Bloomberg Bond News Summary > Wed Mar 4th

Business Briefing

1) Biden’s Big Night: Five Keys to His Super Tuesday Turnaround

(Bloomberg) -- Joe Biden’s Super Tuesday success seemed improbable just a week ago, when Bernie Sanders was flying high atop national polls and the former vice president was bogged down in a fight for the centrist mantle. But then Biden won South Carolina, forced three of those rivals out of the race, and picked up more than 100 endorsements — all on the way to the 14-state ...

2) U.S. Stock Futures Rise on Primaries; Yen Slips: Markets Wrap

(Bloomberg) -- U.S. stock futures rebounded after Tuesday’s sharp decline, and the yen dipped, as investors took in Super Tuesday election results alongside the Federal Reserve’s emergency interest-rate cut. Treasuries pared gains. Joe Biden’s surprise comeback in the race blunted the chance of the Bernie Sanders nomination that had unsettled some investors. Futures on the ...

3) India’s Top Court Strikes Down Curbs on Cryptocurrency Trade (2)

(Bloomberg) -- India’s Supreme Court struck down a central bank directive that effectively outlawed virtual currencies in Asia’s third-largest economy. A three-judge bench headed by Justice Rohinton F. Nariman agreed with petitions by cryptocurrency exchanges, start ups and industry bodies that had challenged the Reserve Bank of India’s April 2018 decision to ban banks from ...

World News Briefing

4) Global Fatality Rate 3.4%; Olympics Delay Possible: Virus Update

(Bloomberg) -- The head of the World Health Organization said the novel coronavirus doesn’t transmit as efficiently as influenza but the fatality rate is higher at 3.4%, based on reported cases. Japan’s Olympics minister said it would be possible to delay the summer games to later in the year. Total infections rose above 93,000, with China reporting 38 more deaths and fatalities ...

5) Biden Surges on Super Tuesday, Blunted by Sanders in California

(Bloomberg) -- Bernie Sanders won the biggest prize of the Super Tuesday primaries with a victory in California, but Joe Biden staged a surprise comeback in the race for the Democratic presidential nomination with victories in eight states. Biden scored wins in Virginia, North Carolina, Arkansas, Oklahoma, Tennessee, Alabama and Minnesota. And in one of the biggest upsets ...

6) Iran Uranium Stockpile Is Enough to Build Bomb If It’s Enriched

(New York Times) -- So far, the evidence suggests that Iran’s recent actions are calculated to pressure the Trump administration and Europe rather than rushing for a bomb. WASHINGTON — Iran’s growing stockpile of nuclear fuel recently crossed a critical threshold, according to a report issued Tuesday by international inspectors: For the first time since ...

7) Japan Olympics Minister Floats Prospect of Postponement on Virus

(Bloomberg) -- Japan’s Olympics minister said it would theoretically be possible to delay this summer’s Tokyo Olympics to a later date in 2020 amid worries the coronavirus could cause the Games to be canceled for the first time since World War Two. Seiko Hashimoto told a parliamentary committee the delay within the calendar year was possible under the terms under which ...

8) Biden Widens Lead Over Sanders in Delegate-Rich Texas: TOPLive

Bonds

9) Credit Suisse Sees Funding-Strain Risk Without Fed Liquidity

(Bloomberg) -- Disruptions to the global supply chain from the coronavirus have sparked the danger of funding strains that could be made worse by steep Federal Reserve interest-rate cuts, according to analysts at Credit Suisse Group AG. “The supply chain is a payment chain in reverse,” Zoltan Pozsar, an investment strategist at the bank in New York, and economist James Sweeney ...

10) Powell’s Misfire Fuels Rally in Asian Bonds, Led by Indonesia

(Bloomberg) -- Indonesian bonds led a rally in Asian debt markets after the Federal Reserve’s emergency interest rate cut failed to restore confidence among investors in the world’s biggest economy. While Asia is just as exposed to the financial fallout of the coronavirus, the focus on Wednesday turned to the higher returns that come with the region’s riskier bonds. ...

11) No Bottom in Sight for Yields After Fed ‘Bazooka’ Misfires

(Bloomberg) -- There’s no bottom in sight for Treasury yields after the Federal Reserve’s aggressive rate cut failed to quell fears that the coronavirus is wrecking the global economy. Before Tuesday, the 10-year note had never yielded less than 1%. Once that historic level was breached, less than 30 minutes later the rate was threatening 0.90% -- or half the amount it ...

12) Fed Raises Bets for Cuts in Japan and New Zealand, QE Down Under

(Bloomberg) -- The Federal Reserve’s first emergency interest-rate cut in over a decade is intensifying bets for monetary easing across major bond markets in the Asia-Pacific region. Expectations for rate cuts have climbed in Japan and New Zealand, while in Australia -- where markets were already pricing for a reduction in the benchmark to a perceived floor -- there are now ...

13) Lebanese Banks Asked to Swap Eurobonds; Foreigners May Get Paid

(Bloomberg) -- Lebanon is reviving an offer for a debt swap with local banks as the government enters crunch time before a $1.2 billion Eurobond comes due next week. At a meeting with bankers Tuesday, the finance minister proposed that local banks swap their entire Eurobond holdings for new debt at a lower coupon, a person familiar with the talks said. ...

14) Hobbled by Virus, China’s Wanda Has $5.7 Billion Bonds Due

(Bloomberg) -- Dalian Wanda Group Co., the Chinese conglomerate that borrowed billions of dollars to fund an acquisition binge, is facing a double whammy this year: a wall of maturing debt and a deadly virus that has hampered its operations. The empire founded by billionaire Wang Jianlin, who once aspired to beat Walt Disney Co. in entertainment, needs to refinance or pay ...

Central Banks

15) Gold Handed Big Win With Powell’s Cut Hammering Treasury Yields

(Bloomberg) -- Gold just got a powerful boost from the Federal Reserve, with bullion extending gains in Asia after the U.S. central bank’s emergency, virus-driven rate cut set off a collapse in 10-year Treasury yields to an all-time low. Bullion prospers from low rates, and more easing is expected from the Fed and other central banks as policy makers seek to blunt the ...

16) A Hedge Fund Pioneer Bets on Higher Rates, Recovery In Stocks

(Bloomberg) -- A top hedge fund manager in Canada says the coronavirus sell-off is a temporary setback that will soon give way to an economic rebound, sending stocks and interest rates higher. “While there will certainly be an economic hit from the virus, when you go back through these ‘pandemic’ periods of time, there’s really, without exception, a fairly significant ...

17) India’s Central Bank Head Says Uncommon Measures are Working (1)

(Bloomberg) -- India’s central bank governor said the unconventional policy steps the authority has undertaken to boost lending to the real economy are starting to work. The gap between the main repurchase rate and the benchmark 10-year bond yield has begun to narrow as a result of its measures aimed at pulling down corporate borrowing costs, Reserve Bank of India Governor ...

Economic News

18) Fed Rate Cut Strains Central Bank Peers With Less Room to Follow

(Bloomberg) -- The Federal Reserve’s decision to slash U.S. interest rates to contain the economic damage from the coronavirus leaves policy makers in Europe and Japan under more pressure from investors to follow suit even though they have less scope to do so. The emergency cut, delivered shortly after Group of Seven finance chiefs jointly vowed to take action where ...

19) Coronavirus Alone Won’t Trigger Italian Debt Crisis: Economics

(Bloomberg Economics) -- Italy has more coronavirus infections than any other country outside Asia, raising the risk of a bigger outbreak and a blow to growth in 2Q. With debt elevated, whenever a crisis hits Italy, the question is: Will bond yields blow out? The answer, we think, is no. The European Central Bank stands ready to contain the financial fallout from the virus and even a ...

20) Virus Scare to Keep Polish Rates on Pause: Decision Day Guide

(Bloomberg) -- The scare to supply chains and economic growth caused by the outbreak of the coronavirus is set to trump Poland’s inflation concerns and help the central bank keep official borrowing costs on hold for longer. All 27 economists in a Bloomberg survey said Poland’s Monetary Policy Council will leave its benchmark interest rate at a record-low of 1.5% at ...

21) Johnson Urged to Look Beyond Big Ticket Spending in Budget

(Bloomberg) -- U.K. Prime Minister Boris Johnson should look beyond large transport projects to ensure the billions of pounds of planned extra spending boosts the whole U.K. economy, according to the Resolution Foundation. Johnson’s budget next week is expected to raise capital spending by 20 billion pounds ($26 billion) a year, taking investment to levels last sustained in ...

22) The G-7 Held a Call on the Virus and Only the Fed Did Anything

(Bloomberg) -- Finance ministers from the richest nations and their central bankers held a rare conference call early Tuesday. They pledged to do whatever it takes to support a global economy under acute threat from the coronavirus. When they hung up the phone, only a single institution sprang into action. The U.S. Federal Reserve cut ...

European Central Bank

23) ECB to Cut Following Fed’s ‘Decisive’ Action, Commerzbank Says

(Bloomberg) -- The European Central Bank will respond to the Federal Reserve’s “decisive” interest rate cut with easing of its own, according to Commerzbank AG. With the outlook deteriorating, officials in Frankfurt are likely to cut the deposit rate by 10 basis points and boost monthly bond buys by 20 billion euros ($22.3 billion) at their meeting next week, Joerg Kraemer, ...

