MICROCOSM: BTPS... Curve Whippy Amid Position Squaring in Illiquid Markets

BTPS…

> Some good colour from our dealers highlights the following:

1) No real news out of Rome this week but the tone of the discourse has shifted to a more conciliatory one with Tria, Savona, Salvini and even DiMaio showing a willingness to give ground.

2) BTPS Italia deal was a mess but it's behind us.

3) Supply is very light for the balance of the year (after next week assuming they cancel their Dec auctions as is norm) and there's a big C&R flow in Dec.

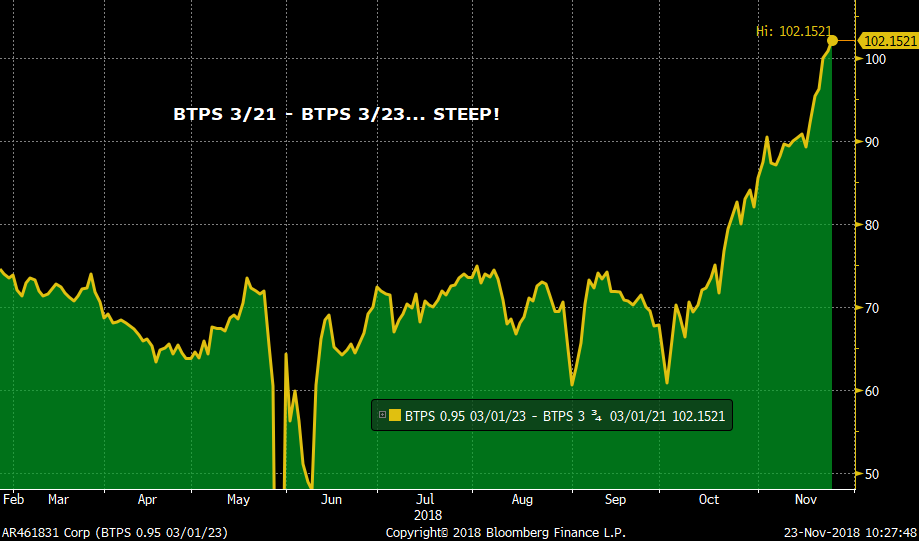

4) The steepening of the curve has been swift and sharp with light volumes of just just 28.5k BTSZ8 driving this am's 31 tick rally.

5) 6bn BOTS 6mo auction next week will be a touger pill to swallow with yields grinding close to zero again.

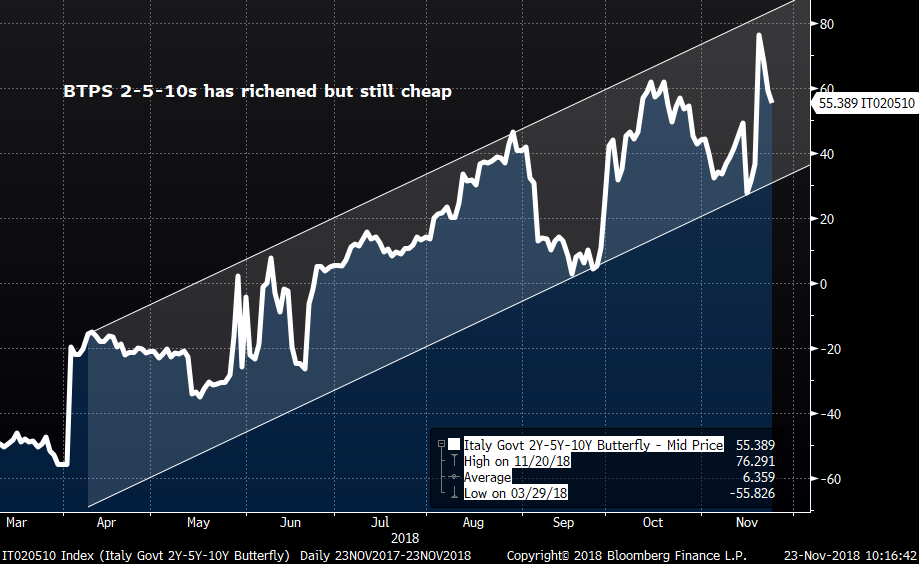

6) BTPS 2-5-10s has richened 19bps since Tues but is still 25bps cheaper than Nov 15th levels.

7) One dealer like selling BTS futures to buy 5yr BTPs as the juice gets squeezed out of short rates and accounts are forced to buy some duration.

8) Most agree the odds of a more significant snap tighter of 10yr BTPS vs DBRs are still low but liquidity will erode into year-end which raises the odds of extreme moves in BOTH directions.

