MACROCOSM: Quick Eurozone/UK RV Thoughts

In no particular order…

BTPS...

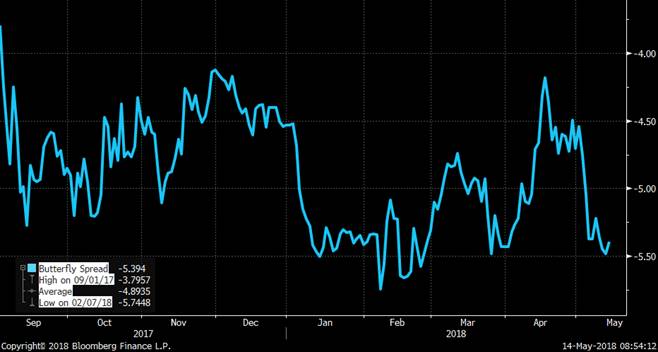

> The pop higher in IKZ8 on the open has driven a bull steepening of the curve, led by the BTS contract. With 3/21-12/28s ~4bps steeper, our BTPS 23-25-27/28 bfiles are cheaper, back to last week's wides that prevailed into the pricing of the new BTPS 11/25s.

> Given the sizeable take-up in the BTPS 11/25s green shoes option (that took the outstanding notional to almost €4.9bln), we could see the 7yr sector languish a bit until dealers have lightened up. That said, the sector is still cheap in our view and if this bid in BTPS persists, we'd expect to see outright demand since the duration of most BTPS indexes is close to 7yrs. The new 11/25s have a mod dur of 6.43 while BAML's BTPS index is 6.31 (for ex).

> We're sticking with our constructive view here - adding to 7yr sector longs with a stop at 41bps and a target of 30bps (in the 23-25-27 version).

BELGIUM...

> Busy day for BGBs issuance with up to €3.9bln total of their BGB .2 23, .8 28, 1.6 47 and 2.25 57s on tap. Unless the is pre-funding for 2019, this is likely to be the last significant chunk of long BGBs this year.

> As a reminder, Belgium is rapidly closing in on their 2018 issuance target, all but finished with their 31bln needs after today's 3.9bln takes them to ~30bln.

> BGB-FRTR and BGB-NETHER sprds are probably the most common RV benchmarks for BGBs. Belgium has one of the longest YTD maturities of issuance in Europe at 14.6yrs but avg maturity of PSPP buying of 9.6yrs compensates for much of that.

> BGBs liquidity can be a challenge at times, limiting RV activity, however, it's never as bad as BTPS/SPGBs and at current spreads to core, there's ample juice to make them worthwhile.

> The 'obvious' trade, from both a liquidity and location standpoint is the simple short OATZ8 into BGB 6/28s sprd which remains elevated (see chart below). C&R flwos in OATs are big into late October so this is a 2-3 week trade.

> An alternative is NETHER 7/28s into BGB 6/28s although this sprd is 5bps off it's wides at +23bps this am.

> If u'd like more colour, pls let me know...

GILTS…

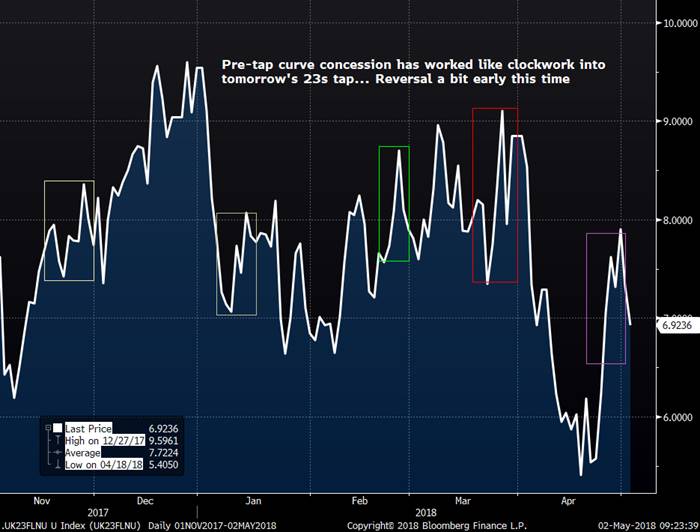

> Main event this week in the gilts market is the tap of the UKT 1F 10/28s which will take them up to around £16.5bln, about 2/3 of the way through their issuance cycle.

> As we highlighted last week, we continue to lean towards a flattening bias on the gilts curve and as the 10yr benchmark, these UKT 1F 10/28s could be an instrumental part of that view.

