MICROCOSM: BUSY Week in the UK! Quick Rundown >

- Today’s the proverbial ‘calm before the storm’ – the only day this week without a significant market event in the UK. Let’s run through the highlights:

- Auctions:

- Tomorrow: £3.25bn UKT 0F25s; £1.5bn UKT 1F54s

- Wednesday: £3.0bn UKT 1Q27s; £3.25bn UKT 124s

- 25% PAOF still applies. This is significantly less DV01 than last week’s supply given concentration of 3 of the 4 taps in the 4-7yr range. (RV colour on this shortly)

- QE Operations:

- Size of daily operations unchanged at £4.5bn per day, £1.5bn per bucket.

- Tomorrow: 1T37s, 1H26, 124, 0F25, 1Q27, 0S29, 1T49, 1F54 ineligible

- Wednesday: 1H26, 124, 2T24, 0F25, 1Q27, 0S29, 1T49, 1F54 ineligible (Just 3 issues in 3-7yr bucket)

- Thursday: 1H26, 124, 2T24, 0F25, 1Q27, 0S29, 1T49, 1F54 ineligible

- Data:

- Tomorrow: Jobs data

- Wednesday: Inflation and House Price data

- Thursday: PMI and CBI trends data

- Friday: Retail Sales data

- UK Treasury Announcement on Apr 23rd:

- Chancellor announces revised funding targets for FT 2020/21, accounting for Covid-19 related spending programs.

- The tone of the OBR’s estimates and the nebulous impact their guidelines have on the UK Treasury’s decision making process have sparked a rather broad array of estimates for the total 20/21 funding package. Some are well above £300bn while others are a more conservative ~£260bn range.

- As noted in our recent notes, the pace of QE buying (in both DV01 and WAM terms) has largely mopped up the DMO’s additional April supply, keeping a lid on gilts yields across the curve. With about £150bn QE buying left in the £190bn announced at the end of March, the market will be keeping a very close eye on the size and timing of any negative net funding over the next 6 months+.

- We should also get some information on the timing of the May syndications of a new 10yr benchmark and perhaps the maturity of the ultras conventionals issue.

- We’ll be back with more soon… Buckle up!

Best,

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS > Impact of Issuance/QE Expansion on Curve Thus Far

- The Gilts market has had a remarkable 5 weeks. The impact of Covid-19 on the markets has been extraordinary, as has been the UK government’s response to the economic pressures a virtual lockdown of the UK has created. Sunak’s announcement of an additional borrowing need of £45bn in April, in advance of a revision to the 2020/21 issuance need on April 23rd that has steadily climbed over the last month (estimates now well north of £300bn gross issuance) was met with expanded QE operations that, thus far, have helped to prevent a bearish backlash in gilts.

- Those who’ve been following our Gilts RV recommendations since mid-March will know that the interplay between the DMO’s auction cycle and the BoE’s QE eligibility guidelines can create fertile ground for profitable trade ideas. While most of the RV ideas have been of the 3-5bps ‘curve dislocation’ variety – which is bread and butter for most of our clients – we think there is a big enough volume of data now that should allow us to detect broader trends and patterns along the curve in response to the auction/QE operations. As with all of these ‘forensic’ investigations, the inputs we use to analyse the impact are very important. For the sake of brevity, we’ll do our best to keep this from becoming a term paper.

- The basics:

The APF reinvestment of the 4T20s began on March 9th in the usual format of one sector per day, ~£1.45bn each which was expected to run until the start of April. Due to Covid-19, the whole operation was summarily concluded with two rather enormous operations on Mar 20th and 23rd.

The new QE operation began on Mar 24th and was a turbo-charged APF with £3bn per day, £1bn per bucket and scheduled for Tues, Wed and Thurs. At this point, the Chancellor still hadn’t announced the new April auction calendar. Importantly, for RV players, the buckets were adjusted, the mediums extended to 4Q39s from 4Q36s with 4Q40s now the shortest issue in the new 20yr+ bucket.

On March 31st, the BoE’s QE operations were expanded to £4.5bn PER DAY in response to the Treasury’s announcement of additional borrowing needs of £45bn in April. The new 2 auctions per day for 2 straight days was unprecedented for the UK. Not only is this more supply than we’ve ever seen but it has played havoc with the eligibility calendar for QE buying.

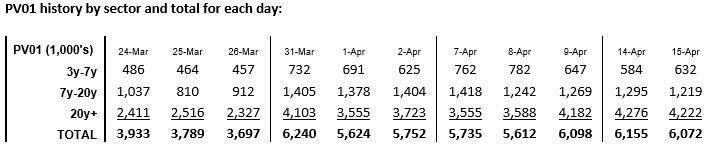

As we’ll see from the charts below, the relief trade on Thursdays where there’s QE without supply has started to have a significant impact on the curve. We’ll also approximate the DV01 per APF/QE operation too which could help reveal a pattern…

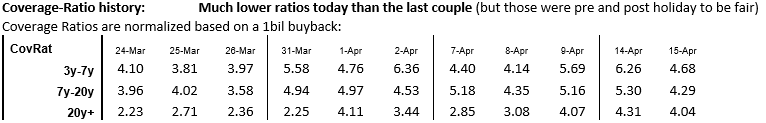

- Some excellent tables provided by my colleague John Wentzell that we’ll borrow for this exercise. The data begins at the start of the QE operations.

- Here’s the auction calendar since Mar 10th, with the PV01s for both issuance and QE since start of April:

Date Issue Size PV01 PV01 of QE Difference

3/10 4T30 £2.587bn £3.4mm

3/17 1T49 £2.3bn £6.33mm

3/19 0F25 £3.25bn £1.66mm

3/20-3/31 NO SUPPLY – APF/QE ONLY

4/1 1F28 £3.3bn £2.975mm £5.624mm +£2.324mm

4/2 1Q41 £2.0bn £4.16mm £5.752mm +£1.592mm

4/7 0E23 £4.06bn £1.14mm

4/7 1T57 £1.562bn £6.05mm £5.735mm -£1.455mm

4/8 4T30 £2.092bn £2.71mm

4/8 225 £2.750bn £1.565mm £5.612mm +£1.337mm

4/9 NO SUPPLY £6.098mm +£4.070mm

4/14 NO SUPPLY £6.155mm +£6.155mm

4/15 0S29 £3.676bn £3.555mm

4/15 1T37 £2.313bn £4.182mm £6.072mm -£1.665mm

We can see that there have only been two days thus far where the PV01 of the auctions was higher than the net PV01 of all the QE bonds bought by the BOE that day.

- Charts > Z-sprd curves

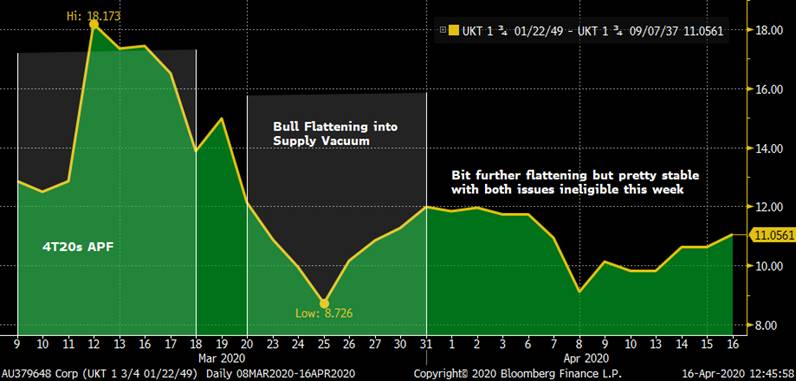

0F25-0S29

Clear bull flattening move when supply ended on Mar 20th – then steepened back when supply resumed. The 0S29s were ineligible for QE last week which contributed to the steepening bias.

