MICROCOSM: New OBL 177s > Should See Solid Demand

- OBL 177s Auction today... Quick thoughts:

- 4bln expected, roll vs OBL 176s quoted +9.75bps.

- Since the start of January the OBL 176s have cheapened 18bps in yield, 6.5bps vs swaps and 11.5bps vs 10s (in the last week).

- With the roll here, this will be the first OBL auction with a positive yield since Sep 2015 which coincides with a large index extension in Germany of .21yrs today. At the margin both of these factors should be supportive for demand today, however, indexes that add issues on settlement date won't include these new 177s in January (they settle Feb 2).

- As for the roll, +9.75bps is a smidge cheap (maybe .5bp) on the OBL curve but less supportive when we compare them to higher cpn old DBRs where spreads are roughly the same.

- At 4bln this auction should see solid demand. There should be interest in flatteners, dealers will see this as a good oppty to pad their auction stats and the positive yield is an obvious attraction into index needs.

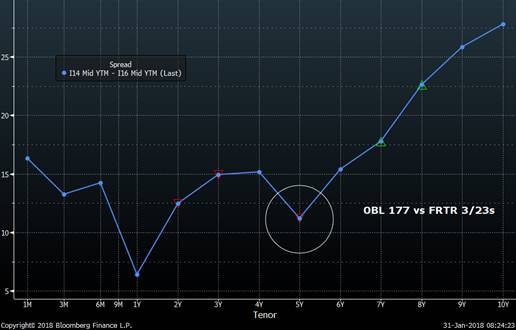

- We expect to see interest to sell FRTR 0 3/23s to buy these new OBL 177s. The FRTR 3/23 vs DBR 2/23 sprd trades at ~16.5bps this am. Two months longer into these OBL 177s and that sprd collapses to around 11.5bps, making it one of the tightest sprds to DBRs on the curve... Similarly, 5yr sector NETHER issues like NETHER 1.75 7/23s could be candidates to sell into these OBL 177s with the yield sprd likely to be inside of 8bps even with a higher cpn and 3 months longer maturity.

OBL 176 vs swaps

OBL 176 Yields w/OBL 177s level noted

FRTR curve vs DBR curve to 10yrs

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

TACTICAL UST LONG Into Month-End > S&P vs UST Index

Trade Idea: Buy T 2.25 11/24 (TYH8) vs sell T 1.75 5/22 (FVH8) and T 2.25 8/27 (UXYH8) at +12.6bps, targeting +9.5bps, stop 13bps.

- The sharp divergence between equities and fixed income this month sets off alarm bells for multi-asset pensions and asset managers. Credit Suisse research (among others) estimates that there could be a total of $24bln worth of equities ($12bln in S&Ps et al, $9bln in international and $3bln in emerging market) that will be sold to move into fixed income by month-end.

- While there are a myriad number of potential homes in fixed income for these flows (USTs, corps, MBS, DBRs, etc etc), we are taking the simple view that the back-up in UST yields to their cheapest levels since April 2014 will attract ample buying interest (at least initially). This isn’t likely to be a ‘lay-up’, however, as Wednesday also coincides with Yellen’s final FOMC meeting where a number of dealers (including GS in this am’s BBG article) think the tone of the statement will be more upbeat than usual, raising fears of a more aggressive path of rate hikes than the current 3 X 25bps priced in. We’re less inclined to jump on that bandwagon as Powell is just getting started and UST rates/curve are already at extremes.

- The modified duration of most UST agg indices, after Wednesday’s .05yr index extension, will be ~6.25yrs. This coincides with 7yr issues from the T 2.125 11/24 to the current T 2.5 1/25 benchmark. We’ve observed across many sovereign curves that the issue/sector closest to the mod duration of the index outperforms the curve when there is significant demand, a reflection of the needs of passive investors. This UST maturity coincides with the CTD into TYH8, a point of huge liquidity on the UST curve.

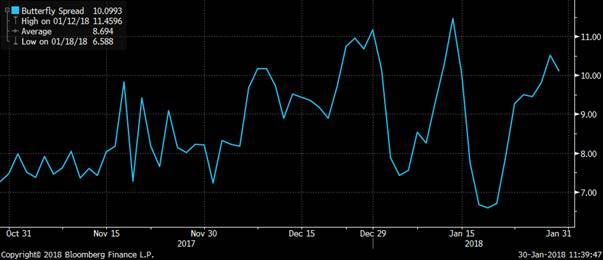

- From an RV perspective, the curve from 6yrs-7yrs is very flat, separated by barely 2bps in yields and MMS space. As this is a tactical, micro, short-horizon position, we are less concerned with roll-down and carry as we are with the location of the fly vs its wings. In this position, the 5yr-7yr leg has remained relatively steep while the 7yr-10yr has flattened back to the mid Jan lows. Given the legs are ~+18bps and ~-6.5bps, this position has an embedded flattening bias which, with the FED likely to remain at worst neutral on Wednesday, makes sense to us. As tempting as it is to put on a steepener here, we’ve seen too many train wrecks of late trying to fade the flattening move. These issues are the current March CTDs which also offers the option to execute some or all of the position in futures rather than cash. The chart below shows the fly is back to a level that has held since September, despite the market’s gyrations. If ~2bps isn’t worth your trouble then look at the short leg and put on the flattener where we’d expect to see more movement, especially in a month-end rally.

