Austrian Supply - Will and James at Astor Ridge

Austria to tap 2/31 & 2/47 next week

RAGB 2/31

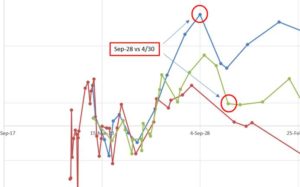

- Cross market Austria is looking a little rich, specifically in 10y space

- RAGB 2/30 vs 2/31 roll conversely looking on the cheap side, but we are seeing a general cheapening of 10y rolls on the back of the overall market selloff

- In addition we think the 2/30 (old 10y) is also a cheap bond, so if anything would look to buy either of the 10y bonds vs shorter issues (4/27, 2/29) as something more structural if we get a 10y specific cheapening

- Consequently we would look to buy a cheapening in 10y space rather than getting short a rich-ish issue into supply, especially given the small size

- Obviously in an ideal world we would see a further 0.5-1 bp cheapening into supply, but this is what is on our radar and likely the expression that dealers will also choose

RAGB 2/47

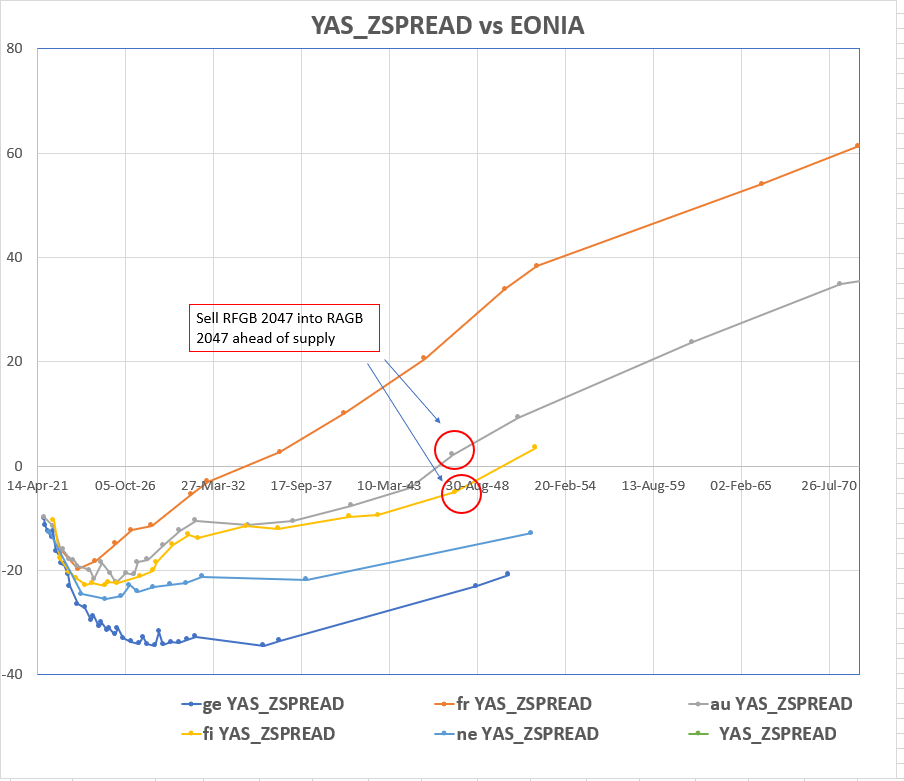

- Generally, but especially after the supply concession, RAGB 25y trades a little cheaper than other curves in the sector

- RAGB 2/47 has seen some concession vs Buxl, but with the direction of travel for spreads a little uncertain at this point we think there are 2 trades worth looking at:

Trade 1: Sell RFGB 4/47 -> RAGB 2/2047 to pick 7 basis points.

- 25y sector trades much cheaper than other sectors (RFGB 9/40 vs RAGB 10/40 is only 3 bp for instance), as can be seen from the below

Trade 2: Sell RAGB 10/40 -> RAGB 2/47 on asw to pick 9.5 bp

- Arguably this trade is not quite there yet, but at 10bp it looks pretty compelling, so we would do a little bit here with a view to adding at steeper levels

![]()

Will Scott

O: +44 (0) 203 - 143 - 4800

M: +44 (0) 789 – 441 -7709

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Will Scott. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades and Fades - Focus On Boxes - Will and James @ Astor Ridge