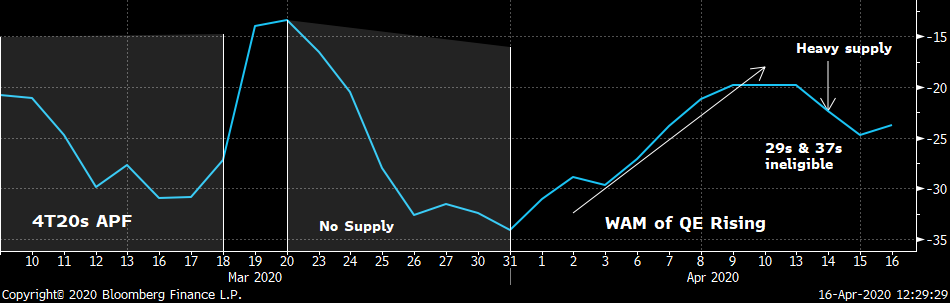

0S29-1T49

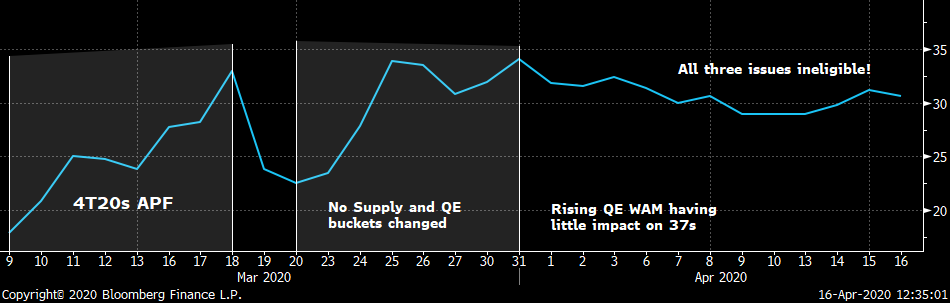

0F25-1T37s

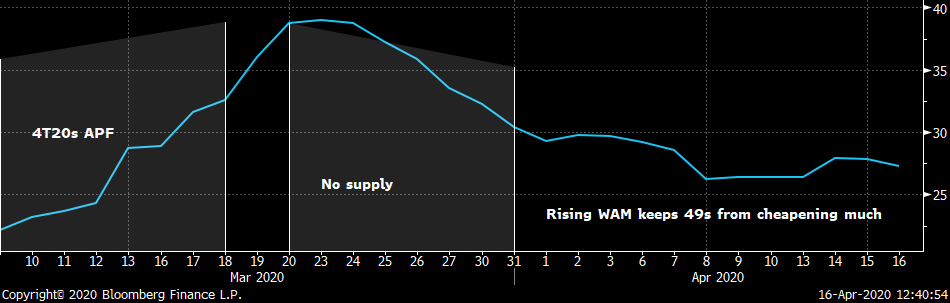

1T37s-1T49s

Yield Butterflies

0F25-0S29-1T37

Big richening of 29s when supply dried up in late March. But 29s gave much of that back when QE WAM began to rise.

0S29-1T37-1T49

The 15-20yr sector really hasn’t done much all things considered. The shifting of the 20yr+ bucket to the 4Q40s and their ineligibility weighed. They seem cheap here given the overall flattening bias.

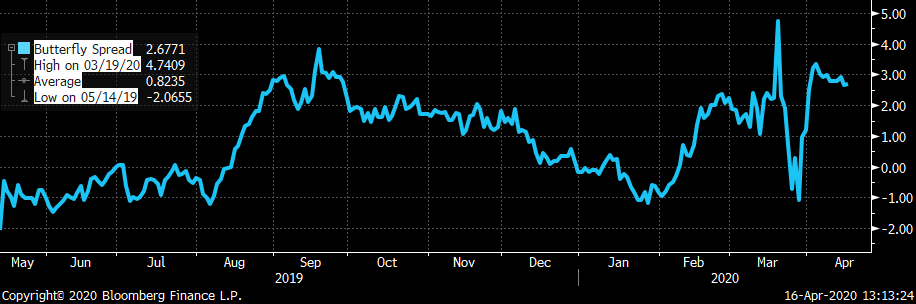

1T37-1T49-1F71

The 49s got clobbered into the end of the APF but rallied nicely when QE kicked into gear. We’ve chopped sideways for most of April though as the market awaits more info on 20/21 issuance.

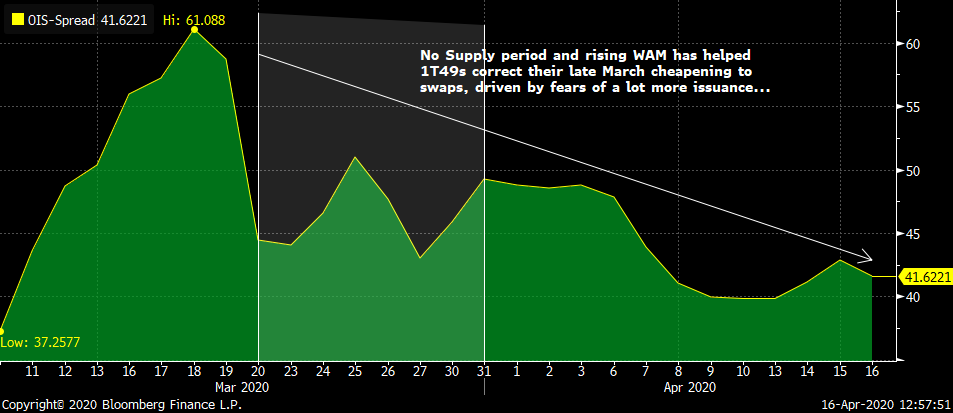

1T49s vs SONIA

There seems little reason to think that this can’t richen some more if QE continues at this pace…

- Other considerations:

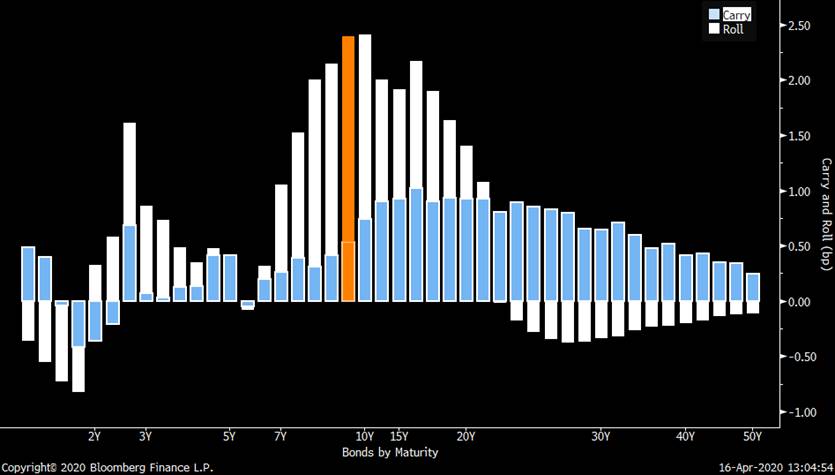

The chart below of carry and roll of the gilts curve is interesting. We can see the ‘sweet spot’ on the curve remains the 10yr sector with the 0S29s the most attractive issue at this point. That said, the 15-20y sector has ample C&R to attract demand and with the 29-37s sprd (for ex) still +36bps and both issues soon to be eligible for QE again, we think this flattener makes sense all things considered.

- Summary… While the charts above don’t reveal any ‘slam dunk’ trade ideas per se, they confirm that the gilts curve is in the midst of an overall long-end driven flattening bias, thanks to the rising WAM of QE purchases. This argues for a continuation of the extension bias we’ve advocated, especially into issues that have lagged due to the QE/auction dynamics. Time to keep an eye on the 1T54s, the next long issue to be tapped and the last ultras until May’s syndication.

UKT 1H47-1F54-3H68 fly

Comments always welcome…

Thanks,

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Bloomberg Bond News Summary > Tues Apr 14th

Business Briefing

1) Commodity Currencies Rally on China Data Beat: Inside G-10

(Bloomberg) -- Commodity currencies advanced as risk sentiment received a boost after China’s exports data beat estimates.