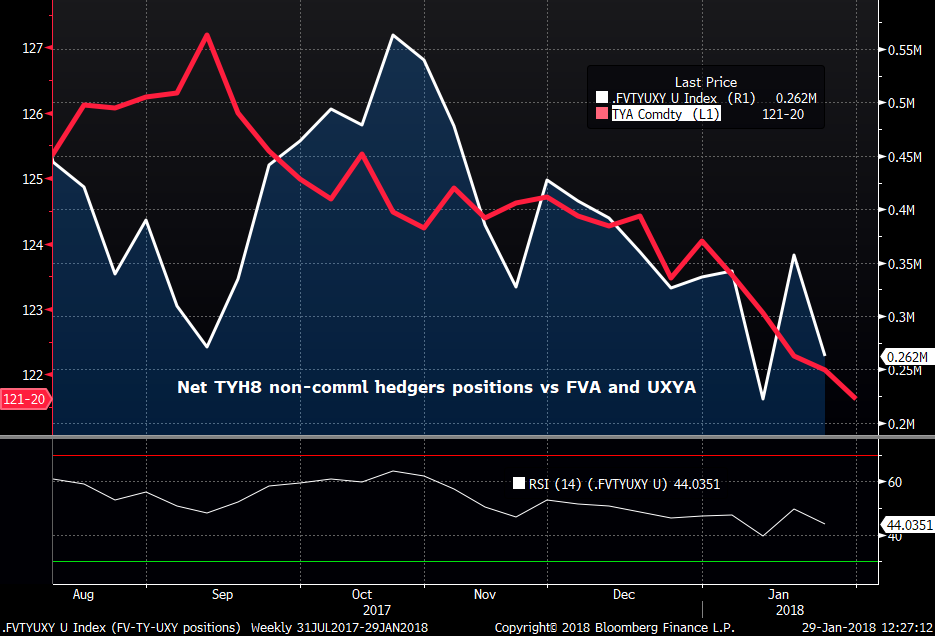

- Lastly, positioning data in the most recent CFTC futures report shows non-commercial hedgers have increased net shorts in TYH8 (-28.6k) while reducing FVH8 shorts (51.2k) and increasing UXYH8 longs (14.4k). This is the equivalent of an increase in market shorts in T 2.25 11/24s of 3.6bln while FVH8 shorts have declined by 4bn (11/24 equiv) and UXYH8 longs increased by +2.7bln. The chart below illustrates this growing imbalance and is reflected in market levels of TYH8. So, it’s reasonable to expect that a bounce in the market would result in TYH8 short covering vs at least the longer leg of this fly where the position looks most overdone.

Charts:

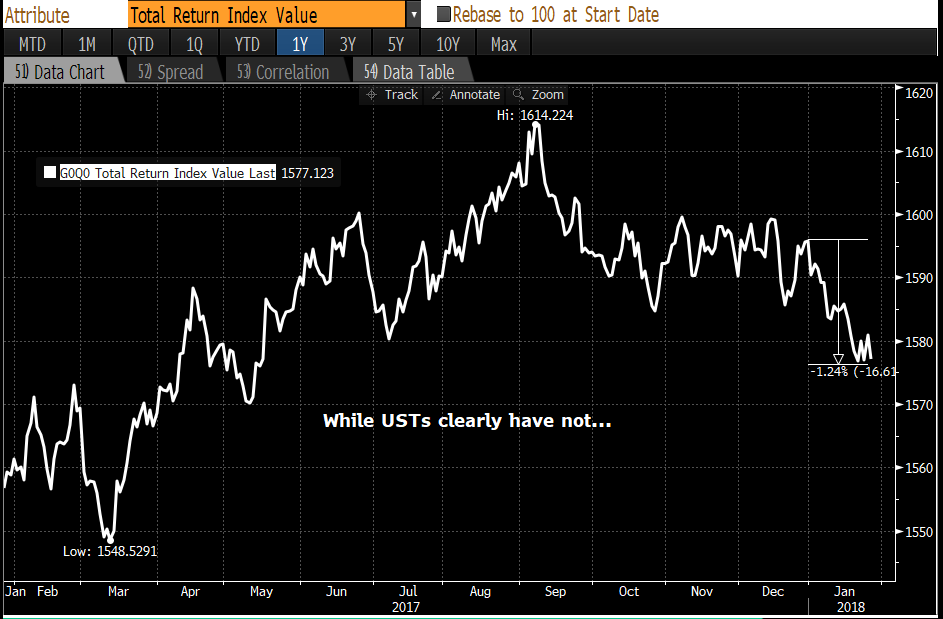

S&Ps up 7.75% this month, a total return of 25.4%.

UST Agg index has had a total return of -1.25% this month…

T 5/22-11/24-8/27 fly

I’ll be in touch.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: International Flows Data in GBP > Gilts RV Implications

Non-Resident purchases of gilts data reported this morning...

