MICROCOSM: Gilts Market - Observations and Ideas w/Charts

GILTS... Some thoughts and observations:

- 53.6% odds of a 25bps hike in May and just 50bps priced in over the next 18 months. Given the tone of Carney’s comments, the tone of the recent data and the state of the Brexit talks, that’s probably about right.

- Theresa May has had a rough week with the House of Lords trying to foist a softer Brexit on her. If this gathers momentum, is it not GOOD for the UK economy if the customs union with the EU remains in all but name? GBP certainly doesn't trade like it feels that way. Here’s an interesting comment in The Independent ‘Brexit minister reveals how MPs can force Theresa May to accept fresh referendum.’ Can the UK reverse Article 50? Have a look.

- The short end has re-steepened (1H 21 v 0H 22 +5bps from May lows) but 22s still not looking cheap enough yet to get back into a flattener. Chart suggests +20 has been key resistance of late which is still ~3bps away.

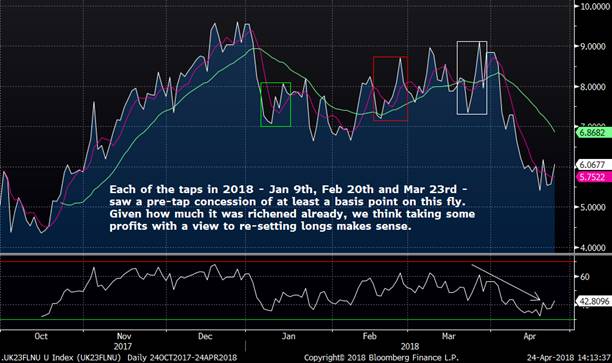

- UKT 0T 7/23s will be tapped May 3rd. Our 7/22-7/23-9/24 fly has stalled in the 5.5-6.0 range for the last 10 days, despite some big gyrations in short sterling/Sonia. As this is the penultimate tap of the issue before an expected new 5yr benchmark in July, there's a coterie of clients who are loathe to part with their UKT 7/23s as they’ll soon stop being tapped. We don’t blame them as they could richen further into July all else equal. For those who want to actively manage their position, however, I think it’s worth taking profits in this zone before the end of this week and look to jump back in after a concession has been priced in. See chart below pls.

- Micro trades still in vogue in gilts while we await the announcement of the new ultra syndication – likely in mid-late May. For example:

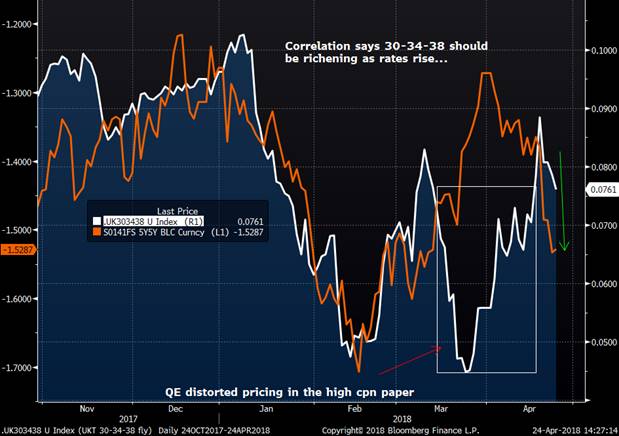

UKT 30-34-38 fly looks too cheap here given the correlation to rates.

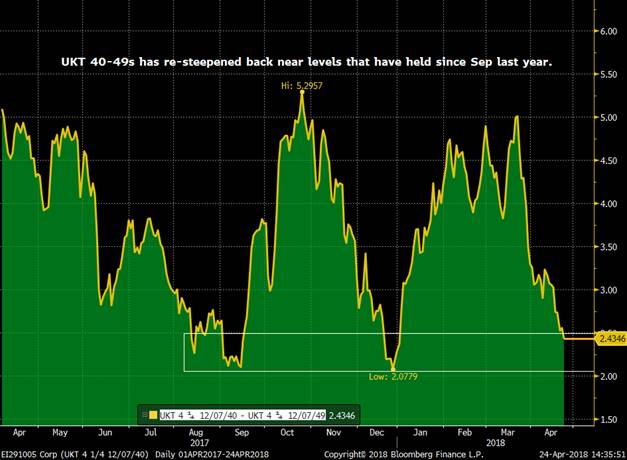

UKT 4Q 40 into UKT 4Q 49 back to key levels that have been good places to get back into flatteners since Sep last year. No 30yr supply due until next qtr at the earliest.

- The ‘elephant in the room’ in May will be the syndicated ultra issue. We don’t know the exact details yet but we do know it’ll have a 2072/73 area maturity and could be in the £4-5bln range. That’s a TON of risk. One development we can draw some comfort from – unless it reverses course soon – is the ~25bps cheapening in ultras yields. That may not sound like much but when you realize that 25bps is almost 17% of the yield on Apr 1st (in absolute terms) and that demand at 1.50% is likely to be a lot different than it’d be at 1.75%, it comes into perspective. When we add in stories like the one about RBS’s likely pension investment needs in May/Jun it makes one think that yes, it’s a ton of risk but somehow the market will find a home for it. That has implications not just for ultras but for the shape of the curve in the long-end which has spent much of the last few weeks dis-inverting. We still like our Long UKT 55s vs 49s and 60s which has richened from -4.2bps to -5.4bps.

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: SPGBS, FRTRS and UKTs - Quick Preview w/Charts

Quick EGB/UKT Supply Preview:

- Spain will bring 35k RXM8 equivalents at 9:30am Ldn, tapping SPGB .45 10/22s, SPGB 1.4 4/28s and SPGB 2.35 7/33s.

