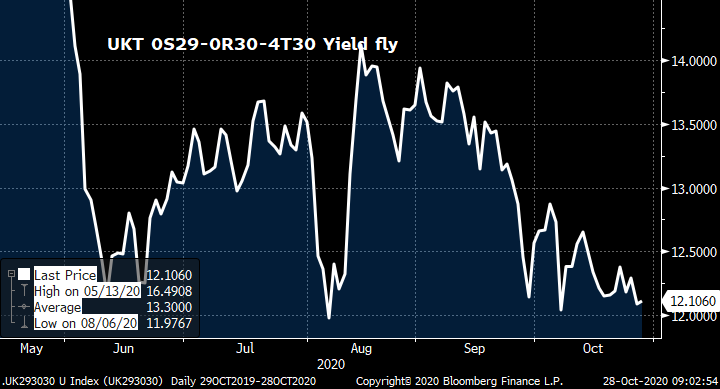

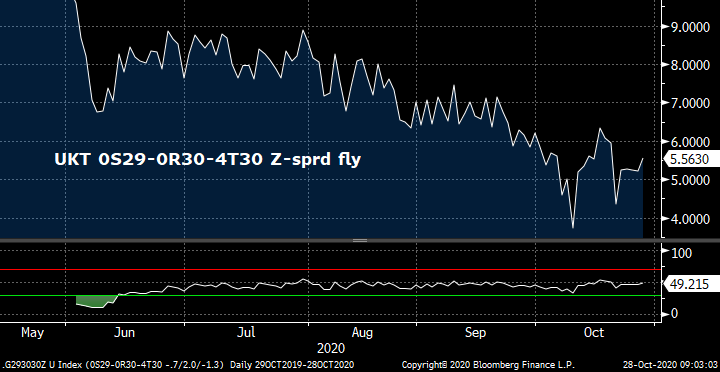

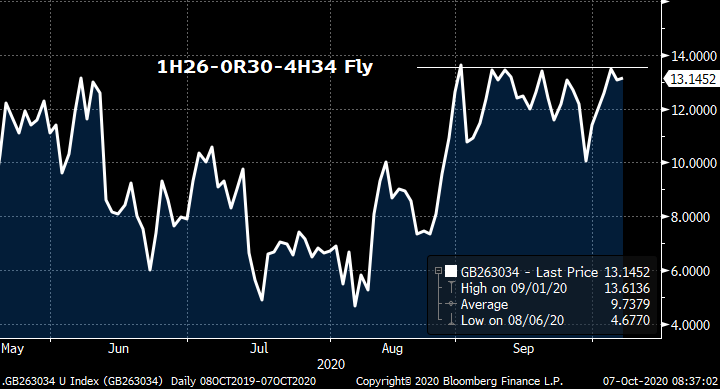

Take a look at the charts below of UKT 29-30-30 yield and Z-sprd flies. The yield fly has been capped at the +12bps level since the syndication (with 0S29-0R30 yield sprd about the same at the 1F28-0S29 sprd). The Z-sprd fly has stalled in the +5bps zone after a solid performance.

> Dealers report that this 0R30s issue is the second most widely held gilts issue by private investors. Not sure where they get those #s but it's not surprising. It does, however, suggest to me that there's going to be a big coterie of investors who will be keen to see where the UKT 7/31s open on the curve with an eye on rolling longer, especially if the tone of the mkt remains bullish.

> In the meantime, we expect this 10am tap to go fine, especially given the stats of each previous tap. That said, we're not buying into the 'they're done tapping it, let's get long' narrative here.

UKT 1H26-0R30-4H34 Fly vs 0R30 yields

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS > Quick Rundown - Today's APF and this Week's Supply

GILTS... Quick Kickstart

> Bull flattening in line with the rest of the G-7 this am has taken back some of the bear-steepening into the end of last week. G Z0's range remains well entrenched, reinforcing the RV bias to play these extremes.

> 3-7yr APF... 0E26s return today which adds to the 124s, 0F25s and 1Q27s. This will be the only op before the 0E26s drop out again for 2 weeks so expect them to feature prominently, especially given how well they've performed.

> £3.25bn UKT 0E24 tap @ 10am tomorrow will take them above the £4bn APF threshold but they won't be on the list until Nov 9th. We're still seeing interest to sell 124s into 0E24s around the +5bps area...

