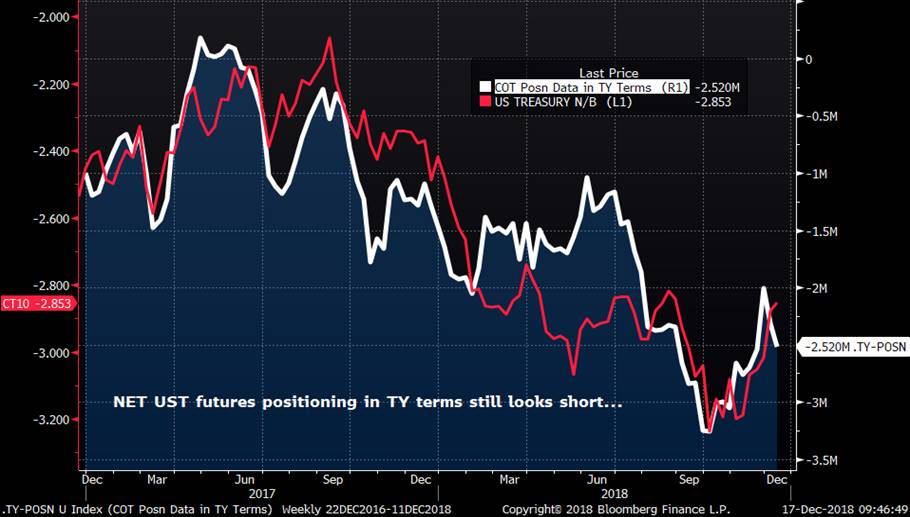

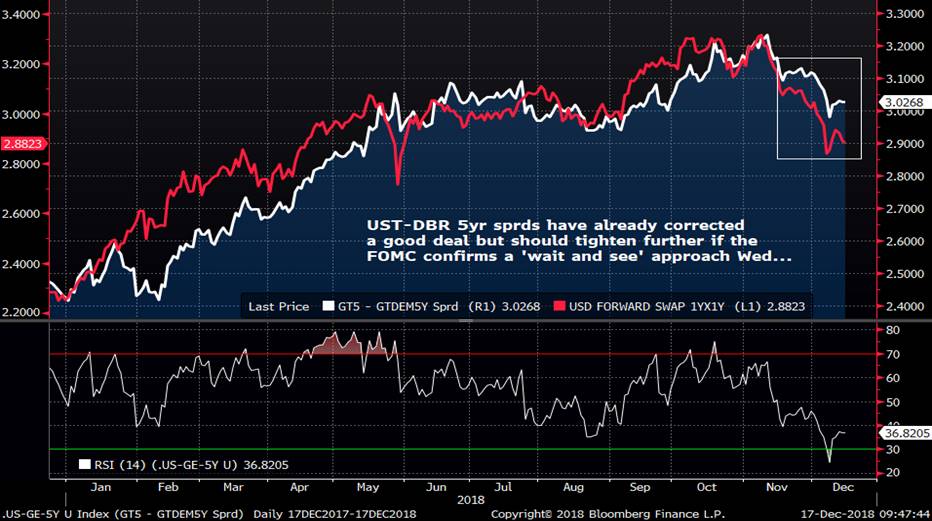

MACROCOSM: Further UST-DBR Spread Compression Looks Likely into FOMC Meeting...

MACRO...

> Handful of pundits are talking about the outlook for the US with the FOMC expected to hike Wednesday but take a 'wait and see' approach to further hikes in their statement. Given signs of slowing momentum across the G-10 and wobbles in major markets like equities, this seems the appropriate approach at this stage.

> While the European outlook is also muddied, 10yr DBRs are within a few bps of 2017's richest levels which leaves UST-DBR spreads still very wide, even after the spread compression over the last month.

> Yes, the US supply outlook is worrying for UST longs, however, positioning across most UST contracts remains short, even after the recent rally, and a dovish FOMC outlook would likely drive further spread narrowing in relatively illiquid Dec markets.

> We like owning UST 5yrs vs OBLs into the FOMC meeting... The spread has compressed but it hasn’t kept up with the rally in USD 1y1y OIS…

Carry and Roll…

OBL 178s have carry and roll of about 3.7bps over 3mos

UST 2.875 11/23 have carry and roll of just 1.55bps over 3mos, however, if the FOMC’s stance shifts, we’d expect 2-5s to grind a bit steeper to reflect a more dovish FED which should improve the UST leg’s roll…

As this is a tactical trade into the FOMC, we’d expect this to be a 1 week horizon trade anyway.