BTSZ8 contracts have rallied to the contract highs as open interest declines, suggesting the short base is unwinding. We’re at a big resistance here which some think should prompt a flattening of the front-end, especially when we consider how steep the BTSZ8 CTD (BTPS 3.75 9/21) vs BTPS .95 3/1/23 is here…

BTPS 3/21 – BTPS 3/23

BTPS generic 2-5-10s

DBR-BTPS 10yr sprd

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Updated Data/Supply and Events Calendars for Week of Nov 26th.

Very busy week for US supply, European data and perhaps the UK’s Brexit talks.

I’ve made a few tweaks thanks to some constructive feedback. Hope they’re helpful.

Please see PDFs attached.

Have a great Thanksgiving All!

Best

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: Quick Brexit GBP/Gilts Update w/Charts

GILTS/GBP Rundown:

> It seems BREXIT's not the only factor driving gilts these days given the early BTPS-driven bid to G Z8 yesterday and contnued concerns over the fate of the equity/oil and now corporate bond markets.

> That said. this am's Brexit news is pretty benign on balance. Rees-Mogg's challenge has gone nowhere, May's off to Brussels amid rumblings from both the DUP and some Europeans and the EU summit on Sunday is expected to happen barring a breakdown in talks.

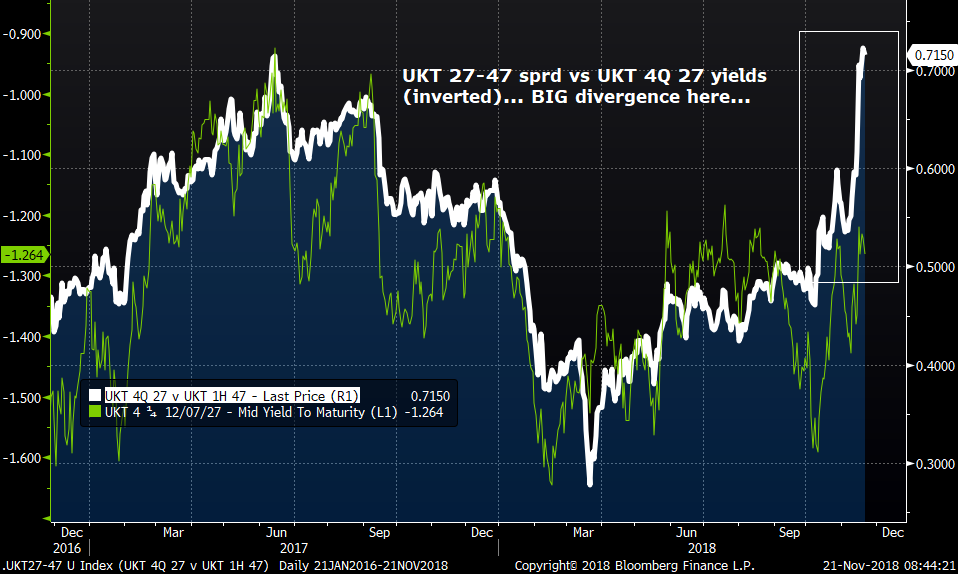

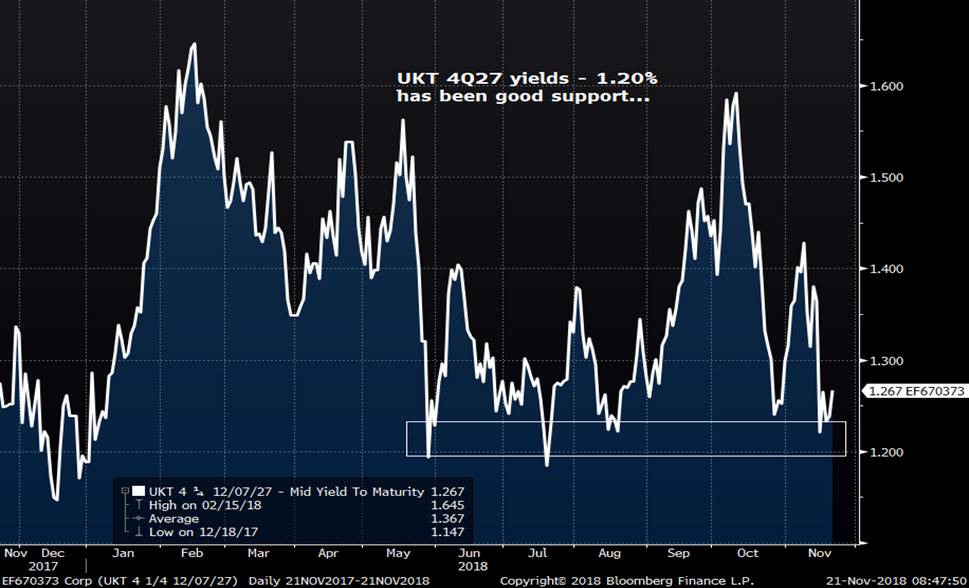