> £1bn tap of the mercurial 1F71s tomorrow at 11:30am is seen as smaller than expected and a far cry from replenishing the float the APF now owns. As such, there's been little concession on the curve with 2H65-1F71 still -9bps. The issue has cheapened almost 10bps in the last few sessions in yield and has been stable vs SONIA so drumming up demand shouldn't be a problem.

> Wednesday's final tap of the 0R30s in £2.5bn takes them to ~£37bn-ish post PAOF. The 0R30-4T30 yield sprd has hovered around 3.75-4.0bps in Oct but the 0R30s have outperformed on Z-sprd, now 1.5bps. As noted last Friday, the market's long these 0R30s and could get impatient, especially since the new 31s are coming on Nov 12th and will be cheap...

More to come...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: CHARTS > Bearish Momentum Building in Rates - Techs at Key Levels

- "Nobody said it would be easy".

- This oft-used quote applies to the markets these days, especially in G-10 rates.

- To the dismay of health officials the world over, Covid-19 has had a nasty resurgence that has many countries poised for more restrictions and lockdowns which is already creeping back into economic data across much of Europe. Fiscal and monetary support has been pledged but we're seeing its limitations.

- So, if things are still bleak, why have yields been rising and curves steepening of late, especially in the US and UK? Lets take a look:

- Little happened at last night's final Biden-Trump debate to make a dent in Biden's considerable lead in the polls. Barring a pre-vote shock, a Biden/Democrats victory should be unassailable, leaving little room for Trump's post-election theatrics. This would remove a major source of market stress and 'flight to quality' demand for USTs. A Biden victory is widely expected to result in more borrowing, bigger deficits and yet more USTs issuance.

- Brexit still isn't a done-deal but noises out of London/Brussels are positive. Cable has surged higher in response.

- Gilead's Remdesivir has been granted FDA approval as a C-19 treatment and vaccine trials are gathering pace with some calling for a Q1 2021 breakthrough.

- Credit ratings agencies are active, reviewing both sovereign and corporate issuers ratings in light of the impact of C-19 on debt levels and economic growth prospects. S&P is expected to cut Italy to BBB- (in line with Moody's and DBRS) while Greece and Netherlands will also be updated. With credit spreads within EGBs still at record levels, strategists are now saying risks are asymmetric towards widening vs Germany.

- With ample fodder for both a bullish and bearish outlook, technical analysis becomes a vital cog in our strategy wheel, especially in light of the 'crossroads' we've arrived at below.

UST 10yr yields – 2yr history – daily. We can see that we are back to levels in the 14 day RSIs that have proven to be a buy-zone on tactical, short-term moves. The 2yr grind richer in the 200 day MA has finally crossed with current market levels which provides a key 'cross road' for the market. A bounce off this level keeps the broader bullish tone alive, a clean break above it will make the bulls antsy.

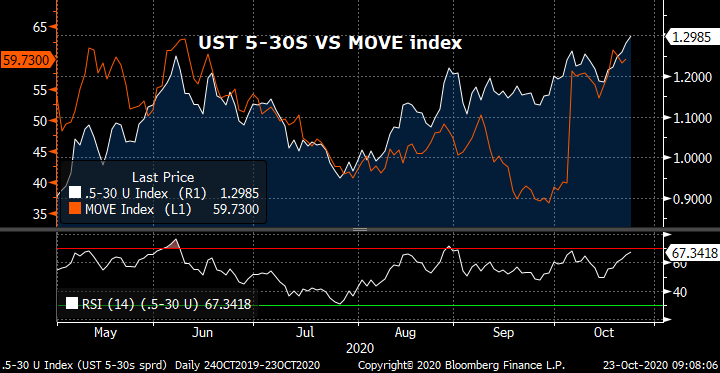

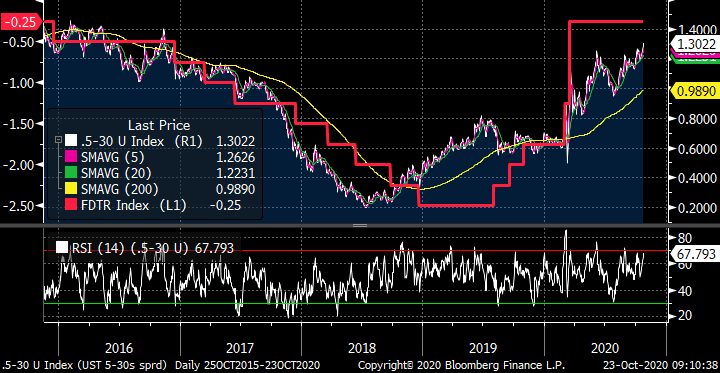

With the FED promising to keep the funds rate target unched until the US economy is back to normal, rising rates must mean a steeper curve. It also means higher implied vol levels (as per chart below).