I’ll be in touch.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Astor Ridge Events/Supply/Data Calendars Dec 17-31

Please see PDFs attached.

Since this covers the rest of December, these are the last calendars of 2018.

Enjoy!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: Conte's Olive Branch Drives BTPS Spreads Tighter... Where now...?

BTPS...

> The announcement of a new 2.04% deficit target drove another sharp tightening move in BTPS which (as we can see from the DBR-BTPS 10yr sprd chart below) has taken us to s/term overbought levels and a critical technical support. (Please see this am’s BBG article below)

> Open interest in IKH9 has hovered around 400k, suggesting there’s still a solid short base and the BTPS curve has re-steepened sharply in sympathy with the move. Even though spreads have come a long way (10yr DBR-BTPS at 267 from 329 just 3 weeks ago) momentum feels like it they will tighten further still, especially in relatively illiquid December markets.

> High-Low BTPS coupons spreads (a barometer of the market’s assessment of default risk in Italy) which blew wider as DBR-BTPS spreads rose sharply have come crashing back to earth, especially in the belly of the curve where Italian banks are most active. The BTPS 5.5 9/22 vs BTPS 1.45 9/22 spread, for example, was as wide as 11.5bps on Oct 23rd and are now almost back top even yield and feel likely to return to the -5bps level that prevailed for until late May this year. (chart below)

> Draghi could hold the key at today's ECB meeting. If he leans dovish on the ECB's unwind of QE, C&R reinvestments and the timing of an eventual rate hike (inflation still soft and growth sputtering) we could see another nice tightening move. The market likes 'nice round #s' so +250bps looks like next big target sprd vs DBRs.

DBR-BTPS 10yr sprds…

BTPS 1.45 9/22 vs BTPS 5.5 9/22 – BIG move…

Italy Offers 2.04% Budget Deficit Target in EU Peace Gesture (1)

- European Commission had rejected budget with 2.4% deficit

- Premier Conte met EU commission chief Juncker in Brussels

By John Follain

(Bloomberg) --

Italian Prime Minister Giuseppe Conte proposed to cut the deficit target to 2.04 percent of output for next year in a significant concession to the European Commission.

Conte told reporters after meeting commission President Jean-Claude Junckerin Brussels that technical analyses had allowed the government to recover resources and lower the 2019 deficit from an initial 2.4 percent. The original number was rejected for being in breach of European Union rules.

“We are not betraying the trust of Italians and we respect the commitments made with the measures which have the most impact,” such as a lower retirement age and a citizen’s income for the poor, Conte said.

The offer now places the ball in the commission’s court, and follows a long tussle between Conte and Finance Minister Giovanni Tria on one side, and on the other the two euroskeptic deputy premiers: Matteo Salvini of the anti-migration League and Luigi Di Maio of the anti-establishment Five Star Movement.

Tria was scheduled to be in Brussels Thursday to guide the remaining phases of the talks on the new budget, his spokeswoman said.

Officials cautioned that there is more work to be done to satisfy EU regulations. Newspaper La Stampa cited an EU “source” as saying that there is “still a gap to bridge, hopefully we can do it with the work that will continue in the coming days.”

Salvini and Di Maio had insisted that their landmark election pledges should not be diluted or delayed.

Financial Markets

The budget tug-of-war has whipsawed financial markets amid concerns about the impact of the proposals on Italy’s sluggish economiy and its mountain of debt, which is the biggest in the euro area in real terms.![]()

Conte said the structural deficit would also fall, and added that “growth will be above our expectations.” He said he was working to avert an infringement procedure that could lead to fines, and called the negotiations “very fruitful.”

The government has said both the pension reform and the welfare benefits should start early next year, and Conte said they would begin “in the period we have set out.” He did not detail where the extra resources were found or how reforms would be tweaked.

Juncker’s commission sounded a similarly encouraging note. A spokesman said Juncker “listened attentively” to Conte, adding that good progress has been made and the commission would now assess the proposals.

The commission has repeatedly insisted that beyond a deficit reduction, what matters most is the impact reforms will have on Italy’s structural balance, which strips out one-off expenditures and the effects of the economic cycle.