> We're currently pricing in 88% of a 25bps hike in base rate by next Nov's MPC meeting with 1y1y SONIA about 6bps off the recent 94bps lows. Cable is 1.2815, also treading water just north of last week's 1.2725 lows and UKT 4Q27 yields are 1.267%, still contained by the 1.20% yield lows since early January. Lastly, despite this period of relative calm, UKT 4Q27-1H47 remains pinned to the steepest levels of the last few years at 71.6bps with evidence of lingering positions in last week's UKT 1T37s tap still weighing on the mkt.

> Positions:

UKT 9/22-9/24-7/26 hovering at -.25bp

UKT 9/25-12/27-12/30 fly -8.3bps.

UKT 7/26-12/27-10/28 fly -6.6bps

UKT 12/38-1/44-12/49 fly +14.15bps

UKT 1Q27-1F28 sprd 10.4bps

UKT 4Q27-1F28 sprd 14.4bps.

UKT 7/20-1/21 sprd 1.0bps.

TOP BREXIT Headlines...

> May heading to Brussels amid scramble to finalise Brexit deal

> Still time for nips and tucks to EU deal?

> Brexit: May gambles on last-minute dash to Brussels

> FT: May revives Irish border proposal to appease Eurosceptics

https://www.ft.com/content/34fcfce0-ecc9-11e8-8180-9cf212677a57

> FT: May set to flag impact of Brexit scenarios on economy

> FT: DUP insists it will ‘of course’ vote against May’s Brexit deal

> WSJ: Brexit & Beyond: Campaign to Oust Theresa May Fizzles—for Now

3mo GBP FRA-OIS sprds finally showing signs of topping out…

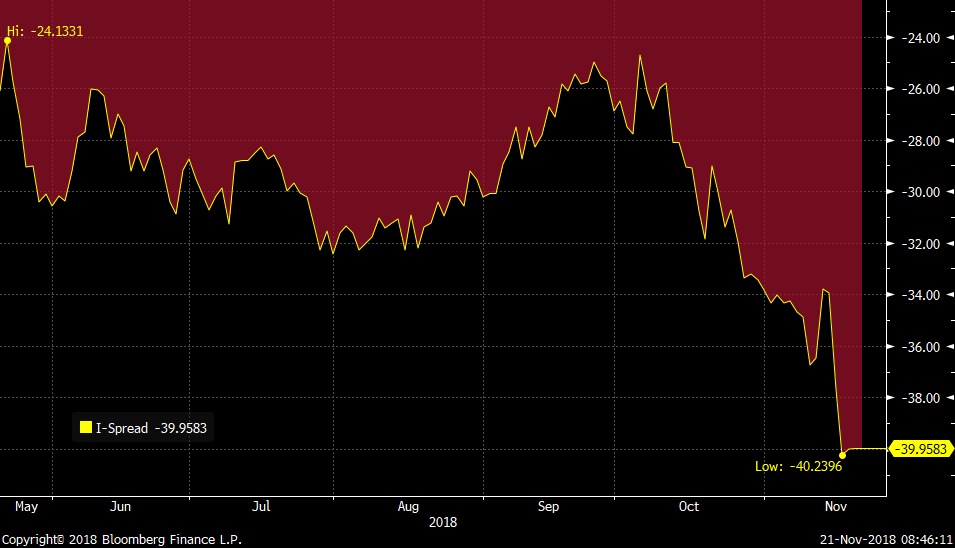

But the path of least resistance in UKT swap spreads remains richer as evidenced by this UKT 2T24 vs BBG I-sprd…

