MICROCOSM: GILTS > Where's the LIQUIDITY? Quick Roadmap...

Here's a message I just put into the chats of some of our favourite UK Gilt Edged Market Makers (GEMMs):

Hiya... We've noticed an appreciable deterioration in gilts liquidity in the last couple weeks which has hampered our ability to get biz done. In an effort to remedy this, we'd like confirmation of the MOST LIQUID issues on the curve. Can u confirm these for us pls?

UKT 1T22

UKT 0T23

UKT 0F25

UKT 1Q27

UKT 0R30

UKT 4T30

UKT 1T37

UKT 1Q41

UKT 1T49

UKT 1T57

Any amendments to this list appreciated! Thanks

Here's what came back (Issues in black are NOT as liquid, Red issues ARE):

UKT 1T22

UKT 0E23

UKT 0T23

UKT 0F25

UKT 0E26

UKT 1Q27 *

UKT 0E28 **

UKT 0R30

UKT 4T30 ***

UKT 1T37

UKT 1Q41

UKT 1T49

UKT 0F50

UKT 1T57 ****

UKT 1F54

UKT 0H61

UKT 2H65 (the ultras curve is 0F50-2H65)

- The 'break in the curve' is between the 26s and 27s I am told, hence the volatility in the sprd of late relative to the market direction.

** The 0E28s are becoming more liquid as they're built up but still not as good as the 0E26s.

*** Despite being the CTD into G A contract, the issue can be a pain to trade.

**** 1T57s are a huge issue but are a challenge to trade which may explain why they trade cheap to the curve.

The rest of the curve is certainly tradeable but will often require an axe. The short-end, due to the negative rates concerns and balance sheet involved, has been more challenging and spreads have widened of late. So, we will endeavour to keep this list in mind when devising our RV trades going forward. Using these points on the curve might help improve liquidity and the performance of micro-RV.

Best,

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: Shifting Tone of Brexit and Impact on GILTS (w/TRADE IDEAS)

Scroll to the bottom for trade ideas.

GILTS... Crossroads?

- Over the last 3-4 days we've had reports of progress in Brussels as both sides make concessions in an effort to close a deal as the deadline nears. While significant hurdles remain, at least the tone sounds more civil and cooperative.

- The question markets will be asking is 'What kind of deal will it be and where does it leave the UK?'. Commentaries like the one this am from Bloomberg's Therese Raphael (click here) suggest it'll likely be a stripped down deal that leaves the UK less well off, at least for the next couple of years. Removing the 'no-deal' scenario from the equation could be the most positive thing about it, especially if we read the left-leaning Guardian this am.

- With Oct-Dec job losses expected from the end of the furlough scheme and consumption expected to take a hit as C-19 restrictions return across much of the country, there will continue to be a cautious economic outlook simmering beneath the surface, regardless of the outcome of the Brexit talks.

- The drivers of the gilts mkt into next qtr are Brexit, the economy, fiscal/monetary support (gilts supply and negative rates pricing) and the BoE's 'More QE or no QE?' dilemma. Until this week, these added up to a bullish outlook for gilts as Brexit talks looked doomed but the improved picture dials that down a notch as the BoE is less likely to extend QE and go down the rabbit hole of negative base rates if Brexit risks have been reduced.

