Italy Q4 funding program - thoughts from Astor Ridge

Few micro moves today on the back of the Q4 issuance programme announcement on Friday evening.

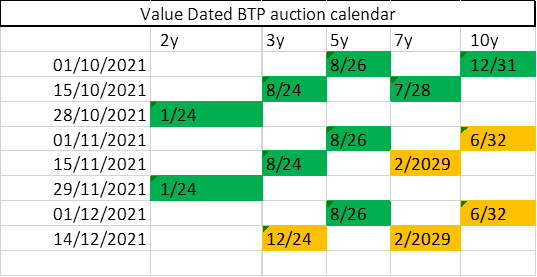

We will get a new 3y (12/24), new 7y (2/29) and new 10y (6/32)

Anything long dated would be done via syndication, so nothing to help us out there, although last week "sources" pushed back expectations of anything long dated for a month or so, but didn't rule out something Green or indeed a BTP Futura.

They will also tap 1/24, 8/24, 8/26, 7/28 & 12/31 at least once

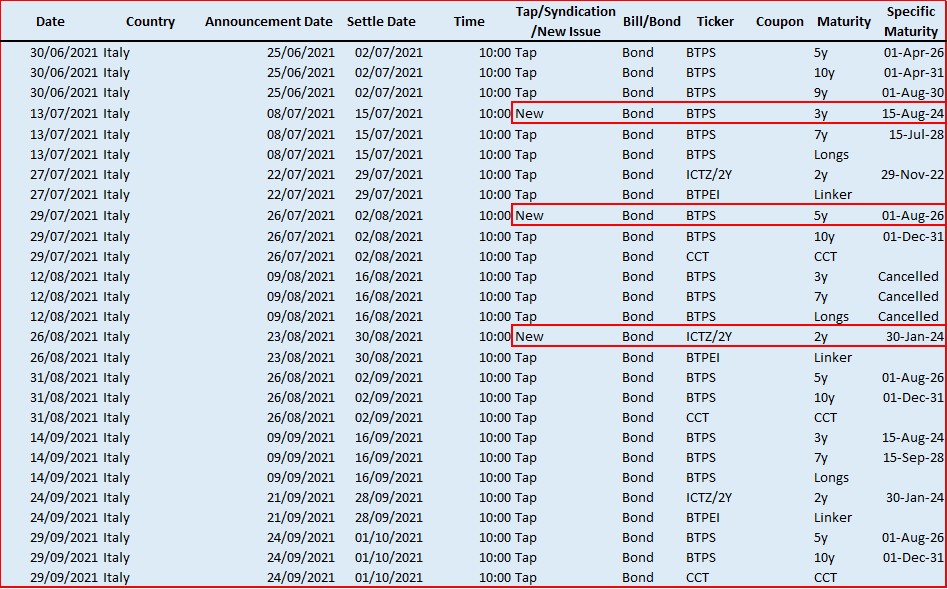

Bear in mind that the Italian programme is value dated. This means that this week's tap of 5y and 10y, which settles on 1st October counts as being in their Q4 programme. This means the new calendar should look something like this (new bonds in Orange):

Assuming my timings are right this means that at issue the current benchmark sizes for the 3y & 7y will end up much smaller than usual

8/24 current size is 8.25bn. 2 more taps takes it up to 13.25. That's vs 18.29bn in the 4/24

7/28 current size is 12.85bn. Assuming 2.5bn at the final tap in 2 weeks with get up to 15.35bn. that's vs 19.6bn in the 3/28

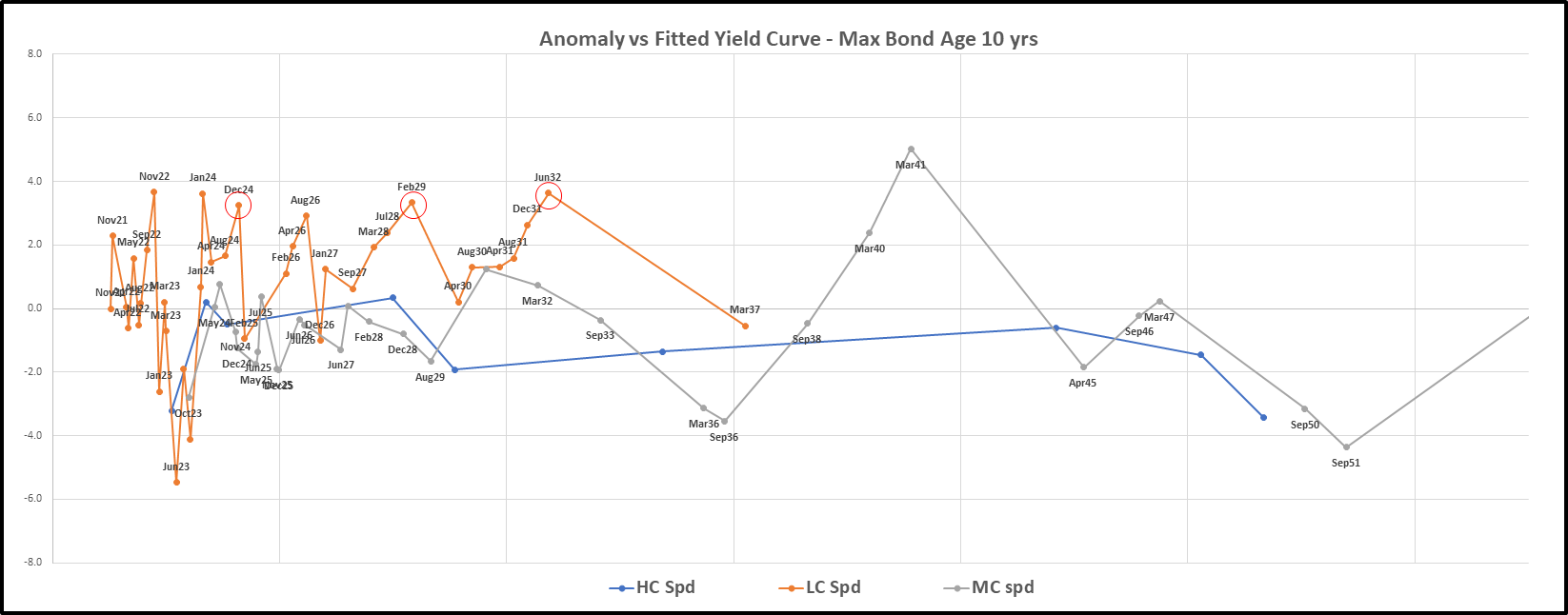

Bottom line – we have struggled to see Bonds perform as they go off the run in 2021, but these smaller final outstanding amounts should be positive for the current 3y & 7y and see a quicker rehabilitation back into the curve. Additionally, we see BTPS 12/31 as cheap.

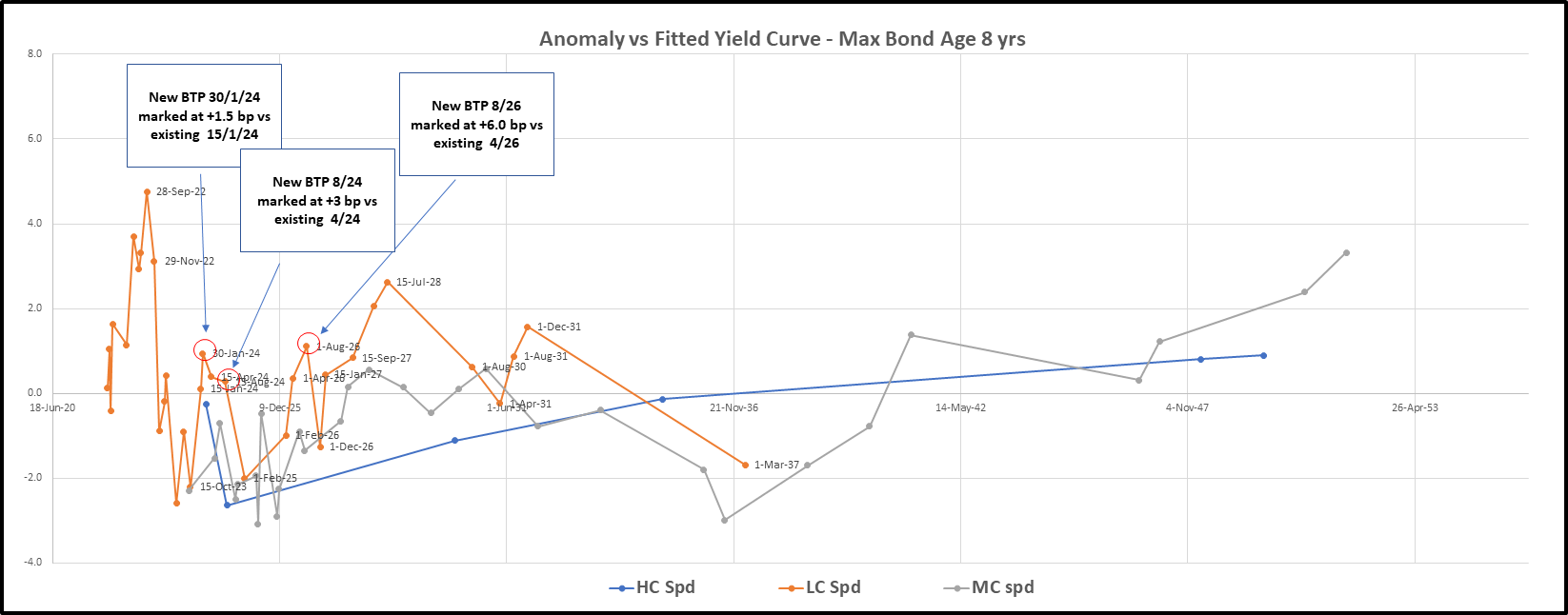

Plotting the new issues gives us this (New Issues in Red):

This makes us want to be long 1/24, 7/28, 12/31 and be short 2/25,8/29,4/30 & 3/36

Sell BTPS 8/29 -> BTPS 7/28

Sell BTPS 4/30 vs 7/28 & 12/31

Buy BTPS 12/31 vs 4/30 & 3/36 (1.5:2:0.5)

Will Scott

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4171

Mobile: +44 (0) 7894417709

Email: WILL>SCOTT@astorridge.com

Website: www.astorridge.com

This marketing was prepared by Will Scott, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

