MICROCOSM: GILTS Supply Today > You're On Your Own! Quick Rundown

GILTS Supply Review/Preview…

- If yesterday's taps of the UKT 0E26s and UKT 0R30s were a sign of things to come in the gilts market then we're in for a more challenged environment going forward.

- Both issues cheapened into the bidding, the 0R30s back to +12.7bps on fly vs 0S29s and 4T30s and the 0E26s had given back .5bps vs 225s and 1H26s. By day's end both flies cheapened further and are opening weaker this morning too, the 30s fly +12.9bps and the 26s fly +14.9bps. While this back pedalling on the curve is by no means a catastrophe, it is a bit worrying that two of cheapest issues on the curve didn't attract enough demand to erase their pre-auction concessions – even with the 0R30s attracting £628mm of PAOF demand. It was also a reminder that the paltry yield levels in the UKT (at least out to 10yrs) are not enough to attract real money demand, especially given the divergence we're seeing vs stocks (chart below).

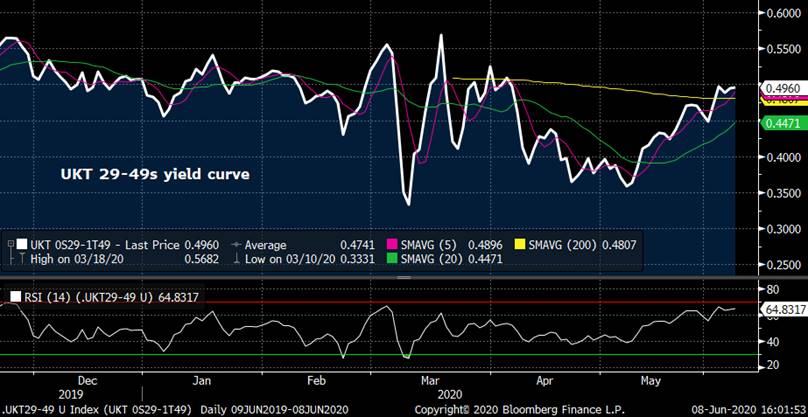

- The 'elephant in the room' here is the impact of the deceleration of the APF purchases this week relative to last week. John Wentzell's post-APF rundown (attached) highlights the results of the APF (14.9yr WAM, £4.488mm DV01) were ok on balance, albeit at a decelerated pace. On a positive note for gilts, the widening of UKT 29s vs FRTR 29s reversed a couple bps and the recent curve steepening has reversed course, UKT 29-49s now 2bps from the recent wides at +52.8bps. That flattening has as much to do with soft demand at the 10yr auction, however, as it does about a lopsided APF WAM vs supply.

- Today's supply is a bigger test for the market. The APF auction resumes tomorrow so no support for today's auctions and the net DV01 of £6.8mm+, given the 2T24s and 1F54s taps, will be longer than yesterday, especially if the PAOFs are taken up.

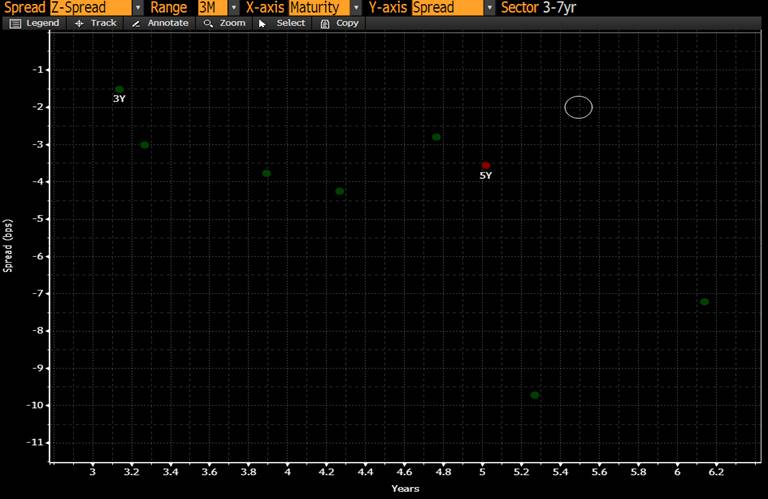

The Z-sprd chart of the 3-7yr sector shows the 2T24s remain one of the richer issues in the sector, despite cheapening vs both libor and Sonia swaps in the last couple weeks. Another tap likely dominated by GEMMs with little PAOF support unless we rally sharply post-auction.

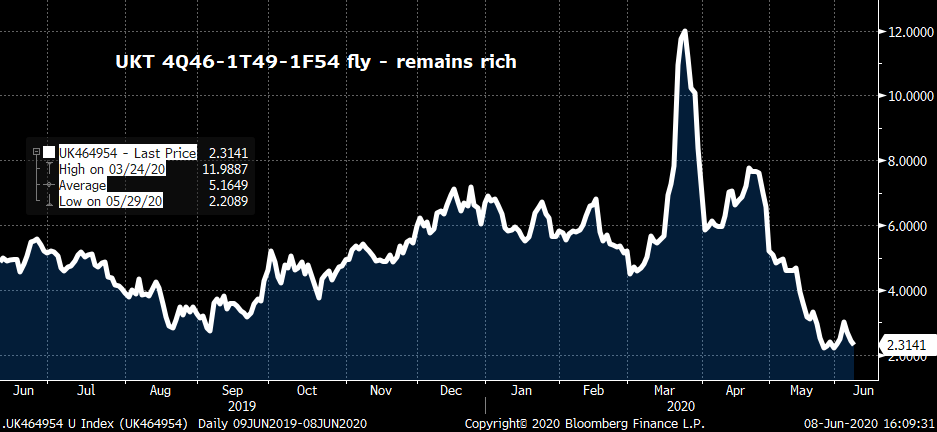

- Those of us who've dipped into the treacherous waters of the ultras-sector lately won't be surprised to learn that the UKT 1F54s are trading cheap to the curve. This will be the issue's FOURTH tap since April 14th which will take the issue up to around ~15.6bn+ (depending on PAOF). The good news for holders of this issue is there are no more scheduled taps on the calendar (at least until the DMO updates it on Jun 29th) and the new 2050s, 2061s and 1F71s are all smaller and will be a bigger priority for the DMO going fwd.