Overview

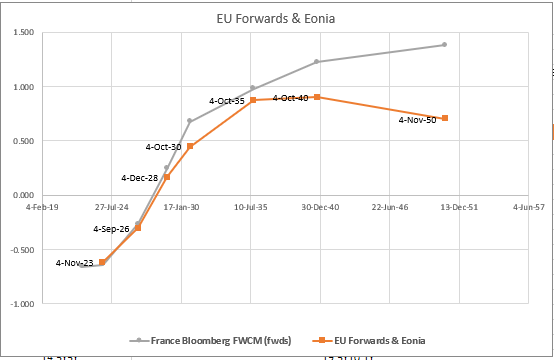

- The market, for now, is firmly in bearish mode. Granted, we saw the exact reverse of this in January when the same strategists were calling for lower rates forever, but given the relative steepness of the 5-10 sector in EGB space it makes sense to take a closer look at value vs. Eonia/Swaps over the next month or so at least

- The risk on rally and the assumed decline in Covid cases in Europe (although not globally) have understandably led to modestly higher core rates

- This in turn leads to assumptions of any eventual withdrawal of stimulus and leaves us thinking about the impact on both spreads and both curve shapes

- Our base case is that the ECB will to everything it can to keep front end rates as low as possible for the foreseeable future

- What the ECB can't control without increasing the PEPP is the direction of travel for longer dated spreads and curve

- Consequently we favour shorter dated flatteners vs eonia and longer dated credit steepeners vs Eonia

- As you will see from the below trades it is harder to construct a steepener with good entry levels than flatteners, but that doesn't mean they aren't worth entertaining

- Note: we have used Euribor boxes where there is no Eonia history

Let us know what you think.

Will and James

Flatteners:

Sell SPGB 4/25 vs Buying 7/26 Eonia Box

Sell DBR 2/25 vs Buying DBR 2/26 (OBL CTD) Eonia Box

Sell FRTR 5/27 vs 11/28 Eonia Box

Sell Nether 7/25 vs 1/27 Euribor Box

Steepeners:

Buy FRTR 2/27 vs 5/28 Eonia Box

Buy SPGB 7/26 vs selling 4/27 Eonia Box

Buy RFGB 9/30 vs Selling 4/31 Euribor Box

Buy BTPS 9/28 vs BTPS 8/30 Eonia Box

Trades and Fades: Will & James @ Astor Ridge

Trades and Fades:

- Sell 5y France into 5y EU

- Sell Finland 7/28 into Holland 7/28

- Sell DBR 2042 vs DBR 2036 & DBR 2046

- Time for a new 10y France at last? Sell FRTR 5/31 -> FRTR 11/30

Month Ahead

- EU Bond markets still very much hostage to the price action in UST

- Lagarde strengthening the ECB's rhetoric this week – "*LAGARDE SAYS INVESTORS CAN TEST ECB AS MUCH AS THEY WANT" – Can they though?

- Some focus on ECB trying to fully decouple EU rates from US rates. It's a nice idea, but can it work in practice? There is a strong argument that the pause the EGB selloff is as much a reaction to the botched vaccine rollout as it is to increased PEPP sizes. GDP weighted yields still flirting with breaking out higher