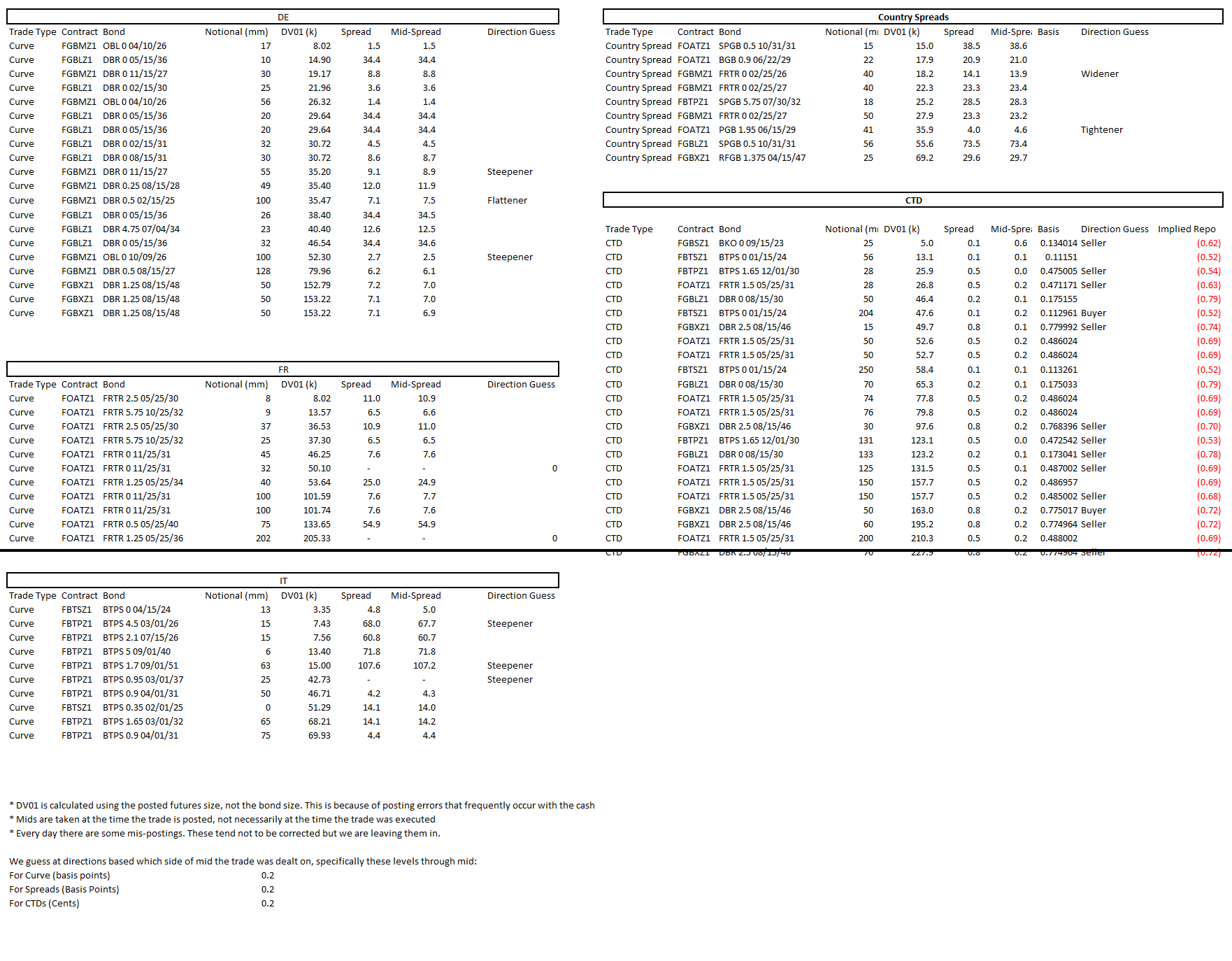

EGB EoD/Trades/Basis flows - Will & James & Astor Ridge

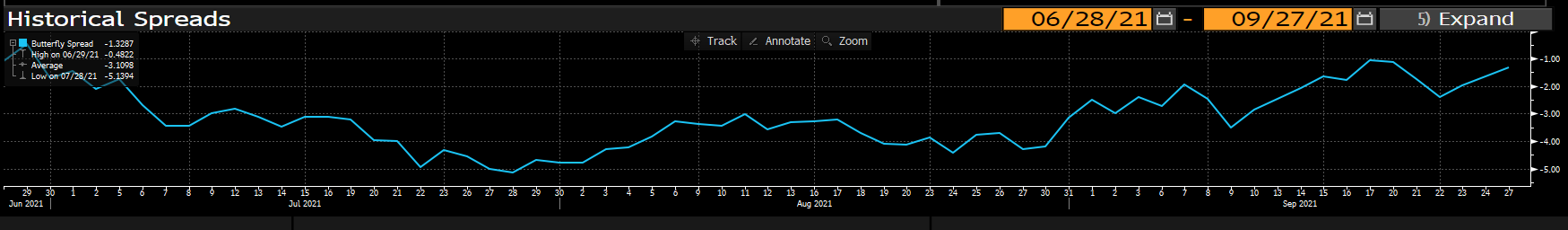

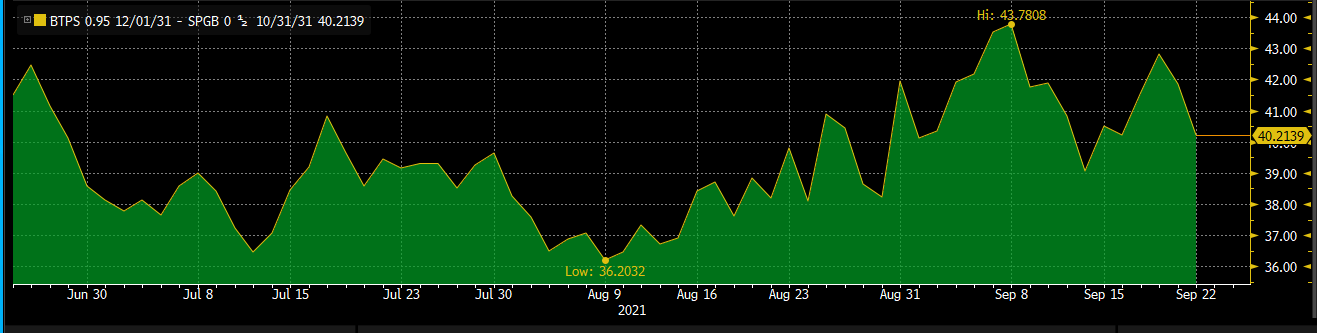

ITALY - BTPs tighter this afternoon on the back of "a source" saying that Italy will skip a syndication this autumn due to improved economic outlook and to close the gap with Spain. Looks like we are still in for a BTP Futura and something Green before year end though. Market clearly a little underweight Italy as an Evergrande hedge? and in the anticipation of some syndicated supply, but less reaction in 10/30 than you would think given the expected syndication was something in the long end. Italy as a result back to the tights vs Germany. BTPS 12/21 vs SPGB 10/31 2 tighter on the day at 40 basis points with YTD lows of 36. Tbh I would think the Tesoro needs to do a bit more than create a temporary supply/demand imbalance, but as with everything we can overshoot so I wouldn't be a seller until 37 bps or below.

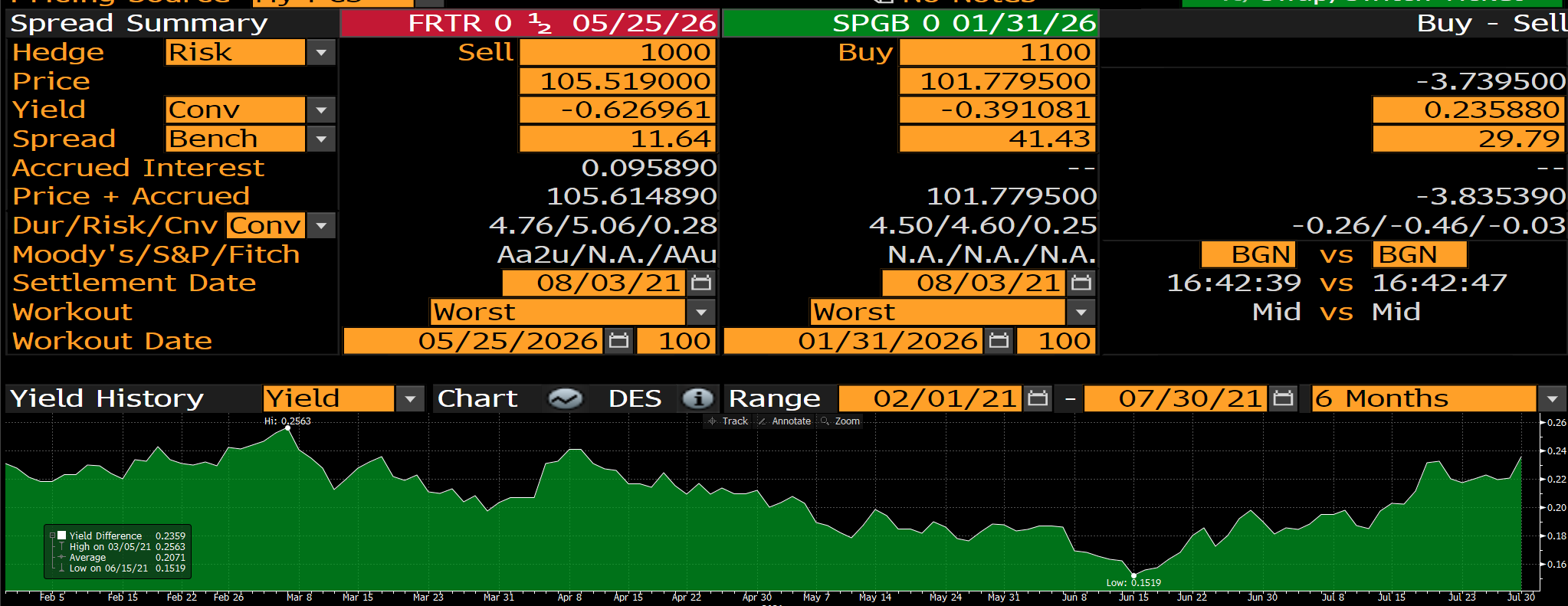

NEGU - EU taps the Jul-26 on Monday for the first time in 2.5bn. At 19 over Bunds it's pretty decent value and we also think it's worth a look vs Spain given the richness of the 5y sector there

PORTUGAL…. on fire again post their exchange. Just to contextualize you can sell PGB 7/26-> EU 7/26 and pick up spread. Not saying it's wrong. But just saying anyway....

FINLAND – 30y looking cheap to Bunds here, backed up by flows in the basis market today.

EUREX BASIS:

In particular some decent buying of Buxl vs DBR 48s.

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by Will Scott, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

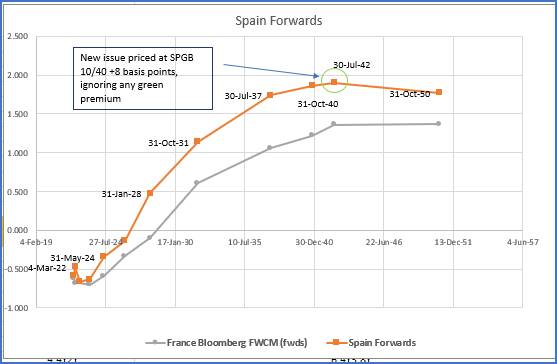

New Spanish Green Bond tomorrow - first attempt at valuation

- Spain will launch their first Green bond tomorrow with a maturity date of 30-Jul-2042

- Market expectations for size seem to be in the region of 5bn, which is at the smaller end of the range in terms of issuance size

- We don't know yet whether we will price vs swaps or bonds, but we will assume for the purposes of this analysis that we will price off the SPGB 10/40