Even a deficit of 2.04 percent may still not be low enough to avoid EU sanctions. It could increase tensions between Salvini and Di Maio, who will have less money to divvy up for their costly promises to voters.

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: US Nov NFP Come in Softer Than Ests... Quick Rundown

Quick Rundown of the Nov NFP Data…

Payrolls rose 155k vs 198k ests and the 2month net revision was -12k. So, all told NFP rose 143k, a 28% ‘miss’ vs ests.

Jobless rate FELL from 3.735% to 3.671%, although the rounding leaves it at 3.7%.

Avg hrly earnings rose .2%, softer than the 0.3% forecasts and even worse given Oct’s downward revision to .1% from .2%.

Not a big enough adjustment to move the YOY needle though, remaining at 3.1%.

Labor force change a modest 133k and the household survey rose 233k, hence the small downward adjustment to the unemployment rate.

Weakest mftg jobs growth since March at +29k

Participation rate never moves (so not sure why we look at it!) at 62.9%. Doesn’t that seem a bit fishy?

So…

One would think this makes Powell and Co think long and hard about making the ‘One more and done (for now)’ official at the next FOMC meeting. Definitely validates the tone of the UST market and argues for continued grind richer vs EGBs for now…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

UPDATED Astor Ridge Data/Events/Supply Calendar for Week of Dec 10th

Please see PDFs attached…

Busy week in store – Brexit vote Tuesday (or not!), ECB meeting Thursday, EU Summit Thu/Fri.

Stay tuned!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: US Treasuries En Fuego This Week! What's Next?

US Treasuries!

Yes, there's life outside Brexit!

USTs have been en fuego this week: 10bps tighter vs DBR 10yrs; 2-5s bull flattening another 4.5bps to inverted levels and USH9 RSIs are the most overbought in over 3yrs! (Will be interesting to see how CFTC positioning is – charts below)...

Powell's comments have been sending mixed messages (strong momentum but impact of hikes delayed) but the market's now convinced that it will be 'Hike and Wait' after their expected Dec 19th hike. Given the growing fragility of the outlook among the G-10, it seems prudent to take a break and reassess. The US-China trade situation remains fragile, Brexit is a mess, European growth and inflation is stagnating and Asia is wobbling – all having a negative impact on global equities in a month that’s supposed to be bullish for the S&P.

Today’s NFP data is broadly expected to show continued job gains in the +200k zone with the jobless rate unched at 3.7% and avg hrly earnings a smidge stronger at .3%/3.1%. U of Michigan survey is expected to soften a bit, however, from 97.5 to 97.0.

While this week’s move has been impressive, as reflected by momentum indicators, it still feels like the path of least resistance here is RICHER, suggesting a consensus number could drive some more short covering as the market eyes the Dec finish line and prepares for what could be a bumpy week in the UK.

Powell Says U.S. Labor Market ‘Very Strong’ by Many Measures

Federal Reserve Chairman Jerome Powell delivered a bullish assessment of the U.S. economy and the job market on the eve of the scheduled release of November employment data. “Our economy is currently performing very well overall, with strong job creation and gradually rising wages,’’ Powell said in the text of a speech to be delivered to a housing conference in Washington on Thursday. “In fact, by many national-level measures, our labor ...

Record-Breaking Day in Front-End Rates as Fed-Hike Bets Crumble

A dramatic day across the front end of the U.S. rates curve was backed by record volumes in a number of futures contracts amid crumbling confidence in the Federal Reserve’s ability to follow through on its projection of three 2019 rate hikes. Heading toward Thursday’s close, a staggering number of contracts had changed hands across eurodollars and fed fund futures, including record volume in December 2019 eurodollars contracts. Trading was also ...

Repo Dislocations Underscore Funding Market’s Fragility

The outsized moves in overnight GC repo this week highlight the vulnerability of the funding markets amid increased Treasury issuance, the Fed’s balance sheet unwind and bank regulations. * “There is something happening in the repo market,” Curvature Securities vice president Scott Skyrm said in Thursday note. “Perhaps it was just a one-day event, but it also demonstrates the fragility of the market” ** “Clearly there are liquidity problems in this ...