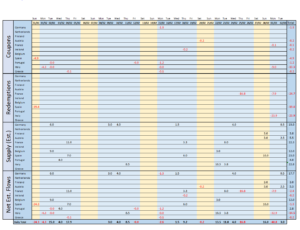

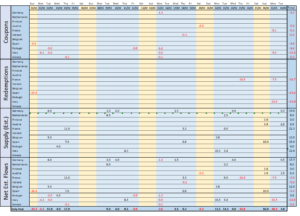

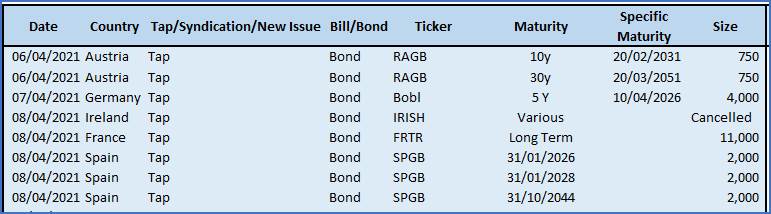

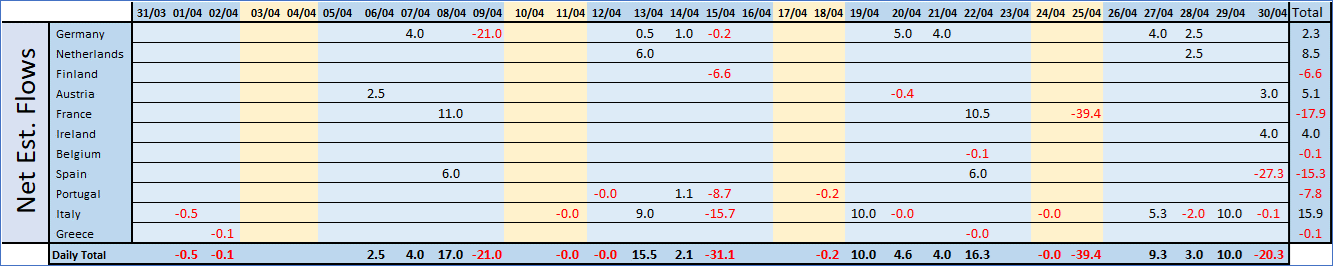

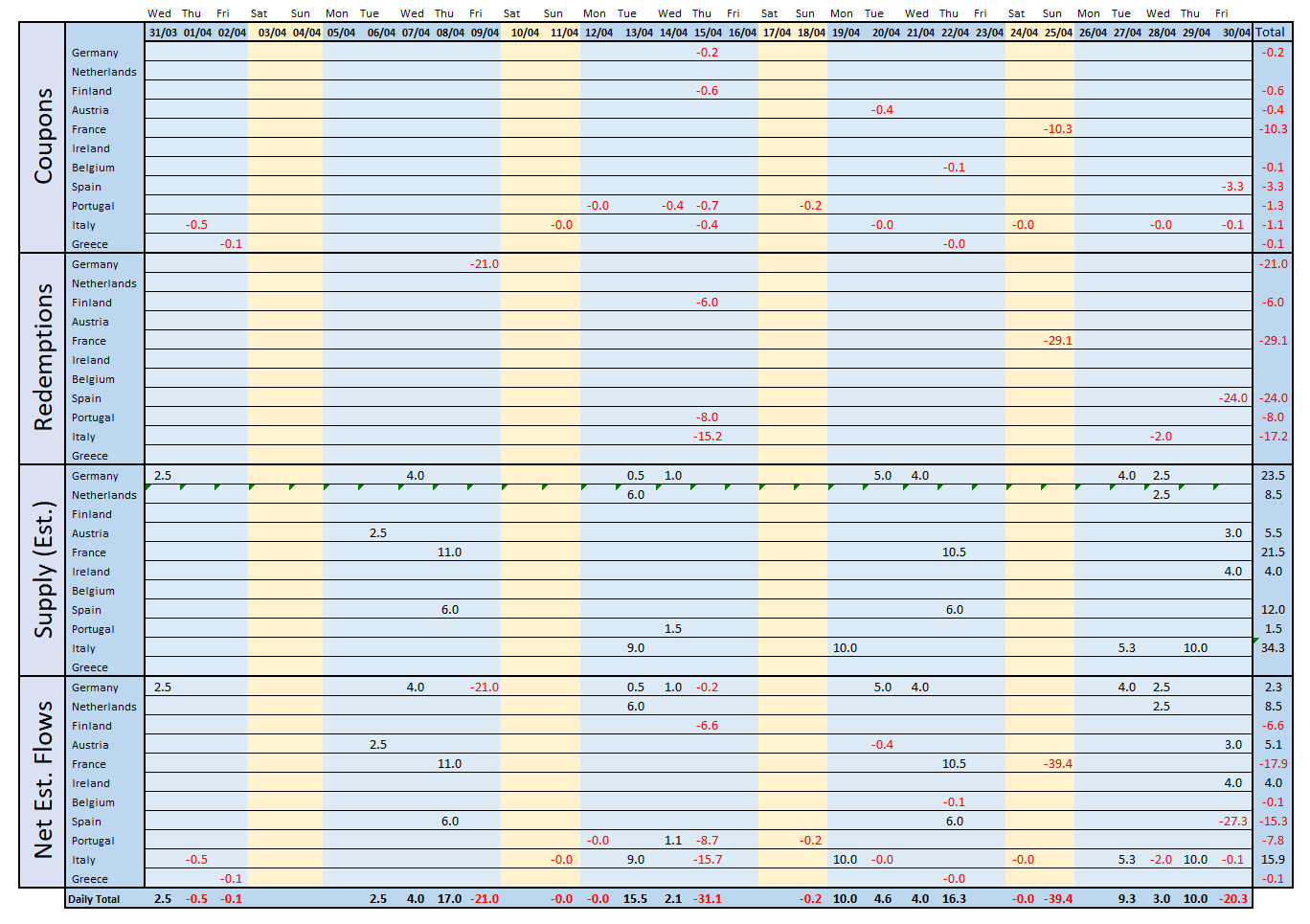

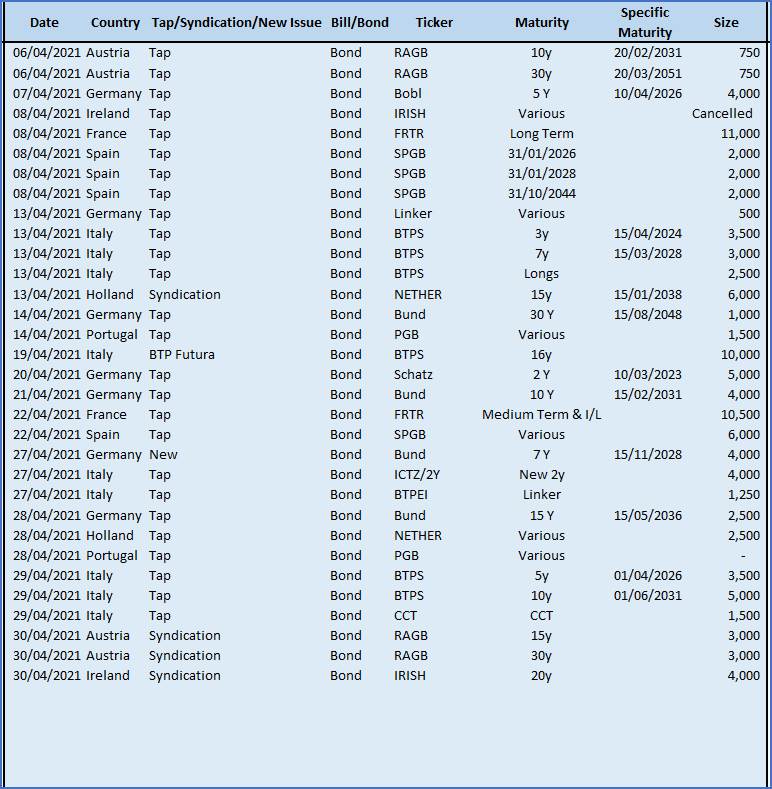

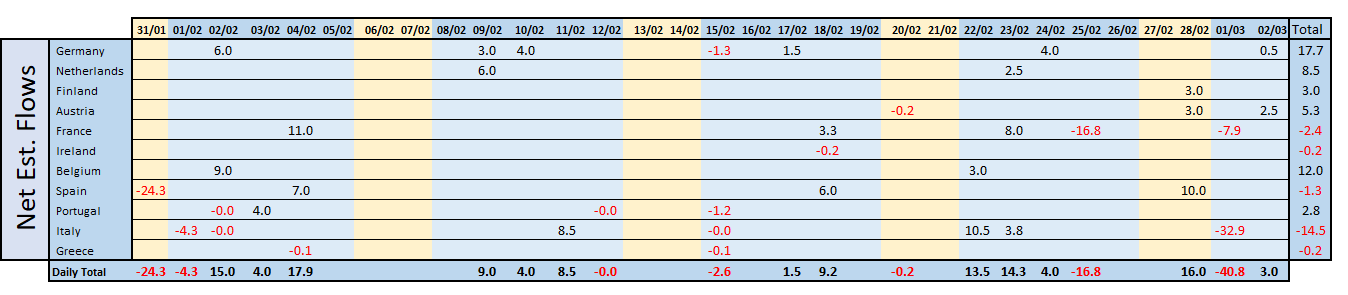

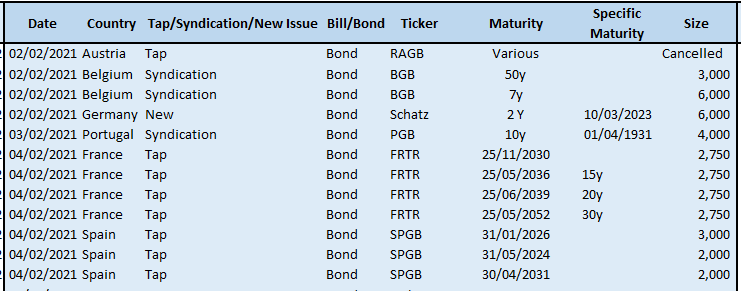

Supply & Cashflows

- Plenty of supply again in April, but solid coupon and redemption flows should prove supportive, particularly for France and Spain.

- Note we have included a 3bn Austria syndication and 4bn Irish syndication in our supply calendar, both for 30th April just to include them in the cashflows. We have also added BTP futura.

- Full estimated cashflow breakdown here

- Full estimated supply schedule here

- Lot of focus on the seasonality of C&R flows, particularly given how "cheap" France is cross market. Whilst an important backdrop, we think the idiosyncratic country risks from Covid add a lot of noise to the long France/Spain vs short DBR/BTP trade. Rightly or wrongly the market is also already looking ahead to French elections, so any meaningful strength in spreads is likely to be sold on a longer term basis

- Auctions next week:

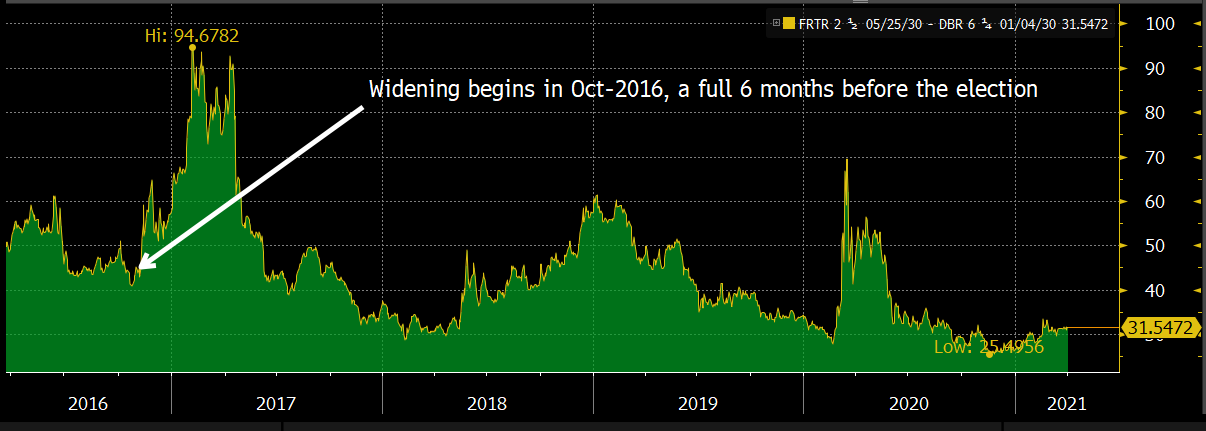

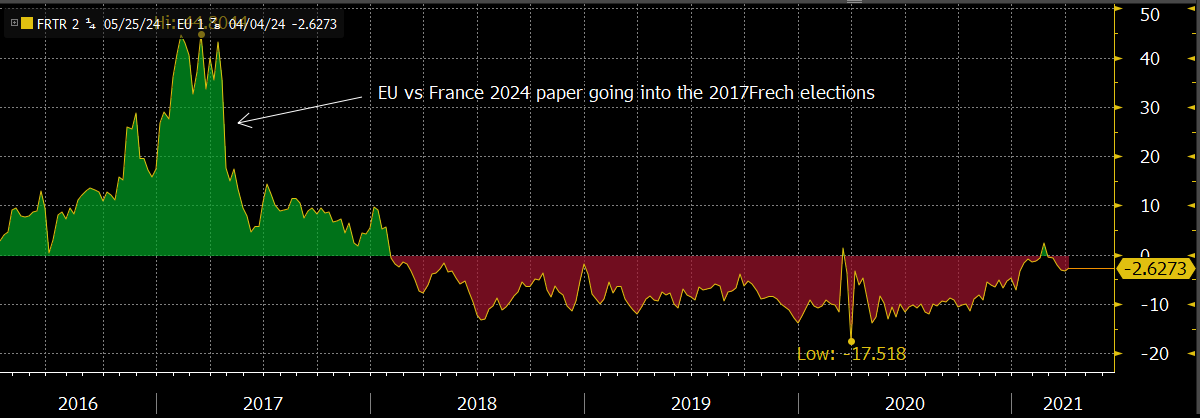

- All of a sudden a lot of conversations are turning towards the fact that French elections are next April and "is there a trade there?"

- First thing to recognise is that it's a year away… and we all know what can happen in a year

- Second thing though is that the widening into the Apr-17 French elections began in 10/16….. that's only 6 months away.

- With 6 months to go though until 10/21 we want something that is

- France Specific risk

- Trades with a general risk off tone

- Low cost

- Works even in the absence of French auction woes

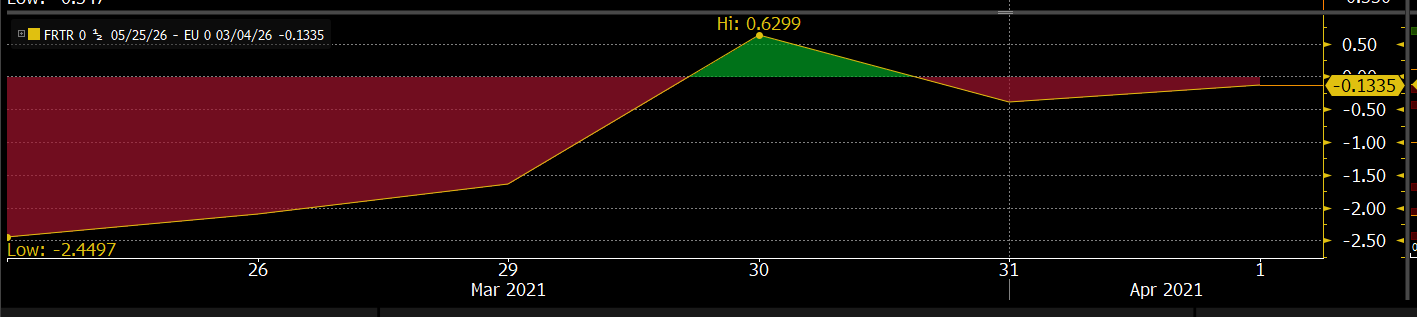

· Sell FRTR 5/26 into EUR 3/26

- Entry level: Flat

- Add: -2

- Target +5 and beyond

- History is light:

- but we can see how similar tenors performed into the 2017 elections

- EU also trades significantly through France in longer tenors

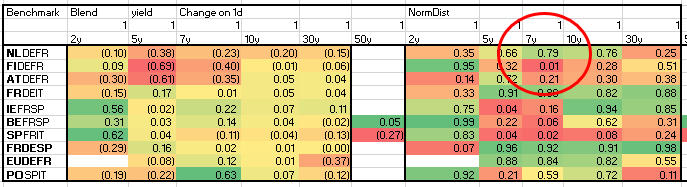

- Our cross issuer model shows Holland as having cheapened and Finland as having richened

- There is good reason for this

- Finland has a 6bn expiry in mid April and little free float to "easily" reinvest it

- Holland will be coming to the market with a new 15y on 13th April

- Dutch PM Mark Rutte is to face a no confidence vote later today

- Nevertheless this relationship looks stretched to us, and we would use any further weakness to sell Finland into Holland in the 7y sector

Entry: 2 bp (25%)

Add: 1 bp (50%), 0bp (25%)

Target: 4 bp

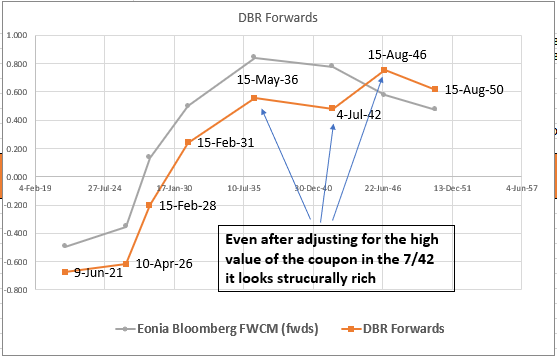

- We view the 20y point in Germany as structurally expensive. Granted, some of this value is explained away by the high coupons of the "richer" bonds, but even when we back out the coupons the forward curve looks too expensive in that sector.

DBR Forwards adjusted for coupon effect

- The recent 15y tap in Germany has cheapened the 15y sector up in Germany, along with the 15y roll (DBR 35 vs 36) on a micro basis

- This cheapening has moved the 36/42/46 fly to attractive entry levels

- In addition April likely see a decent amount of supply on the 20y sector, which should inherently put pressure on richer bonds in the area

Enter: -4bp (50%)

Add: -5bp (50%)

Target 0bp (full reversion of forwards)

- Longer history using DBR 2035 rather than the newer 2036:

- The market has been waiting for quite a while for a new 10y France.

- Market consensus seems to be leaning towards it coming next week

- We like the current 10y 11/30 and think it can richen back into the curve.

- Our favoured expression is to buy the 11/30 vs selling 5/31 as it captures the micro steepening that we think will come from the new roll.

- Assuming the new 10y is Nov-31 and that the roll is at least as steep as the new Nether 7/30 vs 7/31 (just over 8bp) we think the current 2bp spread of 11/30 vs 5/31 is too flat