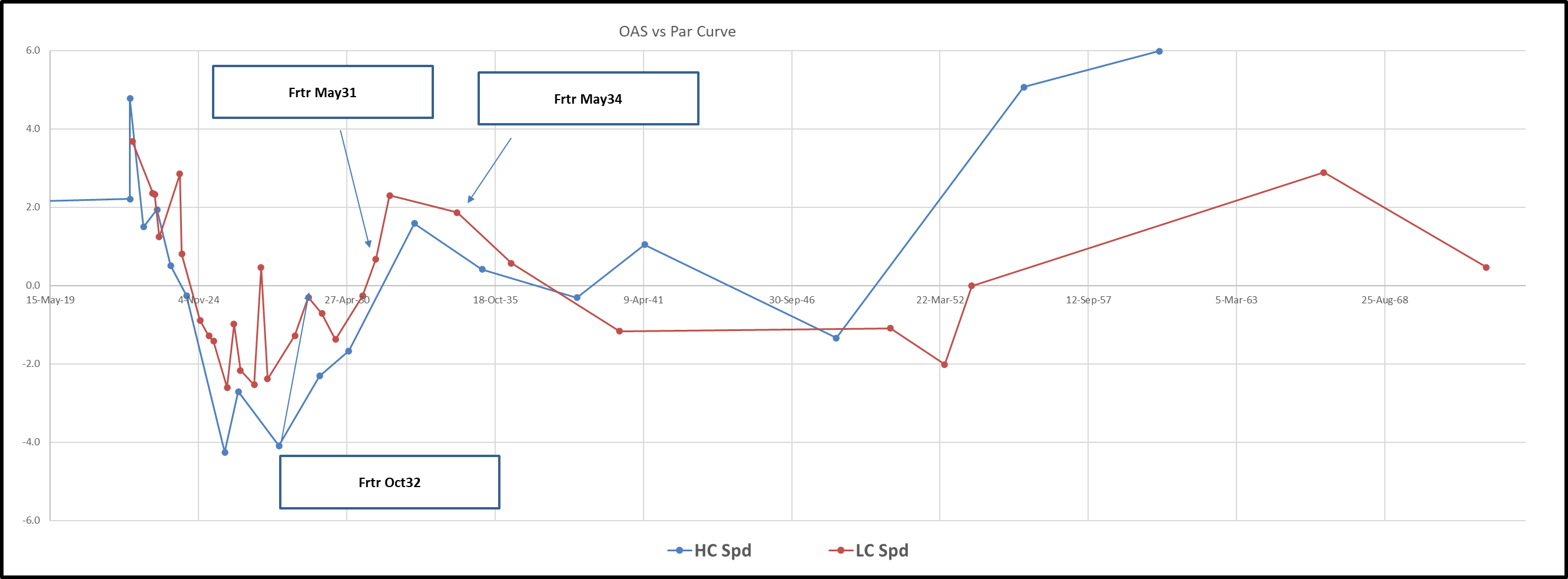

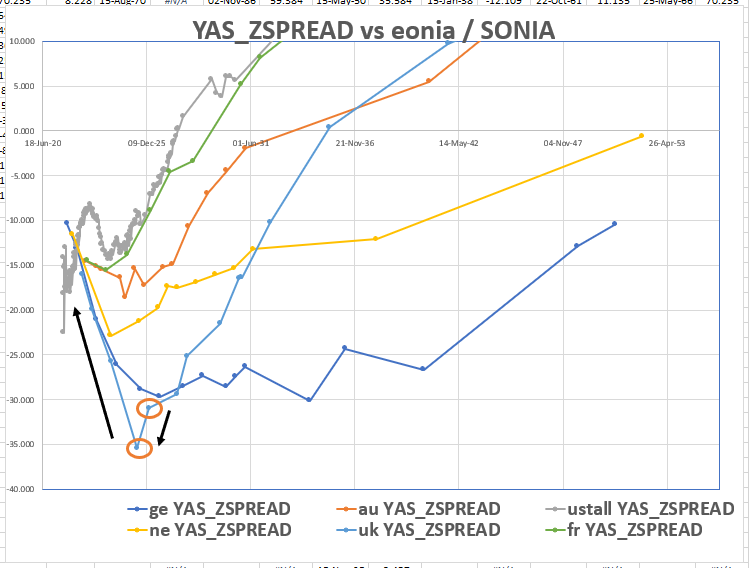

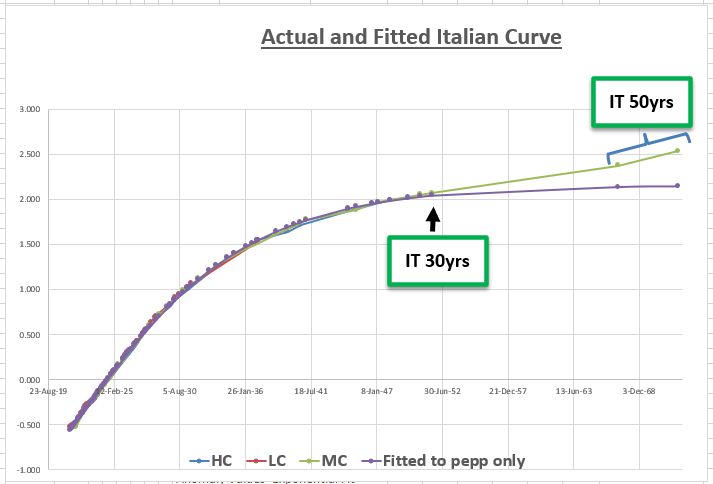

- Pricing the new issue as a non-green we get a fair value of around SPGB 10/40 +8 basis points (Graph Below)

- Looking at Green bonds outstanding we get an "average" Green premium of 6 basis points. Full breakdown below, but the comparable for each bond is subject to its own value distortions such as coupon differential and PEPP impact, so we have looked at the average across the board, which equates to just below 6 basis points.

|

Green Bond Premia (Green Bond Yield on y/y swap vs comparable nominal) |

||||||

|

|

|

|||||

|

|

5y |

10y |

12y |

20y |

25y |

30y |

|

DE |

4.68 |

6.74 |

3.59 |

|||

|

NL |

6.31 |

|

||||

|

FI |

|

|||||

|

AT |

|

|||||

|

FR |

9.80 |

2.66 |

|

|||

|

IE |

7.32 |

|

||||

|

BE |

4.20 |

|

||||

|

SP |

|

|||||

|

PO |

|

|||||

|

IT |

7.05 |

|

||||

|

|

|

|||||

|

|

|

|

|

|

|

|

- Taking all this into account we get a "fair" value for the 42s of SPGB 10/40 +2 basis points

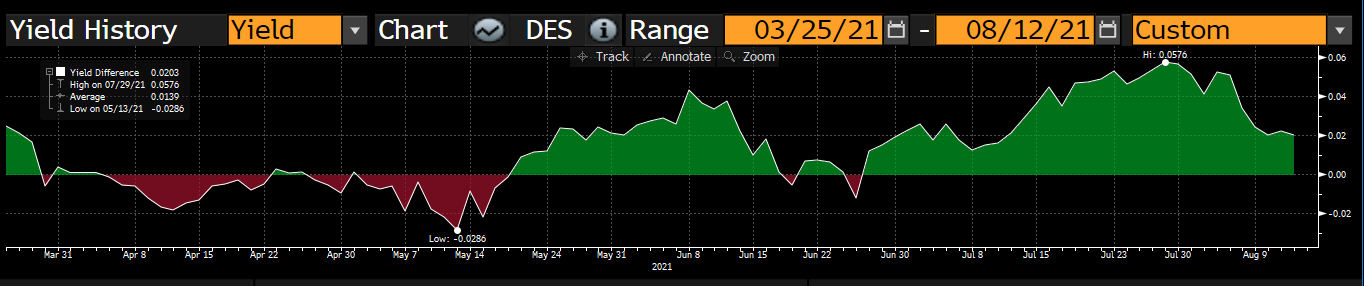

- Looking at Spain more broadly there is little to recommend it cross market (10y has outperformed vs France and Italy over the past 2 weeks)

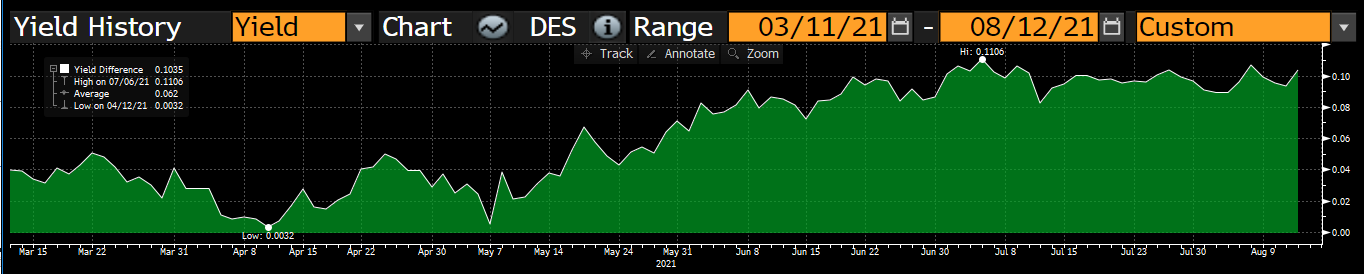

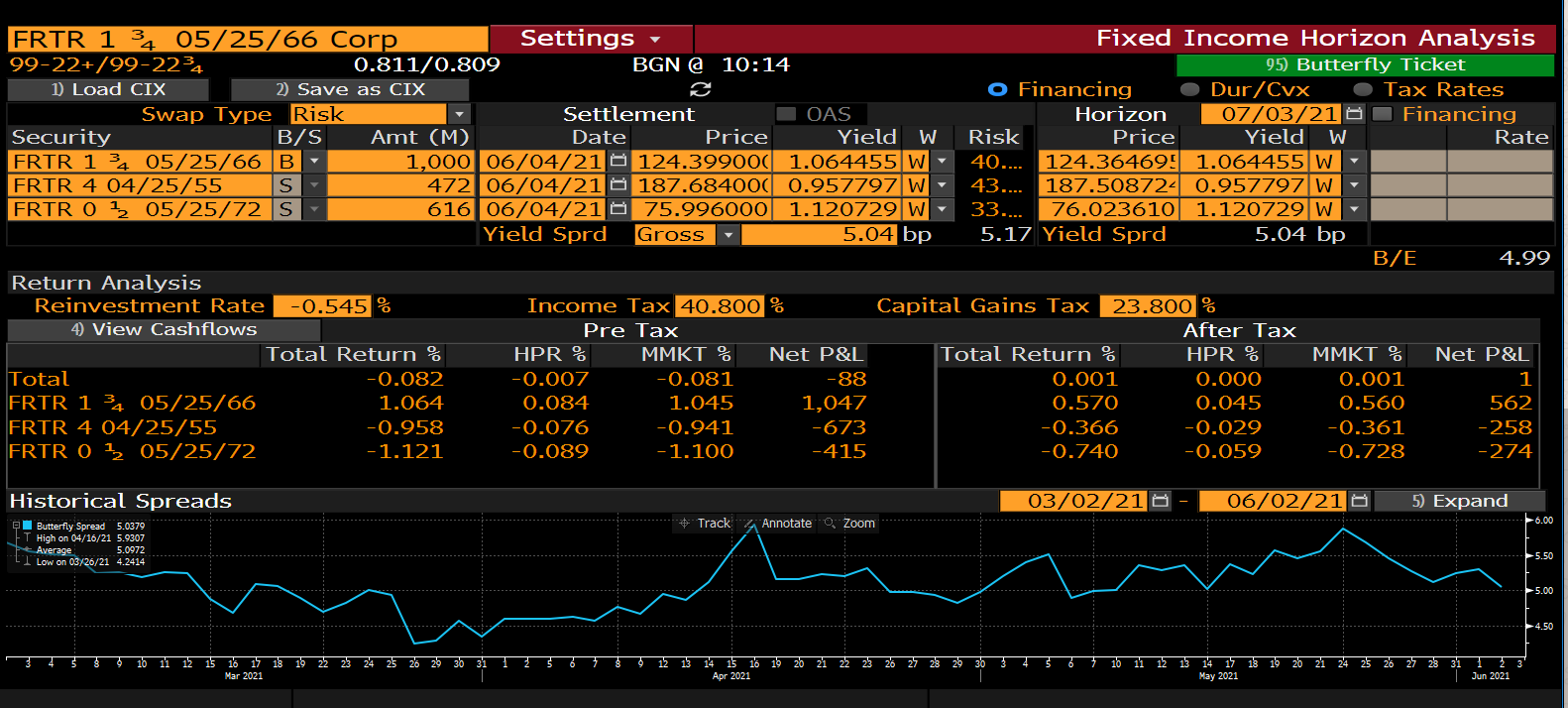

10y Spain vs France and Italy blend

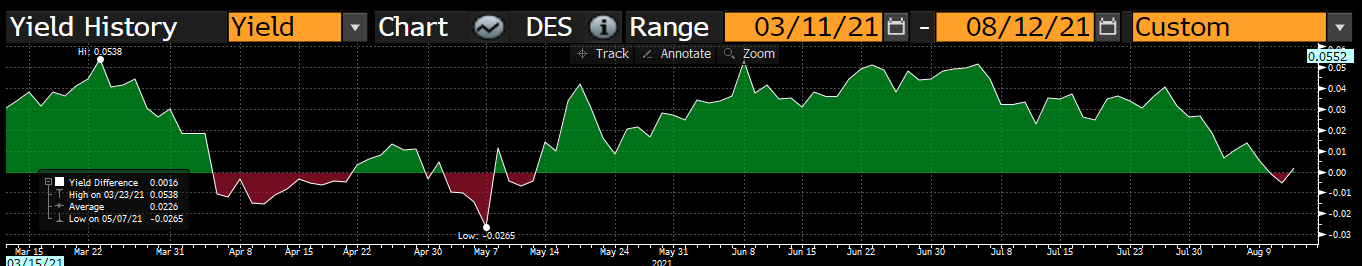

- The 20y sector has, however, given up some ground into the announcement, with 10/40 cheapening nearly 3 basis points vs 10y & 30y wings. In addition, this structure probably offers the most nimble way to absorb the bond if it does come cheap tomorrow.