Treasuries Rally, Front End Re-Prices Fed Hikes on Record Volume

Treasuries rallied aggressively over the U.S. morning session, holding gains during a muted afternoon in New York that left yields at least 4bp richer across the curve; front end was in focus as hike premium was taken out of the 2019 Fed path, while eurodollar, fed funds futures contracts saw record trading volumes. * UST 10-year yields ended at 2.87% shortly after the cash settlement and had dropped as low as 2.824% in the morning; curves were choppy, ...

Bond Market Has Its Most Crucial Repricing Yet: Brian Chappatta

The most resilient part of the $15.4 trillion U.S. Treasury market finally succumbed to the risk-off pressure circling the globe. It’s the strongest signal yet that bond traders are confident the Federal Reserve is going to stop raising interest rates soon. Two-year Treasury yields tumbled as much as 10 basis points on Thursday, the biggest intraday drop since May and one of the largest since the Fed began its quarterly tightening pace in December ...

The Political Heat Is On for Central Banks From U.S. to Europe

South Africa’s top monetary policy maker spoke for his peers around the world last week when he declared that central-bank independence from political meddling is no longer just an “emerging market phenomenon.” The U.S. Federal Reserve, Bank of England and European Central Bank are feeling the heat from elected lawmakers, while India and Turkey are among others under pressure. “There’s concern among the ...

Stay tuned!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

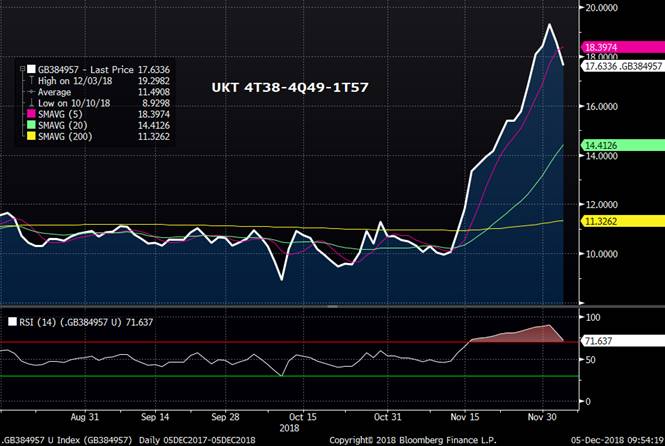

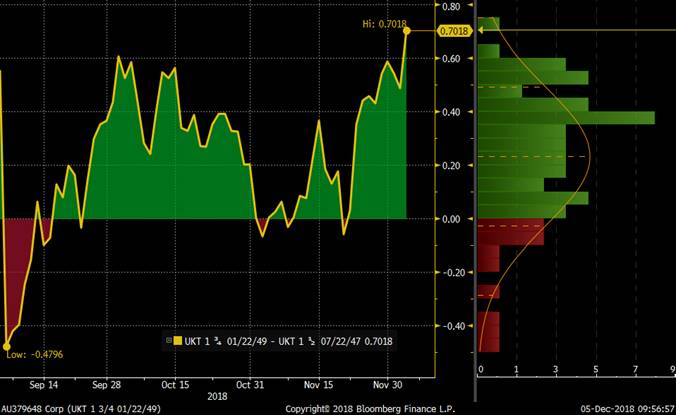

MICROCOSM: The Long GILTS Conundrum & UKT 1T49s Preview

Given the richening in the long-end over the last two days, it appears demand for tomorrow’s 1T49s tap will go fine.

Have a look at the 38-49-57s flies below and/or the very-micro 1H47-1T49 flattener… See below pls.

GILTS...

UKT 27-47 spread is now 3.5bps flatter on thin volumes with G H9 off 26 ticks. Long linkers have given back a bit of yesterday's big rally, the UKTi 47s 2bps cheaper.

The long-end remains the gilts market's achilles heel right now. While improved fundamentals have drained some of the long-end demand from pensions in H2’18, we agree with the conclusions of some strategists that there is still enough pent-up demand out there to support long-yields if the fundamental picture argues the long-end makes sense again.

There are many cross currents to wade through:

1) Credit-related worries if Brexit falls apart and Labour gets in, leading to a downgrade of the UK’s sovereign rating and fiscal decline.

2) Pensions remain largely sidelined amidst the uncertainty (notwithstanding the assumed demand from the BT ruling yesterday).