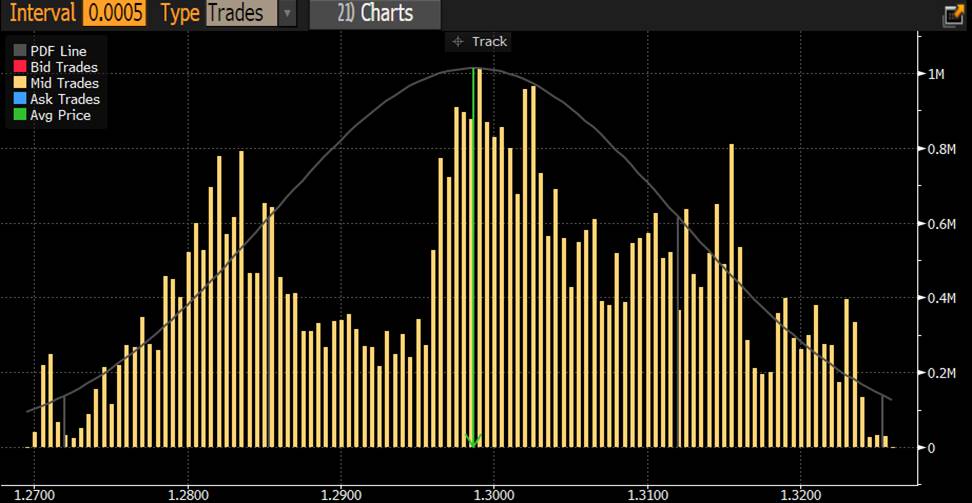

GBP volumes since Oct 1st show some reasonable positions at the 1.285 level but far more at richer levels which could spell trouble…

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: Brexit Brinkmanship in GBP Rates & FX... Quick Charts Rundown

- Chaos reigned in the UK rates and FX markets last week as May’s Brexit deal was summarily rejected by members of both parties, resignations ensued and letters of no-confidence were written. One has to admire Theresa May’s tenacity and political guile in the face of what looked like insurmountable odds. While her deal may not survive in it’s current form (heading into the Nov 25th EU summit to sign off on the final terms), the hard line Brexiteers are well short of the 48 votes they need to file an official vote of no confidence, suggesting a leadership challenge is unlikely for now. Even Dominic Raab has professed his support for May, despite resigning from her cabinet last week. Both May and Corbyn will address the CBI conference later today, followed by May’s trip to Brussels tomorrow/Wed to continue talks.

- Needless to say, the markets will remain very nervous this week and probably next. Aside from the Brexit talks, we’ve also got a busy supply calendar in EGBs, continuing budget talks in Italy and the Thanksgiving holiday on Thursday, impairing liquidity in the US from Wed pm until Friday.

- Let’s look at some charts…

CABLE held the bottom of the Jun-Nov range again, despite heightened volatility…

SONIA has been very volatile, reflecting the moves in cable. We’re pricing in 95% of one 25bps hike by Dec ’19 this morning…

The UKT curve remains pinned to the wides in 10-30s, however, as G Z8 has been the market’s primary source of GBP rates risk. There was substantial demand for the long-end of the curve on Friday as real money investors came to the rescue, however, it wasn’t enough to reverse UKT 27-47s much. While most would agree the contract (and the UKT 4Q27s) looks rich on the curve here, the performance of the issue will be continue to be heavily influenced by the state of play in Parliament.

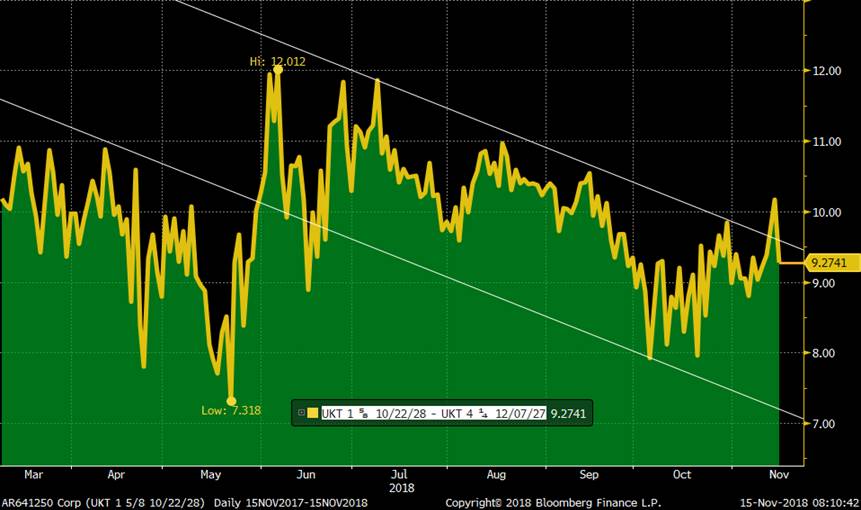

UKT 4Q27-1F28 spread has been VERY closely watched of late. Our regression results late last week suggested this spread is about fair value given the move in rates, however, with the outlook for the 1F28s strong into Q1 due to APF demand and their eventual shift to CTD into G M9, we’re not surprised GEMMS see good interest to buy the 1F28s basis (or just do the 27-28s forward roll) on moves like this one. If there’s a flattener on the curve to fade this recent steepening, this is it.