- While Bonos have lagged the impressive move in BTPS this week, they are still just a few bps off the late March yield lows with SPGB-DBR sprds back to the cycle lows. The SPGB 10/22s have cheapened a bit on the curve (4/22-10/22 +2bps this week), the SPGB 4/28s still look on the rich side of fair, as do the 33s.

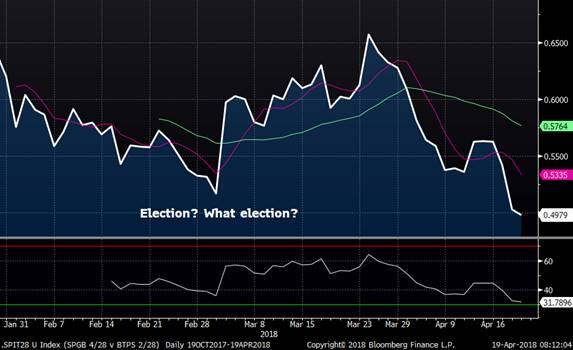

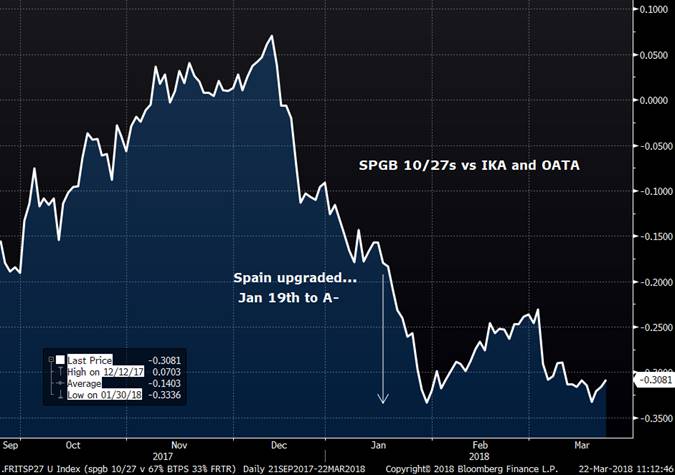

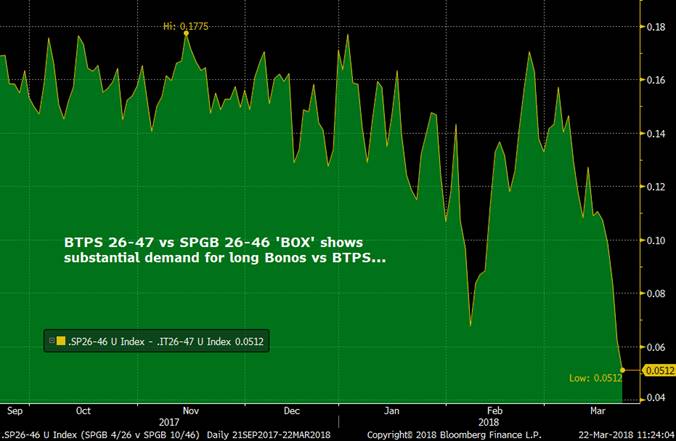

- We've been fans of the BTPS - SPGB sprd compression trade all week but with the 2/28-4/28 sprd narrowing inside of 50bps this morning, we expect to see some unwinds of long BTPS posns into this am's SPGB 4/28s tap.

SPGB 4/28 v BTPS 2/28

- France's AFT will be bringing 24k RXM8 equivalents in the FRTR 0% 2/21, FRTR 0% 3/23 and FRTR 1.75 11/24.

- Tough to find much 'value' amongst this trio aside from the 11/24s which have backed up on the curve since the announcement of their tap. The 10/22-11/24-11/26 fly is hovering around 7bps this am, the 10/22-11/24 leg steepening into this am's tap, now ~34.6bps mid.

OBL 177 vs FRTR 3/23s – 10bps seems a big level here

FRTR 10/22-11/24-11/26 fly

- The impact of the long awaited EUR 41.7 trillion in C&R flows could be felt a bit in today's auction as the flows officially hit Apr 25th, the settlement of Monday's OATs trades. While most are understandably cautious about fading the move, it seems safe to say the effect of these flows is priced in. Price action in OATM8 has been decidedly dull, RSIs dipping into neutral territory as surging open interest has left the market long. While the fundamental picture for OATs (and EGBs more broadly) doesn’t appear to have any dark clouds on the short term horizon, current yield levels and spreads to bunds leave very little room for error and frankly, I am more comfortable taking off long FRTRs positions here, rolling them into low beta steepeners that should do well if the market chops sideways for a while. Take a look at 5-10/15s steepeners which carry and roll well and are at cycle lows.

- The DMO will tap the UKT 1F 10/28s for the first time at 10:30am, about 24k G M8 equivalents.

- On paper the market should love this issue. It’s the first benchmark longer than the CTD of the gilts contract for a while, it’s got a decent coupon and there’s been enough volatility on the gilts curve to keep the RV guys happy. The trouble is, the 10yr sector looks a bit rich to us and these 10/28s have taken back the pre-tap concession on the curve we saw late last week. For example, the UKT 28-34s flattener we recommended around +17.5bps flattened to +15bps (nice!) then steepened back to +18.8bps on the bounce in G M8 (not nice!) and is opening +18.4bps this am. Same goes for the 26-28-30 fly – cheapened to 15.8bps, now 14.7bps. This tap will get done – they always do – but from an RV perspective they just don’t look as tasty to us.

- More broadly, we think gilts are on rather shaky ground. Yesterday’s CPI data was reason enough to cover shorts (at the very least) but the market focused on the jobs data and with open interest surging 9+% in the last few weeks, there are some skittish positions out there. The charts closed with a bearish and this morning’s open – while likely supply related to a degree – confirms this tone. Tough to chase a rich 10yr sector with this kind of signal.