- Norway’s krone was the biggest gainer among Group-of-10 currencies, helped by a rise in crude prices. Australia’s dollar climbed for a seventh session as the China trade report allayed concerns about global demand for commodities

- China’s exports in yuan terms declined 3.5% from a year earlier in March compared with ...

2) North Korea Fires Several Short-Range Missiles, South Korea Says

(Bloomberg) -- North Korea fired multiple projectiles that appeared to be short-range missiles toward waters off its eastern coast on Tuesday, South Korea’s Defense Ministry said. Multiple air-to-surface missiles were fired from fighters jets, with the missiles flying about 150 kilometers (90 miles), the Yonhap News Agency said, citing the South Korea’s Joint Chiefs of ...

3) Stocks Climb Ahead of Earnings; Dollar Slips: Markets Wrap

(Bloomberg) -- Global stocks pushed higher Tuesday ahead of one of the most uncertain earnings seasons on record as the coronavirus pandemic rattles the world economy. The dollar retreated. Stocks climbed across Asia with benchmarks in South Korea and Japan pacing gains. U.S. futures rose after the S&P 500 Index retreated overnight and European contracts pointed higher. ...

4) Renault Scales Back China Presence by Exiting Dongfeng Venture

(Bloomberg) -- Renault SA is scaling back its already limited presence in China, with the French carmaker agreeing to transfer its 50% stake in a local venture to partner Dongfeng Motor Corp. as the coronavirus outbreak weighs on car demand. The manufacturers entered a preliminary agreement over the stock transfer, Renault said in an emailed statement Tuesday, without ...

World News Briefing

5) Trump Declares He Has ‘Total’ Authority to Reopen After Virus

(Bloomberg) -- President Donald Trump declared he has “total” authority to order states to relax social distancing to combat the coronavirus outbreak and reopen their economies, and warned that governors who refuse would face political consequences. Asked what provision gives the president the power to open or close state economies, Trump said: “Numerous provisions. We’ll ...

6) India Extends Lockdown; Countries Weigh Reopenings: Virus Update

(Bloomberg) -- Countries across the globe weighed the timing for easing restrictions, as hot spots showed slower rates of infections. India extended its lockdown, following a similar move by France. In the U.S., governors formed coalitions for the reopening of their economies, setting up a potential clash with President Donald Trump, who insisted he alone has that ...

7) China Says Hong Kong Lawmakers’ Stall Tactics Could Breach Oaths

(Bloomberg) -- China’s top agency overseeing Hong Kong said lawmakers blocking action by the local legislature were potentially violating their oaths, in a signal that Beijing was losing patience with the months-long legislative logjam. The Hong Kong and Macau Affairs Office urged the city’s Legislative Council in a statement released Monday to end the stalemate and resume ...

8) Crisis Gives Germany Sense of Vindication for ‘Black Zero’ Years

(Bloomberg) -- Now Germany is deploying its financial firepower to fight the coronavirus crisis, convincing the country that it was wrong to shun budget deficits for many years just got even harder. The government of Europe’s biggest economy has long faced calls by officials from the International Monetary Fund and the European Central Bank, to the U.S. administration of Donald Trump ...

9) Trump Defends His Coronavirus Record With Anger, and a Video

(Bloomberg) -- President Donald Trump declared “everything we did was right” and angrily denounced media reports suggesting his administration had failed to adequately ramp up coronavirus testing or the production of medical supplies in a testy press conference Monday at the White House. Trump, who said he was frustrated by the reports questioning his administration’s response ...

Bonds

10) Credit Markets in Asia Catch Up to Fed Rally With China Bullish

(Bloomberg) -- Credit markets in Asia returned Tuesday from a public holiday playing catch-up to the improvement in sentiment in the U.S., prompted by the Federal Reserve expanding its bond-buying program to include some high-yield securities. Spreads on top-rated Asian dollar bonds declined while the cost of credit-default swaps retreated, according to traders. China ...

11) Malaysia’s Oil Giant Markets Jumbo Bond as Asian Credit Rallies

(Bloomberg) -- Malaysia’s Petroliam Nasional Bhd. has started marketing a jumbo dollar bond offering Tuesday, in another sign of the easing strain in the region’s credit markets. The offering by the energy company known as Petronas comes only a few days after Indonesia sold its biggest-ever dollar note for funds to help fight the coronavirus crisis, following a lull in the ...

12) Japan’s Fukoku Mutual Prefers Equities Over Debt as Yields Slide

(Bloomberg) -- Equities continue to generate superior stable income over debt, Yusuke Onodera, general manager at Fukoku Mutual Life Insurance Co. in Tokyo, says in an interview.

- Co. can invest in foreign stocks via funds to get both income and capital, Onodera said. His comments come as Fukoku on Tuesday announced its allocation plan for the fiscal year that began April 1

- Co. plans to boost domestic equities holdings by 20b yen and plans to increase foreign ...

13) How the BOJ’s Massive Market Operations Make and Break Investors

(Bloomberg) -- Just when it seemed impossible to do more, along came the coronavirus, spurring the Bank of Japan to double-down on its already massive market operations. The BOJ’s presence is now felt in virtually every corner of Japan’s financial markets and its actions continue to shape global money flows. The first quarter of 2020 saw the central bank add a staggering 30 ...

14) Intelsat Seeks Bankruptcy Loan to Stay Afloat Until C-Band Sale

(Bloomberg) -- Intelsat SA is seeking backers for a bankruptcy loan that would keep the satellite service in business under Chapter 11 court protection while it’s waiting for billions of dollars in proceeds from a government spectrum auction. JPMorgan Chase & Co. is shopping the debtor-in-possession loan to institutional investors, many of whom specialize in financial ...

15) FX/RATES DAYBOOK EUROPE: AUD Extends Winning Run, NOK Jumps

(Bloomberg) -- The Australian dollar climbed for a seventh day as commodity currencies rallied, with its gains aided by better-than-expected Chinese trade data. That’s even as Australian business confidence plummeted to the lowest on record. The Norwegian krone led gains in Group-of-10 currencies against the greenback as oil prices rose. TODAY ...

Central Banks

16) Indonesia Seen Cutting Rate Amid Pandemic: Decision Guide (1)

(Bloomberg) -- Indonesia’s central bank is expected to lower borrowing costs for a third straight month as policy makers take unprecedented steps to bolster the economy amid the coronavirus pandemic. Bank Indonesia will cut its benchmark rate by 25 basis points Tuesday to 4.25%, according to 18 of 28 economists surveyed by Bloomberg. One economist predicted a 50 basis-point ...

17) Commodity Currencies Rally Fueled by China Data: Inside G-10

(Bloomberg) -- Commodity currencies advanced as risk sentiment received a boost after China’s exports data beat estimates.

- Norway’s krone rose 1% against the dollar to become the biggest gainer among its Group-of-10 peers, followed by the Australian dollar

- China’s exports in yuan terms declined 3.5% from a year earlier in March compared with forecast for a 12.8% fall

- “The China data beat definitely plays a part in fueling the risk-currencies’ rally -- it’s ...

18) EM Day Ahead: Indonesia Rates, Poland Trade, Brazil Activity

(Bloomberg) -- Focus will be on Indonesia’s central bank, which is expected to cut the key rate for a third time this year to limit the hit to growth from the Covid-19 pandemic. Helping to convince Bank Indonesia to act looks to be the Federal Reserve’s $60 billion lifeline to provide developing nations with dollars, which helped trim losses for Asia’s worst emerging currency. ...

19) Capitec Withholds Dividend on Central Bank’s Virus Guidance

(Bloomberg) -- Capitec Bank Holdings Ltd. decided against paying a final dividend after South Africa’s central bank urged lenders to withhold shareholder payouts to conserve cash amid the coronavirus pandemic. The Stellenbosch-based lender typically pays out 40% of earnings before one-time items in dividends, Capitec said in an earnings release on Tuesday. Adjusted earnings ...

20) China Agriculture Imports From U.S. Rose 110% in 1Q (1)

(Bloomberg) -- China 1Q exports to U.S. fell 23.6% y/y in yuan terms, China’s customs spokesman Li Kuiwen speaks at press conference in Beijing.