The 3-7yr sector of the gilts curve is all over the place with 0H22 and 2T24s very rich and neighbours cheap…

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: UKT 1T 37 Tap Preview - May Speaks When?! w/charts

GILTS...

> Between the barrage of headlines and mountains of news to read through (please see our chat), we'll have a UKT 1T 37s AUCTION to deal with at 10:30, just when May addresses her peers. As if the market hasn't been screwed up enough, we're supposed to bid on £2bn of this paper while she’s deflecting a barrage of criticism... Good grief.

> Quick Preview:

1) UKT 1T37s are 1.933% this am, well off the Nov 1 levels of 1.77%. The UKT 37-47s spread, which remained stubbornly flat this time yesterday is now about a bp steeper, a sign of short covering in 37s…

2) UKT 4Q27-1T37 is at its steepest yield spread since nov '17. As the chart shows, this spread has steepened over the past few weeks regardless of how G Z8 trades, a clear sign of a supply concession.

3) The curve weighted 4Q27-1T37-1H47 fly (.7/2.0/1.3) is also at i's cheapest with momentum levels (RSIs) back to overdone zone.

4) Much has been written about the weight of 15yr+ supply between now and year-end with today's 37s, some long linkers and UKT 1/49s coming between now and mid Dec. We do have ~£2.4bn in cpns on Dec 7th to help but GEMMs are more worried about demand and distribution into a very twitchy market. The path of least pain is cheaper and steeper.

5) Want a couple lower-beta fade the steepening trades?

UKT 4Q27 into UKT 1F 28 is back to +14bps with the Z-sprd box at the top of the flattening channel in place since June.

UKT 27-28 Z-sprd box

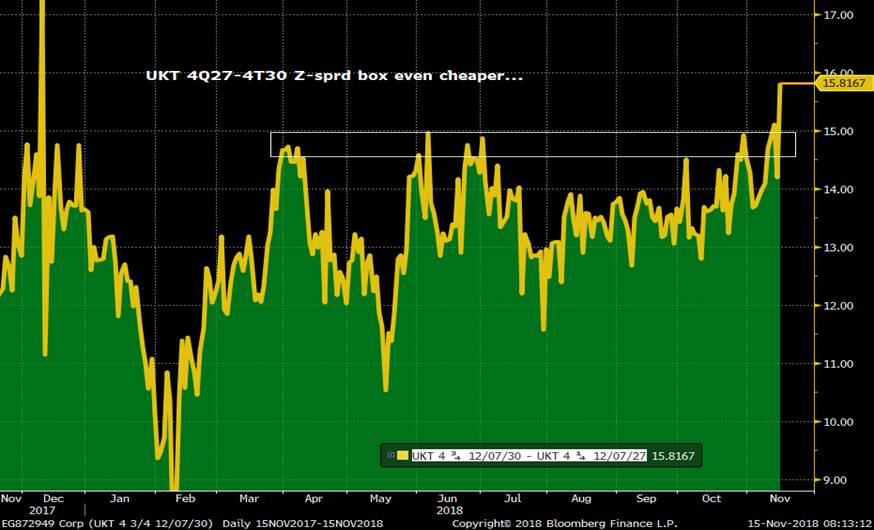

UKT 4Q27 into UKT 4T30 not nearly as ‘clean’ as the 28s but the 30s have cheapened significantly and are at the cheapest to 4Qs since Sep 17…

4Q27-4T30 yield sprd…

We'll keep u posted.

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Astor Ridge - Rates Data/Supply & Events Calendars for Week of Nov 12th

Pls see attached…

The timing of the Brexit talks over the next couple weeks remain fluid although there is mention of a cabinet meeting on Tuesday.

Best,

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GBP Front-End Head Scratchers... Some Quick Charts

- We had a nice call on gilts on Tuesday, looking for a pre-MPC meeting pullback from overbought technicals (see attached). SONIA 1y1y has corrected 10bps, 4Q27-1F28 has flattened .75bp (last 1F 28 tap of 2018 coming on Tuesday) and UKT 21-23-25 fly is ~2bps cheaper. (Our 20-21s steepener is about .7 steeper mid-mid, a slow burner). In light of the stalemate in the Brexit talks, the correction in rates was about as much we could have hoped for, although a rebound in stocks hasn’t hurt our cause.

- Yesterday’s MPC meeting/QIR was roughly as we expected. If you ‘read between the waffling’ about the potential outcomes of Brexit and their expected policy response, what was clear to us is given a choice, they’d like to continue their slow and steady rate hikes. Our market barometers haven’t changed – GBP, SONIA 1y1y and UKT 4Q 27s on the curve – and each of them flashed signs that the market’s pricing of the Brexit outcome was not only overly negative but is not in line with the MPC’s outlook. That still tilts the market’s response unevenly, suggesting positive Brexit headlines will be more bullish than ‘more of the same’ will be bearish.