24) Europe’s Bond Rally Signals Bets on More ECB Quantitative Easing

(Bloomberg) -- Mediterranean debt surged to lead a rally in the region, showing traders expect central bank stimulus may come in the form of more bond buying. Money markets have lifted bets on global interest-rate cuts this month after the Federal Reserve’s emergency 50-basis-point move Tuesday, including at the European Central Bank. Yet with doubts over the value of ...

25) ECB’s Villeroy Says Monetary Policy Is ‘Already Very Expansive’

(Bloomberg) -- Governments should “do their bit” cushioning the economy from the coronavirus hit, while the European Central Bank’s monetary policy is already “very expansive,” Bank of France Governor Francois Villeroy de Galhau says.

- “Our current monetary policy is already very expansive and acts as an economic stabilizer,” Villeroy says in an interview with Dutch ...

26) ECB’s Knot: Virus Could Cause Great Damage to Dutch Economy

(Bloomberg) -- Although the impact from the coronavirus on Dutch economy is “very uncertain, it can potentially cause great damage if the spread of the virus isn’t stopped quickly,” Dutch central bank president Klaas Knot said in a speech in Amsterdam.

- Dutch economy is doing “good” unless you count the potential impact of the virus, according to Knot, who sits on the ECB’s ...

27) ECB INSIGHT: Lagarde’s Policy Options as Fed Drops Rates (1)

(Bloomberg Economics) -- If the coronavirus continues to spread in Europe, the euro-area economy will shrink -- there’s nothing the European Central Bank can do to prevent that. What President Christine Lagarde can do is minimize the extent to which the shock to demand might linger. At the March meeting the Governing Council ought to provide liquidity and cut interest rates, but it may not go that far. The Fed’s emergency half-percentage point cut today ...

First Word FX News Foreign Exchange

28) JPMorgan Asset Says Investors Likely to Pile Into U.S. Bonds

(Bloomberg) -- The Federal Reserve was smart to cut rates now rather than waiting for things to escalate, and its action should boost flows into U.S. bonds, according to JPMorgan Asset Management. Investors should consider longer-dated government bonds in safe markets, Bob Michele, global head of fixed income at the asset manager, said in an email. ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Bloomberg Bond News Summary > Tues Mar 3rd

Business Briefing

1) U.S. Futures, Japan Stocks Slide; Yen Advances: Markets Wrap

(Bloomberg) -- U.S. equity futures surrendered gains, Japanese stocks tumbled and bond yields fell Tuesday as enthusiasm about a shift by global policy makers to aid growth faded. Australia’s dollar rose even after the central bank cut its benchmark rate by a quarter point, underscoring how traders’ expectations have rapidly shifted in recent days. A Reuters report saying ...

2) Global Assets Want G-7 Full Shock and Awe Display: Markets Live

3) Oil Extends Rally as G-7 and OPEC+ Step Up Response to Virus

(Bloomberg) -- Oil extended its rebound from last week’s slump as global policy makers pledged to safeguard markets from the coronavirus, while OPEC and its allies are expected to deepen production cuts. Futures in New York have now recouped more than a third of last week’s 16% plunge in a reversal that’s come amid a broad move upward in financial markets driven by signs ...

4) Gold Investors Savor Cascade of Monetary Easing as Virus Bites

(Bloomberg) -- Gold investors are contemplating prospects for a global wave of monetary policy easing as authorities move to confront the challenges thrown up by the coronavirus crisis, including expectations for lower interest rates from the Federal Reserve that could weigh on the dollar. “As we are likely to head into another easing cycle, the gold price will be supported in ...

World News Briefing

5) Emergency Measures Go Global as Cases Top 90,000: Virus Update

(Bloomberg) -- Governments from Japan to the U.K. prepared emergency measures or economic packages to fight the spread of the coronavirus. Australia’s central bank cut interest rates as the health threat grows and President Donald Trump said the U.S. Federal Reserve should follow suit. Indonesia said it’s working on a second financial stimulus and might block more flights ...

6) Netanyahu Nears Chance to Form Government, Israeli Polls Show

(Bloomberg) -- Prime Minister Benjamin Netanyahu is within striking distance of forming Israel’s next government, exit polls showed, an outcome that bodes well for his efforts to stay out of court but less so for the prospects of Israeli-Palestinian peace. Recently indicted in three graft cases, Netanyahu had gambled on repeat elections to win a majority in parliament and ...

7) Biden Gets Boost From Klobuchar, Buttigieg Before Super Tuesday

(Bloomberg) -- Joe Biden welcomed former rivals Pete Buttigieg, Amy Klobuchar and Beto O’Rourke into the fold Monday in a show of force by the Democratic Party’s establishment against front-runner Bernie Sanders the night before Super Tuesday. Buttigieg and Klobuchar dropped out of the race in the last 24 hours and threw their support behind Biden, whose decisive win in ...

8) U.S. Hits Back at China, Orders Media Outlets to Slash Staff

(Bloomberg) -- The Trump administration ordered four Chinese state-owned news outlets to slash the number of staff they have working in the U.S., part of a broader response to Beijing’s restrictions on American journalists including its expulsion of three Wall Street Journal reporters last month. The move risks further tit-for-tat measures from Beijing as the world’s biggest economies ...

9) Israel Early Vote Count Sees Likud’s Lead Narrowing: TOPLive

Bonds

10) BOJ Displays Resolve on Calming Markets With Another Repo Move

(Bloomberg) -- The Bank of Japan conducted an unscheduled debt buying operation for a second day amid growing expectations of a coordinated effort by global central bankers and finance ministers to mitigate the economic impact of the coronavirus. The BOJ offered to buy 500 billion yen ($4.6 billion) of Japanese government debt with repurchase agreements, the central bank ...

11) Debt-Bloated Firms That Coronavirus Threatens to Drag Down

(Bloomberg) -- From Richard Branson’s Australian airline to U.S.-based cinema chains and casino operators, the companies most vulnerable to the coronavirus outbreak are facing mounting pressure in global credit markets. An escalating outbreak that drives off customers and revenue could lead to ratings downgrades, hinder refinancing efforts, and in some cases trigger ...

12) Kotak Finally Bets on an India Stressed Asset in Boon to Cleanup

(Bloomberg) -- An asset manager backed by Asia’s richest banker has finally invested in a stressed Indian asset, in a positive sign for the broader push to clean up the nation’s massive pile of bad debt. Kotak Special Situations Fund invested 5 billion rupees ($69 million) in beleaguered Jindal Stainless Ltd., India’s largest stainless steel producer, according to a ...

13) BlackRock Says Virus Panic Can Turn Aussie Yields Negative

(Bloomberg) -- Australia may be the next market to see negative yields as the fallout from the coronavirus drives an unstoppable bond frenzy, according to BlackRock Inc. Prolonged equity losses and monetary easing by the Reserve Bank of Australia can send the nation’s 10-year bond yield into negative terrain for the first time, according to Craig Vardy, head of fixed income ...

14) Yen Rises on Report G-7 Silent on Coordinated Cuts: Inside G-10

(Bloomberg) -- The yen advanced after a report that Group-of-Seven nations have not agreed to new fiscal spending or coordinated interest rate cuts to cushion the economic impact of the coronavirus. Treasuries rose.

- Yen climbed as much as 0.6% while the Nikkei-225 Stock Average reversed an initial gain as the news sapped some of the optimism that had swept through markets ...

15) Treasuries Dip, Pivotal RBA Rate Decision, Japan 10-Year Auction

(Bloomberg) -- Treasury futures dip from the open, after being knocked lower into New York close as verbal intervention from central banks keeps risk sentiment supported. RBA rate decision ahead is expected to set the tone after global repricing of rate cuts. Markets fully pricing a cut.

- Japan due to sell 10-year bond for 2.1t yen at 11:35am HKT. This may be challenging given ...

Central Banks

16) RBA Cuts, Signals Ready to Do More in Fiscal-Monetary Shot (1)

(Bloomberg) -- Australia kicked off an expected worldwide policy response to China’s slowdown and fallout from the coronavirus with an interest-rate cut that’s set to operate in tandem with fiscal measures to cushion the economic blow. Reserve Bank chief Philip Lowe reduced the cash rate by a quarter percentage point to 0.5%, a new record low, as expected by traders and ...

17) Australian Stocks Pare Gains After RBA Cuts Benchmark Rate (2)

(Bloomberg) -- Stocks pared gains after the Reserve Bank of Australia cut the benchmark rate by 25 basis points to support the economy amid the coronavirus outbreak. The S&P/ASX 200 index trimmed gains to 0.7% and closed at 6,435.7 after the central bank’s decision. The gauge surged as much as 2.1% earlier in the session after traders bet the RBA would lower rates and ...

Economic News

18) Coronavirus Seen as Yet Another Damaging Blow to Globalization

(Bloomberg) -- The upheaval from the coronavirus outbreak may be the final jolt that the world’s biggest companies need to reevaluate how they operate in a globalized economy, the OECD’s chief economist Laurence Boone said. The sprawling, continent-crossing supply chains of corporations have already come under pressure from trade tensions and climate concerns, and may face ...