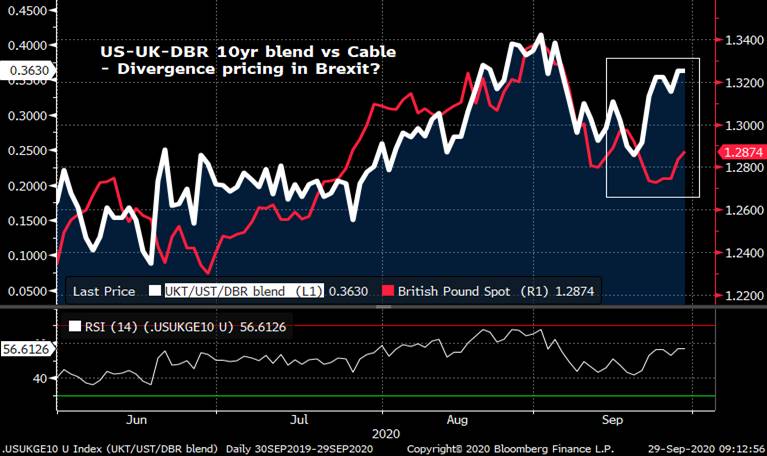

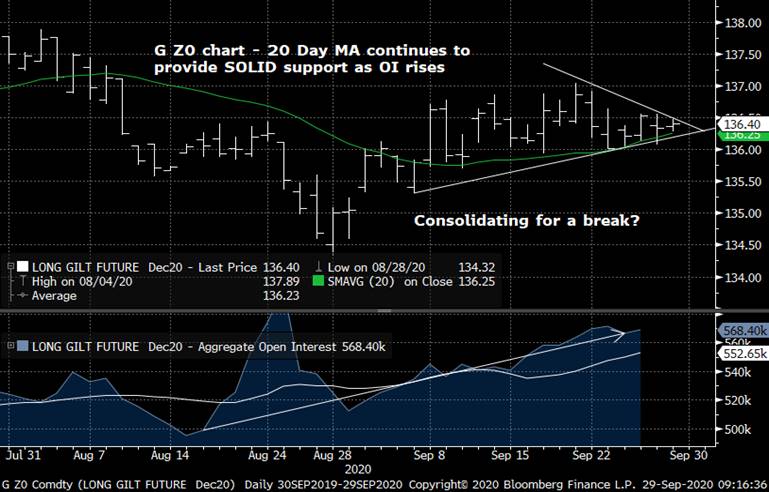

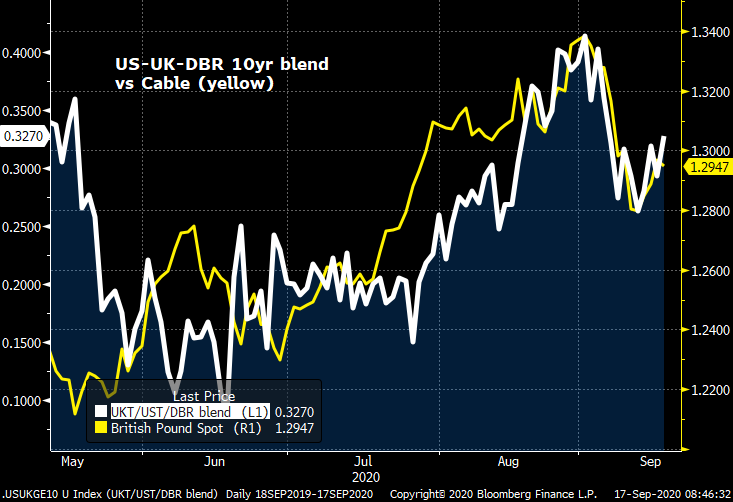

- We have seen evidence that this more positive outlook is being priced into gilts. The chart below of the US-UK-GE 10yr blend shows gilts have cheapened 12bps in the last 10 days while GBP has bottomed. The 10-30s sprd, which has been well-correlated to GBP levels since mid-May, has yet to shift steeper, however, a reflection of positive cash flow dynamics of late and hopes of more stimulus. Open interest in G Z0 has risen to new 1yr highs over the last few weeks, reflecting rising hedging needs and balance sheets.

- We are mindful of the positive APF vs gilts supply dynamics this week as net auction DV01 this week will be smaller than usual, opening the door for a net-negative supply week. That tends to have a bull flattening bias on the curve which we are now looking to FADE. The DV01 of issuance grows from next week until the end of October (1T49s, 0R30s, 1T57s, 0F35s, 0F50s, 1F71s and more 0R30s) which will tip supply cash flows negative.

- TRADES:

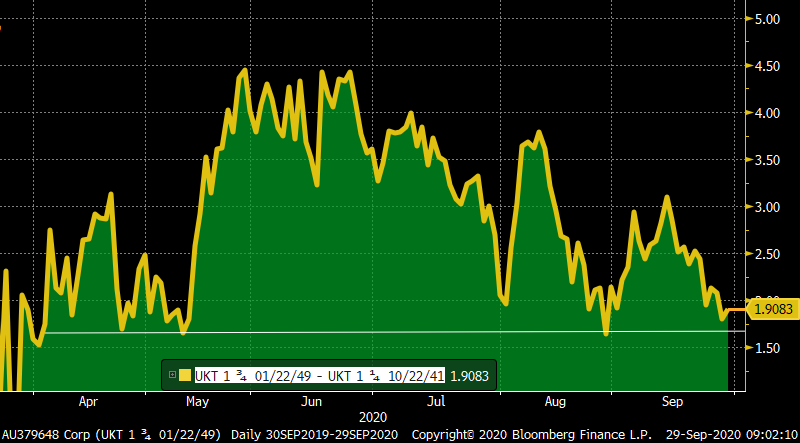

- Buy UKT 1Q41 vs UKT 1T49 – steepener at -2.3bps, targeting -4.3bps+, stop at -1.0bp.

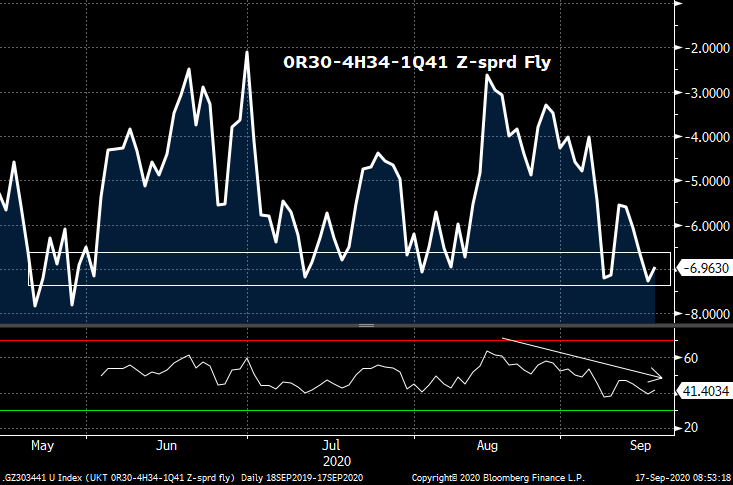

The Z-sprd box has flattened back to support into Thur's 41s tap, levels that have held since April.

The 1T49s will be tapped again next week while 1Q41s aren't tapped until Nov 3rd.

Positive carry and roll of .5bp.