More to come!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: Gauging Impact on Spanish Bonos of a S&P Ratings Boost

- Back on Jan 24th I wrote a quick note on the pending SPGB 4/28s with a CRUDE approximation of where a EGB issuer should trade relative to their peers based on their long-term sovereign rating (attached). While there are plenty of idiosyncrasies that can complicate these estimates (politics, QE, global economic trends, etc) we think the impact of a ratings upgrade on end-user demand can be strong enough to drive significant outperformance of one issuer versus another, just as a downgrade could have an adverse one. The closer an issuer’s ratings get to AAA, the deeper the pockets of potential investors like central banks and sovereign wealth funds.

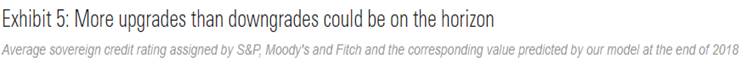

- Combing through the available research on the ratings outlook in Europe paints a fairly uniformly optimistic outlook. The bar chart below, borrowed from our friends at GS, shows improvements not only for Spain (more below) but for Ireland, Italy, Belgium, Finland and Austria. The notable exceptions are France, which is expected to stay put at AA and Portugal which could see a downgrade in their view.

- Spain’s long-term rating is widely expected to be upgraded by S&P tomorrow from BBB+ to A- given their positive outlook on the credit. With Moody’s and Fitch’s outlook for Spain both ‘Stable’ now, this could be it for 2018 unless there’s a change in outlook at their next reviews. The ‘How long is a piece of string?’ question is whether this ratings upgrade is fully priced into SPGB spreads to other EGBs like France’s OATs.

- If we use our back of the envelope guide to EGB spreads as measured by their ratings (see attached), tomorrow’s move to A- would take Spain’s average rating to four notches below France (AA > AA- > A+ > A > A-). The current spread between SPGB 1.4 4/28 and FRTR .75 5/28s is about +50bps which implies 12.5bps per notch – pretty close to our ‘model’.

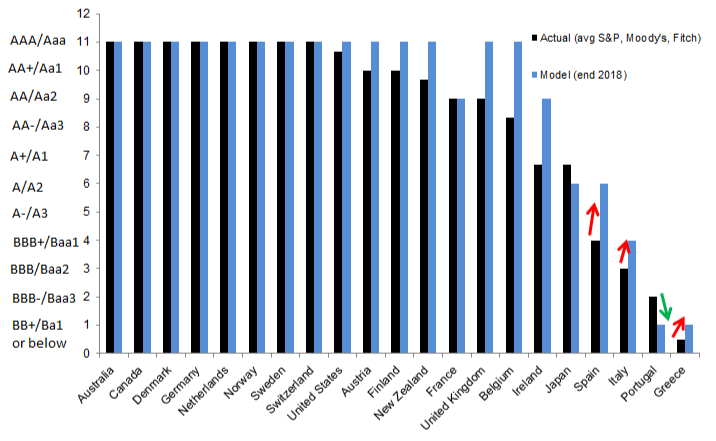

- The chart of our SPGB 10/27s vs IKA and OATA blend below shows that SPGBs were tightening sharply into the Jan 19th Fitch upgrade to A- but just kept going into the end of January. This richening had something to do with the pending Italian elections but regardless, the market saw significant further buying versus its primary ‘competitors’ within the EGB mkt. Now it gets interesting. With this ‘fly’ back to its richest levels there are some important considerations to bear in mind:

- Positioning in SPGBs is long here, especially versus BTPS and to a lesser extent OATs. That said, according to dealers, the demand seen of late (especially in the long end) has largely been international players, not domestics who tend to have stronger hands. If S&P disappoints in some fashion, profit taking flows could be rather large.

- Demand for SPGBs out of Japan, as a percentage of EGB demand, rose in early 2018. EGBs hedged back into JPY still look more attractive than USTs and UKTs and with Japan’s new fiscal year just around the corner, we should see renewed demand for all EGBs but especially SPGBs given their improved aggregate credit rating.

- April is a HUGE month for coupon and redemption flows in France which also leads to a larger than average index extension at months-end. Unless France’s AFT decides to lay a big syndicated deal on the market (as they’ve done in April before), it’s safe to assume OATs will be well supported on balance. This could help prevent SPGBs from tightening much vs OATs, especially in the belly of the curve.

- BTPS spreads to SPGBs remain elevated, even with BTPS trading very well despite the political stalemate in Rome. While Italy’s credit outlook isn’t nearly as rosy as Spain’s, it seems logical to expect profit taking on a SPGB driven further widening from here. After all, if GS is right, Italy’s rating should end the year just 2 notches below Spain’s which, we would argue, makes BTPS look awfully cheap at ~+60bps-plus in 10yrs.

- Long Spain has been ‘En Fuego!’ in March with 10-30s flattening sharply vs Italy. This could persist but would suggest the market’s already placed their bets on a Spanish upgrade.

SPGB 10/27s vs OATA and IKA Blend

- Bottom-line is, in my view, there is a good deal less ‘juice’ in SPGBs now than there was back in January when SPGBs began their epic quest tighter. Unless S&P maintains a positive outlook, implying further 2018 upgrades, it feels like this move is largely priced in. Demand out of Japan could help tighten spreads some more vs OATs but closing in on the +40bps level in 10yrs would be stretching things in my view and worth a fade back into the ‘wings’ of the blend.

We’ll be in touch.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: US Rates > Reconciling Short Rates with 210s - Quick Rundown

- This note is meant to elicit comments and discussion than to offer a specific trade idea as we’ll see below. We’ll use charts to help keep this short and sweet.