19) Emergency Fiscal Action Debated to Cushion World Virus Shock

(Bloomberg) -- Governments struggling to contain the global economic fallout from the coronavirus outbreak face mounting calls to unleash a major fiscal stimulus that could help cushion the blow. While some investors are already betting that the epidemic will warrant the first joint emergency monetary easing since 2008, a gathering throng of analysts is asking if budget aid ...

20) Bailey Faces First BOE Test as Coronavirus Rewrites Outlook

(Bloomberg) -- Andrew Bailey is being thrown in at the deep end. The man who becomes Bank of England governor in less than two weeks is set to make the first public appearance connected to his new role on Wednesday. His tenure starts when concerns about the coronavirus have sparked a flurry of speculation that central banks around the world will start emergency policy ...

21) BOJ Flexes Muscles Within Framework to Calm Markets: Economics

(Bloomberg Economics) -- OUR TAKE: The Bank of Japan’s framework gives it plenty of room to ramp up stimulus -- and it’s making more use of it to shield the economy from the coronavirus. Tuesday’s unscheduled offer to buy 500 billion yen of JGBs -- following a similar operation on Monday when it also made a record one-day purchase of ETFs -- shows it’s ready and willing to use its balance sheet to calm markets. ...

22) Central Bankers Intensify Response to Virus Amid Recession Fears

(Bloomberg) -- Global policy makers sought to reassure markets that they’re ready to respond to the coronavirus outbreak, as fears mount that its spread could push the world economy toward recession. Australia’s central bank reduced the cash rate Tuesday by a quarter percentage point to 0.5%, a record low. That marked a stunning reversal in recent days, with money markets ...

European Central Bank

23) ECB Joins Central Banks Pledging Coronavirus Action If Needed

(Bloomberg) -- European Central Bank President Christine Lagarde belatedly joined the crowd of leading central bankers pledging to take action if needed against the economic damage from the coronavirus outbreak. In a statement late Monday, Lagarde said the outbreak is a “fast-developing situation, which creates risks for the economic outlook and the functioning of financial ...

24) GERMANY DAYBOOK: ECB Ready for Action, Qiagen Takeover Talks

(Bloomberg) -- European Central Bank President Christine Lagarde has pledged to take action if needed against the economic damage from the coronavirus outbreak. Thermo Fisher Scientific is in advanced talks to acquire Qiagen after discussions broke off late last year. For more company events and economic data in Germany, see EVTS and ECO GER. Also see Bloomberg Daybreak for ...

25) ECB’s Lagarde Says ‘We Stand Ready’ to Take Appropriate Steps

(Bloomberg) -- European Central Bank says in a statement that it’s closely monitoring coronavirus developments.

- Story to follow.

26) ECB Says Ready to Take Appropriate, Targeted Steps Amid Virus

(Bloomberg) -- Christine Lagarde, president of the European Central Bank, said the central bank is ready to act to support the economy amid the spreading coronavirus. “The ECB is closely monitoring developments and their implications for the economy, medium-term inflation and the transmission of our monetary policy,” Lagarde said in a statement Monday posted on the ECB’s ...

27) ECB Board Majority Is Opposed to Enria’s Push to Spur Bank Deals

(Bloomberg) -- European Central Bank supervisory board chair Andrea Enria is meeting early resistance to proposals for boosting mergers and acquisitions in the continent’s banking industry, people with knowledge of the matter said. A majority of the ECB’s supervisory board signaled at a meeting last week that they were skeptical of or outright opposed to allowing banks to ...

First Word FX News Foreign Exchange

28) *SWISS ECONOMY GREW 0.3% Q/Q IN FOURTH QUARTER; ESTIMATE 0.2%

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: BIG Month on Tap in UK GILTS Market > Quick Rundown

GILTS... Coordinated Move?

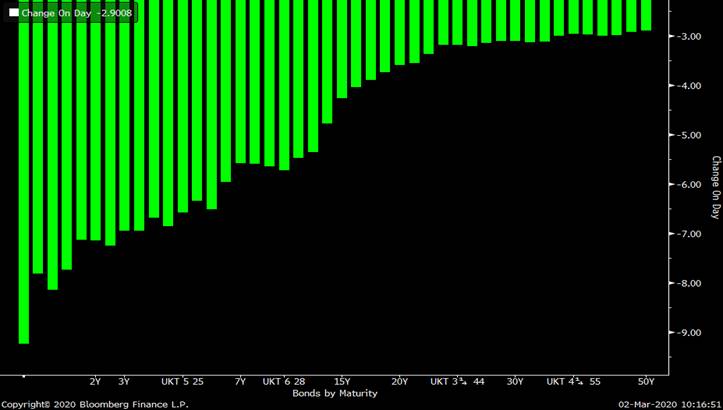

> Dovish chatter from the Fed, BoJ and BoE over the weekend has not only helped to stabilize stocks but, as we can see from the nosedive in 2yr note yields (.76%?!), it's driven heightened expectations of coordinated rate cuts from the major CBs.

> We can debate the efficacy of rate cuts all day long (25bps off UK base rates? ZZZzzzz) but the steepening impact on the curve is undeniable (see below).

UKT Yields – Change on Day Today

UST 2-10s – massive moves

> The GILTs market is a VERY busy place in the next month. Aside from 4 more conventionals auctions (2 X 0F25s, 4T30s and 1T49s) we've got the £17.5bn APF next Monday, the FY 20/21 budget Mar 11th (Gilts issuance ests range from £145bn to £180bn!) yet more Brexit talks and that's not even factoring in Covid-19.

> Heading into March, our views are:

1) Last big APF for the next 16 months will be a backstop but Covid-19 driven longs far outweigh the BoE's demand.

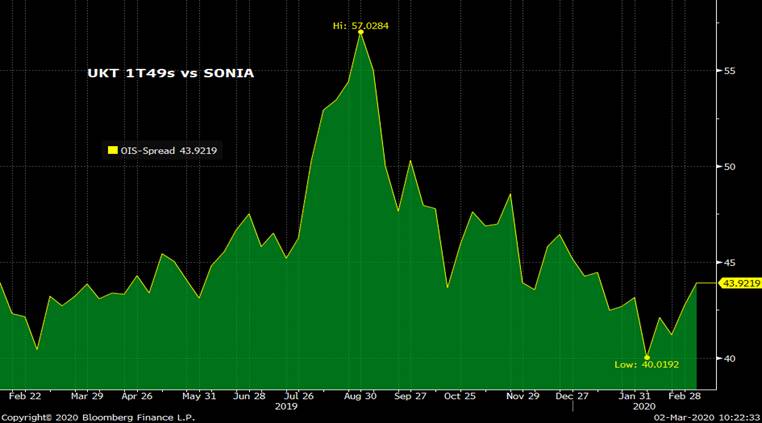

2) Whether Sunak announces £145bn or £180bn, the bottom line is we’ll be getting a lot more NET gilts issuance in FY 20/21. We can see from the chart below that the 1T49s are still just a few bps off their richest levels vs SONIA in the last year.