Enter: 2.25 bp

Add: 1.5bp

Target 5bp

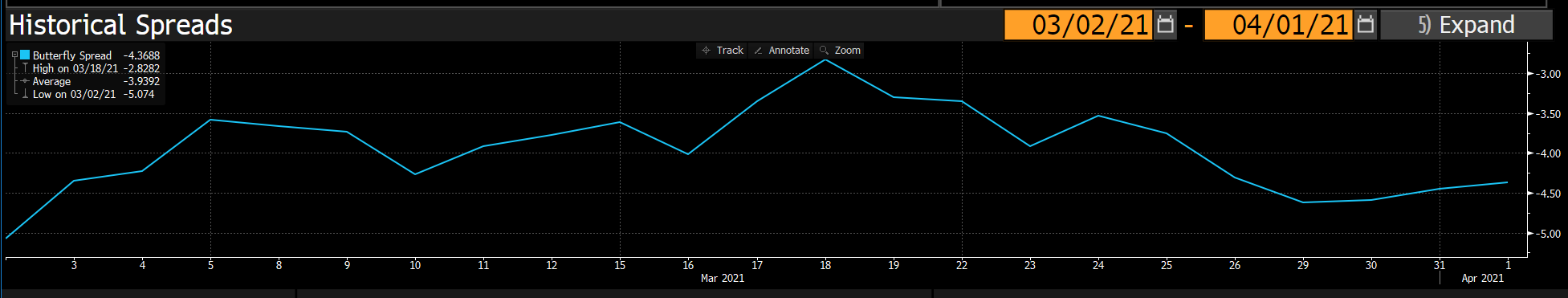

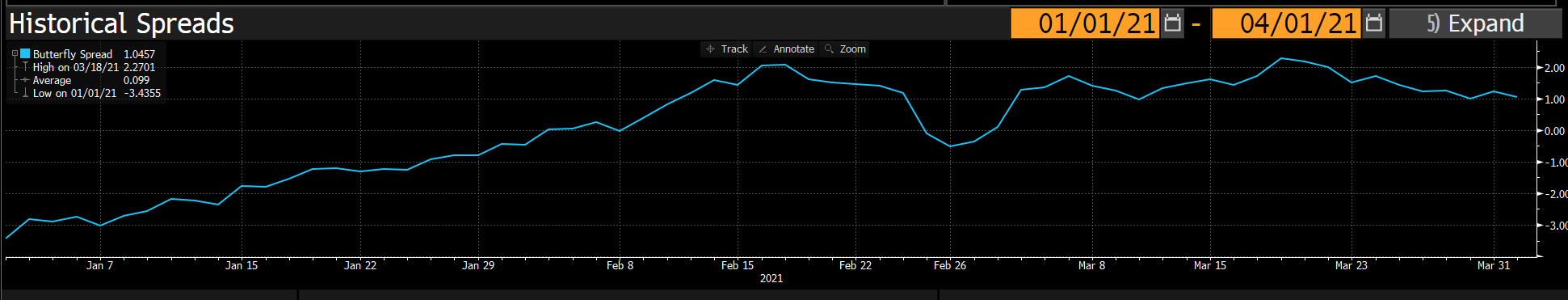

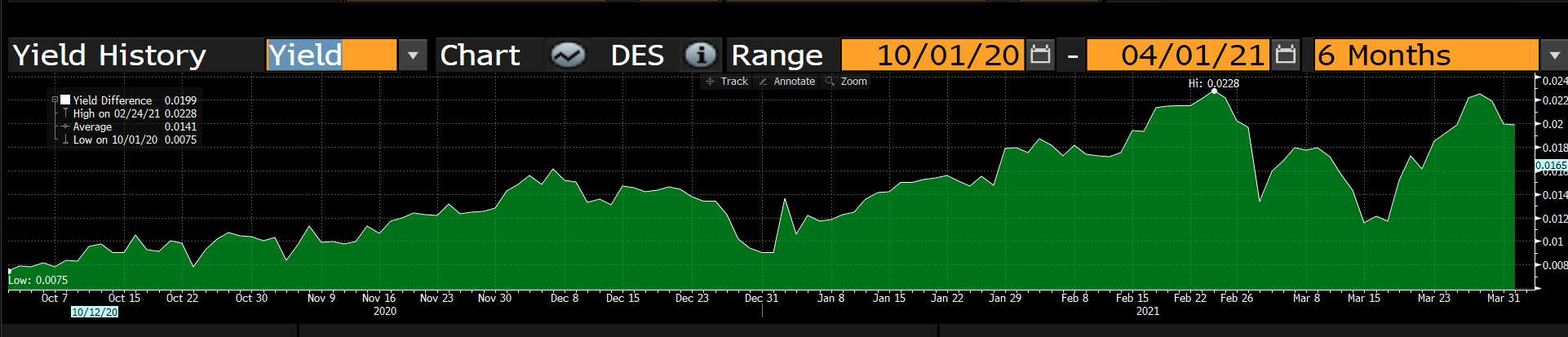

FRTR 11/30 vs FRTR 5/31 yield spread

And still looking pretty flat on Z…

Month Ahead Estimated CashFlows

![]()

Will Scott

O: +44 (0) 203 - 143 - 4800

M: +44 (0) 789 – 441 -7709

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Will Scott. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

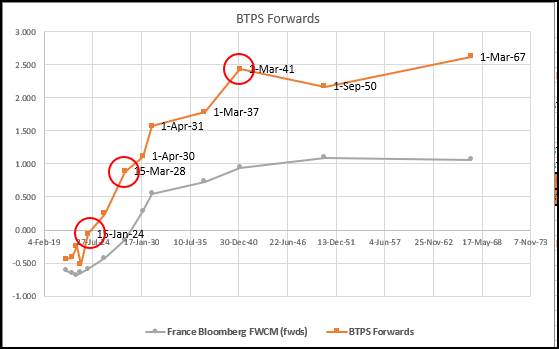

Italy Auction Preview - 11-Feb-2021

Tomorrow Italy will auction the following:

Jan-2024 , 3bn

Mar-2028 , 4bn

Mar-2041, 2bn

Given the rally in IK/RX over the past couple of weeks we think that tomorrow's auctions will be viewed as a liquidity point to add risk, not least because the on-the-run paper is still trading at something of a discount to the rest of the curve.