UKT 1T49-1F54 Z-sprd box remains at cheap end of its range:

UKT 1Q41-1F54-1F71 fly – back close to its wides at +11.6bps

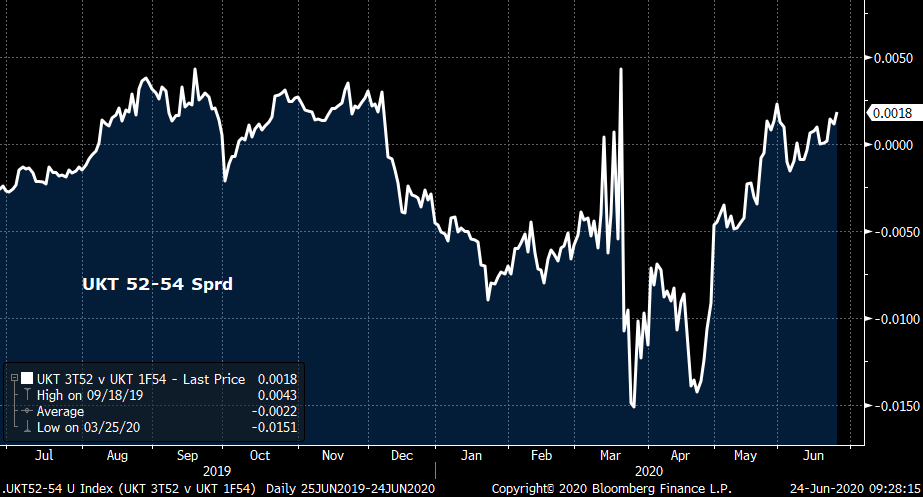

Micro-flattener UKT 3T52-1F54 also back near its cheapest…

- Bottom-line – This is a day where we're supposed to 'let the mkt come to us', buying the auction issues (including yesterday's 26s and 30s) when they look VERY cheap, as opposed to just 'cheap'.

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: NETHERLAND > July's a Big Month - Stay/Get Long

HOLLAND in JULY...

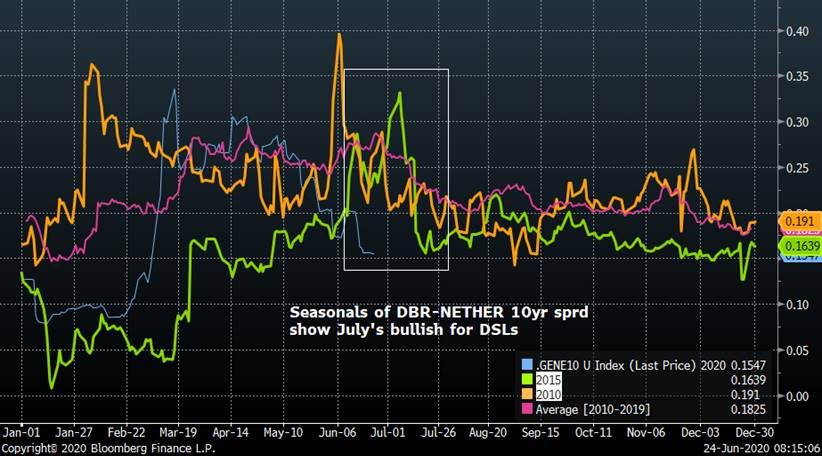

> There are 2 months a year that 'matter' for Dutch State Loans - January and July.

> This July we'll have €2.4bn in cpns and €14.4bn in redemptions that will support DSLs. While that figure is diluted by the sharp increase in DSTA issuance in 2020 due to the Coronavirus (2020 funding is €135.8bn now vs €42.7bn on Jan 8th), there is still a tailwind in July that should provide some support, especially in the 28/29s maturities given the 8.5yr duration of most NETHER indexes.

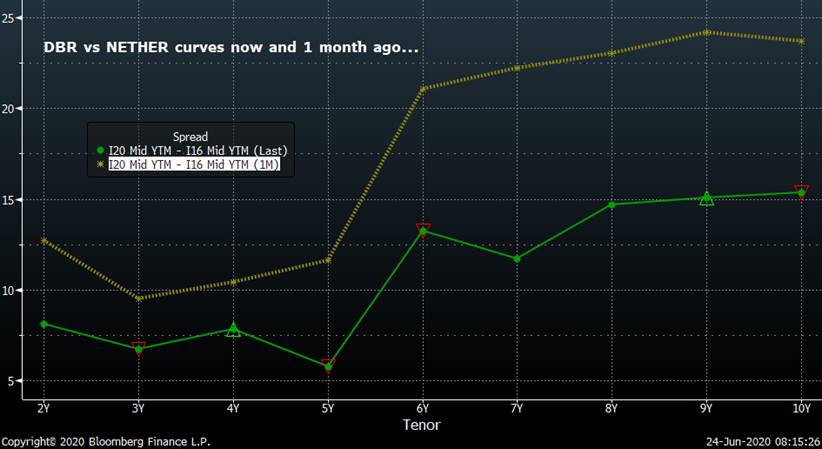

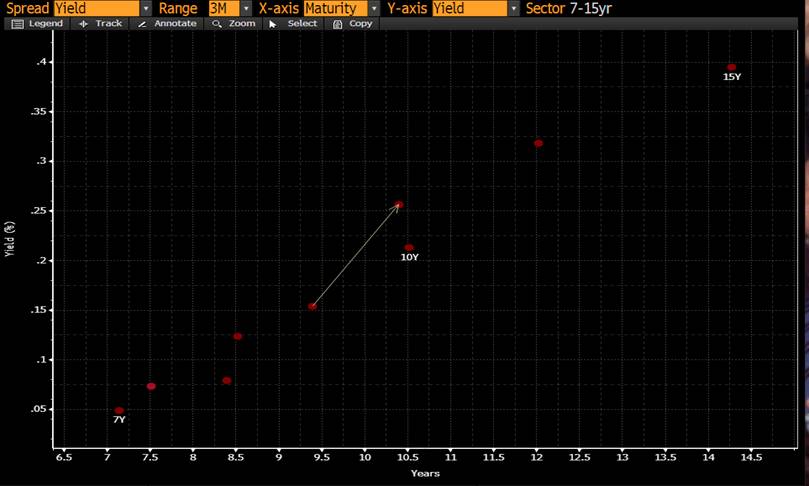

> We've seen a solid narrowing of NETHER-DBR spreads from the wides which, all told, should continue. The same grind flatter of FRTR 26-29s noted yesterday should be replicated in Holland too barring a bearish shock to the mkt. NETHER 7/25-7/29 Z-sprd is still +8.7bps, 5.5bps steeper than in February - we like this as a flattener both yield and Z-sprd and still see room for further spread compression vs DBRs in the 28s-30s sector.

> Happy to discuss other permutations...

DSL 7/25-7/29 Z-sprd box

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACRO/MICROCOSM! GILTS 30yr Syndication Tomorrow - Quick Colour

GILTS... New 2050s Deal

> Back to Macro v Micro here.