- China 1Q imports from U.S. was down 1.3% y/y in yuan terms

- China imports of pork, soybean, cotton from U.S. rose in 1Q

- China’s trade is facing bigger difficulties: Customs ...

Economic News

21) Italy’s Crisis Funds May Come Too Late for Desperate Businesses

(Bloomberg) -- Italy’s companies and small businesses desperately need the 740 billion euros ($807 billion) the government pledged to keep the economy afloat through the pandemic recession. By the time the money arrives, it might be too late. Banks, which have to channel most of the aid to recipients, “have to follow standard procedures because part of the financing risk ...

22) China’s Trade Fell Less Than Expected Even as Virus Spread

(Bloomberg) -- China’s trade performed better than expected in March, with both exports and imports declining less than expected even as the coronavirus prompted business shutdowns around the world.

- Exports declined 6.6% in dollar terms in March from a year earlier, while imports fell 0.9%, the customs administration said Tuesday. Economists had forecast that exports would ...

23) Goldman Sees Advanced Economies Shrinking 35% Amid Pandemic

(Bloomberg) -- Advanced economies will shrink about 35% this quarter from the prior three months, four times as much as the previous record set in 2008 during the financial crisis, according to annualized figures from Goldman Sachs Group Inc. How fast economies will rebound is an open question because nobody knows how quickly people can get back to work, New York-based ...

24) Australia Treasury Sees Unemployment Soaring to 10% This Quarter

(Bloomberg) -- Australia’s jobless rate will almost double this quarter, the nation’s Treasury estimated, as the shutdown of large swathes of the services industry upends the labor market. Unemployment will soar to 10% in the three months through June, from 5.1% in February, Treasurer Josh Frydenberg said Tuesday, citing department forecasts. Without the government’s ...

25) U.K. Likely to Announce Lockdown Extension This Week, Raab Says

(Bloomberg) -- British ministers will decide in the next three days on extending the country’s lockdown, with Foreign Secretary Dominic Raab telling reporters it was likely to carry on and the government’s chief scientific adviser saying he expects the daily rate of deaths to continue to rise. Under the law passed last month to tackle the spread of coronavirus throughout the ...

European Central Bank

26) ECB’s Guindos Says Genuine Recovery Might Not Show Until 2021

(Bloomberg) -- Europe is likely to experience a more severe recession than the rest of the world and might not show proper signs of recovery until next year, according to European Central Bank Vice President Luis de Guindos. Economic prospects are worsening as governments across the 19-nation euro area extend lockdowns to rein in the spread of the coronavirus. The French ...

27) BIS: Luis de Guindos: Interview in La Vanguardia

What is your assessment of the global economic situation in the midst of this coronavirus crisis? The global economy will enter recession and so will the European economy, albeit an even more severe one. The ultimate fall in GDP will depend on how long the lockdown lasts. International bodies have calculated that the economy will shrink by 2% to 3% for each month of lockdown. So one and a half months ...

28) BIS: Christine Lagarde: Interview in Le Parisien 14 Apr 2020

29) BIS: Christine Lagarde: Interview in Le Parisien

From Emmanuel Macron's repeated references to "war" to Queen Elizabeth II invoking the spirit of the Blitz, memories of the darkest hours in our history are resurfacing. Are we in effect facing a war? There are probably points of comparison. What is certain is that an invisible enemy is severely testing our healthcare systems and our extraordinary healthcare workers. And that same enemy is putting ...

30) Daily Bitcoin: ECB Expects Worse Recession in Europe Than Global Economy

The European Central Bank (ECB) expects the European economy to suffer a more severe recession than the global economy. Countries across the euro area will experience “a deep recession,” which entails unprecedented funding needs of more than €1 trillion ($1.1 trillion), explained ECB Vice President Luis de Guindos. Also read: IMF Declares Global Recession, 80 Countries Request Help, Trillions ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: BTPS Supply This AM... Is it Safe? RV Colour/Ideas

BTPS Supply This AM... RV Colour

- So, we've got another Eurogroup meeting at 5pm, well after this am's BTPS auction and before a 4 day holiday weekend (depending where you live). German officials swear up and down a deal is imminent and the ECB's QE efforts have done a pretty good job of limiting any damage caused to BTPS of late. (Case in point, 10yr DBR-BTPS sprds opened at +16bps yesterday on fears of no Eurogroup deal and by lunchtime they were just +5bps - an 11bps correction on no new info)...

- That said, it seems unless something looks really out of whack, RV interest in this am's auctions is likely to be tepid at best. Let's see whether there’s a trade here.

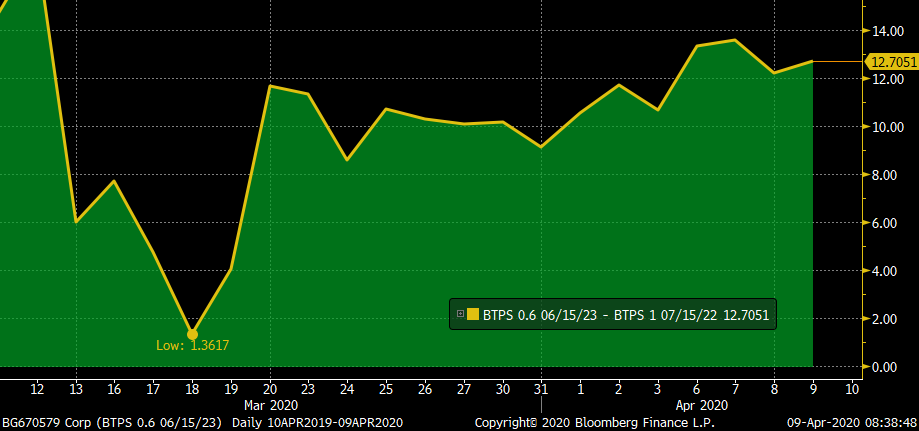

- BTPS .6 6/23 - cheapened 30 basis points in yield since Monday (!), 6/23-10/23 yield sprd is just 3bps, they've got ~16bps of C&R over 3 mos and on fly vs 3/15/23 and 10/23s they're at their cheapest since Mar 24 at +2.8bps mid. The pick-up from BTS contracts (7.22) into these BTPS 6/23s is +14bps mid this am. These should fly off the shelf.

BTPS 7/22-BTPS 6/23 Z-sprd box

- BTPS 0.85 1/27 - Yet MORE 7yr supply, on the heels of deals from Spain, Belgium and Ireland. Interestingly, those deals have done well with their deal concessions attracting ample demand and the market's faith has been rewarded as 7-9/10s has steepened in each of them. The .85 1/27-3 8/29 (IKM0) yield sprd has flattened 8bps back to the lows since Apr 1 and the steepener has 6bps+ of positive C&R. They've cheapened almost 25bps in yield this week and the 7/26-1/27-8/27 fly is at its cheapest since Mar 12th. Not a slam dunk but these 1/27s look pretty damn cheap to me.