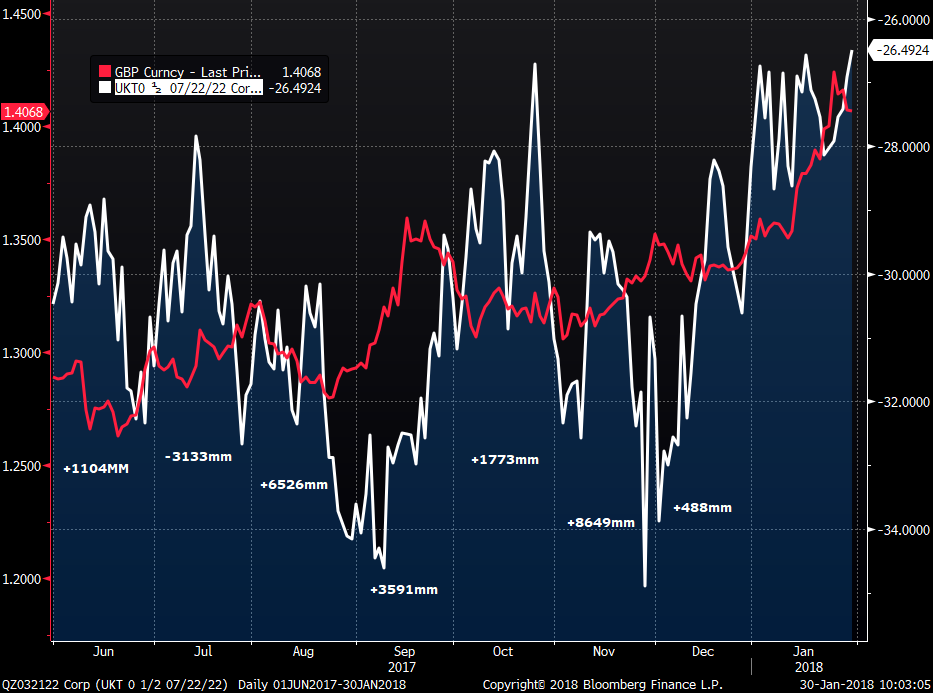

Here's an interesting graph of UKT 0H 7/22 MMS sprds with GBP overlaid and monthly purchases data indicated...

We can see a rather high correlation of these flows and the level of rates/spreads in gilts. With GBP making new med-term highs and 2-5yr UKTs cheapening sharply vs swaps in January, we can expect low/negative intl flows in gilts this month.

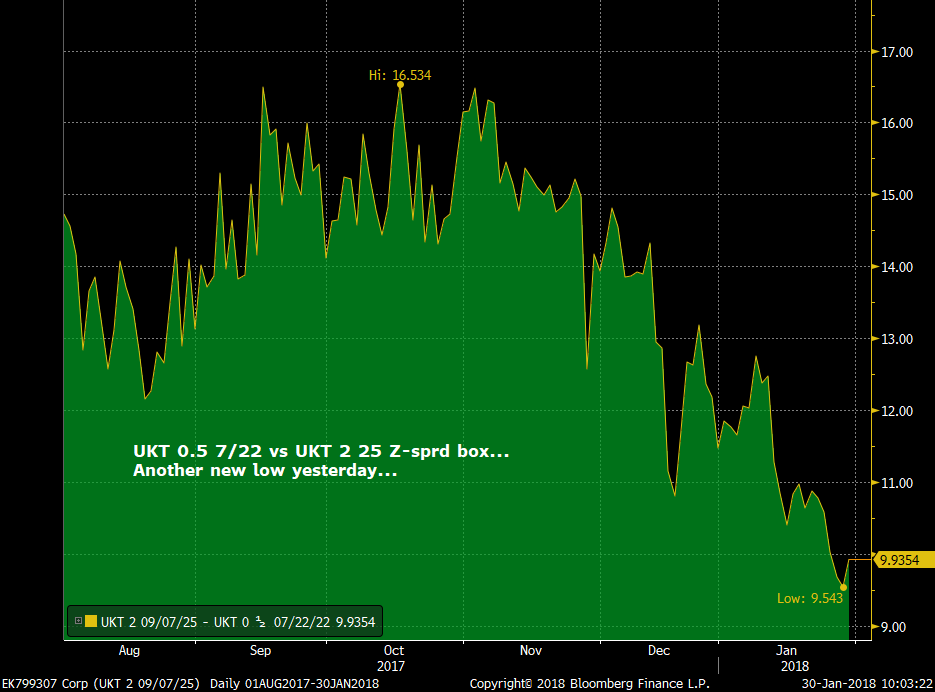

Much of the front-end activity in UKTs is driven by central banks who are not necessarily as nimble as HFs or banks when it comes to changing their currency allocations. That said, once they are done, they have a 'clean slate' into the following month. So, some Feb stability in advance of the March APF reinvestments could, in theory, drive a round of short covering from leveraged accts. Location is very tempting for outright longs vs swaps or MMS steepener boxes like UKT 7/22 vs UKT 9/25s which made new lows yesterday.