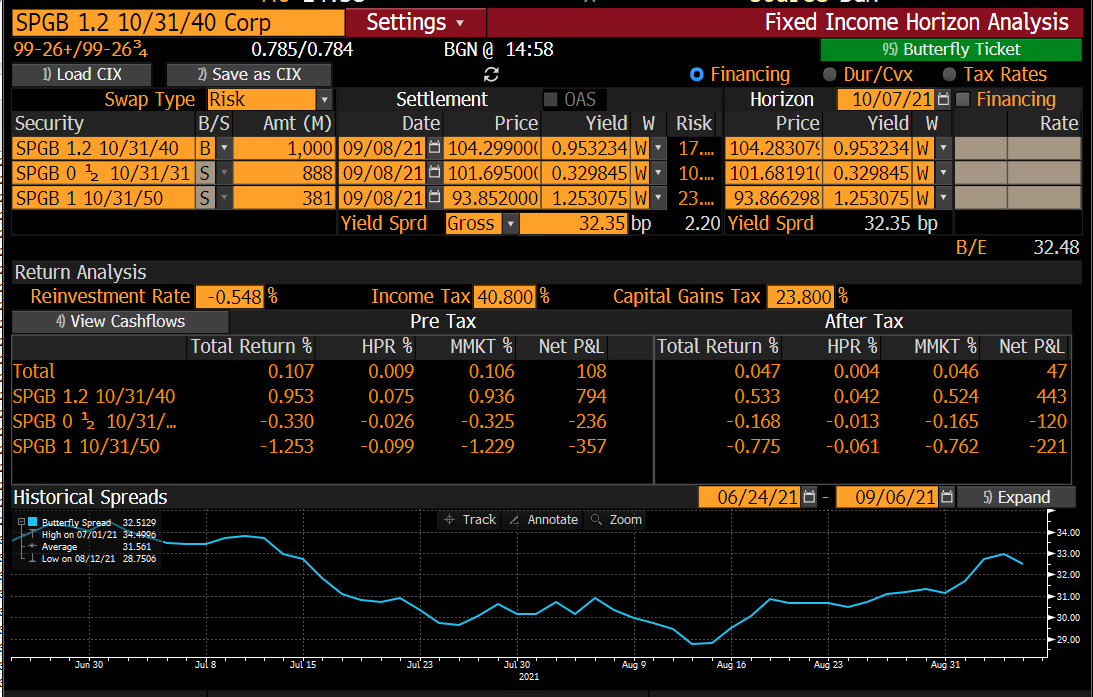

SPGB 10/40 vs 10/31 & 10/2050

Trades and Fades - Will and James @ Astor Ridge

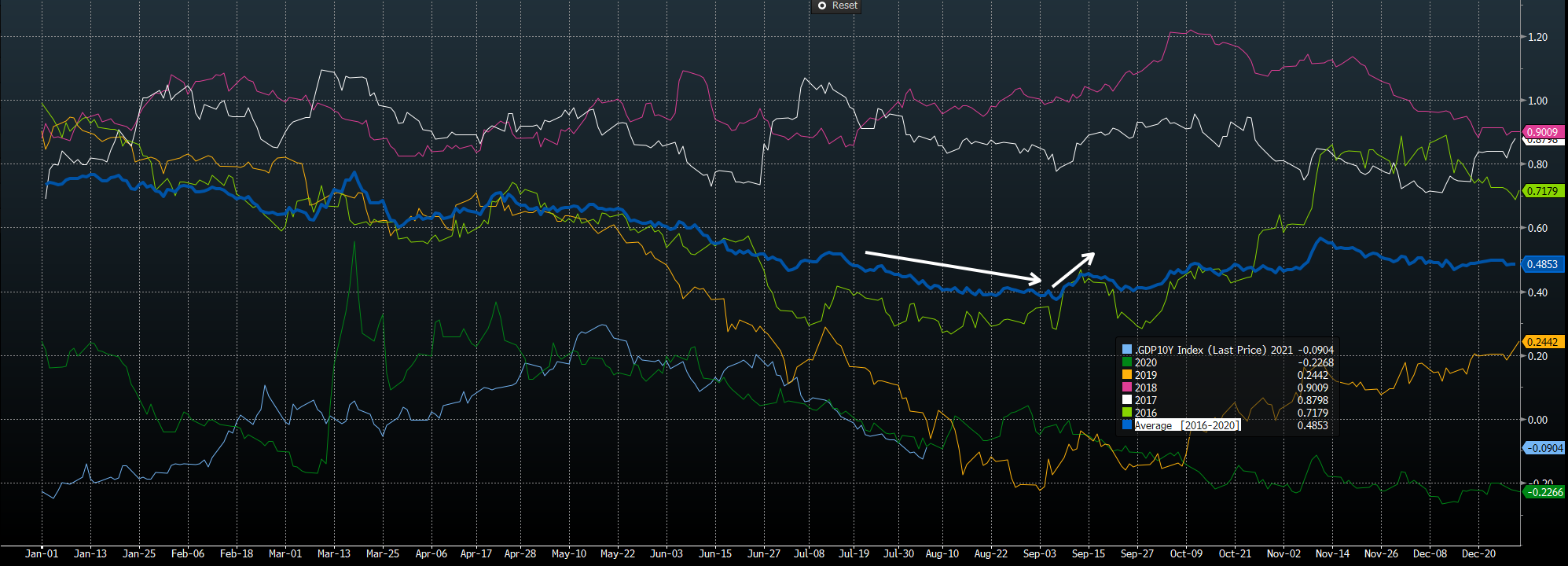

- This being mid-August this is a bit more of a "where are we now" than a trades and fades as we all know that errant micro RV isn't always that tradeable at this time of year!

- Outright market losing some of its froth post NFP, but am wary of getting too carried away to the downside given the power of the move higher last week.

- Seasonality still feels like it will keep the selloff in check until we get nearer to the September supply season:

10y GDP weighted EGB yield seasonality – September supply not usually factored in until final week of August

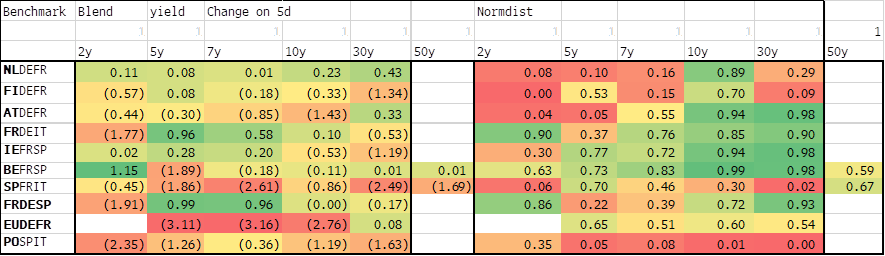

Cross Market Spreads – change on week

- EU paper a stand out performer, but we are only really back to fair value

EU 3/26 vs FRTR 5/26 tichtened nearly 4 bp this week

- Long end Finland doing a disappearing trick over the summer but in Austria, whilst showing signs of recovery in 10y space, we are still seeing weakness in the long end:

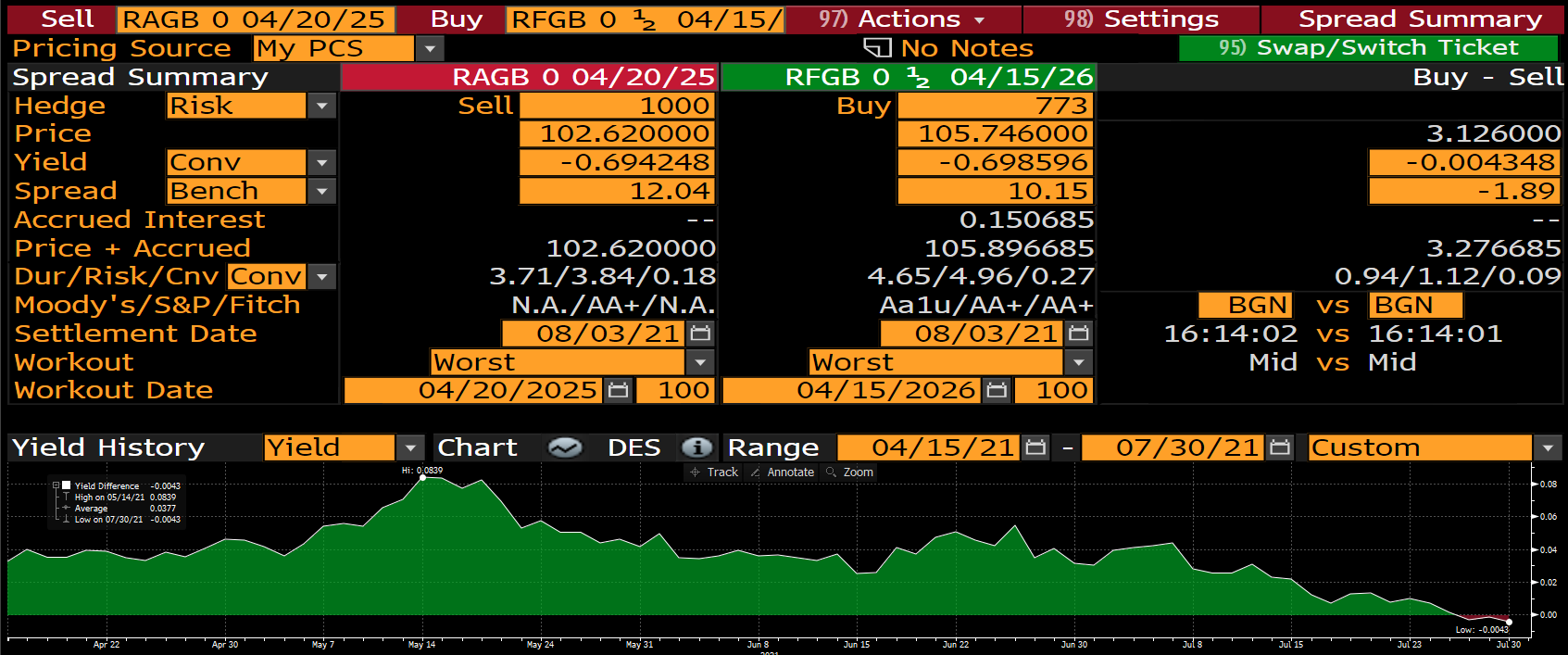

RAGB 30y cheapening vs RFGB 30y

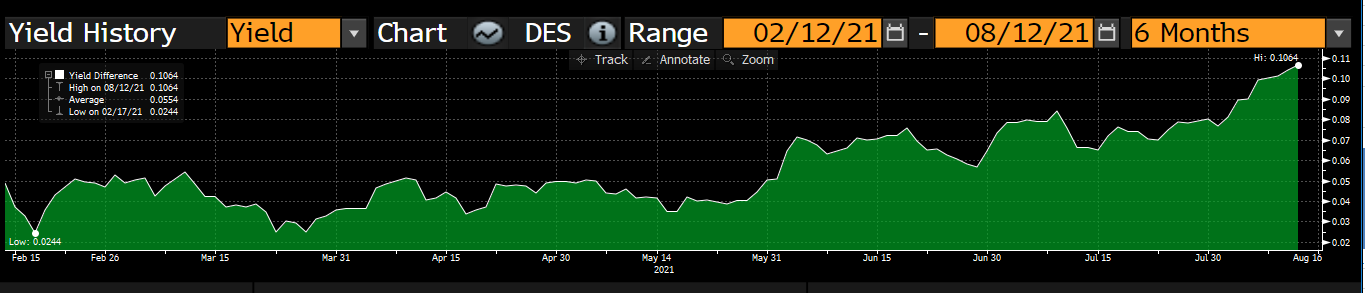

- Despite all this, just how wrong is it all?

- For sure, 6/2036 EU looks pretty cheap here. It's as steep as France in 10/15, but it has a better credit and (by definition) a lower 10y yield. It's tough to justify selling smaller, richer issuers against it though (e.g. Finland), despite how tempting it is:

- Note also that a decent amount of basis has gone through this week buying the EU 6/36 against OAT contracts

EU 2036 vs RFGB 2036

- Conversely the EU 40s are rich. This combined with the cheapness of Austria in the back end makes more sense to us as a way to capture both EU supply concession into September and also a re-richening of Austria into the end of August

EU 10/2040 vz RAGB 10/40 at flat yield

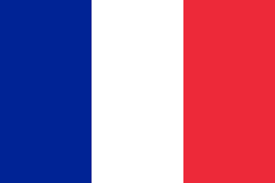

Meanwhile, anyone looking for that French election trade might want to take a look at Belgium. It has steadily underperformed France over the course of July so could be time to start scaling in?

As a reminder the OAT/RX widening for the 2017 French elections began in October 2016, reaching the wides nearly 2 months before the actual voting.

OAT/RX generic curve 5 y history

![]()

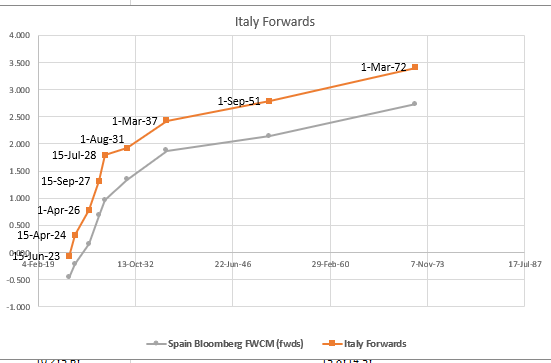

50y curves – Italy did a great job flattening back this week, but little empathy from the other curves, which was somewhat surprising.

But if we look back at the Italy vs Spain 30/50 box though we see that in many ways this is just a very sharp correction to a longer run trend.