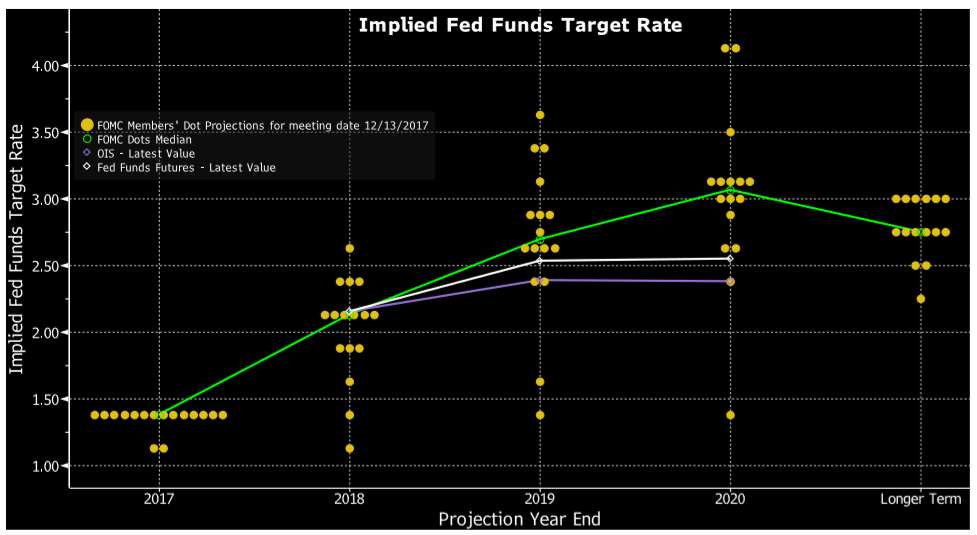

- The FOMC’s last dot plot shows the FOMC raising rates until the funds target hits 3.00% in 2020 although the market isn’t buying it, expecting the funds target to hit a brick wall at 2.50%, in line with most CPI forecasts. There seems little reason to expect the FED to build in a cushion given how stubborn inflation has been which leaves us sympathetic with current pricing. The obvious corollary here is, with the

funds target currently at 1.50% and 3 hikes priced in for 2018, the FED’s hiking cycle should be finished by June ’19 at the latest.