Bigger picture the curves look pretty fairly priced, but if micro RV is all that's left then these are our favourite iterations below:

Italy Forwards – on the run bonds all trading cheap to the curve still

BTPS Jan-24

Buy BTPS 1-24 vs BTSH1 or BTPS 15/3/2023

- This will likely be the last tap of the bond (currently 13.8bn).

- We see it as marginally rich both outright and on maturity weighted fly based on history

- However, it still has around 2 bpts of benchmark discount which will disappear once it goes off the run

- Additionally it can serve as a cheap-ish vehicle to hold a short in front month BTS, which we think has a growing long base that will put pressure on the roll

- We look for a ~ 0.5bp concession to enter the trade

Enter: 9.5 bp

Add: 10.5 bp

Current: 9.25 bp

Take Profit: 6 bp (into roll)

BTPS Mar-28

- Whilst this will no doubt see solid buying outright there is little RV angle to play here

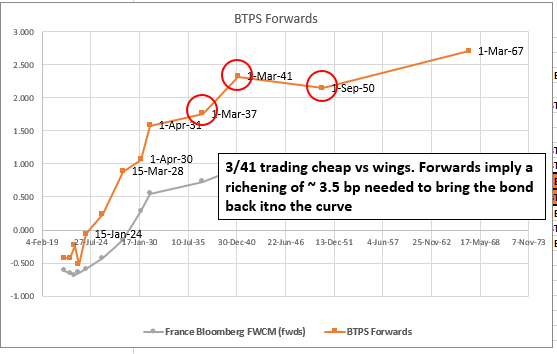

BTPS Mar-2041

Buy BTPS 3/41 vs BTPS 3/37

- As per the below chart the 3/41 is trading cheap relative to surroundings

- Granted, some of this is the expectation of a 20y Green bond at some point, but syndications this year have shown this to be a catalyst for performance rather than underperformance

- Given the recent steepening we like owning the flattener with a view to mutating it into 31/37/41 fly as we head into 10y supply at the end of the month

Enter: 23.4

Current: 23.4

Take profit: 20 bpts

![]()

Will Scott

O: +44 (0) 203 - 143 - 4800

M: +44 (0) 789 – 441 -7709

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Will Scott. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Quick Feb outlook - Will and James at Astor Ridge

- Cashflows supportive for Italy, Spain and France. Least supportive for Germany

- Spain has 24bn redemption this weekend

- Italy has 33bn of Coupons and Redemptions at the end of the month

- Germany sees a drip of supply all month, starting with a new Schatz

- Supply keeps on coming with the second bout of syndications and a slew of long end issuance. Our guesses below:

- Belgium 50y expected as early as next week

- Portugal to syndicate a 10y or possibly even longer

- Finland expected to do a 30y

- Spain likely comes in the 15y sector

- France to issue a green bond, likely towards the end of the month given the green bond tap next week

- Possibility as well that we see a 15y out of Austria

- Full ESTIMATED cashflows and supply for the month attached

Long end Trades on our Radar

Buy Long end Belgium vs France on 10/30 Box

- We feel the the market has overly discounted the long end of Belgium here given the likely small size of a new 50y. It makes sense to us that once the syndication is announced the 10/30 BGB vs FRTR box will revert back to it's normal range and cycle, which is primarily influenced by French long end supply

- Note that the announcement of a new 50y France was the catalyst for a correction

- CIX ((YIELD[BGB 1.7 06/22/50 Corp] - YIELD[BGB 0.1 06/22/30 Corp]) - (YIELD[FRTR 1.5 05/25/50 Corp] - YIELD[FRTR 0 11/25/30 Corp])) * 100

Buy 10y Finland vs French and German wings.

- The anticipation of long dated Finland supply appears to be the driver of recent cheapening in Finland.

- We don't feel that this is warranted and indeed PARTICULARLY in the scenario of lower than anticipated PEPP utilisation we ought to see smaller names outperform as their funding needs will not weigh on the market as much as more funding intensive names

- CIX: (YIELD[RFGB 0 09/15/30 Corp] - YIELD[DBR 0 02/15/30 Corp] * 0.6 - YIELD[FRTR 2.5 05/25/30 Corp] * .4) * 100

Take Profit on 10/30 flatteners in Italy and France vs Bunds

- As Fatboy Slim said, "You've come a long way baby"

- It makes sense to us that people who got long in December will lighten up on these positions as more long end supply leaks into the market

10/30 France vs Germany Box

10/30 Italy vs Germany Box

Plenty more to come and have a great weekend,

Will and James

![]()

Will Scott

O: +44 (0) 203 - 143 - 4800

M: +44 (0) 789 – 441 -7709

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Will Scott. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796