UST 5-30s vs inverted Fed funds target (upper bound) suggests this move could continue before it's 'mispriced' vs historical correlations. That said, momentum indicators above show that on a short-medium term basis the curve is very steep and due for a pause.

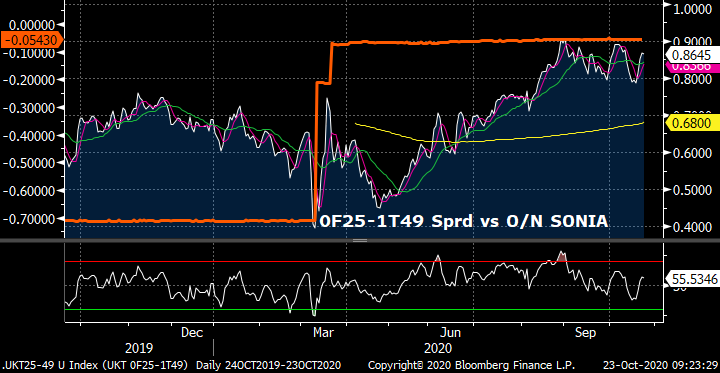

UKT 0F25-1T49 curve is also within a few basis points of it's post-lockdown peak of +90bps. We can see that the curve is showing a similar inverse correlation this year. The current 90bps ceiling has held since mid-August amidst gyrations in Cable (mostly Brexit-driven), economic data and UK borrowing needs/gilts supply. An extension of QE without a commensurate move to negative base rates would likely solidify this 90bps level further. It also suggests to us that on a medium-term basis we'll need a Brexit solution to drive a further steepening, likely reflecting higher long yields.

UKT 4T30 Yields (G Z0) vs Cable… For the second-half of 2019 and the start of 2020 GBP/USD and 4T30s yields were simpatico, tracking each other pretty well. The BoE's cut of the base rate and accelerated pace of QE put an abrupt end to that, leaving G Z0 to chop around in a very narrow 5bps range for most of the Mar-Oct period. With Covid still active, QE likely to be extended (consensus now seems +£75bn for Jan-Mar) and the BoE likely to keep rates unched (at worst), this 5bps range is only in jeopardy if a Brexit deal happens and/or a vaccine is announced. We've been trading this range actively in various directional flies and curve trades.

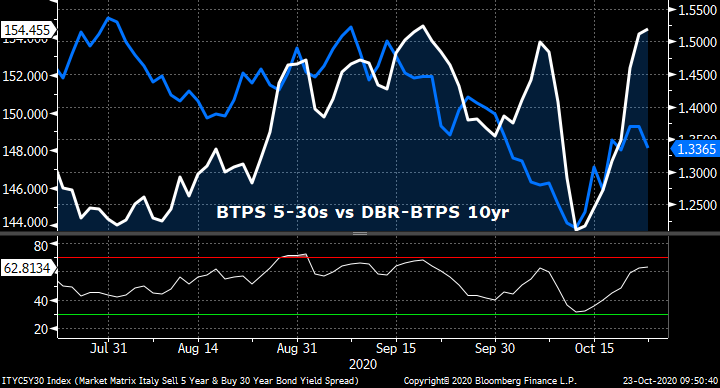

BTPS have been on a mission since spreads exploded wider in April. The correlation with credit indexes was strong until mid-July when 10yr DBR yields bottomed-out and BTPS kept richening. We are seeing some faint signs that BTPS are leaking cheaper, grinding back in line with ITRX. The path of Covid, the size of the expected ECB PEPP extension in Dec (consensus currently Eur 500bn) and Italy's credit outlook will each play a part here. Broader market influences like implied vol levels and sister markets like stocks also weigh-in. Either way, consensus is becoming broader that the BTPS-DBRs spread outlook is asymmetric from here.

The BTPS curve slammed flatter with the snap tighter vs DBRs. This came unglued with the announcement of the new 30yr deal ahead of today's S&P review- steepening 5-30s back to the wides. One of these is going to be right – either the curve is too steep or spreads are too tight.