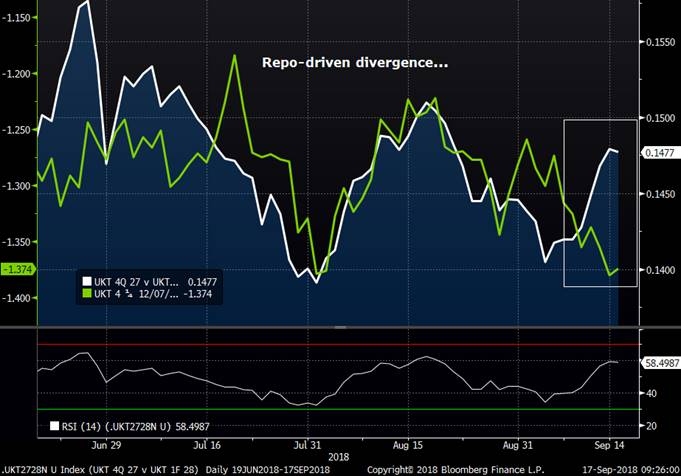

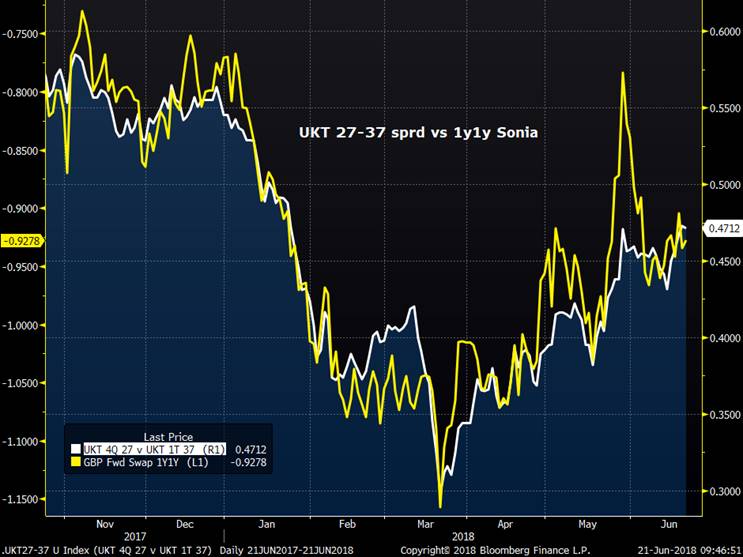

> The UKT 4Q 27 vs UKT 1F 10/28s roll has been a popular position with extension interest brisk in the +14.75-15.25bps range. With open interest in G U8 still huge at 91.5k, the market is concerned that this month’s delivery will dwarf the ~61.5k contracts delivered into G U7, putting pressure on UKT 4Q 27s repo levels. Considering tradeable float in the 4Q 27s is a mere £7.6bln after APF/DMO holdings and the ‘corridor’ between the DMO’s repo facility and base rates is 55bps post the last rate hike, the market has built a repo premium into the roll that supercedes the directionality this spread has exhibited over the past couple months (see chart below).

> UKT 4Q 27 repo opened at 45bps this am which is about 26bps through GC. If we assume that this repo bid could persist until the end of September, we can run the carry numbers until then. As you can see, even a 40bps+ differential until Oct 1 inly costs us .12bps over that span in negative carry which seems a small price to pay for the steeping we’ve seen in this spread, especially in light of the divergence vs yield levels. We expect to see good extension interest.

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: Spain Kicks off Busy AM for EGB/UKT Supply

SPAIN

- Broadly speaking, SPGBs are at a crossroads within the EGB universe.

- On the bearish side, their performance has been a ~40% beta of the moves in BTPS which leaves 10yr spreads to DBRs 40bps wider than their April lows. Concerns about EM contagion persist (with Spanish banks exposure to Turkey sizeable), even with positive noises out of Rome on their budget talks. Despite positive supply-driven seasonals in August, there was little sign of pent-up demand for Bonos.

- On the bullish side, Spain is in solid shape relatively speaking. After today’s taps they'll have just €26.6bn left to auction this year (7 auctions of EUR 3.8bln per auction) and at 12.5yrs their issuance has been one of the longest in Europe. After today’s 2048s tap they’ll have issued ~14.5bln 30yrs, the most in Europe, suggesting the ‘heavy lifting’ in SPGBs issuance has been completed and could leave them to focus on shorter issues like their 7yr (just 4bn YTD). With EUR 20.4bln redemptions and PSPP buying of around 2.5bln per month between now and Dec, net SPGBs supply for the remainder of the year will be slightly negative.

- As those who’ve tried to trade BTPS in the last three months will tell you, liquidity is just awful now. The shenanigans in IKU8/BTPS 9/28s have not only impaired liquidity across the BTPS curve but they've forced long term ‘non-predatory’ investors to the sidelines. Given a green light, those investors would jump at the chance of grabbing BTPS at current spreads to DBRs, however, DiMaio and Salvini have done little to earn their trust just yet. This leaves Spanish Bonos as the next best thing if one wants to make a ‘risk-on’ bet. Liquidity isn’t stellar in Bonos but it’s better than BTPS and they’ll certainly be less volatile.