> From a macro perspective, one could argue we've built in a pretty good concession for tomorrow's new 30yr. 1T49s yields have cheapened about 18bps in the last week, 29-49s is 14bps steeper than it was at the start of May and we're back to the 46bps level vs SONIA - where 1T49s have held since mid-April. While some say 10-30s in gilts is still too flat vs where US/EUR curves are, however, broadly speaking there's a reasonable enticement.

> From a more micro-perspective, however, the 1T49s have held in very well on the curve, especially vs 25-28yr and 35yr+ paper. Our +4Q39/-1T49/+2H65 fly is treading water - just! - but remains at the rich end of its range. There's a growing chorus of players in gilts who are concerned that a sharp selloff in the long-end could prompt some house cleaning in ultras, especially from those who got long 20bps ago (61s came at 96.87 vs 94.07 now) or who've been unable to unload their longs into the APF. While we're not quite there yet, we need to be mindful of how the mkt's positioned and to gauge the odds of a 'V-shaped' recovering on long yields.

> Going fwd, the good news is there are no more syndications scheduled until at least August. As long as the BoE holds their nerve and keeps QE cooking, there will at least be a buyer of last resort that will absorb what should be waning DV01 of supply.

> We're expecting the deal to be in the £8bn zone with a spread in the +1.5-2.0 area (we hope!)... More in the AM

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: Euroland Today > Spain, France and the ECB...

ECB Day But OATs and Bonos First

SPAIN @ 9:30am

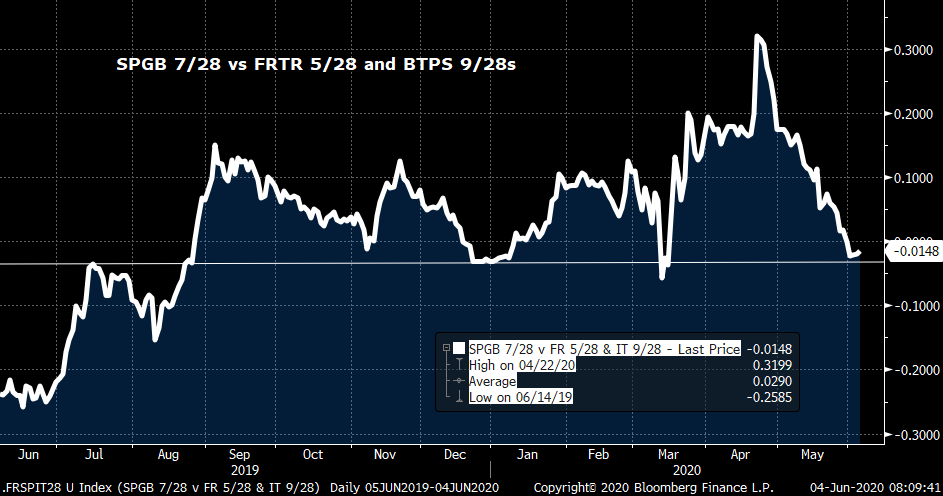

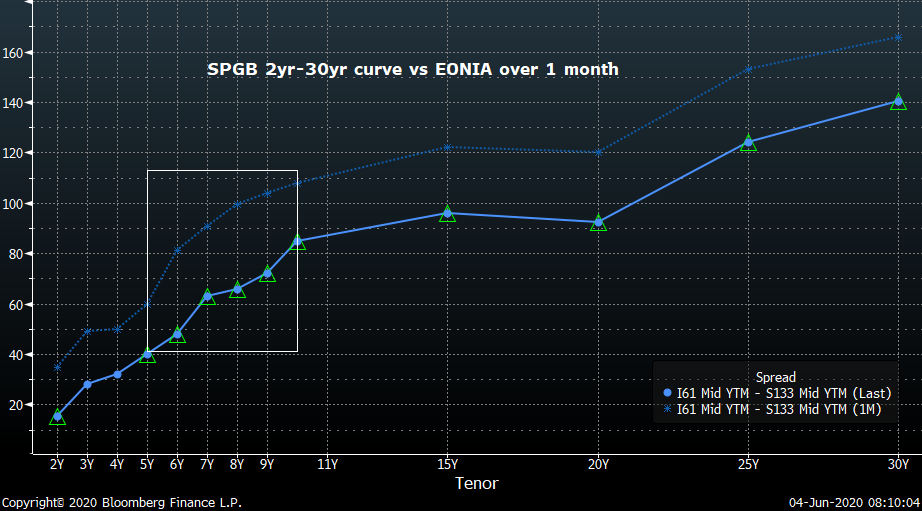

> Bonos are at their tightest sprds to FRTR/DBRs since early-March into this am's €6-7bn total of taps of 4/23s, 1/25s, 4/30s and 7/35s. The chart below of SPGBs vs Eonia shows a modest flattening of 10-20s but a broad out performance over the last month.

> In RV, each of the tapped issues this am have cheapened on the curve, especially 1/25s, 4/30s and 7/35s.

> While there's likely to be RV demand, macro players are likely to hold off adding to long sprd posns until we know whether the ECB extends QE today or not. Spain 28s have richened 32bps on blend vs FRTR/BTPS since late April, back to levels that were good support.

SPGB 1/25 v FRTR 3/25

SPGB 4/30-7/35-10/48 fly

OATS… Please see rundown from yesterday – attached… Themes still apply.

ECB TODAY…

Timing is everything and while the book for yesterday’s monster BTPS benchmark was enormous, there are a lot of RV players who would be quick to hit a bid if the ECB doesn’t extend QE today by another Eur 300-500mm well into 2021. Consensus, even though there’s technically no rush, is for a Eur 500bn extension. Germany’s Eur 130bn stimulus package announced last night adds some fuel to the fire which should be supportive for equities at the margin. The surge in stocks has coincided with a broad steepening bias on most curves in Europe (and US/UK – see note yest) which we’ll be watching closely, especially with stories in the FT this am that the HF community are turning cautious on stocks after their extraordinary recovering from the March lows.