UKT 1Q41-1T49 Z-sprd box

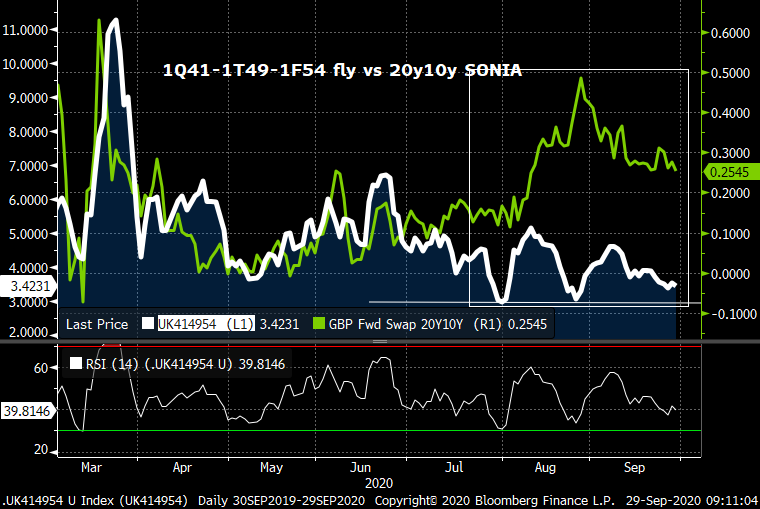

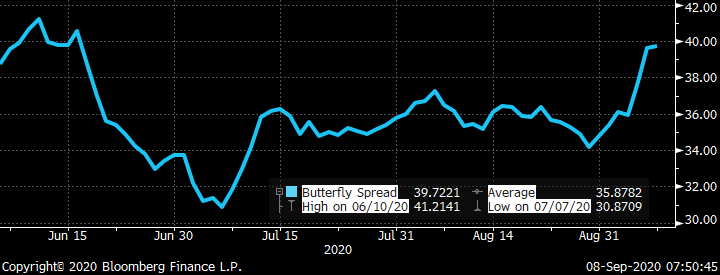

- UKT 1Q41-1T49-1F54 fly – sell belly at 3.8bps, targeting +6.0bps, stop at 2.5bps.

Fly has been stubbornly rich despite diverging SONIA levels. The 3bps support level has been very solid since August.

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Busy Week for EUROZONE Issuance... Quick Preview

Eurozone – Big Issuance.. .

(Apols for the format – had to copy from my BBG chat… Where's my coffee?!)

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Brexit, BoE, Supply and the Curve - Quick Rundown

Gilts are opening weaker, the curve's a bit steeper and cable's about unched.

> UK Retail Sales came in a touch firmer than estimates at +4.3% YOY (ex auto fuel).

> EC President von der Leyen is 'convinced' a deal is possible.

https://blinks.bloomberg.com/news/stories/QGU34HT0AFB6

> London Covid-19 Cases Rise to Be Confirmed Today, Standard Says

https://blinks.bloomberg.com/news/stories/QGUE17T0G1KX

Raising fears of another lockdown in London.

> Market's still digesting the impact of the MPC minutes' mention of their negative rates implementation investigation. 1y1y Sonia remains near the rates lows at -16.7bps. No explicit mention of QE has some GEMMs (like Citi) putting on tactical 10-30s Z-sprd steepeners into next week's 0H61s tap.

> Another 3-7yr APF on Monday, the 0H61s syndicated tap on Tuesday. (more below)

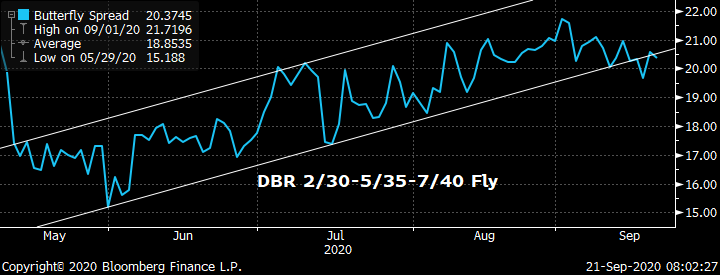

> Combine firm-ish data, positive comments on Brexit, neg rates chatter and next week's supply and we've got a recipe for a steeper curve. We haven't broken any new ground (our 1H26-1Q27 sprd is still just 8.1bps mid and 1H26-0R30-4H34 is ~1.2bp cheaper) but the tactical flattening we were looking for into yesterday's MPC didn't happen.

> RBC is on board with our 1H26-1Q27s flattener idea, advocating it in their AM Rundown today.