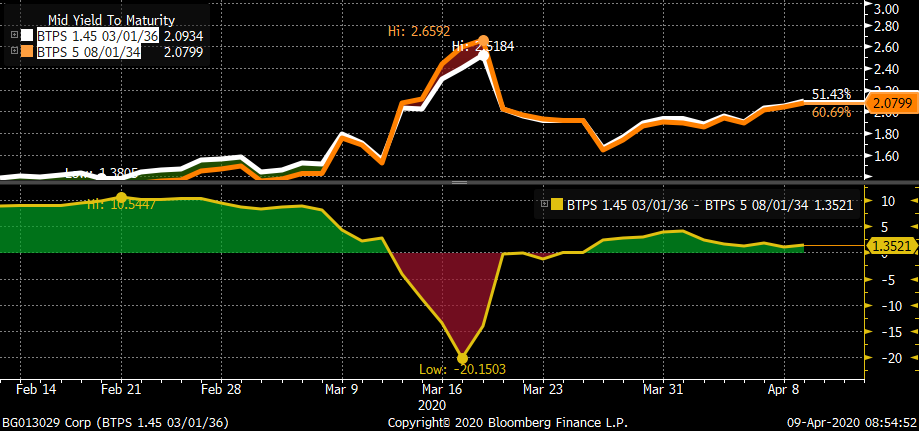

- BTPS 1.45% 3/36 - First tap of the 9bn syndicated deal brought on Feb 11th. The issue has held its own on the curve so far but there was a 2 week window into the end of March where the 15-25yr sector of the BTPS curve became VERY difficult to trade. Volatility was high, balance sheet scarce and risk appetites very low. Having the lowest coupon beyond the BTPS 0.95 8/30s helps them somewhat, not just from a convexity standpoint but also from a credit point of view as we’d expect them to outperform their higher coupon neighbours if things got ugly in BTPS. This helps explain why these BTPS 3/36s trade .7bps THRU the BTPs 3.35 3/35s. As with the 23s and 27s, we’ve seen a nice cheapening on an outright basis, currently 2.09% having started the week at 1.90%. As we can see from the chart below, the BTPS 3/36s trade at a small pick-up over the BTPS 5 34s and slightly through the BTPs 3/35s. We can also see from the chart that when the wheels fell off in mid-March, the 3/36s outperformed the 34s by 20bps at one point. With the ECB backstopping BTPS this kind of mayhem seems less likely, however, it does suggest that the relative safety of these low-coupon BTPS 3/36s is worth owning and should provide support at today’s tap. No, not a slam dunk but supportive nonetheless.

- BTPS 4.75 9/44 > High coupon issue with few redeeming features other than a dealer who really needs them as this has ‘reverse inquiry’ all over it. That said, the issue has cheapened a bit on the curve into this am’s tap. The tap is capped at 750mm so not a massive amount of risk. Unless you really need them, we’re steering clear of this illiquid issue.

We’ll be in touch!

Thanks

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Busy Holiday-Shortened Week on Tap > EGB and UKT Supply

- Morning… This is the first week of the DMO’s new 2 auctions a day for 2 days (Double-Double-Trouble?) which will be met with £4.5bn a day of QE from Tues-Thurs (unchanged from last week). We’ll also have a pretty busy calendar in Europe although it won’t be as heavy as last week. With the markets closed in Europe and the UK on Friday and Monday, we should have an action packed 4 days.

- As noted in my recent notes on the UK, relative-value players have been doing a good job of cheapening new issues into their auctions and QE ineligibility, especially for those that have been trading rich to the curve. With balance sheets and risk appetites taxed amid heightened volatility, we don’t see this pattern changing any time soon, especially now with supply doubling versus last week. Corporates will be bought as well for the first time this QE cycle.

This week’s UK auctions are:

10am tomorrow> £3.25bn NEW UKT 0.875% 2023s (quoted at +6.4bps to the 0T23s on Friday in gray mkt)

11:30am “ > £1.25bn tap of the UKT 1T57s (~40.4k G M0 equivalents). Grinding richer after a sharp cheapening.

10am Wednesday> £2.00bn tap of the UKT 4T30s (CTD). 4T30s have richened ~15bps vs swaps of late.

11:30am “ > £2.75bn “ “ “ UKT 2 25s. Sprd vs 0F25s has cheapened 5bps since peaking at -11.4bps.

As usual, the QE operations will follow this schedule:

3-7yr 12:15-12:45

7yr-20yr 13:15-13:45

20yr+ 14:15-14:45

It’s easier to tell you which issues are excluded and when rather than copy the whole list.

From the DMO’s rundown:

UKT 1.625% 2028 will be excluded from the 07/04/20 operation because it will

have been auctioned by the DMO within one week of the purchase operation.

UKT 1.25% 2041 will be excluded from the 07/04/20, 08/04/20 operation because

it will have been auctioned by the DMO within one week of the purchase

operation.

UKT 1.75% 2057, 2% 2025, 4.75% 2030 will be excluded from the 07/04/20,

08/04/20, 09/04/20 operation because it will have been auctioned by the DMO

within one week of the purchase operation.

UKT 0.875% 2029, 1.75% 2037 will be excluded from the 08/04/20, 09/04/20

operation because it will be auctioned by the DMO within one week of the

purchase operation.

UKT 1.5% 2026, 1.75% 2049 will be excluded from the 09/04/20 operation because

it will be auctioned by the DMO within one week of the purchase operation.

We’ll update our RV ideas later this am.

- Europe’s redemptions in April are substantial which will turbo-charge the ECB’s QE buying. April bunds mature on the 17th, OATs on the 25th, BTPS on the 15th, Bonos on the 30th and Ireland on the 18th, totalling 30.4bn led by Germany and France’s 8.7bn and 8bn respectively. Add to that 13bln+ of QE (depending how aggressive the ECB wants to be) and we’re talking at least 44bn worth of buying from now until the end of the month. Tough to be too short EGBs with that factored in.

- Conventionals Calendar:

Tue 8th

Austria 0% 30s (est 500mm)

“ 0% 24s (est 700mm)

Wed 9th

Germany 4bn DBR 0% 30s

Italy 3yr, 7yr & 30yr (TBC today)

Ireland is expected to syndicate a new issue this month.

- More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: DMO Fills in the Blanks for April's Calendar - Colour/RV IDEAS

> The DMO has completed the calendar for April's auctions - u can find the PDF HERE.

> Nice cross-section of off the run issues. The auctions on top of those we knew yesterday will be 1 24, 2t 24, 1h 26, 1q 27, 0s 29, 1t 37, 1t 49 and 1f 54.

> As noted in our GILTS note yesterday (attached), we'll do our best to take advantage of any cyclicality the auction/QE concessions bring us while focusing on the broader picture. Some initial ideas driven by today’s mini-tender below.

> In the meantime, we’ll have a £3bn mini-tender of the 1F28s this morning. Auction format is largely the same, although there are no non-comps and the Post Auction Option Facility is closed.