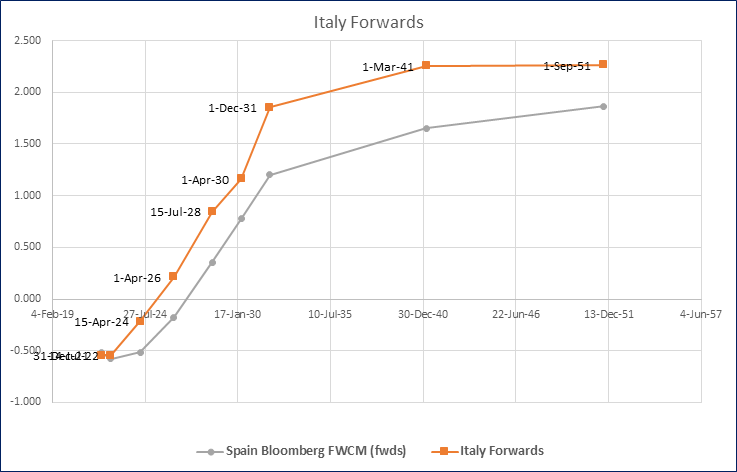

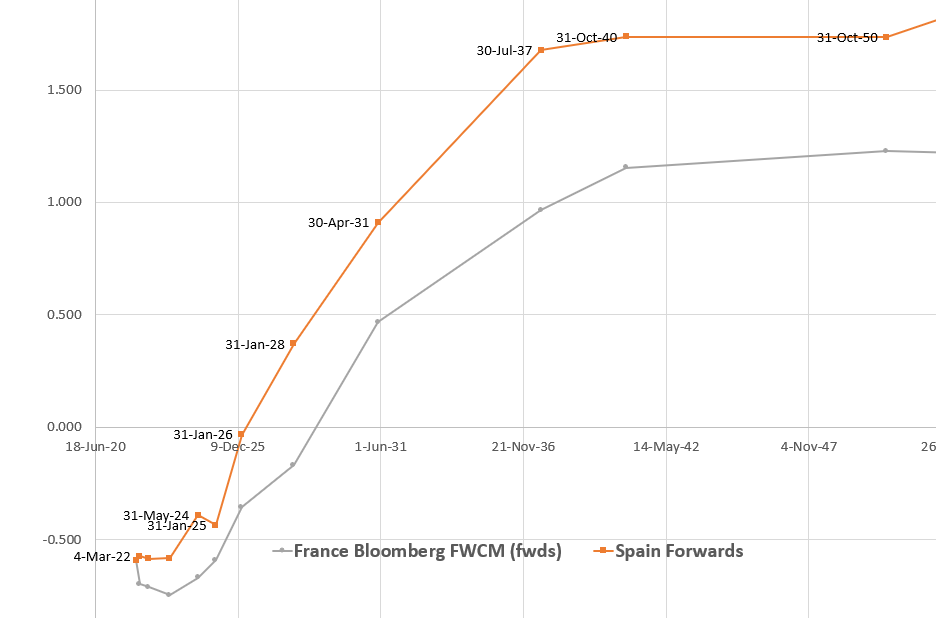

Which is pretty much backed up by the shape of the Italian vs Spanish forward curves:

With so little on the supply calendar we will save the micro RV for next week.

Will and James

![]()

Will Scott

O: +44 (0) 203 - 143 - 4800

M: +44 (0) 789 – 441 -7709

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Will Scott. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

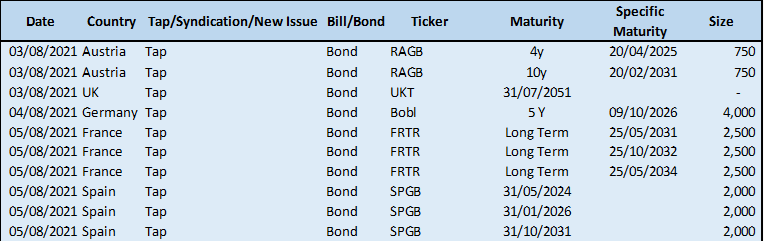

Trades and Fades - Will and James @ Astor Ridge - Week beginning 2nd August

Supply next week low, but no coupons and redemptions

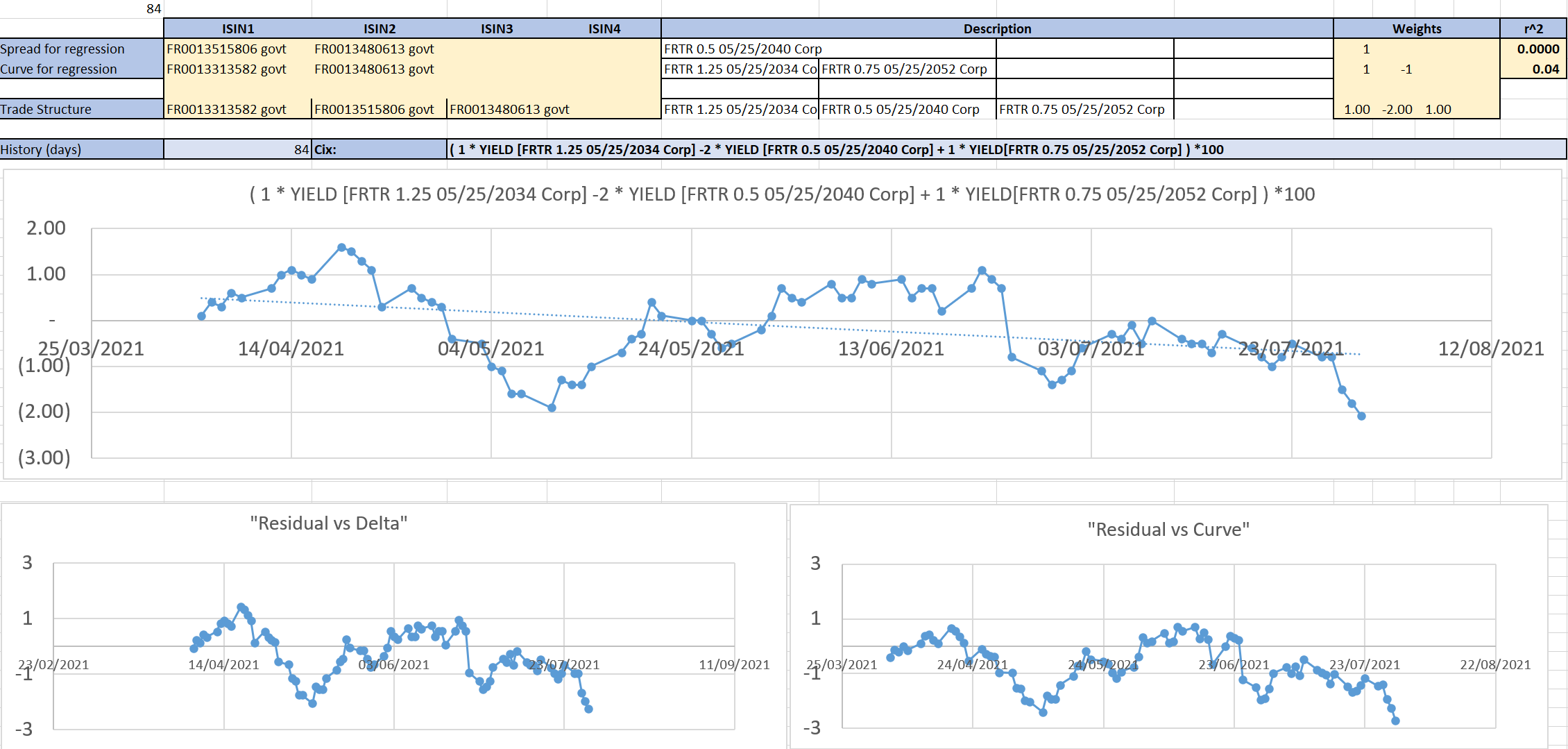

French auction next Thursday – get long 5/34s as the short wing of 34/40/52 fly

Spanish widening in the belly this week should see the auction well supported

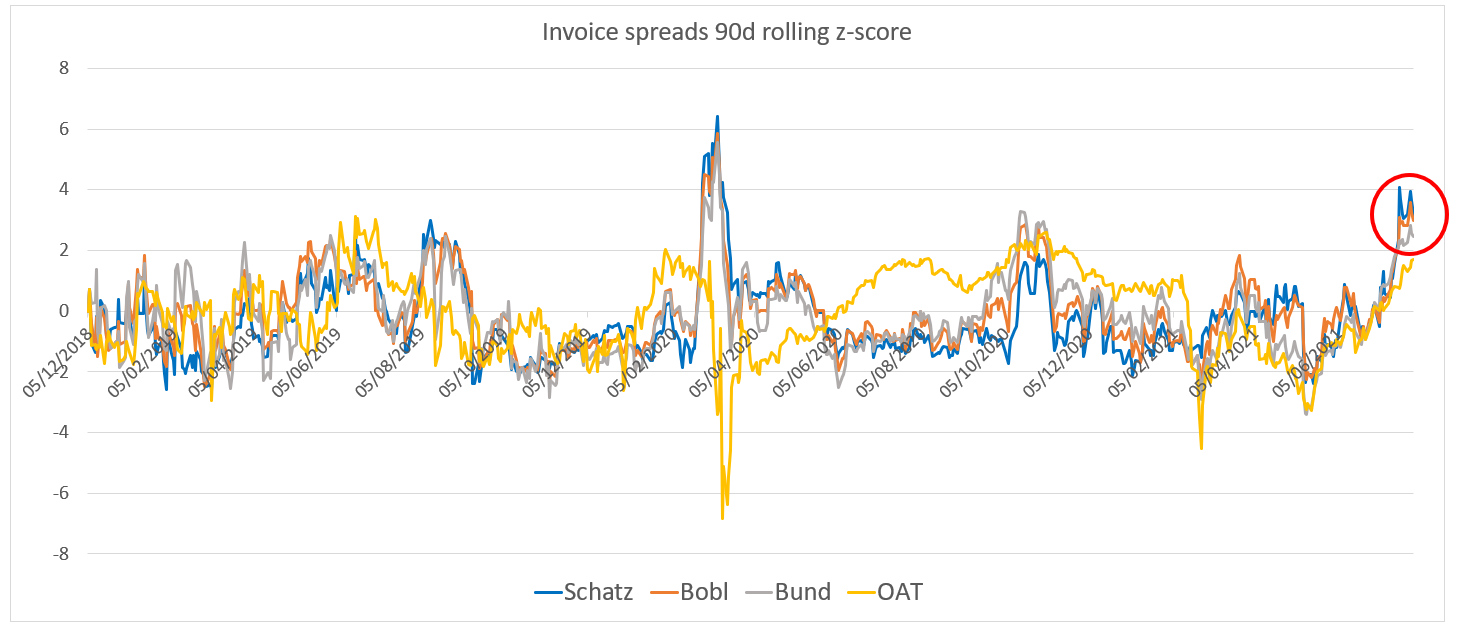

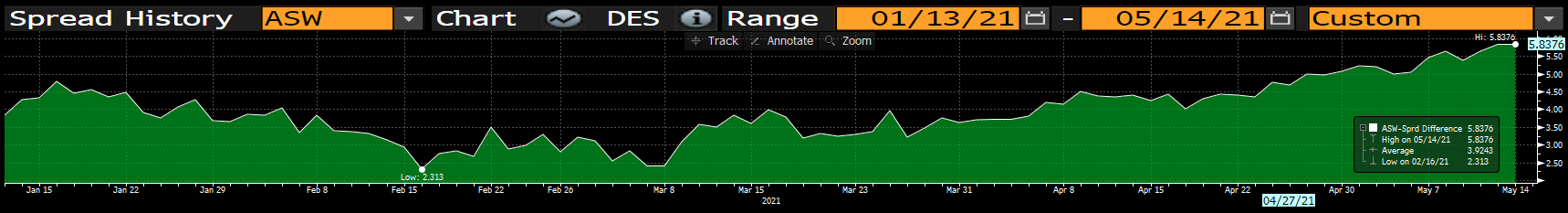

- Asset swap spreads seem to have found a bit of a base here with OAT invoice spreads tightening and Bunds also marginally tighter. Clearly there is directionality here as well so the mild selloff in OAT should precipitate something of a tightening bias, but it does feel like there is money to go to work to play for a correction tighter if we stabilise for another session – it looks pretty stretched here

![]()

- Austria to tap the 4y & 10y

- 10y Austria is looking decent value x-mkt (as is Nether for that matter)

- We like buying RAGB 10y on the blend vs DE & FRTR, or alternatively just long RAGB vs FRTR into the French and Spanish supply on Thursday:

Buy RAGB 2/30 vs selling DBR 2/30 (60%) and FRTR 5/30 (40%)

CIX: ((YIELD[DBR 0 02/15/30 Corp] * -.6) + (YIELD[RAGB 0 02/20/30 Corp]) - (YIELD[FRTR 2.5 05/25/30 Corp] * .4)) * 100

Buy RAGB 2/31 vs selling FRTR 11/31

- RAGB 4/25 look cheap to us here vs surrounding bonds.