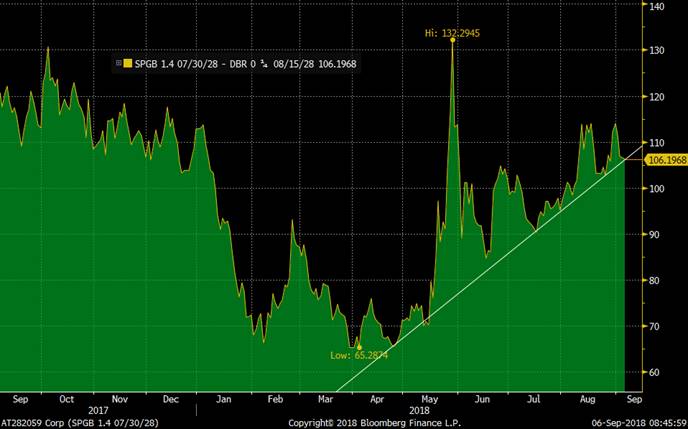

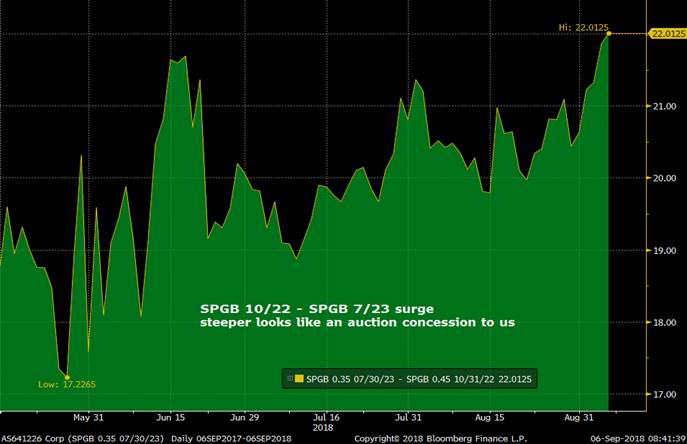

- SPGB .35 7/23s – Expecting ~1bln tap this am to take them to ~8.2bln outstanding, about half-way through their issuance cycle. The 5yr sector of the SPGB curve looks cheap into this am’s tap, the SPGB 1/21-7/23-4/25 fly back near recent wides. In addition, the SPGB .45 10/22 into SPGB .35 7/23 roll is at its wides (both yield and MMS box) at +22bps/11bps mid into this am’s tap. Given the equivalent spread in BTPS has flattened 10bps in the last 10 days, one could argue this spread is here because of this supply. Expect solid demand here.

SPGBs 1/21-7/23-4/25 fly – 7/23s cheap here

- SPGB 1.4 7/28s – Expecting 1.5-2.0bln to take them to 11.5-12.0bln. On a micro basis, the SPGB 10/27-7/28 sprd is back to its wides at +13.9bps mid and 10yr Spain remains near its wides vs 10yr BGBs, having retraced vs OATs into this am’s supply. SPGB 1.4 7/28 yield levels are within 1.5bps of their cheapest since first issued which should tempt real money.

SPGB 7/28 v BGB 6/28

- SPGB 2.7 10/48s – expecting 1.5-2.0bln to take them to ~9.0-9.5bln. This issue looks on the richer side of fair on the SPGB curve, showing little sign of any concession into this am’s tap. The SPGB 48-66s sprd, for example, hasn’t budged since the 48s tap was announced, stuck in a 27.5-28.0bps sprd ad infinitum. They are around 2.60% in outright yield, their cheapest level since mid-July so perhaps that’ll encourage demand. Cross market demand is probably where these 48s make most sense. Not for the faint hearted given liquidity constraints in some of these names but the IRISH 45s vs SPGB 48s, BGB 47s into SPGB 48s and FRTR 48s into SPGB 48s are all at/near their respective wides. Of these, we’d lean towards the OATS version given better liquidity and location.

FRTR 48s into SPGB 48s

Will be in touch!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS Activity Set to Heat-Up... W/Charts

From: Mark Funsch

Sent: 28 August 2018 10:27

Subject: MICROCOSM: GILTS Activity Set to Heat-Up... W/Charts

- Now the summer holidays are drawing to a close (booo!), politics will take center stage again as Brexit and Italian budget talks resume and US trade wars will vie for headlines with Trump’s growing list of legal concerns. The rates market’s focus will shift to a resumption of supply as Finland prices a new 10yr today and Italy has announced EUR 7.75bn for Thursday.

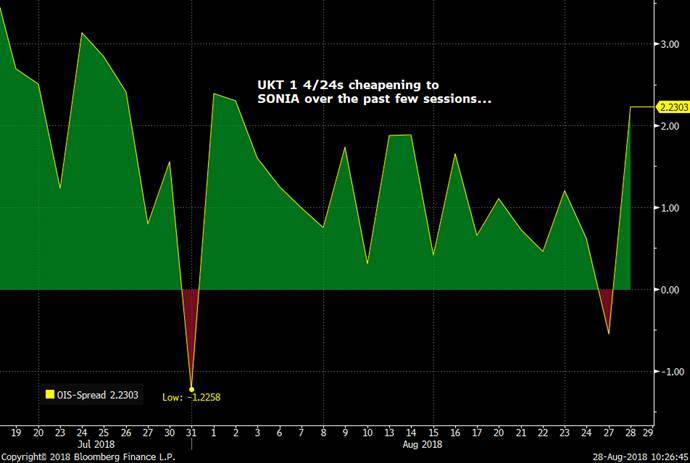

- In the UK, the Sep 6th UKT 1 4/24 tap and the Sep 7th cpn payments will drive much of this week’s activity. As noted in rundowns over the past couple weeks (see attached), gilts that mature in Sep go ex-dividend this Thursday. This ex-div date often marks the end of the bullish Aug seasonals for gilts and a 'running out of steam' for the 5yr sector issues who benefit most from the index extensions we'll see. These seasonals are meant to iron-out some of the macro considerations at work that could impact RV (FTQ flows if pressures on Turkey/Italy resume for ex) but suffice to say that in an all-else-equal environment, we’re expecting the market to build in some concessions on the curve into week’s end.