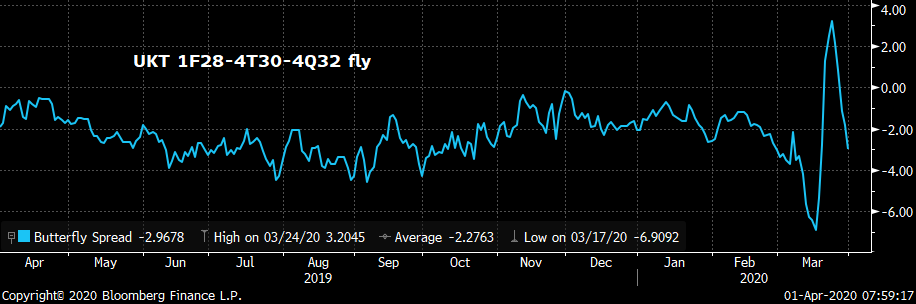

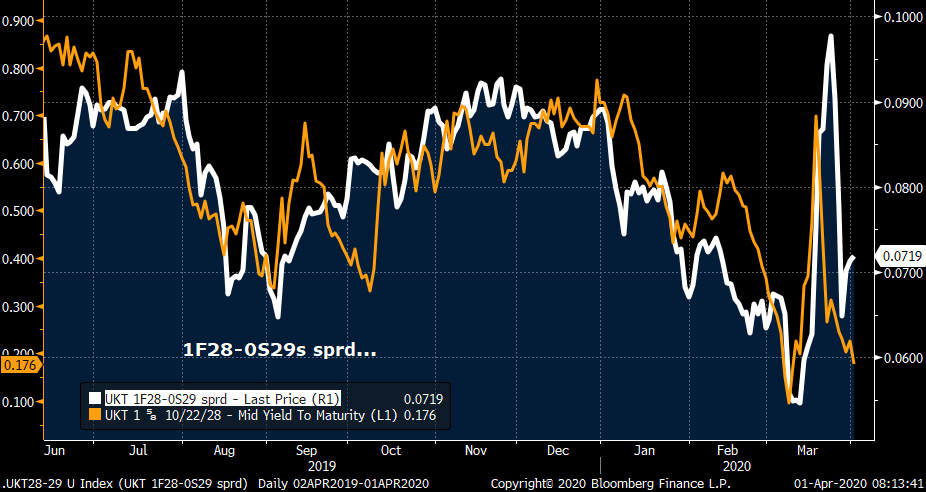

> The 1F28s were one of the richest issues in the belly of the curve before the announcement of this mini-tender, featuring highly in the first couple weeks of the 4T20 APF and QE operations. We wouldn’t call these 1F28s cheap by any means, but we can see from the chart below that the 1Q27-1F28-0S29 fly has cheapened from -4.25bps to -.6bps (having briefly reached +.5bps) and are now closer to ‘fair’ vs their low cpn neighbours. Next week’s 10yr supply will be a tap of the 4T30s on Wednesday which makes them ineligible for QE. We’ve seen a nice reversal of the recent cheapening of the 4T30s over the last several sessions on fly vs 28s and 32s. While the 4Q32s remain ineligible for QE – and trade cheap to the curve – there remains a sharp divergence between yield level and the steepness of the 30-32s sprd. We think the odds are high that this 4T30s cheapening will resume into next week as the weight of 4 auctions a week neutralizes some of the bullish impact of the QE buying.

Also… 1Q27-1F28-0S29 fly

And lastly, the 1F28-0S29 steepener has a nice little bearish bias which could come in handy into next week’s cranking up of supply. Plus, the 0S29s are tapped again on Apr 15th…

AUCTION DATE & CLOSING TIME GILT DETAILS ANNOUNCED (3:30pm)

Thur 2 Apr 10:30am GBP 2,000 MN 1 1/4% Treasury Gilt 2041 Tues 24 Mar

Tues 7 Apr 10:00am GBP 3,250 MN 0 1/8% Treasury Gilt 2023 Tues 31 Mar

Tues 7 Apr 11:30am GBP 1,250 MN 1 3/4% Treasury Gilt 2057 Tues 31 Mar

Weds 8 Apr 10:00am 4 3/4% Treasury Gilt 2030 Weds 1 Apr

Weds 8 Apr 11:30am 2% Treasury Gilt 2025 Weds 1 Apr

Weds 15 Apr 10:00am 0 7/8% Treasury Gilt 2029 Weds 8 Apr

Weds 15 Apr 11:30am 1 3/4% Treasury Gilt 2037* Weds 8 Apr

Thur 16 Apr 10:00am 1 1/2% Treasury Gilt 2026* Thur 9 Apr

Thur 16 Apr 11:30am 1 3/4% Treasury Gilt 2049 Thur 9 Apr

Tues 21 Apr 10:00am 0 5/8% Treasury Gilt 2025 Tues 14 Apr

Tues 21 Apr 11:30am 1 5/8% Treasury Gilt 2054* Tues 14 Apr

Weds 22 Apr 10:00am 1 1/4% Treasury Gilt 2027* Weds 15 Apr

Weds 22 Apr 11:30am 1% Treasury Gilt 2024* Weds 15 Apr

Tues 28 Apr 10:00am 0 7/8% Treasury Gilt 2029* Tues 21 Apr

Tues 28 Apr 11:30am 0 1/8% Index-linked Treasury Gilt 2028 Tues 21 Apr

Weds 29 Apr 10:00am 2 3/4% Treasury Gilt 2024* Weds 22 Apr

Weds 29 Apr 11:30am 1 3/4% Treasury Gilt 2049* Weds 22 Apr

As previously announced, the DMO will also hold a gilt tender for up to GBP

3,000 million (nominal) of 1 5/8% Treasury Gilt 2028 on Wednesday 1 April.

Following publication by the Office for National Statistics of the outturn

for the 2019-20 CGNCR (ex NRAM, B&B and NR), which is due to be published on 23

April 2020, the DMO will publish an announcement setting out a comprehensive

revision to the 2020-21 financing remit. The revision will, as normal, reflect

any impact on the 2020-21 financing remit from the outturn 2019-20 CGNCR (ex

NRAM, B&B and NR) but will also take into account implications for the

Government's borrowing requirement of all measures announced by government up to

that date, to support the economy through the period of disruption caused by

COVID-19.

More to come!

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FT Opinion: Loneliness during the American epidemic

I like this thought provoking piece in today’s FT… M

|

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: UK Rates and Equities > Sentiment Counts - Charts/Comment

GILTS... 'Sentiment Counts'

> Very interesting charts comparing bonds and stocks performance of late.

> Chart below of G M0 (gilts) vs the FTSE over the last 20 days shows unusual shifts in their correlation that has confounded much of the rates community (ourselves included!).

> At the start of March we had a typical inverse relationship - stocks down, bonds up as FTQ flows emerged.

> As stocks began to really sell-off around Mar 9th, however, the relationship became positively correlated as equities sellers had to dump in the money bonds holdings to raise money for margin calls.

> NOW, we've got another positive correlation as BOTH bonds and stocks rally in response to the recovery/ stimulus measures put in place, not the least of which are the BoE's acceleration of the APF buying along with a massive £200bn QE package that has mopped up ~£19bn+ gilts in the last 5 sessions..

> So, what happens NOW? Well, we have NO QE buying from the BoE until Tuesday (qtr-end) AND the stock market is on a tear, not only due to anticipated $2trln bailout package from the US but also in expectation of the mother of all index rebalancing moves into Mar 31st.

> With a mini-tender coming Apr 1, no QE and stocks trading well, we're inclined to take a more bearish view of the rates market over the next couple sessions. Trades like the UKT 25-30-36 fly have stormed back mightily over the past few sessions and issues like the 1F28s, 0S29s and 1T37s have had impressive runs... Time to fade that.

UKT 49s-71s is still very inverted, even after a modest retracement. Here’s 71s into 49s…

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Bloomberg Bond News Summary > Fri Mar 27th

Business Briefing

1) Stocks Should Be Afraid If Dollar Was Their Crutch: Markets Live

2) U.S. Equity Futures Slip; Treasuries Push Higher: Markets Wrap

(Bloomberg) -- U.S. equity futures dropped after the first three-day rally in American stocks since mid-February, while Treasuries advanced as investors take stock of strengthening stimulus efforts across the globe. S&P 500 futures retreated after the index surged over 6% Thursday. European contracts fluctuated. The dollar headed for its biggest weekly fall since 2009, ...

World News Briefing

3) India Cuts Rates; U.S. Cases Surpass China: Virus Update

(Bloomberg) -- The U.S. overtook China for the most coronavirus cases worldwide, fueled by a large jump in infections in New York, while global deaths from the pandemic surpassed 24,000. The Reserve Bank of India cut interest rates, joining central banks around the world in boosting stimulus to counter the economic impact of the coronavirus outbreak. U.S. President Donald ...

4) Sunak’s U.K. Virus Aid Package Beats Financial Crisis Stimulus

(Bloomberg) -- Chancellor of the Exchequer Rishi Sunak said he’d do “whatever it takes” to prop up U.K. businesses and jobs as the country grapples with the coronavirus pandemic, and he’s putting the country’s money where his mouth is. Sunak’s fourth emergency package of measures announced Thursday -- 9 billion pounds ($11 billion) of support for the self-employed -- brings ...

5) Second Virus Shockwave Is Hitting China’s Factories Already

(Bloomberg) -- Since last week, emails from foreign clients have been flooding into export manager Grace Gao’s in-box, asking to delay orders already made, putting goods ready to be shipped on hold until further notice, or asking for payment grace periods of up to two months. Gao’s firm, Shandong Pangu Industrial Co., makes tools like hammers and axes, 60% of which go to ...

6) Trump Touts ‘Very Good’ Talk With Xi as U.S. Cases Surpass China

(Bloomberg) -- U.S. President Donald Trump said he and Chinese leader Xi Jinping had a “very good conversation” about the coronavirus pandemic and that the two nations were working closely together to defeat it. “Just finished a very good conversation with President Xi of China. Discussed in great detail the CoronaVirus that is ravaging large parts of our Planet,” Trump ...