Buy RAGB 4/25 vs selling RFGB 4/26 ahead of syndicated Finland issuance in September

- We would just run this as a yield curve steepener at these levels

- French supply is a curious mixture of bonds, and we aren't really sure what the value proposition is here 5/31 & 10/32 are both high coupon and so there is likely a decent amount of dealer demand to cover PEPP related shorts.

- They also look very different when we value them on discounted cashflows rather than in straight yield space.

- Similarly we don't want to wander into September long France, so are looking for cheapening in the 5/31 to get long vs surroundings (1bp would do the trick)

- FRTR 5/34 is looking cheap to us though

- Sell FRTR 5/40 vs FRTR 5/34 & FRTR 5/52

- Spanish 5y have been a bit beaten up this week, cheapening nearly 2 basis points cross market.

- This leaves 5y Spain vs France at the wides, so this should generate decent interest into the auction.

- That said, the forwards curve in both Spain and France are steep in 3y2y space, so there should be solid support for the 5/24 as well

Will and James

![]()

Will Scott

O: +44 (0) 203 - 143 - 4800

M: +44 (0) 789 – 441 -7709

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Will Scott. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Auction Preview - Spain

Spain to tap the following bonds tomorrow:

0% 1/26

1.4% 4/2028

1% 10/2050

Total size is 4-5bn

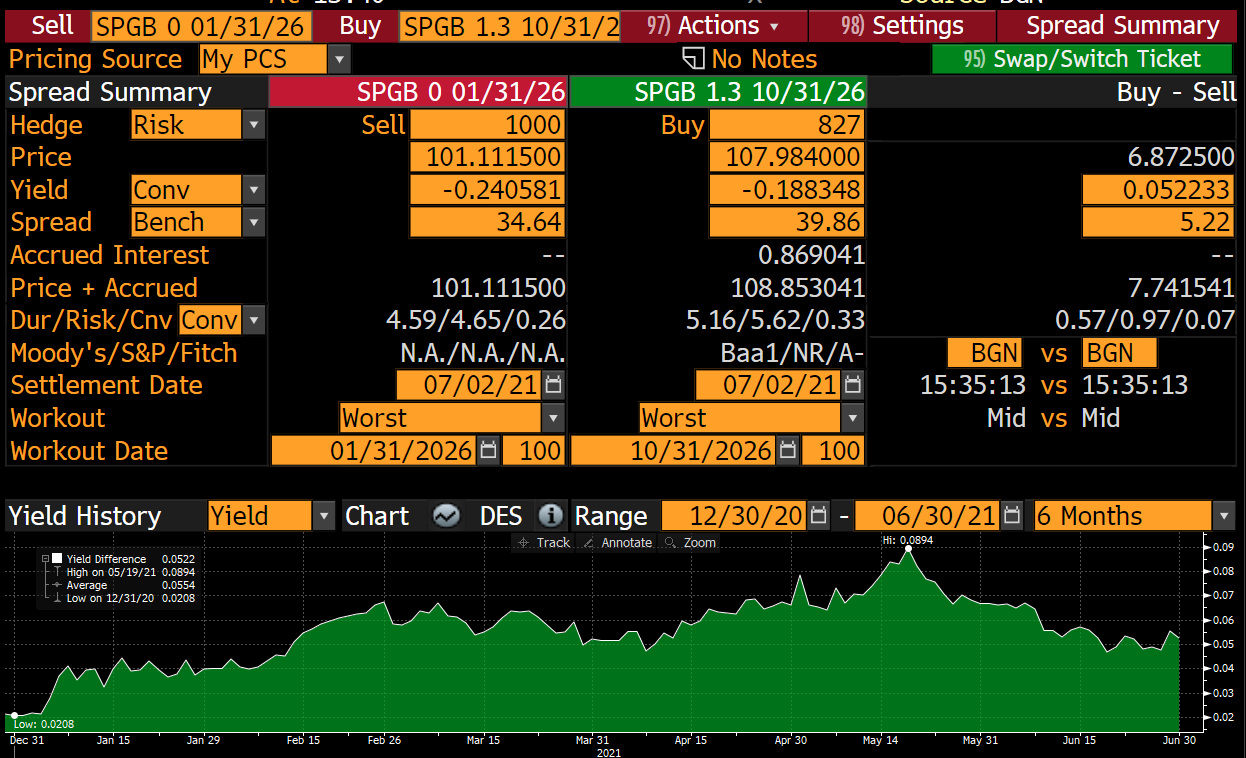

SPGB 1/26

- 1/26 is cheap and on the run.

- Still a good few taps to go

- At these levels we don't mind some steepening gaps in the front end

Trade: Buy SPGB 1/26 vs Selling SPGB 10/26

And on z-spread:

SPGB 4/28

- Frankly there are cheaper bonds to buy, so we will leave this one alone

SPGB 10/50

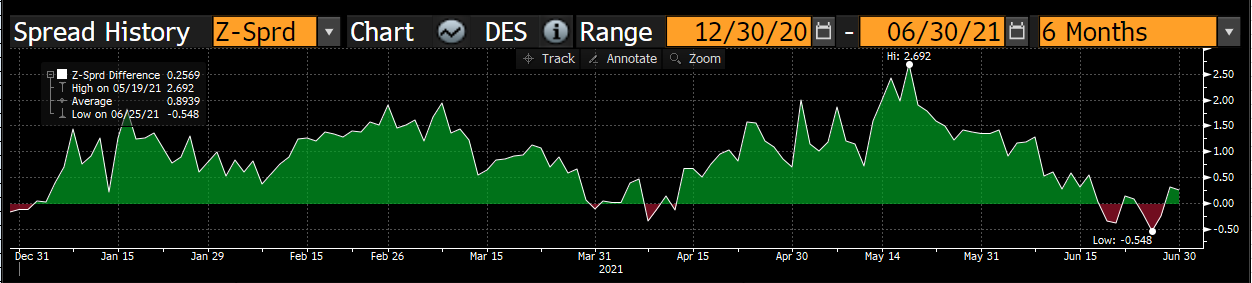

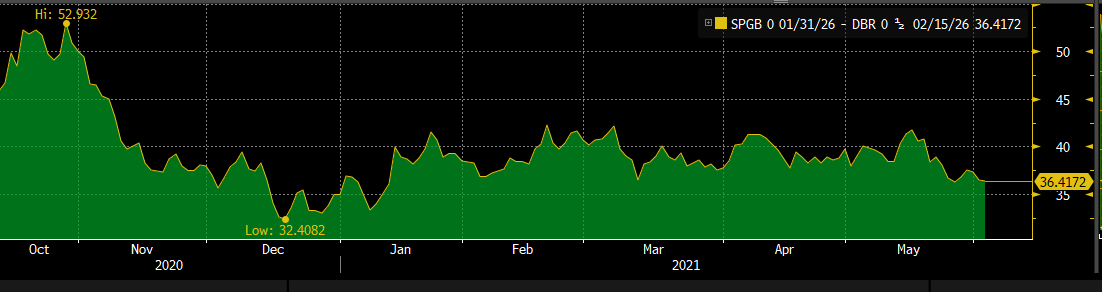

- Long end Spain has lagged the tightening seen in other issuers, most notably France

- There is an argument that the 10/50 should be well supported into year end given that the Tesoro has only got room for one more syndication and it looks highly likely that will be a 20y Green bond.

- Conversely France will be syndicating a new 30y any time from the beginning of July onwards

Sell FRTR 5/50 -> SPGB 10/50

- If you don't like the credit risk then a little IK/RX should do the trick as Italy has done well recently

- Note also that Spain has a 22bn redemption at the end of the month

![]()

Will Scott

O: +44 (0) 203 – 143 - 4171

M: +44 (0) 789 – 441 - 7709

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: US: 60 Rumson rd, rumson, nj 07760

This research was prepared by Will Scott. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

New front end BTP issues coming up / Q3 (assumed) supply calendar

Italian Q3 supply released last Friday gives us a slight shake up to front end issuance. Unexpected extra tap of the 11/22, longer than expected replacement of that bond (1/24) plus new 3y & 5y

We have put the new issues in our forward curves to get an estimated spread and then put the new issues into our curve fit.

- Lot of potential congestion in the 2024 sector – could put pressure on BTS & 2025 paper over the course of the quarter

- Also makes the 4/26 (tapped tomorrow) look like a better potential long than the 8/26 on our models

Just thoughts for now as the bonds don't even exist yet, but worth having in the back pocket . Calendar (indicative and our guesses) below

The structural anomalies within the curve are:

- Buy 11/22 vs selling BTSU1

- Buy 3/28 vs selling 1/27 or 9/27

- Buy 4/26 vs 12/26

![]()

Will Scott

O: +44 (0) 203 – 143 - 4171

M: +44 (0) 789 – 441 - 7709

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: US: 60 Rumson rd, rumson, nj 07760

This research was prepared by Will Scott. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

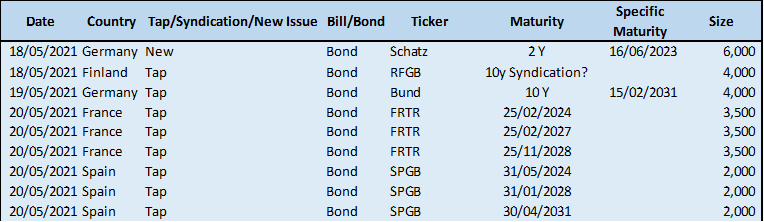

Supply Preview - "It's a bit cheap" - but for how long?

Market somewhat distracted by the futures rolls today, but we go out higher as we head into supply tomorrow despite a pretty decent chunk of issuance ahead.

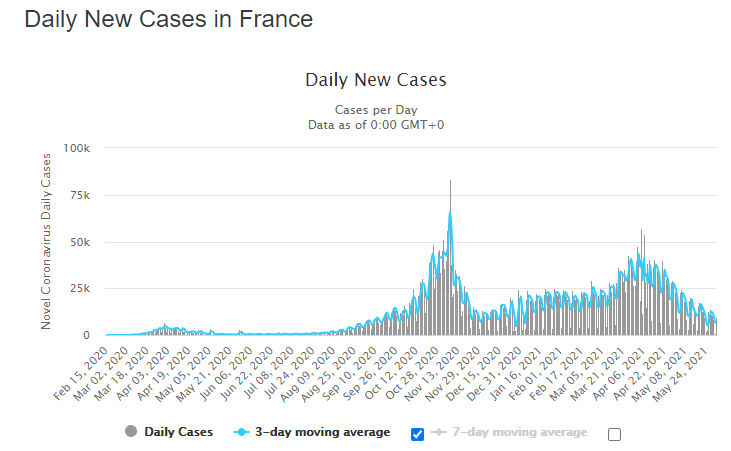

In fact it really is caveat emptor out there as we have a lot of supply next week as we head into the ECB meeting, and despite recent price action there is definitely room for some disappointment for the doves given vaccination numbers and case counts

Tomorrow's supply aside next week brings 7y Bunds, 10y Holland, 3y & 10y Austria, 30y Bund, 3y,7y & 30y Italy, Ireland (TBA) and possibly Portugal and Spanish 10y syndication? (pause for breath)

Week after next we could well see more EU issuance following on from their planned investor call next week. Starting to have conversations about how that will impact the market going forward

France

France to auction 11/31, 6/44, 4/55 & 5/72 tomorrow in up to 11bn. That's a decent chunk of duration.