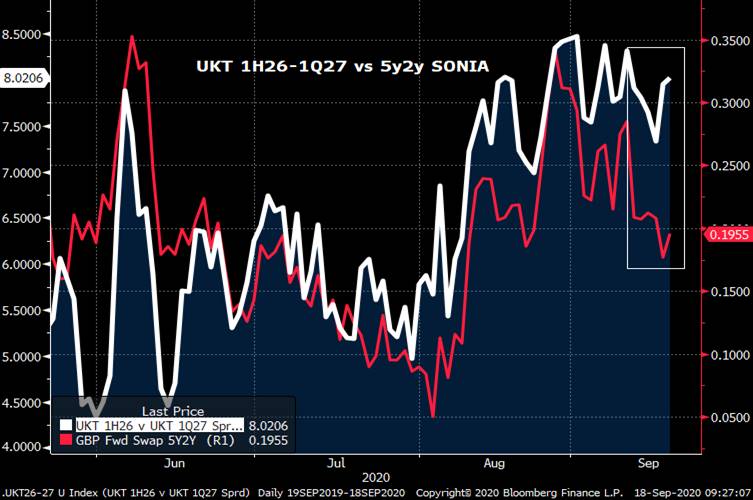

> The syndicated UKT 0.5% 10/61 tap is widely expected to happen next Tuesday with size estimates from £5-7bn. We can see from the charts below that the 0H61s have been trading well lately. They're .9bps rich to the 460s (they came at even yield back on May 19th) and the UKT 1T57-0H61-3H68 fly we recommended last Friday at -1.6bps is now -2.15bps, slowly grinding richer in line with the rally in 20y20y SONIA. As with all these deals, there's a danger the market gets a bit too amped-up and richens the issue too much into the deal, however, given the lack of ultras supply and the house-cleaning we've seen in the long-end APFs lately, we expect real money investors will still need to buy them. As we've also mentioned, other issues in the sector that have lagged this move (like the 57s) should also see some demand, especially if the 61s over shoot the runway.

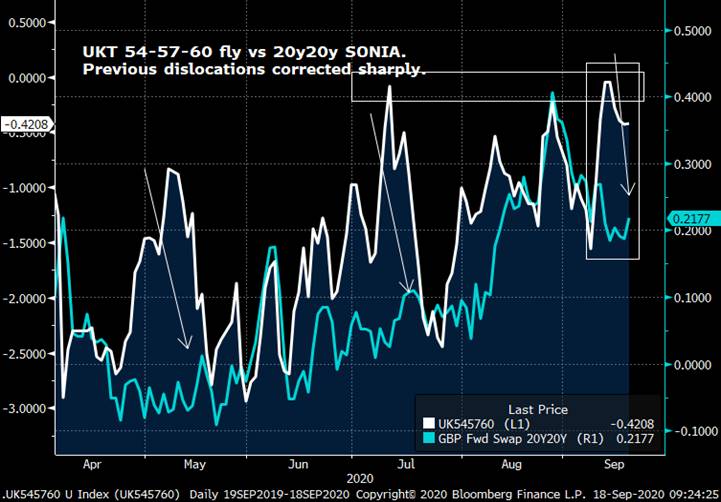

UKT 57-61-68 fly vs 20y20y SONIA

UKT 54-57-60 fly remains cheap given the rally in SONIA. We can see from the chart below that previous cheapening moves corrected, usually within a week. We like buying the belly here.

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: BoE MPC Meeting Today > Quick RV Rundown

UK - MPC Meeting Today

- Powell and Co told us yesterday it'll take an economic miracle to get the FED to raise rates before 2023 and the ECB continues to bang the 'all the support the economy needs' drum, about as dovish as central bankers get.

- So, it stands to reason that the MPC's tone will also lean dovish, particularly with Brexit and furlough worries keeping economists up at night.

- The £2 Trln question is how much more will the rates/FX markets price in relative to current levels?

We've got 1y1y Sonia at -11bps (just off the -14bps lows), UKT 4T30s (G Z0) back to just 21bps and GBP is still sub 1.30 at 1.295 this am.

- Given the MPC has yet to formally confirm that QE is on the table - the final driver of a flatter curve - we're thinking momentum will stall unless they lean that way. The consensus is if the MPC does announce further QE, they will wait until the Nov MPC meeting as they should know by then where Sunak stands on the furlough scheme and any other 'creative support' the government can come up with. The Nov meeting has become a bit less significant in recent days as Sunak is likely to delay the Autumn Budget due to his requests for more economic data, however, either way, the MPC seems to think time is on their side.

- As noted on Monday, momentum richer in the US-UK-DBR blend was running out of steam, also reflected in a bottoming out of Cable. The 6bps cheapening of the blend (chart below) could easily be taken back but with the FED's uber-dovish bias, it's not quite as compelling a trade here.

- On the gilts curve, the 4H34s-1T37s sector have performed well this week, especially the 4H34s which have richened on the Z-sprd fly vs 0R30s and 1Q41s to a level that has held since May. This puts the 4H34s at a cross roads in our view. More flattening SHOULD mean 34s-41s flattens to bring the spread more in line with the move in 30-34s and a bearish steepening bias brings in sellers of 34s vs 30s. By the way – anyone notice the 0F35s? They've run out of gas and are now +12.2bps vs 34s, .7bp cheaper than their post deal tightening and 34-35-36s is now +16.3bps, suggesting profit taking is emerging. Doesn't bode well for the sector…

More to come!

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: UK - SONIA 1y1y, Gilts Curve and Macro Picture - Quick Rundown

GILTS/GBP... 1Y1Y SONIA

- While the gilts mkt has been focusing on the 15yr syndication and Monday's index extension, there's been a storm brewing in the front-end of the curve.

- 1y1y SONIA - a nice barometer of sentiment - has richened back to close at new record low rates yesterday. This has prompted the mkt to price in another 10bps MPC rate cut sooner than it was last week, now possibly as soon as June 2021.

- The combination of this richening along, Monday's index extension AND a bit of a relief trade post 15yr syndication helped explain the market's decision to make the BoE pay up at yesterday's 20Y+ APF operation with some eye-popping premiums.