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: SPGB 10/25s Are Cheap Into Tap > Trade Ideas

Trade Ideas:

- Bullish Credit: SPGB 2.15 10/25 vs SPGB 1.5 4/27 steepener against BTPS 2 12/25 into BTPS 2.2 6/27s flattener box

- Bullish Credit: Long SPGB 2.15 10/25 vs SPGB 2.75 10/24 and SPGB 1.3 10/26 as butterfly

- Bearish Credit: SPGB 2.15 10/25 vs SPGB 1.5 4/27 steepener against FRTR 1 11/25 into FRTR 1 5/27 flattener box

- Bearish Credit: SPGB 2.15 10/25 vs SPGB 1.5 4/27 MMS box

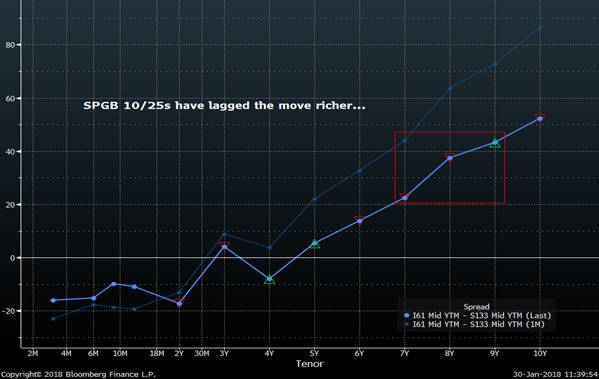

- With SPGBs very well bid since the start of January, the challenge is finding an issue/sector that’s not already rich. The SPGB 2.15 10/25s, tapped on Thursday, have lagged much of this move tighter/flatter and look primed to come back into line once the taps are out of the way. While we have a constructive view of Bonos medium-term, we are also mindful of how aggressive SPGBs have tightened this year and there are likely those who would be keen to take profits and/or oppose this momentum. So, we offer a handful of permutations above that we like from a location & macro perspective.

- Bullish Credit: SPGB 2.15 10/25 vs SPGB 1.5 4/27 steepener against BTPS 2 12/25 into BTPS 2.2 6/27s flattener box

BTPS have cheapened sharply vs SPGBs over the last few weeks, accelerating post-Spain’s ratings upgrade. While the March election in Italy looms over the BTPS market over the next 6 weeks, there are those who think current spreads to SPGBs are too wide. This box should work well if BTPS sprds to SPGBs compress from here. Liquidity would likely be best between today and tomorrow as cash flows are supportive for both markets.

- Bullish Credit: Long SPGB 2.15 10/25 vs SPGB 2.75 10/24 and SPGB 1.3 10/26 as butterfly

This is a plain-vanilla fly that isolates the cheapness of the 10/25s. (Charts below)

- Bearish Credit: SPGB 2.15 10/25 vs SPGB 1.5 4/27 steepener against FRTR 1 11/25 into FRTR 1 5/27 flattener box

The chart below shows that the SPGB sprd has flattened sharply, now almost flat the OATs. This has been a ‘boundary condition’ (one of Mr Rice’s favourite expressions) for this spread since August and looks like an interesting way to fade this flattening move.

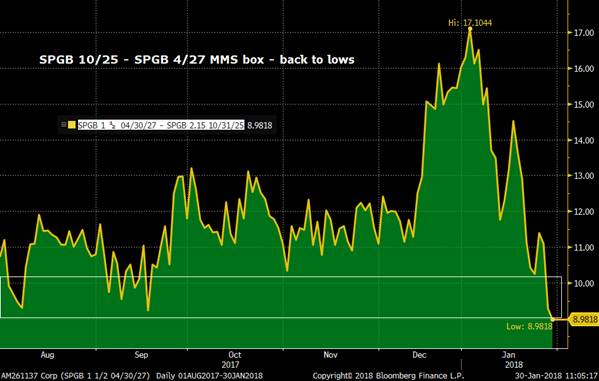

- Bearish Credit: SPGB 2.15 10/25 vs SPGB 1.5 4/27 MMS box

Similar reasoning as the OATs version with better liquidity and less balance sheet.

SPGB 0-10yrs vs EONIA – richened over the past month but SPGB 10/25s have lagged.

SPGB 10/25-4/27 vs BTPS 12/25-6/27 box – SPGBs far flatter now than BTPS curve

Same as above, different way to illustrate it. BTPS steep vs SPGBs

SPGB 10/25-4/27 vs FRTR 11/25-5/27 box – Spain has snapped flatter, now back to almost flat vs OATs.

SPGB 25-27 MMS box has made new lows this week…

SPGB 10/24-10/25-10/26 fly

Would love to hear your thoughts…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