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

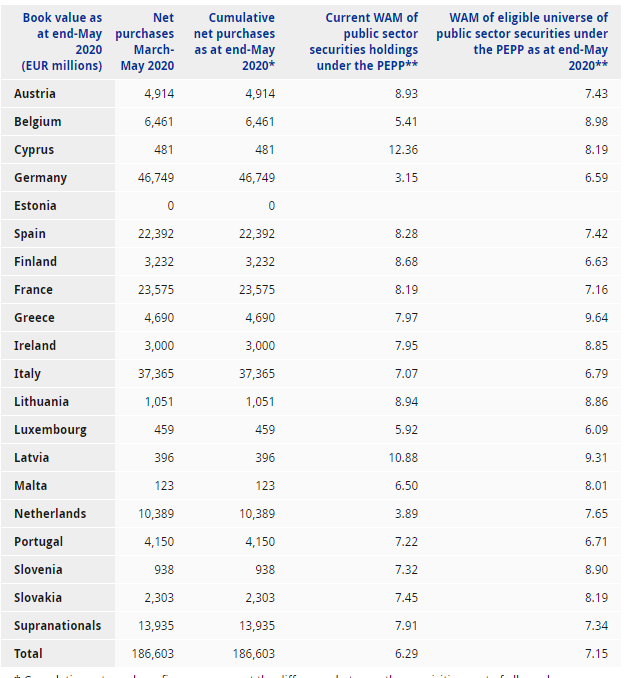

MACROCOSM: ECB Releases the PEPP Account Data > Quick thoughts...

Finally, a bit of detail on what the ECB's PEPP operations have been buying…

So, the big names:

Cntry Cap Key PEPP

Germany 21.4% 27%

France 16.6% 14%

Italy 13.8% 22%

Spain 9.7% 13%

Nether 4.7% 5.5%

WAMS

Cntry PEPP Mkt Wt

Germany 3.15 6.59

France 8.19 7.16

Italy 7.07 6.79

Spain 8.28 7.42

Cntry Iss WAM PEPP WAM

Germany 8.4 3.15

France 11.1 8.19

Italy 9.9 7.07

Spain 9.8 8.28

Nether 12.7 3.89

Portugal 9.0 7.22

Comments:

- Germany has front-loaded their purchases – big time! Perhaps this is a reflection of worries over the outcome of the GCC ruling on future purchases?

- Support for France has been below the cap key and well below their WAM of issuance. Helps explain the curve steepening.

- Italy and Spain have received the lion's share of support, even if it has been below their WAM. Also seeing this reflected in their curves.

- NETHER has not only received less support but their WAM is sharply different. NETHER have done well vs DBRs of late, bull flattening.

- There's an interesting dynamic here as in some cases, the WAMs are a good deal lower than they were in the first couple QE cycles. Perhaps the sense of urgency meant they needed to buy short-end paper as it's most liquid…?

- We still have no idea whether the ECB has scrapped their per issue limits, however. Given the concentration of positions in the front-end of the DBR curve, one would think they've loosened the reins.

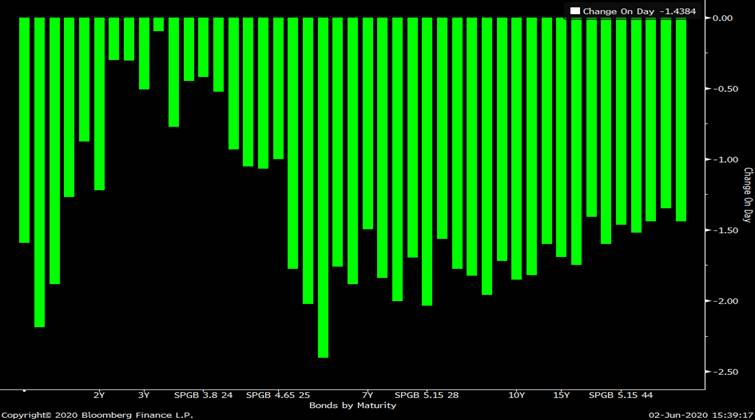

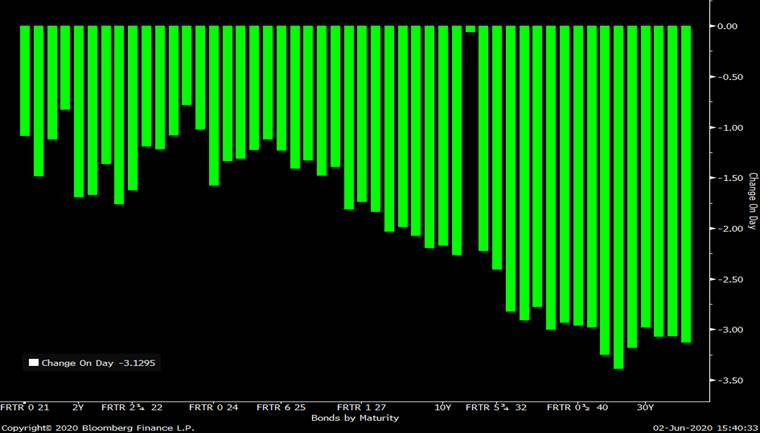

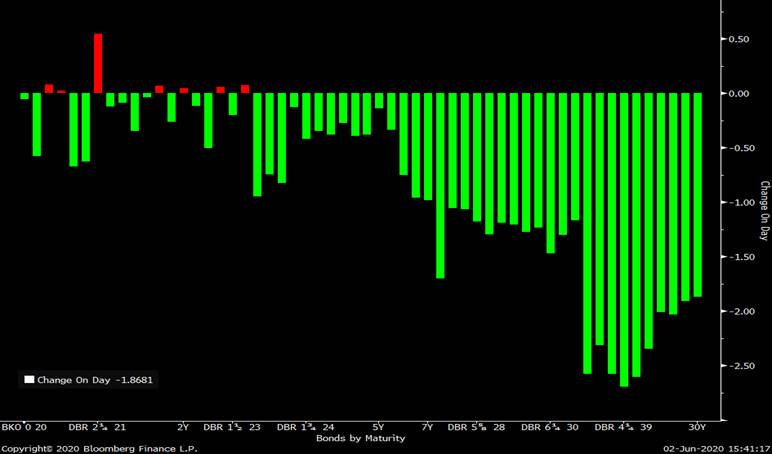

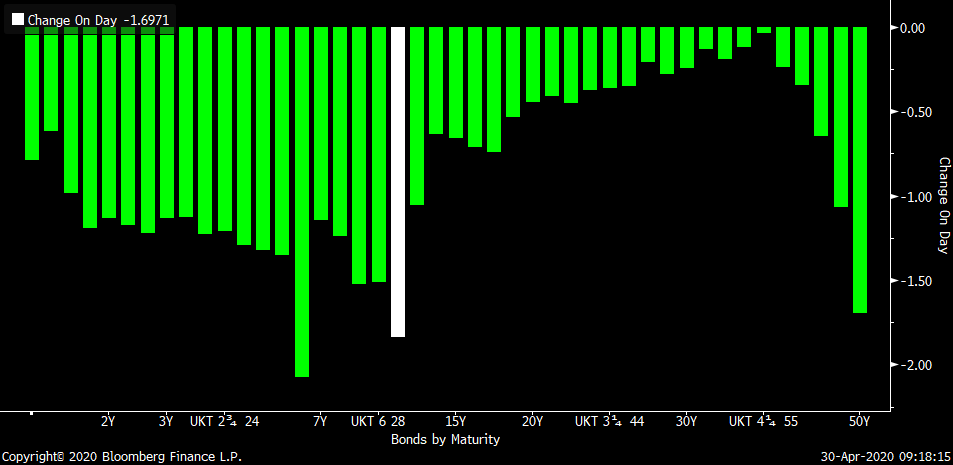

Change on day charts:

Italy – new 10yr benchmark announcement to blame for this!