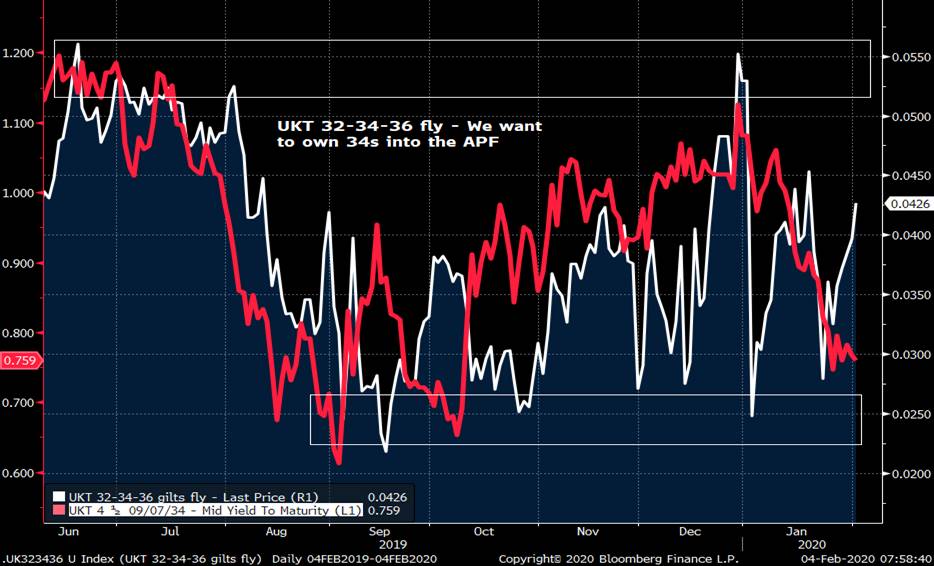

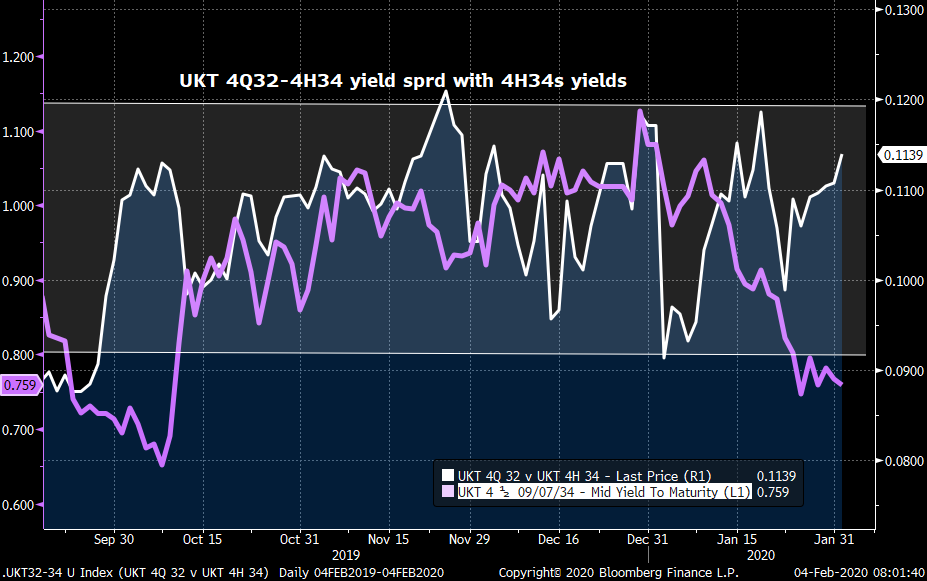

3) As noted in our attached rundown of a couple weeks ago, the 10-20yr sector will be well trodden ground over the next month given the supply calendar, the steepness of the curve and the location of the 4H34s and 4Q36s and the longest/shortest issues in their APF buckets.

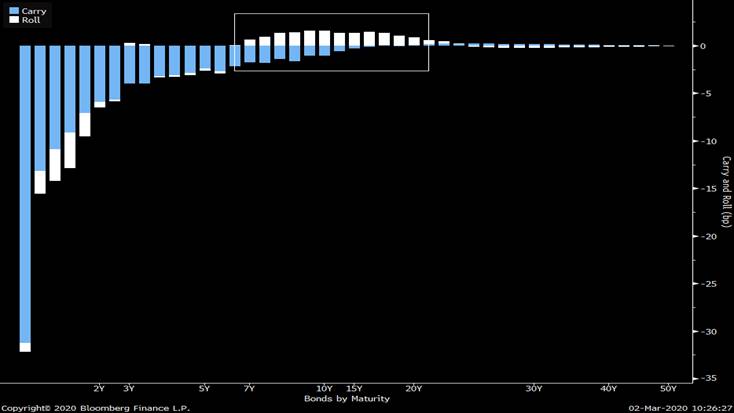

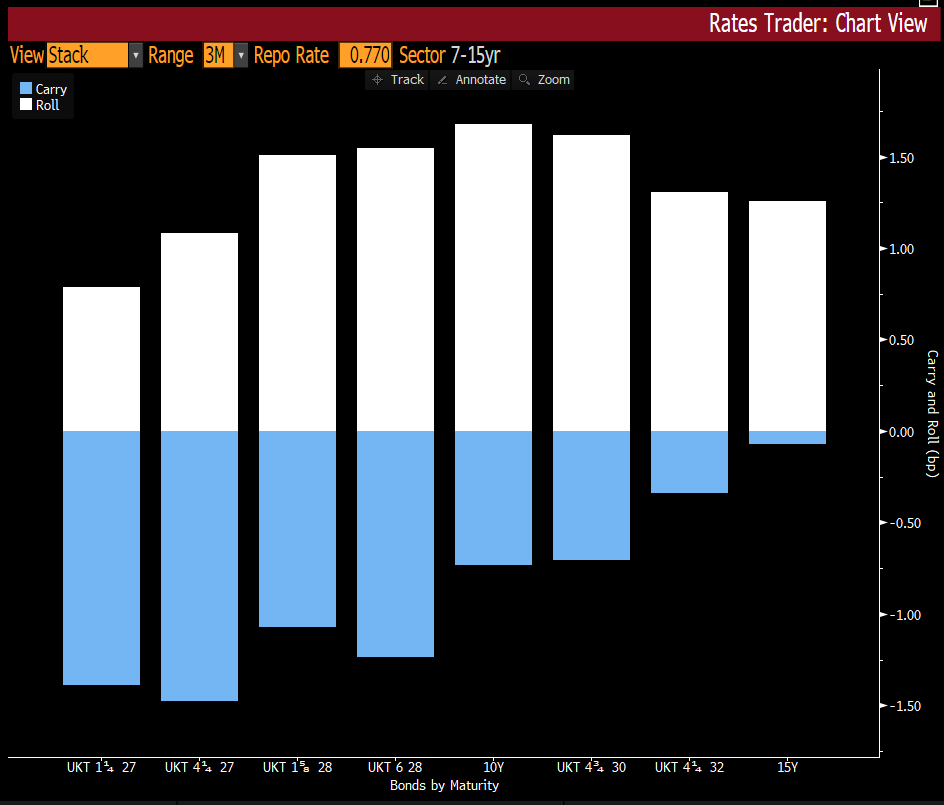

GILTS Carry and Roll

- Base rates in the UK are 75bps which has GC hovering in the low 70s. UKT 1T22s are currently yielding .231% and the 225s are an eye watering .193%. The MPC would have to cut base rates 50bps to get these issues remotely close to positive carry. This ‘Nike Swoosh’ Z-sprd curve out to 25yrs will force the market longer unless the BoE really gets aggressive.

Swoooosh!

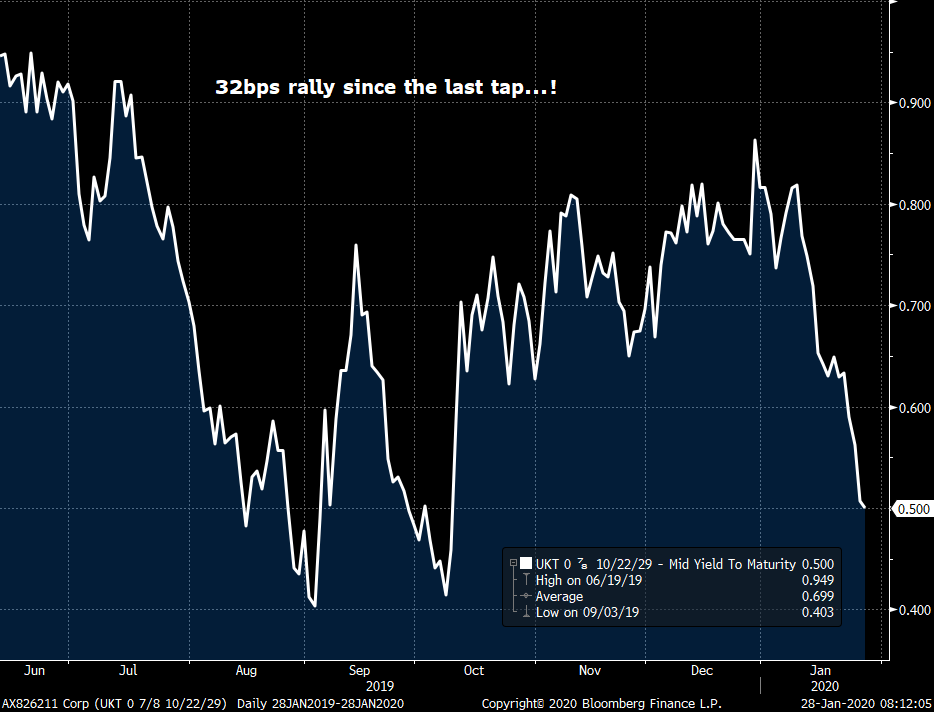

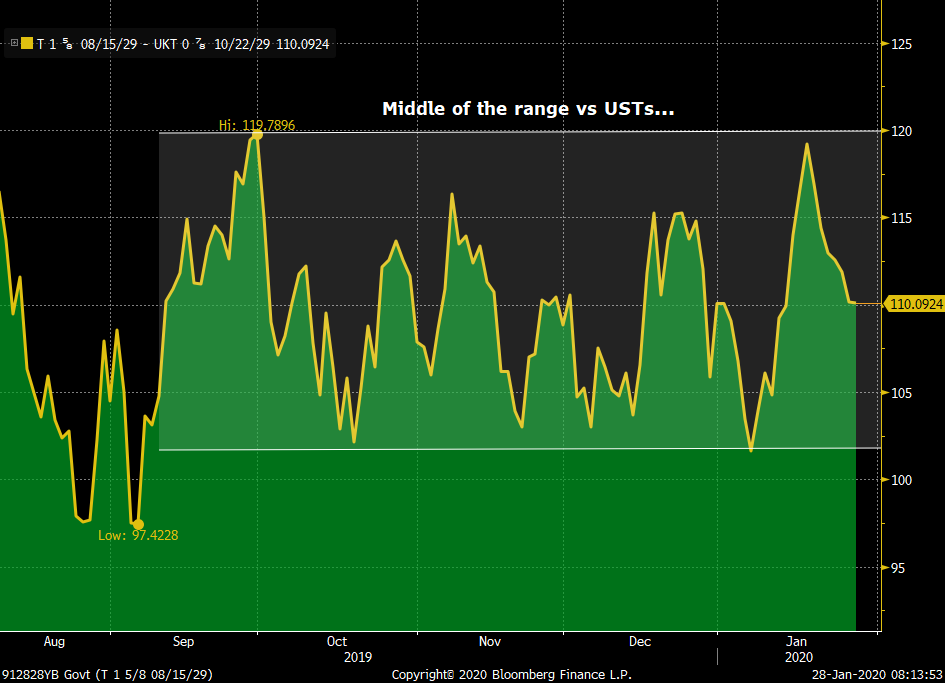

- The 4T30s are in a ‘prove it’ phase for us. They don’t trade with any repo value and have struggled to richen much to the sector, despite being the CTD into one of the biggest rallies we’ve seen in gilts in a long time. Their tap next Tuesday makes them eligible for the APF which could prompt a bit of RV interest but thus far, we’ve seen little evidence of it and would be better sellers of the issue on balance in favour of the 0S29s or 4H34s a bit longer…