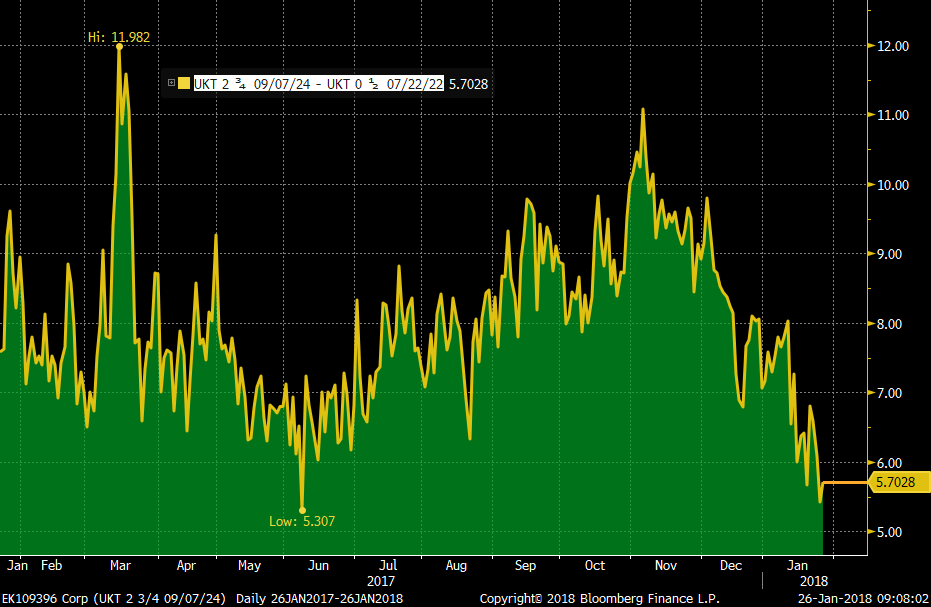

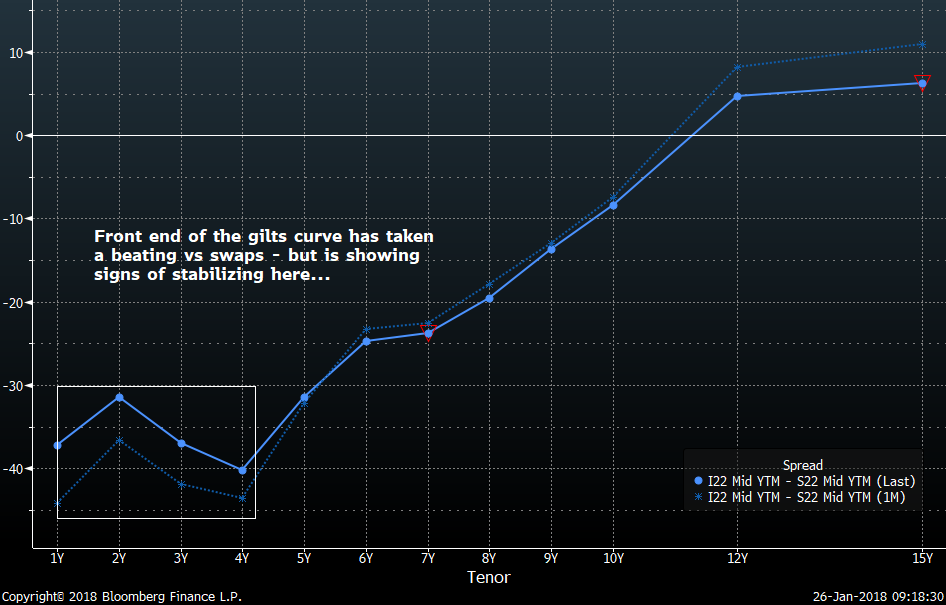

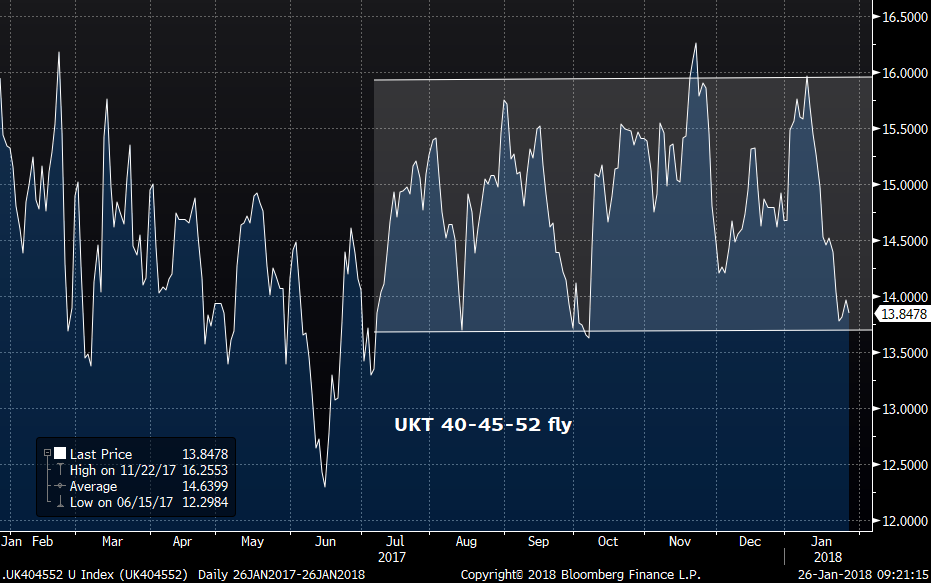

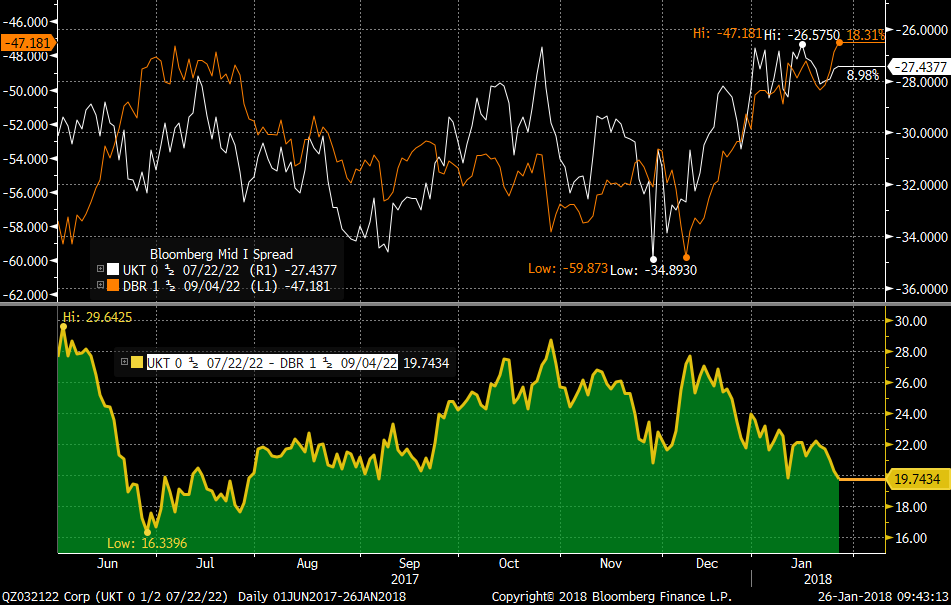

MICROCOSM: Gilts Update - Short-End Stabilizing w/charts

- UK...

Themes: Short end UKT MMS sprds stabilizing

20yr sector remains well bid, tracking GBP

Gilts outperforming DBRs, especially 5yrs – watch MMS box

- Front-end UKTs have stabilized vs swaps even with GBP hovering north of 1.42. A couple dealers are on board with our call that the worst is over here, not just from a positioning view but the wave of GBP corp/SSA issuance is likely to subside. The UKT 0H 7/22s are the focal point here as they're the first liquid point in the eligible basket of short gilts into the Mar APF. A simple expression that's at the sprd/box lows is buying UKT 0H 22s vs UKT 0T 23, the curve now 13.3bps and box ~6bps or even more pronounced is 0H 22 vs 2T 24, better roll and more extreme move. If you’re wary of steepeners given flattener momentum, look at selling UKT 2 25 vs buying UKT 0H 22 and UKT 4Q 27 – currently at 7mos lows. (see below)

- Our short UKT 3H 45 vs UKT 4Q 40 and UKT 3T 52 tactical fly is hovering at the bottom of its recent 2.5bps range. It’s a micro fly that trade that should cheapen if the curve steepens.

- The 20yr sector continues to trade very well, led by big extension trades out of 10s. With the only supply 10yrs and longer until fiscal year-end in the long-end (linker 48s, UKT 57s then 47s) and UKT 1T 37s yields 15bps cheaper than in mid-Dec, we expect to see continued buying of this area of the curve. It looks overdone but is likely to remain that way – buy this area on any dips. Chart below of 25/100/75 weighted fly shows sprd at extremes – but little sign of relenting as cable remains well bid. Unwinds of cable longs could prompt profit taking here.

- UKT 5yrs (7/22) are outperforming 5yr DBRs (9/22s) in this bear flattening move in DBRs, the yield spread tightening ~6bps since Wed. Given momentum in DBRS right now, this spread move could continue, especially if we’re right about UKT 7/22s (as above). That said, this is the tightest this box sprd vs MMS has been since August as the selloff in 5yr DBRs vs swaps has been remarkable, at ~13bps since mid-Dec. So, we like this tightener but admit location isn’t ideal.

Charts:

UKT 0H 7/22 MMS

UKT 7/22 vs UKT 9/24 MMS box

UKT 2 25 vs 0H 22 and 4Q 27

UKT 27-37-47 fly (25/100/75 weighting)