- With the govt limiting gatherings to a max of 6 (as of Monday) to curb the spread of C-19, it's logical to assume risk assets will remain on alert. It also suggests to us that gilts supply concerns will take a back seat to the macro outlook - implying a bull flattening bias will persist s/term.

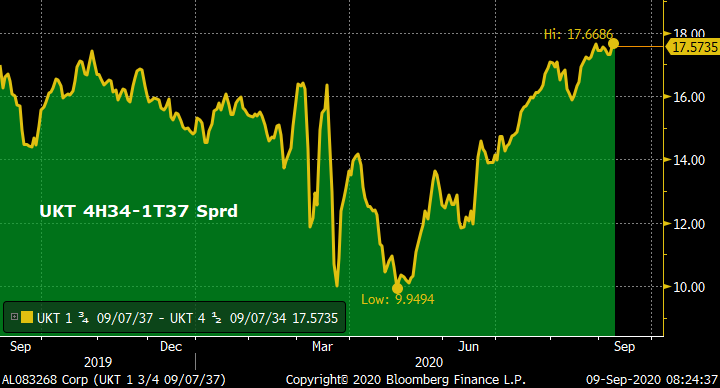

- We have a TAP of the 0F50s tomorrow, followed by 1T37s next Tues. We STILL like the 1T37s here and think they're the cheapest issue (along with the new 0F35s) on the whole curve, especially with their under-performance vs 34s and 36s yesterday.

> UKT 34-37s yield sprd remains at its steepest this am - we like the flattener.

- Yesterday's REACH by the BoE must have gotten the ultras shorts a tad antsy to say the least. GEMMs who didn't want to buy 1T57s from us earlier in the day were scrambling into the close to cover. While there's plenty of time between now and the Sep 22 syndicated tap of the 0H61s, it seems prudent to us to look at leaning long the sector in various guises.

More on this shortly.

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: BTPS 20yr Deal - TODAY - Quick Colour...

BTPS > March 2041 Deal Today

> Rumblings in the mkt of an imminent 15-20yr BTPS deal began late last week so the confirmation yesterday wasn't a shock.

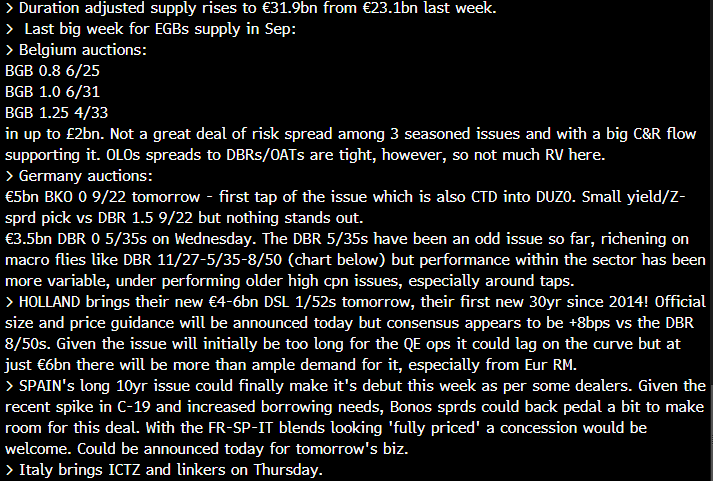

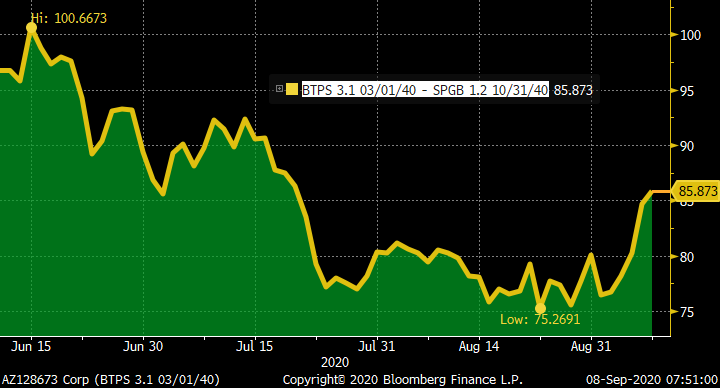

> As you can see from the chart below of the BTPS 12/30-3/40-9/50 fly, the market's already priced in a nice little 6bps concession on the curve for this deal and, if history is any guide, the new BTPS 1.75% (my guess) 3/41s issue will come at an attractive spread with chunky duration and convexity given it's sector-low cpn.

> On a cross-mkt basis we've also had an almost 10bps widening of the SPGB 1.2 40 v BTPS 3.1 40s sprd since the start of Sep, some of that macro-driven after 25bps of tightening over the last few months, and some of that in anticipation of supply. No doubt this will widening will also attract buyers.

> Pundits expect a €7bn-ish deal with a spread in the +9-10bps area vs the 3/40s - putting them a whopping 95bps over SPGBs.

> Books should open early this am...

We’ll keep you updated.

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: NETHER 7/28s Tap Tomorrow - Quick Colour/Ideas

NETHER 7/28s Tap Tomorrow – Taking the issue to ~15bn. Last tapped in Sep 2018, it's unlikely to be tapped again for the foreseeable future.

> Historically, any pre-tap concession into a NETHER issue is drained from the curve by the afternoon before the tap. This is largely due to the early timing of NETHER auctions (9am UK) and the relatively small auction sizes given their limited net issuance vs their peers.