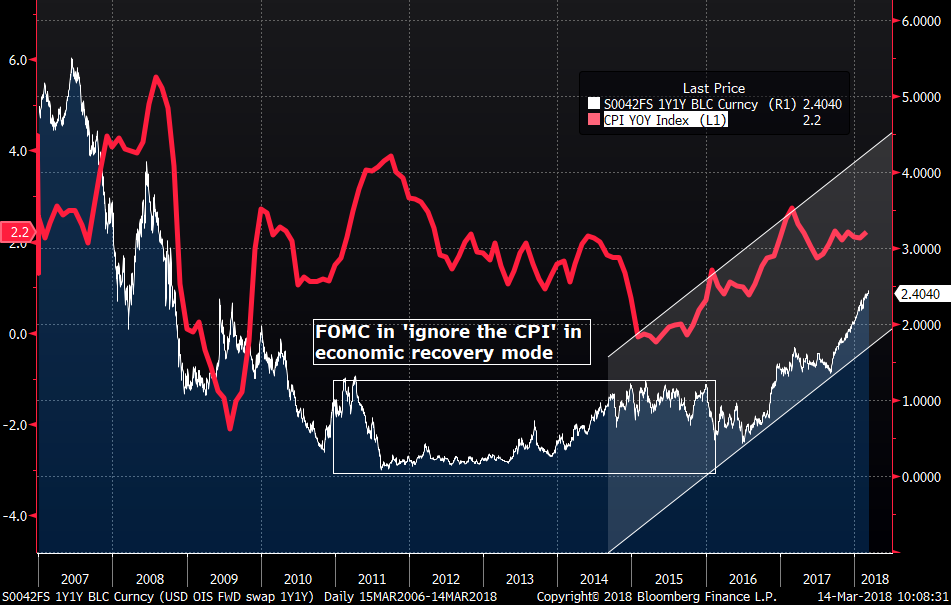

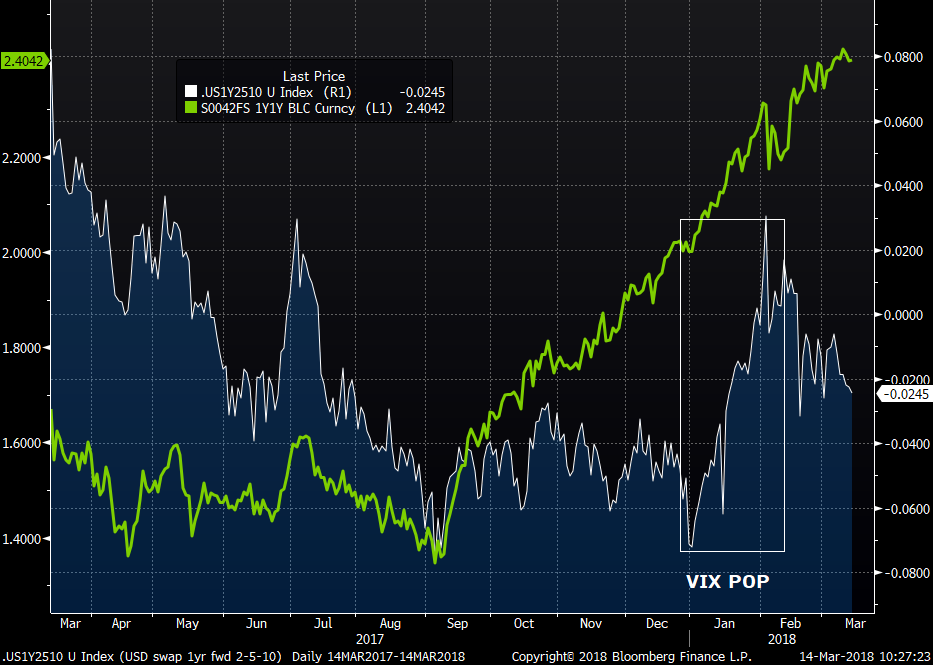

USD 1y1y OIS vs YOY US CPI. After little correlation for most of the last 10yrs, short rates have been tracking CPI pretty well from early 2016 reflecting the market’s anticipation of the FED’s rate hike cycle. With 1y1y OIS at 2.40% and CPI at 2.2% (CORE just 1.8%) and most pundits expecting inflationary pressures to fizzle out by year-end (despite the tax cuts) there seems little impetus to raise rates into negative real rate territory (aka well above 2.50%).

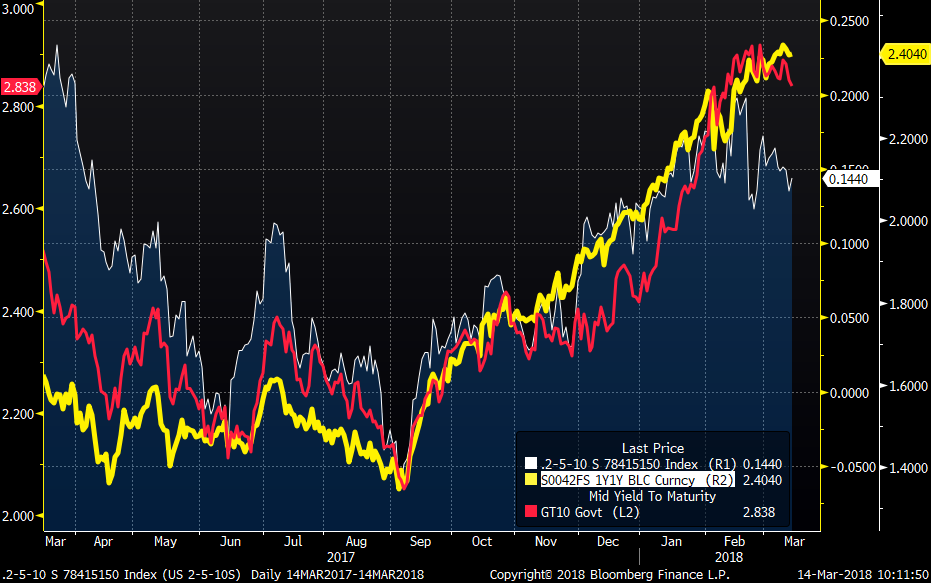

- The chart below is UST 2-5-10s (white) vs 1y1y OIS (yellow) and UST 10yr yields. We can see there’s been a strong correlation since last September, the fly cheapening as rates rose. That all changed in early Feb when stocks had their wobble amid the VIX’s spike, trade tariffs grabbed the headlines and Powell took the reins at the FOMC. The question we’re asking is whether this divergence is justified as the ‘new normal’ or whether 5yrs are too rich here.

- From another angle, 1y fwd 2-5-10s in swaps – a popular trade for the leveraged guys – has snapped back after the FEB spike cheaper, largely due to 2-5s making new lows. Ostensibly, the market’s saying there is little need to build in fears of an inflation spike. The 1yr fwd 2-5s sprd in swaps is just 2.75 bps with spot at 19.3bps, having popped steeper in Feb. The question is, can 1y fwd 2-5s invert? Or perhaps the better question is SHOULD it? What’s worth considering is what happened when the market got antsy? A steepener here is an ‘insurance policy’ of sorts in the event stocks get sick again OR inflation doesn’t cooperate, leaving the FED less inclined to keep their foot on the brake.

1yr fwd 2-5-10 swaps vs 1y1y OIS. OIS could care less what happened at the NYSE but further out the curve things got interesting.

Thoughts… ?

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Quick Thoughts Into Today's ECB Meeting w/charts

- ECB Meeting Today - Quick Colour

- We've been leaning dovish on EUR rates for the last few weeks with the economic data showing signs of plateauing and with the Italian election result inconclusive and a potential trade war brewing, that seems even more justified now.

- From the newswires and opinions of our favourite strategists it appears our take on the ECB has become the consensus view into today's meeting. The collective message is ‘What’s the hurry?’.

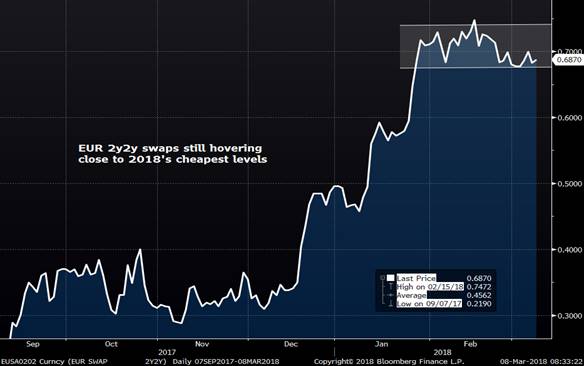

- With EUR 2y2y still hovering just under 70bps and DBR 2-5-10s only 4bps off its late Jan cheapest levels (even with an 11bps rally in DBR 10yrs) market pricing suggests the ECB is merely delaying the inevitable hawkish shift and is unwilling to price in a more dovish stance.

- Clearly, the star of the EGB market over the last few weeks has been Spanish Bonos, tightening sharply to OATs/DBRs over the past week. In addition, our attached note from late last week (MACROCOSM: Euroland Rates A Tough Short Into April) highlighted the wave of coupon and redemption flows that should lend a tailwind to the EGB mkt as we head into April.