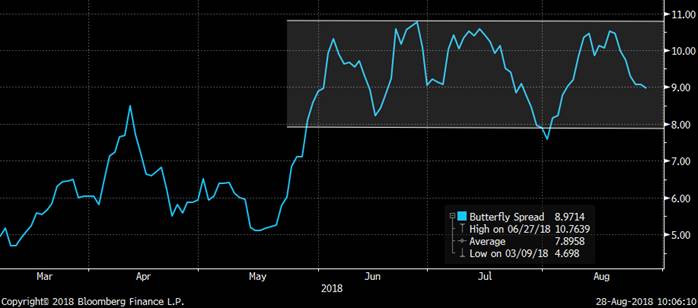

- In addition, last week we highlighted how high open interest in G U8 and a lack of repo demand for the UKT 4Q 27s would likely drive some cheapening of the UKT 4Q 27s on the curve. Well, over the last week, the UKT 7/26-12/27-10/28 fly has cheapened 1.5bps, more than half the range since June which could plateau at the 8.0bps area. (see chart). The wild card here is what happens to the UKT 4Q 27s as roll activity in G U8 resumes AND whether there is any rolling out of the UKT 4Q 27s into the UKT 1F 28s now that the 28s are the official benchmark. (Since I began this note, a large 100k+ roll order came through the mkt)

UKT 26-27-28 fly (27s cheapening)

- On a side note, it seems rather curious to me that aggregate open interest in G U8/G Z8 has risen sharply over the past couple sessions, during roll activity. In previous cycles, aggregate OI usually dips as players who want to avoid roll activity and/or delivery unwind their positions. We’ll keep an eye on the exchange data for signs this is just an aberration (last time this happened a prime broker didn’t net their positions off).

- With the new UKT 4/49s around the corner on Sep 11th, there’s been a modest bounce in ultras as some of our RV positions out there has sprung back to life. The market knows the 47/49s are rich on the curve but ultras struggled to bounce in August, due to yield levels on the rich end of the range and a holiday markets. The ‘many ways to skin a cat’ rule applies here, however, the flatteners/flies we’ve advocated of late (47-57s, 49-68s, 40-49-57s, 37-47-68s) have either bottomed or already turned our way.

UKT 40-49-57 fly

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: Tactical Trade Idea - Long FRTR 11/28 vs NETHER 7/28s

TRADE IDEA: Buy FRTR 11/28s vs NETHER 7/28s @+18bps or better, targeting +13bps, stop at +20bps.

OR Buy the FRTR 11/28s basis vs OATU8 given current steep levels (details below) for lower-beta alternative.

OATs and DSLs...

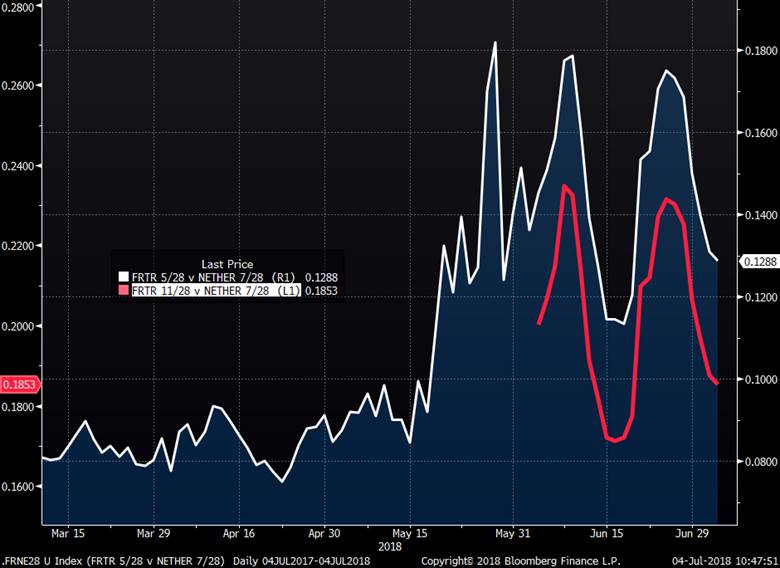

- Back on June 1st I recommended a FRTR 5/28-5/48 flattener boxed vs NETHER 7/28-1/47 (attached) given the widening of OATs and seasonals that support OATS into July.

- The chart below shows that the trade worked, tightening about 4.5bps before chopping around over the next few weeks, now 39.3bps vs inception at +42bps. Compared to how the OATs 10-30s box has traded vs DBRs and/or swaps, one could argue there’s still some juice left in the OATs flattener vs NETHER. The problem is the OATs curve has already pancaked and the auction calendar, especially after tomorrow, doesn’t cooperate. If we’re right about this tactical 28s trade, we could see better entry levels for the box by this time next week.

- At the last tap of the NETHER 1/24s we saw a nice cheapening of the issue on the curve into the tap (which coincided with some overall sprd widening) and in the ensuing couple weeks they richened 8+bps vs OEU8 and RXU8.

- Over the next week we have a tap of the FRTR 11/28s (tomorrow) and next Tuesday a tap of the NETHER 7/28s. With cash flows very supportive this week we expect this week's supply to be well supported, especially given the benign market conditions and supportive seasonals.

- The FRTR 11/28 vs NETHER 7/28s sprd has narrowed 4.8bps from the recent wides, now ~18.6bps mid. The question now becomes, in the current mkt, is the next 5bps tighter or wider in light of the supply calendar and cash flows? We think the next 5bps in this sprd is TIGHTER, looking for a move to +13bps with a stop at +20bps vs our +18bps inception. We look for the bulk of this move to occur in the next 4-5 sessions.

- If you’d prefer to avoid cross market trades and want to dial-down the risk given the recent volatility in intra EGB spreads, then take a look at the buying the FRTR 11/28s basis vs OATU8 (or even FRTR 5/28s). Both yield spreads vs the FRTR 2.75 10/27s CTD have steepened over the past week but are showing signs of topping out in the last 24hrs. This version is more ‘pure OATs auction play’ that has a 1.0-1.5bps profit target that could rise if the curve flattening bias of late accelerates.

- Charts and original trade idea below.