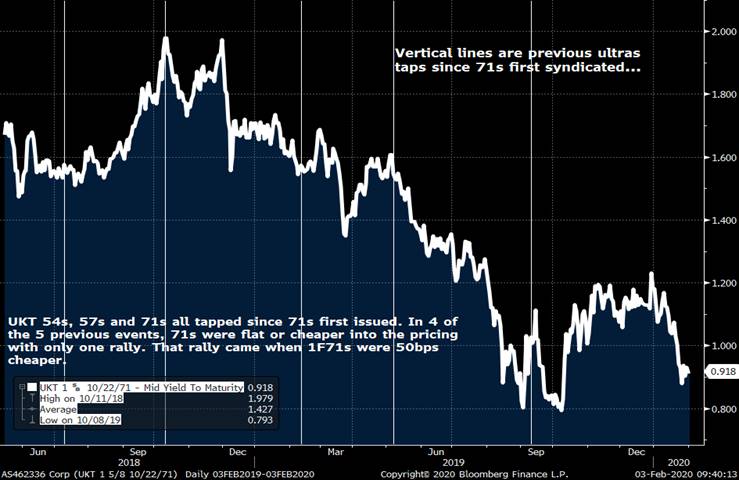

- ULTRAs – DMO is unlikely to issue them for the foreseeable future after last Thursday’s forgettable tap of the 1T57s. They still look rich to us on many metrics but if the budget comes at the higher end of the range then the 30yr point is likely to come under fire again – erasing recent richening vs 40s and 57s (for ex).

More soon…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Bloomberg Bond News Summary > Mon March 2nd

Business Briefing

1) Gold Bulls Will Charge Again After Month-End Blip: Markets Live

2) Stocks Slide Halts on Central Bank Rescue Hopes: Markets Wrap

(Bloomberg) -- The worst stock rout since the global financial crisis showed signs of at least a pause on Monday, prompted by optimism that central banks will again save the day. U.S. futures saw modest gains after the S&P 500 Index closed out its worst week since 2008. Monday began with further declines in stocks and gains in bonds, before the Bank of Japan joined the ...

World News Briefing

3) Berlin Reports First Case; Death Toll Passes 3,000: Virus Update

(Bloomberg) -- U.S. President Donald Trump will meet pharmaceutical executives Monday as Americans grapple with the prospect of a widening epidemic at home. The global death toll from the coronavirus outbreak has surged past 3,000. New cases were reported across the U.S., and two global capitals -- New York City and Berlin -- reported their first infections. In Asia, ...

4) Pete Buttigieg Drops Out of the Democratic Presidential Race

(Bloomberg) -- Pete Buttigieg ended his presidential campaign Sunday after failing to secure the diverse coalition needed to win the Democratic nomination. “Tonight I am making the difficult decision to suspend my campaign for the presidency,” he told a hometown crowd in South Bend, Indiana, adding, “I will do everything in my power to ensure we that have a new Democratic ...

5) Japan Virus Woes Pose Existential Threat to Abe Government

(Bloomberg) -- Shinzo Abe has overcome countless political perils on the road to becoming Japan’s longest-serving prime minister. He may have met his match with the coronavirus. In a sign of mounting concern, Abe abandoned his relatively mild approach to the epidemic last week with a shock announcement urging schools to shut nationwide from Monday. The move sent millions of ...

6) The Border Tells a Different Story To Greece and Turkey’s Claims

(Bloomberg) -- Istanbul’s working class neighborhood of Zeytinburnu was buzzing Sunday as migrants huddled in groups debating whether to travel to the border with Greece so they could achieve their dream: to live in Europe. Following Turkish President Recep Tayyip Erdogan’s decision to open the frontier, excitement rippled through the district of about 300,000 people that’s ...

7) Obama Called Biden to Congratulate Him on South Carolina Win

(Bloomberg) -- Former President Barack Obama called Joe Biden to congratulate him on his victory in the South Carolina Democratic primary on Saturday night, a person familiar with the call said Sunday. Biden won overwhelmingly in South Carolina with 48.4% of the vote. Bernie Sanders was a distant second with 19.9%. Biden got a boost from his status as Obama’s vice ...

Bonds

8) Markets Are Pricing a Rush of Rate Cuts, But Nothing Like 2008

(Bloomberg) -- Investors who thought interest rate cuts were coming to an end in 2020 are bracing for a fresh round of monetary easing. But so far there is nothing to suggest that it will be as radical as 2008. The Federal Reserve and central banks of Australia, New Zealand, Europe, Japan and U.K. are now priced to reduce rates by around a combined 300 basis points this ...

9) Virus Casts Shadow Over Record Dollar Bond Sales in Asia

(Bloomberg) -- Mounting market turmoil from the coronavirus epidemic is set to test an unprecedented corporate debt binge in Asia. As issuers sought to lock in funds before borrowing costs shot up in recent days, sales of dollar bonds in Asia excluding Japan totaled about $33 billion in February, the most ever for the month. More than a dozen issuers from China and Hong ...

10) Few See End of Rout as Central Bank Effectiveness Doubted

(Bloomberg) -- With financial markets bracing for another brutal week as coronavirus cases continue to multiply around the world, there are few investors willing to call the end of the risk-asset rout. And as traders rush to price in a fresh round of global monetary stimulus, questions are emerging about whether interest-rate cuts will be enough to support markets this time ...

11) Asia Dollar Bonds Sell Off More After Worst Week in Over 8 Years

(Bloomberg) -- A selloff of Asian dollar bonds continued Monday, with spreads widening 3-7bps in the morning, according to traders.

- Yield premiums on the notes blew out 37bps last week, the most in more than eight years, according to a Bloomberg Barclays index

- High-yield bonds from commodity-related issuers are down 1.5-3.5 points on Monday morning, according to one trader

- NOTE: Virus Turmoil Casts Shadow Over Record Asia Dollar Bond Sales

12) Yen Falls After BOJ Signals Support, Kiwi Declines: Inside G-10

(Bloomberg) -- The yen faltered on speculation that policy support from major central banks will cushion the global economic impact from the coronavirus outbreak. New Zealand’s dollar fell amid bets for a 50-basis point cut in interest rates this month.

- USD/JPY climbed as much as 0.4% as the Bank of Japan offered liquidity and pledged to ensure market stability. Yields on ...

13) Lebanese Banks Hold Line Against Default, Urge Bond Swap Instead

(Bloomberg) -- Lebanon’s banking lobby made a last-ditch appeal to the government to avoid a debt default and instead offer a swap into new notes for all bondholders. In the clutches of its worst financial crisis in decades, Lebanon is running out of time to decide how to handle a debt burden that economists say is no longer sustainable. It faces a choice of repaying more ...

Central Banks

14) Gold Stages a Fightback After Slump Leaves Haven With Black Eye

(Bloomberg) -- After getting caught up in last week’s punishing virus-driven sell-off that hit everything from equities to commodities, gold rebounded on Monday to refresh its credentials as a haven in troubled times. The metal advanced after a weekend of very negative developments, including a surge in cases around the world and predictions for severe dislocation. With ...

15) What to Watch in Commodities: Virus, OPEC+, Gold, Big Oil, Crops

(Bloomberg) -- After a brutal February capped by an awful, sell-everything Friday, what does March hold for commodities? The coronavirus outbreak is roiling markets from crude to copper, signs of dislocation are stacking up, and raw-materials companies are battling the consequences. In wild trading in the week’s opening session, early losses gave way to gains. The main event in energy this week will be the meeting between OPEC and its allies to ...

16) EM Review: Global Virus Spread Hammered Demand for Risk Assets

(Bloomberg) -- Emerging-market stocks posted their biggest weekly loss since 2011 last week and currencies skidded as the coronavirus spread around the world from South Korea to Iran and Brazil. Currencies and equities posted back-to-back monthly declines and bond spreads widened by the most since August. The following is a roundup of emerging-markets news and highlights for the week ending ...

17) U.S. Stock Futures Swing to Gains After BOJ Emergency Act

(Bloomberg) -- Big swings kept sweeping the U.S. equity market, with index futures rebounding after the Bank of Japan issued an emergency statement Monday morning to support market stability. Following a drop of more than 2% earlier, contracts on the S&P 500 quickly erased the plunge and rallied as much as 1.1%, with investors drawing optimism from the BOJ comment that ...