Spain – yields turn positive at the SPGB 4/26s point

France – big bull flattening into this announcement

Germany – little reaction until we get out to the 6-7yr point…

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS > NEW 0E26s and First Tap of 0R30s > RV Rundown

GILTS... NEW 0E26s @ 10

- Debut of the new UKT 0.125 1/26s at 10am. We'll get £3.25bn with another £812.5mm available via the PAOF. If the full 25% is taken up they'll be over the £4bn threshold for the APF purchases. First tap is scheduled for June 23rd.

- As noted in my GILTS note yesterday (attached), we think the combination of current yield levels within the sector, the APF ineligibility of some of their neighbours (225s, 1h26s, etc) and the continued debate over neg rates will be supportive for this new benchmark, suggesting it will trade fair/rich relative to where the 0F25s came, for ex.

- The 1H26-0E26 sprd is opening +4.9bps mid with most GEMMs making the sprd +4.75/-5.00...

Other sprds to the new 0E26s within the sector:

0F25 v 0E26 +3.4

225 v 0E26 +9.8

- 1Q27 v 0E26 +.7

Z-sprd plot of the 3-7yr sector, the circle is the new 0E26s

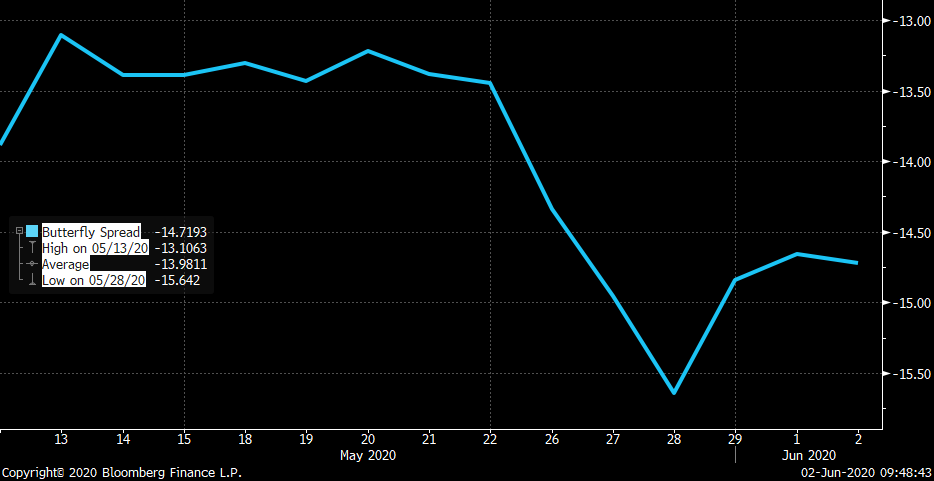

- GILTS 0E26-1F28-0R30 fly...

- I highlighted this fly (short 28s) in my note yesterday as a way of getting long two new issues that should grind richer over time - and short an older benchmark with limited eligibility into APF that's trading rich to the curve...

- The new 0E26s are opening .6bps cheap to the 1Q27s this am. The chart below of the 1Q27-1F28-0R30 fly gives us an idea of the brief history here with the bulk of the sprd on the longer leg. We can play with the weightings to mitigate the flattening bias if one wishes (which will also worsen the C&R) but suffice to say this looks rich to us.

Or using 0E26s with a 1.4/-2.0/.6 weighting

Tap of 0R30s at 11:30

- First tap of the 0R30s at 11:30am in £3bn (25.3k G U0).

- They're trading at 25.5bps, just 3bps off their richest levels and 9.1bps cheap to SONIA.

- We saw a nice steepening of 1F28s-0R30s last Wed/Thu that took the yield sprd from 17.8 to 19.8. This move attracted a swarm of flattening interest which was exacerbated by the 28s losing their repo bid.

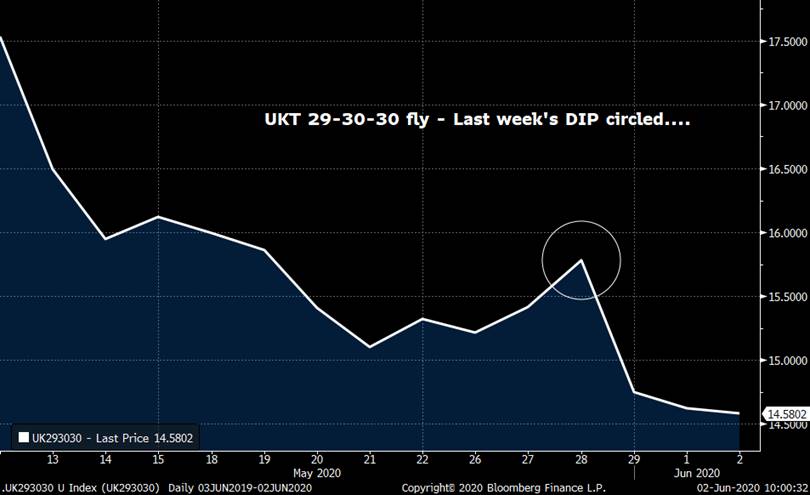

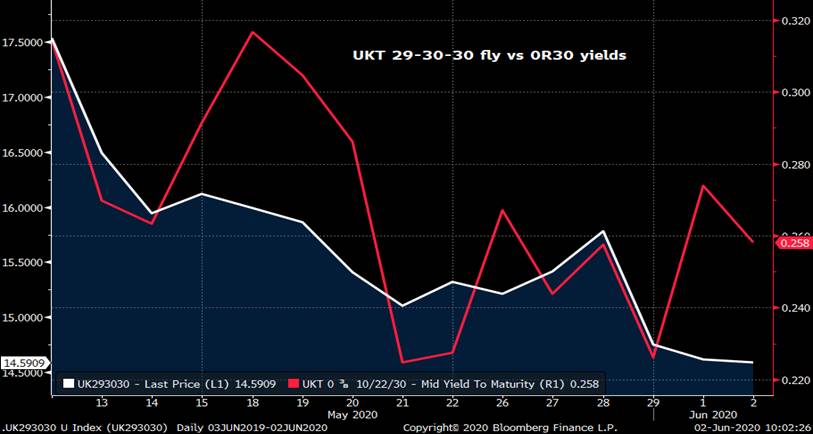

- We've settled back at +17.8bps on 28-0R30s and the 29-30-30 fly is at its richest at 14.5bps.