FRTR 5/28 v NETHER 7/28 and FRTR 11/28 vs NETHER 7/28

FRTR 10/27 vs FRTR 5/28 (white) and vs FRTR 11/28 (much shorter history)

Will be in touch.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: Gilts Remain In Focus Into BoE - TRADE IDEAS UPDATED

The UK…

- BoE is expected to remain on hold again today with the market pricing in a ~47% chance of a 25bps hike in August and a full 25bps+ in Feb ’19. The market is keen to see how much conviction Carney and co have that the Q1 slowdown was indeed weather related and that Q2/Q3 will see the UK back on track. While the MPC statement at the meeting should help, we may need to wait until tonight’s Mansion House speech for the full story. To be frank, Carney’s become rather difficult to read so we don’t know whether we’ll get a hawk (“Q1 a temporary blip”) or a dove (“trade wars and Brexit worries holding us back”). We saw a modest 3bps cheapening of 1y1y sonia yesterday, likely a reflection of Theresa May’s victory in Parliament although another new high in the USD this am has cable making another new 6 month low at £1.31…

- Theresa May and her team are likely breathing a sigh of relief this morning after the histrionics of the last couple weeks. It’s clear, however, yesterday’s victory has come at the cost of the credibility of MPs like Grieve who flip-flopped at the last minute. May’s promise of more money for the NHS will come at the expense of the UK tax payer as Hammond is expected to announce today – clearly bowing to pressure from the Remainers/Labour party. With the fires in Westminster extinguished for the time being David Davis and company are still long overdue for a breakthrough on the Brexit plan as Barnier and his team grow more and more impatient. This stagnation will be reflected in GBP and to a lesser extent how sonia trades.

- Yesterday’s U of Cambridge deal was a bit more risk than initially expected, driving a dis-inversion of 20/30 vs 50s and a modest cheapening of UKT 1F 71s of 2.8bps since Tuesday. Given the correlation of these long-end spreads/flies to the absolute level of ultras yields, we think that flatteners like UKT 46s-55s or UKT 49s-65s are looking cheap here having retraced more than half of the rebound we saw last week (chart below). Supply in the long-end is light next quarter with just a tap of the UKT 57s on Jul 19th (£1.5-2.0bln) and a new 2049 30yr benchmark on Sep 11th. The coupon flows in July will be heavily tilted towards the 15yr+ index as £2.125bln of the £3.047bln will be paid in longs which at the margin is flattener supportive.

- Tuesday’s £2.25bn tap of the UKT 1T 37s is now front and center with just 3 sessions to go. There has been little meaningful movement in gilts so far this week, even with the modest retracement in long-end spreads as the U of Cambridge deal kept the mkt side-lined. As above, there’s still a fair amount of event risk in the UK this week that could drive further cheapening of the 37s on the curve, especially if G U8 rallies and the UKT 27-37 spread continues to steepen, having made another new s/term wide at 47.1bps this am. The chart below shows how well correlated UKT 27-37s has been with Sonia (1y1y, inverted)), suggesting the spread is a good proxy for a bearish MPC trade with the added bonus of coupon and index drivers that are 15yrs+ positive all else equal. The UKT 1T 37s are at the peak of the OAS curve where rolldown begins to gather speed and are unlikely to be tapped again this calendar year. We like buying 37s here on the 36-37-38 fly or vs 27s and 47s on a 25/100/75 beta weighting with a view to adding if they cheapen a bit more.

- Following the Parliamentary vote and Scotia/Experian deals, the UKT 7/23s recovered on the curve, the UKT 7/22-7/23-9/24 fly back to 6.6bps from 7.4bps on Tuesday. We still expect the UKT 7/23s to trade well into next month given the index dynamics and arrival of the new 5yr on July 24th. Along those same lines, our UKT 20-23s flattener is working nicely, now 31.5bps mid, almost 5bps flatter than Jun 6th levels. We see this persisting for now and still target the ~30bps level.

Charts…

- UKT 46-55s retracing the recent curve flattening, back to re-load levels in our view.

- UKT 27-37 Sprd vs 1y1y Sonia (inverted)

- UKT 36-37-38 fly a low octane version of UKT 27-37s

- UKT 20-23s still flattening nicely… Holding on for 30bps area

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: UKT 1F 71s Syndication Dominates Early Week UKT Trading

> Focus of the next couple days will be the market's preparation for tomorrow's UKT 1F 71s syndication. We still don't know how big the issue will be and the sprd it will be priced off the 68s, both factors that can affect demand aside from the obvious level of yields and curve valuations.

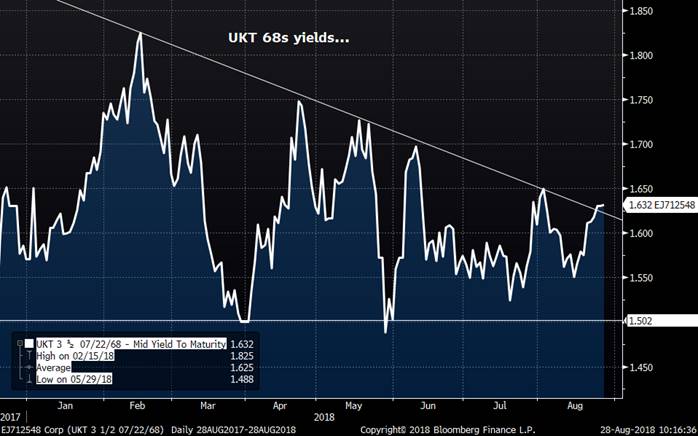

> From an outright perspective, the UKT 3H 68s have grinded cheaper over the last several sessions, knocking on 1.70% this am after an 8.5bps rally in late April. A push above 1.70% should mean more demand out of cash than on the curve...