More to come soon… Feedback ALWAYS welcome…

Best,

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS > Bear Steepening Into 0F35/0F50s Taps > TRADE IDEAS

- Long-end weakness in the US on renewed hopes of a stimulus deal and a $22bn tap of the 20yr have driven a steepening of the UST curve that has leaked into Gilts this am.

- With Vlieghe's front-end friendly comments yesterday, renewed hopes of Brexit progress and a motivated seller of a ton of UKT 0H61s at yesterday's APF, it looks like tomorrow's 0F35 & 0F50s taps will come at cheaper yield/curve levels than expected on Monday.

- We've been highlighting how well-trodden the ~135-00 to ~137-00 range in G Z0 has been since mid-August, despite a handful of supply/data/Brexit driven spikes in volatility during that span. We also highlighted how significant the 20 day MA has been, providing solid support levels in September. The chart below confirms yet another rejection of the highs and a return to the 20 day MA. This has been accompanied by a 2bps cheapening of the 1H26-0R30-4H34 fly and a re-steepening of some of the front-end flatteners we've had on like 1H26-1Q27 et al.

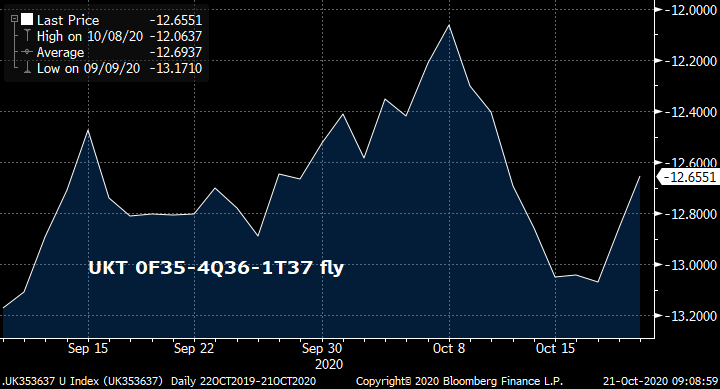

- The inaugural tap of the 0F35s tomorrow, along with more 0F50s will likely provide GEMMs an excuse to keep the curve steep, especially since there's a tap of the 1F71s next week and no long-end APF action until next Tuesday to mop it up. In our recent notes we've highlighted the directional bias of these 0F35s vs their high-cpn neighbours, the HCs outperforming in a rally. The reversal of the last 36hrs has cheapened the 4Q36s on our 0F35-4Q36-1T37 fly recommendation by about .4bps, removing some of the auction concession, however, our 0R30-0F35-1Q41 fly remains at/close to its wides given the steepening we're seeing. Medium-term, we see value in these 0F35s on the curve and will use tomorrow's tap to begin accumulating a position in them given their cheapening on the curve.

- Supply-Trade… UKT 0F35-1Q41-0F50 fly – sell the belly. This is a directional fly that gets us short with 41s still at the rich end of their range vs these cheaper wings. Carry and roll is flat so this is a position we can hold onto for a while as the 35s grind into the curve.

We'll be in touch…

Thanks

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Quick Charts - Rates/Macro, Etc...

- Charts provide a relatively objective view of the markets and often confirm (or refute) consensus sentiment. Here are a handful of charts I put together this am that I think give us a good starting point for discussions.

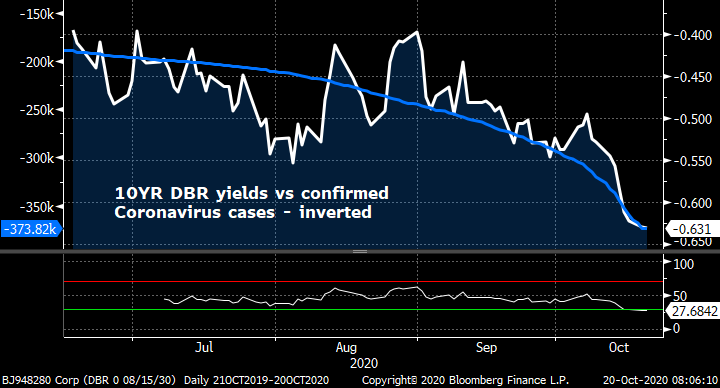

- 10yr Bund yields vs total Coronavirus cases in Germany (inverted). There have been a number of strategists who have targeted -60bps in 10yr Bunds as the lower yield boundary for the 2020 and into 2021. This is partly because we've tested that level in May and got close in August and in both cases the market sold off. This chart, however, suggests that a continued surge in the number of cases could take us further into negative territory.