UKT 0H 7/22 vs DBR 1.5 9/22 MMS box

I’ll be in touch.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

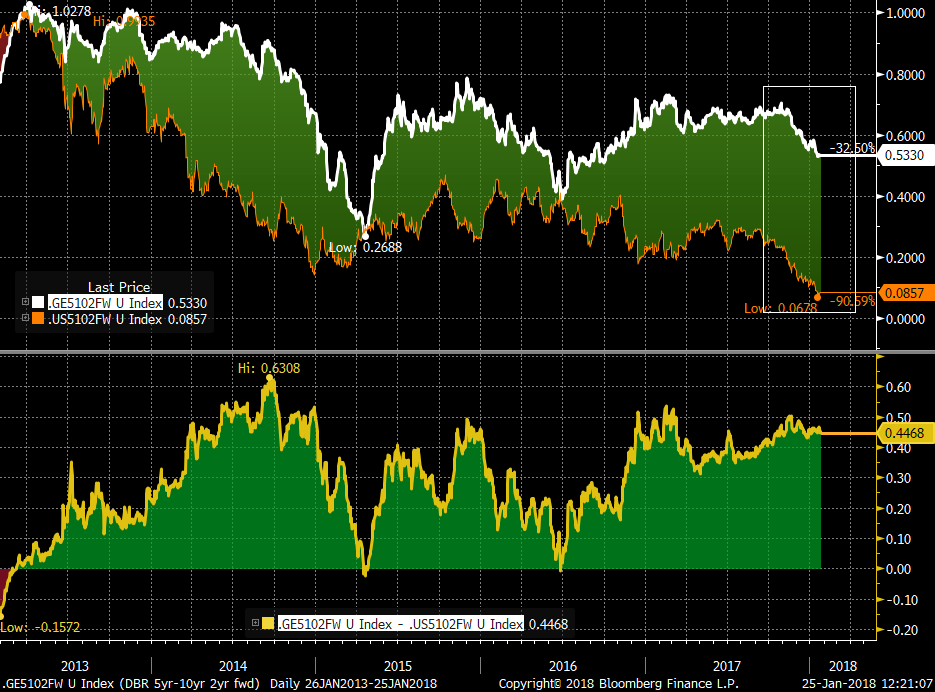

MACROCOSM: US, DBR and BTPS - a look at 2yr fwd 5-10s

- Thoughts post the ECB meeting…

Themes: DBRs into USTs positions – 5-10s

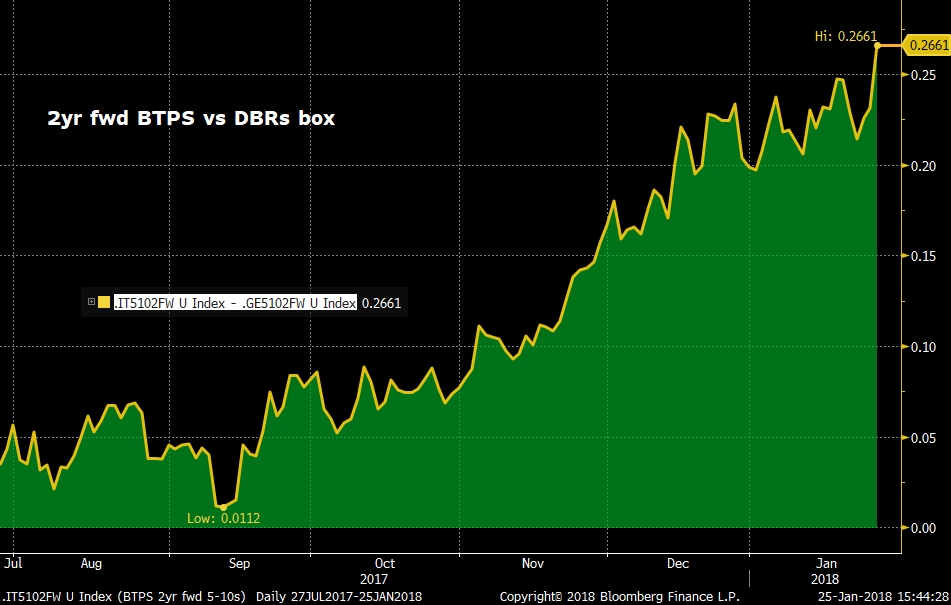

BTPS curve looking too steep vs DBRs here

5yr sector could have dangerous level of positioning

More flattening of the curve to come – but will it happen fast enough to pay for itself?

- Going into today’s meeting the market appeared to be expecting a neutral outcome: recognition of the Eurozone’s positive momentum balanced with disappointing inflation data and the stronger Euro’s tightening bias. That said, the growing chorus of strategists who think Draghi will set the table for a slowing of accommodation at the March meeting have been influencing market sentiment. This has begun to be reflected in the short end of the curve as evidenced by the ~15bps hike in the depo-rate priced in for Mar 2019, ~6 mos after the expected end of QE.

- With UST-DBR spreads in the belly of the curve at/near the recent wides (especially in 5yrs), we were tempted to buy USTs and sell DBRs, not just because the USD looks so technically oversold but because a sign that Europe will become better aligned with the US should mean higher DBR yields vs the US. Frankly, we couldn’t type fast enough to finish this note pre-ECB as EGBs have cheapened 3-5bps vs UST (10s). That’s a hiccup in what could be a far greater move though.

- We took a look at the UST 5-10s sprd vs the DBR 5-10s spread, both spot and 2yrs fwd (charts below, back 5yrs). We can see from the first chart that on a spot basis, DBR 5-10s has bear-steepened a bit to start the year while the UST curve has bear flattened, exacerbating the widening of USTs to DBRs in both 5s and 10s.

- In the second chart of the 2yr fwd 5-10s box, we can see that the DBR curve has flattened since the start of the year, reflecting the steepening of the eonia curve and the market’s view that in 2yrs time the ECB will be well into their rate hike cycle. With the UST 5-10s a mere 13bps flatter than spot (21.5 – 8.5), far less than the annual carry and roll of a 5-10s steepener, one could argue the market doesn’t expect the Fed to still be hiking in 2yrs time. With the funds target current 1.5% and inflation barely 2%, one could argue the Fed could be done raising rates by the end of 2018 so, the UST forwards are perhaps even a touch too flat.

- There are two questions here: Should the 2yr forward 5-10s sprd run out of room to flatten if/when the spread gets to zero? And secondly, Will the 2yr fwd DBR 5-10s sprd accelerate flatter, dragging the spot curve with it?

- The answers appear to be ‘probably’ and ‘yes’ respectively, judging by the market reaction to the ECB. In order for these curves to align more closely we’ll need a sign that the first rate hike could come sooner than later but we’ll also need a sign that market positioning is so offsides that the spot spread volatility will be high enough to compensate us for the negative carry in the flattener. Given the tone of the market for the last few weeks, the market doesn’t appear to have too many trapped longs on a broad basis, especially with the ECB’s PSPP program still at it, even if it’s a scaled back version.