> The NETHER curve doesn't have a great deal of 'juice' in it given the curve is only 16 issues (23s to 47s) and most of them sit at/close to the 1yr tights vs Germany.

> The DBR 8/28-NETHER 7/28 sprd is no exception, despite the surprise tap, both yield and Z-sprd at/close to the lows in the +11.5bps area.

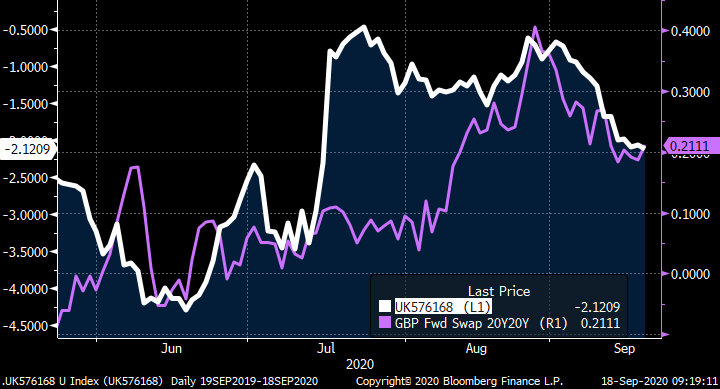

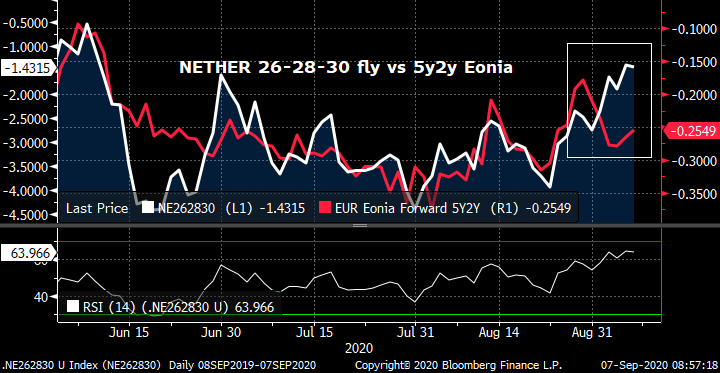

> That said, we have seen a cheapening of the NETHER 7/26-7/28-7/30 fly that has outpaced the move in 5y2y Eonia and in our view, should correct post tap. The eonia correlation says this fly is about 1.3bps cheap here, just to get it back to fair. We like this fly as a micro-auction trade given history and location.

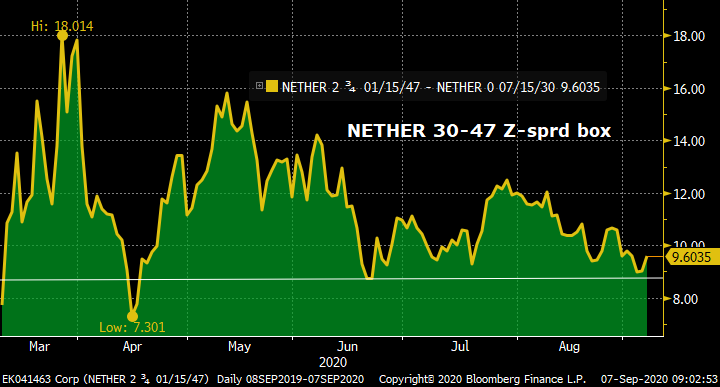

> Additionally, the NETHER 7/28-1/47 Z-sprd box has flattened 5bps since the start of August, now ~12.5bps. With the new 30yr DSL coming on Sep 22 (via syndication), we think the odds of this spread steepening back into the deal are strong.

Additionally, the NETHER 7/30-1/47 Z-sprd steepener looks just as good with the move to 9.3bps on the z-sprd box this am, lows that held in June and July. We expect the NETHER 7/30s to be tapped again next qtr but as the benchmark it should be absorbed easily. With the weight of EGBS supply this month and the first new NETHER 30yr since 2014 (!), we expect the market to build in a curve concession for this deal.

More to come…

Best,

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: GILTS Yields/Spreads - Which Economic #s Matter Most?

