*** US CURVE SPECIAL *** US CURVES TIME TO FLIP : FLIP FROM BACK END STEEPENERS (THAT HAVE WORKED WELL) TO FRONTEND STEEPENERS VIA EITHER THE 210 OR 230 FLY. (OPTIMUM FLY SEEMS TO BE THE US 230).

US CURVES TIME TO FLIP : FLIP FROM BACK END STEEPENERS (THAT HAVE WORKED WELL) TO FRONTEND STEEPENERS VIA EITHER THE 2-5-10 OR 2-5-30 FLY. (OPTIMUM FLY SEEMS TO BE THE US 2-7-30).

I have long advocated US back end steepeners for some time but now it is time to focus on the frontend.

Frontend curves are finally showing signs of basing that JUST as the 5-30 and 10-30 fail MAJOR multi-year resistance.

I think the timing is perfect right now for that switch-fly trade.

The flies themselves have major multi-year dislocations and retracement support.

**A LOT OF THESE CURVE CHARTS HAVE HAD AN AMAZING TECHNICAL PERFORMANCE HENCE THINK ITS WELL WORTH A LOOK AND DISCUSSION.**

**ASIDE THE USUAL FUTURES FLY OUR RESIDENT SWAPS GURU DAVID SANSOM IS WORKING ON SWAPS ALERNATIVES** HAPPY TO DISCUSS ANY IDEAS.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MICROCOSM: US Rates > Reconciling Short Rates with 210s - Quick Rundown

- This note is meant to elicit comments and discussion than to offer a specific trade idea as we’ll see below. We’ll use charts to help keep this short and sweet.

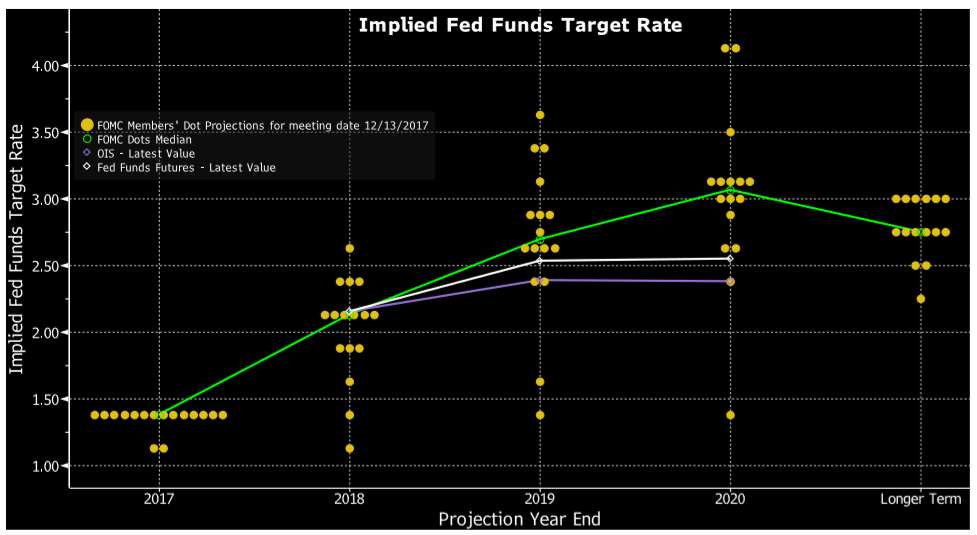

- The FOMC’s last dot plot shows the FOMC raising rates until the funds target hits 3.00% in 2020 although the market isn’t buying it, expecting the funds target to hit a brick wall at 2.50%, in line with most CPI forecasts. There seems little reason to expect the FED to build in a cushion given how stubborn inflation has been which leaves us sympathetic with current pricing. The obvious corollary here is, with the

funds target currently at 1.50% and 3 hikes priced in for 2018, the FED’s hiking cycle should be finished by June ’19 at the latest.

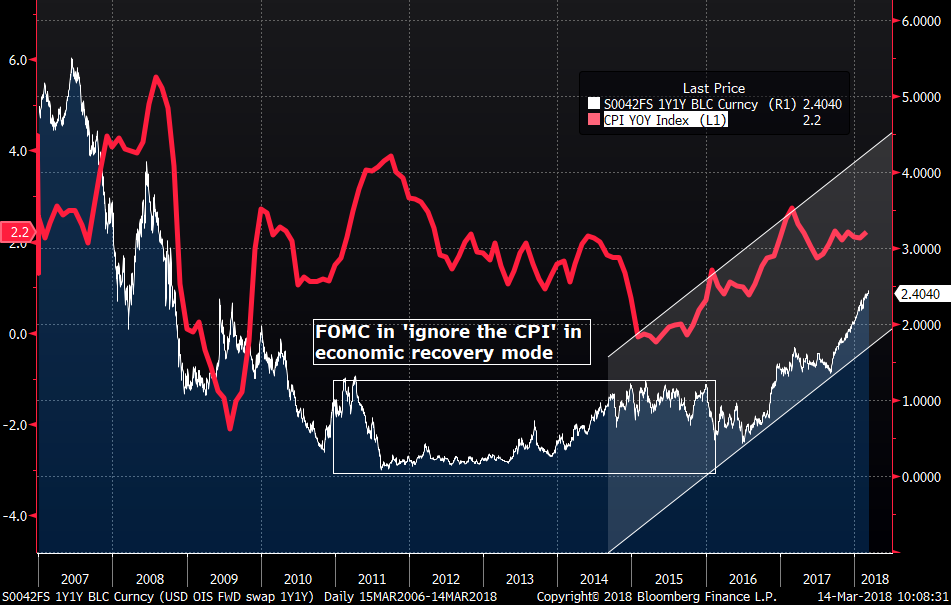

USD 1y1y OIS vs YOY US CPI. After little correlation for most of the last 10yrs, short rates have been tracking CPI pretty well from early 2016 reflecting the market’s anticipation of the FED’s rate hike cycle. With 1y1y OIS at 2.40% and CPI at 2.2% (CORE just 1.8%) and most pundits expecting inflationary pressures to fizzle out by year-end (despite the tax cuts) there seems little impetus to raise rates into negative real rate territory (aka well above 2.50%).