18) Japan Shares Stage Rebound as BOJ Pledges Stability, Liquidity

(Bloomberg) -- Japaneses shares reversed early losses and climbed after Governor Haruhiko Kuroda issued an emergency statement that the Bank of Japan will pump liquidity into the markets as needed to ease the unrest caused by the coronavirus. The Topix index and the Nikkei 225 Stock Average both managed to snap five-day losing streaks. The broader benchmark rose as much as ...

Economic News

19) Fed Ready to Cut Rates Despite Doubt They Can Offset Virus

(Bloomberg) -- The Federal Reserve is now prepared to reduce interest rates this month even though it recognizes monetary policy cannot completely shelter a U.S. economy increasingly threatened by the coronavirus. Fed Chairman Jerome Powell opened the door to a rate-cut at the Fed’s March 17-18 meeting by issuing a rare statement Friday pledging to “act as appropriate” to ...

20) Virus Drives China PMIs to Record Lows, Hurting Asia Output

(Bloomberg) -- Asia’s factories took a tumble in February under the weight of the rapidly spreading coronavirus outbreak, with a severe plunge in activity in China driving down output across the region. China’s Caixin Media and IHS Markit purchasing managers’ index dropped to 40.3, its lowest reading since the series began in 2004, according to figures released Monday. ...

21) Kuroda Leads Japan’s Efforts to Soothe Market’s Virus Jitters

(Bloomberg) -- Bank of Japan Governor Haruhiko Kuroda helped lift Japanese stocks for the first time in six trading days by issuing an emergency statement following a week of turmoil in markets over the implications of the spreading coronavirus outbreak. In the release, which came after the Federal Reserve issued an unscheduled statement on Friday, Kuroda said the BOJ “will ...

22) Virus to Drag China GDP Down to 1.2%, Send Shockwaves: Economics

(Bloomberg Economics) -- The coronavirus threatens to plunge China’s economy into contraction, sending shock waves around the world. Bloomberg Economics is downgrading its forecast for growth, and anticipates larger spillovers to the region and other major economies:

- Our central scenario is for China’s 1Q GDP growth to slow to 1.2% year on year, down from 6% in 4Q 2019 and the lowest ...

23) Brexit Trade Talks Begin as Officials Warn of Risk of Breakdown

(Bloomberg) -- British and European Union officials will start hashing out a future trade deal on Monday amid fears that talks could break down within weeks. As negotiations on the future U.K.-EU partnership formally open in Brussels, three people familiar with the matter privately raised concerns that red lines on both sides could put the chance of an agreement in danger ...

First Word FX News Foreign Exchange

24) Negative U.S. Yields in Sight as Virus Spurs Recession Bets (1)

(Bloomberg) -- The swirl of fresh coronavirus cases and signs of the severity of the hit on the global economy have seasoned strategists warning that U.S. growth could come to a halt this year and some Treasury yields may drop below zero -- possibly as early as this week. The warnings come as a rout in equities and rate-cut expectations sent long-term Treasury yields to ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Bloomberg Bond News Summary > Fri Feb 21st

Business Briefing

1) Stocks Drop With Treasury Yields on Virus Jitters: Markets Wrap

(Bloomberg) -- Asian stocks, U.S. and European futures retreated Friday amid renewed concern about the impact of the coronavirus as cases outside of China increased. Treasuries and gold advanced. Shares in Korea and Hong Kong saw the steepest losses, with more modest declines in Australia. Japanese stocks closed little changed while those in China edged higher. The yield on ...

2) Dollar Has No Equal for Investors Sheltering From Outbreak (1)

(Bloomberg) -- Currency traders seeking shelter as the spreading coronavirus roils financial markets just can’t get enough of the teflon dollar. The greenback has gained versus some 30 major world currencies in the past month, coinciding with mounting concern over the outbreak’s economic impact. The yen and the Swiss franc, two traditional haven currencies, have proven no ...

3) China Rotation Time for Bonds to Run Past Stocks: Markets Live

4) Global Shipping’s ‘Perfect Storm’ to Pass, Veteran CEO Says (1)

(Bloomberg) -- The global shipping industry has run into very rough waters in 2020 as the virus crisis that’s engulfed China and roiled commodity markets added to headwinds from a seasonal slowdown and poor weather. One chief executive who oversees a fleet of 55 vessels says there’ll be a comeback. “This is certainly temporary,” said John Wobensmith of Genco Shipping & Trading Ltd. ...

5) Virus Epidemic Enters New Phase as Cases Outside China Multiply

(Bloomberg) -- South Korea has more than 150 cases. Those for Singapore and Japan have topped 85. And then there are the 600-plus from a quarantined cruise ship in Japan. As the cases of coronavirus infections mount, worries are growing that the outbreak is entering a concerning next phase. Where China had the vast majority of cases and deaths before, there are now signs ...

World News Briefing

6) Korean Infections Jump; Hubei Revises Up New Cases: Virus Update

(Bloomberg) -- The number of coronavirus cases in China topped 75,000, while concerns grew over the pace of infections in other Asian countries. China’s death toll rose to 2,236 with 115 new fatalities in Hubei province. The province at the center of the outbreak revised up its number of new cases to 631 from 411 reported earlier. China has been continually changing the ...

7) Trump Ads Will Take Over YouTube’s Homepage on Election Day

(Bloomberg) -- In the immediate run up to the U.S. presidential election and on Election Day, the homepage of YouTube is set to advertise just one candidate: Donald Trump. The president’s re-election campaign purchased the coveted advertising space atop the country’s most-visited video website for early November, said two people with knowledge of the transaction. The deal ...

8) Merkel’s Succession Has Descended Into Chaos and She Knows It

(Bloomberg) -- While Angela Merkel maintains her characteristically unflappable demeanor in public, behind the scenes the German chancellor realizes she’s all but lost the ability to influence the power struggle raging within her party. In the chancellery, there’s growing concern about how her chosen heir -- Annegret Kramp-Karrenbauer, who resigned last week after failing ...

9) Russia Backs Trump in 2020, and He Rages Over Alert to Congress

(New York Times) -- A classified briefing to House members is said to have angered the president, who complained that Democrats would “weaponize” the disclosure. WASHINGTON — Intelligence officials warned House lawmakers last week that Russia was interfering in the 2020 campaign to try to get President Trump re-elected, five people familiar with the matter ...

10) Overwhelmed Chinese Hospitals Turn Away Patients Without Virus

(Bloomberg) -- Liu Zi’ao was awaiting surgery in a Wuhan hospital to treat the tumor pressing on his spinal cord when, suddenly, he was told to leave. The novel coronavirus had plunged the central Chinese city’s health-care system into crisis, and all resources were being diverted to contain it. In the month since, the 25-year-old former acupuncturist has been turned away from ...

Bonds

11) Bond Traders Double Down on Fed Cut Bets in Rate Markets Rally

(Bloomberg) -- U.S. government bond markets saw a rush of buying Thursday that piled up bets on interest-rate cuts amid concern that the coronavirus will damage global growth. Increasing anxiety over the toll and spread of the virus appears to have contributed to the momentum in trades that took the 10-year yield just shy of 1.50%, to the lowest since Jan. 31. Expectations ...

12) Treasury 10-Year Drops Below 1.50%, Aussie Slips on Virus Spread

(Bloomberg) -- U.S. 10-year bond yields dip below 1.50% for first time since September, with cash yields lower by 1-2bps across the curve. Broad risk-off moves are weighing on markets in Asia as Aussie slips and the yen ekes out a modest gain.

- Volumes in Treasuries are robust with gentle bull flattening move intact, typical of risk-off price action

- Early gains were kick started after another jump in South Korean virus cases, with markets ...

13) HNA Bond Euphoria Cools as Market Weighs State Takeover Talk

(Bloomberg) -- A remarkable rally in dollar bonds of Chinese conglomerate HNA Group Co. eased slightly Friday, as investors awaited confirmation of reported plans of a government seizure of the embattled firm. Once the poster child for China’s debt-fueled overseas acquisition spree, HNA could now find itself a takeover target of Beijing, a plan that may involve the sale of its lucrative airline assets in an ...

14) Aussie Drops, Yen Gains With Widening Virus Spread: Inside G-10

(Bloomberg) -- The yen halted a two-day loss and the Australian dollar fell to a fresh 11-year low as the rising number of coronavirus infections outside of China kept traders on the edge.

- Treasuries advanced as investors sought refuge in havens after South Korea reported 52 more cases while two people evacuated to Australia from a cruise ship in Japan also tested positive ...

15) Investors Come Back for More After 34% Bond Returns in Russia

(Bloomberg) -- Investors who took home 34% returns on Russian local-currency bonds last year are increasing their bullish bets after Central Bank Governor Elvira Nabiullina signaled more rate cuts. Ten-year yields fell below 6% for the first time in at least a decade as money managers topped up the $16 billion they poured into the market last year. High demand at weekly ...

16) Won Leads Drop in EM FX Amid Virus Case Surge: Inside Asia

(Bloomberg) -- South Korea’s won drops, leading a decline in emerging market currencies in Asia, as investors dump risk assets following a wider coronavirus spread in the region.

- South Korea reported 52 more cases, bringing the total to 156, while two people evacuated to Australia from a cruise ship in Japan also tested positive for the virus

- Asia’s biggest economies are already feeling the brunt of the coronavirus shock. Key ...