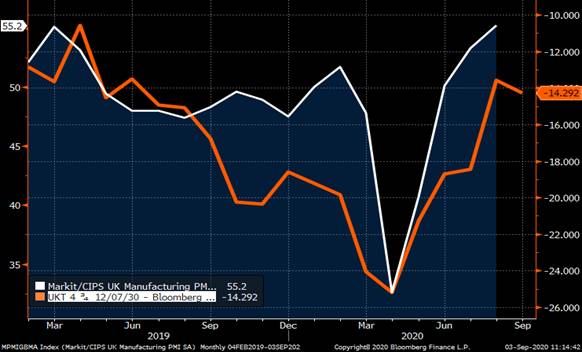

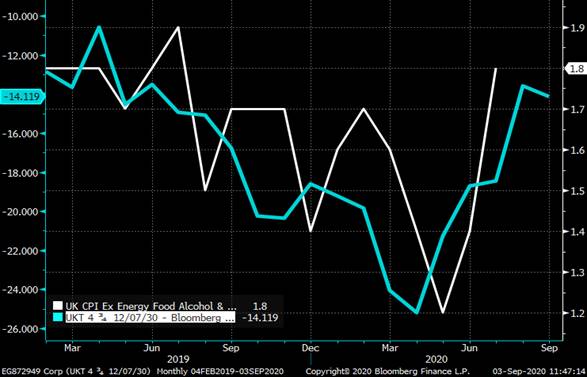

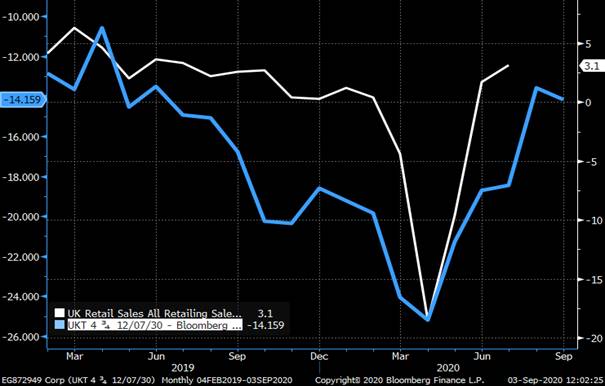

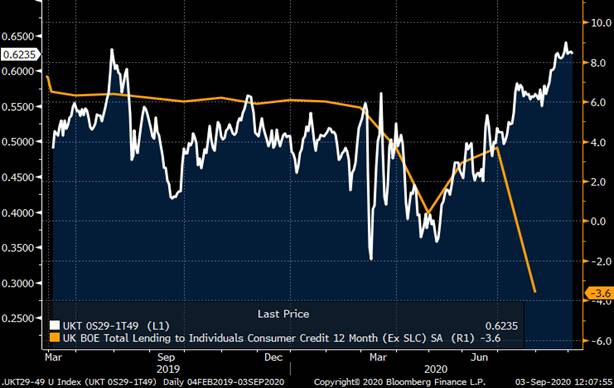

- Back from summer holidays and time to roll up our sleeves and devise a game plan. With Covid-19 still very much in the news (sadly) and countries across the globe dealing with varying levels of infections, we thought it would be useful to nail down which economic indicators have been most useful in helping to forecast the path of rates and/or the curve. With a dizzying number of indicators to choose from across the G-7 from and markets to apply them to, we thought we'd keep it simple and focus on the UK. We've chosen the UKT 0S29-UKT 1T49 yield curve and the UKT 4T30 Z-sprd and then set out on our wild goose chase to find good matches back to Feb 2019. The charts below are the indicators that matched best.

- While there are indicators that matched reasonably well, some of them had a two month lag (only back to June this am for ex) which eliminated them from consideration.

Markit Mftg PMI

Remarkably tight correlation considering the volatility we've seen this year.

Correlation to Z-sprd levels is ok but not as high.

UK CPI MOM is a monthly indicator that's had a solid correlation to both the curve and Z-sprds, especially since the start of the lockdown in March.

Even better for Z-sprd levels…

Core CPI also good, despite the 1 month lag…

Correlation of the curve to consumer confidence USED to be solid UNTIL Covid.

What it's better at is helping to validate YIELD levels as the correlation's improved the worse things got. The rally in 4T30s foretold the erosion in confidence in this case.

Core retail sales YOY has also been a solid predictor, despite the 1 month lag. In this case, the correlation to the curve and Z-sprd has been very good since March – but not with outright yield levels.

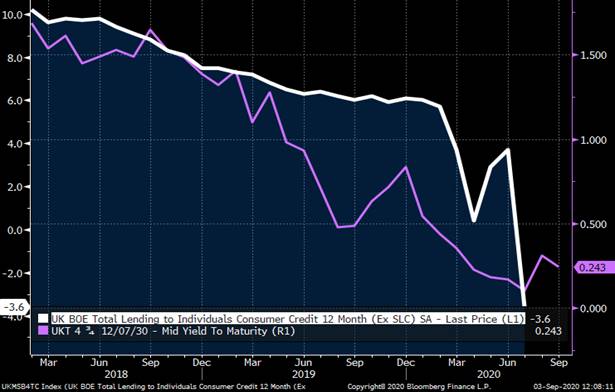

Consumer Credit levels are very interesting as a barometer for gilts/curve. Chart below shows a solid tracking vs the curve but there's been a complete divergence since June – the curve steepening despite a nose-dive in credit. Second chart makes more sense intuitively, yields falling as credit demand evaporates.

Nationwide House Prices have had a solid correlation (inverse) with 4T30 Z-sprds which broke down when the govt rolled out their stamp duty cut and house prices rallied. Yield levels have been detached from house prices since late last year.

But overall yield levels don't seem to care much about housing these days.

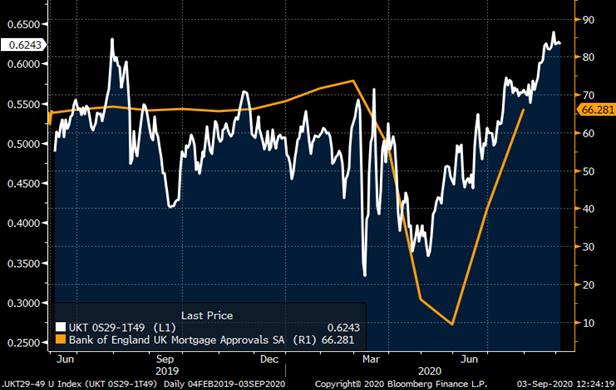

Mortgage approvals seem to matter more to the curve…

New Car Registrations is a monthly series with a 1month lag that's a good barometer of retail demand. Correlation to the curve and Z-sprds is solid.