- However, many of the EGB longs are currently in the 5yr sector, reflecting the weight of 10yrs+ supply in January, the shape of the curve, etc. So, while there may not be a duration- driven need to sell, there could be a rates policy reason that could spark 5 vs 7/10s flattening moves, in sympathy with the moves seen in the US and UK.

- The bull in the china shop here is Italy. The BTPS-DBRs 5-10s box is at extremes both spot and forward, despite an almost 30bps tightening of BTPS-DBR 10yr sprds since the start of the year. This highlights the weight of positions in the 5yr sector of the BTPS curve and their vulnerability to a big selloff and secondly, the relative cheapness of 10yr BTPS vs core (and even Spain here) that could prompt a bull flattening move if the election result is tamer than expected. We have seen some interest in this box trade which should reach a crescendo into the pricing of the new BTPS 10yr/Feb 1 C&R flows.

- The answers appear to be ‘probably’ and ‘yes’ respectively, judging by the market reaction to the ECB. In order for these curves to align more closely we’ll need a sign that the first rate hike could come sooner than later but we’ll also need a sign that market positioning is so offsides that the spot spread volatility will be high enough to compensate us for the negative carry in the flattener. Given the tone of the market for the last few weeks, the market doesn’t appear to have too many trapped longs on a broad basis, especially with the ECB’s PSPP program still at it, even if it’s a scaled back version.

Thanks – I’ll be in touch.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: SPGB 10yr Syndication and a CRUDE Look at Sov Ratings

SPGB 4/28s syndication today with market expecting 8-9bln, in line with the last two new 10yrs.

I have to admit I am a tad surprised how resilient SPGB 10/27s have been in light of the new 10yr. 5-10s in SPGBs has been bull flattening (just a couple bps off the Dec lows now) and sprds to IKH8 have been stubborn around the 67bps level, about 2bps wider than Friday. I was also surprised to read some dealers/clients were surprised by the Fitch upgrade Friday which we thought was well priced into spreads.

We know there's a C&R flow hitting the SPGB mkt of EUR 26.3bn on Jan 31st (the likely settlement date of today's 10yr) which is certainly supportive for SPGBs. Even with that support it's unusual to have little to no concession at all for a deal this size though. We still have a good deal of potential market risk between now and the end of the month with the ECB meeting on Thurs and one would think after a move like this that the market’s leaning long-ish SPGBs.

We're monitoring this closely because right around the corner is a likely new 10yr BTPS issue next week.

Just for grins, lets see where 10yr benchmarks are trading relative to each other with their ratings noted. (I’ve used Fitch since they’ve been most active of late). There will be some curve mismatches given the maturity of their benchmarks but you’ll see below that there would appear to still be some room for further spread compression, particularly since Spain and Portugal are expected to be upgraded again this year.

|

Country |

Issue |

LT Sov Rating |

Yield |

Sprd to DBR |

|

Germany |

DBR .5 8/27 |

AAA |

.544 |

|

|

France |

FRTR 0.75 5/28 |

AA |

.819 |

+27.5 |

|

Italy |

BTPS 2.05 8/27 |

BBB |

1.886 |

+134.2 |

|

Holland |

NETHER .75 7/27 |

AAA |

.584 |

+4.0 |

|

Spain |

SPGB 1.45 10/27 |

A- |

1.349 |

+80.5 |

|

Ireland |

IRISH .9 5/28 |

A+ |

.932 |

+38.8 |

|

Portugal |

PGB 2.125 10/28 |

BBB |

1.859 |

+131.5 |

|

Austria |

RAGB .75 2/28 |

AA+ |

.63 |

+8.6 |

|

Belgium |

BGB .8 6/27 |

AA- |

.68 |

+13.6 |

|

Finland |

RFGB .5 9/27 |

AA+ |

.652 |

+10.8 |

|

Slovenia |

SLOREP 1 3/28 |

A- |

1.011 |

+46.7 |

|

Greece |

GGB 3.75 1/28 |

B- |

3.775 |

+323.1 |

So, let’s make some CRUDE approximations here. If we tighten up the maturity mismatches a bit and compare the DBR 8/27s to the FRTR 10/27s (for example) we get a spread of ~21bps or about 10.5bps per ratings notch. At the other end of the spectrum, Italy’s BBB rating is 8 notches below Germany’s AAA rating. If we apply a similar 10.5bps spread per notch that France trades at, we’re left with a spread of about 85bps over DBRs, or, versus Spain, BTPS should trade about 21bps cheaper, not the current ~54bps the BTPS 8/27-SPGB 10/27 sprd trades at. Even if we widen the per notch spread to 15bps we’ve still got plenty of room there.

Clearly, there are risks embedded in these crude assumptions (politics, supply, etc), however, much of what drove the extraordinary tightening of Portugal’s spread to Germany last year was improvements in Portugal’s fiscal outlook which was captured and applauded by the ratings upgrades. With the Italian election likely holding BTPS back a bit before March (even though 5 Star said they don’t want a referendum on the EU) the market seems to want to make Spain this year’s Portugal and at 4 notches below France (who are not expected to be upgraded this year, given their borrowing needs) there seems room for further spread narrowing from here.

Thoughts…?

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796