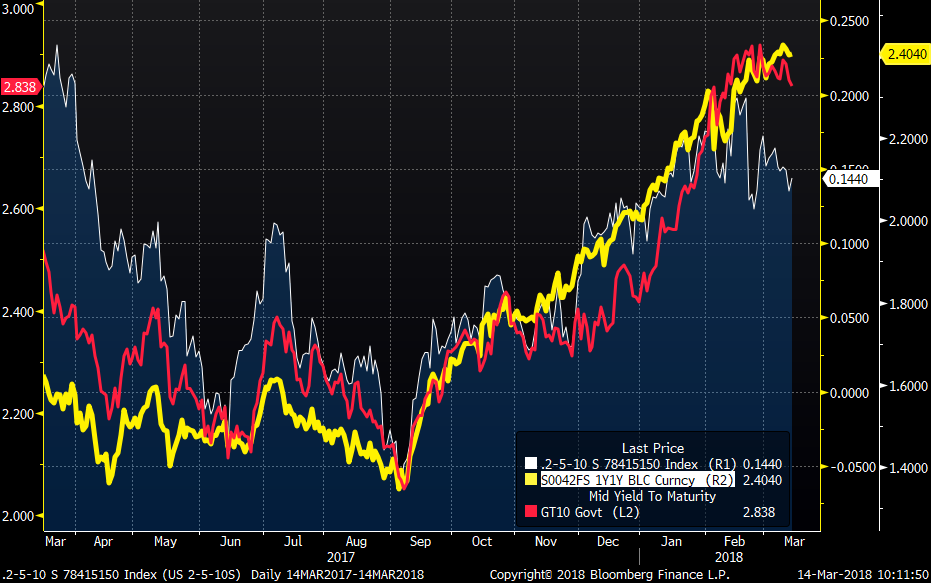

- The chart below is UST 2-5-10s (white) vs 1y1y OIS (yellow) and UST 10yr yields. We can see there’s been a strong correlation since last September, the fly cheapening as rates rose. That all changed in early Feb when stocks had their wobble amid the VIX’s spike, trade tariffs grabbed the headlines and Powell took the reins at the FOMC. The question we’re asking is whether this divergence is justified as the ‘new normal’ or whether 5yrs are too rich here.

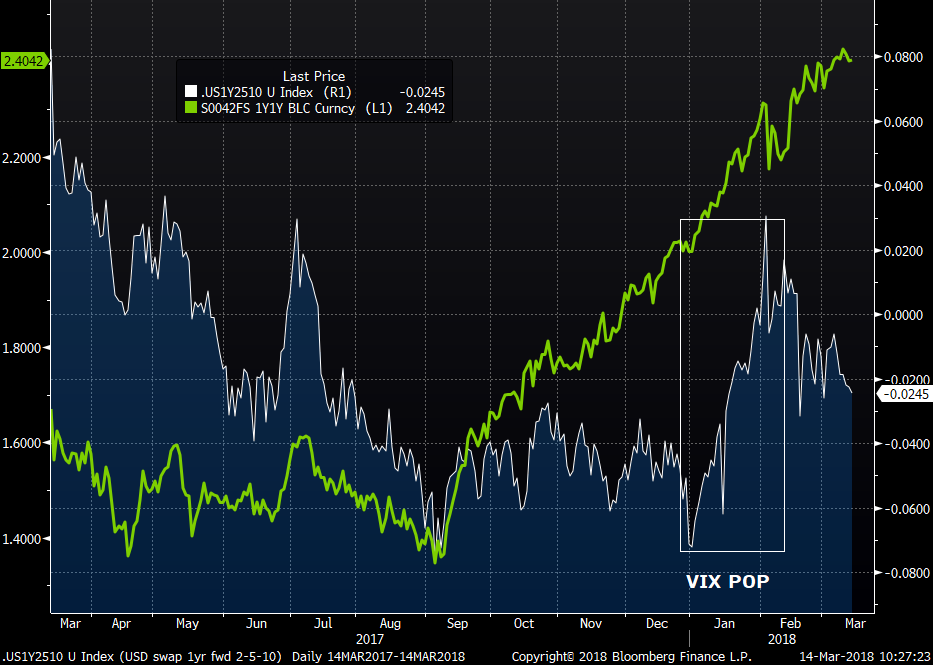

- From another angle, 1y fwd 2-5-10s in swaps – a popular trade for the leveraged guys – has snapped back after the FEB spike cheaper, largely due to 2-5s making new lows. Ostensibly, the market’s saying there is little need to build in fears of an inflation spike. The 1yr fwd 2-5s sprd in swaps is just 2.75 bps with spot at 19.3bps, having popped steeper in Feb. The question is, can 1y fwd 2-5s invert? Or perhaps the better question is SHOULD it? What’s worth considering is what happened when the market got antsy? A steepener here is an ‘insurance policy’ of sorts in the event stocks get sick again OR inflation doesn’t cooperate, leaving the FED less inclined to keep their foot on the brake.

1yr fwd 2-5-10 swaps vs 1y1y OIS. OIS could care less what happened at the NYSE but further out the curve things got interesting.

Thoughts… ?

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796