- To sum up:

- Market UK Mftg PMIs and CPI (agg and core) are both well correlated and released frequently enough to be used as strong indicators when devising a gameplan for the curve and Z-sprd levels.

- Consumer confidence levels are worth monitoring for their correlation to outright yield levels.

- Core retail sales are also solid for curve/Z-sprd and offer a good barometer of demand.

- Consumer credit demand, is an interesting one which is best combined with new car registrations and mortgage approvals for a more complete picture of big ticket spending.

- While the market's focus on the weight of gilts supply on yields/spreads/curve is justified given the size of the UK's borrowing and the QE dynamics at work, these charts help to confirm that fundamental macro indicators are driving a great deal of these moves and ignoring their influence can prove very costly.

More ideas and colour to follow…

Best,

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS - 0E28s Tap Tomorrow - RV Thoughts/IDEAS

GILTs... 0E28s Into Tomorrow

> We've grown accustomed to seeing a nice cheapening of this issue into its taps, attracting good RV demand on the concession that has largely paid off for buyers.

> In my recent note I highlighted how the landscape is changing on this issue - and some of the other low cpn issues. They've become more sensitive to directional forces and positioning due to less overall APF support and a very busy auction calendar.

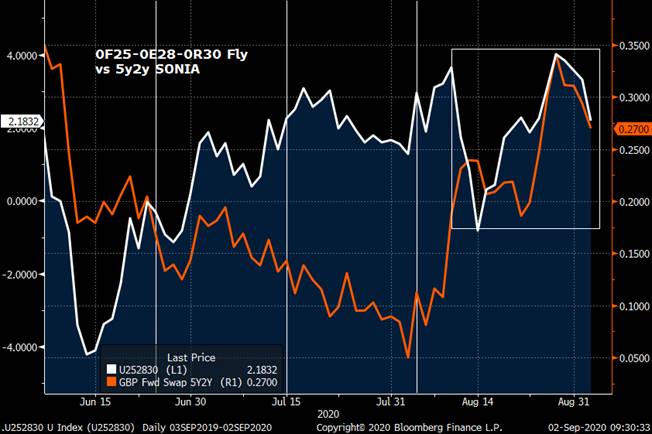

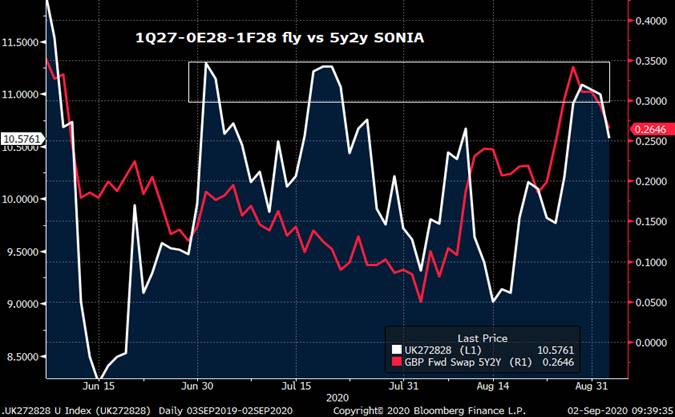

> The chart below of the 0F25-0E28-0R30 fly (one of a handful of popular expressions) shows that since the BoE dialed-down APF ops to the current £4.41bn per week, GBP yields (both SONIA and gilts) have risen but, more importantly for RV, the correlation of this fly to SONIA levels has risen markedly. So, while this yield fly has richened from +4 to +2.2 in the last couple days, it's been driven by a 6bps rally in 5y2y SONIA.

> The second chart of the same fly using Z-sprds also shows a richening of 28s but only 1.1bps, suggesting these 0E28s remain cheap.

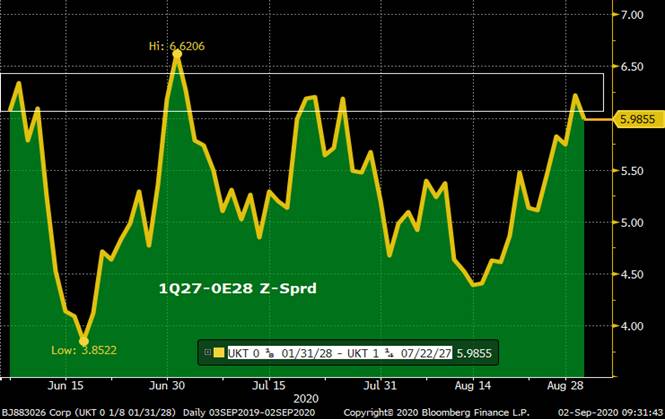

> With the bear steepening bias less prevalent now and a tap of the 1Q27s coming on Sep 15th, I like selling 1Q27s into 0E28s on yield sprd or Z-sprd as we remain close to the Jun-Sep wides (chart below).

- With no 5yr supply until Sep 24th (0E26s) we prefer selling the 1Q27s as the short leg of our fly (as above). The simple 1Q27-0E28-1F28 fly has only richened .5bp from its recent wides and, while also sensitive to the levels of SONIA, there's more 'juice' in this fly than the one above in our view, despite being tighter maturities-wise.

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796