7) Stacks of Urns in Wuhan Prompt New Questions of Virus’s Toll

(Bloomberg) -- The long lines and stacks of ash urns greeting family members of the dead at funeral homes in Wuhan are spurring questions about the true scale of coronavirus casualties at the epicenter of the outbreak, renewing pressure on a Chinese government struggling to control its containment narrative. The families of those who succumbed to the virus in the central Chinese city, where the ...

Bonds

8) Credit Markets Are Set For The Sharpest Weekly Rebound In Years

(Bloomberg) -- Credit markets rebounded sharply this week after unprecedented steps by central banks and governments in response to the coronavirus pandemic. The price of insuring bonds against default in Asia is set for the biggest weekly drop in more than a decade. Spreads on investment-grade dollar notes in the region tightened by a record. It’s a stark contrast to last ...

9) Rupee, Bonds Jump on India Rate Cut, $50 Billion Liquidity Boost

(Bloomberg) -- The rupee and bonds rallied after the Reserve Bank of India slashed interest rates and announced a liquidity infusion of as much as $50 billion, joining global central banks in easing policy to limit the impact of the coronavirus pandemic. Stocks fell after rising initially. The benchmark repurchase rate was cut by 75 basis points to 4.40% on Friday following an ...

10) Pimco Says for Asia Dollar Bonds, It’s ‘Trading by Appointment’

(Bloomberg) -- The coronavirus pandemic has upended financial markets around the world, and few have been altered so drastically as the Asian dollar bond market. After a record stint of activity late last year, issuance and trading has gone eerily quiet in a region that was the first to experience widespread lockdowns and working from home. ...

11) Echoes of Asia Financial Crisis Haunt Region’s Debt Market

(Bloomberg) -- As the coronavirus outbreak roils credit markets around the world, Asia is under particular threat. The region has led the world in economic growth for years as debt helped fuel frenetic construction of airports, bridges and apartment towers for millions of people moving into cities. That model is now running up against an unprecedented spike in borrowing ...

12) Asia Firms Await More Stability to End Lull in Dollar Bond Sales

(Bloomberg) -- A slew of rescue measures from global central banks and nations amid the global Covid-19 crisis might have revitalized U.S. and Europe primary bond sales. In Asia though, dollar issuance remains in freeze. Issuers in the region are waiting for the wild swings in the financial markets to end, with an eye also on whether the premium to borrow dollars in Asia ...

13) Fed Heeds Repo Crisis of 2019 in Tackling Quarter-End Strain

(Bloomberg) -- The Federal Reserve’s massive moves to unclog the financial system’s plumbing are starting to unfreeze short-term funding markets -- just in the nick of time. Pressures from the coronavirus crisis are coinciding with the last days of a quarter, when the market for repurchase agreements can get hairy even during the best of times. The Fed discovered this to ...

Central Banks

14) Australia QE Program Shows ‘Signs of Success’ in First Week (2)

(Bloomberg) -- Australia’s central bank is one week into buying government bonds in order to lower interest rates across the economy and the early verdict: so far so good. The Reserve Bank of Australia has bought A$21 billion of securities ($12.8 billion) since last Friday, after setting an objective for three-year government bond yields of 0.25%, the same as the cash rate. ...

15) Singapore Central Bank Preps Aggressive Move: Decision Guide (1)

(Bloomberg) -- Singapore’s central bankers are poised to take unprecedented action Monday to bolster financial markets and support an economy facing a severe recession. The Monetary Authority of Singapore, which uses the currency as its main policy tool rather than interest rates, will probably take unusually aggressive action of two moves, according to economists surveyed ...

Economic News

16) India’s RBI Unleashes $50 Billion of Liquidity, Slashes Rate

(Bloomberg) -- The Reserve Bank of India cut interest rates and announced steps to boost liquidity in a stimulus worth 3.2% of gross domestic product to counter the economic impact of the coronavirus outbreak. The benchmark repurchase rate was slashed by 75 basis points to 4.40% from 5.15%, Governor Shaktikanta Das said Friday after an emergency meeting of the rate-setting ...

17) From Spain to Germany, Farmers Warn of Fresh Food Shortages

(Bloomberg) -- In his three decades growing strawberries and blueberries, Cristobal Picon has learned how to grapple with problems ranging from droughts and driving winds to floods and freezes. But this year, the coronavirus outbreak has proven too much. Every spring, Picon’s fields in Huelva, on the Atlantic coast of Spain tucked between Seville and the border with ...

18) Federal Reserve’s Balance Sheet Tops $5 Trillion for First Time

(Bloomberg) -- The Federal Reserve’s balance sheet topped $5 trillion for the first time amid the U.S. central bank’s aggressive efforts to cushion debt markets against the coronavirus outbreak through large-scale bond-buying programs. Total assets held by the Fed rose by $586 billion to $5.25 trillion in the week through March 25, according to data published Thursday on ...

19) Vietnam’s GDP Growth Slows in First Quarter as Virus Hits (1)

(Bloomberg) -- Vietnam’s economic growth slowed in the first quarter as the coronavirus outbreak hurt key industries from tourism to manufacturing. Gross domestic product rose 3.82% from a year earlier, the General Statistics Office in Hanoi said Friday, down from 6.97% previously reported for the last quarter of 2019. That would be the slowest growth since at least 2013, ...

European Central Bank

20) ECB Biggest User of Fed Swap Line; BOJ, BOE, SNB Also Used It

(Bloomberg) -- Global central banks tapped the Federal Reserve’s FX swap lines for a total of $206.051b, in the week ended March 25, according to New York Fed data published Thursday.

- The European Central Bank tapped the line for $116.22b across various 7-day and 84-day facilities

- The Bank of Japan tapped the line for $67.175b across various 7-day and 84-day facilities

- The Bank of England tapped the line for $19.015b across various 7-day and 84-day ...

21) Volkswagen Calls on ECB to Speed up Emergency Lending: FT

(Bloomberg) -- Volkswagen has urged the European Central Bank to speed up emergency lending plans to support companies amid the coronavirus outbreak, the Financial Times reports, citing an interview with the company’s CFO Frank Witter.

- ECB should purchase short-term debt, which matures in as little as six or nine months, co. said

- NOTE: Volkswagen is one of Europe’s most ...

22) ECB’s Lagarde Isolated Herself Temporarily After Virus Contact

(Bloomberg) -- European Central Bank President Christine Lagarde isolated herself last week following exposure to a person with the coronavirus, according to two people familiar with the matter. An ECB spokesman declined to comment, but said the president has been working in her office this week. The precautionary measures haven’t prevented Lagarde from leading policy discussions. Last ...

23) After Bailing Out Euro Area, Lagarde Tackles Merkel on Debt (1)

(Bloomberg) -- Just over a week after Christine Lagarde stepped in to shield European Union governments from a market rout, they rejected her appeal to show more solidarity in the face of the coronavirus pandemic. The European Central Bank president reiterated her appeal for joint debt issuance on a video conference with EU leaders on Thursday, saying the bloc is facing a ...

24) ECB, Banks in Talks on Dividend Options Including Delays (2)

(Bloomberg) -- The European Central Bank is in talks with the continent’s lenders on dividends as banks across the region grapple with shareholder payouts amid one of the worst economic crises in recent years. One option under discussion between the euro area’s main financial supervisors and the banks is to delay paying out profits to shareholders until at least the third ...

Federal Reserve

25) Recession Busting Buffers May Rise Faster When Good Times Return

(Bloomberg Intelligence) -- The coronavirus crisis's unexpected and severe onset may prompt the Fed and other central banks to increase countercyclical capital buffers (CCyB) faster in good times as countries using them, like the U.K., are now releasing the buffers to stoke lending. We expect governments that haven't raised CCyB above zero may opt to in the next expansion.