- BTPS-DBR 10yr Spread vs US MOVE Index. While these are different markets, in theory, both the DBR-BTPS 10yr index and the UST MOVE index are barometers of volatility and have been well correlated since April. In the last couple weeks we've seen a pop wider in the MOVE which seemed isolated until BTPS came under fire late last week, cheapening 12bps intraday before ending 6bps wider. With S&P reviewing Italy's credit rating on Friday (they are widely expected to finally cut them to BBB-, in line with Moody's and DBS although negative outlook would be a surprise given BBB- is the lowest rung on the investment grade ladder) and new C-19 cases making the outlook unclear, it's time to lighten up on BTPS on a cross market basis and consider steepening positions.

- Gamesmanship or Legitimate? While recent articles in the press paint a rather disturbing lack of mutual cooperation and respect in the Brexit talks, most pundits expect a deal to be done, even if it's a barebones one. We're not at Armageddon levels yet but you can see from the chart below that gilts have outperformed 10yr USTs and DBRs by about 14bps in the last 2 weeks, a reflection of the state of Brexit and the Covid-driven restrictions that have hit much of the UK, further dampening the economic outlook.

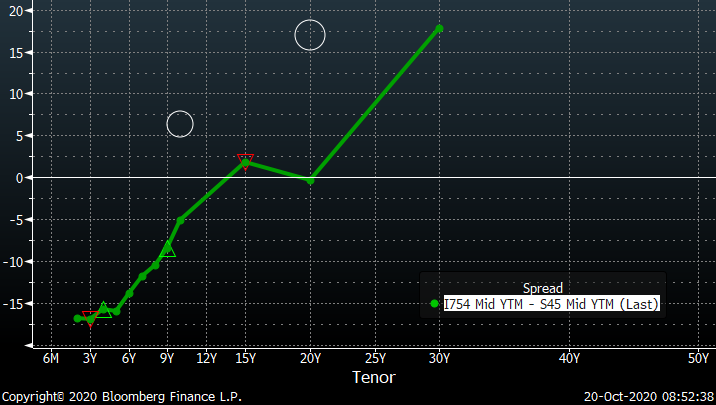

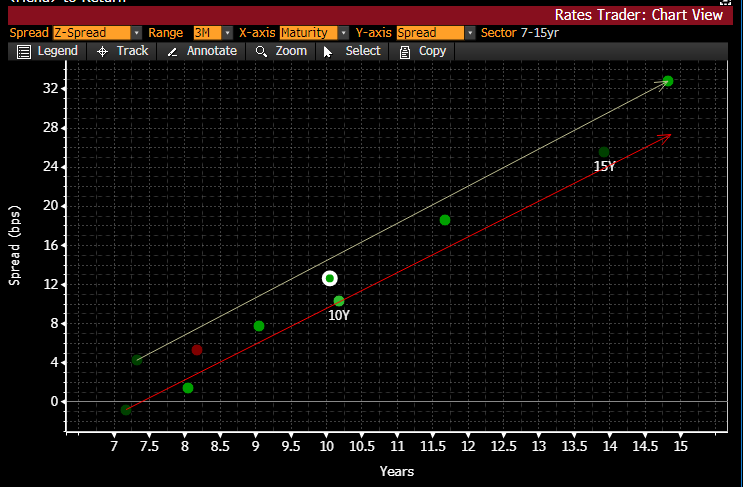

- New EU SURE program kicks off today with a new 10yr and 20yr benchmark. This will be an interesting issuer that should add some 'firepower' to the core/semi-core market with ample support from the PEPP program to keep them well bid. Dealers are already quoting these issues up to 6bps richer than IPT, well before the books have been built.

EIB curve below vs swaps > with estimated spreads to swaps of today's EU deals circled

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS > What Now? Quick Thoughts...

GILTS! What now?

> First day this week w/o supply or APF so we're left to our own devices. These are days where we'll get a feel for where positioning is both outright and on the curve.

> Out of the chute we've got a modest bull flattening, the mirror image of yesterday. As we noted yesterday PM, with APF DV01 of £7mm+ this week (the highest since July), we've mopped up all of this week's gilts supply DV01 which leaves us with a pretty clean slate.