3) We've got a £1.75bn tap of the UKT 1T 49s tomorrow which is anyone's guess how it will fare. (see below)

4) Coupon flows of ~£1.6bn support the long-end Friday which at the very least could mop up some of the 49s supply.

5) Long-gilts have cheapened on every metric we observe, to oversold levels we haven't seen in years. Yesterday's ~10bps snap flatter in illiquid markets was a good indicator of how the mkt is positioned now.

6) Cable is literally sitting on support levels that have held since Jun '17 and is clearly a driver for UKT demand too.

7) And lastly, long gilts supply, even with tomorrow's 49s tap (more on this below) is relatively light with 37s Jan 22, 57s Feb 21 and more 49s Mar 14.

UKT 1T49s Preview

Tomorrow’s tap is £1.75bn which is smaller than they could have brought and is perhaps a reflection of the DMO’s realization that long-end demand is tepid at best right now.

The £1.75bn takes the issue to a mere ~£4.25bn and won’t be tapped again until March next year. This is a good-news/bad-news for the issue – fewer of them to go around than expected short term but the issue will be tapped well into 2020 at this pace.

The UKT 1T49s have a longer duration than the UKT 4Q55 and are trading +1.9bps cheap to the UKT 4Q 49s (richer the last 2 days) and ~3.4bps cheap vs 1H47s and 4Q49s on the fly – at the recent wides.

Want a proxy for the UKT 27-47s steepening that is still near it’s cheapest levels?

Buy the UKT 1T49s vs 4T38s and 1T57s which is only a bp off it’s cheapest levels since the 1T49s were first auctioned. If you want to avoid the 1T49s, the 4Q49s look just as good.

1T49 vs 4T38 and 1T57

UKT 1H 47 vs UKT 1T49

More to come!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Astor Ridge Updated Supply/Data/Events Calendars for Week of Dec 3rd

Please see attached PDFs…

If you find these useful but have suggestions on how to improve them, I am all ears…

Have a good weekend.

Best,

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: Q1 '19 GILTS Supply Calendar Just Released... Details Below

|

|

AUCTION AND SYNDICATION PROGRAMMES |

The UK Debt Management Office (DMO) announces that in the period January-

March 2019 it plans to hold nine outright gilt auctions and one index-linked

gilt syndication in the final quarter of FY 2018-19, as set out below:

(a) Auctions:

AUCTION DATE (10:30am) GILT DETAILS ANNOUNCED (3:30pm)

2019

Tue 8 Jan 1 5/8% Treasury Gilt 2028 Fri 28 Dec

Thu 17 Jan 1% Treasury Gilt 2024 Tue 8 Jan

Tue 22 Jan 1 3/4% Treasury Gilt 2037 Tue 15 Jan

Thu 14 Feb 1 5/8% Treasury Gilt 2028 Tue 5 Feb

Thu 21 Feb 1 3/4% Treasury Gilt 2057 Tue 12 Feb

Tue 26 Feb 0 1/8% Index-linked Treasury Gilt 2028 Tue 19 Feb

Wed 6 Mar 1% Treasury Gilt 2024 Tue 26 Feb

Thu 14 Mar 1 3/4% Treasury Gilt 2049 Tue 5 Mar

Tue 26 Mar 0 1/8% Index-linked Treasury Gilt 2048 Tue 19 Mar

[* subject to confirmation]

b) Planned Index-linked Syndicated Offering (subject to market and demand

onditions):

DATE GILT FURTHER DETAILS ANNOUNCE

Late Jan/mid Feb 0 1/8% Index-linked Treasury Gilt 2041 around two weeks in advance

|

(c) Gilt tenders: |

|

The DMO is open to receiving any representations from market participants |

|

about demand for a gilt tender, or gilt tenders, in the period December 2018 - |

|

March 2019. Views on particular gilts to issue and the timing of any such |

|

tenders would be welcome. The DMO would aim to announce the date, the choice of |

|

gilt to be sold and the maximum size of any gilt tender at least two business |

|

days in advance. |

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Technicals > EGBs - German Bunds Closing in on BIG Yield Level...

- Here’s a snapshot of the current state of the EGB market as we head into a couple very important weeks that could determine how the markets trade in H1’19.