- Observations on spreads/curves:

- The 5yr sector on most curves (especially core) remain at the cheaper side of fair but unless there’s a meaningful shift in the view on the timing of a hike (either much sooner or much later), 5yrs are likely to stay that way for the time being.

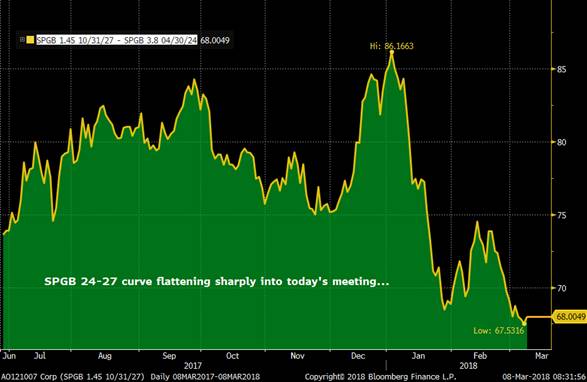

- On some curves – notably, SPGBs – 5/7s into 10s has flattened sharply, the SPGB 4/24-10/27 spread making new lows this week, revealing a growing concentration of longs in the 9-10yr point on the curve. Given the 10yr’s significance as a liquidity point on most EGB curves (largely due to the futures contracts in GE/FR/IT) this bull flattening isn’t surprising but also bears close monitoring as it could present a ‘powder keg’ if sentiment turns bearish.

- The 10-30s sprds on most curves have been remarkably stable for the past couple weeks after a sharp flattening to start 2018. On one hand, one would have expected a bull steepening of 10-30s given demand for 10s vs the belly, however, index extensions were large in Feb and long end supply well absorbed.

- A ‘status quo’ ECB today means the trend is our friend, look for more flattening in the belly and for off the run issues that have lagged the moves (like the BTPS 3.5% 3/30s we like) to show signs of life.

- The 5yr sector on most curves (especially core) remain at the cheaper side of fair but unless there’s a meaningful shift in the view on the timing of a hike (either much sooner or much later), 5yrs are likely to stay that way for the time being.

We’ll be back with more….

Mark

EUR 2y2y

SPGB 4/24-10/27

EUR 2-5-10 swaps

SPGB 10/27s vs IKA and OATA – taking back cheapening in Feb

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: Quick UK Update Ahead of Inflation Report

Gilts... Inflation Report On Tap

> No shortage of opinions on the outcome today but the consensus looks like 'rate hikes coming but no hurry' with a 7-2 vote on a rate hike, both of which seem to be priced into the market.

> Dec MPC - Spot Sonia is 32.1bps this am which prices in 1.28 25bps rate hikes this year, off from a high of 36.3bps (1.45 hikes) last Fri. So, the 'boundaries' would appear to be ~36.5bps on the upside and 25bps on the downside (1.5 hikes vs 1 hike).

> Our belly steepeners are at their s/term highs (7/22-9/24 ~21.9bps vs 19.2bps entry) and 10yr gilts remain at their cheapest levels on the curve (vs 22s and 37s) after last night's disappointing UST 10yr note auction. While a dovish bias would be bullish for the short end, we'd still expect G H8 to see solid short-covering too, richening this fly, especially given how much 27-37s has flattened (even with bounce Mon/Tues).

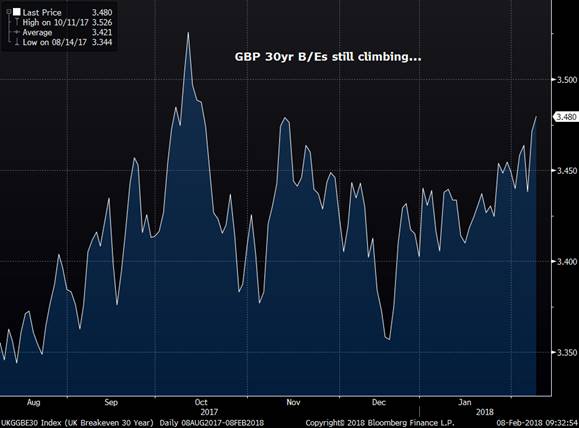

> Inflation breakevens in the UK remain well bid, now at their s/term wides, levels that were resistance in Nov. Structural needs remain supportive but softer than expected inflation ests today could prompt some profit taking.

Charts:

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Reality Check Rattles the Market - Quick Thoughts... w/charts

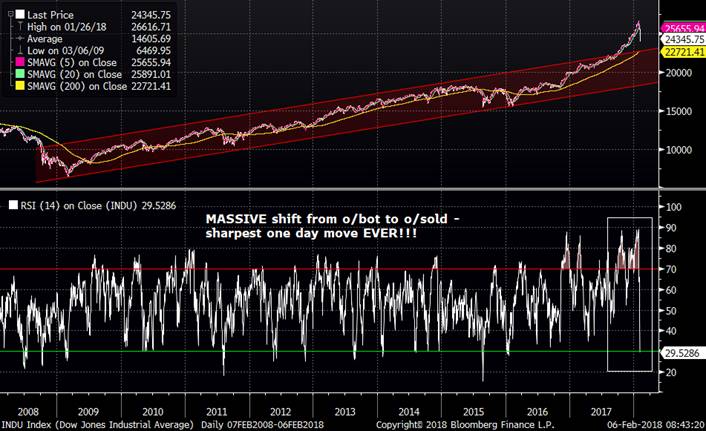

- And here we thought stocks were bullet-proof, protected from the slings and arrows the rates and FX markets were enduring these last couple months. Yesterday’s selloff in the DOW was not only the biggest one day move in history, it was also the biggest momentum shift and one of the biggest events for the VIX.