> We're also keeping an eye on micro relationships like UKT 65-68s, UKT 57(60)-65-58 fly, UKT 49-55-60 fly, UKT 42-60s sprds, etc.

> Our natural inclination given the historical precedent here is to come out of the syndication long ultras (even if it isn't the 71s), however, we'll be mindful of location too. The market's done a pretty good job of cheapening 68s on the curve, for example, so another .1/.2 vs 65s is just 'gravy' here.

Stay tuned…

UKT 68s…

UKT 65-68s…

UKT 57-65-68 fly at the rich end of a narrow range…

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Taking Off RXM8 Longs, Eyeing Supply & Busy Data Calendar

Lots to talk about so let’s get cookin’…

MACRO…

- OIL remains on everyone’s radar given the headlines in the press this week: Iran allegedly cheating on nukes deal and Israel up in arms; Houthi rebels lobbing rockets into Saudi Arabia; Russia/OPEC sticking to production cut agreements; US inventories declining into summer driving season, etc. WTI is off the highs but only just at $67.70 a barrel vs $69.55 1yr highs. The correlation of oil prices to UST yields remains solid, remaining a focal point for the market.

- Politics continue to provide a rather unhealthy distraction for the markets as Italy’s post-election melee continues, Theresa May’s hold on her party looks more and more tenuous with Tory rebellions on the customs union brewing and Trump’s legal issues could worsen as Mueller threatened to subpoena him if he refuses an interview over the Russia meddling affair.

- Stocks have stabilized (AAPL posts some remarkable results along with a $100bln buyback) with the 200 day MA providing solid support for the S&P.

- Today’s FOMC meeting should be a non-event given the modest slowing in G-10 economic data since the last meeting, the rally in the USD and renewed curve flattening pressures. All told, one could argue the market’s already tightened for the Fed and we’d agree with El-Arian that the market’s earned a breather.

- UST qtrly refunding will be announced later today with most pundits expecting an additional $2bn 3yrs to $32bn, $1bn 10yrs to $25bn and $1bn 30yrs to $17bn which would make this the biggest refunding since the financial crisis. With 10yr notes still hovering up near 3% some would argue this is priced in – others think it just adds to the bearish tone. Also talk of a new 2-month t-bill out there. We’ll see.

EUROZONE...

- We're taking off our tactical RXM8 long now that the post- ECB month-end index flows that helped drive the move are behind us. The 20-Day MA level I highlighted as first key resistance held well and with the mkt dipping on the open (in response to USTs yesterday), the tone has shifted more neutral/bearish.

- Supply over the next two days is pretty chunky in Europe with Germany tapping 3bn OBL 177s today, Spain tapping their 1/21s, 4/28s and 7/66s and France tapping their 5/26s, 5/34s and 5/48s. It’s a good deal of risk for a market that has feels a bit toppy.

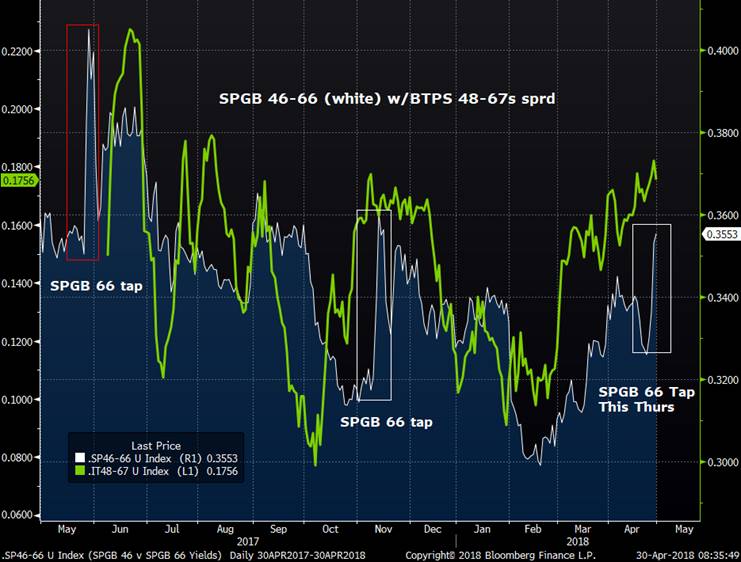

- The SPGB 7/66s have cheapened up nicely vs SPGB 46/48s into tomorrow’s tap, attracting tactical flattening interest which we think makes sense, particularly since our BTPS 48-67s flattener has held in well despite the 50yr supply.

- BTPS have been all over the map the last few days as 5-Star’s DiMaio threw PD under the bus late last week but his calls for June elections have been denied by the President. BTPS will remain volatile over the next few weeks, however, we think it’ll be tough for them to ignore the overall tone of EGB yields if they begin to rise.

- PMIs trickling in this morning, Spain 54.4 vs 54.1, Italy 53.5 vs 54.5, France 53.8 vs 53.4 and Germany on the way soon.

UK…

- What a tangled web they’ve weaved… Telegraph reports that Tory MP Rees-Mogg has a faction of 60 conservatives who are willing to take May to task for her flip flopping on the customs union and the Irish border issue. With the House of Lords calling for a Parliamentary vote on any Brexit plan (suggesting a Remain bias) and local elections tomorrow that have the Tories potentially losing more support, it’s no wonder Cable is under more pressure.