> We can see from the charts below that selling pressure in gilts this week has been a G-7 rates thing, not unique to G Z0 as the blend of US-UK-GE 10yrs remains around the +40 area.

> The outlook for the UK into next week remains the same - Brexit, UK data (GDP tomorrow) and the eternal debate around neg rates and/or more QE.

> Next week's DV01 of supply will be a touch longer than this week with 0E26s, 1T57s and 0S29s coming. More on this in a min but suffice to say that the 0E26s are well on their way to converging into the curve while the 0S29s and 1T57s are both trading cheap on the curve. (charts below)

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS > Penultimate Tap of UKT .375% 10/30s Today - RV Colour

The DMO will tap the UKT 0R30s for the penultimate time before the new UKT 2031 benchmark is auctioned on November 12th.

Today's £2.5bn+ tap will take them to ~£34.25bn, easily the most rapid issuance of a new 10yr benchmark ever. Some salient points:

- DIRECTION

- We've highlighted the bearish dynamics brewing in the G Z0 contract over the past week, noting how the previously solid support of the 20 day MA gave way, opening the door for a solid correction which left the market with longs at considerably higher levels. Due in part to net neutral/positive supply vs APF flows this week and signs that Brexit talks are still challenged, the market managed to set floor yesterday and we are opening higher, despite this AM's supply. Open interest remains elevated, suggesting there's been little sign of capitulation.

- The 10yr sector has led the selloff, the 5-10-20 fly cheapening to the recent wides which has attracted both short covering and new longs in various structures (1H26-0R30-4H34 remains popular, for ex).

- CURVE

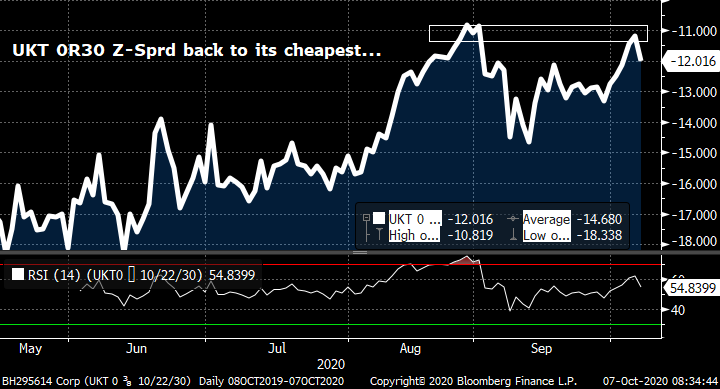

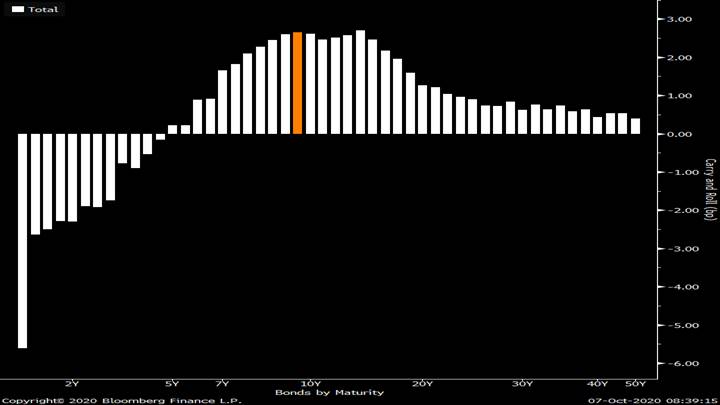

- We have also seen 0R30s back to their cheapest on Z-sprd which, when combined with their curve-best carry and roll, makes them a very tempting buy here whether you prefer steepeners or flatteners.

BBG Gilts curve C&R with 0R30s marked

- High cpn and low cpn gilts have their own Z-sprd curves right now (white arrow low cpns). They aren't likely to converge completely but we've seen a richening of the 0E26s, 0E28s and 0R30s lately that suggests as the issues grow older (and they're no longer being tapped), there will be convergence.

- UKT 0R30-4T30 yield sprd has taken out the bottom of the July-Oct range, taking one more step towards normalizing.

- UKT 0E28-0R30 Z-sprd is at it's recent wides (with the yield sprd at new wides) which will attract flattener interest, despite the collective wisdom that 0E28s are still a good long.