- Why no concession on the curve for this tap? With another tap on Jun 23rd and mid-July (tbc), are they cheap enough?

- To answer #1 - one could argue that with the level of rates still extraordinarily low (29s at 15.6bps), there's little room or impetus for a yield or curve concession, much as we'd like to see one.

- And #2 - "Cheap enough" will hinge on the level of rates but also the APF eligibility of the issues in their sector. The BoE has bot a ton of 1F28s and 0S29s and are down to £5.18bn and £11.38bn notional under the 70% limit respectively. The 29-30s gap is still the steepest 1yr gap on the curve at +10.2bps and unless we see a sharp bear-steepening that's going to grind into +7bps over the next month...

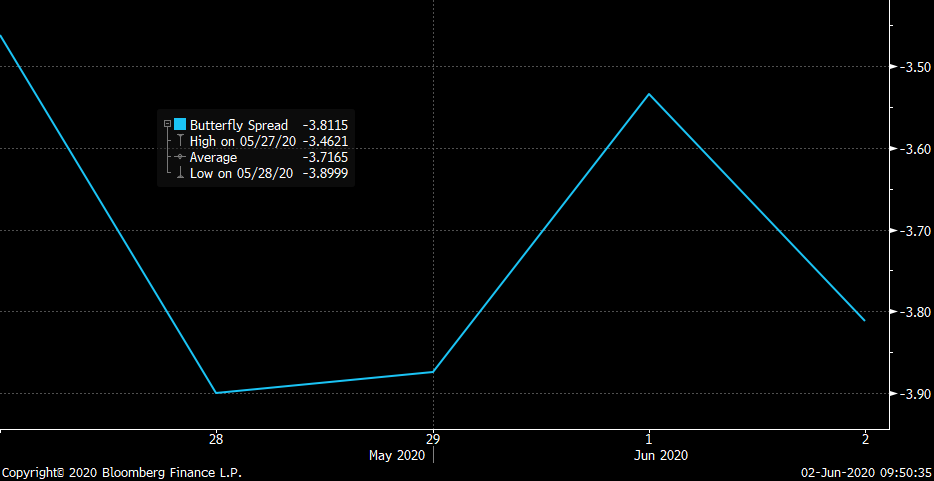

7-15yr sector of the yield curve – 0S29-0R30s sprd noted

- 0S29-0R30-4T30 fly – big move since the syndication all the way down to 14.6bps. The WAVE of buying we saw in the 0R30s when this fly got back to the high 15s last week was evidence that there is a DEEP well of buyers looking for a DIP. When this happens, those dips become harder to find.

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS > DMO Releases May-July Supply Calendar - RV Thoughts...

- Very interesting announcement from the DMO this am (see their PDF HERE) which will shape curve activity until July.

- While we won’t know where the BoE stands regarding and extension of QE beyond their current £190bn (for gilts) until May 7th or perhaps as late as June 18th, we can get a good idea from this am on where the risk is concentrated. As you’ll see from the rundown, the initial indication of a shorts/ mediums heavy load has been smoothed out with more longs supply, especially the inclusion of a new 30yr syndication on top of the 10yr and 40yr we knew about.

- Here are some points:

- NEW 7yr > Jan 2028 issue on June 11th

- NEW 5yr benchmark June 23rd 1/2026 maturity

- NEW 2050 VIA SYNDICATION in first half of JUNE...

- Tap of the 4Q32s and 4H34s (!)

- NO SIGNS of a NEW 15yr benchmark yet...

- The rest is a smattering of old and new with taps of the 0F25s, 1Q27s, 1Q41s, 1T57s, 1F54s, 1H26s, 4T30s, etc.

- They've left the specific issues blank for the second half of July...

- So, the DMO has corrected some of the short/medium vs longs imbalance due to feedback from the market:

"...the short conventional auction proposed on Thursday 28 May has been replaced with a long conventional

auction and the ordering of the auctions has changed, with the medium auction now at 10:00am and the long auction at 11:30am; and (iv) the medium conventional auction proposed on Tuesday 7 July has been replaced with a long conventional auction."

- 4Q32s... Tap would make them eligible again for QE which, in theory, should be bullish for the issue.

The tap is on May 21st and would likely be £2bn, maybe a bit more... So, given the QE guidelines, they're really not eligible until late May and only £2bn or so. Either way, it's still positive for the issue rv-wise and is probably why they didn't bring a new 15yr. I think it's probably a bit early to start buying them although this will certainly get the 4Q32 shorts a bit antsy....

- > It'll take the rest of this am for the new calendar to sink in but here are some more RV-salient points:

1) May 19 we've got the 2061 syndication (mkt assuming £4bn or so) then May 21 4Q32s tap. Following Wed 1T57s tap and Thurs 1T49s tap. That's a lot of long risk crammed into 2 weeks.

2) No 0S29s! Mkt figured that one out pretty sharply and they rocketed richer on the curve on the open. At £35.3bn they're not exactly 'rare' but with 1F28s losing their lustre with a new 1/28 7yr coming, 29s will remain popular.

3) Concentration risk?

Let's tally this up:

1F28s tap

1Q27s tap

new 7yr benchmark 1/28s

new 10/30s synd/taps

4T30s tap

4Q32s tap

4H34s tap

Suddenly the 4-6yr sector doesn't seem so crowded (and explains why the 1H26s have done so well this am). Nor, does the 36s-39s area with 3 taps of the 1Q41s on the way which makes them ineligible for QE for 6 weeks of this May-July period.

4) Ghost town or promised land?

We've got at least 3 taps of the 1Q41s and LOTS of paper 29yrs and longer. That leaves a gaping hole in the 2042-2047s sector. No, C&R isn't great and convexity is better in ultras but with a new 30yr syndication announced on top of the 54s, 57s and new 2061s, this 22-27yr sector looks interesting, especially since it’s all still eligible for QE…

Charts:

GILTS – Change on Day with 0S29s highlighted. The 1H26s have shot out of the gates too with the new 1/26 5yr not until June 2nd.