DOW back 10yrs with 14 day RSIs… HUGE shift

Check this one out – this is the inverse VIX index

- The pop to 2.9% in last Friday’s YOY avg hrly earnings could prove temporary but its timing couldn’t have been worse for USTs and now, equities. Coming after a 13.5% one-month rise in 10yr note yields, the NFP data drove a move to new 4-year highs which finally got the attention of the equity market. Pick your favourite stocks vs bonds barometer and it becomes glaringly obvious that bonds are starting to look more attractive vs stocks than they’ve been in quite a while.

- This morning’s BBG article quoting Paul Tudor Jones is worth a mention too:

“We are replaying an age-old storyline of financial bubbles that has been played many times before,” Jones, founder of Tudor Investment Corp., wrote in a Feb. 2 letter to clients seen by Bloomberg. “This market’s current temperament feels so much like either Japan in 1989 or the U.S. in 1999. And the events that have transpired so far this January make me feel more convinced than ever of this repeating history.”

- Question for you: You’re Jerome Powell and you’ve been chairman of the Fed for all of 2 days and the Dow has it’s biggest one day sell-off in history. You’ve got Tudor-Jones in one ear telling you you’re behind the curve and in the other ear some of the biggest fund inflows into equities in history suddenly under a lot of water. Are you going to bang a hawkish drum and fan the flames of another 5-10% correction in the Dow? Probably not.

- All this volatility will make this week’s refunding all the more interesting. CFTC data tells us there are some chunky shorts out there, 5-10-30s has cheapened to levels not seen since 2014 (when the funds target was 25bps) as 5-10s widened 8.5bps and 10yr USTs are at +206bps vs DBRs after bouncing off 210bps resistance. Our hunch is after the melee we’ve seen over the last week, the market will be happy to cover a few shorts into this week’s supply, particularly if we can cheapen them back up a few more bps. The lower-beta 5-10-30s expression would be a good compromise for those who want to be involved but perhaps sleep better at night.

UST 5-10-30 vs Fed Funds target

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: Conflicting Signals In UK Amid Selloff w/charts

Gilts...

- Conflicting stories for gilts/ GBP in the press this am. On one hand, headlines like BBG's 'May Under Fire as Brexit Reality Sparks Conservative Civil War' are painting an ugly picture of the state of the UK govt which one would assume is bearish for cable and darkens the outlook for Brexit negotiations.

- On the other hand, there are the 'Carney Faces Up to Newly Hawkish Market as Bets on May Hike Grow' and 'BoE Forecasts May Pave the Way for Higher Interest Rate' articles which in theory should be keeping some pressure on the front-end.

- As we saw into the end of last week, the bear-flattening has its limits in both curve and outright yield terms. In other words, once major yield thresholds are broken, the selling becomes broad-based and duration is shed more aggressively, bear-steepening the curve. We saw evidence of this in the UST market too as 5-10s steepened 7bps last week as shorts in TYH8 grew while FVH8 declined.

- With the UKTi 48s coming tomorrow and the US quarterly refunding (3/10/30s) starting tomorrow, I think this bear-steepening in the UK (and US for that matter) can persist s/term. The UKT 0H 7/22 v UKT 2T 24 steepener has stalled at resistance around 21bps after a 1.5bps widening late last week. This looks like a key level before a move to 24bps. (we have seen interest in other versions of this theme)

Charts below.

UKT 0H 22 v UKT 2T 24 curve

G H8 are the most oversold they’ve been in over a year while open interest turns lower…

We’ll be in touch.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: The Buyers Strike In Rates Continues... Quick Colour

- The 2018 sell-off in rates, led by the UST market, has been remarkable in its magnitude and ferocity. To put into perspective, the last time USTs closed higher on two consecutive days was Dec 26-27 when TYH8 closed up ½ point. We could play ‘arm chair quarterback’ (with the Super Bowl this weekend) and debate whether this move was justified or not, but that would be futile. We’re where we are now and need to decipher whether this sell-off continues or whether a round of short covering is looming. Let’s look at some market barometers below.

- This TYH8 chart is illustrative. This is the most oversold TYA has been since Trump’s election win. In one regard, we could look at this latest move as a validation of the post-Trump selloff. What’s significant here is not just the oversold momentum but the almost 700k increase in TYH8 open interest since the last big selloff. (This pop in OI is has been replicated in FV too but not in US/WN.) With the Put/Call ratio still elevated across the curve (with some significant TY puts bought this am pre-NFP), one can assume this return to the highs in OI is the accumulation of new shorts by the spec set. So, even after a ~40bps selloff in 10yrs since the start of the year, the market’s still buying downside protection.

v This BBG article caught our eye this morning: “Bank of America Sell Signal Rings Louder on Record Equity Inflow”

“Investors poured $25.7 billion into equities in the week to Jan. 31, taking the total inflow for the year to a "remarkable" $102 billion, the bank said, citing EPFR Global data.” Even after the 2.2% ‘correction’ in S&Ps into month-end they are still up 5% year to date with the 20-day MA holding as support. The market is clearly making an expensive bet that the impact of the 14% cut in US corporate tax rates will be VERY good for earnings. With open interest mirroring the rates market – only this time they’re longs – one could argue there have been an extraordinary number of bullish bets being made that make these levels vulnerable to disappointment.

v What do USD forwards say? Spot 2-10s in swaps is currently 47bps and 17bps 2yrs forward. Since the Fed started their rate hike cycle in Dec 2015, there has been a mechanical rise in US short rates that has tracked the increase in the Fed Funds target (as one would expect). The chart below of 2yr fwd 2-10s (white line) compared to the FFT (inverted) illustrates this correlation nicely. With the forwards currently 40bps through spot, one could argue that they could flatten further with Fed Funds expected to rise 75bps this year and perhaps another 50-75bps next year.