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS > Quick Rundown of Today's Supply and Technicals

GILTs > Supply this AM

> £3.25bn of the NEW UKT 0E24s at 10am. Sprd to UKT 124s is opening +4.8bps, .3 richer than where they were yesterday am.

There are some GEMMs (like BAML) who think the BoE could expand the 3-7yr bucket to 1-7yrs to allow the inclusion of the new short benchmark and widen the net of available issues. This would clearly benefit the 0E23s and this new 0E24 issue but we're a way off the BoE addressing QE with 7 weeks left before the end of Nov. In the meantime, these 0E24s will only be eligible for APF ops until January when they roll sub 3yrs.

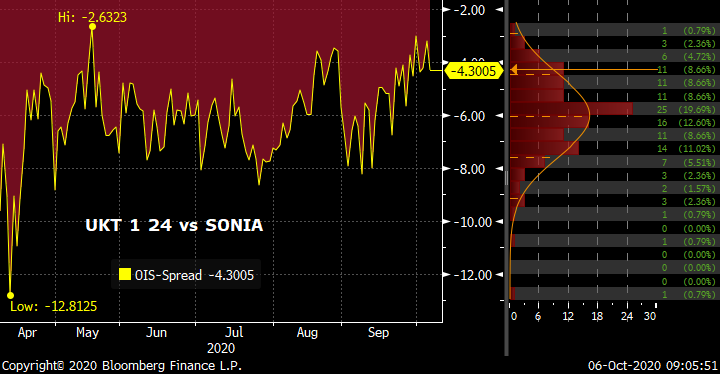

Either way, the 124s have been cheapening nicely vs SONIA (chart below) and with this new issue trading cheap to SONIA, there's sure to be ample demand.

> £2bn UKT 1T49s at 11:30am. The 1T49s have been trading well on the curve, richening on micro flies like 47-49-52 but in the last 3 days we've seen a nice cheapening of the issue vs both SONIA and Libor swaps as 10-30s bear steepened in response to the selloff in G Z0. We expect these micro and macro moves will attract some demand. The 39-49-65 fly (which has been stubbornly rich) has even cheapened 1.5bps to 18.5bps into this am.