- While messing around with some charts I found a couple rather odd divergences that have made forecasting the GBP front-end more challenging than usual. We can attribute this wobble to a Brexit-Fog but worth pointing out nonetheless.

- GBP vs SONIA 1Y1Y.

This a 1yr history of Cable vs SONIA 1y1y. We can see the correlation was high from the Nov-May, however, Brexit driven GBP shorts were contrary to market pricing and MPC policy outlook. While the last couple months have been more in line with historical correlations, this chart illustrates how much catching up GBP should do if Brexit is resolved positively.

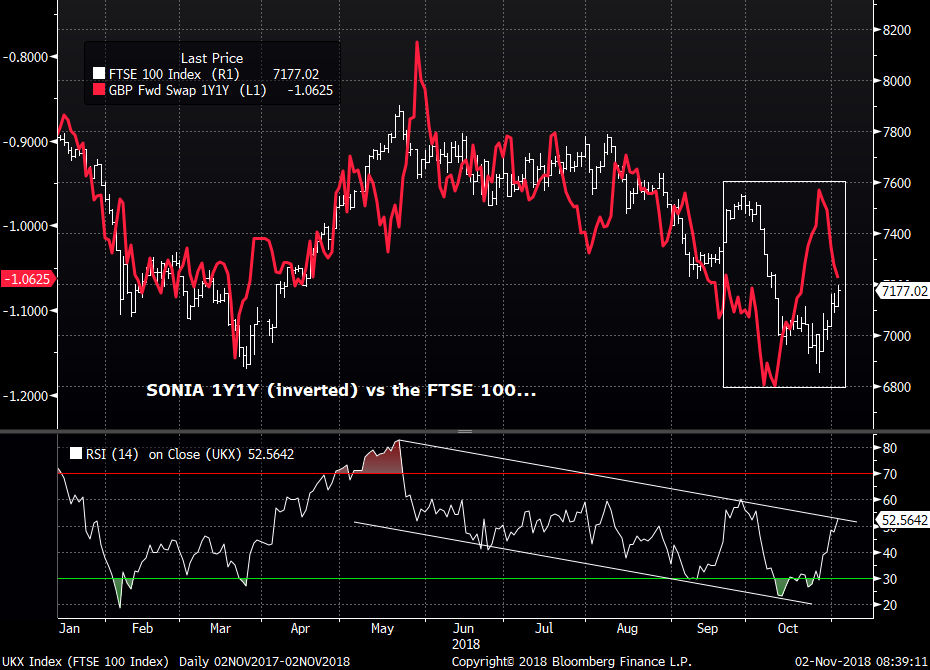

- SONIA 1Y1Y vs FTSE 100…

This is an odd one – the white line is the FTSE which has bounced nicely off the lows and helped to drive a correction in SONIA. What’s interesting here is this SONIA line well correlated to stocks but inversely! So, stocks rally and the market prices in a dovish MPC? Hmmmm…