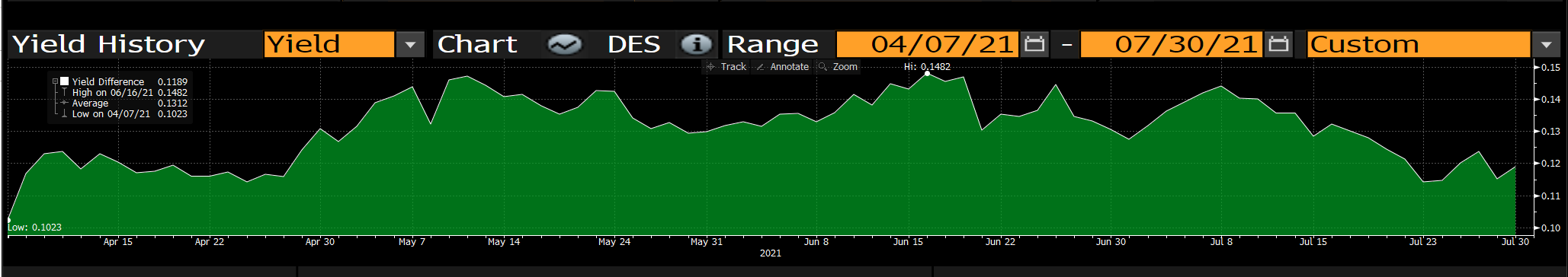

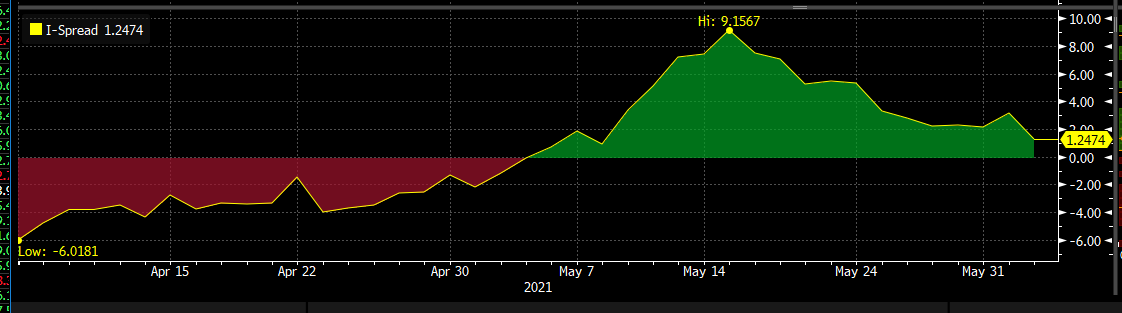

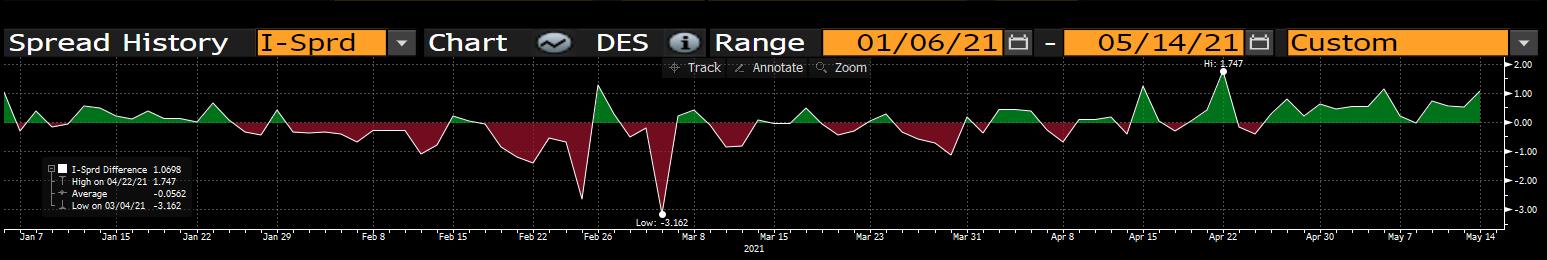

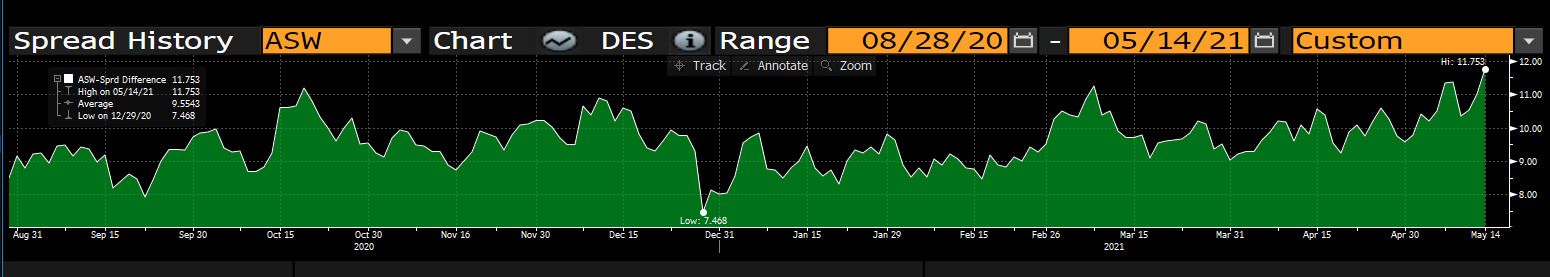

France still looking cheap on a cross market basis as spreads have pretty much retraced in unison over the past couple of week, but have done a huge amount of work vs swaps now:

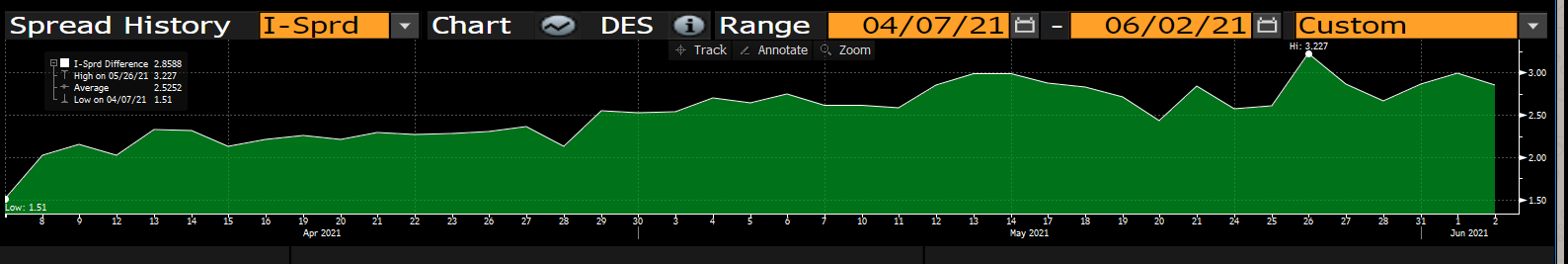

FRTR 11/31 swap spread

We prefer to take the 11/31 down on the 10y roll as we regard it as a soft bullish structure:

Anything above 3.0 basis points on MMS worth a look:

Moving to the longer end the box to Germany has steepened out somewhat, but we don't see it as quite steep enough yet:

Similarly, whilst there has been some degree of concession in the longer bonds, the reality is that it has been pretty minimal:

Buy FRTR 4/55 vs FRTR 2067 & 2072

Would love to see this down at 4.5, but I won't hold my breath

Spain

- Frankly the jury is out on Spain and from the conversations we have had recently we could put together a pretty decent tug of war team on both sides

- Spain to tap 26s, 27s & 40s

- The general spread compression has left Spain looking rich to Bunds, but perhaps a touch cheap x-mkt in the 5y sector

- SPGB 10/40 we like owning on a Blend vs DBR & BTPS (50/50)

- Graph below shows Spread of Spreads SPGB 10/40 vs DBR 8/46 vs BTPS 4/37

(SP210[SPGB 1.2 10/31/40 Corp] - 0.5 * SP210[DBR 2.5 08/15/46 Corp] - 0.5 * SP210[BTPS 0.95 03/01/37 Corp])

Have a good evening

![]()

Will Scott

O: +44 (0) 203 – 143 - 4171

M: +44 (0) 789 – 441 - 7709

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: US: 60 Rumson rd, rumson, nj 07760

This research was prepared by Will Scott. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades and Fades - Will & James at Astor Ridge

Quick Take

- Pretty fierce week with back end swap spreads collapsing as the market continues to price in less support for EGBs from PEPP post the June ECB and at the same time choosing to use swaps over cash in the back end to get back some delta

- Issuer spreads widening as well, but the France-specific cheapening seems to have slowed

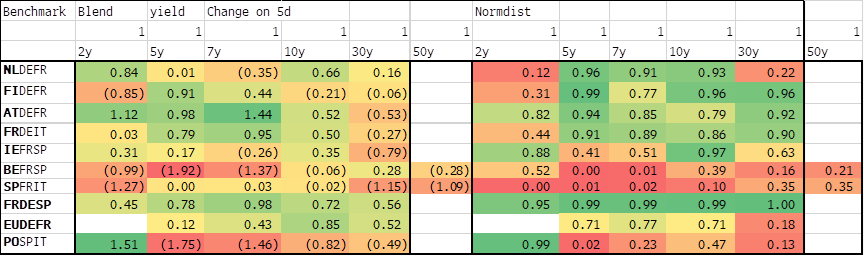

- That said, Belgium and Spain are standing out from the crowd as a little rich. The Spanish story seems particularly flow driven for now, and the richness of Belgium is more than likely a function of a smaller issuer being used as a proxy for France

Cross Market Spread changes on week and rich/cheap in percent

- Supply next week is relatively light, but similarly nothing in the way of coupons and redemptions. Highlights include:

- We think the Finland 10y syndication will come next week given that the tap date has disappeared from the Finnish treasury website. It's about time too. We look to take off our 9/30 vs 4/31 steepener into the pricing

- Last tap of the current DBR 2/31. Time to buy the roll?

Trades and Fades:

- You will note a lot of these are boxed to swap, which we think makes sense in this environment

- There is also a little less analysis of some of these trades than usual, but if you want the extended version don't hesitate to ask

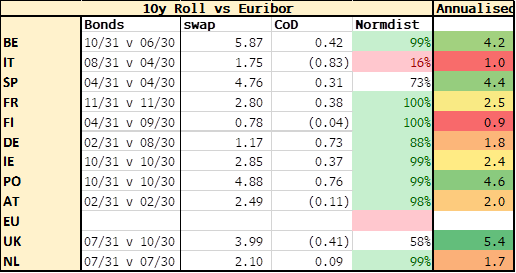

Focus on 10y rolls

- 10y rolls have cheapened up a lot, and for good reason. That said, when the market does turn we think that the on the run bonds will be bought because they are 1) on the run and 2) the cheapest bonds in the sector

- The below table shows the bonds used for the roll vs Euribor and then the annualised roll (e.g. if the roll is 18months wide we scale back by Roll * 12/18)

Buy DBR 2/31 vs DBR 8/30 on asw @ pick 1bp

- Ok, there are more exciting ways to make a basis point or so, but we think it makes sense to get this on whilst there is the liquidity into supply next week

- It's the last tap, which historically has been a good time to get in

Buy BGB 10/31 vs BGB 6/30 on asw @ pick 5.5bp

- Whilst rich cross market, Belgium is likely to be treated as a proxy for France into the end of the year.