Central Banks

17) Buffett, JPMorgan, HKEX, Bank of Korea: Week Ahead in Functions

(Bloomberg) -- Berkshire Hathaway Inc. releases results on Saturday, Tuesday is JPMorgan Chase & Co.’s investor day, Hong Kong Exchange & Clearing Ltd. reports Wednesday, Bank of Korea sets rates on Thursday and U.S. consumer sentiment is due Friday. Use Bloomberg functions to prepare for the week’s events and act when news breaks. ...

18) Australia Banks to Face Climate Stress Tests, Regulator Says (1)

(Bloomberg) -- Get serious on climate change risks. That’s the message from Australia’s prudential regulator as it joined counterparts in the U.K., the Netherlands and Singapore in ramping up its surveillance of how ready financial institutions are to deal with climate change. Banks will have to undertake stress tests to measure their resilience to a broad range of ...

19) EUROPE PREVIEW: PMIs to Lay Economic Weakness Bare in 1Q (1)

(Bloomberg Economics) -- Today is important for the European economy -- the flash PMIs are among the most reliable gauges of economic momentum and they’ll be closely monitored by policy makers and investors alike. Here’s what to expect:

- The euro area’s business surveys for January suggested the outlook was steadily improving. We don’t think that trend has been sustained in February ...

20) JAPAN REACT: Hotel Stays, Durable Goods, and Virus Impact on CPI

(Bloomberg Economics) -- OUR TAKE: Japan’s core inflation (excluding fresh food and energy) slowed in January, pulled down by lower accommodation and durable goods prices. It’s hard to be certain but that may partly reflect hotel reservation cancellations by Chinese tourists affected by measures to contain the coronavirus. The hit to sales from the sales-tax hike explains the weakness in durable goods prices. ...

21) Japan Price Gains Buoyed by Energy Offer BOJ Little Comfort (2)

(Bloomberg) -- Japan’s core inflation accelerated for a fourth month in January, but with the gain boosted by gasoline costs the data does little to bolster a case that consumer-led price momentum is picking up as the Bank of Japan hopes. Consumer prices excluding fresh food rose 0.8% from a year earlier, picking up speed from a 0.7% gain in December, the ministry of ...

Economic News

22) Asia’s Economies Flash Early Signs of Virus Hit as G20 Meets

(Bloomberg) -- Asia’s biggest economies are already feeling the brunt of the coronavirus shock. Key gauges for manufacturing in Australia and Japan fell while early export orders for South Korea showed a slump in Chinese demand. Data from China showed car sales sank 92% in the first half of February while its Commerce Ministry said trade and inbound investment would take an ...

23) The World’s Biggest Economies Get a Jolt of Government Spending

(Bloomberg) -- Governments across the world are starting to use more fiscal firepower to boost economies, though the shift may not be happening fast enough to appease central bankers who say they’re sick of carrying the burden of stimulus alone. In more than half of the world’s 20 biggest economies, analysts now expect looser budgets ...

24) Big Economic Reads: Beijing Steps Up Response to Virus Outbreak

(Bloomberg) -- The coronavirus continues to ripple through the world economy, prompting mounting fears over the outlook for the Chinese economy and beyond. With Group of 20 finance minsters and central bankers convening for talks in Saudi Arabia on Friday, here’s a run down of this week’s best stories, enterprise and analysis from Bloomberg Economics. ...

25) G-20 Chiefs to Meet as China, Japan, Europe Stall: Economics

(Bloomberg Economics) -- Group-of-20 finance chiefs, meeting Saturday, will confront a dreary and deteriorating picture on global growth. A combination of the China virus, Japan sales-tax hike, and Europe factory slump mean six of the world’s eight biggest economies have stalled. That raises two questions: first, could isolated short-term shocks compound into something bigger and longer lasting; second, if that happens, ...

26) SNB Isn’t Panicking About the Franc And Here’s One Reason Why

(Bloomberg) -- The Swiss National Bank appears to be content for now to allow the franc to drift higher, with little evidence that it’s getting into a dogfight with markets. While reluctance to aggressively sell the franc may be partly driven by fear of being labeled a currency manipulator by the U.S., SNB data also suggest the valuation may not be so extreme as it appears. ...

European Central Bank

27) ECB REACT: Policymakers' Optimism Yet to Find `Firmer Grounds'

(Bloomberg Economics) -- Minutes from the January monetary policy meeting of the European Central Bank confirm the cautiously optimistic tone adopted by President Christine Lagarde at the press conference. But this nascent hopefulness is unlikely to survive the blows taken by the economy since policy makers met in January.

- The Governing Council slightly tweaked its assessment of risks facing the euro area. It ...

28) ECB Warned of Caution on Economy Even Before Coronavirus Hit (1)

(Bloomberg) -- European Central Bank policy makers warned against signaling too much economic optimism at their January rate-setting meeting, a view that proved prescient now that the coronavirus outbreak is dashing hopes for an upturn any time soon. The Jan 22-23 Governing Council meeting was held as trade tensions appeared to be easing -- with a first phase of a ...

29) ECB PREVIEW: Minutes May Reveal Policy Makers Views on Review

(Bloomberg) -- The European Central Bank launched a review of its monetary policy strategy on Jan. 23. The review, expected to take a year to complete, will focus mainly on the ECB’s price stability objective. But will also cover financial stability, employment and environmental sustainability.

- The ECB’s self-appraisal will probably be the main point of interest in the minutes of its ...

30) ECB tone upbeat on eurozone growth before coronavirus struck

Preview text not available for this story.

31) Christine Lagarde Has a Troubling Ambition: Ferdinando Giugliano

(Bloomberg Opinion) -- Christine Lagarde is eager to make her mark at the European Central Bank. At the moment, we know precious little about her views on the future course of monetary policy. But one thing is clear, the new president wants the ECB to take on a bigger role in the fight against climate change. Lagarde thinks it’s possible to reconcile this ambition with the ECB’s mandate, which ...

First Word FX News Foreign Exchange

32) Japan Lawmaker Says Digital Yen Isn’t Coming Anytime Soon

(Bloomberg) -- Anyone expecting the Japanese government or its central bank to issue a digital currency in the near future is likely to be disappointed, according to the head of a ruling party group that’s studying the idea. Hideki Murai, a lawmaker who heads the digital money team of Prime Minister Shinzo Abe’s party, says creating a new state-issued digital currency ...

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Bloomberg Bond News Summary > Tues Feb 18th

Business Briefing

1) HSBC Targets Revamp with 15% Staff Cuts, $7.3 Billion Charge

(Bloomberg) -- HSBC Holdings Plc is set to slash about 15% of its workforce, and is taking $7.3 billion of charges in its latest attempt to revive its fortunes since the global financial crisis. The London-based lender is also targeting cost cuts by $4.5 billion as it faces challenges including Hong Kong protests and the coronavirus. HSBC, which earns the bulk of its ...

2) Stocks, Bond Yields Decline After Apple Warning: Markets Wrap

(Bloomberg) -- U.S. futures fell with Asian stocks and bond yields after Apple Inc. said quarterly sales would miss forecasts, illustrating the blow to corporate earnings and economic growth from the deadly coronavirus. Equity benchmarks in Tokyo, Seoul and Hong Kong saw declines of over 1%. Sydney and Shanghai saw more modest drops. Apple suppliers including TDK Corp. and ...

3) TOPLive Starts: Follow Glencore Full-Year Earnings in Real Time

World News Briefing

4) Canadians Aboard Cruise Liner Reportedly Infected: Virus Update

(Bloomberg) -- Canada said 32 of its citizens aboard the stricken Diamond Princess have tested positive for the coronavirus, according to a tweet from the Toronto Star. Japan said earlier Tuesday that it expected to remove all passengers from the cruise liner by Friday, and South Korea said it would evacuate its citizens and fly them back to Seoul. The ship remains docked ...

5) Rare Release of Xi’s Speech on Virus Puzzles Top China Watchers

(Bloomberg) -- China’s elite politics are a black box and the country’s leaders like to keep it that way. That’s what makes the events of this weekend so perplexing even to seasoned China watchers. On Saturday, the ruling Communist Party’s top theoretical publication, Qiushi Journal, released a speech showing that President Xi Jinping was directing efforts to contain the ...

6) A Single Cruise Guest Sparks a Global Rush to Contain Virus

(Bloomberg) -- As passengers from the shunned cruise liner Westerdam head home following two weeks in limbo at sea, health authorities around the world are having to mobilize to prevent further spread of the coronavirus after an American guest from the ship was found to be infected. Cruise operator Holland America Line -- which gave assurances that the pathogen that’s killed ...

7) Lung Biopsy of Deceased China Patient Shows SARS-Like Damage

(Bloomberg) -- Doctors studying a 50-year-old man who died in China last month from the new coronavirus found that the disease caused lung damage reminiscent of two prior coronavirus-related outbreaks, SARS and MERS. The patient died on Jan. 27 after a two-week illness that left him increasingly breathless. His heart stopped following damage to his alveoli, tiny grape-like ...

8) I Flew to See My Parents and Ended Up in Coronavirus Quarantine

(Bloomberg) -- I felt hundreds of eyes staring as my heart pounded, blood rushed to my face and sweat dripped down the back of my neck. I had just stepped off the plane at Seoul’s Incheon International Airport, and this wasn’t what I’d expected. For weeks I’d been covering the coronavirus outbreak for Bloomberg News in Hong Kong -- tracking the case counts, the travel ...