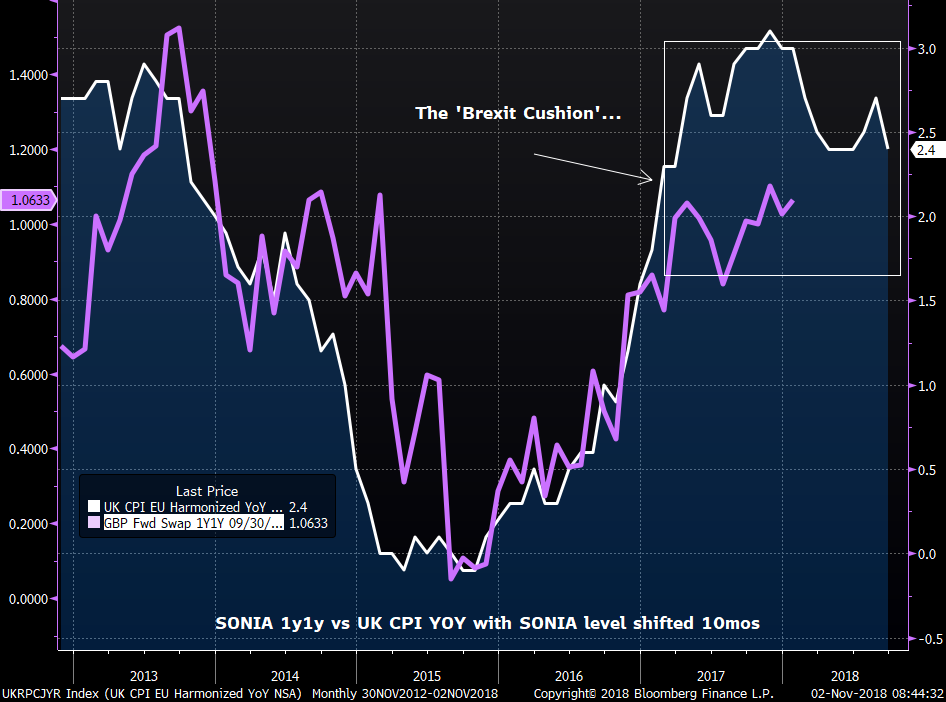

- UK CPI YOY vs SONIA 1Y1Y (shifted 10mos)…

Now, this chart makes some sense! The MPC has an inflation fighting mandate – inflation rises and they raise rates! What’s interesting here is not only the 10 month lag (which seems a bit long to me) but also the divergence between the two since late 2016 – the Brexit Cushion – which one would expect to be closed. If it was up to the MPC, it would be some time in the next 9mos.

More to come!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Quick Technicals Snapshot on PAYROLLS Day...

- Today’s release of the Sep US non-farm payrolls data is the main event, putting an exclamation point on what’s been another odd week in rates-land.

- Consensus for the NFP:

- Change in NFP Est +185k vs +201k last. The above-consensus ADP release on Wed (230k vs 184k w/5k upward revision) has the market pricing an upward surprise in.

- Jobless rate est 3.8% vs 3.9% last – will depend on movements in the size of the labor force though. Where are these people coming from?!

- Avg hrly earnings est .3% mom/2.8% yoy vs .4%/2.9% last.

- Change in NFP Est +185k vs +201k last. The above-consensus ADP release on Wed (230k vs 184k w/5k upward revision) has the market pricing an upward surprise in.

- As you know, leveraged players have been VERY SHORT the belly of the curve which, on paper means they’re doing very well of late. What’s interesting to us is this lopsided positioning has been the cause (in our view at least) of the bear-steepening of 5/10-30s this week. Basically, the market’s selling what they’re long now – ignoring the flattener-at-all-costs mantra – that also suggests a softer than consensus result could spark short covering in the belly that exacerbates this steepening bias. The 5-30s sprd has been capped by the 31.5bps level since early June, suggesting this is a key trigger for curve capitulations today.

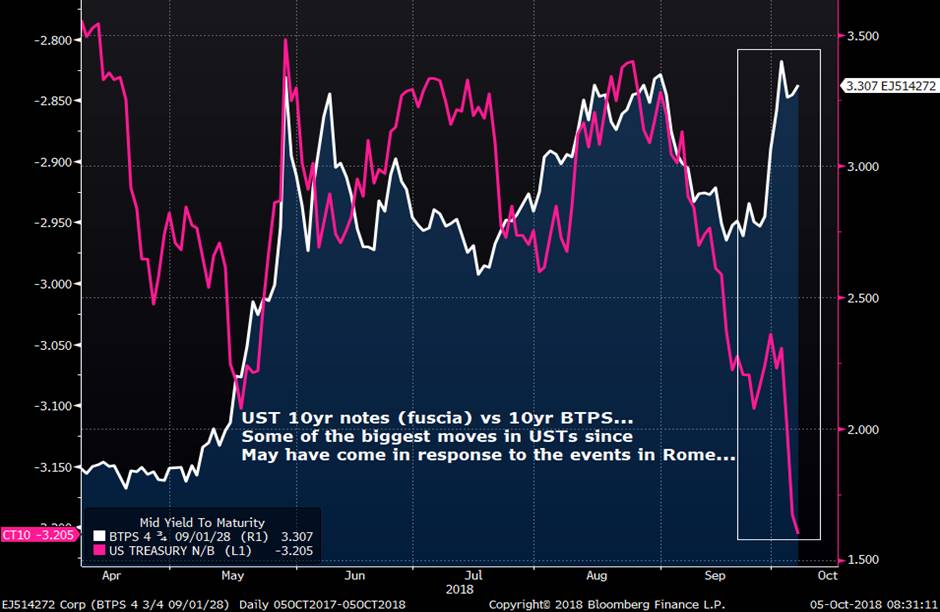

- UST 10yr notes with NFP releases (Green flag, NFP were better than forecasts, red flag, worse). What we notice here – which isn’t a major surprise I suppose – is we’ve gone into many of the NFP days over the past year with 10yr note yields oversold (high) on momentum indicators like the RSI here. What’s troubling from a trading perspective is market reaction in many cases has been pretty muted - both rallies and selloffs are pretty benign even with fairly big misses. Could today be different? Well, yes, simply because positioning is shorter, yields are higher and sentiment has shifted into another gear. Plus, we’ve got a long weekend coming up and with Italy’s situation still an accident waiting for a microphone, not sure we want to carry a huge short into 3 days off.