- UKT 0T 7/23s to be tapped tomorrow. We saw a push up to +8.1bps on the popular 7/22-7/23-9/24 fly briefly yesterday morning in response to more soft data before some chunky buying of the 23s took it back to the ~7.4bps area into the close. It’s opening at 7.0bps this morning and barring a breakdown of cable or some really nasty Brexit news, it looks to us like the pre-tap concession has likely run its course. Glad we could get a handful of clients back in at solid levels.

- Next week’s £2.75bn tap of the UKT 1F 10/28s has been confirmed. We’ll be back with more RV colour on this shortly.

- More significantly, however, is the DMO’s confirmation of the details of the new ultras syndication. We’ll be getting a syndicated October 2071 issue the week of May 14th which, given current 2068 yields, will likely be a 1.625% coupon. This maturity is a year or two shorter than initial market estimates but even a £4.75bln 2071 issue flat to the 2068s will be £19mm DV01 and if they use some of the unallocated cash to take it to £5.75bln that would be £21mm/bp – a ton of risk.

- Our UKT 49-55-60s fly is back to our inception level after richening to +5.8bps last week. We’re keeping a close eye on this one but from the price action so far this week, we think this -4.0/.1 area will hold, making this a good place to add.

- In addition, our UKT 37-47-68 fly has richened 1.2bps to 21.0bps over the last couple sessions. Still like this one.

- With the May meeting now pricing in 20% (or so) odds of a hike (and HSBC saying the MPC will be on hold until 2020!) the front-end appears pretty well anchored for now. This most recent rally has drained the front-end of much of it’s short base and given the shift in sentiment, we’re back to being more ‘prone’ to good news than bad. Trouble is, there hasn’t been any really good news for a few weeks now.

More to come…

Mark

Charts:

Stocks

Oil

RXM8

UKT 22-23-24 fly

UKT 37-47-68 67/100/33 weighted fly

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Preview of a Busy Week & Highlight on BTPS/SPGBs Long-End w/charts

Interesting week lined up...

Highlights:

> Today's month-end index extensions are significant in Europe (+.12yrs) while the US (+.04yrs) and UK's (+.01yrs) moves are below avg.

> Europe's +.012yr aggregate move (BAML's #s) is one of the year's highest, highlighted by +.24yrs in FRA, +.11yrs in GER, +.08yrs in ITA, BEL, and FIN and +.07yrs in SPA. IRE's +.27yrs must be a record although market impact will be subdued given IRE's small share of the EG00 index.

> Flows/liquidity this week could be more sporadic than usual as it's Golden Week in Japan, tomorrow is May Day across Europe, Wed is Independence Day in Spain and there's a long-weekend in the UK coming up. This could impair the market's ability to take down some OBLs Wed and a pretty chunky amount of SPGB and FRTR duration Thurs. (see below)

> Add to this the FOMC meeting Wed and US's NFP release on Friday, coming after a handful of other info (Pers income, PCE & Chic PMI today, ISM tomorrow). With CFTC data reporting RECORD shorts in TY/UXY futures and 3% 10yr yields still a sneeze away, technicals could have a lopsided impact on s/term biases.

BTPS and SPGBs...

> Our bearish BTPS 48-67s flattener position is opening at 18.3bps, about where it closed Friday. On the one hand, the bearish tone of EGBs on the open is helpful (see 5 Star's Di Maio's comments over the weekend) but the surprise announcement Friday of Spain's tap of their SPGB 66s this Thursday didn't do our BTPS 67s any favours and I suspect that until that supply is out of the way, there will be pressure on 50yr EGBs across the board.

> The SPGB 46-66s sprd has steepened about 2.75bps since the tap announcement, the biggest steepening of this spread since the last tap was announced in Nov last year. We can see from the last two taps that the avg pre-tap concession has been about 4bps which, given how little time we have to set up for the tap, seems about right this week too. A spike 4bps steeper was a buying opportunity the last couple times and given the tone of the market last week, a move like that is likely to provide a similar opportunity this week. (see chart below)

> Last Thursday we called for a corrective bounce in EGBs post-ECB and into today's index moves which has worked nicely as the 157.75 fibo support in RXM8 provided a floor for a bounce to within a couple ticks of first key resistance (20 Day MA at 158.87 area). (see attached) We're opening with a modest bearish bias which reiterates the importance of this resistance (followed by 159.00 breakdown level). First support is 158.18 (5 day MA). We expect that once this index event is done the tailwinds EGBs enjoyed in April will have passed, opening the door for a more symmetrical trading bias but for the time being the market’s likely to be trading from a buy the dip mentality today.

RXM8

SPGB 46-66 vs BTPS 48-67

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: UKT 37-47-68 Fly At Attractive Levels (Amended)

(Small amendment to the fly-weighting below)

- May and June will be big months for UK gilts supply. Here’s the calendar:

- May 3rd UKT 0T 7/23

- May 9th UKT 2.0 2/28

- May 18th (street consensus) 2073 Ultras syndication

- May 24th UKTi .128 36

- Jun 6th UKT 0T 7/23

- Jun 20th New UKTi 10yr

- Jun 26th UKT 1T 9/37

- May 3rd UKT 0T 7/23

- The conspicuous absence in the list of auctions above is the 30yr benchmark. This means a few things to us:

- The absence of 30yr supply means the sector should out-perform the 20yr and 50yr, in the 1-2 weeks before their auctions.

- With the UKT 1H 7/47s already £24bn+, there is a strong likelihood in our view that we will get a new 30yr benchmark in the next couple quarters via auction.

- If a new benchmark is indeed on tap, the UKT 1H 7/47s should richen to the curve, removing some of the cheapness that we’ve seen in the issue since it’s launch, much like the recent normalization of the UKT 1Q 7/27s.