First Word FX News Foreign Exchange

26) Dollar Slides on Rising U.S. Virus Cases, Poor Data: Inside G-10

(Bloomberg) -- The dollar slipped versus all its Group-of-10 currency peers after the U.S. overtook China for the most coronavirus cases globally and jobless claims surged to all-time highs. Treasuries rose.

- The Bloomberg Dollar Spot Index fell 0.3%, taking its loss this week to 3.7%, set to be a record in data going back to 2005. A total of 3.28 million Americans filed for ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Bloomberg Bond News Summary > Wed Mar 18th

Business Briefing

1) U.S. Stock Futures Slide After Rally; Yen Gains: Markets Wrap

(Bloomberg) -- U.S. and European stock futures slumped and the yen advanced, retracing some of the previous day’s moves as traders continue to test where fundamental valuations lie amid rapidly changing news flow. Rallies fizzled throughout Asia, with Japanese shares ending barely up after rising over 4% at one point. Sydney stocks plunged more than 6%, while shares in Hong ...

2) Sorry European Stocks It All Turned Ugly in Asia: Markets Live

3) U.S. Index Futures Hit Limit Down as Volatility Grips Market

(Bloomberg) -- U.S. stock futures slid, hitting exchange-enforced bands that prevent further losses, as investors assess the Trump administration’s beefed up policy response to the coronavirus. Contracts on the S&P 500, Nasdaq 100 and Dow Jones Industrial Average all reached the so-called limit down level established each day by the Chicago Mercantile Exchange. Futures ...

World News Briefing

4) Federal U.S. Government Shifts to Work-From-Home: Virus Update

(Bloomberg) -- The White House ordered the federal U.S. government to maximize the use of teleworking and minimize face-to-face interactions, emulating moves by major employers across the globe. Travel curbs continue to expand. European countries agreed to shut their borders to foreigners, Taiwan made a similar move and Hong Kong is considering the step. Australia told its ...

5) Trump Told Mnuchin to Go Big, and a $1 Trillion Stimulus Emerged

(Bloomberg) -- Steven Mnuchin had an ominous message for Senate Republicans gathered Tuesday in a marble-clad meeting room in the Russell office building: we need to pass a virus stimulus bill, or the U.S. could be looking at a 20 percent unemployment rate. The message was a far cry from little more than a week ago, when Trump and his aides had declared the economy was ...

6) Putin Shocked Aides Caught Out by His Presidential Power Play

(Bloomberg) -- Vladimir Putin’s surprise move to allow himself to remain as president until 2036 caught even many Kremlin insiders off guard, leaving some feeling deceived by his motivation for changing the constitution. His sudden reversal -- approving a plan that he’d long publicly resisted -- was a blow to some senior officials’ hopes that he would find a more elegant ...

7) Biden Sweeps Tuesday Votes, Taking Command of Democratic Race

(Bloomberg) -- Joe Biden swept the Democratic presidential primaries being held Tuesday, winning in Arizona, Florida and Illinois giving him a commanding lead over his rival Bernie Sanders in the battle to secure the party’s nomination. Biden’s domination of the race since the South Carolina primary has put him on a glide path to the party’s nomination to take on President ...

8) China Further Erodes Hong Kong’s Autonomy With Journalist Cull

(Bloomberg) -- In ousting a group of American reporters in Beijing, China also dealt a severe blow to Hong Kong’s autonomy that could have lasting repercussions for media freedom in the city. China on Wednesday said that U.S. journalists set to be expelled from Beijing wouldn’t be allowed to work in the special administrative regions of Hong Kong or Macau, either. That’s ...

Bonds

9) Fallout From Turmoil in Global Credit Markets Is Spreading

(Bloomberg) -- The fallout from the worst rout in credit markets since the global financial crisis is spreading, threatening everything from mortgage debt in Australia to short-term money markets in the U.S. As the deadly coronavirus pandemic brought more grim headlines Wednesday, spreads on Asian dollar bonds and credit-default swaps pushed out further in another volatile ...

10) Yardeni Says Bond Vigilantes May Return After Virus Crisis Fades

(Bloomberg) -- The market veteran credited with coining the term “bond vigilantes” says there’s a chance they could make a return in the aftermath of the coronavirus, after being largely absent for decades. Government debt in most developed nations has seen a powerful rally the past two months as the deadly epidemic throttled economic growth. But once the outbreak finally ...

11) How a Little Known Trade Upended the U.S. Treasury Market

(Bloomberg) -- It is said that liquidity is a coward, it disappears at the first sign of trouble. What happened in Treasuries last week was one example of this, as problems in one small corner of the bond market helped spark a liquidity crisis in another that lead to a $5 trillion Federal Reserve promise to calm markets. As coronavirus cases spiked around the world and unprecedented travel restrictions ...

12) Credit Turmoil Is Closing In on Japan’s $650 Billion Market

(Bloomberg) -- Japan’s corporate bond market had been an oasis of calm in recent weeks, with deals staying steady even as the coronavirus pandemic caused the worst sell-offs elsewhere since the global financial crisis. That’s now changing. The cost to insure company debt against default in Japan has surged 77 basis points so far in March, the sharpest monthly increase since ...

13) Australia’s Mortgage-Backed Security Market ‘Effectively Closed’

(Bloomberg) -- Australia’s mortgage-backed security market, a crucial source of finance for consumer loans, has gummed up. With credit markets everywhere reeling as investors wake up to the severity of the coronavirus crisis, local fund managers say they expect to see new issuance pulled. “The market is effectively closed for new residential mortgage-backed security issuance. ...

14) Oaktree Planning New Distressed Fund to Catch Bad Debt Surge

(Bloomberg) -- Oaktree Capital Management LLC is planning a new distressed debt fund as recent credit market turmoil throws up investment opportunities. “High-yield bonds, loans and CLO tranches, for example, offer markedly better opportunities than they did in the very recent past,” co-founder Howard Marks said in a March 16 client note titled ‘A Different World’. ...

Central Banks

15) Pound Snaps Six-Day Loss as U.K. Announces Stimulus: Inside G-10

(Bloomberg) -- The pound halted a six-day losing streak against the dollar after some investors judged its recent losses as excessive and as the U.K. government announced a stimulus package.

- GBP/USD jumped as much as 0.6% after touching 1.2003 on Tuesday, its lowest since Sept. 3. Boris Johnson’s administration announced a massive rescue package of loans and grants for ...

16) BOJ’s $112 Billion ETF Target Boosts Topix Index Over Nikkei 225

(Bloomberg) -- The Bank of Japan’s record purchase of exchange-traded funds is clearly having an impact on at least one thing: the Topix index’s outperformance versus the Nikkei 225 Stock Average. The benchmark Topix gained 2.8% over the past two sessions, compared with a loss of 1.6% for the Nikkei 225. The divergence “makes sense,” given the BOJ’s plan to double its ...

17) Fed Unleashes Emergency Loan Facilities as U.S. Braces for Virus

(Bloomberg) -- The Federal Reserve unleashed two emergency lending programs on Tuesday to help keep credit flowing to the U.S. economy amid strain in financial markets that it blamed on the coronavirus pandemic. The central bank is using emergency authorities to establish a Commercial Paper Funding Facility with the approval of the Treasury secretary, according to a Fed statement ...

18) Turkey’s Emergency Steps Push Real Rate Near World’s Lowest (2)

(Bloomberg) -- Turkey’s central bank cut borrowing costs by a full percentage point and announced a series of measures to boost liquidity amid the coronavirus outbreak, pushing its interest rates adjusted for inflation near the world’s lowest. The benchmark rate was cut to 9.75% from 10.75% at an emergency meeting, the central bank said on Tuesday. The Monetary Policy ...

19) The Only Question on South African Rate Cut Is ‘How Much?’ (1)

(Bloomberg) -- The debate around South African interest rates has now moved from whether the central bank will cut on Thursday to how much it will cut. Of 21 economists in a Bloomberg survey, 11 predict a 50 basis-point reduction, while the balance expect the rate to be lowered by 25 basis points. Forward-rate agreements show traders have switched from pricing in a less ...

Economic News

20) Surging U.S. Dollar Is Next Big Headache for the World Economy