This tap takes the available APF room to ~£4bn if we assume some PAOF demand

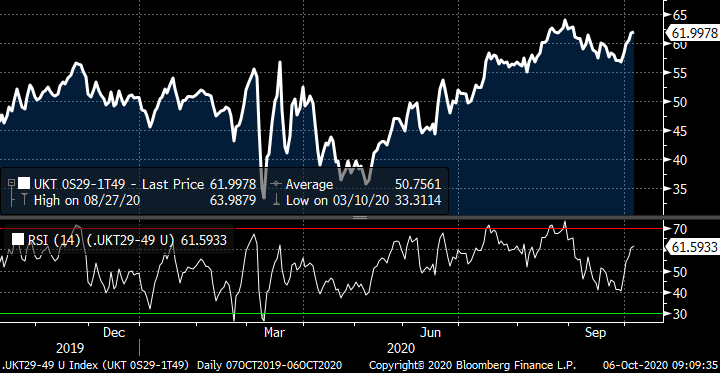

DBR 48 v UKT 49

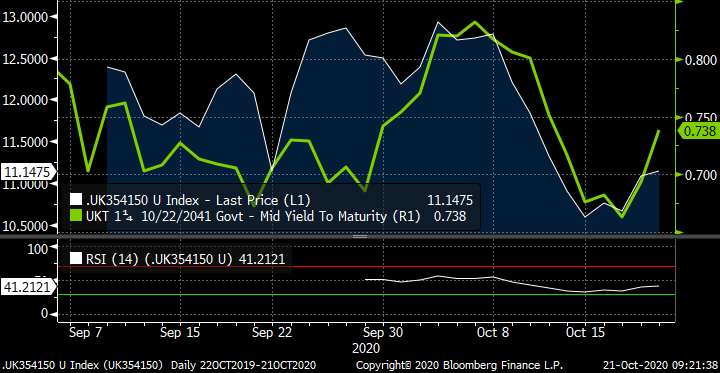

UKT 1T49 yields

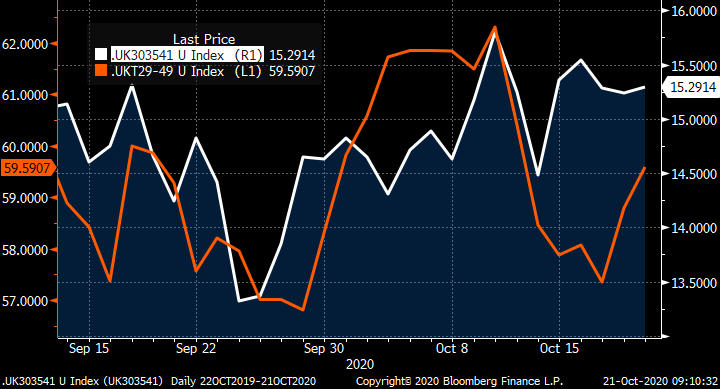

UKT 29-49 Yield Sprd

Quick GILTS Charts > O/Sold

> Gilts opened better offered but we're about 5 ticks in the black with light volumes ahead of this am's supply.

> G Z0 has sold off 136 ticks since the start of October which has taken the 14 day RSIs down to their most oversold levels since late August.

> Open interest hasn't budged much in the last couple weeks from the ~550k level and the volume at price chart shows that the bulk of the positioning since Sep 1st has been in the mid 136s so, despite the cheapening outright and vs USTs/DBRs, there's been no overt sign of capitulation.

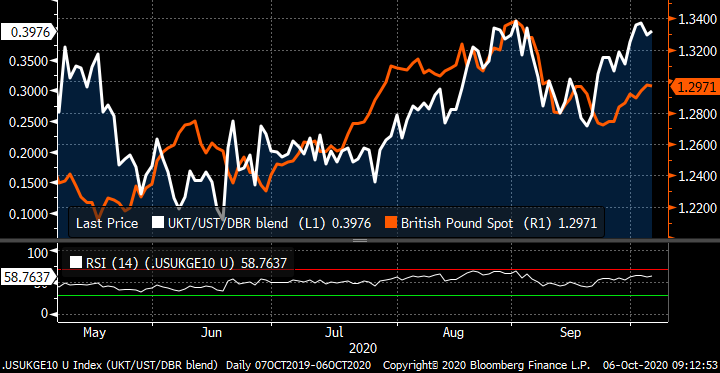

US-UK-GE 10yr blend w/GBP – the +40 level proving to be solid resistance

> Which leaves us wondering how much of this sell-off is macro and how much of it is supply-driven...? While we've been banging the gilts bear steepener drum in hopes of a break-through in Brexit talks (which has worked for 3+bps in 29-49s for ex), we've also had some set-backs in Brexit talks, along with new lock-down chatter, that are tempering our near-term bearish stance towards a more neutral one. In other words, we expect to see SHORT COVERING in gilts this am, especially in the long-end, with the ~48.25k G Z0 equivalent 1T49s tap and a 0R30s tap tomorrow.

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS > Supply and APFs This Week - Quick Rundown

GILTS... Supply/APFs this Week

> APF 3-7yr Bucket Today - no exclusions so 124, 0F25, 0e26 and 1Q27s all available. This is the first time in 3 weeks the 0E26s are eligible and they've traded well on the curve (on balance) so we'd expect to see GEMMs look to lighten up on them this pm.

> Inaugural £3.25bn UKT 0E24 auction tomorrow at 10am with the 0e24-124 sprd opening +5.1bps mid this am. This isn't far from where 0E23-0T23s sprd opened when we factor in 3mos tighter sprd. Should see good demand.

£2bn 1T49s tap at 11:30am with 49s on the richer side of fair within the sector. This £2bn tops them up a bit for APFs.

> APF 20yr+ Tomorrow - 1Q41s, 1T49s and 1T57s won't be on the list due to this week and next's supply calendar. Most issues have ample room under 70% limit.

> Wed's £2.5bn tap of 0R30s is it's penultimate before the new 31s arrive. The 0R30s have been trading well on the micro-fly (29-30-30), close to the 12.0bps bottom of the range at 12.6bps. On more macro-flies, however, the recent weakness in G Z0 has cheapened up the sector (26-30-34 flies et al have been volatile, for ex) so we're keeping a close eye there. With one more tap to go, the temptation is to buy them for further normalization but we think the mkt's already long.

> APF 7-20y bucket Wed - a rare 3 straight weeks of eligibility for the 0E28s begins on Wed but the 0R30s drop out for 2 weeks

due to their tap on Thurs.

More to come...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796