- As such we think that the 10/31 should be trading better on the asw roll

- Enter at 5.5

- Take profit at 3.5

_____________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Buy RFGB 9/30 vs selling Nether 7/29 on asw @ 11.5bp

- Finland has cheapened up cross market as dealers have slowly priced in the advent of a new 10y (we expect middle of next week)

- We like rolling out of the Nether 7/29 into what will become the old 10y RFGB 9/30

- RFGB 9/30 should rehabilitate back into the curve and perform between 1-2 bpts

- Finland is at the top of the recent range vs Holland in 10y

- Nether 7/29 is rich to the Nether curve

- Enter @ 11.5

- Take profit at 9.0

_____________________________________________________________________________________________________________________________________________________________________________________

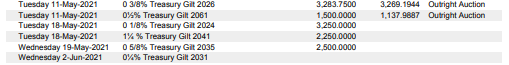

Sell UKT fe25 vs buy UKT e26 vs OIS

(P2509[UKT 0.125 01/30/26 Corp] - P2509[UKT 0.625 06/07/25 Corp])

UK Supply in 20y, 15y and 10y– get short 37s – rich on cash flow discounted curve

Buy Ukt 46 selling Sell Ukt 37 & Ukt 50

(2 * YIELD[UKT 0.875 01/31/46 Corp] - YIELD[UKT 0.625 10/22/50 Corp] - YIELD[UKT 1.75 09/07/37 Corp]) * 100

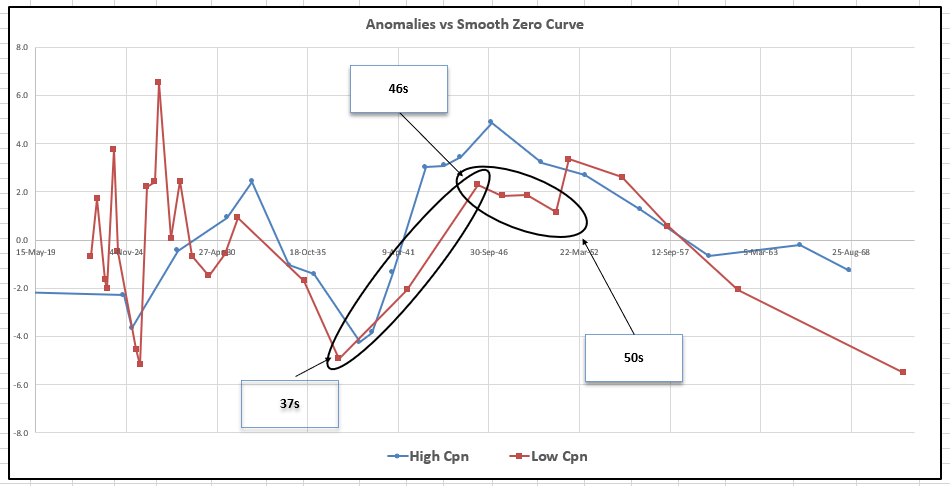

UKT Anomalies using Zero Curve Cash flow Discounting

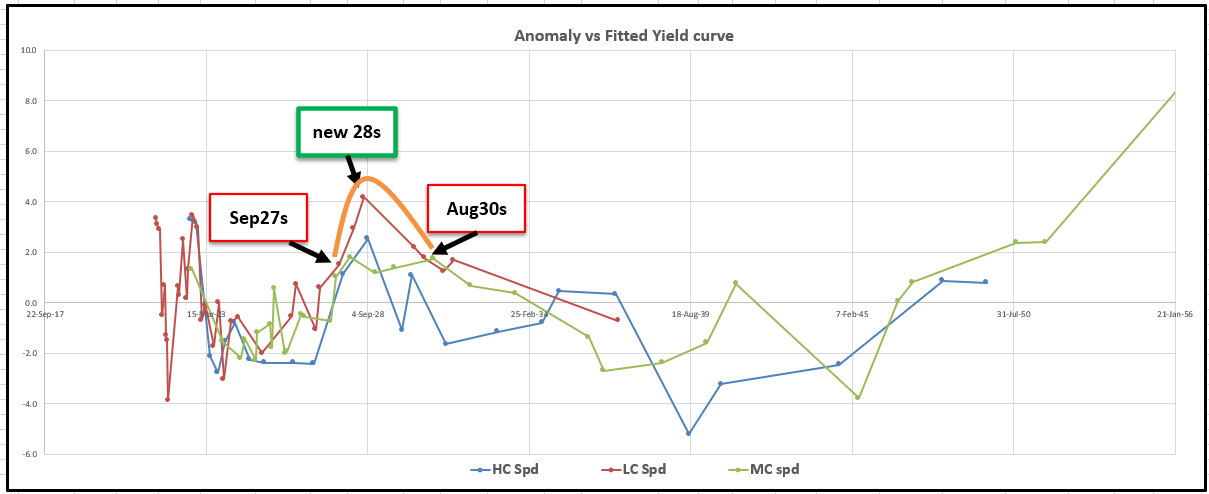

Italy – New 7yr just too cheap

Buy Btps Jul28 vs. Sell Btps Sep27s & Sell Btps Aug30s

Level

Enter: -10.5bp

Add: -9bp

* Aug30s , as it stands don't get a shot at being CTD and have poor carry

* New Btps 28 is a cheap bond in a cheap sector – should see RM buying

* The double old 7y is a low coupon with poor carry and rolls toward the issuance sector of 5years

Italy –30y/50y flattener – regression weighted

Sell 93% Btps Sep51

As tapering anti-PEPP mood surfaces - a lack of ongoing stimulus could force issuers back into the market – with wider credit spreads and flatter back end curves

Using older issuers for History – see below

(YIELD[BTPS 2.8 67 Corp] - 0.93 * YIELD[BTPS 2.45 50 Corp] - 0.38) * 100

Sell Old, High Coupon Dbr 34s vs Buy On the run German 10y, Dbr Feb31 vs OIS

High Coupon Germany are the only European, High coupons that are truly rich – and without the sustenance of PEPP they are taking a breather particularly as it is possibly full of these issues

Dbr Feb31 have one more tap – and then go off the run and roll down in the basket

(P2509[DBR 4.75 07/04/34 Corp] - P2509[DBR 0 02/15/31 Corp])

As always we would love to discuss

Have a good weekend,

Will and James

![]()

Will Scott

O: +44 (0) 203 - 143 - 4800

M: +44 (0) 789 – 441 -7709

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Will Scott. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

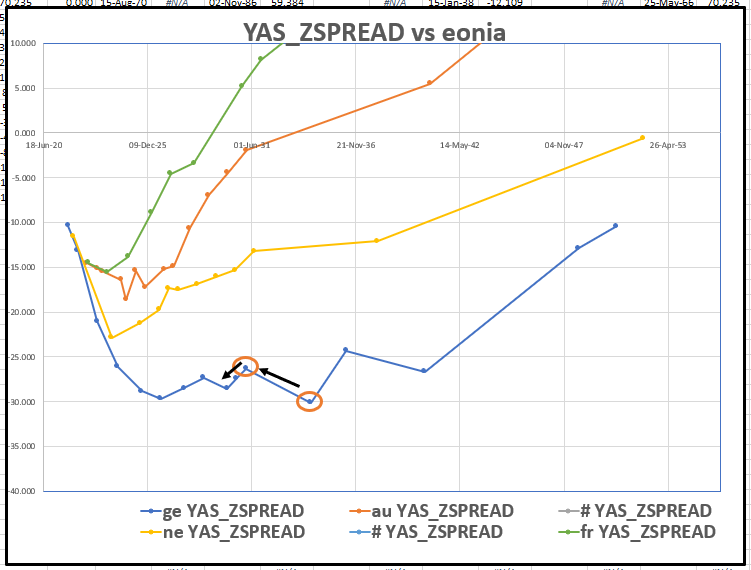

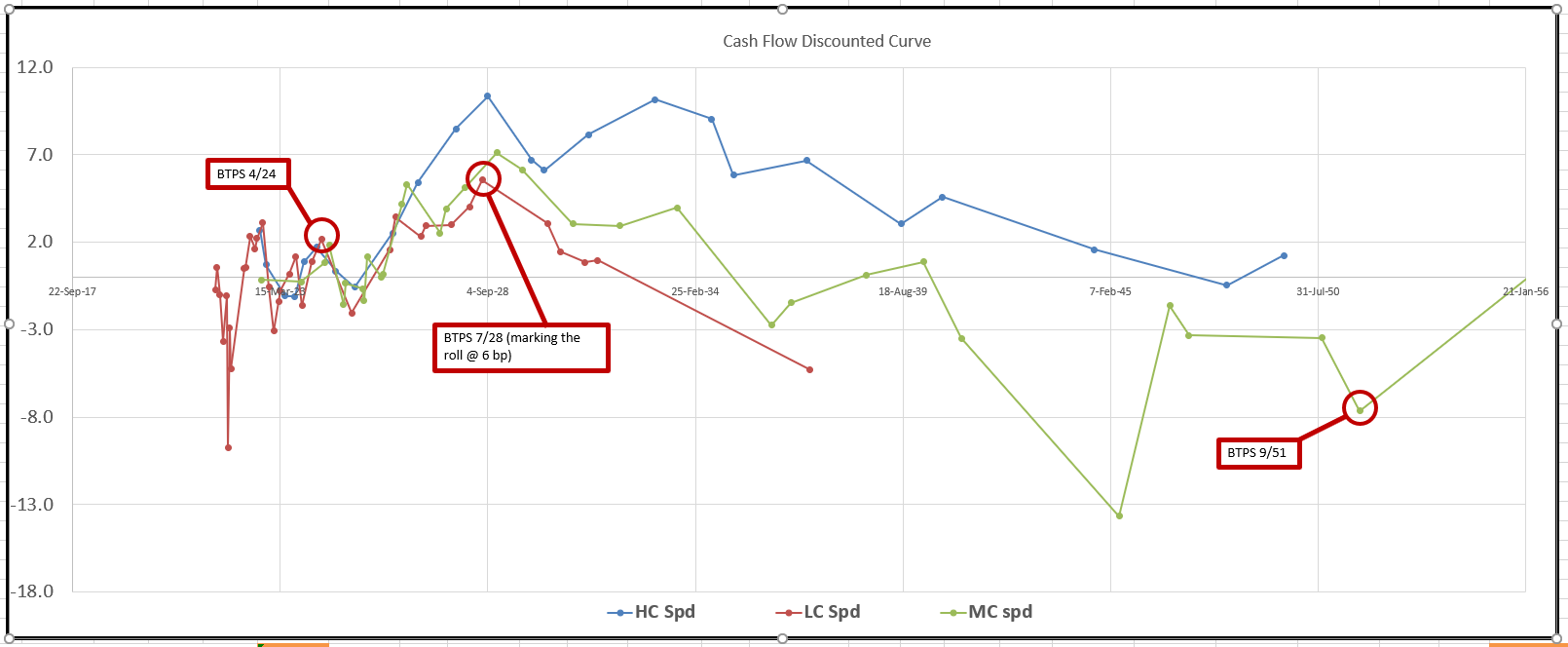

Italy auction preview

Italy to tap 3 lines tomorrow

15-4-2024 in 3bn

15-7-2028 in 4.5bn (new issue)

01-9-2051 in 1.75bn

- As we said yesterday this is a decent test for BTPs. The cheapening in France has left semi-core spreads cheap both vs Bunds and Swaps (albeit the swap moves are broadly tracking the outright), leaving Italian spreads vulnerable on a cross market basis should semi-core widen further

- That said we are at key levels of 1% in 10y and 2% in 30y. Is it enough though? With PEPP easing being rapidly priced in and stocks at pre-pandemic levels do we need Italian yields another 50 basis points higher?

Apr-2024

- It's the cheap on the run in the front end, but we have at least 2 more taps to go until we get a new one

- The bonds rolls nicely enough into the BTS contract, but without a further concession we don't really feel there is enough of an angle to get very excited

Jul-2028

- We are marking this roll at 6 bp vs the 3/28, and anything further North of this looks appealing in our view to roll out of 1/27, 6/27 or 9/27

- In addition, the shape of the forwards curve should see continued demand for steepening trades vs. the back end given how cheap the 7y point looks vs 15y+ tenors

Sep-2051

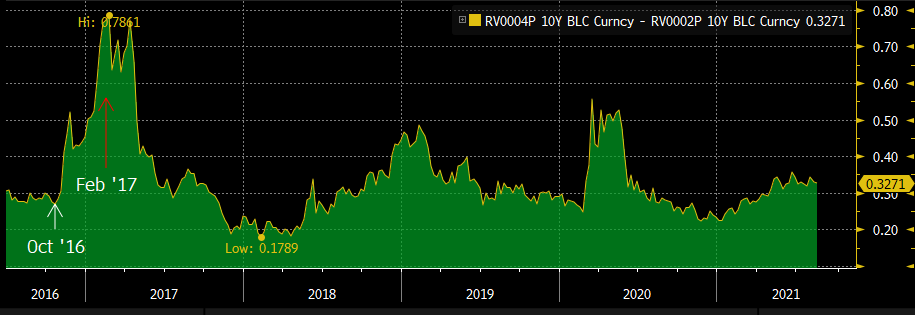

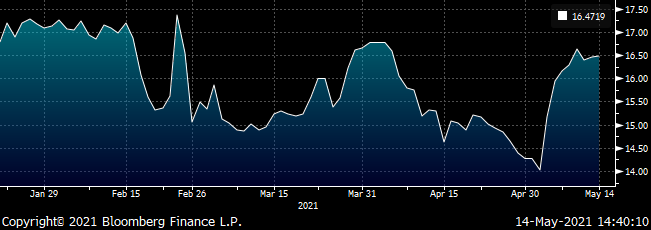

- Once again this sector isn't offering any obvious value. Italy Germany 10/30 box is at quite benign levels and the bond isn't particularly cheap on the roll

Italy vs Germany Generic 10/30 Box (BBG RV Series)

So in short unless we get some bond specific concessions into the supply then aside from the structural cheapness of the 7y point this supply is very much a test of risk appetite for Italy at these higher yield levels.

![]()

Will Scott

O: +44 (0) 203 – 143 - 4171

M: +44 (0) 789 – 441 - 7709

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: US: 60 Rumson rd, rumson, nj 07760

This research was prepared by Will Scott. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796