RV ideas on the way…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Bloomberg Bond News Summary > Mon Apr 27th

The following are today's top stories from Bloomberg on your My News Page categories:

Business Briefing

1) Oil Slides Back Near $15 on Glut While Producers Start Cuts

(Bloomberg) -- Oil resumed its decline to trade near $15 a barrel as swelling global crude stockpiles made it more difficult for leading producers to balance the market by curbing output. Futures in New York slid as much as 11.8%, snapping a four-day gain. While U.S. drilling is sliding and Saudi Arabia has started reducing output ahead of the start date for OPEC+ supply ...

2) Deutsche Bank Reports Surprise Profit Amid Uncertain Outlook (1)

(Bloomberg) -- Deutsche Bank AG joined other investment banks in beating first quarter earnings expectations while putting a question mark over its outlook. Revenue amounted to about 6.4 billion euros ($6.9 billion), exceeding estimates, and net income of 66 million euros defied analyst predictions for a loss. At the same time, provisions for soured credit hit the highest ...

3) Citigroup Sees Asset Sales Boosting $47 Billion Gulf Debt Binge

(Bloomberg) -- Oil-rich Gulf nations may turn to asset sales to complement an almost $50 billion debt spree to support economies rocked by the coronavirus pandemic and the collapse in crude prices, according to Citigroup Inc. Countries including Saudi Arabia and the United Arab Emirates have “really attractive” government-owned assets, which could be sold to the public or ...

World News Briefing

4) Regions Move Toward Reopening; BOJ Takes Action: Virus Update

(Bloomberg) -- Global coronavirus cases approached the 3 million mark, though Spain and France reported the fewest deaths in more than a month and the rise in U.S. infections trailed the one-week average. Italy will ease its lockdown in just over a week, a key test in efforts across Europe to broadly restart public life. New York, the center of the U.S. outbreak, outlined reopening plans ...

5) Johnson Returns to Work as Business Demands Lockdown Clarity

(Bloomberg) -- Boris Johnson returns to work for the first time in a fortnight with one key item at the top of his in-tray: when will he let Britain do so? The prime minister will chair the government’s Monday morning meeting to coordinate efforts to tackle the virus. He spent the last two weeks recuperating at Chequers, his grace-and-favor countryside house, after ...

6) Singapore Becomes Asia’s Most Infected Nation After China, India

(Bloomberg) -- Singapore -- which has one of Asia’s smallest populations -- is emerging with the region’s highest number of coronavirus cases after the world’s two most populous countries. The island-nation reported 931 new cases on Sunday, with the total number of infections exceeding 13,000, overtaking Japan. Only China and India have more cases in Asia. ...

7) Kim Jong Un Mystery Grows on Reports of Train, Medical Team

(Bloomberg) -- Speculation about Kim Jong Un’s health intensified over the weekend after tantalizing -- yet unverified -- reports about a visit by a Chinese medical team and movements of the North Korean leader’s armored train. China sent a team including doctors and senior diplomats to advise its neighbor and longtime ally, Reuters reported on Saturday, citing three people ...

8) Cuomo Announces Phased Plan to Reopen New York; Deaths Drop

(Bloomberg) -- New York’s coronavirus deaths dropped to 367 Sunday, the lowest in almost a month, as Governor Andrew Cuomo sketched out a phased-in reopening that begins with construction and manufacturing. That could start as soon as May 15, he said, probably upstate before the New York City area. The governor’s briefing -- filled with technicalities and conditions for restarting the ...

Bonds

9) Philippines Offers Dollar Bonds as Deficit Set To Worsen

(Bloomberg) -- The Philippines is marketing sovereign bonds denominated in dollars, joining a host of borrowers raising cash buffers to weather the coronavirus pandemic. The country, whose projected deficit ratio would be the worst in two decades, is offering 10-year and 25-year tranches, people familiar with the matter said. Just last week, central bank Governor Benjamin ...

10) Contagion Risks Build in India’s Credit Market After Fund Freeze

(Bloomberg) -- India’s credit markets were jolted late last week when a major money manager halted withdrawals from mutual funds, adding to a worrying string of superlatives that have been piling up since well before the coronavirus pandemic. Franklin Templeton’s decision to wind up $4.1 billion of Indian debt funds was the biggest-ever forced closure of funds in the ...

11) Rich Asians Feel Pain on $10 Billion Bond Bets After Crash

(Bloomberg) -- Risky bond investments that wealthy Asians often made with borrowed money are coming back to haunt them after the credit market’s crash. Before the coronavirus pandemic roiled global financial markets this year, those investors piled into so-called fixed maturity funds in a hunt for stable yields. Barclays estimated last month that there’s more than $10 ...

12) Won Leads Rise in Currencies on Virus Stabilization: Inside Asia

(Bloomberg) -- Most emerging Asian currencies gain, led by South Korea’s won, as the dollar weakens and traders take comfort in moves by some countries to ease restrictions imposed to curb the virus pandemic. A gauge of regional equities rallies.

- Spain and France reported the fewest virus deaths in more than a month and the rise in U.S. infections trailed the one-week ...

13) JAPAN PREVIEW: BOJ Set to Enhance Corporate Finance Support

(Bloomberg Economics) -- The Bank of Japan is likely to roll out further support for companies at its meeting on Monday, in the latest -- and probably not the last -- initiative to help the economy get through the pandemic. The main objective now is to head off systemic risks that could snowball in the event of a surge in bankruptcies and unemployment, while keeping rates low to support the government’s stepped-up fiscal ...

Central Banks

14) U.S. Stock Futures Rise After BOJ Stimulus Boosts Asian Equites

(Bloomberg) -- U.S. stock index futures gained for a second day after the Bank of Japan expanded stimulus and investors looked out for further signs of progress in the global fight against the coronavirus. Contracts on the S&P 500 rose 1% as of 6:42 a.m. in London, while futures climbed 1.2% on the Nasdaq 100 Index and 1.1% on the Dow Jones Industrial Average. The BOJ ...

15) Global Stocks Rise; Yen Ticks Up on BOJ Support: Markets Wrap

(Bloomberg) -- Global stocks started the week with gains amid signs of positive developments in the fight against the coronavirus and a boost to stimulus measures from the Bank of Japan. The dollar retreated. Asian shares climbed, U.S. futures reversed earlier losses to trade higher and European contracts pushed up. Trading volumes remained subdued amid the risk-on move. In ...

16) India Stocks Extend Gains on RBI Support to Mutual Funds

(Bloomberg) -- India’s benchmark equity index extended gains after the central bank announced measures to help asset managers tackle any run on mutual funds in case of mounting redemption pressure from investors after Franklin Templeton said it would wind up Indian debt funds. The S&P BSE Sensex climbed 2.4% to 32,066.16 as of 10:25 a.m. in Mumbai. The benchmark index ...