The green line on the chart is US YOY CPI minus the Fed Funds target rate. The rise in the line from early 2015 to Q1 2017 reflected the long-overdue bounce in CPI back in line with the FOMC’s target rate, a surge that the FOMC must have welcomed given their decision to begin raising rates. What’s interesting on this chart is the convergence of the CPI-FDTR line to the forwards. With the spread currently 60bps (CPI 60bps higher than FDTR) and the market pricing in 3 25bps rate hikes this year, we will end the year with the funds target ~10-15bps higher than YOY CPI. Some dealers (like BARC) are forecasting a mid-year CPI blip up to 2.75% area but that’s not expected to last, fading back to 2.1% by year-end. So, if this year’s 75bps of hikes takes Fed Funds north of CPI, can the FOMC justify keeping their pedal to the metal for another 75bps in 2019 as some have forecasted? Perhaps this is why the forwards aren’t priced as aggressively as they could be. This could also be a reflection of market positioning as duration concerns have now cropped up, the UST 5-10-30s fly cheapening 12bps this month to overbought levels.

UST 5-10-30s

v Speaking of the forwards… The Fed’s rate hikes have forced short rates higher in the US, however, there are some (including yours truly) who think that 2y2y USD rates are looking rather tasty at 2.85% this morning, especially given our back of a cocktail napkin analysis above. This pop to new highs has coincided with a widening vs EUR 2y2y back close to the early 2017 wides, levels that provided significant resistance. Back in early 2017 when we last saw these levels, there was little talk of the end of ECB QE or a relenting of stimulative policies, however, this year it’s different. While the ECB did their best to present a balanced case at last week’s meeting, the market is still expecting a turn to a more hawkish bias in March or, at the latest June. Given the expectation that an ECB rate hike cycle would begin 6-9mos after the end of QE AND would be ‘measured’, there’s little reason to expect a dramatic shift in sentiment. However, short-end positioning in BKOs has already had a blood letting (invoice spreads 15bps cheaper since mid-Dec) and the 2y2y rate would be the ‘sweet spot’ for those looking to price in a rate hike cycle in Europe. The chart below illustrates how ‘out of whack’ this relationship is vs trade-weighted USD which could prove unrealistic given Coeure’s FX comments earlier this week.

v Emerging markets keep on truckin’, another sign of ‘exuberance’…? Chart below is of the EM corporates index spread to govts. This is 1yr of history but if we go back just 2yrs to Jan 2016, we’ll see a spread that was well north of 500bps. While the recent grind to new lows vs govts of 20bps since the start of January pales in comparison to the overall move, this is still a 10% outperformance in a month. In addition, there’s been a 26% increase in the market value of the index over that span. So, there’s still a ton of money going into EM equities (as above) but that demand is also replicated in EM rates where liquidity can be ‘challenging’ at best when the wheels fall off.

v We will resist the temptation to call the lows here, treacherous before a NFP release and given current momentum. However, we are mindful of the extremes the market is currently presenting us which, historically, have proven unsustainable without considerable catalysts.

I’d love to hear your thoughts.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: SPGB and FRTR Supply This AM... Quick color

Just under the wire!

Quick color > SPGB supply at 9:30am

> Broadly speaking, Spanish bonos performance since mid-Dec has been extraordinary, accelerating richer post their Fitch upgrade. So, from a cross mkt basis vs other EGBs, it's tough to suggest they look 'cheap' s/term.

> SPGB .05 21 - This is a domestics driven issue where they park cash and with its yield at its highest since Oct, it will go fine.

> SPGB 2.15 10/25 - We like this issue on the curve (as per our note on Tues) and expect it to be well supported given the cash flows into SPGBs we've seen. The 24-25-26 fly we recommended has richened about a bp so not quite as juicy as we'd like but we still think the issue's relatively cheap, especially if the flattening momentum wanes a bit.

> SPGB 4.7 41s - The 'fly' vs FRTR 4/41s and BTPS 9/40s has richened ~70+bps since mid-Dec and 10-30s. Cheap, no? But they rarely tap these off the run issues without knowing there's an audience out there.

Quick color > FRTR Supply at 9:50am...

> After a remarkable performance in Q4, OATs have been pretty quiet to start the year. The Japanese buying that drove much of the tightening (by their own account) has largely been absent as issuance has kicked in, the mkt has sold off and sister markets like SPGBs have taken the spot light. This am's long-end supply adds a big chunk of duration into a market lacking C&R flows.

> FRTR 5/28s > This issue has underperformed on the curve over the past week, as 10-30s has pancaked 12bps post the ECB meeting and almost 20bps since the start of Jan. This flattening move is directional as 23-28-48 has shot cheaper in this selloff (overdone on any momentum indicator) which could attract some interest for those who think rates are too cheap. The lower beta version of this dip buying is to buy the FRTR 5/28s vs FRTR 5/30s, currently at the 2018 lows at 11.8bps. We'd expect decent support at these levels.

> FRTR 34s > new 15yr coming. This is a sector that goes from fair to rich, rarely cheap. The 1.25% cpn matches the 36s and at +16.5bps vs the 31s, that puts them about 9bps rich vs the 36s. So, at roughly 5bps a year between the 31s and 36s, that seems about fair-ish. The auction format adds a bit more risk to the event and, as above, 10-15/20s has flattened and 28-36-48s is at its 2018 lows at 12.8bps, 4+bp richer in the last week. So, this isn't compelling to me on an RV basis, unless you want them vs 48s or on sprd to SPGBs.

> FRTR 1.75 66s > 48s-66s has flattened 1.2bps in the last 2 days to 13.6bps, flattest since Oct. Small tap, should go ok given tightening of SPGBs and BTPS to FRTRs.

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796