- The absence of 30yr supply means the sector should out-perform the 20yr and 50yr, in the 1-2 weeks before their auctions.

- As an offshoot of the above, we like owning the UKT 1H 7/47s, either has a flattener vs the UKT 1T 37s or on butterfly versus the UKT 3H 7/68s. The timing looks good to us, here’s why:

- UKT 1T 37 vs UKT 1H 47s sprd is climbing to resistance levels that have held over the last year.

- A May hike from the MPC appears to be off the table as data has disappointed and Carney’s comments leaning dovish. That has pushed the first hike out to Nov and reduced the rate rises to just 44bps over the next 18 months. This has reduced the bear flattening by about 17bps (5-30s) since late March and we would suggest much of the short base in the front-end.

- The syndicated ultra issue will be a TON of risk, our back of the envelope calculation says somewhere around £20mm a bp. LDI players, who dominate these syndications, are very yield sensitive, particularly when we are trading a stone’s throw from historic lows. So, we were pleased to see UKT 68s cheapen from 1.50% to 1.75% during April, hoping that the move would ensure strong demand in mid-May. Well, 1.75% was breached briefly on Apr 23rd, triggering a flood of demand that has richened the 68s 10bps, taking them from cheap back to fair. (see chart) We think the market will be incentivised to build that concession back into ultras before the syndication is formally announced, either on the curve or in outright yield space.

- UKT 1T 37 vs UKT 1H 47s sprd is climbing to resistance levels that have held over the last year.

- This UKT 1T 37 – UKT 1H 47 – UKT 3H 68 fly is a bit lopsided, the short leg around +1.9bps and the longer leg around -20bps. Some might be inclined to look at the absolute levels of each of the wings and use a ratio that reflects the inherent risk in the fly. In this case, however, what makes more sense to us is to consider the trading range of the wings of the past year to determine how volatile they are and vs each other. Over the past year, the range in the UKT 37-47 spread has been 4.8bps, the UKT 47-68 sprd 10bps, which looks like the short leg is about half as volatile as the longer leg. So, we’ll shift half the risk in the long-leg to the short leg, giving us a 67-100-33 weighting. We can see that this changes the absolute level of the ‘fly’ and, interestingly enough, it improves the location of it while tightening up the trading range of the last year to about 3bps. Clearly, if you prefer the 1-2-1 approach and want to bet on a more dramatic shift in the ultras leg then, by all means, that remains an option.

In light of the timing of the syndication relative to the tap of the 37s, we may be inclined to unwind the 47-68s leg first and let the 37-47s leg ride.

L U8 has rebounded nicely

UKT 37-47s sprd

UKT 37-47-68 1-2-1 fly vs 1y1y Sonia.

UKT 37-47-68 fly with a 67%-100%-33% weighting… Changes profile – perhaps for the better.

I’ll call to discuss.

Thanks

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: Tactical Bullish EGB Trades Into ECB & April Month-End

- We’ve been trading the European govt bond and UK gilts markets from the bearish side for about the last 10 sessions which has worked out well on balance. Our bearish bias was driven largely by the realization that fears of a trade-war were overblown (for now), April coupon and redemption flows in EGBs were largely priced in, price action deteriorated as positioning grew longer and a steady climb in oil prices awoke fears of a bounce in inflation. In addition, seasonals in EGB rates and spreads return to a more neutral/bearish outlook from May until July (especially in France). Add to that a grind towards the psychological 3.00% level and the bearish bias made sense.

- While some of the concerns noted above will likely hang over the rates markets for the next 3-4 weeks at least (positioning, oil and supply for starters), it looks to us like we could be in for a tactical bounce in EGBs between now and Monday. Here’s why:

- RXM8 charts show the 38.2% retracement level – 157.75 – has proven significant support this week, the market ‘building value’ around this level. This has coincided with oversold RSIs bottoming out. This morning’s rally to 158.00 confirms this support.

- OIL’s over bought technicals have stalled, consolidating just below the highs, momentum slowing.

- As this morning’s WSJ opines (click here) , Draghi is likely to not only keep any mention of winding up QE on hold until July but could strike a more dovish tone than we’ve seen of late. Trade tensions (real or imagined), trade weighted Euro remains at multi-year highs, stubbornly low inflation and some unseasonal weather are all fair game.

- Monday’s index extension in Europe is estimated +.11/.12 yrs (depending whose system you use), driven by +.23yrs in Ireland, +.20yrs in Spain, +.16yrs in France and Portugal. This is one of the biggest extensions of the year which favours OATs most given the combination of their share of the index (usually around 24%) and the size of the move.

- Next week is Golden Week in Japan which generally means activity out of Japan dies down sharply. Yesterday dealers reported some dip buying from Japan in USTs, DBRs and OATs which appears to have resumed this morning. With Oats hedged back into JPY at levels last seen in early March, this dip buying could be significant.

- To provide protection (hedges) for some of our bearishly biased positions (like BTPS 48-67s flatteners, DBR and FRTR steepeners in the belly, etc), we suggest a tactical outright long in OATM8 and/or RXM8 or invoice spreads, bull flattening positions like FRTR 3/23 into FRTR 5/27s or BTPS 3/23 into BTPS 8/27s. These may turn out to be 2-3 day positions into month-end but it could be worthwhile insurance if the market becomes more volatile.

RXM8 bouncing off support

OATs seasonals have been working nicely so far this year. Could see one last bounce, however, before selling emerges.

OIL’s steep climb has run out of steam…

RXAISP…

I’ll be in touch…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796