UST 5-30s…

- Check this chart out… Talk about a roller coaster! Since May, flight to quality moves into 10yr USTs have been massive when BTPS have blown up, a far bigger influence on USTs than NFP numbers have been. This latest divergence (see chart below) is curious as the UST market has basically decided that the situation in Rome is no longer a cause for alarm. BTPS don’t think that, why should USTs?

More to come….

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Updated RATES Calendar - For Week of Oct 8-12

Please see attached PDFs….

Thanks

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Today's Technicals Rundown > Fri Sep 21st

US:

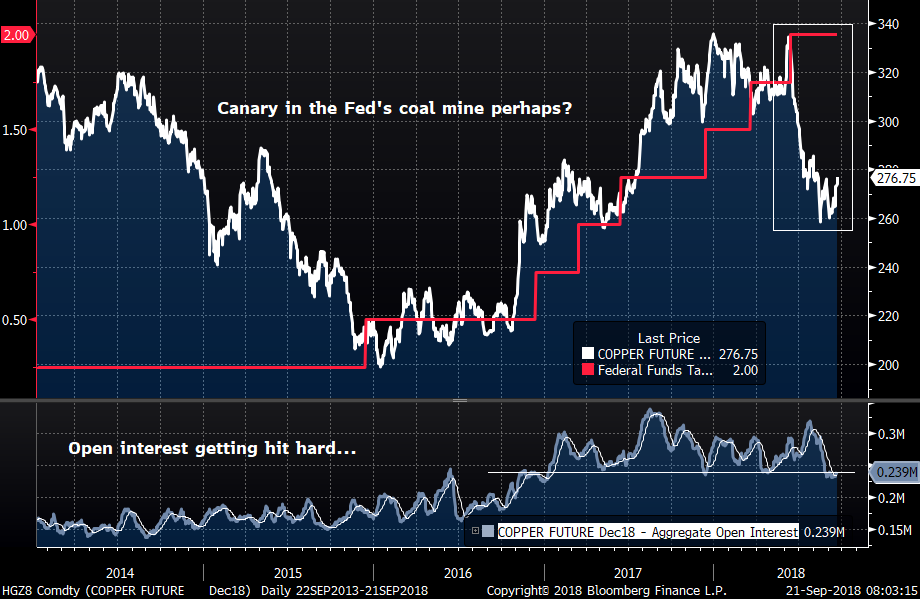

We were talking about copper this morning, about how it’s vital for the production of electric cars. As an industrial metal, demand for copper is considered a key barometer of economic momentum, especially in manufacturing. The chart below is a simple daily copper chart going back 5yrs (white line) with the Fed Funds target rate overlaid (red). We can see that the bottoming of copper back in early 2016 coincided with the first rate hike following the financial crisis which accelerated from Oct ’16 onwards.

Following the last rate hike copper got clobbered, retracing over 50% of the rally since 2016. We can debate the root cause of this pullback, however, one could argue that this stalling of demand for copper could have a bearing on the FED’s decision to continue to raise rates well into 2019.

EUROPE:

BTPs… If you’ve been involved in BTPS over the last several months, you’re probably well aware of the mayhem going on in the IKA contract and the current CTD, the BTPS 4.85 9/28s. In a nutshell, the supply of repo for the BTPS 9/28s has basically vanished over the past 6 weeks, due in part to a shortage of collateral. There’s a debate raging on the source of that shortage – official or private – but needless to say, it has crated havoc with the BTPs contract and, by extension, impaired liquidity dramatically across the curve. This is an interesting chart brought to my attention yesterday by a pal of mine, illustrating just how nuts this has become. This is about as tight as a BTPS fly gets at 2/28-9/29-12/28 – it shows that the BTPS 9/28s have richened 14bps since late August, dealing a blow to IKZ8 shorts. This is far from over…

UK:

We’ve been leaning a bit more hawkish/bearish/flattener than the consensus lately and it’s been well timed. While we maintain that bias on a medium term basis, given our hopes (prayers…?) of a positive outcome for Brexit, we are also mindful of not only the hurdles ahead (talks this week in Austria still showing deep divisions), we are also mindful of the significance of overcooked momentum and positioning. With the 10yr supply out of the way and no supply longer than 5yrs until the syndicated tap of the UKT 10/71s in early October (we’re thinking the 9th), the market could see a bounce from this key support level.

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796