Economic News

17) BOJ Vows to Buy as Many Bonds as Needed in Stimulus Move

(Bloomberg) -- The Bank of Japan scrapped a limitation on buying government bonds and ramped up its purchases of corporate debt, joining global counterparts in their unprecedented expansion of monetary stimulus as the coronavirus hammers the world economy. The bank had come under increasing pressure to take more action as the declaration of a nationwide state of emergency ...

18) PBOC’s Yi Pledges Support to Virus-Weakened Economy

(Bloomberg) -- China should maintain liquidity at a reasonably ample level and offer targeted support to companies hit by the coronavirus epidemic, China’s central bank Governor Yi Gang said. The impact from the virus on China’s economy will be short-lived, and the fundamentals won’t change, according to the article by Yi published by the Economic Research Journal in its ...

19) World’s Battered Supply Chains Shift to Recover-and-Survive Mode

(Bloomberg) -- When the timeline of the pandemic of 2020 is complete, March 24 will stand out as a day to remember for everyone from sports fans to anthropologists to cola drinkers. Japan postponed the Summer Olympics that day. India put 1.3 billion people under lockdown. Inhabitants of the U.K. awoke to their first day in home ...

20) BOJ’s Focus Shifts to Keeping Japan Inc. Afloat: Economics

(Bloomberg Economics) -- OUR TAKE: The Bank of Japan is pulling out the stops to shore up the nose-diving economy. The measures will allow the central bank to do more to prop up Japan Inc. and support fiscal stimulus. The primary objective appears to be to provide sufficient assistance to head off any surge in bankruptcies that could cripple longer-term prospects. The reflation effort is now on hold. ...

21) Tale of Two Economies Will Determine Post-Lockdown Growth

(Bloomberg) -- The restart of the world economy risks going ahead without a key ingredient: the consumer. Getting companies to resume operations and factories to reopen is one thing. Persuading consumers to brave catching the coronavirus and go out to shop, eat, travel or watch sports is another. “Nothing about reopening the economy will be easy, but restarting businesses will be more ...

European Central Bank

22) FT Markets: ECB set to beef up asset purchases with shift into ‘junk’ bonds https://t.co/nindYwX7wJ

FT Markets

@FTMarkets

ECB set to beef up asset purchases with shift into ‘junk’ bonds on.ft.com/3cPDMut

Sent via SocialFlow. View original tweet.

23) Letter: Those challenging the ECB’s rescue measures are not mad

Preview text not available for this story.

24) ? ECB expected to start [...]

Preview text not available for this story.

25) Those challenging the ECB's rescue measures are not mad

Preview text not available for this story.

26) ECB expected to start buying riskier fallen angel bonds

Preview text not available for this story.

First Word FX News Foreign Exchange

27) *THAILAND PLANS TO EXTEND ITS STATE OF EMERGENCY TO MAY 31

28) Bolsonaro Seen Tapping Ally to Head Justice Ministry Amid Crisis

(Bloomberg) -- President Jair Bolsonaro is expected to nominate a close ally to head Brazil’s justice ministry, replacing a previous cabinet member who accused him of trying to meddle in police investigations, according to Folha de S.Paulo newspaper. The move would do little to dismiss allegations of political interference leveled against the president by Sergio Moro, a ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

GILTS Revision Note - Corrected DMO PDF link

Sorry about that!

This shld work well:

https://www.dmo.gov.uk/media/16478/sa230420.pdf

Thanks

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: UK's Revised Funding Remit and Impact on GILTS > Quick Rundown

- The UK DMO has announced their funding plans for the May-Jul period (click HERE for the PDF)

- Here’s summary of the salient points for RV-driven gilts investors:

- £180bn issuance from May to July which will be mostly conventional gilts. Next funding remit announced Jun 29th .

- The current 2 auctions per day for 2 days schedule will continue.

- There will be 5 linker auctions.

- The new Oct 2030 benchmark syndication confirmed for Tues May 12th and the 30yr+ syndication for Tues May 19th.

- Additional syndications could be announced for Jun/Jul.

- The usual market consultations process will continue in devising an appropriate auctions schedule.

- DMO announced possible new 7yr and 15yr benchmarks.

- The £60bn per month schedule is £53bn MORE issuance than is left under the current £190bn BoE QE program.

- BoE will review their QE plans on May 7th, followed by another meeting on June 18th. Given the weight of the supply the DMO is asking the market to take down, the BoE might want to err on the side of caution and extend the program, at least by enough to cover July’s supply.

- Current QE buckets of 23-26s, 27s-39s and 40s and longer remains in place but could be adjusted to reflect changes to the auction calendar.

- Market Reaction and Comment:

- This remit is larger than the market was expecting, all told. The Treasury/DMO have left the door wide open by not committing to a budget beyond July, which, under these extraordinary circumstances, seems rational. That said, this May-July supply barrage suggests Johnson’s government won’t be shy about their dependence upon the market to help finance the UK economy’s recovery. Bottom line is, we still don’t know what the TOTAL funding remit for 2020/21 will be.

- Market reaction was initially bearish but we’ve clawed back early losses and G M0 is just 8 ticks weaker on the day. Doesn’t hurt that there’s no supply today and another APF operation waiting in the wings.

- A potential new 7yr and 15yr benchmark were a surprise and suggests the focal point of issuance will remain in the 3-20yr sector given we could have a 3yr, 5yr, 7yr, 10yr, 15yr and 20yr.

- Initial dealer reaction was ‘cautious’ regarding the outlook for the 15-20yr sector given the potential for a new 15yr benchmark. While we share the view that ‘exclusivity’ that the lack of issuance and great carry and roll that the 2034s to 2038s have enjoyed of late could be jeopardized by more supply, we would also anticipate that there will be substantial real money demand for that sector given the changing landscape Brexit has created and the continued wave of buy-ins that drive the long-end.

- The 1F28s have gone from zero to hero and back to zero in the last 3-4 days. The 1Q27-1F28-0S29 fly that we’ve been in and out of is now -4.2bps mid, almost 3bps cheaper in the last 24hrs. After yesterday’s APF buying, the 1F28s have just £6.3bn left under the BoE’s 70% per-issue limit. Add to that now, the solid odds of a new early 2028 issue to compete with these 1F28s and the market sees little reason to hold into them.

- For us, the bottom line here is the UK GILTS market will continue to be very fertile ground for the RV community for the foreseeable future!

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796