- Short Rates

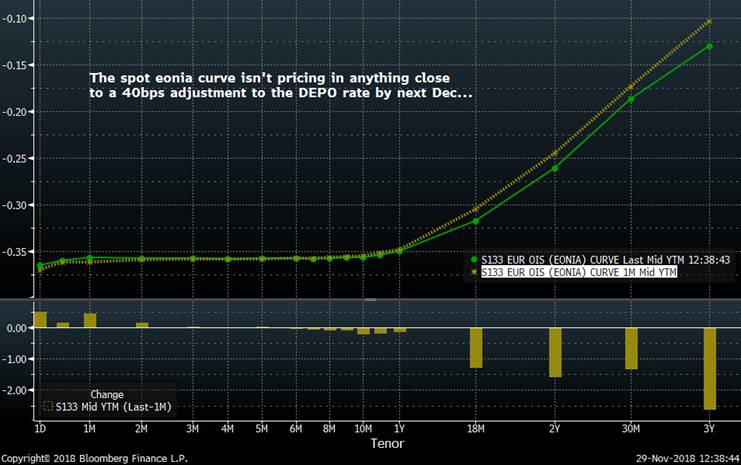

When polling our dealer-friends for their call on the likely path of short rates in Europe, the consensus – with a handful of more dovish strategists – is for two hikes of the depo rate starting in Sep ’19 that will take the depo rate back close to zero by the end of the year. The Sep date not only gives the ECB time to see how the economy fares after QE is suspended at the end of 2018 but also leaves ample time for the results of May’s Parliamentary elections and any market impact they have to play out. What’s curious, however, is the market’s struggling to price this in as EONIA is dragged richer in the face of Brexit/Italy driven FTQ flows.

EONIA Curve

EONIA 1y1y rallying sharply of late, back to overbought levels and sitting on 200 day MA.

EUR Fra-OIS tightening back in as Italy settles down…

- Intermediates

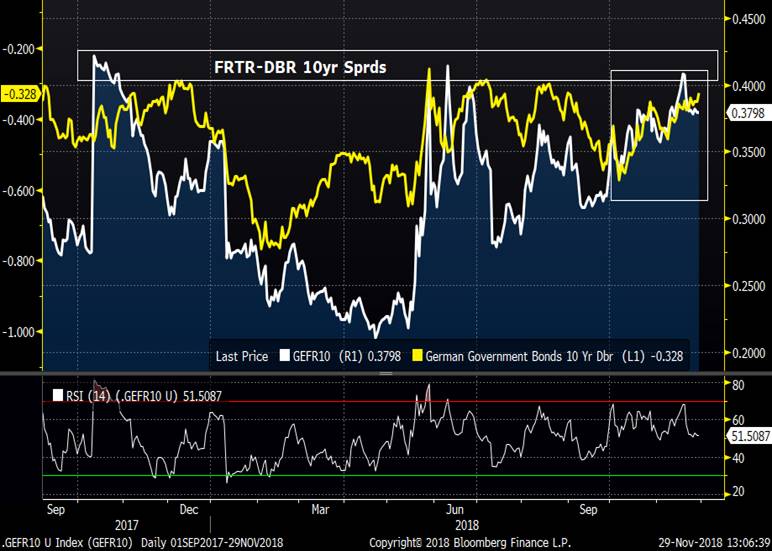

We’re back to a BIG level for 10yr bunds which has held since June ’17.

UST-DBR 10yr sprd…

OATs have also rallied back sharply, especially in Yen terms. These lofty valuations are likely to impair demand out of Japan given their historical biases.

The correlation of outright DBR 10yr yield level to DBR-FRTR spreads has been more loose over the last year than one would think. In Q4 it’s been high, however, suggesting if DBR 10yrs fail at this 30bps yield level again, it should prompt a tightening of DBR-FRTR levels that remain pinned to the 15mo wides.

Italy remains a major focus, especially into year-end. Positioning still feels short to us (5yrs and longer) so a sharp tightening of IKA invoice spreads into an illiquid year-end market wouldn’t surprise us.

On a ‘pound for pound’ risk basis, the compression of high vs low cpn BTPS spreads has been a better trade over the last few weeks than RXZ8 into IKZ8. The BTPS 1.6 6/26 into BTPS 4.5 3/26 still looks a bit wide given where other spreads are…

- Sister Markets

Eurostoxx

Trade weighted Euro – still elevated even after recent correlation… What happens if Trump makes good on his car-tax?

More to come!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796