Bonds

9) World’s Biggest Glovemaker Raises Money as Virus Fuels Demand

(Bloomberg) -- The world’s biggest glovemaker is turning to the credit market to raise funds as the coronavirus outbreak tests the Malaysian company’s capacity to churn out the rubber products. Top Glove Corp. plans to raise 1 billion ringgit ($241 million) from perpetual Islamic notes as demand soars for gloves to help protect against the deadly virus, which has infected ...

10) Sex Abuse Claims Drive Boy Scouts of America to Seek Bankruptcy

(Bloomberg) -- The Boy Scouts of America filed for bankruptcy to protect itself from a rising tide of claims tied to sexual abuse of children in its ranks. The group filed under Chapter 11 of the bankruptcy code, which allows the organization to keep operating while it works out a plan to pay its debts and design a recovery plan. Court papers filed in Delaware listed liabilities of up to $1 billion and assets as much ...

11) Default Fear Pushes India Funds to Ring-Fence Vodafone Idea Debt

(Bloomberg) -- Indian mutual funds are carving out their investments in troubled Vodafone Idea Ltd.’s debt into separate portfolios as they seek to limit any fallout from a possible default by the telecom carrier. UTI Mutual Fund and Nippon Life India Asset Management have moved to ring-fence their holdings in Vodafone Idea’s debt on Monday after credit assessor Care Ratings Ltd. ...

12) Commodity Currencies Slide on Global Growth Worries: Inside G-10

(Bloomberg) -- Commodity currencies dropped after Apple Inc. flagged that Chinese factories are resuming production at a slower pace than anticipated, renewing concerns over the economic impact of the coronavirus outbreak.

- The currencies of New Zealand, Australia and Norway fell at least 0.4% to lead losses among Group-of-10 peers. Treasuries rallied across the curve as ...

13) China Dollar Bonds Worth $20.9 Billion Are Yielding Above 15%

(Bloomberg) -- The yield on these securities from Chinese companies was above 15% this week, bringing the total face value of Chinese dollar bonds in that category to $20.9 billion.

- 26 out of 67 bonds on the list are from the real estate industry

- Majority of issuers on the list are Beijing-based and represent $12.3b of bonds

- Note: Items in white have payments due within a month ...

14) Traders in ‘Complacency’ as Shorts Wither: Volatility Monitor

(Bloomberg) -- Short interest on the SPDR S&P 500 ETF Trust has begun this year at levels not seen since 2007, according to the latest exchange-reported data compiled by Bloomberg. Btig LLC strategist Julian Emanuel said in a note Sunday that “a quiet sort of complacency seems to have descended over investors, weary of the last several weeks’ gyrations,” partially because “the bears have capitulated -- with ...

Central Banks

15) Search for Big G-10 FX Movers Points to Yen, Aussie: Macro View

(Bloomberg) -- Japan, Australia and Canada are among the Group of 10 countries whose currencies have the greatest room to strengthen this year, according to a model based on factors such as real-effective exchange rates and rate differentials.

- The currencies stand to gain anywhere from 4% to 6% against the dollar in 2020, based on the model, which factors in REER, real ...

16) French MiFID II Research Revamp May Ease Asset-Manager Pressure

(Bloomberg Intelligence) -- French asset managers from Amundi to AXA to Lyxor may win easier access to more and better-quality investment research, supporting fund performance and easing revenue-margin pressure, with the Authorite des Marches Financiers' plan to overhaul its MiFID II regime. The changes could give the country's managers a competitive edge over EU and U.K. peers, in our view.

17) Philippines Offers to Sell More 2029 Bonds as Yield Falls (1)

(Bloomberg) -- The Bureau of the Treasury sold all 30b pesos of 2029 treasury bonds it offered at an auction Tuesday as bids were twice more than what it offered.

- Average yield fell to 4.409% from 4.617% at previous auction on Nov. 12, according to data at auction covered live in Manila

- Bids reached 83.6b pesos vs 30b pesos offer

- Treasury opened a tap facility, offering to sell 15b pesos more of the re-issued bonds ...

18) TRANSLATION: Yonhap Infomax: BOK launches 'Blockchain Bond' Treasury Trading Test

19) RBA Reviewed Case for Further Rate Cut, Worried About Borrowing

(Bloomberg) -- Australia’s central bank reviewed the case for a further interest-rate cut, but decided against it in order to avoid encouraging additional borrowing as house prices climb, minutes of its Feb. 4 meeting in Sydney showed. The Reserve Bank also expects the coronavirus outbreak to “subtract from growth in exports over the first half of 2020,” the minutes ...

20) N.Z. Economists Agree With RBNZ on Limit to House-Price Gains

(Bloomberg) -- New Zealand economists agree with the RBNZ that there will be a pick up in house-price inflation in early 2020, but this will be short-lived amid increased supply, slowing population growth and credit constraints. according to emailed notes.

- ANZ Bank sees house price inflation lifting to 8% by mid-2020 with a “fairly sharp moderation” to ~3% thereafter

- Westpac raises its house-price inflation projection to 10% by mid-2020 but sees a slowdown ...

Economic News

21) How Fast Can China’s Economy Bounce Back from Virus Lockdown

(Bloomberg) -- The biggest question for the global economy right now is how quickly China can get back to anything like normal operations while it’s battling the coronavirus outbreak that has killed almost 1,900 people and sickened tens of thousands. Government controls and people’s fears to go outside have decimated spending for businesses from local noodle joints and ...

22) Boris Johnson’s 570 Billion Reasons for Wanting an EU Trade Deal

(Bloomberg) -- Brexit shattered 50 years of trade policy in Britain, divorcing the country from its single largest market. Prime Minister Boris Johnson is now trying to glue the pieces back together. Since Britain left the European Union on Jan. 31, Johnson has dispatched his foreign secretary on a tour of Australia and Japan to show that Britain is open for business, while ...

23) U.S. Is Considering New Wave of China Tech Restrictions

(Bloomberg) -- The Trump administration is considering new restrictions on exports of cutting-edge technology to China in a push aimed at limiting Chinese progress in developing its own passenger jets and clamping down further on tech giant Huawei’s access to vital semiconductors, according to four people familiar with the discussions. Senior officials are expected to decide by the end of this month whether to block exports ...

24) Most Economists See Virus Pushing Japan Into Recession: Survey

(Bloomberg) -- Japan is falling into recession as the coronavirus pummels an economy already weakened by a sales tax hike, according to a Bloomberg survey. Nine out of 14 polled economists see the economy shrinking again in the three months to the end of March, following the sharpest contraction in more than five years last quarter. The median forecast of analysts shows ...

25) Korean President Calls for ‘Extraordinary Steps’ to Combat Virus

(Bloomberg) -- President Moon Jae-in said the spreading coronavirus is an emergency for South Korea’s economy and called for “extraordinary” steps to minimize its impact. “An emergency situation warrants an emergency prescription,” Moon told his Cabinet on Tuesday, warning that the virus’s impact could be bigger and longer-lasting than a 2015 epidemic that killed 38 people ...

European Central Bank

26) ECB Added LVMH’s New Euro-Denominated Bonds to CSPP Last Week

(Bloomberg) -- The ECB added 10 new securities to its CSPP program during the week ended Feb. 14, according to central bank data analyzed by Bloomberg.

- Two securities matured and the value of the CSPP portfolio increased by EU1.997b at amortized cost

- Size of CSPP now at EU192.556b

- NOTE: Central bank reinstated net asset purchases on Nov. 1

27) Lagarde Confronts Political Cost of ECB’s Subzero Rate Policy

(Bloomberg) -- “Nobody trusts you,” lawmaker Joerg Meuthen told European Central Bank chief Christine Lagarde, switching briefly to English during a tirade in his native German. “You should be aware of that.” The far-right Alternative for Germany representative was railing about negative interest rates -- and while enduring bluster is par for the course for ECB presidents, ...

28) Euro Options Turn More Bearish in Repeat of 2019 ECB Easing Bets

(Bloomberg) -- Options traders are turning increasingly negative on the euro in a move that resembles the pricing adjustment seen in July when the currency market positioned for potential easing by the European Central Bank.

- Risk reversals are now trading in favor of puts in the short- to medium-term as concerns over the coronavirus outbreak and the health of the euro ...

29) Global Policy, Lagarde’s Challenge, China Rate Cut: Eco Day

(Bloomberg) -- Welcome to Monday, Europe. Here’s the latest news and analysis from Bloomberg Economics to help get your week started:

- The broad policy direction for many of the world’s central banks and governments now hinges on one question: how will the Chinese government respond to the economic shock?

- Finance leaders from across the world will gather in Saudi Arabia this week to discuss a global economy ...

30) After Fed and ECB, India May Turn Next to BOE for Inspiration

(Bloomberg) -- First it was the Federal Reserve. Then the European Central Bank. Now, India’s monetary authority may look to the Bank of England for ideas to revive growth, economists say. The Reserve Bank of India could possibly draw inspiration from BOE’s Funding for Lending Scheme to jump start loan growth in the economy that’s set for its weakest expansion in 11 years, ...

First Word FX News Foreign Exchange